#digital document services

Explore tagged Tumblr posts

Text

Legal Document Data Entry for Accuracy & Compliance

Document data entry in the legal sector is highly important to implement in order to attain organized datasets which are easy to access and protect crucial information. Checkout in detail about document data entry for legal firms.

#document digitization#document data entry services#data entry services#document management company#digital document services#document data entry#document data solutions#outsourcing data entry#data entry services provider#best data entry services

2 notes

·

View notes

Text

IETM for Beginners A Quick Guide to IETM Code and Pixels

IETM: Interactive Electronic Technical Manual

Training Aids to Defence Client

If you are a supplier of defence then along with the system/equipment you also need to provide Training Aids

(CBT) — Computer-Based Training

Charts and Bloups

Video Film

Training Work Modules

Manuals Hard Copies

IETM

Evolution of Documentation in Defence

Before — Hardcopies and PDFs in DVDs (Upto 2015)

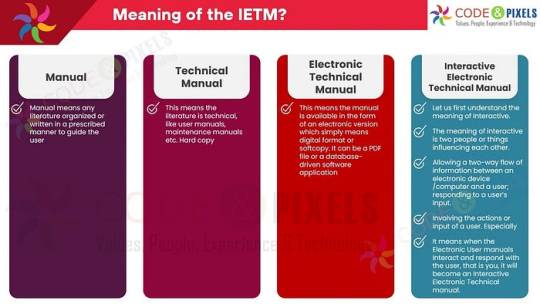

What is the meaning of the IETM?

Manual: Manual means any literature organized or written in a prescribed manner to guide the user.

TechnicalManual: This means the literature is technical, like user manuals, maintenance manuals etc. Hard copy

Electronic Technical Manual: This means the manual is available in the form of an electronic version which simply means digital format or softcopy. It can be a PDF file or a database-driven software application.

Interactive Electronic Technical Manual:

Let us first understand the meaning of Interactive. The meaning of interactive is two people or things influencing each other.

Allowing a two-way flow of information between an electronic device /computer and a user; responding to a user’s input.

Involving the actions or input of a user. Especially

It means when the Electronic User manuals Interact and respond with the user, that is you, it will become an Interactive Electronic Technical manual.

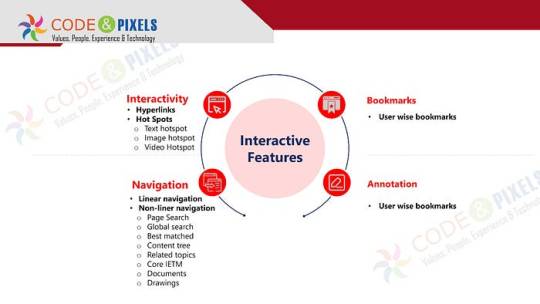

Interactive Features

Interactivity

Hyperlinks

Hot Spots

Text hotspot

Image hotspot

VideHotspot

Bookmarks

User wise bookmarks

Navigation

Linear navigation

Non-liner navigation

Page Search

Global search

Best matched

Content tree

Related topics

Core IETM

Documents

Drawings

Annotation

User wise bookmarks

The documents and pages are many hence, for easy and fast accessibility complete content is converted and stored as a database.

Whenever the user wants some information, IETM software produces the information in a fraction of a second.

Use or Purpose of the IETM?

The purpose of the Manual is to give information related to the equipment to the end user for quick reference.

All the technicality is written in detail so that when an issue arises, the user can refer to the manual, as every time OEM or technical person or subject matter expert might not be available on the spot to resolve the issue.

If the manual has 10 pages users can refer easily.

But any system used by the defence will have multiple manuals and thousands of page counts and many times a user has to cross-refer between manuals, intra-manual and inter-manual to resolve the issue.

Referring to 10- 15 hard-copy or even soft-copy books simultaneously will be difficult and time-consuming.

How to access the IETM ?

IETM is a web-based application like our bank software or any other web application. The graphic user interface will be provided to use IETM through which users can interact and get the desired data.

Like all other standard software, Unauthorized users cannot access the IETM. IETM is a Login - login-based application. Only users having valid Login credentials can access the software.

