#high risk payment processing in uk

Explore tagged Tumblr posts

Text

Online Dating Merchant Account Solutions | Offshore Unipay

Get secure online dating merchant account solutions with Offshore UniPay. Accept payments globally with our high-risk payment gateway for dating websites.

#dating merchant account#merchant account for dating site#high risk payment processing in uk#offshore unipay#dating payment processing#dating payment processor

0 notes

Text

Gaming businesses in the UK face high chargebacks and strict regulations, making traditional payment processing challenging. A high-risk payment gateway ensures secure transactions, fraud protection, and seamless payments. It supports multiple currencies, fast payouts, and compliance with industry standards. Stay ahead in the gaming industry with a reliable, high-risk payment solution.

#high risk payment processing#radiant pay#merchant account providers#payment processing solutions in uk

0 notes

Text

Offshore Company Registrations with Bank Account?

In today's globalized economy, businesses are increasingly looking beyond domestic borders to "optimize their operations", reduce costs, and gain access to international markets. One strategy that has gained popularity among entrepreneurs and investors is the establishment of offshore companies. In this comprehensive guide, we'll explore the concept of "offshore company registrations", their benefits, considerations, and the process of setting up an offshore company with a bank account.

Understanding Offshore Companies

Definition and characteristics of offshore companies

"Offshore companies are entities registered" in a jurisdiction different from where they conduct their primary business activities or where their owners reside. These companies often enjoy favorable tax treatment, regulatory advantages, and enhanced privacy compared to domestic entities.

Reasons why businesses choose to register offshore Businesses may opt for "offshore company registrations" for various reasons, including tax optimization, asset protection, confidentiality, access to global markets, and simplified regulatory requirements.

Legal and financial implications of offshore company registration While offshore companies offer several benefits, they also come with legal and financial considerations. It's crucial to understand the regulatory environment, tax implications, and compliance requirements associated with offshore operations.

Benefits of Offshore Company Registrations

Tax advantages Offshore companies often benefit from low or zero corporate tax rates, allowing businesses to minimize their tax liabilities and retain more profits.

Asset protection By holding assets offshore, businesses can shield them from potential legal claims, creditors, or other financial risks.

Privacy and confidentiality Offshore jurisdictions typically offer strict confidentiality laws, ensuring the privacy of company ownership and financial information.

Access to global markets Offshore companies can facilitate international trade and investment by providing a platform to conduct business across borders more efficiently.

Simplified regulatory requirements Some offshore jurisdictions have lenient regulatory frameworks, reducing administrative burdens and compliance costs for businesses.

Considerations Before Registering an Offshore Company

Jurisdiction selection Choosing the right jurisdiction is critical, as it determines the regulatory environment, tax implications, and overall suitability for the business's objectives.

Legal requirements and regulations Businesses must comply with the legal and regulatory requirements of both the offshore jurisdiction and their home country to avoid legal issues and potential penalties.

Banking and financial considerations Access to banking services is essential for offshore companies. However, some jurisdictions may have restrictions or challenges in opening and maintaining bank accounts.

Costs involved in setting up and maintaining an offshore company While "offshore company registrations" offer potential cost savings, businesses should consider the upfront and ongoing expenses associated with incorporation, administration, and compliance.

Risks and challenges associated with offshore operations Offshore companies may face risks such as regulatory changes, political instability, reputational damage, and increased scrutiny from tax authorities.

Steps to Register an Offshore Company with Bank Account

Conducting thorough research Before proceeding with offshore company registration, businesses should conduct comprehensive research on potential jurisdictions, legal requirements, and service providers.

Choosing the right jurisdiction Selecting a jurisdiction that aligns with the business's objectives, preferences, and industry requirements is crucial for successful offshore operations.

Hiring professional services Engaging legal, financial, and other professional services is advisable to navigate the complexities of "offshore company registrations" and ensure compliance with relevant laws and regulations.

Preparing and submitting necessary documents Businesses must gather and submit the required documents, such as identification proofs, business plans, and incorporation forms, to the offshore jurisdiction's authorities.

Opening a bank account for the offshore company Securing banking services is an integral part of "offshore company registrations in UK". Businesses should approach reputable banks in the chosen jurisdiction and fulfill their account opening requirements.

Compliance with ongoing regulatory requirements Once the "offshore company" is registered and the bank account is opened, it's essential to maintain compliance with ongoing regulatory requirements, including filing annual reports, tax returns, and other obligations.

Common Challenges and Solutions

Regulatory compliance issues Navigating complex regulatory frameworks and staying compliant with evolving laws and "regulations can be challenging for offshore companies". Seeking professional advice and regular updates on regulatory changes is essential.

Banking restrictions and challenges Some offshore jurisdictions may "face banking restrictions" or challenges due to regulatory scrutiny or international sanctions. Exploring alternative banking options or engaging specialized banking services can help overcome these challenges.

Tax implications and controversies Offshore companies may face scrutiny and controversies related to tax avoidance or evasion. Maintaining accurate records, adhering to tax laws, and seeking tax advice from experts can mitigate tax-related risks.

Reputation risks associated with offshore entities Offshore companies often face stigma and negative perceptions due to associations with tax evasion, money laundering, or illicit activities. Maintaining transparency, ethical business practices, and good corporate governance can help mitigate reputational risks.

#Offshore Company Registration#Offshore payment processors#Offshore high risk payment gateway#Offshore payment gateway high risk#Offshore online payment processing#Offshore payment service provider#Offshore merchant payment services#Offshore bitcoin debit card#Offshore Company#Offshore companies#Offshore company in UK#Offshore company in USA#Offshore company Registration in UK#Offshore company Registration in USA#Offshore company formation#Offshore incorporation services

0 notes

Text

Good News - March 8-14, 2024

Like these weekly compilations? Support me on Ko-fi! Also, if you tip me on here or Ko-fi, at the end of the month I’ll send you a link to all of the articles I found but didn’t use each week - almost double the content! (I’m new to taking tips on here; if it doesn’t show me your username or if you have DM’s turned off, please send me a screenshot of your payment)

1. Colorado could bring back wolverines in an unprecedented rewilding effort

“A bipartisan group of Colorado lawmakers are proposing legislation to reintroduce wolverines, one of the country’s rarest carnivores, into a state primed with deep snow and high mountains. The unprecedented move would be the first wolverine reintroduction in North America, and is part of an ongoing effort by Coloradans to restore the state’s native species.”

2. heat pumps slash emissions even if powered by a dirty grid

“Installing a heat pump now is better for the climate, even if you run it on U.S. electricity generated mostly by fossil fuels. […] Across the 48 continental states, RMI found that replacing a gas furnace with an efficient heat pump saves emissions not only cumulatively across the appliance’s lifetime, but also in the very first year it’s installed.”

