#how much money can I make trading forex

Text

Learn Forex Trading. Facilitating Cash on Global Forex Trading.

Learn Forex Trading. Facilitating Cash on Global Forex Trading. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb Practically all internet marketers have become aware of forex trading or online currency trading as it is sometimes referred to and numerous wonder about how the forex trading system works and where they can go to find out forex trading. To become a successful forex trader you need to understand what forex trading is and how to effectively trade forex. To attain adequate knowledge it is vital to learn forex trading from experts. This can be carried out in the form of a forex tutorial and there are hundreds of forex businesses offering online tutorials and guides. An online forex tutorial will discuss how the foreign exchange market works and will likewise discuss the kinds of forex orders that are offered to you as a forex trader. A forex tutorial will likewise explain technical indications and what they mean, the economic indications you will need to be familiar with, and the various options and methods that are offered to you as a forex trader. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb If you are brand-new to forex trading then you must discover forex trading before parting with any of your tough-made money. Many online forex businesses provide free training and demonstrations that look like that of real-time forex trading. There are likewise forex trading courses readily available and these are likewise a valuable way to learn forex trading as you can describe these courses time and time once again. When it comes to forex trading is important to find out forex trading so that you comprehend how to trade and how to trade effectively, the most important element. The more you find out about forex trading the more understanding you will have and the more success. Finding a forex tutorial or forex trading course is easy. All you need to do is a brief web search and you will have a great deal of courses and tutorials to choose from. If you are serious about prospering as a forex trader, then it's down to you, to learn forex trading now and discover to prosper. Facilitating Cash on Global Forex Trading. There are various forms of company. However, the simplest way of earning money is to trade forex. Among the leading companies of forex trading on a real-time basis is worldwide forex trading. It started its operation in 1997. It provides opportunities for individuals to trade forex online in real time and it offers a chance to most forex brokers to earn millions each day. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb International forex trading is presently serving over one hundred nations. It utilizes the DealBrook FX2 software application and supplies twenty-four-hour access to the forex market. It is also equipped with the greatest quality of consumer service which is commonly available in the market of forex trading. The forex brokers are provided the chance to gain access to the costs of over sixty currency pairs and provide analytical services from distinguished experts. The traders are likewise upgraded with the most recent news on currency status and available forex charts. Global Forex Trading is the only company of trading platforms on forex appropriate for beginners along with specialists. When trading forex, there are various advantages. It is extremely available since it is open twenty-four hours besides having the most liquid market. The take advantage of the strategy is always offered in which the traders have the option of utilizing a 100:1 leverage. This decreases the requirement for larger capitals that are to be opened on the trader's account. Forex trading has trading and no commission is widely readily available over sixty currencies all over the world. Forex trading is internationally readily available which is why the traders have larger trading opportunities despite any market conditions. Because of the given benefits, don't assume that forex trading is just for huge investors. International forex trading has opened the way for smaller deals. In this method, both small and huge financiers are given the chance to make money from trading forex. In rare cases, some people assume that the marketplace for international forex trading dwarfs the equities. Nevertheless, this is not true since the volume of forex trading surpasses 2 trillion dollars every day. Global forex trading is thought about as the leader in the field of competitive market exchange. There are numerous reasons worldwide forex trading is amazing. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb -The forex market is extensively readily available. The traders can trade currencies twenty-four hours a day, seven days a week no matter their variations. When stock exchanges are readily available, this supplies a greater market chance for traders compared to equities which can only negotiate organization on market hours. -The worldwide forex trading perspective utilized is astonishing. Compared to equip trading, the trader can either trade with the cash that they have or open margin accounts and double the take advantage of when trading. Take, for example, if you moneyed your margin accounts with 25,000 then you can manage an equity position of 50,000. But in worldwide forex trading, your initial capital can acquire leverages as much as 20, 50, and even 100 times. In this way, the traders can open a forex brokerage online with just 5,000 dollars and can control positions of approximately 200,000 dollars or above. And if the trader can money an account with 10,000 dollars then he can manage positions approximately 500,000 dollars. Whether the trader can only gain 5% on the positions, then it would still be equivalent to a 25,000-dollar gain with only an initial capital of 10,000 dollars. -There are lots of traders in the forex market. However, even if it is possible to make fast revenues, the risk of losing is likewise very high. That is why the technical and fundamental analysis of forex markets is extremely crucial. Traders should get a forex education to have a great start. It could increase their opportunity to become effective forex traders. The traders must secure their business from prospective losses. Worldwide forex trading is certainly a highly speculative endeavor. Remember that the traders who are successful in trading forex are those who are systematic, have strong controls over their emotions and impulses, are fault-analytical, and are disciplined. The traders can earn big revenues in just a few days of trading, it will grow as time passes, but, only prevent making any errors. One of the leading companies of forex trading on a genuine time basis is global forex trading. It offers chances for people to trade forex online on genuine times and it offers an opportunity to most forex brokers to make millions each day. Global Forex Trading is the only supplier of trading platforms on Forex suitable for newbies as well as specialists. Forex trading has trading and no commission is widely available for over sixty currencies all over the world. Forex trading is globally readily available which is why the traders have wider trading chances regardless of any market conditions. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb Thank you for looking at my Video from Ian Jackson.

#Forex Trading#FX trader#how to trade forex#learn to trade#how much money can I make trading forex#options trading#how to trade bitcoin#knowledge to action#how much money do I need to trade forex#is trading a scam#financial freedom#earn money online#Money#Trading for beginners#how to trade basics#free trading course

1 note

·

View note

Text

Forex Musings

It's been a little bit but I'm going to talk about my trading and the things I've had to learn.

I guess I'd start by saying that it isn't gambling. When you gamble, the house is against you, or another player. No one is against you when trading. The market does what the market does and absolutely does not care one bit about whether it's a buy or sell or if you're winning or losing. The market just...IS.

Unlike gambling, it's not over until you say it's over. You can get in and out within a minute or for hours. You can win and win and win and it's not over until you say it's over. Same with losing positions. You CAN lose extensively, until you run out of money, in one go.

Then there's the different types of analysis, and the ways one thinks to get an edge. I have mostly been doing fundamental analysis, learning about trade balance, unemployment, GDP, interest rates, inflation, etc. There's scheduled news about all of these things, and I've been doing my homework, waiting for the news, and making bank off of it.

After a few weeks of watching and testing, I've found something that works. There are hints of what could happen, I set up a trade to trigger if things go the way I think they will. I'm ready to snap trade the other way if not. There's a jump in value and that's where the money is made.

For example, the Fed cut interest rates by 50 basis points. I set up a trade for the US dollar to gain in value, even though interest rate cuts should drop the US dollar value. Doesn't matter. I made $1000 in about 40 seconds.

There's also a second chance to make money. The initial reaction is always over the top. That means it goes the opposite direction, and a chance to make money. Today there was unemployment news and I made on the initial and the pullback, although I definitely didn't do it well. I jumped the gun and committed the other way too early. I had to wait around for about 40 minutes and watch my potential loss rise to $600 before it finally came around and I made $350.

Then there's the actual fundamentals, where the price balance comes back to where it should be after the news ripples fade away. Those are long-term trades and that's way too much stress to watch happen.

I visit the Forex subreddit regularly and I can't make heads or tails of the technical analysis that all these people are trying to do. I don't understand why they are doing this. Most of them are stuck, tired, stressed, and broke. I see why 90% of people fail. Trying to predict the future based on the past is not how any of this works. There may be some patterns that repeat, but every moment in the market is unique, and it can go any way at any time.

