#tech startups to invest in

Text

How to Invest in Startups for Equity and Make High Returns

The startup world is a breeding ground for innovation and disruption. It's where revolutionary ideas take root and have the potential to blossom into industry giants. As an investor, this presents a unique opportunity to get in on the ground floor of the next big thing. By investing in startups for equity, you can share in their success and potentially reap high returns. However, startup investing is not without its risks. These companies are young and unproven, and there's a high chance of failure.

This blog will guide you through the process of how to invest in startups for equity, helping you understand the risks and rewards involved, identify promising startups, and navigate the investment landscape.

Understanding Startup Investment

Before diving in, it's crucial to understand the basics of startup investment. Here's a breakdown of key concepts:

Equity: When you invest in a startup for equity, you essentially become a part-owner of the company. In return for your investment, you receive shares in the company. The value of these shares fluctuates with the company's performance. If the startup succeeds, your shares could become significantly more valuable, potentially leading to high returns. However, if the startup fails, your investment could be lost entirely.

Investment Stages: Startups go through various funding stages, each with its own risk profile. Early-stage investments (seed and Series A) carry the highest risk but also the potential for the highest returns. Later-stage investments (Series B and beyond) are generally considered less risky but also offer lower potential returns.

Identifying Promising Startups

Finding the right startups to invest in is crucial for success. Here are some tips to help you identify promising ventures:

Market: Focus on industries with high growth potential. Look for startups that address a clear need in the market and offer a unique solution.

Team: The team behind the startup is one of the most important factors to consider. Invest in companies with passionate, experienced founders who have a proven track record of success.

Product: Analyze the startup's product or service. Is it innovative and well-designed? Does it have a clear value proposition?

Traction: Has the startup achieved any traction? Look for evidence of customer growth, revenue generation, or partnerships with established players.

Investing in Startups: Different Approaches

There are several ways to how to invest in startups for equity. Here's a breakdown of the most common methods:

Angel Investing: Angel investors are accredited individuals who invest their own money directly into startups. This is a popular option for early-stage investing.

Venture Capital Firms: Venture capital firms pool funds from various investors and invest in startups with high growth potential. [venture capital firms in india] specialize in funding Indian startups.

Crowdfunding Platforms: Some crowdfunding platforms allow you to invest in startups alongside other investors. This can be a good option for smaller investments.

How to Get Started

Do your research: Before investing in any startup, thoroughly research the company, the market, and the team. Due diligence is essential to minimize risk.

Connect with the startup ecosystem: Attend industry events, join startup communities, and network with other investors. This will help you identify promising startups and gain valuable insights.

Seek professional advice: Consider consulting with a financial advisor experienced in startup investments. They can guide you through the investment process and help you make informed decisions.

Important Considerations

Liquidity: Unlike stocks or bonds, startup investments are highly illiquid. There's no guarantee you'll be able to sell your shares easily, and it may take years to see a return on your investment.

Risk Tolerance: Startup investing is inherently risky. Be prepared to lose your entire investment. Only invest what you can afford to lose.

Investing in startups for equity can be a rewarding experience, offering the potential for high returns. However, it's crucial to understand the risks involved and approach this asset class with caution. By conducting thorough research, diversifying your portfolio, and seeking professional advice, you can increase your chances of success in the exciting world of startup investing.

Finding the Right Platform

Navigating the startup investment landscape can be challenging. Krystal Ventures Studio is a platform designed to connect the needs of startups with the interests of investors. They offer a curated selection of promising startups across various industries and stages of growth. [Krystal Ventures] can help you identify suitable investment opportunities and streamline the investment process.

0 notes

Text

How to Choose The Right Tech Startups to Invest in for Your Portfolio

Investing in tech startups has become an increasingly popular choice for individuals looking to diversify their portfolios and capitalize on the fast-paced world of technology. However, with numerous emerging companies and venture capital firms in India, it can be challenging to determine which tech startups are worth investing in. In this blog post, we will explore some key considerations to help you choose the right tech startups to invest in for your portfolio.

