#exploding topics pro api

Explore tagged Tumblr posts

Text

youtube

Exploding Topics Pro Overview

Everything you need to know about Exploding Topics Pro in 4 mins. Including main features, pricing plans and trial.

Missing out on trends? Exploding Topics Pro will help you find trends before everyone else!

This Exploding Topics Pro Overview will start by telling you what are trends and their importance.

Content, products, and ideas that ride trends are easily noticed. People are already desperately searching for those topics.

This surge in interest often means increased online searches, social media discussions, overall engagement and also more sales.

That’s exactly what happened with AI that already existed in 1956 but saw a rise in popularity due to chat bots like chatgpt.

Suddenly every software started to show off their AI capabilities.

To make your campaigns or content more effective you need to incorporate trends and trending topics into your strategy!

#exploding topics pro#exploding topics#exploding topics pro overview#exploding topics pro features#exploding topics pro trial#exploding topics pro pricing#exploding topics pro entrepreneur#exploding topics pro investor#exploding topics pro business#exploding topics pro api#trends database#trend search#trend tracking#trend reports#trending startups#trending products#meta trends#trending topics#trend analysis#trends#seo#digital marketing#Youtube

1 note

·

View note

Text

Can Someone Find Your Exact Location With An Ip Address

What is IP Address Geo-location?

There are several geolocation tools that you can use to find the exact location of an IP address or a domain. Though, most of them don't work effectively a reason why most people end up scammed and regretting their actions. However, the use of IP location geolocation tool has proven to be the best decision to make. Calm your t!ts, an IP address only shows a person the general area where you live. It would take someone an extreme ammount of experience, time and sometimes even money to track you down to your home address and full name, unless you managed to piss someone far enough to drive them to that point like doing their sister, or stealing money then you shouldn't be worried about some kid on the.

IP geo-location maps an IP address to the physical location of the computer or device to which that address is assigned. By geographically mapping the IP address, it provides information such as the country, state, city, zip code, latitude/longitude, ISP, area code, and other information.

How Does IP Geolocation Work?

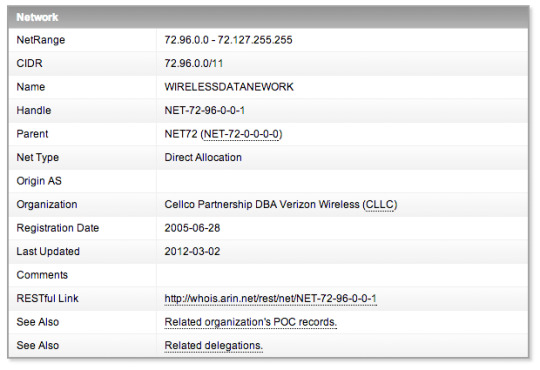

An IP address is a sequence of numbers that uniquely identify any Internet-connected device. The management of these numbers is critical to the functionality of the Internet. The Internet Corporation for Assigned Names and Numbers (ICANN) oversees the assignment of all Internet IP addresses. ICANN assigns IP addresses to Regional Internet Registries (RIRs), who in turn assign them to Internet Service Providers (ISPs).

When an IP addresses is allocated by an ISP, the physical location of the endpoint to which that address is assigned is registered with the governing RIR. All of this data is stored in databases managed by organizations, such as IP2Location, IPligence, MaxMind and Neustar who make this data publically available.

What is an IP Address?

Every device on the Internet, or private computer network is assigned a unique identifier. Just as a home or office is assigned a unique mailing address and postal code to facilitate mail delivery, a computer has a unique identifier to facilitate the delivery of data. The Internet utilizes a protocol known as TCP/IP to allow the routing of data to each Internet-connected device. TCP/IP uses IP Addresses to uniquely identify each device.

There are two types of IP address: IPV4 and IPV6. IPv4 uses 32 binary bits to create a single unique address on the network. An IPv4 address is expressed by four number dotted-decimal format (e.g. 192.168.125.20). Each segment is commonly referred to as an octet. Each octet is a decimal representation of an eight-bit binary number. Decimal numbers are used as they are more human-readable. IPV4 allows for approximately 4.3 billion addresses to be allocated Internet-wide. While that would appear adequate, since addresses are allocated in blocks, an ISP may not necessarily allocate all addresses in a given block. This results in large numbers of unused addresses.

