#how to find investors for startups in india

Text

Top Tips for Working with Venture Capital Firms in India

The Indian startup ecosystem is booming. With a young, tech-savvy population and a rapidly growing economy, India presents a goldmine of opportunities for entrepreneurs. However, securing funding remains a crucial hurdle for many startups. This is where venture capital firms in India come in, acting as investment partners and providing the fuel to propel your venture forward. But how do you navigate the world of VC and build a successful partnership with these firms?

Here are some top tips to help you work effectively with venture capital firms in India:

1. Do Your Homework: Before approaching any VC firm, it's vital to understand their investment thesis. Every firm has specific sectors, stages of growth, and deal sizes they focus on. Researching their portfolio companies and past investments will give you valuable insights into their preferences. This targeted approach demonstrates respect for their expertise and increases your chances of securing a meeting.

2. Craft a Compelling Story: Investors are not just funding a business; they're backing a vision. Your pitch deck and presentations should tell a compelling story about your startup. Clearly articulate the problem you're solving, the unique value proposition you offer, and the market opportunity you're addressing. Focus on the "why" behind your business and how it will disrupt the existing landscape.

3. Know Your Numbers: Investors are looking for solid financial projections and a clear understanding of your revenue model. Prepare a well-defined financial plan that showcases your projected growth trajectory, burn rate, and potential for profitability. Be prepared to answer questions about your unit economics, customer acquisition costs, and funding requirements with confidence.

4. Build a Strong Team: A strong founding team is paramount for any startup. Investors want to see a passionate, experienced, and complementary team with the skills necessary to navigate the challenges and opportunities ahead. Highlight the diverse skillsets and domain expertise each team member brings to the table.

5. Demonstrate Traction, But Be Realistic: While early-stage startups might not have massive revenue figures, demonstrating traction through user growth, pilot projects, or other early validation metrics is crucial. This shows investors you're not just an idea on paper, but a venture with a proven concept and the potential to scale. However, be realistic about your stage of development and avoid overpromising on metrics you haven't achieved.

6. Network Like Crazy: Building relationships within the startup ecosystem is vital. Attend industry events, conferences, and workshops to connect with other entrepreneurs and potential investors. Network with mentors, advisors, and industry professionals who can provide valuable guidance and introductions to relevant VC firms.

7. Be Prepared for Due Diligence: Once you secure an initial meeting, be prepared for a thorough due diligence process. This may involve a deep dive into your financial records, legal documents, and market research. VC firms will want to assess the feasibility of your business model and identify any potential risks. Transparency and open communication are key during this stage.

8. Negotiate with Confidence: Terms are negotiable, so be prepared to discuss the investment details with confidence. This includes aspects like valuation, deal structure, board representation, and liquidation preferences. Research industry benchmarks and consult with advisors to ensure a fair and mutually beneficial agreement.

9. Build a Long-Term Partnership: The relationship with a VC firm doesn't end after the money is secured. View them as strategic partners who can offer valuable mentorship, industry connections, and support throughout your growth journey. Keep them informed of your progress, milestones achieved, and any upcoming challenges.

10. Find the Right Fit: Choosing the right venture capital firm is as important as securing funding itself. Look for firms that not only align with your investment needs but also share your vision and values. An ideal VC firm should be a value-added partner, providing guidance and support beyond just capital.

How to Find Investors for Startups in India - How to find investors for startups in India, can be a daunting task. Numerous firms operate across various sectors and investment stages. Platforms like Krystal Ventures Studio can be instrumental in connecting startups with relevant investment partners. Krystal Ventures Studio acts as a bridge, fostering meaningful connections between startups seeking funding and venture capital firms looking for promising ventures to support.

By following these tips and leveraging resources like Krystal Ventures Studio, you can significantly improve your chances of successfully working with venture capital firms in India and securing the funding your startup needs to thrive. Remember, building a successful startup is a marathon, not a sprint. With dedication, perseverance, and the right investment partners by your side, you can turn your innovative idea into a flourishing business that makes a real impact.

#how to invest in startups for equity#tech startups to invest in#how to find investors for startups in india

0 notes

Text

Tech Startups to Invest In: Maximizing Your Returns in the Digital Age

In today's rapidly evolving digital landscape, investing in tech startups has emerged as a lucrative opportunity for investors seeking high returns. As the world becomes increasingly interconnected, the demand for innovative technologies continues to soar. This presents a remarkable chance for individuals to invest in promising tech startups that are driving digital transformation across various industries. In this article, we will explore the potential of investing in tech startups, discuss venture capital firms in India, and provide insights on how to invest in startups companies to maximize your returns.

The Rising Tide of Tech Startups:

The realm of technology startups has witnessed exponential growth, with countless success stories emerging from various corners of the globe. India, in particular, has emerged as a hotbed for tech innovation, harboring a thriving startup ecosystem. With a large pool of talent, a supportive government, and a booming digital market, India has become a favorable destination for startups and investors alike.

Venture Capital Firms in India:

When it comes to investing in tech startups, partnering with venture capital firms can be a prudent strategy. These firms specialize in identifying and nurturing promising startups, providing them with the necessary capital and guidance to scale their operations. In India, several renowned venture capital firms have played a pivotal role in fostering the growth of startups. Some notable names include Accel Partners, Sequoia Capital India, Nexus Venture Partners, and IDG Ventures India.

How to Invest in Startup Companies:

Investing in startup companies requires a comprehensive understanding of the risks and rewards associated with this dynamic sector. Here are some key steps to consider when venturing into startup investments:

Research and Due Diligence: Thoroughly research the startups you are interested in and evaluate their business model, market potential, competitive landscape, and team expertise. Conducting due diligence is crucial to make informed investment decisions.

Diversify Your Portfolio: Allocate your investment across multiple startups to reduce risk. Diversification allows you to hedge your bets and maximize your chances of benefiting from a successful startup while minimizing potential losses.

Seek Professional Advice: Engaging with experienced financial advisors or consulting venture capital firms can provide valuable insights and guidance throughout the investment process. These professionals can help identify the startups with the highest potential and navigate the complex startup landscape.

Krystal Ventures: A Promising Investment Opportunity

As you explore potential tech startups to invest in, Krystal Ventures stands out as a notable option. With a track record of identifying disruptive startups with transformative potential, Krystal Ventures has established itself as a leading venture capital firm in India. Their expertise in the technology sector and their network within the startup ecosystem make them an ideal partner for investors looking to capitalize on the digital age.

Conclusion:

Investing in tech startups offers immense potential for maximizing your returns in the digital age. With the support of venture capital firms in India and a robust investment strategy, investors can tap into the fast-paced world of startups. Remember to conduct thorough research, diversify your portfolio, and seek professional advice to make informed investment decisions. In this ever-evolving landscape, Krystal Ventures emerges as a compelling choice, guiding investors towards promising tech startups and ensuring potential success in the digital era.

#d2c startups#venture capital firms in india#how to invest in startups companies#how to find investors for startups in india

0 notes

Text

Why Bangalore is a Global Hub for Start-ups

Bangalore, known as the Silicon Valley of India, has evolved as a global hub for start-ups. Explore why this place is gaining the attention of entrepreneurs worldwide and Know why Bangalore is a Global Hub for Start-ups.

Bangalore, known as India's Silicon Valley is now one of the prominent start-up hubs not just in India but in the world. Starting in the 80s, India established Electronics City to draw multinational corporations and encourage the technological transformation of their city.

