#international finance assignment help service

Text

Unlocking Success with International Finance Assignment Help

Celebrating one year of academic triumphs with FinanceAssignmentHelp.com and their exceptional international finance assignment help! As a student navigating the intricate world of international finance, I stumbled upon this academic haven when the challenges seemed insurmountable. Today, on my one-year anniversary with their services, I can't help but reflect on how they have been instrumental in shaping my academic journey.

How FinanceAssignmentHelp.com Helped Me:

International finance is a labyrinth of concepts, theories, and practical applications. Navigating through the complexities of exchange rates, capital flows, and risk management can be daunting for even the most dedicated students. That's where FinanceAssignmentHelp.com stepped in to illuminate the path to success.

This online platform offers unparalleled international finance assignment help, providing customized solutions tailored to individual needs. Whether it's understanding the intricacies of foreign exchange markets or deciphering the nuances of global investment strategies, their team of experts has consistently delivered top-notch assistance.

Why I Needed This Service:

The realm of international finance demands a comprehensive understanding of economic principles, market dynamics, and geopolitical factors. As a student with a fervent desire to excel, I found myself grappling with the intricate details of my international finance assignments. The need for clarity and expert guidance became evident, and that's when I turned to FinanceAssignmentHelp.com.

This service became my academic anchor, offering a lifeline when the waters of financial theories seemed too turbulent. Their team not only possesses profound knowledge of international finance but also has a knack for simplifying complex concepts, making them accessible to students at any level.

How to Find This Service:

Discovering FinanceAssignmentHelp.com was a game-changer for me, and it's a journey that began with a simple online search. The website's user-friendly interface and transparent approach stood out immediately. Navigating through their services, I found a dedicated section for international finance assignment help, complete with testimonials from satisfied students.

The process of finding this service is straightforward. A quick search using keywords like "international finance assignment help" led me straight to their website. The clear layout and detailed information about their services instilled confidence from the start. It's evident that they understand the unique challenges students face in international finance courses and are committed to providing targeted assistance.

Steps to Submitting Assignments and Receiving Solutions:

One of the aspects that sets FinanceAssignmentHelp.com apart is the seamless process they've established for submitting assignments and receiving solutions. The user-friendly interface ensures that even those new to online academic assistance can navigate the process effortlessly.

Place an Order:

Start by placing an order on their website, specifying the details of your international finance assignment. This includes the topic, deadline, and any specific requirements provided by your instructor.

Receive a Quote:

Shortly after submitting your order, you'll receive a quote outlining the cost of the service. The transparent pricing model ensures that you know exactly what to expect, with no hidden fees.

Make Payment:

Once you approve the quote, proceed to make the payment securely through their platform. Multiple payment options are available for convenience.

Work Commences:

The moment your payment is processed, their team of experts starts working on your international finance assignment. Regular updates and communication ensure that you're in the loop throughout the process.

Review and Feedback:

Before the final solution is delivered, you have the opportunity to review the work and provide feedback. This collaborative approach ensures that the solution aligns with your expectations.

Receive the Solution:

Once the assignment is finalized and reviewed, you'll receive the solution promptly. The comprehensive and well-explained answers serve as a valuable learning resource, enhancing your understanding of international finance concepts.

Conclusion:

As I celebrate one year of academic excellence with FinanceAssignmentHelp.com, I can confidently say that their international finance assignment help has been a cornerstone of my success. The journey from grappling with complex concepts to mastering the intricacies of international finance has been transformative, thanks to their unwavering support.

For any student navigating the challenging waters of international finance, I wholeheartedly recommend FinanceAssignmentHelp.com. Their commitment to academic excellence, transparent processes, and a team of knowledgeable experts make them the go-to destination for those seeking not just answers, but a profound understanding of international finance. Here's to many more years of partnership and continued success!

