#fha guidelines

Text

Kentucky FHA Loan Requirements

Kentucky FHA Mortgage Loan Lender Guidelines

Kentucky FHA Loan Requirements

The requirements for Kentucky FHA loans are set by HUD.

Borrowers must have a steady employment history of the last two years within the same industry or line of work. Recent college graduates can use their transcripts to supplant the 2-year work history rule as long as it makes sense.

Self-Employed will need a 2-year…

View On WordPress

#Appraisers FHA#bad credit fha loan#collections fha loan#credit scores fha loan#FHA#fha $100 down program#fha appraisals#FHA Approved Condos Louisville Kentucky#FHA Back to Work Program Ky#fha borrowers#FHA Co-signors#fha collections#fha credit score#fha foreclosure#FHA Guidelines#First-time buyer#Kentucky

0 notes

Text

FHA Mortgage Insurance Premiums To Be Cut By 30bps

FHA To Cut FHA Mortgage Insurance Premiums By 30bps On March 20th. White House Says Homeowners Will Save An Average Of $800 Annually

The Biden Administration announced that FHA Mortgage Insurance premiums be decreased by 30 basis points. FHA charges premiums on the loans they underwrite. FHA charges the fee on top of the monthly principal and interest payments. The White House expects new…

View On WordPress

1 note

·

View note

Text

Although it can be difficult, getting a mortgage after bankruptcy is possible. For borrowers who have emerged from bankruptcy, completed a waiting period, and satisfying other eligibility conditions, several lenders have created rules.

It’s critical to comprehend how bankruptcy affects your capacity to obtain a mortgage and which mortgage programs are accessible to you if you want to purchase a property following the bankruptcy procedure.

#bad credit for mortgage#fha guidelines#bad credit for home loans#NON-QM MORTGAGES#NON-QM LOANS#MANUAL UNDERWRITING#FHA LOANS WITH BAD CREDIT#fha loan indiana#COMPENSATING FACTORS#VA RESIDUAL INCOME#MORTGAGE AFTER BANKRUPTCY

0 notes

Text

Understanding the FHA Bankruptcy Waiting Period

Navigating the world of home loans can be particularly challenging if you've recently filed for bankruptcy. If you're thinking about an FHA loan, it's crucial to understand the FHA bankruptcy waiting period and how it impacts your eligibility. This comprehensive guide covers everything you need to know, answering key questions to help you along the way.

What Is an FHA Loan and How Does It Work?

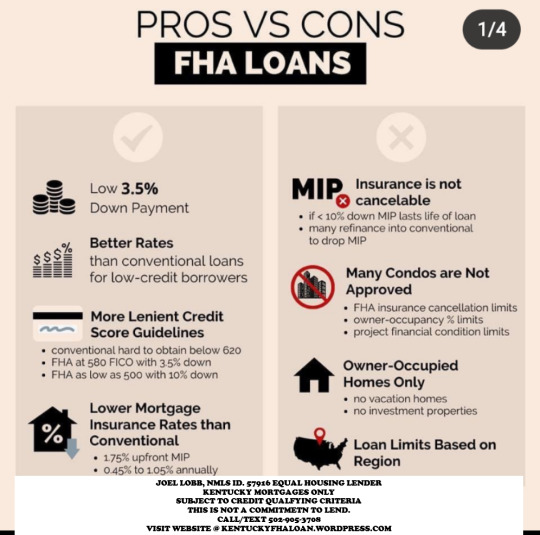

An FHA loan is a mortgage insured by the Federal Housing Administration (FHA). These loans are designed to assist individuals who may not qualify for conventional mortgages, including first-time homebuyers, borrowers with lower credit scores, and those with adverse credit events such as bankruptcies. FHA loans typically feature lower down payments and more lenient credit requirements compared to conventional loans, making them an appealing option for many borrowers.

Benefits of an FHA Loan

Lower Down Payment Requirements: FHA loans allow down payments as low as 3.5%, making homeownership more accessible.

Flexible Credit Score Requirements: FHA loans are particularly accommodating for borrowers with lower credit scores or past bankruptcies.

Low Interest Rates: FHA interest rates are generally lower than those of conventional loans, such as those offered by Fannie Mae.

Cash-Out Refinances: FHA loans allow for cash-out refinances up to 80% loan-to-value, providing flexibility for homeowners needing access to cash.

A Note on Mortgage Insurance: While FHA loans require both upfront and monthly mortgage insurance, it's worth noting that conventional loans also require mortgage insurance when the down payment or equity is less than 20%. Mortgage insurance protects lenders in case a borrower defaults on their loan.

How Does Bankruptcy Affect Your FHA Loan Eligibility?

Bankruptcy can have a considerable impact on your credit history and financing options, but it doesn’t mean you’re permanently ineligible for an FHA loan. Understanding the waiting periods and specific requirements tied to different types of bankruptcy is crucial for determining your eligibility for an FHA loan, whether you're looking to refinance or purchase a home.

Chapter 7 Bankruptcy

For Chapter 7 bankruptcy, you generally need to wait at least two years from the discharge date before qualifying for an FHA loan. This waiting period is designed to give you time to rebuild your credit and show improved financial stability. During this time, you'll need to:

Rebuild Your Credit: Re-establish a good credit history and provide a satisfactory explanation for the bankruptcy.