Recent statistics reveal that Bangalore now hosts over 10,000 start-ups worth an estimated $50 billion. These numbers attest to Bangalore's entrepreneurial spirit while creating an ideal ecosystem that helps start-ups grow successfully.

Bangalore stands out for both its impressive number of start-ups as well as significant venture capital funding. In 2020 alone, over $10 billion was invested into ventures located here - surpassing even San Francisco and London! This funding influx allowed start-ups in Bangalore to rapidly scale and enter new markets more effectively.

How and What made Bangalore one of the biggest hubs for start-ups

If you are thinking about what made Bangalore one of the biggest hubs for start-ups, Find out below:

Overview of Bangalore's start-up ecosystem

Bangalore's start-up ecosystem is made up of a dynamic mix of entrepreneurs, investors, mentors, and incubators. This city provides co-working spaces, accelerators, and networking events that foster innovation and collaboration between startups. Not only this, startups here also enjoy support from organizations like the National Association of Software and Service Companies (NASSCOM) and Karnataka Biotechnology and Information Technology Services (KBITS), providing resources and guidance for entrepreneurial success.

Statistics and market trends showcasing the impact of start-ups in Bangalore:

Bangalore startups' impact can be gauged from their numbers as detailed below:

According to a report released by NASSCOM, Bangalore held 44% of India's start-up funding in 2020, attracting investments worth an estimated total of $4.2 billion.

Flipkart, Swiggy, and Ola are among the many unicorns found here that have not only revolutionized their respective industries but have also created jobs and promoted economic development.

Expert opinions on the factors contributing to Bangalore's success as a start-up hub:

Experts attribute Bangalore's success as a start-up hub to several factors.

First of all, its strong talent pool includes top educational institutions like IISc and IIM that produce skilled graduates for start-up ventures.

Bangalore's supportive government policies - like the Karnataka Start-up Policy that offers incentives and exemptions to start-ups. It has created an inviting atmosphere for entrepreneurs.

Venture capitalists and angel investors who fund promising start-ups also contribute greatly to Bangalore's success.

What changes did it bring to Bangalore as a city and to India:

Bangalore's start-up scene has resulted in profound transformation both locally and nationally.

First and foremost, the start-up ecosystem has caused a shift in workspace culture, with co-working spaces and flexible work arrangements becoming commonplace. This allows entrepreneurs from different backgrounds to come together and share their vision and resources.

Start-ups have led to an expansion of other industries in Bangalore, such as hospitality, real estate, and transportation, creating employment opportunities while strengthening local economies and raising salaries in general.

Furthermore, India has gained international prominence as an incubator of innovative start-ups resulting from Bangalore's start-up success story.

A Lot More that Defines How Bangalore has Become a Global Hub For Startups

There is a lot more that defines how Bangalore has become a global hub for startups in every sector. Keep reading.

Factors influencing Bangalore's start-up scene:

Bangalore's vibrant start-up scene can be attributed to multiple factors.

Firstly, there are government policies that foster start-up growth. The Karnataka government's establishment of the Karnataka Startup Cell and Elevate 100 program provides startups with funding, mentorship, and networking opportunities.

Access to funding has also played a critical role in Bangalore's start-up growth. There exists an established investor community here with venture capital firms, angel investors, and corporate funds actively investing in promising start-ups - this capital fuelled their expansion.

Impact of start-ups on various sectors in Bangalore:

Start-ups have had an enormous impact in various sectors in Bangalore. Within technology, start-ups have driven innovation and disruption that led to cutting-edge solutions being created by companies like Flipkart and Ola in terms of e-commerce and transportation. Zoho and Freshworks were revolutionizers within the software industry, respectively.

E-commerce start-ups like Flipkart and Myntra have revolutionized retail shopping experiences while creating employment opportunities and contributing to overall economic development in cities around the country.

Start-ups like Practo and Portea Medical have used technology to offer accessible and cost-effective health solutions that bridge the gap between patients and providers. These platforms serve to bridge this divide.

What's Next:

Now you might think about what lies ahead in India’s Silicon Valley, find what we expect below. Read on.

Predictions for Future Growth and Development:

According to a report released by NASSCOM, Bangalore boasts over 7,000 start-ups. Making it India's leading start-up hub and accounting for 20% of India's overall startup activity. It also brings a 20% surge due to the favorable policy environment and funding options available here.

Thanks to government initiatives like Digital India and Make in India, policy conditions that support start-ups have become conducive. Furthermore, increasing accessibility of funding options from both domestic and foreign investors could fuel further development in this city.

Emerging technologies such as artificial intelligence, blockchain, and the Internet of Things present start-ups in Bangalore with numerous opportunities. These technologies hold immense promise to disrupt various industries while creating innovative solutions. Furthermore, the growing demand for sustainable and clean technologies should stimulate further start-up growth within sectors like renewable energy or waste management.

Potential Challenges and Opportunities:

Bangalore's start-up ecosystem has experienced phenomenal growth over recent years; however, there remain several challenges it must navigate as part of this development process. One such issue is competition for talent; with new start-ups emerging each day, there are fewer qualified professionals available, and competition increases exponentially, resulting in rising talent costs. To sustain growth, it is vital that start-ups focus on recruiting and retaining staff for optimal business operations.

One challenge of start-up business ownership lies in continuous innovation and differentiation. Due to an ever-increasing number of start-ups entering certain sectors, competition may become intense in certain arenas; therefore, start-ups must adapt their offerings over time in order to remain ahead of their rivals and remain in their game.

Conclusion

Bangalore's start-up ecosystem plays a pivotal role in driving economic development and progress. Generating employment opportunities, encouraging innovation, and drawing investment are just a few benefits it brings, while established start-ups and successful unicorns create ripple effects that lead to the growth of ancillary industries and the diversification of the economy overall. Bangalore's longstanding history as an incubator of technological progress, combined with its supportive infrastructure, makes it the ideal location for ambitious entrepreneurs looking to start businesses of their own. The start-up ecosystem here has become an engine of economic progress, which contributes to globally recognized success stories like Bangalore.

6 notes

·

View notes

Text

Propviewz — Revolutionizing Real Estate Practices Or Propviewz — A Paradigm Shift in Real Estate Practices

The real estate scenario in India has seen a gradual surge in profits in the last few years. More & more home buyers and investors are now investing in properties that will yield them their gains in the long run. But are they making an informed decision on the property of their choice? This is something that needs to be discussed in detail.

To revolutionize the real estate industry, Apartments in Pune — based startup Propeye Technologies launched its first-ever kind digital portal Propviewz.com which will empower customers and clients to make informed decisions regarding properties they want to buy, sell or rent. Through the use of data analytics, all the information regarding properties is available on this website. This is an eye-opener as well as a game-changer that will give every individual a fair advantage over their deal and ensure a smooth transition for both parties.

The Role of Propviewz

‘Propviewz’, the brainchild of entrepreneurs Amar Shah, Gaurav Mittal and Riya Shah who revolutionized this concept by bringing a user-friendly and customer-centric platform to address all the key issues related to real estate industry under one roof. Amar Shah who has been in the real estate industry for over 15 years has a strong foothold and understands the need to close the gap between the information needed by the customers and what is available.

