#forex indicators for mt4

Explore tagged Tumblr posts

Text

Discover the Best MT4 Indicators for Maximum Profits!

MT4 indicators are an essential tool in the toolbox of forex traders.

#mt4 indicators#indicators mt4#indicators for mt4#best mt4 indicators#mt4 best indicators#forex indicators for mt4#best indicators mt4#forex indicators mt4#best indicators for mt4#forex mt4 indicators

2 notes

·

View notes

Text

Discover the Best MT4 Indicators for Maximum Profits!

Mt4 Indicators

MT4 indicators are an essential tool in the toolbox of forex traders. These technical analysis tools help traders to identify trends, potential breakouts, and other market dynamics that can inform their trading decisions. MT4 indicators are available in various forms and can be customized to suit different trading styles.

The purpose of this article is to provide a comprehensive guide on MT4 indicators, exploring their types, customization options, and tips for effective use. By understanding the fundamentals of these tools, traders can enhance their decision-making process and maximize their trading potential.

Additionally, we will discuss how MT4 indicators fit into the broader context of forex trading strategies and how they can complement other analytical tools such as price action analysis or fundamental analysis.

Understanding the Purpose of MT4 Indicators

The purpose of MT4 indicators is to provide traders with a visual representation of market data in the forex industry. These technical tools serve as an aid for traders in making informed trading decisions by analyzing price and trend movements. They are designed to be contextually relevant, meaning that they are specific to the trader's preferred currency pairs, time frames, and trading strategies.

MT4 indicators offer a range of benefits for traders such as identifying potential entry and exit points, highlighting market trends, and providing signals for technical analysis. By using these tools, traders can develop strategies based on real-time data which can increase their chances of success in the forex market.

Furthermore, MT4 indicators allow traders to conduct thorough analysis without having to spend hours manually scanning through charts and graphs.

Overall, understanding the purpose of MT4 indicators is crucial for any trader looking to succeed in the highly competitive world of forex trading.

Exploring the Different Types of MT4 Indicators

Various categories of tools are available on MT4 that help traders to analyze the market and make better decisions. Among these tools, MT4 indicators play a crucial role in identifying market trends, predicting future price movements and providing signals for entry and exit points.

There are different types of MT4 indicators, each designed to serve a specific purpose. Exploring these different types of indicators can help traders to choose the ones that best fit their trading style and strategy.

One type of MT4 indicator is trend indicators, which shows the direction and strength of a market trend. These include moving averages, MACD (Moving Average Convergence Divergence), and Ichimoku Kinko Hyo.

Another type is support and resistance indicators that identify key levels where prices are likely to find support or resistance. Examples include pivot points, Fibonacci retracement levels, and Bollinger Bands.

Other types of MT4 indicators include volatility indicators such as Average True Range (ATR) and Relative Strength Index (RSI), momentum oscillators like Stochastic Oscillator and Williams Percent Range (WPR), as well as volume-based indicators like On-Balance Volume (OBV).

By understanding the different types of MT4 indicators available, traders can use them effectively to improve their trading performance by making informed decisions based on accurate analysis of market trends.

Customizing MT4 Indicators to Suit Your Trading Style

Customizing MT4 indicators can significantly enhance a trader's ability to analyze the market and make informed decisions that align with their unique trading style. The standard settings on an MT4 indicator might not always match the preferences of every individual trader, which is why customizing them becomes crucial.

For instance, traders may want to adjust the parameters of certain indicators such as moving averages or stochastic oscillators to better capture price movements in specific timeframes. This customization process allows traders to tailor their analysis to their trading style and preferences.

Forex traders who use MT4 indicators can also customize them by adding or removing features based on their needs. Some traders prefer simple tools while others may need more complex ones depending on their experience level and strategy.

Customization presents an opportunity for traders to integrate multiple indicators into one chart, which offers a comprehensive view of market trends and price movements. By selecting the right combination of indicators, traders can develop a trading system that suits their unique style and helps them identify potential entry and exit points in the market.

Ultimately, customizing MT4 indicators allows forex traders to optimize their analysis techniques and achieve better trading outcomes over time.

Tips for Using MT4 Indicators Effectively

To effectively utilize MT4 indicators, traders should consider the specific market conditions and timeframe in which they are trading. It is important to understand that different indicators work better in different market conditions.

For example, trend-following indicators like moving averages are more effective in trending markets, while oscillators like Relative Strength Index (RSI) perform well in range-bound markets. Therefore, it is essential for traders to identify the prevailing market conditions before using any indicator.

Moreover, traders must also use MT4 indicators alongside other technical analysis tools like price action analysis or support and resistance levels to gain a comprehensive view of the market. Additionally, it is crucial to avoid over-reliance on indicators as they can provide false signals or delay entry/exit points.

Lastly, utilizing the best MT4 indicators requires proper installation and configuration; hence it's advisable to download MT4 indicators from reputable sources and seek guidance from experienced traders or brokers.

By following these tips for using MT4 indicators effectively, traders can enhance their trading strategies and improve their chances of success in the forex market.

