#franchise owner bookkeeping

Text

Accounting & Bookkeeping Services for Franchise Business:

At PABS, we develop a standardized system for franchise businesses & franchisors to streamline operations, reduce costs, and increase profitability.

#franchise accounting#franchise bookkeeping#franchise business bookkeeping#franchise owner bookkeeping#franchise owner accounting#franchise business accounting

0 notes

Note

You said that Beck's dad was like the villain of the previous story. do you have any lore about him you can or want to share like what type of villain he was? as well who else on the roster would have been a returning character and was it one of them the took him down?

I haven't explored him too much since he's such a background element but I picture him as an M. Bison / Sagat style big bad. Juggernaut playstyle like Ganondorf Smash Bros or Marisa SF6

Since the fighting game story centers around most of the cast banging each other I didn't really feel like it was a great idea to put her dad into the cast.

In the fictional "fighting game" history the only returning character's from the "previous game" at the moment are Helen and Vincent. With some references to predecessors like Sister Leona's mentor and the original owner of Gibson's body. Rumble After Dark is meant to evoke a Street Fighter: Third Strike where an existing franchise suddenly gets a mostly new generation cast.

I have a bucket of loose lore tidbits about the setting and cast though I like to leave it mostly evocative rather than go into detail about every tiny thing. I tend to think implicit vibes and snippets of flavor text style worldbuilding is more evocative than the somewhat tedious "wiki" style lore bookkeeping that happens in some of the more hardcore fandoms.

456 notes

·

View notes

Text

How to Write Your Business Pitch: 15 Elevator Pitch Examples

An elevator pitch is a quick, engaging way to present your business during a conversation. The name "elevator pitch" comes from its length—ideally, it should last about as long as an elevator ride. Since people’s attention spans are short, being concise is crucial. Below are 15 elevator pitch examples and a template to help you create your own. This guide also includes key tips for writing an effective business pitch.

What is an Elevator Pitch?

An elevator pitch is a brief summary of your work experience designed to highlight your achievements to potential clients or investors. It aims to spark interest, build rapport, and potentially lead to further conversations or business opportunities. The goal is to introduce yourself confidently, capture attention, and encourage others to learn more about your business.

Guidelines for Crafting an Elevator Pitch

Crafting a standout pitch requires planning and practice. Here are key dos and don’ts:

Do:

Practice beforehand to deliver a smooth pitch.

Follow a clear outline to keep your message concise.

Speak clearly and at a moderate pace to ensure understanding.

Be persuasive and maintain a positive tone.

Record yourself practicing to identify areas for improvement.

Don’t:

Avoid technical jargon that may confuse your audience.

Don’t overload the listener with too many details.

Avoid ignoring your audience’s needs or interests.

Don’t stick to just one pitch—adapt it to fit different scenarios.

Skimping on practice will hinder your delivery.

Though it can be challenging to condense your achievements into just a few sentences, the following elements are crucial for a strong elevator pitch.

1. Introduce Yourself

In the opening of your pitch, introduce yourself succinctly. For example:

"I run a boutique public relations firm."

"I’m a personal trainer."

"I manage a bookkeeping and accounting business."

"I’m a graphic designer."

Remember, it’s about them, not you. Wait for questions before diving into your full story. The purpose of the elevator pitch is to capture attention while allowing the other person to express interest in your business.

2. Describe the Problem You Solve

Focus on who your company helps and the problem it solves rather than merely explaining what it does. This makes it easier for listeners to understand your target market and why they should work with you. For example:

"We help tech startups gain media coverage in business and trade publications."

"We help clients regain strength after recovering from illness or injury."

"We provide small business owners with financial management solutions, giving them peace of mind."

"We offer design and animation services to sports franchises and their fans."

Clearly defining the problem your business addresses helps make your pitch more relatable.

3. Present Your Solution

After stating the problem, explain how your company solves it. For example:

"We’ve developed a patented AI tool that drafts emails faster."

"We offer transport services for people who cannot easily move between locations due to illness."

"Our financial advisors proactively guide clients to avoid common business challenges."

"We customize meal kits based on the customer’s dietary needs to ensure they receive healthy, allergen-free food."

Tailor your solution to the audience’s needs to make this part of your pitch as compelling as possible.

4. Highlight What Makes You Unique

Showcase something special about your business. For example:

"Unlike large PR firms, we focus on offering high-level executives for media interviews."

"I operate a home-based interior design business with a specialized gym equipment system called Gyrotonic to increase flexibility without putting pressure on joints."

"As a small business owner, I take pride in helping other businesses grow."

"I create animations for sports franchises, including those used in professional hockey broadcasts."

Mention unique tools, techniques, or a backstory to add a personal touch to your pitch.

5. End with a Call to Action

Once you’ve presented your pitch, guide the conversation toward a follow-up. For example:

"Would you like more information about how we can help you?"

"Here’s my business card—please contact me with any questions."

"Let’s connect on LinkedIn to keep the conversation going."

"How about we discuss your options over coffee? When are you available?"

A strong call to action helps keep the conversation alive and builds rapport.

Template for an Elevator Pitch

Here’s a simple template to follow when constructing your elevator pitch:

"As a [type of industry] company specializing in [niche], we understand the complexities of your field. We’ve helped many improve their [issue] through [solution], offering a unique approach tailored to our clients’ needs. Have you ever tried [your product or service]?"

Real-World Elevator Pitch Examples

Below are 15 examples that show how you can tailor an elevator pitch to different audiences.

General Example:

"As a vegan and vegetarian meal delivery service, we understand the challenge of finding tasty, healthy meals. By offering personalized meal kits, we’ve helped many enjoy convenient, nutritious options tailored to their needs. Have you worked in the healthy food industry before?"

Target Audience Example:

"Finding a reliable barber in a new place can be tough. Our company makes it easier for professionals to find top hairdressers on the go. Over 3,000 businesspeople have used our service across the U.S. We’re expanding to include dog grooming, too. Follow us on Instagram for more details!"

New Customer Example:

"Hi, I’m Jen from Water. Are you familiar with our products? By choosing us, you’re providing your team with clean, filtered water. Our advanced filtration system removes harmful contaminants. Here’s my business card if you’d like more information."

Data-Driven Example:

"Seeing how many small businesses struggled during the pandemic, I created a network for sharing shop rental costs. My candle business partnered with a florist, and we saw a 15% income increase. Let’s grab coffee if you’d like to hear more."

Investor Pitch Example:

"Our company matches businesses with drivers to move inventory. Discarded drives now generate revenue for shipping firms. With over 20 years in the industry, we aim for a 40% sales increase. Let’s discuss how your investment could help us achieve this."

Startup Example:

"My company specializes in creating personalized sales funnels that enhance user experience. We provide automated solutions, and our latest client saw a 120% increase in net sales. Does your business use e-commerce automation?"

Storytelling Example:

"As a truck driver away from family for months, you’re missing out on important moments. What if you could send them a tangible expression of your feelings? We create custom care packages tailored to your route."

Emotional Example:

"Our company creates personalized portraits to help families cope with the loss of their pets. With just a few photos, we can create a lifetime keepsake. Would you like to help us make these precious memories?"

Longstanding Business Example:

"For over 40 years, we’ve helped local businesses create extraordinary events. We handle all the details—from florists to caterers—to design unforgettable experiences. Next week, visit our shop to explore our gala options."

Job Interview Example:

"I switched careers because I saw how expensive farming equipment was. I now want to help local businesses use renewable energy to live greener lives. Can we schedule an interview to discuss how I can contribute?"

Conference or Trade Fair Example:

"Our company has partnered with [company name] to help nonprofits save 20% on operational costs. We offer durable products that streamline processes. Let’s meet tomorrow to discuss further."

