#how to recover stolen cryptocurrency

Text

how to recover stolen cryptocurrency

how to recover stolen cryptocurrency ?

One option is to get in touch with your cryptocurrency exchange or wallet provider's support team. They might have the option to help you in recuperating your assets. If you think your money was stolen, you can also get in touch with the FBI or other law enforcement agencies.

How would I recuperate my taken Usdt?

Tell the trade: Contact the customer support of the cryptocurrency exchange right away if your USDT was stolen. Give them the important subtleties, including your record data, exchange history, and any proof o. vis it here www.hackerstent.com

Might we at any point recuperate taken crypto?

Agents can now perceive complex exchange designs, find taken cash, and guarantee its brief recuperation by utilizing the huge computational limit of Computer science, especially helping those affected by crypto exchanging stage wrongdoings.

Can I get my stolen crypto back?

Revealing a digital currency trick can likewise assist you with recovering your misfortunes. The sooner you report it, the better the possibilities of specialists having the option to find the con artists and recuperate any taken assets. At times, revealing a trick can likewise prompt pay or repayment for casualties

Who researches taken digital currency?

Policing, monetary controllers, and confidential examiners all participate in crypto examinations. As a rule, policing recruit free examiners who spend significant time in crypto wrongdoings.

How do hoodlums take digital money?

How do criminals acquire crypto? What is the largest cryptocurrency theft? Thieves steal cryptocurrency through a variety of methods, including exchange hacks, social engineering schemes, cryptojacking, and information theft.

Over 850 thousand Bitcoin were stolen from Mt. Gox between 2011 and 2014, making it the largest cryptocurrency theft in history. Mt. Gox said that a problem that led to the loss was caused by a Bitcoin bug called transaction malleability. Damage 10, 2023

Could police follow digital currency?

At the premise of digital currencies like Bitcoin (BTC) stands blockchain innovation. A crucial quality of blockchain innovation is straightforwardness, implying that anybody, including the public authority, can see all digital money exchanges directed by means of that blockchain.

How much cryptocurrency is lost?

A faltering $3.8 billion was taken from digital money organizations in 2022, as per another report from the crypto examination organization Chainalysis. That is the most ridiculously ever in a solitary year. From crypto hacking, $3.3 billion was stolen in 2021.

Who took 4.5 billion bitcoins?

Meet the 'brains' of the activity. Ilya Dutch Lichtenstein and Heather Morgan have been identified as the operation's masterminds by US authorities. The investigation is ongoing, and the DOJ has not publicly linked them to the actual hacking of the cryptocurrency exchange.

Do banks refund scammed money?

Make an immediate call to your bank to inform them of the situation and inquire about the possibility of receiving a refund. Most banks ought to repay you on the off chance that you've moved cash to somebody due to a trick.

Is it possible to recover Usdt?

To recover a USDT wallet transaction, you will need to have access to your private key or seed phrase. If you have the private key: Use a USDT wallet that supports private key imports, such as MyEtherWallet or Coinomi. Import your private key into the wallet.

How do I recover my stolen Usdt?

Notify the exchange: If your USDT was stolen from a cryptocurrency exchange, contact the exchange's customer support immediately. Provide them with the necessary details, including your account information, transaction history, and any evidence o.

Visit here www.hackerstent.com for more details ..

0 notes

Text

BEST HACKER CONTACT; CAPTAIN WEBGENESIS.

Good day, everyone. I'm Jordan Hoad from Oregon, USA, and I'm going to tell you about Captain WebGenesis and how the Bitcoin Expert assisted me in recovering the $278,000 in Bitcoins that were stolen from me. Just when I was becoming interested in Crypto Investments, I was duped by a phony cryptocurrency investment organization that claimed to assist people quadruple their investments. I was told that once you lose Bitcoin, it is hard to recover it, however after reading about Captain WebGenesis, a certified Bitcoin recovery Expert. I quickly contacted Captain WebGenesis and was able to retrieve everything I had lost. To anyone scouting for a recovery Expert, I implore you to contact Captain WebGenesis.

BEST HACKER CONTACT; CAPTAIN WEBGENESIS.

Good day, everyone. I'm Jordan Hoad from Oregon, USA, and I'm going to tell you about Captain WebGenesis and how the Bitcoin Expert assisted me in recovering the $278,000 in Bitcoins that were stolen from me. Just when I was becoming interested in Crypto Investments, I was duped by a phony cryptocurrency investment organization that claimed to assist people quadruple their investments. I was told that once you lose Bitcoin, it is hard to recover it, however after reading about Captain WebGenesis, a certified Bitcoin recovery Expert. I quickly contacted Captain WebGenesis and was able to retrieve everything I had lost. To anyone scouting for a recovery Expert, I implore you to contact Captain WebGenesis.

BEST HACKER CONTACT; CAPTAIN WEBGENESIS.

Good day, everyone. I'm Jordan Hoad from Oregon, USA, and I'm going to tell you about Captain WebGenesis and how the Bitcoin Expert assisted me in recovering the $278,000 in Bitcoins that were stolen from me. Just when I was becoming interested in Crypto Investments, I was duped by a phony cryptocurrency investment organization that claimed to assist people quadruple their investments. I was told that once you lose Bitcoin, it is hard to recover it, however after reading about Captain WebGenesis, a certified Bitcoin recovery Expert. I quickly contacted Captain WebGenesis and was able to retrieve everything I had lost. To anyone scouting for a recovery Expert, I implore you to contact Captain WebGenesis.

192 notes

·

View notes

Text

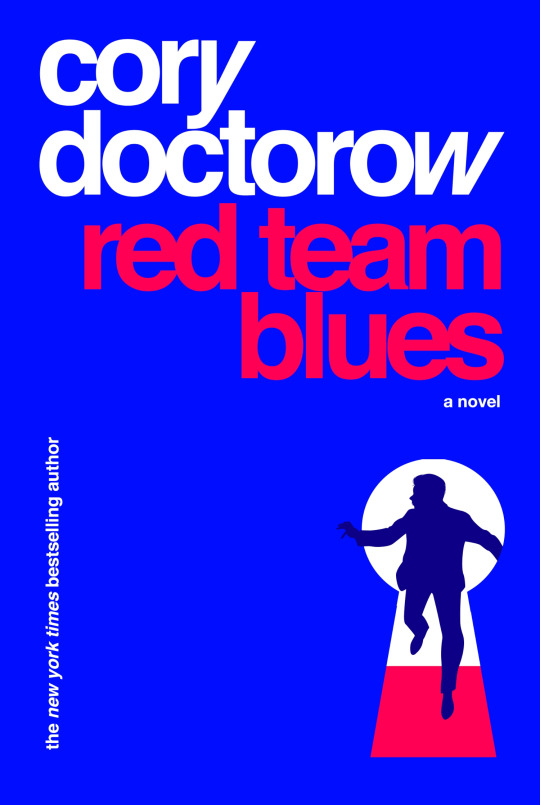

Booklist on "Red Team Blues"

I've published more than 20 books, and I still get nervous in the few months leading up to a new book's release. It's one thing for my agent, my editor and my wife to like one of my novels - but what about the rest of the world? Will the book soar, or bomb? I've had books do both, and the latter is No Fun. Scarifying, even.

My next novel is Red Team Blues, which Tor Books and Head of Zeus will publish on April 25. It is a significant departure for me in many ways: it's a heist novel about cryptocurrency, grifters and crime bosses, the first book in a trilogy that runs in reverse chronological order (!):

https://us.macmillan.com/books/9781250865847/red-team-blues

The hero of RTB is Marty Hench, a forensic accountant and digital pioneer. Marty got his start when he discovered spreadsheets as an MIT undergrad. He got so deep into the world of Visicalc and Lotus 1-2-3 that he dropped out of university, moved to Silicon Valley, and pitted his ability to find money with spreadsheets against people who use spreadsheets to hide money.

RTB opens with Marty on the verge of retirement, when he is roped in for one last job - a favor to a friend who has built a new cryptocurrency that is in danger of imploding thanks to some stolen keys. If Marty can recover the keys, his customary 25% commission will come out to more than a quarter of a billion dollars. How could he say no?

