#hyperledger fabric

Explore tagged Tumblr posts

Text

Real Estate Tokenization 101: A Beginner’s Guide to the Future of Property Ownership

The world of real estate is rapidly transforming, and real estate tokenization is at the forefront of this change. Fueled by advancements in blockchain technology and the growing relevance of asset tokenization platforms, property ownership is becoming more accessible, efficient, and liquid. This shift is not a fleeting trend—it’s a long-term disruption backed by numbers. In 2024 alone, the market for tokenized real estate is estimated at $3.5 billion, and projections suggest it could exceed $19 billion within the next decade.

So, what’s powering this transformation? A powerful combination of blockchain solution consultancy services, evolving investor demands, and the increasing need for transparent and secure transactions. Let’s dive into the basics and uncover why this innovation is reshaping the real estate investment landscape.

What Is Asset Tokenization?

At its core, asset tokenization is the process of converting rights to an asset—physical or digital—into a blockchain-based token. These tokens are stored and transferred on decentralized networks, making ownership and investment much more accessible.

For instance, instead of needing millions to invest in a commercial property, tokenization allows the same asset to be split into digital tokens. Each token can be sold individually, enabling fractional ownership for smaller investors. This innovative method, supported by advanced asset tokenization platforms, brings more flexibility, transparency, and accessibility to both investors and property developers.

How Real Estate Tokenization Works

In simple terms, real estate tokenization turns real estate assets into tradable tokens on a blockchain. These tokens represent a portion of ownership in a property, much like shares in a company. When an investor buys tokens, they gain rights to a part of the property, including profits, rents, or future value appreciation.

Here’s how the process unfolds:

Asset Selection: A property is selected for tokenization.

Legal Structuring: Legal frameworks are established to define token-holder rights.

Token Creation: A blockchain-based asset tokenization platform creates and issues the digital tokens.

Distribution: Investors purchase tokens via the platform.

Trading: Tokens can be traded on secondary markets for liquidity.

The role of blockchain solution consultancy firms is vital here. They ensure that every step adheres to regulatory guidelines and that the blockchain infrastructure is secure and scalable.

Key Benefits of Real Estate Tokenization

1. Improved Liquidity

Traditionally, real estate investments are known for being illiquid. Properties can take weeks or even months to sell. With real estate tokenization, investors can buy or sell tokens on a secondary market almost instantly, drastically improving liquidity.

2. Fractional Ownership

Tokenization opens doors to a broader range of investors. Even individuals with a few hundred dollars can invest in premium real estate projects that were once reserved for the wealthy. Through asset tokenization platforms, ownership becomes democratized.

3. Reduced Costs

By removing intermediaries like brokers, legal representatives, and banks, tokenization reduces overall transaction costs. Blockchain’s automated processes make deals faster, cheaper, and more transparent.

4. Global Accessibility

Using blockchain, property investments are no longer limited by geography. Investors from different parts of the world can participate in a property deal via tokens—provided they meet the necessary compliance standards.

5. Transparency and Security

Thanks to blockchain’s immutable ledger, all token transactions are traceable and secure. Investors get full transparency into ownership rights, transaction history, and property-related documents. This builds trust and reduces fraud.

Industry Growth and Market Trends

The rise of real estate tokenization reflects broader trends in digital finance. The global asset tokenization market is expected to grow at a compound annual growth rate (CAGR) of over 40% in the coming years. Specifically, tokenized real estate is projected to grow by over 20% annually through 2033.

Meanwhile, institutional adoption is picking up pace. Real estate developers, private equity firms, and investment funds are increasingly turning to blockchain solution consultancy experts to tokenize assets and reach a global pool of investors.

As regulations become clearer and technology matures, more than $4 trillion worth of real estate could be tokenized by the mid-2030s.

Role of Asset Tokenization Platforms and Blockchain Solution Consultancies

To enable the seamless and secure tokenization of real estate, two main players are essential: asset tokenization platforms and blockchain solution consultancies.

Asset Tokenization Platforms

These platforms provide the tech backbone needed to issue, manage, and trade digital tokens. They offer compliance features, investor dashboards, KYC/AML checks, smart contracts, and payment integrations. Without them, the entire tokenization process would be fragmented and inefficient.

Blockchain Solution Consultancies

Consultancies bring deep technical and regulatory expertise. They help real estate companies and investors navigate the complex world of tokenization, from choosing the right blockchain protocol to aligning with jurisdictional regulations. Their role is critical in ensuring long-term success and scalability.

Challenges and Considerations

While promising, real estate tokenization still faces several hurdles:

1. Regulatory Uncertainty

Regulations around digital assets differ globally and are still evolving. Without clear guidelines, projects risk legal complications. However, partnering with a skilled blockchain solution consultancy can help navigate this maze.

2. Technology Adoption

Implementing blockchain requires technical know-how and robust cybersecurity. Not all real estate firms have the infrastructure or skill set to adopt these technologies yet.

3. Market Trust

While the concept is growing, many traditional investors are still skeptical. Education and proven success stories are crucial to building market trust in asset tokenization platforms.

The Future of Property Ownership

Real estate tokenization is more than a buzzword—it’s the future of investing. It enables property ownership to become more accessible, diversified, and dynamic. Thanks to blockchain solution consultancies and advanced asset tokenization platforms, tokenized real estate is no longer a niche concept. It’s becoming a practical strategy for modern investors who seek better returns, lower barriers, and greater flexibility.

As tokenization technology becomes mainstream, we can expect dramatic shifts in how real estate is bought, sold, and owned. Investors who adapt early will be well-positioned to benefit from this next wave of financial innovation.

Final Thoughts

In conclusion, real estate tokenization offers a new path for investors and developers alike. By leveraging asset tokenization platforms and tapping into expert guidance from blockchain solution consultancies, the barriers to entry are lowering. Whether you’re a seasoned investor or a curious beginner, understanding what asset tokenization is and its role in transforming property markets is essential for future-proofing your portfolio.

0 notes

Text

1 note

·

View note

Text

A Comprehensive Guide to Blockchain-as-a-Service (BaaS) for Businesses

In today's digital landscape, a blockchain app development company plays a crucial role in transforming industries with decentralisation, immutability, and transparency. However, building and managing a private blockchain network can be complex and costly, which deters many businesses. Blockchain-as-a-Service (BaaS) simplifies this by allowing businesses to leverage blockchain without the challenges of infrastructure development.

This comprehensive blog covers the hurdles businesses face when adopting blockchain, how BaaS can bridge these gaps, and why it is a game-changer for various sectors.

I. Challenges for Businesses in Blockchain Adoption

Despite the undeniable potential of blockchain technology, businesses face several significant challenges when contemplating its adoption:

Limited Internal Expertise: Developing and maintaining a private blockchain network requires a skilled team with deep blockchain knowledge, which is often lacking in many organisations.

High Cost: The infrastructure investment and ongoing maintenance fees associated with blockchain can strain budgets, especially for small and medium-sized businesses (SMBs).

Integration Complexities: Integrating a blockchain network with existing enterprise systems can be challenging, requiring seamless data flow and compatibility between the blockchain system and legacy infrastructure.