Industry Colleague Example:

"We focus on B2B finance in our social media services. We’ve helped your peers increase social media engagement by over 20%. Would you like to learn how we could help you?"

Acquaintance Example:

"Hi Maria! Ted mentioned you’re interested in a content management system. We developed a user-friendly app that consolidates files for small businesses. Would you like a demo?"

Old Friend Example:

"Great to see you! We’ve created a dry-cleaning service that picks up and delivers with just one click, helping busy professionals stay wrinkle-free at meetings. Let’s discuss more over coffee."

Fundraising Example:

"Our organization rehabilitates livestock with a loving home. We’ve secured a grant for a 10-acre plot and staff for our media team. Additional donations will help cover vet care. Would you like to learn more?"

Start Your Business

Creating a compelling elevator pitch is the first step toward gaining new clients, attracting investors, and growing your business. Make sure you have the strategies in place to build on the interest you capture with your pitch.

0 notes

Text

Understanding the Importance of a Franchise in Accounting: A Comprehensive Guide

In today’s competitive business landscape, many entrepreneurs are considering franchising as a way to expand their operations. Whether you're running a fast-food chain, a service-oriented business, or even an accounting firm, franchising offers a proven model for growth. But just as every business needs a robust financial system to function smoothly, accounting franchises face unique challenges and opportunities. This article will explore why a franchise in accounting is critical for both franchisors and franchisees, and how it can help streamline financial processes and ensure success.

Why Choose a Franchise in Accounting?

When a business expands into a franchise, its financial complexities increase. Tracking revenue from multiple locations, managing expenses, and maintaining consistency in bookkeeping becomes more difficult. This is where a franchise in accounting steps in. It provides a standardized accounting system that can be applied across all franchise units, ensuring that financial data is accurate, up-to-date, and compliant with regulations.

Here’s why opting for a specialized accounting franchise can be beneficial:

Streamlined Financial Management

A franchise in accounting helps franchisees keep their financial operations streamlined. It provides a clear framework for managing invoices, payroll, taxes, and expenses. For franchisors, it ensures consistency in how financial data is recorded and reported, allowing them to oversee multiple locations with ease.

Cost Efficiency

Managing the financials of multiple franchise units can be costly. A franchise in accounting often offers software and tools that are designed to be used across franchises. These tools help in reducing labor costs and minimizing errors, making financial processes more efficient. Franchisees also benefit from shared resources, such as accounting expertise and access to financial software, which can significantly lower their operational costs.

Compliance with Regulations

Franchise businesses operate under different legal jurisdictions, and each may have specific financial regulations. A franchise in accounting ensures that all financial reporting adheres to local, state, and national regulations. This reduces the risk of non-compliance, which can result in hefty fines or legal issues.

Financial Reporting and Analysis

Consistent and reliable financial reporting is crucial for the success of any franchise. By investing in a franchise in accounting, both franchisors and franchisees can benefit from detailed financial analysis. This data-driven insight allows franchise owners to identify trends, monitor performance, and make informed decisions.

Franchisee Support

One of the key advantages of a franchise in accounting is the ongoing support provided to franchisees. From helping set up accounting systems to offering advice on tax planning, an accounting franchise offers specialized support that helps franchisees stay financially healthy.

Accounting Franchises: What to Look For

If you are considering buying a franchise in accounting, it’s essential to know what to look for. Here are some factors to consider:

Proven Business Model: The franchise should have a track record of success in the accounting industry.

Training and Support: Look for franchises that offer comprehensive training programs and ongoing support for franchisees.

Software Integration: The franchise should provide or recommend accounting software that can integrate with other business tools.

Regulatory Compliance: Make sure the franchise has a solid understanding of the financial regulations specific to your location.

Franchise Fees: Be aware of the upfront costs and ongoing royalty fees that come with joining the franchise.

Conclusion

A franchise in accounting offers immense value to both franchisors and franchisees. It helps streamline financial operations, ensure compliance with regulations, and provide the support needed to grow the business. By opting for an accounting franchise, entrepreneurs can focus on scaling their business while leaving the complex financial processes in the hands of experts.

Whether you're a franchisor looking to expand your business or a franchisee seeking a reliable accounting solution, partnering with a franchise in accounting can significantly improve your financial management and contribute to long-term success.

0 notes

Text

Accounting Pennsylvania

Accounting in Pennsylvania: Navigating Financial Success in the Keystone State

Introduction

Accounting is the backbone of any business, ensuring that financial records are accurate, taxes are properly filed, and financial health is maintained. In Pennsylvania, a state known for its diverse economy, from agriculture to advanced manufacturing, the role of accounting is particularly crucial. Businesses across the Keystone State rely on skilled accountants to help them navigate the complexities of state and federal regulations, manage finances effectively, and plan for sustainable growth. Whether you're a small business owner, a large corporation, or an individual looking to manage your finances, understanding the importance of accounting in Pennsylvania is essential for financial success.

In this comprehensive article, we will explore the significance of accounting in Pennsylvania, the unique challenges faced by businesses in the state, the role of accountants in ensuring compliance and financial health, and the benefits of outsourcing accounting services. By the end of this article, you will have a clear understanding of why accounting is a vital component of doing business in Pennsylvania and how it can contribute to your financial success.

The Importance of Accounting in Pennsylvania

Accounting is a critical function for any business, regardless of size or industry. It involves the systematic recording, analyzing, and reporting of financial transactions to provide a clear picture of a company's financial health. In Pennsylvania, where businesses operate in a highly competitive and regulated environment, accounting plays an even more significant role. Here are some key reasons why accounting is vital in Pennsylvania:

Regulatory Compliance: Pennsylvania has its own set of state-specific regulations, including tax laws, labor laws, and environmental regulations. Accountants help businesses stay compliant with these laws, avoiding costly penalties and legal issues. For example, Pennsylvania's unique tax structure, which includes the Corporate Net Income Tax (CNI) and the Capital Stock/Franchise Tax, requires careful planning and accurate reporting.

Tax Planning and Preparation: Pennsylvania's tax system is complex, with various taxes at the state, county, and local levels. Accountants play a crucial role in tax planning, ensuring that businesses take advantage of available deductions and credits while remaining compliant with tax laws. Proper tax planning can significantly reduce a company's tax liability and improve its bottom line.

Financial Management: Effective financial management is essential for business growth and sustainability. Accountants help businesses in Pennsylvania manage their finances by providing insights into cash flow, profitability, and financial performance. They also assist in budgeting, forecasting, and financial analysis, enabling businesses to make informed decisions.

Business Planning and Strategy: Accountants are key partners in business planning and strategy development. They provide valuable financial data and analysis that help business owners make informed decisions about expansion, investment, and other strategic initiatives. In Pennsylvania, where industries like manufacturing, healthcare, and technology are rapidly evolving, having a solid financial strategy is crucial for staying competitive.

Audit and Assurance Services: Many businesses in Pennsylvania are required to undergo audits to ensure the accuracy and reliability of their financial statements. Accountants provide audit and assurance services, giving stakeholders confidence in the company's financial reporting. This is particularly important for publicly traded companies and those seeking investment or financing.

Unique Challenges Faced by Businesses in Pennsylvania

While accounting principles are universal, businesses in Pennsylvania face unique challenges that require specialized knowledge and expertise. Understanding these challenges is essential for effective financial management and compliance. Some of the key challenges include:

State-Specific Taxation: Pennsylvania's tax system presents several challenges for businesses. The state imposes a Corporate Net Income Tax (CNI) on businesses, which is one of the highest in the nation. Additionally, Pennsylvania has a unique Capital Stock/Franchise Tax, which is phased out but still affects some businesses. Navigating these taxes requires careful planning and a deep understanding of state tax laws.