Speaking on the launch of the new endeavour, Shah, Director, Propviewz’ said “ While the real estate industry has witnessed the much-needed change, a more innovative approach is required to handle real issues faced by our customers while purchasing a property. We strongly believe that closing the information gap and bringing in more transparency about the last transacted price will empower the customers and help them make the right decisions which will, in turn, benefit the real estate industry.”

He added that “Propviewz with its user-friendly features makes it easier for a customer to navigate through the website and find the last transacted price, to avoid a possible dream crash of a customer who spends his life’s savings to buy properties. The website will also provide reviews of the project and qualitative and quantitative feedback.”

Shah while explaining, this is the only available conceptualised platform in India said, “While buying property the customers do not know the last transacted price in the vicinity of the particular area and end up calling family or friends. So it is hard to find out the actual value of the property. So to help them clear their misconceptions about their chosen Apartments in Pimpri Chinchwad property we have provided them with this opportunity to find all the information they want through this website.”

As he further elaborates, “The information available currently through various portals will only give a quoted price that the developer wants to sell the property in. Apart from this, there are other key aspects crucial for decision making like how the previous customers rated the property, whether they are writing about any legal hassles and so on. All this is a big factor for a buyer to make an informed and confusion free decision.”

Shah added that the objective of having this platform is for people to start having this habit of checking real estate on the last transacted price instead of going and negotiating blindly.”

Propviewz has developed a straightforward and user-friendly platform where not only the views, reviews and ratings but also the last transacted price is available to the buyer. These authentic details of the last transacted prices have been procured from government records which are often unavailable or complex. “We have used ‘AI’ to simplify the data and provide the information in an analytical format so that users can make wise decisions. The users will also have this information as a negotiating tool to avoid smart marketing tactics used by real estate portals. Propviewz is all set to create a digital revolution in the real estate market,

The portal will also be a useful tool for investors, resale buyers, tenants, and brokers to know factual transactions of the new and resale properties and tentative guiding prices. The platform also enables developers and investors to get several reports on a single platform like project planning reports, results, market development (RMD) reports and instant valuation reports (IVR) in a single click”, he added thoughtfully.

Shah ends on a positive note, ”Propviewz has a long way ahead but the journey of a thousand miles begins with one small step”, he adds with a positive smile.

https://propviewz.com/pune

0 notes

Text

Suggested Business Ideas for Entrepreneurs and Startups

Finding the right startup business is one of the most popular subjects today. Starting a business is no easy endeavor, but the time, effort, and challenges can be worth it if you succeed. To give yourself the best chance to be successful, take your time to carefully find the right business for you.

One of the first steps in your entrepreneurial journey is identifying the right business idea. The right business idea is the cornerstone of any project cycle. Investors and entrepreneurs need to zero in on a business or project that aligns with their requirements and goals before committing significant time and resources. Moreover, conducting a detailed feasibility study of the proposed project or business is crucial before planning the subsequent steps of the project cycle. Various aspects need to be studied before picking a project, including market demand, competition, financial requirements, and potential profitability.

At Entrepreneur India, we understand the complexities involved in starting a new business. Our recently published webpage offers a comprehensive list of business ideas based on different investment levels. Whether you are looking for low, medium, or high investment opportunities, this page serves as a valuable resource to help you find the right business idea that fits your investment capacity and goals.

Explore our page on business ideas with low, medium, and high investment for a curated list of businesses, industries, and projects you can consider starting. This page is designed to assist you in navigating through various business ideas and identifying the one that resonates with your vision and resources.

Why Choosing the Right Business Idea Matters

Choosing the right business idea is a critical step that can determine the success of your venture. Here are some reasons why it is essential:

Alignment with Goals and Interests: Selecting a business idea that aligns with your personal interests and goals increases your chances of long-term success. Passion and commitment are crucial factors that drive business success.

Market Demand: Understanding market demand is essential. A business idea that addresses a gap in the market or meets a specific need has a higher likelihood of success.

Resource Availability: Assessing the resources required, including financial, human, and material resources, helps ensure that you are well-prepared to support the business operations.

Competitive Advantage: Identifying a business idea that offers a unique selling proposition or competitive advantage can help you stand out in the market and attract customers.

Risk Management: Conducting a feasibility study and understanding the potential risks associated with a business idea allows you to develop strategies to mitigate those risks.

How Entrepreneur India Can Help Entrepreneurs and Startups

At Entrepreneur India, we provide a range of services designed to support entrepreneurs and startups in their journey to establish successful businesses. Our expertise lies in preparing Market Survey cum Detailed Techno Economic Feasibility Reports for setting up new industries or businesses. Here’s how Entrepreneur India can be helpful:

Comprehensive Feasibility Reports: Our reports contain detailed information on the manufacturing process, market research, flow sheet diagrams, product mix, machinery details, raw material details, and complete project financials. This comprehensive data helps assess the feasibility of the project.

Market Research and Analysis: We conduct in-depth market research to provide insights into market trends, demand and supply dynamics, competition, and potential opportunities.

Project Financials: Our reports include detailed financial projections, including capital investment, operating costs, revenue forecasts, and profitability analysis. This helps entrepreneurs understand the financial viability of their projects.

Technical Consultancy: We offer technical consultancy services to guide you through the technical aspects of your project, ensuring that you have the right knowledge and resources to succeed.

Customized Business Plans: We prepare detailed business plans tailored to your specific needs and goals. Our business plans provide a roadmap for your venture, helping you navigate through the various stages of your business development.

Starting a business requires careful planning and informed decision-making. At Entrepreneur India, we are committed to providing the support and expertise you need to turn your business ideas into successful ventures. Explore our range of services and let us help you embark on your entrepreneurial journey with confidence.

Visit our business ideas page to find the perfect business idea that suits your investment capacity and start your journey towards building a successful business today.

0 notes

Text

Pre-Seed Fundraising: A Crucial Step for Startups by SME IPO India

In the dynamic world of startups, securing funding is one of the most critical challenges entrepreneurs face. Pre-seed fundraising is the initial step in this journey, providing the necessary capital to turn innovative ideas into viable business ventures. SME IPO India, a trusted name in the financial ecosystem, delves into the nuances of pre-seed fundraising and offers insights on how startups can navigate this crucial stage effectively.

What is Pre-Seed Fundraising?

Pre-seed fundraising is the process of obtaining the initial capital required to start a business. This stage typically involves raising funds from personal savings, family, friends, or angel investors. The amount of money raised in a pre-seed round varies but usually ranges from 50,000 to 250,000. These funds are primarily used for research, product development, market validation, and building a core team.

Importance of Pre-Seed Fundraising

Idea Validation: Pre-seed funding allows entrepreneurs to validate their business ideas before seeking larger investments. It provides the resources needed to conduct market research, develop prototypes, and test the feasibility of the product or service.

Building a Strong Foundation: Early-stage funding helps in laying a solid foundation for the startup. It enables the founders to create a minimal viable product (MVP), hire key team members, and establish initial operations.

Attracting Future Investors: Successful pre-seed fundraising demonstrates to future investors that the startup has potential and is capable of attracting initial capital. It builds credibility and increases the likelihood of securing subsequent rounds of funding.

Strategies for Successful Pre-Seed Fundraising

Develop a Compelling Pitch: A well-crafted pitch is essential for convincing investors. It should clearly articulate the problem your startup aims to solve, the market opportunity, your unique solution, and the business model. Visual aids, such as pitch decks, can be very effective in communicating your vision.

