#homeownership barriers

Text

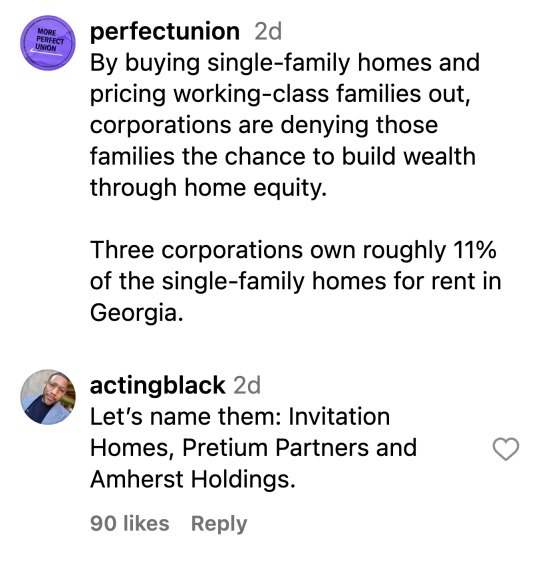

#housing inequality#corporate ownership#home equity#affordable housing#real estate market#wealth disparity#housing crisis#single-family homes#working-class families#corporate landlords#Georgia housing market#property investment#economic disparity#housing affordability#rental market#housing market inequality#corporate real estate#wealth gap#homeownership barriers#housing investment#financial disparity#real estate monopoly#housing affordability crisis#rental housing#economic inequality#property ownership#housing accessibility#corporate influence#affordable homeownership#investment firms in real estate

140 notes

·

View notes

Text

Opinion-Joe Biden: We must keep marching toward Dr. King’s dream

From the Joe Biden Washington Post opinion piece August 27, 2023

Sixty years ago, the Rev. Martin Luther King Jr. and hundreds of thousands of fellow Americans marched on Washington for jobs and freedom. In describing his dream for us all, Dr. King spoke of redeeming the “promissory note to which every American was to fall heir” derived from the very idea of America — we are all created equal and deserve to be treated equally throughout our lives. While we’ve never fully lived up to that promise as a nation, we have never fully walked away from it, either. Each day of the Biden-Harris administration, we continue the march forward.

That includes a fundamental break with trickle-down economics that promised prosperity but failed America, especially Black Americans, over the past several decades. Trickle-down economics holds that taxes should be cut for the wealthiest Americans and biggest corporations, that public investments in priorities such as education, infrastructure and health care should be shrunk, and good jobs shipped overseas. It has exacerbated inequality and systemic barriers that make it harder for Black Americans to start a business, own a home, send their children to school and retire with dignity.

Vice President Harris and I came into office determined to change the economic direction of the country and grow the economy from the middle out and bottom up, not the top down. Our plan — Bidenomics — is working. Because of the major laws and executive orders I’ve signed — from the American Rescue Plan, the bipartisan infrastructure law, the Chips and Science Act, the Inflation Reduction Act, my executive orders on racial equity and more — we’re advancing equity in everything we do making unprecedented investments in all of America, including for Black Americans.

Black unemployment fell to a historic low this spring and remains near that level.More Black small businesses are starting up than we’ve seen in over 25 years. More Black families have health insurance. We cut Black child poverty in half in my first year in office. We aredelivering clean water and high-speed internet to homes across America. We’re taking on Big Pharma to reduce prescription drug costs, such as making the cost of insulin for seniors $35 a month. We’re taking the most significant action on climate ever, which is reducing pollution and creating jobs for Black Americans in the clean energy future.

This administration will continue to prioritize increasing access to government contracting and lending. We awarded a record $69.9 billion in federal contracts to small, disadvantaged businesses in fiscal 2022. We’re taking on housing discrimination and increasing Black homeownership. To date, we’ve invested more than $7 billion in historically Black colleges and universities to prepare students for high-growth industries. We’ve approved more than $116 billion in student loan debt cancellation for 3.4 million Americans so that borrowers receive the relief they deserve. And a new student debt repayment plan is helping Black students and families cut in half their total lifetime payments per dollar borrowed. We’re doing all of this by making sure the biggest corporations begin to pay their fair share, keeping my commitment that Americans earning less than $400,000 a year not pay a single penny more in federal taxes.

And to help guide these policies, I made it a priority to appoint Black leaders to my Cabinet, my staff, in the judiciary and to key positions in agencies such as the Federal Reserve to ensure policymakers represent the experiences of all Americans in the economy.

But we know government can’t do it alone. Private-sector leaders have rightly acted to ensure their companies are more reflective of America, often in response to their employees, their customers and their own consciences. Right now, the same guardians of trickle-down economics who attack our administration’s economic policies are also attacking the private sector and the views of the American people. A recent poll from the nonpartisan Black Economic Alliance Foundation shows overwhelming bipartisan support for promoting diversity as central to a company being more innovative and more profitable, and central to fulfilling the promise of our country for all Americans. Despite the attacks, we all must keep pushing to create a workforce that reflects America.

For generations, Black Americans haven’t always been fully included in our democracy or our economy, but by pure courage and heart, they have never given up pursuing the American Dream. We saw in Jacksonville, Fla., yet another community wounded by an act of gun violence, reportedly fueled by hate-filled animus. We must refuse to live in a country where Black families going to the store or Black students going to school live in fear of being gunned down because of the color of their skin. On this day of remembrance, let us keep showing that racial equity isn’t just an aspiration. Let us reject the cramped view that America is a zero-sum game that holds that for one to succeed, another must fail. Let us remember America is big enough for everyone to do well and reach their God-given potential.

That’s how we redeem the promissory note of our nation.

