#digi tech los angeles

Text

Morgan Cunningham - Ford Models

Photography + Direction: Lindsey Kusterman

Styling + Direction: Emily Batson | IG

Makeup : Bailee Wolfson | IG

Model: Morgan Cunningham with Ford Models | IG

Photographed at my home studio in Los Angeles California- All digital.

#los angeles beauty photographer#los angeles fashion photographer#emily batson#bailee wolfson#lindsey kusterman#beauty photographer los angeles#los angeles retoucher#los angeles photographer#los angeles editorial photographer#los angeles film photographer#morgan cunningham#ford models#digi tech los angeles

0 notes

Photo

“Villains of Verano”

WOKE! Film Reviews for a Hot Time in the City

by

Lucas A Cavazos

No summer cinema season is complete without some bad guys and gals to muck things up oh just so right. These three films have just hit our movie screens, and while they don’t necessarily run circles round a boogeyman, they surely do make it easy to despise a few characters. Let’s

Once Upon a Time in Hollywood #### Quite likely one of the finest films I’ve seen all year, Quentin Tarantino’s latest film burst into Spanish cinemas this week, and I do declare that this is perhaps some of the most fun he has had making one of his celluloid, revenge opuses in years. Why, you ask? Because he gets to return to the envisioned Hollywood of his childhood and in this way, we the viewers get to escape into an idealised late 60s Los Angeles. Starring Leo DiCaprio, who plays former TV Western actor Rick Dalton, as well as, Brad Pitt as his stalwart driver and stunt double, Cliff Booth, director Tarantino takes us into the hills to his Cielo Drive home and lets comical magic just flow. What we then learn is that his next door neighbours are Roman Polanski and his young actress and beautiful wife, Sharon Tate, played to utmost perfection by my newest fave actress over the last few years, Margot Robbie. It is certainly important to state that Tarantino more than takes his time giving us plenty to think about. I’ve heard that DiCaprio would not permit workers on set to look him in the eyes, even when speaking to him…only other actors of his ilk. If that is so, and it likely is, fuck him, but boy does the director do his fair job making us look at our own desperate attempts to not be left stuck in the past when we so want to be relevant in the here and now. DiCaprio plays this fear to utter success and there are so many joyously hilarious scenes that should earn him a spot on actors’ awards lists later this year, assuredly. But it’s the scenes with Pitt as Cliff that engage us and ingratiate us more into the goings-on of the time and just how easily Tarantino starts to play historian and detailing the scenes of US-American life via California, long before it was a Democratic/liberal haven. Using Pitt in his car, we meet some of the guys and gals that were clamouring together at the Spahn Ranch, and we even meet Charlie Manson for a quick spell. And one gets roused by the way Tarantino also tips his hat to filmmakers of yesteryear, players like Sergio Leone or the silly minds behind Sharon Tate’s film Wrecking Crew, nothing lost on me, and he paints a picture that definitely comes across as nostalgia gone all-too-real. When the finale presents itself, and it does so on an evening that hints at incorporating a good time and all next to Polanski’s compound, we kind of know what we are in for, but naturally Tarantino loves to paint history to his own liking. We then determine who lives on and who doesn’t. One thing should be known: Tarantino and his oeuvre will continue to live on proudly…Loves!

Cold Pursuit ### Oh Liam Neeson, we verily know thee…If you think that this is just another over-55/60 year-old, angry dad getting revenge movie that the actor’s been so famous for the last decade, you’d be right. If you think that this may be the last in the tired genre that he can possibly eke out to moderate success, you’d also be very correct! As it stands now, the film which cost roughly $60 million to make has only recuperated $75 million in its worldwide box office. Let it be known that a film, in order to be considered financially successful, in this millennial digi-age in which we live, a film must garner two-and-a-half to three times more than its total budget. To have a varied cast that also includes Laura Dern as Neeson’s wife, as well as, TV faves Emmy Rossum and Tom Bateman, you certainly lack not for having a set of decent, emotionally-charged actors. The challenge with this hopefully last of the Livid & Vengeful Neeson series is that we dive so quickly and head-long into his pursuit of the band of no-goodniks who attacked his family and thereby set off the action which the film follows. Norwegian film director Hans Petter Moland remakes his own film from five years back, merely changing the main character’s name from Nils Dickman to Neeson’s Nels Coxman. Phallic naming aside, the film’s Denver setting does little to paint a picaresque action film and instead, stays true to the Neeson theme of late, pursuing him as he pursues those responsible for his family member’s demise until he slowly makes his way to the top drug lord. How this ski-lift plow man has the skills to bust up a ring like this and simply murder away is beyond anyone, except perhaps the Native Americano thugs thrown in for, I suppose, PC measure although that falls flat. In the end, what we get is a sometimes engaging, sometimes too formulaic film and a pile of mob boss and Native American villains do nothing to enhance the fun. Over it…NEXT!

Fast & Furious Presents Hobbs and Shaw ###-1/2… Say what you will about this interminable franchise as one must certainly have an opinion about this modern testosterone putz-fest by now, but man alive, do they serve up incredible, often impeccable, action sequences that either keep you at the edge of or throw you right the hell off of your seat. A couple of flicks ago, we had to say our goodbyes to poor Paul Walker after his uncannily and ill-fated final car ride demise. Since then, the last F&F was a sad complaint of a film, cast members had a series of rows and since Dwayne Johnson is also a businessman, his smart self decided to screw over shmuck Vin Diesel and silly-ass Tyrese and buddy up with charming Brit Jason Statham and POOF!... another branch of the series is born! This time around, we focus on a more comical, emotional and familial Hobbs and Shaw as, early on, we see a split-screen sequence between their US/UK lives, but soon enough after that, the action gets legit lit when we’re introduced to Shaw’s sister and criminal Hattie (Vanessa Kirby) who has been in possession of a fast-acting super-virus which can jelly one’s guts instantly. Throw in eye candy delight Idris Elba and a Robin Hood-esque attempt at “saving humanity’ from the spread of this virus only serves to boost the action and fun when we realise we’re also up against a real villain of verano, which in this case is a big tech demon called Etheon. As all my readers know, I despise spoilers so all I can say is that, even when the film cuts to a boring scene or two, it is the symbiotic nature and wittiness between the main characters that keep you smiling and highly convinced that F&F should be put to rest please and the mid-life crises adventures of Hobbs and Shaw should slide easily into its place…perhaps served up with non-stop celeb cameos and hot cars as always.