As the growth of the internet exploded, IP addresses were being allocated at an exponential rate. This raised concerns about the possible exhaustion of IPV4 addresses worldwide. This concern prompted the development and introduction of IPV6. IPV6 is a 128-bit binary address, which accommodates a maximum of 340 undecillion, or 340 billion billion billion billion, addresses. Cleary IPV6 allayed any fears of the IP address supply drying up. The Internet now operates using IPV4 and IPV6 addresses, both running on the original TCP/IP protocol.

What is IP Geolocation Useful For?

Every device on the Internet, or private computer network is assigned a unique identifier. Just as a home or office is assigned a unique mailing address and postal code to facilitate mail delivery, a computer has a unique identifier to facilitate the delivery of data. The Internet utilizes a protocol known as TCP/IP to allow the routing of data to each Internet-connected device. TCP/IP uses IP Addresses to uniquely identify each device.

Common Uses for IP Geolocation Information

The mapping of IP addresses to physical locations is useful for many reasons. If you run a web site or online service, tracking the IP addresses of visits to your site identifies what geographic areas your visitors are coming from. This data can be leveraged when selecting target areas for advertising campaigns or other marketing.

When operating a web site that supports multiple languages, IP geolocation data can be used to automatically determine which language to display site content in or pre-select country or city options in fillable forms.

IP location data has proven to be very effective in identifying the source of spam emails, hack attempts, or fraudulent activity against a web site or service. Although IP geolocation data generally cannot pinpoint an exact address, it can certainly narrow down the general area from which a hack originates.

We've encountered a wide range of questions and assumptions about what information you can find regarding an IP address. We decided to go ahead and create a detailed guide on the IP address information overview.

IP Address basics

At its core, an IP address is quite similar to a physical street address. It allows other devices to identify and connect to the device at the IP address. Perhaps without you realizing it, your web browser has connected to multiple IP addresses in order for you to read this post and you are using multiple IP addresses yourself.

Types of IP Addresses

IPv4 vs IPv6 Addresses

When most of us starting connecting to this amazing thing we call the Internet, we were all using IPv4 addresses. An IPv4 address looks something like 216.239.32.21 and there are 4,294,967,296 (2^32) addresses in total. When originally deployed in 1983, it was assumed that 4.2 billion IP addresses would be more than sufficient for us to use. Turn the clock to 2020 and we've exhausted all 4.2 billion IPv4 addresses.

Starting in the late 1990s, the Internet Engineering Task Force (IETF) began addressing the impending IPv4 address exhaustion and created IPv6. While your typical IPv4 address looks like 216.239.32.21, an IPv6 address looks like 2001:0db8:0000:0000:0000:ff00:0042:8329. The biggest and most important difference is that IPv6 allows us to go from 4.2 billion addresses to 340,300,...,000 (2^128) addresses. In case you were wondering, that's called 340 Undecillion.

While IPv6 should allow for every single internet-connected device its own IP address for the foreseeable future, IPv6 and IPv4 are not compatible so the adoption has been slower than IETF and others had hoped for. We could do an entire post on that alone.

Dynamic vs Static IP Addresses

Because the transition to IPv6 has been slow, most of us are using dynamic IP addresses. This means that your phone, router, etc may have its IP address changed periodically. When this happens you don't even notice. Unless you're hosting a server this doesn't impact you. If you stumbled upon this because you are hosting a server and your dynamic IP address makes it hard for people to connect to you, check out a Dynamic DNS service such as noip.com

Some people (and typically businesses) have what's called a static IP address. While a dynamic IP address may change, a static IP address does not. The pros and cons of a dynamic vs static IP address are another topic we could make an entire post on.

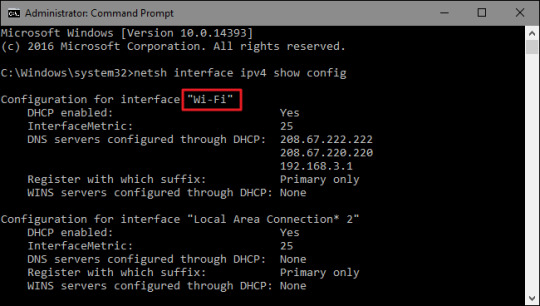

Public vs Private IP Addresses

While most IP addresses are public, meaning that people from all over the world can connect to it (just like you connected to a number of IP addresses to read this post), there are some ranges that have been set aside for private use. The best example is if you have a router you connect your phone or computer to. The private IP ranges for IPv4 are:

10.0.0.0 – 10.255.255.255

172.16.0.0 – 172.31.255.255

192.168.0.0 – 192.168.255.255

If you have a router, you can have 192.168.1.1 and I can have the same address.