15 notes

·

View notes

Text

Wednesday, February 21, 2024

High-profile Republicans head for the exits amid House GOP dysfunction

(CNN) The GOP is facing a grand old exodus as the House of Representatives continues to struggle through one of the most turbulent sessions of Congress ever. So far, the 118th Congress has seen a historically-long race for speaker, the ousting of that speaker, an expulsion of a member, and a multitude of failed votes despite the GOP’s majority. 23 GOP Representatives have resigned or declared that they won’t be running for re-election, including five House committee chairs. Some Republicans are not concerned. “Brain drain? Why don’t you survey the country and see if there is any brain to drain in Congress. Congress has a 20% approval rating. Most of what we do to the country is bad,” said House Freedom Caucus Chairman Bob Good. “I think the retirements are a wonderful thing … I have no concerns, zero concerns. We probably need a few more retirements.”

The Great Compression: Smaller Houses

(NYT) America is the land of the free, the home of the brave, and the country where everything is just bigger. At least, that used to be true—now, as the cost of materials, land, and mortgages continue to rise, people are looking into smaller and smaller houses for a chance at home ownership. Builders have begun constructing ever-smaller homes (sometimes the size of studio apartments) in recent years as part of an effort to tap into the first-time home buyer market. “Their existence is telling,” said one economist. “All the uncertainty over the past few years has just reinforced the desire for homeownership, but land and material prices have gone up too much. So something has to give, and what builders are doing now is testing the market and asking what is going to work.” Suburban developments across the country have joined the trend, building more 800-square-foot “tiny homes” and cutting back on the 2,000-square-foot, two-story cul-de-sac houses that Americans have been sold for decades.

Why some travelers are skipping the US: ‘You guys are not afraid of this?’

(USA Today) What Uneaka Daniels experienced the last couple of times she was in the United States was enough to keep her away for a long time. Bermuda-born and raised Daniels was in Atlanta in 2019 and decided to get her hair done. On her way to the salon, she stopped a man to ask for directions. Suddenly, everyone ducked. It was a drive-by. “I could actually see the gun and see it being fired,” she told USA TODAY. “The people on the street acted…as if it didn’t happen, and I’m here trying to crouch behind a tree. I said, ‘You guys are not afraid of this,’ and he said, ‘It happens so often.’” Besides this experience and another, Daniels has been turned off by the U.S. due to the rise of mass shootings and rates of homelessness. For the past four years, she’s avoided travel to the U.S. A growing number of international travelers are opting out of trips to the U.S. There were 12 million fewer visitors in 2023 than in 2019, according to a recent study by the U.S. Travel Association and EuroMonitor International. The U.S. ranked 17th out of the top 18 travel markets, slotting in just above China, with one major factor being safety following visa time barriers and the strength of the U.S. dollar.

Pro-Israel group targets Post reporter

(Semafor) Pro-Israel groups, deeply critical of American news outlets such as the Washington Post over their coverage of the war in Gaza, have been working in public and behind-the-scenes to discredit specific journalists seen as biased against Israel. The 10/7 Project, a consortium of five Jewish organizations, has been keeping tabs on reporters that it felt were reporting and tweeting unfairly about Israel, and putting pressure on major national news organizations to punish or remove these reporters from the beat. In particular, the group has singled out the Washington Post and its foreign correspondent Louisa Loveluck, who has covered the war in Gaza with an emphasis on Palestinian civilians impacted by the violence. The group has compiled a dossier complaining about everything from her current reporting to her past tweets and participation in college activism against tuition fees in the UK in an effort to get her taken off the story of Israel’s war with Hamas.

Afghans blocked from UK by special forces’ veto

(BBC) Afghan commandos accompanied British special forces on some of the most dangerous missions of the war in Afghanistan. When the Taliban swept to power in August 2021, soldiers in these units were among the groups most at risk of reprisals. They were eligible to apply for resettlement to the UK. But leaked documents seen by the BBC show UK special forces rejected hundreds of applications, despite some containing compelling evidence of service alongside the British military. Dozens have reportedly been beaten, tortured, or killed by the Taliban since. “I was sure that my British colleagues and friends, who we worked for several years alongside, would help me to evacuate to safety. Now I feel that the sacrifices I made have been forgotten,” one told the BBC. “I have been left alone in the midst of hell.” At the time the applications were vetoed, UK Special Forces were at the centre of an independent inquiry, to which Afghan Special Forces members could have been asked to provide evidence, had they been in the UK.

How much is a baby worth? A $75,000 bonus, this South Korean firm says.

(Washington Post) Successive South Korean governments have tried pretty much everything to try to persuade women to have babies. Now corporate South Korea is getting in on the act, trying to stave off a demographic crisis that could see the country’s workforce halve within 50 years. Some are pledging millions of dollars in bonuses for their staff who become parents. “We will continue to do what we can as a company to solve the low-birth issue,” Lee Joong-keun, the chairman of Booyoung Group, a Seoul-based construction company, said last week after awarding a total $5.25 million to his employees for 70 babies born since 2021. Both male and female employees at Booyoung are eligible for a $75,000 payout each time they have a baby—no strings attached. This development has come about as South Korea’s fertility rate—the average number of children a woman has over her lifetime—has plummeted to be the lowest in the world, at 0.78 in 2022. That means the population is aging rapidly. By 2072, half the population will be over 65—meaning companies big and small will have trouble finding people of working age to employ.

The sailor straining US-Japan relationship

(BBC) US Navy officer Ridge Alkonis was sentenced in Japan to three years jail in 2021 for killing two Japanese citizens in a car accident. His release on parole from a US prison after less than two years, following a pressure campaign from his family, drew public anger in Japan. The incident highlighted the resentment and frustration Japanese people hold against the 54,000 US servicemen in the country. Since the US-Japan Status of Forces Agreement (SOFA) was inked in 1960—enabling the deployment of US military forces in the country—there have been hundreds of criminal cases involving US military personnel. Few have forgotten the infamous 1995 incident where three servicemen raped a 12-year-old Okinawan girl, sparking months-long protests.