#Tarantino#OnceUponATimeInHollywood#DiCaprio#BradPitt#dadsploitation#ColdPursuit#LiamNeeson#LauraDern#VillainsOfVerano#CinemaLife#HobbsandShaw#DwayneJohnson#JasonStatham#VanessaKirby#VOSEng#FastandFurious#EnglishRadioBCN#ABitterLifeThroughCinema#WOKE

1 note

·

View note

Photo

Directed and photographed the new Honest Mama care campaign. Thanks to another great team to work with. Co Director: Yoni Sandler Art Director: Ally Neuman Brand Director: Jamil Moen Model: Chiana Jenell Producer: Lisa Huyck Digi Tech: Rhea Aldridge Photo Assistant: Joshua Elan DP: Benji Dell Gaffer: John Fisher 1st AC: Sebastien Thiebeau PA: Arrielle Santos PA: Maddie Knight Hair Stylist: Albena Afraim MU: Shannon Pezzetta (at Los Angeles, California) https://www.instagram.com/p/B74gSlrAE7v/?igshid=uvvpalko9oph

0 notes

Photo

‘Alright, Alright, Alright...’ - Critically acclaimed actor and producer, Matthew McConaughey | 📷: @KarlFergusonJr for @Complex & @WildTurkey - 1st Assis: @zac_1 2nd Assis: @jtergo Digi Tech: @photosbyrome - I had the opportunity to shoot portraits with Mathew McConaughey and a few guest including @therealtrapkitchen for @complex and @wildturkey ‘s new series ‘Talk Turkey’ A new episode drops every Friday. Not to mention product shots for Wild Turkey’s entire line of super-premium bourbon. A special thanks to my head producer @jarrettdp for this incredible opportunity and shout to his amazing team @adonald @jakewasserman @rustin.peace @huntertherrick @sabatinoedit @alanbucaria @irvingharvey @heathershae @eazeetho on an incredible job well done on all the video content!!! - #MatthewMcConaughey #portrait #photography #portraitphotography #academyaward #actor #celebrityphotography #portraitsnyc #portrait_ig #profoto #blacknwhite #bnw (at Los Angeles, CA) https://www.instagram.com/p/B4QWCkSFtHo/?igshid=iwnuvbh6dubs

#matthewmcconaughey#portrait#photography#portraitphotography#academyaward#actor#celebrityphotography#portraitsnyc#portrait_ig#profoto#blacknwhite#bnw

0 notes

Photo

Weekly Funding & People Roundup: Two Bit Circus raises $15M, DigiLens raises $22M, Hugo Barra Leaves Xiaomi To Become Facebook’s VP of VR & HTC's Top Vive Designer Leaves For Daydream

Funding:

1) Two Bit Circus has raised $15 million in a funding round led by Jazz Venture Partners, with participation from existing investors, including Foundry Group, Techstars Ventures, Intel Capital, and a handful of new investors.

Two Bit Circus’ latest fund will be used specifically to build micro-amusement parks comprising more than 30,000 square feet of entertainment, including VR and mixed reality, as well as social games, fire, lasers, robots, and more. The first such entertainment park will open in Los Angeles, with a date yet to be announced. Read more on VentureBeat.

2) Display technology maker DigiLens has raised $22 million to create better augmented reality and virtual reality products in which digital information lies on top of transparent glass. The Sunnyvale, California-based company makes diffractive optical waveguide technology and nanomaterials for AR and VR, which could be a $108 billion market by 2021, according to tech advisor Digi-Capital.DigiLens’ technology can enable “eyeglass-thin” AR heads-up displays for motorcycle helmets, car windshields, VR headsets, aerospace applications such as fighter jets, and AR smartglasses, said Jonathan Waldern, CEO of DigiLens, in an interview with VentureBeat. Read more on VentureBeat.

People:

1) Hugo Barra is leaving Xiaomi to lead Facebook’s virtual reality division. “Hugo shares my belief that virtual and augmented reality will be the next major computing platform. They'll enable us to experience completely new things and be more creative than ever before. Hugo is going to help build that future, and I'm looking forward to having him on our team.” - Mark Zuckerberg. Read more on QZ.

2) Claude Zellweger, who most recently led HTC's Vive design team and played a major role in developing HTC's smartphone design language is joining the Google Daydream team. Zellweger’s intimate familiarity with mobile hardware should also be an asset in helping to accelerate the development of Daydream. Read more on The Verge.

2 notes

·

View notes

Text

Some interesting April Fools' Day 2019 Technology Jokes

This year April Fools' Day wasn't as fun as the last one, even though it was on Monday. Many tech companies that make effort didn't make one this year. In fact Microsoft went even further and banned any public facing April Fools' pranks. Anyway, here are some of the jokes that I found interesting.

Parallel Wireless 7G Vision

This one was important for me as it features me (Yay!) and also enhanced my video editing skills. Grateful to CW (Cambridge Wireless) for being part of it too.

Parallel Wireless would today like to announces our 7G Vision (#7GVision) - https://t.co/Ffj63NX5F3 - Cambridge Wireless (@cambwireless) will form new Special Interest Group (SIG) to support the 7G Vision with @zahidtg joining the team too. pic.twitter.com/puz3cOoOGn

— Parallel Wireless (@Parallel_tw) April 1, 2019

Video is slightly long but funny hopefully

youtube

In short, the focus for the next few years will be do design a 7G logo that can explain the vision and connect with people. Did I mention 7GPPPPP?

"#7G Public Private Political Polling Partnership (7GPPPPP) with many different companies and organizations has also been formed to work on this vision."

