#i know my local grocery store is like in a higher class neighborhood but still!!!

Text

being lactose intolerant & being allergic to nuts is literally hell when trying to find things for cooking. i try to have dairy but i wind up having stomach issues for like, days. so i really need to try and pull away from dairies.

then im trying to eat better and it's so expensive. like i got ingredients for pasta salad which can make 2 nights worth. but it cost almost $20 for a few ingredients e_e

why does it have to be so difficult to eat better.

#.txt#i have to keep buying new veggies cause the ones i bought a week ago are bad now!#i know my local grocery store is like in a higher class neighborhood but still!!!#one small pack of grape tomatoes was like. $4 for maybe a handful?#and ppl say to try protein pasta to help. but that's like $4-5 as well?#so might as well get the cheap $1 pasta that's not the greatest but still

1 note

·

View note

Text

Little Differences between Everyday Life in the US and in Israel

After a few months in Israel, I created a Google Sheet, which I titled “Differences Israel/USA,” where I would jot little differences down when I noticed them. I now have a bonafide list of amusing differences to share.

Car Locks - In the USA, you lock your car. In Israel, you lock your car and most people also have a second lock for their steering wheel (that has a numeral code that you enter each time you want to start the car).

Strollers - Babies in the US, generally sit up in their strollers, after about six months. It must be a faux pas to have an upright baby in Israel, because almost all babies lay flat in strollers here.

Bathroom Light Switches - In the USA, bathroom light switches are on the inside of bathrooms. In Israel, bathroom light switches are outside bathrooms, most of the time. I asked one of my colleagues about this, and she said it was due to some concern about electricity and water. I find this amusing, because there are often exposed wires in bathrooms (and our bathroom has a heater - a welcome addition to the lack of central heat - with open coils).

Gender & Bathrooms - Gender and bathrooms combine to create an explosive political issue in the USA, but in Israel, most bathrooms are co-ed or genderless. Many restaurants have two or three small, genderless toilets behind closed doors, and a shared sink area.

Cost of Cell Phone Plans - In the US, Kenny paid $50 a month for his bring-your-own phone cell phone plan. I was still on my parents plan (thanks, Mama and Papa). In Israel, we pay $15 dollars a month for both of our plans. That includes enough data and some international minutes!

Penny Pinching - When your food costs $5.52 in the US, you better have those two pennies. In Israel: "Ehh, you don't have that last 6 shekels - no big deal!" When paying in cash at small businesses (like falafel stands), don't be surprised if the last little bit of your bill is waved off.

Negotiating - In the US, even at markets, prices are set and price tags are present. In Israel, when you go to markets (or even when you are working to decide on rent with your landlord), you are expected to haggle. Most items do not have price tags - their prices are almost entirely subjective and sometimes tourists are given higher prices than locals.

Bagging Groceries - At most grocery stores in the US (except Aldi), someone is there to bag your groceries. And in most places, plastic bags are free (I’ve only paid for a plastic bag in the US once and that was in DC). Even small-town grocers have high schoolers to bag your groceries (Kenny was once a bag boy). In Israel, you are expected to bag your own groceries, and the plastic bags are not free. What surprises me, in our middle-class neighborhood, is that most people pay for the bags, rather than bring their own reusable bags! How wasteful (squared)!

Hot Water - In the US, most homes and apartments have electric or gas hot water heaters. In Israel, most homes and apartments have solar water heaters AND an electric water heater for the winter. The water in the summer is incredibly hot, but it gradually cools down as the winter rains arrive.

Cleaning the Floor - Maybe I have just missed something here? When you clean the floor in the US, you generally use a mop and bucket or a swiffer. Here, there are just these oversized squeegees and rags. It is a skill that I have not honed, which is why our tile floors are less than sparkling. I am happy to acquire this skill, if anyone is willing to share their knowledge.

College-Aged Adults - In the US, college-aged people carry their smartphone, wallet, and car keys. In Israel, they carry their smartphone, wallet, automatic rifle, and bus/train pass. Conscription exists in Israel for all non-Arab citizens. The normal length of compulsory service is currently two years and eight months for men (with some roles requiring an additional four months of service), and two years for women. It’s hard to get used to seeing pimple-faced 18 year olds, dressed in street clothes, carrying automatic weapons.

Lines - Lines in the US mean “wait your turn,” and most are respected. In Israel, they are merely suggestions. Kenny and I have witnessed a vicious screaming match over who was first at the grocery deli counter (we didn’t weigh in), and I have often had to muscle in front of someone who was trying to jump the line at the checkout counter. I have heard this is the case in many places around the world. In my opinion, it is the worst while waiting in line to check into flights at the airport (especially for those dreadful 5AM flights to the US out of Tel Aviv). The problem has been mediated at the Post Office, Pharmacy, and Health Clinic by machines that have you take a number and wait until your number is called.

Bag Check / Security - In the US, you sometimes have to show the contents of your bag when you are exiting a store, to ensure that you did not steal something. In Israel, you have to show the contents of your bag when entering most larger stores, malls, or large buildings. At our local grocery, the security staff no longer checks my bag (they recognize me), but they often ask Kenny (in Hebrew) if he is carrying a weapon.

Traffic Lights - I love Israeli traffic lights! They have an “on your mark, get set, go” feature! When the red light is changing to green, the red starts to blink, and then turns to yellow, and then green. The same is true in reverse. People are less likely to get caught on their phones or buzz through a yellow light.

Illegal Parking - In the US, if you park illegally, you will be towed. Promptly! In our neighborhood, so many Israelis ignore the traffic rules that it is simply not possible to tow all the illegally parked cars away. It doesn't help that there are never enough parking places; cars are often parked on sidewalks.

Rules in General - Much like lines, in the US, rules are respected and generally followed. In Israel, rules are considered suggestions. The one who gets ahead in Israeli society knows how to bend the rules to fit his own goals.

Car Seats - In the US, it is not legal to have child car seats in the front seat. Here, in Israel, there are countless infant seats in the front seat of cars. HOW IS THIS SAFE?

Water Glasses - When you go to a restaurant in the United States and order a glass of water, you will receive a healthy helping of ice cold H20. In Israel, you will receive a sad, room temperature shot glass of water. I am a very thirsty person, drinking on average 120 ounces of water a day. And... I just miss ice (especially in the heat of Israeli summer). I would like a big girl glass, please, with so much ice that it is sweating.

Food - Food is just of such a higher quality here. All grocery stores are also mini-bakeries, with absolutely amazing fresh bread and pastries. In the US, when Kenny and I would go out to eat, he would usually have his pick of the menu, while there would be two or three vegetarian options for me. Here, it is the exact opposite! And SALADS here are respected and honored, given the proper place they deserve as real (and not diet food).

Does anybody have anything else that I should add to my list?

4 notes

·

View notes

Text

Week 1 (Jan 6 - 13)

Hallo aus Berlin!!

I’m so excited to share with you what I've been up to the past week! It’s been pretty crazy getting adjusted to my new dorm, learning how to get around in Berlin, going to the store, and meeting new people. I can already tell I’m going to love Berlin and I’ve had such a great time so far. This post is so much longer than I anticipated, but I hope you enjoy reading about my first week!!

