#fraud using Aadhaar ID

Text

How Instantpay Aadhaar Verification API Works: A Comprehensive Guide

Aadhaar verification has become a cornerstone of identity verification processes in India and is integral to numerous administrative and financial transactions. With over a billion people enrolled, the Aadhaar system is the world's most extensive biometric ID system.

This guide provides a detailed understanding of Aadhaar verification, its benefits, and the verification process, focusing on how the system works.

What is Aadhaar?

Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI).

Introduced in 2009, Aadhaar is designed to provide a single, robust, and easily verifiable identity document for residents of India.

Need for Aadhaar Verification

Aadhaar verification, also known as Aadhaar authentication, involves validating an individual’s identity using their Aadhaar number.

This process is crucial for ensuring that services, subsidies, and benefits reach the correct recipients, thereby reducing fraud and enhancing security across various sectors such as banking, telecom, and government services.

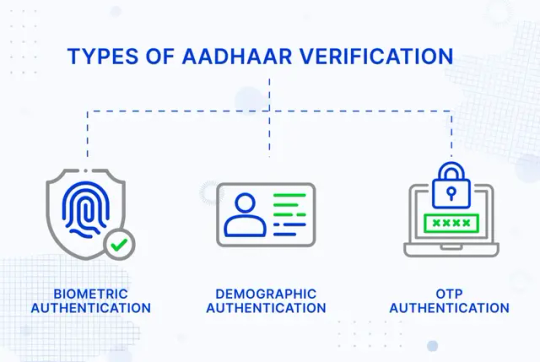

Types of Aadhaar Verification

1. Biometric Authentication

To verify identity, biometric authentication uses an individual’s unique physical characteristics, such as fingerprints, iris scans, or facial recognition.

This method is highly secure as these biometric traits are unique to each individual and difficult to replicate.

Process:

The individual provides their Aadhaar number.

Biometric data (fingerprints, iris scans, or facial images) is captured using a biometric device.

The captured data is sent to UIDAI for verification against the stored biometric data.

UIDAI responds with a "Yes" or "No" indicating whether the biometrics match the Aadhaar number provided.

2. Demographic Authentication

Demographic authentication verifies an individual's identity using basic demographic information such as name, address, date of birth, and gender.

This method is often used in conjunction with biometric authentication to enhance security.

Process:

The individual provides their Aadhaar number along with demographic information.

This information is sent to UIDAI to be verified against the data stored in the UIDAI database.

UIDAI responds with a "Yes" or "No" indicating whether the demographic details match the Aadhaar number provided.

3. OTP Authentication

One-Time Password (OTP) authentication involves sending a unique code to the individual’s mobile number registered with Aadhaar.

This method adds an extra layer of security to the verification process.

Process:

The individual provides their Aadhaar number.

An OTP is sent to their registered mobile number.

The individual enters the OTP to complete the verification process.

UIDAI verifies the OTP and responds with a "Yes" or "No".

Learn More:

Everything You Need To Know About Aadhaar Verification

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

Identity Verification - How to Check PAN Aadhaar Linking Status with API

Aadhaar Verification Using API

What is an API?

An Application Programming Interface (API) is a set of protocols and tools that enable different software applications to communicate and interact with each other. APIs allow systems to share data and functionalities seamlessly, facilitating integration and automation.

In the context of Aadhaar verification, APIs serve as a bridge between an organization's application and the UIDAI's Aadhaar database. This connection allows real-time verification of an individual's identity by cross-referencing the provided Aadhaar number and associated data with the UIDAI's records.

How are APIs used?

APIs can be used in numerous ways to enhance various processes across different industries. For instance, an API can retrieve essential information from a database, such as names and addresses, based on specific input criteria.

On the other hand, more advanced APIs can provide comprehensive details, including biometrics or transaction histories, using multi-factor authentication methods like OTPs.

These APIs ensure secure, quick, and reliable data exchange, making them invaluable tools for banking, telecommunications, healthcare, and e-commerce sectors. By integrating APIs, organisations can streamline operations, improve user experience, and maintain high security and efficiency standards.

Critical Key Terms in APIs

1. Request

The request is the message sent by the client to the server to perform an action (like retrieving or sending data)

2. Response

The response is the message sent back from the server to the client, indicating the result of the request.

3. API Endpoint

A specific URL where the API can access a resource or perform an action.

Example: Aadhaar Verification API

4. API HTTP Methods

Defines the type of operation the client wants to perform:

GET: Retrieve data.

POST: Create new data.

PUT: Update existing data.

DELETE: Remove data.

5. Header

Part of the request and response carries additional information such as content type, authentication tokens, and other metadata.

6. Parameters

Data is sent with the request to specify details or modify the request.

7. Authentication

Methods to verify the client's identity, make the request, and ensure they have the correct permissions. Standard methods include API keys, tokens, and Auth.

What is a REST API or RESTful?

A REST API (Representational State Transfer API) is a web service architecture that uses standard HTTP methods (GET, POST, PUT, DELETE) to interact with URL-identified resources.

REST APIs are stateless, meaning each request contains all the information needed for processing. They are known for their simplicity, scalability, and flexibility in handling various data types.

What is API Testing and How Do We Test It?

API testing ensures APIs meet functionality, reliability, performance, and security expectations. Key methods include:

1. Unit Testing: Testing individual endpoints.

2. Integration Testing: Ensuring multiple API calls work together.

3. Performance Testing: Checking response times and load handling.

4. Security Testing: Protecting against unauthorised access.

What is an API Key and Why is it Important?

An API key is a unique identifier used to authenticate a client requesting an API. It ensures only authorised users can access resources, helps track usage, manage quotas, and prevent abuse.

What is Web API and Why is it Beneficial?

A Web API is an API accessed via the web using HTTP protocols. It allows different applications to communicate and exchange data over the internet. Benefits include:

1. Integration: Seamlessly connects systems and applications.

2. Accessibility: Accessible from any internet-connected device.

3. Scalability: Handles increasing loads and user demands.

4. Reusability: Leverages existing functionalities without rebuilding.

What is API Integration?

API integration connects different applications and systems via APIs, enabling them to share data and work together. It automates processes, improves data accuracy, and enhances functionality, creating efficient and scalable digital ecosystems.

Aadhaar Verification APIs on Instantpay

Instantpay offers seamless integration of Aadhaar verification through its APIs, making the verification process efficient and secure for businesses.

1. Aadhaar Demographics API

The Aadhaar Demographics API provides basic demographic information using only the Aadhaar number as input. This API is useful for simple identity verification where detailed information is not required.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar Demographics API endpoint with the Aadhaar number.

Processing: UIDAI processes the request and retrieves demographic details.

Response: The API returns a JSON response containing the demographic information (e.g., name, address, date of birth, gender).

2. Aadhaar offline e-KYC API

The Aadhaar offline e-KYC API provides comprehensive details but requires both the Aadhaar number and an OTP sent to the Aadhaar-linked mobile number. This ensures thorough verification for services needing extensive identity details.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar OKYC API endpoint with the Aadhaar number.

OTP Generation: UIDAI sends an OTP to the registered mobile number.

OTP Verification: The client system captures the OTP and sends it back to the API.

Processing: UIDAI processes the request, fetching both demographic and biometric details.

Response: The API returns a detailed JSON response containing all relevant information (e.g., name, address, date of birth, gender, photograph).

Step-by-Step Guide to Aadhaar Verification on the Instantpay Dashboard

Step 1: Log in to the Instantpay Dashboard and Navigate to Verification Suite.