Well played @Parallel_tw @cambwireless! ;)#AprilFools https://t.co/Lhxqk2Eifq

— Emanuel Kolta (@EmanuelKolta) April 1, 2019

Google Sssnakes on a map

Google temporarily added a version of the classic game Snakes into its Google Maps app for April Fools’ Day this year.

The company says that the game is rolling out now to iOS and Android users globally today, and that it’ll remain on the app for the rest of the week. It also launched a standalone site to play the game if you don’t have the app.

Jabra Ear bud(dy)

World’s first shared headphone - engineered for shared music moments. The website says:

The headphones come with an ultra-light headband that extends seamlessly to accommodate the perfect fit for every pair of buddies, so you’ll never have to enjoy another music moment alone. The Jabra Earbud(dy)™ comes with a unique Buddy mode that promises a shared music experience that is tailored to suit each person’s preferences. Fans of voice command will be thrilled to know that with just one touch, the Jabra Earbud(dy)™ can connect to dual voice assistant.

T-Mobile Phone BoothE

T-Mobile USA and their CEO John Legere never disappoints. They always come up with something interesting. Here is a video of the prank

youtube

From MacRumours:

T-Mobile is again fighting one of the so-called pain points of the wireless industry with the launch of the Phone BoothE, a completely sound-proof and high-tech phone booth that lets T-Mobile customers escape from noisy areas to make their phone calls. Inside the Phone BoothE you can charge your devices, connect to a smart screen called "Magenta Pages" to mirror your smartphone display, and adjust the lighting to take great selfies.

In regards to the name, T-Mobile is taking a shot at AT&T's misleading 5GE label: "The Phone BoothE is an evolution towards the new world of mobility. Like many in the tech and wireless industry today, we decided that by adding an "E" to the name, you would know it's a real technology evolution."

Although this is an April Fools' Day joke, T-Mobile has actually built the Phone BoothE and deployed them in select locations around New York City, Seattle, and Washington, DC, where anyone will be able to use them. The company on Monday also revealed the T-Mobile Phone BoothE Mobile EditionE, which is more in line with a straightforward April Fools' Day hoax, as it's "literally a magenta cardboard box with a hole in it."

While the actual site disappeared after April 1, the archived version can be seen here.

X-Ray vision Nokia 9 PureView

UPDATE: Getting ready for go-live! pic.twitter.com/ijsAXz8QhG

— Juho Sarvikas (@sarvikas) April 1, 2019

The Nokia 9 PureView has plenty of cameras on its back, but did you know that the black sensor isn’t a 3D ToF camera but rather an X-Ray sensor? Can be unlocked with the new Nokia X-Ray app in Play Store

"Digi-U" from Ericsson Digital

We announce a new innovation from our @EricssonDigital team - a Digi-ize yourself app called: "Digi-U". This app is available for download to your smart phone and within 10 minutes you will have transformed yourself into a mini-me hologram.

For more: #HappyAprilFoolsDay :-) pic.twitter.com/iCDiU1lHhj

— Ericsson Digital (@EricssonDigital) April 1, 2019

Parallel Wireless Adds AMPS (1G) Capabilities to Their Unified ALL G Architecture

From the press release:

Worlds First Fully Virtualized AMPS (vAMPS) to enable Modernization and Cost Savings

Parallel Wireless vAMPS is compatible with: Total Access Communications Systems (TACS) in the U.K.; Nordic Mobile Telephone (NMT) System in Scandinavia; C450 in Germany; and NTT System in Japan, among others, and will allow global operators to modernize their 1G infrastructure. The 1G vAMPS solution is also software upgradable to vD-AMPS, for operators who wish to follow that path.

Truphone foldable SIM (F-SIM) for Foldable Smartphones

From Truphone website:

F-SIM – the foldable SIM – designed especially for the new foldable smartphones and tablets demonstrated at this February’s MWC Barcelona, including Huawei’s Mate X and Samsung’s Galaxy Fold.

Widely tipped as the next generation in SIM technology, the foldable SIM works on minute hinges that allow it to fold smaller than any previous SIM form factor. Made specifically for foldable phones and other devices, Truphone’s latest innovation fulfils on its broader brand promise to engineer better connections between things, people and business—anywhere in the world.

The F-SIM comes in ‘steel grey’ and, for only £5 more, ‘hot pink’. Pricing structures vary depending on data, storage, roaming charges and device model.

Google Screen Cleaner in the Files app

youtube

Mother of All USB-C Hubs for Apple Macbook - HyperDrive Ultimate Ultimate Hub

The Mother of All USB-C Hubs for Apple Macbook - HyperDrive Ultimate Hub with built-in battery, speaker, 3.5" floppy disk drive, parallel, serial, PS/2, AT ports & 40 other ports from @Hyper - https://t.co/KpbZflRDcY #AprilFoolsDay #AprilFools2019 #AprilFools pic.twitter.com/xLIGXLcr8G

— 3G4G (@3g4gUK) April 2, 2019

Other funny April Fools jokes:

Captain Marvel Universal Pager

Polite Car Horn from Honda Canada

Duolingo Push

Shutterstock Announces Plans to Build World’s Largest Brick-and-Mortar Library

Parody Apple Ad: "The Sound Gardener"

Audible for Fish

Logitech Hamsters

Nissin/HyperX Limited Edition Cup Noodle Headphones

Roku Press Paws Remote for Pets

OnePlus Warp Car - Los Angeles to Las Vegas on a single 20 minute charge

Google Tulip: Decoding the language of flowers

Introducing Waymo Pet - a self-driving service for pets

Nvidia R.O.N.: The world's first AI powered virtual gaming assistant.

One of the funniest jokes is Qualcomm's HandSolo that was released back in 1998. You may enjoy watching here.

Related posts:

Some interesting April Fools' Day 2018 Technology Jokes

Some interesting April Fools' Day 2017 Technology Jokes

Some interesting April Fools' Day 2016 Technology Jokes

Some interesting April Fools' Day 2015 Technology Jokes

Some interesting April Fools' Day 2014 Technology Jokes

from My Updates http://blog.3g4g.co.uk/2019/04/some-interesting-april-fools-day-2019.html

0 notes

Photo

New Post has been published on http://uplust.pw/2018/01/10/americas-test-kitchen-season-16-trailer/

America's Test Kitchen Season 16 Trailer

Content is still king. With Dalian Wanda Group’s $3.5 billion acquisition of Legendary Entertainment in January, this year’s media and entertainment M&A activity kicked off with a bang that hasn’t slowed down.