Research the Market: Before making any investment decisions, it's essential to conduct thorough market research. Identify the trends and areas of growth within the tech industry. Look for startups that are working on innovative solutions to existing problems or have the potential to disrupt traditional industries. Understanding the market landscape will help you make informed investment choices.

Evaluate the Team: The team behind a startup plays a critical role in its success. Assess the founders' experience, expertise, and track record. Look for individuals who have a deep understanding of the industry and possess the necessary skills to execute their vision. A strong and capable team increases the likelihood of a startup's long-term success.

Analyze the Product or Service: Evaluate the uniqueness and viability of the startup's product or service. Is it solving a real problem? Does it have a competitive advantage? Assess the potential market demand and scalability of the offering. A compelling product or service with a large addressable market is more likely to attract customers and generate substantial returns.

Financial Health and Scalability: It's crucial to examine the financial health of a startup before investing. Evaluate their revenue streams, growth projections, and financial forecasts. Assess the scalability of their business model and determine if it has the potential to generate significant returns over time. A financially stable startup with a scalable business model is an attractive investment opportunity.

Seek Expert Opinions: Don't hesitate to seek advice from industry experts, venture capital firms in India, and experienced investors. They have the knowledge and experience to identify promising tech startups. Attend startup conferences, join industry networks, and participate in startup pitch events. Engaging with the startup ecosystem will provide valuable insights and help you connect with potential investment opportunities.

Assess the Risk-Reward Ratio: Investing in startups involves inherent risks. Consider the risk-reward ratio of each potential investment. Higher-risk ventures may offer greater potential returns, but they also come with increased uncertainty. Diversify your investments across different startups to mitigate risk and increase the chances of overall portfolio success.

The question is how to find investors for startups in India, one notable venture capital firm to consider is Krystal Ventures. With its deep industry knowledge and extensive network, Krystal Ventures has a proven track record of identifying promising startups and nurturing them to success. Their expertise in the tech sector and commitment to supporting innovative ideas make them an ideal partners for aspiring entrepreneurs.

In conclusion, choosing the right tech startups to invest in requires careful analysis and consideration. Researching the market, evaluating the team and product, analyzing financial health, seeking expert opinions, and assessing the risk-reward ratio are essential steps in making informed investment decisions. By following these guidelines and considering the expertise of venture capital firms like Krystal Ventures, you can enhance your chances of investing in successful tech startups that can yield substantial returns for your portfolio.

0 notes

Text

Opened twitter and Nico is going to be a VC now? With the fund vale at $75Mn?

#he's pooling money from his rich European friends for investing#i have opinions......#but imo Nico was going to end up doing this at some point#waits to be seen what he will invest into#of course tech but given Nico's own history they might end up doing hard sciences too#I hope whatever sustainability startups he ends up investing into aren't halfway scams#nico rosberg#nr6#f1#formula 1

11 notes

·

View notes

Text

what's up with estonia lol

12 notes

·

View notes

Text

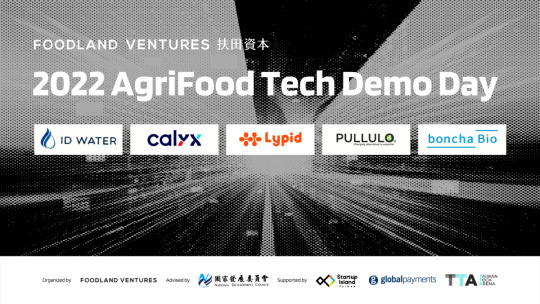

Foodland Ventures Unveils Batch 2 at AgriFood Tech Demo Day - 5 Innovative Teams Solving Challenges Across the Food Supply Chain

Foodland Ventures Unveils Batch 2 at AgriFood Tech Demo Day – 5 Innovative Teams Solving Challenges Across the Food Supply Chain

Foodland Ventures, the VC & accelerator built for AgriFood tech founders, has unveiled its latest batch of startups in its 2022 Demo Day held on November 30th. The diverse portfolio consists of 5 teams from Taiwan, Singapore and the US.