II. Understanding BaaS and Its Operational Fundamentals

Blockchain-as-a-Service (BaaS) simplifies the development and deployment of blockchain applications by providing a cloud-based platform managed by third-party providers. The BaaS market, valued at $1.5 billion in 2024, is projected to grow to $3.37 billion by 2029, reflecting a robust 17.5% CAGR.

Key Components of BaaS

Cloud-Based Infrastructure: Ready-to-use blockchain infrastructure hosted in the cloud, eliminating the need for businesses to set up and maintain their networks.

Development Tools and APIs: Access to a suite of tools and APIs to create and deploy blockchain applications quickly.

Platform Support: Compatibility with various blockchain protocols such as Ethereum, Hyperledger Fabric, and Corda, offering flexibility to businesses.

Managed Service Model: Providers handle tasks like network maintenance, security updates, and scalability.

Pay-as-you-go Pricing Model: Reduces upfront investment and operational costs associated with blockchain software development.

III. Business Benefits of Blockchain as a Service

Adopting BaaS offers numerous advantages, including:

Enhanced Scalability: Businesses can easily scale their blockchain network as their needs grow.

Increased Efficiency: Eliminates intermediaries and streamlines transactions, improving productivity.

Enhanced Transparency: Tamper-proof records of transactions foster trust and improve auditability.

Reduced Costs: The pay-as-you-go model eliminates large upfront investments.

Improved Security: Built on secure cloud infrastructure with robust encryption protocols.

Enhanced Customer Engagement: Facilitates secure and transparent interactions with customers, building trust and loyalty.

IV. Industry-wise Key Use Cases of Blockchain as a Service

BaaS is transforming business operations across various industries:

Finance: Streamlines trade finance, secures cross-border payments, and enhances KYC and AML compliance.

Supply Chain Management: Improves transparency and traceability of goods, automates logistics processes, and reduces counterfeiting risks.

Healthcare: Facilitates secure sharing of patient data and tracks the provenance of pharmaceuticals.

Government: Enhances transparency with secure citizen identity management and verifiable voting systems.

V. Region-wise Adoption of BaaS

The BaaS market is experiencing rapid growth worldwide:

North America: Leading with over 35% of global revenues, driven by early adoption.

Europe: Countries like Germany, the UK, and France are at the forefront.

Asia-Pacific: China, India, Japan, and South Korea are key contributors.

Rest of the World: Growing adoption in South & Central America, the Middle East, and Africa.

VI. Why Choose a Prominent BaaS Provider?

Opting for a blockchain app development company that offers BaaS can significantly impact the success of your blockchain initiatives:

Specialised Expertise: Providers possess in-depth knowledge and experience in blockchain technology.

Cost Efficiency: Eliminates the need for in-house infrastructure investment and maintenance.

Time Savings: Accelerates the development process and reduces time-to-market.

Scalability and Flexibility: Offers scalable solutions that can adapt to business growth.

Risk Mitigation: Providers handle security, maintenance, and updates.

Conclusion

By adopting Blockchain-as-a-Service (BaaS), businesses can simplify blockchain integration and focus on innovation without the complexities of managing infrastructure. Systango, a leading blockchain app development company, offers tailored BaaS solutions that help businesses leverage blockchain technology for enhanced efficiency, scalability, and security. As one of the top , Systango also excels in integrating AI solutions to drive business growth and efficiency.

Original Source - https://systango.medium.com/a-comprehensive-guide-to-blockchain-as-a-service-baas-for-businesses-5c621cf0fd2f

2 notes

·

View notes

Text

Web 3.0 Blockchain Industry Takes Off Amid Rising Demand for Transparency

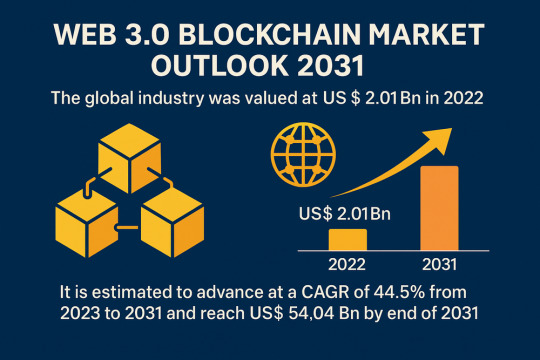

The global Web 3.0 blockchain market is on a fast-track trajectory, poised to grow from USD 2.01 Bn in 2022 to a remarkable USD 54.04 Bn by 2031, expanding at a CAGR of 44.5% during the forecast period from 2023 to 2031. This growth is fueled by rising demand for data ownership, increased adoption of blockchain in supply chain and retail, and unprecedented investment in decentralized technologies.

Market Overview: Web 3.0 represents the next evolutionary phase of the internet, integrating decentralized technologies such as blockchain to foster transparency, user empowerment, and data security. Blockchain, the foundational technology of Web 3.0, is transforming digital interaction by eliminating the need for intermediaries and creating trust through cryptographic protocols.

Market Drivers & Trends

1. Surge in Data Ownership Awareness: With the rise in cyberattacks and data misuse, users are demanding control over their personal data. Web 3.0 blockchain enables data decentralization, thereby ensuring secure ownership and enhancing user privacy.

2. Skyrocketing Venture Capital Investments: Investors are pouring billions into blockchain startups. According to CB Insights, global blockchain venture funding soared from US$ 3.1 Bn in 2020 to US$ 25.2 Bn in 2021, signaling strong investor confidence.

3. Corporate Blockchain Integration: Major corporations like Amazon and Walmart are integrating blockchain into operations to enhance transparency and operational efficiency, further validating its commercial viability.

Latest Market Trends

Blockchain in E-commerce & Retail: Amazon is utilizing managed blockchain to streamline operations, while Walmart is using Hyperledger Fabric to improve traceability in the food supply chain.

Smart Contracts & Digital Identity Solutions: Businesses are leveraging smart contracts to automate transactions, reduce fraud, and build trust. Blockchain-backed digital identities are also gaining traction, particularly in financial services and government sectors.

NFT and Metaverse Innovations: The rise of NFTs and immersive experiences in the metaverse is drawing entertainment giants like Shemaroo into the Web 3.0 fold, creating new revenue streams.

Key Players and Industry Leaders

Prominent players in the Web 3.0 blockchain landscape include:

Helium Inc.

Polygon Labs UI (Cayman) Ltd.

Consensys

Kadena LLC

Ocean Protocol Foundation Ltd.

Coinbase

Filecoin

Terra

Binance

Livepeer, Inc.

Biconomy

Fireblocks

These companies are heavily investing in R&D, expanding their product portfolios, and forming strategic alliances to stay competitive in the rapidly evolving market.

Recent Developments

Shemaroo & Seracle Partnership (Sep 2022): Launched entertainment-focused Web 3.0 solutions including NFTs and metaverse content.

WazirX Launches Shardeum (Feb 2022): Introduced a decentralized platform designed to scale blockchain solutions efficiently.

Deutsche Börse Acquires Crypto Finance AG (June 2021): Strengthens its position in digital assets and blockchain financial services.

Market Opportunities

The market holds vast potential in several areas:

Supply Chain Optimization: Blockchain can reduce inefficiencies and improve transparency across global supply chains.

Healthcare Record Management: Secure, tamper-proof medical records managed via blockchain can enhance patient outcomes and reduce costs.

Decentralized Finance (DeFi): Growth in DeFi applications is revolutionizing traditional financial systems by offering trustless and permissionless services.