Based on the user log credentials data will be provided to the user.

IETM has 2 types of Users and one Administrator

Maintainer

Operator

If the operator logs in, the user gets all the content related to operator use, similarly if the maintainer logs in only maintenance-related content is visible for that user.

Ideally, all the content is available for both users, because the purpose of the IETM is to refer to the manual to fix the issue.

Administrators can create users who can see the user’s navigation and log-in history and interact with the users using user dashboards through Annotations.

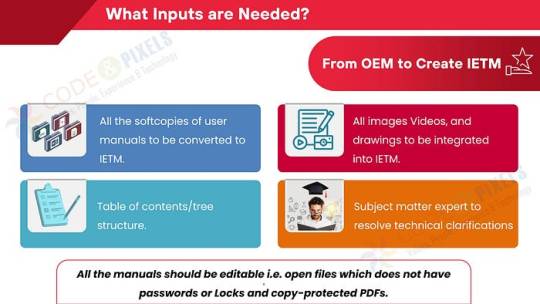

What Inputs are Needed? (From OEM to Create IETM)

All the softcopies of user manuals to be converted to IETM.

All images Videos, and drawings to be integrated into IETM.

Subject matter expert to resolve technical clarifications

Table of contents/tree structure.

Minimum Hardware Requirements?

NO High-end hardware or servers are required to run IETM.

However, if more concurrent users, then a good configuration server with good LAN connectivity must be ensured.

i3 with 8 GB RAM systems is the minimum configuration required for the server or for Node.

Deliverables

BASED DB (Manuals are covered in the Database)

IETM VIEWER Software

User Manual and Installation Manual

Standards — compliance

Costing of IETM: (Interactive Electronic Technical Manual)

Level of IETM, is it Level 3 or Level 4

Cost will be based on the number of pages that are to be converted

The vendor calculates the cost per page. And a fixed cost of IETM viewer software

If you want to create IETM by yourself self then you also need to buy IETM authoring software.

What are these Levels?

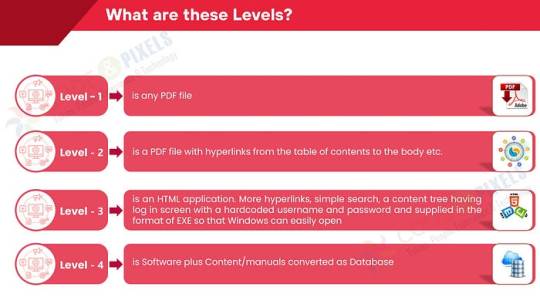

Level — 1 is any PDF file

Level — 2 is a PDF file with hyperlinks from the table of contents to the body etc.

Level — 3 is an HTML application. More hyperlinks, simple search, a content tree having log a screen with a hardcoded username and password and supplied in the format of EXE so that Windows can easily open

Level — 4 is Software plus Content/manuals converted as Database

Regarding Level — 5, rest assured, till 2028 it will be Level — 4 only. As of now, there is nothing practically called Level — 5. Few are calling virtual reality and Augmented reality and Artificial intelligence Level — 5.

Pulling data from many user inputs and analyzing and giving results are done in Level — 5. IETM software cannot pull the data from various real-time points as No OEM will give the real-time information to third-party software directly. Yes, if the information is available offline, then that information can be imported into IETM and can be used as a reference.

#ietm#software#technology#ietm developement#ietm code and pixels ietm hyderabad#ietm software#elearning#code and pixels#ietm level iv#codeandpixels#ietm level 4 software requirements#technical documentation#ietm document#ietm documentation#interactive electronic technical manual#Ietm Service Providers#Ietm Software Designers of India#Software Development Company#Elearning Solutions Company#E Learning Content Development Company#Online Education#Digital Education#Digital Content#Software Development Solutions#Elearning#Ietm Developers#Econtent Development#Elearning Solutions Providers#Econtent Developers#Econtent

3 notes

·

View notes

Text

LifeStepX helps you with Business and Side Hustle Support

Have a big idea? LifeStepX will help you launch it; not only that, it also helps you with Business and Side Hustle Support. From brainstorming and planning to execution, we offer expert guidance on building your business or side hustle, empowering you to create new income streams and live life on your terms.