For this week, I'm up $4000 that includes $1900 in losses. So that could have been $6000 in my pocket, but I did have some bad spells where I got caught in a bad pattern until I stepped away.

But that's a 3:1 profit to loss ratio with a win percent of ~60%. If I can keep to my strategy and stop making dumb trades, things are going to work out with this as an income stream.

More on this as October starts.

0 notes

Text

Why Are Overnight Fees Eating Into My Profits? Here’s What I Learned

As a forex trader, I recently faced an unexpected challenge that made me dive deeper into the intricacies of trading costs. It all started when I noticed a recurring charge on my trading account—a fee that seemed to appear every time I held a position overnight. At first, I was puzzled and a bit frustrated, wondering why my profits were being eaten away by what my broker referred to as an "overnight fee."

I hadn't paid much attention to this before, assuming it was just a minor charge. However, as I began to trade more frequently and held positions for longer periods, I realized that these overnight fees were adding up and starting to significantly impact my overall profitability. This led me to a critical question: What exactly is an overnight fee, and why is it charged?

Driven by curiosity and the need to optimize my trading strategy, I decided to do some thorough research. I poured over various articles, broker explanations, and financial textbooks, trying to get to the root of what these fees were and how they worked. It became clear that understanding these fees was essential not just for managing costs but also for making smarter trading decisions. After diving into the mechanics of overnight fees and understanding their impact on trading, I want to share my findings with you, my fellow traders, to help you better navigate this aspect of trading.

What is an Overnight Fee?

An overnight fee, or swap fee, is the interest paid or received for holding a position overnight in financial markets. This fee comes into play primarily in forex trading, contracts for difference (CFDs), and other leveraged instruments. When you hold a position overnight, you're essentially borrowing one currency to buy another, and this borrowing comes with a cost or, in some cases, a small profit depending on the interest rate differential between the two currencies involved in the trade.

In more straightforward terms, the overnight fee is the cost or benefit of carrying a trade from one day to the next. It is a critical factor to consider, especially for traders who hold positions for more than a day.

Factors Influencing Overnight Fees

Through my research, I discovered that several factors determine the amount of the overnight fee. Understanding these can help you anticipate and manage these fees better:

Interest Rate Differentials: One of the most significant factors influencing overnight fees is the interest rate differential between the two currencies in a currency pair. If the currency you are buying has a higher interest rate than the currency you are selling, you may receive an interest payment. Conversely, if the currency you're buying has a lower interest rate, you will likely pay an interest fee.

Leverage and Position Size: The amount of leverage you use and the size of your position can also affect the overnight fee. Higher leverage increases the notional value of the trade, thus increasing the fee or credit for holding the position overnight. This is because the interest is calculated based on the total value of the leveraged position, not just your initial margin.

Type of Financial Instrument: Different financial instruments have different overnight fee structures. In forex trading, overnight fees are typically based on the interest rate differentials of the currency pair. In CFD trading, the fees might be based on the underlying asset's market interest rate or other factors set by the broker.

Pros and Cons of Overnight Fees

From a trader's perspective, overnight fees can have both advantages and disadvantages, which should be carefully considered when developing trading strategies.

Pros:

Compensation for Funding Costs: For brokers, overnight fees help cover the costs associated with holding a trader's position open overnight, especially in leveraged trades where the broker essentially lends the money to the trader.

Opportunity for Interest Income: Traders can earn interest if they are long on a currency with a higher interest rate compared to the one they are short on. This can provide an additional income stream, especially in a favorable interest rate environment.

Encourages Short-Term Trading: For short-term traders, the presence of overnight fees can be an incentive to close positions before the market closes, avoiding the fees altogether. This promotes more active trading and liquidity in the markets.

Cons:

Increased Costs: Overnight fees add to the overall cost of trading, which can negatively impact profitability, particularly for those who frequently hold positions overnight.

Volatility and Unpredictability: Because overnight fees can fluctuate based on market conditions and interest rate changes, they can be unpredictable. This unpredictability introduces an element of risk and uncertainty for traders.

Differences Across Markets: Different markets and financial products may have varying overnight fee structures and calculations, requiring traders to spend time understanding and managing these fees effectively.

Limitations on Long-Term Strategies: High overnight fees can discourage traders from holding positions for the long term, as the costs can accumulate and eat into profits, making long-term strategies less attractive.

Understanding overnight fees is crucial for any forex or CFD trader who holds positions for more than a day. These fees are not just a minor detail—they can significantly impact your trading costs and profitability. By understanding how overnight fees are calculated and what factors influence them, you can make more informed decisions about when to hold or close a position. This knowledge helps you manage your trades better, minimize unnecessary costs, and maximize your potential returns. Always keep an eye on the fees associated with your trades, as they can be the difference between a profitable and an unprofitable trade in the long run.

References

1.Understanding Overnight Fees in Trading

2.Overnight fees

3.Overnight Fee - Glossary - TraderKnows

1 note

·

View note

Text

How to Create Passive Income from Scratch with No Money

I’ve never been a fan of the 9–5 grind, waiting for a paycheck that shows up when it feels like it. My old job paid on the 5th of every month, but even then, it felt like a drag. I know some people genuinely enjoy the stability of a regular job—my cousin loves his 9–5 more than his YouTube channel! And that’s perfectly fine.

But for those of us looking for something different, there are ways to create passive income streams, either alongside your day job or as a full-time pursuit. Here’s a journey into how you can start small and gradually build your passive income empire.

Lessons Learned from a 9–5 Disaster

I’ve had my fair share of job changes—four times, to be exact—and my last 9–5 job was the absolute worst. I had a heated argument with my boss, and after that, everything went downhill. I remember being made to wait for four hours in the reception area, only to be told my paycheck would come when the boss “felt like it.” That was the last straw.

This experience pushed me to go full-time with my writing business and explore other passive income avenues. I realized that the freedom to work on my terms was priceless. I could decide what to pursue, when to get paid, and if I didn’t like something, I could simply walk away from it.

Finding Freedom Through Passive Income

I love working online and running my own show. The best part? If one income stream slows down, others keep me afloat. It’s about diversification and creating multiple safety nets, so you and your family are never reliant on a single source.

For those looking to step into passive income, here’s a guide to finding your perfect fit:

List Your Interests: Focus on what excites you—whether it’s writing, finance, creativity, or digital products. For me, it’s all about creative writing and digital products. I stay away from niches that don’t align with my passions.

Identify Your Skills: Match your skills to your interests. If you’re good at content creation, you might excel in blogging or creating digital products.

Pick Your Platform: Choose a platform where you’d enjoy spending time. For example, if you love writing, Medium or a personal blog might be your space.

Keep It Authentic: Create original content. Use AI for research, but let your voice and expertise shine through.

Passive Income Ideas You Can Start with Zero Money

Content Creation: My top pick because it’s the backbone of my income. Whether it’s blogging, writing eBooks, or creating videos, good content opens multiple income streams.

Forex Trading with SureShotFX: If you're keen on automated trading, SureShotFX offers algorithm-driven trading solutions that can work for you even when you're not actively involved. Their services, including the Telegram Signal Copier, let you tap into expert strategies without the steep learning curve. You can get started with minimal capital and scale as you gain confidence.