Last Sunday, I took one plane from Charlotte to London and then a short flight from London to Berlin. Everything went smoothly with with the flights and I got a few hours of sleep which was good! The meal I got on the plane was a pasta dish, which was pretty delicious. Here’s a picture of the airline meal and a picture of me with my suitcase for proof that I packed light!

I met up with some people in my same program who were on my flight from London to Berlin. Once I got to the Berlin airport, I met up with my roommate, who is also named Sarah, and then the program provided a bus that took us from the airport to the program center.

The place where I’m staying is a center for study abroad students from the US. The bottom section has a lobby and cafe and classrooms and then the top floors are the rooms where students live. My room is dorm style with bunk beds, a desk, a wardrobe, a mini-fridge/microwave set, and then a bathroom. Here are a few pictures!

The first day we were in Berlin we had a welcome toast to the semester, then we went on a short walking tour around the neighborhood, and then dinner with some people in the program.

One the second day, we had morning sessions that covered helpful information about our classes, the center, and the culture in Berlin. Then in the afternoon, we went on one of those bus tours of Berlin, which was cool because we saw the main tourist attractions (pictures below!) and learned about their history in addition to getting a better feel for the layout of the city. And by that I mean realizing just how big Berlin is!

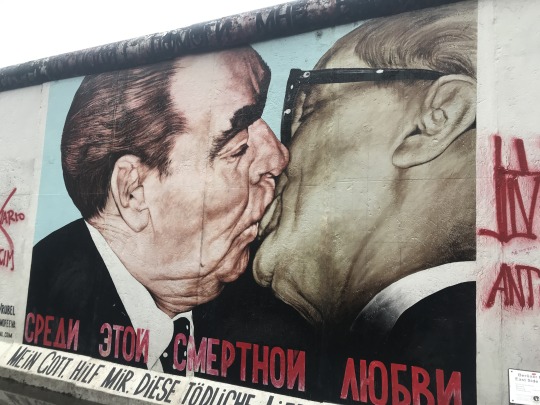

The first stop was the East Side Gallery, which is the longest remaining piece of the Berlin Wall. After it was torn down, the city preserved this section and asked local artists to paint what peace and unity meant to them, so it’s covered in really cool murals. This picture is probably the most famous section - it depicts Leonid Brezhnez (Leader of the Soviet Union) and Erich Honecker (East Germany Leader) kissing and was based off of a photo taken when the German Democratic Republic (East Germany) was created.

Then we went to the Brandenburg Gate, which was pretty cool just because you see references to it everywhere in the city (including on the fabric in the seats in the U-Bahn) But the history of it is super cool - it’s actually pretty old (18th century) and was a part of the old Berlin Customs Wall, which was a literal wall around the city that regulated people to pay taxes on the goods they brought into and out of the city. The Brandenburg Gate was one of many gates in the wall, but it was used for people of higher nobility or special occasions. Then it was used later for triumphal processions by Napoleon and the Nazis.

The last stop was the Memorial to the Murdered Jews of Europe. It’s hard to get a good picture that shows the whole memorial because it’s so big, but it’s a large open space with grey concrete-looking boxes of various heights. There’s apparently a lot of controversy about this memorial, but the artist, Peter Eisenman, was also very intentional in his design. The monument resembles a cemetery and walking through the stone boxes makes you feel somewhat uncomfortable and trapped. Eisenman didn’t want to label the monument or label the boxes because he wanted viewers come to their own realization and form their own opinions about the meaning behind his work. The monument is one of the largest public spaces in Germany and was really moving. There’s also an underground documentation section, but we didn’t see that on our tour.

That night we went to a German/Austrian restaurant, and I had my first schnitzel of the semester! This was a veal schnitzel that is popular in Austria and it was incredible. I’ve also been trying different beers at restaurants because Berliners are obsessed with their beers.

P.S. the beer glass was smaller so don’t use it as a size comparison to the schnitzel which looks ginormous in this picture

On Wednesday we started our first day of class! I only had my International Finance class that day, but I think the class will be really interesting. The professor is also really awesome - he was discussing a concept in class and mentioned this tea beverage but no one in the class knew what he was talking about because it’s only made in Berlin, so during our break (they’re 10 minutes since the class the 3 hours) he went a bought one and had some plastic cups so we could all try it!

We also went to Real, which is kind of like Germany’s Walmart or Target. It was my first experience going on the U-Bahn (Berlin’s subway/metro) and to the store in Berlin and it was a wild experience. The U-Bahn is pretty simple, especially given my experience in New York, but it’s big and all the names of the stops have at least ten letters. At the store, they have a lot of the same brands as the United States, but it was definitely an experience. I just got some notebooks for class and other things that I didn’t want to worry about packing like a bigger shampoo bottle. The whole trip was a little overwhelming but my friends from the program were there too so we struggled together and are now laughing about how confused we were.

On Thursday, we went to the grocery store for the first time! It was super fun and we got stuff to make dinner and lunch since there is a communal kitchen at the center. I have a picture just because I was proud that we went and were cooking. Also, in the German grocery stores they only sell half loaves of bread and I think that’s genius. Also their cheese is way better than deli cheese from Harris Teeter.

It was also a slightly warmer and sunnier day, so we went for a walk around the neighborhood. The river was super beautiful and we also saw some interesting apartments too.

Afterwards, we went to a super cute cafe where we had some coffee and cherry cake.

On Friday, I don’t have any classes which means I got to spend a full day doing whatever I wanted! We went to this mall and got some more items that we needed and also just walked around to the different stores to see what they were like.

That afternoon we also went to the Berliner Dom, which is the big Cathedral in Berlin. It was super beautiful on the outside and it sits on what they call “Museum Island” because it’s an island in the middle of the Spree River that runs through Berlin and is where a lot of the main museums are. The inside is also really pretty and you can go to the top and see an awesome view of Berlin! It was foggy and dark outside when we were there but I’d like to go back when you can see more.

This is the view from the top! The TV Tower is to the left.

Also, a little bit of winter-y decorations were still up from Christmas and I thought they were really pretty!!

That night, we went to Curry 36, which they say at the program is a late-night staple. It’s a currywurst place, which is a fast-food dish consisting of sausage, French fries, curry-flavored ketchup, and mayonnaise. It is honestly life-changing and I would consider Curry36 similar to the Cookout of Berlin, which as many of you know is a pretty bold statement coming from me.

On Saturday, I went to an all-day German Survival Course that the program put on. It was somewhat helpful because we learned a little about ordering food and how to say some phrases. It’s definitely a hard language though so I can’t say that I have a large German vocabulary as of now.

