#evcfl

Text

3 Graphs that Prove there is NO Foreclosure Crisis coming

Here’s the scoop: while the number of foreclosure filings might be inching up, we’re nowhere near a foreclosure crisis.

The market’s stable, buyer demand is strong, and homeowner equity is higher than ever.

Keep calm, carry on, and don’t get scared by any foreclosure headlines – that’s the message to share with your clients right now.

Because this news isn’t going away anytime soon. So, use the insights and visuals in this article to let them know why there’s no cause for alarm.

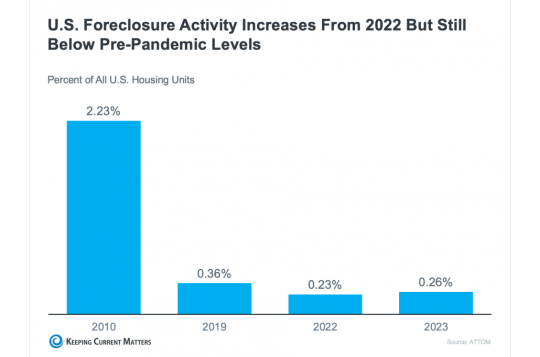

Foreclosures Have Increased, But Not By Much

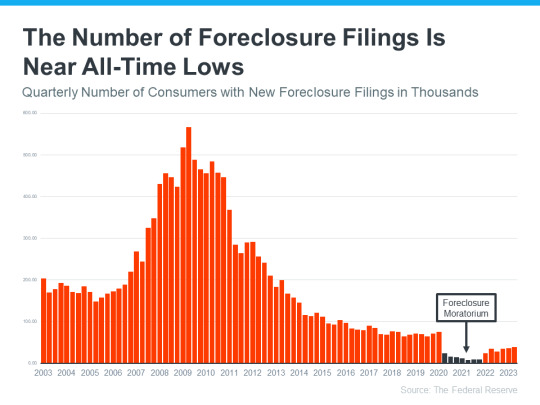

During the Great Recession, millions of homes went into foreclosure. In 2010, there were almost 3 million foreclosure filings in this country.

In comparison, there were only about 357,000 last year.

The graph below shows the number of foreclosure filings going back to 2005 – before the housing crash.

The red bars are when there were over 1 million filings per year. You can see that not only are foreclosure numbers nowhere near where we were during the Great Recession, but they’re also still significantly lower than where they were before the pandemic.

As Rick Sharga, Founder and CEO of the CJ Patrick Company, explains:

“Foreclosure activity is still only at about 60% of pre-pandemic levels. . .”

Now, let’s focus in on 2020 and 2021. Remember the foreclosure moratorium and forbearance programs during the pandemic? They were lifesavers for millions of homeowners, giving them a chance to bounce back during some seriously tough times.

When those programs wrapped up, it was inevitable that we’d see a bump in foreclosures. But here’s the key point: just because foreclosures are ticking up, it doesn’t mean there’s a crisis or a wave on the horizon.

Just take a look at the graph above to help put that into perspective. We’re still below pre-pandemic numbers and way below the height of the housing crash in 2010.

One of the biggest reasons why is that homeowners are sitting on tons of equity right now. That means that even if they hit challenging times, they have options to use that equity to sell and avoid foreclosure altogether.

This perspective helps people understand why the market today is so much different than back in 2008.

As for what’s happening right now, the graph below says it all. All foreclosure metrics are down. That means active foreclosure inventory, foreclosure sales, and foreclosure starts are lower than they were a year ago.

Therefore, those headlines blowing up your newsfeed are painting a pretty exaggerated picture. They’re cherry-picking recent numbers and comparing them to a time when foreclosures were at an all-time low.

It’s like comparing apples to oranges – not exactly fair, right?

Bottom Line

Headlines have been creeping their way into the news cycle again. They claim that foreclosures are on the rise. The reality, however, is a little more complex.

In the wake of inflation and what have been some tough years for housing affordability, some people want a crash to happen. They’re holding out for that deal of a lifetime.

On the other end of that, anything foreclosure related will immediately put homeowners on high alert. Who wants to sell their house and buy a new one that immediately drops in value?

These visuals and insights help put any fears at ease, letting consumers know there’s no foreclosure crisis on the horizon and therefore, no cause for alarm.

0 notes

Text

Essential Tips for Hiring a Remodeling Contractor

Embarking on a home remodeling project is an exciting venture, but finding the right remodeling contractor is crucial to ensuring a successful outcome. With numerous options available, it's essential to approach the hiring process with diligence and care. To guide you through this important decision, we've compiled a list of invaluable tips for hiring a remodeling contractor.

Obtain Multiple Estimates:

Before making any decisions, seek at least three written estimates from different contractors. This not only provides you with a comprehensive understanding of the project's cost but also allows you to compare services and determine the most reasonable pricing.

Check References:

Go beyond the estimates and delve into the contractor's track record. Request and check references, and if possible, visit previous projects they have completed. This firsthand insight into their work quality and client satisfaction can be instrumental in making an informed decision.

Investigate Complaints:

Take the time to investigate the contractor's reputation by checking with local entities such as the Chamber of Commerce or Better Business Bureau for any complaints or disputes. A clean track record is a positive indicator of a contractor's reliability and professionalism.

Detailed Contracts:

Ensure that the contract is detailed and explicitly outlines the scope of work. Clearly define what is to be done and establish procedures for handling change orders. A comprehensive contract serves as a blueprint for the project and minimizes misunderstandings.

Minimal Down Payment:

Protect your investment by making the smallest down payment possible. This precautionary measure safeguards your finances in case the contractor fails to complete the job or encounters unforeseen challenges.

Verify Permits, Licenses, and Insurance:

Confirm that the contractor possesses the necessary permits, licenses, and insurance. This ensures that they comply with local regulations and have the coverage needed to address any potential issues during the project.

Timelines and Recourse:

Clearly stipulate in the contract when the work will be completed, and outline the recourse available if deadlines are not met. Familiarize yourself with your right to cancel a contract within three business days of signing it, should any concerns arise.

Subcontractor Involvement:

Clarify whether the contractor's employees will handle the entire job or if subcontractors will be involved. Understanding the dynamics of the workforce contributes to effective project management and coordination.

Indemnification for Code Compliance:

Secure an indemnification clause in the contract, holding the contractor responsible if the work fails to meet local building codes or regulations. This adds an extra layer of protection and accountability.

Cleanup and Damage Responsibility:

Specify in the contract that the contractor is responsible for cleaning up after the job and addressing any damages incurred during the remodeling process. This ensures a seamless transition to enjoying your newly renovated space.