3. Bald eagles seen nesting in Toronto for first time in city’s recorded history

“Presence of birds proof of improving health of city’s green spaces, as they are highly sensitive to environmental disturbances”

4. Good news for coral reef restoration efforts: Study finds 'full recovery' of reef growth within four years

“"We found that restored coral reefs can grow at the same speed as healthy coral reefs just four years after coral transplantation," says Ines Lange of University of Exeter, UK. "This means that they provide lots of habitat for marine life and efficiently protect the adjacent island from wave energy and erosion."”

5. The rewilding project bringing back an ancient breed of cattle to Portugal

“For millennia, grazing aurochs created open spaces for other species to thrive. As the closest to the extinct auroch depicted on the prehistoric engravings, Goderie says tauros can fulfil [sic] a similar ecological function that is vital for biodiversity. "Natural grazing will lead to more natural processes that are missing from local ecosystems, more habitats and more biodiversity," he says.”

6. Sycamore Gap: New life springs from rescued tree

“The horticulturalists also successfully planted seeds from the Sycamore Gap tree, now its descendants. Five months on, they are looking after nine surviving grafted plants and 40-50 seedlings.”

7. Massachusetts library will excuse overdue book charges in exchange for cat photos: ‘Feline Fee Forgiveness’

““Some of the staff were in a meeting and they were coming up with ways to bring people back to the library, and they thought, ‘What if we removed as many barriers as possible and told people they could show us a picture of a cat, draw a picture of a cat or just tell us about a cat?'””

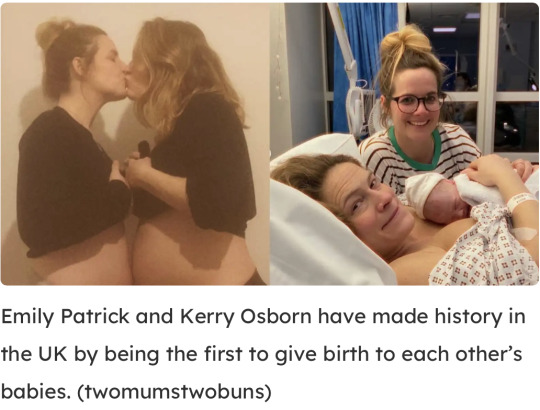

8. Lesbian couple give birth to each other’s baby in UK first

“Their success marks the first time the procedure – which allows lesbian parents to simultaneously share in the pregnancy process, with one supplying eggs and the other carrying the baby – has been carried out in the UK.”

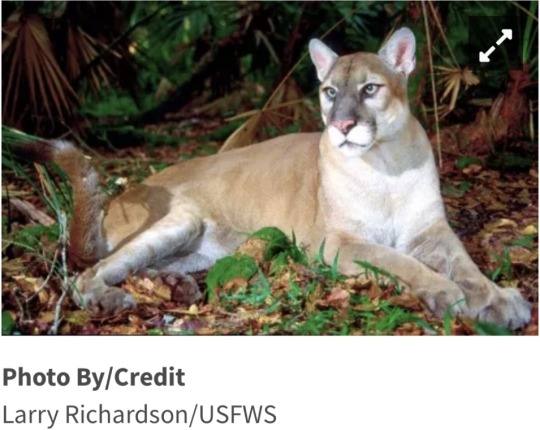

9. Biden-Harris administration has established four new units in the National Wildlife Refuge System

“The new four-million-acre conservation area will provide crucial protected wildlife corridors, enhance outdoor recreation access to the public and bolster climate resilience in southwest Florida.”

10. New truck front to save lives

“[B]etter truck designs can reduce passenger car compartment deformations by 30-60 percent, which reduces the risk of injury for the car occupants. Deformation of the truck was also reduced in sensitive areas and improved truck driver safety and cargo security.”

March 1-7 news here | (all credit for images and written material can be found at the source linked; I don’t claim credit for anything but curating.)

#hopepunk#good news#bald eagle#eagles#trees#sycamore gap#aurochs#portugal#cattle#heat pump installation#wolverine#colorado#coral reef#library#cats#lgbtqia#lgbtq#ivf#florida#puma#cougar#wildlife#habitat restoration#trucks#safety#animals#ecology#tauros#rewilding#uk

8 notes

·

View notes

Text

A Comprehensive Guide to Blockchain-as-a-Service (BaaS) for Businesses

In today's digital landscape, a blockchain app development company plays a crucial role in transforming industries with decentralisation, immutability, and transparency. However, building and managing a private blockchain network can be complex and costly, which deters many businesses. Blockchain-as-a-Service (BaaS) simplifies this by allowing businesses to leverage blockchain without the challenges of infrastructure development.

This comprehensive blog covers the hurdles businesses face when adopting blockchain, how BaaS can bridge these gaps, and why it is a game-changer for various sectors.

I. Challenges for Businesses in Blockchain Adoption

Despite the undeniable potential of blockchain technology, businesses face several significant challenges when contemplating its adoption:

Limited Internal Expertise: Developing and maintaining a private blockchain network requires a skilled team with deep blockchain knowledge, which is often lacking in many organisations.

High Cost: The infrastructure investment and ongoing maintenance fees associated with blockchain can strain budgets, especially for small and medium-sized businesses (SMBs).

Integration Complexities: Integrating a blockchain network with existing enterprise systems can be challenging, requiring seamless data flow and compatibility between the blockchain system and legacy infrastructure.

II. Understanding BaaS and Its Operational Fundamentals

Blockchain-as-a-Service (BaaS) simplifies the development and deployment of blockchain applications by providing a cloud-based platform managed by third-party providers. The BaaS market, valued at $1.5 billion in 2024, is projected to grow to $3.37 billion by 2029, reflecting a robust 17.5% CAGR.

Key Components of BaaS

Cloud-Based Infrastructure: Ready-to-use blockchain infrastructure hosted in the cloud, eliminating the need for businesses to set up and maintain their networks.

Development Tools and APIs: Access to a suite of tools and APIs to create and deploy blockchain applications quickly.

Platform Support: Compatibility with various blockchain protocols such as Ethereum, Hyperledger Fabric, and Corda, offering flexibility to businesses.

Managed Service Model: Providers handle tasks like network maintenance, security updates, and scalability.

Pay-as-you-go Pricing Model: Reduces upfront investment and operational costs associated with blockchain software development.

III. Business Benefits of Blockchain as a Service

Adopting BaaS offers numerous advantages, including:

Enhanced Scalability: Businesses can easily scale their blockchain network as their needs grow.

Increased Efficiency: Eliminates intermediaries and streamlines transactions, improving productivity.