Global investment in AgriFood Tech hit a record high with USD 51.7 billion in 2021; however, the need for innovative solutions grows with rising concerns for…

View On WordPress

#Agricultural Tech - Farming Tech#Agriculture#AgriFoodTech#AgTech#AgTech and FoodTech Funding#AgTech Startup#Aquaculture#Climate Change#Data-Driven#Food and Agribusiness#Food Processing#Food Security#FoodTech#Investments#Nutrition#poultry#Protein#Proteins Alternatives

4 notes

·

View notes

Text

Best Indian Venture Capital Firms for Startups · SEAFUND

Navigating the early stages of a startup can be challenging, but the right seed investors in Bangalore can make all the difference. SEAFUND stands out among the best pre-seed funding companies in India, providing early-stage startups with the support they need to thrive.

Initiatives in Seafund | Seed Investors in Bangalore

Why Choose SEAFUND?

Tailored Funding Solutions: Eximius offers custom funding strategies that align with your startup’s unique vision and goals, making them a top choice among seed funding companies in India open now.

Deep Sector Expertise: With a strong focus on sectors like Fintech, Healthtech, and Frontier Tech, Eximius provides insights that go beyond just capital, which is why they are recognized as one of the leading pre-seed funding companies in India.

Founder-Centric Approach: Emphasizing empathy and personal chemistry, Eximius supports founders with honest advice and mentorship, without unnecessary interference, setting them apart from other seed investors in Bangalore.

Strategic Initiatives for Growth

SEAFUND initiatives are dedicated to fostering innovation and driving growth across various sectors. By investing in underserved markets and emerging technologies, they empower startups to make significant impacts both in India and globally. SEAFUND’s initiatives focus on accelerating growth and supporting entrepreneurs through strategic investment and mentorship, making them a key player among seed investors in Bangalore.

Join the Success Stories

SEAFUND has already helped numerous startups achieve their potential. By leveraging their vast network and deep industry knowledge, you too can be the next success story with the support of leading seed funding companies in India.

Get Involved

Ready to partner with one of the best seed investors in Bangalore? Explore SEAFUND to discover how they can help turn your startup dreams into reality, whether you’re in need of pre-seed funding companies in India or looking for seed funding companies in India open now.

#Keywords#best venture capital firm in india#venture capital firms in india#popular venture capital firms#venture capital firm#seed investors in bangalore#deep tech investors india#startup seed funding india#funding for startups in india#early stage venture capital firms#invest in startups bangalore#funders in bangalore#startup investment fund#fintech funding#india alternatives investment advisors#best venture capital firms in india

0 notes

Text

Why Kenya's Agritech Startups Struggle to Penetrate the Market Despite Strong Investment

Discover why Kenya’s agritech startups struggle with market penetration despite strong investment, and explore how regulatory challenges and fragmented services hinder growth in the sector.

Kenya’s agritech industry faces hurdles beyond funding, including complex regulations and data security concerns. Learn how startups can overcome these challenges to scale and succeed.

Uncover the key barriers…

#agricultural technology Kenya#agritech ecosystem#agritech innovation challenges#agritech investment Kenya#agritech market penetration#agritech partnerships#Agritech Startups#AI in farming#climate resilience farming#data privacy in agriculture#data security agritech.#digital agricultural transformation#digital farming tools#digital financial services for farmers#farmer adoption of technology#fragmented service providers#IoT in agritech#Kenya agritech challenges#Kenya’s digital ecosystem#Mercy Corps AgriFin#public sector data in agriculture#regulatory barriers agritech#small-scale farming Kenya#smart farming Kenya#stakeholder engagement in agritech#sustainable agriculture Kenya#tech solutions for farmers#technology adoption barriers#technology-driven agriculture

1 note

·

View note

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

35K notes

·

View notes

Text

Understanding the Benefits of Investing in India's Tech Startups in 2024

In recent years, India's startup ecosystem has experienced exponential growth, fueled by a combination of factors such as favorable demographics, increasing internet penetration, government initiatives, and a thriving entrepreneurial culture. Among the various sectors, the tech startup ecosystem in India has emerged as particularly attractive for investors seeking high growth potential and innovation-driven opportunities. In this blog, we'll explore the benefits of investing in India's tech startups in 2024, highlighting key factors driving the sector's growth and the opportunities it presents for investors.