Material Specifications:

Guarantee the use of materials that meet your specifications by clearly outlining them in the contract. This prevents any discrepancies and ensures that your vision for the project is realized.

Final Payment Satisfaction:

Hold off on making the final payment until you are completely satisfied with the completed work. This gives you the leverage to address any lingering issues or concerns before concluding the project.

Choosing the right remodeling contractor is a pivotal step in the success of your home improvement project. By adhering to these tips, you empower yourself to make informed decisions, mitigate risks, and ultimately transform your vision into a beautifully renovated reality.

#realestate#28northgroup#evcfl#realestateadvisor#home & lifestyle#lifestyle#realestatemarket#homerenovation#renovation#construction#home improvement

0 notes

Text

If Your House Hasn’t Sold Yet, It May Be Overpriced

Has your house been sitting on the market a while without selling? If so, you should know that’s pretty unusual, especially right now. That’s because the supply of homes available for sale is still far lower than what we’d see in a normal year. That means buyers have fewer options than they usually would, so your house should be an oasis in an inventory desert.

So, if homebuyers have limited choices and your house still hasn’t sold, there’s a reason why. Let’s break one potential sticking point that may be turning buyers away: your asking price.

Especially with today’s higher mortgage rates already putting a stretch on their budget, buyers are being a bit more sensitive about price. As a recent article from the Wall Street Journal (WSJ) says:

“If you are serious about selling your home now, don’t get greedy with the asking price. This is still a seller’s home market as there simply aren’t enough affordable homes for sale in many parts of the country. But with average 30-year mortgage rates above 6%, buyers are much more price-sensitive than they were a year ago.”

Why Setting the Right Price Matters

While you want to maximize the return on your investment when you sell your house, you also need to be realistic based on current market conditions. The simple truth is your house is only going to sell for what people are willing to pay right now.

This can be a hard thing to accept. Especially since emotions can run high during the selling process, which only complicates matters more. After all, you may have lived in this house for years, so it’s only natural you’re emotionally tied to it – and those heartstrings can make it harder to be objective.

But it’s important to acknowledge that a bigger-than-expected price tag deters buyers and may make them dismiss your house as a possibility before even seeing it. And if no one’s looking at it, how will it sell?

If you want to get your house sold, you’ll need to do something to spark interest in your home again. That’s where a local real estate advisor comes in. They’ll help use data to find out if it’s priced too high for your local market. They balance the value of homes in your neighborhood, current market trends and buyer demand, the condition of your house, and more to find the right price for your house, so you can close this chapter and start your next one.

Bottom Line

While it’s true there aren’t that many homes available for sale right now, your home’s asking price still matters. And, if it’s not selling, it may be priced too high.

0 notes

Text

Are You a Homebuyer Worried About Climate Risks?

The increasing effects of natural disasters are leading to new obstacles in residential real estate. As a recent article from CoreLogic explains:

“As the specter of climate change looms large, the world braces for unprecedented challenges. In the world of real estate, one of those challenges will be the effects of natural catastrophes on property portfolios, homeowners, and communities.”

That may be why, according to Zillow, more and more Americans now consider how climate risks and natural disasters can impact their homeownership plans (see below):

This study goes on to explain that climate risks affect where many people look for a home. That’s because homebuyers are interested in finding out if the house they want will be exposed to things like floods, extreme heat, and wildfires.

If you’re in the same situation and are thinking about what to do next, here’s some important information to consider as you start looking for a home.

Expert Advice for Homebuyers To Reduce Climate Risks

The first thing to do is understand how to go about buying a home while thinking about climate risks. With the right help and resources, you can simplify the process.

The Mortgage Reports provides these tips for buying your next home:

Evaluate climate risks: Before buying a home, it's important to check if it's in a flood-prone area using the FEMA website, review the seller's property disclosure for any past damage, and get an inspection for issues like cracks and mold to make sure it's a safe investment.

Consider future preventative maintenance costs: For areas that get tropical storms, you may need to purchase hurricane shutters and sandbags to protect the home. In wildfire-prone areas, you may want to clear plants five feet from the house, consider rooftop sprinklers, or possibly buy gutter guards to prevent fire hazards. Factor these future expenses in when touring homes that may need them.

Take steps to avoid losing your assets: Getting the right insurance for a home in a high-risk climate area is crucial. You should shop around and talk to multiple insurance agents to compare prices and options before deciding to bid on a home.

Above all else, your most valuable resource during this process is a trusted real estate expert. They'll always focus on your goals while keeping your concerns top of mind. Even if they don't have all the answers about how your home can handle natural disasters, they can connect you with the right experts and information.

Bottom Line

If you want to buy a home, but you're also thinking about climate risks, you're not alone. Your home is a big investment, and if anything can impact that, you want to know. Let’s connect so you have someone you can trust to guide you as you find your next home.

0 notes

Text

Income Properties Are Trending, But Is Landlord Life for You?

If the thought of investing your money into brick and mortar—or perhaps some stylishly-painted siding—excites you, join the club.

Investing in real estate has long been one of Americans' favorite ways to grow their wealth. In fact, over 70% of single-family rental properties are currently owned by individual investors rather than corporations, according to Census data.1

Moreover, a decade's worth of Bankrate surveys has found that Americans often prefer real estate for long-term wealth building over other investments. According to Bankrate's latest survey, for example, Americans have historically embraced real estate, in part, because of the strong return on investment it can offer—especially to investors willing to stick with a property over time.2 It’s also a popular way to hedge against inflation since both rental income and property values tend to rise in tandem with overall prices.3

Now, as higher interest rates continue to push priced-out homebuyers to the sidelines, a new crop of “mom and pop” investors are eyeing the mushrooming rental market as a potential goldmine.4 Interest in buying a home to both live in and rent is also on the rise, especially amongst cash-strapped buyers looking to supplement their mortgage payments.5

But how do you know if you’re well-suited to take advantage of these real estate investment opportunities? Here are three signs that owning a rental property could be right for you.

YOU'RE A HOMEBUYER WHO WANTS HELP COVERING THE MORTGAGE

If you're looking for a creative way to buy a home without overspending, “house hacking” could be the answer. Increasingly popular with first-time homebuyers and budget-conscious investors, house hacking simply means buying a home that you intend to live in while renting out a portion of it to one or more tenants.5

House hacking also tends to be easier to break into than traditional real estate investing since you don't need as high a credit score or as large a down payment to qualify for a mortgage. In fact, some government-backed mortgage programs will let you buy a primary residence with little to no money down.6 Buying a home you don't plan to live in, by contrast, may require you to put down as much as 15% to 25% to qualify for a loan.7

If you house hack, the money you collect for rent each month can help cover your mortgage and other homeownership expenses. Depending on your setup, you may also be able to save on utility bills by splitting them with your tenant or tacking a portion onto their monthly rent. Another major advantage of house hacking is that it entitles you to certain tax benefits and deductions available only to landlords.8

When it's time to start your search, we can help you find a property that's ideal for house hacking, such as a house with a walkout basement, a multifamily unit, or a home with enough outdoor space to build an accessory dwelling unit or garage apartment.