Maximizing Your Trading Potential with MT4 Indicators

By exploring the features and capabilities of MT4 indicators, traders can unlock their full potential and achieve greater success in their forex trading endeavors. One of the best ways to maximize your trading potential using MT4 Indicators is by identifying the best ones that suit your strategy.

There are countless MT4 indicators available on various platforms, but not all of them will work for you. Some of the best MT4 indicators include support and resistance indicators, trend indicators, and momentum indicators.

Support and resistance indicators can help traders identify key levels where prices may bounce or break through, while trend indicators provide insights into market direction and momentum. Momentum indicators can also be useful in determining whether a trend is likely to continue or reverse.

By utilizing these different types of MT4 indicators effectively, traders can make more informed decisions about when to enter or exit trades, potentially leading to greater profits in the long run.

Conclusion

MT4 indicators are a crucial tool in the arsenal of any forex trader. They provide valuable insights into market trends, price movements, and potential trade opportunities. By utilizing MT4 indicators effectively, traders can make informed decisions based on accurate data analysis.

There are various types of MT4 indicators available that cater to different trading styles and strategies. These include trend-following indicators, momentum indicators, volatility indicators, and volume indicators. Traders can customize these indicators to suit their unique needs by adjusting parameters such as timeframes or periods.

To use MT4 indicators effectively, traders should have a thorough understanding of their purpose and how they work. It is also essential to use them in conjunction with other technical analysis tools for more comprehensive market analysis. Additionally, it is crucial to avoid over-reliance on these tools as they are not infallible.

In conclusion, MT4 indicators are an indispensable resource for forex traders seeking to gain an edge in the markets. By utilizing them effectively alongside other technical analysis tools and adhering to sound trading principles, traders can maximize their potential for success in this dynamic industry.

Author Box: I am a highly regarded trader, author, and coach with a proven track record of over 16 years of experience in trading financial markets. Throughout my extensive career, I have dedicated myself to the development and refinement of forex trading strategies and MT4 indicators, establishing myself as a leading figure in the field. Visit: https://free-forex-indicators.com/category/mt4-indicators/

#mt4 indicators#indicators mt4#indicators for mt4#best mt4 indicators#mt4 best indicators#forex indicators for mt4#best indicators mt4#forex indicators mt4#best indicators for mt4#forex mt4 indicators

1 note

·

View note

Text

Forex MT4 Plataform, #BUY SWING TRADE #US30Cash INDEX $4.100 Profits. Official Website to have access: wWw.ForexCashpowerIndicator.com . Forex Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell powerful Signals with Smart algorithms that emit signals in big trades volume zones. Works in all Charts inside your Broker MT4 Plataform and all timeframes . ✅ NO Monthly Fees ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notifications 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account.

#US30Cash#forex index#usd30cash#us500cash#us30cash#best forex trade system#forex volume indicators#nt4 bollinger bands#mt4 fibonacci#metatrader4 fibonacci

3 notes

·

View notes

Text

#forex#forex robot#forex expert#forex indicators#forex ea#https://atomfx.store/product/pound-yen-trader-ea-v1-24-mt4/

0 notes

Text

🎄✨ Gift Yourself the Ultimate Christmas Present: Forex Success with SureshotFX 📈💰

The holiday season is all about giving, but this year, why not give yourself the ultimate gift? Picture this: waking up every day with the power of SureshotFX's tools at your fingertips—tools that can truly transform the way you trade.

Christmas is the perfect time to reflect and plan ahead. If you’ve been waiting for the right moment to invest in Forex, now is that time. For only $299, you get everything you need to succeed in Forex for life!

Here’s what’s included in this exclusive Christmas deal:

FX VIP Signals: Premium signals for Forex trades.

Gold VIP Signals: Timely signals for trading gold.

Indices VIP Signals: Expert signals for index trading.

SSF Copier: Automate your trades with ease.

SSF Guardian: Protect your trades and minimize risk.

3 eBooks: Boost your Forex knowledge.

3 Indicators: Improve your setups for better trading decisions.

FX Academy: Enhance your skills with expert training.

And there’s more—Algo Trading!

Algo Trading uses advanced algorithms to automate trades and make quick, smart decisions without the need for manual input. SureshotFX provides Algo tools with real-time performance data available on their Myfxbook account. Plus, they’re offering free VPS for uninterrupted trading.

Why choose SureshotFX this Christmas?

Featured in top news outlets for credibility.

4.5 Trustpilot rating, reflecting their excellent customer satisfaction.

Unbeatable Christmas combo lifetime deal with all Forex tools.

This Christmas, treat yourself to the tools that will help you trade smarter and build your Forex success. One-time payment, lifetime access—don’t miss this amazing deal with SureshotFX!

#forex#forexsignals#forextrading#traderslife#forex market#indices#copier#algo#christmas#holidays#telegramsignalcopier#mt4#mt5

0 notes

Text

Maximize Your Trading Potential with MA Crossover Pro Bot

In the fast-paced world of forex and stock trading, success often comes down to timing, strategy, and having the right tools at your disposal. Whether you are a seasoned trader or just getting started, the right trading bot can make a huge difference in your trading experience. Enter the MA Crossover Pro Bot—a game-changer designed to elevate your trading to the next level.