Demonstrate Financial Stability: Show that you have managed your finances responsibly since the bankruptcy discharge.

Chapter 13 Bankruptcy

If you’re in a Chapter 13 repayment plan, you may qualify for an FHA loan under specific conditions:

While in Repayment Plan: You can apply for an FHA loan if you’ve made timely payments for at least one year and have received court approval.

After Discharge: There’s typically a 12-month waiting period post-discharge before you can apply for an FHA loan.

Consistent, timely payments during the repayment period are crucial to demonstrate financial responsibility.

FHA Chapter 7 Bankruptcy Waiting Period

The waiting period for an FHA loan following Chapter 7 bankruptcy is generally two years from the discharge date. This allows you time to rebuild your credit and demonstrate improved financial stability. Here's how to use this period effectively:

Rebuilding Credit: Key Steps to Improve Your Score

Obtain Secured Credit Cards: Secured credit cards require a cash deposit as collateral, which typically becomes your credit limit. Use these cards for small purchases and pay off the balance in full each month. This will help rebuild your credit score over time.

Pay Bills on Time: Consistently paying all bills, including utilities and rent, is crucial. Timely payments are the largest factor in your credit score, so set up automatic payments or reminders to avoid missing due dates.

Monitor Your Credit Report: Regularly check your credit report for errors or inaccuracies. You’re entitled to a free credit report from each major bureau (Experian, TransUnion, and Equifax) once a year. Dispute any incorrect information to ensure your report accurately reflects your financial behavior.

Keep Credit Utilization Low: Aim to keep your credit utilization ratio below 30%. This ratio is the percentage of your credit card balances relative to your credit limits. High credit utilization can negatively impact your score, while a lack of utilization can also be detrimental.

Avoid Opening Too Many Credit Accounts: While having at least three credit accounts is beneficial, opening too many accounts in a short period can lower your credit score due to hard inquiries. Focus on managing your existing accounts before considering new credit.

Saving for a Down Payment: Why It Matters

Even though FHA loans require a lower down payment, saving more can enhance your loan application and provide several benefits:

Strengthen Your Loan Application: A larger down payment reduces the lender’s risk and demonstrates financial discipline, which can be especially important after bankruptcy.

Lower Monthly Payments: A bigger down payment reduces the amount you need to borrow, lowering your monthly mortgage payments and making homeownership more affordable.

Better Loan Terms: While less of a factor with FHA loans, a substantial down payment might help you negotiate better terms, such as a lower interest rate.

Emergency Fund: Extra savings not only aid with the down payment but also provide a safety net for unexpected expenses, helping you avoid future financial difficulties.

What Is the FHA Chapter 13 Bankruptcy Waiting Period?

If you've filed for Chapter 13 bankruptcy, the waiting period to qualify for an FHA loan differs from that of Chapter 7. Here’s a breakdown of what you need to know to prepare for your FHA loan application after a Chapter 13 bankruptcy:

While in the Chapter 13 Repayment Plan

Eligibility: You may qualify for an FHA loan while still in the Chapter 13 repayment plan if you meet specific criteria.

Timely Payments: You must have made at least 12 months of timely payments to the bankruptcy trustee and/or creditors.

Court Approval: You need to obtain written approval from the bankruptcy court. This approval indicates that the court believes you can handle new debt without jeopardizing your repayment plan.

After Chapter 13 Discharge

12-Month Waiting Period: Once your Chapter 13 bankruptcy is discharged, there is typically a 12-month waiting period before you can apply for an FHA loan.

Maintaining Stability: During this period, continue to manage your finances responsibly. Ensure timely payments on all remaining debts and avoid any new derogatory marks on your credit report.

Document Financial Improvement: Be prepared to provide documentation of your financial history and improvements since your bankruptcy discharge. This includes your credit report, proof of income, and a letter explaining your bankruptcy and the steps you've taken to improve your financial situation.

Understanding these timelines and requirements will help you navigate the FHA loan process more effectively and increase your chances of securing financing for your future home.

During the Repayment Plan: Can I Qualify for an FHA Loan?

Yes, it's possible to qualify for an FHA loan while you're still in a Chapter 13 repayment plan, but there are specific conditions you need to meet. Here’s what you need to know:

Timely Payments

Requirement: You must have made at least 12 months of timely payments to the bankruptcy trustee and/or creditors as specified in your Chapter 13 repayment plan.

Purpose: This shows lenders that you have successfully managed your financial obligations and regained financial stability.

Court Approval

Obtain Approval: You’ll need written approval from the bankruptcy court to proceed with an FHA loan application.

Reason: This approval confirms that the court has reviewed your financial situation and agrees that you can handle new debt without disrupting your repayment plan.

Conditions: The court’s permission is often based on your ability to continue making Chapter 13 payments while managing a new mortgage.

Documenting Your Financial Responsibility

Payment Documentation: Prepare to provide detailed records of your payment history during the Chapter 13 plan. This includes receipts or statements showing consistent, on-time payments.

Explanation Letter: Write a letter explaining the circumstances of your bankruptcy and how your financial situation has improved. This letter helps lenders understand your financial journey and the steps you’ve taken to improve your creditworthiness.

