#insurtech software

Explore tagged Tumblr posts

Text

Reimagine Your Business with Aixtor’s Insurance Portal Solution

Struggling with outdated systems, rising customer demands, or complex compliance needs? We get it — and we’ve built the solution.

At Aixtor, we help insurance companies modernize with: ✅ Customer Self-Service Portals ✅ Agent & Partner Portals ✅ Secure Policy Management ✅ Seamless Claims Processing ✅ Scalable, Future-Ready Architecture

🔒 Boost compliance 💼 Streamline operations 📈 Drive customer satisfaction

Let’s turn your digital challenges into growth opportunities. Read More: https://www.aixtor.com/industry/insurance/

👉 Explore our Insurance Portal Solutions today!

#InsuranceTech#DigitalInsurance#CustomerExperience#InsurTech#PortalSolutions#Aixtor#InsuranceInnovation#DXP#Liferay#customer self service portal#Agent portal#Insurance portal#insurance solutions#insurance software

0 notes

Text

Upgrade Your Insurance Process with a Powerful CRM Solution!

In today's competitive insurance landscape, Insurance CRM software is more essential than ever. Streamline client interactions, manage policies efficiently, and boost sales with Mindzen's cutting-edge Insurance CRM. Whether you’re looking to improve customer satisfaction or drive growth, our solutions are designed to help you succeed.

Learn more: Mindzen Insurance CRM

#InsuranceCRM#CRMSoftware#InsuranceManagement#ClientSuccess#InsuranceIndustry#PolicyManagement#SalesAutomation#CustomerExperience#Mindzen#InsurTech#insurance#insurance agency#insurance broker#employee benefits#employee engagement#insurance brokers#employee health benefits#employee management software#insurance software

0 notes

Text

#commercial insurance#reinsurance software#insurtech#advantagego ecosystem#insurance ecosystem#cyber underwriting solution

0 notes

Text

InsurTech Software Development

Putting a seamless effort into managing policies for insurance will reduce the complexity involving in it. This can be done with the help of Chimera that offers a centralised view and enhances service quality, efficiency and accuracy.

Tap the link to know more: https://www.chimeratechnologies.com/insurance-software-development-solutions

0 notes

Text

From Claims to Profits: Leveraging Technology to Maximize Revenue in Insurance Agencies

Advancements in insurtech have enabled insurance businesses to enhance their revenue generation by improving various aspects of their operations. These improvements encompass streamlined claims processing, more accurate risk assessment, personalized customer experiences, and increased operational efficiency. It enables insurers to improve claims processes and bottom lines. Read the full blog here:

0 notes

Text

Outdated Technology Is No Recipe for Success in Any Insurance Company

The insurance industry is witnessing a profound shift due to changing consumer attitudes and technological advancements. To thrive in this dynamic landscape, insurance companies must replace legacy technology with advanced digital systems. This blog explores: https://www.rdglobalinc.com/outdated-technology-is-no-recipe-for-success-in-any-insurance-company/ the need for digital transformation, its benefits, and the three modernization paths insurers can choose.

Benefits of Digital Transformation:

Digital transformation offers numerous advantages to insurance organizations.

Enhanced Service Provisions and Internal Processes

Faster Customer Service

Efficient Risk Assessment and Product Innovation

Access to Data

Reduced Costs

Insurers with legacy systems have three modernization approaches to choose from:

Modernization Approaches for Insurers:

Insurance companies have three modernization options.

Modernizing Existing Legacy IT Platform

Refactoring legacy systems allows some modernization without complete rebuilding, though it can be complex and costly.

Building a Proprietary IT Platform:

Creating a custom system tailored to the company's needs offers flexibility but may have longer timelines and higher costs.

Acquiring a Standard Software Package:

Opting for standard software systems with readymade functionalities provides quicker implementations and cost-effectiveness.

Conclusion:

Digital transformation is imperative for insurers to thrive in the ever-changing business landscape. By embracing advanced technologies, insurance companies can enhance customer service, target marketing efforts, and reduce costs. Selecting the appropriate modernization approach depends on the company's unique requirements and available resources. RD Global, a software services company, can provide valuable guidance and solutions for insurers undertaking this transformative journey. Contact RD Global today for a comprehensive consultation on your digital transformation requirements.