#International Finance Assignment Help#Help With International Finance Assignment#Online International Finance Assignment Help#International Finance Assignment Help Service

10 notes

·

View notes

Text

GAAP vs IFRS

Decoding US Accounting Rules: GAAP vs IFRS | Expert Insights in 2024

Navigate the GAAP vs IFRS debate in US Accounting effortlessly. Gain expert insights, make sense of regulations. Your guide to financial clarity.

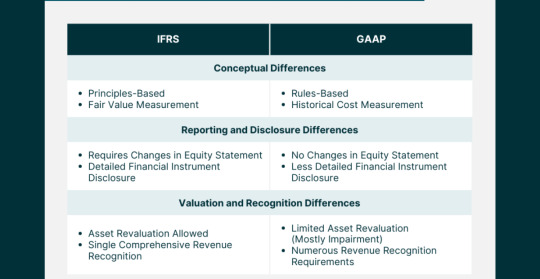

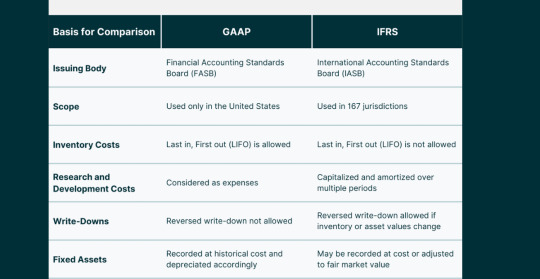

The evolving landscape of accounting standards unfolds a nuanced debate between the Generally Accepted Accounting Principles and the International Financial Reporting Standards. These two frameworks, while sharing a common goal of transparent financial reporting, diverge in their approaches, giving rise to a multifaceted discourse with far-reaching implications for the financial world.

1. Introduction

The evolution of accounting standards has witnessed the crystallization of two dominant frameworks – General Accounting Accepted Principles and International Financial Reporting Standards. In the labyrinth of financial reporting, companies grapple with choosing between these standards, each with its unique history, principles, and global relevance. The debate surrounding GAAP vs IFRS is not a mere academic exercise but a pivotal consideration with implications for investment decisions, legal compliance, and the global financial landscape.

1.1. Evolution of Accounting Standards

The journey of accounting standards traces back to the aftermath of the 1929 stock market crash when the need for standardized, transparent financial reporting became glaringly apparent. What emerged were the General Accounting Accepted Principles, designed to restore investor confidence by providing a reliable framework for financial statements. Over time, GAAP has become deeply embedded in the U.S. financial system, shaping the way companies communicate their financial health.

On the global stage, the International Financial Reporting Standards evolved as a response to the growing interconnectedness of economies. The International Accounting Standards Board (IASB) took the reins in developing IFRS, aiming for a standardized global language of financial reporting. This set the stage for a two-pronged approach to financial reporting standards – General Accounting Accepted Principles dominating in the U.S. and International Financial Reporting Standards gaining traction internationally.

1.2. The Crucial Role of GAAP and IFRS

GAAP stands as the bedrock of accounting standards in the United States, overseen by the Financial Accounting Standards Board (FASB). Its principles, rooted in historical cost, revenue recognition, and matching, provide stability and a familiar structure for U.S. businesses. On the other hand, IFRS, under the stewardship of the IASB, operates as a global player, emphasizing fair value, substance over form, and materiality.

The significance of General Accounting Accepted Principles lies in its historical context and its alignment with the unique needs of the U.S. business environment. Its principles have served as a guiding light for American companies, offering a consistent framework for financial reporting. International Financial Reporting Standards, with its global perspective, caters to the interconnectedness of today’s businesses, providing a common language for multinational corporations.

1.3. Navigating the GAAP vs IFRS Dilemma

The choice between General Accounting Accepted Principles and International Financial Reporting Standards is not a one-size-fits-all decision. Companies grapple with a complex decision-making process, considering factors such as their geographical reach, industry nuances, and investor preferences. This debate is not isolated to boardrooms; it resonates in financial markets, legal proceedings, and regulatory landscapes, shaping the very fabric of financial reporting practices.