Leverage Your Network: Tap into your personal and professional network to find potential investors. Friends, family, former colleagues, and mentors can be great sources of initial funding. Additionally, attending startup events and joining incubators or accelerators can help you connect with angel investors.

Show Traction: Demonstrating early traction, such as a growing user base, partnerships, or initial sales, can significantly boost investor confidence. This evidence of market demand shows that your startup has the potential to scale.

Prepare Financial Projections: Investors need to see that you have a clear financial plan. Provide realistic financial projections, including revenue forecasts, expense estimates, and cash flow analysis. This shows that you have a strategic vision for the business.

Highlight Your Team: Investors invest in people as much as they do in ideas. Highlight the strengths and expertise of your team members, showcasing their ability to execute the business plan successfully.

Role of SME IPO India in Pre-Seed Fundraising

SME IPO India plays a pivotal role in the startup ecosystem by providing valuable resources and guidance for pre-seed fundraising. With a wealth of experience in supporting small and medium-sized enterprises (SMEs), SME IPO India offers the following services:

Investor Connect: Through an extensive network of angel investors and venture capitalists, SME IPO India connects startups with potential investors who are looking for promising opportunities.

Mentorship Programs: SME IPO India runs mentorship programs that provide startups with expert advice on business strategy, financial planning, and market entry.

Workshops and Webinars: Regular workshops and webinars on fundraising strategies, pitch preparation, and financial management equip entrepreneurs with the knowledge and skills needed to succeed.

Resource Library: A comprehensive library of resources, including templates, guides, and case studies, helps startups navigate the complexities of pre-seed fundraising.

Conclusion

Pre-seed fundraising is a critical step in the journey of any startup. It provides the initial capital necessary to transform an idea into a tangible product or service. By leveraging the right strategies and resources, startups can successfully secure the funding they need to build a strong foundation and attract future investments. SME IPO India stands as a reliable partner, offering the support and guidance needed to navigate the pre-seed fundraising landscape effectively.

For more information on how SME IPO India can assist your startup in pre-seed fundraising, visit our website or contact us directly. Together, let's turn your entrepreneurial dreams into reality.

0 notes

Text

Navigating the investment landscape: Insights into startup investment in India without sacrificing equity

In the pulsating heart of India's entrepreneurial ecosystem, startup founders often find themselves at a crossroads: how to secure vital funding without diluting their equity. This dilemma is not unique, but navigating it successfully requires a nuanced understanding of the investment landscape, leveraging alternative financing models such as equity-free startup funding, revenue-based finance, and business loans tailored for startups in India.

Equity free startup funding: As traditional venture capital funding comes with the cost of equity ownership, many founders are turning to equity free startup funding. These avenues include grants, competitions, crowdfunding, and accelerators. In India, government initiatives, such as the Startup India program, offer grants and incentives to foster innovation without the equity sacrifice.

Revenue Based Finance: Another innovative approach gaining traction is Revenue Based Finance (RBF), where startups repay investors through a percentage of their monthly revenue until a predetermined cap or multiple is reached. This model aligns investor returns with the startup's performance, offering a win-win scenario without relinquishing equity. In India, RBF is gradually gaining popularity as startups seek sustainable growth paths. Klub, a pioneering player in the Indian startup financing scene, offers a fresh perspective on funding through its innovative revenue-based financing model. By providing capital without the burden of equity dilution, Klub empowers startups to fuel their growth while retaining ownership and control. With a focus on supporting early-stage ventures, Klub's approach aligns investor returns with the startup's revenue trajectory, fostering a symbiotic relationship between entrepreneurs and investors. This novel approach not only addresses the capital needs of startups but also contributes to the overall dynamism and sustainability of India's burgeoning startup ecosystem. As startups thrive, Klub paves the way for sustainable growth.

Startup investment in India: India's startup ecosystem has experienced exponential growth in recent years, attracting both domestic and international investors. From angel investors and venture capital firms to corporate venture arms and sovereign wealth funds, there's a diverse pool of capital available for promising ventures. With the government's supportive policies and initiatives like the Atal Innovation Mission, startup investment in India has surged across sectors, from technology and healthcare to agriculture and fintech.

Business loans for startups in India: While equity financing often grabs the headlines, business loans remain a crucial lifeline for startups, especially those startups in the early stages. Financial institutions and non-banking financial companies (NBFCs) offer tailored loan products designed to meet the unique needs of startups. These loans, ranging from working capital loans to equipment financing and trade finance, provide the necessary capital infusion without equity dilution. In conclusion, for startups in India, the path to funding success lies in understanding and leveraging the myriad options available in the investment landscape. By exploring equity-free startup funding, revenue-based finance, startup investment opportunities in India, and business loans tailored for startups, founders can chart a course towards growth and success without sacrificing equity. As the ecosystem evolves, embracing these alternative financing models will be key to unlocking the full potential of India's entrepreneurial spirit.

#equity free startup funding#revenue based finance#startup investment in india#business loans for startups in india

0 notes

Text

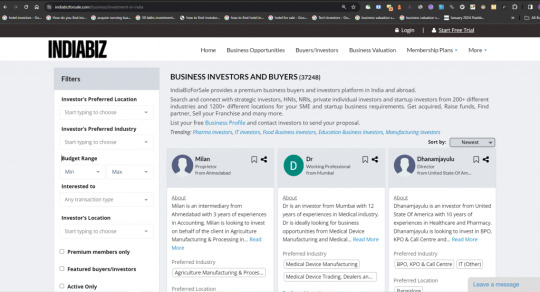

How To Find Investors For Business? - Here's the ultimate list

Over 11 years, we’ve cultivated a network of over 37,700 active business investors. Thousands of business owners/startup founders to connecting with potential investors/buyers or partners by their own to get funded/exit in the fastest and easiest way possible.

Locations Based Business Investors in India

We know how crucial your time is. So, we made location based business investors list below to help you find the right matches instantly.

So with less effort, you can click in only that fits your preferences and initiate the connection with the right potential investor matches;

1653 business investors in Andhra Pradesh Andhra-Pradesh

303 business investors in Arunachal Pradesh

350 business investors in Assam

502 business investors in Bihar

437 business investors in Chhattisgarh

905 business investors in Goa

2731 business investors in Gujarat

1486 business investors in Haryana

757 business investors in Himachal Pradesh

464 business investors in Jharkhand

2832 business investors in Karnataka

1130 business investors in Kerala

1021 business investors in Madhya Pradesh

3638 business investors in Maharashtra

273 business investors in Manipur

275 business investors in Meghalaya

274 business investors in Mizoram

272 business investors in Nagaland

456 business investors in Orissa

885 business investors in Punjab

1105 business investors in Rajasthan

300 business investors in Sikkim

2404 business investors in Tamil Nadu

1366 business investors in Telangana

283 business investors in Tripura

1425 business investors in Uttar Pradesh

813 business investors in Uttarakhand

970 business investors in West Bengal

Business Investors Based on Union Territories

972 business investors in Chandigarh

3894 business investors in Delhi

290 business investors in Diu

517 business investors in Pondicherry

281 business investors in Andaman Nicobar

335 business investors in Jammu and Kashmir

100 business investors in Dadra-and-Nagar-Haveli

1539 other business investors in India

Industry Based Business Investors in India

During our 11 years of journey, we came to know that, for business owners (like those like you who are looking for right partner/investor) are more focusing on specific business based matches.