1. Vibrant Ecosystem and Innovation Hub:

India's tech startup ecosystem has evolved into a vibrant hub of innovation, entrepreneurship, and collaboration. Major cities like Bangalore, Mumbai, and Delhi-NCR have emerged as hotspots for tech startups, fostering a conducive environment for creativity, networking, and knowledge exchange. The ecosystem is characterized by a diverse range of startups operating across sectors such as e-commerce, fintech, healthtech, edtech, and deeptech, offering investors a wide array of investment opportunities.

Here's a deeper look at what makes this ecosystem so dynamic and attractive for investors:

1. Thriving Startup Hubs:

Major cities like Bangalore (also known as the Silicon Valley of India), Mumbai, and Delhi-NCR have emerged as thriving startup hubs, attracting entrepreneurs, investors, and talent from across the country and around the world. These cities offer a conducive environment for startups to establish their presence, access resources, and network with industry peers, mentors, and investors.

2. Diverse Range of Startups:

India's tech startup ecosystem is characterized by a diverse range of startups operating across various sectors and verticals. From e-commerce and fintech to healthtech, edtech, agritech, and deeptech, startups in India are addressing a wide array of market needs and opportunities. This diversity not only reflects the breadth of innovation but also offers investors a plethora of investment options to choose from.

3. Culture of Innovation and Risk-Taking:

India's entrepreneurial culture encourages innovation, risk-taking, and experimentation, fostering a spirit of creativity and resilience among startups. Entrepreneurs are not afraid to disrupt traditional industries, challenge existing norms, and push the boundaries of technology to solve complex problems and create value. This culture of innovation attracts investors who seek high-growth opportunities and are willing to support disruptive ideas and visionary founders.

4. Collaboration and Knowledge Exchange:

The startup ecosystem in India thrives on collaboration, knowledge exchange, and community building. Startup incubators, accelerators, co-working spaces, and networking events play a crucial role in facilitating interactions between startups, investors, industry experts, and ecosystem enablers. These platforms provide startups with access to mentorship, funding, and market insights, while also fostering a culture of learning, sharing, and mutual support.

2. Large and Growing Consumer Market:

India's massive population, increasing internet penetration, and rising disposable incomes have created a fertile ground for tech startups to thrive. With over 1.3 billion people, India represents one of the largest consumer markets globally, offering a vast customer base for startups to target and scale their products and services. Investors can capitalize on India's demographic dividend by backing startups that cater to the evolving needs and preferences of Indian consumers across urban and rural areas.

Here's why this aspect is crucial for investors:

1. Massive Population:

India’s vast population translates into a huge consumer base for startups to target and serve. With a large addressable market, startups have the potential to reach millions of customers across urban and rural areas, driving adoption and revenue growth.

2. Increasing Internet Penetration:

India has witnessed a rapid increase in internet penetration in recent years, driven by factors such as falling data costs, smartphone proliferation, and government initiatives like Digital India. As more people come online, there is a growing demand for digital products and services, creating opportunities for startups to innovate and disrupt traditional industries.

3. Rising Middle Class and Disposable Incomes:

The rising affluence of India's middle-class population has led to increased discretionary spending on consumer goods and services. As incomes rise and lifestyles evolve, there is a growing demand for aspirational products, premium services, and lifestyle enhancements. Startups that cater to the needs and preferences of this burgeoning middle class stand to benefit from their purchasing power and willingness to adopt new technologies.

4. Urbanization and Changing Consumption Patterns:

India's ongoing urbanization trend is reshaping consumption patterns and driving demand for urban-centric products and services. From on-demand delivery and mobility solutions to smart homes and digital entertainment, startups are capitalizing on urban consumers' preferences for convenience, efficiency, and quality of life enhancements. By tapping into urban markets, startups can unlock significant growth opportunities and build scalable business models.

5. Rural Market Potential:

While urban markets offer significant growth potential, India's rural areas present untapped opportunities for startups to address unmet needs and capture emerging demand. With over 65% of India's population residing in rural areas, there is a growing appetite for rural-focused solutions in areas such as agriculture, healthcare, education, and financial inclusion. Startups that can tailor their offerings to rural consumers' requirements and affordability stand to gain a competitive advantage in this vast and underserved market.