(If this isn't visible, please get in touch with [email protected] to enable it.)

Step 2: Click on the Verify Data Tab

Step 3: Choose Aadhaar Demographic API

Step 4: Download and fill template for Bulk Verification

Or If you want to try out the API click the button below

Step 5: Enter the Aadhaar Number you want to Verify

Step 6: Enter your iPin for authentication

Step 7: Congratulations, you have successfully retrieved the Aadhaar Demographic Data

Step 8: You can view and download the bulk verification files by clicking on the “Download” Button

Who Can Use Aadhaar Verification APIs?

Aadhaar Verification APIs can be utilised by a various organisations and sectors to streamline their identity verification processes. These APIs provide a reliable and secure way to verify the identities of individuals, ensuring that only genuine people can access services and benefits.

Here are five examples of entities that can benefit from using Aadhaar Verification APIs:

1. Banks and Financial Institutions

Banks and financial institutions can use Aadhaar Verification APIs to verify customers' identities during account opening, loan applications, and other financial transactions. This ensures compliance with KYC (Know Your Customer) regulations and helps prevent identity fraud.

Example

A bank uses the Aadhaar Offline EKYC API to verify the identity of a new customer applying for a savings account. The customer provides their Aadhaar number and OTP, allowing the bank to quickly and securely verify their details and open the account.

2. Telecom Companies

Telecom companies can utilise Aadhaar Verification APIs to authenticate customers when new SIM cards or mobile connections are issued.This process helps prevent fraudulent activities and ensures that mobile connections are issued to legitimate users.

Example:

A telecom company uses the Aadhaar Demographics API to verify a customer's identity when they apply for a new SIM card. By entering their Aadhaar number, the company can instantly retrieve and verify the customer's demographic information.

3. Government Agencies

Government agencies can use Aadhaar Verification APIs to authenticate beneficiaries of various schemes and services. This ensures that subsidies and benefits are disbursed to the right individuals, reducing the risk of fraud and providing efficient service delivery.

Example

A government welfare department uses the Aadhaar Verification API to verify the identity of individuals applying for a social welfare scheme. This helps ensure that only eligible beneficiaries receive the benefits.

4. E-commerce Platforms

E-commerce platforms can leverage Aadhaar Verification APIs to verify the identities of sellers and buyers, enhancing trust and security in online transactions. This helps prevent fraudulent activities and builds trust among users.

Example

An e-commerce platform uses the Aadhaar Demographics API to verify the identity of a new seller registering. This ensures that only legitimate sellers can list their products, improving the platform's credibility.

5. Educational Institutions

Educational institutions can use Aadhaar Verification APIs to verify students' identities during admissions and examinations. This helps maintain the integrity of the admission process and ensures that only eligible students are enrolled and assessed.

Example

A university uses the Aadhaar offline - KYC API to verify the identity of applicants during the admission process. Using the Aadhaar number and OTP, the university can authenticate the students' details and ensure that only genuine applicants are admitted.

These examples illustrate the versatility and utility of Aadhaar Verification APIs by Instantpay across various sectors. By integrating these APIs, organisations can enhance security, improve efficiency, and ensure that services and benefits are delivered to the right individuals.

Conclusion

By focusing on how Aadhaar verification works and its implementation through APIs, this guide aims to provide a comprehensive understanding of the process and its significance in various sectors.

For detailed API documentation, visit Instantpay Developer Portal, and for further assistance, contact support at [email protected].

0 notes

Text

The Iris Recognition Market is projected to grow from USD 6572.1 million in 2024 to USD 20527.62 million by 2032, achieving a CAGR of 15.30%.The iris recognition market has seen significant growth over the past decade, driven by increasing security concerns, advancements in biometric technology, and widespread adoption across various sectors. This article delves into the key factors propelling the market, the technology behind iris recognition, and its diverse applications.

Browse the full report at https://www.credenceresearch.com/report/iris-recognition-market

Understanding Iris Recognition Technology

Iris recognition is a biometric method that uses unique patterns in the colored part of the human eye to identify individuals. The iris's intricate structures remain stable over time, making it a highly reliable identifier. This technology involves capturing a high-resolution image of the iris, extracting unique features, and comparing them against a stored database to authenticate an individual's identity.

Market Growth and Key Drivers

The global iris recognition market has experienced rapid growth, with projections indicating a compound annual growth rate (CAGR) of around 18% from 2021 to 2028. Several factors contribute to this robust expansion:

1. Enhanced Security Requirements: As security threats become more sophisticated, the need for advanced and reliable identification systems has escalated. Iris recognition provides a higher level of security compared to traditional methods like passwords or PINs.

2. Government Initiatives: Numerous governments worldwide are adopting biometric systems for national security and citizen identification programs. For instance, India’s Aadhaar program, which is the world’s largest biometric ID system, includes iris recognition as a key component.

3. Advancements in Technology: Continuous innovations in biometric technology have improved the accuracy, speed, and affordability of iris recognition systems. Developments in artificial intelligence (AI) and machine learning have further enhanced these systems' ability to handle large-scale databases efficiently.

4. Increasing Adoption in Various Sectors: Iris recognition is gaining traction across multiple industries, including healthcare, banking, automotive, and travel. Its applications range from patient identification in hospitals to secure access control in financial institutions.

Key Applications of Iris Recognition

1. Security and Access Control: Iris recognition systems are widely used in securing physical and logical access. High-security facilities such as government buildings, data centers, and military bases utilize this technology to restrict access to authorized personnel only. Additionally, iris recognition is being integrated into smartphones and laptops for user authentication.

2. Healthcare: In the healthcare sector, iris recognition helps in accurate patient identification, ensuring that medical records are correctly matched to the right individual. This reduces the risk of medical errors and enhances patient safety.

3. Banking and Financial Services: Banks and financial institutions employ iris recognition for secure customer authentication and fraud prevention. This technology ensures that only authorized users can access sensitive financial information and conduct transactions.

4. Travel and Immigration: Airports and immigration authorities use iris recognition to expedite the identification process, improving security and reducing wait times for passengers. Automated border control systems and e-gates equipped with iris recognition technology are becoming increasingly common.

5. Automotive Industry: Iris recognition is being incorporated into advanced driver assistance systems (ADAS) and vehicle access control. It enhances driver authentication and provides personalized settings, improving both security and user experience.

Challenges and Future Prospects

Despite its numerous advantages, the iris recognition market faces several challenges. Privacy concerns and the potential for misuse of biometric data are significant issues that need to be addressed. Additionally, the high initial costs associated with implementing iris recognition systems can be a barrier for smaller organizations.

Looking forward, the market is poised for continued growth, driven by technological advancements and expanding applications. Integrating iris recognition with other biometric modalities, such as facial recognition and fingerprint scanning, could offer even higher security levels. Moreover, ongoing research and development efforts aim to make iris recognition more affordable and accessible to a broader range of users.

Key Player Analysis

Thales (France)

IDEMIA (France)

HID Global Corporation (US)

Iris ID, Inc. (US)

IriTech, Inc. (US)

IrisGuard Ltd. (UK)

EyeLock LLC (US)

NEC Corporation (Japan)

Princeton Identity (US)

CMITech Company, Ltd. (Korea)

Segments:

Based on Component

Hardware

Software

Based on Product

Smartphones

Wearables

Tablets & Notebooks

Personal Computers/Laptops

Scanners

Based on Application

Identity Management and Access Control

Time Monitoring

E-Payment

Based on Vertical

Government

Military & Defense

Healthcare

Banking & Finance

Consumer Electronics

Travel & Immigration

Automotive

Based on the Geography:

North America

The U.S.

