#exchangerates

Explore tagged Tumblr posts

Text

💰 BULK VS. FREQUENT TRANSFERS: WHICH SAVES MORE?

Bulk Transfers Pros: • Lower per-transaction fees • Less time spent managing transfers • Often better for amounts over $5,000

Frequent Small Transfers Pros: • Dollar-cost averaging on exchange rates • Less currency risk • Better for budgeting monthly expenses

Research shows the answer depends on the service: • For Western Union: Bulk transfers win (better rates for larger amounts) • For Wise: The advantage is minimal either way

Consider your recipient's needs too - elderly parents might prefer predictable monthly amounts rather than large lump sums.

Get more insights: https://blog.remit2any.com/2024/10/09/understanding-exchange-rates-how-to-get-the-best-rate-when-sending-money-to-india/

0 notes

Text

youtube

How Exchange Rate Movements Impact South and Southeast Asian Agrifood Exporters — and Strategic Recommendations

In today’s global markets, currency swings can make or break agrifood exporters in South and Southeast Asia. From sourcing inputs in INR, PKR, BDT, THB, VND, IDR, and more, to invoicing in USD, EUR, or RMB, exchange-rate volatility is a constant challenge. Our latest article unpacks:

• The real cost when the dollar weakens—think 12% less revenue for Indian spice exporters. • Pros and cons of euro and renminbi invoicing, including Belt & Road financing perks and liquidity considerations. • Practical steps: real-time rate monitoring, multi-currency contracts, simple hedging tools, and flexible pricing clauses.

Whether you export rice, rubber, coffee, or seafood, these insights will help you safeguard margins and seize new opportunities. Read the full article to build a resilient currency strategy and keep your agribusiness thriving.

#AgrifoodExports#SouthAsiaTrade#SoutheastAsiaTrade#CurrencyRisk#ExchangeRates#USD#EUR#RMB#TradeFinance#Hedging#ExportStrategy#BeltandRoad#AgriBusiness#GlobalTrade#FoodSecurity#Youtube

0 notes

Text

Discover the ideal foreign currency exchange methods for 2024. Learn about secure, efficient options to maximize your currency conversions.

#CurrencyExchange#ForeignExchange#GlobalFinance#ExchangeRates#MoneyTransfer#ForexStrategies#FinancialPlanning

0 notes

Text

Send money to Peru from Latvia (EUR to PEN) quickly and securely with RemitAnalyst. Get the best exchange rate today.

0 notes

Text

Send Money to Germany From India | Online Money Transfer

Send Money to Germany From India seamlessly with Zenith Forex. Try hassle-free ways to transfer money abroad securely and swiftly. Sending money abroad is now easier and more convenient with online money transfer services. Zenith Forex offers secure and fast transfers, allowing you to send funds with just a few clicks.

Benefits

Secure and Fast Transfers

Competitive Exchange Rates

Low Transfer Fees

Multiple Payment Options

24/7 Customer Support

Easy and Convenient

Fast Processing Times

Safe and Regulated

User-Friendly Platforms

Visit us today for all your needs! Send Money Now! 🌐 https://zenithforexonline.com/ 📱 +91 8448289666

#TransferMoneytoGermany#SendMoneyFromIndiatoGermany#sendmoneyGermany#ExchangeRates#MoneyExchange#TravelMoney#ForexExperts#zenithforexonline#Zenithforex

0 notes

Text

0 notes

Link

#ContractManagement#exchangerates#FIDIC#financialplanning#internationalprojects#multi-currencypayments

0 notes

Text

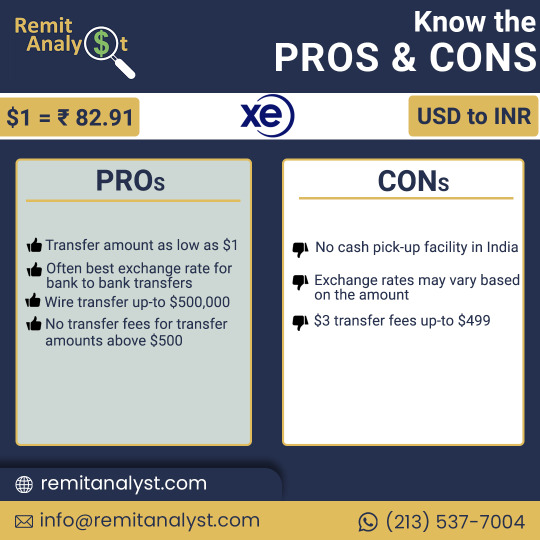

Are you looking to send money from the USA to India and searching for the best exchange rates? Look no further! RemitAnalyst is here to help you find the most competitive USD to INR rates in the market, ensuring that you save more with every transfer.