#Business and side hustle support#Career advancement coaching#Digital skills training online#Vocational training online#Financial planning for beginners#Relocation assistance services#Visa and documentation help#Entrepreneurial support programs#Skill enhancement courses#Career readiness programs#Personal development courses#Low-cost learning platforms#Expert career advice online#Custom educational roadmap#Accessible career coaching

0 notes

Text

Document Scanning Services Pune

PDMPL offers reliable and secure Document Scanning Services in Pune, helping businesses go paperless with ease. Our high-speed scanners and expert team ensure accurate digital conversion of documents, improving accessibility and storage. Whether for legal, medical, or corporate records, we deliver quality scanning solutions tailored to your needs. Trust PDMPL for cost-effective, eco-friendly, and efficient document digitization services that streamline your operations and support your digital transformation goals in Pune.

#Document Scanning Services Pune#document digitizing service#document scanning services delhi#scanning service

0 notes

Text

0 notes

Text

Mastering Compliance: Efile and Erecord Renewal of Judgment Safely Across California Courts

In today’s digital age, legal compliance doesn't just mean following the rules—it means adapting to new technologies that ensure accuracy, efficiency, and speed. For law firms, collections agencies, and individual creditors in California, one of the most crucial tasks is ensuring timely and compliant efile and erecord renewal of judgment. With Countrywide Process, professionals can now navigate this process with unmatched reliability and security across all California courts.

The Importance of Renewal of Judgment in California:

In California, a money judgment is enforceable for 10 years. If not renewed before this period lapses, the judgment becomes unenforceable—meaning the creditor loses the legal right to collect. That’s where the efile and erecord renewal of judgment comes into play. It ensures creditors retain their ability to collect debts legally and timely, without going through the courts again for a new ruling.

What Does It Mean to Efile and Erecord a Renewal of Judgment?

Traditionally, renewing a judgment required paper filings, multiple court visits, and delays due to processing. Now, efile and erecord technology have transformed this routine legal task into a fast and streamlined digital process.

E-Filing allows for the electronic submission of the Application for Renewal of Judgment to the respective California Superior Court.

E-Recording ensures the updated judgment is recorded with the appropriate county recorder’s office, maintaining its lien status and legal validity.

With both combined, the process becomes seamless, helping legal professionals meet deadlines and compliance requirements without the usual bottlenecks.

Why Compliance Matters?

Court compliance isn’t just about filing on time—it’s about filing correctly, with accurate documentation, through approved systems. Mistakes in filing can lead to costly delays, rejected applications, or worse, missed renewal windows.

By using a trusted partner like Countrywide Process, you eliminate the guesswork. Their platform ensures your e-file and e-record renewal of judgment submissions meet all procedural requirements across multiple jurisdictions in California.

Countrywide Process: Your Partner in Digital Judgment Renewal

Countrywide Process is California’s leading provider of digital legal support services, offering specialized assistance in e-file and e-record renewal of judgments. Here’s what sets them apart:

Statewide Coverage: They provide services across all California counties.

Compliance-Focused: Their processes align with current court mandates and filing systems.

Fast Turnaround: Same-day or next-day filings help avoid costly delays.

Secure Platforms: All filings are submitted through encrypted, secure portals.

Expert Support: Their legal filing professionals help avoid common errors.

The Step-by-Step Process:

If you're new to this process, here's a quick overview of how Countrywide Process helps you manage the e-file and e-record renewal of judgment:

Document Collection: Submit your judgment details and any supporting documents.

E-Filing: Countrywide files your renewal application with the relevant Superior Court.

E-Recording: Upon court approval, the renewal is electronically recorded with the county recorder’s office.

Confirmation: You receive proof of submission and confirmation of acceptance.

Who Needs This Service?

Law Firms managing high volumes of debt recovery cases.

Collection Agencies ensure the timely renewal of enforceable debts.

Individual Creditors are protecting their right to collect long-standing debts.