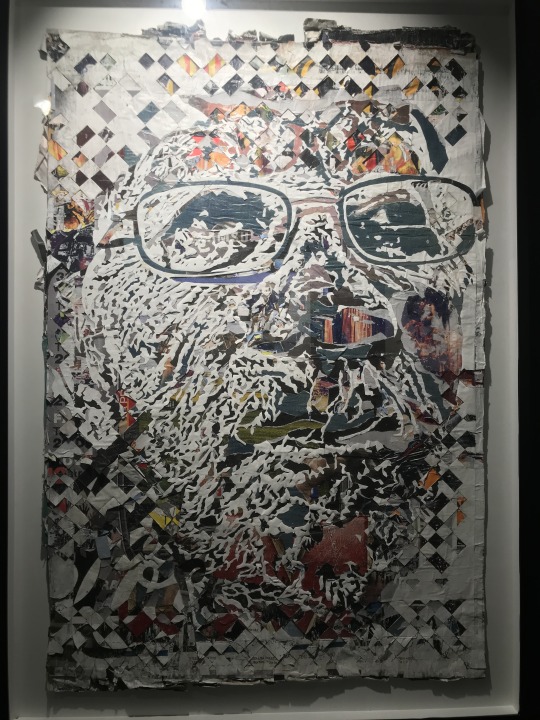

Today (Sunday), we went to a brunch place and then a museum called Urban Nation, which is a contemporary art museum that focuses a lot on street art too. It was super cool.

And then tonight I’m just finishing up some homework!

Wow - it’s been a really busy week but I’ve loved being able to explore and experience new things, even if it was sometimes intimidating. Berlin seems like an amazing city and I’ve loved making new friends who are studying here with me too.

I miss you all!! Auf Wiedersehen!

the view from my dorm!

2 notes

·

View notes

Note

So I'm a Canadian who will be moving to Scotland later this month for university and I'm wondering: Do you have any tips for getting settled in a new country? This will be the first time I'm buying my own groceries and not using student loans so budgeting advice is also welcome.

This ask has been sitting in my inbox for like at least a month... I’m so sorry! Some posts take more time to write then others. I actually have about four asks that are all essentially this same question, so I’m going to just combine them all into one post.

As for budgeting... here’s my two cents, in terms of Minimum Wage.

Budgeting on Minimum Wage

Overview

The average minimum wage in the US is $7.25/hr. Even working full time at 40 hours a week, that’s only a profit of $290 before taxes. This is not a fair living wage! You are worth way more than this amount! I strongly encourage you to start looking for another job that pays better, look for something around the $10-$15 range.

While $7.25 is atrocious, thousands of people around the world support families on much less. If they can do it while supporting children, so can you! To live off a minimum wage budget you need to declare yourself independent. If your parents are still claiming you as a dependent YOU WILL NOT BE ABLE TO DO THIS. I also recommend that you have the highest amount possible taken out of your taxes so that you get money back from your state at the end of the year, instead of being in debt to them.

What I’ve done is come up with a budgeting plan based off some made up factors and my own personal experience.

Housing

1. City life. Forget about the city! Apartments located in cities can be three times as expensive as apartments in small towns or villages. On top of the extra expense, they’re much smaller and have less amenities included. I’d much rather live in a one bedroom apartment with a dishwasher and a conveniently located Laundromat, than a literal closet with no windows on a fifth floor walkup. Look for apartments twenty minutes to a half hour outside of your closest city. Now you have the close conveniences of a city, with none of those pesky city prices that your budget can’t handle.

2. College towns. Shop around and look at apartments by local colleges. Large colleges with have apartment complexes within walking distance of the school grounds. Landlords know that college students have less money (you might even be a college student yourself) and adjust their prices accordingly. Even apartments next to ivy league schools are priced this way, so don’t be discouraged by the institution’s “prestige”.

3. Locale. Your safety is more important than your bank account. It doesn’t matter if you live in Section 8 housing or in an affluent suburb. Some apartment complexes and neighborhoods are just safer than others. I live in a heavily populated and upper middle class suburb, and the first year I moved in, a drunk woman tried to throw a beer bottle at my car. Thankfully this is the only time this happened to me, but it made me feel unsafe in my environment. Before signing a lease, walk or drive around your prospective home’s neighborhood at night. Take in the atmosphere, and make sure it’s one where you could comfortably run to the local supermarket at 10:30pm and pick up toilet paper.

4. Roommates. Living on minimum wage requires that you find one or two roommates to help split the rent. The more the better! Get together with your more responsible friends, so at least you’re living with people whose company you enjoy. There are lots of “roommate wanted” forums and message boards for you to browse on the internet, but always bring a responsible adult with you before meeting a stranger. Please. Bring your mom if you have too.

Food

1. Low-spoon food. I created this post a few months ago which offers lots of suggestions about cooking and shopping on a budget.

2. Online recipes. Here are some of my favorite online Tumblr cookbook resources.

- College Student Cookbook. Click here.

- Meals On The Go. Click here. (Not a cookbook, but super helpful)

- Broke College Kid Masterpost. Click here.

- Cooking on A Bootstrap. Click here.

- Good and Cheap. Click here.

- Budget Bytes. Click here.

3. I also regularly update my cooking on a budget tag.

Misc Expenses

1. Gas. Shop around and find the cheapest gas in your area. Avoid gas stations next to colleges, highways, and in touristy areas. Look into getting as gas rewards card from your favorite supermarket. I get 10 cents off a gallon with Stop & Shop every time I do a big shop.

2. Dollar store. Get to know your local dollar and bargain stores. You can buy everything from pots and pans to bed sheets there. These stores often sell bulk ramen for $1 and large cans of crushed tomatoes for 75 cents. That’s enough food for you to live off of for several days. When shopping, I make three grocery store stops to ensure that I spend the least amount possible on my pantry needs. I go Dollar Store, Stop and Shop, and then to my local organic grocery store. I’m going to make a list of things that I buy at Dollar Stores and things that I don’t buy at Dollar Stores soon!

3. Cable. We are living in the digital age- you don’t need cable television. Use Netflix or Hulu or whatever. It will save you tons of $$.

4. Internet. As far as internet speed goes, if you’re living with roommates you will probably need a higher speed. Living by yourself, choose a lower one. Most internet companies offer large discounts to new subscribers. These typically only last a year, but will save you serious money. Make sure to take note of when this discount expires, and contact the company before it does. If you don’t, they’ll begin charging you the full amount without notice.

5. Verizon. I just want to take a moment to talk about how much I love Verizon because they have literally saved me so much money in the three years I’ve been with them. After you sign a contract with a new internet company, they charge you a bunch of ridiculous fees like “activation fees” and “installation fees”. I called Verizon and was like “I’m a poor college student, I can’t afford this” and they were like “don’t worry, we’ll waive the fee”. I signed a two year contract with them that saved me $80 on a high-speed internet bill per month (my price being only 50.99 a month). After the contract expired I call them and they put me on a month to month, keeping the price absolutely the same. TLDR- get Verizon if you can.

6. Utility. Get on a monthly budget with whatever utility company services your new apartment. Although it may seem like the cheaper option, paying the actual amount of electricity you spend per month is the more expensive. It’s also unpredictable, and a minimum wage budget won’t allow for it. See this for more info.

7. Amazon. I buy a lot of my beauty, cleaning, and cat products online. Amazon offers Prime shipping free for a year with a student email address, and then offers it at a greatly reduced price after the year. If you are a student, snap up that free deal ASAP. If it’s in your budget, I’d greatly recommend investing in Amazon Prime.