Israel May Put New Restrictions on Visiting Aqsa Mosque as Ramadan Nears

(NYT) The Israeli government was locked in debate on Monday on whether to increase restrictions on Muslims’ access to an important mosque compound in Jerusalem during the holy month of Ramadan, leading to predictions of unrest if the limits are enforced. On Sunday, Israeli cabinet ministers debated whether to bar some members of Israel’s Arab minority from attending prayers at the Aqsa Mosque compound, according to the two officials. Israel has long limited access to Al Aqsa for Palestinians from the Israeli-occupied West Bank, and since the start of the war in Gaza, it has imposed extra restrictions on Arab citizens and residents of Israel. Some had hoped those limits would be largely lifted for Ramadan, which is expected to begin around March 10—but the talk now is of increasing them, instead. Dan Harel, a former deputy chief of staff in the Israeli military, said in a radio interview that such a move would be “unnecessary, foolish and senseless” and might “ignite the entire Muslim world.” One Arab Israeli lawmaker, Waleed Alhwashla, said on social media that it would be “liable to pour unnecessary oil on the fire of violence.”

Israel orders new evacuations in northern Gaza, where UN says 1 in 6 children are malnourished

(AP) Israel ordered new evacuations from parts of Gaza City on Tuesday, as a study led by the U.N. children’s agency found that one in six children are acutely malnourished in the isolated and largely devastated north of the territory, where the city is located. The report finds deepening misery across the territory, where Israel’s air and ground offensive, launched in response to Hamas’ Oct. 7 attack, has killed over 29,000 Palestinians, obliterated entire neighborhoods and displaced more than 80% of the population. On Tuesday, the military ordered the evacuation of the Zaytoun and Turkoman neighborhoods on the southern edge of Gaza City, an indication that Palestinian militants are still putting up stiff resistance in areas of northern Gaza that the Israeli military said had been largely cleared weeks ago.

Crew abandon UK-registered cargo ship after Houthi attack off Yemen

(BBC) On Sunday night, a Belize-flagged, British-registered cargo vessel was struck by Houthi missiles, causing the crew to abandon ship. According to security firms, the ship was carrying “very dangerous,” highly explosive fertilizer. A spokesman for the Houthis has claimed that the ship was forced to a “complete halt” thanks to the attack, and the owners are reportedly considering towing the vessel.

Big stink in Cape Town

(AP) What stinks? Authorities in Cape Town launched an investigation Monday after a foul stench swept over the South African city. City officials inspected sewage facilities for leaks and an environmental health team was activated before the source of the smell was discovered: a ship docked in the harbor carrying 19,000 live cattle from Brazil to Iraq. The ship was due to depart soon, likely to the relief of residents.

When Eyes in the Sky Start Looking Right at You

(NYT) For decades, privacy experts have been wary of snooping from space. They feared satellites powerful enough to zoom in on individuals, capturing close-ups that might differentiate adults from children or suited sunbathers from those in a state of nature. Now, quite suddenly, analysts say, a startup is building a new class of satellite whose cameras would, for the first time, do just that. “We’re acutely aware of the privacy implications,” Topher Haddad, head of Albedo Space, the company making the new satellites, said in an interview. His company’s technology will image people but not be able to identify them, he said. Anyone living in the modern world has grown familiar with diminishing privacy amid a surge security cameras, trackers built into smartphones, facial recognition systems, drones and other forms of digital monitoring. But what makes the overhead surveillance potentially scary, experts say, is its ability to invade areas once seen as intrinsically off limits. “This is a giant camera in the sky for any government to use at any time without our knowledge,” said Jennifer Lynch, general counsel of the Electronic Frontier Foundation. “We should definitely be worried.”

2 notes

·

View notes

Text

When it comes to commercial real estate ownership in majority-Black neighborhoods, Black business owners are often systemically excluded from the economic benefits such ownership can generate, while other investors amass control over profits and the trajectory of neighborhood development.

“There is an assumption that [small business owners] can pay rent in South LA but cannot own property here,” Olympia Auset, a South Los Angeles-based small business owner, told us. “There are so many people here who stay in a rental property for 10 years or longer, but whenever they want to own something, they are given a hard time.” Auset’s words speak to a broader systemic trend not only in the historically Black area of South Los Angeles, but in majority-Black neighborhoods nationwide.

While much attention has been paid to the importance of homeownership in supporting economic mobility for Black people, commercial property ownership has been an understudied avenue for accomplishing this imperative. That’s changing: Last year, The Los Angeles Times covered the same uphill battle Auset referred to by chronicling the challenges that Black business owners face in purchasing commercial property in Leimert Park, a gentrifying neighborhood in South Los Angeles that has historically been a mecca for Black arts, culture, events, and businesses.

This report examines why racial disparities in commercial real estate ownership matter and offers recommendations for policymakers to better support Black entrepreneurs in their attempts to “buy back the block.” Drawing from a qualitative study conducted by Los Angeles-based organizations Inclusive Action for the City and Destination Crenshaw with Black business owners and real estate developers in South Los Angeles, the report presents the barriers they face in purchasing and managing commercial real estate. Based on qualitative insights and the existing evidence base on local ownership, the report offers five actionable recommendations for how policymakers can better support local efforts to purchase commercial real estate.

4 notes

·

View notes

Text

Pathways To Home

At My Home Pathway, we believe that homeownership isn’t just the right of the few. We're helping you break financial limitations through homeownership. Our mission is to teach you how to build wealth, train you to improve financial habits, and achieve the freedom you dream of.

0 notes

Text

How Do Climate Risks Affect Your Next Home | KM Realty Group LLC

Climate change is impacting where people buy homes. As the experts at the National Association of Realtors (NAR) explain:

“sixty-three percent of people who have moved since the pandemic began say they believe climate change is — or will be — an issue in the place they currently live.”

If you’re planning to move, climate change is something you might want to consider, no matter where you are. A recent study from Realtor.com helps put the growing impact climate change is having on real estate into perspective (see below):

So, how can you be sure your investment is safe from the elements?

For starters, work with a local real estate agent to understand the likelihood of your future home being exposed to hazards like wind, floods, and wildfires. Your agent will know the area and be able to tell you about the risks you’ll most likely face.