Comcast’s $3.8 billion acquisition of DreamWorks Animation just three months later continued the trend of content consolidation and IP aggregation. Both transactions have varying motivations, but the common denominator is access to franchises and content that can be leveraged across the parent companies’ various business units.

Content and digital transformation strategies have driven M&A activity so far in 2016, with no signs of slowing down — and thus providing clues about where we’ll see activity during the rest of the year.

One major trend that continues is Chinese investment flowing into the United States. Almost 50 percent of all U.S.-targeted M&A transactions from foreign investors came from China in Q1, and media and entertainment is a significant driver of that figure. In addition to acquisitions, there were a number of investments in U.S. film studios, including Film Carnival’s $500 million investment in Dick Cook Studios and Perfect World Pictures’ $500 million investment in Universal Pictures’ upcoming film slate.

A sample image

China’s continued interest in gaining insight into how Hollywood works is paying off for both sides of these deals. This insight will continue to help them ramp up their own production capabilities and speed up their ability to compete with the current global content creators. As a result, Chinese investment and M&A in U.S. media and entertainment should continue throughout 2016.

Wanda’s massive Legendary transaction allows it to vertically integrate content production with its exhibition business. Its announced acquisition of Carmike Cinemas in March for $1.1 billion added more theatres to its current count, which already includes other global exhibitors. This news came days after Wanda announced plans for a $3.3 billion theme park outside Paris. When viewed as a whole, this ecosystem of content and distribution outlets positions Wanda as a global media and entertainment leader for the foreseeable future.

In China, Wanda also holds a trump card over the other major studios in that it is a Chinese-owned/operated business, allowing it to navigate and potentially circumnavigate the Chinese theatrical quota system. Wanda’s ability to leverage its insider position with future Legendary productions, as well as its own forthcoming Wanda Studios at Qingdao, should give Wanda a significant market share in the theatrical film industry going forward.

Comcast’s acquisition of DreamWorks Animation gives it a wealth of content that it can use across its numerous lines of business, including its cable subscription service (Xfinity), theme parks (Universal Parks and Resorts), cable networks (USA, Syfy, Sprout), digital platforms (Watchable, Seeso) and production companies (Universal Pictures, Illumination Entertainment).

As the digital ecosystem expands, traditional studios are seeing an opportunity to diversify their tech and content strategies.

The potential overlap in animation capabilities with Illumination Entertainment is complicated, but could help Universal compete against Disney’s formidable one-two punch of Pixar and Walt Disney Animation Studios (if managed correctly). Comcast and NBCU also now have access to AwesomenessTV’s target demographic, production capabilities and original IP. The key to this transaction will be the extent to which they successfully integrate their content cross-platform.

Content strategy factored heavily in Warner Bros.’ move to acquire Korean Drama SVOD service DramaFever for an undisclosed sum, which will help the studio broaden its digital presence. Korean dramas are big business around the world, and WB has made a bet on proven content to widen its market reach. FuboTV, a soccer-focused SVOD service, raised $15 million led by 21st Century Fox, and Turner led a $15 million round in Mashable. As the digital ecosystem expands, traditional studios are seeing an opportunity to diversify their tech and content strategies.

Virtual reality/augmented reality (VR/AR) investment has ramped up in “the year of VR,” taking in $1.1 billion through February alone. Most of that investment was Magic Leap’s Series C round of funding at almost $800 million, but other companies involved included MindMaze with a $100 million round and Wevr with a $25 million round. While consumer products are still in the early phases, the overall excitement and wide-ranging applications for VR and AR are driving investment for those who want to get involved early.

Just an image for demo pủpose

Following Baobab Studios’ $6 million round in December, Penrose Studios raised $8.5 million in March, highlighting a competitive race to become the go-to VR content creator for immersive animated content. Comcast Ventures recently led a $6.8 million investment in Felix & Paul Studios, producers of cinematic VR experiences. Investors see this industry as a tremendous growth opportunity, with projected industry potential revenue of $120 billion by 2020, according to Digi-Capital. It doesn’t appear that investment and M&A will slow down anytime soon.

Live streaming has had activity as well, with IBM’s purchase of UStream for a reported $130 million being the biggest transaction of 2016 so far. Twitter made a strategic decision to purchase the live-streaming digital rights for 10 Thursday Night Football games this year. The $10 million price tag was especially low, considering Yahoo paid a reported $15-$20 million for the rights to live-stream one game last year. This gives Twitter a way to flaunt its Periscope functionality, potentially acquire users, increase engagement and recoup some of its investment with a limited amount of ad inventory that it will retain.

The NFL gets to broaden its distribution, experiment with alternative revenue streams, target a younger demographic and, ultimately, create more competition for the NFL’s overall rights when they expire in 2022. It is very possible that the future of NFL broadcasts may lie with a digital-first platform like Netflix, Amazon, Facebook, Google or Twitter, each of whom has deep enough pockets to bid for the opportunity to capture the most valuable must-see live content in the United States. Expect the other professional sports leagues to watch this development closely.

The rest of 2016 should continue to see plenty of activity across the media and entertainment space as companies brace for the future of mobile and digital consumption trends.

Based on activity in 2016 thus far, it’s clear we haven’t seen the end of key transactions. Paramount Pictures is looking for a strategic investor to build out its international and digital capabilities, which would provide key content and IP access to the investor (although this process has become very muddled recently). Yahoo is fielding multibillion-dollar offers for its core business, and Anonymous Content, creators of Oscar darlings Spotlight and The Revenant, as well as TV hits True Detective and Mr. Robot, is reportedly looking for a minority investor.