So here, we make a list based on major industry based investors for you to get stated with;

2738 Agriculture business investors in India

1230 entertainment business investors in India

3877 automobile business investors in India

4376 services-based business investors in India

2241 real estate and construction business investors in India

2136 finance business investors in India

6852 healthcare and pharmaceutical business investors in India

11676 hotel and restaurant business investors in India

5220 IT/Tech business investors in India

9281 manufacturing business investors in India

3501 personal care business investors in India

5875 retail/wholesale business investors in India

1613 travel business investors in India

3141 utilities & energy business investors in India

4517 education business investors in India

5864 startup investors in India

480 media and broadcasting business investors in India

5244 franchise business investors in India

Above all industry-based investors list may go beyond the total of 37,700 networks as many investors have multiple industry preferences. For example one of our Investor (Saurabh) from Indore, is open to investing in IT, Food, Agriculture, and Pharmaceutical businesses.

So, you can find your potential matches and close your fundraising or M&A deal straight away.

Best of luck!

Source: https://indiabizforsale.com/blog/37700-investors-to-contact-for-your-business-in-india

#how to find investors#how to find investors for business#how to find investors for startups#business investors network#37700 private investors#indiabizforsale#fundraising opportunities

0 notes

Text

Complete Investment Banking Solutions in 120 Days - IBGrid

So you've got a fantastic startup idea, or maybe you're looking to grow your business through a merger or acquisition (M&A). Awesome! But let's be honest, building a successful business in India isn't easy. Finding the money you need and making smart deals can feel like navigating a maze blindfolded.

That's where IBGrid comes in. They're an investment banking team focused on helping Indian startups like yours win.

Why You Need Help (and Why Most Startups Fail)

The truth is, most startups fail. Like, 90% of them. Yikes! One big reason is funding. You need money to get your idea off the ground, but convincing investors to take a chance on you can be tough.

Even if you're an established business, M&A deals can be risky too. Believe it or not, a whopping 90% of them don't work out as planned. Often, it's because people jump in without a clear plan or the right guidance.

How IBGrid Gets You Funded and Makes Winning Deals (Fast!)

IBGrid gets it. They know the challenges Indian startups face. That's why they offer a special 120-day program designed to help you secure funding or navigate an M&A smoothly and quickly.

Here's what makes them different:

Laser Focus, Maximum Results: They keep things tight with a 120-day program, so you don't waste time or resources.

Your Indian Startup Dream Team: Their team is packed with experts who know the Indian market inside and out.

Your Plan, Not a Template: They don't just churn out cookie-cutter solutions. They take the time to understand your specific needs and craft a strategy just for you.

Getting Things Done Right: Fundraising and M&A involve a lot of moving parts. IBGrid is there to make sure everything runs smoothly from start to finish.

Don't Be a Statistic - Let IBGrid Help You Win

Those scary failure rates shouldn't hold you back. With the right partner and a solid plan, you can significantly increase your chances of success.

IBGrid: Your Bridge to Funding and Growth

IBGrid has a team of experienced investment banking tam (25+ years of experience) and provides complete investment banking solutions in 120 days Indian startups looking to raise capital or conquer M&A. Their expertise, focus, and commitment to getting things done can be the difference between just getting by and achieving your entrepreneurial dreams. So don't wait. Partner with IBGrid and take control of your financial future!

0 notes

Text

Planify - Online Stock Investing Platform for Pre-IPO shares in India

Did you know that you can invest in some of the most promising and profitable companies in India before they go public? Yes, This is possible through Investing in Pre-IPO shares or Unlisted shares.

Investing in companies before they go public can be a lucrative opportunity for investors who want to get an early stake in the next big thing. However, finding and accessing such pre-IPO deals can be challenging, especially for retail investors who lack the connections and resources like institutional investors.

That’s where Planify comes in. Planify is an online platform that connects investors with entrepreneurs who are raising funds for their startups, MSMEs, unicorns and pre-IPO companies. Planify offers a marketplace-style investment platform that benefits both founders and funders.

Pre-IPO shares are shares of a company that are sold to investors before the company launches its initial public offering(IPO). Pre-IPO shares offer a unique opportunity to get early access to high-growth companies and potentially earn huge returns. However, investing in Pre-IPO shares isn't always easy, as it entails risks, uncertainties, and regulations. That's why you need a reliable and trustworthy platform that can help you find, buy, and sell Pre-IPO shares in India.

Planify is an online platform that allows investors to buy and sell shares of unlisted companies in India, before they go public through an initial public offering (IPO). Planify aims to democratize access to private equity, which usually includes institutional investors, High-net- worth individuals as well as the retail investors.

By investing in pre-IPO shares, investors can benefit from the potential growth and valuation of promising startups, MSMEs, unicorns, and other private companies. Planify also provides various services to entrepreneurs, such as financial projections, pitch decks, valuations, and equity restructuring. Planify claims to be the biggest private equity marketplace in India, with over 300 companies and 50,000 investors on its platform.

Why to invest in Pre IPOs?

Investing in Pre-IPO presents several compelling reasons:

1. Low Allotments: Securing shares in a good IPO in India can be challenging, with oversubscriptions ranging from 30x to 50x. Retail investors often struggle to get shares before listing, and post-listing prices can become overvalued.

2. Invest in Growth: Many companies choose to stay private for an extended period, and retail investors may miss out on the high-growth phase. Private companies often experience significant valuation increases before going public, providing investors with an opportunity to ride the growth wave.

3. Big Private Equity Impact: The success of a startup is often measured by its ability to go public. However, retail investors face limitations, with a maximum application of ₹2 lakh, whereas private equity investments in India start at ₹2 crores. This stark contrast highlights the significant opportunities that private equity investors have over retail investors.

Planify aims to bridge this gap by identifying opportunities for retail investors to participate in companies poised to enter the stock market in the short to mid-term.

How Planify makes a difference in the Pre-IPO space

Planify brings "Private Equity for Retail Investors". One can invest in companies before they get listed on the stock market with a minimum ticket size of ₹25,000 rupees. This enables even small investors to invest in partnership with Planify and diversify their portfolio.

Planify offers a wide range of Pre-IPO shares from various sectors and industries, such as e-commerce, fintech, healthcare, education, and more. You can browse through the available Pre-IPO shares on Planify's website or mobile app, and filter them by sector, valuation, growth potential, or other criteria.

It offers transparent and fair pricing for Pre-IPO shares, based on the company's financials, valuation, growth potential, risks, and exit strategy. Planify also provides you with research reports, pitch decks, and investment decks that you can download and study before making a decision.

It enables easy and secure transactions for Pre-IPO shares, with personalised support and guidance from Planify's team of experts. Planify also ensures legal and regulatory compliance for Pre-IPO investments, and facilitates you with the documentation and verification procedure.

Planify also offers networking opportunities with angel investors, and in-depth resources on angel investing and startup funding. You can also access unlisted shares and startups on Planify's platform, and explore more investment options.

Some Successful Pre-IPO Shares by Planify:

Pre IPO Selling Rate

One of the main features of Planify is that investors can browse through the available Pre-IPO shares on Planify's website or app, and filter them by sector, valuation, growth rate or other criteria. You can also view the detailed information and analysis of each Pre-IPO share, such as the company profile, financials, valuation, growth potential, risks, and exit strategy.

Pre-IPO investing can offer several benefits to investors, which includes:

Higher returns: Pre-IPO investing can offer higher returns than investing in the stock market, as the share price of a company can increase significantly after it goes public. For instance,in the above table investors who bought shares of Avenue Supermarts Ltd (D-Mart) at Rs. 280 per share before its IPO in 2017 could have sold them at Rs. 1875 per share in 2023, earning a return of 569%.

