#efficient blockchain mining

Explore tagged Tumblr posts

Text

Useful Proof of Work (uPoW) - Blockchain’s Latest Way to Train AI and Secure Networks

Useful Proof of Work (uPoW): Merging Blockchain and AI Blockchain and AI are two big technologies, but both come with big problems. Blockchain networks need a lot of energy to secure the system, AI needs powerful computers to train machine learning models. Useful Proof of Work (uPoW) is a new system that solves these problems by using the energy from blockchain mining to train AI models. This secures the blockchain and allows AI to train faster, using the same energy for both. Consensus in Blockchain and AI Blockchain networks need to agree on which transactions are valid. This is called consensus. Different consensus methods have been developed, each with its own strengths. Traditional Proof of Work (PoW) is one of the most well-known, used by Bitcoin. It requires computers (miners) to solve complex puzzles to secure the network. But PoW has been criticized for wasting a lot of energy for no other benefit. AI needs a lot of computing power to train machine learning models which can be expensive. The idea behind uPoW is to use the computational resources from blockchain mining to help with AI training, turn the energy used for mining into something valuable for both.

To Know More- Read the latest Blogs on Cryptocurrencies

#Proof of Work#uPoW#proof of stake#proof of work vs proof of stake#ai training#Useful Proof of Work (uPoW) benefits#blockchain AI integration#efficient blockchain mining#uPoW vs traditional PoW#AI training with blockchain#decentralized AI development#Qubic blockchain uPoW

0 notes

Text

The Rise of DeFi: Revolutionizing the Financial Landscape

Decentralized Finance (DeFi) has emerged as one of the most transformative sectors within the cryptocurrency industry. By leveraging blockchain technology, DeFi aims to recreate and improve upon traditional financial systems, offering a more inclusive, transparent, and efficient financial ecosystem. This article explores the fundamental aspects of DeFi, its key components, benefits, challenges, and notable projects, including a brief mention of Sexy Meme Coin.

What is DeFi?

DeFi stands for Decentralized Finance, a movement that utilizes blockchain technology to build an open and permissionless financial system. Unlike traditional financial systems that rely on centralized intermediaries like banks and brokerages, DeFi operates on decentralized networks, allowing users to interact directly with financial services. This decentralization is achieved through smart contracts, which are self-executing contracts with the terms of the agreement directly written into code.

Key Components of DeFi

Decentralized Exchanges (DEXs): DEXs allow users to trade cryptocurrencies directly with one another without the need for a central authority. Platforms like Uniswap, SushiSwap, and PancakeSwap have gained popularity for their ability to provide liquidity and facilitate peer-to-peer trading.

Lending and Borrowing Platforms: DeFi lending platforms like Aave, Compound, and MakerDAO enable users to lend their assets to earn interest or borrow assets by providing collateral. These platforms use smart contracts to automate the lending process, ensuring transparency and efficiency.

Stablecoins: Stablecoins are cryptocurrencies pegged to stable assets like fiat currencies to reduce volatility. They are crucial for DeFi as they provide a stable medium of exchange and store of value. Popular stablecoins include Tether (USDT), USD Coin (USDC), and Dai (DAI).

Yield Farming and Liquidity Mining: Yield farming involves providing liquidity to DeFi protocols in exchange for rewards, often in the form of additional tokens. Liquidity mining is a similar concept where users earn rewards for providing liquidity to specific pools. These practices incentivize participation and enhance liquidity within the DeFi ecosystem.

Insurance Protocols: DeFi insurance protocols like Nexus Mutual and Cover Protocol offer coverage against risks such as smart contract failures and hacks. These platforms aim to provide users with security and peace of mind when engaging with DeFi services.

Benefits of DeFi

Financial Inclusion: DeFi opens up access to financial services for individuals who are unbanked or underbanked, particularly in regions with limited access to traditional banking infrastructure. Anyone with an internet connection can participate in DeFi, democratizing access to financial services.

Transparency and Trust: DeFi operates on public blockchains, providing transparency for all transactions. This transparency reduces the need for trust in intermediaries and allows users to verify and audit transactions independently.

Efficiency and Speed: DeFi eliminates the need for intermediaries, reducing costs and increasing the speed of transactions. Smart contracts automate processes that would typically require manual intervention, enhancing efficiency.

Innovation and Flexibility: The open-source nature of DeFi allows developers to innovate and build new financial products and services. This continuous innovation leads to the creation of diverse and flexible financial instruments.

Challenges Facing DeFi

Security Risks: DeFi platforms are susceptible to hacks, bugs, and vulnerabilities in smart contracts. High-profile incidents, such as the DAO hack and the recent exploits on various DeFi platforms, highlight the need for robust security measures.

Regulatory Uncertainty: The regulatory environment for DeFi is still evolving, with governments and regulators grappling with how to address the unique challenges posed by decentralized financial systems. This uncertainty can impact the growth and adoption of DeFi.

Scalability: DeFi platforms often face scalability issues, particularly on congested blockchain networks like Ethereum. High gas fees and slow transaction times can hinder the user experience and limit the scalability of DeFi applications.

Complexity and Usability: DeFi platforms can be complex and challenging for newcomers to navigate. Improving user interfaces and providing educational resources are crucial for broader adoption.

Notable DeFi Projects

Uniswap (UNI): Uniswap is a leading decentralized exchange that allows users to trade ERC-20 tokens directly from their wallets. Its automated market maker (AMM) model has revolutionized the way liquidity is provided and traded in the DeFi space.

Aave (AAVE): Aave is a decentralized lending and borrowing platform that offers unique features such as flash loans and rate switching. It has become one of the largest and most innovative DeFi protocols.

MakerDAO (MKR): MakerDAO is the protocol behind the Dai stablecoin, a decentralized stablecoin pegged to the US dollar. MakerDAO allows users to create Dai by collateralizing their assets, providing stability and liquidity to the DeFi ecosystem.

Compound (COMP): Compound is another leading DeFi lending platform that enables users to earn interest on their cryptocurrencies or borrow assets against collateral. Its governance token, COMP, allows users to participate in protocol governance.

Sexy Meme Coin (SXYM): While primarily known as a meme coin, Sexy Meme Coin has integrated DeFi features, including a decentralized marketplace for buying, selling, and trading memes as NFTs. This unique blend of humor and finance adds a distinct flavor to the DeFi landscape. Learn more about Sexy Meme Coin at Sexy Meme Coin.

The Future of DeFi

The future of DeFi looks promising, with continuous innovation and growing adoption. As blockchain technology advances and scalability solutions are implemented, DeFi has the potential to disrupt traditional financial systems further. Regulatory clarity and improved security measures will be crucial for the sustainable growth of the DeFi ecosystem.

DeFi is likely to continue attracting attention from both retail and institutional investors, driving further development and integration of decentralized financial services. The flexibility and inclusivity offered by DeFi make it a compelling alternative to traditional finance, paving the way for a more open and accessible financial future.

Conclusion

Decentralized Finance (DeFi) represents a significant shift in the financial landscape, leveraging blockchain technology to create a more inclusive, transparent, and efficient financial system. Despite the challenges, the benefits of DeFi and its continuous innovation make it a transformative force in the world of finance. Notable projects like Uniswap, Aave, and MakerDAO, along with unique contributions from meme coins like Sexy Meme Coin, demonstrate the diverse and dynamic nature of the DeFi ecosystem.

For those interested in exploring the playful and innovative side of DeFi, Sexy Meme Coin offers a unique and entertaining platform. Visit Sexy Meme Coin to learn more and join the community.