What is MA Crossover Pro Bot?

The MA Crossover Pro Bot is an advanced trading algorithm that leverages the power of moving averages to identify optimal trading opportunities. It automatically analyzes market trends, signals, and price movements to execute trades on your behalf. This bot is designed to reduce the stress of manual trading by providing a hands-off, automated solution to capitalize on market opportunities.

Key Features of MA Crossover Pro Bot

Automated Trading One of the key benefits of using the MA Crossover Pro Bot is its ability to automatically execute trades based on pre-defined settings. This means you no longer have to monitor the market 24/7 or react to every price movement. The bot handles everything, allowing you to focus on other aspects of your life or business while still profiting from the market. Read More

0 notes

Text

#forex indicators mt4#forextrading#forexsuccess#forexindicator#forexscalping#forexmarket#forexsignals

0 notes

Text

Forex HEDGE Trade #SELL after #BUY signal running together M30 Timeframe GBPUSD. Live Trade with Indicator Hunter NON REPAINT Signal.

. 🎓 https://www.HunterForexIndicator.com Powerfull Non Repaint signals to make constant profits. Lifetime License of HUNTER Forex Indicator. . 💲 The Hunter Forex Indicator for Metatrader4 is a Fixed and No Repaint signals send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Indicator concept.

🔊 Sound Alerts with 🔊Visual Popup alerts email 🔊 alerts actvation option. This Power indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

#forex signal#forex trading#forex signals#forexsignals#forexindicator#forexindicators#forex#forex indicators#forextrader#forexfactory

3 notes

·

View notes

Text

Best Platforms to Trade for Forex in 2025

Forex trading continues to captivate traders worldwide, offering a dynamic and lucrative avenue for financial growth. In 2025, identifying the best platforms to trade for forex has become more crucial than ever, as technology and market demands evolve. From user-friendly interfaces to advanced tools for technical analysis, these platforms are tailored to meet the needs of both novice and seasoned traders. Whether you're diving into major currency pairs, exploring exotic options, or utilizing automated trading strategies, choosing the right platform is the foundation for success.

Core Features of Top Forex Trading Platforms

Forex trading platforms in 2025 must combine advanced functionality with accessibility to meet diverse trader needs. The following core features highlight what distinguishes the best platforms.

User-Friendly Interface

A user-friendly interface enhances efficiency and reduces errors, especially for beginners. Key features include:

Intuitive navigation for rapid trade execution.

Customizable layouts to match user preferences.

Comprehensive tutorials for ease of onboarding.

Efficient design with minimal lag, even during high volatility.

Example Platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are renowned for streamlined interfaces designed to accommodate traders at all levels.

Comprehensive Charting Tools

Forex trading requires precision, and advanced charting tools are critical for analysis. The following charting tools enhance strategy formulation:

Drawing Tools: Support for trendlines and channels.

Indicators: Integration of MACD, RSI, Bollinger Bands, and Fibonacci Retracement.

Timeframes: Options to analyze data across multiple periods.

Custom Indicators: Flexibility to program and integrate personal strategies.

Automation and Algorithmic Trading

Automation is indispensable for modern forex trading. Platforms like cTrader and NinjaTrader excel with features like:

Pre-built Strategies: Ready-to-use templates for scalping and trend following.

Custom Algorithms: Integration with programming languages such as C# and Python.

Backtesting: Evaluate strategies with historical data.

Integration with APIs: Seamless syncing with advanced trading bots.

Mobile Accessibility

Forex traders increasingly require the flexibility of trading on-the-go. Mobile accessibility ensures:

Synchronization: Real-time updates between desktop and mobile devices.

Push Notifications: Alerts for market changes and trade execution.

Compact Design: Optimized for smaller screens without losing functionality.

App Examples: MT4 and MT5 apps, offering full trading capabilities on iOS and Android.

Key Takeaway: Platforms combining a robust desktop experience with seamless mobile integration empower traders with unmatched convenience.

The best forex trading platforms for 2025 excel in usability, advanced charting, automation, and mobile functionality. By integrating these features, platforms like MT5, cTrader, and TradingView offer versatile solutions for traders of all expertise levels.

Trading Instruments Supported by Leading Platforms

The diversity of trading instruments available on forex platforms is crucial for building effective strategies and achieving long-term trading success. This section explores the breadth and advantages of various trading instruments.

1. Major Currency Pairs

Major currency pairs, such as EUR/USD, USD/JPY, and GBP/USD, dominate forex markets due to their high liquidity and tighter spreads. Leading platforms like MetaTrader 5 and TradingView offer advanced tools for analyzing these pairs, enabling traders to capitalize on predictable movements.

Key Features:

High liquidity ensures minimal price fluctuations during trades.

Access to real-time market data for precise decision-making.

Supported by most trading strategies, including scalping and swing trading.

These pairs are ideal for traders seeking consistent opportunities in stable market conditions.

2. Exotic Pairs

Exotic pairs combine major currencies with currencies from emerging markets, such as USD/TRY or EUR/SEK. While they offer higher potential rewards, they also come with increased volatility and wider spreads.