Assistance

Seek Expert Help: Work with a lender who has experience handling bankruptcies. An experienced lender can guide you through the process, answer your questions, and help ensure that you meet all the necessary requirements for your FHA loan application.

By following these steps and meeting the requirements, you can navigate the FHA loan process more effectively while still in a Chapter 13 repayment plan.

After Discharge: What Are the Next Steps?

Once you've successfully completed your Chapter 13 repayment plan and received your discharge, you're looking at a 12-month waiting period before you can apply for an FHA loan. Here’s what you need to focus on during this time:

12-Month Waiting Period

Start Date: The waiting period begins from the date of your Chapter 13 discharge.

Purpose: This period is designed to help you further stabilize your financial situation and continue rebuilding your credit profile.

Maintaining Financial Stability

Timely Payments: Continue to make timely payments on all your remaining debts and obligations. Maintaining a clean payment history is crucial.

Avoid Negative Marks: Steer clear of late payments or any new derogatory marks on your credit report, as these can impact your FHA loan application.

Saving for a Down Payment

Importance: While FHA loans require a down payment as low as 3.5% (for those with credit scores of 580 or higher), saving more can strengthen your application.

Benefits: A larger down payment not only improves your attractiveness as a borrower but can also lower your monthly mortgage payments and potentially secure better loan terms.

Documentation and Proof of Financial Improvement

Prepare Documentation: Gather comprehensive documentation of your financial history and improvements since your bankruptcy discharge. This should include:

Credit report

Proof of income

Employment history

Any other relevant financial documents

Explanation Letter: Write a letter explaining your bankruptcy and how your financial situation has improved since then. This can help lenders understand your financial journey better.

Consultation with a Mortgage Professional

Seek Expertise: Engage with a mortgage professional who has experience handling cases involving bankruptcy. They can provide valuable guidance and help you navigate the FHA loan application process effectively.

By focusing on these steps, you'll be better prepared to apply for an FHA loan once the waiting period has elapsed, and you’ll be on your way to achieving your homeownership goals.

How Can I Improve My Chances of Getting an FHA Loan After Bankruptcy?

Improving your chances of securing an FHA loan after bankruptcy involves several key steps. Here’s how you can enhance your application:

Build a Positive Credit History

Make On-Time Payments: Ensure all your current debts and bills are paid on time. Payment history is a significant factor in your credit score.

Keep Credit Utilization Low: Maintain a low ratio of credit card balances to credit limits, ideally below 30%.

Avoid New High-Interest Debt: Be cautious about taking on new debt, especially high-interest loans, which can negatively impact your credit profile.

Save for a Down Payment

Increase Your Down Payment: Although FHA loans have a lower down payment requirement, saving more can strengthen your application. A larger down payment not only demonstrates financial responsibility but can also help reduce your monthly mortgage payments.

Provide a Detailed Explanation

Explain Your Bankruptcy: Prepare a clear, honest explanation of the circumstances that led to your bankruptcy and how your financial situation has improved since then. This explanation can help lenders understand your financial journey and assess your current stability.

Obtain Court Approval (For Chapter 13 Applicants)

Seek Court Permission: If you are still under a Chapter 13 repayment plan, make sure to obtain written approval from the bankruptcy court. This approval indicates that the court believes you can manage a new mortgage without disrupting your repayment plan.

By following these steps, you’ll be better positioned to navigate the FHA loan process and enhance your chances of approval, paving the way toward your homeownership goals.

What Are the Exceptions to the FHA Bankruptcy Waiting Period?

While FHA guidelines typically adhere to standard waiting periods after bankruptcy, there are exceptions for cases involving extenuating circumstances. If you can prove that your bankruptcy resulted from factors beyond your control, you might be eligible for a waiver. Here are some scenarios that might qualify for an exception:

Significant Income Loss

Criteria: Demonstrate a temporary loss of at least 20% of your income for a minimum of six months.

Evidence: Provide documentation such as unemployment records, income statements, or other proof of reduced earnings.

Medical Emergencies

Criteria: Severe illness or injury that led to substantial financial hardship.

Evidence: Medical records, hospital bills, or other documentation showing the impact of the medical emergency on your finances.

Death of the Primary Earner

Criteria: The death of the main income earner in your household.

Evidence: Death certificate, financial statements showing the impact on household income.

To qualify for an exception, you’ll need to present thorough documentation of these extenuating circumstances and show that you have maintained responsible financial behavior since your bankruptcy discharge.

Frequently Asked Questions

What is the FHA bankruptcy dismissal waiting period?

If your Chapter 13 bankruptcy case is dismissed rather than discharged, you must wait two years before qualifying for an FHA loan. This waiting period provides time to re-establish your credit and demonstrate financial stability.

How Long Does It Take to Get an FHA Loan?

Once you meet the qualifications, securing an FHA loan typically takes 30 to 45 days. Here’s a quick breakdown:

Application and Documentation: 1-2 weeks to submit and review documents.

Loan Processing: 2-3 weeks for verification and appraisal.

Underwriting: 1-2 weeks for final approval.

Closing: About 1 week to sign documents and finalize the loan.

Factors that can affect timing include the lender’s processing speed, the complexity of your financial situation, and any property issues. Staying prompt with your paperwork can help expedite the process.