Sell Digital Products: E-books, Google Sheets, printables—if you can create it, you can sell it. I’ve had success with budget trackers and other simple digital tools.

Rent Out Space: Got an extra room or parking spot? Consider renting it out. Platforms like Airbnb make it easy to earn without much hassle.

E-commerce: Even if you’re starting small, like my Instagram music store, every little bit adds up.

Blogging: It’s straightforward, requires minimal investment, and if done right, can bring in a steady income through ads and affiliate marketing.

Invest in Forex with SureShotFX: Their Telegram Signal Copier service is another great way to generate income passively. It allows you to copy trades from experts, automate your trading, and keep your investment working around the clock. You can start small, monitor the results, and scale up as you grow more comfortable with the process.

Conclusion: Start Small and Grow Gradually

You don’t need to dive into everything at once. Choose one or two income streams that align with your skills and interests, and build from there. Whether it's content creation, digital products, or automated trading with SureShotFX, the goal is to find what works for you and stick with it. Your journey to financial freedom doesn’t have to start big—it just has to start.

#forex#forex trading#forexsignals#forextrading#telegram#signal copier#passive income#make money online

0 notes

Text

8 Ways to Make $100,000 Selling Information Products

I got out my trusty calculator and did a little math. Assuming you make your own information products, what would it take to earn $100,000 in a year if you work with affiliates and pay them 50% commission?

$47 Ebooks: You'd need to sell 355 of these a month, or 12 per day.

$97 Teleseminars and Webinars: You'll be selling 172 seats a month, or 5.7 per day. Think no one would pay that kind of money for a teleseminar? If your information is timely and valuable, they'll line up for it. For example, stock market and forex trading advice would fit this category.

$197 Audio Courses: You only need to sell 85 of these a month, or 2.9 per day. Now who's going to pay $197 for an audio course? Actually, a lot of people. The trick is to make a big promise, record on a library of CD's, and make sure you fulfill that promise. Example titles might be; 7 Days To Speaking Confidence or perhaps Improve Your SAT Scores by 33% In Two Weeks or even How To Become A Master Pick Up Artist Practically Overnight.

$497 Video Courses: I know what you're thinking – who's going to pay $497 for a video course? The truth is, many people have paid TWICE that amount. Sample title? How about... How to Generate a Six Figure Income in 90 Days. Oh yes, and to earn $100,000 a year using affiliates at 50% commission, you'd only need to sell 33.5 a month. That's practically one per day.Now then – would you rather make 12 sales a day, or 1 sale a day? Are you ready to step up and start selling big ticket products?And by the way, other products you can sell for $497 and MORE are...

- Home Study Courses (video, audio and written material)

- Online Study Courses (video, audio and written material, plus it's more interactive and more likely to actually be used by the buyers.)

- Seminars and Workshops

- Group CoachingSo let me ask you a question: What if you put on a killer online study course and you charged $997 – how many sales would you need to reach that $100,000 mark (assuming all sales were made through affiliates?) Just 16.7 per month.

Or what if you charge $2,000 for your seminar – you'd only need 100 attendees to make a $100,000 payday.Or if you charge $300 a month for group coaching – you'd need just 55 members.

And in any of the above scenarios, what if you didn't use affiliates? What if you made all the sales yourself? Then of course you'd only need half as many sales to make just as much money. So in the $997 product example, you'd only need 8 or 9 sales a month to generate a $100,000 income.

If you've been paying attention here, you might have noticed I left out one major possibility. Do you know what it is?Recurring subscriptions or membership sites. 355 members paying $47 a month yields $200,000 – half for you and half for your affiliates. Can you retain 355 for the full 12 months? You'll have to offer killer content and incentives to come close.One more thought – what if you do a combination of the above? Perhaps you choose two things, or three or four. Then instead of earning $100,000, you're earning $200,000 or more.

I'll let you in on a secret: We tend to get so bogged down in day to day thinking that we forget to step back and look at the big picture. And so is it any wonder that we think small, instead of thinking in numbers like these? You can indeed attain these marks and more, but the first step is to think the thoughts and the second is to believe you can do it.

And you already know the third step – take action on a massive scale and don't stop until you reach your goal.

Read the full article

0 notes

Text

What are bots in Forex EA?

Introduction:

A Forex EA is a software program that can automatically trade on your behalf in the MetaTrader 5 trading platform. They are written in the MQL5 programming language and can be used to automate a variety of trading strategies, including trend following, scalping, and arbitrage.

Types:

There are many different types of Forex EA (EAs) available for the MetaTrader 5 (MT5) trading platform. Some of the most common types of EAs include:

Trend following EAs: These EAs trade in the direction of the trend. They typically use moving averages or other technical indicators to identify trends.

Scalping EAs: These EAs open and close trades very quickly, often within minutes or even seconds. They typically use small stop losses and take profits in order to profit from small price movements.

Hedging EAs: These EAs open trades in both the buy and sell direction in order to reduce risk. They typically use stop losses and take profits to protect profits and limit losses.

** Arbitrage EAs:** These EAs take advantage of price differences between different markets. They typically use automated trading to buy an asset in one market and sell it in another market at a profit.

Bots: These EAs are designed to automate a variety of trading tasks, such as placing orders, managing risk, and analyzing market data. They can be used to trade a variety of financial instruments, including forex, stocks, commodities, and cryptocurrencies.

How do EAs work?

EAs work by following a set of instructions that are written in the MQL5 programming language. These instructions are called a trading algorithm. The trading algorithm tells the EA how to trade, such as when to open a trade, when to close a trade, and how much to risk.

Benefits:

There are many benefits to using Forex EA, including:

They can help you to save time and effort. EAs can automatically execute trades according to your trading strategy, freeing up your time to focus on other aspects of your trading.

They can help you to improve your trading performance. EAs can help you to avoid emotional trading and to stick to your trading plan.

They can help you to reduce your risk. EAs can be programmed to take profits and to cut losses automatically, helping you to protect your capital.

Risks:

There are also some risks associated with using Forex EA, including:

They can be expensive. EAs can range in price from a few dollars to hundreds of dollars.

They can be complex to set up and configure. It is important to have a good understanding of the MQL5 programming language in order to set up and configure an EA.

They can be buggy or unreliable. EAs are not perfect and can sometimes make mistakes. It is important to test an EA on a demo account before you use it with real money.

They can be hacked or manipulated. EAs can be hacked or manipulated by malicious actors. It is important to take steps to protect your EA, such as using a secure password and keeping your computer up to date with the latest security patches.

How to choose:

When choosing a Forex EA, there are a few things you should keep in mind:

The trading strategy: Make sure that the EA is based on a trading strategy that you understand and that you are comfortable with.

The performance: Backtest the EA on historical data to see how it has performed in the past.

The price: Don't pay too much for an EA. There are many high-quality EAs available for a reasonable price.

The reviews: Read reviews from other traders who have used the EA.

Where can I find:

There are many places where you can find Forex EA, including:

The MetaTrader 5 marketplace

The MQL5 community

Private trading groups

Individual developers

4xPip:

4xPip is a website that provides traders with a variety of tools and resources to help them succeed in the forex market. One of the most popular tools offered by 4xPip is its Forex EA marketplace.

The 4xPip EA marketplace is home to a wide variety of EAs, all of which have been thoroughly reviewed by the 4xPip team. This ensures that traders can be confident that the EAs they choose are of high quality and will help them to achieve their trading goals.