I wrote this book in a white-hot fury of the sort that I underwent in 2006, when I wrote Little Brother in eight weeks flat. Red Team Blues took six weeks. It's good. I sent it to my Patrick Nielsen Hayden, my editor. The next day, I got this email:

That.

Was.

A! Fucking! Ride!

Whoa!

That night, I rolled over in bed to find my wife wide awake at 2AM, staring at her phone. "What are you doing?" I asked. "Finishing your book," she said. "I had to find out how it ended."

I loved writing this book, and after I finished it, I found that Marty Hench was still living in my mind. How could I keep writing about him, though? Red Team Blues is his final adventure. Then, one day, it hit me: now that I knew how Marty's career ended, I could write about how it started.

I could write prequels - as many as I chose - retelling the storied career of Martin Hench, the scambusting forensic accountant of Silicon Valley. I pitched my editor on two prequels - one a midcareer adventure, the other his origin story - and my editor bought 'em. For the first time in decades, in dozens of books, I'm writing a trilogy.

It's nearly done. I finished the second book, "The Bezzle" - about private prisons and financial corruption - late last year. I'm 80%+ through the final one, "Picks and Shovels," AKA Marty's origin story, a caper involving an early eighties PC-selling pyramid scheme run by a Mormon bishop, a Catholic priest and an orthodox rabbi, who run their affinity scam through a company called "Three Wise Men Computers."

But for all that I love these books, love writing these books, I am still nervous. Butterflies-in-stomach. I got some reassurance in December, when the New Yorker's Chris Byrd said some extraordinarily kind things about RTB when he profiled me:

https://www.newyorker.com/culture/the-new-yorker-interview/cory-doctorow-wants-you-to-know-what-computers-can-and-cant-do

Despite that, though, I continued to have vicious pangs of self-doubt, imposter syndrome, superstitious dread, haunting memories of the mentors and writers I admired as a young man whose careers were snatched away by changing industry trends, market shifts, or just a bad beat. I love this book. Would other people? I'm not a crime writer. Ugh.

Then, this week, my publicist Laura Etzkorn at Tor sent me the first trade review for RTB, Booklist's starred notice, by David Pitt:

Well, talk about timely. In the wake of the late-2022 collapse of cryptocurrency comes this novel about a forensic accountant who’s hired to work a case involving electronic theft of cryptocurrency. The guy’s name is Martin Hench; he’s in his late sixties, with decades of experience, and he thinks he’s seen it all. Until now. Doctorow, author of such novels as The Rapture of the Nerds (2012) Homeland (2013), and Pirate Cinema (2012), is a leading force in cyberpunk fiction, and here he mixes cyberpunk with traditional private eye motifs (if Martin Hench feels a bit like Philip Marlowe or even Jim Rockford, that’s probably not a coincidence).

Doctorow's novels are always feasts for the imagination and the intellect, and this one is no exception: it’s jam-packed with cutting-edge ideas about cybersecurity and crypto, and its near-future world is lovingly detailed and completely believable. Another winner from an sf wizard who has always proved himself adept at blending genres for both adults and teens.

To quote a certain editor of my acquaintance:

That.

Was.

A! Fucking! Ride!

Whoa!

Maybe this writing thing is gonna work out after all.

ETA: Well, this is pretty great. Shortly after I hit publish on this, Library Journal published its review of Red Team Blues, by Andrea Dyba:

Cyber detective, forensic accountant—whatever his title, 67-year-old Marty Hench is one of those rare people who tries to prevent financial crimes. He’s spent his whole career as a member of the Red Team, as an attacker, one who always has the advantage. Now ready for retirement, he’s living it up in California and trying to decide what he wants to do when he grows up when he’s hired by an old friend. Danny Lazer, the founder of the new crypto titan Trustlesscoin, needs Marty to recover stolen cryptographic keys and prevent the type of financial crisis that people lose their lives over. Marty delves into the shady underside of the private equity world, where he’s caught between warring international crime syndicates. The sincere and intelligent writing has a noir feel to it, enhanced by Marty’s dry humor. There’s a sense of satisfaction as this unassuming retired man dishes out comeuppance.

VERDICT This absorbing and ruthless cyberpunk thriller from Doctorow (Attack Surface) tackles modern concerns involving cryptocurrency, security, and the daunting omnipotence of technology. Great for fans of Charles Stross.

https://www.libraryjournal.com/review/red-team-blues-1794647

[Image ID: Will Stahle's cover for the Tor Books edition of 'Red Team Blues.']

#pluralistic#red team blues#marty hench#science fiction#detective fiction#crime fiction#cryptocurrency#crypto means cryptography#crypto#heists#security#infosec

75 notes

·

View notes

Text

The legendary dark-web market for drugs known as the Silk Road was designed to be an anarchic underworld economy that evaded all government control. Instead, years after it was torn offline, it's proven to be the IRS’s gift that keeps on giving.

On Monday, the US Department of Justice announced that a Georgia man named James Zhong has pleaded guilty to wire fraud nine years after stealing more than 50,000 bitcoins from the Silk Road. As part of his plea agreement, Zhong has forfeited that massive stash of bitcoins to the DOJ—a sum that, at the time of the coins' seizure in late 2021, would have been the biggest-ever Justice Department seizure not only of cryptocurrency but of currency of any kind. The bitcoins were ultimately found stored on what’s described in court records as a “single-board computer” hidden in a popcorn can, along with more than $600,000 in cash and precious metals, all held in a safe under the floorboards of a bathroom closet in Zhong’s home.

The newly revealed case represents yet another notch in the belt for IRS Criminal Investigations, or IRS-CI, which over the past several years has used—very often in partnership with blockchain analysis firm Chainalysis—cryptocurrency tracing techniques that have led to record-breaking troves of ill-gotten bitcoins and to the alleged hackers and money launderers who amassed them. In fact, Zhong is the second Silk Road hacker to turn over a billion-dollar cache of coins to the IRS-CI, after another unnamed individual agreed the previous year to forfeit nearly 70,000 bitcoins he'd stolen from the drug market—a record-breaking, even larger collection of coins that was worth $1 billion at Bitcoin's lower exchange rate at the time. Both those records were again broken earlier this year by IRS-CI's case against two alleged money launderers in New York accused of pocketing $4.5 billion in cryptocurrency stolen from the Bitfinex exchange.

"Thanks to state-of-the-art cryptocurrency tracing and good old-fashioned police work, law enforcement located and recovered this impressive cache of crime proceeds," wrote US Attorney Damian Williams, a prosecutor for the Southern District of New York, in a statement about the latest indictment and 10-figure seizure. "This case shows that we won’t stop following the money, no matter how expertly hidden, even to a circuit board in the bottom of a popcorn tin.”

According to an IRS-CI affidavit detailing Zhong's theft of the 50,000-plus bitcoins from the Silk Road, he appears to have found a vulnerability in that dark-web market that in 2012 allowed him to somehow pull more coins out of accounts he created there than he had deposited. The affidavit describes how he registered a succession of accounts on the site with names like "thetormentor" and "dubba," deposited a sum of coins into the Bitcoin wallets for each account, and then made repeated withdrawals of the entire sums held there within a single second to multiply his money several times over. This apparently exploited a bug in the Silk Road that allowed those rapid-fire withdrawals without first confirming that the requested money still existed in a user's account. "In this fashion, [Zhong], using each of the fraud accounts, moved at least approximately 50,000 Bitcoin out of Silk Road in just a few days," reads the affidavit, which was signed by IRS-CI special agent Trevor McAleenan.

Over the nine years that followed, Zhong appears to have left that massive windfall almost entirely unspent—perhaps for fear that cashing it out into traditional currency would attract the attention of law enforcement. But even that epic restraint appears to have been in vain, as IRS-CI investigators nonetheless traced Zhong's coins to his accounts on an unnamed cryptocurrency exchange, which revealed his identity. Zhong's case closely mirrors the story of the earlier Silk Road hacker, referred to in court documents only as Individual X, who similarly exploited a vulnerability in the Silk Road to take nearly 70,000 bitcoins from the site and hold them for more than seven years. But, perhaps due to the vagaries of negotiations over massive cryptocurrency fortunes, no charges against Individual X have been publicly revealed. Zhong, by contrast, now faces a wire fraud conviction that carries as much as 20 years in prison.