#rdglobalinc#insurtech#insurance software development company#custom insurance software development#insurance software solutions

0 notes

Text

Intelics Insurance Solutions | Digital Transformation for Insurers

Intelics empowers insurers with digital tools for claims automation, policy issuance, and customer onboarding. Reduce risk and drive faster turnaround with secure, scalable insurance solutions. Discover more: https://tinyurl.com/yc5udrmf nsurance automation, digital insurance solutions, claims processing automation, policy issuance software, digital transformation for insurers, Intelics insurance platform, life insurance workflow tools, health insurance onboarding, general insurance automation, customer onboarding for insurance, insurance compliance management, digital claims system, insurance fraud detection, paperless insurance processing, AI-powered insurance, underwriting automation, insurance renewal management, insurance document digitization, insurance CRM integration, insurance customer service tools, smart insurance systems, cloud-based insurance solutions, insurance workflow efficiency, insurance policy lifecycle management, InsurTech innovations, enterprise insurance technology, secure insurance platforms

#IntelicsInsurance#InsuranceAutomation#DigitalClaims#PolicyIssuance#InsuranceOnboarding#TechForInsurers#SmartInsurance#WorkflowInInsurance#DigitalInsurance#InsuranceCompliance

0 notes

Text

Your Trusted Partner in FinTech App Development Services

In today’s fast-moving digital world, financial software services are evolving faster than ever—and fintech is leading the charge. Whether it's digital banking, peer-to-peer payment systems, or investment platforms, the demand for innovative financial solutions is skyrocketing. That’s where SMT Labs steps in. As a leading fintech software development company, SMT Labs specializes in delivering tailor-made, secure, and scalable financial technology solutions that meet the unique needs of modern businesses.

Why FinTech Matters More Than Ever

The financial sector is no longer about long queues in banks or waiting days for a transaction to process. Today, it’s all about speed, accessibility, personalization, and most importantly, security. That’s why developing fintech apps has become more than just a trend—it’s an essential part of staying competitive in today’s financial landscape. From mobile banking to blockchain-based solutions, fintech is helping businesses offer smarter, faster, and safer services.

And when it comes to creating these solutions, the right partner makes all the difference.

What SMT Labs Brings to the Table

At SMT Labs, we understand the nuances of financial ecosystems. Our team doesn’t just write code—we craft digital experiences that are intuitive, powerful, and future-ready. Here’s what sets our financial software development services apart:

1. Custom FinTech Solutions Tailored to Your Business

Every financial service is unique, and so are its challenges. We don’t believe in one-size-fits-all. Our experts work closely with you to understand your business goals and build solutions that are tailored for your audience and market. Whether you’re a startup launching a new product or an established enterprise looking to modernize, SMT Labs has your back.

2. Security Comes First

In fintech, trust is everything. That’s why our fintech software development services put security at the forefront. From end-to-end encryption to compliance with global financial regulations like GDPR, PCI-DSS, and PSD2, we ensure your platform is safe and reliable.

3. Scalable Architecture for Growing Demands

We build with growth in mind. Our architecture is designed to handle everything from a handful of users to millions of daily transactions. So, as your business grows, your platform scales smoothly without performance hiccups.

4. Expertise Across the Financial Spectrum

As a full-fledged financial software development company, SMT Labs delivers a wide range of solutions including:

Mobile banking apps

Digital wallets

Payment gateway integration

Investment and wealth management tools

Loan origination and management systems

InsurTech platforms

Blockchain and crypto-based solutions

5. User-Centric Design and Seamless UX

Even the most powerful tech won’t matter if users find it hard to navigate. Our UI/UX designers focus on creating user-friendly interfaces that your customers will love using—again and again.

Why Choose SMT Labs as Your FinTech App Development Company?

Choosing SMT Labs means choosing innovation, reliability, and excellence. With a proven track record of successful fintech projects, our team of seasoned developers, designers, and financial tech experts are here to bring your vision to life.

We use the latest technologies, including AI, machine learning, blockchain, and cloud computing, to develop intelligent platforms that not only meet industry standards but push the boundaries of what's possible.

From ideation to post-launch support, we handle every stage of the development lifecycle so you can focus on what you do best—growing your business.

Get in Touch with SMT Labs

Ready to bring your fintech idea to life? Or maybe you want to upgrade your existing financial platform? SMT Labs is here to help.

Contact SMT Labs today to discuss your project requirements, timelines, and how we can transform your vision into a robust fintech solution that drives results.

You can reach out to us directly via our contact form

Whether you need a secure payment app, a smart investment platform, or a fully-integrated banking system, SMT Labs is your go-to partner for all things fintech.

Experience the future of finance—built with SMT Labs.