Local Taxes and Regulations: In addition to state taxes, businesses in Pennsylvania must comply with local taxes and regulations. These can vary significantly depending on the location of the business. For example, the Philadelphia Business Privilege Tax is a unique tax that applies to businesses operating within the city. Understanding and managing local tax obligations is crucial for businesses operating in multiple locations across the state.

Economic Diversity: Pennsylvania's economy is diverse, with industries ranging from agriculture and energy to healthcare and technology. Each industry has its own set of financial and regulatory challenges. For example, the manufacturing industry may face complex inventory accounting issues, while the healthcare industry must navigate strict compliance with healthcare regulations. Accountants in Pennsylvania must be well-versed in the specific needs of different industries to provide effective financial management.

Regulatory Compliance: Pennsylvania businesses must comply with a wide range of state and federal regulations, from labor laws to environmental regulations. Failure to comply can result in significant fines and legal issues. Accountants play a crucial role in helping businesses understand and comply with these regulations, reducing the risk of non-compliance.

Seasonal Businesses: Pennsylvania has a significant number of seasonal businesses, particularly in the tourism and agriculture sectors. These businesses face unique accounting challenges, such as managing cash flow during off-seasons and accurately reporting income and expenses. Accountants with experience in seasonal businesses can help manage these challenges and ensure financial stability year-round.

The Role of Accountants in Ensuring Compliance and Financial Health

Accountants play a multifaceted role in helping businesses in Pennsylvania maintain compliance and financial health. Their responsibilities go beyond bookkeeping and tax preparation; they are strategic partners who contribute to the overall success of the business. Here are some of the key roles that accountants play:

Tax Compliance and Planning: Accountants ensure that businesses comply with all tax obligations at the federal, state, and local levels. They stay up-to-date with changes in tax laws and regulations, helping businesses take advantage of tax-saving opportunities while avoiding penalties. Tax planning is a proactive process that involves analyzing the company's financial situation and making strategic decisions to minimize tax liability.

Financial Reporting and Analysis: Accurate financial reporting is essential for making informed business decisions. Accountants prepare financial statements, including income statements, balance sheets, and cash flow statements, that provide a clear picture of the company's financial health. They also perform financial analysis, such as ratio analysis and trend analysis, to identify areas of strength and weakness.

Budgeting and Forecasting: Accountants help businesses create realistic budgets and financial forecasts that guide decision-making and resource allocation. By analyzing historical financial data and market trends, accountants can provide insights into future financial performance and help businesses plan for growth and sustainability.

Internal Controls and Risk Management: Implementing strong internal controls is essential for preventing fraud and ensuring the accuracy of financial reporting. Accountants design and monitor internal controls, such as segregation of duties and authorization procedures, to reduce the risk of errors and fraud. They also assess and manage financial risks, such as credit risk, liquidity risk, and market risk.

Audit and Assurance Services: Accountants provide audit and assurance services to verify the accuracy and reliability of financial statements. Audits are often required by investors, lenders, and regulators to ensure that financial statements are free from material misstatements. Accountants also provide assurance services, such as reviews and compilations, that provide varying levels of confidence in the accuracy of financial statements.

Business Advisory Services: In addition to traditional accounting services, many accountants in Pennsylvania offer business advisory services. These services may include financial planning, business valuation, mergers and acquisitions, and succession planning. Accountants act as trusted advisors, helping business owners make strategic decisions that align with their long-term goals.

The Benefits of Outsourcing Accounting Services in Pennsylvania

For many businesses in Pennsylvania, outsourcing accounting services is an effective way to manage financial responsibilities while focusing on core business activities. Outsourcing accounting services offers several benefits, including:

Cost Savings: Outsourcing accounting services can be more cost-effective than hiring in-house accounting staff. Businesses can save on salaries, benefits, and overhead costs associated with maintaining an internal accounting department. Additionally, outsourcing allows businesses to pay only for the services they need, rather than maintaining a full-time accounting team.

Access to Expertise: Outsourcing accounting services gives businesses access to a team of experienced accountants with specialized knowledge in various areas, such as tax planning, financial analysis, and regulatory compliance. This expertise is particularly valuable for businesses operating in complex industries or facing unique accounting challenges.

Scalability: Outsourcing accounting services provides flexibility and scalability, allowing businesses to adjust the level of service based on their needs. For example, a business experiencing rapid growth can easily scale up its accounting services to handle increased financial transactions and reporting requirements. Conversely, a business facing a downturn can scale back services to reduce costs.

Focus on Core Business Activities: By outsourcing accounting services, business owners and managers can focus on core business activities, such as sales, marketing, and operations. This allows them to allocate more time and resources to growing the business, rather than managing financial tasks.

Compliance and Risk Management: Outsourced accounting firms stay up-to-date with changes in tax laws, regulations, and accounting standards, reducing the risk of non-compliance and financial misstatements. They also implement strong internal controls and risk management practices to protect the business from fraud and financial losses.

Improved Decision-Making: Outsourced accounting firms provide accurate and timely financial information that supports better decision-making. Business owners and managers can rely on financial data and analysis provided by outsourced accountants to make informed decisions about investments, expansion, and other strategic initiatives.

Conclusion

Accounting is an essential component of business success in Pennsylvania. Whether you're navigating the complexities of state-specific taxes, managing finances in a diverse and competitive economy, or ensuring compliance with a myriad of regulations, having a skilled accountant by your side is crucial. The unique challenges faced by businesses in Pennsylvania require specialized knowledge and expertise, making accounting a critical function for companies of all sizes and industries.

Outsourcing accounting services offers numerous benefits, including cost savings, access to expertise, scalability, and improved decision-making. By partnering with a reputable accounting firm, businesses in Pennsylvania can focus on what they do best—growing their business—while leaving the financial management to the experts.

In the ever-changing landscape of Pennsylvania's economy, the role of accountants will continue to evolve. As businesses face new challenges and opportunities, accountants will remain trusted advisors, helping them navigate the complexities of financial management and achieve long-term success. Whether you're a small business owner, a large corporation, or an individual seeking financial guidance, the importance of accounting in Pennsylvania cannot be overstated.

1 note

·

View note

Text

Succentrix Business Advisors is a 21st Century full service business advisory franchise that provides accounting, payroll, bookkeeping, and tax preparation to assist small business America. Our Business Advisors, Accountants, CPA’s, Bookkeepers and Payroll Experts are trained to provide each small business owner with professional services that create lifetime partnerships. We value each and every client, and we assure our loyalty and dedication to do the best job possible to save our clients money, and bring success to small businesses across America.

1 note

·

View note

Text

What Software Solutions Are Best For Bookkeeping In Indian Retail Stores?

Meru Accounting software solutions offer a comprehensive and effective bookkeeping system that simplifies financial administration and complies with Indian accounting rules. They are specifically tailored to meet the specific requirements of Indian retail stores. Indian retail stores can track inventory, handle finances, and provide accurate reports with ease when they use Meru. Meru Accounting software's capacity to manage numerous locations and branches with ease is one of its main features, which makes it the perfect choice for franchises and retail chains. Additionally, users may easily customize the software to fit their own business requirements and workflows because to its high degree of adaptability.

Users may efficiently and precisely manage their finances with Meru Accounting software's sophisticated capabilities, which include batch processing, ledger management, and automatic journal entries. Additionally, the platform gives retailers real-time visibility into financial performance, empowering them to manage their operations and make well-informed decisions.

Furthermore, Meru Accounting software complies with Indian accounting norms and laws, guaranteeing that customers are always aware of the most recent specifications. Indian retail stores may increase their overall financial performance, cut down on errors, and automate their bookkeeping operations using Meru. Additionally, the software is simple to use and intuitive, negating the need for in-depth technical knowledge or training.