Canada

Mexico

Europe

Germany

France

The U.K.

Italy

Spain

Rest of Europe

Asia Pacific

China

Japan

India

South Korea

South-east Asia

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

GCC Countries

South Africa

Rest of the Middle East and Africa

About Us:

Credence Research is committed to employee well-being and productivity. Following the COVID-19 pandemic, we have implemented a permanent work-from-home policy for all employees.

Contact:

Credence Research

Please contact us at +91 6232 49 3207

Email: [email protected]

0 notes

Text

The Evolution and Significance of PVC ID Cards in India

In the rapidly evolving landscape of identification and security, PVC ID cards have emerged as a crucial tool in India. As technology advances and the need for secure identification grows, PVC ID cards are becoming the standard for various applications, from corporate environments to educational institutions and government services. This blog explores the evolution, significance, and future of PVC ID cards in India, highlighting their benefits and widespread adoption.

A Brief History of PVC ID Cards in India

The journey of identification cards in India has seen a significant transformation over the years. Initially, paper-based IDs were the norm, but they were prone to damage and forgery. The introduction of PVC (Polyvinyl Chloride) ID cards marked a revolutionary change, offering a durable, tamper-resistant solution. These cards are not only more secure but also versatile, capable of incorporating various technologies such as magnetic stripes, barcodes, and smart chips.

Why PVC ID Cards?

Durability and Longevity: PVC ID cards are known for their durability. Unlike paper or laminated cards, PVC cards can withstand wear and tear, making them ideal for long-term use. This durability is particularly important in India, where climatic conditions can be harsh and variable.

Enhanced Security: Security is a primary concern in identification. PVC ID cards can be embedded with various security features such as holograms, watermarks, and microtexts, making them difficult to counterfeit. These features are crucial in preventing fraud and ensuring the authenticity of the ID.

Cost-Effective: While the initial cost of PVC ID card production might be higher compared to paper cards, their longevity makes them a cost-effective solution in the long run. They do not require frequent replacements, saving both time and money.

Versatility: PVC ID cards can be customized to suit different needs. They can incorporate technology like RFID for access control, magnetic stripes for data storage, and even smart chips for multi-purpose applications. This versatility makes them suitable for a wide range of sectors, including corporate offices, educational institutions, healthcare, and government agencies.

Applications of PVC ID Cards in India

Corporate Sector: In the corporate world, PVC ID cards are essential for employee identification and access control. Many companies integrate these cards with their security systems to manage access to different areas within the workplace, ensuring only authorized personnel can enter sensitive zones.

Educational Institutions: Schools, colleges, and universities in India use PVC ID cards for student and staff identification. These cards often double as library cards, meal cards, and access cards for various facilities, streamlining campus management.

Healthcare: Hospitals and clinics use PVC ID cards for patient identification and management. These cards can store critical information, including medical history, which can be accessed quickly during emergencies.

Government Services: The Indian government has adopted PVC ID cards for various services. For instance, the Aadhaar card, a crucial identification tool for Indian citizens, is now available in a PVC format. This enhances its durability and ease of carrying.

The Future of PVC ID Cards in India

As India continues to digitize its infrastructure, the role of PVC ID cards is set to expand further. The integration of advanced technologies like biometrics and contactless smart chips is on the horizon, promising even greater security and functionality. Additionally, with the rise of mobile ID solutions, PVC cards might evolve to complement digital identification methods, providing a hybrid approach to secure identification.

Conclusion

PVC ID cards have become an indispensable part of India's identification landscape. Their durability, security features, and versatility make them ideal for a wide range of applications, from corporate environments to educational institutions and government services. As technology continues to advance, PVC ID cards will likely incorporate even more sophisticated features, ensuring they remain a vital tool for secure and reliable identification in India.

Whether you're a business owner looking to enhance your security protocols or an educational institution aiming to streamline your operations, investing in PVC ID cards is a forward-thinking move. Embrace the future of identification with PVC ID cards and ensure your organization stays ahead in the ever-evolving landscape of security and identification.

0 notes

Text

Cyber Crime Complaint kaise kar

So, if any cyber fraud or online scam has happened to you and you want to register your complaint under cyber crime, then in today's blog I will tell you how you can file your complaint under cyber crime. Now I am saying the right complaint here because many people register complaints under cyber crime but there some details are wrong or the complaint itself is wrong due to which it takes a long time. The complaint that remains for some time remains pending and after that the complaint is closed. Now this is not my first blog. Even before this I had made a blog and posted it on my channel on how to register a complaint in cyber crime.

And on top of that, you people have got around 2 lakh views, in which the money of many people has been frozen and the money has also been returned. Now I am making this blog after the new update of 2024 that within 2024, there will be a rise in the cyber crime website. What new changes have happened and in what way can you people lodge your complaint and this will not be a demo complaint, this is the complaint of our client or subscriber who wanted to register in cyber crime, then I will give you a live complaint of absolutely everything. I will show you how to file the correct complaint and I will also show you how many minutes or hours after filing the complaint, action is taken on it and your money gets frozen.

Also Read- bank account freeze by noida cyber crime

So without wasting time let's start the blog. If you are visiting our channel for the first time then make sure to subscribe the channel because a lot of such content keeps coming on our channel and such content is already there. If any fraud or scam has happened to you then you can know how you can get your money back and share this blog with your friends who have also been cyber fraud or cyber scammed. And if you want to register your complaint under cyber crime, then let's start the blog while sitting at home, so first of all you guys have to go to google.com.

And the search here is Cyber Crime. As soon as you type, the first option you will see is Cyber Crime Portal. You people have to click on it. Let's click, after that you people will get to see multiple options here. So you people have to click on Register a Complaint and Financial Fraud, okay here also you will get to see multiple options, you people have to click on Financial Fraud and after that you can read this detail, after that you people have filed complaint. Have to click on And click on this act. Okay, so what are the things you should have to lodge a complaint? Any complaint, no matter whether it is financial fraud or any other kind of fraud.

Also Read- Vapi cyber cell bank account freeze karde to kya kare

So, what all should you have, which is the Mentorial details, it is given inside every complaint, okay, so first of all, you people should have the date and time of the incident, meaning on which day that thing happened to you, you people should know the incident. Key detail means a rough detail, you can write it in Hindi or English, it should have 200 characters and no special character should be used inside it. Apart from that, you should have some ID proof like Aadhaar. You can apply card here or apart from that here you can also apply PAN card. Okay, apart from PAN card, you can also apply driving license or anything else. Age ID proof, the format of which you are making your complaint should be.

That JPG should be inside JPG or PNG is fine and its size should be less than 5 MB. In this case, if any bank scam or online fraud happens to you, then what are the things required by you first of all? You should know your bank or wallet address, the 12 digit transaction or UTRO, the date of transaction, you should know the amount of fraud, apart from that, soft copy of relevant evidence for example, your screenshots. If you have WhatsApp2, you will have to show that here on this platform, you have been cheated. For example, if it has happened on any website, then you can also put that, what should be its format, it should be below 10 MB.