YOU'RE AN INVESTOR LOOKING FOR STEADY AND RELIABLE INCOME

If you’re not crazy about the idea of a live-in tenant but still desire an additional stream of income, a dedicated long-term rental property could be a better option for you. Besides the monthly proceeds, purchasing a rental home can also add diversity and long-term stability to your investment portfolio and help you build wealth over time.9

According to data from the Federal Reserve, real estate owners have historically prospered. In early 2020, for example, the median home was worth almost triple what it was 30 years prior. Then, during the pandemic-era real estate boom, average home prices grew at an especially frenzied clip, climbing by nearly 50%, on average, in just two and a half years.10

However, the rate of appreciation can be hard to predict, so it’s prudent to invest in a property that also offers positive cash flow, which means the rent you take in exceeds your expenses. This strategy helps to ensure that you’ll put money in your pocket each month, even if the property’s value takes time to grow.

While today’s higher mortgage rates can make it more challenging for landlords to turn a profit, investment opportunities aren’t reserved for cash buyers. In fact, currently, almost 60% of real estate investors take out a loan to finance their purchase, according to Thomas Malone, an economist at the real estate data firm CoreLogic.4 He also notes that more small investors are stepping in to meet demand for rental housing, which has grown since many would-be buyers remain priced out of the purchase market.4

If you want to explore opportunities for a residential rental property that's good for your wallet and attractive to renters, we can help. Reach out with questions or to schedule a free consultation.

YOU'RE AN EXPERIENCED INVESTOR LOOKING TO MAXIMIZE YOUR POTENTIAL RETURNS

Another increasingly popular way to draw income from an investment property is to convert it to a short-term vacation rental. But beware: This strategy can be riskier as some municipalities have tightened rental restrictions and others are suffering from market oversaturation.11,12

With that said, if you're an experienced investor who can afford to take on some uncertainty, then investing in a short-term rental could make sense for you.

If you find the right property, for example, you could earn significantly more renting it short-term on a platform like Airbnb than if you rented the home to a long-term tenant.11

The key is to keep it occupied as much as possible at a premium nightly rate. To do that, you’ll need some marketing savvy, hospitality skills, and business acumen. Of course, you can always hire a professional property manager, but you’ll need to factor the cost into your budget.

The vacation rental market enjoyed a boom during the pandemic, and some inexperienced investors are finding they bit off more than they can chew. As a result, there's an opportunity to snap up some of these properties, but you'll need some cash on hand and a willingness to learn the business.12

We can help you scout opportunities in our local market or, if you’re interested in investing in another area, we can refer you to an agent there for assistance.

BOTTOMLINE

Investing in real estate can be a great way to build your wealth long-term and earn some extra income. But to make the most of your investment, it pays to be strategic.

Call us for a consultation so we can discuss your goals and budget. We'll help you discover neighborhoods with the best income potential, point out the homes most suited to renting, and help you brainstorm the best investment strategy for you.

Before you take the plunge, make sure you can answer “YES”

to these three questions:

Are you ready to be a landlord?

Owning a rental property can take a lot of time and energy. You're not just buying passive income, you're also building sweat equity since the time you spend maintaining, marketing, and managing your rental can add up quickly. So be prepared to do some soul-searching to ensure you’ll not only flourish as a landlord, but actually enjoy it.

If you want to invest in real estate but aren’t prepared to put in the day-to-day effort required, we can refer you to a property management service for help.

Can you afford to invest in real estate?

The last thing you want is to get over-extended with your new real estate venture. Besides the cost of purchasing the property, you’ll need to consider additional expenses, like property taxes, insurance, administrative costs, and maintenance and repairs. You will also need a cash reserve for unexpected issues or potential vacancies.

We can help you run the numbers to determine whether you can charge enough rent to offset your expenditures.

Have you found the right income property?

Even if you’ve got your finances in order and are emotionally ready to invest, your success as a landlord will also depend on the property you buy. The criteria for a good rental home and a good family home are often different, so it’s important to lean on professionals for advice.

We can help you find an ideal rental property, taking into account your budget, risk appetite, and investment goals. If you decide to invest in a different area, we'll connect you with an agent who's more plugged into that community. Reach out today to schedule a free consultation.

The above references an opinion and is for informational purposes only. It is not intended to be financial, legal, or tax advice. Consult the appropriate professionals for advice regarding your individual needs.

Sources:

PR Newswire

Bankrate

Forbes

MarketWatch

Realtor.com

NerdWallet

LendingTree

Quicken Loans

Investors Business Daily

St. Louis Fed FRED Economic Data

Story by J.P. Morgan

Skift

0 notes

Text

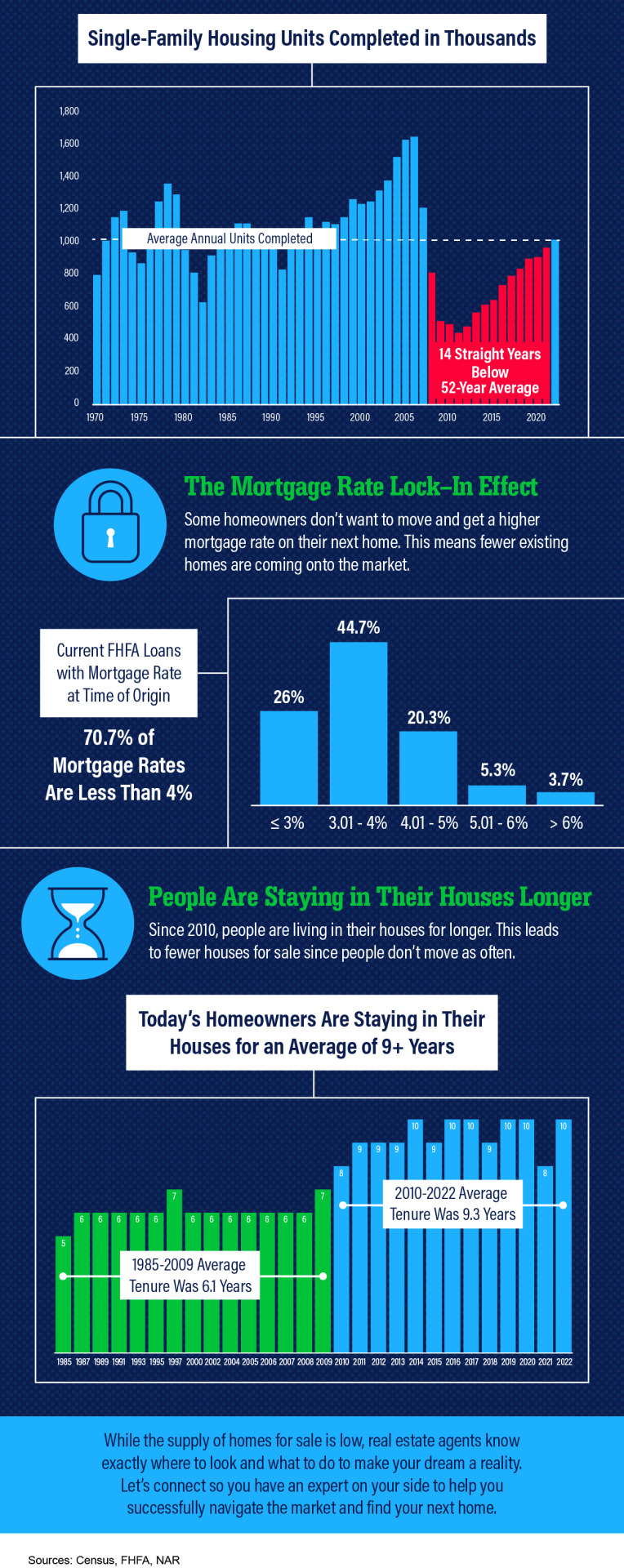

Explaining Today’s Low Housing Supply

Some Highlights

Wondering why the supply of homes for sale is limited today? There are a few factors at play.

Lack of building over time, the mortgage rate lock-in effect, and people staying in their houses longer are three of the main reasons why supply is low.

But real estate advisors know exactly where to look and what to do to make your dream a reality. Let’s connect so you have an expert on your side to help you successfully navigate the market and find your next home.

0 notes

Text

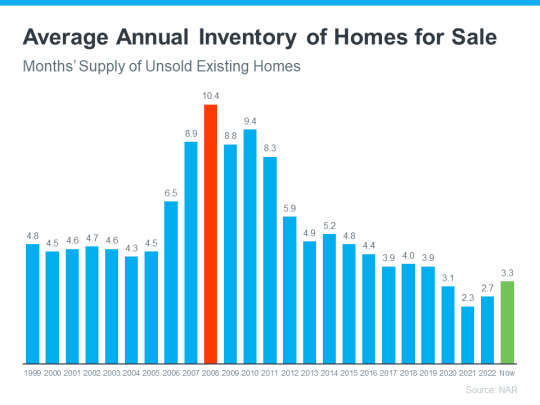

Why Today’s Housing Inventory Shows a Crash Isn’t on the Horizon

You might remember the housing crash in 2008, even if you didn't own a home at the time. If you’re worried there’s going to be a repeat of what happened back then, there's good news – the housing market now is different from 2008.

One important reason is there aren't enough homes for sale. That means there’s an undersupply, not an oversupply like the last time. For the market to crash, there would have to be too many houses for sale, but the data doesn't show that happening.

Housing supply comes from three main sources:

Homeowners deciding to sell their houses

Newly built homes

Distressed properties (foreclosures or short sales)

Here’s a closer look at today's housing inventory to understand why this isn’t like 2008.

Homeowners Deciding To Sell Their Houses

Although housing supply did grow compared to last year, it’s still low. The current months’ supply is below the norm. The graph below shows this more clearly. If you look at the latest data (shown in green), compared to 2008 (shown in red), there’s only about a third of that available inventory today.

So, what does this mean? There just aren't enough homes available to make home values drop. To have a repeat of 2008, there’d need to be a lot more people selling their houses with very few buyers, and that's not happening right now.

Newly Built Homes

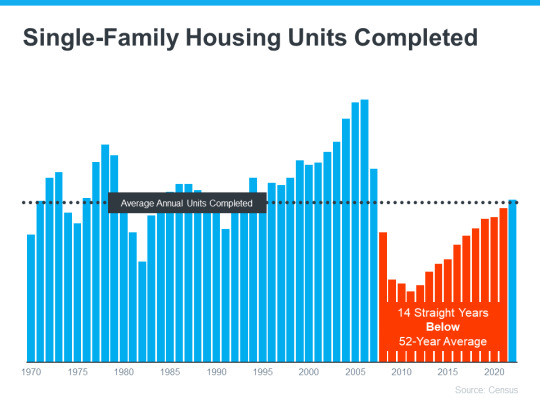

People are also talking a lot about what's going on with newly built houses these days, and that might make you wonder if homebuilders are overdoing it. The graph below shows the number of new houses built over the last 52 years:

The 14 years of underbuilding (shown in red) is a big part of the reason why inventory is so low today. Basically, builders haven’t been building enough homes for years now and that’s created a significant deficit in supply.

While the final blue bar on the graph shows that’s ramping up and is on pace to hit the long-term average again, it won’t suddenly create an oversupply. That’s because there’s too much of a gap to make up. Plus, builders are being intentional about not overbuilding homes like they did during the bubble.

Distressed Properties (Foreclosures and Short Sales)

The last place inventory can come from is distressed properties, including short sales and foreclosures. Back during the housing crisis, there was a flood of foreclosures due to lending standards that allowed many people to get a home loan they couldn’t truly afford.

Today, lending standards are much tighter, resulting in more qualified buyers and far fewer foreclosures. The graph below uses data from the Federal Reserve to show how things have changed since the housing crash:

This graph illustrates, as lending standards got tighter and buyers were more qualified, the number of foreclosures started to go down. And in 2020 and 2021, the combination of a moratorium on foreclosures and the forbearance program helped prevent a repeat of the wave of foreclosures we saw back around 2008.

The forbearance program was a game changer, giving homeowners options for things like loan deferrals and modifications they didn’t have before. And data on the success of that program shows four out of every five homeowners coming out of forbearance are either paid in full or have worked out a repayment plan to avoid foreclosure. These are a few of the biggest reasons there won’t be a wave of foreclosures coming to the market.

What This Means for You

Inventory levels aren’t anywhere near where they’d need to be for prices to drop significantly and the housing market to crash. According to Bankrate, that isn’t going to change anytime soon, especially considering buyer demand is still strong:

“This ongoing lack of inventory explains why many buyers still have little choice but to bid up prices. And it also indicates that the supply-and-demand equation simply won’t allow a price crash in the near future.”

Bottom Line

The market doesn’t have enough available homes for a repeat of the 2008 housing crisis – and there’s nothing that suggests that will change anytime soon. That’s why housing inventory tells us there’s no crash on the horizon.