Enhanced Transparency: Tamper-proof records of transactions foster trust and improve auditability.

Reduced Costs: The pay-as-you-go model eliminates large upfront investments.

Improved Security: Built on secure cloud infrastructure with robust encryption protocols.

Enhanced Customer Engagement: Facilitates secure and transparent interactions with customers, building trust and loyalty.

IV. Industry-wise Key Use Cases of Blockchain as a Service

BaaS is transforming business operations across various industries:

Finance: Streamlines trade finance, secures cross-border payments, and enhances KYC and AML compliance.

Supply Chain Management: Improves transparency and traceability of goods, automates logistics processes, and reduces counterfeiting risks.

Healthcare: Facilitates secure sharing of patient data and tracks the provenance of pharmaceuticals.

Government: Enhances transparency with secure citizen identity management and verifiable voting systems.

V. Region-wise Adoption of BaaS

The BaaS market is experiencing rapid growth worldwide:

North America: Leading with over 35% of global revenues, driven by early adoption.

Europe: Countries like Germany, the UK, and France are at the forefront.

Asia-Pacific: China, India, Japan, and South Korea are key contributors.

Rest of the World: Growing adoption in South & Central America, the Middle East, and Africa.

VI. Why Choose a Prominent BaaS Provider?

Opting for a blockchain app development company that offers BaaS can significantly impact the success of your blockchain initiatives:

Specialised Expertise: Providers possess in-depth knowledge and experience in blockchain technology.

Cost Efficiency: Eliminates the need for in-house infrastructure investment and maintenance.

Time Savings: Accelerates the development process and reduces time-to-market.

Scalability and Flexibility: Offers scalable solutions that can adapt to business growth.

Risk Mitigation: Providers handle security, maintenance, and updates.

Conclusion

By adopting Blockchain-as-a-Service (BaaS), businesses can simplify blockchain integration and focus on innovation without the complexities of managing infrastructure. Systango, a leading blockchain app development company, offers tailored BaaS solutions that help businesses leverage blockchain technology for enhanced efficiency, scalability, and security. As one of the top , Systango also excels in integrating AI solutions to drive business growth and efficiency.

Original Source - https://systango.medium.com/a-comprehensive-guide-to-blockchain-as-a-service-baas-for-businesses-5c621cf0fd2f

2 notes

·

View notes

Text

Short Term Loans UK: The Best Substitute for Quick Borrowing

The lender's unwanted fees for the loan process have now been paid. At this point, short term loans UK are presented to you. These loans are designed specifically for salaried people to successfully cover unforeseen needs in between two consecutive paychecks. As a result, you don't need to worry about unpaid invoices. You can guarantee the correct loan quantity under this planned financial solution without providing any kind of security to safeguard the money that is being supplied to you.

There are several benefits that come with short term loans UK, including amounts between £100 and £2500 and repayment terms of 14 to 30 days. This can be used to pay for prior credit card payments, travel expenses, medical treatment bills, electricity bills, grocery shop bills, child tuition or school fees, and so on.

Negative credit criteria such as arrears, foreclosure, late or missing payments, CCJs, IVAs, or bankruptcy shouldn't be detested. The reason for this is that the lender designed short term loans UK direct lender specifically for borrowers with unfavorable credit histories. All customers must meet certain requirements, such as being at least eighteen years old, being a citizen of the United Kingdom, having a permanent job with a stable income, and having an open checking account.

What is a direct lender for short-term loans with high acceptance rate?

When it comes to other loan kinds and even other short term loans, a high acceptance payday loan is one that has a higher approval rate. This is typically the case with short term loans direct lenders since these borrowers are those that are struggling financially, have a bad credit history, and are probably going to be turned down by other payday lenders. Payday loans with high acceptance rates come in several forms. Let's examine this.

Payday loans from direct lenders are more likely to be accepted than loans from banks or other mainstream lenders since they place a higher priority on affordability than credit score. Those who would like to borrow money but have negative credit might apply for their short term loans UK direct lender. Guaranteed loans, sometimes known as guarantor loans, are among the most popular kinds of negative credit loans. This is the situation where someone, generally a close friend or relative, undertakes to repay your loan on your behalf in the event that you are unable to. However, there are many lenders giving bad credit payday loans that do not require guarantors, so don't worry if you're looking for high acceptance payday loans direct lenders no guarantor.

Your application is processed by loan brokers, like Payday Quid, and forwarded to several direct lenders on their panel. Brokers match you with a suitable lender by comparing your information to their requirements. After that, you will work with the direct lender to finalize the same day loans UK arrangement. Because brokers may locate you a new lender if your current one rejects you, this means that brokers will have a far higher acceptance rate than direct lenders. The best part is that brokers conduct all of this using a soft search, saving you the risk of doing numerous credit checks when you switch lenders. Using Payday Quid to apply doesn't even impact your credit score.

https://paydayquid.co.uk/

4 notes

·

View notes

Text

Building the Future of Finance: A Comprehensive Guide to Fintech App Development

In an age of rapid digital transformation, financial services are being revolutionized by technology at an unprecedented pace. From mobile banking to AI-powered investment platforms, Fintech apps are reshaping how we interact with money. Whether you're a startup founder or a product manager at an established financial institution, understanding the core elements of fintech app development is critical to staying ahead.

This guide walks you through the key stages, challenges, and trends in building a successful fintech application.

Why Fintech Matters More Than Ever

The global fintech market is projected to reach $936 billion by 2030, driven by increasing demand for contactless payments, online lending, digital wallets, and crypto-based services. Consumers expect seamless, secure, and personalized financial experiences—creating both opportunity and pressure for fintech innovators.

Types of Fintech Applications

Before development begins, it’s important to define the niche your app will serve. Common categories include:

Mobile Banking Apps (e.g., Revolut, Chime)

Peer-to-Peer Payment Systems (e.g., Venmo, PayPal)

Investment & Trading Platforms (e.g., Robinhood, eToro)

Lending Platforms (e.g., LendingClub)

Personal Finance Management Tools (e.g., Mint, YNAB)

Insurtech Apps

Blockchain/Crypto Wallets & Exchanges

Key Features of a Successful Fintech App

To meet user expectations and regulatory standards, your app must offer:

Secure Authentication (Biometrics, MFA)

Real-Time Transaction Updates

Data Encryption & Protection

Regulatory Compliance (e.g., KYC, AML, PSD2)

User-Friendly Interface (UI/UX)

Integration with Banks and Payment Gateways

AI/ML for Personalization or Risk Assessment

Tech Stack for Fintech App Development

Here’s a typical stack to consider:

Frontend:

Frameworks: React Native, Flutter, Swift (iOS), Kotlin (Android)

Tools: Redux, Axios

Backend:

Languages: Node.js, Python (Django), Java (Spring Boot)

Databases: PostgreSQL, MongoDB

APIs: Plaid, Stripe, Paystack, Yodlee

Cloud Services: AWS, Azure, Google Cloud

Security:

OAuth 2.0

SSL/TLS Encryption

Tokenization

End-to-End Encryption

Regulatory & Compliance Considerations

Navigating legal regulations is crucial. Depending on your region and service type, ensure compliance with:

PCI DSS (for card payments)

GDPR/CCPA (data privacy)

KYC & AML (identity and fraud prevention)

PSD2/Open Banking Regulations (EU/UK)

Working with a legal advisor or compliance consultant during the early development stages is highly recommended.