6. Demographic Dividend:

India's youthful demographic profile, with a large population of millennials and Gen Z, presents a demographic dividend for startups targeting younger consumers. These digital natives are tech-savvy, digitally connected, and increasingly influential in shaping consumer trends and preferences. Startups that cater to the needs and aspirations of the youth demographic can build loyal customer bases and drive viral adoption of their products and services through social media and digital channels.

3. Rapid Digitization and Technological Adoption:

The acceleration of digitization and technological adoption in India has opened up new avenues for tech startups to disrupt traditional industries and drive innovation. Factors such as the proliferation of smartphones, affordable data plans, and government initiatives like Digital India have fueled the demand for digital solutions across sectors such as e-commerce, digital payments, healthtech, and agritech. Investors can leverage this trend by investing in startups that leverage technology to address market gaps, improve efficiency, and enhance customer experience.

4. Government Support and Policy Reforms:

The Indian government has taken several initiatives to support the growth of the startup ecosystem and attract investment in the sector. Programs such as Startup India, Make in India, and Atmanirbhar Bharat aim to provide startups with access to funding, mentorship, regulatory support, and market opportunities. Additionally, recent policy reforms aimed at easing compliance requirements, simplifying taxation, and promoting foreign investment have further boosted investor confidence in India's startup ecosystem.

5. Access to Talent and Expertise:

India is home to a large pool of skilled professionals, including engineers, developers, designers, and business professionals, who contribute to the success of the country's tech startups. The availability of talent with diverse skill sets and domain expertise enables startups to build innovative products, scale operations, and compete on a global scale. Investors can benefit from India's talent pool by backing startups with strong leadership teams and a track record of execution and innovation.

6. Potential for High Returns and Exits:

Investing in startups in India offers the potential for high returns and lucrative exit opportunities for investors. As startups grow and mature, they attract interest from venture capital firms, private equity investors, and strategic acquirers looking to capitalize on their growth potential. Successful exits through IPOs, mergers, or acquisitions can generate significant returns for early-stage investors, making India's tech startup ecosystem an attractive asset class for investment portfolios.

In conclusion, investing in India's tech startups in 2024 presents a compelling opportunity for investors looking to capitalize on the country's growing entrepreneurial ecosystem, large consumer market, rapid digitization, and government support. By backing innovative startups with strong leadership teams, scalable business models, and disruptive technologies, investors can not only generate attractive returns but also contribute to India's economic growth and technological advancement. As India continues to emerge as a global innovation hub, the potential for investment in its tech startup ecosystem remains promising for investors seeking exposure to high-growth opportunities in the digital age.

This post was originally published on: Foxnangel

#investing in india#tech startups#startup ecosystem#government initiatives#tech startups in india#investment opportunities#consumer market#digital india#startup india#invest in india startups#foxnangel

0 notes

Text

Yang Ou: The Charm and Determination of a Female Investor | UTALK Business Interview

Our UTALK interview

UTALK – Global Business Interview

04/12/2024

Article | UTALK Editorial Team

Interviewer | FayEditor | SineReview | Qing Shen

In the early 2000s, international venture capital firms represented by Sequoia Capital and IDG gradually entered China, marking the beginning of a booming two-decade development in China’s investment landscape. However, driven by factors such as new asset management…

View On WordPress

#Accelerating#Capital Operations#interview#investor#Risk Investment#Tech Startups#Women in Venture Capital

0 notes

Text

High-Growth Potential: Invest in Startups for Equity India as an Accredited Investor

The Indian startup ecosystem is booming. From innovative solutions in fintech and e-commerce to disruptive ideas in healthcare and cleantech, there's a constant buzz of creativity and potential. As an accredited investor in India, you have the unique opportunity to be a part of this growth story by invest in startups for equity India. This approach offers the chance for high returns while fostering the development of groundbreaking companies that shape the future.

But before diving headfirst, it's crucial to understand the landscape of investing in startups for equity in India. This blog will delve into the benefits, considerations, and resources available to accredited investors seeking promising startups to invest in.

Why Invest in Startups for Equity in India?