Risks and Rewards:

Volatility: Significant price movements create potential for larger profits.

Higher Spreads: Costs can be prohibitive for short-term trading strategies.

Economic Dependence: Price movements often correlate with specific geopolitical or economic conditions.

Platforms like cTrader often feature analytical tools tailored for exotic pair trading, helping traders manage the associated risks.

3. CFDs and Futures

Contracts for Difference (CFDs) and futures are derivatives enabling traders to speculate on forex price movements without owning the underlying assets. Futures contracts are often traded on platforms like NinjaTrader, while CFDs are supported on MetaTrader platforms.

CFDs vs. Futures in Forex Trading

Wider spreads but no commissionCommissions and exchange fees

CFDs and futures cater to traders seeking flexibility and hedging opportunities in volatile markets.

4. Spot Forex vs. Forward Contracts

Spot forex trades settle instantly at prevailing market rates, making them ideal for day traders. Forward contracts, however, lock in future exchange rates and are often used by businesses to hedge against currency fluctuations.

Spot Forex:

Instant execution for quick trades.

Supported by platforms like TradingView, which offers robust charting tools.

Forward Contracts:

Customizable settlement dates.

Reduced risk of unfavorable exchange rate changes.

Forward contracts are frequently utilized for long-term strategies requiring stability.

5. Options Trading in Forex

Forex options provide traders the right, but not the obligation, to buy or sell currencies at a predetermined price. Options trading is supported on platforms like MetaTrader 5, offering flexibility for speculative and hedging strategies.

Advantages:

Defined risk due to limited loss potential.

Compatibility with advanced trading strategies like straddles and strangles.

Access to multiple expiration dates for tailored strategies.

Options trading is an excellent choice for traders seeking diversification and controlled risk in uncertain markets.

Market Indicators for Effective Forex Trading Forex trading in 2025 requires mastery of market indicators for successful trades. Platforms integrating technical tools like RSI, Bollinger Bands, and Fibonacci retracements provide invaluable support for analyzing currency pairs and spotting trends.

1: Moving Averages and RSI

Moving averages and RSI (Relative Strength Index) are staples in forex trading for spotting trends and identifying overbought or oversold market conditions. Here's how they work:

Moving Averages:

Smooth out price data for better trend analysis.

Common types: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

Platforms like MetaTrader 5 (MT5) allow customizable moving average periods for traders’ needs.

RSI:

Measures the speed and change of price movements.

Values above 70 indicate overbought conditions, while below 30 signals oversold.

Both indicators are excellent for detecting market reversals and consolidations, making them essential for scalping and swing trading strategies.

2: Bollinger Bands and Fibonacci Retracements

Bollinger Bands and Fibonacci retracements are complementary tools for determining price ranges and potential reversals.

Bollinger Bands:

Comprised of a central moving average and two bands (standard deviations).

Highlights volatility and identifies breakout opportunities in exotic pairs and minor pairs.

Fibonacci Retracements:

Based on key levels derived from the Fibonacci sequence (23.6%, 38.2%, 61.8%, etc.).

Used to forecast retracement zones for entry and exit points.

Platforms like TradingView provide advanced integration of these tools for technical analysis.

3: Pivot Points and Volume Analysis

Pivot points and volume analysis serve as complementary methods for intraday traders.

Pivot Points:

Calculate potential support and resistance levels based on previous trading sessions.

Widely used in day trading to set intraday targets.

Volume Analysis:

Measures market activity to validate price movements.

Higher volume during breakouts confirms trends.

Together, these indicators help traders plan risk-reward ratios effectively and refine strategies. Platforms offering integrated market indicators like RSI, Fibonacci retracements, and volume analysis provide forex traders with precise insights for decision-making. Combining these tools with strategic risk management and discipline ensures a competitive edge in forex trading for 2025.

Risk Management Tools in Forex Platforms

Risk management is the cornerstone of sustainable forex trading. Platforms offering advanced tools like Stop-Loss Orders and Position Sizing empower traders to mitigate risks while optimizing potential gains.

1. Stop-Loss Orders

Stop-loss orders safeguard capital by automatically closing trades at pre-set levels. Key benefits include:

Capital Protection: Prevents losses from spiraling during volatile markets.

Emotional Discipline: Reduces impulsive decisions by automating exit points.

Wide Platform Integration: Available on MetaTrader 4, TradingView, and cTrader for seamless trading execution.

2. Take-Profit Orders

Take-profit orders lock in profits when the market reaches a target price. Steps for setting take-profit orders effectively:

Analyze Moving Averages and RSI to determine target levels.

Input the price level in trading platforms like NinjaTrader or MT5.

Monitor trade performance and adjust as needed.

3. Position Sizing Calculators

Accurate position sizing minimizes overexposure to any single trade. Here’s how these calculators work:

Calculate lot sizes based on account balance, risk percentage, and stop-loss distance.

Adjust trade sizes to align with Risk-Reward Ratios.

Enable traders to maintain diversified exposure.

4. Risk-Reward Ratio Analysis

Risk-reward ratios evaluate trade viability by comparing potential profits to losses. Tips for effective use:

Aim for a minimum ratio of 1:2 or higher.