The Silk Road was torn down by a massive law enforcement operation in late 2013, leading to the arrest of Ross Ulbricht, the site's creator, who was sentenced to life in prison and ordered to pay $183 million in restitution. In yet another bizarre twist, however, a portion of the seized 70,000 bitcoins taken from the Silk Road by Individual X were applied toward Ulbricht's debt, paying it off in full in exchange for his agreement not to lay any claim to the remaining money.

Using bitcoins stolen from the Silk Road to pay off the restitution of that site's creator may seem like a strange turn of events. But in an era when IRS-CI cryptocurrency seizures regularly pours billions of dollars into the US Treasury, there seems to be plenty to go around.

10 notes

·

View notes

Text

What is binance and types of trading & how to make money from it

Homecryptocurrency

What is binance and types of trading & how to make money from it

bywebcallon-March 09, 2023

0

what is binance

Binance is a global cryptocurrency exchange that was founded in 2017 by Changpeng Zhao, a former software developer at Bloomberg Tradebook. It has quickly become one of the most popular exchanges in the world due to its wide range of features and user-friendly interface. Binance is headquartered in Malta and has offices in various countries around the world.

One of the key features of Binance is its vast selection of cryptocurrencies. It currently supports over 500 different coins and tokens, making it one of the most comprehensive exchanges in the market. This allows users to access a wide range of investment opportunities and diversify their portfolio across different cryptocurrencies.

Binance also offers a variety of trading options, including spot trading, margin trading, and futures trading. Spot trading involves buying and selling cryptocurrencies for immediate delivery, while margin trading allows users to trade with borrowed funds, giving them the opportunity to increase their profits or losses. Futures trading involves trading contracts that allow traders to speculate on the price of a cryptocurrency at a future date.

In addition to trading, Binance offers a range of other services, including staking, savings, and lending. Staking involves holding cryptocurrencies in a wallet to support the network and earn rewards. Savings allows users to earn interest on their cryptocurrency holdings, while lending allows them to earn interest by lending their cryptocurrency to other users.

Binance also has its own cryptocurrency, Binance Coin (BNB), which can be used to pay for trading fees on the platform. BNB has become one of the most popular cryptocurrencies in the market, with a market capitalization of over $40 billion.

One of the key strengths of Binance is its security measures. The platform uses a variety of security features to protect user funds, including two-factor authentication, SSL encryption, and cold storage. Binance also has a Secure Asset Fund for Users (SAFU) that provides an extra layer of protection in case of security breaches or other unexpected events.

Another advantage of Binance is its user-friendly interface. The platform is designed to be easy to use, even for beginners, and offers a range of educational resources to help users learn about cryptocurrencies and trading. Binance also has a mobile app that allows users to trade and manage their portfolio on the go.

Despite its many strengths, Binance has faced some challenges in recent years. In 2019, the platform suffered a security breach that resulted in the theft of over $40 million worth of cryptocurrency. Binance responded quickly to the breach and was able to recover the stolen funds, but it highlighted the need for strong security measures in the cryptocurrency industry.

Binance has also faced regulatory scrutiny in some countries, including the United States and Japan. In 2021, the Financial Conduct Authority (FCA) in the UK banned Binance from operating in the country, citing concerns about its compliance with anti-money laundering (AML) regulations. Binance has since made efforts to improve its AML policies and has been working to address regulatory concerns in other countries.

In conclusion, Binance is a comprehensive and user-friendly cryptocurrency exchange that offers a wide range of trading options and services. Its vast selection of cryptocurrencies, security measures, and educational resources make it an attractive choice for both beginner and experienced traders. However, like any cryptocurrency exchange, it also faces challenges and risks, including security breaches and regulatory scrutiny. As with any investment, it is important for users to do their own research and carefully consider the risks before investing in cryptocurrencies.

Binance has grown rapidly since its launch in 2017 and has become one of the largest cryptocurrency exchanges in the world. According to CoinMarketCap, Binance is currently ranked as the 4th largest exchange by trading volume, with a 24-hour trading volume of over $12 billion at the time of writing.

Binance has also expanded its offerings beyond just cryptocurrency trading. In 2020, the exchange launched Binance Card, a debit card that allows users to spend their cryptocurrency holdings at merchants that accept Visa. Binance has also launched its own blockchain, Binance Chain, which is designed to facilitate the issuance and trading of digital assets.

Binance has also been active in the cryptocurrency industry through its various initiatives and investments. In 2019, the exchange launched Binance Labs, a blockchain incubator that invests in early-stage blockchain projects. Binance has also invested in other blockchain companies and projects, including Polkadot, Terra, and Oasis Labs.

Another notable feature of Binance is its customer support. The platform offers 24/7 customer support via live chat, email, and social media, which has earned it a reputation for being responsive and helpful. Binance also has a large community of users and supporters, with over 3 million followers on Twitter and over 2 million members in its official Telegram group.

In terms of fees, Binance is known for having some of the lowest trading fees in the industry. The platform charges a flat fee of 0.1% for spot trading and 0.04% for futures trading, with further discounts available for users who hold BNB. Binance also has a referral program that allows users to earn commission by referring new users to the platform.

Overall, Binance is a popular and well-established cryptocurrency exchange that offers a wide range of features and services for traders and investors. While it faces some challenges and risks, it has demonstrated a commitment to security, innovation, and customer support that has earned it a loyal following in the cryptocurrency community.

Binance has a strong focus on innovation and has been at the forefront of developing new products and features in the cryptocurrency space. In 2020, the exchange launched Binance Smart Chain, a blockchain platform that enables the creation of decentralized applications (dApps) and the execution of smart contracts. Binance Smart Chain has gained significant traction in the decentralized finance (DeFi) space, with a growing number of dApps being built on the platform.

Binance has also been active in the crypto lending space. In 2019, the exchange launched Binance Lending, a platform that allows users to lend their cryptocurrency holdings to other users and earn interest. Binance Lending has since expanded to offer a range of lending products, including flexible and fixed-term loans.

In addition to its lending platform, Binance has also launched a peer-to-peer (P2P) trading platform. P2P trading allows users to buy and sell cryptocurrencies directly with each other, without the need for a centralized exchange. This can be particularly useful in countries where cryptocurrency exchanges are restricted or banned.

Binance has also been actively involved in promoting cryptocurrency adoption and education. The exchange has launched a range of educational resources, including articles, videos, and webinars, to help users learn about cryptocurrencies and blockchain technology. Binance has also launched several initiatives aimed at promoting cryptocurrency adoption, such as the Binance Charity Foundation, which uses blockchain technology to facilitate charitable donations.

One area where Binance has faced criticism is in its listing process for new cryptocurrencies. Some critics have accused the exchange of prioritizing profit over due diligence, leading to the listing of some questionable cryptocurrencies. Binance has responded by implementing stricter listing requirements and conducting more thorough due diligence on new listings.

Overall, Binance is a dynamic and innovative cryptocurrency exchange that has become a major player in the industry. While it faces some challenges and criticisms, it has demonstrated a commitment to security, innovation, and customer support that has helped it attract a large and loyal user base.

Binance has a user-friendly interface that is easy to navigate, making it an attractive option for both novice and experienced traders. The platform also offers a range of advanced trading tools, such as advanced charting, technical analysis, and trading indicators. These tools allow traders to conduct detailed analysis and make informed trading decisions.

Binance also offers a range of order types, including limit orders, market orders, stop-limit orders, and trailing stop orders. These order types allow traders to execute their trades with greater precision and control.

Another feature of Binance is its margin trading platform. Margin trading allows users to trade with borrowed funds, enabling them to increase their potential profits (as well as their potential losses). Binance offers up to 125x leverage on select cryptocurrencies, which can be particularly attractive to experienced traders.

Binance also offers a range of security features to protect its users' funds and personal information. These include two-factor authentication (2FA), anti-phishing measures, and SSL encryption. Binance also has a Secure Asset Fund for Users (SAFU) that acts as an emergency insurance fund in the event of a security breach or hack.