254 notes

·

View notes

Text

Understanding XRP: The Future of Cross-Border Payments

🔎 What Is XRP — and Why It Matters XRP is the native token of the XRP Ledger (XRPL), an open-source payments blockchain launched in June 2012 by Jed McCaleb, Arthur Britto, and David “JoelKatz” Schwartz. With a max supply fixed at 100 billion XRP (divisible to six decimals, known as “drops”), XRP is not mined or staked—making it fast, energy-efficient, and cost-effective. Unlike Bitcoin (mined,…

#Bitcoin#crypto#Crypto Education#cryptocurrency#ethereum#games#Origin Story#ripple#web3 culture#xrparmy

3 notes

·

View notes

Text

GranWIFhat: Shaping the Future of Cryptocurrency"

Dear Community,

We are thrilled to introduce you to GranWIFhat, a revolutionary cryptocurrency project designed to shape the future of digital finance. In a world where technology evolves rapidly, GranWIFhat stands out as a beacon of innovation and opportunity.

Why GranWIFhat?

Cutting-Edge Technology: At the heart of GranWIFhat is a state-of-the-art blockchain technology that ensures fast, secure, and transparent transactions. Our advanced algorithms and smart contract capabilities offer unparalleled efficiency and reliability.

Empowering Users: GranWIFhat is designed with the user in mind. Whether you're an experienced trader or new to the world of cryptocurrency, our platform provides intuitive tools and resources to help you make informed decisions and maximize your potential.

Community-Driven Growth: We believe in the power of community. GranWIFhat thrives on the collective strength of its users. By participating in our project, you become part of a vibrant, dynamic ecosystem that supports and rewards its members.

Future-Ready: As the digital landscape continues to evolve, GranWIFhat is committed to staying ahead of the curve. Our dedicated team of experts is constantly researching and implementing the latest advancements to ensure our platform remains at the forefront of innovation.

Sustainable and Secure: GranWIFhat prioritizes sustainability and security. Our eco-friendly mining solutions and robust security protocols protect your investments and the environment, creating a safe and sustainable future for all.

Join Us on This Journey

GranWIFhat is more than just a cryptocurrency project; it's a vision for a better future. By joining us, you're not just investing in a digital asset, but in a transformative movement that will redefine the financial landscape. Together, we can create a world where financial freedom and technological advancement go hand in hand.

Thank you for being a part of GranWIFhat. The future is bright, and we're excited to have you with us on this journey.

Warm regards,

The GranWIFhat Team

Visit our Dexscreen to know more

15 notes

·

View notes

Text

if people stopped mining BTC

If people stop mining Bitcoin, it would have several serious consequences for the network. Here are the major effects:

1. Reduced Network Security

Proof-of-Work and Security: The Bitcoin network relies on Proof-of-Work (PoW) to ensure that all transactions are valid and to protect the network from attacks. Miners use their computational power to solve cryptographic problems and create new blocks, which makes it extremely difficult to manipulate the blockchain.

Attacks: If no one is mining, the network would become highly vulnerable to various types of attacks. The most well-known attack is a 51%-attack, where someone controls more than 50% of the network’s computational power and can alter historical transactions or block new ones. If there are no miners working to solve PoW puzzles, there would be no computational power to secure the network.

2. No New Bitcoin Created

Creation of New Bitcoin: Mining is the only process that creates new Bitcoin. If no one mines, no new Bitcoin will be created. This would halt the continuous influx of new coins into the market.

No Reward: When the Bitcoin network reaches its maximum limit of 21 million Bitcoin, miners will have to rely on transaction fees as their income. If no one mines, there would be no rewards, and transaction fees wouldn't be processed.

3. Transactions Can't Be Processed

Blockchain: Mining is also the process that processes and verifies transactions. Without miners, transactions couldn’t be included in new blocks, and the Bitcoin network wouldn't be able to process any new transactions.

Transaction Delays: If no one mines, the Bitcoin network would effectively become "stuck" because transactions couldn’t be confirmed or included in blocks.

4. Difficulty Adjustment and Economic Effects

Difficulty Adjustment: If the number of miners drops significantly, the Bitcoin network’s difficulty would automatically adjust downward to make it easier to mine blocks. But if mining completely ceases, no one would be able to create new blocks, and it would be impossible to adjust the difficulty to a level where new blocks could be created.

Market Reaction: The market would likely react negatively to a sudden cessation of mining, as it would mean Bitcoin loses its decentralized nature, and trust in the network would decrease. This could lead to a sharp drop in Bitcoin prices and potentially other cryptocurrencies taking over.

Mining Becomes Unprofitable: Given that the difficulty of mining has increased over the years, it is now much more expensive and resource-intensive to mine Bitcoin. As the network's difficulty rises, miners need more powerful and specialized hardware, such as ASICs, to remain competitive. If mining rewards (block rewards and transaction fees) aren't sufficient to cover the increased costs, mining becomes unprofitable. This could cause miners to exit the network, further destabilizing the ecosystem.

5. Long-Term Outlook: A Shift to a New Cryptocurrency?

Inevitable Decline: Eventually, Bitcoin may face a point where it becomes unsustainable due to the increasing difficulty of mining and the rising costs involved. While the network may continue to operate for some time, the challenges Bitcoin faces—such as high energy consumption, lack of scalability, and an increasingly centralized mining landscape—will become harder to ignore. As the mining process becomes more costly and less profitable, Bitcoin’s appeal could decline.

A New Cryptocurrency: In the near future, people may begin to realize these limitations and may look for a cryptocurrency with better prospects for scalability, energy efficiency, and decentralization. New cryptocurrencies or blockchain projects could emerge with improved consensus mechanisms, better economic models, and stronger networks that could replace Bitcoin as the leading cryptocurrency. This shift may not happen overnight, but over time, Bitcoin could find itself overshadowed by more advanced alternatives that offer better long-term viability.

6. Conclusion

Bitcoin is built on the premise that decentralization and mining drive the network forward. Mining allows for the creation of new Bitcoin, transaction verification, and ensures that no one can manipulate the network. Without mining, Bitcoin would quickly lose its core functions and could become unusable as a secure, decentralized currency.

While it is unlikely that all miners would stop simultaneously, a massive reduction in mining would make Bitcoin much more vulnerable and potentially non-functional. Additionally, with the difficulty level so high and mining becoming increasingly expensive, many miners could find it unprofitable to continue, further compromising the network's security and stability. Bitcoin may eventually face a situation where it becomes increasingly obsolete, and the rise of a new cryptocurrency with better future prospects and a more sustainable network could be just a matter of time.

3 notes

·

View notes

Text

Understanding the Bitcoin Halving: What It Means for the Future

Introduction

In the ever-evolving world of cryptocurrencies, the term "Bitcoin halving" frequently pops up in discussions, often accompanied by predictions of significant market shifts and opportunities. But what exactly is Bitcoin halving, and why does it hold such importance? In this blog post, we'll explore the mechanics behind Bitcoin halving, its historical impacts, and what it could mean for the future of Bitcoin and the broader financial landscape.

What is Bitcoin Halving?

Bitcoin halving is a predetermined event that occurs approximately every four years, or after every 210,000 blocks are mined. During this event, the reward for mining new blocks is halved, effectively reducing the rate at which new Bitcoins are created. This mechanism is built into Bitcoin's code as a deflationary measure to control the supply of Bitcoin over time.

The Mechanics Behind Bitcoin Halving

To understand the significance of halving, it's essential to grasp how Bitcoin mining works. Bitcoin miners use powerful computers to solve complex mathematical problems, validating transactions and adding them to the blockchain. As a reward for their efforts, miners receive a certain number of Bitcoins. Initially, this reward was set at 50 Bitcoins per block. However, after the first halving in 2012, it dropped to 25 Bitcoins, then to 12.5 in 2016, and most recently to 6.25 in May 2020. The latest halving in 2024 reduced the reward to 3.125 Bitcoins per block.