Staying Ahead of Deadlines:

California law requires the renewal of a judgment to occur before the initial 10-year enforcement period expires. Failure to act can permanently forfeit your collection rights. With Countrywide Process, you get timely reminders and proactive service to ensure you never miss a critical deadline.

Final Thoughts:

Compliance isn’t optional—especially when it comes to legal judgments. With California courts embracing digital transformation, legal professionals must follow suit. By leveraging efile and erecord renewal of judgment services through Countrywide Process, you're not just staying compliant—you're staying ahead.

#efile and erecord renewal of judgment#judgment renewal California#Countrywide Process#California courts efiling#e-recording services#judgment enforcement#renewal of judgment services#digital legal services#court compliance California#legal document filing

0 notes

Text

Call Now 9650825786 And Visit Krishna Documentation vardhman times plaza pitampura Rani bagh delhi

Driving License Aadhar Card Pan Card Passport Voter Id Card Birth Certificate Death Certificate Income Certificate E-Stamp Services Available Government-authorized e-stamping Fast & secure document stamping Property agreements, affidavits, and more Digital & printed copies available Instant photo capture & print New PAN card application PAN correction/update service High-quality printouts (35mm x 45mm) Fast digital processing & tracking

Call Now 9650825786 And Visit Krishna Documentation vardhman times plaza pitampura Rani bagh delhi

#Driving License#Aadhar Card#Pan Card#Passport#Voter Id Card#Birth Certificate#Death Certificate#Income Certificate#E-Stamp Services Available#Government-authorized e-stamping#Fast & secure document stamping#Property agreements#affidavits#and more#Digital & printed copies available#Instant photo capture & print#New PAN card application#PAN correction/update service#High-quality printouts (35mm x 45mm)#Fast digital processing & tracking

0 notes

Text

Everything You Need to Know About Getting a Personal Loan in India

In today’s fast-paced world, financial needs can arise unexpectedly. Whether it’s for a medical emergency, home renovation, debt consolidation, or a much-needed vacation, a personal loan can be your go-to solution. With the advent of technology, applying for an online personal loan has become faster, easier, and more accessible than ever.

In this article, we’ll break down what a personal loan is, how you can get an instant personal loan, and tips to increase your chances of approval—all while making sure you borrow smartly and responsibly.

What is a Personal Loan?

A personal loan is an unsecured loan offered by banks, NBFCs, and digital lenders that does not require any collateral. It’s a flexible form of credit that you can use for various purposes—be it personal, professional, or even educational.

Unlike home or car loans, a personal loan doesn’t tie you to a specific purpose. Lenders usually offer loan amounts ranging from ₹10,000 to ₹25 lakhs, with repayment tenures from 1 to 5 years, depending on your eligibility.

Why Choose an Online Personal Loan?

Applying for an online personal loan is gaining popularity due to the convenience and speed it offers. Here’s why more Indians are going digital for their borrowing needs:

Faster Approvals: Many digital platforms offer instant personal loan approvals, sometimes within minutes.

Paperless Process: No need to visit a branch or submit physical documents. Upload everything digitally.

Real-time Tracking: Monitor your application status and EMIs through online dashboards or apps.

Better Comparisons: Evaluate interest rates and loan terms across multiple lenders easily.

Gone are the days of waiting in long bank queues. With an online personal loan, you can apply and get the funds from the comfort of your home or office.

What is an Instant Personal Loan?

An instant personal loan is exactly what it sounds like—a loan that gets approved and disbursed quickly, often within a few hours. These loans are ideal for urgent requirements such as medical bills, last-minute travel, or emergency repairs.

Lenders use technology and AI-based credit assessment tools to offer instant personal loans based on minimal documentation and pre-approved offers. Salaried individuals with a stable income often qualify for these loans effortlessly.

Features of a Personal Loan You Should Know

Before applying, it’s essential to understand the key features of a personal loan:

No Collateral Required: You don’t have to pledge assets like property or gold.

Fixed Tenure & EMI: Repayment terms are clearly defined, helping with budget planning.

Flexible Usage: Funds can be used for anything, from wedding expenses to business growth.

Quick Disbursal: Particularly true for online personal loans, where disbursal can happen in under 24 hours.