Early access: Pre-IPO investing can give investors early access to the next big thing, as they can invest in companies that have a strong competitive advantage, a loyal customer base, a proven business model, and a high growth potential. Pre-IPO investing can also give investors a sense of pride and satisfaction, as they can support the vision and mission of the entrepreneurs and contribute to the economic and social development of the country.

Therefore, if you are interested in investing in Pre-IPO shares in India, you should consider Planify as a reliable and trustworthy platform that can help you achieve your financial goals. These are some of the ways that Planify makes a difference in the Pre-IPO space and offers unique value to its users.

If you want to learn more about Planify, you can visit their website or download their Mobile app - Android, ios . You can also read some of their blog articles or watch some of their videos to get more insights on Pre-IPO investing.

#Shae market India#Upcoming IPO#Startups#Startup India#Angel Investors#Angel Investing#share market India#Investment App#investing app#share market app#Startup Investing#angel investors app

0 notes

Text

What Criteria Do Venture Capital Firms in India Use to Assess the Potential of Startups?

In the dynamic landscape of entrepreneurship, startups often find themselves at the crossroads, seeking the backing of venture capital (VC) firms to propel their innovative ideas into profitable ventures. Understanding what criteria Venture Capital firms in India employ to assess the potential of startups is paramount for aspiring entrepreneurs navigating this terrain. From Mumbai to Bangalore, VC firms in India serve as the investment partners for budding businesses, driving economic growth and fostering innovation.

1. Market Potential and Traction - One of the foremost criteria VC firms in India scrutinize is the market potential of the startup's product or service. They meticulously evaluate the size of the target market, its growth trajectory, and the startup's ability to capture a significant share. Moreover, VC firms assess the traction gained by the startup, indicating market validation and customer interest. Startups that demonstrate a clear understanding of their market and exhibit promising traction stand a better chance of securing investment from VC firms in India.

2. Team Capabilities and Experience - Behind every successful startup is a cohesive and competent team driving its vision forward. VC firms in India place immense importance on the capabilities and experience of the startup's founding team. They look for a diverse skill set, entrepreneurial acumen, and a track record of execution. Additionally, the ability of the team to adapt to market dynamics and navigate challenges is closely evaluated. A strong, capable team significantly enhances the investment appeal of a startup to VC firms in India.

3. Innovative Technology or Business Model - Innovation lies at the heart of every successful startup, and VC firms in India actively seek out ventures that offer disruptive technologies or innovative business models. Whether it's leveraging artificial intelligence, blockchain, or other cutting-edge technologies, startups that demonstrate a unique value proposition and the potential to disrupt existing markets capture the attention of VC firms. Furthermore, VC firms assess the scalability of the startup's technology or business model, envisioning its potential for widespread adoption and profitability.

4. Financial Viability and Growth Potential - VC firms in India meticulously analyze the financial viability and growth potential of startups before making investment decisions. They delve into revenue projections, cost structures, and scalability to ascertain the startup's ability to generate sustainable returns. Startups with a clear path to profitability, backed by robust financial projections and a scalable business model, are more likely to attract investment from VC firms in India.

5. Market Differentiation and Competitive Advantage - Standing out in a crowded marketplace is imperative for startups seeking investment from VC firms in India. These firms assess the startup's market differentiation and competitive advantage, evaluating factors such as intellectual property, proprietary technology, and unique value propositions. Startups that offer compelling solutions to pressing market needs and possess a defensible competitive position are viewed favorably by VC firms.

Krystal Ventures: Bridging the Gap Between Startups and Investment Partners - In the dynamic ecosystem of venture capital in India, Krystal Ventures emerges as a pivotal player, bridging the gap between startups' needs and investment partners' interests. With a keen understanding of the criteria employed by VC firms in India, Krystal Ventures provides a platform for startups to showcase their potential and connect with investors aligned with their vision. By facilitating meaningful partnerships and fostering innovation, Krystal Ventures propels the growth of startups, contributing to the vibrant entrepreneurial landscape of India.

While the criteria of VC firms in India may vary depending on various factors such as sector focus, stage of investment, and market trends, certain fundamental aspects remain consistent. Startups that embody innovation, market potential, a capable team, financial viability, and competitive differentiation are well-positioned to attract investment from VC firms in India. As the startup ecosystem continues to evolve, understanding and aligning with the criteria of VC firms is essential for entrepreneurs embarking on the journey of growth and success.

#vc firms in india#tech startups to invest in#venture capital firms in india#how to find investors for startups in india#how to invest in startups companies

0 notes

Text

Investing in India's Brightest: Exploring the Leading VC Firms Making Waves

India's startup ecosystem has been witnessing a remarkable surge in recent years, fueled by a combination of entrepreneurial talent, technological advancements, and supportive government policies. As the landscape continues to evolve, VC firms in India have emerged as crucial catalysts in driving innovation, funding promising startups, and shaping the future of the country's entrepreneurial ecosystem. In this article, we delve into the world of, explore how to find investors for startups in India and highlight some of the leading investment partners making waves in the industry.

Venture capital firms play a pivotal role in nurturing and scaling startups by providing them with the necessary capital, expertise, and networks. In India, VC firms have been instrumental in transforming various sectors, such as technology, e-commerce, fintech, healthcare, and more. They act as a bridge between startups with innovative ideas and potential investors seeking opportunities to diversify their portfolios while supporting the growth of India's entrepreneurial landscape.

For entrepreneurs and startups in India, finding the right investors can be a crucial step toward realizing their visions. Here are some key strategies to consider when seeking investment partners:

Research and Identify: It is important to conduct thorough research to identify VC firms that align with your industry, stage of growth, and business model. Look for firms with a successful track record in your sector and those that have previously invested in similar startups. This will increase your chances of finding investors who understand your business and can provide strategic guidance.

Network and Attend Events: Building a strong network can open doors to potential investors. Attend industry events, startup conferences, and networking sessions to connect with venture capitalists. These platforms provide opportunities to showcase your startup, learn from experienced investors, and establish valuable connections that may lead to future investment prospects.

Engage with Incubators and Accelerators: Joining startup incubators and accelerators can significantly enhance your chances of finding investors. These programs not only provide mentorship, guidance, and resources but also have strong networks of investors who actively seek investment opportunities within their portfolios. Engaging with such programs can increase your visibility and credibility in the eyes of potential investors.

Leverage Online Platforms: In the digital age, online platforms have become an essential tool for connecting startups with investors. Websites, forums, and social media platforms dedicated to startup funding can help showcase your venture to a wider audience of investors. Platforms like AngelList, Gust, and LinkedIn can be valuable resources to find and engage with potential investment partners.

Now, let's delve into some of the leading VC firms in India that have been making waves in the startup ecosystem:

Accel Partners India: Accel Partners has been a prominent player in the Indian VC landscape for over a decade. With a focus on technology and consumer businesses, they have successfully invested in notable startups like Flipkart, Freshworks, and Swiggy. Their extensive experience and deep industry connections make them a sought-after investment partner for early-stage and growth-stage startups.

KRYSTAL VENTURES STUDIO: This is known for its robust portfolio of successful investments in the Indian startup ecosystem. With a broad focus on sectors like technology, healthcare, and consumer services. Their strong network and expertise in scaling businesses have made them a go-to choice for many entrepreneurs seeking investment.