0 notes

Text

Evaluating Your Wants and Needs as a Homebuyer Matters More Today

When it comes to buying a home, especially with today’s affordability challenges, you’ll want to be strategic. Mortgage rates impact how much it costs to borrow money for your home loan. And, to help offset the higher borrowing costs today, some homebuyers are taking a close look at their wish list and re-evaluating what features they really need in their next home to avoid overextending. As a recent NerdWallet article says:

“A pool, for example, may be nice to have, but it may not provide as much day-to-day value as a garage or a space for a home office . . .”

While that pool may be appealing, think twice on whether or not it’s really something you must have to be happy in your next home. Is getting that pool the main reason you’re moving? Probably not. It’s more likely a need for more space, a home office, or proximity to loved ones, friends, or work that’s motivating you to make a change.

So, if you’re looking to buy a home, take some time to consider what’s truly essential for you in your next house. Make a list of all the features you’ll want to see, and from there, work to break those features into categories. Here’s a great way to organize your list:

Must-Haves – If a house doesn’t have these features, it won’t work for you and your lifestyle (examples: distance from work or loved ones, number of bedrooms/bathrooms, etc.).

Nice-To-Haves – These are features you’d love to have but can live without. Nice-to-haves aren’t dealbreakers, but if you find a home that hits all the must-haves and some of these, it’s a contender (examples: a second home office, a garage, etc.).

Dream State – This is where you can really think big. Again, these aren’t features you’ll need, but if you find a home in your budget that has all the must-haves, most of the nice-to-haves, and any of these, it’s a clear winner (examples: a pool, multiple walk-in closets, etc.).

Once you’ve categorized it in a way that works for you, discuss your top priorities with your real estate advisor. Remember to think carefully about what’s a non-negotiable for your lifestyle and what’s a nice-to-have that’s more of an added bonus. Be sure to discuss where each feature falls with your agent. They’ll be able to help you refine the list further, coach you through the best way to stick to it, and find a home in your area that meets your top needs.

Bottom Line

Putting together your list of necessary features for your next home might seem like a small task, but it’s a crucial planning step on your homebuying journey today. If you’re ready to find a home that fits your needs, connect with a local real estate advisor.

#realestate#realestatemarket#housingmarket#orlandorealestate#realestateadvisor#lifestyle#28northgroup#evcfl

0 notes

Text

7 Costly Mistakes Home Sellers Make (And How to Avoid Them)

No matter what’s going on in the housing market, the process of selling a home can be challenging. Some sellers have a hard time saying goodbye to a treasured family residence. Others want to skip ahead to the fun of decorating and settling into a new place. Almost all sellers want to make the most money possible.

Whatever your circumstances, the road to the closing table can be riddled with obstacles — from issues with showings and negotiations to inspection surprises. But many of these complications are avoidable when you have a skilled and knowledgeable real estate agent by your side.

For example, here are seven common mistakes that many home sellers make. These can cause anxiety, cost you time, and shrink your financial proceeds. Fortunately, we can help you avert these missteps and set you up for a successful and low-stress selling experience.

MISTAKE #1: Setting an Unrealistic Price

Many sellers believe that pricing their homes high and waiting for the “right buyers” to come along will net them the most money. However, overpriced homes often sit on the market with little activity, which can be the kiss of death in real estate — and result in an inevitable price drop.1

Alternatively, if you price your home at (or sometimes slightly below) market value, it can be among the nicest that buyers see within their budgets. This can increase your likelihood of receiving multiple offers.2

To help you set a realistic price from the start, we will do a comparative market analysis, or CMA. This integral piece of research will help us determine an ideal listing price based on the amount that similar properties have recently sold for in your area.

Without this data, you risk pricing your home too high (and getting no offers) or too low (and leaving money on the table). We can help you find that sweet spot that will draw in buyers without undercutting your profits.

MISTAKE #2: Trying to Time the Market

You’ve probably heard the old saying, “Buy low and sell high.” But when it comes to real estate, that’s easier said than done.

Delaying your home sale until prices have hit their peak may sound like a great idea. But sellers should keep these factors in mind:

Predicting the market with certainty is nearly impossible.

If you wait to buy your next home, its price could increase as well. This may erode any additional proceeds from your sale.

If mortgage rates are rising, your pool of potential buyers could shrink — and you would have to pay more to finance your next purchase.

Instead of trying to time the market, choose your ideal sales timeline. This may be based on factors like your personal financial situation, shifting family dynamics, or the seasonal patterns in your neighborhood. We can help you figure out the best time to sell given your individual circumstances.

MISTAKE #3: Failing to Address Needed Repairs

Many sellers hope that buyers won’t notice their leaky faucet or broken shutters during home showings. But minor issues like these can leave buyers worrying about more serious — and costly — problems lurking out of sight.

Even if you do receive an offer, there’s a high likelihood that the buyer will hire a professional home inspector, who will flag any defects in their report. Neglecting to address a major issue could lead buyers to ask for costly repairs, money back, or worse yet, walk away from the purchase altogether.

To avoid these types of disruptions, it’s important to make necessary renovations before your home hits the market. We can help you decide which repairs and updates are worth your time and investment. In some cases, we may recommend a professional pre-listing inspection.

This extra time and attention can help you avoid potential surprises down the road and identify any major structural, system, or cosmetic faults that could impact a future sale.3

MISTAKE #4: Neglecting to Stage Your Home

Staging is the act of preparing your home for potential buyers. The goal is to “set the stage” to help buyers envision themselves living in your home. Some sellers opt to skip this step, but that mistake can cost them time and money in the long run. A 2021 survey by the Real Estate Staging Association found that, on average, staged homes sold nine days faster and for $40,000 over list price.4

Indoors, staging could include everything from redecorating, painting, or rearranging your furniture pieces to removing personal items, decluttering, and deep cleaning. Outdoors, you might focus on power washing, planting flowers, or hanging a wreath on the front door.

You may not need to do all these tasks, but almost every home can benefit from some form of staging. Before your home hits the market, we can refer you to a professional stager or offer our insights and suggestions if you prefer the do-it-yourself route.

MISTAKE #5: Evaluating Offers on Price Alone

When reviewing offers, most sellers focus on one thing: the offer price. While dollar value is certainly important, a high-priced offer is worthless if the deal never reaches the closing table. That’s why it’s important to consider other factors in addition to the offer price, such as:

Financing and buyer qualifications

Deposit size

Contract contingencies

Closing date

Leaseback options

Depending on your circumstances, some of these factors may or may not be important to you. For example, if you’re still shopping for your next home, you might place a high premium on an offer that allows for a flexible closing date or leaseback option.

Buyers and their agents are focused on crafting deals that work well for them. We can help you assess your needs and goals to select an offer that works best for you.