Customizable Amounts: Borrow based on your specific need—no more, no less.

Eligibility Criteria for Personal Loans

While eligibility can differ across lenders, most follow these standard criteria:

Age: Between 21 to 60 years

Income: Minimum ₹15,000 – ₹25,000 monthly income

Employment: Salaried or self-employed with regular income

Credit Score: 700 or above is considered ideal

Meeting these requirements increases your chances of securing a personal loan, especially an instant personal loan where lenders rely on quick eligibility checks.

Documents Required for Online Personal Loan Application

One of the biggest perks of applying for an online personal loan is the minimal paperwork involved. Most platforms require:

PAN Card

Aadhaar Card

Salary slips (last 3 months)

Bank statements (last 6 months)

Address proof

With digitized verification, uploading these documents online speeds up the process for an instant personal loan.

How to Apply for an Online Personal Loan

The application process for an online personal loan is straightforward:

Visit a Trusted Lending Platform: Use platforms like Fincrif to compare and select the best offers.

Fill Out Basic Information: Name, employment type, income, loan amount, etc.

Upload Documents Digitally: Scan and upload the required documents.

Instant Approval Check: Many platforms offer a pre-approval in real-time.

Loan Disbursal: Upon verification, the loan amount is credited directly to your bank account.

By opting for an online personal loan, you save time, effort, and the hassles of traditional loan applications.

Benefits of Choosing a Personal Loan

Still unsure if a personal loan is the right choice? Here are some undeniable advantages:

Multi-purpose Utility: Fund any expense without restrictions.

Boosts Credit Score: Timely repayments improve your creditworthiness.

Pre-approved Offers: If you're an existing customer, many banks offer instant personal loan options.

Flexible Tenure: Choose repayment terms that suit your financial situation.

No Collateral Stress: No asset risk involved as these are unsecured loans.

Tips to Get Your Personal Loan Approved Instantly

Want to improve your chances of getting an instant personal loan? Keep these tips in mind:

Maintain a High Credit Score: Aim for a score above 700.

Avoid Multiple Applications: Too many inquiries can lower your score.

Choose a Lender That Fits Your Profile: Some lenders specialize in loans for self-employed or low-income earners.

Have a Stable Income Source: Lenders prefer applicants with consistent earnings.

Use Pre-approved Offers: If available, pre-approved offers almost guarantee quick approvals.

Common Mistakes to Avoid

When applying for a personal loan, watch out for these common pitfalls:

Not Checking the Fine Print: Hidden fees or high processing charges can surprise you.

Over-borrowing: Don’t take more than you need. Remember, it’s a loan, not a gift.

Ignoring the EMI Burden: Always calculate your EMI in advance using an online EMI calculator.

Defaulting or Missing Payments: It affects your credit score and incurs penalties.

Falling for Fraudulent Lenders: Always apply through verified platforms like Fincrif for a secure online personal loan experience.

Conclusion

Whether you're planning a dream vacation, facing a medical emergency, or simply consolidating debt, a personal loan can be a reliable financial partner. Thanks to digital innovation, getting an online personal loan or even an instant personal loan is just a few clicks away.

However, remember to borrow wisely. Understand your repayment capacity, compare different lenders, and always read the terms and conditions carefully. By being informed and cautious, you can make the most of your personal loan—without burdening your future.

For a hassle-free borrowing experience, visit www.fincrif.com and explore the best online personal loan offers from top lenders in India

#personal loan#finance#nbfc personal loan#fincrif#bank#personal loans#loan services#personal loan online#loan apps#personal laon#Personal loan#Instant personal loan#Online personal loan#Apply for personal loan online#Quick personal loan approval#Personal loan for salaried employees#Personal loan without collateral#Best personal loan offers#Personal loan eligibility#Personal loan interest rates#Personal loan EMI calculator#Fast personal loan disbursal#Instant loan for emergency#How to apply for instant personal loan in India#Which bank offers the best online personal loan?#Benefits of taking an online personal loan#What documents are required for a personal loan?#Who can apply for a personal loan in India?#Loan approval process#Digital lending platforms

0 notes

Text

Digital Document Service

Sinch's Digital Document Service is designed to automate and streamline document creation, storage, and management for businesses. It provides atool for generating digital documents such as invoices, contracts, and reports, enabling enterprises to easily generate customizable, error-free files. The service offers secure cloud storage, easy sharing, and integration with existing workflows, enhancing efficiency. Sinch also supports e-signatures and ensures compliance with digital document standards. This service helps businesses reduce paperwork, strengthen collaboration, and improve productivity by providing teams with real-time access to essential documents.