Development Process in 6 Key Stages

Market Research & Ideation Validate your idea by studying user needs, competitors, and industry trends.

Prototyping & UX/UI Design Create wireframes and interactive prototypes to visualize the user journey.

Architecture & Tech Stack Planning Choose scalable, secure, and interoperable technologies.

Core Development Build frontend, backend, and APIs while adhering to secure coding practices.

Testing & QA Conduct unit tests, security audits, and user acceptance testing (UAT).

Deployment & Maintenance Launch on app stores or web, monitor performance, and roll out updates continuously.

Common Challenges in Fintech App Development

Ensuring High-Level Security

Complying with Complex Financial Regulations

Achieving Smooth Integration with Third-Party APIs

Building User Trust in Early Adoption

Scaling Infrastructure to Handle High Volume Transactions

Future Trends in Fintech Development

Stay ahead by exploring these emerging trends:

AI-Powered Financial Advisors (Robo-Advisors)

Decentralized Finance (DeFi)

Voice-Activated Banking

Biometric and Behavioral Security

Embedded Finance & Banking-as-a-Service (BaaS)

Final Thoughts

Fintech app development is more than just coding a payment feature—it’s about transforming the way people experience finance. With the right strategy, technology, and security approach, you can build applications that are not only functional but genuinely change lives.

Whether you’re creating a neobank or an AI-driven investment tool, success lies in combining innovation, compliance, and trust.

0 notes

Text

Streamline Your Sales with the Right Adult Merchant Account

Running a business in the adult industry comes with unique challenges—especially when it comes to payment processing. Whether you’re selling adult toys online or managing a subscription-based platform, traditional financial institutions often label your business as “high-risk.” That’s where OffshoreUniPay steps in, offering tailored adult merchant account solutions designed for your industry's needs.

Why You Need a Specialized Merchant Account for an Adult Toy Business

If you operate an eCommerce store that sells adult products, you've likely faced issues with declined payments, frozen accounts, or even sudden service termination from mainstream providers. This is because adult businesses are frequently categorized under high-risk sectors due to reputational concerns, chargeback rates, and regulatory scrutiny.

A merchant account for an adult toy store needs to be more robust, compliant, and flexible. At OffshoreUniPay, we provide secure and discreet payment solutions that ensure your customers can pay without friction while you receive payments quickly and reliably.

Choose the Right Adult Payment Processor

Not all processors are created equal—especially when it comes to handling adult industry transactions. You need an adult payment processor that understands your challenges and supports recurring billing, subscription management, and chargeback prevention.

OffshoreUniPay’s processing solutions are fully equipped to handle online sales, mobile payments, and international transactions. Plus, our risk management tools help protect your business from fraud and chargebacks, giving you peace of mind and operational stability.

High-Risk Merchant Account UK Solutions with Global Reach

If you're based in the UK, you’ve likely encountered even tighter regulations when it comes to payment processing for adult businesses. Our high risk merchant account UK service is specifically designed for companies in regions with strict compliance frameworks.

OffshoreUniPay partners with a global network of acquiring banks to offer you reliable, cross-border solutions. Whether you operate in the UK or internationally, we can help you scale your adult business without facing the roadblocks of traditional banking systems.

Why OffshoreUniPay?

Specialized Industry Focus: We’ve helped hundreds of adult businesses thrive by offering tailored merchant solutions.

Global Acquiring Network: Accept payments in multiple currencies from around the world.

Fast Approvals: Get your adult merchant account set up quickly with minimal paperwork.

Full Support: 24/7 expert support from professionals who understand the adult industry inside and out.

Don’t let payment restrictions stall your growth. With OffshoreUniPay, you get a trusted partner that supports your adult business with secure, scalable, and seamless merchant services.

#adult merchant account#merchant account for an adult toy#adult payment processor#high risk merchant account uk

0 notes

Text

Simplify Your High Risk Transactions with E-Check Payment Processing

Quadrapay has been a reliable source of low-risk merchant accounts for businesses across the US, Canada, the UK, and the European Union since 2016. Our team has designed this guide, which we refer to as the Swiss Army knife of low-risk merchant accounts. In this article, we will discuss various aspects related to low-risk merchant accounts. You can identify industries considered low-risk due to minimal fraud and legal complications. Such industries maintain a consistent transaction pattern. Reading this guide, you will be able to understand whether you qualify as a low-risk merchant.

e-check payment processing

E-check payment processing involves a customer authorizing payment from their bank account, which is then electronically transferred via the Automated Clearing House (ACH) network to the merchant's account. An electronic check, or e-check, is similar to a paper check, except that customers provide their bank account information, including the routing number and payment authorization, through an online form for electronic processing.

Paper checks are dying off, but high transaction fees make credit card payments a terrible alternative. E-checks are a more affordable alternative to credit cards, faster than paper checks, and allow you to automate your billing process with recurring charges. Not all e-check offerings are the same: only Quadrapay gives you everything you need to accept e-check alongside credit cards in a single checkout with instant funds verification.

High-risk merchant account

A high-risk merchant account is a specialized credit card processing solution designed for businesses that experience high chargebacks, above-average fraud, and rigorous regulatory scrutiny. Specialized high-risk processors provide these accounts. Merchants from industries such as dating, gaming, vaping, CBD, paraphernalia, business coaching, and adult e-commerce utilize these credit card processing accounts.

Finding the right high-risk credit card processing company is not an easy task. Many merchants continue to submit applications but never find a solution. The QuadraPay team has massive experience working with high-risk PSPs and merchants. Our team has written this guide for you. The guide examines various factors associated with high-risk merchant account processing. After reading it, you can easily find the best high-risk merchant account provider for your business.

0 notes

Text

Common Myths and Facts About Robotic Knee Replacement in Delhi

Robotic technology has revolutionized the medical field, especially in orthopedics, where precision, accuracy, and patient recovery matter more than ever. Robotic Knee Replacement in Delhi has emerged as a top choice for patients suffering from chronic knee pain, arthritis, and degenerative joint issues. Yet despite its growing popularity, several myths continue to circulate about this innovative procedure.