For accredited investors, venturing beyond traditional investment avenues can unlock exciting possibilities. Here are some key reasons why investing in startups for equity can be a compelling proposition:

High-Growth Potential: Startups have the potential to disrupt entire industries and experience explosive growth. Early investment in a successful startup can translate to significant returns on your capital.

Diversification: Equity in startups can add a new dimension to your investment portfolio. Unlike established companies, startups offer exposure to innovative ideas and emerging markets, reducing your reliance on traditional assets.

Impact Investing: By supporting promising startups, you contribute to the development of solutions that address critical challenges and create a positive social impact.

Early Access: Accredited investors gain access to exclusive investment opportunities not available to retail investors. You can get in on the ground floor of a promising venture before it goes mainstream.

Considerations for Investing in Startups

While the potential rewards are significant, investing in startups for equity also comes with inherent risks. Here are some key points to consider:

High Risk: Startups are inherently unproven ventures. There's a significant chance of failure, and you could lose your entire investment.

Illiquidity: Unlike stocks on the public market, startup equity is illiquid. It can be difficult to sell your shares quickly, and you may have to wait for an exit event like an acquisition or IPO.

Long Investment Horizon: It typically takes several years for a startup to mature and deliver returns. Be prepared for a long-term commitment.

Extensive Due Diligence: Thorough research and analysis are crucial before investing in a startup. You need to assess the company's business model, team, market potential, and financial projections.

Finding Promising Startups to Invest In

As an accredited investor, you have several options to find promising startups for equity investment in India:

Venture Capital Firms in India: Partnering with established venture capital firms in India is a popular approach. These firms have a proven track record of identifying and investing in high-growth startups. They conduct extensive due diligence and provide valuable guidance to investors.

Angel Investor Networks: Joining an angel investor network allows you to connect with other accredited investors and access a wider pool of potential startups. These networks often organize events and provide resources to help you make informed investment decisions.

Startup Platforms: Several online platforms connect startups with potential investors. These platforms provide information about startups seeking funding, their business models, and funding rounds.

Krystal Ventures Studio: Connecting Investors with Promising Startups

Krystal Ventures Studio understands the challenges and opportunities associated with investing in startups for equity in India. Our platform is designed to bridge the gap between startups seeking funding and accredited investors looking for promising ventures.

By registering with Krystal Ventures Studio, you gain access to a curated network of market-ready startups across various sectors. We provide comprehensive information on each startup, including their business plans, financial projections, and team profiles. Our team also helps investors with due diligence and facilitates connections with the startups they are interested in.

Investing in startups for equity in India offers a unique opportunity for accredited investors to achieve high returns and contribute to the nation's entrepreneurial ecosystem. By understanding the risks and rewards, conducting thorough due diligence, and leveraging the right resources, you can make informed investment decisions and participate in the growth story of promising Indian startups.

0 notes

Text

From Seed to Success: How to Find Investors for Startups in India

Are you an aspiring entrepreneur in India with a groundbreaking idea but lack the necessary funding to turn it into a reality? Don't fret! India's startup ecosystem is booming, and there are numerous investors eager to support innovative ventures. In this blog post, we will guide you through the process of finding investors for your startup in India and provide valuable insights into the world of venture capital firms in the country.

One of the first steps in your journey is to understand how to find investors for startups in India. The key lies in networking and building relationships within the startup ecosystem. Attend startup events, conferences, and pitch competitions to connect with potential investors. Engage with industry experts, mentors, and successful entrepreneurs who can introduce you to the right people in the investor community. Online platforms and angel investor networks also offer a convenient way to showcase your business idea to a wide range of potential investors.

When it comes to finding venture capital firms in India, thorough research is essential. Explore the Indian startup landscape and identify firms that specialize in your industry or have a track record of investing in similar startups. AngelList, NASSCOM 10,000 Startups, and YourStory are valuable resources to discover potential investors. Create a compelling pitch deck and business plan to captivate investors and highlight the growth potential of your startup. Be prepared to present your idea concisely and convincingly, showcasing your market research, competitive advantage, and financial projections.