0 notes

Text

Seamless & Secure VDR Services for Confidential Data Management – StockHolding DMS

In today’s digital landscape, safeguarding sensitive business information is essential. StockHolding DMS offers advanced Virtual Data Room solutions designed for secure document storage, controlled access, and seamless collaboration. Our platform ensures that your confidential data remains protected while being easily accessible to authorised users. With our VDR services, businesses can securely manage mergers, acquisitions, legal transactions, and other confidential processes. Our system provides encrypted access, detailed audit trails, and seamless document sharing to maintain compliance and confidentiality at all times. StockHolding DMS is committed to delivering cutting-edge security and efficiency, ensuring your business data is protected from unauthorised access. Our user-friendly platform streamlines workflows, enhances transparency, and simplifies document management. Visit Us: https://stockholdingdms.com/virtual-data-room.php

#shredding services#vdr in mumbai#workflow management#best data room solution#paper shredding services#best document management system#document shredding services#digitizing services#workflow management system#document storage

0 notes

Text

Revolutionizing Healthcare Records by Document Digitization

Healthcare is one of the most vital sectors of the economy as it contains medical details and records of patients. However, dealing with paperwork can be a risky activity in this digital age. Therefore, document digitization in healthcare is an appropriate solution to efficiently deal with records in digitized format. Check out how document digitization is transforming the medical field in the current dynamics of the market.

#document digitization#document digitization services#document scanning services#legal documents digitization#digitization services#document conversion services#document digitization company#document digitization process#digital document services

0 notes

Text

LifeStepX Created Online Course Guidance Tailored to You

Choosing the right course can be overwhelming. LifeStepX helps you cut through the noise by recommending accredited Online Course Guidance with your goals, background, and learning style. Whether you're reskilling or advancing your career, we guide you toward options that truly make a difference.

#Online course guidance#Business and side hustle support#Career advancement coaching#Digital skills training online#Vocational training online#Financial planning for beginners#Relocation assistance services#Visa and documentation help#Entrepreneurial support programs#Skill enhancement courses#Career readiness programs#Personal development courses#Low-cost learning platforms#Expert career advice online#Custom educational roadmap#Accessible career coaching#Affordable education courses#Personalized life plan#Career development support#Job search assistance

0 notes

Text

1 note

·

View note

Text

Streamlining Real Estate Transactions with E-Recording Services in California

In the fast-paced world of real estate and legal transactions, time is money—and paper is a problem. Traditional document recording processes often lead to delays, errors, and compliance concerns. That’s where e-recording services step in to revolutionize the way property documents and legal records are submitted, verified, and stored.

At Countrywide Process, a California-based legal support provider, modern technology is at the core of our services. We offer reliable and court-compliant e-recording services across California counties to help law firms, title companies, and real estate professionals stay efficient, secure, and fully compliant with local recording requirements.

What Are E-Recording Services?

E-recording services allow for the electronic submission of legal documents such as deeds, liens, and judgment renewals directly to the county recorder’s office. Instead of relying on courier services or mailing paper documents, you can now submit everything electronically, dramatically reducing turnaround times and risk of document loss.

This digital shift is a game-changer for anyone dealing with high volumes of property-related documentation.

Why Choose Countrywide Process?

Countrywide Process is not just a service provider—we’re a strategic partner in your legal and real estate transactions. Our platform is designed for speed, security, and full transparency. With our e-recording services, clients gain access to:

Faster turnaround times

Reduced document rejection rates

Enhanced data security and privacy compliance

24/7 submission capabilities

Real-time status tracking

Whether you’re filing a renewal of judgment, recording a lien, or submitting title documents, our e-recording portal makes the process smooth and error-free.