Beyond that, there are two important factors to think about: the quality of the home you want to buy and the insurance you’ll need to protect it.

A Home Built to Last

If you’re planning to be in your home for many years, you want to know it’s going to last. One way to think ahead is to work with your real estate agent to ensure the home you buy can withstand environmental hazards. They’re up to date on the most common building and remodeling techniques — like a secondary water barrier on the roof or noncombustible, fire-resistant exterior walls — used to protect homes from the effects of climate change.

And if the home you’re interested in doesn’t have the features you’re looking for, they can help you determine what you may be able to negotiate in the contract or what work it might require in the future.

Insurance To Protect It

Once you’re confident the home you’re looking at is well built, the next step is finding out what it’s going to take to insure it. As Selma Hepp, Chief Economist at CoreLogic, says:

“. . . homeowners are going to become increasingly more aware of risks of living in some areas as it becomes prohibitively expensive or very difficult to obtain hazard insurance.”

In areas where climate risks are having a bigger impact, the right home insurance can make a big difference. And the price of that insurance is an important factor when thinking about your budget and the true cost of buying and protecting your home. Get an insurance quote early in the process because you may want to compare multiple quotes and it can take several weeks to get them.

While this may feel like a lot to consider, don’t worry. An agent can help. Your real estate agent will be your go-to resource on the homebuying process, what to look for and consider, and how climate change may affect your next home. With the right planning and an agent’s expert advice, you can make this happen. Homeownership is worth it. And with a great agent by your side, you can make sure the home you find is the right fit.

Bottom Line

Climate change is an important factor to think about when buying a home. After all, your home is a huge investment, and you want to be ready for anything that might affect it. Let’s chat so you can find the perfect home.

0 notes

Text

Unlocking Opportunities: FHA Loan and Bad Credit Home Financing

Understanding FHA Loan

For many aspiring homeowners, the path to owning a house seems fraught with obstacles, especially when dealing with financial constraints or a less-than-ideal credit score. However, the Federal Housing Administration (FHA) offers a ray of hope through its FHA loan program. This initiative, backed by the government, aims to make homeownership accessible to individuals who may not qualify for conventional loans. With lower down payment requirements and more lenient credit score criteria, FHA loans open doors for those with limited financial resources or less-than-perfect credit histories. FHA loan provides a vital avenue for individuals to step onto the property ladder, even amidst financial challenges.

The Promise of FHA Loan

What sets FHA loans apart is their flexibility and accessibility. Traditional mortgage lenders often require substantial down payments, sometimes as high as 20% of the property's value, making it an insurmountable barrier for many. In contrast, FHA loans typically demand a down payment as low as 3.5%, significantly reducing the upfront financial burden on borrowers. Moreover, while conventional loans may mandate pristine credit scores, FHA loans are attainable for individuals with credit scores as low as 580. This inclusivity ensures that homeownership remains within reach for a broader spectrum of society, irrespective of their financial backgrounds or credit histories.

Navigating Bad Credit Home Financing

For individuals grappling with poor credit scores, the prospect of securing a mortgage may appear dim. However, the realm of bad credit home financing offers a lifeline to those facing such challenges. While conventional lenders may shy away from applicants with less-than-stellar credit histories, specialized lenders catering to individuals with bad credit provide tailored solutions. These lenders understand the nuances of bad credit and are equipped to assess borrowers' financial profiles holistically. By focusing on factors beyond credit scores, such as employment history and income stability, bad credit home financing providers offer a pathway to homeownership for those overlooked by conventional institutions.

Embracing Opportunities

Despite the hurdles posed by financial constraints or imperfect credit scores, opportunities abound in the realm of homeownership. FHA loans and bad credit home financing exemplify this ethos by offering viable paths to individuals who may have otherwise deemed homeownership unattainable. By leveraging these initiatives, aspiring homeowners can transcend the limitations imposed by traditional mortgage practices and realize their dreams of owning a home. Whether it's availing the benefits of FHA loan lenient eligibility criteria or tapping into the tailored solutions offered by bad credit home financing providers, individuals can seize control of their housing aspirations and embark on a journey towards financial stability and security.

Conclusion: Seizing the Moment with Bcreditkings.com

In the landscape of homeownership, challenges may abound, but so do solutions. FHA loans and bad credit home financing represent beacons of hope for individuals navigating the complexities of securing a mortgage. Whether it's the accessibility of FHA loans or the tailored approaches of bad credit home financing, avenues exist for realizing the dream of homeownership. For those seeking guidance and assistance in navigating these paths, platforms like bcreditkings.com stand ready to provide invaluable support and expertise. With the right resources and guidance, homeownership becomes not just a distant aspiration but a tangible reality for individuals from all walks of life.

0 notes

Text

Five Practical Ways You Can Buy A Home With Cash

Buying a home with cash may seem like a daunting task, especially for those accustomed to traditional mortgage financing. However, with careful planning and strategic approaches, purchasing a home outright can be achievable.

Here are five practical ways you can buy a home with cash:

Savings and Investments: One of the most straightforward methods of cash purchasing a house is by using your savings or investments. Start by setting a goal to accumulate the necessary funds over time through diligent saving and disciplined financial management. Consider setting up a dedicated savings account specifically for your home purchase and contribute to it regularly.

Additionally, explore investment opportunities that offer the potential for higher returns, such as stocks, bonds, mutual funds, or real estate investment trusts (REITs). By prioritizing saving and investing, you can gradually build up the cash reserves needed to buy your dream home.

Liquidating Assets: Another option for funding a cash home purchase is to liquidate assets, such as stocks, bonds, mutual funds, retirement accounts, or other investments. Evaluate your investment portfolio and identify assets that can be sold or redeemed to generate the necessary cash.

Keep in mind any tax implications or penalties associated with liquidating certain assets, and consult with a financial advisor to develop a strategic plan for optimizing your portfolio while achieving your homebuying goals. By converting assets into cash, you can expedite the process of accumulating funds for your home purchase.