Another area that could see more investment is the e-sports industry. It is expected to be a $1.1 billion industry by 2019, and traditional sports insiders are paying attention. Former Los Angeles Lakers basketball player Rick Fox bought his own e-sports team for a reported $1 million in December, while former and current athletes Shaquille O’Neal, Alex Rodriguez and Jimmy Rollins have recently invested an undisclosed sum in e-sports team NRG. FaceIt, an online e-sports platform, raised $15 million in January. Brands and advertisers are beginning to spend money in e-sports as they take advantage of the massive viewership opportunities for targeted demographics.

The rest of 2016 should continue to see plenty of activity across the media and entertainment space as companies brace for the future of mobile and digital consumption trends. Consolidation of content and the need for diversification in the digital environment will fuel interest from traditional players like telcos and major studios. Investment from China does not appear to be slowing anytime soon, so expect those eye-popping headlines to continue throughout 2016 as it plays the long game.

VR will begin to consolidate around content and tech, allowing leaders in both areas to emerge by the end of the year. As e-sports continues to gain traction via mainstream coverage and traditional advertising opportunities, it won’t be long before we see e-sports live events vying for the same eyeballs as the current pro sports leagues and attracting additional investment dollars along with them.

0 notes

Photo

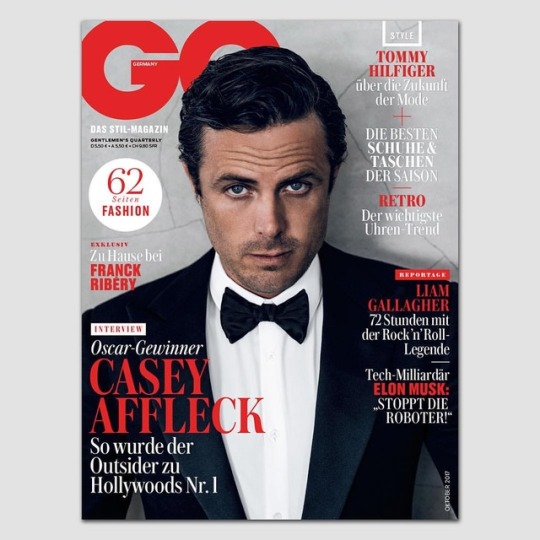

Our new cover story with Casey Affleck for @GQ_germany. - Styling: @chanti__chacha. Groomer: @BarbaraGuillaume. Photo Asst.: Brad Nelson. Digi Tech: @Mrcs.rx. Producer: @JeanJarvis. Production Asst.: Anna Alexander. Stylist Asst.: @ZoyaSkya. Casting: @AnissaPayne. Editor: @UlfPape. - #CaseyAffleck #GQ #GQGermany #LosAngeles #StudioWunsch #RobertWunsch #CoverStory #Leica (at Los Angeles, California)

0 notes

Photo

Getting certified to be my own digi tech or maybe yours? #phaseone #captureonepro #digitech #photography #education #technology 📸📷 (at Digital Transitions - Los Angeles HQ)

0 notes

Photo

New Post has been published on http://uplust.pw/2018/01/10/methode-technology-hall-intro/

Methode Technology Hall Intro

Content is still king. With Dalian Wanda Group’s $3.5 billion acquisition of Legendary Entertainment in January, this year’s media and entertainment M&A activity kicked off with a bang that hasn’t slowed down.

Comcast’s $3.8 billion acquisition of DreamWorks Animation just three months later continued the trend of content consolidation and IP aggregation. Both transactions have varying motivations, but the common denominator is access to franchises and content that can be leveraged across the parent companies’ various business units.

Content and digital transformation strategies have driven M&A activity so far in 2016, with no signs of slowing down — and thus providing clues about where we’ll see activity during the rest of the year.

One major trend that continues is Chinese investment flowing into the United States. Almost 50 percent of all U.S.-targeted M&A transactions from foreign investors came from China in Q1, and media and entertainment is a significant driver of that figure. In addition to acquisitions, there were a number of investments in U.S. film studios, including Film Carnival’s $500 million investment in Dick Cook Studios and Perfect World Pictures’ $500 million investment in Universal Pictures’ upcoming film slate.

A sample image

China’s continued interest in gaining insight into how Hollywood works is paying off for both sides of these deals. This insight will continue to help them ramp up their own production capabilities and speed up their ability to compete with the current global content creators. As a result, Chinese investment and M&A in U.S. media and entertainment should continue throughout 2016.

Wanda’s massive Legendary transaction allows it to vertically integrate content production with its exhibition business. Its announced acquisition of Carmike Cinemas in March for $1.1 billion added more theatres to its current count, which already includes other global exhibitors. This news came days after Wanda announced plans for a $3.3 billion theme park outside Paris. When viewed as a whole, this ecosystem of content and distribution outlets positions Wanda as a global media and entertainment leader for the foreseeable future.

In China, Wanda also holds a trump card over the other major studios in that it is a Chinese-owned/operated business, allowing it to navigate and potentially circumnavigate the Chinese theatrical quota system. Wanda’s ability to leverage its insider position with future Legendary productions, as well as its own forthcoming Wanda Studios at Qingdao, should give Wanda a significant market share in the theatrical film industry going forward.

Comcast’s acquisition of DreamWorks Animation gives it a wealth of content that it can use across its numerous lines of business, including its cable subscription service (Xfinity), theme parks (Universal Parks and Resorts), cable networks (USA, Syfy, Sprout), digital platforms (Watchable, Seeso) and production companies (Universal Pictures, Illumination Entertainment).

As the digital ecosystem expands, traditional studios are seeing an opportunity to diversify their tech and content strategies.

The potential overlap in animation capabilities with Illumination Entertainment is complicated, but could help Universal compete against Disney’s formidable one-two punch of Pixar and Walt Disney Animation Studios (if managed correctly). Comcast and NBCU also now have access to AwesomenessTV’s target demographic, production capabilities and original IP. The key to this transaction will be the extent to which they successfully integrate their content cross-platform.

Content strategy factored heavily in Warner Bros.’ move to acquire Korean Drama SVOD service DramaFever for an undisclosed sum, which will help the studio broaden its digital presence. Korean dramas are big business around the world, and WB has made a bet on proven content to widen its market reach. FuboTV, a soccer-focused SVOD service, raised $15 million led by 21st Century Fox, and Turner led a $15 million round in Mashable. As the digital ecosystem expands, traditional studios are seeing an opportunity to diversify their tech and content strategies.