Utilize tools like Bollinger Bands to estimate price movements.

Integrated calculators on platforms like MT4 simplify these computations.

5. Diversification Tools

Diversification spreads risk across multiple trading instruments. Features on platforms include:

Multi-asset trading options: CFDs, Futures, and Currency Pairs.

Portfolio analysis tools to track exposure by instrument type.

Real-time updates for Exotic Pairs and niche markets.

6. Backtesting Strategies

Backtesting allows traders to evaluate strategies using historical data. Its advantages are:

Testing risk management techniques like Stop-Loss Orders without live market risk.

Platforms such as TradingView support customizable backtesting scripts.

Insights into strategy weaknesses improve long-term profitability.

With advanced tools for Stop-Loss Orders, Position Sizing, and Backtesting, modern forex trading platforms empower traders to proactively manage risks. Leveraging these features leads to more disciplined and effective trading.

Psychological and Strategic Insights for Forex Trading

Mastering trading psychology is key to navigating the complexities of forex. Platforms enhance this through features that promote discipline, performance tracking, and trader confidence, empowering strategic growth and mitigating psychological pitfalls.

Building Discipline Through Alerts

Platforms offering robust alert systems, like MetaTrader 5, help instill discipline by:

Preventing Overtrading: Custom alerts signal market entry points, limiting impulsive trades.

Time Management: Reminders help traders stick to predefined schedules.

Market Trend Notifications: Alerts for moving averages or Relative Strength Index (RSI) changes enable focused decisions.

Tracking Performance Metrics

Trading platforms integrate tools that help traders evaluate performance, including:

Win/Loss Ratio Analysis: Shows trade success rates.

Equity Curve Monitoring: Visualizes account performance trends.

Journal Features: Logs trade entries and exits for review.

Customizable Dashboards

Platforms like TradingView allow traders to configure dashboards by:

Adding favorite currency pairs and indicators like MACD or Bollinger Bands.

Creating multi-screen setups to monitor multiple trades.

Integrating news feeds to stay updated with central bank announcements.

Educational Resources

The inclusion of in-platform education fosters confidence through:

Interactive Tutorials: Step-by-step videos on strategies like swing trading or technical analysis.

Webinars and Live Sessions: Experts discuss trading instruments like CFDs and options.

AI-based Learning Modules: Adaptive lessons based on trader performance.

By integrating tools for discipline, self-awareness, and strategy refinement, trading platforms empower users to overcome psychological challenges, enhance risk management, and make data-driven decisions for long-term success.

Conclusion

Forex trading in 2025 offers exciting opportunities, but success begins with choosing the right platform. As highlighted throughout this content pillar, top trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, and TradingView stand out for their robust features, diverse trading instruments, and advanced integrations. These platforms empower traders to navigate the complexities of the forex market through tools such as technical indicators like Moving Averages and RSI, risk management solutions like stop-loss orders and position sizing calculators, and integrations with vital economic indicators such as GDP, inflation, and central bank announcements.

The best forex trading platforms not only provide access to currency pairs, CFDs, and other instruments but also integrate cutting-edge charting tools, educational resources, and analytics to build confidence and discipline—critical factors in mastering the psychological demands of trading.

By understanding the interplay between platform features, market tools, and strategy development, traders can optimize their approach to trading forex in 2025. Whether you're focused on scalping, day trading, or long-term swing trading, the right platform will be your foundation for executing trades effectively, managing risk, and staying informed in a fast-paced market.

Take the insights from this guide to make an informed decision, choosing a platform that aligns with your trading goals and enhances your ability to trade forex with precision and confidence. With the right tools and strategies in hand, you're poised to navigate the evolving forex market and unlock its full potential in 2025 and beyond.

2 notes

·

View notes

Text

FxPro Review: Unveiling the World's Leading Online Forex Broker

In the dynamic realm of financial trading, the significance of efficient and reliable online forex brokers cannot be overstated. Among the myriad options available, FxPro stands out as a beacon of excellence, earning its reputation as the world’s number one online forex (FX) broker. This detailed FxPro review aims to explore the unique features, offerings, and overall experience that have established this broker as a preferred choice for traders globally.

youtube

Discovering FxPro: A Legacy of Trust and Innovation

Founded in 2006, FxPro has carved a niche for itself in the competitive forex market, showcasing a steadfast commitment to providing an exceptional trading experience. As a Top Forex Brokers review, FxPro has successfully built a reputation for transparency, reliability, and innovation, making it a trusted partner for thousands of traders around the world. With a user-centric approach, the broker continuously evolves to meet the needs of its clients, ensuring they have the tools and resources necessary to thrive in the fast-paced world of forex trading.

The FxPro Trading Platforms: A Gateway to Success

Central to FxPro's appeal is its diverse array of trading platforms, designed to cater to the varied preferences of both novice and experienced traders. Each platform boasts unique features that facilitate seamless trading, empowering users to make informed decisions in real-time.