In addition to providing a wide selection of EAs, 4xPip also offers a number of other features that make it a valuable resource for traders. These features include:

Forex EA reviews: 4xPip reviews all of the EAs in its marketplace, providing traders with detailed information about each EA's performance, features, and risks.

Forex EA backtesting: 4xPip allows traders to backtest EAs on historical data, giving them a better idea of how the EAs will perform in the future.

Forex EA support: 4xPip offers support to traders who are having problems with their EAs.

If you are looking for a reliable and trustworthy source for Forex EA, then 4xPip is the perfect place for you. With its wide selection of EAs, expert reviews, and backtesting tools, 4xPip can help you to find the best EA for your needs and achieve your trading goals.

Here are some additional benefits of using 4xPip to find Forex EA:

You can be sure that the EAs you find are of high quality and have been thoroughly reviewed.

You can backtest EAs on historical data to see how they would have performed in the past.

You can get support from 4xPip if you have any problems with your EAs.

Conclusion:

Forex EA can be a valuable tool for traders who want to automate their trading and improve their performance. However, it is important to do your research and to choose an EA that is right for you.

I hope this blog post has been helpful. If you have any questions, please feel free to leave a comment below.

#black tumblr#automate trading bots#auto trading bots#black fashion#black art#black history#black literature#custom bot ea#custom bots#custom bots trading#Forex EA

0 notes

Text

Learn Forex Trading. Facilitating Cash on Global Forex Trading.

Learn Forex Trading. Facilitating Cash on Global Forex Trading. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb Practically all internet marketers have become aware of forex trading or online currency trading as it is sometimes referred to and numerous wonder about how the forex trading system works and where they can go to find out forex trading. To become a successful forex trader you need to understand what forex trading is and how to effectively trade forex. To attain adequate knowledge it is vital to learn forex trading from experts. This can be carried out in the form of a forex tutorial and there are hundreds of forex businesses offering online tutorials and guides. An online forex tutorial will discuss how the foreign exchange market works and will likewise discuss the kinds of forex orders that are offered to you as a forex trader. A forex tutorial will likewise explain technical indications and what they mean, the economic indications you will need to be familiar with, and the various options and methods that are offered to you as a forex trader. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb If you are brand-new to forex trading then you must discover forex trading before parting with any of your tough-made money. Many online forex businesses provide free training and demonstrations that look like that of real-time forex trading. There are likewise forex trading courses readily available and these are likewise a valuable way to learn forex trading as you can describe these courses time and time once again. When it comes to forex trading is important to find out forex trading so that you comprehend how to trade and how to trade effectively, the most important element. The more you find out about forex trading the more understanding you will have and the more success. Finding a forex tutorial or forex trading course is easy. All you need to do is a brief web search and you will have a great deal of courses and tutorials to choose from. If you are serious about prospering as a forex trader, then it's down to you, to learn forex trading now and discover to prosper. Facilitating Cash on Global Forex Trading. There are various forms of company. However, the simplest way of earning money is to trade forex. Among the leading companies of forex trading on a real-time basis is worldwide forex trading. It started its operation in 1997. It provides opportunities for individuals to trade forex online in real time and it offers a chance to most forex brokers to earn millions each day. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb International forex trading is presently serving over one hundred nations. It utilizes the DealBrook FX2 software application and supplies twenty-four-hour access to the forex market. It is also equipped with the greatest quality of consumer service which is commonly available in the market of forex trading. The forex brokers are provided the chance to gain access to the costs of over sixty currency pairs and provide analytical services from distinguished experts. The traders are likewise upgraded with the most recent news on currency status and available forex charts. Global Forex Trading is the only company of trading platforms on forex appropriate for beginners along with specialists. When trading forex, there are various advantages. It is extremely available since it is open twenty-four hours besides having the most liquid market. The take advantage of the strategy is always offered in which the traders have the option of utilizing a 100:1 leverage. This decreases the requirement for larger capitals that are to be opened on the trader's account. Forex trading has trading and no commission is widely readily available over sixty currencies all over the world. Forex trading is internationally readily available which is why the traders have larger trading opportunities despite any market conditions. Because of the given benefits, don't assume that forex trading is just for huge investors. International forex trading has opened the way for smaller deals. In this method, both small and huge financiers are given the chance to make money from trading forex. In rare cases, some people assume that the marketplace for international forex trading dwarfs the equities. Nevertheless, this is not true since the volume of forex trading surpasses 2 trillion dollars every day. Global forex trading is thought about as the leader in the field of competitive market exchange. There are numerous reasons worldwide forex trading is amazing. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb -The forex market is extensively readily available. The traders can trade currencies twenty-four hours a day, seven days a week no matter their variations. When stock exchanges are readily available, this supplies a greater market chance for traders compared to equities which can only negotiate organization on market hours. -The worldwide forex trading perspective utilized is astonishing. Compared to equip trading, the trader can either trade with the cash that they have or open margin accounts and double the take advantage of when trading. Take, for example, if you moneyed your margin accounts with 25,000 then you can manage an equity position of 50,000. But in worldwide forex trading, your initial capital can acquire leverages as much as 20, 50, and even 100 times. In this way, the traders can open a forex brokerage online with just 5,000 dollars and can control positions of approximately 200,000 dollars or above. And if the trader can money an account with 10,000 dollars then he can manage positions approximately 500,000 dollars. Whether the trader can only gain 5% on the positions, then it would still be equivalent to a 25,000-dollar gain with only an initial capital of 10,000 dollars. -There are lots of traders in the forex market. However, even if it is possible to make fast revenues, the risk of losing is likewise very high. That is why the technical and fundamental analysis of forex markets is extremely crucial. Traders should get a forex education to have a great start. It could increase their opportunity to become effective forex traders. The traders must secure their business from prospective losses. Worldwide forex trading is certainly a highly speculative endeavor. Remember that the traders who are successful in trading forex are those who are systematic, have strong controls over their emotions and impulses, are fault-analytical, and are disciplined. The traders can earn big revenues in just a few days of trading, it will grow as time passes, but, only prevent making any errors. One of the leading companies of forex trading on a genuine time basis is global forex trading. It offers chances for people to trade forex online on genuine times and it offers an opportunity to most forex brokers to make millions each day. Global Forex Trading is the only supplier of trading platforms on Forex suitable for newbies as well as specialists. Forex trading has trading and no commission is widely available for over sixty currencies all over the world. Forex trading is globally readily available which is why the traders have wider trading chances regardless of any market conditions. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb Thank you for looking at my Video from Ian Jackson.

#Forex Trading#FX trader#how to trade forex#learn to trade#how much money can I make trading forex#options trading#how to trade bitcoin#knowledge to action#how much money do I need to trade forex#is trading a scam#financial freedom#earn money online#Money#Trading for beginners#how to trade basics#free trading course

1 note

·

View note

Text

How Much Money Can You Make in Trading Stocks?

Do you know what is stock market trading? It is nothing but buying and selling stocks on the same day. To get the biggest deal, traders use technical indicators, monitor charts, and implement momentum strategies. In this article, let's discuss in detail about how much money you can earn in trading stocks.

Several factors govern the potential earnings from stock trading:

People often ask how much money I can make in trading stock in a month. Well, the answer to this question is that there is no limit. The money you can make can be thousands, lakhs, or even higher. But here are the few factors that intraday profits depend on.

The market you choose to trade in:

Each market offers unique advantages. Stocks typically require more capital than asset classes like forex or futures.