The integration of Meru Accounting software with other modules, including inventory management, payroll processing, and point-of-sale systems, is another noteworthy benefit. Retailers may increase accuracy and efficiency by streamlining their operations and minimizing data duplication thanks to this integration. Retailers may also find areas for development and obtain important insights into their business performance with the help of Meru Accounting software's extensive reporting and analytics features.

Meru Accounting software is the perfect option for bookkeeping in Indian retail stores because of its extensive feature set, user-friendliness, and adherence to Indian accounting standards. Retailers may boost business growth, cut expenses, and enhance financial management by putting Meru Accounting software into practice.

Benefits of Meru Accounting Software for Indian Retail Stores:

Streamlined Financial Management: Describe how the use of Meru Accounting software streamlines the tracking, spending control, and financial management processes. Talk about features that assist retail owners in monitoring their financial health, such as real-time reporting and automated data entry.

Indian Tax Law Compliance: Talk about how Meru Accounting software makes sure that Indian tax laws are followed. Emphasize features that streamline the tax filing procedure for retail companies, such as automated tax calculations, GST compliance tools, and the creation of GST invoices.

Integration of Inventory Management: Highlight the ease with which Meru Accounting may be integrated with systems for inventory management, allowing for the tracking of stock levels, reordering, and cost control. This connection lowers the cost of inventory and helps to maintain ideal stock levels.

Analytics and Customizable Reporting: Describe the value of customized reporting in helping decision-makers in the company. Explain how retailers may plan for growth by using Meru Accounting software's comprehensive financial reports, sales analysis, and insights into consumer patterns.

User-Friendly Interface and Training Support: Highlight how Meru Accounting software's user-friendly interface makes it accessible to people who aren't accountants. Talk about the support and training that are available to help retail store owners and their employees use the program efficiently.

What are the common bookkeeping challenges faced by retail stores in India?

For Indian retail stores to be financially stable and run efficiently, good bookkeeping is essential. However several difficulties could make this process more difficult, which would affect compliance and corporate performance. The following are a few of the most common issues that retail establishments face:

1. Complicated GST Compliance: Handling the complicated rules of Goods and Services Tax (GST) presents a big obstacle for Indian stores. Retailers are responsible for making sure that GST is calculated correctly, returns are filed on time, and rules are followed. Maintaining compliance and avoiding fines can be difficult due to the multiple GST rates for various product categories and the regular changes to the GST regulations.

2. Inventory Control: Effective inventory control is a common challenge for retail stores. Ineffective inventory management can negatively impact cash flow and profitability by causing overstocking, stockouts, or obsolete inventory. Retailers are always faced with issues such as tracking inventory movement, monitoring reorder points, and reconciling physical inventory with book records.

3. Cash Flow Management: Retail stores must maintain a healthy cash flow, but this can be difficult because of changing sales quantities, seasonal swings in demand, and customer payment delays. To make sure they have enough cash flow to pay for operating costs and inventory investments, retailers need to implement strong cash flow management techniques.

4. Accurate Sales Records: Retail stores handle a substantial amount of sales transactions every day, all of which need to be precisely documented in their ledgers. The accuracy of financial reporting is frequently impacted by problems like as manual entry errors, differences between credit and cash transactions, and difficulties balancing sales records with bank deposits.

5. Tracking and managing expenses: is crucial for preserving profitability, but it can be difficult for retail establishments. Maintaining accurate records and doing frequent expense analyses are necessary for tracking costs across multiple categories, including rent, utilities, payroll, and inventory prices. Ineffective cost monitoring might result in overspending and lower profitability.

6. Data entry errors and manual processes: A lot of retail stores still use manual bookkeeping procedures, which are prone to mistakes and inefficiencies. The potential for errors and delays in obtaining real-time financial information is increased when transactions, inventory updates, and financial reporting are done by hand. Using automated bookkeeping programs helps lessen these difficulties.

7. Financial Reporting and Analysis: Decision-making and compliance depend on the timely and correct generation of financial reports. Retailers frequently struggle to compile information from many sources, create thorough financial statements, and carry out insightful financial analyses to spot patterns and expansion prospects.

8. Lack of Accounting Knowledge: Small and medium-sized retail companies may lack internal accounting knowledge. Insufficient understanding of accounting concepts and practices might impede efficient financial management and compliance with regulatory requirements. Investing in staff training or contracting out bookkeeping services can help lessen this difficulty.

9. Requirements for Audit and Compliance: Tax authorities are required to audit retail stores to ensure compliance with regulations. Meticulous planning and strict adherence to legal standards are necessary for maintaining appropriate documentation, supporting financial records, and getting ready for audits.

Conclusion

Even though stores in India have a variety of bookkeeping difficulties, these barriers can be addressed by utilizing technology, implementing automated solutions, and spending money on expert knowledge. Retail stores can increase overall profitability, operational effectiveness, and financial transparency by taking proactive steps to solve these issues.

#retail_stores_in_india#bookkeeping_for_retail_stores#retail_stores_services#retail_store_in_accounting

0 notes

Text

Getting Back To The Basics: 15 Bookkeeping Terms Every Business Owner Should Know

15 Important Bookkeeping Terms To Know

Properly managed finances are key to long-term success for any business. Even though it is recommended that you hire a professional to help manage your business’s finances, it is important as a business owner to know the basics to ensure your finances are being managed properly. Become a more empowered business owner by familiarizing yourself with these accounting terms:

1. Financial Statements Financial Statements are records of your business’s financial situation. When you apply for a business loan, most lenders will want to see four financial statements: the balance sheet, income statement, cash flow statement, and statement of owners’ or shareholders’ equity.

2. Balance Sheet A balance sheet is a document that outlines your business’s financial status at a point in time. It reports assets, liabilities, and equity.

3. Income Statement An income statement shows revenues, expenses, and profit or loss for a specific period. Profit or loss is determined by subtracting expenses from revenue.

4. Cash Flow Statement A cash flow statement describes the sources of your business’s money and shows how that money was spent over some time.

5. Asset An asset is anything owned by your business that’s of monetary value. An asset can be tangible like land, equipment, or cash, or it can be intangible like a patent or franchise agreement. Assets are shown in terms of cash value on the balance sheet.

6. Liability Liability is a debt your business owes such as a loan, salary, income tax, or rent. On the balance sheet, liabilities are classified by current and long-term liabilities.

7. Equity Equity is the value of your business’s assets minus any liabilities. If your business is a sole proprietorship or partnership, equity is also known as “owner’s equity.”

8. Draw Also known as an “owner’s draw,” this is money you take out of your business for personal use. Business owners can do this by writing a check to themselves from a business checking account.

9. Revenue Revenue is the sum of all money collected for goods or services sold (before expenses are subtracted).

10. Expenses Expenses are the costs incurred by your business to generate income. Fixed expenses stay consistent, such as with rent or salaries, while variable expenses, like raw materials and commissions, fluctuate according to the market.

11. Accounts Receivable Accounts receivable is money owed to your business by your customers. This is considered an asset on the balance sheet.

12. Fiscal Year The fiscal year is a period that a business uses for accounting purposes and to prepare financial statements. It can coincide with the calendar year or take place during a different 12-month period.

13. Depreciation Depreciation is some of your business’s assets, such as vehicles or equipment, will decline in value, or depreciate, over time. Used as a tax deduction, depreciation can help your business recover the cost of some expenses.

14. Capital/Working Capital Capital is the money your business has for paying bills or investing. It equals current assets minus liabilities.

15. General Ledger The general ledger is a complete recording of your company’s financial transactions over its lifetime. This includes assets, equity, expenses, liabilities, and revenue.