8. Saving money. It’s so important to attempt to break way from the “paycheck to paycheck” vicious cycle. Living this way does not allow for emergency expense money, and trust me, sometime soon you will need emergency expense money. Your cat might get sick or your car may die, whatever it is, it’s always smart to have at least $500 squirreled away. I’m gonna level with you, things have been tight for my budget and I haven’t been able to save anything for the past three months. But this month I will!

Example Budgets

Full Time

Working with the $7.25/hr and 40hr/week model, here’s an example budget for living on minimum wage. That’s $1,160 a month without taxes.

Housing: Let’s say you’re sharing an apartment with two close friends, the rent being $1,500 without any amenities. That rent split three ways is $500 each.

Gas I commute twenty minutes every day, and I drop about $20-$25 a week on gas. That’s $100 on gas a month.

Food: I do one big shopping a month with my boyfriend. We drop around $180 and that’s including toiletries and soap and stuff. So maybe you’ll spend about $100 a month on all your shopping needs.

Cable/internet: Hopefully you took my advice and skipped cable. Let’s say you’re paying around $50 per month for internet. Split three ways that’s $17 each.

Laundry: Hopefully you’re not like me and are only spending around $20 on laundry per month.

Random expenses: Because there always are some. Let’s just tack on another $100.

With everything added up, you still have around $290 left before taxes! That money can go into a savings account, and after several months, you’ll have that $500 worth of emergency money saved.

Part Time

Working with the $7.25/hr and 25hr/week model, here’s an example budget for living on minimum wage. That’s $725 without taxes.

Housing: In this case, you need to look for apartments in the $800-900 range. In my area, one bedroom apartments go for around $1000, so you may need to get creative with your roommate (I don’t think you could have more than one roommate in this situation). Buy dividers to split the bedroom or studio in half! Let’s say your rent is $850 with nothing included, that’s $425 each.

Gas You’re still looking at a large gas bill per month, so it may be more inexpensive to ride a bike or use public transportation. Let’s say you use public transportation, and spend around $50 a month on that. Or maybe you and your roommate can split gas expenses and share a car?

Food: Pinch those pennies! Use some of those budget cookbooks I linked above to help you cook healthy and delicious meals for under $4 each. See if you can only spend $80 a month on groceries.

Cable/internet: Hopefully you took my advice and skipped cable. Let’s say you’re paying around $50 per month for internet. Split two ways is $25 each.

Laundry: Hopefully you’re not like me and are only spending around $20 on laundry per month.

Random expenses: Because there always are some. Let’s just tack on another $100.

That leaves you $25 to put in your bank account, if that. This is a paycheck to paycheck situation, and you will probably need to get another source of income to feel secure. But you can still do it!

107 notes

·

View notes

Text

Lesotho Infinity And Beyond: 24 December 2016: Zimbabwe- Bulawayo

From Francistown, I got on this bus to the Ramokgwebana/Plumtree border between Botswana and Zimbabwe. To get out of Botswana, it was slowish, but organized. The bus picked everyone up after we’d all stamped out and took us to the Zimbabwe side, and there it took insanely longer and was much more chaotic, with people butting in, crowding around the counters, etc. It costs $30 for an American to get a single-entry visa to Zim. I had the option to pay with USD, Rand, Pula, Pounds, or Euros.

Let me elaborate on the money situation here, oh readers, because it is an interesting one indeed. Seriously- I went down the internet wormhole just reading so far into this. Here’s the Wikipedia link if you’re interested in reading more.

The gist of the situation is that in the 1980s, Zimbabwe was doing pretty well economically. In the late 90s, though, Mugabe’s government instituted land reforms that put the land owned by white people into the hands of black people. This included a lot of farmland, which the white farmers had been growing lots of successful crops on. Once the whities were forced out and the new black “farmers” took over, it was soon evident that they didn’t have any experience with farming, and the country fell into a food shortage situation. The fact that banks were also failing didn’t help, and Zimbabwe turned from an exporter into an importer, effectively accruing lots of foreign debt. So how do you get out of debt? You need more money. What’s the easiest thing you can do to get more money in a bunk economy? Print it, of course. What could possibly go wrong? Answer: everything.

Printing vast quantities of money, as you probably learned in some economics class, causes inflation, as there is more money for the same amount of goods, so the money loses its value. The money becomes more and more worthless, so you have to print more and more bills of higher denominations to keep up. What results is a horrific vicious cycle of hyperinflation. It was so bad that at the end of 2008, the money was inflating at a rate of about 80 billion percent…per month! You’ve probably heard about Germans taking wheelbarrows of money to the store to buy a loaf of bread in the 1920s. Yep, same story here in Zim. The highest denomination that the government printed, right before the currency was abandoned in 2009, was 100 trillion dollars. Yep, that’s trillion with a capital T, which rhymes with P, which stands for pandemonium. But it wasn’t even really 100 trillion; the number value should have actually been 1025 times more than that, because of various droppings of zeroes in the process of successive printings. If you checked the price of, say, eggs at a shop in the morning, went home to get wads and wads of cash to pay for said eggs, and returned in the afternoon, whoops, the price skyrocketed and you don’t have even close to enough money anymore. Even before the Zim dollar was discontinued, the country informally, and then formally, switched to a multi-currency economy. Bartering was also very common. The USD was the currency of choice, as it was the strongest currency, but you could also use a whole host of other global currencies. I’ll go into the current currency situation a little more in the next post, but this just gives you a good idea about how chaotic things got, and how uncertain anything concerning money was/continues to be in this country.

So yes, back to the journey at hand. But before I continue, loyal readers, my mom in the next room would like to add that she was in Zimbabwe in the 70s when it was still called Rhodesia. Wild. Anyway, overall, from border to border to freedom, it was three hours, mostly spent waiting in lines. I walked to the taxi rank on the Zim side and got the last spot (read, the taxi was full but I got squeezed in there anyway) on a minibus taxi to Bulawayo for $5, plus another $2 for my bag in the back trailer. Not wanting to use my dollars, I paid 80 Botswanan Pula instead, which they happily accepted.

After getting off the taxi in Bulawayo, I immediately went to the Pick and Pay grocery store where, guess what, I waited in more interminable lines for both the parcel counter to drop my bags and for the registers. I forgot that it was super close to Christmas, so that was probably why the store was so crowded. Then I wandered through the outdoor market to find my way back to the taxi rank. Everyone was very friendly directing me to the local taxi going to Burnside, the neighborhood my hostel was in. It was a short 50 cent ride. Here they only took USD. They laughed when I tried to pay with Pula again. But the cool thing about that ride is that I paid with a $10 bill, and in my change, among the super gross and floppy dollar bills I received (they never go out of circulation since they can’t afford to have less currency going around), I also got some new Zimbabwe Bond Notes, which are the government’s answer to the currency shortage. The thing about the Bond Notes is that they are only good within Zimbabwe, so they can’t be used to pay for foreign goods, so they’re pretty worthless in the grand scheme of things. They were only introduced a month before I got to Zimbabwe, and they're made in the form of coins and $2 notes (they have since started making $5 notes), tied to the USD.