Get more information: https://smtlabs.io/

#fintech app development#fintechinnovation#fintech#fintech app development company#fintech app development services#fintechtrends#mobile app development

0 notes

Text

How Insurtechs Are Strengthening Core Software with Advanced Cybersecurity Measures

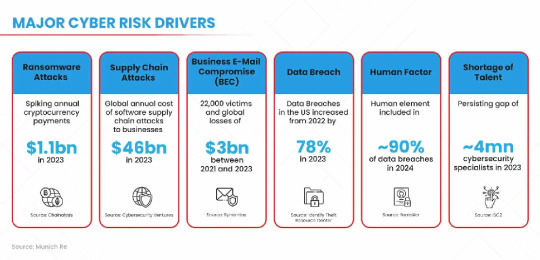

As cyber threats continue to evolve in complexity, securing sensitive customer information has become a top priority, particularly within the core software systems that drive the insurance industry. Insurers are enhancing their cybersecurity efforts, and it’s fascinating to see how they are approaching this critical challenge.

Many insurtech companies are leading this transformation by incorporating state-of-the-art technologies, such as AI-powered threat detection systems soc security operations center, into their platforms. Instead of merely reacting to cyberattacks, these companies are taking proactive steps to identify and mitigate risks before they escalate into significant issues.

The Growing Need for Cybersecurity in Insurance

Property & Casualty (P&C) insurance companies are sitting on a wealth of sensitive personal and financial data, making them prime targets for cybercriminals. As insurers embrace technologies like cloud computing, artificial intelligence (AI), and the Internet of Things (IoT) to streamline operations, they gain substantial efficiencies—but also open themselves to new vulnerabilities.

For insurers, investing in cybersecurity isn’t just about avoiding regulatory penalties. In today's increasingly hostile digital environment, robust cybersecurity is essential for long-term survival.

To underscore this point, let’s take a look at a real-world example that rattled the insurance sector: the 2020 data breach at Folksam, one of Sweden’s largest insurance providers. This incident served as a major wake-up call for the industry. Folksam unintentionally leaked sensitive data for around one million customers, not due to an external cyberattack, but because of an internal oversight. In an attempt to analyze customer behavior and provide more personalized services, the company shared private customer information with tech giants such as Facebook, Google, Microsoft, LinkedIn, and Adobe.

While Folksam stated there was no evidence of misuse by these third parties, the breach raised serious concerns among customers and regulators alike. It demonstrated that even well-intentioned actions could lead to significant security failures if proper safeguards are not in place.

Core Platform Security: A Critical Priority

Your core platform—the system responsible for policy management, claims processing, billing, and customer relations—is the backbone of your insurance business. But it also becomes a prime target for cyberattacks if not adequately protected.

AI: The Ultimate Security Co-Pilot

Leading insurers are increasingly integrating AI-powered soc security operations center “co-pilots” into their core platforms. These AI-driven systems analyze vast amounts of data to:

Detect Anomalies: Machine learning algorithms can identify unusual patterns in claims, underwriting, or policy modifications that may indicate fraudulent activity or a security breach. For instance, an unexpected increase in claims from a particular region or a sudden surge in requests to modify policy details could signal potential fraud.

Automate Incident Response: Once a threat is detected, AI can automatically isolate compromised systems, preventing the breach from spreading. This might involve shutting down affected servers or disabling user accounts to contain the damage.

Predict Attack Vectors: By analyzing data from threat intelligence feeds and the dark web, AI can help insurers anticipate and defend against future attacks. This might include identifying emerging malware strains or pinpointing vulnerabilities in third-party software.

Take Zurich Insurance, for example. Their AI models soc security operations center successfully identified and stopped a credential-stuffing attack targeting their Asian SME clients, blocking thousands of fraudulent login attempts within hours. This kind of rapid response is only achievable when AI is deeply embedded in the core platform.

0 notes

Text

Insurance IT Consultant Cost Breakdown to Hire

Learn about the cost breakdown when hiring an IT consultant for insurance. Understand fees, services, and how to manage your insurance IT consultant cost.

#insurance it services#insurance technology services#insurance engineering services#insurance it solutions#Insurtech services#insurtech advisors#insurtech solutions#insurtech companies#insurtech company#insurtech development services#insurtech companies in india#insurtech consulting#insurtech software companies#hire insurtech developers#insurtech software development services#insurtech software#insurance software development#insurance software development company#insurance software development services#custom insurance software development#software development insurance#insurance mobile app development#insurance application development#insurance app development

0 notes

Text

Bolttech Improves Customer Experience with AWS Generative AI

Bolttech

Bolttech powers hyper-personalized customer services with AWS generative AI.