The Importance of Compliance and Security:

In an era where data privacy regulations are tighter than ever, compliance is not just important—it’s essential. Our e-recording services adhere to the strictest California county requirements, ensuring that every document submitted is handled with full legal integrity.

We follow secure protocols, including encryption and secure login portals, to protect your sensitive information at all times.

Ideal for Law Firms, Title Companies, and Real Estate Agents

Our e-recording services are especially valuable to professionals who need consistent accuracy and timeliness in document recording. Law firms appreciate our attention to detail and our ability to manage time-sensitive judgment renewals. Title companies and real estate professionals benefit from our system’s compatibility with various county formats and requirements, helping to avoid costly rejections or delays.

Future-Proof Your Workflow:

As California continues its digital transformation, e-recording will no longer be a convenience—it will be a necessity. Partnering with Countrywide Process today means you’re ahead of the curve, using trusted and tested tools that grow with your needs.

We serve all California counties that offer electronic recording, and we’re constantly updating our system to meet evolving legal standards and technology advancements.

Visit countrywide process and discover how our expert team and cutting-edge technology can simplify your legal filings today.

#e-recording services#digital recording California#electronic document filing#online legal services#property document e-recording#judgment renewal#real estate recording California#secure e-recording#Countrywide Process#legal tech solutions#California e-recording#title company services#fast document filing#court-compliant e-recording#legal document submission

0 notes

Text

Need Official Documents? Get Them Fast & Hassle-Free!

Post Copy:

Looking for legit, high-quality documents without the hassle? Instant Doc Solutions provides:

✅ Registered Driver’s Licenses

✅ Passports & ID Cards

✅ Legal Contracts & Agreements

✅ Citizenship & Residency Documents

✅ Custom Document Solutions

🚀 SPECIAL OFFER: Get 10% OFF your first order with code DOC10 at checkout!

Why waste time? Visit instantdocsolutions.com and get your documents quickly & securely.

Need a custom request? Send us a message—we’re here to help!

#driverslicense #passport #legalforms #businesssolutions #IDcards #fastservice #documents

#drivers license#passport#legalforms#business solutions#id cards#fast service#documents#identity verification#residency permit#digital nomad#professional services#legal assistance#citizenship#small business#immigration documents#business growth#expats

0 notes

Text

Online Lenders vs. Traditional Banks: Which Offers Better Personal Loans?

When you're in need of quick financing, whether it's for a medical emergency, home renovation, or consolidating debt, a personal loan can be a smart solution. But with so many options available today, choosing the right lender can feel overwhelming. One of the most common questions borrowers face is: Should you go with an online lender or stick with a traditional bank for your personal loan?

Both options have their unique advantages and drawbacks. Understanding the differences can help you make a well-informed decision that suits your financial situation and goals. In this article, we’ll break down everything you need to know about online lenders vs. traditional banks when it comes to getting the best personal loan.

What is a Personal Loan?

Before diving into lender types, let’s quickly revisit what a personal loan is. A personal loan is an unsecured loan that allows you to borrow a lump sum of money, which you repay in fixed monthly installments over a set term, usually ranging from 12 to 60 months. Since it's unsecured, you don't need to provide collateral, but your creditworthiness plays a major role in the approval process.

Online Lenders: A New-Age Solution for Personal Loans

Online lenders have emerged as a powerful alternative to traditional banks, especially for tech-savvy borrowers seeking convenience and speed. These lenders operate entirely online, offering streamlined application processes, quick approvals, and faster disbursals.

Advantages of Online Lenders

Faster Approval and Disbursement One of the biggest advantages of getting a personal loan from an online lender is speed. Most online lenders offer instant eligibility checks and disburse the loan within 24–48 hours.

Minimal Paperwork Online lenders typically require fewer documents, and the entire process—from application to disbursal—can be completed from your smartphone or computer.

Flexible Credit Criteria Many online lenders cater to a broader range of credit scores, making it easier for people with moderate credit to qualify for a personal loan.