Inheritance or Windfall: If you're fortunate enough to receive an inheritance, windfall, or substantial lump sum of money, consider using a portion or all of it toward buying a home with cash. While it's essential to approach windfalls with careful consideration and planning, dedicating a portion of unexpected funds toward homeownership can provide long-term financial security and stability.

Whether it's an inheritance from a loved one, a bonus from work, or a lottery win, leveraging windfalls can offer a unique opportunity to realize your homeownership dreams without the need for mortgage financing.

Downsize or Sell Current Property: If you already own a home or other real estate assets, consider downsizing or selling your current property to fund the purchase of a new home with cash. Evaluate your current housing situation and assess whether downsizing to a smaller, more affordable home aligns with your lifestyle and financial goals.

By selling your existing property, you can unlock the equity accumulated over time and use the proceeds to buy your next home outright. Additionally, explore the option of selling any other real estate holdings or investment properties to further bolster your cash reserves for the purchase.

Partnering with Family or Investors: Another practical way to buy a home with cash is by partnering with family members or investors who are willing to contribute funds toward the purchase. Consider forming a joint venture or partnership agreement that outlines each party's financial contribution, ownership stake, and responsibilities.

By pooling resources with trusted partners, you can increase your purchasing power and access higher-value properties that may have been out of reach individually. Just be sure to formalize the arrangement with a legally binding agreement and clearly define the terms and conditions of the partnership to avoid misunderstandings or disputes down the road.

Buying a home with cash requires careful planning, discipline, and resourcefulness. By leveraging savings, liquidating assets, utilizing windfalls, downsizing or selling existing property, or partnering with others, you can overcome financial barriers and achieve your goal of homeownership without the need for mortgage financing. Evaluate these practical strategies based on your financial situation and objectives, and take proactive steps toward realizing your dream of owning a home outright.

0 notes

Text

The Future of Housing: Why Relocatable Homes are Here to Stay

In an era marked by rapid technological advancements and shifting societal needs, the housing landscape is undergoing a significant transformation. Traditional notions of permanent, immobile homes are giving way to a more dynamic and flexible alternative: relocatable homes.

These innovative dwellings offer a plethora of benefits that cater to the evolving demands of modern living. From environmental sustainability to economic feasibility, relocatable homes are poised to revolutionise the way we think about housing. Let’s delve deeper into why relocatable homes Waikato are not just a passing trend but are indeed here to stay.

Flexibility and Mobility

Gone are the days when individuals were bound to a single location due to the permanence of their homes. Relocatable homes empower residents with the freedom to move and adapt to changing circumstances effortlessly.

Whether it's a job relocation, a desire for a change of scenery, or simply seeking new opportunities, these homes offer unparalleled flexibility. With the ability to be easily disassembled, transported, and reassembled, relocatable homes Waikato redefine the concept of homeownership, enabling individuals to embrace a nomadic lifestyle without sacrificing comfort or stability.

Sustainable Living

The environmental impact of traditional housing construction cannot be overlooked, with substantial resource consumption and carbon emissions associated with building materials and processes. Relocatable homes, however, present a more sustainable alternative.

By utilising eco-friendly materials, incorporating energy-efficient designs, and minimising construction waste, these homes significantly reduce their ecological footprint. Moreover, their modular nature allows for efficient use of resources and promotes a circular economy by facilitating the reuse and repurposing of components. As sustainability becomes an increasingly pressing concern, relocatable homes emerge as a promising solution to mitigate environmental degradation while offering comfortable living spaces.

Affordability and Accessibility

The skyrocketing cost of homeownership has become a barrier for many individuals and families, particularly in urban areas where housing prices continue to escalate. Relocatable homes offer a viable solution to this affordability crisis.

Their modular construction methods often result in lower overall costs compared to traditional homes, making homeownership more accessible to a broader demographic. Furthermore, the ability to customise and scale these homes according to specific needs and budgets further enhances their affordability. Whether as a primary residence, a vacation retreat, or an additional dwelling unit, relocatable homes provide an affordable housing option without compromising on quality or comfort.

Read More: Moving Services in Waikato

Innovation and Customisation

One of the most compelling aspects of relocatable homes is their potential for innovation and customisation. Unlike conventional homes constrained by fixed designs and layouts, relocatable homes embrace a culture of innovation, allowing for endless possibilities in terms of architecture, functionality, and aesthetics.

From futuristic, minimalist designs to cozy, traditional cottages, the versatility of relocatable homes caters to diverse preferences and lifestyles. Advanced technologies such as smart home automation, energy management systems, and sustainable features can be seamlessly integrated into these dwellings, offering residents a truly modern and personalised living experience.

Resilience and Adaptability

In an unpredictable world characterised by natural disasters, economic fluctuations, and social upheavals, the resilience and adaptability of housing have never been more critical. Relocatable homes excel in this regard, offering inherent resilience to various challenges.

Their modular construction allows for quick assembly and disassembly, making them ideal for emergency housing solutions in the aftermath of disasters.

Moreover, the ability to relocate these homes mitigates risks associated with changing environmental conditions or economic downturns, ensuring long-term security for residents. By embracing the principles of resilience and adaptability, relocatable homes pave the way for a more sustainable and secure future.

Conclusion

The rise of relocatable homes Waikato signals a paradigm shift in the housing industry, driven by the need for flexibility, sustainability, affordability, innovation, and resilience. Far from being a fleeting trend, relocatable homes represent a fundamental evolution in how we conceptualise and approach homeownership.

As society continues to evolve and confront new challenges, relocatable homes offer a beacon of hope, providing a versatile and adaptable housing solution for the future. From urban dwellers seeking mobility to environmentally conscious individuals advocating for sustainability, the appeal of relocatable homes transcends boundaries, making them a permanent fixture in the ever-changing landscape of housing.