Now apart from this, this is an optional detail for the example of a suspect who has committed a fraud on you. What details do you have regarding him so that the suspect can be caught using the software? For example, you have his mobile number and email ID. If you have any ID proof that he has sent or has sent a photo, then all those things are there. If you apply these things then your chances increase a lot, then all these things are mandatory, you try as much as possible. If you can give more information, you all have to give it. Okay, so what will happen is that the fraudster will be caught soon or he does not have quick identification, so first of all you guys have to click on Create a New Account, after that you People have to select their state, after that you have to type your email ID, whatever your email ID is, type it here, type the mobile number and click on Get OTP, OTP will come, fill it and captcha code. Have to fill and click on submit

This will create your ID which will remain inside the cyber crime. If your ID is already created, if you have forgotten it then you have to click on Forget ID and enter your mobile number. You will get OTP, after that you have to fill the captcha code and click on submit. You have to do this, what will happen with this, your ID will be there, a message will come on your mobile number, so you can see, now we have the ID already created, so we log in directly, okay, so first of all we login. We fill the ID here and after that we enter the mobile number here and click on Get OTP, like you click on OTP, an OTP will come on your phone, that OTP you people have entered here. If you have to fill it, let's fill the OTP quickly.

Also Read- how to unfreeze bank account from ghaziabad cyber cell

After filling the OTP, you guys have to fill the captcha code here, so let's fill the captcha code also which is z a t yvi, the small letters are to be filled only, whether it is big or small, you guys can see it. If you fill it wrongly then you will have to process everything again. Ok, click on submit, after that you will see some details like this. So first of all you people have to go inside the user profile. After this you have to enter your details here like your name etc. So let's fill them. First of all we will fill the name of our client here then it will come in the title Mr. Message Doctor Mr. Mrs. So you can choose as per your choice. If you can, our clients are Ms. So we use Ms. after that their name will come.

So we have filled Kajal here, after that their mobile number will come, so whatever mobile number will be your client's or sorry, it will be yours, you all have to fill it here, after that you have filled their date of birth. You have to fill the same date of birth which will be there on any ID proof. If it is on Aadhar Card then fill that date, it will be better. After that you have to select the gender and after that you all have to fill it here. You have to fill the email ID here on which you will get updates related to the complaint, so we have filled the email ID here, after that you have to fill the name of father, mother or spouse, then we are filling the name of the spouse. And after that you people have to type the complete address here, whatever is the address of your house, you people have to enter it here, after entering everything, you people have to update it. This is for those people who are first. We are registering the time complaint, we will click on update and click on OK, after that you all have to click.

Report Cyber Time Pay and after that you will get to see the pay option here. First of all, we select in all categories whoever has been fraud with you, our clients have transferred money from bank to bank, that is why we You are selecting internet banking related plot. If you have done it through UPI, then you can do UPI. Now here, if you have lost your money, you will say yes. After that, first of all, you have to enter your details, then select your bank account first. Their bank account is Central Bank of India, so we will type it here, after that we will enter our bank account number here, then we will enter the bank account number here, after that we will enter the transaction ID. Which is of 12 digits, which you people have to fill when you transfer money to someone, UTRO there, let's fill it here and after that you people have to enter the amount, whatever. Your amount will be there, you have to fill it here.

And you have to enter the date on which you have transferred the money. You have to enter it here. If you know the time then you can enter it. If you don't know then there is no problem. Click on Save in the same way. You guys have to enter all the details here. Our client had two transactions, so we have entered the two transactions here. Now we have to enter the details of the account in which the money has gone, that is, if the suspect's is ours, then the suspect is ours. If we have transferred within the bank itself, then we will select the bank, after that we will select the name of the bank. Okay, so we search the name of the bank here which is Install Bank. After selecting the bank, now We have to fill the account number of the froster here.

So we enter the account number of Froster's bank account, after that we have to fill the transaction ID and after that we have to enter the amount, that is, the amount of fraud that has happened with the transaction ID, we have to enter it here. You have to select the date again and click on Add More, then in the same way you have to enter the details of the other transactions here, we have entered both of them here, okay, after that it will ask you that Approximate time, when the fraud started with you, then you guys have to put that date i.e. the first transaction, which is the first transaction you did, you guys have to put the details here, so we have mentioned the first transaction. had done

That was done on 26th at 8:8, you people have to put those details. You people delayed in making any report. Yes, we did not do it. After that, we have to tell where the incident took place. If you can, we do not know the ID. If we know the name, then we enter it here. VIP Advance. Okay, after that we know the bank account number. So we have the bank account number now, so we enter it here. There is a little more space here. We will remove the space on it, that's why I had already told you to enter here as much details as you have, so we have put the details here, click on the bank key and save and next, after that whatever is missing of yours is here. You guys have to fill the details like here her husband's name is missing.

So we put it here, okay after that we will scroll down and want to upload any ID proof, I have put the Aadhar card here, so we upload it here, click on save and proof, save and complete. Clicking means that you people have to verify all the details you have entered properly once, I verify everything properly here, whatever I have put here, if everything is correct. If yes, then we will do it by clicking on 'I agree' and 'Confirm' and 'Submit', after that your complaint will be registered, okay, after that you can download its PDF file by clicking on 'Download PDF', okay. If you are seeing this type of error many times, your complete copy is not downloading.

So you have to cross it and then you guys have to go back to the cyber website and here you have to click on the check status. As soon as you guys click on the check status, you guys will get to see your amendment number. You have to click and after that there will be a blue colored button at the top. If you want to print it then you have to click on that button and download your cyber crime complaint copy. So in this way you can People can also register their complaint under cyber crime, however, their complaint was registered on 27th and on 28th they got a message that their money was transferred to their account for free. That is, within a short time of 24 hours, their money was frozen in Froster's account by cyber crime. So, you guys saw how quickly action is taken if you register a correct complaint. Cyber crime. Because this is a cyber crime, it takes action very fast against Frost and if the details are correct then the money is spent very quickly.

0 notes

Text

How to Link Aadhaar Card with Pan Card Online

Overview

The linking of the Aadhaar number with the Permanent Account Number (PAN) card has been a significant move in India’s financial landscape. This process aims to streamline and enhance transparency in financial transactions, prevent tax evasion, and promote efficient governance. In this blog, we will delve into the importance of linking your Aadhaar number with your PAN card, the process involved, and the implications of not doing so.

What is PAN and Aadhaar?

The Permanent Account Number (PAN) is a 10-digit alphanumeric identifier issued by the Income Tax Department of India. It plays a vital role in monitoring financial transactions that attract tax liability from a single source, making it convenient for the government to maintain accurate tax records. Notably, having a PAN card is mandatory for filing income tax returns. Moreover, PAN serves as an authentic identity proof for various purposes.

The Aadhaar card is a 12-digit unique identification number issued by the Unique Identification Authority of India to every Indian citizen. It serves the dual purpose of identity and address proof. In recent times, the Indian government has made it compulsory for all citizens to possess a single identification document. This requirement includes linking your Aadhaar card with PAN, irrespective of whether you file an income tax return or not.

Why is it important to link Aadhaar number with PAN card?

Linking your Aadhaar number with your PAN card is essential for several reasons:

Prevent tax evasion: It enables the government to monitor financial transactions effectively, reducing the scope for tax evasion.

Simplified income tax filing: It streamlines the process of filing income tax returns, making it more convenient for taxpayers.

Effective identity verification: Linking Aadhaar with PAN ensures the accuracy of personal details, reducing the risk of identity fraud.

Eligibility for government subsidies:Many government welfare schemes require Aadhaar-PAN linkage for beneficiaries to receive their entitlements.

How to link Aadhaar number with PAN card

There are multiple methods to link your Aadhaar card with PAN, such as through SMS, online portals, and during the PAN application process. The official Income Tax e-filing website provides a user-friendly platform for creating an Aadhaar-PAN link. The online linking facility is accessible to all citizens of the country, ensuring a hassle-free process. This mandate for linking Aadhaar with PAN aims to enhance transparency and streamline financial transactions, making it a crucial step in India’s financial compliance framework.