How to Rebuild Your Credit After Bankruptcy

Get Secured Credit Cards: Apply for one or more secured credit cards and make timely payments to start rebuilding your credit.

Manage Credit Utilization: Keep your credit utilization below 30% and avoid high-interest debt.

Pay Bills on Time: Consistently pay existing debts like rent and utilities to build a positive payment history.

Establish Credit Accounts: Aim to have at least three credit accounts, which can be a mix of credit cards and installment loans.

FHA Loan Requirements for 2024

Credit Score:

580 or higher for a 3.5% down payment.

500–579 for a 10% down payment.

Debt-to-Income Ratio:

Typically under 43%, though exceptions can apply.

Income & Employment:

Proof of steady income and employment is required

Property Use:

The home must be your primary residence.

Yes, the same guidelines apply to both refinances and purchases when it comes to bankruptcies. You can refinance your existing mortgage during and after bankruptcy, following the same rules as for new home purchases.

The Bottom Line

Navigating the FHA bankruptcy waiting period can be complex, but you don’t have to do it alone. At JVM Lending, we specialize in helping borrowers with unique financial situations, including those who have filed for bankruptcy. Our team of experts is dedicated to providing personalized service and guiding you through every step of the loan process. Whether you’re rebuilding your credit, saving for a down payment, or looking to refinance, JVM Lending is here to help.

Read more

#FHA bankruptcy waiting period#home loan options#FHA loans#bankruptcy impact#real estate financing#mortgage guidelines#loan approval

0 notes

Text

How to Meet Conventional Loan Home Condition Requirements?

Found your dream home? Congratulations! But before you pop the champagne, there are a few hurdles to clear, especially if you’re financing with a conventional loan. Unlike Government-backed loans, conventional loans don’t have super strict requirements for the house itself. That might sound like good news, but it also means understanding what kind of condition your future home needs to be in to…

View On WordPress

#conventional appraisal guidelines#conventional appraisal requirements#conventional financing for manufactured homes#conventional loan appraisal requirements#conventional loan home condition requirements#conventional loan home inspection#conventional loan inspection requirements#conventional loan property requirements#conventional loan requirements#conventional loan requirements 2024#conventional loan vs fha#do conventional loans require inspection#does a conventional loan require a home inspection#financing for mobile homes#guidelines for conventional mortgage#how to buy a mobile home with no money down#manufactured home mortgage#mortgage for mobile home#mortgage manufactured home#mortgage on manufactured home#requirements for conventional loan#what are the requirements for a conventional mortgage

0 notes

Text

History of Red Lining

Redlining is a malicious practice that has plagued the United States for decades, with its effects still being felt by marginalized communities today. This discriminatory practice has its roots in the early 20th century, when federal housing policies and mortgage lending practices effectively institutionalized segregation and economic disenfranchisement of minority communities. The history of redlining is a dark stain on the social fabric of this country, and it is crucial to understand its origins and impact in order to combat its lasting effects.

The term “redlining” originated from the practice of marking certain neighborhoods on maps with red lines to indicate high-risk areas for mortgage lending. This practice became widespread after the passage of the National Housing Act of 1934, which established the Federal Housing Administration (FHA) and the Home Owners’ Loan Corporation (HOLC). These agencies were responsible for establishing lending guidelines and rating systems that effectively excluded minority communities from accessing affordable housing and loans.

The HOLC implemented a system of color-coded maps to assess the risk of lending in different neighborhoods, using racial demographics as a major factor in determining the risk level. Neighborhoods with predominantly white residents were typically graded as safe and received favorable lending terms, while those with minority populations, particularly African American and Latino communities, were graded as high-risk and were denied access to fair lending practices.

This deliberate and systematic discrimination led to the physical and economic segregation of communities, as minority residents were effectively blocked from accessing homeownership and the wealth-building opportunities that come with it. This practice perpetuated the cycle of poverty and reinforced the systemic inequality that still plagues American society today.

The impact of redlining is evident in the persistent wealth gap between white and minority communities, with minority households significantly lagging behind in homeownership rates and household wealth. The legacy of redlining is also seen in the disparities in access to quality education, healthcare, and economic opportunities in predominantly minority neighborhoods.

While redlining was officially banned with the passage of the Fair Housing Act of 1968, its effects continue to reverberate in the present day. The discriminatory lending practices that stemmed from redlining have contributed to the racial wealth gap and the continued segregation of neighborhoods across the country.

It is imperative to recognize the history of redlining as a form of institutionalized racism and to work towards remedying its lasting effects. Efforts to address these disparities must include policies that promote equitable access to housing, financial resources, and economic opportunities for marginalized communities. This includes initiatives to increase affordable housing options, improve access to fair lending practices, and invest in underserved neighborhoods to promote economic development and revitalization.

Additionally, addressing the legacy of redlining requires acknowledging the systemic racism that underlies these disparities and working towards creating a more just and equitable society. This involves confronting deep-rooted prejudices and biases, dismantling discriminatory policies, and actively promoting diversity, inclusion, and equality in all facets of society.