Initial investment:

The amount of money you start with will impact your potential income. Someone beginning with a larger sum will have higher earning potential than someone starting with a smaller amount

Time you spend on trading education:

You must develop a solid trading plan. It takes time and effort. It may take a year or more to create a consistent strategy. If you are trading part-time, achieving a consistent return rate may take even longer. Depending on your ability to trade, you may double your amount in a single trade or even halve it.

How can you make money from trading stocks?

Here are some guidelines that you can follow to increase your earnings when you invest in stocks.

Discipline:

Spend quality time developing an efficient approach. It is wise to remain patient and then invest in promising stocks. As you know, the stock market is unpredictable and always risky. Hence, you must make productive decisions.

Research:

You need to put in a lot of effort before buying stocks. First, research the company and learn about its operation and future goals. This will increase the number of good investments. You can expect a high return if you understand the business sectors well. Also, educate yourself about different stock trading platforms.

Broaden your Portfolio:

Build your portfolio by investing in different asset classes. This will help you manage your risk and optimize your return. You can diversify your investments according to your wishes.

Set Realistic Expectation:

When setting expectations, make sure your feet are planted in reality. It is important to understand that no asset class can continuously assure large sums of money. An unrealistic approach may lead to incorrect assumptions, which can result in a loss in investment.

Final thoughts:

If you are new to trading, do some research about an online stock trading platform and start investing. But before that, educate yourself on trend prediction and market changes. Are you looking for an online stock trading platform? If so, then you can check out ICM, which is the best choice for you. They use the best platform to provide you with an amazing trading experience.

0 notes

Text

Forecasting 2024 with DecodeEx: Key Economic Indicators Impacting Forex Trading

Greetings, fellow traders, readers, and friends! As we embark on the journey through 2024, I am excited to share insights into the critical economic indicators that will shape our forex trading adventures. Much like the warm ambiance of an Irish pub, I invite you to join me in exploring the financial world and understanding how these indicators can impact our trading decisions.

Understanding Economic Indicators

Before we delve into the indicators, let’s establish a common understanding. Economic indicators are like the compass of a nation’s economy. They provide essential data about a country’s economic health and play a pivotal role in determining currency values.

DecodeEx: Uncovering the Significance of Economic Indicators

DecodeEx, your trusted source for forex insights, recognizes the importance of these indicators in making informed trading decisions. Let’s delve into key indicators and their potential influence on our trading strategies.

DecodeEx: Anticipating 2024 Trends

Inflation Rate

Similar to the lively conversations and banter in an Irish pub, the inflation rate is a topic that remains evergreen. Inflation, or the rise in prices over time, can erode a currency’s value. A rising inflation rate may prompt a central bank to tighten monetary policy, potentially strengthening the currency.

Interest Rates

Interest rates, much like the tunes of traditional Irish music, can set the tone in the forex market. Central banks utilize interest rates to control the money supply. Higher interest rates can attract foreign capital, bolstering the currency, while lower rates can have the opposite effect.

GDP Growth

Gross Domestic Product (GDP) growth is akin to the heartbeat of a nation’s economy. A growing economy typically attracts investments and can lead to a stronger currency. Conversely, a contracting economy may weaken the currency.

DecodeEx: Impact on Currency Pairs

EUR/USD

The EUR/USD pair, much like the cultural connections between Ireland and Europe, remains a significant player in the forex world. Keep a close watch on economic indicators from both the Eurozone and the United States, as they can exert influence on the pair’s movements.

GBP/USD

The GBP/USD pair, reflecting the UK’s economic fortunes, is also worth monitoring. Developments related to Brexit and UK economic data will be key drivers for this pair.

Emerging Market Currencies

Don’t overlook emerging market currencies, much like Ireland’s own emergence as an economic force. Economic indicators from countries like India (INR) and China (CNY) can provide trading opportunities.

Strategies for Success

As we navigate the forex market in 2024, let’s keep these strategies in mind, much like the Irish spirit of resilience and adaptability.

Risk Management

Preserve your capital, just as we treasure our heritage. Set clear risk parameters and employ stop-loss orders to safeguard your investments.

Diversification

Diversify your portfolio, much like the rich tapestry of Irish culture. Spread risk across different currency pairs and asset classes to minimize exposure.

Stay Informed

Keep a vigilant eye on economic calendars and news sources. Stay abreast of global events and economic developments that can impact currency movements.

Conclusion

I’m thrilled to embark on this trading journey with you in 2024. DecodeEx is your trusted companion, providing insights into the economic indicators that will shape our trading decisions. Just as the Irish pub fosters camaraderie and good conversations, let’s embrace the forex market’s opportunities and challenges. Here’s to a prosperous year of trading ahead, filled with the luck of the Irish and informed decision-making! Sláinte (Cheers)!

0 notes

Text

recover money from tfxpro

In the world of cryptocurrency and online trading, the name Bitonext has been making waves lately. If you’ve stumbled upon Bitonext, you might have encountered various questions and concerns, such as “Is Bitonext legit?” and “How can I recover my money from Bitonext?” In this blog, we will delve into the Bitonext phenomenon, discussing its legitimacy, company information, complaints, and recovery options.

Bitonext Overview

Bitonext is an online trading platform that claims to offer an array of financial services related to cryptocurrencies and forex trading. To access their services, you’ll need to go through the Bitonext login process, which requires providing personal information and, often, an initial deposit.

Is Bitonext Legit?

The legitimacy of Bitonext has been a subject of much debate and concern within the online trading community. It’s crucial to exercise caution and conduct thorough research before engaging with any online trading platform, especially if it involves your hard-earned money.

Before signing up with Bitonext, it’s essential to verify their registration, licenses, and regulatory compliance to ensure they are operating within the bounds of the law. Look for reviews and feedback from other users to gain insights into their experiences with the platform. Remember that fraudulent entities often use enticing promises to lure unsuspecting investors.

Bitonext Company Information

When considering whether Bitonext is a reputable platform, it’s important to gather information about the company itself. Check for details like their physical address and contact number. An established and transparent company should readily provide such information. A lack of transparency or reluctance to share this data could be a red flag.

Bitonext Complaints

To gain a more comprehensive understanding of Bitonext’s reputation, search for customer complaints and reviews. While some complaints may be inevitable for any service, an excessive number of unresolved grievances can be indicative of problems within the company. Pay attention to the specific nature of these complaints and how Bitonext has responded to them.

Recovering Your Money from Bitonext

If you find yourself in a situation where you need to recover money from Bitonext, there are steps you can take:

Contact Bitonext: Start by reaching out to their customer support and express your concerns. In some cases, issues can be resolved through direct communication.

Consult Legal Advice: If your efforts to recover your money through Bitonext prove fruitless, consider seeking legal advice. Consult an attorney with experience in financial disputes and online trading.

Contact Your Payment Provider: If you made your initial deposit through a bank or payment service, contact them for assistance. They may be able to initiate a chargeback or help you recover your funds.

Report to Regulatory Authorities: If you suspect Bitonext of fraudulent activities, consider reporting them to the appropriate regulatory authorities. This can help prevent further potential scams.

Bitonext.com is Now Bitonext.co

It’s important to stay updated on any changes in Bitonext’s domain or online presence. Be cautious of any sudden transitions, and ensure that you’re interacting with the official website to avoid phishing attempts and scams.

Bitonext Email and Contact Number

Legitimate businesses typically provide reliable contact information, including email addresses and contact numbers. Use this information to communicate with Bitonext’s customer support or to verify their legitimacy.