Online Method of Linking Aadhaar number with PAN

Follow these steps to link PAN with Aadhaar:

Visit the official website www.incometaxindiaefiling.gov.in and click on the link to link Aadhaar.

Provide PAN number, Aadhaar number, enter the actual name as per Aadhaar card and enter the captcha code. Then click on ‘link Aadhaar’.

Make sure the name, gender and date of birth in Aadhaar in PAN is exactly the same.

Follow these steps to link PAN and Aadhaar after logging to the income tax website:

Register yourself on the portal of income tax e-filing.

Go to the profile setting and click on ‘link Aadhaar’.

Enter your login ID, password and date of birth to log in to the official portal of Income Tax Department.

Click on the option ‘Aadhaar link to PAN’ in the pop up window.

Cross check the details that will automatically appear on the e-filing portal.

Enter your Aadhaar card number and captcha code and click on ‘link Aadhaar’ button. A message will pop up confirming the successful linking process.

Apart from the online process, you can link Aadhaar card with PAN card using the simple SMS process:

Send SMS to 567678 or 56161 in the format: UIDPAN <12 DIGIT AADHAAR NUMBER> <10 DIGIT PAN>

Missed due date for Aadhaar-PAN linking? Here’s what you need to know!

The deadline for linking your Aadhaar and PAN card was June 30, 2023, and the government has not granted an extension to this deadline. Failure to link your PAN and Aadhaar by this date will render your PAN inoperative.

Starting from July 1, 2023, if your PAN is not linked with Aadhaar, it will be considered inoperative. However, there is an option to reactivate your PAN by submitting the Aadhaar-PAN linking request after June 30, 2023. This reactivation process will require you to pay a penalty.

It’s crucial to stay updated with any changes or announcements from the government regarding the Aadhaar-PAN linking process to ensure compliance with tax regulations and avoid any disruptions in your financial transactions.

Who is exempted from linking Aadhaar with PAN?

Referece:

There are specific categories of individuals who are not mandated to link their Aadhaar with their PAN card. These exemptions include:

Residents of Assam, Jammu and Kashmir, and Meghalaya.

Non-residents as defined by the Income Tax Act, 1961.

Individuals aged 80 years or above at any point during the previous year.

Non-citizens of India.

It’s important to note that individuals falling within any of these exempt categories can voluntarily choose to link their Aadhaar with their PAN without incurring any fees. Furthermore, it’s essential to stay updated on any potential modifications to these exemptions, as they are subject to change in the future.

Implications of not linking Aadhaar with PAN

If you fail to link your Aadhaar with PAN, the consequences can be significant. The most notable impact is on the Tax Deducted at Source (TDS) rate. Suppose your PAN is not linked to Aadhaar by the specified deadline. In that case, the TDS rate on various financial transactions may increase to 20%, which is substantially higher than the usual rates.

Illustration: Let’s say you have a Fixed Deposit (FD) with a bank that provides an interest rate of 6% annually. Without Aadhaar-PAN linkage, the TDS rate on the interest earned would be 20%. So, if your FD earns Rs. 10,000 in interest, Rs. 2,000 would be deducted as TDS, leaving you with only Rs. 8,000.

PAN Card Status: Operative and Inoperative

PAN cards can have two statuses: operative and inoperative. An operative PAN card is one that is linked with your Aadhaar number, while an inoperative PAN card is not linked.

Consequences of an Inoperative PAN Card

If your PAN card becomes inoperative due to the lack of Aadhaar linkage, you may face difficulties in conducting various financial transactions. Additionally, you could be penalized with a higher TDS rate, as mentioned earlier.

How to Make a PAN Card Operative

After June 30, 2023, PAN which is not linked with Aadhaar, will be considered inoperative. However, there is an option to reactivate your PAN card by submitting the Aadhaar-PAN linking request which comes with a penalty.

If your PAN has become inactive, you can reactivate it by paying a fine. To initiate the Aadhaar-PAN linking request, follow these steps:

Go to incometax.gov.in/iec/foportal/ and navigate to ‘e-Pay Tax’ to start the Aadhaar-PAN linking process.

Enter your PAN details and proceed to CHALLAN NO./ITNS 280 for submitting the Aadhaar-PAN linking request.

Ensure that the fee payment is made under Minor head 500 (Fee) and Major head 0021 [Income Tax (Other than Companies)] in a single challan.

Choose the mode of payment.

Enter your PAN, select the Assessment year, and provide your address details.

Enter the Captcha code and click on the Proceed tab to complete the process.

Conclusion

Linking your Aadhaar number with your PAN card is not just a regulatory requirement; it’s a crucial step toward a more transparent and efficient financial system. Failing to link the two may lead to higher TDS rates and complications in your financial transactions. So, it’s essential to complete this process in a timely manner to enjoy the benefits and avoid unnecessary hassles. Those who failed to complete the process must know the implications and submit a linking request to further make their PAN card operative.

MI Lifestyle is dedicated to incorporating best practices and complying with all regulatory standards, maintaining the utmost levels of ethics and transparency. It is crucial to highlight that the compulsory linking of Aadhaar with PAN is a requirement for all citizens of India. And hence, it is necessary for every Indian citizen, including MI Lifestyle distributors to be vigilant towards the government updates and announcements.

#How to Link Aadhaar Card with Pan Card Online#Link Aadhaar Card with Pan Card#Aadhaar Card with Pan Card

0 notes

Text

How to Choose The Best Packers And Movers in India for Safe Moving Experience

New things bring excitement and when the things related to our new home our excitement level goes to another level. Our excitement easily turns into worry when the shifting process starts. If you are relocating from India and looking for a professional Packers and Movers Mumbai to Chennai then you landed on the right page. We will help you to find the best packers and movers in India.

Home shifting process is not easy, a lot of tasks occur during and after the process like Disassembling, Packing, loading, unloading, Unpacking, assembling. Also this process is boring and time-consuming. In this home shifting process you need to pack and move the entire household goods and furniture. If in this process you have to do yourself without any experience and knowledge then there are more chances of your goods may get damaged, or you may get injured. All these problems can be avoided with the help of professional Packers and Movers in India. But the difficulty to find reliable packers & movers in India because India is a big city and availability of home shifting services in India are more.

When the availability of Home shifting services in India are more so it is difficult to figure out genuine, and fake service providers. With fake packers and movers in India there are chances you will face losses because of their unprofessional services and mishandling. In this situation it is very difficult to trust randomly on any packers and movers in India.

If you don't want to bear losses and you want 100% safe and secure home relocation In India then you need to look for the trustworthy movers & packers India. For that you need to search for the trusted portal where all trusted and verified movers & packers India are connected. One of the best trusted and verified portal is Householdpakers where only genuine movers & packers India are listed.

Visit Website: All professional home shifting services in India Marathahalli have their website. You need to visit their website and look for information like company profile, years of experience, contact details. After checking the website you need to personally call on the company's phone number or you can visit the office location to verify contact information.

Validate Documents: You need to check companies legal documents like their GST number, registration, licence, owner ID proof such as Aadhaar Card, PAN card, etc.

Compare Services: Before finalising the company you need to look for different companies' services offered by them and the quality of services they offered to their customers. Also, you need to check the quality of the material they use & methods they follow of packaging and moving and what type of equipment they use.

Read Reviews & Ratings: Also before choosing any home relocation services in India online you need to check the company's past history by checking previous customer reviews, feedback and star ratings.