Source: https://classickinect.quora.com/The-Future-of-Housing-Why-Relocatable-Homes-are-Here-to-Stay

0 notes

Text

The Safe Florida Home Program: Enhancing Hurricane Preparedness and Home Safety

In Florida, where the weather is as beautiful as it is unpredictable, preparing for hurricane season is a critical aspect of homeownership. The My Safe Florida Home Program, championed by Chase Roofing, offers a comprehensive solution to fortify homes against the wrath of nature. This initiative not only enhances the safety of residences but also brings peace of mind to homeowners across the state.

Understanding the My Safe Florida Home Program

The My Safe Florida Home Program is a state-sponsored initiative designed to help homeowners strengthen their properties against hurricanes. The program focuses on improving the structural integrity of homes through a variety of services, including free wind mitigation inspections and matching grants for recommended home improvements. By participating in this program, homeowners can significantly reduce the risk of hurricane damage and potentially lower their insurance premiums.

Key Services Offered

1. Free Wind Mitigation Inspections:

One of the standout features of the My Safe Florida Home Program is the provision of free wind mitigation inspections. These inspections are carried out by certified professionals who assess the vulnerability of a home to hurricane damage. The inspection covers several key areas, including the roof, windows, doors, and overall structural integrity. The detailed report generated from the inspection provides homeowners with actionable insights on how to enhance their home’s resilience against high winds and flying debris.

2. Matching Grants for Home Improvements:

After receiving the wind mitigation inspection report, homeowners can apply for matching grants to make recommended improvements. These grants cover up to $10,000 for eligible upgrades, such as roof reinforcement, door and window protection, and the installation of secondary water barriers. This financial assistance makes it more feasible for homeowners to undertake necessary modifications, ensuring their properties are better equipped to withstand hurricanes.

3. Expert Guidance and Support:

Chase Roofing plays a pivotal role in the My Safe Florida Home Program by offering expert guidance and support throughout the process. From the initial inspection to the completion of home improvements, their team of professionals is dedicated to helping homeowners navigate the requirements and maximize the benefits of the program. Their expertise in roofing and home fortification ensures that every upgrade is performed to the highest standards of quality and safety.

Key Services Offered:

1. Free Wind Mitigation Inspections:

One of the standout features of the My Safe Florida Home Program is the provision of free wind mitigation inspections. These inspections are carried out by certified professionals who assess the vulnerability of a home to hurricane damage. The inspection covers several key areas, including the roof, windows, doors, and overall structural integrity. The detailed report generated from the inspection provides homeowners with actionable insights on how to enhance their home’s resilience against high winds and flying debris.

2. Matching Grants for Home Improvements:

After receiving the wind mitigation inspection report, homeowners can apply for matching grants to make recommended improvements. These grants cover up to $10,000 for eligible upgrades, such as roof reinforcement, door and window protection, and the installation of secondary water barriers. This financial assistance makes it more feasible for homeowners to undertake necessary modifications, ensuring their properties are better equipped to withstand hurricanes.

3. Expert Guidance and Support:

Chase Roofing plays a pivotal role in the My Safe Florida Home Program by offering expert guidance and support throughout the process. From the initial inspection to the completion of home improvements, their team of professionals is dedicated to helping homeowners navigate the requirements and maximize the benefits of the program. Their expertise in roofing and home fortification ensures that every upgrade is performed to the highest standards of quality and safety.

Why Homeowners Should Embrace the My Safe Florida Home Program?

Enhanced Home Safety:

The primary benefit of participating in the My Safe Florida Home Program is the increased safety and security of your home. By addressing vulnerabilities and reinforcing key structural elements, homeowners can significantly reduce the risk of severe damage during hurricanes. This proactive approach not only protects the property but also safeguards the lives of residents.

Potential Insurance Savings:

Another significant advantage of the program is the potential for lower insurance premiums. Homes that are fortified against hurricanes are less likely to sustain damage, making them less risky for insurance companies. As a result, homeowners who complete the recommended improvements may qualify for discounts on their home insurance policies, leading to long-term savings.

Increased Property Value:

Investing in home fortification also enhances the overall value of the property. Prospective buyers are more likely to be attracted to homes that are well-protected against natural disasters, making them a more appealing option in the real estate market. This increase in property value is a tangible benefit that homeowners can enjoy when it comes time to sell.

Conclusion

The My Safe Florida Home Program with Chase Roofing, is an invaluable resource for homeowners in Florida. By offering free wind mitigation inspections, matching grants for essential upgrades, and expert support, the program empowers residents to take proactive steps in safeguarding their homes against hurricanes. Embracing this program not only ensures a safer living environment but also brings financial and long-term benefits, making it a wise investment for any Florida homeowner.

#Roofing services#Roof Replacement#Roof Repair#Roof Maintenance#Roof Inspection#My Safe Florida Home Program#florida home

0 notes

Text

How Do Climate Risks Affect Your Next Home?

Climate change is impacting where people buy homes. As the experts at the National Association of Realtors (NAR) explain:

“Sixty-three percent of people who have moved since the pandemic began say they believe climate change is—or will be—an issue in the place they currently live.”

If you’re planning to move, climate change is something you might want to consider, no matter where you are. A recent study from Realtor.com helps put the growing impact climate change is having on real estate into perspective (see below):

So, how can you be sure your investment is safe from the elements?

For starters, work with a local real estate agent to understand the likelihood of your future home being exposed to hazards like wind, floods, and wildfires. Your agent will know the area and be able to tell you about the risks you’ll most likely face.

Beyond that, there are two important factors to think about: the quality of the home you want to buy and the insurance you’ll need to protect it.

A Home Built to Last

If you’re planning to be in your home for many years, you want to know it’s going to last. One way to think ahead is to work with your real estate agent to ensure the home you buy can withstand environmental hazards. They’re up to date on the most common building and remodeling techniques—like a secondary water barrier on the roof or noncombustible, fire-resistant exterior walls—used to protect homes from the effects of climate change.

And if the home you’re interested in doesn’t have the features you’re looking for, they can help you determine what you may be able to negotiate in the contract or what work it might require in the future.