Historical Impact of Bitcoin Halving

Historically, Bitcoin halving events have been followed by significant price increases. The reduced supply of new Bitcoins tends to create a scarcity effect, driving demand and, consequently, the price. For example, after the 2012 halving, Bitcoin's price rose from around $12 to over $1,000 within a year. Similarly, post-2016 halving, the price surged from approximately $650 to nearly $20,000 by the end of 2017.

However, it's crucial to note that while past performance can provide insights, it doesn't guarantee future results. Various factors, including market sentiment, regulatory developments, and technological advancements, can influence Bitcoin's price.

The 2024 Halving and Its Impact

The 2024 halving has already made its mark on the Bitcoin market. Here are a few notable outcomes and their implications:

Increased Scarcity and Higher Prices: As anticipated, the reduction in new Bitcoin supply created a scarcity effect, driving prices higher. This attracted more investors, further fueling the price surge.

Greater Miner Efficiency: With reduced rewards, miners sought more efficient ways to operate, leading to advancements in mining technology and energy use. This has also driven a shift towards sustainable energy sources in mining operations.

Market Maturity: Bitcoin continues to mature as a store of value and medium of exchange. The halving event reinforced Bitcoin's deflationary nature, appealing to those seeking a hedge against inflation.

Potential Market Corrections: While prices have generally increased, the market has also experienced corrections. High volatility remains a hallmark of the crypto market, and investors should be prepared for potential price swings.

What the Future Holds

As we move forward, the crypto community remains abuzz with speculation. Here are a few potential outcomes and their implications:

Continued Price Growth: Following the trend of previous halvings, Bitcoin may continue to see price growth as demand outstrips supply.

Innovations in Mining: The push for more efficient and sustainable mining practices could lead to significant technological advancements.

Increased Adoption: As Bitcoin's deflationary nature becomes more apparent, we may see increased adoption as a store of value and medium of exchange.

Regulatory Developments: Ongoing regulatory developments could play a crucial role in shaping the future of Bitcoin and the broader cryptocurrency market.

Conclusion

Bitcoin halving is a critical event that underscores the unique economic model of Bitcoin. By systematically reducing the supply of new Bitcoins, halving events contribute to Bitcoin's scarcity and deflationary characteristics. As we look to the future, the 2024 halving has already shown significant market developments, impacting miners, investors, and the broader financial ecosystem. Whether you're a seasoned investor or a newcomer, understanding Bitcoin halving is essential to navigating the ever-changing landscape of cryptocurrencies.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

Let’s learn about the Bitcoin Revolution together. Your financial freedom starts now!

#Bitcoin#Cryptocurrency#BitcoinHalving#Blockchain#Crypto#DigitalCurrency#BitcoinMining#CryptoInvesting#FinancialRevolution#EconomicFreedom#InflationHedge#CryptoCommunity#CryptoMarket#BTC#CryptoEducation#FutureOfMoney#DeflationaryCurrency#DigitalAssets#Bitcoin2024#CryptoInsights#financial education#unplugged financial#globaleconomy#financial experts#financial empowerment#finance

7 notes

·

View notes

Text

The Future of Mining: Sustainability and Ethical Sourcing

The mining industry is undergoing a profound transformation. As the global demand for raw materials like lithium, cobalt, and rare earth elements surges, driven by renewable energy technologies and electric vehicles, the emphasis on sustainability and ethical sourcing has never been more crucial. This shift is not just a moral imperative but a business necessity, with stakeholders demanding transparency and responsibility throughout the supply chain.

The Push for Sustainability in Mining

Mining has long been associated with significant environmental challenges, including habitat destruction, water contamination, and carbon emissions. However, modern technologies and innovative practices are paving the way for greener operations.

Renewable Energy Integration: Mining companies are increasingly adopting renewable energy sources such as solar and wind to power their operations. For instance, some mines in Chile and Australia now operate entirely on renewable energy, reducing their carbon footprint and operational costs.

Circular Economy Practices: Recycling metals from electronic waste and repurposing mining byproducts are becoming more common. These initiatives not only reduce the need for virgin material extraction but also address the issue of mining waste.

Water Management Innovations: Water is a critical resource in mining, often used in large quantities for processing minerals. Companies are investing in technologies to recycle water and reduce consumption, ensuring minimal impact on local communities and ecosystems.

Ethical Sourcing: A Growing Priority

Consumers and businesses alike are increasingly prioritizing ethically sourced materials. This trend has put pressure on the mining industry to ensure fair labor practices, community welfare, and environmental stewardship.

Fair Labor Practices: Reports of child labor and unsafe working conditions in some mining regions have raised global concerns. Ethical sourcing requires adherence to international labor standards and active monitoring of supply chains to prevent exploitation.

Community Engagement: Mining operations often disrupt local communities. Ethical sourcing involves consulting with and compensating affected populations, ensuring that mining benefits are shared equitably. Initiatives such as community-driven mining agreements are fostering collaboration and trust.

Transparency and Certification: Organizations like the Responsible Mining Initiative and Fairmined Certification are helping companies demonstrate their commitment to ethical practices. Blockchain technology is also being used to trace materials from mine to market, providing verifiable proof of ethical sourcing.

The Role of Innovation

Innovation is a cornerstone of the mining industry’s sustainable future. From automation and artificial intelligence to reduce waste and increase efficiency, to biotechnologies that use microbes to extract metals in a less invasive manner, the possibilities are vast. Additionally, partnerships with tech companies are helping mining firms harness data for better decision-making and improved sustainability outcomes.

Challenges and Opportunities Ahead

Despite these advancements, the path to sustainability and ethical sourcing in mining is not without challenges. High implementation costs, lack of regulatory frameworks in some regions, and the complexity of global supply chains are significant hurdles. However, these challenges also present opportunities for collaboration between governments, NGOs, and the private sector.

Conclusion

The future of mining lies at the intersection of sustainability and ethical sourcing. As the world transitions to a greener economy, the mining industry has a pivotal role in ensuring that the materials powering this change are sourced responsibly. By embracing innovation, transparency, and community collaboration, the mining sector can pave the way for a more ethical and sustainable future.

2 notes

·

View notes

Text

Blockchain Investment: A New Frontier for Investors

The rise of blockchain technology over the last decade has sparked interest across various industries, from finance and supply chain management to healthcare and entertainment. As blockchain matures, investors are starting to recognize its potential not only for transforming traditional sectors but also for offering new investment opportunities. In this article, we explore the significance of blockchain investment, the types of investments available, the associated risks, and the future outlook for this promising technology.

What is Blockchain?

Blockchain is a decentralized digital ledger technology that securely records transactions across multiple computers. It allows information to be stored transparently, immutably, and without the need for intermediaries such as banks or government bodies. The most famous application of blockchain technology is Bitcoin, the first cryptocurrency, but its potential extends far beyond digital currencies.

Blockchain’s unique features—decentralization, transparency, and security—make it an appealing foundation for various applications, ranging from finance to supply chain management to voting systems. With an increasing number of industries exploring blockchain’s use cases, it has garnered significant attention from investors.

youtube

Why Invest in Blockchain?

Disruption of Traditional Systems: Blockchain has the potential to disrupt a wide range of industries by providing more efficient, transparent, and secure alternatives to legacy systems. For example, blockchain-based financial services can lower transaction costs, reduce fraud, and offer access to previously unbanked populations. The transformation of industries such as healthcare, logistics, and government services is just beginning.