Government and Identity Management: Governments are exploring blockchain for land records, voting systems, and digital IDs, presenting untapped potential for vendors.

Discover valuable insights and findings from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=85198

Future Outlook

The Web 3.0 blockchain market is expected to flourish as enterprises and governments seek resilient, transparent, and decentralized digital infrastructures. With exponential growth projected through 2031, this market is poised to redefine how businesses operate and users interact with digital systems.

Analysts' Viewpoint: The Web 3.0 blockchain ecosystem is still in its formative years, but its potential is vast. As scalability improves and regulatory frameworks mature, adoption across sectors will accelerate. Players investing early in R&D and partnerships will be best positioned to capture the lion’s share of future growth.

Market Segmentation

By Blockchain Type:

Public

Private

Hybrid / Consortium

By Application:

Payments

Smart Contracts

Digital Identity

Supply Chain Management

Others

By End-user:

Retail & E-commerce

BFSI

IT & Telecom

Media & Entertainment

Healthcare

Others

Regional Insights

North America leads the global market owing to early blockchain adoption and significant venture funding, especially in the U.S.

Asia Pacific is projected to witness the fastest CAGR during the forecast period. The presence of rapidly digitizing economies like China and India, combined with government interest and tech-savvy populations, is creating fertile ground for Web 3.0 adoption.

Europe and Latin America are also advancing due to supportive policies and increasing fintech innovation.

Why Buy This Report?

In-depth Analysis: Provides detailed insights into growth drivers, restraints, trends, and opportunities.

Company Profiles: Extensive competitive landscape analysis, including key strategies and financials.

Segmented Insights: Cross-segment analysis by application, blockchain type, end-user, and geography.

Latest Trends & Developments: Up-to-date on major investments, partnerships, and product launches.

Forecasting Intelligence: Reliable market forecasts from 2023 to 2031 to support strategic planning.

Frequently Asked Questions (FAQs)

1. What is the current size of the Web 3.0 Blockchain market? As of 2022, the market is valued at US$ 2.01 Bn.

2. What is the projected market size by 2031? The market is expected to reach US$ 54.04 Bn by 2031.

3. What is the expected CAGR of the Web 3.0 Blockchain market? The market is projected to grow at a CAGR of 44.5% during 2023–2031.

4. Who are the leading players in this market? Helium Inc., Polygon Labs, Coinbase, Consensys, Binance, and Fireblocks are among the leading players.

5. What regions are witnessing the fastest growth? Asia Pacific, particularly India and China, is expected to record the highest growth rate.

6. What are the key applications of Web 3.0 blockchain? Payments, smart contracts, digital identity, and supply chain management are major application areas.

Explore Latest Research Reports by Transparency Market Research: Biometric Payment Market: https://www.transparencymarketresearch.com/biometric-payment-market.html

RAN Analytics & Monitoring Market: https://www.transparencymarketresearch.com/radio-access-network-ran-analytics-monitoring-market.html

eGRC (Enterprise Governance, Risk and Compliance) Market: https://www.transparencymarketresearch.com/enterprise-governance-risk-compliance-market.html

Managed Learning Services Market: https://www.transparencymarketresearch.com/managed-learning-services-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected] of Form

Bottom of Form

0 notes

Text

Hyperledger Fabric Redefining Enterprise Trust and Traceability

Living in a world where trust is the most valuable currency, businesses are constantly seeking ways to streamline operations, enhance security, and foster collaboration without compromising privacy. Enter Hyperledger Fabric—a blockchain framework that’s redefining how enterprises build and deploy distributed ledger solutions. While public blockchains like Bitcoin and Ethereum have captured the…

0 notes

Link

0 notes

Text

The Ultimate Guide to Blockchain Application Development in 2025

By 2025, development of blockchain applications has ceased to be niche or speculative and has undergone sufficient growth to become one of the foundational pillars involved in digital transformation across multiple industries. From banks that want transaction transparency to healthcare organizations securing patient data, blockchain is central to many breakthrough solutions. As Blockchain application development snowballs into a global demand, a strategic investment is being considered first by both startups and enterprises. The technology aims desirably at cutting out intermediaries, cutting down on operational costs, and creating costs that can never be changed. thus, something even more valuable in an increasingly decentralized and secure world. In 2025, developers are creating blockchain innovation using sophisticated toolkits and frameworks, project development of blockchain is now more robust, more user-friendly, and more scalable than ever before.

Key Trends Driving Blockchain Development in 2025

The blockchain stratosphere is fast-aging and, as a result, key trends are sewn into development approaches for the year 2025. One of the biggest developments accelerating adoption is the modular blockchain structure, which permits tailoring to the needs of each project. Such platforms with all their thrust are currently required for real adoption; be it Ethereum 2.0, Polkadot, Cosmos, or Avalanche. Others that have yet to see the light of mainstream adoption, such as zkProofs or Layer 2 scaling solutions, aim at dealing with concerns around scalability and privacy without trade-offs in true decentralization. On the fringes, DeFi and NFTs are still maturing, and there is real buzz around tokenization of real-world assets and blockchain for supply-chain traceability. Moreover, developers are putting a lot of effort into the build-up of cross chain ecosystems to allow frictionless movement of assets and data across heterogeneous networks, thus ushering in the new dawn of collaboration and interoperability.

Choosing the Right Blockchain Platform

The decision on which blockchain platform to select plays a very big role in how applications release out to long-term success. Public blockchains such as Ethereum, Solana, and Near are the most suited for open, decentralized apps having too broad a user base and vigorous community backing. They may, however, be useful only in rare cases. Usually, private and permissioned blockchains-or-intended enterprise use are such as Hyperledger Fabric, R3 Corda, and Quorum that might request a little more privacy, access control, and regulation. One must also look at parameters like consensus protocols, transaction price, development tools, community support, and ecosystem maturity in making this choice. If these parameters are fully looked into, the developers and organizations will make sure that their blockchain applications get built on a platform that supports their immediate needs and growth.

Design and Development Best Practices

Effective blockchain application development is much more than smart contract programming. It is about building secure, scalable, and user-centric systems that realize concrete value. Being well-versed with the problem in question and clearly defining the value that blockchain adds to it is the first step. While developing, one must follow secure coding standards, employ robust testing frameworks, and have smart contracts audited to the fullest. Keeping in mind the modular nature of components will allow reusability and easy upgradeability, while an appropriate integration with off-chain services allows for seamless run-time operations. The other important point here is the UX, where simpler interfaces, wallet connections, and onboarding processes might accelerate adoption immediately. Of course, this does assume all systems stay updated with changes in governance, fork events, and past protocol updates to ensure continued system integrity and performance.

The Role of Web3 and Decentralized Identity

Web3 is much more than a buzzword. It is a paradigm shift in user interaction with the internet. In 2025, the blockchain powered the key tenets of Web3: decentralization, data ownership, and peer interaction. Decentralized identity systems, or DID systems, are leading the way, whereby individuals can control and share personal information securely without depending on any centralized agency. This shift in orientation leads not only to more privacy and security but also to more trust among users of such digital platforms. Blockchain-based identity verification is applied in many scenarios, including but not limited to e-commerce, voting, healthcare, and education. Meanwhile, decentralized storage systems like IPFS and Arweave are granting developers the capability to build DApps that are fully decentralized and, thus, will not rely on conventional web infrastructure. In unison, these developments are reshaping the digital scene, with blockchain as the backbone for a fair vendor-transparent online world.