Bolttech, a Singapore-based insurtech company, said today that it is integrating Amazon Web Services (AWS) Gen AI technology into its internal and customer operations. The project aims to cut costs, boost efficiency, and personalise client experiences.

Bolttech GenAI Factory, a Gen AI platform using Amazon Bedrock, serves millions of users in 37 countries on four continents. Bolttech's Amazon Connect-powered omni-channel customer experience solution will benefit from this platform. Bolttech's internal teams will use the GenAI Factory to develop and deploy Gen AI apps in addition to customer interactions.

As a first GenAI Factory application, Bolttech's chatbots have advanced speech-to-speech capabilities. This connection is meant to promote natural multilingual customer conversations. This is tested in Korean first. The service provides tailored, real-time insurance policy replies in local languages. It can answer simple to complex enquiries with practically rapid responses. Human agents can focus on higher-value interactions by automating monotonous tasks like claims processing with the software. This should improve operational efficiency and Bolttech's international customer service.

“At Bolttech, it remains steadfast in the vision to connect people with more ways to protect the things they value,” stated Philip Weiner, Asia CEO, concerning the cooperation. The right data and AI infrastructure are needed to achieve this ambition, he said. Weiner claims that AWS's cloud computing and Gen AI services, such as Amazon Bedrock, provide the framework for accessing a variety of model options, excellent price-performance ratios, and strong enterprise trust and safety features that Bolttech needs.

Weiner stressed that having many AI models, like Amazon Nova, encourages speedy innovation to improve consumer experiences. Agentic AI can deliver near-human AI interactions, real-time policy explanations, and quick claims processing. His conclusion was that this relationship allows Bolttech to provide its partners and clients more options and cutting-edge security solutions.

The Bolttech GenAI Factory drives enterprise-wide innovation beyond call centre augmentation and claims settlement. It lets internal teams build and deploy Gen AI apps. These apps encompass product design, customer assistance, underwriting, and claims processing along the insurance value chain.

Bolttech will use AWS's infrastructure to improve its client product offerings' prediction, prevention, and recovery with AI.

AI is used to improve risk assessment and deliver personalised insurance products like real-time vehicle insurance price changes based on driving behaviour prediction.

AI-driven early warning systems for cyberattacks, natural disasters, and other threats are the core goal of prevention. Policyholders can prevent losses by adopting precautions.

Recovery entails using AI-powered chatbots and virtual assistants to accelerate up claims processing and help policyholders immediately after an occurrence.

These changes should lower loss ratios over time and provide speedy, complete recovery and remediation after inevitable loss events.

According to Priscilla Chong, Country Manager, AWS Singapore, the Southeast Asian insurance business is using generative AI and new cloud technologies to make asset protection simpler, more accessible, and cheaper. She noted Bolttech, which uses generative AI to improve client experiences, operational efficiency, and global insurance service innovation. Chong said AWS is pleased to cooperate with Bolttech and that AWS's model-neutral, choice-based philosophy gives AI-first clients AI-powered ease.

Bolttech also uses AWS to accelerate time to market and simplify software development. According to sources, Amazon Q Developer experimental use cases have benefits. Bolttech saved over 50% of development time by updating code documentation files. Amazon Q Developers learnt codebases faster.

It quickly analyses large file sets and returns low-level details and high-level intents, speeding learning. Amazon Q Developer works well with Bolttech's main programming languages, Python and JavaScript, making it suitable for data scientists and backend and frontend developers. This avoids key distractions and lets Bolttech developers code and multitask.

As noted in previous updates, Bolttech's extensive usage of AWS Gen AI capabilities enables its international expansion and strategic relationships. Bolttech prioritises AI-driven customisation, efficiency, and product innovation to improve its platform and protective product delivery.

#Bolttech#GenAI#generativeAI#GenAIFactory#GenAIplatform#AWSGenAI#AmazonQDeveloper#GenAIservices#technology#technews#technologynews#news#govindhtech

0 notes

Text

Insurtech Market Size, Share, Analysis, Forecast, and Growth Trends to 2032: A Decade of Smart Insurance Evolution

Insurtech Market was worth USD 8.24 billion in 2023 and is predicted to be worth USD 378.08 billion by 2032, growing at a CAGR of 53.03 % between 2024 and 2032.

Insurtech Market is rapidly reshaping the insurance landscape across the USA, driven by the need for agility, automation, and improved customer engagement. Startups and legacy insurers alike are leveraging AI, machine learning, big data, and blockchain to reimagine policy delivery, pricing models, and claims processing—delivering faster, smarter, and more personalized insurance experiences.