The Growth of Cryptocurrencies: Blockchain is the backbone of cryptocurrencies, which have seen exponential growth in recent years. Bitcoin, Ethereum, and other altcoins have become established assets, and decentralized finance (DeFi) platforms built on blockchain promise further innovation in financial markets. Investors can benefit from both the appreciation of these digital assets and the broader adoption of cryptocurrency ecosystems.

Tokenization of Assets: Blockchain enables the tokenization of real-world assets, including real estate, art, and commodities. This allows investors to gain fractional ownership in previously illiquid assets, opening up new avenues for diversification and investment. Tokenization can also improve liquidity and streamline processes such as cross-border payments and property transfers.

Venture Capital and Startups: Many blockchain-based startups are developing innovative applications, from decentralized applications (dApps) to non-fungible tokens (NFTs) to blockchain-based identity verification systems. Venture capitalists and angel investors can tap into the high growth potential of these companies, as blockchain adoption continues to rise globally.

Types of Blockchain Investments

Blockchain investments can be approached in several ways. Some of the most common types include:

Cryptocurrencies: Direct investment in digital currencies like Bitcoin, Ethereum, and other altcoins is the most straightforward form of blockchain investment. These cryptocurrencies can be purchased through exchanges and stored in digital wallets. While Bitcoin and Ethereum are the most well-known, there are thousands of altcoins that investors can explore.

Blockchain-related Stocks and ETFs: Rather than investing directly in cryptocurrencies, investors can gain exposure to blockchain technology by purchasing stocks in companies that are integrating blockchain into their operations. Public companies such as Nvidia (which provides hardware for mining), Coinbase (a cryptocurrency exchange), and Block (formerly Square) are examples of firms investing heavily in blockchain. Additionally, blockchain-focused exchange-traded funds (ETFs) allow investors to diversify their exposure to the sector.

Initial Coin Offerings (ICOs) and Token Sales: ICOs and token sales are fundraising mechanisms where startups issue their own cryptocurrency tokens in exchange for investments. While ICOs were initially seen as high-risk, high-reward ventures, they have become more regulated over time. This form of investment allows early-stage investors to gain a stake in blockchain projects before they are widely adopted.

Blockchain Real Estate: The tokenization of real estate allows fractional ownership of property via blockchain-based tokens. Platforms like RealT and Propy have been pioneers in this space, enabling investors to buy shares in real estate and receive dividends from rental income. Blockchain’s transparency and immutability make it ideal for managing property transactions.

Decentralized Finance (DeFi): DeFi is a rapidly growing sector that leverages blockchain to provide financial services such as lending, borrowing, and trading without intermediaries. By investing in DeFi projects or liquidity pools, investors can earn returns in the form of interest or tokens.

Risks of Blockchain Investment

While blockchain presents exciting investment opportunities, there are several risks to consider:

Volatility: Cryptocurrencies, in particular, are known for their extreme price volatility. Dramatic price swings can occur in a short time, making blockchain investments high-risk, especially for short-term traders. Long-term investors should be prepared for fluctuations in value.

Regulatory Uncertainty: Blockchain and cryptocurrencies are still in the early stages of regulatory development. Governments around the world are working on creating frameworks to govern blockchain and digital currencies, but until clear regulations are established, there could be sudden changes in legal and tax requirements that impact investment returns.

Security and Fraud Risks: While blockchain technology itself is secure, the platforms and exchanges built on top of it may not always be. Hacks, scams, and fraud have occurred in the blockchain space, with investors losing substantial amounts of money. Conducting thorough research and choosing reputable platforms is crucial.

Technological Risks: Blockchain is still an emerging technology, and its long-term scalability, interoperability, and environmental impact remain open questions. For instance, Ethereum, one of the leading blockchains, is transitioning from a proof-of-work to a more energy-efficient proof-of-stake consensus mechanism, highlighting the potential for technical challenges.

The Future of Blockchain Investment

As blockchain technology evolves, it’s expected that adoption across industries will only increase. Many experts believe that blockchain will play a central role in reshaping the global economy, particularly in areas like supply chain transparency, decentralized finance, and digital identity verification.

The rise of central bank digital currencies (CBDCs), which are government-backed digital currencies that leverage blockchain technology, will likely spur further mainstream adoption. Additionally, innovations in smart contracts, which automate transactions based on predefined conditions, will expand the use of blockchain beyond simple transactions into complex business processes.

For investors, this presents an exciting opportunity to position themselves at the forefront of a technological revolution. However, as with any emerging technology, it is important to approach blockchain investment with caution, conducting thorough due diligence and maintaining a diversified portfolio to manage risk effectively.

Conclusion

Blockchain investment offers promising opportunities for those willing to navigate its complexities. From cryptocurrencies to tokenized assets to decentralized finance, the potential for growth in this sector is vast. However, investors should carefully consider the risks associated with volatility, regulation, and security before diving in. As blockchain technology matures and becomes more widely adopted, it will likely be a key driver of innovation, providing unique opportunities for savvy investors to capitalize on the next generation of digital transformation.

2 notes

·

View notes

Text

Top 10 In- Demand Tech Jobs in 2025

Technology is growing faster than ever, and so is the need for skilled professionals in the field. From artificial intelligence to cloud computing, businesses are looking for experts who can keep up with the latest advancements. These tech jobs not only pay well but also offer great career growth and exciting challenges.

In this blog, we’ll look at the top 10 tech jobs that are in high demand today. Whether you’re starting your career or thinking of learning new skills, these jobs can help you plan a bright future in the tech world.

1. AI and Machine Learning Specialists

Artificial Intelligence (AI) and Machine Learning are changing the game by helping machines learn and improve on their own without needing step-by-step instructions. They’re being used in many areas, like chatbots, spotting fraud, and predicting trends.

Key Skills: Python, TensorFlow, PyTorch, data analysis, deep learning, and natural language processing (NLP).

Industries Hiring: Healthcare, finance, retail, and manufacturing.

Career Tip: Keep up with AI and machine learning by working on projects and getting an AI certification. Joining AI hackathons helps you learn and meet others in the field.

2. Data Scientists

Data scientists work with large sets of data to find patterns, trends, and useful insights that help businesses make smart decisions. They play a key role in everything from personalized marketing to predicting health outcomes.

Key Skills: Data visualization, statistical analysis, R, Python, SQL, and data mining.

Industries Hiring: E-commerce, telecommunications, and pharmaceuticals.

Career Tip: Work with real-world data and build a strong portfolio to showcase your skills. Earning certifications in data science tools can help you stand out.

3. Cloud Computing Engineers: These professionals create and manage cloud systems that allow businesses to store data and run apps without needing physical servers, making operations more efficient.

Key Skills: AWS, Azure, Google Cloud Platform (GCP), DevOps, and containerization (Docker, Kubernetes).

Industries Hiring: IT services, startups, and enterprises undergoing digital transformation.

Career Tip: Get certified in cloud platforms like AWS (e.g., AWS Certified Solutions Architect).

4. Cybersecurity Experts

Cybersecurity professionals protect companies from data breaches, malware, and other online threats. As remote work grows, keeping digital information safe is more crucial than ever.

Key Skills: Ethical hacking, penetration testing, risk management, and cybersecurity tools.

Industries Hiring: Banking, IT, and government agencies.

Career Tip: Stay updated on new cybersecurity threats and trends. Certifications like CEH (Certified Ethical Hacker) or CISSP (Certified Information Systems Security Professional) can help you advance in your career.

5. Full-Stack Developers

Full-stack developers are skilled programmers who can work on both the front-end (what users see) and the back-end (server and database) of web applications.

Key Skills: JavaScript, React, Node.js, HTML/CSS, and APIs.

Industries Hiring: Tech startups, e-commerce, and digital media.