These misconceptions can deter patients from seeking the care they need or make them hesitant about opting for advanced treatments. In this blog, we will debunk common myths and present the facts, helping you understand why choosing the Best Robotic Knee Replacement in Delhi and experienced Robotic Knee Replacement Surgeons in Delhi can be life-changing.

Myth 1: Robotic Knee Replacement Means a Robot Performs the Surgery Alone

Fact: One of the most common myths is that the robot performs the surgery independently. In reality, the robot is a tool used by the surgeon. It assists in enhancing the surgeon's precision and accuracy but never acts autonomously.

Robotic Knee Replacement Surgeons in Delhi are extensively trained to operate robotic systems. They control the robotic arm and use real-time data and 3D imaging to make informed decisions during the procedure. The robot enhances their ability to make precise incisions and implant placements, but the surgeon remains fully in control throughout.

Myth 2: Robotic Knee Replacement Is Still Experimental

Fact: Robotic-assisted knee replacement is FDA-approved and widely practiced in leading hospitals across the globe. In India, and particularly in Delhi, this technique is being successfully performed with high patient satisfaction rates.

Top hospitals offering the Best Robotic Knee Replacement in Delhi utilize advanced systems like MAKO, NAVIO, and ROSA. These platforms have been extensively tested, validated, and adopted in medical centers worldwide, including those in the US, UK, and Europe.

Myth 3: It Is Only Suitable for Younger Patients

Fact: Another misconception is that robotic knee replacement is only ideal for younger, active individuals. The truth is, patients of all age groups can benefit from Robotic Knee Replacement in Delhi, provided they are medically fit for surgery.

In fact, many elderly patients with severe osteoarthritis have experienced faster recovery and better mobility outcomes with robotic-assisted surgery compared to traditional methods. The procedure’s precision and minimally invasive nature make it suitable for a wide demographic.

Myth 4: Robotic Surgery Takes Longer Than Traditional Surgery

Fact: While the planning and setup phase of robotic surgery might take a bit longer due to the detailed mapping and imaging, the actual surgical procedure is often faster and more efficient.

Robotic Knee Replacement Surgeons in Delhi report that once familiar with the system, the total time in the operating room becomes comparable to or even shorter than traditional surgery. Moreover, the reduced risk of complications and faster recovery time outweigh the minimal increase in preparation time.

Myth 5: Robotic Knee Replacement Is Too Expensive

Fact: It’s true that robotic knee replacement may have a slightly higher upfront cost compared to traditional surgery. However, when you factor in the overall benefits—shorter hospital stay, quicker recovery, fewer complications, and minimal need for revision surgery—the cost difference narrows significantly.

Many hospitals offering the Best Robotic Knee Replacement in Delhi also provide flexible payment plans and insurance coverage. The long-term cost savings and improved quality of life make it a worthwhile investment for most patients.

Myth 6: The Recovery Process Is the Same as Traditional Surgery

Fact: One of the biggest advantages of Robotic Knee Replacement in Delhi is the faster and smoother recovery process. The robotic arm allows surgeons to preserve more of the natural bone and tissue, leading to less post-operative pain and quicker mobility.

Patients who undergo robotic procedures often begin walking within 24–48 hours after surgery and can resume light activities within a couple of weeks. This is a stark contrast to traditional knee replacement, where recovery can be slower and more painful.

Myth 7: Robotic Surgery Has Higher Risk of Complications

Fact: In truth, robotic surgery tends to have lower risk of complications. The precision of robotic systems ensures accurate implant placement, reducing the chances of alignment issues, premature wear, and joint instability.

Moreover, experienced Robotic Knee Replacement Surgeons in Delhi take stringent safety measures and follow protocols that further minimize risks. Infection rates, blood loss, and readmission rates are generally lower with robotic-assisted procedures compared to conventional techniques.

Myth 8: All Hospitals Offering Robotic Surgery Provide the Same Results

Fact: The success of robotic surgery depends significantly on the expertise of the surgeon and the quality of the facility. Not all hospitals offering Robotic Knee Replacement in Delhi are created equal.

When choosing where to undergo the procedure, consider:

Surgeon’s experience and qualifications

Hospital infrastructure and robotic systems

Post-operative care and rehabilitation programs

Patient testimonials and success rates

Facilities that offer the Best Robotic Knee Replacement in Delhi typically combine cutting-edge technology with highly skilled professionals to ensure optimal outcomes.

Myth 9: You Cannot Have a Revision Surgery After Robotic Replacement

Fact: Another false belief is that robotic surgery limits the ability to undergo revision surgery if needed in the future. This is not true. In fact, robotic-assisted procedures often lead to better outcomes during revision surgeries because of the precise documentation and implant alignment achieved during the initial procedure.

Should a revision ever be required, surgeons will have detailed data about your knee structure and implant positioning, making the next procedure safer and more effective.

Myth 10: You’ll Have Visible Scars from Robotic Surgery

Fact: Thanks to minimally invasive techniques used in robotic knee replacement, scarring is minimal. The incisions are smaller than those used in traditional surgery, leading to better cosmetic results and faster wound healing.

Patients receiving the Best Robotic Knee Replacement in Delhi often express satisfaction not only with the pain relief and functionality they regain but also with the aesthetic outcome of their surgery.

Why Are Patients Choosing Robotic Knee Replacement in Delhi?

Delhi has quickly become a hub for advanced orthopedic procedures. The availability of top-tier hospitals, experienced Robotic Knee Replacement Surgeons in Delhi, and the latest robotic platforms make it an ideal destination for patients from across India and abroad.

Benefits of undergoing Robotic Knee Replacement in Delhi include:

High success rates

Personalized surgical planning

Faster recovery and rehabilitation

Lower risk of complications

Affordable and transparent pricing

Testimonials and Real-Life Results

Patients who once struggled with daily mobility, joint stiffness, and chronic pain now lead active lives thanks to robotic-assisted surgery. Here are just a few outcomes:

A 58-year-old woman with advanced osteoarthritis walked without a cane just three days post-surgery.

A 70-year-old retired teacher resumed cycling six weeks after his robotic knee replacement.

A young athlete, previously sidelined by knee pain, returned to light sports within two months of undergoing the Best Robotic Knee Replacement in Delhi.

These real-life cases demonstrate the transformative impact of robotic surgery and debunk the misconceptions surrounding it.

Conclusion

With any medical advancement, it’s natural for myths and misunderstandings to emerge. But when it comes to Robotic Knee Replacement in Delhi, the facts speak for themselves. The procedure is safe, effective, and backed by cutting-edge technology and experienced surgeons.

