#gstr1

Text

GST Return Filing

Complete GST Service on one platform

0 notes

Text

Must watch...

High Court Judgement on Back Date GST cancellation...

For more information visit- gstkanotice.com or DM GST ka Notice

#best gst consultation in india#best gst lawyers in india#best taxation law firm#corporate lawyer in india#best gst services in india#gst#gst consultation firm#gst experts in india#gst india#gst help#high court#supreme court#gst registration#gstr1#gstr 3b#gstreturns#gst services#gst services in india#gst notice reply

1 note

·

View note

Text

Learn how to simplify GSTR-9 filing with our complete guide. Understand the essentials of the annual GST return, from data preparation to submission, and avoid common pitfalls to ensure timely and accurate filing.

0 notes

Text

Delhi GSTR 1 Quarterly Return Filing by Taxgoal

Streamline your GSTR 1 filing with Taxgoal's expert services. Our team ensures accurate and timely quarterly returns for your business in Delhi. Stay compliant, avoid penalties, and focus on growth while we handle the details. Contact us for efficient GSTR 1 filing solutions! Call us at +91 9138531153| To know more visit here: https://taxgoal.in/service/gst-return-filing/

#Taxgoal#GSTR1#QuarterlyReturn#DelhiTaxServices#GSTFiling#TaxConsultancy#GSTReturn#TaxServicesDelhi#TaxExperts#GSTCompliance

0 notes

Text

CA Audit Tips and Tricks For Tally Users

In today's fast-paced business environment, the ability to troubleshoot common audit queries is invaluable. Our blog covers a range of issues, from sales invoices not appearing in GSTR1 to expenses without GST. Explore step-by-step troubleshooting methods for resolving these issues within Tally, empowering you to streamline the audit process and impress clients with your expertise.

With the latest features in TallyPrime 3.0, auditing is simpler than ever. Explore new tools like voucher numbering series and filters designed for auditing tasks. These features make it easier to track transactions and analyze data, making audits smoother and faster.

Ready to tackle common audit challenges? Our blog covers everything from reconciling sales invoices to identifying expenses without GST. With our tips, you'll feel confident handling any audit situation. Don't miss out on becoming a Tally auditing pro!

To learn more about Audit Tips and Tricks For Tally, follow this link.

CA Audit Tips and Tricks For Tally

Visit our Website: Antraweb Technologies Pvt. Ltd.

#tally erp 9#tallyprime#tallysolutions#tally customization#accounting software#automation#tally customisation#Tally audit#TallyPrime 3.0#Sales invoice GSTR1#GSTR1#GSTR2A

0 notes

Text

GSTR-1 Guide Return Filing Date Revision

Unlocking the simplicity of GSTR-1! Your go-to resource for mastering GST return filing, format compliance, eligibility, and rules.

Read Our Detailed article in the below link 👇-

https://www.mygstrefund.com/GSTR-1-Guide-Return-Filing-Date-Revision

THANKS FOR READING!

We provide GST refund solutions for customers.

To know more please visit: www.mygstrefund.com

Contact Us: - +91 9205005072

Mail- [email protected]

1 note

·

View note

Text

All about the mistakes to avoid while filing GSTR 1

Introduction

In India, a comprehensive indirect tax known as the Goods and Services Tax (GST) is imposed on the provision of goods and services. Every person who has registered for GST is expected to submit a number of reports, including GSTR 1, a monthly or quarterly report that includes information on all outbound supplies made during the specified time. Businesses could find it challenging to submit GSTR 1 and other GST returns, and any errors in the GST filing could result in penalties and legal implications. We will go over the errors to avoid when submitting GSTR 1 in this article.

What errors should be avoided when submitting GSTR 1?

Several errors should be avoided when submitting GSTR 1. Following is a list of some of them:

1) Incomplete or incorrect data

The most frequent error made when filing GSTR 1 is giving false or incomplete information. This can cause inconsistencies in the return, which might get it rejected or get it under the authorities’ inspection. To prevent this, firms should make sure that all information about outward supply, such as the recipient’s name, address, and GSTIN, the goods’ or services’ HSN code, as well as the amount, price, and tax rate, is put accurately in the return.

2) Late GSTR 1 filing

Businesses also frequently file GSTR 1 after the deadline, which is another error. Penalties, interest, and possibly the cancellation of the registration may result from late GSTR 1 filing. Businesses should be sure to file the return by the deadline, which is the 11th of the month after the return is due for monthly filers and the 13th of the month after the return is due for quarterly filers, in order to prevent this.