Career Tip: Create a strong GitHub profile with projects that highlight your full-stack skills. Learn popular frameworks like React Native to expand into mobile app development.

6. DevOps Engineers

DevOps engineers help make software faster and more reliable by connecting development and operations teams. They streamline the process for quicker deployments.

Key Skills: CI/CD pipelines, automation tools, scripting, and system administration.

Industries Hiring: SaaS companies, cloud service providers, and enterprise IT.

Career Tip: Earn key tools like Jenkins, Ansible, and Kubernetes, and develop scripting skills in languages like Bash or Python. Earning a DevOps certification is a plus and can enhance your expertise in the field.

7. Blockchain Developers

They build secure, transparent, and unchangeable systems. Blockchain is not just for cryptocurrencies; it’s also used in tracking supply chains, managing healthcare records, and even in voting systems.

Key Skills: Solidity, Ethereum, smart contracts, cryptography, and DApp development.

Industries Hiring: Fintech, logistics, and healthcare.

Career Tip: Create and share your own blockchain projects to show your skills. Joining blockchain communities can help you learn more and connect with others in the field.

8. Robotics Engineers

Robotics engineers design, build, and program robots to do tasks faster or safer than humans. Their work is especially important in industries like manufacturing and healthcare.

Key Skills: Programming (C++, Python), robotics process automation (RPA), and mechanical engineering.

Industries Hiring: Automotive, healthcare, and logistics.

Career Tip: Stay updated on new trends like self-driving cars and AI in robotics.

9. Internet of Things (IoT) Specialists

IoT specialists work on systems that connect devices to the internet, allowing them to communicate and be controlled easily. This is crucial for creating smart cities, homes, and industries.

Key Skills: Embedded systems, wireless communication protocols, data analytics, and IoT platforms.

Industries Hiring: Consumer electronics, automotive, and smart city projects.

Career Tip: Create IoT prototypes and learn to use platforms like AWS IoT or Microsoft Azure IoT. Stay updated on 5G technology and edge computing trends.

10. Product Managers

Product managers oversee the development of products, from idea to launch, making sure they are both technically possible and meet market demands. They connect technical teams with business stakeholders.

Key Skills: Agile methodologies, market research, UX design, and project management.

Industries Hiring: Software development, e-commerce, and SaaS companies.

Career Tip: Work on improving your communication and leadership skills. Getting certifications like PMP (Project Management Professional) or CSPO (Certified Scrum Product Owner) can help you advance.

Importance of Upskilling in the Tech Industry

Stay Up-to-Date: Technology changes fast, and learning new skills helps you keep up with the latest trends and tools.

Grow in Your Career: By learning new skills, you open doors to better job opportunities and promotions.

Earn a Higher Salary: The more skills you have, the more valuable you are to employers, which can lead to higher-paying jobs.

Feel More Confident: Learning new things makes you feel more prepared and ready to take on tougher tasks.

Adapt to Changes: Technology keeps evolving, and upskilling helps you stay flexible and ready for any new changes in the industry.

Top Companies Hiring for These Roles

Global Tech Giants: Google, Microsoft, Amazon, and IBM.

Startups: Fintech, health tech, and AI-based startups are often at the forefront of innovation.

Consulting Firms: Companies like Accenture, Deloitte, and PwC increasingly seek tech talent.

In conclusion, the tech world is constantly changing, and staying updated is key to having a successful career. In 2025, jobs in fields like AI, cybersecurity, data science, and software development will be in high demand. By learning the right skills and keeping up with new trends, you can prepare yourself for these exciting roles. Whether you're just starting or looking to improve your skills, the tech industry offers many opportunities for growth and success.

#Top 10 Tech Jobs in 2025#In- Demand Tech Jobs#High paying Tech Jobs#artificial intelligence#datascience#cybersecurity

2 notes

·

View notes

Text

A Simple Guide to Staking: How to Make Your Crypto Work for You

Have you ever wished your money could work as hard as you do? In the world of cryptocurrency, this is entirely possible through staking. Think of it as putting your crypto into a savings account that not only keeps it safe but also rewards you for letting it sit there. Let’s break down staking in a way that’s easy to understand and relatable.

What Is Staking?

Staking is like locking your money in a fixed deposit at a bank. When you stake cryptocurrency, you’re committing it to a blockchain network to help keep the system secure and operational. In return, the network rewards you, usually in the form of additional tokens.

But here’s the cool part: staking isn’t just about earning rewards. It’s also about actively participating in the blockchain’s growth. Unlike mining, which requires heavy computing power, staking is energy-efficient, making it a more sustainable option for blockchain enthusiasts.

Why Should You Consider Staking

1. Passive Income

Staking allows you to earn extra crypto without actively trading or investing in new projects. It’s a steady way to grow your holdings while you focus on other things.

2. Eco-Friendly Contribution

By staking, you’re contributing to blockchain networks without the energy-intensive processes of mining. It’s a win for you and the planet.

3. Support the Blockchain Ecosystem

Staking strengthens the blockchain, helping to ensure its reliability and security.

Staking on STON.fi: Why It Stands Out

If you’re ready to dive into staking, STON.fi offers unique incentives that go beyond traditional rewards. Here’s what makes it special:

1. ARKENSTON: Your Soulbound NFT

When you stake STON tokens, you receive an ARKENSTON—a non-fungible token permanently linked to your wallet.

It’s not for sale and can’t be transferred.

It will serve as your access pass to the STON.fi DAO, an exclusive community where you can help decide the platform’s future direction.

2. GEMSTON Tokens: Instant Rewards

GEMSTON is a community token from the STON.fi family. It’s tradable and adds immediate value to your staking experience.

On STON.fi, you can use a built-in calculator to estimate how much GEMSTON you’ll earn when you stake, so there are no surprises.

How to Stake on STON.fi

Getting started with staking on STON.fi is simple:

1. Visit the "Stake" section on the platform.

2. Enter the amount of STON tokens you want to stake.

3. Choose the staking duration that works for you.

4. Confirm the transaction, and that’s it—your staking journey begins!

The interface is intuitive, making it beginner-friendly while offering advanced options for seasoned users.

What Should You Know Before Staking

While staking is a fantastic way to grow your crypto, it’s not without its considerations.

Lock-Up Period: The tokens you stake will be inaccessible for a set period, so only stake what you can afford to lock away.

Market Volatility: The rewards you earn may vary based on the token’s market value.

Research Is Key: Always ensure you’re staking on a reliable platform like STON.fi.

The Bigger Picture

Staking isn’t just about earning rewards—it’s about becoming part of a larger ecosystem. Platforms like STON.fi empower users to take an active role in shaping the blockchain’s future while benefiting financially.

Think of staking as planting seeds in a garden. With patience, care, and the right tools, those seeds can grow into something fruitful. Platforms like STON.fi provide the fertile ground for your crypto to flourish.

Finally

Staking is one of the simplest ways to make your crypto work for you. It’s a low-effort, high-reward strategy that benefits both you and the blockchain networks you support.

If you’re ready to start staking, STON.fi is an excellent choice, offering unique rewards like ARKENSTON NFTs and GEMSTON tokens. Take the first step today, and let your crypto do the heavy lifting for a change.

Have questions or want to share your staking experience? Let’s discuss in the comments below!

2 notes

·

View notes

Text

A Simple Guide to Staking: How to Earn Rewards with Your Crypto

If you’ve ever wondered how to make your cryptocurrency do more than just sit in your wallet, staking might be the answer you’ve been looking for. Think of it as a way to earn rewards while supporting the blockchain network. In this guide, I’ll walk you through what staking is, why it’s worth your attention, and how you can get started—especially with platforms like STON.fi.