Virtual reality/augmented reality (VR/AR) investment has ramped up in “the year of VR,” taking in $1.1 billion through February alone. Most of that investment was Magic Leap’s Series C round of funding at almost $800 million, but other companies involved included MindMaze with a $100 million round and Wevr with a $25 million round. While consumer products are still in the early phases, the overall excitement and wide-ranging applications for VR and AR are driving investment for those who want to get involved early.

Just an image for demo pủpose

Following Baobab Studios’ $6 million round in December, Penrose Studios raised $8.5 million in March, highlighting a competitive race to become the go-to VR content creator for immersive animated content. Comcast Ventures recently led a $6.8 million investment in Felix & Paul Studios, producers of cinematic VR experiences. Investors see this industry as a tremendous growth opportunity, with projected industry potential revenue of $120 billion by 2020, according to Digi-Capital. It doesn’t appear that investment and M&A will slow down anytime soon.

Live streaming has had activity as well, with IBM’s purchase of UStream for a reported $130 million being the biggest transaction of 2016 so far. Twitter made a strategic decision to purchase the live-streaming digital rights for 10 Thursday Night Football games this year. The $10 million price tag was especially low, considering Yahoo paid a reported $15-$20 million for the rights to live-stream one game last year. This gives Twitter a way to flaunt its Periscope functionality, potentially acquire users, increase engagement and recoup some of its investment with a limited amount of ad inventory that it will retain.

The NFL gets to broaden its distribution, experiment with alternative revenue streams, target a younger demographic and, ultimately, create more competition for the NFL’s overall rights when they expire in 2022. It is very possible that the future of NFL broadcasts may lie with a digital-first platform like Netflix, Amazon, Facebook, Google or Twitter, each of whom has deep enough pockets to bid for the opportunity to capture the most valuable must-see live content in the United States. Expect the other professional sports leagues to watch this development closely.

The rest of 2016 should continue to see plenty of activity across the media and entertainment space as companies brace for the future of mobile and digital consumption trends.

Based on activity in 2016 thus far, it’s clear we haven’t seen the end of key transactions. Paramount Pictures is looking for a strategic investor to build out its international and digital capabilities, which would provide key content and IP access to the investor (although this process has become very muddled recently). Yahoo is fielding multibillion-dollar offers for its core business, and Anonymous Content, creators of Oscar darlings Spotlight and The Revenant, as well as TV hits True Detective and Mr. Robot, is reportedly looking for a minority investor.

Another area that could see more investment is the e-sports industry. It is expected to be a $1.1 billion industry by 2019, and traditional sports insiders are paying attention. Former Los Angeles Lakers basketball player Rick Fox bought his own e-sports team for a reported $1 million in December, while former and current athletes Shaquille O’Neal, Alex Rodriguez and Jimmy Rollins have recently invested an undisclosed sum in e-sports team NRG. FaceIt, an online e-sports platform, raised $15 million in January. Brands and advertisers are beginning to spend money in e-sports as they take advantage of the massive viewership opportunities for targeted demographics.

The rest of 2016 should continue to see plenty of activity across the media and entertainment space as companies brace for the future of mobile and digital consumption trends. Consolidation of content and the need for diversification in the digital environment will fuel interest from traditional players like telcos and major studios. Investment from China does not appear to be slowing anytime soon, so expect those eye-popping headlines to continue throughout 2016 as it plays the long game.

VR will begin to consolidate around content and tech, allowing leaders in both areas to emerge by the end of the year. As e-sports continues to gain traction via mainstream coverage and traditional advertising opportunities, it won’t be long before we see e-sports live events vying for the same eyeballs as the current pro sports leagues and attracting additional investment dollars along with them.

0 notes

Photo

New Post has been published on http://uplust.pw/2018/01/10/a-guide-to-american-football/

A Guide To American Football

Content is still king. With Dalian Wanda Group’s $3.5 billion acquisition of Legendary Entertainment in January, this year’s media and entertainment M&A activity kicked off with a bang that hasn’t slowed down.

Comcast’s $3.8 billion acquisition of DreamWorks Animation just three months later continued the trend of content consolidation and IP aggregation. Both transactions have varying motivations, but the common denominator is access to franchises and content that can be leveraged across the parent companies’ various business units.

Content and digital transformation strategies have driven M&A activity so far in 2016, with no signs of slowing down — and thus providing clues about where we’ll see activity during the rest of the year.

One major trend that continues is Chinese investment flowing into the United States. Almost 50 percent of all U.S.-targeted M&A transactions from foreign investors came from China in Q1, and media and entertainment is a significant driver of that figure. In addition to acquisitions, there were a number of investments in U.S. film studios, including Film Carnival’s $500 million investment in Dick Cook Studios and Perfect World Pictures’ $500 million investment in Universal Pictures’ upcoming film slate.

A sample image

China’s continued interest in gaining insight into how Hollywood works is paying off for both sides of these deals. This insight will continue to help them ramp up their own production capabilities and speed up their ability to compete with the current global content creators. As a result, Chinese investment and M&A in U.S. media and entertainment should continue throughout 2016.

Wanda’s massive Legendary transaction allows it to vertically integrate content production with its exhibition business. Its announced acquisition of Carmike Cinemas in March for $1.1 billion added more theatres to its current count, which already includes other global exhibitors. This news came days after Wanda announced plans for a $3.3 billion theme park outside Paris. When viewed as a whole, this ecosystem of content and distribution outlets positions Wanda as a global media and entertainment leader for the foreseeable future.

In China, Wanda also holds a trump card over the other major studios in that it is a Chinese-owned/operated business, allowing it to navigate and potentially circumnavigate the Chinese theatrical quota system. Wanda’s ability to leverage its insider position with future Legendary productions, as well as its own forthcoming Wanda Studios at Qingdao, should give Wanda a significant market share in the theatrical film industry going forward.