Get a Handle on Your Business’s Finances

Do you still need more bookkeeping guidance and help? Contact the professionals at Stash Bookkeeping for all your bookkeeping needs. Together, we can look over your business’s finances and get you on track for success.

#payroll#bookkeepingservices#small business bookkeeping#bookkeepingtips#accounting#bookkeeping#smallbusiness#stashbookkeeping

0 notes

Text

Sexual adventure

Like the Netherlands, prostitution is legal in Curaçao.

Near the airport is an adult resort called Campo Alegre (Happy Camp), a jaw-droppingly enormous brothel.

Because of the shape and color of the logo, locals discretely refer to the camp as "The Green Leaf.”

The $6 admission fee (they don't check identification) is so worth the adventure.

The sprawling open-air property was originally an army encampment.

And it has recently undergone considerable refurbishment: There's a sleek high-speed Internet cafe, a gift shop, a clothing boutique (that sells Falcon's Mike Branson dildos), a massage parlor, an S/M dungeon, a business center, a lounge bar and even a water fountain.

Campo Alegre is like a small town — with boulevards that guests can stroll through as they pass by the tiny 1940s cabins where the prostitutes live.

Except for a couple of restricted trips per week, the women are not permitted to leave, less they start independently cutting their own deals.

The employees keep in shape at the gym.

And after a sweaty workout, guests can watch them rinse off through the glass-walled shower stall.

Upon a recent visit, I was told that I had just missed the annual "community day" — where locals are invited to inspect Happy Camp and see how well maintained it is.

Apparently, parents are encouraged to bring the kids.

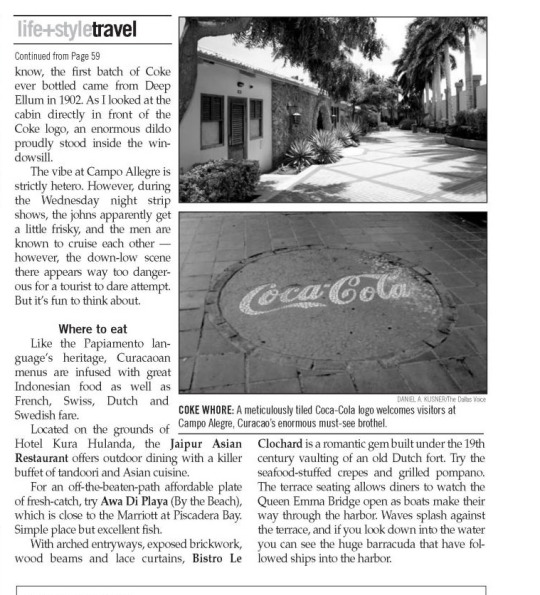

Corporate sponsorship is big at Campo Allegre.

Huge neon-lit beer signs arch across the boulevards.

But my Dallas civic pride burst with joy when I stumbled across gigantic meticulously tiled Coca-Cola logo.

In case y'all didn’t know, the first batch of Coke ever bottled came from Deep Ellum in 1902.

As I looked at the cabin directly in front of the Coke logo, an enormous dildo proudly stood inside the windowsill.

The vibe at Campo Allegre is strictly hetero.

However, during the Wednesday night strip shows, the johns apparently get a little frisky and the men are known to cruise each other — however, the down-low scene there appears way too dangerous for a tourist to dare attempt.

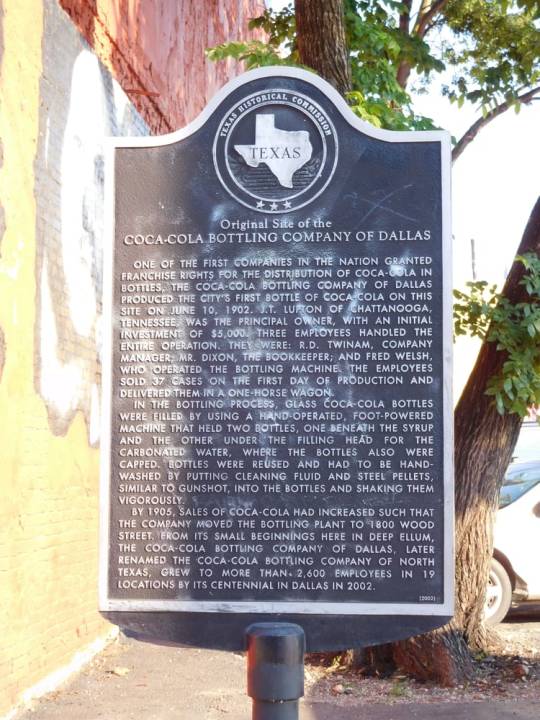

Original Site of the Coca-Cola Bottling Company of Dallas

One of the first companies in the nation granted franchise rights for the distribution of Coca-Cola in bottles, the Coca-Cola Bottling Company of Dallas produced the city's first bottle of Coca-Cola on this site on June 10, 1902.

J.T. Lupton of Chattanooga, Tennessee, was the principal owner, with an initial investment of $5,000.

Three employees handled the entire operation. They were: R.D. Twinam, company manager; Mr. Dixon, the bookkeeper; and Fred Welsh, who operated the bottling machine.

The employees sold 37 cases on the first day of production and delivered them in a one-horse wagon.

In the bottling process, glass Coca-Cola bottles were filled by using a hand-operated, foot-powered machine that held two bottles, one beneath the syrup and the other under the filling head for the carbonated water, where the bottles also were capped.

Bottles were reused and had to be hand-washed by putting cleaning fluid and steel pellets, similar to gunshot, into the bottles and shaking them vigorously.

By 1905, sales of Coca-Cola had increased such that the company moved the bottling plant to 1800 Wood Street.

From its small beginnings here in Deep Ellum, the Coca-Cola Bottling Company of Dallas, later renamed the Coca-Cola Bottling Company of North Texas, grew to more than 2,600 employees in 19 locations by its centennial in Dallas in 2002. (2002)

The Universal Drink

How Coca-Cola came to rule the world.

In the fizzy world of carbonated beverages, today marked a notable anniversary.

On May 8, 1886, a pharmacist in Georgia named John Pemberton sold the first glass of Coca-Cola, inaugurating what is arguably the most successful product in history.

According to the beverage maker, Pemberton sold nine servings per day during the soft drink’s first year; by the time The New Yorker’s E. J. Kahn wrote about it, in 1959, that number had soared to forty thousand servings every minute.

European royalty drank it; so had Hitler.

The Ethiopian Emperor Haile Selassie imported special deliveries on his imperial plane—or he did, that is, until a bottling plant opened in Addis Ababa.

Despite the company’s astonishing rise, the quintessentially American creation was not without detractors.

Critics across the political spectrum derided Coke’s sweeping expansion, identifying “a new type of imperialism” in the form of “Coca-Colonialism.”

The Second World War had played a major role in the company’s global spread, but the Cold War was proving a serious obstacle.

(Although the Iron Curtain had a few cracks: Soviet-bloc athletes guzzled more Coke than anyone else at the 1956 Olympics, in Australia.)

At the end of the article, Kahn jokes that Coca-Cola might prove the key to global peace—a prophecy that didn’t come to pass, unfortunately, but one that did anticipate the company’s iconic “I’d Like to Buy the World a Coke” ad campaign, which launched a little more than a decade later.

0 notes

Text

LaMar Van Dusen: A Dynamic Member of Toronto's Business Community

LaMar Van Dusen is an esteemed member of the thriving business community in Toronto, boasting a wealth of experience in various aspects of business, such as marketing, corporate finance, managerial finance, financial analysis, sourcing, staffing, sales, and consulting. Currently, he holds the position of Director at Phoenix Management, a reputable financial and accounting firm based in Ontario, Canada, which he established in 2010.