Bitonext raises legitimate concerns, and it’s crucial to exercise caution when dealing with online trading platforms. Research, gather information, and consult legal advice if necessary, especially if you encounter difficulties recovering your money. Staying informed and vigilant is key to navigating the world of online trading safely.

recover money from tfxpro

0 notes

Text

Salut Roger Federer,

My Financial Strategies

Welfare

Play Defense

Try not to go back to being poor instead of trying to get rich (save 25% of each ODSP and Taxes Check, invest 15% in REITS & high dividend stocks, and keep 10% for an emergency fund)

Every time I buy something, look at the price and tell myself I'm gonna have $___ less money. Is the thing I want worth having less money?

If something costs $100 and it's on sale for 30% you lost $70; You didn't save $30

Do not to save what is left after spending; but spend what is left from saving

It's not about how much you make; but how much you save. If you make $100,000 but spend $90,000 I only have 10,000 to invest, but if I make $60,000 and save $30,000 I'll have $30,000 to invest and grow more money.

Create a mindset

Budget

Food & Supplements

Internet & Subscriptions

Phone Bill

Cleaning Supplies

Political Influence

Recycling ROI

Take savings and invest in REITs. On the returns for a REIT, invest in a Government Bond. On the return of an Government Bond; invest in an ETF. On return for an ETF invest in Forex. On return of Forex invest in Money Market Fund. On the return for Money Market Fund re-invest in REITs

What Is a Money Market Fund?

A money market fund is a kind of mutual fund that invests in highly liquid, near-term instruments. These instruments include cash, cash equivalent securities, and high-credit-rating, debt-based securities with a short-term maturity (such as U.S. Treasuries). Money market funds are intended to offer investors high liquidity with a very low level of risk.

What Is a Real Estate Investment Trust (REIT)?

A real estate investment trust (REIT) is a company that owns, operates, or finances income-generating real estate. Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investments—without having to buy, manage, or finance any properties themselves.

What Is the Forex Market?

The foreign exchange market is where currencies are traded. Currencies are important because they enable purchase of goods and services locally and across borders. International currencies need to be exchanged to conduct foreign trade and business.

What Is an ETF?

An exchange traded fund (ETF) is a type of security that tracks an index, sector, commodity, or other asset, but which can be purchased or sold on a stock exchange the same way a regular stock can. An ETF can be structured to track anything from the price of an individual commodity to a large and diverse collection of securities. ETFs can even be structured to track specific investment strategies.

What Is a Government Bond?

A government bond is a debt security issued by a government to support government spending and obligations. Government bonds can pay periodic interest payments called coupon payments. Government bonds issued by national governments are often considered low-risk investments since the issuing government backs them.

Financial Point of View

Mindset

Focus on what money can do instead of the accumulation of money

Investing

Banking Opportunities

Business Ownership

Creation of Passive Income

Affluent Social Networking

Health

Political Influence

Be focused on the financial situation your in to make realistic decisions

Don't make a $1000 purchase when you make $500 a month

Marriage Strategy

No Roles in Marriage

Live on the smaller income and save & invest the larger income

Live below your means

More to invest

Larger emergency fund

Larger budget for Professional Financial Support

Example: A couple has 2 revenue streams of $100,000. If one is invested completely in 20 revenue streams at $5,000 a piece, the couple would have 22 revenue streams the following year. The 2 from work and the 20 created. The second year the number increases to 42 revenue streams. It's the compounding effect.

Income isn't Wealth

Focus on Tomorrow

Income is what you bring in today, while wealth is what you have for tomorrow

Periodic income certainly affects your net worth (balance sheet), but doesn't define true wealth.Consider an individual who makes $1 million in wages in a year and spends 1.2 million in consumption during that year. The wealth (balance sheet) impact would be negative $200,000

Wealth is how much you accumulate

A net worth is a balance sheet—the net of your assets less your liabilities

Income is what you bring in over a period of time, and you report it on your annual income tax return

Habit Building for Kids

Extinction is the learned inhibition of retrieval of previously acquired responses. Fear extinction is used as a major component of exposure therapy in the treatment of fear memories such as those of the posttraumatic stress disorder (PTSD). Can be used for experience.

Money Lessons

Money Jars: Give 100$ for every 5 book reports, then divide among jars. 10$ Tithe (opened at the end of the month), 10$ Giving and Offering (opened on Sundays), 10$ Saving (opened on special occasions), 20$ Investing (only opened when full), 50$ Spending.

This teaches multiple personal finance skills

Motivates independent reading

Teaches oral and presentation skills

Build habit of gathering information when they are young

Build Corporate Executive mindset

Instead having this system with chores which creates employee mindset, teach kids to be in control of the information they use to get money

After the first trial runs this should be viewed as passive income for your

While balancing school and at home book reports; this simulates and exposes them to the similarities of having a job and starting their own company

I also have Family Traditions and Principles.

FOR THOSE WHO DO NOT KNOW HIS NAME: The ancient roots of the Federer family are found in the German state of Bavaria. Federer was a local name, for someone who lived in Bavaria, where they made great contributions to the feudal society which would become the backbone of early development of Europe.

Salut,

Adrien Blake-Trotman

0 notes

Text

Learn Forex Trading. Facilitating Cash on Global Forex Trading.