Comcast’s acquisition of DreamWorks Animation gives it a wealth of content that it can use across its numerous lines of business, including its cable subscription service (Xfinity), theme parks (Universal Parks and Resorts), cable networks (USA, Syfy, Sprout), digital platforms (Watchable, Seeso) and production companies (Universal Pictures, Illumination Entertainment).

As the digital ecosystem expands, traditional studios are seeing an opportunity to diversify their tech and content strategies.

The potential overlap in animation capabilities with Illumination Entertainment is complicated, but could help Universal compete against Disney’s formidable one-two punch of Pixar and Walt Disney Animation Studios (if managed correctly). Comcast and NBCU also now have access to AwesomenessTV’s target demographic, production capabilities and original IP. The key to this transaction will be the extent to which they successfully integrate their content cross-platform.

Content strategy factored heavily in Warner Bros.’ move to acquire Korean Drama SVOD service DramaFever for an undisclosed sum, which will help the studio broaden its digital presence. Korean dramas are big business around the world, and WB has made a bet on proven content to widen its market reach. FuboTV, a soccer-focused SVOD service, raised $15 million led by 21st Century Fox, and Turner led a $15 million round in Mashable. As the digital ecosystem expands, traditional studios are seeing an opportunity to diversify their tech and content strategies.

Virtual reality/augmented reality (VR/AR) investment has ramped up in “the year of VR,” taking in $1.1 billion through February alone. Most of that investment was Magic Leap’s Series C round of funding at almost $800 million, but other companies involved included MindMaze with a $100 million round and Wevr with a $25 million round. While consumer products are still in the early phases, the overall excitement and wide-ranging applications for VR and AR are driving investment for those who want to get involved early.

Just an image for demo pủpose

Following Baobab Studios’ $6 million round in December, Penrose Studios raised $8.5 million in March, highlighting a competitive race to become the go-to VR content creator for immersive animated content. Comcast Ventures recently led a $6.8 million investment in Felix & Paul Studios, producers of cinematic VR experiences. Investors see this industry as a tremendous growth opportunity, with projected industry potential revenue of $120 billion by 2020, according to Digi-Capital. It doesn’t appear that investment and M&A will slow down anytime soon.

Live streaming has had activity as well, with IBM’s purchase of UStream for a reported $130 million being the biggest transaction of 2016 so far. Twitter made a strategic decision to purchase the live-streaming digital rights for 10 Thursday Night Football games this year. The $10 million price tag was especially low, considering Yahoo paid a reported $15-$20 million for the rights to live-stream one game last year. This gives Twitter a way to flaunt its Periscope functionality, potentially acquire users, increase engagement and recoup some of its investment with a limited amount of ad inventory that it will retain.

The NFL gets to broaden its distribution, experiment with alternative revenue streams, target a younger demographic and, ultimately, create more competition for the NFL’s overall rights when they expire in 2022. It is very possible that the future of NFL broadcasts may lie with a digital-first platform like Netflix, Amazon, Facebook, Google or Twitter, each of whom has deep enough pockets to bid for the opportunity to capture the most valuable must-see live content in the United States. Expect the other professional sports leagues to watch this development closely.

The rest of 2016 should continue to see plenty of activity across the media and entertainment space as companies brace for the future of mobile and digital consumption trends.

Based on activity in 2016 thus far, it’s clear we haven’t seen the end of key transactions. Paramount Pictures is looking for a strategic investor to build out its international and digital capabilities, which would provide key content and IP access to the investor (although this process has become very muddled recently). Yahoo is fielding multibillion-dollar offers for its core business, and Anonymous Content, creators of Oscar darlings Spotlight and The Revenant, as well as TV hits True Detective and Mr. Robot, is reportedly looking for a minority investor.

Another area that could see more investment is the e-sports industry. It is expected to be a $1.1 billion industry by 2019, and traditional sports insiders are paying attention. Former Los Angeles Lakers basketball player Rick Fox bought his own e-sports team for a reported $1 million in December, while former and current athletes Shaquille O’Neal, Alex Rodriguez and Jimmy Rollins have recently invested an undisclosed sum in e-sports team NRG. FaceIt, an online e-sports platform, raised $15 million in January. Brands and advertisers are beginning to spend money in e-sports as they take advantage of the massive viewership opportunities for targeted demographics.

The rest of 2016 should continue to see plenty of activity across the media and entertainment space as companies brace for the future of mobile and digital consumption trends. Consolidation of content and the need for diversification in the digital environment will fuel interest from traditional players like telcos and major studios. Investment from China does not appear to be slowing anytime soon, so expect those eye-popping headlines to continue throughout 2016 as it plays the long game.

VR will begin to consolidate around content and tech, allowing leaders in both areas to emerge by the end of the year. As e-sports continues to gain traction via mainstream coverage and traditional advertising opportunities, it won’t be long before we see e-sports live events vying for the same eyeballs as the current pro sports leagues and attracting additional investment dollars along with them.

0 notes

Photo

New Post has been published on http://uplust.pw/2018/01/10/hd-jessie-j-ariana-grande-nicki-minaj-bang-bang-amas-2014/

Jessie J, Ariana Grande & Nicki Minaj - Bang Bang - AMA's 2014

Content is still king. With Dalian Wanda Group’s $3.5 billion acquisition of Legendary Entertainment in January, this year’s media and entertainment M&A activity kicked off with a bang that hasn’t slowed down.

Comcast’s $3.8 billion acquisition of DreamWorks Animation just three months later continued the trend of content consolidation and IP aggregation. Both transactions have varying motivations, but the common denominator is access to franchises and content that can be leveraged across the parent companies’ various business units.

Content and digital transformation strategies have driven M&A activity so far in 2016, with no signs of slowing down — and thus providing clues about where we’ll see activity during the rest of the year.

One major trend that continues is Chinese investment flowing into the United States. Almost 50 percent of all U.S.-targeted M&A transactions from foreign investors came from China in Q1, and media and entertainment is a significant driver of that figure. In addition to acquisitions, there were a number of investments in U.S. film studios, including Film Carnival’s $500 million investment in Dick Cook Studios and Perfect World Pictures’ $500 million investment in Universal Pictures’ upcoming film slate.