Nexus Venture Partners: Nexus Venture Partners is a leading early-stage venture capital firm that focuses on investing in technology startups in India. They have made significant investments in companies like Unacademy, Postman, and Druva. Nexus's hands-on approach, industry knowledge, and commitment to long-term partnerships have made them a preferred choice for entrepreneurs looking for early-stage funding.

Kalaari Capital: Kalaari Capital is a venture capital firm that has been actively investing in early-stage and growth-stage startups in India. With a sector-agnostic approach, they have backed companies across various domains, including fintech, healthcare, and e-commerce. Some of their notable investments include Urban Ladder, Dream11, and Cure. fit. Kalaari Capital's deep sector expertise and strong network make them a valuable partner for startups at different stages of growth.

The Indian startup ecosystem is flourishing, and venture capital firms are playing a pivotal role in fueling its growth. Finding the right investors for your startup in India requires diligent research, networking, and leveraging online platforms. VC firms like Accel Partners India, KRYSTAL VENTURES STUDIO, Sequoia Capital India, Nexus Venture Partners, and Kalaari Capital are leading the way in supporting innovative startups and shaping the future of India's entrepreneurial landscape. By exploring these investment partners and following effective strategies, entrepreneurs can increase their chances of securing the funding they need to thrive and make their mark in India's dynamic startup ecosystem.

0 notes

Text

From Learning Hubs to Business Hubs: How Coworking Spaces Shape Chennai's Continuous Growth in Entrepreneurship

Introduction:

Situated on the southeastern coast of India, Chennai stands as a bustling metropolis that has evolved into a thriving center for entrepreneurship. Amidst the various factors propelling the city's entrepreneurial zeal, coworking spaces have emerged as significant contributors. These shared workspaces extend beyond mere business settings; they serve as dynamic environments fostering collaboration, networking, and innovation. This article will delve into how coworking spaces in Mount Road, Chennai contribute to and shape the city's entrepreneurial landscape.

Cultivating Collaboration:

In Chennai, coworking spaces act as catalysts for collaboration, providing a platform for professionals, startups, and freelancers to collaborate in a shared environment. The diverse community within these spaces encourages the exchange of ideas and expertise across different industries. This collaborative culture enhances creativity, leading to the development of innovative solutions and fostering an entrepreneurial spirit.

Networking Opportunities:

Networking, a pivotal aspect of entrepreneurial success, is facilitated by coworking spaces in Chennai. Entrepreneurs working in these spaces have the opportunity to interact with a diverse array of individuals, ranging from potential collaborators to investors. Events organized by coworking spaces become valuable networking forums, creating opportunities for business growth and partnerships.

Flexible Workspace Solutions:

Chennai's entrepreneurial landscape, known for its dynamic nature, finds support in coworking spaces that offer flexible solutions to accommodate this dynamism. Startups and small businesses benefit from scalable office plans, allowing them to adjust their workspace according to evolving needs. This adaptability is particularly valuable in an environment where businesses often face uncertainties and rapid growth phases.

Cost-Effective Infrastructure:

For startups and small businesses, coworking spaces in Thousand Light Chennai present a cost-effective alternative to traditional office setups. Shared resources, including meeting rooms, high-speed internet, and administrative support, contribute to significant cost savings. This cost efficiency empowers entrepreneurs to direct their financial resources toward innovation, product development, and business expansion.

Continuous Learning Opportunities:

Coworking spaces in Chennai often serve as hubs for continuous learning and skill development. Through workshops, seminars, and networking events, entrepreneurs gain access to valuable insights and expertise. The learning culture within coworking spaces ensures that entrepreneurs stay updated on industry trends and best practices, contributing to the overall knowledge base of the entrepreneurial community.

Building a Supportive Community:

The sense of community within coworking spaces acts as a powerful driver for entrepreneurial success in Chennai. Beyond shared office space, these environments create a support system where individuals can find mentorship, guidance, and a sense of camaraderie. This community-centric approach fosters motivation and resilience, essential qualities for navigating the challenges inherent in entrepreneurship.

Conclusion:

In conclusion, coworking spaces in Chennai play a pivotal role in nurturing and sustaining the city's entrepreneurial spirit. Through the cultivation of collaboration, provision of networking opportunities, offering flexible workspace solutions, ensuring cost-effective infrastructure, promoting continuous learning, and building a supportive community, these spaces play a substantial role in the expansion and prosperity of startups and small businesses. As Chennai continues to evolve as a hotspot for innovation, the role of coworking spaces in shaping its entrepreneurial landscape remains indispensable.

0 notes

Text

Navigating the IPO Wave: How Investment Banks Fuel Startup Growth

In the dynamic tapestry of India's entrepreneurial landscape, startups evolve from inventive concepts to thriving enterprises. The pivotal juncture arrives when these enterprises consider the Initial Public Offering (IPO). This transformative step not only symbolizes financial maturity but also calls forth the strategic expertise of investment banks. In the intricate dance of capital markets, investment banks in India emerge as architects, steering startups through the complex process of transitioning from private entities to publicly traded market contenders.

The IPO Ballet: A Prelude

Before we dive into the hows and whys, let's grasp the basics. An IPO is like a startup's grand debut on the stock market stage. It's the moment when a company transitions from being privately held to publicly traded, offering shares to the public. And no, it's not just about raising capital; it's about visibility, credibility, and the opportunity to accelerate growth.

Why the IPO? Unpacking the Motivation

Startups, fueled by their early investors and venture capitalists, reach a point where expansion requires a financial boost beyond private funding. This is where investment banks strut in, showcasing the benefits of going public. An IPO provides a cash injection, a liquid market for existing shareholders, and a platform for the company to be recognized and valued by a broader audience.

The Role of Investment Banks in India

Investment banks in India assume the role of an invaluable advisory compass in a startup's IPO journey. Acting as seasoned guides, they navigate startups through the intricate terrain of financial structuring, market conditions, and regulatory intricacies. Their expertise ensures that companies not only meet the prerequisites for a successful IPO but also embark on this transformative journey with strategic precision. As advisors extraordinaire, investment banks pave the way for startups to confidently take their place on the public stage.

Advisors Extraordinaire

Before the IPO dance begins, startups need guidance. Investment banks like ICICI Bank, HDFC Bank, Kotak Mahindra Bank, and many more step in as seasoned advisors, offering strategic counsel on financial structuring, market conditions, and regulatory requirements. They help companies navigate the complex web of IPO preparations, ensuring every T is crossed and I dotted.

Also Read: The Intersection of Investment Banks and Global Economic Trends

Underwriting: Backing the Future

One of the investment banks' significant roles is underwriting. They commit to purchasing a certain number of shares at a pre-determined price, acting as a safety net for the IPO. This not only instills confidence in potential investors but also guarantees that the startup receives the expected capital infusion.

Market-Making Magic

Post-IPO, investment banks continue to work their magic through market-making. They facilitate the buying and selling of the newly issued shares, maintaining liquidity and stabilizing the stock price. This ensures a healthy trading environment for both the company and its investors.

Equity Capital Markets: A Deep Dive

Delving into the intricate domain of equity capital markets is akin to navigating uncharted financial waters. This dynamic realm, where stocks find their home, holds the key to a startup's growth trajectory. Investment banks in India serve as skilled navigators, guiding companies through the ECM's ebb and flow. Understanding the nuances of this financial deep dive is essential, as it is here that startups connect with potential investors, fostering a symbiotic relationship that fuels expansion and market prominence.