I got out and walked to Burke’s Backpackers. It’s a beautiful and green property with the Burke family home, a pool, a pond, lots of trees, and some rooms and space for camping. That night, the family was having lots of people over to (badly) sing Christmas songs on the porch. Their out-of-tune voices lulled me to sleep as I lay in my tent that I set up next to the pool.

The next day, the owners put me in touch with two other guests, a Swiss German and French Canadian who were traveling between semesters studying in Stellenosch, which is the wine country right outside of Cape Town. I recognized their car from several other places in Botswana, where we both had been staying, but somehow we had never talked to each other. I distinctly remembered them at Planet Baobab in Gweta, where they had quite a loud girl with them who never stopped singing and talking. She had since left the trip to go see family or something, and the two guys seemed relieved to have dropped her off a few days earlier.

Making friends with people with cars is great. The three of us drove around Matopos National Park ($15 entry fee each person, $10 for the car). This park has lots of rock formations and balancing boulders, which feature on one side of each Zimbabwe Dollar note and the new Bond Notes (see picture above). We drove around the park, admiring the rocks, and did a little hiking including up to some cave paintings, then to the top of this small mountain. At one point, there was the option to pay $10 more to see Cecil Rhodes’s grave, but we enthusiastically declined. Why should we pay our respects (and our money) to a guy who took over and exploited Southern Africa for its diamonds and other natural resources? He is highly vilified by most people around here, so we passed.

Push!

Cave drawings

Hiking

A view of the park

The next afternoon, after paying for my camping spot at Burke's in both Pula and USD, I got all my stuff and walked to the road to wait for a taxi to pass by. Without even trying to flag down anyone, a guy just stopped for me and took me straight to the train station. On the way, he stopped at the Spar grocery store to see if his friend had cash for him. No cash today. This country is so strapped for cash and there isn’t any in most banks. And if there is, you can only take out $50 per day. This means that a lot of company owners effectively can’t take out enough money to pay their workers. One method of getting cash is at the grocery stores, because they seem to be the biggest source of it. You pay with a card, then get some cash back.

So after the obligatory asking me to marry him and bring him to the US and me subsequently shutting down the conversation by truthfully saying that I literally did not have a sim card on which he could call me, the guy dropped me off at the train station. It’s so weird- even when I so vehemently shut down someone like that, they’re still super friendly, and he still said that it was nice to speak English with me and get to know what I was doing in this part of the world.

In the next post, your hero takes an overnight train to Victoria Falls!

Another view of Matopos

The whole crew

On top of the rock mountain

Balancing rocks

More balancing rocks (middle)

from Blogger http://ift.tt/2mRxeSl

via IFTTT

0 notes

Photo

New Post has been published on http://fitnessandhealthpros.com/foods/what-to-consider-when-deciding-what-to-spend-on-food/

What to Consider When Deciding What to Spend on Food

Farmers market it Portland, OR

Money is a touchy subject. Even without bringing up finances directly, people like me who encourage others to eat Real Food often get branded as elitist out of hand.

I get it. Finding and affording fresh food can be difficult or impossible for some people, and that is heartbreaking. But I don’t think that should make the entire subject off limits.

Food is a complex topic that includes issues related to health, economics, culture, human rights, animal welfare and the environment/sustainability. We also need to make food decisions multiple times a day in order to survive.

I consider all these things when deciding what to purchase for myself and my family, and know first hand what kinds of tradeoffs come up when choosing what to eat. Over the years both my priorities and financial means have changed dramatically, and ultimately evolved into the system I use today.

Here I’ll take you through my thought process in making food decisions, including how I’ve adapted to lower and higher income levels.

Of course none of this is intended as a judgement or condemnation on anyone else’s decisions. Everyone’s values are personal and equally valid, and obviously you need to do what works for you and your family.

My goal here is to shed some light on a difficult subject and hope it provides some clarity for those who are trying to make heads or tails of these issues.

But first a bit about me

For context you should know that I don’t come from money, and even calling my family middle class is a stretch. While I grew up in a decent suburban neighborhood, my family sometimes needed help from our church putting food on the table. My dad lived his entire adult life without owning a bank account, let alone a savings account. We did our best, but often had to sell things to make rent.

When I got to college (paid for by scraping together scholarships, student loans and a few jobs), money was really tight. My dad would send me fifty bucks when he could, but there was never any real safety net. It wasn’t unusual for me to live on eggs and canned tuna for the last week of the month. The dieter in me found this to be only moderately inconvenient.

At the time my main priority in food shopping was low price. I shopped at Costco and Trader Joe’s and thought organics were a scam to take money from chemophobic hippies (I know! LOL). I ate a lot of cheap takeout, which in Berkeley was still pretty good, if only moderately healthy.

In grad school things changed a lot. I started becoming a foodist, learned about Real Food and discovered the farmers market. I was a recipient of a fancy NSF graduate fellowship grant that afforded me a luxurious salary of $ 30,000/year, but because I was living in San Francisco I was still spending over 30% of my income on rent.

Still I ate pretty great. The Ferry Plaza Farmers Market in SF is one of the best farmers markets in the US, if not the world. I know a lot of people who consider it ludicrously expensive, but that was not my experience at all.

Yes, it’s possible to pay $ 4.50 for a peach, but it will be the best peach you’ve ever eaten. More important is that I could pack a bag full of kale, radishes, squash, onions, carrots, herbs and other incredible seasonal produce for $ 30. Fruit, especially ripe seasonal fruit, is expensive. Vegetables are cheap. I actually saved money during this period by cooking way more at home and cutting down on how often I ate meat. I also felt amazing and lost 12 lbs.

Things really changed after I graduated, wrote Foodist and got married. Suddenly I could afford steak and sit-down restaurants whenever I wanted, but by then my priorities had shifted as well.

I had never had to worry much about the ethics of eating before I had disposable income. I mostly bought produce from local organic farmers, a convenient luxury that was a byproduct of where I lived. I knew that industrial meat and dairy production were terrible for the environment and a disgusting form of cruelty to animals, but I couldn’t afford it anyway so there wasn’t any conflict. My biggest splurges were an occasional wedge of fancy cheese and wild Alaskan smoked salmon.

Now that more animal products were literally and figuratively back on the table for me, I wanted to make the most responsible choices I could.

There’s no way around it, ethical food costs more money.

Conventional produce is cheaper because big industrial farms exploit workers (sometimes as literal slave laborers) and demolish the environment with cheap petroleum-based fertilizers and Monsanto’s pesticides and herbicides. Smaller organic farmers must spend the time and energy tending to the soil to keep it healthy, and diversify their fields to prevent weed and bug infestations. More time and resources means more money to produce the same amount of food, and higher prices at the market.

Farmers market fruit tastes better because it is grown in season and picked while ripe, making losses due to bruising much more common. Organic certifications are also expensive. Even more cost.

Grass-fed beef and pasture-raised poultry and eggs require more (higher-quality) land, better feed, and sanitary living conditions. Farmers also face more difficulty and expense in processing these products, because they lack economies of scale. Again, these all cost more.