Low-Cost Quotes: Never choose packers and movers in India who offer low-price quotes, they may be fraud or unprofessional companies which may involve you in moving scams without providing promised services.

Pay Attention Before Signing Papers: At the time of signing you need to read the companies terms and conditions carefully, clarify doubts, before signing any contract with the movers. Also it is advisable to collect an original copy of insurance policy papers if you have purchased.

Timing : Nowadays no one is having time to waste on the unprofessional work or process of packers and movers. The movers and packers which are having no experience give you a slower process than those who have experience. They always waste their time searching and monitoring. They always work very slow and inefficiently. But with experienced packers and movers of India, you will not face this problem. They are fully equipped and understand the process of the job correctly and they are aware of the types of materials to be used and how much people will be required to do packaging and loading of the items.

0 notes

Text

How to Choose The Best Packers And Movers in India for Safe Moving Experience

New things bring excitement and when the things related to our new home our excitement level goes to another level. Our excitement easily turns into worry when the shifting process starts. If you are relocating from India and looking for a professional Packers and Movers Mumbai to Chennai then you landed on the right page. We will help you to find the best packers and movers in India.

Home shifting process is not easy, a lot of tasks occur during and after the process like Disassembling, Packing, loading, unloading, Unpacking, assembling. Also this process is boring and time-consuming. In this home shifting process you need to pack and move the entire household goods and furniture. If in this process you have to do yourself without any experience and knowledge then there are more chances of your goods may get damaged, or you may get injured. All these problems can be avoided with the help of professional Packers and Movers in India. But the difficulty to find reliable packers & movers in India because India is a big city and availability of home shifting services in India are more.

When the availability of Home shifting services in India are more so it is difficult to figure out genuine, and fake service providers. With fake packers and movers in India there are chances you will face losses because of their unprofessional services and mishandling. In this situation it is very difficult to trust randomly on any packers and movers in India.

If you don't want to bear losses and you want 100% safe and secure home relocation In India then you need to look for the trustworthy movers & packers India. For that you need to search for the trusted portal where all trusted and verified movers & packers India are connected. One of the best trusted and verified portal is Householdpakers where only genuine movers & packers India are listed.

Visit Website: All professional home shifting services in India Marathahalli have their website. You need to visit their website and look for information like company profile, years of experience, contact details. After checking the website you need to personally call on the company's phone number or you can visit the office location to verify contact information.

Validate Documents: You need to check companies legal documents like their GST number, registration, licence, owner ID proof such as Aadhaar Card, PAN card, etc.

Compare Services: Before finalising the company you need to look for different companies' services offered by them and the quality of services they offered to their customers. Also, you need to check the quality of the material they use & methods they follow of packaging and moving and what type of equipment they use.

Read Reviews & Ratings: Also before choosing any home relocation services in India online you need to check the company's past history by checking previous customer reviews, feedback and star ratings.

Low-Cost Quotes: Never choose packers and movers in India who offer low-price quotes, they may be fraud or unprofessional companies which may involve you in moving scams without providing promised services.

Pay Attention Before Signing Papers: At the time of signing you need to read the companies terms and conditions carefully, clarify doubts, before signing any contract with the movers. Also it is advisable to collect an original copy of insurance policy papers if you have purchased.

Timing : Nowadays no one is having time to waste on the unprofessional work or process of packers and movers. The movers and packers which are having no experience give you a slower process than those who have experience. They always waste their time searching and monitoring. They always work very slow and inefficiently. But with experienced packers and movers of India, you will not face this problem. They are fully equipped and understand the process of the job correctly and they are aware of the types of materials to be used and how much people will be required to do packaging and loading of the items.

0 notes

Text

SBI Elite Credit Card

In today's digital age, credit cards have become an essential tool for managing financial transactions conveniently and securely. Among the prominent players in the credit card industry, SBI Credit Cards stand out as a reliable and customer-centric option. With a wide range of cards tailored to suit various lifestyles and financial needs, SBI Credit Cards offer numerous benefits and rewards to their users. Let's explore the features and advantages that make SBI Credit Cards an excellent choice for individuals seeking a reliable financial companion.

Benefits of SBI Elite Credit Card

Welcome Benefits

- Get e-gift voucher worth Rs. 5,000 Movies

- Free movie tickets worth Rs. 6,000 every year

- Transaction valid for at least 2 tickets per booking every month. Maximum discount is Rs. 250/ticket for 2 tickets only

Rewards

- Get 5X Reward Points on Dining, Departmental stores and Grocery Spends

- Earn 2 Reward Points per Rs. 100 on all other spends, except fuel

Milestone

- Earn upto 50,000 Bonus Reward Points worth Rs. 12,500 per year

- Earn 10,000 bonus Reward Points on achieving annual spends of Rs. 3 lakhs and 4lakhs

Travel

- Enjoy complimentary Trident Privilege Red Tier membership

- Enjoy 2 complimentary Domestic Airport Lounge visits every quarter in India

- Enjoy complimentary Club Vistara Silver membership

- Get 1 complimentary Upgrade Voucher

- Earn 9 Club Vistara Points for every Rs. 100 spent on Vistara flights

- Get exclusive 1,000 Welcome Points on registration

- Enjoy 1,500 Bonus Points on your first stay & additional Rs. 1,000 hotel credit on extended night stay, by using Promo code: SBITH

Others

- Lowest Foreign Currency Markup Charge of 1.99% on International usage

- Complimentary membership to the Priority Pass Program worth $99

- Dedicated assistance on flower delivery, gift delivery, online doctor consultation

- 1% fuel surcharge waiver, on every transaction between Rs. 500 to Rs. 4,000, at any petrol pump across the country (maximum surcharge waiver of Rs. 250 per statement cycle, per credit card account)

- Complimentary credit card fraud liability cover of Rs. 1 Lakh

Eligibility Criteria Salaried

- Age Group: 21 - 65 years

- Income Range: ₹20,000+

- Documents Required:

- Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, or any other government-approved ID

- Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Salary certificate, Recent salary slip, Employment letter, etc.

- You should be new to SBI Bank You must be an Indian resident

- Credit Score should be 730+

Eligibility Criteria Self-employed

❏ Age Group: 21-70 years❏ Income Range: ₹30,000+❏ Documents Required:

- Identity proof: Any one of the documents - Passport, PAN Card, Ration Card, Aadhaar Card, Voter ID Card, Driving Licence, , or any other government-approved ID

- Address proof: Any one of the documents - Telephone bill, Electricity bill, Passport, Ration card, Rental agreement, Aadhaar card, or any other government-approved ID

- Income Proof: Certified financials, Recent ITR (Income Tax Returns), Audited profit and loss statement or balance sheet, etc.

- You should be new to SBI Bank You must be an Indian resident

- Credit Score should be 730+

Application Process

Visit the SBI credit card website by clicking on the link shared by your advisor. Keep the following details handy to start the process

- Your PAN card

- Aadhaar card and

- Bank account details

01 Click on ‘Start apply journey’ Now, select any card of your choice and click on ‘Apply Now’ Enter your personal details such as name, mobile number, tick the terms & conditions checkbox and click on 'Continue'

02 Enter your professional details such as employment type, office address and click on 'Continue to Digilocker'

03 Enter your Aadhaar number, Security code(captcha) and click ‘Next’

04 Enter the OTP sent to your mobile number and click on 'Continue'

05 Your application has been

06 successfully submitted If your application is approved, the bank executive will contact you in the next 48 hours for verification and completion of KYC

- On completion of the due process, the bank will take a final decision on card approval

- Once approved, you will get the credit card within 7 to 15 days of the final decision

Help & Support FAQs

Experience Convenience and Rewards with SBI Credit Cards

In today's fast-paced world, financial transactions have become an integral part of our daily lives. Whether it's paying bills, shopping online, or dining out, having a reliable and rewarding credit card can make a significant difference. State Bank of India (SBI), one of the largest and most trusted banks in India, offers a range of credit cards tailored to suit various needs. With SBI credit cards, customers can experience convenience, security, and exciting rewards like never before.

