#early investors

Text

The Apple Marketing Philosophy

“Empathy

We will truly understand their needs better than any other company.

Focus

In order to do a good job of those things we decide to do we

must eliminate all of the unimportant opportunities.

Impute

People DO judge a book by its cover.

We may have the best product, the highest quality, the most useful software etc.; if we present them in a slipshod manner, they will be perceived as slipshod; if we present them in a creative, professional manner, we will impute the desired qualities.”

Mike Markkula

January 3, 1977

#Apple#Marketing Principles#Empathy#Focus#Impute#Product Development#Customer Needs#Brand Identity#Tech Industry#Customer Relations#Innovation#Steve Jobs#Company Culture#Business Strategy#Corporate Values#Leadership#Memo#Early Investors#Creative Presentation#Professionalism#quoteoftheday#deep thinking

1 note

·

View note

Text

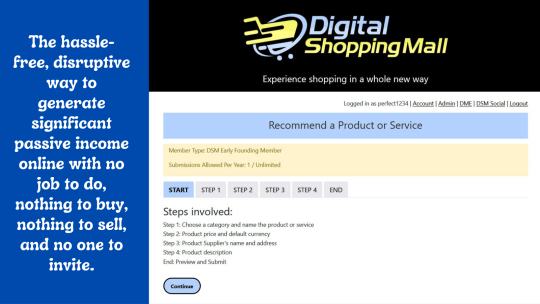

Digital Shopping Mall is on the verge of pushing a button that will initiate a revolutionary new world order, where financial freedom becomes accessible to everyone who participates in it, particularly the early birds engaging in DSM's groundbreaking ground-floor opportunities.

https://social.digitalshoppingmall.net/content/perma?id=12603&cd1=4&cd2=4

#digital shopping mall#digital shopping points#digital shopping coin#affiliate income#passive income#work from home#affiliate program#angel investors#early investors#cryptocurrency#service recommendations#product recommendations#recommendation commissions#endorsement commissions#new economic order#new monetary system#new world order

0 notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

If you found this helpful, consider joining our Patreon.

#personal finance#saving money#retirement#saving for retirement#retirement account#retirement fund#401k#FIRE movement#early retirement#financial independence#investing#stock market#investors

76 notes

·

View notes

Text

I did post initially during the thick of scriptgate that I believed Nick’s scripts were fake, but I’ve now held the opinion for awhile that they were probably real, the Duffers are just very unserious writers

#putting stuff like DRY AS A CALIFORNIA SUMMER and so many nonvisual details in a script is not something a Real Person would do#if the duffs were writing scripts to send to an outside investor then it would probably be cleaner like the snippets they posted on twitter#however if you were writing for your own show you could probably do whatever you wanted in your scripts#esp an early draft that is not being sent to the emmys for award consideration#‘i love you but you are not serious people’#scriptgate#byler#<- target audience

33 notes

·

View notes

Text

Happy Fucking Joe Day!!!

You wanna know what my crazy ass did last night? I scrolled Joe’s whole LiveJournal and made a playlist of every song he put as his current music. Granted, it’s not a carbon copy. I couldn’t put any repeats, and I couldn’t get some of the covers, and some tracks just weren’t there, and it’s not in perfect order, BUT I did it. What can I say? The man has impeccable taste.

Spotify:

YouTube:

#he was an early investor and appreciator of the Black Eyed Peas and I really hope he has recovered#didn’t include any songs from the tangent about R Kelly songs and how panty-dropping they are because they weren’t on “current music”#and also because no#samoa joe

7 notes

·

View notes

Note

I believe the workers who say Kurvitz was difficult to work with, especially Argo since he’s known the guy for a long time but now I have to wonder if those people now regret speaking in it.

Do I think they regret what they said? I can't say for sure because a) I cannot claim to know, let alone guess, exactly how they feel about this mess since I am not them, and b) unless someone decides to come forward about it we likely will never know.

But what I can talk about is what we do know for certain.

I've spoken on this before in a post I made about the misgivings I had with Chris Bratt's take on the ZA/UMa (ZA/UM drama) where I expressed that I felt like the video overexaggerated some of Kurvitz's behaviors and actions to make him appear like some kind of villain when we know he was slowly being frenzied by the investors for months on end. Now despite that, it still does not excuse the fact that Argo Tuulik, Kaspar Tamsalu, and Petteri Sulonen were hurt by him regardless of the circumstance (which they will resolve with him on their own time if they so choose). But as you’d also know, Tuulik has stated in his interview that even though he has his personal gripes with the man, he still greatly admires and respects Kurvitz which is a sentiment Kurvitz has echoed about all his former colleagues in an interview with Jacobin.