Photo by Unseen Histories on Unsplash

4 notes

·

View notes

Text

FHA Guidelines

FHA guidelines refer to the specific rules and requirements set forth by the Federal Housing Administration (FHA) for mortgage loans insured by the FHA. These guidelines are established to ensure that borrowers who seek FHA-insured loans meet certain criteria and that lenders follow standardized procedures when originating and underwriting these loans. The primary goal of FHA guidelines is to make homeownership more accessible to a broader range of borrowers, including those with lower credit scores or smaller down payments. These guidelines are subject to change, so borrowers and lenders should always consult the latest FHA requirements and work with FHA-approved lenders to understand and meet the criteria for FHA-insured loans. FHA guidelines are designed to promote responsible homeownership and expand access to mortgage financing for a wide range of individuals and families.

#fha loan#gca mortgage#property#real estate#united states#gustancho associates#usa#first time home buyer#va loans#bad credit score

2 notes

·

View notes

Link

10 FHA Guidelines EVERY Home Buyer Should Know https://www.madisonmortgageguys.com/fha-guidelines/

4 notes

·

View notes

Text

What Does a Mortgage Professional Do?

A mortgage professional is a licensed financial professional who gathers borrowers' financial documentation, compares rates and connects them with lenders. They can help with both residential and commercial mortgages.

Lenders typically require a debt-to-income ratio of 43% or less. However, professionspecific mortgage lenders understand that doctors in residency and attorneys early in their careers may have higher DTIs.

Qualifications

A mortgage professional assists clients with one of the most important investments in their lives. They have a wide range of responsibilities, including preparing loan documents and communicating with lenders, closing agents and real estate professionals. They also help clients choose the right type of loan and negotiate rates. They must be knowledgeable about the mortgage market and have excellent math skills.

Many mortgage brokers have a college degree or a high school diploma, which helps them understand complex data and deal with challenges. In addition, they should have strong reading comprehension and mathematical reasoning skills. The mortgage industry is constantly changing, so it is important to keep up with new regulations and trends. Mortgage professionals should also pursue mentorship opportunities and attend networking events to improve their knowledge of the industry. They should also obtain a license from the National Mortgage Licensing System and Registry (NMLS). This allows them to work in any state and helps ensure compliance with federal laws.

Fees

Mortgage professionals often develop relationships with lenders and have access to different loan programs that are not available to the general public. This means that they are able to help you find the right type of mortgage for your situation. They will also explain the various fees associated with mortgage lending and help you fill out paperwork. They will also communicate with the lender company, closing agent and real estate agent to make sure that all the details are taken care of.

Mortgage fees vary between lenders and brokers, and some are negotiable. Watch out for fees that are redundancies or excessive, and be aware of the ways in which a broker can be compensated for their services. For instance, some lenders may add mortgage broker fees into the loan origination fee. This can be misleading for borrowers. Also, be careful to look at the complete list of mortgage fees on the Loan Estimate and Closing Disclosure.

Loan types

The mortgage loan industry offers a variety of loans to suit different types of homebuyers. These include Conventional Mortgage Loans, FHA-Insured Loans, home loans and Government-Guaranteed Loans.

A professional can help borrowers determine which loan programs will work best for them. These professionals understand mortgage laws and lender guidelines, so they can save borrowers time and money by helping them choose the right loan program for their unique circumstances.

Besides conventional mortgages, there are also loan programs geared towards specific professions. For example, mortgage lenders offer mortgages for doctors, attorneys and other high-income professionals. These mortgages often have a lower down payment and do not require PMI payments.

Before choosing a mortgage broker, be sure to research the various options available. Look for reviews, social media pages and Better Business Bureau profiles. Also, ask for recommendations from friends and family. It is essential to find a broker who can get you the specific loan type you need.

Closing

You wouldn’t make a major financial investment without consulting with a stockbroker, so why would you shop for a home loan without talking to a mortgage professional? They are your resource for answering questions, structuring a financing solution that works best for your goals and closing on time.

During the closing process (also known as consummation), you and your mortgage professional will sign several documents related to the purchase of your home. These documents confirm your agreement to pay a specific sum of money and the terms of your mortgage. You may provide funds in the form of certified checks or wire transfers to fund your mortgage loan, and a closing agent will ensure that these funds are properly disbursed.

Mortgage professionals also prepare and review your Closing Disclosure, ensuring that all necessary fees are included in the final amount you sign for. They are also present during your final walkthrough to address any last-minute concerns you might have about the property.

#mortgage professional#investment property#investment property loan#australian finance group#finance group australia#business loans for new businesses#investment loans#home loans#asset finance#heavy vehicle finance#trailer finance#Cash flow finance#floorplan finance

0 notes

Text

Document Automation and the Future of Non-QM Loans with IDP solutions

As margins thin out, lenders are faced with the task of reconfiguring their existing cost structures while looking for alternate revenue streams. The non-QM market is emerging as a lucrative and practical solution for many. COVID-19 halted the boom of non-QM due to the liquidity constraint, however, it regained its market share and finished 2021 with 25 billion worth of originations and is anticipated to double in 2022.

What is a Non-QM Loan?

A loan which has any one of the criteria below will be considered non-QM:

Debt-to-Income greater than 43%

Blemish on FICO credit due to unforeseen circumstances

Self-employed for less than two years

Low income on tax returns

A non-qualified mortgage doesn’t conform to the consumer protection provisions of the Dodd-Frank Act.