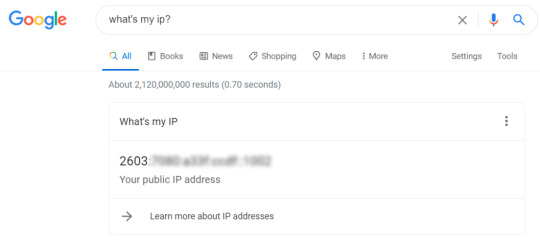

Full IP address information

The reason that our amazing customers use IPinfo is because of the incredible information you can learn about a single IP address. Using our basic service, I looked up my IP address as I was writing this at Starbucks (Trenta water with either a Grande Americano or Grande Caramel Machiatto in case you're wondering) and this is what our services at IPinfo provided:

The Basics - Geolocation

Most of this information is straight forward, I want to make note that if you look up the latitude/longitude listed, you won't find a Starbucks on the map. Why is that? IP address geolocation is aimed at city or postal code level, not at the exact physical location.

ASN API

With an ASN you can learn when it was allocated ownership of the IP, how many IPs they own, their main domain, business name, and what type of entity they are.

Hosting Data

More information about who is hosting/providing this IP address

Company Data

Exactly what you think it is

Privacy API

This service allows you to learn whether or not the IP address in question is likely coming from a provider that is providing privacy services to the actual end user. IP address: 43.241.71.120

Abuse Contact API

Is this API address engaging in some type of abuse, such as hacking, hosting copyrighted material, etc? You can quickly find out who to contact to report this behavior.

Can Someone Find Your Exact Location With An Ip Address Free

Common Questions on IP Information

The most common questions we see around learning about an IP address are:

Can Someone Find Your Exact Location With An Ip Address Phone Number

Q: How do I look up information on a specific IP address? A: That's exactly what IPinfo is all about. Once you create an account, you can use our web-based tool in your account at https://ipinfo.io/account. Simply type in the IP address and we'll take care of the rest.

Can Someone Find Your Exact Location With An Ip Address Finder

Q: How someone can use IP address information? What can someone do with your IP address? A: We have amazing customers doing some incredible things with this information, from providing geo-specific content to security research to learning more about their customers and habits based on location.

Q: Can I track the physical location of my phone or an individual person based on their IP address? A: In short, no, not really. You can get a general idea of where your phone is, but to track it down to the table it is sitting on is not really feasible. For those of you like myself who value privacy, this should come as a relief.

If you have more questions regarding IP address information, we'd love to hear there. We are constantly learning and developing incredible tools to help our customers makes the most of the Internet and the data out there. We'd love to see what ideas you have.

0 notes

Text

The DeFi market is developing rapidly, will it be a bubble like ICO?

DeFi liquidity mining tripped a wave, but what goes on following the wave? Original title: "Viewpoint丨 Has liquidity mining turn into a new trend in DeFi? 》 Published by: Citadel. One Compiler: Liam Decentralized finance (DeFi) has changed into a hot topic before couple weeks, and you will find speculations that people will see a growth similar to the 2017 ICO. The consumer and transaction level of the DeFi market keeps growing rapidly, particularly in the lending sector. There is a new trend-"liquid mining (yiedl farming)"-lending tokens on the DeFi protocol, or being a part of the market-making pool to earn higher returns, which are generally a lot more than ordinary commercial bank savings The interest rate on the account is many times higher. This trend has attracted the eye of many people. You can find already some instructions on how to "rent" different assets on different platforms, such as Maker, Compound, Curve, Ren Protocol, Curve, Synthetix, Balancer, and so on DeFi liquidity mining uses the leverage of multiple protocols to have rewards through the borrowing of the platform's native tokens, thereby performing compound interest. With the rapid growth of tokens for several projects, interest rates in the DeFi field seem very attractive. In some cases, users can participate in multiple DeFi platforms to help expand increase their APY (annual interest rate). Needless to say, the interest rates we see now are the result of the immaturity of the market. With the growth of market size and volume, interest rates will fall over time. The rapid growth of the DeFi market we're seeing could be related to the following facets:

* Since mid-March, the DeFi market has seen steady growth. * Coinbase announced that it will support many DeFi projects later on. * Compound (COMP) token issuance. Market growth Previously several years, Decentralized Finance (DeFi) has become an essential and highly valued direction in the blockchain community. In line with the DeFi pulse, the total locked-in value (TVL) of DeFi projects in February exceeded US$1 billion for the first time, but after Bitcoin's plunge, the worth fell right back the following month. Nevertheless , before month, DeFi TVL broke the previous record and today reaches $1. 67 billion. Although this can be a relatively bit by the standards of the traditional financial industry and the crypto market, it obviously shows that the market sees the potential of the DeFi industry.