MetaTrader 4 (MT4): The Industry Standard

The MetaTrader 4 (MT4) platform is a cornerstone of the forex trading experience, and FxPro offers an optimized version that enhances its functionality. Known for its user-friendly interface, MT4 provides traders with powerful charting capabilities, a plethora of technical indicators, and automated trading options through Expert Advisors (EAs). This platform is particularly favored by those who appreciate a straightforward yet effective trading environment.

MetaTrader 5 (MT5): The Next Generation

For traders seeking a more advanced experience, FxPro also provides access to the MetaTrader 5 (MT5) platform. MT5 is a comprehensive trading environment that includes advanced order management, a greater array of analytical tools, and an integrated economic calendar. Its multi-asset capabilities extend beyond forex, allowing traders to delve into commodities, stocks, and futures, making it an excellent choice for those looking to diversify their trading portfolio.

cTrader: Innovative and Intuitive

In addition to MT4 and MT5, FxPro offers the cTrader platform, which is designed for traders who prefer a more innovative and user-friendly experience. cTrader features a clean interface, advanced charting tools, and customizable workspaces, catering to both manual traders and algorithmic trading enthusiasts. The platform also includes a community-driven marketplace where traders can share and access trading tools, fostering collaboration and innovation.

Competitive Spreads and Pricing Structure

When it comes to trading costs, FxPro excels in providing competitive spreads and transparent pricing. The broker’s commitment to low trading costs is evident across its various account types, allowing traders to choose an option that best fits their trading style and budget.

FxPro offers several account types—each tailored to different trading needs—ensuring that clients can find a suitable option. For instance, the FxPro MT4 account is popular for its tight spreads and no commission trading, while the FxPro cTrader account provides a commission-based structure with slightly tighter spreads. This flexibility allows traders to optimize their trading strategies while minimizing costs.

Moreover, the broker’s commitment to transparency ensures that traders are always aware of the costs associated with their trades, allowing for effective financial planning and decision-making.

A Diverse Selection of Trading Instruments

One of the standout features of FxPro is its extensive range of trading instruments. While the broker is predominantly known for its forex offerings, it also provides access to a wide array of asset classes, including commodities, indices, and cryptocurrencies.

Forex Trading

FxPro covers a vast selection of currency pairs, encompassing major, minor, and exotic pairs. This diversity enables traders to capitalize on global economic trends and currency fluctuations, providing ample trading opportunities.

Commodity Trading

For those interested in commodities, FxPro offers trading in popular assets such as gold, silver, oil, and agricultural products. This allows traders to hedge against inflation or geopolitical risks while diversifying their investment portfolios.

Indices and Cryptocurrencies

In addition to traditional forex and commodities, FxPro provides access to global indices and a selection of cryptocurrencies. Traders can engage with major indices like the S&P 500 and FTSE 100, or explore the burgeoning cryptocurrency market, including popular coins such as Bitcoin and Ethereum. This extensive range of instruments empowers traders to explore various market dynamics and seize opportunities across different sectors.

Robust Security and Regulatory Oversight

In an industry where security is paramount, FxPro stands out for its commitment to safeguarding client funds and personal information. The broker is regulated by multiple reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Financial Sector Conduct Authority (FSCA) in South Africa. This multi-tiered regulatory framework offers clients peace of mind, knowing that their investments are protected by stringent regulations.

FxPro also employs advanced security measures to ensure the safety of its clients’ funds. These measures include SSL encryption for data protection and two-factor authentication for account security. The broker’s proactive approach to security and regulatory compliance underscores its dedication to maintaining a trustworthy trading environment.

Enhanced Customer Support

Exceptional customer support is a hallmark of a reputable broker, and FxPro does not disappoint in this regard. The broker offers a robust support system designed to assist traders at any stage of their trading journey.

FxPro’s customer support team is available 24/7, providing multilingual assistance to cater to its diverse global clientele. Whether you require help with account management, technical inquiries, or trading strategies, the knowledgeable support staff is always ready to assist.

Additionally, FxPro offers a wealth of educational resources, including webinars, trading tutorials, and market analysis, empowering clients to enhance their trading skills and knowledge. This commitment to client education is a testament to FxPro’s dedication to fostering a supportive trading community.

Educational Resources and Trading Tools

FxPro goes beyond offering trading platforms and customer support by providing a comprehensive suite of educational resources and trading tools. The broker recognizes that informed traders are successful traders, and it strives to equip its clients with the knowledge they need to navigate the complexities of the forex market.

Webinars and Tutorials

FxPro hosts regular webinars led by industry experts, covering a variety of topics ranging from trading strategies to market analysis. These interactive sessions provide valuable insights and allow traders to ask questions in real time, fostering a collaborative learning environment. Additionally, the broker offers a library of tutorials and articles, catering to traders of all experience levels.

Market Analysis

To help traders make informed decisions, FxPro provides daily market analysis and insights. This analysis includes technical and fundamental reports, helping traders understand market trends and identify potential trading opportunities. By staying informed about market developments, traders can enhance their strategies and improve their overall performance.

Trading Tools

FxPro also offers a range of trading tools to enhance the trading experience. These tools include economic calendars, calculators, and trading signals, all designed to assist traders in making informed and timely decisions. Such resources are invaluable for both novice and experienced traders, facilitating a more strategic approach to trading.