For example, if you have a DTI of more than 43% or have erratic income and don’t meet the income verification requirements set out in the Dodd-Frank Act or by most lenders, you are not eligible for a qualified mortgage and may be offered a non-qualified mortgage instead.

How Do Lenders Verify Income for Non-QM Loans?

Non-QM loans don’t adhere to the standards required for QM loans, but that doesn’t mean they are low-quality loans. A study conducted in 2018 shows that the differences in credit score and loan-to-value ratio between non-QM borrowers and QM borrowers are minimal. However, non-QM borrows on average do have a higher DTI ratio.

Non-QM loans provide flexibility for lenders to offer mortgages to people not eligible for QM loans. Nevertheless, lenders still need to substantiate the documents provided, including income sources. They may also want to verify assets or any other information that assures them the borrower will be able to repay the loan. Non-QM loans are not insured, guaranteed, or backed by FHA, VA, Fannie Mae, or Freddie Mac.

The Evolution of the Mortgage Market

The non-QM market shows promise for the future due to the below factors:

Stricter Regulations

Regulatory bodies, Fannie Mae, and Freddie Mac have made stricter restrictions to reduce possible risks by limiting the percentage of qualified loans offered. This has resulted in a smaller government box, isolating a large section of borrowers who do not conform with the GSE. Moreover, with bank lending restrictions also becoming stricter, this aided non-QM loans to become a more accommodative alternative for loan seekers.

2. Evolving Borrower Profile

There has been a radical change in employment profiles across the country triggered by the COVID-19 pandemic. Entrepreneurship is on the up with a significant percentage of salaried individuals starting their own business due to loss of jobs.

According to statistics, the growth of start-up businesses in the country has risen by 24% from 2019 to 2020. A Forbes report published in 2019 estimated that nearly 30% of Americans are self-employed. This opens the non-QM market to a large number of individuals who become natural candidates for non-QM loans as Fannie Mae and Freddie Mac primarily favor the salaried class.

3. Soaring Home Prices

Home prices over the past few years have seen a gradual rise. The mortgage market is generally shifting away from refinances, which made up over 50% of the market in the last 12 months, to a purchase driven market. The demand for large-sized loans has increased – mostly in the form of Non-QM, as the GSE guidelines around investment properties have been disqualifying most candidates for agency loans.

Key Challenges Faced by Lenders in the Non-QM Space

While interest in the market is on the rise, there are challenges for Non-QM loans. Despite the growing interest, the sector does face some basic functional challenges that lenders are required to overcome. The key ones are detailed below-

Managing Error-Prone Manual Processes

Manual processing of Non-QM can lead to errors, longer timelines and higher costs. Non-QM products do tend to be a bit diverse. This makes the requirement of proper technology to streamline tasks and improve efficiency levels across the organization quite a pressing one. Though there are many generic automation solutions available in the market, Non-QM loans require specialized solutions to get the domain intelligence into the system.

2. Mitigating Risks of Frauds

Mortgage fraud has been rising steadily in the last decade. Due to a relaxation in DTI ratio and other criteria, it becomes critical for Non-QM providers to have a robust risk and fraud mitigation mechanism.

3. Dealing with the Changing Cost Structures

When looking at the total number of mortgage units over the last 10 years, the market has fluctuated up or down by up to 50% each year. It’s clear that mortgage is an industry that is subject to high fluctuations. Due to this ambiguity, increasing fixed costs by investing in additional capacity can be a risk.

The pivotal role of specialized document automation technology in overcoming functional challenges

Specialized solutions can help to overcome functional challenges faced in disbursing Non-Qualified Mortgages. Document automation involves using advanced technology such as AI to simplify the lengthy tasks pertaining to disbursing a typical non-QM loan – right from onboarding, processing, underwriting, pricing, packaging, and closing in a cost-effective way.

DocVu.AI – the most innovative AI/ML solution for BFSI* is designed to be workflow-driven and follows the same set of rules that is adhered to when tasks are manually executed. With the use of intelligent algorithms, the solution significantly increases the pace of execution and reduces the probability of costly human errors.

As a result, Non-QM Mortgage lenders gain increased freedom to take on additional workload due to the automation introduced at several points without worrying about capacity constraints. This empowers the lenders to place their undivided focus on core areas for sustainable growth.

*As per IBS Intelligence 2021 ratings

0 notes

Text

Finding the Right Boise Mortgage Company for Your Needs

When it comes to securing a home loan, choosing the right Boise mortgage company is crucial for a smooth and successful transaction. With a variety of options available, understanding what a reputable Boise mortgage lender offers can help you make an informed decision.

Why Choose a Local Boise Mortgage Company?

A local Boise mortgage company can provide personalized service that larger, national lenders may lack. Local lenders are familiar with the Boise housing market, including current property values and neighborhood trends. This local expertise allows them to tailor loan products to fit the unique needs of Boise residents. Whether you're a first-time homebuyer or looking to refinance, a local lender can guide you through the entire process, making it easier to understand your options.

Types of Loans Offered

Most Boise mortgage lenders offer a range of loan products, including conventional loans, FHA loans, VA loans, and USDA loans. Understanding the differences between these options is essential for choosing the right mortgage for your situation. A knowledgeable Boise mortgage company can help you navigate these choices and find the loan that best suits your financial goals.