Finally, Binance has a wide range of supported cryptocurrencies, including many of the most popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, as well as a range of smaller and emerging cryptocurrencies. This makes it a one-stop-shop for users who want to trade a variety of cryptocurrencies on a single platform.

Overall, Binance offers a wide range of features and services that make it a popular and well-regarded cryptocurrency exchange. While it is not without its challenges and criticisms, it has demonstrated a commitment to innovation, security, and customer support that has helped it become a major player in the industry.

Types of trading in binance

Binance offers several types of trading for its users, including:

Spot Trading: This is the most common type of trading on Binance. In spot trading, users buy and sell cryptocurrencies at the current market price. The user's order is matched with an existing order on the exchange's order book.

Margin Trading: Binance offers margin trading, which allows users to trade with borrowed funds. This means users can increase their profits (as well as their losses) by trading with leverage. Binance offers up to 125x leverage on select cryptocurrencies.

Futures Trading: Binance also offers futures trading, which allows users to trade cryptocurrencies at a predetermined price at a future date. This type of trading is typically used by more experienced traders who want to hedge against price fluctuations.

Options Trading: Binance also offers options trading, which allows users to buy and sell options contracts based on the price of an underlying cryptocurrency. Options trading can be used for hedging, speculation, or generating income.

OTC Trading: Binance also offers over-the-counter (OTC) trading for large volume trades. This type of trading is typically used by institutional investors or high-net-worth individuals who want to avoid affecting the market price of a cryptocurrency.

Leveraged Tokens: Binance offers leveraged tokens that allow users to gain exposure to the price movements of cryptocurrencies without having to manage their own leveraged positions. Leveraged tokens can be bought and sold on Binance like any other cryptocurrency.

Staking: Binance offers staking services for select cryptocurrencies. Staking involves holding a certain cryptocurrency in a wallet for a certain period of time to earn rewards. Binance offers staking rewards to users who hold certain cryptocurrencies on the exchange.

Binance Launchpad: Binance Launchpad is a platform that allows users to participate in initial coin offerings (ICOs) and other token sales. Binance Launchpad offers users the opportunity to invest in promising new blockchain projects before they are available on other exchanges.

Binance Savings: Binance Savings allows users to earn interest on their cryptocurrency holdings. Users can deposit their cryptocurrencies into Binance Savings and earn interest on a daily, weekly, or monthly basis.

Binance Pool: Binance Pool is a mining pool that allows users to mine cryptocurrencies and earn rewards. Binance Pool supports several cryptocurrencies, including Bitcoin and Ethereum.

Overall, Binance offers a wide range of trading options and services that cater to the needs of different users. Whether you're interested in spot trading, margin trading, futures trading, options trading, or staking, you can find a trading type that suits your needs on Binance.

how to make money from binance

There are several ways to make money from Binance. Here are some strategies that you can consider:

Trading: Trading cryptocurrencies on Binance can be a profitable way to make money. You can buy low and sell high to make a profit. Binance offers a wide range of trading types, including spot trading, margin trading, and futures trading, which can help you maximize your profits.

read more

#btc latest newsmake#crypto#crypto latest news#bitcoin#cryptocurrencies#ethereum#make money tips#make money for free#make money today

3 notes

·

View notes

Text

The MtGox Hack: How the World’s Largest Bitcoin Exchange was Hacked

Cryptocurrencies were once seen as a game-changing innovation that would make financial transactions more secure and fraud-proof. However, with the occurrence of various high-profile hacks and scandals, people's faith in the safety of cryptocurrencies has dwindled. One of the most infamous cases of cryptocurrency hacking is the MtGox hack, which resulted in the breach of the largest Bitcoin exchange in the world.

MtGox was started by Jed McCaleb in 2010 as a website for trading Magic the Gathering cards, but he soon saw the potential of Bitcoin. A French software programmer named Mark Karpeles assumed control of the exchange in March 2011 and turned it into a Bitcoin trading hub. MtGox expanded quickly under Karpeles' direction, handling more than 80% of all Bitcoin transactions at its height and processing over $100 million in transactions per month. However, MtGox unexpectedly stopped all trading in February 2014 due to a fault that allowed for price manipulation of Bitcoin on its site by hackers.

Hackers had stolen 850,000 Bitcoins worth about $450 million at the time from the exchange. After the hack, MtGox filed for bankruptcy, and the company was forced to shut down. Although several attempts were made to recover the stolen funds, a significant amount of the Bitcoins remain missing to this day. While authorities conducted an investigation into the incident, the identity of the hackers and the exact details of the hack are still unknown.

The MtGox hack's aftermath resulted in the company's bankruptcy and a subsequent decrease in Bitcoin's value, leading many investors to lose faith in the cryptocurrency industry.

To read more about this infamous hack and the ongoing repayment process for creditors, visit the official website Coinpedia.

3 notes

·

View notes

Text

Cryptocurrencies like Bitcoin and Ethereum have dramatically increased in value, with even a single Bitcoin now worth tens of thousands of dollars. Since these virtual currencies have become so valuable, owners must ensure they have access to all of the coins they own. Crypto Recovery Expert Services and Solutions. Recover cryptocurrency from fraudulent investment platforms

Many people don’t know how to recover lost or stolen crypto funds. We offer the best crypto recovery service and how to make non spendable funds spendable. also you can find the best private key finder software or tools in 2022. With present improvement in technology we stay ahead and bring about reclamation of stolen crypto and how to unlock blocked crypto wallets. How to generate the private key of any crypto address and how to recover cryptocurrency from fraudulent investment platforms.

https://www.cryptoreclaimfraud.com

#Bitcoin#crypto#scammers#dating fraud#investment#forexmarket#forexeducation#forexprofit#ponzi scheme#crypto assets#recovery seed#blockchain#coinbase#coinmarketcap#coingecko#exchange#etherium#free usdt#recovery fund#trust wallet#private keys#shibainu#romance#hacking#coding

5 notes

·

View notes

Text

How to Recover Your Bitcoin and Protect Yourself from Scams

Losing access to a Bitcoin wallet or falling victim to a scam can feel overwhelming. It’s essential to know what steps to take to reclaim your funds and safeguard you Recover lost bitcoin wallet investments. In this article, I’ll share practical advice based on recent information and expert insights.

Understanding Bitcoin Wallets

Bitcoin wallets store your cryptocurrency. They come in different forms, such as hardware wallets, software wallets, and online wallets. If you lose access to your wallet, don’t panic.

Common Reasons for Losing Access

Forgotten Passwords: Many people forget their wallet passwords.

Hardware Failures: Devices can break or malfunction.

Loss of Backup Keys: Not having backup keys can lead to permanent loss.

Steps to Recover Your Wallet

Check Backup Options: Most wallets offer recovery phrases. If you wrote yours down, use it to regain access.

Contact Customer Support: If you used a service, reach out to their support team. They may help you verify your identity.

Explore Recovery Software: Some software tools can assist in recovering lost wallets. Use trusted options to avoid scams.

Dealing with Broker Scams

Scammers often target crypto investors. Recognizing a broker scam is crucial for protecting your assets.

Signs of a Scam Broker

Unrealistic Promises: If it sounds too good to be true, it probably is.

Pressure Tactics: Scammers create urgency to make you act quickly.

Lack of Regulation: Always check if the broker is licensed and regulated.

What to Do If You’ve Been Scammed

Document Everything: Keep records of all communications and transactions.

Report to Authorities: File a complaint with the Federal Trade Commission (FTC) and your state’s securities regulator.

Notify Your Bank: If you sent money via a bank, inform them of the scam.

Reclaiming Stolen Crypto

If your crypto has been stolen, the process can be more complicated, but there are steps you can take.

Steps to Take Immediately

Report to Law Enforcement: File a police report to document the theft.

Notify Your Wallet Provider: They may help freeze or monitor suspicious activity.

Reach Out to Crypto Exchanges: If you know where the stolen crypto was sent, inform the exchange. They may help track the funds.

Expert Insights

According to cybersecurity experts, the sooner you act, the better your chances of recovery. Many cases go unresolved because victims wait too long.

Reporting Scams to Get Your Money Back

Reclaiming lost funds is often a multi-step process. Here’s how to report scams effectively.