Insurance To Protect It

Once you’re confident the home you’re looking at is well built, the next step is finding out what it’s going to take to insure it. As Selma Hepp, Chief Economist at CoreLogic, says:

“. . . homeowners are going to become increasingly more aware of risks of living in some areas as it becomes prohibitively expensive or very difficult to obtain hazard insurance.”

In areas where climate risks are having a bigger impact, the right home insurance can make a big difference. And the price of that insurance is an important factor when thinking about your budget and the true cost of buying and protecting your home. Get an insurance quote early in the process because you may want to compare multiple quotes and it can take several weeks to get them.

While this may feel like a lot to consider, don’t worry. An agent can help. Your real estate agent will be your go-to resource on the homebuying process, what to look for and consider, and how climate change may affect your next home. With the right planning and an agent's expert advice, you can make this happen. Homeownership is worth it. And with a great agent by your side, you can make sure the home you find is the right fit.

Bottom Line

Climate change is an important factor to think about when buying a home. After all, your home is a huge investment, and you want to be ready for anything that might affect it. Let’s chat so you can find the perfect home.

0 notes

Text

How Do Climate Risks Affect Your Next Home?

How Do Climate Risks Affect Your Next Home?

Climate change is impacting where people buy homes. As the experts at the National Association of Realtors (NAR) explain:

“Sixty-three percent of people who have moved since the pandemic began say they believe climate change is—or will be—an issue in the place they currently live.”

If you’re planning to move, climate change is something you might want to consider, no matter where you are. A recent study from Realtor.com helps put the growing impact climate change is having on real estate into perspective (see below):

So, how can you be sure your investment is safe from the elements?

For starters, work with a local real estate agent to understand the likelihood of your future home being exposed to hazards like wind, floods, and wildfires. Your agent will know the area and be able to tell you about the risks you’ll most likely face.

Beyond that, there are two important factors to think about: the quality of the home you want to buy and the insurance you’ll need to protect it.

A Home Built to Last

If you’re planning to be in your home for many years, you want to know it’s going to last. One way to think ahead is to work with your real estate agent to ensure the home you buy can withstand environmental hazards. They’re up to date on the most common building and remodeling techniques—like a secondary water barrier on the roof or noncombustible, fire-resistant exterior walls—used to protect homes from the effects of climate change.

And if the home you’re interested in doesn’t have the features you’re looking for, they can help you determine what you may be able to negotiate in the contract or what work it might require in the future.

Insurance To Protect It

Once you’re confident the home you’re looking at is well built, the next step is finding out what it’s going to take to insure it. As Selma Hepp, Chief Economist at CoreLogic, says:

“. . . homeowners are going to become increasingly more aware of risks of living in some areas as it becomes prohibitively expensive or very difficult to obtain hazard insurance.”

In areas where climate risks are having a bigger impact, the right home insurance can make a big difference. And the price of that insurance is an important factor when thinking about your budget and the true cost of buying and protecting your home. Get an insurance quote early in the process because you may want to compare multiple quotes and it can take several weeks to get them.

While this may feel like a lot to consider, don’t worry. An agent can help. Your real estate agent will be your go-to resource on the homebuying process, what to look for and consider, and how climate change may affect your next home. With the right planning and an agent's expert advice, you can make this happen. Homeownership is worth it. And with a great agent by your side, you can make sure the home you find is the right fit.

Bottom Line

Climate change is an important factor to think about when buying a home. After all, your home is a huge investment, and you want to be ready for anything that might affect it. Let’s chat so you can find the perfect home.

0 notes

Text

Empowering First-Time Home Buyers: Fresh Water Financial Services' Commitment to the Dream

Owning a home is a milestone that many aspire to achieve, yet the journey towards homeownership can often seem daunting, particularly for first-time buyers. In an era where the real estate market can be unforgiving and financial barriers can loom large, organizations like Fresh Water Financial Services stand as beacons of hope. With a focus on empowerment and accessibility, Fresh Water Financial Services has emerged as a trusted ally for individuals embarking on the exciting yet complex path to homeownership.

At the heart of Fresh Water Financial Services' mission lies a dedication to facilitating the dreams of first-time home buyers. Central to this commitment is their comprehensive understanding of the challenges faced by those seeking to purchase their inaugural property. One such obstacle is the formidable hurdle of accumulating a deposit, often perceived as an insurmountable barrier to entry into the housing market.

Recognizing the significance of this challenge, Fresh Water Financial Services has aligned itself with initiatives like the "first home buyer deposit scheme," designed to provide crucial assistance to individuals striving to gather the necessary funds for their down payment. By leveraging this scheme, Fresh Water Financial Services empowers prospective homeowners by offering tailored solutions that accommodate their unique financial circumstances.

A cornerstone of Fresh Water Financial Services' approach is their specialized loan offerings crafted explicitly for first-time home buyers. Through these bespoke financial products, individuals are afforded the opportunity to navigate the intricate landscape of property acquisition with confidence and peace of mind. Whether it's navigating the intricacies of mortgage options or securing favorable interest rates, Fresh Water Financial Services ensures that each client receives personalized guidance every step of the way.

The "Loan for first time home buyers" program epitomizes Fresh Water Financial Services' commitment to inclusivity and support. By providing accessible financing options tailored to the specific needs of first-time buyers, the company empowers individuals to turn their homeownership aspirations into tangible realities. Moreover, through transparent communication and unwavering support, Fresh Water Financial Services fosters a nurturing environment where clients feel empowered to make informed decisions regarding their financial future.

In addition to their dedication to providing financial solutions, Fresh Water Financial Services places a premium on education and guidance. Recognizing that navigating the complexities of the real estate market can be overwhelming, particularly for novices, the company offers comprehensive resources and expert advice to demystify the process. From informative seminars to one-on-one consultations, Fresh Water Financial Services ensures that clients are equipped with the knowledge and tools necessary to make informed decisions regarding their homeownership journey.