Learn Forex Trading. Facilitating Cash on Global Forex Trading. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb Practically all internet marketers have become aware of forex trading or online currency trading as it is sometimes referred to and numerous wonder about how the forex trading system works and where they can go to find out forex trading. To become a successful forex trader you need to understand what forex trading is and how to effectively trade forex. To attain adequate knowledge it is vital to learn forex trading from experts. This can be carried out in the form of a forex tutorial and there are hundreds of forex businesses offering online tutorials and guides. An online forex tutorial will discuss how the foreign exchange market works and will likewise discuss the kinds of forex orders that are offered to you as a forex trader. A forex tutorial will likewise explain technical indications and what they mean, the economic indications you will need to be familiar with, and the various options and methods that are offered to you as a forex trader. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb If you are brand-new to forex trading then you must discover forex trading before parting with any of your tough-made money. Many online forex businesses provide free training and demonstrations that look like that of real-time forex trading. There are likewise forex trading courses readily available and these are likewise a valuable way to learn forex trading as you can describe these courses time and time once again. When it comes to forex trading is important to find out forex trading so that you comprehend how to trade and how to trade effectively, the most important element. The more you find out about forex trading the more understanding you will have and the more success. Finding a forex tutorial or forex trading course is easy. All you need to do is a brief web search and you will have a great deal of courses and tutorials to choose from. If you are serious about prospering as a forex trader, then it's down to you, to learn forex trading now and discover to prosper. Facilitating Cash on Global Forex Trading. There are various forms of company. However, the simplest way of earning money is to trade forex. Among the leading companies of forex trading on a real-time basis is worldwide forex trading. It started its operation in 1997. It provides opportunities for individuals to trade forex online in real time and it offers a chance to most forex brokers to earn millions each day. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb International forex trading is presently serving over one hundred nations. It utilizes the DealBrook FX2 software application and supplies twenty-four-hour access to the forex market. It is also equipped with the greatest quality of consumer service which is commonly available in the market of forex trading. The forex brokers are provided the chance to gain access to the costs of over sixty currency pairs and provide analytical services from distinguished experts. The traders are likewise upgraded with the most recent news on currency status and available forex charts. Global Forex Trading is the only company of trading platforms on forex appropriate for beginners along with specialists. When trading forex, there are various advantages. It is extremely available since it is open twenty-four hours besides having the most liquid market. The take advantage of the strategy is always offered in which the traders have the option of utilizing a 100:1 leverage. This decreases the requirement for larger capitals that are to be opened on the trader's account. Forex trading has trading and no commission is widely readily available over sixty currencies all over the world. Forex trading is internationally readily available which is why the traders have larger trading opportunities despite any market conditions. Because of the given benefits, don't assume that forex trading is just for huge investors. International forex trading has opened the way for smaller deals. In this method, both small and huge financiers are given the chance to make money from trading forex. In rare cases, some people assume that the marketplace for international forex trading dwarfs the equities. Nevertheless, this is not true since the volume of forex trading surpasses 2 trillion dollars every day. Global forex trading is thought about as the leader in the field of competitive market exchange. There are numerous reasons worldwide forex trading is amazing. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb -The forex market is extensively readily available. The traders can trade currencies twenty-four hours a day, seven days a week no matter their variations. When stock exchanges are readily available, this supplies a greater market chance for traders compared to equities which can only negotiate organization on market hours. -The worldwide forex trading perspective utilized is astonishing. Compared to equip trading, the trader can either trade with the cash that they have or open margin accounts and double the take advantage of when trading. Take, for example, if you moneyed your margin accounts with 25,000 then you can manage an equity position of 50,000. But in worldwide forex trading, your initial capital can acquire leverages as much as 20, 50, and even 100 times. In this way, the traders can open a forex brokerage online with just 5,000 dollars and can control positions of approximately 200,000 dollars or above. And if the trader can money an account with 10,000 dollars then he can manage positions approximately 500,000 dollars. Whether the trader can only gain 5% on the positions, then it would still be equivalent to a 25,000-dollar gain with only an initial capital of 10,000 dollars. -There are lots of traders in the forex market. However, even if it is possible to make fast revenues, the risk of losing is likewise very high. That is why the technical and fundamental analysis of forex markets is extremely crucial. Traders should get a forex education to have a great start. It could increase their opportunity to become effective forex traders. The traders must secure their business from prospective losses. Worldwide forex trading is certainly a highly speculative endeavor. Remember that the traders who are successful in trading forex are those who are systematic, have strong controls over their emotions and impulses, are fault-analytical, and are disciplined. The traders can earn big revenues in just a few days of trading, it will grow as time passes, but, only prevent making any errors. One of the leading companies of forex trading on a genuine time basis is global forex trading. It offers chances for people to trade forex online on genuine times and it offers an opportunity to most forex brokers to make millions each day. Global Forex Trading is the only supplier of trading platforms on Forex suitable for newbies as well as specialists. Forex trading has trading and no commission is widely available for over sixty currencies all over the world. Forex trading is globally readily available which is why the traders have wider trading chances regardless of any market conditions. It's a great time to start! an introducing broker: https://live.4xc.com/signup/FG4aG6qb Thank you for looking at my Video from Ian Jackson.

#Forex Trading#FX trader#how to trade forex#learn to trade#how much money can I make trading forex#options trading#how to trade bitcoin#knowledge to action#how much money do I need to trade forex#is trading a scam#financial freedom#earn money online#Money#Trading for beginners#how to trade basics#free trading course

0 notes

Text

7 Critical Saving and Investing Mistakes You Must Avoid for Financial Success

Saving and investing are essential components of achieving long-term financial success. However, many individuals make critical mistakes that can hinder their progress. In this article, we will discuss seven common saving and investing mistakes and provide practical tips to avoid them. By understanding these pitfalls and adopting better financial habits, you can set yourself up for a more secure and prosperous future.

Mistake 1: Neglecting to Set Financial Goals

Unlock the Secrets of Forex Trading: Discover a Free, Yet Powerful Learning Course at ForexFinanceTips.com

Setting clear financial goals is crucial for effective saving and investing. Without goals, it becomes challenging to track progress and make informed decisions. For example, if your goal is to save for a down payment on a house, you can determine how much you need to save each month to achieve it. Without a goal, you might aimlessly save without a purpose.

Mistake 2: Failing to Create an Emergency Fund

One common mistake is not having an emergency fund. Life is full of unexpected events, such as medical emergencies or job loss, and having a safety net is essential. Aim to save three to six months' worth of living expenses in an easily accessible account. For instance, consider a high-yield savings account that offers both accessibility and growth potential.

Mistake 3: Not Diversifying Investments

Learn Python Coding and Django Web Development, 100% Course, Easy to navigate and complete learning road map at dtlpl.com

Investing all your money in a single asset class is a risky move. Diversification helps reduce the impact of volatility and potentially increases returns. For instance, instead of investing solely in stocks, consider allocating a portion of your portfolio to bonds or real estate. By diversifying, you spread your risk and increase the likelihood of achieving better long-term results.

Mistake 4: Trying to Time the Market

Attempting to time the market is a common mistake that even experienced investors struggle with. Predicting short-term market movements is extremely challenging, if not impossible. Rather than chasing short-term gains, focus on a long-term investment strategy. For example, regularly invest a fixed amount of money each month, regardless of market conditions.

Mistake 5: Ignoring the Impact of Fees and Expenses

Fees and expenses can eat into your investment returns over time. It's essential to understand the costs associated with your investments and choose options with lower fees when possible. For instance, consider low-cost index funds or exchange-traded funds (ETFs) instead of high-cost actively managed funds.

Mistake 6: Letting Emotions Drive Investment Decisions

Emotional decision-making can lead to poor investment choices. Fear and greed are common emotions that influence investors. For instance, selling stocks during a market downturn due to fear can result in substantial losses. It's crucial to stay disciplined and stick to your investment strategy based on research and analysis rather than emotions.

Mistake 7: Not Staying Informed and Seeking Professional Advice

Staying informed about financial news and trends is vital for making informed investment decisions. Additionally, seeking advice from qualified professionals can provide valuable guidance. For example, consider consulting with a financial advisor who can help create a personalized investment plan based on your goals and risk tolerance.

If you have a Dog, Cat, Bird, or any Pet at home, The Most Informative Pet Blog NiceFarming.com

Frequently Asked Questions

Q: How much should I save each month?

- The amount you should save each month depends on your income, expenses, and financial goals. A general rule of thumb is to save at least 20% of your income but adjust it according to your circumstances.

Q: Can I invest a small amount of money?

- Yes, you can start investing with a small amount of money. Many online brokerage platforms offer low minimum investment requirements, and you can gradually increase your investment as you save more.

Q: Should I pay off debt before investing?

- It's generally wise to prioritize high-interest debt repayment before investing. By paying off debt, you reduce financial burdens and free up more funds for saving and investing.

Conclusion

By avoiding these seven critical saving and investing mistakes, you can set yourself on the path to financial success. Remember to set clear goals, create an emergency fund, diversify your investments, avoid market timing, be mindful of fees, stay rational, and seek professional advice when needed. Cultivating these habits and making informed decisions will help you build a strong financial foundation and achieve your long-term objectives.

We hope this article has provided you with valuable insights and guidance. If you have any further questions or personal experiences to share, please leave a comment below. We'd love to hear from you and continue the conversation!