3) Lack of data reconciliation

Businesses should make sure the information on the GSTR 1 corresponds to the books of accounts. Any data inconsistencies could cause problems during audits and inspections. Businesses should routinely reconcile the information in the GSTR 1 with their books of accounts to prevent this.

4) Debit and credit notes not being reported

Businesses also frequently err by neglecting to report credit notes and debit notes in the GSTR 1. Debit notes are issued when the value of the outgoing supplies increases, whereas credit notes are issued when the value of the outgoing supplies decreases. Debit and credit notes must be reported accurately to avoid errors in the return, fines, and legal ramifications. Businesses must make sure that all credit notes and debit notes are accurately documented in the GSTR 1 in order to prevent this.

5) Not reporting nil returns

Companies who didn’t produce any supplies for sale throughout the time should nevertheless submit a nil return. Penalties and legal problems may result from failure to comply. Businesses should be careful to file a nil return if they did not make any outward supplies throughout the period in order to prevent this.

6) Not reporting exports and deemed exports

The taxes paid on the inputs used to produce the goods or services can be refunded on exports and considered exports, which are zero-rated supply. Losing the refund is possible if exports and considered exports are not reported in the GSTR 1. Businesses should make sure to accurately record and deem exports in the return in order to prevent this.

7) Not reporting advances received

Advance payments made for the provision of goods or services must be disclosed in the GSTR 1. The return may be incorrect if advances are not reported, which could result in fines and other legal repercussions. Businesses should take care to accurately declare advances received in the return in order to avoid this.

8) Failing to file amendments

Businesses may be required to modify the GSTR 1 for a number of reasons, including erroneous information, changes to the recipient’s information, or termination of the supply. For businesses, not filing can have a variety of negative effects. Businesses must make sure that all of their sales data is submitted accurately and on time in GSTR 1 in order to avoid any penalties or compliance difficulties.

Conclusion

Businesses must take care to prevent frequent errors while filing GST Returns in order to avoid penalties and fines. The blunders listed above are a few of the most frequent ones that companies make when submitting GSTR 1. Businesses can simplify the tax system by avoiding these errors and making sure accurate and comprehensive information is entered into GSTR 1.

0 notes

Video

undefined

tumblr

What is GSTR-1? and When GSTR-1 Due?

Who Should File and How to File?

Book Your FREE DEMO for the Accounting Software.

#Grossaccountingsoftware#accounting#accountants#accountant#accounting software#bestaccountingsoftware#GST#GST India#gstr#gstr1#due date#filing

0 notes

Text

GST Amendments and Procedural Changes: Streamlining Compliance and Recovery

Title: GST Amendments and Procedural Changes: Streamlining Compliance and Recovery

Introduction

The Goods and Services Tax (GST) regime in India is an ever-evolving framework that seeks to enhance tax compliance and streamline processes for both taxpayers and authorities. In this vein, several crucial amendments and procedural changes have been recommended by the GST Council in its 48th…

View On WordPress

#gst#gstindiadaily#gstregistrations#inputtaxcredit#ITC#itcundergst#gstr1 vs gstr3b#gstr3b vs gstr2b#link of bank account

0 notes

Video

youtube

Reporting of Supplies to Un-Registered Dealers in GSTR1 / GSTR 5 - GSTN

0 notes

Text

GST Return Filing

All GST registered businesses have to file monthly or quarterly GST returns and an annual GST return based on the type of business. GST Return Filing is mandatory in nature and non – filing will attract penalty and may result of GST Cancellation also.