When I was a brokeass grad student I cared about these issues, but opting out was easy because I couldn’t afford it. Now that I can afford higher-quality, ethically produced products I’m happy to pay extra for the farmers who care enough to grow the best crops and for the animals I eat to live a decent life.

I’m also willing to spend a little extra time sourcing those products, which are not always easy to find.

San Francisco makes a foodist’s life easy, but I’ve found it much more difficult to eat to these standards in New York. Restaurants and grocers that source sustainable, ethically-raised food exist, but it isn’t the default like it is in the Bay Area and I often have to take looooong extra trips to find what I want. And I live in bougie Williamsburg.

I find myself preferring to cook at home even more in NYC than I did in SF, largely because I’m unsure of where restaurants sources their ingredients and it’s kind of obvious they aren’t amazing. A lot of the time I end up eating vegetarian so I don’t have to worry about it.

These experiences have led to me to create a mental hierarchy for my priorities when choosing what to eat. It isn’t perfect, and I make exceptions often, but it helps me to have a framework to think about these issues since I eat pretty darn often.

My priorities when buying food

1. Health

My personal energy (and I’d bet yours too) is highly dependent on how I fuel my body. If I’m not eating a wide array of different kinds of vegetables, legumes, grains and seafood/meats I feel lethargic and foggy, and will usually get sick.

Since feeling crappy impacts 100% of my other responsibilities in life, eating a diverse assortment of Real Foods is my number one priority when it comes to grocery and meal selection.

This has some implications. If I’m traveling or even very busy I don’t always eat local/seasonal/organic/sustainable. I try to avoid these scenarios, but when it comes down to it I’ll take what I can get.

It also means that sometimes I pay stupid prices for room service salads if greens have been hard to come by.

2. Quality

Quality is a very close second to health, largely because they are often related. As someone who prioritizes health to the point where my daily nutrition is almost always well-balanced, quality is often the deciding factor in choosing a specific meal.

What I mean by quality is close to what I mean by Real Food. To me, quality food has been crafted with care and fashioned from real ingredients, rather than mass produced in a factory. However, quality doesn’t always correlate with the healthiest choice.

If I’m traveling in Texas and have a choice between an artisan brisket sandwich from a world class family owned restaurant or a salad from Starbucks, I’ll take the sandwich on most days and hope there isn’t too much sugar in the coleslaw. That said, I wouldn’t make a choice like that two meals in a row, so health still wins down the stretch.

On the ethics side I am not going to repeatedly buy bad tasting chocolate just because it is fair trade. Ideally I’d find a delicious fair trade chocolate, but if I’m bothering with chocolate at all it had better be tasty.

3. Ethics/sustainability

I want to live in a world where the people who grow our food are respected and earn a living wage, and where we don’t pretend animals raised for food are less sentient than pets we keep at home. There are people who raise food this way, and I consider it an honor (not a luxury) to support their work.

I understand that it is not practical to demand this standard for 100% of the food I eat. Ethical and sustainable food is still sadly hard to find in most locations, and can be prohibitively expensive for many people.

That said, I would encourage anyone who does have the means to consider supporting ethical and sustainable food whenever possible. Our support is they only way these practices will be able to grow and reach more people.

I hope to see a day where sustainable food is ubiquitous enough that I can move it to #2 or #1 on this list.

4. Price

When it comes down to it I don’t want low-quality, unhealthy or unsustainable food, so even at a super low price it isn’t worth buying.

That said, it also drives me bonkers when restaurants and grocery stores try to sell mediocre food at artisan prices. I can tell the difference you jerks!

For me, as long as pricing seems fair (or I’m completely desperate for something green) I’m willing to pay for food that fuels my body and soul, and supports my values. I don’t consider stores like Whole Foods a rip off, because they are working so hard to offer transparency where nobody else will. In fact, I’m happy to support their mission.

It’s unfortunate that so many of us need to make such tough decisions in order to feed ourselves and our families. As always, all we can do is our best.

What factors do you consider when deciding what to spend your food dollars on?

Originally at :Summer Tomato

Written By : Darya Rose

0 notes

Note

I've been looking around for a while and I don't know if minimum wage would be enough to get an apartment, buy food, and take care of all my cats and it's just generally stressing me out and now I'm wondering if I should even think of living alone

Take a deep breath! While not ideal, living on minimum wage can be done. My advice to you would be to look for some sort of roommate situation as opposed to living on your own. You could also rent a room in a house which would be significantly cheaper than a one bedroom apartment. Your cats shouldn’t cost you more than $50 extra a month, and they will give you such relief and comfort. Moving out of your parent’s house and living on your own can be stressful and feel overwhelming- you’ll want your furry friends by your side!

Budgeting on Minimum Wage

Overview

The average minimum wage in the US is $7.25/hr. Even working full time at 40 hours a week, that’s only a profit of $290 before taxes. This is not a fair living wage! You are worth way more than this amount! I strongly encourage you to start looking for another job that pays better, look for something around the $10-$15 range.

While $7.25 is atrocious, thousands of people around the world support families on much less. If they can do it while supporting children, so can you! To live off a minimum wage budget you need to declare yourself independent. If your parents are still claiming you as a dependent YOU WILL NOT BE ABLE TO DO THIS. I also recommend that you have the highest amount possible taken out of your taxes so that you get money back from your state at the end of the year, instead of being in debt to them.

What I’ve done is come up with a budgeting plan based off some made up factors and my own personal experience.

Housing

1. City life. Forget about the city! Apartments located in cities can be three times as expensive as apartments in small towns or villages. On top of the extra expense, they’re much smaller and have less amenities included. I’d much rather live in a one bedroom apartment with a dishwasher and a conveniently located Laundromat, than a literal closet with no windows on a fifth floor walkup. Look for apartments twenty minutes to a half hour outside of your closest city. Now you have the close conveniences of a city, with none of those pesky city prices that your budget can’t handle.

2. College towns. Shop around and look at apartments by local colleges. Large colleges with have apartment complexes within walking distance of the school grounds. Landlords know that college students have less money (you might even be a college student yourself) and adjust their prices accordingly. Even apartments next to ivy league schools are priced this way, so don’t be discouraged by the institution’s “prestige”.

3. Locale. Your safety is more important than your bank account. It doesn’t matter if you live in Section 8 housing or in an affluent suburb. Some apartment complexes and neighborhoods are just safer than others. I live in a heavily populated and upper middle class suburb, and the first year I moved in, a drunk woman tried to throw a beer bottle at my car. Thankfully this is the only time this happened to me, but it made me feel unsafe in my environment. Before signing a lease, walk or drive around your prospective home’s neighborhood at night. Take in the atmosphere, and make sure it’s one where you could comfortably run to the local supermarket at 10:30pm and pick up toilet paper.

4. Roommates. Living on minimum wage requires that you find one or two roommates to help split the rent. The more the better! Get together with your more responsible friends, so at least you’re living with people whose company you enjoy. There are lots of “roommate wanted” forums and message boards for you to browse on the internet, but always bring a responsible adult with you before meeting a stranger. Please. Bring your mom if you have too.