2. Understanding GAAP

2.1. The Foundation of GAAP

a. Historical Roots and Evolution

GAAP’s roots delve deep into the need for a standardized accounting framework post the 1929 stock market crash. FASB emerged as a response to the chaos that ensued, charged with the responsibility of establishing and improving financial accounting and reporting standards. The journey of GAAP has been one of continuous evolution, adapting to the changing business landscape and regulatory requirements.

b. FASB’s Ongoing Influence

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, playing a pivotal role in setting and refining accounting standards. FASB’s mission goes beyond rule-making; it seeks to improve financial reporting, providing transparency and relevance in financial statements. The ongoing influence of FASB ensures that GAAP remains adaptive and responsive to the dynamic nature of business transactions.

2.2. Core Principles Anchoring GAAP

a. Embracing the Historical Cost Principle

One of the cornerstones of GAAP is the historical cost principle, dictating that assets should be recorded at their original cost. This principle provides stability and reliability in financial statements, allowing users to assess the financial health of a company based on the actual cost of its assets at the time of acquisition. While critics argue that this approach may not reflect current market values, proponents emphasize the prudence and consistency it offers.

b. Revenue Recognition as a Cornerstone

GAAP’s approach to revenue recognition centers on the realization and earned criteria. Revenue is recognized when it is realized or realizable and earned. This conservative approach ensures that revenue is not prematurely recognized, aligning with the matching principle. While this method may defer recognizing revenue until later stages in the sales cycle, it safeguards against potential overstatement and presents a cautious picture to investors.

c. The Significance of the Matching Principle

The matching principle is a guiding force in GAAP, emphasizing the alignment of expenses with the revenue they generate. This principle ensures that the costs associated with generating revenue are recognized in the same period as the revenue itself, presenting a more accurate portrayal of a company’s profitability. While adhering to the matching principle might result in lower reported profits during high-revenue periods, it provides a more realistic long-term view.

2.3. Scrutinizing Criticisms and Recognizing Limitations

a. Rigidity vs. Stability

One common criticism leveled against GAAP is its perceived rigidity, particularly regarding the historical cost principle. Critics argue that this approach may not capture the true economic value of assets, especially in industries with rapidly changing market conditions. However, proponents assert that this rigidity provides stability and consistency, allowing for easier comparison across periods and industries.

b. The Balancing Act of Revenue Recognition

The conservative approach to revenue recognition in GAAP has faced scrutiny for potentially understating a company’s immediate financial performance. Critics argue that this caution may not be reflective of a company’s true economic position, especially in industries where revenue realization is instantaneous. However, the balancing act lies in mitigating the risk of premature revenue recognition, ensuring financial statements maintain integrity and accuracy.

c. Challenges in Adhering to the Matching Principle

While the matching principle aligns expenses with revenue, critics contend that it introduces complexities in determining the direct association between costs and specific revenue streams. This challenge becomes more pronounced in industries with diverse revenue sources. Despite these challenges, adhering to the matching principle remains integral in presenting a holistic view of a company’s financial health, helping investors make informed decisions.

3. Embracing IFRS

3.1. IFRS: A Global Framework

a. The Rise of International Financial Reporting Standards

The emergence of IFRS marks a significant shift towards a globalized approach to financial reporting. As businesses expanded internationally, the need for a common accounting language became evident. IFRS, under the stewardship of the International Accounting Standards Board (IASB), rose to prominence as a framework that transcends borders, providing a standardized set of principles for companies operating on the world stage.

b. IASB’s Pivotal Role in Shaping IFRS

The International Accounting Standards Board (IASB) shoulders the responsibility of developing and maintaining IFRS. Unlike GAAP, IFRS operates under a principles-based approach, focusing on broad principles rather than detailed rules. This flexibility allows for easier adaptation to diverse business environments, making IFRS an attractive choice for multinational corporations seeking a harmonized approach to financial reporting.