Why Choose RemitAnalyst? RemitAnalyst is committed to providing you with a seamless and reliable remittance experience. Our goal is to empower you to make informed decisions when sending money to India, maximizing the value of your transfers.

Trusted Worldwide Service Provider: RemitAnalyst collaborates with XE Money, a renowned and trustworthy remittance service provider with a global footprint. Trust and reliability are at the core of our services.

Best USD to INR Exchange Rates: We understand the importance of getting the best value for your money. Our platform allows you to compare USD to INR exchange rates from various providers to ensure you secure the most favorable rate available.

Save More with Every Transfer: Comparing exchange rates through RemitAnalyst allows you to identify the best current rates for transferring money from the USA to India. Saving on exchange rates means more funds reaching your loved ones back home

How to Get Started:

Visit RemitAnalyst: Navigate to our user-friendly website at www.remitanalyst.com .

Select Your Transfer Details: Input the amount you wish to send and choose the currency pair (USD to INR).

Compare Rates: View and compare the current exchange rates offered by various service providers to find the best deal.

Choose Your Provider: Select the remittance service provider offering the most attractive rates and services for your transfer.

Initiate the Transfer: Follow the steps to initiate your transfer securely and conveniently.

RemitAnalyst is here to simplify your remittance process and help you save more on your USD to INR transfers. Compare rates, choose wisely, and send money to your loved ones in India with confidence and savings.

Disclaimer: Exchange rates may vary and are subject to change. Please refer to the respective remittance service provider for the most up-to-date rates.

#RemitAnalyst#USDtoINR#MoneyTransfer#Remittance#XEMoney#SendMoneyToIndia#ExchangeRates#SaveMore#CurrencyExchange#InternationalTransfers

0 notes

Text

Abstract:On August 15, the N980/US$ exchange rate was on the rise. The CBN would take action to stop speculating in the middle of the day. Not economists, but FX traders, went into a panic over that. The exchange rate on Broad Street decreased to N760-790/US$ the following morning.

0 notes

Text

Dollar price Fluctuations: A Comprehensive Guide Understanding

Dollar price fluctuations Introduction:

In this article, we will delve deep into the determinants of Dollar price fluctuations, their implications on the global economy, and the significance of monitoring these changes. As the US Dollar is the world's leading reserve currency, it impacts several aspects of the global financial system. Consequently, through our comprehensive exploration of the factors influencing the Dollar, readers will gain a solid understanding of its dynamics and importance.

Body:

I. The Role of the US Dollar in the Global Economy

A. Firstly, the US Dollar as a reserve currency B. Subsequently, the Dollar's influence on international trade and investment C. Additionally, the exchange rate systems

II. Factors Influencing Dollar Price Fluctuations

A. Importantly, economic indicators and data 1. Particularly, interest rates and monetary policy 2. Furthermore, inflation rates 3. As a result, GDP growth and unemployment rates B. Simultaneously, geopolitical events and crises C. Lastly, market sentiment and speculation

III. The Impact of Dollar Fluctuations on Global Markets

A. Initially, interest rates and bond markets B. Also, commodity prices, particularly oil C. Correspondingly, currency markets and international trade D. Conversely, stock markets and corporate earnings

IV. Strategies for Managing Dollar Price Fluctuations

A. Firstly, diversification of investments B. Additionally, currency hedging techniques C. Similarly, using economic indicators to anticipate changes D. Moreover, monitoring political and economic events

V. The Future of the US Dollar in the Global Economy

A. First and foremost, the rise of alternative reserve currencies B. For instance, the impact of digital currencies and blockchain technology C. Hence, potential structural changes in the global financial system

Learn more about the history of the US Dollar and its global role at The Federal Reserve.