By choosing the Best Robotic Knee Replacement in Delhi and relying on the expertise of seasoned Robotic Knee Replacement Surgeons in Delhi, patients are achieving better outcomes, faster recoveries, and improved quality of life.

Don’t let myths keep you from exploring the best treatment option for your knee pain. Consult with a robotic knee replacement expert today and take the first step toward a pain-free, mobile future.

#Robotic Knee Replacement Surgeons in Delhi#Best Robotic Knee Replacement in Delhi#Robotic Knee Replacement in Delhi

0 notes

Text

DJK LAW GROUP helps you to recognize the scam and recover your loss

With the rapid development of fintech, cryptocurrencies and online trading platforms have gained huge popularity among investors. However, this surge has also attracted numerous scams disguised as legitimate investments. From beginners to seasoned investors, anyone can fall victim to a well-packaged fraud and suffer significant financial loss.

DJK LAW GROUP(https://www.djkllp.com/), a U.S.-based law firm with extensive experience in financial fraud cases, specializes in helping victims recover losses. This article outlines common crypto and fake platform scams, teaches you how to identify them, and explains how DJK LAW GROUP uses legal tools to safeguard investor rights.

Cryptocurrency Scams: High-Tech Disguises for Classic Fraud Fraudulent platforms claiming to offer crypto investments, trading, or mining opportunities often share the following traits:

1)Promise of High Returns with Low Risk Scammers lure victims by advertising extremely high annual returns—sometimes over 100%.

2)“International Platform” Illusion Fake platforms present polished websites, claim regulation by global financial authorities, and even forge licenses.

3)Assigned “Advisors” for Trust Building Victims are paired with personal “account managers” to encourage ongoing investment.

4)Withdrawal Restrictions When victims try to withdraw, the platform delays or refuses with excuses like “taxes due” or “system maintenance,” then disappears.

Fake Platforms: Multi-Layered Schemes Beyond crypto, fake forex, gold, and binary options platforms are also widespread. Common tactics include:

1)Fake Trading Data: The backend controls profits and losses, showing victims only virtual gains.

2)Leverage Manipulation: Victims are encouraged to increase leverage, risking more capital.

3)Sudden Account Termination: Once a victim suspects fraud, their account may be closed or deleted without notice.

How to Identify Scam Platforms 1)Verify Regulatory Licenses Legit platforms are regulated by bodies like the U.S. SEC, UK FCA, or Australia’s ASIC. Check official sites for license status.

2)Check Domain Registration Scam sites often have recently registered, anonymous domains. Legit platforms display clear company information.

3)Avoid Blind Trust in Social Media Ads Scams often spread via WeChat, TikTok, or Instagram. Be wary of unsolicited recommendations or suspicious links.

DJK LAW GROUP: Expertise in Fraud Recovery Victims of tech-savvy, international financial scams often face difficulty gathering evidence or pursuing justice. DJK LAW GROUP provides:

1)Professional Investigative Team Tracks fund flows, identifies key players, and works with law enforcement to gather actionable evidence.

2)Cross-Border Legal Tools Utilizes U.S. federal courts to issue TROs (Temporary Restraining Orders) and subpoenas to freeze assets and gather information.

3)Tailored Legal Strategies Each case is evaluated individually to maximize recovery prospects.

4)No Upfront Fees (in select cases) Contingency-based services available to minimize financial burden on victims.

Case Study In 2023, DJK LAW GROUP helped a Chinese investor recover over $700,000 lost to a fake crypto platform “BitEx Pro.” The victim was recruited via a Telegram group, showed fake profits, and was later blocked from withdrawals.

Upon investigation, DJK LAW GROUP traced the funds through a Caribbean shell company and a U.S. payment processor. With court-issued subpoenas and negotiation, over 70% of the funds were recovered.

Conclusion: Act Fast, Fight Smart While financial scams are becoming more sophisticated, timely legal action can make a major difference. DJK LAW GROUP is committed to helping victims pursue justice and reclaim their financial security.

If you or someone you know has fallen victim to such a scheme, contact DJK LAW GROUP immediately to stop further loss and begin the recovery process.

1 note

·

View note

Text

Top 9 High-Risk Payment Processing Companies in the UK

In the world of digital transactions, businesses considered "high-risk" often face challenges when it comes to payment processing. Whether you operate in industries like CBD, IPTV, online gaming, or other high-risk sectors, finding a reliable payment processor can be tricky. The UK is home to several companies that specialize in providing high-risk payment solutions, ensuring smooth transactions and financial security.

In this blog, we’ll dive into the top 9 high-risk payment processing companies in the UK that offer tailored solutions for businesses facing higher financial risks.

1. OffshoreUniPay

OffshoreUniPay has made a name for itself as one of the most reliable high-risk payment processing companies in the UK. Specializing in industries like IPTV, CBD, and online gaming, they offer customized high-risk payment solutions in the UK. OffshoreUniPay provides a seamless merchant account setup, fraud protection, and multi-currency support, making it a go-to option for businesses looking for secure payment gateways.

Key Features:

High-risk merchant account approval

Strong fraud protection system

Multi-currency payment processing

2. Paytriot

Paytriot is another reputable high-risk payment processor based in the UK. They specialize in offering flexible solutions tailored to businesses with higher-than-normal chargebacks or industries classified as high-risk, such as adult entertainment, gaming, and forex. Paytriot provides quick onboarding and multiple payment gateway integrations.

Key Features:

Quick onboarding process

24/7 customer support

High approval rates for high-risk businesses

3. WorldPay

WorldPay, a global leader in payment processing, has carved out a specific niche for high-risk businesses in the UK. They offer high-risk payment solutions in the UK with a strong emphasis on fraud prevention and compliance with industry regulations. WorldPay is known for handling large-scale transactions for high-risk industries such as travel and nutraceuticals.

Key Features:

Extensive fraud protection

Tailored services for high-risk sectors

Global payment acceptance

4. Cardstream

Cardstream is a UK-based high-risk payment processing company that offers a robust and flexible solution for businesses that require custom payment gateways. Their platform supports a wide range of high-risk industries, including forex, CBD, and online betting. Cardstream stands out with its white-label payment services and multi-currency options.

Key Features:

White-label payment gateway options

Full PCI DSS compliance

Comprehensive reporting and analytics

5. iPayTotal

iPayTotal specializes in high-risk payment processing and provides tailored merchant accounts for a variety of industries including CBD, online gambling, and cryptocurrency. They offer chargeback management services and fraud prevention tools to help high-risk businesses maintain smooth operations.