Also Read: Bridging the Gap: The Role of Investment Banks in Empowering Modern Investors

The IPO Journey: A Win-Win Scenario

In the symphony of financial evolution, the IPO emerges as a crescendo, marking a startup's triumphant entry into the public arena. Investment banks, the orchestrators behind this transformative journey, not only usher companies into the market spotlight but also pave the way for investors to partake in the success story. As the curtain falls on the IPO journey, we salute the investment banks—guiding stars that illuminate the path from entrepreneurial dreams to tangible market triumphs. Cheers to a future where startups thrive, and investments flourish!

0 notes

Text

How do I register a company in T-Hub Hyderabad?

To register a company in T-Hub Hyderabad, you need to follow these steps:

First, you need to have a startup idea that is innovative, scalable, and has a potential market. You can check out the Startup Telangana portal for some inspiration and guidance on how to validate your idea and build a prototype.

Second, you need to apply for one of the startup programs offered by T-Hub, which is a Hyderabad-based startup ecosystem enabler1. T-Hub’s state-of-the-art startup programs are designed to foster a culture of innovation through access to cutting-edge technology and a network of corporates, mentors, investors, and government agencies2. You can choose from various programs depending on your stage of development, such as Lab32, T-Angel, T-Works, etc. You can find more details and application forms on the T-Hub website.

Third, if you are selected for a program, you will get access to the T-Hub facilities and services, such as co-working space, mentorship, workshops, events, funding opportunities, etc. You will also get to interact with other startups and ecosystem stakeholders, and learn from their experiences and feedback. You will also get exposure to the global market and potential customers through T-Hub’s partnerships with various corporates and governments3.

Fourth, you need to register your company as a legal entity in India, and comply with the relevant laws and regulations. You can choose from various types of company structures, such as sole proprietorship, partnership, limited liability partnership, private limited company, etc. You can consult a legal expert or use online platforms to help you with the registration process. You will also need to obtain a PAN card, a GST number, a bank account, and other documents for your company.

Fifth, you need to grow your business by developing your product or service, acquiring customers, generating revenue, and scaling up. You can leverage the T-Hub network and resources to help you with your growth strategy and challenges. You can also apply for more advanced programs or incubation support from T-Hub or other partners, such as T-Hub – Invest Telangana, which provides incentives and benefits for startups in Telangana.

I hope this answer helps you understand how to register a company in T-Hub Hyderabad. If you want to learn more, you can listen to this podcast RawTalks with T-HUB CEO MSR | Startups | Telugu Business

0 notes

Text

How PEO can benefit startups

For every entrepreneur, the success of their start-up lies in the spirit of the employees. Once the business idea translates into a reality, you need a dedicated workforce for the execution of your goal. Every startup has its vibe right from the initial stage of conceptualization, strategizing, and streamlined execution. But ultimately, the business growth of your startup rests on the shoulders of your employees. That is why investors entrust their funding decisions to the growth of potential resources of your company.

Considering the fundamental requirement of the start-up business, do you struggle to source the best-skilled resources and reduce execution overheads while thinking of growing in a competitive market?

You can get rid of these headaches by joining hands with an international PEO. A Professional Employer Organization or EOR (Employer of Record) will equip your team with skilled resources without delving into the hassle of subsidiary formation.

How can a PEO benefit your startup company?

With the help of a PEO based in India, you can employ the most suitable and skilled resources in your organization. A PEO can easily onboard a team from India into your company. A PEO steps in as a legal employer for your company employees and takes upon all the administrative hassles, legal compliances, statutory regulations, bookkeeping, etc, leaving your startup to focus on core business.

According to a study conducted by economists and global leader Laurie Bassi, companies who avail of PEO services reach 40% higher revenue growth, are 50% less likely to go out of business, and experience 14-16% lower turnover rates. You can visit the NAPEO website to find out what the voice of the PEO industry has to say about this industry.

Engaging with a PEO service company can help your start-up in the following ways:

Easy availability of skilled resources

Whether you need high-end product developers, digital marketers, engineering designers, or territorial sales employees, a PEO solutions company can source the ideal candidate for you.

India has a high literacy rate with qualified individuals. A dedicated number of educational institutions groom the students into ideal-trained professionals and challenging work positions. You can choose from a plethora of sought-after profiles with skill sets like product design, digital marketing, software development, product testing, data analysis, etc.

India was ranked first for its skilled and trained workforce with more than 3 lakh highly-educated Indians in the OECD (Organization for Economic Cooperation) countries.

The Government of India, Prime Minister Narendra Modi, reorganized the UPA’s Skill India policy to mandatory training of 300 million Indians by 2022 during the National Skill Development Mission announcement.

Reduction of overheads and burn rate

Your overheads for resources will be cut down to a considerable margin without compromising on the deliverables or quality of work. As the cost of living and overall pay structure in India is affordable compared to western countries.

A PEO will offer benefits like insurance, benefits, and office infrastructure to employees that you as a startup company may not be able to offer, making your startup attractive to top talent and lowering the turnover rates.

Time management

A startup is like a baby business and babies grow fast. The faster growth of your company means it will require more hands for better management.

You can transfer all the HR management and compliance headaches onto a PEO while devoting your time and energy to your core business. A PEO knows the multi-tasking approach required by a startup company, so they leave you with enough bandwidth time to focus on running your business. A PEO in India will ensure your India team complies with all the HR and legal compliances as per Indian law. The PEO will cover your employees under group insurance policies, conduct payroll executions, and taxation compliances.

Competitive edge with a global presence for your startup business

With a PEO organization, you can enjoy the presence of your teams in two different countries. An in-house team of employees at your location and a virtually connected remote team in India. This will increase your company’s brand, credibility, and culture in the competitive market. A PEO will extend hand-holding while learning the business culture in India and set up a skilled remote team for your start-up company as well.

Entering a large consumer market

Research suggests India is expected to become the third-largest consumer market by 2030 and consumer spending in India is expected to grow from $1.5 trillion to $6 trillion by 2030, according to a World Economic Forum report.

Due to urbanization, these days Indian consumers desire a better lifestyle and good salary packages as well. They wouldn’t mind spending extra bucks from their pockets on healthy food and brand-conscious clothes. As per World Economic Forum, it is predicted that by 2030 India will experience a 4x growth in its consumer spending course and have more than a billion Indian internet consumers. The purchases will grow by 40% digitally. Twenty million households will upgrade to a high-income bracket, and the user’s mindset will change. Keeping in mind examples like these, you can start a business decoding the Indian consumer mindset.

A PEO company will help you to enter India and give access to understanding the country’s work culture through team operations in India. The PEO model is a smooth way to explore the potential market in India if you wish to internationalize your business in the future.

Remunance provides large company benefits to startups…

At Remunance, we extend hand-holding to your start-up route in India. When you think of transforming your idea into a start-up company, you probably think about growth and revenue. But probably not about government compliances, payroll, taxation, human resources, etc. Simply transfer that onto us. We will handpick the best talent for your remote team in India.

Our PEO services offerings include HR, payroll, insurance, benefits, and risk management. We also go a step further in providing employee training, leave management, HR management, recruiting, and office infrastructure. To kickstart your business in a few days or know more about our co-employment offerings.

1 note

·

View note