Conclusion:

Ultimately, this comprehensive guide has provided readers with a deep understanding of the factors influencing Dollar price fluctuations and their implications on the global economy. By closely monitoring economic indicators, geopolitical events, and market sentiment, both investors and individuals can better anticipate these fluctuations and make informed decisions. As the global financial landscape continues to evolve, staying informed about current trends and developments is essential to navigate the complex world of currency markets successfully.

"Learn more about the global economic trends we've covered previously." Read the full article

0 notes

Text

youtube

African agrifood exporters face a unique currency challenge: they purchase inputs in local currencies (CFA franc, naira, cedi, shilling) but invoice in US dollars. When the dollar weakens—say, from 600 to 500 CFA francs per USD—export revenues can drop by up to 17% in local‐currency terms, squeezing margins even if overseas prices stay flat.

In our latest article, we explore whether invoicing in euros can offer greater stability—especially for WAEMU‐pegged currencies—and outline five concrete strategies to stay ahead of rate swings:

Real-time monitoring: Build dashboards and set alerts for USD/local and EUR/local rates.

Currency diversification: Negotiate mixed USD and EUR contracts tailored to buyer regions.

Simple hedging: Lock in forward rates through your bank or trade‐finance partner.

Market alignment: Focus euro-denominated exports on Europe, USD ones on Asia and the Americas.

Flexible pricing: Embed rate-adjustment clauses and continuously optimize local costs.

Ready to transform currency risk into competitive advantage? Read the full article to discover how dynamic exchange-rate management can keep your agrifood exports resilient and profitable—and start applying these tactics today.

#AfricanExports#Agrifood#ExchangeRates#CurrencyRisk#USD#Euro#Hedging#TradeFinance#CFAFranc#Naira#Cedi#Shilling#ExportStrategy#Profitability#BusinessTips#Youtube

0 notes

Text

Explore various foreign currency exchange options in this in-depth overview. Understand the methods, benefits, and best practices for currency trading.

0 notes

Text

Exchange rates: the hidden force shaping our financial world. From travel expenses to stock market investments, their impact is far-reaching. Gain insights into how exchange rates in India influence the nation and explore their workings in this enlightening article. Here for your brain and business: Exchange Rates in India💡💰

1 note

·

View note

Text

Transfer money to Peru from Lithuania (EUR to PEN) at the best rates. Make your money go further with RemitAnalyst.

0 notes

Text

Best Currency Exchange Service in Rajkot

Looking for the best currency exchange service in Rajkot? Look no further! We offer competitive rates, quick transactions, and hassle-free service. Whether you need to exchange USD, EUR, GBP, or any other currency, we’ve got you covered. Visit us today and experience top-notch service from a trusted provider. Your satisfaction is our priority!

Benefits

Best exchange rates in Rajkot for USD, EUR, GBP, and more

Quick and hassle-free transactions

Trusted service with years of experience

Secure and confidential dealings

Convenient location with friendly staff

Special offers for bulk currency exchange

Visit us today for all your currency exchange needs! 🌐 https://zenithforexonline.com/ 📱 +91 8448289666

#CurrencyExchange#ForexRajkot#BestRates#RajkotServices#ForexDeals#ExchangeRates#MoneyExchange#TravelMoney#ForexExperts#Zenithforexonline