Central to Fresh Water Financial Services' ethos is the belief that homeownership should be within reach for all individuals, regardless of background or circumstance. As such, the company remains steadfast in its commitment to fostering inclusivity and accessibility within the real estate landscape. Through their innovative programs and unwavering dedication, Fresh Water Financial Services continues to redefine the narrative surrounding homeownership, transforming dreams into reality for countless individuals.

Beyond their role as a financial services provider, Fresh Water Financial Services serves as a catalyst for positive change within the community. By partnering with local organizations and initiatives aimed at promoting affordable housing and financial literacy, the company extends its impact far beyond the realm of finance. Through these collaborative efforts, Fresh Water Financial Services strives to create a future where homeownership is not merely a dream but a tangible and attainable goal for all.

In a world where the dream of homeownership can sometimes feel out of reach, Fresh Water Financial Services stands as a beacon of hope, guiding individuals towards a brighter and more prosperous future. Through their unwavering commitment to empowerment, accessibility, and community engagement, the company continues to redefine the landscape of homeownership, one client at a time. Aspiring homeowners can rest assured knowing that with Fresh Water Financial Services by their side, the journey to owning their first home is not just a possibility but a promise waiting to be fulfilled.

0 notes

Text

Best home loan company in the united states

At My Home Pathway, we believe that homeownership isn’t just the right of the few. We're helping you break financial limitations through homeownership. Our mission is to teach you how to build wealth, train you to improve financial habits, and achieve the freedom you dream of.

0 notes

Text

Turning Homeownership Dreams into Reality: The Benefits of No Down Payment Mortgage Edmonton

Do you envision owning your own home in Edmonton but find it challenging to save for a down payment? For many potential homeowners, the hefty down payment requirement can appear like an obstacle too large to overcome. Yet, with groundbreaking financial solutions such as Ratefair's No Down Payment Mortgage, the prospect of owning a home in Edmonton is now within grasp for a wider demographic than ever before.

Ratefair is reshaping the mortgage landscape by offering zero down payment mortgages, opening up a feasible path to homeownership for individuals and families in Edmonton. But what are the advantages of choosing a No Down Payment Mortgage Edmonton, and how does it function?

No Down Payment Mortgage Edmonton

Firstly, a zero down mortgage Edmonton removes the necessity to amass a substantial sum for a down payment, a hurdle that many prospective buyers struggle with. Rather than waiting years to accumulate sufficient savings, individuals can expedite their home purchase and commence building equity immediately.

Furthermore, by abolishing the down payment prerequisite, Ratefair's No Down Payment Mortgage promotes inclusivity and accessibility to homeownership for a broader spectrum of people, including first-time buyers, young professionals, and those with limited savings. This democratization of homeownership bridges the gap between renters and homeowners, fostering financial stability and wealth accumulation for more individuals and families in Edmonton.

Moreover, amid the current competitive housing market and escalating prices, saving for a traditional down payment can feel like a never-ending race against inflation. Ratefair's zero down mortgage option allows buyers to seize the current low-interest rates and favorable market conditions without delaying to save for a down payment, enabling them to secure a mortgage at today's rates and commence reaping the rewards of homeownership sooner.

While a zero down payment mortgage presents numerous advantages, it's crucial to evaluate your financial circumstances and ensure that you can comfortably afford the monthly mortgage payments. Ratefair's team of seasoned mortgage professionals can assist you in assessing your eligibility and navigating the process, guaranteeing that you make informed decisions every step of the way. Ratefair's No Down Payment Mortgage is a game-changer for aspiring homeowners in Edmonton, offering a flexible and accessible solution to surmount the traditional barriers to homeownership. With this innovative financial product, owning a home in Edmonton transforms from a mere dream into a tangible reality for more individuals and families than ever before. Reach out to Ratefair today to discover how you can embark on the journey towards homeownership with zero down mortgage Edmonton.

0 notes

Text

Exploring Alternative Financing Options for Buying a House for Rental

Investing in real estate for rental purposes is a lucrative venture, but traditional financing options may not always be feasible for everyone. Fortunately, there are alternative financing options available that can make owning buying rental properties more accessible. In this blog, we'll explore some of these alternative methods to help you achieve your goal of owning a rental property.

Subheading: Rent-to-Own Agreements

Rent-to-own agreements, also known as lease options, offer a unique approach to acquiring a rental property. In this arrangement, a tenant rents the property with the option to purchase it at a predetermined price within a specified period, typically one to three years. This option allows aspiring landlords to generate rental income while working towards homeownership, making it an attractive alternative financing option.

Subheading: Seller Financing

Seller financing is another alternative option that can benefit both buyers and sellers. In a seller financing arrangement, the seller acts as the lender and finances the purchase of the property for the buyer. This option is particularly useful for individuals who may not qualify for traditional bank loans or who prefer more flexible terms. With seller financing, buyers can negotiate terms directly with the seller, potentially resulting in lower interest rates and reduced closing costs.

Subheading: Crowdfunding Platforms

Crowdfunding platforms have revolutionized real estate investing by allowing individuals to pool their resources and invest in properties collectively. Through crowdfunding, investors can contribute funds towards the purchase of a rental property and receive a share of the rental income and potential appreciation. This option provides a low barrier to entry for investors looking to diversify their portfolio without the hassle of property management.

Subheading: Hard Money Loans

Hard money loans are short-term, asset-based loans that are typically used by real estate investors to finance the purchase and renovation of properties. Unlike traditional bank loans, hard money loans are based on the value of the property rather than the borrower's creditworthiness. While hard money loans often come with higher interest rates and fees, they offer fast approval and flexible terms, making them an attractive option for investors looking to quickly acquire rental properties.

Conclusion:

Exploring alternative financing options for buying a house for rental can open up new possibilities for aspiring landlords. Whether through rent-to-own agreements, seller financing, crowdfunding platforms, or hard money loans, there are various avenues to pursue your real estate investment goals. At MySmartCousin, we understand the importance of exploring alternative financing options to help you achieve your dreams of owning a rental property. Contact us today to learn more about how we can assist you in navigating the world of real estate investing.

0 notes