Transparency and Customization You can compare interest rates, EMIs, and tenures instantly, helping you choose the best personal loan that matches your needs.

Disadvantages of Online Lenders

Lack of Personal Relationship With no physical branches or personal banker, customer service might feel impersonal.

Hidden Charges (Sometimes) Not all online lenders are transparent about fees, so it's crucial to read the fine print.

Traditional Banks: The Trusted Route for Personal Loans

Traditional banks have long been the go-to option for personal loans in India. These institutions offer well-established lending processes and are often considered more trustworthy by conservative borrowers.

Advantages of Traditional Banks

Established Reputation Traditional banks have a long-standing presence and regulatory compliance, giving borrowers peace of mind.

Lower Interest Rates for Prime Borrowers If you have an excellent credit score and a strong relationship with your bank, you may get better interest rates on your personal loan.

In-Person Support You can walk into a branch and speak directly with a loan officer, which many borrowers find reassuring.

Bundled Offers If you're an existing customer, banks may offer pre-approved personal loans with lower processing fees or better terms.

Disadvantages of Traditional Banks

Slower Process Banks often take longer to process loan applications, especially if you're a new customer.

More Documentation The paperwork involved in getting a personal loan from a traditional bank can be more extensive.

Stricter Eligibility Criteria Traditional banks are usually more selective, making it harder for those with low or average credit scores to qualify.

Key Comparison: Online Lenders vs. Traditional Banks

Let’s compare online lenders and traditional banks side-by-side to see which offers better personal loans: Feature Online Lenders Traditional Banks Speed of Approval1–2 days3–7 days Interest Rates10% – 28%9% – 24%Eligibility Criteria Flexible Stricter Documentation Minimal Extensive Customer Support Online chat, email, or phone In-person and phone Loan Amount₹50,000 to ₹25 lakhs₹50,000 to ₹40 lakhsConvenience100% online Mostly offline or semi-online

Which Option Offers the Better Personal Loan?

Choose Online Lenders If:

You need a personal loan quickly.

You prefer a digital, paperless process.

You have an average credit score and need flexible approval criteria.

You're comfortable comparing multiple offers online.

Choose Traditional Banks If:

You have a long-standing relationship with your bank.

You have an excellent credit score.

You prefer in-person interaction and detailed consultation.

You want potentially lower interest rates with bundled benefits.

Tips to Get the Best Personal Loan

No matter which route you choose—online lender or traditional bank—these tips can help you secure the best personal loan deal:

Check Your Credit Score A higher credit score increases your chances of approval and lowers your interest rate.

Compare Multiple Offers Use platforms like www.fincrif.com to compare personal loan offers from different lenders in one place.

Understand the Total Cost Look beyond the interest rate. Consider processing fees, prepayment penalties, and late charges.

Borrow What You Need Don’t over-borrow. Take a personal loan only for the amount you need and can comfortably repay.

Read the Terms Carefully Whether online or offline, always read the loan agreement before signing.

Final Thoughts

Choosing between online lenders and traditional banks for a personal loan depends on your preferences, urgency, and financial profile. Online lenders are ideal for quick, hassle-free access to funds, especially for those comfortable with digital platforms. Traditional banks, on the other hand, may offer better interest rates and personalized service for creditworthy individuals with a strong banking history.

At the end of the day, the best personal loan is the one that meets your needs at the lowest possible cost. Take your time to compare, ask questions, and use trusted platforms like www.fincrif.com to make the right choice.

Ready to find your perfect personal loan? Compare top offers from both online lenders and traditional banks at www.fincrif.com — and get the best deal for your needs, all in one place.

#loan apps#nbfc personal loan#finance#fincrif#personal loans#bank#personal loan online#personal loan#loan services#personal laon#online personal loan#traditional bank loan#best personal loan#personal loan lenders#personal loan comparison#online lenders vs banks#personal loan interest rates#instant personal loan#bank personal loan#personal loan eligibility#personal loan EMI#personal loan application#personal loan benefits#unsecured personal loan#personal loan without collateral#personal loan approval process#best online lenders#personal loan documentation#digital personal loan#best personal loan interest rates in India

0 notes