Wide Range of Credit Cards to Suit Your Needs:

SBI understands that every individual has unique requirements when it comes to credit cards. That's why they offer an extensive range of credit cards, ensuring there's something for everyone. Whether you are a frequent traveler seeking travel rewards, a shopaholic looking for cashback offers, or someone who wants to build their credit score, SBI has the perfect credit card for you.

SBI Prime Card: This card is ideal for those who love to travel and indulge in luxury. With attractive travel benefits, complimentary lounge access, milestone rewards, and accelerated reward points, the SBI Prime Card is designed to provide a superior experience.

SimplyCLICK SBI Card: Geared towards the tech-savvy generation, this card offers exciting rewards on online shopping. Earn accelerated reward points on e-commerce transactions and access exclusive deals from partner websites.

SBI Card ELITE: For those who appreciate the finer things in life, the SBI Card ELITE is a premium offering that brings exclusive lifestyle privileges, golf privileges, and an extensive rewards program.

SBI SimplySAVE Card: Designed to make everyday expenses more rewarding, this card offers cashback on various spends such as groceries, dining, and department store purchases.

SBI IRCTC Card: Travel enthusiasts can make the most of this card as it provides excellent benefits on railway ticket bookings and other travel-related expenses.

Convenience and Security:

SBI credit cards are equipped with cutting-edge technology and security features, ensuring a safe and hassle-free experience for cardholders. With the added layer of security provided by the chip-and-PIN feature, customers can have peace of mind while making transactions at both physical stores and online portals. Moreover, SBI's 24x7 customer support is always available to assist with any queries or concerns, making the overall experience even more convenient.

Rewarding Loyalty:

One of the significant advantages of using SBI credit cards is the rewards program. Cardholders can earn reward points on every transaction and redeem them for a wide range of products, gift vouchers, or even to pay off outstanding bills. Additionally, SBI frequently offers exciting promotional campaigns, providing cardholders with the chance to earn bonus points and avail themselves of exclusive discounts.

Easy Bill Payments:

With SBI credit cards, paying utility bills becomes a breeze. Customers can set up autopay facilities for their bills, ensuring they never miss a due date. This feature not only saves time but also helps build a positive credit history, boosting one's credit score over time.

Financial Discipline and EMI Options:

SBI offers a convenient feature known as "Flexipay," which allows customers to convert big-ticket purchases into easy EMIs with attractive interest rates. This feature promotes financial discipline and empowers users to make essential purchases without straining their budget.

Contactless Payments:

SBI credit cards are contactless-enabled, making transactions quicker and more convenient. By simply tapping the card on the point-of-sale terminal, customers can make secure payments without the need to enter a PIN for small-ticket transactions.

Conclusion:

SBI credit cards have proven to be valuable financial tools for millions of individuals across India. The wide range of cards, coupled with convenience, security, and exciting rewards, makes SBI an excellent choice for both seasoned credit card users and those new to the world of credit. Whether you want to travel in style, earn cashback on everyday expenses, or experience financial flexibility, SBI has a credit card tailored to meet your needs. So why wait? Experience the world of convenience and rewards with SBI credit cards today!

- Is SBI Pulse credit card beneficial for fitness freaks?

Yes, you can say that the SBI Pulse credit card is made for fitness freaks, where the user gets a complimentary Noise ColorFit Pulse Smartwatch after paying the joining fee. You can track your fitness activities through this smartwatch.

- How can I access my FITPASS PRO membership using the SBI Card Pulse?

You will have to make a prior reservation using the FITPASS mobile application.

- Can I use SBI Card Pulse internationally?

Yes, SBI Card Pulse can be used in over 24 million outlets across the world.

- Is SBI Card Elite credit card internationally acceptable?

SBI ELITE credit card is accepted at over 24 million Visa outlets worldwide, including 3,25,000 outlets in India.

- Does SBI Card Elite credit card provide Fraud liability cover?

Yes, you get a cover of Rs. 1 Lakh against fraudulent transactions.

- Does SBI Card Elite credit card offer fuel surcharge waiver & if yes, where can I avail it?

Yes, SBI Elite Credit Card offers fuel surcharge waiver. It can be availed at any petrol pump in India.

- How can I connect with SBI Bank customer care?

Please call SBI's 24X7 helpline number i.e. 1800 1234 (toll-free), 1800 11 2211 (toll-free), 1800 425 3800 (toll-free),1800 2100(toll-free), or 080-26599990.

Congratulations!

Enjoy the benefits of SBI Credit Card.

Read the full article

0 notes

Text

Aadhaar Verification API: Redefining Trust in the Digital Age

In today's fast-paced digital world, trust and security are paramount. With the increasing reliance on online services, it has become crucial to verify the identities of individuals accurately and efficiently. Aadhaar Verification API emerges as a game-changer, offering a robust solution to redefining trust in the digital age.

The Power of Aadhaar Verification API

1. Introduction to Aadhaar

Aadhaar, a unique identification system in India, has transformed the way individuals verify their identities. With over a billion Aadhaar cards issued, it is the largest biometric ID system globally. Aadhaar contains essential information, including demographic and biometric data, making it a reliable source for identity verification.

2. Streamlined Verification Process

Aadhaar Verification API simplifies the verification process for businesses and organizations. By integrating this API into their systems, they can instantly verify individuals' identities, reducing the risk of fraud and ensuring a seamless user experience.

3. Enhanced Security

Security is a top priority in the digital age. The Aadhaar Verification API leverages biometric data, making it nearly impossible for fraudsters to impersonate someone else. This level of security ensures that only legitimate users gain access to services and benefits.

4. Versatile Applications

The versatility of Aadhaar Verification API extends across various industries. Whether it's banking, healthcare, government services, or e-commerce, this API can be tailored to meet the specific needs of different sectors, enhancing the overall user experience.

5. Cost-Efficiency

Implementing Aadhaar Verification API can lead to significant cost savings for businesses. By automating the verification process, organizations can reduce the need for manual verification, saving time and resources.

Why Choose Aadhaar Verification API?

6. Accuracy and Reliability

One of the primary reasons to choose Aadhaar Verification API is its unmatched accuracy and reliability. With biometric data at its core, it minimizes the chances of false identities and ensures that only authorized individuals gain access to services.

7. Compliance with Regulations

In an era of increasing data privacy regulations, Aadhaar Verification API is designed to comply with all relevant laws and regulations. This ensures that businesses using the API stay in line with legal requirements, avoiding potential penalties.

8. User-Friendly Integration

Integrating Aadhaar Verification API into existing systems is a seamless process. It is user-friendly and requires minimal technical expertise, making it accessible to a wide range of businesses.

9. Real-Time Verification

With Aadhaar Verification API, verification happens in real-time. This means that businesses can provide immediate access to services, improving user satisfaction and reducing waiting times.

10. Competitive Advantage

By implementing Aadhaar Verification API, businesses gain a competitive advantage. They can offer a more secure and efficient user experience, attracting and retaining customers in a crowded digital marketplace.