Conclusion

As blockchain continues to evolve, the demand for specialized skills and strategic guidance is more important today than ever before. Organizations trying to develop blockchain solutions must acknowledge that this technology demands not only technical skills but an understanding of cryptoeconomics, security, and user behavior. Collaborative teams of experienced experts offering end-to-end Blockchain application development services can guide clients through complexities like architecture design, protocol selection, smart contract auditing, and user interface development. These professionals will therefore assist the client to ensure their application is truly functional but also scalable, secure, and legally compliant. Through a combination of strategic roadmap and the apt development team, businesses can then harness the full power of blockchain to build their own strongholds in the digital economy of 2025 and beyond.

0 notes

Text

5 Things You Didn't Know You Could Learn in an IBM Course

You might think IBM courses focus exclusively on mainframes and legacy systems. That assumption misses the innovative technologies IBM teaches today. Beyond the expected database and cloud content, IBM's educational programs contain surprising elements that can transform your technical capabilities. Let's explore five unexpected skills you'll acquire through IBM course offerings.

1. Design Thinking for Technical Solutions

IBM pioneered the application of design thinking to enterprise technology, and its courses teach this human-centered approach to problem-solving. You'll learn to conduct empathy interviews, create journey maps, and prototype solutions rapidly. This IBM course material transforms how you approach technical challenges, moving beyond pure engineering to consider user experience and business outcomes. The methodology includes techniques for stakeholder alignment, creative brainstorming, and iterative testing that apply to any technology project.

2. Explainable AI and Ethical Algorithm Design

While everyone talks about AI implementation, IBM courses dive deep into AI transparency and ethics. You'll learn to build models that explain their decisions, implement fairness metrics, and detect algorithmic bias. The curriculum covers regulatory compliance for AI systems, including GDPR's "right to explanation." Through IBM course exercises, you'll audit existing models for bias, implement interpretability techniques, and create documentation that non-technical stakeholders can understand.

3. Blockchain Supply Chain Applications

Beyond cryptocurrency basics, IBM teaches practical blockchain implementation for supply chain management. You'll build smart contracts for tracking shipments, implement provenance systems for authenticating products, and design consortium networks. The IBM course covers Hyperledger Fabric, teaching you to create permissioned blockchains for enterprise use. Real-world case studies include food safety tracking, pharmaceutical authentication, and sustainable sourcing verification. You'll understand how to convince stakeholders of blockchain's value beyond the hype.

4. Augmented Reality for Industrial Applications

IBM's courses include surprising content on AR development for manufacturing and maintenance. You will learn to create AR experiences that overlay digital information onto physical equipment, helping technicians perform complex repairs. The curriculum covers IBM's AR toolkit, teaching you to build applications that recognize machinery, display repair instructions, and provide real-time diagnostics. This unexpected IBM course content bridges the physical and digital worlds, preparing you for Industry 4.0 implementations.

Why These Skills Matter

These unexpected topics reflect IBM's evolution from hardware manufacturer to cognitive technology leader. Each skill addresses emerging enterprise needs that traditional IT education overlooks. Quantum computing prepares you for the next computing revolution. Design thinking ensures your technical solutions actually solve business problems. Explainable AI addresses growing regulatory requirements. Blockchain knowledge opens opportunities in supply chain transformation. AR skills position you for the industrial metaverse.

Conclusion

IBM course offerings extend far beyond traditional enterprise computing topics. These five areas represent just a sample of the innovative content available. By exploring quantum computing, design thinking, ethical AI, blockchain applications, and augmented reality through IBM's educational programs, you'll acquire skills that differentiate you in the technology market. Don't let preconceptions about IBM limit your learning opportunities. Their courses contain forward-thinking content that prepares you for technology's future, not just its past.

For more information, visit: https://www.ascendientlearning.com/it-training/ibm

0 notes

Text

Which are the Best Technology and Stacks for Blockchain Development?

The Digital palpitation of Blockchain

The world is still being rewritten by lines of law flowing through blockchain networks. From banking to supply chain and indeed healthcare, the monumental plates of technology are shifting — and blockchain is at the center.

Why Choosing the Right Tech mound Matters

In the blockchain realm, your tech mound is not just a toolkit; it’s your legion. Picking the wrong combination can lead to security loopholes, scalability agonies, or simply development backups. In discrepancy, the right mound empowers invention, adaptability, and lightning-fast performance.

A regard Into Blockchain’s Core Principles

Blockchain is basically a distributed tally. inflexible, transparent, and decentralized. Every decision about development tech must round these foundational values.

Public vs Private Blockchains Know the Battleground

Public blockchains like Ethereum are open, permissionless, and unsure. Private blockchains like Hyperledger Fabric offer permissioned access, suitable for enterprises and healthcare CRM software inventors looking for regulated surroundings.

Top Programming Languages for Blockchain Development

Reliability The Ethereum Favorite

erected specifically for Ethereum, Solidity is the language behind smart contracts. Its tight integration with Ethereum’s armature makes it a no- brainer for inventors entering this space.

Rust The Arising hustler

Lightning-fast and memory-safe, Rust is dominating in ecosystems like Solana and Polkadot. It offers fine- granulated control over system coffers a gift for blockchain masterminds.

Go Concurrency Champion

Go, or Golang, stands out for its simplicity and robust concurrency support. habituated considerably in Hyperledger Fabric, Go helps gauge distributed systems without breaking a sweat.

JavaScript & TypeScript Web3 Wizards

From UI to connecting smart contracts, JavaScript and TypeScript continue to dominate frontend and dApp interfaces. Paired with libraries like Web3.js or Ethers.js, they bring the Web3 macrocosm alive.

Smart Contract Platforms The smarts Behind the Chain

Ethereum

The undisputed leader. Its vast ecosystem and inventor community make it a top choice for smart contract development.

Solana

Known for blazing speed andultra-low freights, Solana supports Rust and C. Ideal for high- frequence trading and DeFi apps.

Frontend Technologies in Blockchain Apps

Reply and Angular UX Anchors

Both fabrics give interactive, scalable stoner interfaces. React’s element- grounded design fits impeccably with dApp armature.

and Ethers.js

They're the islands between your blockchain and cybersurfer. Web3.js supports Ethereum natively, while Ethers.js offers a lighter and further intuitive API.

Backend Technologies and APIs

Perfect for handling multiple connections contemporaneously, Node.js is extensively used in dApps for garçon- side scripting.

A minimalist backend frame, Express.js integrates painlessly with APIs and Web3 libraries.

GraphQL

In a data- driven ecosystem, GraphQL enables briskly, effective queries compared to REST APIs.

Blockchain fabrics and Tools

Truffle Suite

Complete ecosystem for smart contract development collecting, testing, and planting.

Databases in Blockchain Systems

IPFS( InterPlanetary train System)

A peer- to- peer storehouse result that decentralizes train storehouse, essential for apps demanding off- chain data.

BigchainDB

Blending blockchain features with NoSQL database capabilities, BigchainDB is knitter- made for high- outturn apps.

Essential DevOps Tools

Docker

Ensures harmonious surroundings for development and deployment across machines.