I can 100% understand where Tuulik is coming from in his statements about Kurvitz. It's always going to be a difficult adjustment when the person who you've been friends with for years becomes your boss because it suddenly creates a power dynamic that didn't exist before. At least in Kurvitz's case, who obviously didn't have any experience in leadership positions, it's no surprise he became such a shitty boss towards his friends and coworkers since the man clearly had no clue how to properly lead a team, was demanding perfection from everyone, on top of his stress levels being exacerbated from constant conflict with the meddling investors.

Now, if I were to speculate on this issue knowing all this, I'd say at the very least Tuulik probably feels like he's in the same boat as Kurvitz given the similarities of how they were dismissed from the studio. Whatever comes of this, whether it'd be reconciliation between the two or officially parting ways for good, is up to him. Honestly, I just hope he isn’t feeling guilty for bringing up both the good and bad about working with Robert Kurvitz in his interview. It was very brave of him to do as well as provided us outsiders with a window into the dynamic he had with Kurvitz. He couldn’t have possibly known the investors would one day retaliate against him and anyone else who voiced their dissent against their authoritarian rule of the studio. His only mistake was blindly trusting the people who spent years systematically othering Kurvitz and co in order to split the group apart so that they could be further manipulated by them.

#disco elysium#studio za/um#za/um#argo tuulik#robert kurvitz#people make games#even martin luiga who left the project early on made a statement about him long before the investors released their own version of events#he admits that yes kurvitz can be difficult to work with given his perfectionism#but still loves and respects him and will always be his friend despite their history of constantly butting heads#ofc that same sentiment was then echoed by tuulik a year later in his pmg interview#from that alone it's clear a pattern exists for those who have worked with kurvitz before#turns out he doesn't sound as bad as the investors or Bratt made him out to be#it's just that the investors went out of their way to imply kurvitz was somehow above everyone else's labor to feed the growing resentment#and it worked#mp

11 notes

·

View notes

Text

Heartstopper is bringing up traumatic sophomore year memories of dating a blonde golden retriever boy who was a grade above me and also we did in fact compare ourselves to Nick and Charlie…

11 notes

·

View notes

Text

Perhaps a minor expenditure -- the faintest skin off his proverbial nose; An investment -- could save DIO from a degree of stress in the future . . . or prove to add certain assets to his resources.

#[dash commentary]#Star Of The Masquerade. // DIO#Dio is an early investor in witches and witchcraft#I promise

2 notes

·

View notes

Text

Best Indian Venture Capital Firms for Startups · SEAFUND

Navigating the early stages of a startup can be challenging, but the right seed investors in Bangalore can make all the difference. SEAFUND stands out among the best pre-seed funding companies in India, providing early-stage startups with the support they need to thrive.

Initiatives in Seafund | Seed Investors in Bangalore

Why Choose SEAFUND?

Tailored Funding Solutions: Eximius offers custom funding strategies that align with your startup’s unique vision and goals, making them a top choice among seed funding companies in India open now.

Deep Sector Expertise: With a strong focus on sectors like Fintech, Healthtech, and Frontier Tech, Eximius provides insights that go beyond just capital, which is why they are recognized as one of the leading pre-seed funding companies in India.

Founder-Centric Approach: Emphasizing empathy and personal chemistry, Eximius supports founders with honest advice and mentorship, without unnecessary interference, setting them apart from other seed investors in Bangalore.

Strategic Initiatives for Growth

SEAFUND initiatives are dedicated to fostering innovation and driving growth across various sectors. By investing in underserved markets and emerging technologies, they empower startups to make significant impacts both in India and globally. SEAFUND’s initiatives focus on accelerating growth and supporting entrepreneurs through strategic investment and mentorship, making them a key player among seed investors in Bangalore.

Join the Success Stories

SEAFUND has already helped numerous startups achieve their potential. By leveraging their vast network and deep industry knowledge, you too can be the next success story with the support of leading seed funding companies in India.

Get Involved

Ready to partner with one of the best seed investors in Bangalore? Explore SEAFUND to discover how they can help turn your startup dreams into reality, whether you’re in need of pre-seed funding companies in India or looking for seed funding companies in India open now.

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india

0 notes

Text

How Unicornivc Identifies and Supports Promising Small Businesses

Early-stage investment serves as a vital lifeline for small businesses, often determining their ability to scale, innovate, and compete in the marketplace. A notable player in this arena is UnicornIVC, a venture capital firm focused on identifying and nurturing startups with significant growth potential.

What is UnicornIVC?

UnicornIVC is a venture capital firm specializing in early-stage funding for startups. The firm's mission is to identify and support companies with the potential to become "unicorns"—privately held startups valued at over $1 billion. By concentrating on the initial phases of a company's development, UnicornIVC aims to assist businesses through crucial growth stages, enabling them to reach the scale required for long-term success.

How Does UnicornIVC Operate?

Identifying Potential: Unicorn india venture capital actively scouts for startups that demonstrate innovation, strong market potential, and a capable founding team. The firm leverages data-driven analysis and industry expertise to pinpoint companies with a high likelihood of long-term success.