0 notes

Text

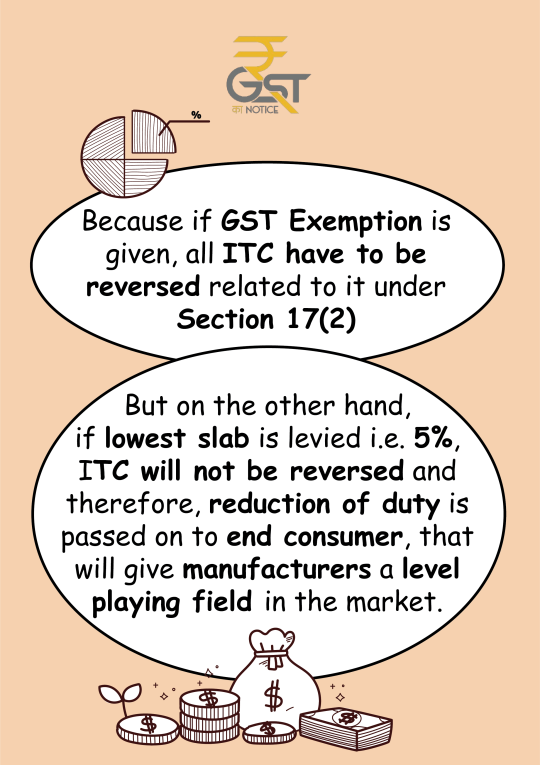

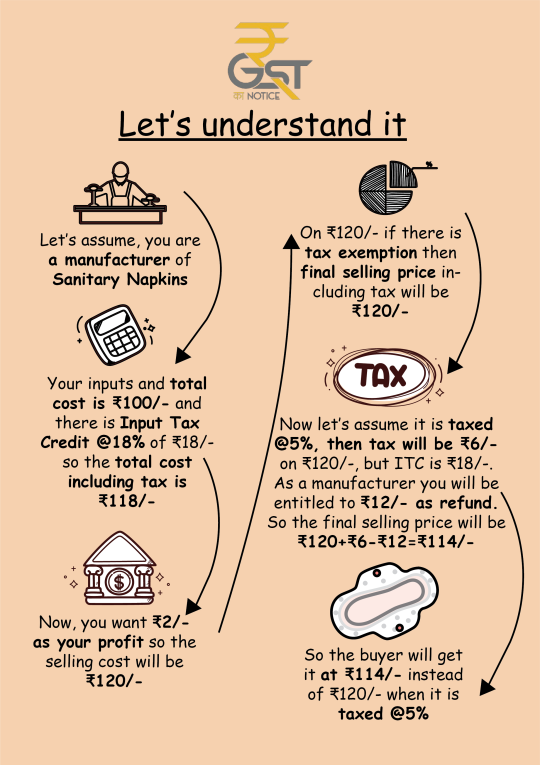

No positive effect of GST exemption on Sanitary Napkins....

GST Updates... For more updates visit- gstkanotice.com or DM us.

#gst #gstexemption #gstkanotice #cbic #CA #charteredaccountant #ev #electricvehicle #sanitarynapkins #vaccine #gstr1 #gstupdates #gsthelp #vendor #india #taxlawyer #tax #gstreturn

#GST#GST notices#GST services#GST help#GST India#GST experts in India#GST Notice Reply#Tax Assistance#tax law firm services#professional GST help#Best GST Services in India#GST Services in India#reply to GST Notices#Best GST Lawyers in India#Reply to GST Assessment#GST notice services#Best GST Consultation in India#Corporate Lawyer in India#GST Consultation firm#Best taxation law firm#GST ka Notice

1 note

·

View note

Text

BUSY 18 Software

BUSY 18 was an upgraded version of BUSY Accounting Software, but it has now been replaced by BUSY 21. The latest version offers features like direct GSTR1 uploads, WhatsApp API messaging, GSTR 2B reconciliation, and a cloud-synced mobile app, enhancing functionality and compliance. For more details, visit BUSY 18 Software https://busy.in/busy-18-software/

0 notes

Text

GST Return Filing Quarterly in Delhi

Taxgoal makes GST return filing easy and convenient for businesses in Delhi. With our quarterly GST return filing services, you can stay compliant with the latest tax regulations without the hassle. Our expert team ensures accurate and timely submissions, helping you avoid penalties. Focus on your core business activities while we take care of your GST returns. Trust Taxgoal for seamless GST compliance solutions in Delhi. To know more visit here: https://taxgoal.in/service/gst-return-filing-quarterly-package/

#Taxgoal#GSTR1#DelhiTaxFiling#QuarterlyFiling#GSTCompliance#EasyTaxFiling#GST#TaxCompliance#DelhiBusiness#DelhiEntrepreneurs

0 notes

Text

A Guide To Essential Reports In Oracle NetSuite For Indian CFOs

In the fast-paced world of Indian finance, accurate reporting isn’t just smart—it’s essential for CFOs. Meet Oracle NetSuite, your cloud-based ERP sidekick armed with a toolkit of India-focused reports tailored for the unique challenges of the Indian business landscape. NetSuite simplifies financial reporting, ensuring compliance and strategic insights for CFOs navigating the intricacies of Indian finance.

As CFOs navigate the twists and turns of India’s financial rules, let’s delve into NetSuite’s must-have reports:

1. GSTR1: Outward Supplies Report

The GSTR1 report captures details of outward supplies of goods and services. This monthly or quarterly report is vital for GST compliance, ensuring accurate representation of sales transactions.

2. GSTR2: Inward Supplies Report

Complementing the GSTR1, the GSTR2 report provides details of inward supplies. It helps reconcile and verify the input tax credit claimed by your organization against the tax paid by your suppliers.