Ethereum continues to take over the DeFi field. Most major DeFi protocols are made on Ethereum, and new projects are always being launched. In addition , complex transactions related to DeFi have increased five times before 2 yrs. Ethereum analytics company Covalent predicts a "flippening" event, that's, DeFi transactions exceed ordinary ETH transfers. Market performance source: coinmarketcap. com As is seen from the above dining table, DeFi projects such as Kyber Network, 0x, Synthetix, Aave, Loopring, Bancor, and so on performed significantly a lot better than Ethereum and Bitcoin in the weekly, monthly, and 3-month periods. DeFi has always been a rapidly developing field in the crypto world. Although the market share of the DeFi ecosystem is far less than that of the overall crypto market, new borrowing and profit methods have attracted attention. People's interest is reflected in the explosive growth of a few new and old projects in this field. Coinbase Announcement On June 10, Coinbase revealed that they're exploring the chance of adding 18 new cryptocurrencies. Aave (LEND), Bancor (BNT), Compound (COMP), Numeraire (NMR), Keep Network (KEEP), Ren (REN) and Synthetix (SNX), they're all part of the decentralized financial sector. Although the exchange's announcement stated that they were only evaluating whether to list those tokens, following the announcement, the above-mentioned assets all experienced an increase. On the afternoon of the announcement alone, some tokens rose by 10%, and transaction volume grew rapidly. These tokens enjoy the well-known "Coinbase effect"-currencies mentioned or listed on exchanges, temporarily rising (because listing on Coinbase frequently contributes to an increase in trading volume), which also reflects investors in the market Emotions". Although the trading level of Coinbase listed or mentioned currencies is going to be consistent with other currencies on the market following the hype ceases, and there will be a callback, this really is still among the market's stimulating facets. Several days following the Compound (COMP) token was issued, after Coinbase provided a small boost to DeFi, Ethereum-based Compound and Balancer publicly released their native tokens. The launch event generated a great deal of transactions and further publicity surrounding the DeFi project. Investors earnestly got on the claimed "train" and started initially to participate in the agreement, hoping to get as much profit as you can using this booming market.

Compound is just about the hottest DeFi lending agreement and surpassed MakerDAO in total lock-up value, with an overall total lock-up value of more than 100 million US dollars (July 3, 20, Compound's TVL was 624. five million US dollars, Maker was 510. 4 million US dollars ). By the launch of the protocol's governance and reward token COMP on June 16, Compound's TVL has risen sharply. On June 23, the price tag on the token exploded rapidly from $90 to a lot more than $400 on Coinbase Pro, however it has came ultimately back to about $180. Compound's circulating supply is the reason about 25% of its total supply, as well as therefore it's enough to surpass MakerDAO in market value ($464 million and $450 million, respectively). The huge difference with 2017 Now a lot of industry insiders are worried that the hype of DeFi this time is the same as the “ICO bubble” in 2017. We think that it's important to outline some obvious differences.

* Most DeFi projects are decentralized benchmarking projects of conventional enterprises. Industry they focus on has existed for a long time, and their proportion to the encryption field is huge. We have reason to think that DeFi projects can seize a percentage with this existing market since they provide similar services (but they work differently). However, many ICOs are trying to create new markets, and their use cases are not that easy. * Real assets take part in the DeFi agreement. Although they've been digital assets, they've been still locked in a smart contract, which represents the collateral for loans, exactly like locked assets provide liquidity. They do not rely purely on speculative incentives to build revenue, however they are essential "gears" for project operations. * DeFi products will not attract unqualified investors, because most of them have utility tokens and are generally perhaps not thought to be speculative asset types. Exactly what do we study on the existing situation in Ethereum? The more DeFi projects launched on Ethereum, the more we recognize that PoW can become an obstacle to such projects. Previously month, we've seen a sharp increase in transaction costs, which is the original condition of the blockchain industry. As users and their transaction volume grow, so do transaction costs, which might significantly decrease adoption. Low-value transactions have become too expensive. As is seen from the figure below, June 10 and 11 are incredibly expensive days.

And again, Ethereum's ~13 second block time frame causes it to be impossible for blockchain developers to build DApps that need high tps. This is a potential bottleneck for DApps. Ethereum 2. 0 should be able to solve these issues, make financial-oriented DApps more capable, and eliminate the limitations of block time and high Gas Price.