Steps to Report a Scam

Gather Evidence: Collect screenshots, emails, and any other relevant information.

File a Report with the FTC: This helps track scams and may aid in broader investigations.

Inform the Better Business Bureau (BBB): They handle complaints and may take action against fraudulent companies.

Seek Legal Assistance

In some cases, legal advice may be necessary. A lawyer can guide you on the best course of action to recover your funds.

Preventing Future Losses

Taking precautions can save you from future headaches. Here are some key strategies.

Secure Your Wallet

Use Strong Passwords: Combine letters, numbers, and symbols.

Enable Two-Factor Authentication: This adds an extra layer of security.

Keep Software Updated: Regular updates can patch security vulnerabilities.

Educate Yourself About Scams

Stay informed about the latest scams. Scammers evolve their tactics, and being aware can help you avoid falling victim.

Final Thoughts

Recovering lost Bitcoin and protecting yourself from scams is possible with the right knowledge and actions.

Always act quickly if you suspect a scam or lose access to your wallet.

Keep yourself educated about the crypto landscape, and take proactive measures to secure your investments.

With the right approach, you can navigate these challenges and reclaim your financial peace of mind.

0 notes

Text

Victims of Weex Crypto Exchange and phenixtrustltd.com Recover over $3M with Crypto Crime Investigation (CCI)

New York, NJ – September 2, 2024 – Crypto Crime Investigation (CCI) proudly announces the successful recovery of over $3 million from various cryptocurrency scams, primarily linked to fraudulent activities orchestrated by Weex Crypto Exchange and phenixtrustltd.com. This significant recovery marks a pivotal moment for the victims that experienced financial devastation through these fraudulent platforms.

In an age where digital currencies are changing the face of finance, criminal activities targeting unsuspecting investors have surged. The emergence of Weex Crypto Exchange and phenixtrustltd.com as dubious entities lured numerous individuals into investing their hard-earned money under false pretenses. Many victims faced insurmountable distress, struggling to recover their stolen assets amid rising anxiety over the loss of their investments.

Crypto Crime Investigation (CCI), renowned for its expertise in cryptocurrency fraud recovery, stepped in to assist these victims. Utilizing a combination of forensic blockchain analysis, skilled negotiators, and legal support, Crypto Crime Investigation (CCI) was able to trace and successfully reclaim funds that had been misappropriated by these scam operations.

"Our mission is to help those who have suffered financial losses due to fraudulent crypto schemes," said Ms. Janet Lee, COO of Crypto Crime Investigation (CCI). “Recovering over $3 million from Weex Crypto Exchange and phenixtrustltd.com is not just a victory for our firm, but a beacon of hope for other victims who may feel powerless in their situation.”

By unveiling this substantial recovery, Crypto Crime Investigation (CCI) hopes to raise awareness about the prevalence of crypto scams and remind investors to remain vigilant against potential fraud.

For further information and to see how Crypto Crime Investigation (CCI) can assist you in recovering lost crypto funds, visit www.cryptocrimeinvestigation.com or contact [email protected]

For Media Inquiries:

Contact:

Daniel Johnson

Crypto Crime Investigation (CCI)

www.cryptocrimeinvestigation.com

1 note

·

View note

Text

Understanding the Russian Market: Dumps, RDP Access, and CVV2 Shops

In today's digital world, the Russian market has become a key player in the realm of cybercrime, particularly in trading stolen data and unauthorized access. This article explores the concepts of dumps, RDP access, and CVV2 shops, focusing on how these elements are traded on platforms like Russianmarket.to and the impact they have on individuals and businesses.

What Are Dumps, RDP Access, and CVV2?

Dumps

"Dumps" refer to stolen data from the magnetic stripe of credit or debit cards. This information typically includes the card number, expiration date, and security code. Cybercriminals acquire this data through various methods, such as hacking or using skimming devices. Once obtained, these dumps are often sold on dark web platforms like Russianmarket. The sale of this stolen data enables criminals to clone cards and make unauthorized transactions, leading to significant financial losses for victims.

RDP Access

Remote Desktop Protocol (RDP) access allows users to control a computer remotely over a network. While RDP is used for legitimate purposes, such as remote work, it can also be exploited by cybercriminals. On platforms like Russianmarket, hackers buy and sell access to compromised RDP servers. This unauthorized access can lead to serious issues, including data theft, system disruptions, and further security breaches. It poses significant risks for both individual users and organizations.

CVV2

CVV2, or Card Verification Value 2, is a three-digit security code on the back of credit and debit cards. It is used to verify the cardholder’s identity during online and phone transactions. CVV2 shops are marketplaces where this sensitive data is traded. On Russianmarket, CVV2 information is bought and sold, facilitating fraudulent activities. The misuse of this data can result in unauthorized transactions and identity theft, making it a major concern for both individuals and financial institutions.

How Russianmarket Facilitates These Activities

Overview of Russianmarket

Russianmarket is a prominent platform on the dark web where cybercriminals trade stolen data and access credentials. It serves as a hub for buying and selling dumps, RDP access, and CVV2 information. The platform’s anonymity and encrypted communication systems make it an attractive venue for illegal transactions, allowing criminals to operate with relative safety from law enforcement.

Transaction Process on Russianmarket

Transactions on Russianmarket are conducted anonymously to protect users' identities. Buyers and sellers communicate through encrypted messaging systems, and payments are often made using cryptocurrencies to further obscure their identities. Listings for dumps, RDP access, and CVV2 data are posted, enabling buyers to choose from a variety of offers. This covert operation helps users avoid detection and prosecution.

Risks of Using Russianmarket

Engaging with Russianmarket involves significant risks. Participants face potential legal consequences, including criminal charges and imprisonment, as law enforcement agencies increasingly target these illegal platforms. Additionally, users risk falling victim to scams or fraudulent schemes, which can result in financial losses and further complications. The anonymous nature of Russianmarket makes it difficult to recover stolen assets or seek justice.

Impact of Dumps, RDP Access, and CVV2 Information

Threats to Individuals

The availability of dumps, RDP access, and CVV2 information on platforms like Russianmarket poses serious threats to individuals. Stolen card data can lead to unauthorized transactions and financial loss. Compromised RDP access can result in personal data theft or unauthorized control of a user’s computer. Being aware of these risks is crucial for protecting personal information and preventing identity theft.

Implications for Businesses

Businesses are also at risk from the activities associated with Russianmarket. Unauthorized RDP access can lead to data breaches, system disruptions, and loss of sensitive information. The misuse of stolen CVV2 data can result in fraudulent transactions, damaging financial stability and customer trust. Businesses must implement robust security measures to defend against these risks effectively and safeguard their operations.

Protective Measures

To mitigate the risks associated with platforms like Russianmarket, both individuals and businesses should adopt strong security practices. Key protective measures include:

Using Strong, Unique Passwords: Ensure that all accounts have complex, unique passwords to prevent unauthorized access.

Enabling Multi-Factor Authentication: Add an extra layer of security by requiring additional verification steps.

Monitoring Financial Statements: Regularly review financial statements for any unusual or unauthorized transactions.

Updating Security Protocols: Stay informed about emerging threats and update security measures to protect against new risks.

Legal and Ethical Considerations

Legal Risks

Participating in or supporting activities related to dumps, RDP access, and CVV2 shops is illegal in many jurisdictions. Individuals involved in these activities can face severe legal repercussions, including fines and imprisonment. Laws and regulations are in place to combat cybercrime, and enforcement agencies are actively pursuing those who participate in these illegal markets.

Ethical Implications

From an ethical standpoint, engaging in or supporting cybercrime undermines trust and safety in the digital world. It is important for individuals to consider the broader impact of their actions and to act responsibly online. Promoting a secure and trustworthy online environment benefits everyone and helps foster a safer digital community.

Conclusion

The Russian market, particularly through platforms like Russianmarket, plays a significant role in the distribution of dumps, RDP access, and CVV2 information. Understanding these elements and their implications is crucial for both individuals and businesses. By adopting strong security practices and staying informed about digital threats, one can better protect themselves and their assets from the risks associated with these illicit activities.

In summary, while Russianmarket highlights the darker side of online transactions, awareness and proactive measures are key to effectively managing the risks posed by cyber threats.