What Exactly Is Staking

Imagine putting your money in a savings account that earns interest. You don’t lose your money—it’s just temporarily locked in, and the bank rewards you for it. Staking works in a similar way but in the world of blockchain.

When you stake your cryptocurrency, you “lock” it in a network, helping to keep the blockchain secure and functional. In return, you earn rewards, which can come in the form of more cryptocurrency or other benefits.

It’s like planting a fruit tree: you give it care and patience, and over time, it produces fruit for you to enjoy.

Why Should You Stake Your Crypto

Staking isn’t just about earning rewards; it’s about being part of something bigger. By staking, you’re actively contributing to the health and security of the blockchain network. Here’s why staking could be worth your while:

Passive Income: Earn rewards without actively trading. Your crypto works for you, even while you sleep.

Community Building: Some platforms, like STON.fi, offer additional perks like exclusive community access.

Eco-Friendly Contribution: Staking is more energy-efficient compared to mining, making it a greener option in the crypto space.

It’s not just about financial gains—it’s about participating in a decentralized future.

Why Choose STON.fi for Staking

STON.fi takes staking to another level by offering unique rewards and an easy-to-use platform. Here’s what makes it stand out:

1. Receive ARKENSTON

When you stake STON tokens, you get an ARKENSTON NFT. This isn’t your regular NFT—it’s soulbound, meaning it’s permanently linked to your wallet. You can’t sell it or transfer it.

Why does this matter? ARKENSTON will serve as your ticket to the STON.fi DAO—a private community where you can participate in shaping the platform’s future. Think of it as joining an exclusive club where your voice matters.

2. Earn GEMSTON Tokens

GEMSTON is a special token you earn as a reward for staking. It’s a tradable token within the STON.fi ecosystem and beyond. With GEMSTON, you’re not just earning passive rewards—you’re gaining assets that could appreciate over time.

How to Stake STON Tokens

Getting started with staking on STON.fi is straightforward and beginner-friendly.

1. Head to the "Stake" Section

Visit the STON.fi platform and click on the “Stake” tab.

2. Choose Your Amount and Duration

Decide how many STON tokens you want to stake and for how long. The longer you stake, the higher the potential rewards.

3. Use the Reward Calculator

Before confirming, use the built-in calculator to see exactly how much GEMSTON you’ll earn. This feature helps you make informed decisions.

4. Confirm Your Stake

Once satisfied, confirm your stake and start earning.

It’s that simple. No complicated steps or technical know-how required.

Things to Keep in Mind Before Staking

While staking is a fantastic opportunity, there are a few things to consider:

Lock-Up Periods: Your tokens will be inaccessible during the staking period. Make sure you’re okay with that before committing.

Market Volatility: The value of your staked tokens can fluctuate due to market changes.

Platform Reputation: Always research the platform you’re staking on. STON.fi is trusted, but it’s good to do your due diligence.

Think of staking like investing in a bond. You lock your funds for a fixed period, and in return, you earn interest. But, like any investment, it’s important to understand the risks.

Why STON.fi Is a Game-Changer

STON.fi isn’t just about staking—it’s about building a community. By staking STON tokens, you’re not just earning rewards; you’re securing a place in an ecosystem that values its contributors.

Your ARKENSTON NFT symbolizes your commitment and gives you access to decision-making power in the DAO. Meanwhile, GEMSTON tokens offer immediate and tangible rewards, making your staking experience both rewarding and meaningful.

It’s like being an early investor in a promising company—you’re not just earning; you’re helping to shape the future.

Final Thoughts

Staking is one of the simplest ways to make your cryptocurrency work for you. Whether you’re new to crypto or a seasoned investor, platforms like STON.fi make staking accessible, rewarding, and community-focused.

By staking your STON tokens, you’re not just earning rewards—you’re actively participating in the growth of a decentralized ecosystem. It’s a win-win: your crypto grows, and so does the network you’re supporting.

So, what’s stopping you? Dive into staking with STON.fi and watch your crypto journey transform.

Have questions or need guidance? Let’s continue the conversation in the comments.

3 notes

·

View notes

Text

Explora Chain $EXRA : A Revolutionary Formula for Blockchain Success

Explora Chain $EXRA : A Revolutionary Formula for Blockchain Success

In the fast-paced world of blockchain technology, Explora Chain has emerged as a trailblazer, setting new standards for scalability, sustainability, and adoption. At the core of our success lies a unique formula that combines innovation, technology, and community.

The Explora Chain Formula for Success

The foundation of Explora Chain is built on the following formula:

E = (S × T × C) ÷ E²

Where:

E: Explora Chain Impact

S: Scalability – The ability to handle millions of transactions per second.

T: Technology – Advanced cryptographic security and eco-friendly mining protocols.

C: Community – A global network of developers, investors, and enthusiasts.

E²: Energy Efficiency – A commitment to sustainability, reducing blockchain’s environmental footprint.

This formula ensures that Explora Chain maximizes its impact while maintaining a balance between innovation and responsibility.

Breaking Down the Formula

Scalability (S): Explora Chain uses cutting-edge consensus algorithms to process transactions faster than ever before, making it ideal for DeFi, NFTs, and enterprise applications.

Technology (T): By integrating robust cryptographic protocols, Explora Chain guarantees secure, transparent, and immutable transactions.

Community (C): Our decentralized model prioritizes community governance, ensuring that every voice contributes to the growth and direction of the ecosystem.

Energy Efficiency (E²): Sustainability is at the heart of Explora Chain. We’ve minimized energy consumption, making blockchain adoption environmentally conscious.

Explora Chain Price Growth Formula

Our price projection follows a growth model influenced by adoption, utility, and innovation:

Price (P) = (A × U) ÷ R

Where:

A: Adoption Rate – Number of users joining the ecosystem.

U: Utility – The real-world applications and integrations of Explora Chain.

R: Resistance – Market challenges like competition and volatility.

Price Predictions

Using this formula, we forecast Explora Chain’s price trajectory:

2025: $0.14 to $1 USDT 🚀

2026: $2 USDT

2027: $4 USDT

2028: $8 USDT

2029: $16 USDT

2030: $30 USDT

Join the Explora Chain Movement

With a robust formula driving its success, Explora Chain is ready to transform industries and empower communities worldwide. Be part of this journey as we redefine blockchain’s future.