Food

1. Low-spoon food. I created this post a few months ago which offers lots of suggestions about cooking and shopping on a budget.

2. Online recipes. Here are some of my favorite online Tumblr cookbook resources.

- College Student Cookbook. Click here.

- Meals On The Go. Click here. (Not a cookbook, but super helpful)

- Broke College Kid Masterpost. Click here.

- Cooking on A Bootstrap. Click here.

- Good and Cheap. Click here.

- Budget Bytes. Click here.

3. I also regularly update my cooking on a budget tag.

Misc Expenses

1. Gas. Shop around and find the cheapest gas in your area. Avoid gas stations next to colleges, highways, and in touristy areas. Look into getting as gas rewards card from your favorite supermarket. I get 10 cents off a gallon with Stop & Shop every time I do a big shop.

2. Dollar store. Get to know your local dollar and bargain stores. You can buy everything from pots and pans to bed sheets there. These stores often sell bulk ramen for $1 and large cans of crushed tomatoes for 75 cents. That’s enough food for you to live off of for several days. When shopping, I make three grocery store stops to ensure that I spend the least amount possible on my pantry needs. I go Dollar Store, Stop and Shop, and then to my local organic grocery store. I’m going to make a list of things that I buy at Dollar Stores and things that I don’t buy at Dollar Stores soon!

3. Cable. We are living in the digital age- you don’t need cable television. Use Netflix or Hulu or whatever. It will save you tons of $$.

4. Internet. As far as internet speed goes, if you’re living with roommates you will probably need a higher speed. Living by yourself, choose a lower one. Most internet companies offer large discounts to new subscribers. These typically only last a year, but will save you serious money. Make sure to take note of when this discount expires, and contact the company before it does. If you don’t, they’ll begin charging you the full amount without notice.

5. Verizon. I just want to take a moment to talk about how much I love Verizon because they have literally saved me so much money in the three years I’ve been with them. After you sign a contract with a new internet company, they charge you a bunch of ridiculous fees like “activation fees” and “installation fees”. I called Verizon and was like “I’m a poor college student, I can’t afford this” and they were like “don’t worry, we’ll waive the fee”. I signed a two year contract with them that saved me $80 on a high-speed internet bill per month (my price being only 50.99 a month). After the contract expired I call them and they put me on a month to month, keeping the price absolutely the same. TLDR- get Verizon if you can.

6. Utility. Get on a monthly budget with whatever utility company services your new apartment. Although it may seem like the cheaper option, paying the actual amount of electricity you spend per month is the more expensive. It’s also unpredictable, and a minimum wage budget won’t allow for it. See this for more info.

7. Amazon. I buy a lot of my beauty, cleaning, and cat products online. Amazon offers Prime shipping free for a year with a student email address, and then offers it at a greatly reduced price after the year. If you are a student, snap up that free deal ASAP. If it’s in your budget, I’d greatly recommend investing in Amazon Prime.

8. Saving money. It’s so important to attempt to break way from the “paycheck to paycheck” vicious cycle. Living this way does not allow for emergency expense money, and trust me, sometime soon you will need emergency expense money. Your cat might get sick or your car may die, whatever it is, it’s always smart to have at least $500 squirreled away. I’m gonna level with you, things have been tight for my budget and I haven’t been able to save anything for the past three months. But this month I will!

Example Budgets

Full Time

Working with the $7.25/hr and 40hr/week model, here’s an example budget for living on minimum wage. That’s $1,160 a month without taxes.

Housing: Let’s say you’re sharing an apartment with two close friends, the rent being $1,500 without any amenities. That rent split three ways is $500 each.

Gas I commute twenty minutes every day, and I drop about $20-$25 a week on gas. That’s $100 on gas a month.

Food: I do one big shopping a month with my boyfriend. We drop around $180 and that’s including toiletries and soap and stuff. So maybe you’ll spend about $100 a month on all your shopping needs.

Cable/internet: Hopefully you took my advice and skipped cable. Let’s say you’re paying around $50 per month for internet. Split three ways that’s $17 each.

Laundry: Hopefully you’re not like me and are only spending around $20 on laundry per month.

Random expenses: Because there always are some. Especially when you have cats. Let’s just tack on another $100.

With everything added up, you still have around $290 left before taxes! That money can go into a savings account, and after several months, you’ll have that $500 worth of emergency money saved.

Part Time

Working with the $7.25/hr and 25hr/week model, here’s an example budget for living on minimum wage. That’s $725 without taxes.

Housing: In this case, you need to look for apartments in the $800-900 range. In my area, one bedroom apartments go for around $1000, so you may need to get creative with your roommate (I don’t think you could have more than one roommate in this situation). Buy dividers to split the bedroom or studio in half! Let’s say your rent is $850 with nothing included, that’s $425 each.

Gas You’re still looking at a large gas bill per month, so it may be more inexpensive to ride a bike or use public transportation. Let’s say you use public transportation, and spend around $50 a month on that. Or maybe you and your roommate can split gas expenses and share a car?

Food: Pinch those pennies! Use some of those budget cookbooks I linked above to help you cook healthy and delicious meals for under $4 each. See if you can only spend $80 a month on groceries.

Cable/internet: Hopefully you took my advice and skipped cable. Let’s say you’re paying around $50 per month for internet. Split two ways is $25 each.

Laundry: Hopefully you’re not like me and are only spending around $20 on laundry per month.

Random expenses: Because there always are some. Let’s just tack on another $100.

That leaves you $25 to put in your bank account, if that. This is a paycheck to paycheck situation, and you will probably need to get another source of income to feel secure. But you can still do it!

120 notes

·

View notes

Note

Hello, I'm the anon who's freaking out about being thrown into adulthood, and thank you for your previous help. 1.) How do I mamage/budget a minimum wage salary? 2.) I've never been great with any sort of organization, but would you mind teaching me about home organization and important paper organization?

Okay, so this post will be about budgeting on minimum wage, and later in the day I will also post about paper organization. Enjoy!

Budgeting on Minimum Wage

Overview

The average minimum wage in the US is $7.25/hr. Even working full time at 40 hours a week, that’s only a profit of $290 before taxes. This is not a fair living wage! You are worth way more than this amount! I strongly encourage you to start looking for another job that pays better, look for something around the $10-$15 range.

While $7.25 is atrocious, thousands of people around the world support families on much less. If they can do it while supporting children, so can you! To live off a minimum wage budget you need to declare yourself independent. If your parents are still claiming you as a dependent YOU WILL NOT BE ABLE TO DO THIS. I also recommend that you have the highest amount possible taken out of your taxes so that you get money back from your state at the end of the year, instead of being in debt to them.

What I’ve done is come up with a budgeting plan based off some made up factors and my own personal experience.

Housing

1. City life. Forget about the city! Apartments located in cities can be three times as expensive as apartments in small towns or villages. On top of the extra expense, they’re much smaller and have less amenities included. I’d much rather live in a one bedroom apartment with a dishwasher and a conveniently located Laundromat, than a literal closet with no windows on a fifth floor walkup. Look for apartments twenty minutes to a half hour outside of your closest city. Now you have the close conveniences of a city, with none of those pesky city prices that your budget can’t handle.