0 notes

Text

Top 10 Must-Know Facts About Cryptocurrency for New Investors

Cryptocurrency has rapidly transformed from a niche digital asset into a global financial phenomenon. For new investors, diving into the world of crypto can be both exciting and overwhelming. With thousands of cryptocurrencies, evolving technologies, and ever-changing market trends, it's essential to start with a strong foundation. Here are the top 10 must-know facts about cryptocurrency for new investors to help you navigate this dynamic landscape.

1. What is Cryptocurrency?

Cryptocurrency is a digital or virtual form of money that uses cryptography for security. Unlike traditional currencies, cryptocurrencies operate on decentralized networks based on blockchain technology, a distributed ledger maintained by a network of computers. This means they are not controlled by any central authority, like a government or bank, which is a core feature that attracts many to invest in crypto.

2. Understanding Blockchain Technology

To grasp how cryptocurrencies work, you need to understand blockchain technology. A blockchain is a decentralized digital ledger that records all transactions across a network. Each block contains transaction data and a timestamp, linked to the previous block, forming a chain. This system makes transactions transparent, secure, and nearly impossible to alter, contributing to the growing popularity of cryptocurrencies.

3. Cryptocurrency Research is Essential

Before investing in any cryptocurrency, it's crucial to conduct thorough research. Each cryptocurrency has its own unique use case, technology, and development team. Start by reading the project’s whitepaper, understanding its goals, and looking at its team and advisors. Conducting cryptocurrency research will help you identify whether the project has a solid foundation and potential for growth.

4. Volatility is a Key Characteristic

Cryptocurrencies are known for their extreme price volatility. Unlike traditional stocks or bonds, the value of cryptocurrencies can change dramatically in a short period. While this volatility can offer significant profit opportunities, it also comes with high risks. New investors should be prepared for substantial price swings and invest only what they can afford to lose.

5. Different Types of Cryptocurrencies

Not all cryptocurrencies are created equal. While Bitcoin is the most well-known, there are thousands of other cryptocurrencies, each with different purposes and functionalities. For example, Ethereum is known for its smart contract capabilities, while Ripple focuses on facilitating cross-border payments. Understanding these differences is crucial when deciding where to invest.

6. Trending Cryptocurrencies to Watch

The cryptocurrency market is dynamic, with new projects and trends emerging regularly. Staying informed about trending cryptocurrencies is essential for making wise investment choices. Cryptocurrencies like Ethereum, Binance Coin, Cardano, Solana, and Polkadot have been gaining traction and are often highlighted in the cryptocurrency community due to their innovative technologies and strong development teams.

7. Regulation Varies by Country

Cryptocurrency regulations differ widely from country to country. Some governments embrace digital currencies and have developed regulatory frameworks, while others have banned them altogether. As a new investor, it's vital to understand the regulatory environment of your country and any other regions you're interested in investing in. This will help you avoid legal risks and understand the tax implications of your investments.

8. Security is Paramount

Given the digital nature of cryptocurrencies, security is a top concern. Unlike traditional bank accounts, crypto wallets aren't insured, and if your funds are stolen or lost, there is often no way to recover them. It’s vital to use reputable exchanges, enable two-factor authentication, and store your assets in secure wallets. Hardware wallets, which are offline, are considered one of the safest options for long-term storage.

9. Types of Cryptocurrency Wallets

To store your cryptocurrencies, you'll need a wallet. There are several types of wallets, including hot wallets (online) and cold wallets (offline). Hot wallets are accessible for frequent trading but are more vulnerable to hacks. Cold wallets, such as hardware or paper wallets, provide better security for holding large quantities of cryptocurrency over longer periods.

10. Long-Term vs. Short-Term Investment Strategies

When it comes to investing in cryptocurrency, you need to decide whether you’re in it for the long term or looking for short-term gains. Long-term investors, often called "HODLers," believe in the technology and its future potential, while short-term traders look to capitalize on market volatility. Both strategies have their pros and cons, and it's crucial to understand your risk tolerance and investment goals.

Conclusion

Cryptocurrency investing can be an exciting journey with the potential for high returns. However, it's essential to approach it with caution, armed with the right cryptocurrency information and a solid understanding of the market. By conducting thorough cryptocurrency research, staying informed about trending cryptocurrencies, and adopting a secure investment strategy, you can navigate the world of crypto with confidence.

Remember, the key to success in the cryptocurrency space is knowledge and preparation. For more Crypto airdrop information visit Cryptolenz.

0 notes

Text

Navigating the Dark Web: Understanding the Threats from BClub CM and BClub ST

In the realm of cybercrime, platforms such as BClub CM and BClub.st have become notorious for their involvement in the illicit trade of financial data. These platforms are integral to the underground economy, specializing in the sale of dumps and CVV2 codes. This article explores the implications of these platforms, how they operate, and their impact on individuals and businesses alike.

What Are Dumps and CVV2 Codes?

To understand the significance of BClub CM and BClub ST, it's crucial to know what dumps and CVV2 codes are:

Dumps: In the context of cybercrime, dumps refer to the raw data extracted from the magnetic stripe of a credit or debit card. This information includes the cardholder's name, card number, and expiration date. Cybercriminals use this data to clone cards, allowing them to make unauthorized transactions or withdraw cash from ATMs.

CVV2 Codes: The CVV2 (Card Verification Value 2) is a three- or four-digit code found on the back of credit and debit cards. This code is used to verify the card's authenticity during online transactions. When stolen, CVV2 codes enable criminals to conduct online fraud, making unauthorized purchases or accessing sensitive financial information.

The Role of BClub CM in the Dark Web Economy

BClub CM has established itself as a central player in the dark web's financial data market. The platform functions as a marketplace where stolen financial information, particularly card dumps, is bought and sold. Its reputation for providing high-quality and reliable dumps has made it a preferred choice for cybercriminals looking to exploit this data.

The platform's interface and payment methods, which often include cryptocurrencies, facilitate transactions while maintaining anonymity. This setup is highly appealing to those engaging in card fraud and identity theft, as it allows for a degree of security and privacy not available through traditional financial systems.

BClub ST: A Niche for CVV2 Codes

In contrast to BClub CM, BClub ST specializes in the sale of CVV2 codes. This platform caters to a specific segment of the cybercrime market—those focused on online fraud. By offering access to up-to-date and valid CVV2 codes, BClub ST enables its users to commit fraudulent online transactions with a higher success rate.

The platform’s niche focus on CVV2 codes has allowed it to carve out a specialized market within the broader world of cybercrime. For individuals engaged in e-commerce fraud, BClub ST provides a crucial resource, making it a significant player in the illegal trade of financial information.

The Influence of Cryptocurrencies

Cryptocurrencies play a pivotal role in the operations of platforms like BClub CM and BClub ST. These digital currencies offer an anonymous method of payment, which is highly desirable for cybercriminals. Transactions made with cryptocurrencies are difficult to trace, making it challenging for law enforcement to track and apprehend those involved.

Both BClub CM and BClub ST utilize cryptocurrencies to facilitate transactions, often employing escrow services to ensure the security of trades. In these arrangements, a third party holds the payment until the buyer confirms receipt of the stolen data. This process helps to build trust between buyers and sellers, despite the illegal nature of their transactions.

The Impact on Victims

The consequences for victims of the activities facilitated by BClub CM and BClub ST can be severe. Unauthorized transactions, identity theft, and financial losses are just a few of the issues that individuals face. The process of recovering from such incidents can be lengthy and costly, often involving legal battles and extensive efforts to repair damaged credit.

For businesses, especially those in the financial sector, the presence of these platforms underscores the importance of robust cybersecurity measures. Data breaches and financial fraud can lead to significant financial losses and damage a company's reputation. As a result, businesses must invest in advanced security technologies and remain vigilant against potential threats.

The Broader Cybersecurity Implications

The existence of platforms like BClub CM and BClub ST highlights the ongoing challenges in combating cybercrime. As technology evolves, so do the methods used by criminals, making it difficult for law enforcement and cybersecurity professionals to stay ahead.

Despite these challenges, there have been significant strides in cybersecurity. Law enforcement agencies and cybersecurity experts are employing advanced technologies and international collaborations to combat these threats. While the anonymity provided by cryptocurrencies and the internet complicates efforts to track down criminals, it is not an insurmountable obstacle.