#ExploraChain

#BlockchainFormula

#CryptoInnovation

#SustainableBlockchain

#DeFiRevolution

#CryptoFuture

#Web3

#ExploraChainSuccess

Explora Chain: The perfect formula for blockchain success. 🌍✨

2 notes

·

View notes

Text

"How Cryptocurrency Ripple XRP Is Transforming Global Finance"

```html

The Rise of Ripple (XRP): A Game Changer in the Cryptocurrency World

Crytocurrencies have taken the world by storm in recent years, and one of the most intriguing players in this space is Ripple (XRP). Unlike many other cryptocurrencies that aim to replace traditional currencies, Ripple has a more focused objective: facilitating real-time cross-border payments.

What is Ripple and XRP?

Ripple is a digital payment protocol that allows for fast and secure transactions between parties across the globe. The cryptocurrency associated with this network is known as XRP. Together, they aim to make international banking and digital payments more efficient.

Key Features of Ripple:

Speed: Ripple transactions can be settled in just a few seconds, significantly faster than traditional banking methods which can take days.

Low Transaction Costs: The fees for using XRP are generally much lower compared to those of conventional financial transfers.

Liquidity: XRP can provide liquidity for financial institutions, allowing them to facilitate easier and quicker transactions.

How Does Ripple Work?

Ripple operates through a unique consensus algorithm rather than the typical mining processes seen in Bitcoin and Ethereum. This allows its transactions to be processed more quickly and environmentally friendly. By using a system of validators and a shared ledger, Ripple ensures the integrity and accuracy of each transaction while maintaining incredibly low fees.

Ripple’s Use Cases

The primary use case for Ripple is in the banking sector. Financial institutions have begun adopting Ripple's technology to move money across borders in a matter of seconds, which helps in reducing costs and improving efficiency. Major banks like Santander and American Express have already formed partnerships with Ripple.

The Future of Ripple (XRP)

As blockchain technology continues to evolve, the potential for Ripple is considerable. The demand for faster and more efficient payment systems only continues to grow. Thus, Ripple's unique model positions it well within the cryptocurrency landscape. However, it is essential to note that its association with traditional banking can attract skepticism from purists who advocate for decentralization.

Challenges Ahead:

Regulatory Scrutiny: Like all cryptocurrencies, Ripple faces scrutiny from governments and regulatory bodies, which can impact its growth and adoption.

Competition: With many alternative solutions entering the market, maintaining relevance and market share is crucial for Ripple’s success.

Conclusion

Ripple (XRP) stands out as an innovative solution for improving the speed and cost-effectiveness of international financial transactions. Its partnerships with various banking institutions pave the way for a more integrated, digital financial future. As Ripple continues to grow and adapt to the ever-changing landscape of cryptocurrency, it will be interesting to see how it navigates the challenges ahead while aiming to fulfill its mission.

In a world where the traditional financial systems are being questioned more than ever, Ripple offers a glimpse of what the future of digital payments might look like. Stay tuned, because the journey has only just begun!

``` "How Cryptocurrency Ripple XRP Is Transforming Global Finance"

2 notes

·

View notes

Text

Top Reasons Why Mint Tokens Are the Future of Digital Finance in 2024

Introduction

The world of digital finance is rapidly evolving, with innovations emerging at an unprecedented pace. One of the most promising developments in this space is the rise of mint tokens. These digital assets are redefining the way we think about finance, offering new opportunities for investment, transactions, and economic growth. As we look ahead to 2024, it’s clear that mint tokens are poised to play a crucial role in shaping the future of digital finance. In this blog, we’ll explore the top reasons why mint tokens are set to dominate the financial landscape in the coming year.

What Are Mint Tokens?

Understanding Mint Tokens

Mint tokens are digital assets created on a blockchain network. Unlike traditional cryptocurrencies like Bitcoin, which are mined through complex computational processes, mint tokens are typically created through a process called minting. This involves the issuance of new tokens directly on the blockchain, often by a centralized entity or through decentralized protocols.

Types of Mint Tokens

Mint tokens can serve various purposes, including utility tokens, security tokens, governance tokens, and even memecoins. Each type of token has its unique characteristics and use cases, contributing to the diverse ecosystem of digital finance.

1. Enhanced Security and Transparency

Blockchain Technology

One of the primary reasons mint tokens are gaining traction is their inherent security and transparency. Built on blockchain technology, these tokens benefit from decentralized and immutable ledgers, which record every transaction. This ensures that all token movements are transparent and verifiable, reducing the risk of fraud and enhancing trust among users.

Smart Contracts

Mint tokens often utilize smart contracts, which are self-executing contracts with the terms directly written into code. These contracts automatically enforce agreements and transactions, eliminating the need for intermediaries and further enhancing security and efficiency.

2. Accessibility and Inclusivity

Democratizing Finance

Mint tokens have the potential to democratize finance by providing access to financial services for individuals who are underserved by traditional banking systems. With just a smartphone and internet connection, anyone can participate in the digital economy, regardless of their location or socio-economic status.

Lower Barriers to Entry

Creating and trading mint tokens is often more accessible than traditional financial instruments. Platforms that facilitate the minting process have simplified the creation of new tokens, allowing users to launch their digital assets without extensive technical knowledge or significant capital investment.

3. Decentralized Finance (DeFi) Integration

Expanding the DeFi Ecosystem

Mint tokens are integral to the growth of decentralized finance (DeFi), a movement that aims to create an open and permissionless financial system. By integrating with DeFi protocols, mint tokens enable a wide range of financial activities, such as lending, borrowing, trading, and staking, without relying on centralized institutions.

Yield Farming and Liquidity Provision

One of the key features of DeFi is yield farming, where users earn rewards by providing liquidity to decentralized exchanges (DEXs) and other DeFi platforms. Mint tokens can be staked in liquidity pools, generating passive income for holders and contributing to the overall liquidity and stability of the DeFi ecosystem.

4. Enhanced Interoperability

Cross-Chain Compatibility

As the blockchain ecosystem grows, interoperability between different networks becomes increasingly important. Mint tokens are often designed to be cross-chain compatible, allowing them to move seamlessly between various blockchains. This enhances their utility and opens up new possibilities for decentralized applications (dApps) and financial services.

Bridging Traditional and Digital Finance

Mint tokens can also serve as a bridge between traditional financial systems and the emerging digital economy. By tokenizing real-world assets such as stocks, bonds, and real estate, mint tokens enable fractional ownership and easier transfer of these assets, making them more accessible and liquid.

5. Innovation in Tokenomics

Dynamic Supply Mechanisms

Mint tokens offer innovative tokenomics models that can adapt to changing market conditions. For example, some mint tokens have dynamic supply mechanisms that adjust the token supply based on demand, helping to stabilize prices and incentivize user participation.

Incentive Structures

Many mint tokens incorporate incentive structures to encourage long-term holding and active participation in the ecosystem. These incentives can include staking rewards, governance rights, and access to exclusive services or benefits, driving user engagement and loyalty.

6. Environmental Considerations

Energy Efficiency

Traditional proof-of-work (PoW) mining methods used by cryptocurrencies like Bitcoin are often criticized for their high energy consumption. In contrast, mint tokens typically use more energy-efficient consensus mechanisms, such as proof-of-stake (PoS) or delegated proof-of-stake (DPoS), reducing their environmental impact.

Sustainable Growth

As the world becomes more conscious of environmental issues, the sustainability of financial systems is gaining importance. Mint tokens, with their lower energy requirements and innovative approaches to consensus, align with the growing demand for environmentally friendly financial solutions.

7. Regulatory Compliance

Aligning with Regulations

As the cryptocurrency market matures, regulatory compliance is becoming a critical factor for the long-term success of digital assets. Mint tokens can be designed to comply with regulatory requirements, providing greater assurance to investors and facilitating wider adoption.

Enhancing Investor Confidence

Regulatory compliance enhances investor confidence by ensuring that mint tokens adhere to established legal and financial standards. This can attract institutional investors and contribute to the overall legitimacy and stability of the digital finance ecosystem.

8. Increased Adoption and Market Growth

Expanding Use Cases

The versatility of mint tokens is driving their adoption across various industries, from finance and gaming to supply chain management and healthcare. As more use cases emerge, the demand for mint tokens is expected to grow, further solidifying their position in the digital economy.

Mainstream Acceptance

Mint tokens are gaining mainstream acceptance as more businesses and individuals recognize their potential benefits. High-profile endorsements, partnerships, and integrations with established platforms are helping to drive awareness and adoption, paving the way for widespread use.

Conclusion

Mint tokens are poised to revolutionize digital finance in 2024, offering enhanced security, accessibility, and innovation. Their integration with DeFi, cross-chain compatibility, and environmentally friendly features make them a compelling choice for investors and users alike. As the digital finance landscape continues to evolve, mint tokens are set to play a pivotal role in shaping the future of the economy.