2. College towns. Shop around and look at apartments by local colleges. Large colleges with have apartment complexes within walking distance of the school grounds. Landlords know that college students have less money (you might even be a college student yourself) and adjust their prices accordingly. Even apartments next to ivy league schools are priced this way, so don’t be discouraged by the institution’s “prestige”.

3. Locale. Your safety is more important than your bank account. It doesn’t matter if you live in Section 8 housing or in an affluent suburb. Some apartment complexes and neighborhoods are just safer than others. I live in a heavily populated and upper middle class suburb, and the first year I moved in, a drunk woman tried to throw a beer bottle at my car. Thankfully this is the only time this happened to me, but it made me feel unsafe in my environment. Before signing a lease, walk or drive around your prospective home’s neighborhood at night. Take in the atmosphere, and make sure it’s one where you could comfortably run to the local supermarket at 10:30pm and pick up toilet paper.

4. Roommates. Living on minimum wage requires that you find one or two roommates to help split the rent. The more the better! Get together with your more responsible friends, so at least you’re living with people whose company you enjoy. There are lots of “roommate wanted” forums and message boards for you to browse on the internet, but always bring a responsible adult with you before meeting a stranger. Please. Bring your mom if you have too.

Food

1. Low-spoon food. I created this post a few months ago which offers lots of suggestions about cooking and shopping on a budget.

2. Online recipes. Here are some of my favorite online Tumblr cookbook resources.

- College Student Cookbook. Click here.

- Meals On The Go. Click here. (Not a cookbook, but super helpful)

- Broke College Kid Masterpost. Click here.

- Cooking on A Bootstrap. Click here.

- Good and Cheap. Click here.

- Budget Bytes. Click here.

3. I also regularly update my cooking on a budget tag.

Misc Expenses

1. Gas. Shop around and find the cheapest gas in your area. Avoid gas stations next to colleges, highways, and in touristy areas. Look into getting as gas rewards card from your favorite supermarket. I get 10 cents off a gallon with Stop & Shop every time I do a big shop.

2. Dollar store. Get to know your local dollar and bargain stores. You can buy everything from pots and pans to bed sheets there. These stores often sell bulk ramen for $1 and large cans of crushed tomatoes for 75 cents. That’s enough food for you to live off of for several days. When shopping, I make three grocery store stops to ensure that I spend the least amount possible on my pantry needs. I go Dollar Store, Stop and Shop, and then to my local organic grocery store. I’m going to make a list of things that I buy at Dollar Stores and things that I don’t buy at Dollar Stores soon!

3. Cable. We are living in the digital age- you don’t need cable television. Use Netflix or Hulu or whatever. It will save you tons of $$.

4. Internet. As far as internet speed goes, if you’re living with roommates you will probably need a higher speed. Living by yourself, choose a lower one. Most internet companies offer large discounts to new subscribers. These typically only last a year, but will save you serious money. Make sure to take note of when this discount expires, and contact the company before it does. If you don’t, they’ll begin charging you the full amount without notice.

5. Verizon. I just want to take a moment to talk about how much I love Verizon because they have literally saved me so much money in the three years I’ve been with them. After you sign a contract with a new internet company, they charge you a bunch of ridiculous fees like “activation fees” and “installation fees”. I called Verizon and was like “I’m a poor college student, I can’t afford this” and they were like “don’t worry, we’ll waive the fee”. I signed a two year contract with them that saved me $80 on a high-speed internet bill per month (my price being only 50.99 a month). After the contract expired I call them and they put me on a month to month, keeping the price absolutely the same. TLDR- get Verizon if you can.

6. Utility. Get on a monthly budget with whatever utility company services your new apartment. Although it may seem like the cheaper option, paying the actual amount of electricity you spend per month is the more expensive. It’s also unpredictable, and a minimum wage budget won’t allow for it. See this for more info.

7. Amazon. I buy a lot of my beauty, cleaning, and cat products online. Amazon offers Prime shipping free for a year with a student email address, and then offers it at a greatly reduced price after the year. If you are a student, snap up that free deal ASAP. If it’s in your budget, I’d greatly recommend investing in Amazon Prime.

8. Saving money. It’s so important to attempt to break way from the “paycheck to paycheck” vicious cycle. Living this way does not allow for emergency expense money, and trust me, sometime soon you will need emergency expense money. Your cat might get sick or your car may die, whatever it is, it’s always smart to have at least $500 squirreled away. I’m gonna level with you, things have been tight for my budget and I haven’t been able to save anything for the past three months. But this month I will!

Example Budgets

Full Time

Working with the $7.25/hr and 40hr/week model, here’s an example budget for living on minimum wage. That’s $1,160 a month without taxes.

Housing: Let’s say you’re sharing an apartment with two close friends, the rent being $1,500 without any amenities. That rent split three ways is $500 each.

Gas I commute twenty minutes every day, and I drop about $20-$25 a week on gas. That’s $100 on gas a month.

Food: I do one big shopping a month with my boyfriend. We drop around $180 and that’s including toiletries and soap and stuff. So maybe you’ll spend about $100 a month on all your shopping needs.

Cable/internet: Hopefully you took my advice and skipped cable. Let’s say you’re paying around $50 per month for internet. Split three ways that’s $17 each.

Laundry: Hopefully you’re not like me and are only spending around $20 on laundry per month.

Random expenses: Because there always are some. Let’s just tack on another $100.

With everything added up, you still have around $290 left before taxes! That money can go into a savings account, and after several months, you’ll have that $500 worth of emergency money saved.

Part Time

Working with the $7.25/hr and 25hr/week model, here’s an example budget for living on minimum wage. That’s $725 without taxes.

Housing: In this case, you need to look for apartments in the $800-900 range. In my area, one bedroom apartments go for around $1000, so you may need to get creative with your roommate (I don’t think you could have more than one roommate in this situation). Buy dividers to split the bedroom or studio in half! Let’s say your rent is $850 with nothing included, that’s $425 each.

Gas You’re still looking at a large gas bill per month, so it may be more inexpensive to ride a bike or use public transportation. Let’s say you use public transportation, and spend around $50 a month on that. Or maybe you and your roommate can split gas expenses and share a car?

Food: Pinch those pennies! Use some of those budget cookbooks I linked above to help you cook healthy and delicious meals for under $4 each. See if you can only spend $80 a month on groceries.

Cable/internet: Hopefully you took my advice and skipped cable. Let’s say you’re paying around $50 per month for internet. Split two ways is $25 each.

Laundry: Hopefully you’re not like me and are only spending around $20 on laundry per month.

Random expenses: Because there always are some. Let’s just tack on another $100.

That leaves you $25 to put in your bank account, if that. This is a paycheck to paycheck situation, and you will probably need to get another source of income to feel secure. But you can still do it!

#budget#budgeting#how to budget#living on a budget#low spoon#low spoons#college#college student#first apartment#new apartment#small apartment#living alone#apartment living#living on your own#broke#cheap#saving money#minimum wage#minimum wage apartment

5K notes

·

View notes