Conclusion

In an increasingly digital world, trust is the cornerstone of all interactions. Aadhaar Verification API has redefined trust by offering a secure, accurate, and cost-effective solution for identity verification. Its versatile applications and compliance with regulations make it a top choice for businesses across various industries. By embracing this technology, businesses can not only enhance security but also gain a competitive edge in the digital age. Aadhaar Verification API is more than just a tool; it's a testament to the power of innovation in redefining trust in the digital age.

0 notes

Link

0 notes

Text

HOW CAN A DIGITAL IDENTITY MAKE A DIFFERENCE IN THE LIVES OF PEOPLE?

A digital identity can make a difference in the lives of people. This has been exemplified by Aadhaar, which documented the biometric details of each and every citizen in India. Digital identity can help in realizing ideals that cannot be measured quantitatively. These include better access to education, healthcare, and labor markets. The primary goal that Aadhaar has achieved is to ensure inclusivity. In this blog, we will discuss the ways in which a digital identity can help people and governments.

Countries that are adopting a digital identity

Developing countries have tried to establish identification systems with different degrees of success.

• Malaysia, Brazil and Indonesia are a few countries which have partially managed to establish a credible identification system.

• The Brazilian government announced the launch of the Carteira de Identidade Nacional (CIN), which will replace the current national identity document called Registro Geral (RG). The card has a QR code intended to facilitate the identification of cardholders and prevent fraud.

• MyKAD is the identification system of Malaysia that can help a citizen make payments at public infrastructure places such as toll plazas, car parks, and railway stations. To prevent any fraud, the Malaysian ID card has biometric security information on a computer chip along with photo identification.

• Indonesian national identity card called Karta Tanda Penduduk (KTP) helps streamline the bureaucratic process.

Benefits of Aadhaar for Indians

UIDAI is promoting the Aadhaar Program to gather and manage the names, addresses, and biometric information of people in India in an effort to create a society in which the entire nation can enjoy equal access to public and financial services. The benefits of Aadhaar for Indians have been listed below.

Ensures inclusivity

With the help of digital identity, a government can ensure inclusivity in all the programs launched. Opening bank accounts will be easier for people as they will not have to show many documents. People who are below the poverty line have got Jandhan accounts opened with the help of Aadhaar, a digital identity. The aad-haar-enabled payment system has enabled financial inclusion for people at the bottom of the pyramid.

Reduces Leakages

Many schemes are launched by the government to benefit the people. Since they are marginalized, it is pertinent that they get the maximum benefit out of these schemes. However, leakages happen in the schemes of pensions, scholarships, and public distribution. By linking the bank account with the digital identity, it is possible to reduce the possibility of leakages. In India, Direct Benefit Transfer has become a reality with the help of Aadhaar.

Participation in democracy

Exercising franchise becomes easier because of digital identity. At polling booths, it is easy to identify a voter using a digital identity like Aadhaar. The use of ID proofs like driving licenses and PAN cards etc., has become redundant after Aadhaar became the universal identity for all Indians.

Mobility of Indians

With many Indians migrating to a different state to get a better job, a digital identity can help them in getting fresh documentation done. In a way, Aadhaar has improved the mobility of Indians, making their lives smooth.

Improves customer experience

Many banks are doing away with the physical verification of documents for opening accounts. E-KYC requires a person to upload a digital identity to get a bank account opened. Customer experience has improved due to Aadhaar.

Transparency

Authentication of a person is effortless with the help of digital identity. In this way, fraudulent practices like bogus beneficiaries and siphoning of funds can be checked efficiently.

NECI’s role in providing digital identity

NECI has played a stellar role in providing Indians with a digital identity. NECI provides a large-scale biometric identification system that utilizes fingerprints, face images, and iris images for the national identification system. The identification system of NECI utilizes three types of biometric information – fingerprints, face images, and iris images. The biometric information ensures that there is no duplication.

A unique 12-digit number is allotted to a citizen. A reliable national identification system should ensure that the same ID is not issued twice. NECI’s fingerprint and face identification technologies ranked first in the benchmark tests conducted by the National Institute of Standards and Technology in the United States.

Aadhaar has become a voice for the people of India. To get more details about how Aadhaar has changed the lives of Indians, please click on the link mentioned below

0 notes

Text

Cyber Crime Complaint Kaise Kare

Friends, if any online financial fraud or scam has happened to you, even if you are new to the channel like UPI App, then do not forget to subscribe. So let us quickly understand the whole process step by step [Sangeet] So the first step is NCRP. That is, to complain in the National Cyber Crime Reporting Portal, because without this there is no use of the remaining four processes, so first of all you have to visit this official site, the link of which is given below in the description, click from there and open it. So to make an online complaint, go to the Cyber Crime Report option and click on Financial Fraud, then scroll down the screen, click on File a Complaint, after that click on Accept.

And if you are complaining here for the first time, then first you will have to register here, for which you will click on Click Here for New User, then here you have to enter your details like select the state from which you are, then here you You will enter your email ID, then below you have to enter your mobile number and click on Get OTP. Now an OTP will come on this number, type it here and then enter the captcha code as written here and click on submit. Then in the next page you have to enter your personal details, like whatever you use in front of your name in the title, like Mr. Mrs. Doctor, Mr. Mrs., you have to tick it here, then below you have to write your full name.

Also Read- binance trading se bank account kese unfreeze karaye

And here your mobile number which you had just verified will come automatically. Then below you have to select your date of birth and gender and here you have to enter your email ID. Keep in mind that the mobile number and email ID you have given will be sent to all communication messages. It will be sent to you here, like your complaint number and whatever status of the complaint will be updated here, then here you have to select your father, mother, spouse, any one relation and write its name, after that at the bottom, at the end, you will get your Present address has to be mentioned wherever you live and here you will select the district, then below you have to select the police station near you, then click on Save and Continue here. Now you have to tell some things related to your complaint here. have to tell

So here you have to understand every option carefully because the information on this page is the most important, in which first of all you have to select the category of complaint, that is, how has fraud happened with you, like if someone has cheated on the social media platform, select the second option. Similarly, if someone has hacked your computer or laptop or there is cyber trafficking or fraud from online gambling or betting site, then select this option according to whatever incident has happened to you. After this, see its sub category below. Have to select, like above I had selected online financial fraud, then here I have to tell how online fraud happened to me like Aadhaar Enabled Payment System Fraud, if someone stole your Aadhaar details like fingerprint information and money from the bank account. If you want to remove, select this option

Also Read- Bank Account Freeze Ho Jaye To Kya kare

And if the fraud has happened by sending an email, then you will select this option and if someone has committed a fraud of money because of your credit card, debit card or phone SIM, then you will select this option, similarly if through demat account or e-wallet. Which is also called digital wallet or whether someone has committed fraud by calling or through internet banking or like UPI app. Select the name of the bank from which your money has been deducted and below select the UPI app which you used. If it was like amazonbusiness.in then you can enter it or leave it blank, then if you click on save here then all the details will appear in the table here and if money has been debited more than once then fill each and every detail in the same manner. If you click on save, all the transactions will appear here, now here under the suspect account details who has defrauded you.

If you have his account details then you can add it here by saying yes and if not then select no. Then after this here you have to tell the date and time of that incident. If you do not remember exactly then you can also fill it with idea. But it is necessary to fill it so that whatever money has been transferred can be tracked. Now here, if you have filed a complaint of fraud late then select Yes, otherwise select No. Then below you have to tell where online fraud has happened with you. For example, if someone has committed fraud through email, then the email ID of the scammer will have to be given below and if facebooksignup.in can tell how this fraud happened.