MISTAKE #6: Acting on Emotion Instead of Reason

It’s only natural to grow emotionally attached to your home. That’s why so many sellers end up feeling hurt or offended at some point during the selling process. Low offers can feel like insults. Repair requests can feel like judgments. And whatever you do — don’t listen in on showings through your security monitoring system. Chances are, some buyers won’t like your decor choices, either!

However, it’s a huge mistake to ruin a great selling opportunity because you refuse to counter a low offer or negotiate minor repairs. Instead, try to keep a cool head and be willing to adjust reasonably to make the sale. We can help you weigh your decisions and provide rational advice with your best interests in mind.

MISTAKE #7: Not Hiring a professional Real Estate Advisor

There’s a good reason 90% of homeowners choose to sell with the help of a real estate agent. Homes listed by agents sold for 22% more than the average for-sale-by-owner home, according to a recent study by the National Association of Realtors.5

Selling a home on your own may seem like an easy way to save money. But in reality, there is a steep learning curve. And a listing agent can:

Skip past time-consuming problems

Use market knowledge to get the best price

Access contacts and networks to speed up the selling process

If you choose to work with a listing agent, you’ll save significant time and effort while minimizing your personal risk and liability. And the increased profits realized through a more effective marketing and negotiation strategy could more than make up for the cost of your agent’s commission.

We can navigate the ins and outs of the housing market for you and make your selling process as stress-free as possible. You may even end up with an offer for your home that’s better than you expected.

BYPASS THE PITFALLS WITH A KNOWLEDGEABLE GUIDE

Your home selling journey doesn’t have to be hard. When you hire us as your listing agent, we’ll develop a customized sales plan to help you get top dollar for your home without any undue risk, stress, or aggravation. If you’re thinking of buying or selling a home, reach out today to schedule a free consultation and home value assessment.

Sources:

The Washington Post -

https://www.washingtonpost.com/business/2019/07/22/just-because-its-sellers-market-doesnt-mean-you-should-overprice-your-home/

Realtor.com -

https://www.realtor.com/advice/sell/spark-a-bidding-war-for-your-home/

American Society of Home Inspectors - https://www.homeinspector.org/Newsroom/Articles/Before-You-Sell-6-Reasons-to-Get-a-Pre-Listing-Inspection/15766/Article

Real Estate Staging Association -

https://www.realestatestagingassociation.com/content.aspx?page_id=22&club_id=304550&module_id=164548

National Association of Realtors -

https://www.nar.realtor/research-and-statistics/quick-real-estate-statistics

#realestateagent#realestatetips#realestatemarketing#realestate#houseforsale#realestateadvisor#28northgroup#realestatemarket#housingmarket#orlandorealestate#evwinterpark#evcfl

0 notes

Text

5 Ways to Write a Winning Offer in Today’s Real Estate Market

Our nation is in the midst of a serious housing crunch. Last year, a lack of inventory and soaring prices left many would-be homebuyers feeling pinched. But now, with interest rates climbing, many of them are also feeling desperate to lock in a mortgage—which has only added fuel to the fire.1

Fortunately, if you’re a buyer struggling to find a home, we have some good news. While it’s true that higher mortgage rates can decrease your purchasing budget, there are additional ways to compete in a hot market.

Yes, a high offer price gets attention. But most sellers consider a variety of factors when evaluating an offer. With that in mind, here are five tactics you can utilize to sweeten your proposal and outshine your competition.

We can help you weigh the risks and benefits of each tactic and craft a compelling offer designed to get you your dream home—without giving away the farm.

1. Demonstrate Solid Financing

The reality is, no one gets paid if a home sale falls through. That’s why sellers (and their listing agents) favor offers with a high probability of closing.

Sellers particularly love all-cash offers because there’s no chance of financing issues cropping up at the last moment. But don’t despair if you can’t pay cash for your home. According to the National Association of Realtors, only about 1 in 4 home purchases are all-cash deals, which means the vast majority are financed with a mortgage.2

If sellers are assured that financing will come through, buying with a mortgage doesn’t have to be a big disadvantage. The most important step you can take as a buyer is to get preapproved before you start looking for homes. A preapproval letter shows sellers that you are serious about buying and that you will be able to make good on your offer.

It’s also important to consider the reputation of your lender. While sellers may not know or care about a lender’s reputation, their agents often do. Some lenders are much easier to work with than others, especially if you are pursuing certain types of mortgages like FHA or VA loans.3 If so, you’ll want a lender who specializes in these types of mortgages. If you’re unsure who to choose, we are happy to refer you to reputable lenders known for their ease of doing business.

2. Put Down a Sizeable Deposit

Buyers can show sellers that they’re serious about their offer and have “skin in the game” by putting down a large earnest money deposit.

Earnest money is a deposit held in escrow by a title company or the seller’s broker or lawyer. If the purchase goes through, it is applied to the down payment and closing costs—if the sale falls through, the buyer may lose some or all of that deposit.

While an earnest money deposit is typically around 1-2% of the sale price, offering a higher deposit can help demonstrate to the buyer that you are serious about the property.4 However, this strategy can also be risky. We can help you determine an appropriate deposit to offer based on your specific circumstances.

3. Ask for Few (or No) Contingencies

Most real estate offers include contingencies, which are clauses that allow one or both parties to back out of the agreement if certain conditions are not met. These contingencies appear in the purchase agreement and must be accepted by both the buyer and seller to be legally binding.5

Common contingencies include:

Financing: A financing contingency gives the buyer a window of time in which to secure a mortgage. If they are unable to do so, they can withdraw from the purchase and the seller can move on to other buyers.

Inspection: An inspection contingency gives the buyer the opportunity to have the home professionally inspected for issues with the structure, wiring, plumbing, etc. Typically, the seller may choose whether or not to remediate those issues; if they do not, the buyer may withdraw from the contract.

Appraisal: Most lenders will not offer a mortgage on a home that costs more than it's worth. An appraisal contingency gives the buyer an opportunity to get the home professionally assessed to ensure that its value is at or above the sales price. If an appraisal comes in low, the seller may be asked to renegotiate the contract.

Sale of a prior home: Some buyers cannot afford to purchase a new home until they sell their previous one. If the buyer is unable to sell their current home within a specified window of time, this contingency enables them to withdraw from the contract without penalty.

Since contingencies reduce the likelihood that a sale will go through, they generally make an offer less desirable to the seller. The more contingencies that are included, the weaker the offer becomes. Therefore, buyers in a competitive market often volunteer to waive certain contingencies.