By understanding the unique advantages of mint tokens and staying informed about the latest developments, investors can position themselves to capitalize on the opportunities presented by this exciting and transformative technology. Whether you are a seasoned investor or new to the world of digital finance, mint tokens offer a promising avenue for growth and innovation in the years to come.

3 notes

·

View notes

Text

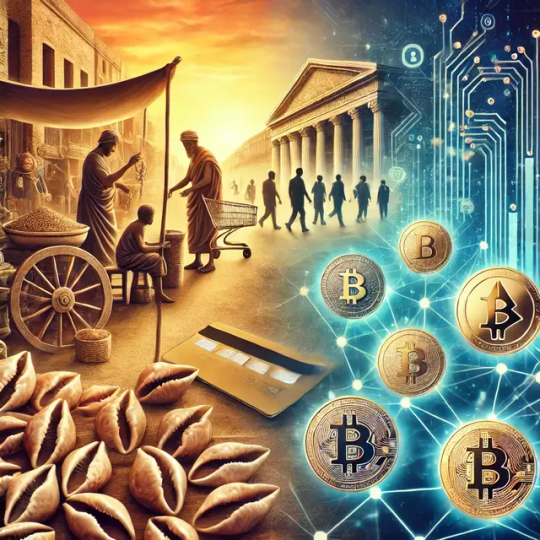

From Seashells to Satoshis: The Evolution of Money

Picture an ancient marketplace, where the currency jingling in your pouch might not be coins at all, but seashells. For centuries, cowrie shells were prized for their shiny appeal and rarity, transforming them into one of humanity’s earliest forms of money. Over time, these shells gave way to metals—iron, copper, silver, and gold—that gleamed with an unmistakable allure. Soon enough, our ancestors decided that lugging heavy gold and silver everywhere was a bit too cumbersome, so they started stamping metals into more convenient coins. This was the moment rulers realized something fundamental: whoever controls the mint, controls the economy. It wasn’t long before some couldn’t resist the temptation to mix cheaper metals in, keeping the gold for themselves. Those sneaky tactics brought about a new kind of challenge—trust.

Civilizations continued to experiment with what they could use as a medium of exchange, but ultimately, the golden standard took hold in many parts of the world. Gold’s scarcity, durability, and shiny mystique made it perfect for coins. That system thrived, yet society yearned for the next innovative step: paper currency. People quickly discovered that thin, foldable, and easy-to-carry notes were far superior to a pocketful of metal, and so governments printed paper money backed by vaults of precious metal. With the rise of fiat currency, the day came when the promise that these notes could be traded for gold or silver fizzled out entirely. Suddenly, many currencies were worth something simply because a central authority claimed so, and people believed it—or at least went along with the collective delusion. This arrangement flourished as economies globalized, but it also planted the seeds of modern financial headaches, like inflation and incessant money printing.

Still, the convenience of paper money was unmatched—until credit cards and online banking arrived. With a simple swipe or a tap on an app, individuals could pay for things in a purely digital sense. Transactions happened at lightspeed, all orchestrated by a network of banks and payment processors. Yet that centralization, which at first looked efficient, also created single points of failure. If banks had technical issues or simply felt your transaction was “suspicious,” access to your funds could vanish faster than you could say “insufficient funds.”

Enter Bitcoin, launched by the mysterious Satoshi Nakamoto. The idea behind Bitcoin was to create a system that didn’t require permission or trust in any single authority. Think of it as the next stage in the evolution of money—just like going from shells to gold, gold to paper, and paper to digital banking, the concept of decentralized digital coins felt like a natural leap. Here, the currency isn’t printed arbitrarily by a central bank; it’s “mined” through solving cryptographic puzzles. More importantly, every transaction is recorded on a public ledger called the blockchain, ensuring transparency, security, and an unwavering limit on the total supply.

Some critics argue that cryptocurrencies are too volatile or still too complex for mainstream adoption. Others worry about the energy consumed in mining. Yet, even those skeptics acknowledge that Bitcoin and other digital assets have ignited a global conversation. The very fact that governments and big financial institutions are grappling with how to regulate or incorporate crypto is proof that we’ve reached a tipping point. Humanity has always been restless when it comes to improving its systems, especially the system of money.

From shells in the marketplace to cryptographic tokens on the internet, the thread connecting us across history is innovation. We are constantly reimagining how to store and exchange value. The real question is not whether money will evolve once more—it’s how quickly this new chapter will redefine our personal freedoms, our economic structures, and the ways we trust one another. Will we cling to old traditions until they crumble, or embrace a future where blockchains, decentralized finance, and digital currencies reshape how we think about worth itself?

In the grand tapestry of civilization, money isn’t just coins and notes; it’s a story we tell ourselves about trust, power, and possibility. As we move ever closer to a world shaped by digital networks, the ancient shells on a faraway beach remind us that the idea of value is never fixed—it’s created, adapted, and refined. And now, in the age of Bitcoin, we’re just beginning to write the next chapter.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#Bitcoin#Cryptocurrency#MoneyEvolution#Blockchain#DigitalCurrency#FinancialRevolution#BitcoinEducation#CryptoHistory#FutureOfFinance#Decentralization#BitcoinFixesThis#SeashellsToSatoshis#MoneyMatters#EconomicFreedom#Hyperbitcoinization#SoundMoney#Finance#MoneyTalks#CryptoMindset#FiatVsBitcoin#financial experts#unplugged financial#financial empowerment#financial education#globaleconomy

3 notes

·

View notes

Text

youtube

Cryptocurrency Trading Presentation *Slide 1: Introduction* - Title: "Cryptocurrency: The Future of Money" - Subtitle: "Understanding the Basics and Beyond" - Image: a relevant cryptocurrency-related image *Slide 2: What is Cryptocurrency?* - Definition: "A digital or virtual currency that uses cryptography for security and is decentralized, meaning it's not controlled by any government or institution." - Examples: Bitcoin, Ethereum, Litecoin, etc. *Slide 3: History of Cryptocurrency* - Brief overview of the history of cryptocurrency, starting with Bitcoin in 2009 - Key milestones and events #crypto #currencytrading #money #wealthcreationjourney *Slide 4: How Cryptocurrency Works* - Explanation of the underlying technology: blockchain, mining, and cryptography - How transactions are made and verified *Slide 5: Benefits of Cryptocurrency* - Decentralization and autonomy - Security and transparency - Speed and efficiency - Accessibility and inclusivity *Slide 6: Types of Cryptocurrencies* - Bitcoin and altcoins - Tokens and coins - Stablecoins and CBDCs (central bank digital currencies) *Slide 7: Cryptocurrency Use Cases* - Payments and transactions - Smart contracts and DeFi (decentralized finance) - NFTs (non-fungible tokens) and digital art - Gaming and virtual worlds *Slide 8: Cryptocurrency Risks and Challenges* - Volatility and price fluctuations - Security risks and hacking - Regulatory uncertainty and compliance - Adoption and scalability *Slide 9: Cryptocurrency Regulation* - Overview of current regulatory landscape - Key regulations and laws - Impact on adoption and innovation *Slide 10: Future of Cryptocurrency* - Trends and predictions - Potential applications and use cases - Challenges and opportunities *Slide 11: Conclusion* - Summary of key points - Final thoughts and call to action *Slide 12: Additional Resources* - List of relevant websites, articles, and books - Further learning and exploration Note: This is just a basic outline, and you can add or remove slides as per your requirement. You can also add images, charts, and graphs to support your points. Cryptocurrency: The Future of Money published first on https://www.youtube.com/@Moneywavetv/

#Personal finance#Investing#Wealth-building#Financial literacy#Money management#Stock market analysis#Cryptocurrency#Entrepreneurship#Financial freedom#Wealth creation#Youtube

2 notes

·

View notes