His journey began with a solid educational foundation, having studied business administration and marketing at St. Clair College. He later obtained a Bachelor of Commerce degree from Windsor University, cementing his knowledge and expertise in the field. LaMar's dedication to continuous professional growth is evident through his active membership in prominent Canadian professional organizations, including the Canadian Council for Aboriginal Business and the Indo Canada Chamber of Commerce.

Before launching Phoenix Management, LaMar Van Dusen held the role of Vice President of Sales at Advanced Presentation Products. Throughout his tenure of over two years with the company, he demonstrated exceptional leadership skills by building a successful sales team that propelled revenue from $6 million to an impressive $10 million.

Since 2010, LaMar Van Dusen has been fulfilling his role as Director at Phoenix Management, a company that initially began in his home office. At the onset, he specialized in developing business plans for independent business owners, assisting them in securing crucial capital to start and expand their ventures. During this period, LaMar formulated a distinctive service offering that seamlessly integrated principled accounting with attentive financial consulting.

Phoenix Management, under LaMar's direction, offers a comprehensive range of services, including full-service bookkeeping and accounting, business plan creation, finance consulting, business management, government grants, and strategy advisory services. The firm has successfully helped numerous Ontario-based companies secure working capital, acquire commercial properties, and invest in franchises since its establishment.

A notable achievement of Phoenix Management is its unique approach to pricing. It is the sole company in the Greater Toronto Area that offers full-service bookkeeping and corporate accounting for a single monthly flat fee. This groundbreaking concept simplifies bookkeeping and accounting for business owners while ensuring transparency and eliminating hidden fees or additional costs.

In his leisure time, LaMar Van Dusen prioritizes his well-being through engaging in various fitness-related activities. He dedicates four days a week to workout training, emphasizing the importance of maintaining a healthy and balanced lifestyle.

LaMar Van Dusen's multifaceted expertise, leadership skills, and commitment to delivering exceptional financial and accounting services have solidified his reputation as an influential member of the Toronto business community. Through Phoenix Management, he continues to empower business owners and foster their growth, contributing to the prosperity of the local economy.

0 notes

Text

How Taxation Works

Taxes are a significant part of the financial framework, and they're not always easy to understand. In fact, many people don't fully grasp how taxes work.

So, let's cover the basics of taxation so you can see how it fits into the bigger picture. I'll go into just what you need to know about taxes so that you can maximize your benefits.

WHO MUST PAY TAXES?

Taxation is based on earnings. So, anyone that is making money must pay taxes. This includes:

Individuals that are employees and earn a paycheck.

Individuals that earn an income through sources other than employment like independent contracting, freelancing, self-employed, and digital nomads work online while traveling the world. These individuals receive 1099 from their clients.

Otherwise, you’re likely the owner of a registered business. Your Business earns revenue and must file a tax return to pay its taxes.

HOW MUCH SHOULD YOU PAY?

How much in taxes a business pays largely depends on the type of taxes. There are five major kinds of business taxes:

GROSS RECEIPTS refers to sales. The goal is to reduce sales by taking tax deductions, thereby lowering taxes due.

EMPLOYMENT WITHHOLDING TAX is deducted from employees' wages when payroll is processed. As an employer, you are required to match some of those taxes and pay the employer withholding taxes portion.

CORPORATE FRANCHISE TAXES, also known as privilege tax, is a tax paid by certain companies that wish to conduct business in specific states.

EXCISE TAX is taxation on specific goods and services as you purchase them, like fuel or tobacco or alcohol for example.

VALUE ADDED TAX VAT is a consumption tax on goods and services, or when you the seller add value to those products and services.

HOW TO LOWER YOUR TAXES

The process is the same for both personal and business. However, the type of deductions and other factors vary. For example,

INCOME TAX (personal wages) - the goal is to reduce income earned by taking deductions, credits, and allowances to lower the gross income down to a Net Income amount. This lower amount (net income) is what is used to determine your tax liability based on your household. Theoretically, a single person with a $5000 net income should pay more taxes than a family of four with the same net income.

GROSS RECEIPTS TAXES (sales revenue) – is generally what is referred to for business. The goal is to reduce sales revenue by taking business deductions to lower the gross sales down to a Net Profit or Loss amount.

Businesses are allowed to deduct expenses, fancy “allowances” like depreciation on assets, or make extraordinary purchases for example. This may seem suspect to common folk, but the fact is, this is how the wealthy can move the billions they earn into lower tax brackets.

Make “NOBOSS Moves”

Now that you know how taxation works, you can take advantage of tax deductions and allowances too. But bear in mind that you're not operating on the same financial level as the wealthy. You must make every dollar count.

That being said, spending money just to take a deduction is NOT smart. There is even a commercial of a group of entrepreneurs fighting over the restaurant check because they can take a business deduction. This is highly misleading, and I'll give you two reasons why:

You’re spending money now so you can get it back later. What’s the benefit of that? This concept does nothing more than disrupt your cash flow.

Not all deductions are 100% deductible, specifically Food & Drink (Meals Exp) is only 50% deductible!

You want to make some “NOBOSS moves” by investing your money into income-generating opportunities. Depending on the type of “NOBOSS moves” you make you might be able to reduce your net income, reduce your taxes, and make money too!

KEEPING GOOD RECORDS

When you start your new business, you should also set up your bookkeeping system. One of the biggest mistakes a new business can make is waiting to set up its bookkeeping system. This is a dangerous financial mistake that happens far too often.

Keeping good records is the foundation of financial management. Documenting your business activity from the first expense is critical to building your business and minimizing taxes.

Start with a bookkeeping system that is simple and easy to update on a regular basis. No law says you must have a bookkeeper, accountant, or CPA when you start your business, so you have a few options to consider who will maintain your records properly:

Do your own bookkeeping.

Hire a bookkeeper.

Outsource to a bookkeeping service like AccountSOFT. Find out more about their implementation, bookkeeping, and training services for new business owners.

Considering you are required to pay taxes, you will ultimately make a decision by year-end so that your Tax Preparer or CPA can review your records, lower your taxes, and file business tax returns.

This information is part of the Should You Incorporate series. For more information about Legal Biz Structures, How Taxation Works, How to Pay Yourself, Starting a Business, or NOBOSS tools and resources for entrepreneurs, please visit our website at www.noboss.business

#tax#taxation#financial#incorporating#business#corporate#revenue#bookkeeping#records#accounting#how taxation works

1 note

·

View note

Text

5 Essential Accounting Best Practices for Franchise Owners

Running a franchise business comes with its own unique set of challenges, especially when it comes to managing finances. Proper franchise accounting is crucial for success, as it helps owners maintain financial stability, make informed decisions, and ensure compliance with regulations. Here are five key franchise accounting best practices every owner should know.

Standardize Financial Processes : Consistency is key in franchise accounting. Implement standardized financial processes across all franchise locations to ensure accurate and comparable financial data. This includes setting up uniform bookkeeping procedures, invoicing methods, and expense tracking systems. Standardization simplifies the consolidation of financial reports and enhances the overall financial visibility of the franchise business.

Leverage Accounting Software : Investing in reliable accounting software tailored for franchise businesses can streamline your bookkeeping tasks. Modern accounting software offers features like automated invoicing, expense tracking, and real-time financial reporting. These tools not only reduce manual errors but also save time and improve efficiency. Choose software that allows for integration with other business systems and provides scalability as your franchise grows.

0 notes

Text

519: Using Financial Reconciliation To Keep Your Construction Business On Track

This Podcast Is Episode Number 519, And It's About Using Financial Reconciliation To Keep Your Construction Business On Track

As a small business owner, you're likely already aware of the importance of keeping your finances in order. Financial management goes deeper than paying your bills on time and collecting invoices (although those are also important). It involves regularly checking your financial situation to ensure your accounts are in order, your records are up-to-date, and you're spending within your budget.