Kubernetes

Automates deployment, scaling, and operation of containerized operations.

Jenkins

The robotization backbone of nonstop integration and delivery channels in blockchain systems.

Security Considerations in Blockchain Tech Stacks

Security is n’t a point. It’s a necessity. From contract checkups to secure portmanteau integrations and sale confirmation, every subcaste needs underpinning.

Tech mound for Blockchain App Development A Complete Combo

Frontend React Web3.js

Backend Node.js Express GraphQL

Smart Contracts reliability( Ethereum) or Rust( Solana)

fabrics Hardhat or Truffle

Database IPFS BigchainDB

DevOps Docker Kubernetes Jenkins

This tech stack for blockchain app development provides dexterity, scalability, and enterprise- readiness.

Part of Consensus Algorithms

evidence of Work

Secure but energy- ferocious. PoW is still used by Bitcoin and other heritage systems.

evidence of Stake

Energy-effective and fast. Ethereum’s transition to PoS marked a vital shift.

Delegated Proof of Stake

Used by platforms like EOS, this model adds governance layers through tagged validators.

Part of Artificial Intelligence in Banking and Blockchain Synergy

AI and blockchain are reconsidering banking. Fraud discovery, threat modeling, and smart contracts are now enhanced by machine literacy. The role of artificial intelligence in banking becomes indeed more potent when intermingled with blockchain’s translucency.

Blockchain in Healthcare A Silent Revolution

Hospitals and pharma titans are integrating blockchain to track case records, medicine authenticity, and insurance claims.

Healthcare CRM Software Developers Leading the Change

By bedding blockchain features in CRM platforms, companies are enhancing data sequestration, concurrence shadowing, and real- time health analytics. In this invention surge, healthcare CRM software developers Leading the Change are setting new norms for secure and effective case operation.

Popular Blockchain Use Cases Across diligence

Finance Smart contracts, crypto holdalls

Supply Chain Tracking goods from origin to shelf

Voting Tamper- proof digital choices

Gaming NFTs and digital power

Challenges in Blockchain App Development

Interoperability, scalability, energy operation, and evolving regulations challenge indeed the stylish inventors.

The Future of Blockchain Development Tech Stacks

We'll see confluence AI, IoT, and edge computing will integrate with blockchain heaps, making apps smarter, briskly, and indeed more decentralized.

0 notes

Text

Understanding the Four Types of Blockchains

Public, Private, Consortium & Hybrid — Which One Powers What?

Blockchain technology isn’t one-size-fits-all. As the technology evolves, we’re seeing different flavors of blockchain emerge — each tailored to specific use cases and governance models. In Episode 4 of Unpacking Blockchain Technology with Thabiso Njoko, we break down the four main types of blockchains and explain how each one functions in the real world.

If you’ve ever wondered why some blockchains are open and others are gated, this episode is your gateway to clarity.

The Four Main Types of Blockchains

Whether you're launching a cryptocurrency, managing a supply chain, or modernizing government services, choosing the right type of blockchain is critical. Here's how they compare:

1. Public Blockchains

These are fully decentralized and open to anyone. Anyone can read, write, or participate in the network. Popular examples include Bitcoin, Ethereum, and Solana.

Features:

Open-source

Transparent and secure

Powered by consensus mechanisms like Proof of Work (PoW) or Proof of Stake (PoS)

Use Cases:

Cryptocurrencies

NFTs

Decentralized Finance (DeFi)

Open-access Web3 applications

“Public blockchains are the backbone of the trustless Web3 world,” says Thabiso.

2. Private Blockchains

These are permissioned systems controlled by a single organization. Only selected participants can access the network or validate transactions.

Features:

High speed and scalability

Restricted access

Centralized authority and governance

Use Cases:

Internal business operations

Financial institutions

Healthcare data management

Think of private blockchains as enterprise-grade solutions for data security and control.

3. Consortium Blockchains

Also known as federated blockchains, these are governed by a group of organizations rather than a single entity. Each participant in the consortium has certain rights.

Features:

Semi-decentralized

Shared control among participants

Collaborative governance

Use Cases:

Supply chain tracking

Trade finance between banks

Joint ventures between corporations

These are ideal for industries that rely on shared infrastructure but don’t want to go fully public.

4. Hybrid Blockchains

As the name suggests, hybrid blockchains combine features of both public and private systems. This offers flexibility—you can keep some data public while keeping sensitive data private.

Features:

Controlled access + transparency

Combines the best of both worlds

Complex but powerful

Use Cases:

Government records (public data + confidential citizen info)

Healthcare systems (open research + private patient data)

Real estate platforms

Hybrid blockchains are perfect when trust, control, and openness need to co-exist.

How Do You Choose the Right One?

Thabiso emphasizes that context determines the blockchain. Ask:

Who needs access?

Who verifies the data?

How sensitive is the information?

What are the trust assumptions?

Each blockchain type serves a purpose. The key is understanding your goals before choosing the structure.

Real-World Examples

A public blockchain like Ethereum is widely used for DeFi and NFTs, while a private blockchain such as Hyperledger Fabric powers IBM's supply chain solutions. In the banking and finance sector, a consortium blockchain like R3 Corda is commonly used. Meanwhile, XinFin (XDC) serves as a hybrid blockchain, particularly effective in trade finance applications.

Final Thoughts from Thabiso

“Not every blockchain has to be open to the world. Some need privacy, speed, and control. But understanding why each model exists helps us build smarter systems.”

As blockchain adoption grows, knowing the differences between these models will shape how we design solutions, collaborate with others, and build trust across systems.

Tune In Now

Catch Episode 4 of Unpacking Blockchain Technology with Thabiso Njoko to hear the full breakdown and use-case comparisons.

Join the Discussion

Which blockchain type best fits your project or organization? Share your thoughts or questions in the comments — let’s unpack it together.

#BlockchainTechnology#Web3#CryptoEducation#DigitalTransformation#FutureOfTech#Decentralization#BlockchainRevolution#CryptoExplained#BlockchainInnovation#TechForAfrica#BlockchainPodcast#Web3Podcast#ThabisoNjoko#UnpackingBlockchain#PodcastSeries#LearnBlockchain#EducationalContent#BlockchainForBeginners#CryptoForEveryone#BlockchainAfrica#EswatiniTech#AfricanInnovation#TechInAfrica#Web3Africa#DigitalAfrica#EswatiniBlockchain

0 notes

Text

Enterprise Guide to Asset Tokenization: Benefits, Use Cases, and Risks

Asset Tokenization Explained

Asset tokenization is the process of digitally representing ownership of real-world assets, like real estate, gold, intellectual property, or even company shares, on a blockchain. These digital representations, or tokens, allow assets to be divided, sold, or traded securely and efficiently. This shift is transforming the way enterprises manage, trade, and leverage their assets.

With the asset tokenization market rapidly growing and projected to hit trillions in value over the next decade, it's clear this innovation is not just a passing trend. For enterprises, this is an opportunity to boost liquidity, expand investor access, and streamline operational costs.

But what makes tokenization truly valuable isn’t just the technology—it’s the real-world business impact. Companies can unlock previously inaccessible capital, reduce administrative overhead, and dramatically improve transparency in asset tracking. Tokenization enables a paradigm shift in enterprise asset management, allowing businesses to manage their portfolios in real-time, across borders, with unbreakable audit trails.