Competitive Rates and Fees

One of the most significant advantages of working with a local Boise mortgage lender is the potential for competitive interest rates and lower fees. Because these companies operate within the local market, they often have better insights into what rates are realistic. Additionally, many local lenders have less overhead than national banks, which can translate into savings for you.

Streamlined Process

Another benefit of choosing a Boise mortgage company is the streamlined application process. Local lenders often have more flexibility in their underwriting guidelines, which can lead to faster approvals. Their familiarity with local regulations and requirements also means fewer delays and complications along the way.

Personalized Support

Navigating the mortgage process can be daunting, but a dedicated Boise mortgage lender can provide the support you need. They can answer your questions, help you understand your credit score, and provide advice on how to improve your financial standing before applying for a loan. This personalized attention ensures that you feel confident and informed every step of the way.

Conclusion

Choosing the right Boise mortgage company can make all the difference in your home-buying experience. With local expertise, a range of loan options, competitive rates, and personalized support, a Boise mortgage lender is an invaluable partner in achieving your homeownership dreams. Take the time to research and connect with a reputable lender in Boise to ensure a successful and stress-free mortgage journey.

0 notes

Text

Best Kentucky FHA lenders to get an Approval to buy a house.

How to Qualify for a Kentucky FHA Loan Approval:

If you’re looking to buy a home in Kentucky and are considering a Kentucky FHA loan, it’s essential to understand the qualifying criteria and the necessary steps. This article covers all the crucial aspects you need to know, from credit scores, bankruptcy, work history, collections, closing, home insurance, title, debt ratio , down payment and…

View On WordPress

#$100 Down FHA Mortgage#2020 Kentucky FHA Mortgage Guidelines#and work history requirements for Kentucky Mortgage loan approval for FHA#Credit score#FHA#fha $100 down program#fha 2014 fico score requirements#fha appraisals#FHA Approved Condos Louisville Kentucky#FHA Back to Work Program Ky#fha borrowers#FHA Co-signors#fha collections#fha credit score#First-time buyer#Kentucky#louisville#Mortgage#Mortgage loan#Zero down home loans

0 notes

Text

FREE HOMEBUYER SEMINAR! SEE IF YOU QUALIFY FOR UP TO $ 150K GRANT

FREE HOMEBUYER SEMINAR! SEE IF YOU QUALIFY FOR UP TO $ 150K GRANT

Free Homebuyer’s Seminar

Come find out:

How to qualify for up to $ 150,000.00 in grants (guidelines)

Get Pre-approved & lock in your rate (Rates are going down)

Sonyma, FHA, FHA 203K , DSCR, & much more

Saving counseling, Credit counseling & more!

Own Cheaper than renting! Buy with as low as 1% down

House Tours—2 fam 600’s, Condo 200’s -300’s, Mixed Use

Hosted by Brooklyn Real Property, Inc & Banks

Brooklyn Real Property Inc/ BRP Associates, Inc.

77 Conklin Avenue

Between: East 94 Street & East 93rd Street

Sunday September 22 2024 at 1:00 PM EST

To RSVP Call 718-875-8899

www.BrooklynRealProperty.com

1 note

·

View note

Text

Top Mortgage and Loan Pre-Approval Letter Templates for 2024

When seeking a mortgage or loan, one of the essential documents that homebuyers or borrowers encounter is the pre-approval letter. This letter not only signifies a lender’s intent to offer a loan but also gives potential buyers a competitive edge in a crowded market. As we approach 2024, the demand for well-structured and effective pre-approval letters continues to rise. In this article, we’ll discuss the top mortgage and loan pre-approval letter templates for 2024, outlining their significance, key components, and how you can utilize them.

Why is a Mortgage Pre-Approval Letter Important?

A pre-approval letter is a formal statement from a lender declaring that you are qualified for a loan based on a thorough review of your financial background. This letter differs from a pre-qualification, which is a preliminary assessment based on self-reported financial data. A pre-approval letter, on the other hand, involves the lender analyzing your credit report, income, debts, and assets to determine your eligibility and loan amount.

Key benefits include:

Increased Credibility: A pre-approval letter signals to sellers that you are a serious buyer, and this can give you an edge in negotiations.

Clear Budgeting: It provides a clear indication of how much you can afford, streamlining your home search.

Faster Loan Process: Pre-approval shortens the mortgage approval process once you find your dream home.

Essential Components of a Mortgage Pre-Approval Letter

Before diving into the top templates for 2024, it’s essential to understand the critical components that every mortgage pre-approval letter should include:

Loan Amount: The maximum amount the lender is willing to offer.

Interest Rate: The tentative interest rate, although it may change before the final loan agreement.

Loan Type: The type of mortgage or loan, such as FHA, VA, or conventional.

Expiration Date: The letter's validity period, typically ranging from 60 to 90 days.

Lender’s Contact Information: Details for follow-up inquiries or additional negotiations.

Contingency Clauses: Any conditions, such as final credit approval or home appraisal requirements.

Top Mortgage Pre-Approval Letter Templates for 2024

Here are some of the best pre-approval letter templates available for 2024, designed to meet varying financial needs and market conditions:

1. Basic Mortgage Pre-Approval Template

This template is simple and straight to the point, ideal for first-time homebuyers. It includes all the necessary information without overwhelming the recipient with jargon.