Key Features:

Advanced fraud detection

Chargeback management system

High-risk industry expertise

6. GSPay

GSPay is a high-risk payment processing company that focuses on providing secure payment gateways for industries like e-commerce, forex trading, and adult entertainment. GSPay offers flexible payment solutions and reliable customer support to ensure businesses in the UK can easily process payments while minimizing risk.

Key Features:

Secure payment gateways

Real-time reporting

Specialized services for e-commerce and forex

7. Allied Wallet

Allied Wallet has been a popular choice for businesses looking for high-risk payment solutions in the UK. Their services cover industries such as gaming, online dating, and travel, providing businesses with secure, scalable payment solutions. Allied Wallet offers a wide array of services, including fraud prevention, multi-currency support, and recurring billing.

Key Features:

Multi-currency support

Fraud prevention tools

Recurring billing for subscription-based businesses

8. EmerchantPay

EmerchantPay is a high-risk payment processing company that offers payment solutions tailored to businesses in high-risk industries like forex, digital content, and online retail. They provide comprehensive fraud management and security features, as well as a global payment network that allows businesses to accept payments in multiple currencies.

Key Features:

Global payment acceptance

Comprehensive fraud management

Multi-currency support

9. Instabill

Instabill specializes in high-risk payment solutions and has extensive experience with industries like adult entertainment, gaming, and nutraceuticals. With strong fraud protection and a dedicated account management team, Instabill ensures that high-risk businesses in the UK can access secure and efficient payment processing services.

Key Features:

Dedicated account management

Strong fraud protection

Flexible payment gateway options

Conclusion

Finding the right high-risk payment processing company is crucial for businesses operating in industries where transaction risks are higher. Whether you're in the CBD industry, forex trading, or online gaming, the companies mentioned above offer high-risk payment solutions in the UK to ensure smooth, secure, and compliant transactions. From fraud protection to multi-currency support, these payment processors have the tools and expertise to help your business succeed in a challenging financial landscape.

If you’re in the UK and in need of a reliable high-risk payment processing company, consider these top options to ensure your business remains on the path to growth.

#high risk payment processing in UK#high risk payment processing#high risk payment processor#offshore unipay#high risk merchant services in UK

0 notes

Text

Why Gaming Businesses in the UK Need a High-Risk Payment Gateway

The UK online gaming industry is a dynamic and lucrative market, but it also presents unique challenges for businesses. One of the most critical aspects is securing a reliable and efficient payment gateway. Traditional payment processors may be hesitant to work with gaming companies due to the inherent risks associated with the industry. This is where a specialized high-risk payment gateway becomes indispensable.

What Makes Gaming a High-Risk Industry?

The gaming industry is considered high-risk due to several factors:

Chargebacks: Chargebacks are frequent in gaming transactions, often due to disputes over in-game purchases, unauthorized transactions, or subscription cancellations.

Fraud: The gaming industry is susceptible to various forms of fraud, including account takeovers, identity theft, and money laundering.

Regulatory Compliance: The UK Gambling Commission (UKGC) has strict regulations regarding anti-money laundering (AML) and Know Your Customer (KYC) procedures, which require robust compliance measures.

Volatility: The gaming industry can experience significant fluctuations in transaction volumes, making it challenging for traditional payment processors to manage.

Benefits of a High-Risk Payment Gateway for Gaming Businesses

Enhanced Security: High-risk payment gateways are equipped with advanced fraud detection and prevention tools, such as AI-powered algorithms and machine learning models, to minimize fraudulent transactions.

Improved Chargeback Management: These gateways offer robust chargeback management solutions, including dispute resolution services and fraud prevention tools, to minimize chargeback rates.

Regulatory Compliance: High-risk payment processors are well-versed in the UKGC regulations and can help gaming businesses maintain compliance with all relevant AML and KYC requirements.

Increased Approval Rates: Specialized gateways have a deeper understanding of the gaming industry's unique characteristics, leading to higher approval rates for transactions.

Seamless Integration: High-risk payment gateways are designed for easy integration with various gaming platforms and software.

24/7 Support: Reliable customer support is crucial for resolving issues promptly and ensuring business continuity.

Radiant Pay: Your Trusted Partner for UK Gaming Businesses

Radiant Pay is a leading provider of high-risk payment gateway solutions for the UK gaming industry. We offer:

UKGC-Licensed Processing: We are fully licensed and regulated by the UKGC, ensuring compliance with all relevant regulations.

Advanced Fraud Prevention: Our state-of-the-art fraud detection systems utilize AI and machine learning to identify and prevent fraudulent transactions.

Robust Chargeback Management: We offer comprehensive chargeback management services to minimize disputes and protect your revenue.

Seamless Integration: Our payment gateway integrates seamlessly with various gaming platforms and software.

Dedicated Account Management: Our team of experts provides dedicated account management and 24/7 customer support to address any concerns promptly.

Conclusion

Choosing the right payment gateway is crucial for the success of any UK gaming business. By partnering with a specialized high-risk payment processor like Radiant Pay, you can:

Enhance security and reduce fraud.

Improve chargeback management and minimize losses.

Ensure compliance with all relevant regulations.

Boost transaction approval rates.

Streamline payment processing operations.

Contact Radiant Pay today to learn more about our comprehensive payment solutions for the UK gaming industry.

#high risk payment processing#radiant pay#high-risk payment gateway#payment processing solutions in uk

0 notes

Text

Top Security Features in Modern Card Payment Machine UK

In today’s fast-paced retail and digital environment, secure transactions are the cornerstone of consumer trust. As card payments continue to dominate in the UK, ensuring payment security is essential for businesses of all sizes. A modern card payment machine UK is more than just a transaction tool—it’s a sophisticated device built with powerful security measures. From encrypted data transfers to fraud detection algorithms, these machines are designed to protect both merchants and consumers. At Compare Card Processing, we understand the critical role that security plays in shaping consumer behavior and supporting regulatory compliance.

End-to-End Encryption Protects Every Card Transaction

Modern Card Payment Machine UK systems now include end-to-end encryption (E2EE) to protect cardholder data from the moment the card is tapped or inserted. This encryption ensures that sensitive data cannot be intercepted or tampered with during transmission. Whether payments are processed online or in-store, E2EE secures the full path from the terminal to the payment processor. For merchants using Compare Card Processing, this feature translates to reduced data breach risk and enhanced customer trust.

PCI DSS Compliance Ensures Secure Card Handling Standards

Every reputable card payment machine in the UK must meet Payment Card Industry Data Security Standard (PCI DSS) compliance. This set of regulations governs how payment data is stored, processed, and transmitted. PCI-compliant machines adhere to best practices in both hardware and software, protecting merchants from liability and fines in case of a breach. Compare Card Processing provides only machines that meet or exceed PCI standards, giving businesses peace of mind. With rising cases of cyber fraud, adherence to such global standards is not just about compliance—it’s about building a secure payment environment.