Among those activities, financial reconciliation is vital in keeping your finances and business on track. Force reconciliations can cause your net income to be over or understated, which means you pay too much in taxes now or too little now and the rest later with penalties and interest because the IRS can ask for a copy of your bookkeeping record.

Here's what you should know about financial reconciliation and how it can help your construction business.

What is financial reconciliation?

Financial reconciliation is a process of ensuring your financial records are consistent and accurate. When you conduct a financial reconciliation, you review financial statements and compare them with your bank statements, credit card statements, vendor statements, and other relevant financial records, such as invoices.

As you do this, you'll look for errors or discrepancies–for example, if a payment appears on your bank statement but not your accounting records or the costs are for different amounts on different records. When you conduct a financial reconciliation, you want to ensure that the money in your bank account matches the money your financial documents show you should have.

Discrepancies need to be addressed, or you'll wind up with financial information that isn't accurate, which affects your cash flow and your ability to make financial decisions. If the discrepancy involves an ongoing payment to you or a vendor, catching it early could save you much money.

Financial reconciliation ensures that all financial transactions are recorded accurately and thoroughly in your accounting system. That way, you know exactly how much money you have and how much is moving into and out of your business, and you can make informed financial decisions.

Types of financial reconciliation

Every business has different reconciliation needs, depending on how big, how many, and what types of transactions it has.

Bank reconciliation involves your business's bank statement to your accounting records to ensure that all transactions have been recorded correctly. You're looking to safeguard your bank statement's bottom line matches your bank account balance. If not, you'll want to determine why. Is there an automatic withdrawal not yet posted to your account? If so, you need to be aware of it to prevent yourself from overdrawing on your account.

Credit card reconciliation involves reconciling your business's credit card statements with your accounting records to ensure that all charges have been recorded accurately. This is similar to a bank reconciliation in that you need to know exactly how much you've spent on your credit card–including pending transactions–to understand how much you have available.

You can also conduct vendor statement reconciliation, examining your vendor statements against your accounting records to ensure all invoices have been paid and recorded accurately. This can prevent any errors in paying your vendors.

You'll need to conduct intercompany reconciliation if you have two units of business or more–such as divisions, subsidiaries, or franchises. This is where you compare financial records between two or more companies to ensure transactions are recorded accurately and consistently.

Why you need financial reconciliation

Financial reconciliation is a vital tool that helps you manage your business more effectively. It ensures your financial records are accurate, complete, and up-to-date. This prevents errors or discrepancies that could lead to financial losses or legal or compliance issues.

It can also help identify any fraudulent activity or transactions you disapprove of, protecting you against fraud and lessening the risk of financial losses. If you have numerous transactions that are difficult to track, regular financial reconciliation prevents accidental overspending or missed payments that could ultimately affect your relationships with vendors.

As mentioned above, many businesses must comply with financial regulations and reporting requirements. Financial reconciliation helps ensure that your business complies with these requirements. If you're not compliant, you can take measures to address the issue quickly before it gets out of control.

How to conduct financial reconciliation

If you're looking to establish a solid, repeatable process, these are a few steps you can take:

Step 1: Identity what types of financial reconciliation you need to perform.

Step 2: Establish roles and responsibilities for each team member involved. Make sure everyone knows and understands what they are responsible for and when.

Step 3: Create a schedule for conducting financial reconciliation regularly. This may vary depending on the size of your business, and you may perform different types of reconciliation on various programs depending on your unique business needs.

Step 4: Ensure all financial data is easily accessible to those who need it. Each time you conduct a financial reconciliation, ensure you have all the necessary documentation and data. Cloud accounting software can help you manage your reconciliation.

Step 5: Conduct the reconciliation: Compare your financial statements to your accounting records to identify discrepancies or errors.

Step 6: Investigate and resolve discrepancies: If you find errors or inconsistencies, look into them and do what you can to fix them. You may have to hunt down additional paperwork, contact vendors to discuss payments, or contact your bank or credit card issuer.

Final thoughts

As a construction business owner, you must make vital decisions to move your company forward. Accurate financial records enable you to make those decisions based on your cash flow and current financial standing.

Bank and credit card accounts are the hubs of all your construction accounting and bookkeeping, meaning all transactions must be coded and input properly to have meaningful, reliable reports.

If you have questions about financial reconciliation or other important financial aspects of your business, don't hesitate to contact us. We're always happy to answer questions and show you how we can simplify business management.

About The Author:

Sharie DeHart, QPA, is the co-founder of Business Consulting And Accounting in Lynnwood, Washington. She is the leading expert in managing outsourced construction bookkeeping and accounting services companies and cash management accounting for small construction companies across the USA. She encourages Contractors and Construction Company Owners to stay current on their tax obligations and offers insights on managing the remaining cash flow to operate and grow their construction company sales and profits so they can put more money in the bank. Call 1-800-361-1770 or [email protected]

Check out this episode about Contractors Marketing - Accounting - Production (M.A.P.)!

0 notes

Text

How To Start Freelancing

Wondering how to start in freelancing makes you think of a lot of questions and also misconceptions as well. Whatever it is, it is important that those questions are answered to have clarity in all areas of freelancing.

Here are some of the FAQs and we would like to address them effectively. Also, we would like to give you guidance and clarity in terms of productivity and in choosing freelancing as your career.

1. What is #freelancing?

Freelancing is a career where you will enjoy the options it gives like choosing your career path, contract, freelancing niche, hourly rate, time of work and many more. Most of the nature of work in freelancing is the same as Virtual Assistance and online jobs.

When you start in freelancing, you will experience building your own business while having the freedom to choose your projects and how many hours you will be working with them.

2. How does it work?

Freelancing is when there is an exchange of services or works online to your clients anywhere in the world. You will be doing a virtual assistant’s tasks or office tasks online, using the internet.

In freelancing, you can provide different types of services like online bookkeeping, web design, web development, eCommerce, and many more.

When you start in freelancing, you will transition to working at the comfort of your home while doing transactions and providing services remotely via the internet.

3. How to get started?

It’s very easy to start freelancing. As long as you have access to a computer and the internet, you can start right away.

If you don’t have access to a computer and internet yet, you can borrow, rent or work in an internet cafe.

Also, in freelancing, you need to have the skills thus, you have to research thoroughly in google and youtube or you may enrol in any online courses. As such, you will be earning thorough guidance in starting and learning freelancing skills.

4. Why are some online courses paid?

When you’re a freelancer, acquiring a skill is a requirement. Many have been asking this question, yes there may be lots of resources online. Yet, if you want to have thorough guidance and you don’t want to experience the mistakes that the experts had gone through before, you will enrol in an online course.

Behind every paid online course are apps and platforms and people at the backbone of the whole process that the online academies are paying,

Free courses are also good but, in terms of thorough guidance, curriculum and experiences that you will earn while enrolling the course, you will not experience the same with the paid ones.

5. Why are some online courses expensive?

I’d like to mention two things that will help you with the realization about expensive courses. First is the VALUE, it means when you enrol in a more expensive course like a web development course, it will lead you to more opportunities because this course is a bit difficult than other courses. Next is INVESTMENT, when you enrol in an expensive course, you are not just purchasing the course but, you are investing. Why investing? With the experiences, thoroughness of detail, feedback, success factor that is being shared to you, it is too little compared to the return of investment (ROI) when you will be working soon.

Expensive courses are competitive courses which means the salary you will receive is higher compared to cheaper ones.

6. Are classes done online?

Yes, online courses are done online because it uses a lot of flatforms during live coaching and recorded coaching sessions.

One of the purposes of having the class online is to be able to cater to people all around the globe at the same time.