3. GSTRB: Consolidated GST Return

The GSTRB is a consolidated GST Return form, encompassing outward and inward supplies along with tax liabilities. It serves as a comprehensive summary for GST filing.

4. TDS 26Q: TDS On Payments Report

This report focuses on TDS deducted on payments other than salaries. It’s essential for maintaining compliance with TDS regulations and provides a detailed view of deductor and deductee information.

5. TDS FILE WITH FUV Format

A format-compliant TDS report, this ensures your TDS details are compliant with regulatory requirements, covering deductor, deductee, and TDS amounts.

6. TCS: Tax Collected At Source Report

For businesses collecting tax at source, the TCS report is indispensable. It captures the collector’s details and the tax amounts collected, aiding in TCS compliance.

7. Purchase Register

The Purchase Register provides a detailed list of all purchases made by the organization, offering insights into vendor relationships and purchase expenses.

8. Sales Register

The Sales Register lists all sales transactions, offering a comprehensive view of revenue streams, customer relationships, and sales performance.

9. Schedule III AND IV: Financial Statement Schedules

These schedules are essential for preparing the balance sheet and profit and loss statement in compliance with statutory requirements, ensuring transparency and accuracy in financial reporting.

Conclusion

As an Indian CFO, leveraging these reports in Oracle NetSuite can streamline your financial operations, enhance compliance, and provide valuable insights for strategic decision making. By harnessing the power of these India-specific reports, you can navigate the intricacies of Indian finance with confidence and efficiency.

Explore NetSuite’s robust reporting capabilities and empower your finance team to drive success in the competitive Indian market.

Ready To Simplify Your Financial Reporting?

In the fast-paced world of Indian finance, accurate reporting isn’t just smart—it’s essential for CFOs. Meet Oracle NetSuite, your cloud-based ERP sidekick armed with a toolkit of India-focused reports tailored for the unique challenges of the Indian business landscape. NetSuite simplifies financial reporting, ensuring compliance and strategic insights for CFOs navigating the intricacies of Indian finance.

As CFOs navigate the twists and turns of India’s financial rules, let’s delve into NetSuite’s must-have reports:

1. GSTR1: Outward Supplies Report

The GSTR1 report captures details of outward supplies of goods and services. This monthly or quarterly report is vital for GST compliance, ensuring accurate representation of sales transactions.

2. GSTR2: Inward Supplies Report

Complementing the GSTR1, the GSTR2 report provides details of inward supplies. It helps reconcile and verify the input tax credit claimed by your organization against the tax paid by your suppliers.

3. GSTRB: Consolidated GST Return

The GSTRB is a consolidated GST Return form, encompassing outward and inward supplies along with tax liabilities. It serves as a comprehensive summary for GST filing.

4. TDS 26Q: TDS On Payments Report

This report focuses on TDS deducted on payments other than salaries. It’s essential for maintaining compliance with TDS regulations and provides a detailed view of deductor and deductee information.

5. TDS FILE WITH FUV Format

A format-compliant TDS report, this ensures your TDS details are compliant with regulatory requirements, covering deductor, deductee, and TDS amounts.

6. TCS: Tax Collected At Source Report

For businesses collecting tax at source, the TCS report is indispensable. It captures the collector’s details and the tax amounts collected, aiding in TCS compliance.

7. Purchase Register

The Purchase Register provides a detailed list of all purchases made by the organization, offering insights into vendor relationships and purchase expenses.

8. Sales Register

The Sales Register lists all sales transactions, offering a comprehensive view of revenue streams, customer relationships, and sales performance.

9. Schedule III AND IV: Financial Statement Schedules

These schedules are essential for preparing the balance sheet and profit and loss statement in compliance with statutory requirements, ensuring transparency and accuracy in financial reporting.

Conclusion

As an Indian CFO, leveraging these reports in Oracle NetSuite can streamline your financial operations, enhance compliance, and provide valuable insights for strategic decision making. By harnessing the power of these India-specific reports, you can navigate the intricacies of Indian finance with confidence and efficiency.

Explore NetSuite’s robust reporting capabilities and empower your finance team to drive success in the competitive Indian market.

Ready To Simplify Your Financial Reporting?

Learn More -

#CFO#Finance#OracleNetSuite#IntegsCloud#NetSuite#iPaaS#BusinessInsights#DigitalTransformation#ERP#FinanceReporting#Reporting#Visibility#financeReports#Reports

0 notes

Video

youtube

GST Reconciliation & mismatch Report in Seconds|GSTR1 - GSTR2A - GSTR2B

#GSTReconciliation #Report #Tally #Analytics #Suvit

0 notes