Top Benefits of Asset Tokenization for Enterprises

1. Improved Liquidity

Traditionally, assets like real estate or fine art are hard to sell quickly. Tokenization changes this. Enterprises can break large, illiquid assets into smaller digital shares, making it easier to buy, sell, or trade fractions of those assets. This increases liquidity and accelerates access to capital.

2. Enhanced Transparency and Trust

Every transaction made using tokens is recorded on the blockchain, a decentralized digital ledger that cannot be altered. This immutability provides full transparency, helping enterprises and their stakeholders verify asset histories and avoid disputes.

3. Reduced Costs Through Automation

By cutting out middlemen such as brokers and agents, tokenization significantly reduces transaction fees. Additionally, smart contracts—self-executing digital agreements—automate functions like compliance checks and transfers, saving both time and money.

4. Speed and Efficiency in Transactions

Traditional asset transactions can take days or weeks due to paperwork, approvals, and coordination. Blockchain-based tokenization compresses this timeline to minutes or hours, creating faster, more streamlined operations.

5. Global Access to Investors

Digital tokens can be accessed globally, which opens up investment opportunities to a much broader base of potential stakeholders. Enterprises are no longer limited by geographic constraints and can attract global capital with ease.

Key Use Cases Across Industries

1. Real Estate

Real estate tokenization allows properties to be divided into multiple shares and sold to investors worldwide. Enterprises managing commercial or residential property portfolios can raise capital faster and enable fractional ownership without complex legal structures.

2. Commodities and Natural Resources

Companies managing resources like gold, oil, or agricultural goods can tokenize these commodities for easier trading. Instead of dealing with physical assets, buyers and sellers exchange digital tokens that represent real-world value.

3. Intellectual Property

Businesses that rely heavily on intellectual property—like tech companies or media firms—can tokenize patents, copyrights, and trademarks. This makes it easier to license, trade, or monetize these intangible assets.

4. Art and Luxury Goods

Tokenizing fine art or luxury items enables investors to own a fraction of a valuable item. It also provides provenance and authenticity verification, which is especially important in high-value asset markets.

5. Supply Chain and Logistics

Tokenization adds transparency to supply chains. Companies can track goods as they move through the process, with tokens representing ownership or certification at each step. This boosts traceability, reduces fraud, and improves efficiency.

Risks and Challenges to Consider

While the advantages are compelling, enterprises must navigate certain risks when implementing asset tokenization.

1. Regulatory Uncertainty

Laws around digital assets vary significantly between countries. Enterprises must ensure they comply with regional securities laws, taxation, and investor protection regulations. Failing to do so could result in fines, project shutdowns, or legal liability.

2. Technological Complexity

Blockchain is still an emerging technology. Integrating tokenization into legacy systems may require a complete overhaul of enterprise architecture. Companies must invest in staff training, cybersecurity, and infrastructure upgrades to succeed.

3. Volatility and Market Risks

Although tokens represent real assets, their market value can fluctuate due to investor sentiment, platform demand, or regulatory news. Enterprises must prepare for potential volatility and ensure that their financial planning accounts for it.

4. Security Concerns

If not implemented correctly, blockchain networks and smart contracts can be vulnerable to attacks. Enterprises must partner with experienced blockchain solution consultancies to build secure platforms, perform regular audits, and protect user data.

5. Adoption Barriers

Internally, some employees and executives may resist adopting new systems. Externally, investors may be unfamiliar with tokenized models, requiring robust education and communication strategies.

How Blockchain Solution Consultancies Help

A blockchain solution consultancy plays a vital role in helping enterprises implement asset tokenization effectively. These firms provide tailored advice, technical development, regulatory navigation, and long-term support. Whether it’s designing smart contracts, integrating blockchain with existing systems, or ensuring compliance, consultancies help reduce risk and accelerate time-to-value.

Enterprises seeking to stay competitive in a token-driven future should seriously consider working with experts who specialize in digital asset transformation.

Final Thoughts: Is Tokenization Right for Your Enterprise?

Asset tokenization isn't just a buzzword—it's a strategic tool that’s reshaping how businesses manage and leverage their assets. From reducing costs to expanding investor pools, the potential is vast. However, success depends on clear planning, smart partnerships, and a long-term vision.

If your enterprise manages high-value assets, seeks faster access to capital, or wants to modernize its financial operations, now is the time to explore tokenization. With the right approach, you can unlock new efficiencies and stay ahead in the evolving digital economy.

0 notes

Text

Top Blockchain Development Frameworks for Building Scalable Solutions

The global blockchain ecosystem is evolving rapidly. With enterprises and startups alike exploring decentralized solutions, the demand for robust, scalable, and secure blockchain applications has never been higher. However, building such applications from the ground up is no small feat. It requires not only a deep understanding of distributed ledger technologies but also the right development frameworks that simplify and accelerate the process.

If you're planning to enter the blockchain space, choosing the right framework can make all the difference. And more importantly, you need to hire blockchain app developers who are proficient in leveraging these frameworks to build scalable solutions tailored to your business goals.

In this blog, we’ll dive deep into the top blockchain development frameworks available in 2025 and explain how each can empower you to create high-performance decentralized applications (dApps).

1. Ethereum (with Truffle & Hardhat)

Ethereum remains one of the most popular platforms for decentralized application development. As an open-source, public blockchain, Ethereum offers smart contract functionality through Solidity and has a vast developer ecosystem.

Why It’s Ideal for Scalable Solutions:

Mature ecosystem with extensive tooling

Layer 2 solutions (like Optimism, Arbitrum) enhance scalability

Rich community support and documentation

Truffle and Hardhat are two of the most widely used frameworks for Ethereum development. Truffle provides built-in smart contract compilation, migration, and testing. Hardhat, on the other hand, is a developer-friendly environment with robust debugging and local node simulation.

2. Hyperledger Fabric

Hyperledger Fabric, an enterprise-grade permissioned blockchain framework hosted by The Linux Foundation, is perfect for building scalable private networks.

Key Features:

Modular architecture

Pluggable consensus mechanisms

Granular control over data privacy

Hyperledger Fabric is ideal for supply chain, finance, and healthcare applications where data privacy is paramount. It also supports high transaction throughput, making it suitable for large-scale enterprise deployments.

3. Polygon SDK

As scalability became a major issue for Ethereum, Polygon emerged as a Layer 2 solution offering faster and cheaper transactions. The Polygon SDK now enables developers to build their Ethereum-compatible blockchain networks.

Benefits:

Ethereum compatibility with high throughput

Customizable consensus mechanisms

Ideal for DeFi and NFT projects

By using Polygon, developers can bypass Ethereum’s congestion while maintaining interoperability.

4. Substrate (by Parity Technologies)

Substrate is a framework for building custom blockchains from scratch, created by the team behind Polkadot. It is written in Rust and supports modular, upgradable, and interoperable chains.

Why Use Substrate:

Highly customizable runtime modules (pallets)

Native integration with the Polkadot ecosystem

On-chain governance and upgrades

Developers can build their own blockchains tailored to specific use cases and connect them via Polkadot’s relay chain.

5. Corda

Developed by R3, Corda is another permissioned blockchain platform designed for business use cases, especially in banking and finance.