Tokenization Masks Card Details During Processing

Another key security layer built into the card payment machine UK systems is tokenization. Rather than transmitting actual card numbers, machines convert card data into a non-sensitive, randomly generated string—known as a token. This token can be used for recurring billing or refunds, but it’s meaningless to hackers if intercepted. This technology dramatically lowers the chances of financial data theft. Businesses that use tokenization through Compare Card Processing enjoy an added level of transaction safety without compromising user experience or speed at checkout.

Fraud Detection Algorithms for Real-Time Protection

Advanced card payment machine UK models are now equipped with real-time fraud detection tools. These algorithms evaluate transaction patterns, device behavior, and geolocation to identify suspicious activities. When a potential risk is flagged, the transaction can be paused, declined, or escalated. For businesses partnered with Compare Card Processing, these intelligent systems mean proactive defense against costly fraud. By identifying and reacting to anomalies instantly, fraud detection tools add another powerful layer of protection to modern payment systems.

Tamper-Resistant Hardware Prevents Physical Breaches

Security isn’t only about digital threats—physical tampering is also a concern. Each card payment machine UK used by Compare Card Processing is equipped with tamper-evident and tamper-resistant hardware. These features prevent unauthorized access to internal components or installation of skimming devices. If tampering is detected, the machine will automatically shut down to protect sensitive data. This is especially crucial for high-traffic locations like retail counters or kiosks, where terminals are publicly accessible. With anti-tampering design, merchants can confidently operate in any environment.

Secure Wireless and Contactless Connectivity Options

With the rise of contactless and mobile payments, secure connectivity is essential. Every wireless card payment machine UK must ensure that Bluetooth, Wi-Fi, or 4G connections are encrypted and shielded from interference. Card Processing machines support multiple secure communication protocols to reduce vulnerability. Whether accepting payments curbside or at a trade show, businesses benefit from fast, safe connections that keep transactions flowing smoothly. This mobility combined with security provides flexibility without sacrificing customer data protection.

Software Updates Keep Security Features Up-To-Date

Ongoing software updates play a vital role in protecting every card payment machine UK from emerging threats. Outdated firmware can leave systems exposed, which is why Compare Card Processing ensures all terminals receive timely patches. These updates often include bug fixes, security enhancements, and compliance changes. Automated updating reduces manual work for business owners while ensuring machines are protected 24/7. Keeping software current is one of the most overlooked yet crucial parts of a well-secured payment system.

Conclusion

The landscape of payment processing is constantly evolving, and so are the threats that come with it. That’s why understanding the security features of a modern card payment machine in the UK is essential for any business that values its customers’ trust. From encryption and tokenization to fraud detection and tamper-resistant hardware, these machines are engineered to protect every transaction. At Compare Card Processing, we help businesses choose devices with the highest security standards and most advanced features. Investing in the right card payment machine not only safeguards your revenue but also enhances your brand's credibility in a competitive marketplace.

0 notes

Text

Using Data Analytics and AI to Uncover Procurement Irregularities

Introduction

Government procurement processes often involve millions—or even billions—of dollars in public spending. With this scale comes increased risk of fraud, waste, and abuse. Traditional audit methods alone may not be enough to detect sophisticated schemes. Today, data analytics and artificial intelligence (AI) are emerging as powerful tools to identify procurement irregularities and support real-time oversight.

What Are Procurement Irregularities?

Procurement irregularities refer to deviations from lawful or ethical standards in public purchasing. These can include bid rigging, inflated pricing, fake vendors, overbilling, conflicts of interest, or fraudulent invoicing. Many of these schemes are difficult to detect manually, particularly when they involve complex transactions across multiple agencies or regions.

The Role of Data Analytics in Procurement Oversight

1. Detecting Anomalies

Data analytics allows for the rapid review of large datasets, such as procurement logs, invoices, contract histories, and vendor records. By setting benchmarks and norms, analysts can identify anomalies like:

Duplicate invoices or payments

Unusual price variations between suppliers

Repeated awards to a single vendor

Short procurement windows for high-value contracts

2. Pattern Recognition

Repeated procurement behaviors—Indicators of government procurement fraud such as consistently rounding contract amounts or last-minute bid submissions—can be indicators of collusion or fraud. Data analytics helps uncover these patterns by scanning across years and departments.

3. Cross-Referencing Data

By linking procurement data with employee records, company registrations, or bank transactions, analysts can identify conflicts of interest or relationships between officials and suppliers.

How Artificial Intelligence Enhances Detection

1. Predictive Modeling

AI systems can be trained using historical fraud data to predict the likelihood of fraud in new transactions. For example, if a supplier profile shares characteristics with past fraudulent vendors, the AI system can flag it for closer inspection.

2. Natural Language Processing (NLP)

AI-powered NLP tools can analyze textual data, such as emails, procurement justifications, or internal memos, to detect suspicious language or unauthorized communications that suggest irregular activity.

3. Machine Learning Algorithms

Machine learning continuously improves its detection capabilities by learning from new data inputs. It can automatically adapt to emerging fraud schemes and offer increasingly accurate insights over time.

Real-World Applications

1. Government Auditors

National audit agencies in countries like the UK, Brazil, and South Korea use AI and analytics tools to scan procurement records in real time. These systems can flag potential issues before contracts are awarded or payments are made.

2. Anti-Corruption Commissions

AI is used to build fraud risk scores for vendors or contracts, allowing investigators to prioritize high-risk cases for deeper review.

3. Public Procurement Portals

Some governments have integrated AI into open data portals, where civil society groups and journalists can access and analyze procurement data to ensure transparency.

Benefits of Data Analytics and AI in Procurement

Speed and Efficiency: Analyze thousands of transactions in seconds

Scalability: Monitor large and complex procurement systems across departments

Objectivity: Remove human bias in fraud detection

Prevention: Identify fraud risks before funds are disbursed

Challenges and Considerations

1. Data Quality and Integration

Analytics is only as good as the data it processes. Fragmented, outdated, or inaccurate data limits the effectiveness of AI systems.

2. Privacy and Ethical Concerns

Use of personal or financial data must comply with privacy laws and ethical guidelines to avoid misuse.

3. Cost and Expertise

Deploying AI tools requires investment in technology and skilled personnel capable of managing and interpreting the outputs.

Conclusion

The integration of data analytics and AI into procurement oversight is transforming the fight against fraud and corruption. By automating anomaly detection, predicting risk, and enabling real-time monitoring, these technologies offer governments a smarter, faster way to protect public funds. While challenges remain, the potential for increased efficiency, accountability, and transparency makes AI and data analytics indispensable in modern procurement systems.

0 notes