Reconciliation Software Market in the U.S. Poised for Growth Amid Rising Demand for Financial Accuracy

Insurtech Market is evolving as consumer demand pushes the boundaries of traditional services. From instant digital onboarding to AI-powered underwriting, technology is enabling insurers to cut costs, reduce fraud, and offer tailored solutions. The U.S. market, with its tech-savvy population and investor backing, remains at the forefront of this disruption.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/2800

Market Keyplayers:

Damco Group

DXC Technology Company

Insurance Technology Services

Majesco

Oscar Insurance

Quantemplate

Shift Technology

Policy Bazaar

Wipro Limited

Clover Health Insurance

ZhongAn Insurance

Acko General Insurance Limited

Market Analysis

The U.S. Insurtech Market is fueled by a convergence of digital transformation and shifting customer expectations. Traditional insurers are partnering with or acquiring insurtech firms to modernize their operations, while startups continue to attract funding by targeting niche segments with innovative solutions. Regulatory environments are adapting, further supporting agile development and faster time-to-market.

The adoption of cloud platforms, API ecosystems, and mobile-first strategies is enabling greater flexibility and scale. Customers increasingly expect seamless, real-time interactions—mirroring trends from fintech and e-commerce sectors—prompting insurers to invest in digital tools that deliver convenience and trust.

Market Trends

Surge in usage-based and on-demand insurance models

AI-driven underwriting and chatbot-based customer service

Blockchain adoption for secure and transparent transactions

Advanced analytics for risk scoring and fraud prevention

Rise of digital-only insurers and self-service portals

Expansion of embedded insurance within e-commerce platforms

Personalized policy offerings using behavioral data

Market Scope

The Insurtech Market is gaining vast ground across both consumer and commercial segments. With growing digital literacy and demand for instant solutions, insurtech is no longer a niche—it’s the new standard.

Seamless digital onboarding

Custom coverage plans based on real-time data

Telematics and wearable-based insurance products

Scalable platforms for small and mid-sized insurers

Cross-platform mobile apps with integrated services

API-enabled ecosystem for third-party innovation

Forecast Outlook

The future of the Insurtech Market in the USA looks transformative, with continued emphasis on user experience, automation, and intelligent systems. As traditional barriers collapse, technology will drive deeper integration across the insurance value chain—from risk assessment to claim payout. The market is expected to foster a culture of continuous innovation, marked by rapid experimentation, strong VC support, and increasing regulatory clarity. The next wave of growth will likely be led by platforms that combine personalization, security, and speed at scale.

Access Complete Report: https://www.snsinsider.com/reports/insurtech-market-2800

Conclusion

The Insurtech Market is not just revolutionizing how insurance works—it's redefining what consumers expect. Across the U.S., tech-enabled insurers are unlocking faster claims, smarter coverage, and stronger customer loyalty.

Related Reports:

Reconciliation Software Market in the U.S. Poised for Growth Amid Rising Demand for Financial Accuracy

U.S. Enterprises Drive Innovation in Team Collaboration Software: Market Trends & Forecasts 2025–2030

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

0 notes

Text

Revolutionizing Insurance with Retail POS Insurance Broker Management Software

Discover how Retail POS Insurance Broker Management Software is transforming the insurance industry in India. This cutting-edge solution enables brokers to streamline policy sales, manage claims efficiently, and offer personalized customer experiences. From real-time policy management to better compliance handling, it's driving the digital revolution for brokers.

Explore the full potential of this innovative software and how it’s empowering insurance professionals to deliver enhanced services to their clients. Learn more here: How Retail POS Insurance Broker Management Software is Revolutionizing the Insurance Industry in India

#InsuranceTechnology#InsuranceSoftware#POSP#IndiaInsurance#BrokerManagement#Mindzen#DigitalInsurance#InsurTech#InsuranceBrokers#POSInsurance#InsuranceSolutions#InsuranceManagement#CustomerExperience#PolicyManagement#TechInInsurance#insurancecrm#insurance#insurance agency#insurance broker#employee benefits#employee engagement#insurance brokers#employee health benefits#employee management software#insurance software

0 notes

Text

#commercial insurance#insurance solutions#insurance software#underwritingsoftware#insurance news#insurance#reinsurance#reinsurance software#insurtech#insurance coverage#advantagego ecosystem

0 notes

Text

Insurtech Recruiting | Find Top Insurance & Tech Talent

Hire top insurtech talent with specialized recruiting. We help companies build teams in insurance technology, underwriting, claims, product, and software development.

0 notes