0 notes

Text

USDX Uncovered: A Comprehensive Guide to Exchange Rates and Global Trade

USDX: Navigating the Complexities of Currency Exchange, Trade, and Economic Dynamics. By Amir Shayan Exchange rates play a crucial role in the global economy, influencing international trade, investments, and tourism. Understanding exchange rates and their impact is essential for individuals, businesses, and governments alike. In this comprehensive guide, we will delve into the world of exchange rates, focusing on the USDX (U.S. Dollar Index) and its significance in global trade. Whether you are a seasoned investor, a business owner, or simply curious about the intricacies of the foreign exchange market, this article will provide you with valuable insights and knowledge to navigate the complex landscape of exchange rates. Section 1: What Are Exchange Rates? In this section, we will start by defining exchange rates and explaining their role in facilitating international trade. We will explore the concept of currency pairs, exchange rate regimes, and the factors that influence exchange rate movements. Understanding the basics of exchange rates is crucial for grasping their significance in the global economy. Section 2: Introducing the USDX The USDX, also known as the U.S. Dollar Index, is a widely recognized measure of the value of the U.S. dollar relative to a basket of other currencies. In this section, we will explore the composition of the USDX, the calculation methodology, and its historical significance. We will also discuss the relationship between the USDX and global trade and how it impacts various sectors of the economy. Section 3: Factors Affecting Exchange Rates Exchange rates are influenced by a multitude of factors, ranging from economic indicators to geopolitical events. In this section, we will examine the key drivers that impact exchange rates, including interest rates, inflation, economic growth, political stability, and market sentiment. By understanding these factors, readers will gain valuable insights into the dynamics of exchange rate fluctuations. Section 4: Exchange Rate Determination Models Several models have been developed to explain how exchange rates are determined. In this section, we will explore two prominent models: the purchasing power parity (PPP) and the interest rate parity (IRP). We will explain the underlying concepts of these models and their implications for exchange rate forecasting. Section 5: Exchange Rate Risk Management Exchange rate fluctuations pose risks to businesses engaged in international trade and investments. In this section, we will discuss various strategies that businesses can employ to manage exchange rate risk, including hedging techniques, diversification, and currency derivatives. Understanding these risk management strategies is essential for businesses to safeguard their profitability and competitiveness in the global market. Section 6: The Impact of Exchange Rates on Global Trade Exchange rates have a profound impact on international trade flows and competitiveness. In this section, we will explore how exchange rate movements affect export and import dynamics, trade balances, and the overall economic performance of countries. We will also discuss the role of central banks in managing exchange rates to support their economic objectives. Section 7: Exchange Rates and Investment Decisions Exchange rates play a crucial role in investment decisions, especially for individuals and institutions engaged in foreign investments. This section will explore the relationship between exchange rates and investment returns, the concept of currency risk, and how investors can factor in exchange rate considerations when making investment decisions. Section 8: Forecasting Exchange Rates Forecasting exchange rates is a challenging task due to the complex nature of the foreign exchange market. In this section, we will discuss various approaches to exchange rate forecasting, including fundamental analysis, technical analysis, and the use of econometric models. We will highlight the limitations and uncertainties associated with exchange rate forecasts and provide insights into best practices for making informed predictions. Section 9: The Role of Central Banks in Exchange Rate Management Central banks play a critical role in managing exchange rates to achieve economic objectives such as price stability and economic growth. In this section, we will examine the tools and techniques used by central banks to influence exchange rates, including monetary policy, intervention in the foreign exchange market, and capital controls.

Conclusion

In this comprehensive guide, we have explored the fascinating world of exchange rates and their significance in global trade. We have discussed the basics of exchange rates, introduced the USDX as a key measure of the U.S. dollar's value, and examined the factors that influence exchange rate movements. We have also explored exchange rate risk management, the impact of exchange rates on global trade and investment decisions, and the challenges of exchange rate forecasting. By understanding these concepts and dynamics, readers will be better equipped to navigate the complexities of exchange rates and make informed decisions in the global marketplace. Remember, exchange rates are not only numbers on a screen or in the financial news; they are the underlying drivers of international commerce. A deep understanding of exchange rates is invaluable for individuals and businesses involved in international transactions, as it can help identify opportunities, mitigate risks, and optimize financial outcomes. With this comprehensive guide, you now have the knowledge and insights to navigate the intricate world of exchange rates and global trade with confidence. Meta Description: Explore the comprehensive guide to exchange rates and global trade. Understand the USDX, factors influencing exchange rates, risk management, forecasting, and the impact on investments and trade decisions. Gain valuable insights into the complex world of currency exchange. Read the full article

#CentralBanks#Currencyexchange#exchangerateforecasting#ExchangeRates#Foreignexchangemarket#globaltrade#internationaltrade#investmentdecisions#Riskmanagement#USDX

0 notes