Starting in 2020, the gas level of the complete network has steadily increased, and in June there's been an amazing increase.

Although the majority of the DeFi hype involves ETH projects, the transaction volume can be increasing steadily, however it still has really not reached 1, 349, 890 ATH. The substantial increase in transaction volume in June was due mainly to the increase in how many DeFi users. There are some unusual use cases in the crypto magic market: one asset can be utilized as collateral, yet another asset could be borrowed, and the asset could be borrowed again following the exchange. The actual rate of get back is negative, but at precisely the same time it's obtained as a result of rapid growth of COMP Positive yield price. It is a very strange situation. Users can make complex solutions with certain risks to create money, because the worldwide mentality of "high risk and high return" is permanently linked to the crypto industry. This may perhaps not work in any conventional banking context. It only works because COMP is too speculative. Financial attractiveness If the trend of encryption technology application continues and the gateway from currency to encryption technology will build up further, then DeFi projects is going to be extremely attractive weighed against conventional financial markets. Lending platforms like Compound provide the same services while at precisely the same time, their interest rates are much higher than most first-tier banks (or better still to some degree, due to the fact the borrower is over-collateralized). Balancer Vulnerability According to Coindesk, DeFi liquidity provider Balancer Pool admitted in early morning of June 29 that it had turn into a victim of a bad hacker attack. The hacker used a vulnerability to deceive the release of tokens worth $500, 000. In a post, Balancer CTO Mike McDonald stated that the attacker borrowed $23 million worth of WETH tokens from dYdX, which is an Ethereum-backed token ideal for DeFi transactions. Then, they trade with Statera (STA), an investment token that uses a toll model, and each transaction consumes 1% of its value. The attacker made 24 transactions between WETH and STA, exhausting the STA's liquidity pool before balance was very nearly zero. Because Balancer believes that it has the same amount of STAs, it releases WETH comparable to the original balance, allowing the attacker to acquire a larger deposit each time a transaction is completed. As well as WETH, the attackers also used WBTC, LINK, and SNX to conduct the same attack, all targeting Statera tokens. The identity of the hacker remains a mystery, but analysts at 1inch exchange, a decentralized exchange aggregator, said that the hackers have covered their tracks well. The Ether used to cover transaction fees and deploy smart contracts is laundered through Tornado Cash, an Ethereum-based mixer service. 1inch stated in its post about the breach, “The man behind this attack is really a very experienced smart contract engineer who has extensive knowledge and understanding of leading DeFi protocols. ” What's next? The way the DeFi hype will build up and how much the DeFi market will pull right back following the end of the hype cycle is going to be a fascinating question. It is difficult to express what impact this period will have on the worldwide crypto market. Might it be just like the "ICO bubble" that leads developers to create DeFi projects? Will we see some negative consequences brought by DeFi "liquid mining"? The systemic threat of hackers is greater than ever, and we possibly may view a situation similar to the destructive consequences of DAO. If the smart contract of a lending platform is attacked or exploited by way of a major hacker, it might trigger a chain reaction, causing a number of position liquidation of different DeFi agreements, leading to a top degree of hatred and cautious market sentiment towards DeFi. Another interesting topic is how a DeFi department will contend with the Stake department. Because part of DeFi is dedicated to passive yield, it mainly involves the Ethereum 2. 0 plan, because most projects are based on ETH. All this is determined by the incentives given by the project, because most investors will follow an increased APY, which makes me doubt whether DeFi's "liquidity mining" will affect the economic model of ETH 2. 0. In addition , it is also curious whether there will be major DeFi projects built on networks other than Ethereum.

0 notes

Text

youtube

In this Exploding Topics Pro Demo I'm going to show you all Exploding Topics Pro features.

And how to use those features to find topics, startups and products that sell!

You might have high quality content but if people are not interested you won't see a lot of results.

And It’s hard to figure out what’s currently popping if you don’t have a trends research tool!

Exploding Topics Pro is one of the best tools to find high interest topics, products, business opportunities... before they even become popular.

If you want to see how it works then watch my Exploding Topics Pro Demo. It will paint a better picture than a review.

This Exploding Topics Pro Demo will be perfect if you are thinking about buying it or learning how to use the tool.

#exploding topics pro#exploding topics pro demo#exploding topics pro dashboard#exploding topics pro features#exploding topics pro tutorial#exploding topics pro api#exploding topics pro business#trends database#trend search#trend tracking#trend analysis#trend forecasting#trend reports#trending topics#trending startups#trending products#meta trends#how to find trends#brian dean#trends#seo#digital marketing#Youtube

0 notes