FVAs coaching and training encompass a commitment that will lift up each of the graduates to become successful.

7. Who can join?

In FVA the age range of our students is from 15-64 years old.

These 15 years old work as online writers and when their mother found out the perks of freelancing, their mothers enrolled in FVA as well.

In freelancing, everything can be acquired as long as you have the determination and passion in pursuing it.

Not all FVA graduates end in freelancing. Though the majority of the graduates pursue freelancing, some of them use and apply the knowledge and skills that they earned in their business or in opening a consultancy business.

8. Can I work as a VA? I am not a techie, I don’t have the experience, I am not good with English.

Yes, anybody can start as a freelancer but, when you’re not a techie and good in English, you will need more time to work on that.

Whether a mother, father, teachers, and PWDs, you can start freelancing.

The secret to success is not your educational attainment or your social-economic status, what matters most is your work ethics and your character and determination to become a successful freelancer.

9. Will you help us get a client?

Yes, it is integrated into all of the courses. Whatever course you are taking, FVA will provide you with the branding techniques, optimizing freelancing platforms, how you will earn a 100k a month, and many more.

As part of FVAs commitment, we are here to support you. And, the reward that will make us fulfilled is when you become a successful freelancer.

10. Will you give us a certificate?

Yes, when you finish the course, we will provide a certificate that you can show to clients during application.

Bonus Questions:

1.

What is FVA?

The FVA offered three services namely: Provide online freelancing training with different online courses, VA services to all business owners and franchisers, and joining the mission to become coach and trainer under the FVA brand.

FVA is registered in local government, DTI, BIR because we want to help you by showing legitimacy and truthfulness. We would like to provide services with accountability with a heart.

2. What are FVA’s courses?

FVA has a total of nineteen courses. But, if you’re starting from scratch, I suggest to enroll in a freelancing course first and grow later on in different courses.

Are you new to this page, freelancing community or work from home niche? Watch the video here to help you to get started with freelancing.

Interested in freelancing but, don’t know where to start?

Let us know how we can help.

Email us at [email protected].

1 note

·

View note

Text

What Is ServiceU.S.nating About Tax Preparation Service?

You are going to learn a lot through the procedure, together with through yearly comparison. If you're going to take up the tax filing process on your own, you would want to employ new staffs for the procedure, and you may have to train them. An essential step in the little small business startup procedure is deciding whether to go into business in any respect. Mobile tax preparation allows for a selection of marketing programs geared toward growing your customer base by bringing tax services right to the customer. The taxpayer may do it with or without the help of tax preparation software and online services. If you're looking for U.S. ex-pat tax preparation (even in the event you haven't filed in many years), we're here to assist. The necessary tax preparation related to the business payroll can be rather tedious and exacting on the moment, cost and workforce of the business.

If you can get businesses as clients, you can earn money year-round. Before you begin your organization, ensure you consider how to form an excellent small business program. Just as you maintain your organization confidentially, we do the very same with your financial records. The very first step in determining if a tax business is the most suitable option for you is to complete research to find out the feasibility. You have your tax preparation enterprise. A tax preparation company is an ideal prospect for a WAHM. You desire a tax preparation business that's experienced in all sorts of returns, especially if you're self-employed or run a business enterprise.

When you're picking a service, you should ask about her or his qualifications to make sure you're obtaining a skilled tax preparer. Tax services are produced to help business owners avoid making a few massive and costly mistakes. Just bear in mind that not every tax preparation service is exactly like the next. Now the expert tax preparation service can help you file U.S. taxes from the United Kingdom. Such a top tax preparation service won't only give you the capacity to ready the taxation, but also they can suggest you more ideas about how you can spend less. To prevent any problems with your annual taxes, it's essential to discover a tax preparation service locally that may professionally prepare your taxes.

Following are the essential documents and data you must bring or attach with to allow the volunteers to help you file income tax support. Besides helping your company with every-day bookkeeping, accounting services from McLan Accounting Services LLC will supply you with the financial reports; you have to make more informed and timely decisions about your company. Thus, it's far better to acquire the help of companies who focus on filing returns.

Request references from different taxpayers who have used their services. An excellent tax prep service will give a guarantee at no additional charge. First off, you're likely to have to figure out when you honestly think and feel you'll require the help of a tax preparation supplier. Several services also provide utterly free state tax returns, raising the prospect of a wholly fee-free tax season. Known Service Your Service is going to be known by the general public.

While every company can benefit from outsourcing accounting solutions, we know that every company is unique. Many tax businesses can testify to the frustration of not being able to prepare returns the initial two weeks of last tax season due to internet software issues from one of the biggest tax computer software providers in the business! Ordinarily, you have the tax franchise business for a fixed length of time, with the right to renew.

If you're only claiming general small business tax deductions, you're paying more than you should in taxes. Individuals will always have to pay taxes. You should know what sorts of fees you have to pay in the U.K. while living here. Prices are still likely to be part of life, and within America, the tax code is extremely complicated. Compile all documents, and other details that you think may apply to your taxes. Several have commented on how they cannot prepare their taxes without the assistance of TurboTax. If you only believe that you want to pay the charges in the united kingdom and you're able to avoid or ignore the taxation of your home country, then you're incorrect.

A US tax accountant with international experience can give a degree of expertise a preparer in the USA with no global experience would be hard-pressed to match. When you're thinking of a tax preparer, don't forget to ask what their total fee is. Therefore, if you're trying to find a tax preparer, here are seven tips on how best to locate the best ones. You would like a preparer who's up-to-date with the most recent technology in the tax world. The more information you find it possible to bring to your tax preparer, the more he or she is going to be able to assist you, and the better value you'll get for your wealth. As stated by the IRS, an income tax preparer is any man or woman who receives reimbursement for the preparation of all or a considerable part of any tax return for a different person. Before you select an income tax preparer, you should make a decision as to what kind of services you need and how much you are able to afford to pay.

1 note

·

View note

Text

Why You Should Get Accounting Services

Everybody today that is a business owner is surely always trying to find ways that they can really take their business one step further. Everybody that wants to do this will be very wise to have a quick look at what exactly big businesses around them are doing to improve. Everybody that checks what is up around them will see that accounting services is something that is very popular in the business world today. So many people today are going and getting accounting services for themselves because they have discovered that there are a ton of advantages that they can enjoy with it. People who have never tried anything like this before will certainly be curious to know what exactly the advantages of getting accounting services are exactly. Today, we are going to have a short look at some of the very many benefits that everybody who makes the right decision by getting accounting services will definitely enjoy when they do this.

All people that make the right decision by getting bookkeeping franchises services can be sure that their accounting is going to be very professionally done indeed. When it comes to your businesses finances, you are going to need cold hard facts. This is why one of the best things that people can do is to outsource this to someone with not attachment to the business. This is because if there is some sort of attachment to a business, the reports might not be cold hard facts, but riddled with some emotion to make things seem better than they actually are.

Everybody today that goes and gets accounting services will also be happy to know that they are going to have a team of professionals who will be the ones handling this for them. This is why everybody can be sure that when they go and get accounting services, the accounting of their business is going to be exceptionally well done indeed. Make sure to learn more here!

All people that go on ahead and get accounting services will also find that this is something that will free up so much time and energy for themselves as well. Not only is it a bad idea for you to handle your own accounting, but this is also something that will eat up all of your time and energy. And everybody today that is a business owner will find that there is really so many things that they have to see to every single day of their business. This is why all people should know that taking the job of accounting on themselves is really not a good decision for them to make. This is why everybody should instead go and let the professionals do this for them instead so that they can free up a lot of time and energy indeed. For more insights regarding accounting, go to https://www.britannica.com/topic/auditing-accounting.

1 note

·

View note