A sample image

China’s continued interest in gaining insight into how Hollywood works is paying off for both sides of these deals. This insight will continue to help them ramp up their own production capabilities and speed up their ability to compete with the current global content creators. As a result, Chinese investment and M&A in U.S. media and entertainment should continue throughout 2016.

Wanda’s massive Legendary transaction allows it to vertically integrate content production with its exhibition business. Its announced acquisition of Carmike Cinemas in March for $1.1 billion added more theatres to its current count, which already includes other global exhibitors. This news came days after Wanda announced plans for a $3.3 billion theme park outside Paris. When viewed as a whole, this ecosystem of content and distribution outlets positions Wanda as a global media and entertainment leader for the foreseeable future.

In China, Wanda also holds a trump card over the other major studios in that it is a Chinese-owned/operated business, allowing it to navigate and potentially circumnavigate the Chinese theatrical quota system. Wanda’s ability to leverage its insider position with future Legendary productions, as well as its own forthcoming Wanda Studios at Qingdao, should give Wanda a significant market share in the theatrical film industry going forward.

Comcast’s acquisition of DreamWorks Animation gives it a wealth of content that it can use across its numerous lines of business, including its cable subscription service (Xfinity), theme parks (Universal Parks and Resorts), cable networks (USA, Syfy, Sprout), digital platforms (Watchable, Seeso) and production companies (Universal Pictures, Illumination Entertainment).

As the digital ecosystem expands, traditional studios are seeing an opportunity to diversify their tech and content strategies.

The potential overlap in animation capabilities with Illumination Entertainment is complicated, but could help Universal compete against Disney’s formidable one-two punch of Pixar and Walt Disney Animation Studios (if managed correctly). Comcast and NBCU also now have access to AwesomenessTV’s target demographic, production capabilities and original IP. The key to this transaction will be the extent to which they successfully integrate their content cross-platform.

Content strategy factored heavily in Warner Bros.’ move to acquire Korean Drama SVOD service DramaFever for an undisclosed sum, which will help the studio broaden its digital presence. Korean dramas are big business around the world, and WB has made a bet on proven content to widen its market reach. FuboTV, a soccer-focused SVOD service, raised $15 million led by 21st Century Fox, and Turner led a $15 million round in Mashable. As the digital ecosystem expands, traditional studios are seeing an opportunity to diversify their tech and content strategies.

Virtual reality/augmented reality (VR/AR) investment has ramped up in “the year of VR,” taking in $1.1 billion through February alone. Most of that investment was Magic Leap’s Series C round of funding at almost $800 million, but other companies involved included MindMaze with a $100 million round and Wevr with a $25 million round. While consumer products are still in the early phases, the overall excitement and wide-ranging applications for VR and AR are driving investment for those who want to get involved early.

Just an image for demo pủpose

Following Baobab Studios’ $6 million round in December, Penrose Studios raised $8.5 million in March, highlighting a competitive race to become the go-to VR content creator for immersive animated content. Comcast Ventures recently led a $6.8 million investment in Felix & Paul Studios, producers of cinematic VR experiences. Investors see this industry as a tremendous growth opportunity, with projected industry potential revenue of $120 billion by 2020, according to Digi-Capital. It doesn’t appear that investment and M&A will slow down anytime soon.

Live streaming has had activity as well, with IBM’s purchase of UStream for a reported $130 million being the biggest transaction of 2016 so far. Twitter made a strategic decision to purchase the live-streaming digital rights for 10 Thursday Night Football games this year. The $10 million price tag was especially low, considering Yahoo paid a reported $15-$20 million for the rights to live-stream one game last year. This gives Twitter a way to flaunt its Periscope functionality, potentially acquire users, increase engagement and recoup some of its investment with a limited amount of ad inventory that it will retain.

The NFL gets to broaden its distribution, experiment with alternative revenue streams, target a younger demographic and, ultimately, create more competition for the NFL’s overall rights when they expire in 2022. It is very possible that the future of NFL broadcasts may lie with a digital-first platform like Netflix, Amazon, Facebook, Google or Twitter, each of whom has deep enough pockets to bid for the opportunity to capture the most valuable must-see live content in the United States. Expect the other professional sports leagues to watch this development closely.

The rest of 2016 should continue to see plenty of activity across the media and entertainment space as companies brace for the future of mobile and digital consumption trends.

Based on activity in 2016 thus far, it’s clear we haven’t seen the end of key transactions. Paramount Pictures is looking for a strategic investor to build out its international and digital capabilities, which would provide key content and IP access to the investor (although this process has become very muddled recently). Yahoo is fielding multibillion-dollar offers for its core business, and Anonymous Content, creators of Oscar darlings Spotlight and The Revenant, as well as TV hits True Detective and Mr. Robot, is reportedly looking for a minority investor.

Another area that could see more investment is the e-sports industry. It is expected to be a $1.1 billion industry by 2019, and traditional sports insiders are paying attention. Former Los Angeles Lakers basketball player Rick Fox bought his own e-sports team for a reported $1 million in December, while former and current athletes Shaquille O’Neal, Alex Rodriguez and Jimmy Rollins have recently invested an undisclosed sum in e-sports team NRG. FaceIt, an online e-sports platform, raised $15 million in January. Brands and advertisers are beginning to spend money in e-sports as they take advantage of the massive viewership opportunities for targeted demographics.

The rest of 2016 should continue to see plenty of activity across the media and entertainment space as companies brace for the future of mobile and digital consumption trends. Consolidation of content and the need for diversification in the digital environment will fuel interest from traditional players like telcos and major studios. Investment from China does not appear to be slowing anytime soon, so expect those eye-popping headlines to continue throughout 2016 as it plays the long game.

VR will begin to consolidate around content and tech, allowing leaders in both areas to emerge by the end of the year. As e-sports continues to gain traction via mainstream coverage and traditional advertising opportunities, it won’t be long before we see e-sports live events vying for the same eyeballs as the current pro sports leagues and attracting additional investment dollars along with them.

0 notes