What Makes Corda Unique:

Direct peer-to-peer data sharing

No global broadcast of data

Focused on privacy and legal compliance

Corda enables enterprises to transact securely and privately while preserving auditability. Unlike public blockchains, Corda emphasizes trust and identity management between known participants.

6. Solana Frameworks

Solana is a high-performance blockchain known for its speed and low transaction costs. It uses a unique Proof-of-History (PoH) consensus mechanism that enables it to process over 65,000 transactions per second.

Why Solana?

Exceptional scalability and speed

Suitable for high-frequency trading, DeFi, and gaming

Active developer community with tools like Anchor

7. NEAR Protocol

NEAR Protocol offers a developer-friendly, scalable, and carbon-neutral blockchain environment. It supports sharding and has a unique “Nightshade” architecture to scale dApps with minimal costs.

Highlights:

Easy onboarding and human-readable account names

Smart contracts in Rust and AssemblyScript

Low gas fees with high throughput

With NEAR’s intuitive dev tools and scalability features, it is perfect for both startups and large-scale dApp deployments. Look to hire blockchain app developers who are up-to-date with NEAR’s smart contract development and ecosystem integrations.

8. Avalanche (AVAX)

Avalanche is gaining momentum as a scalable, eco-friendly platform for launching DeFi protocols and enterprise blockchain solutions.

Core Features:

Subnets for creating custom blockchains

Very high throughput (4,500+ TPS)

Fast finality and low latency

9. Cosmos SDK

Known as the “Internet of Blockchains,” Cosmos allows developers to create independent yet interoperable blockchains. Its Cosmos SDK is modular and focuses on fast development and easy customization.

Pros:

Tendermint Core for fast consensus

Supports cross-chain communication via IBC (Inter-Blockchain Communication)

Custom blockchain creation with plug-and-play modules

Cosmos is best suited for projects that demand interoperability and scalability without compromising sovereignty. To build an effective Cosmos-based project, you should hire blockchain app developers with deep knowledge of Tendermint, IBC, and Golang.

Conclusion

The blockchain landscape in 2025 is rich with frameworks designed to tackle real-world challenges — from scalability and speed to privacy and customization. Whether you're developing a DeFi platform, a private ledger for your enterprise, or the next generation of NFTs, choosing the right development framework is crucial.

Equally important is having the right team behind your vision. When you hire blockchain app developers with hands-on experience in these frameworks, you're not just investing in code — you're investing in strategic innovation and future-proof scalability.

Start by analyzing your business needs, and then choose the best blockchain framework to bring your ideas to life. With the right developers and tools, your blockchain journey can be both successful and scalable.

0 notes

Text

Custom vs. Prebuilt Blockchain Solutions: What's Right for Your UAE Business?

While blockchain technology is transforming various sectors worldwide, businesses in the UAE are considering how to leverage it for their own operations. From reliable financial services to immutable supply chains, blockchain is facilitating innovation at an astonishing pace. But before implementing a blockchain initiative for your business in the UAE, one critical question needs urgent attention: Do you go for a custom blockchain solution or a prebuilt one with quicker implementation?

This article covers both options in detail and aims to assist you in identifying the focus areas of your business model, industry scope, and other long-term aspirations to make the right decision. From fintech startups in Dubai to logistics firms in Abu Dhabi, or even government bodies in Sharjah, the distinction between custom and prebuilt blockchain development services in the UAE is essential for the success of the project.

The Boom of Blockchain Development Services In UAE

Having analyzed the government efforts like the Emirates Blockchain Strategy 2021 and Dubai Blockchain Strategy designed to bolster blockchain adoption, it seems its implementation across UAE is picking up pace. The strategies aim to make UAE a global blockchain innovation hub, which will in turn drive adoption from both private and public sectors.

Exploring these Blockchain Development Services and Investments, companies based in the UAE are seeking advanced IT technologies to improve their market position. Regardless, they still face one of the most challenging and important decisions: build a custom blockchain solution or use an existing one.

What is Prebuilt Blockchain?

Prebuilt Blockchain is the generic word for white label or off-the-shelf solutions. It refers to a generic set of actions performed by a blockchain framework and can easily be implemented with little to no alterations. The most important features of these frameworks are already developed which include issuance or token and smart contract capabilities plus consensus mechanisms.

Examples of such include Ethereum, Hyperledger Fabric, and Binance Smart Chain. These platforms provide a token of form and framework with a set of developing tools and have active supporting developer communities which facilitates their use.

Advantages of Prebuilt Solutions:

Faster Deployment - Certain businesses looking to join the competition aligned with their branding will be able to set up faster.

Lower Initial Costs - The easers learned during the pre-built activities led to a cheaper overall investment for development and initial configuration

Community Support - Friendly community which would provide assistance for anyone joining.

Proven Security Models - High security placed along developed infrastructure leads to high chance blocks added would be under solid protection.

Disadvantages of Prebuilt Solutions:

Limited Customization - For those who want or basic seeking tailored touch's and enhancements will have to step back.

Scalability Constraints - Expansion beyond framework based construction causes significant obstacles.

Shared Infrastructure - Little autonomy and ownership.

Vendor Lock-In: Later changes of platforms can be difficult and expensive.

What Are Custom Blockchain Solutions?

Custom blockchain solutions are created to address the particular needs of a business or industry, starting from scratch. Custom solutions offer the flexibility to create everything from proprietary consensus mechanisms and unique governance structures to industry-specific compliance features.

This approach is best suited for businesses that operate in complex workflows or highly regulated environments, which are not served by standard solutions.

Pros of Custom Blockchain Solutions:

Tailored Features: Custom features that address all operational aspects.

Full Ownership: Complete control over the source code, data, and infrastructure.

Enhanced Security: Security best practices can be tailored to specific vulnerabilities.

Competitive Advantage: Distinct capabilities provide an edge over competitors.

Cons of Custom Blockchain Solutions:

Higher Costs: Both initial development and ongoing maintenance are more expensive.

Longer Time to Market: A lot of planning and testing goes into customization.

Resource Intensive: Requires specialized developers and ongoing assistance.

Complexity: Increased integration sophistication and risk management.

Factors to Consider When Choosing Between Tailor-Made and Off the Shelf Blockchains

Choosing a course of action is not only a technical problem, but also a strategic one. Here are the order of considerations that Dubai-based companies need to take into account when deciding between bespoke or off the shelf blockchain solutions:

1. Business Goals

Are you seeking to improve an existing model, or address a niche problem? If your project is geared towards capturing a particular market or offers solving a very unique problem, custom development is likely the better option.

2. Financial Plans

For Dubai’s startups or SMEs, a prebuilt solution renders more economical and viable. However, large enterprises and government agencies may view the financial expenditure on customized systems as having worthwhile mid-to-long-term returns.

3. Speed of Launch

Prebuilt systems offer faster launch capabilities, which is critical for time constrained initiatives or MVPs. Aligned timelines with strategic objectives tend to take longer, although custom developed solutions are more favourable in aligning to them.

4. Strategic Business Compliance

Healthcare, finance, and logistics are some of the heavily regulated industries in the UAE. Custom solutions can be created to meet compliance with local legislation like the UAE Data Protection Law and Central Bank stipulations.