However, it’s very important to make this decision carefully and recognize the risks of doing so. For example, a buyer who chooses to waive a home inspection contingency may find out too late that the home requires extensive renovations, and a buyer who waives the appraisal may risk their mortgage falling through. If you back out of a home purchase without the protection of a contingency, you could lose your earnest money deposit.6 We can help you assess the risks and benefits involved.

4. Offer a Flexible Closing Date and/or Leaseback Option

When it comes to selling a house, money isn’t everything. People sell their homes for a wide variety of reasons, and flexible terms that work with their personal situations can sometimes make all the difference. For example, if a seller is in the process of planning a significant move, they may prefer a longer closing timeline that gives them time to find housing in their new location.

Similarly, short-term leaseback options, in which the sale is completed but the seller retains the right to rent the home for a specified period of time, can be compelling.7 These arrangements enable the seller to use the money from the sale of their home to purchase their next house. A leaseback agreement also makes it possible for them to avoid moving twice when their next home is not yet ready to occupy.

Flexible closing dates and leaseback options can provide a powerful advantage for first-time homebuyers. If you have a month-to-month or easily transferable lease, for example, you may be able to offer a more flexible timeline than a buyer who is simultaneously selling their existing home.

Of course, the value of these terms depends on the seller’s situation. We can reach out to the listing agent to find out the seller’s preferred terms, and then collaborate with you to write a compelling offer that works for both parties.

5. Work With a Skilled Buyer’s Agent

In this ultra-competitive real estate market, one of the greatest advantages you can give yourself is to work with a skilled and trustworthy real estate professional. We will make sure you fully understand the process and help you submit an appealing offer without taking on too much risk.

Plus, we know how to write offers that are designed to win over both the seller and their listing agent. The truth is, listing agents play a huge role in helping sellers evaluate offers, and they want to work with skilled buyer’s agents who are professional, communicative, and courteous.

Once your offer is accepted, we’ll also handle any further negotiations and coordinate all the paperwork and other details involved in your home purchase. The best part is, you’ll have a knowledgeable, licensed advocate on your side who is watching out for your best interests every step of the way.

Helping You Get to the Right Offer

In many cases, a competitive offer doesn’t need to be all-cash, contingency-free, or significantly above asking price. But if you’re serious about buying a home in today’s market, it’s important to consider what you can do to sweeten the deal.

If you’re a buyer, we can help you compete in today’s market without getting steamrolled. And if you’re a seller, we can help you evaluate offers by taking all the relevant factors into account. Contact us today to schedule a free consultation.

Sources:

National Association of Realtors -https://www.nar.realtor/newsroom/pending-home-sales-dwindle-4-1-in-february

National Association of Realtors -https://www.nar.realtor/newsroom/existing-home-sales-fade-7-2-in-february

Forbes -https://www.forbes.com/advisor/mortgages/housing-crisis-tips/

Realtor.com -https://www.realtor.com/advice/finance/earnest-money-deposit-mistakes-buyers-make/

Bankrate -https://www.bankrate.com/real-estate/contingency-clause/

Home Buying Institute -http://www.homebuyinginstitute.com/mortgage/risks-of-waiving-a-contingency/

7. Realtor.com -https://www.realtor.com/advice/sell/what-is-a-rent-back-agreement

#homebuyingtips#homebuyingprocess#homebuying101#homebuyingtip#realestateadvice#homesearch#homebuyerstips#homebuyereducation#buyahome#realestateagent#realestate#28northgroup#evcfl#realestatemarket#housingmarket#orlandorealestate#realestateadvisor

1 note

·

View note

Text

What are experts saying about todays mortgage rates

It's essential to know what experts are saying about today's rising mortgage rates. Let's connect so we can discuss why making your move sooner rather than later could be your best plan.

#risingrates#mortgagerates#realestate#28northgroup#evcfl#realestatemarket#housingmarket#orlandorealestate

0 notes

Text

How the Appraisal and Inspection Empower You as a Homebuyer

Even in today's competitive market, it's important not to waive an appraisal or inspection. Let's connect so you can feel empowered when you submit an offer on the home of your dreams.

#appraisal#homeinspection#homebuying#28northgroup#evcfl#realestate#realestatemarket#housingmarket#orlandorealestate#realestateagent

0 notes

Text

Things To Avoid After Applying for a Mortgage

It's essential to avoid mishaps after applying for a mortgage. Let's connect so you know what to avoid during this part of the homebuying process.

#mortgage#realestatetips#homebuying101#28northgroup#evcfl#realestate#realestatemarket#housingmarket#orlandorealestate#realestateagent

1 note

·

View note

Text

The Spring Homebuying Season Is in Full Bloom

Spring is the most popular time to buy a home, making it a great time to sell. Let's connect so you can take advantage of the spring buying season.

Source for Data in Video

https://cdn.nar.realtor/sites/default/files/documents/2022-02-realtors-confidence-index-03-18-2022.pdf

#sellyourhouse#springrealestate#sellersmarket#28northgroup#evcfl#realestate#realestatemarket#housingmarket#orlandorealestate#realestateagent

0 notes

Text

Seller’s Checklist: A Timeline to Prep Your Home for Sale

We’re still in a seller’s market, but that doesn’t mean your home is guaranteed to easily sell.1 If you want to maximize your sale price, it’s still important to prepare your home before putting it on the market.

Start by connecting with a real estate agent as soon as possible. Having the eyes and ears of an insightful real estate professional on your side can help you boost your home’s appeal to buyers. What’s more, beginning the preparation process early allows you to tackle repairs and upgrades that can increase your property’s value.

Use the checklist below to figure out what other tasks you should complete in the months leading up to listing your home. While everyone’s situation is unique, these guidelines will help you make sure you’re ready to sell when the time is right. Of course, you can always call us if you’re not sure where to start or what to tackle first. We can help customize a plan that works for you.

AS SOON AS YOU THINK OF SELLING

Some home sellers want to plan their future move far in advance, while others will be required to pack up on very short notice. Whatever your circumstances, these first steps will help assure you’ll be ahead of the listing game.

● Contact Your Real Estate Agent

We go the extra mile when it comes to servicing our clients, and that includes a series of complimentary, pre-listing consultations to help you prepare your home for the market.

Some sellers make the mistake of waiting until they are ready to list their home to contact a real estate agent. But we’ve found that the earlier we’re brought into the process, the better the result. That often means a faster sale—and more money in your pocket after closing.

We know what buyers want in today’s market, and we can help devise a plan to maximize your property’s appeal. We can also connect you with our trusted network of contractors, vendors, and service professionals, so you’ll be sure to get the VIP treatment. This network of support can alleviate stress and help ensure you get everything done in the weeks or months leading up to listing.

● Address Major Issues and Upgrades

In most cases, you won’t need to make any major renovations before you list. But if you’re selling an older home, or if you have any doubt about its condition, it’s best to get us involved as soon as possible so we can help you assess any necessary repairs.