Conclusion: The Ultimate Choice for Forex Traders

In this comprehensive FxPro review, we have explored the myriad features and advantages that make this broker a top choice for forex traders worldwide. From its cutting-edge trading platforms and competitive pricing structure to its diverse selection of trading instruments and robust security measures, FxPro has established itself as a leader in the online forex brokerage space.

Through its unwavering commitment to customer support and education, FxPro empowers traders to hone their skills and navigate the complexities of the financial markets with confidence. Whether you are a seasoned trader or just starting your journey in forex trading, FxPro offers the tools, resources, and support to help you succeed.

In conclusion, FxPro stands as a testament to what a premier forex broker should aspire to be. With its extensive offerings and client-focused approach, FxPro is not just a broker; it is a partner in your trading journey, ready to elevate your forex trading experience to new heights.

2 notes

·

View notes

Text

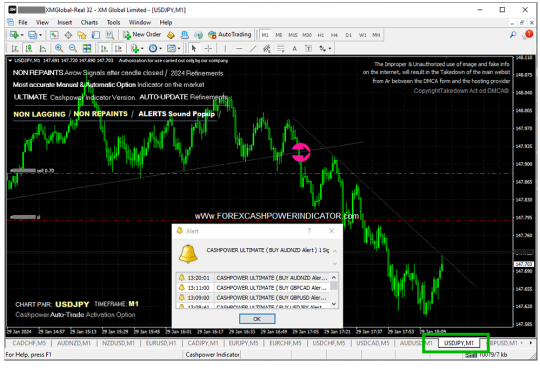

Scalper trade #USDJPY M1 (1 minut chart) Timeframe Metatrader4. Trade Profits Protected with Stop Loss in positive area. Official Website: wWw.ForexCashpowerIndicator.com . Cashpower Indicator Lifetime license one-time fee with No Lag & Non Repaint buy and sell Signals. ULTIMATE Version with Smart algorithms that emit signals in big trades volume zones. . ✅ NO Monthly Fees ✅ * LIFETIME LICENSE * ✅ NON REPAINT / NON LAGGING 🔔 Sound And Popup Notification 🔥 Powerful & Profitable AUTO-Trade Option . ✅ ** Exclusive: Constant Refinaments and Updates in Ultimate version will be applied automatically directly within the metatrader 4 platform of the customer who has access to his License.** . ( Ultimate Version Promotion price 60% off. Promo price end at any time / This Trade image was created at XM brokerage. Signals may vary slightly from one broker to another ). . ✅ Highlight: This Version contains a new coding technology, which minimizes unprofitable false signals ( with Filter ), focusing on profitable reversals in candles with signals without delay. More Accuracy and Works in all charts mt4, Forex, bonds, indices, metals, energy, crypto currency, binary options. . 🔔 New Ultimate CashPower Reversal Signals Ultimate with Sound Alerts, here you can take No Lagging precise signals with Popup alert with entry point message and Non Repaint Arrows Also. Cashpower Include Notification alerts for mt4 in new integration. . 🛑 Be Careful Warning: A Fake imitation reproduction of one Old ,stayed behind, outdated Version of our Indicator are in some places that not are our old Indi. Beware, this FAKE FILE reproduction can break and Blown your Mt4 account. .

#forexsignals#cashpowerindicator#forex#forexindicator#forextradesystem#forexvolumeindicators#forexindicators#indicatorforex#forexprofits#forexchartindicators#forex accurate indicatoraccurate buy sell signal indicator mt4accurate non repaint indicatoraccurate indicator for scalping accurate buy se#accurate buy sell signal indicator mt4#accurate non repaint indicator#accurate indicator for scalping

2 notes

·

View notes

Text

SureShotFX Algo: The Best Algo for MT4 and MT5

SureShotFX Algo is the best algo trading app for Forex that works with MT4 and MT5. It isn’t just about automated trading—it’s your secret trading weapon in the forex market. With its smart algorithms and hands-off approach, it stands with you 24/7 like a trading expert on your team, providing accurate and profitable forex signals.

SSF Algo uses an advanced algorithm combining multiple strategies and advanced indicators to operate seamlessly within the MetaTrader 4 – MT4, MT5 & cTrader platforms. It executes trades based on predefined parameters and market data to generate automated Forex trading signals like a pro.

Whether you’re new to trading or a seasoned pro, this tool offers precision, flexibility, and total control over your investments.

Benefits of Using SureShotFX Algo:

Smart Trading: Harness the power of advanced algorithms for intelligent trade execution and decision-making.

Enhanced Accuracy: The algorithm’s sharp entry strategy increases the likelihood of successful trades.

Effective Risk Management: Adaptive stop-loss modes and flexible lot management help traders manage risks effectively.

Automated Profit Securing: The Auto Close Partial feature ensures that profits are secured at optimal points during a trade.

Proven Performance: Real-time results and performance data are available on Myfxbook, demonstrating the algorithm’s effectiveness with a potential monthly growth of 8-30%.

Total Control and Flexibility: Maintain control over your trading capital and strategy parameters, with the flexibility to customize settings to suit your preferences.