Understanding how to invest in startup companies can also be beneficial as an entrepreneur. Familiarize yourself with the investor's perspective to communicate effectively and negotiate favorable terms. Investors generally seek high-potential startups with scalable business models and a strong founding team. They evaluate factors such as market size, revenue projections, and competitive advantage. Be prepared to answer tough questions about your market strategy, target audience, and growth plans.

Now, let's talk about Krystal Ventures, a renowned venture capital firm in India. With a stellar track record of supporting early-stage startups, Krystal Ventures has emerged as a prominent player in the Indian startup ecosystem. The firm focuses on investing in technology-driven startups across various sectors, including e-commerce, SaaS, healthcare, and fintech. Krystal Ventures provides not only capital but also valuable mentorship, strategic guidance, and a vast network of industry connections to help startups thrive.

If you are a budding entrepreneur in India looking for investors, Krystal Ventures could be an ideal partner. Their experienced team understands the challenges faced by startups and actively supports them throughout their journey. With a deep understanding of the Indian market, Krystal Ventures offers the expertise and resources necessary to scale your startup to new heights.

In conclusion, finding investors for startups in India requires proactive networking, thorough research, and a compelling business pitch. Leverage the power of the startup ecosystem, engage with potential investors, and showcase your startup's potential. Remember, the process may involve several rejections, but perseverance and resilience are key traits of successful entrepreneurs. And when it comes to venture capital firms in India, consider reaching out to Krystal Ventures for a partnership that can pave the way for your startup's success.

0 notes

Text

Top 10 Small Business Machines Under 1 Lakh

Starting a small manufacturing business can be an exciting venture, but it often requires the right machinery to get started. With technological advancements, numerous affordable machines are available that cater to various industries and production needs. However, for many entrepreneurs, budget constraints pose a significant challenge when it comes to investing in equipment. Thankfully, there…

View On WordPress

#best business ideas#Budget Tech#Business Equipment#Business Gadgets#business ideas#Business Innovation#Business machines#Entrepreneur Tools#garage business machines#low investment business ideas#new business ideas#new business machines#profitable business ideas#small business ideas at home#Small Business Machines#Small Business Solutions#small machines for home business#small manufacturing business#Startup Essentials#top 10#Under 1 Lakh

0 notes

Text

The economic indicators speak of nothing less than an economic catastrophe. Over 46,000 businesses have gone bankrupt, tourism has stopped, Israel’s credit rating was lowered, Israeli bonds are sold at the prices of almost “junk bonds” levels, and the foreign investments that have already dropped by 60% in the first quarter of 2023 (as a result of the policies of Israel’s far-right government before October 7) show no prospects of recovery. The majority of the money invested in Israeli investment funds was diverted to investments abroad because Israelis do not want their own pension funds and insurance funds or their own savings to be tied to the fate of the State of Israel. This has caused a surprising stability in the Israeli stock market because funds invested in foreign stocks and bonds generated profit in foreign currency, which was multiplied by the rise in the exchange rate between foreign currencies and the Israeli Shekel. But then Intel scuttled a $25 billion investment plan in Israel, the biggest BDS victory ever.

These are all financial indicators. But the crisis strikes deeper at the means of production of the Israeli economy. Israel’s power grid, which has largely switched to natural gas, still depends on coal to supply demand. The biggest supplier of coal to Israel is Colombia, which announced that it would suspend coal shipments to Israel as long as the genocide was ongoing. After Colombia, the next two biggest suppliers are South Africa and Russia. Without reliable and continuous electricity, Israel will no longer be able to pretend to be a developed economy. Server farms do not work without 24-hour power, and no one knows how many blackouts the Israeli high-tech sector could potentially survive. International tech companies have already started closing their branches in Israel.

Israel’s reputation as a “startup nation” depends on its tech sector, which in turn depends on highly educated employees. Israeli academics report that joint research with universities abroad has declined sharply thanks to the efforts of student encampments. Israeli newspapers are full of articles about the exodus of educated Israelis. Prof. Dan Ben David, a famous economist, argued that the Israeli economy is held together by 300,000 people (the senior staff in universities, tech companies, and hospitals). Once a significant portion of these people leaves, he says, “We won’t become a third world country, we just won’t be anymore.”

19 July 2024

6K notes

·

View notes