In some instances, we may recommend a pre-listing inspection. Although it's less common in a seller's market, a pre-listing inspection can help you avoid potential surprises down the road. We can discuss the pros and cons during our initial meeting.

This is the time to address major structural, systems, or cosmetic issues that could hurt the sale of your home down the line. For example, problems with the frame, foundation, or roof are likely to be flagged on an inspection report. Issues with the HVAC system, electrical wiring, or plumbing may cause the home to be unsafe. And sometimes outdated or unpopular design features can limit a home’s sales potential.

Remember, when you’re dealing with major repairs or renovations, it’s best to give yourself as much time as possible. Given rampant labor and material shortages, starting right away can help you avoid costly delays.2 Contact us so we can guide you on the updates that are worth your time and investment.

1 MONTH (OR MORE) BEFORE YOU LIST

Once any large-scale renovations have been addressed, you can turn your attention to the more minor updates that still play a major role in how buyers perceive your home.

● Make Minor Repairs

Look for any unaddressed maintenance or repair issues, such as water spots, pest activity, and rotten siding. This is the time to take care of those small annoyances like squeaky hinges, sticking doors, and leaky faucets, too.

Many of these issues can be handled by going the DIY route and using a few simple tools. Tackle the ones you can and be sure to call a professional for the ones you’re not comfortable doing yourself. We can refer you to local service providers who can help.

Remember that it’s easy to overlook these small issues because you live with them. When you work with us, you get a fresh set of eyes on your home—so you don’t miss any important repairs that could make a big difference to buyers.

● Refresh Your Design

This is a great time to think about some simple design updates that can make a significant impression on buyers. For example, a fresh coat of paint is an easy and affordable way to spruce up your home. One survey found that interior paint offered a 107% return on investment.3For broad appeal, opt for warm, neutral colors.

And never underestimate the importance of good curb appeal. Homes with good curb appeal sell for 7% more, on average, than similar homes with an “uninviting exterior.”4 If weather permits, lay fresh sod where needed, plant colorful flowers, and add some new mulch to your beds.

Even just repositioning your furniture can make a huge difference to buyers. A survey by the Real Estate Staging Association found that staged homes sold faster, and 73% sold over list price.5We can refer you to a local stager or offer our insights and suggestions if you prefer the DIY route.

● Declutter and Depersonalize

Doing a little bit of decluttering every day is a lot easier than trying to take care of it all at once right before your home hits the market. A simple strategy is to do this one room at a time, working your way through each space whenever you have a bit of free time.

Start by donating or discarding items that you no longer want or need. Then pack up any seasonal items, family photos, and personal collections you can live without for the next few weeks. Bonus: This will give you a head start on packing for your move!

1 WEEK BEFORE YOU GO TO MARKET

With just one week before your home is available for sale, all major items should be crossed off your to-do list. Now it’s time to focus on the small details that will really make your home shine. Here are a few key areas to focus on during this last week.

● Check-In With Your Agent

We’ll connect again to make sure we’re aligned on the listing price, marketing plan, and any remaining prep. We will be there every step of the way, ensuring you’re fully prepared to maximize the sale of your home.

● Tidy Your Exterior

You’ve already done the major landscaping—now it’s time to tackle the last few details. Make sure your lawn is freshly mowed, hedges are trimmed, and flower beds are weeded.

In addition, now is the time to clean your home’s exterior if you haven’t already. Power wash your siding, empty the gutters, and wash all your windows and screens.

● Deep Clean Your Interior

Your house should be deep cleaned before listing, including a thorough deodorizing of the home’s interior and steam cleaning for all carpets. Consider hiring a professional cleaning company to ensure the space smells and looks as fresh as possible.

In addition to cleaning, take some time to tidy up. Buyers will look inside your closets, pantries, and cabinets, so make sure they are neat and organized. Small appliances and toiletries should be cleared off the countertops.

DAY OF SHOWING

Now you’re all set to go and there are just a few small things you need to handle on the day of showings or open houses. Do a final walk-through and take care of these finishing touches to give potential buyers the best possible impression.

● Pre-Showing Prep

Happy and comfortable buyers are more likely to submit offers! Make them feel at home by adjusting the thermostat to a comfortable temperature. Open any blinds and curtains throughout the house, and turn on all lights so buyers can see all the potential in your home.

Then tidy up by vacuuming and sweeping floors, emptying (or hiding) trash cans, and wiping down countertops. In the bathrooms, close toilet lids and hang clean hand towels.

Don’t forget to secure firearms, jewelry, sensitive documents, prescription medications, and any other items of value in a safe or store them off-site.

Finally, it’s best to have pets out of the house during showings. If possible, you should also remove evidence of pets (litter box, dog beds, etc.), which can be a turn-off for some buyers.

DON’T WAIT TO PREP YOUR HOME FOR SELLING

If you want to get top dollar for your home, don’t put it on the market before it’s ready. The right preparation can make all the difference when it comes to maximizing the offers you get. The upgrades and changes you need to make will depend upon your home’s condition, so don’t wait to speak with an agent.

Call our team if you’re thinking about selling your home, even if you’re not sure when. It’s never too early to seek the guidance of your real estate agent and start preparing your home to sell.

Sources:

1. Fortune - https://fortune.com/2022/02/08/should-i-buy-house-sellers-market-housing-real-estate-fannie-mae/

2. Forbes - https://www.forbes.com/advisor/home-improvement/labor-materials-shortage-impacts-renovations/

3. PR Web - https://www.prweb.com/releases/2012-homegain/home-improvement-survey/prweb9433460.htm

4. Realtor Magazine - https://magazine.realtor/daily-news/2020/01/27/how-much-does-curb-appeal-affect-home-value

5. Real Estate Staging Association - https://www.realestatestagingassociation.com/content.aspx?page_id=22&club_id=304550&module_id=164548

#realestate#housing#realestatemarket#realestateexpert#realestateagent#28northgroup#evcfl#housingmarket#orlandorealestate#evwinterpark#realestateadvisor

0 notes

Text

Veteran Hiring Event

Are you a Veteran or do you know a Veteran who is unemployed, underemployed, or just looking for opportunities?

Join us for a Veterans Hiring event on February 22nd at the VFW in Apopka, FL.

We will employers on site to discuss opportunities. There will be vendors offering special pricing for Veterans.

This event is open to Veterans, spouses, and children from 12-6 and the general public from 4-6. Don't miss this opportunity.

#helpingveterans#employveterans#evorlandowinterpark#evclermont#apopkastrong#vfwapopka#vfw#apopkachamber#myapopka#realestate#28northgroup#evcfl#evpurpleagent

0 notes