2 notes

·

View notes

Text

Make the Most of Your Christmas Trading with SureShotFX's Holiday Offers 🎄📈

As the festive season draws near, why not combine the joy of the holidays with strategic trading? SureShotFX is here to make your trading experience even better this Christmas with exclusive promotions and offers for traders at all levels.

🎯 VIP Signal Channels: Get accurate Forex, Gold, and Indices signals to boost your trades. ⚙️ SSF Algo: Automate your trades for more precision. 📊 SSF Copier: Replicate expert trades effortlessly across multiple accounts. 🎁 Holiday Bonuses: Enjoy special trading bonuses as a thank you for being with SureShotFX.

Exclusive Christmas Packages:

Rise Package (1 Month): 1 month free + daily premium signals.

Pro Package (6 Months): 2 months free + eBooks and advanced tips.

Advance Package (Lifetime): Lifetime SSF Copier + 3 eBooks and 3 indicators.

What's included:

2–8 daily trading signals

24/7 expert support

Premium market analysis for strategic decisions.

This holiday season, level up your trading with SureShotFX's limited-time offers. Make 2025 your best trading year yet! 🎄📈

Happy Holidays and Happy Trading! ✨

1 note

·

View note

Text

Master Forex Trading with AIPIPS’ Innovative Trendometer Indicator

In the dynamic world of forex trading, where markets change in seconds and decisions must be swift, having the right tools can make all the difference. At AIPIPS, we provide traders with cutting-edge solutions to stay ahead in the highly competitive forex market. Among our most powerful tools is the Trendometer Indicator—a game-changer for traders seeking clarity, precision, and confidence in their trading strategies.

The Challenges of Forex Trading

Forex trading is one of the most liquid and fast-paced markets in the financial world. With over $6 trillion traded daily, the opportunities are vast, but so are the risks. Traders face several challenges:

Volatility: Currency prices can fluctuate dramatically due to geopolitical events, economic reports, or market sentiment.

Complex Analysis: Analyzing charts, trends, and patterns requires significant time, expertise, and experience.

Emotional Decisions: Fear and greed often lead traders to make impulsive decisions that result in losses.

To overcome these challenges, traders need tools that offer clear insights, reliable data, and actionable information. That’s where the Trendometer Indicator comes in. Read More

#trendometer#forex trading#bots#forex indicators#mt4#cryptocurreny trading#forextrading#ai#forexsignals

0 notes

Text

Mysteel UK Limited

Broker Modus UK Limited offers a wide range of financial instruments for trading in international markets. This includes currency pairs, stocks, indices, commodities and other financial assets. The variety of instruments allows traders to choose the ones that best suit their trading strategies and objectives.

Metatrader 4 (MT4): This is a popular trading platform that provides ample opportunities to analyse the market, develop trading strategies and execute trades. MT4 has an intuitive interface and an extensive suite of tools for technical analysis.

Metatrader 5 (MT5): This is an enhanced version of the MT4 platform offering more advanced functionality, including a wider selection of tools and the ability to trade not only in Forex, but also in other markets.

WebTrader: This is a web-based platform, which enables traders to trade directly via a web browser without the need to download and install any software. WebTrader provides flexibility and accessibility, allowing traders to trade from their computer or mobile device from anywhere in the world.

Mobile applications: Mysteel UK Limited broker also offers mobile applications for trading on iOS and Android platforms. This allows traders to be flexible and trade anytime, anywhere using their smartphones or tablets.

3 notes

·

View notes

Text

Sell trade in #EURNZD opens with a Sell Signal of HUNTER Indicator.

🎓HUNTER NON REPAINT Forex Indicator Signals is developed for Metatrader 4 is a Fixed and "Non Repaint signals for Metatrader4" send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Ultimate Indicator concept available for Forex.

The process to receive the download of Hunter Indicator is automatically after your purchase you will auto-redirectly to download page.

Please access now this link: https://hunterforexindicatormt4.wordpress.com/

Inside this link you can have access to Official Hunter Website www HunterForexIndicator com.

🎓Hunter is a complete and last generation Indicator, is a Lifetime License, NOT have Monthly Fees and give in your accuracy signals,Hunter is a complete and last generation Indicator:

🔔 SOUND ALERTS for all signals./ 🔔 VISUAL ALERTS texts for all signals./ 🔔 EMAIL ALERTS actvation option.This Metatrader indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

⚠️HUNTER indicator is The most efficient way to Trade Manually and safely in Forex Market (Majors and exotics pairs), Indices, bonds, cryptos and shares, which is one of the best indicator for MT4 plataform. VIP Tool. Powerful fixed signals not move or transfer the signal to another candle.

⚠️HUNTER is a simple Indicator, it can be used for any type of trading and any type of counters/pairs, the interface of the indicator is very simple to use, buy when blue signal apears and sell when red arrow apears ; so you can use right immediately, the success ratio is 93% higher than the failure ratio, is a solid technical indicator.

#forex trading#forexindicators#forex signal#forex#forexindicator#hunter forex indicator#non repaint forex signals#forex signals service

3 notes

·

View notes