Read the full article

0 notes

Text

What is Forex Risk Management? Learn the Basics

Effective Forex risk management allows currency traders to minimize losses that occur as a result of exchange rate fluctuations. Consequently, having a proper Forex risk management plan in place can make for safer, more controlled, and less stressful currency trading. In this piece, we cover the fundamentals of FX risk management and how best to incorporate them into your process.

What is Forex risk management?

Forex risk management comprises individual actions that allow traders to protect against the downside of a trade. More risk means higher chance of sizeable returns — but also a greater chance of significant losses. Therefore, being able to manage the levels of risk to minimize loss, while maximizing gains, is a key skill for any trader to have.

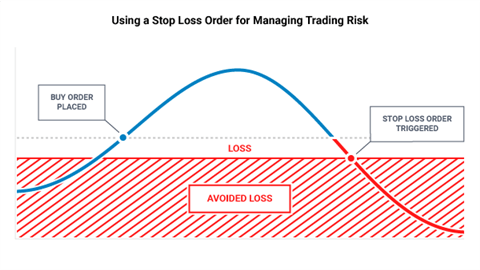

How does a trader do this? Risk management can include establishing the correct position size, setting stop losses, and controlling emotions when entering and exiting positions. Implemented well, these measures can prove to be the difference between profitable trading and losing it all.

Top 5 Fundamentals of Forex Risk Management

1. Appetite for Risk

Working out your appetite for risk is central to proper Forex risk management. Traders should ask: How much am I willing to lose in a single trade? This is particularly important for the most volatile currency pairs , such as certain emerging market currencies . Also, liquidity in Forex trading is a factor that affects risk management, as less liquid currency pairs may mean it is harder to enter and exit positions at the price you want.

If you don’t know how much you are comfortable with losing, your position size may end up too high, resulting in losses that may affect your ability to take on the next trade — or worse.

Let’s say 50% of your trades are winners. In the long term, mathematically you can expect to have runs of multiple losing trades in a row. Over a trading career of 10,000 trades, the odds suggest that you will face 13 sequential losses at some point. This underlines the importance of knowing your appetite for risk, as you need to be prepared, with sufficient money on your account, for when bad runs hit.

So how much should you risk? A good rule of thumb is to only risk between 1 and 3% of your account balance per trade. So, for example, if you have an account of $100,000, your risk amount would be $1,000-$3,000.

2. Position Size

Selecting the right position size , or the number of lots you take on a trade, is important as the right size will both protect your account and maximize opportunities. To select your position size, you need to work out your stop placement, determine your risk percentage and evaluate your pip cost and lot size. For more on how to do these things, click on the link above.

3. Stop Losses

Traders should use stops and also limits to enforce a risk/reward ratio of 1:1 or higher. For 1:1, this means you are risking $1 to potentially make $1. Place a stop and a limit on each trade, ensuring that the limit is at least as far away from current market price as your stop.

The table shows how the outcomes of different risk-reward ratios can change a strategy:

Risk-Reward1–11–2Total Trades1010Total Wins (40%)44Profit Target100 pips200 pips Stop Loss100 pips100 pips Pips Won400 pips800 pips Pips Lost600 pips400 pips Net Gain(-200 pips)200 pips

As can be seen in the table, if the trader was only looking for one dollar in reward for every one dollar risked, the strategy would have lost 200 pips. But by adjusting this to a 1-to-2 risk-to-reward ratio, the trader tilts the odds back in their favor (even if only being right 40% of the time). For a full breakdown of this concept, read more on risk reward ratios for Forex .

4. Leverage

Leverage in Forex allows traders to gain more exposure than their trading account might otherwise allow, meaning higher potential to profit, but also higher risk. Leverage should, therefore, be managed carefully.

While researching how traders fared based on the amount of trading capital being used, Strategist Jeremy Wagner found that traders with smaller balances in their accounts, in general, carried much higher leverage than traders with larger balances. However, the traders using less leverage saw far better results than the smaller-balance traders using levels over 20-to-1. Larger-balance traders (using average leverage of 5-to-1) were profitable over 80% more often than smaller-balance traders (using average leverage of 26-to-1).

Based on this information, at least when starting out, it’s advisable for traders to be very wary of using leverage and to be mindful of the risks it poses.

5. Controlling Your Emotions

It’s important to be able to manage the emotions of trading when risking your money in any financial market. Letting excitement, greed, fear or boredom affect your decisions may expose you to undue risk. To help you take your emotions out of the equation and trade objectively, maintaining a Forex trading journal or log can help you refine your strategies based on prior data — and not on your feelings.

Forex risk management: Top takeaways

In summary, to practice solid Forex risk management, traders should:

Work out their attitude to risk, thinking about risk/reward ratio, position size, and percentage of the account balance for each trade

Place stop losses to protect against the market going against their position

Be wary of leverage and using too much

Keep a handle on emotions

Use a journal to make decisions based on existing data rather than personal feelings.

#youtube#forexbot#accounting#forex online trading#gambit#financialservices#marketing#forex#forextrading

1 note

·

View note

Text

How Do I Start Trading Forex? A Beginner's Guide || Earn 1000$ by trading || Earn money online ||

Introduction

Trading forex, also known as foreign exchange or FX trading, can be an exciting and potentially profitable venture. However, for beginners, it may seem overwhelming and complex. In this article, we will guide you through the steps to start trading forex and provide valuable insights to help you navigate this dynamic market successfully.

Understanding Forex Trading

Forex trading involves the buying and selling of currencies in the global foreign exchange market. Traders aim to profit from the fluctuations in exchange rates between currency pairs, such as the EUR/USD or GBP/JPY. Unlike traditional stock markets, the forex market operates 24 hours a day, allowing traders to participate at their convenience.

Setting Up a Forex Trading Account

To start trading forex, you need to open an account with a reputable forex broker. Research different brokers and choose one that suits your trading needs. Look for brokers that offer competitive spreads, a user-friendly trading platform, reliable customer support, and strong security measures.

Learning the Basics

Before diving into trading, it's crucial to grasp the basics. Familiarize yourself with essential concepts such as currency pairs, pips, lot sizes, margin, and leverage.

Currency Pairs

Currency pairs represent the two currencies being traded. The first currency is the base currency, while the second currency is the quote currency. Understanding the relationship between currency pairs is fundamental to forex trading.

Pips and Lot Sizes

Pips refer to the smallest price increment a currency pair can make. They determine the profit or loss in a trade. Lot sizes represent the volume of a trade and can vary from standard lots (100,000 units) to mini lots (10,000 units) and micro lots (1,000 units).

Margin and Leverage

Margin is the collateral required to open and maintain a position. Leverage allows traders to control larger positions with a smaller amount of capital. It amplifies both profits and losses, so it's essential to use leverage cautiously.

Developing a Trading Strategy

A trading strategy is a set of rules that guides your decision-making process in the forex market. It helps you identify potential trade opportunities and manage risk effectively. Your strategy should consider factors such as timeframes, indicators, entry and exit points, and risk tolerance.

Utilizing Technical Analysis

Technical analysis involves studying historical price data and using indicators and chart patterns to predict future price movements. By analyzing charts and applying technical indicators, traders aim to identify trends, support and resistance levels, and potential market reversals.

Practicing Risk Management

Risk management is vital to protect your capital and ensure long-term success. Set a risk-reward ratio for each trade, use stop-loss orders to limit potential losses, and avoid risking too much of your account balance on a single trade. Additionally, consider diversifying your trades to minimize overall risk.

Choosing a Reliable Broker