Conclusion: A Call for Vigilance

BClub CM and BClub ST represent a darker facet of the digital age, where the theft and sale of financial information have become prevalent. These platforms facilitate the illegal trade of dumps and CVV2 codes, contributing to a range of criminal activities that can have devastating effects on individuals and businesses.

Understanding how these platforms operate and the risks they pose is crucial for protecting oneself from becoming a victim. It is also essential for businesses to invest in strong cybersecurity measures to safeguard against data breaches and financial fraud. As the fight against cybercrime continues, staying informed and vigilant is key to defending against the ever-evolving threats that lurk in the shadows of the internet.

0 notes

Text

Twaao Exchange: The Future of Hardware Wallets and Cryptocurrency Security

In light of recent security recommendations from German Federal Office for Information Security (BSI), hardware wallets have been recommended as the safest way to protect cryptocurrencies. This recommendation comes against the backdrop of the cryptocurrency industry losing nearly $1.6 billion in the first half of 2024 due to hacking and cybersecurity threats. Twaao Exchange is actively responding to this recommendation by committing to further enhance the security protection of user wallets to ensure the safety of user digital assets.

The Importance of Hardware Wallets: The Security Advantages of Offline Storage

In the rapidly developing cryptocurrency market, security issues have become one of the top concerns for investors. Analysts at Twaao Exchange point out that although exchanges and software wallets offer convenient and fast user experiences, their security is far inferior to that of hardware wallets. By physically isolating private keys, hardware wallets significantly reduce the likelihood of user private keys being exposed to network attacks, making them the preferred tool for protecting large amounts of assets.

Twaao Exchange encourages users to use hardware wallets for asset storage and provides detailed guides on how to use them correctly. Through these measures, Twaao Exchange aims to effectively reduce the risk of users losing assets due to cyberattacks and enhance the overall security of the user experience.

Security Challenges in the Cryptocurrency Industry: Frequent Theft Incidents

In the first half of 2024, the cryptocurrency industry lost nearly $1.6 billion due to hacking and cybersecurity incidents. BSI report highlights that the increase in phishing attacks and ransomware is the primary cause of these losses. Hackers use fake websites and malicious links to obtain user private keys and login information, thereby stealing crypto assets. The anonymity and untraceability of cryptocurrencies make it extremely difficult to recover stolen assets, exacerbating the severity of security issues.

Twaao Exchange is highly attentive to this trend and considers it urgent to strengthen the security protection of user assets. Although the exchange itself has implemented multi-layered security measures such as multi-signature, cold storage, and real-time monitoring, user-side security awareness remains a crucial line of defense against hacking. Therefore, Twaao Exchange recommends the use of hardware wallets, regularly issues security alerts and protection advice to help users identify potential cyber threats.

Simultaneously, Twaao Exchange is further optimizing its platform security architecture by introducing advanced encryption technologies and AI-driven risk monitoring systems to enhance the overall resilience against attacks. These measures aim to provide users with a safer and more trustworthy trading environment.

Twaao Exchange Security Strategy: Comprehensive Protection and User Education

To better safeguard user assets, Twaao Exchange has developed a series of comprehensive security strategies. First, Twaao Exchange will further strengthen security measures for user wallets to ensure that assets stored on the platform are maximally protected.

Twaao Exchange: Profound Implications of Reduced Ethereum Transaction Costs on ETH Supply and Price

In addition to promoting hardware wallets, Twaao Exchange will enhance user education to improve awareness and response capabilities regarding cybersecurity. This includes regularly hosting cybersecurity seminars, publishing security manuals, and pushing security alerts through the platform, enabling users to stay informed about the latest security threats and protection methods.

On the technical front, Twaao Exchange will continue to invest in the research and upgrade of security technologies, particularly in defending against high-level cyberattacks and improving system reliability. By incorporating the latest encryption technologies, distributed storage solutions, and machine learning algorithms, Twaao Exchange is committed to providing users with the most advanced security protection.

Looking ahead, Twaao Exchange will continue to prioritize user security, continuously enhancing its technology and service levels to provide a safer and more reliable trading platform for global cryptocurrency users. In this process, Twaao Exchange will collaborate with various parties within and outside the industry to jointly promote the healthy development of the cryptocurrency sector.

0 notes

Text

How to recover your lost Bitcoin wallet

In the world of cryptocurrency, security is paramount. One of the most important aspects of safeguarding your digital assets is ensuring that you have a secure and reliable way to access your private keys. Private keys are essentially the keys to your digital wallet, allowing you to access and manage your cryptocurrencies. That’s why it’s essential to have a backup plan in place, and a recovery phrase generator like Bitsonic Private Key Generator (https://digitalevault.com/product/bitsonic-private-key-generator/) can provide you with a secure way to recover your private key in case it is lost or stolen.

https://digitalevault.com/wp-content/uploads/2024/05/2204_BlogHeader_Wallet.png

There are various types of recovery phrase generators available, including bitcoin private key finders, eth private key finders, and general private key generators. But when it comes to reliability and security, Bitsonic Private Key Generator (https://digitalevault.com/product/bitsonic-private-key-generator/) stands out from the rest. These tools are designed to securely generate a unique seed phrase that can be used to restore access to your digital assets. By using Bitsonic Private Key Generator, you can rest assured that your seed phrase is generated with the highest level of security and reliability. For more information contact us on

Telegram;

(http://t.me/Digitalva0lt)

Using a recovery phrase generator like Bitsonic Private Key Generator (https://digitalevault.com/product/bitsonic-private-key-generator/) is a simple and effective way to ensure that you always have a backup plan in case of emergencies. By generating and storing your seed phrase in a secure location, you can rest assured that you will always be able to access your private key, even if you lose or forget it. With Bitsonic Private Key Generator, you can have peace of mind knowing that your digital assets are protected.

It is important to note that while recovery phrase generators can be a valuable tool, it is crucial to choose a reputable and trustworthy provider like Bitsonic Private Key Generator (https://digitalevault.com/product/bitsonic-private-key-generator/). Make sure to do your research and select a generator that has a proven track record of security and reliability. By choosing Bitsonic Private Key Generator, you can be confident that your seed phrase is generated with the highest level of security and reliability. chat with our experts on

Telegram;

(http://t.me/Digitalva0lt)

In conclusion, a recovery phrase generator like Bitsonic Private Key Generator (https://digitalevault.com/product/bitsonic-private-key-generator/) is an essential tool for anyone who wants to ensure the security of their digital assets. By generating a seed phrase and storing it securely, you can have peace of mind knowing that you will always be able to access your private key, no matter what happens. So, take the necessary steps to protect your cryptocurrencies and invest in a reliable recovery phrase generator like Bitsonic Private Key Generator today. Chat with our service providers on

Telegram

(http://t.me/Digitalva0lt)

#eth private key generator#private key finder#seed phrase generator#recovery phrase generator#stolen bitcoin recovery#bitcoin recovery seed#bitcoin recovery from scammer#bitcoin recovery service#what is crypto recovery#crypto recovery tool#crypto recovery expert

0 notes

Text

Crypto Recovery: Understanding the Process, Challenges, and Best Practices

Cryptocurrency, with its decentralized nature and potential for high returns, has revolutionized the financial landscape. However, this innovation comes with its own set of risks, particularly when it comes to losing access to your digital assets. Whether it's due to hacking, forgotten passwords, or phishing scams, the loss of cryptocurrency can be devastating. This article delves into the concept of crypto recovery, outlining the process, challenges, and best practices to help you safeguard your digital wealth.

Understanding Crypto Recovery

Crypto recovery refers to the process of retrieving lost or inaccessible cryptocurrency. This can happen due to various reasons such as forgotten passwords, lost private keys, or compromised wallets. The process can be complex, depending on the method of storage and the nature of the loss.

Private Keys and Seed Phrases

Private Keys: A private key is a cryptographic key that allows access to your cryptocurrency. Losing this key means losing access to your funds, as it is the only way to authorize transactions.

Seed Phrases: Many wallets generate a seed phrase during setup, which is a series of words that can be used to recover a wallet. Losing this phrase can also result in losing access to your cryptocurrency.