5. Adaptability and Growth Potential

Custom solutions are best suited for addressing future expansions such as integration requirements or new emerging governance paradigms due to their inherent flexibility.

6. Integration Requirements

How deeply does the blockchain have to integrate with your organization’s existing infrastructure (ERP, CRM, IoT devices, etc.)? Off-the-shelf solutions offer plugins or APIs, but custom solutions will provide tailor-made adaptations for seamless integration.

Use Cases in the UAE: Real-World Scenarios

Custom Blockchain in UAE Government Services

Dubai’s Department of Economic Development uses best of breed custom blockchain solutions for managing business licenses. Processing time for business licenses has improved dramatically due to increased processing efficiency.

Prebuilt Blockchain in UAE Fintech

A number of UAE based Ethereum centered fintech startups have utilized Ethereum’s infrastructure for the rapid token launching and automation of smart contracts, minimizing development while maintaining requisite dependability.

Hybrid Approach in Supply Chain

Some logistics companies in Jebel Ali Free Zone are using a modular approach, combining prebuilt blockchain elements with customized systems to document and prevent fraud, demonstrating effectiveness of a hybrid model.

Which One Is Right for Your Business?

Every company or business is different from one another. This decision requires careful consideration of your business strategy, the regulatory landscape, and long-term goals. Out-of-the-box solutions are ideal for businesses that aim for rapid returns with minimal expenditures. Tailored options work well for enterprises that desire feature-rich systems along with absolute control and significant scalability.

For most businesses operating out of the UAE, especially those in the realms of finance, real estate, and public administration, advanced custom solutions provide strategically invaluable advantages. On the other hand, industry newcomers operating in the retail and eCommerce sectors may prefer prebuilt solutions as low-cost starting options before transitioning to custom development upon achieving scaling.

Closing Remarks

As blockchain advances towards becoming a core component of the ongoing digital transformation in the UAE, determining a suitable development approach has never been more important. Understanding the tradeoffs between custom and prebuilt blockchain solutions enables businesses to strategically align with defined criteria and achieve set objectives.

Ready to Establish The Future Using Blockchain Technology?

WDCS Technology offers best services in the UAE that include custom and prebuilt blockchain development services. We offer seamless collaboration that guides you starting from nurturing your startup idea, developing it further, or helping scale an established company WDCS is there for you throughout the entire journey. Visit Our Website today https://www.wdcstechnology.ae/blockchain-development-services-uae and schedule an initial consultation that will help you discover the endless possibilities blockchain technology can offer your business in the UAE!

0 notes

Text

NFTのユースケースとHyperledger Fabricでの実装

#NFT使用用途#Cloud#NFT#クラウド#ブロックチェーン#エコシステム#blockchain#非代替性トークン#HyperledgerFabric#NFT販売事例#Hyperledger#エンタープライズ#事例#enterprise#ユースケース#NFTスマートコントラクト#Oracle#Chaincode#オラクル#ブロックチェーン活用#テクノロジー#開発#デベロッパー#developer#開発者#technology

0 notes

Text

How to Choose the Right Blockchain Platform: Ethereum vs. Solana vs. Hyperledger

In today's rapidly evolving tech landscape, blockchain is no longer a buzzword. It's a powerful technology shaping the future of finance, supply chain, healthcare, gaming, and beyond. However, selecting the right blockchain platform is critical to your project's success. Ethereum, Solana, and Hyperledger are three widely used platforms, each offering unique strengths tailored to different business needs.

At Infograins, one of the leading blockchain development company in India, we guide businesses across industries in choosing and building on the ideal platform. This blog offers a deep dive into these platforms to help you decide which one best suits your use case.

1. Ethereum: The Smart Contract Pioneer

Overview: Ethereum is the most established public blockchain platform, known for introducing smart contracts and decentralized applications (dApps). It enables developers to create tokenized assets and applications that run on a decentralized network.

Key Features:

Decentralized and open-source

Supports ERC-20, ERC-721 (NFTs), and other token standards

Active developer community and strong documentation

Transitioned to Ethereum 2.0 for improved scalability (Proof of Stake)

Use Cases:

Decentralized Finance (DeFi)

Non-Fungible Tokens (NFTs)

dApps and DAOs

Blockchain-based gaming

Pros:

Highly secure and battle-tested

Rich ecosystem of tools and integrations

Extensive learning resources and community support

Cons:

Slower transaction speeds compared to newer platforms

High gas fees (mitigated with Layer 2 solutions like Polygon)

2. Solana: High-Speed & Scalable

Overview: Solana is known for its speed and low transaction fees. It's designed to support high-performance applications and is gaining popularity in gaming, NFTs, and DeFi spaces. Solana uses a combination of Proof of History (PoH) and Proof of Stake (PoS) to achieve its performance.

Key Features:

Handles up to 65,000 transactions per second

Sub-second block finality

Low gas fees

Developer-friendly SDKs and documentation

Use Cases:

Real-time DeFi platforms

NFT marketplaces

Scalable games and metaverse applications

Payment networks

Pros:

Fast and efficient

Ideal for high-throughput dApps

Rapidly growing ecosystem and developer interest

Cons:

Network outages have occurred in the past

Slightly more centralized compared to Ethereum

3. Hyperledger: Enterprise-Grade Blockchain

Overview: Hyperledger is an open-source collaborative project by The Linux Foundation that focuses on enterprise blockchain solutions. Unlike Ethereum and Solana, Hyperledger is permissioned, meaning only authorized participants can access the network.

Key Features:

Modular architecture (supports multiple frameworks like Fabric, Sawtooth)

Private and permissioned blockchain

High performance and scalability

Supports private transactions and data confidentiality

Use Cases:

Supply chain management

Healthcare data exchange

Financial services and interbank settlements

Identity management systems

Pros:

Tailored for enterprise-level requirements

Flexible and customizable for specific needs

Strong backing by industry leaders (IBM, Intel, etc.)

Cons:

Smaller developer ecosystem

Not suitable for public dApps or token launches

How to Choose the Right Platform

Choosing the right blockchain depends on several key factors:

Project Type:

For public applications like DeFi or NFT platforms, Ethereum or Solana is ideal.

For internal enterprise solutions, Hyperledger offers privacy and control.

Performance Needs:

Choose Solana for speed and real-time performance.

Ethereum is better for security-focused applications.

Ecosystem & Community:

Ethereum has the largest developer base.

Solana is growing fast with new tools.

Hyperledger offers strong enterprise-level support.

Cost & Scalability:

Solana provides low-cost operations.

Ethereum costs are higher but come with robust tools.

Data Privacy:

Hyperledger is the best option when data control and confidentiality are a priority.

Why Infograins?

As a trusted Blockchain Development Company in India, Infograins offers:

Deep expertise in Ethereum, Solana, Hyperledger, and more

Custom blockchain solutions tailored to your business

Smart contract development and audit

NFT, DeFi, and enterprise blockchain consulting

24/7 support and agile development methodology

We don’t just build blockchain apps—we build secure, scalable, and future-ready ecosystems.

Conclusion

There is no "one-size-fits-all" blockchain platform. The best choice depends on your business goals, scalability needs, privacy requirements, and user base. Whether you're a startup or an enterprise, choosing the right platform is the first step toward blockchain success.

Let Infograins help you make the right move in your blockchain journey.

0 notes

Link

0 notes