Early-Stage Funding: Upon identifying a promising startup, UnicornIVC provides essential capital to fuel its growth. This funding is typically directed towards product development, market expansion, and talent acquisition.

Strategic Support: Beyond capital, UnicornIVC offers strategic support to its portfolio companies, including mentorship, networking opportunities, and access to industry experts. This guidance helps startups navigate the complexities of scaling their operations.

Building a Growth Path: UnicornIVC collaborates closely with the management teams of its portfolio companies to establish a clear growth trajectory. This involves setting milestones, refining business models, and preparing for future funding rounds.

Exit Strategy: UnicornIVC’s ultimate goal is a successful exit, usually through acquisition or an IPO. By helping startups reach a level of maturity and market presence, UnicornIVC aims to secure significant returns for both the company and its investors.

The Impact of UnicornIVC on Small Businesses

UnicornIVC plays a critical role in the success of small businesses by providing the necessary resources and support to help them thrive in competitive markets. Their early-stage investments often act as a catalyst for growth, allowing startups to scale more quickly than traditional funding sources would permit. For small businesses, partnering with UnicornIVC can unlock their full potential, leading to lasting success.

Understanding how early-stage investors like UnicornIVC operate can help small business owners navigate the complexities of raising capital and growing their ventures.

Contact Details Of Unicornivc

Contact Us Page: https://www.unicornivc.com/contact.php

#Unicorn#Unicorn India Venture Capital#Unicorn India#Early Stage inverstors#investors for small businesses#early stage investors in small businesses

0 notes

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

35K notes

·

View notes

Text

You can now log in to your Digital Shopping Mall account and view your Digital Shopping Point (DSP) wallet and other information.

Open the DSM website link below and then click on the main menu (three horizontal lines, also known as the Hamburger sign) at the top right corner and choose "Login" if you are already a member or "Sign Up" if you are not a member yet and want to join.

Don't create a new account if you are already a member. Just click on Login and use your login credentials to login.

https://digitalshoppingmall.net/d/1/

For now, you will see 1 DSP credited to your account, with its value displayed in both USD and your local currency, as a reward for joining DSM during this period of free Founding Membership opportunities.

Soon, we will add DSPs earned for free through referrals 10 levels deep, as well as purchased DSPs, to their respective owners' wallets.

We will keep you updated as things unfold.

#digital shopping mall#digital shopping points#digital shopping coin#affiliate income#passive income#cryptocurrency#work from home#affiliate program#angel investors#early investors#airdrop#free crypto#crypto revolution

0 notes

Text

Artium Academy secures seed funding from Sonu Nigam and leading early-stage investors.

Mumbai: Artium Academy, an online music learning and community platform has successfully completed its seed round of 750k USD led by Sonu Nigam and early stage investors like Jet Synthesis and Whiteboard capital. Artium Academy also has onboarded Swapnil Shinde, Snehal Shinde and Vivek Raicha as founder investors given their vast experience in technology, media and direct to consumers businesses.

ALSO READ MORE- https://apacnewsnetwork.com/2021/09/artium-academy-secures-seed-funding-from-sonu-nigam-and-leading-early-stage-investors/

#Artium Academy#artium academy Chennai#artium academy fees#artium academy fees payment#artium academy fees structure#artium academy reviews#Ashish Joshi#early-stage investors#Founder and CEO of Artium Academy#Nithya Sudhir#Patron In Chief#Rajan Navani Vice Chairman and CEO#Sonu Nigam

0 notes

Text

Hey! I'm using SoFi Invest 📊 to buy and sell stocks (and pieces of stocks) with zero fees. Open an Active Investing account with $10 or more, and you'll get $25 in stock. Use my link: https://www.sofi.com/invite/invest?gcp=812f7555-0053-45f7-be46-69645940564a&isAliasGcp=false

Open a SoFi and we both get paid! Yes this SoFi Bank an official sponsor on the NBA so it’s legit!

I get paid 2 days early like clockwork!

1 note

·

View note

Text

Navigating Early Stage Venture Capital: A Guide for Entrepreneurs

Venturing into the realm of early stage venture capital (VC) can be both exhilarating and daunting for aspiring entrepreneurs. The journey from concept to capitalization requires strategic planning, networking prowess, and a deep understanding of the investment landscape. Visit: https://sites.google.com/view/ausmequity/home

0 notes

Text

How an Early PEPE Investor Turned $3,000 into $30 Million

In the fast-paced world of cryptocurrencies, tales of overnight fortunes are not uncommon. One such extraordinary story revolves around an early investor in PEPE, a digital asset that has seen its fair share of ups and downs. Back in April 2023, an investor made a modest investment of approximately $3,000 in PEPE tokens. Little did they know that this initial bet would soon turn into a…

View On WordPress

#crypto market#cryptocurrency#digital asset#early investor#investment#overnight fortune#PEPE#success story#volatility#wealth generation#windfall

0 notes