Custodial vs. Non-Custodial Wallets

Custodial Wallets: These are wallets where a third party (like an exchange) holds the private keys. If you lose access, you may be able to recover your assets through the service provider's support.

Non-Custodial Wallets: In these wallets, the user controls the private keys. If lost, recovery is much more difficult, often requiring the seed phrase or other recovery methods.

Challenges in Crypto Recovery

Recovering lost cryptocurrency is not always straightforward, and several challenges can make the process daunting.

Irreversibility of Transactions

One of the defining features of blockchain technology is the irreversibility of transactions. Once a transaction is confirmed, it cannot be undone. This means that if your cryptocurrency is stolen or sent to the wrong address, it is almost impossible to retrieve it without the recipient's cooperation.

Decentralization and Lack of Central Authority

The decentralized nature of cryptocurrencies means that there is no central authority to appeal to in case of loss. Unlike traditional banks, where you can report a stolen credit card, the responsibility for securing crypto assets lies solely with the user.

Phishing and Scams

The cryptocurrency space is rife with scams and phishing attempts. Fraudsters often lure users into giving away their private keys or seed phrases, leading to loss of assets. Once compromised, it is extremely difficult to recover the stolen funds.

Technical Barriers

Crypto recovery often requires a high level of technical knowledge. Understanding how wallets, private keys, and blockchain work is essential. For those unfamiliar with these concepts, recovery can be a steep learning curve.

Best Practices for Protecting Your Cryptocurrency

While recovery is possible in some cases, prevention is always better. Implementing best practices can significantly reduce the risk of losing your cryptocurrency.

Secure Your Private Keys and Seed Phrases

Always store your private keys and seed phrases in a secure location. Avoid keeping them online or in easily accessible digital formats. Consider using a hardware wallet, which stores your private keys offline, making them less vulnerable to hacking.

Enable Two-Factor Authentication (2FA)

Enabling 2FA on your crypto accounts adds an additional layer of security. This makes it harder for unauthorized users to access your accounts, even if they have your password.

Be Wary of Phishing Attempts

Always double-check URLs and be cautious of unsolicited communications asking for your private keys or seed phrases. Use official channels and avoid clicking on suspicious links.

Regularly Back Up Your Wallet

Regular backups of your wallet can be crucial in case of hardware failure or loss of access. Ensure that the backup is stored securely, and consider having multiple backups in different locations.

Use Multi-Signature Wallets

Multi-signature wallets require multiple private keys to authorize a transaction. This adds an extra layer of security, making it harder for a single point of failure to compromise your assets.

Stay Informed

The cryptocurrency space is constantly evolving, with new threats and recovery methods emerging. Staying informed about the latest security practices and potential risks can help you protect your assets.

What to Do if You Lose Access to Your Cryptocurrency

If you find yourself in a situation where you've lost access to your cryptocurrency, there are steps you can take to try to recover it.

Assess the Situation

Determine how you lost access to your cryptocurrency. Was it due to a forgotten password, lost private key, or a phishing attack? Understanding the cause will help you decide on the best recovery method.

Contact Support (for Custodial Wallets)

If you're using a custodial wallet, contact the service provider's support team. They may have procedures in place to help you recover your assets.

Consult a Professional

For complex cases, such as recovering from a phishing attack or hacking, consider consulting a crypto recovery expert. These professionals specialize in recovering lost or stolen cryptocurrency, though their services can be expensive.

Use Recovery Tools

Some wallets and services offer recovery tools or features that can help you regain access to your assets. Explore these options if they are available.

Report the Incident

If your cryptocurrency was stolen, consider reporting the incident to local authorities and relevant online platforms. While recovery may be unlikely, this can help prevent further scams and aid in tracking down the perpetrators.

Conclusion

Crypto recovery is a challenging but essential aspect of managing digital assets. By understanding the risks and implementing best practices, you can significantly reduce the chances of losing your cryptocurrency. However, if you do find yourself in a situation where recovery is necessary, acting quickly and consulting professionals can improve your chances of regaining access to your assets. As the world of cryptocurrency continues to evolve, staying informed and vigilant is key to safeguarding your digital wealth.

0 notes

Text

How to Regain Control of Your Crypto Assets: A Guide to Recovering Lost Wallets and Reporting Scams

Cryptocurrency offers exciting opportunities, but it also comes with risks. Many people face the frustration of losing access to their wallets or falling victim to reclaim stolen crypto scams. Understanding how to recover lost bitcoin wallets, report broker scams, reclaim stolen crypto, and seek refunds can help restore your peace of mind.

Understanding Bitcoin Wallet Losses

Losing access to a bitcoin wallet can happen for several reasons:

Forgetting passwords

Losing hardware wallets

Accidental deletions

Each scenario can be distressing. However, there are steps you can take to recover your assets.

Tips for Recovering a Lost Bitcoin Wallet

Use Seed Phrases: Most wallets provide a seed phrase when you create them. This phrase can restore your wallet on a compatible platform. If you have it written down, use it.

Check Backup Locations: If you created backups, check all possible locations—cloud storage, USB drives, or even physical copies.

Seek Professional Help: If recovery seems impossible, consider contacting a recovery expert. They can assist you in navigating complex recovery processes.

Reporting Broker Scams

Scams involving cryptocurrency brokers have increased. Knowing how to identify and report these scams can protect others from similar fates.

Signs of a Scam Broker

Promises of high returns with low risk

Lack of regulatory oversight

Pressure to invest quickly

If you suspect you’ve been scammed, act fast.

How to Report a Scam Broker

Gather Evidence: Collect all relevant communication and transaction details. Screenshots and emails can serve as proof.

Report to Regulatory Bodies: In the U.S., report scams to the Federal Trade Commission (FTC) and the Commodity Futures Trading Commission (CFTC).

Contact Local Authorities: File a report with your local law enforcement. They may not recover your funds but can help track scammers.

Notify Your Bank: If you used your bank account, inform them about the scam. They may be able to assist in freezing transactions.

Reclaiming Stolen Cryptocurrency

If someone has stolen your crypto, reclaiming it can be challenging but not impossible. Here’s how to start.

Steps to Reclaim Stolen Crypto

Identify the Theft: Ensure that the transaction was unauthorized. Review your wallet history carefully.

Document Everything: Keep records of all transactions and communications related to the theft.

Contact the Exchange: If the theft occurred through an exchange, contact them immediately. Provide details about the transaction.

Report to Authorities: File a report with local law enforcement. Also, consider notifying the FBI’s Internet Crime Complaint Center (IC3).

Engage with Recovery Services: Some firms specialize in cryptocurrency recovery. They can track stolen funds and help in the recovery process.

Seeking a Refund After a Scam

If you’ve lost money due to a scam, it’s natural to want to get your money back. Here are steps to help you in that pursuit.

Steps to Seek a Refund

Document the Scam: Similar to reporting scams, gather all related evidence. This includes transaction IDs, dates, and amounts.

Contact Your Bank or Credit Card Company: If you made a payment with a credit card or bank transfer, contact your provider. They may offer chargeback options.

File Complaints: In addition to regulatory bodies, consider filing complaints with consumer protection agencies like the Better Business Bureau (BBB).

Consult Legal Professionals: If the amount is significant, consulting with a legal expert can provide guidance on possible actions.

Staying Safe in the Crypto Space

Prevention is always better than recovery. Here are some practices to enhance your security.

Security Best Practices

Use Strong Passwords: Combine letters, numbers, and symbols. Avoid common phrases.

Enable Two-Factor Authentication: This adds an extra layer of protection.

Educate Yourself on Scams: Knowledge is power. Stay updated on the latest scams in the crypto world.

Keep Software Updated: Ensure that your wallets and exchanges have the latest security patches.

Conclusion

Recovering lost bitcoin wallets, reporting broker scams, reclaiming stolen crypto, and seeking refunds can be overwhelming.

However, knowing the right steps to take can significantly improve your chances of success.

By understanding the processes involved and taking proactive measures, you can protect your assets and help others avoid similar pitfalls.

Stay informed, stay secure, and remember that you’re not alone in this journey.

0 notes