Key Features:

Clear breakdown of the loan amount and estimated interest rate.

Essential contact information for both borrower and lender.

Standard expiration date and contingencies.

Usage: Ideal for straightforward residential property purchases.

2. FHA Loan Pre-Approval Letter Template

FHA (Federal Housing Administration) loans are popular among buyers with lower credit scores or down payments. This template ensures that the borrower’s financial background meets FHA guidelines.

Key Features:

Mention of government-backed FHA mortgage.

Detailed explanation of loan-to-value ratio (LTV).

Clear outline of credit score requirements.

Usage: Perfect for buyers seeking an FHA loan with low down payment requirements.

3. VA Loan Pre-Approval Template

Designed for veterans, active military personnel, and their families, this template caters specifically to VA loan applicants. It ensures compliance with VA loan requirements and highlights the zero down payment advantage.

Key Features:

Emphasizes the VA loan benefit of no down payment.

Explanation of VA funding fees and loan limit.

Includes lender’s verification of veteran status.

Usage: Best suited for qualified military personnel and veterans.

4. Jumbo Loan Pre-Approval Template

Jumbo loans exceed the conforming loan limits set by the Federal Housing Finance Agency (FHFA). This template provides clarity on the borrower’s capacity to handle larger loan amounts.

Key Features:

Breakdown of borrower’s income, assets, and liabilities.

Explanation of higher down payment and stricter credit score requirements.

Specific mention of non-conforming loan type.

Usage: Ideal for luxury home purchases or properties in high-cost areas.

5. Investment Property Pre-Approval Letter Template

For individuals or businesses looking to invest in rental or commercial properties, this template addresses the unique financial qualifications required for investment property loans.

Key Features:

Highlights the need for higher down payments and stricter credit scores.

Breakdown of expected rental income and its contribution to loan qualification.

Clear mention of investment property regulations.

Usage: Perfect for borrowers looking to finance multi-family units or commercial real estate.

Customizing a Mortgage Pre-Approval Template

While these templates provide an excellent starting point, it’s essential to tailor them to meet individual borrower needs. When customizing, consider the following:

Include the Borrower’s Financial Story: Highlight stable employment, consistent income, and strong credit history.

Be Transparent About Limitations: Lenders should be honest about potential obstacles, such as debt-to-income ratio limits or credit score requirements.

Use Professional Language: Avoid overly technical jargon while maintaining a formal tone.

youtube

SITES WE SUPPORT

Approved Certified Mail – Wix

1 note

·

View note

Text

The Ultimate Beginner’s Guide to Conventional Loans

Buying a home is a big step, and understanding your financing options is crucial. One common type of mortgage is a conventional loan. If you’re new to home buying or just exploring your options, this guide will help you understand conventional loans in simple terms.

What is a Conventional Loan?

A conventional loan is a type of mortgage not backed by the government. Unlike FHA, VA, or USDA loans, which have government support, conventional loans are provided by private lenders like banks. They follow guidelines set by Fannie Mae and Freddie Mac, which are organizations that help manage the mortgage market.

Types of Conventional Loans

Conforming Loans: These loans meet the standards set by Fannie Mae and Freddie Mac. They’re usually easier to get and offer competitive interest rates.

Non-Conforming Loans: These loans don’t meet the guidelines of Fannie Mae and Freddie Mac. Jumbo loans are a common type of non-conforming loan and typically have stricter requirements and higher interest rates.

Key Features of Conventional Loans

Down Payment: Conventional loans often require a down payment of at least 3% of the home’s price. If you put down 20% or more, you can avoid paying private mortgage insurance (PMI), which is an extra cost added to your monthly payment to protect the lender.

Credit Score: Your credit score affects your loan. While the minimum is usually 620, a higher score can help you get better rates and terms.

Interest Rates: Conventional loans can have fixed or adjustable rates. Fixed rates stay the same throughout the loan, while adjustable rates can change over time. Your rate will depend on your credit score, down payment, and current market rates.

Loan Terms: Conventional loans often come in 15, 20, or 30-year terms. Shorter terms usually mean higher monthly payments but less interest paid over the life of the loan. Longer terms mean lower monthly payments but more total interest.

Advantages of Conventional Loans

Flexibility: These loans offer various options and terms, so you can find one that fits your financial situation.

No PMI with 20% Down: If you can put down 20% or more, you won’t have to pay PMI, which saves you money each month.

Potentially Lower Rates: With a good credit score and a solid down payment, you might get a lower interest rate compared to other loan types.

Things to Consider

Credit Health: Check your credit report and work on improving your score if needed. A higher score can help you get better loan terms.

Financial Stability: Make sure you have a stable job and manageable debt. Lenders look at your financial health to decide if you qualify.

Budgeting for Costs: Besides the down payment, be ready for closing costs, like fees for appraisals and inspections. Planning for these costs helps avoid surprises.

Final Thoughts

A conventional loan can be a good option if you’re buying a home. By understanding the basics—like down payments, interest rates, and credit score—you can make a smart choice. Take your time to prepare and talk to a mortgage expert to find the best loan for you. With the right knowledge, you’ll be ready to make your home-buying journey smoother and more successful.

0 notes