3.2. Unpacking Core Principles of IFRS

a. Fair Value Measurement: A Paradigm Shift

One of the fundamental differences between GAAP and IFRS lies in the approach to asset valuation. While GAAP predominantly adheres to the historical cost principle, IFRS leans towards fair value measurement. Fair value reflects the current market value of assets, providing a more dynamic and responsive perspective. Critics argue that fair value introduces volatility, but proponents emphasize its relevance in capturing real-time economic conditions.

b. Substance Over Form: Emphasizing Economic Reality

In IFRS, the substance of transactions takes precedence over their legal form. This principle ensures that financial statements reflect the economic reality of transactions, promoting transparency and accuracy. While this approach aligns with the overarching goal of providing relevant information to users, it requires careful judgment and interpretation, potentially introducing subjectivity in financial reporting.

c. Materiality’s Role in Flexibility

IFRS introduces greater flexibility in materiality judgments compared to GAAP. Materiality refers to the threshold at which information becomes relevant to users. The more flexible stance in IFRS allows entities to exercise judgment in determining what information is material, considering both quantitative and qualitative factors. This flexibility, while enhancing the adaptability of IFRS, also raises concerns about potential inconsistencies in financial reporting.

3.3. Weighing Advantages and Drawbacks

a. IFRS Flexibility: A Double-Edged Sword

The flexibility embedded in IFRS is both its strength and weakness. Proponents argue that this adaptability makes IFRS suitable for diverse business environments, allowing for easier integration with various industries and legal systems. However, critics contend that this very flexibility can lead to inconsistencies and a lack of comparability, challenging the reliability of financial statements for investors and stakeholders.

b. Global Appeal vs. Application Challenges

The global nature of IFRS makes it an attractive choice for multinational companies aiming for consistency in financial reporting across borders. The common language of IFRS facilitates international transactions and fosters a seamless global financial landscape. However, the application of IFRS can pose challenges in jurisdictions with varying legal and regulatory frameworks, potentially leading to complexities in implementation and interpretation.

4. Key Differences Between GAAP and IFRS

4.1. Delving into Variances

a. Revenue Recognition: The GAAP-IFRS Divergence

One of the pivotal differences between GAAP and IFRS lies in the recognition of revenue. While both frameworks aim to depict the economic reality of transactions, their approaches diverge in certain key aspects. GAAP tends to be more prescriptive, providing specific guidelines for various industries, whereas IFRS adopts a broader principles-based approach, allowing entities more room for interpretation.

b. Inventory Valuation: Differing Approaches

The treatment of inventory valuation varies significantly between GAAP and IFRS. GAAP typically follows a specific set of rules for valuing inventory, such as the Last In, First Out (LIFO) or First In, First Out (FIFO) methods. In contrast, IFRS permits the use of various methods, including FIFO and weighted average, offering companies more flexibility in choosing an approach that aligns with their specific business dynamics

c. Consolidation Methods: Navigating Complexity

Consolidation methods, particularly in the context of subsidiaries and investments, showcase differences between GAAP and IFRS. GAAP often employs a more rule-based approach, specifying conditions for consolidation. In contrast, IFRS focuses on a principles-based approach, considering the substance of relationships rather than relying on rigid criteria. This variance introduces nuances in financial reporting, influencing how companies present their financial position and performance.

4.2. The Impact on Financial Statements

a. Shaping Investor Perception

The differences in revenue recognition, inventory valuation, and consolidation methods contribute to variations in financial statements produced under GAAP and IFRS. Investors, as key stakeholders, must navigate these differences to gain an accurate understanding of a company’s financial health. The choice between GAAP and IFRS significantly shapes investor perception, influencing investment decisions and risk assessments.

b. Decision-Making Dynamics

Companies, in choosing between GAAP and IFRS, must consider the implications on decision-making dynamics. The framework adopted affects how financial information is presented, potentially influencing strategic decisions, mergers and acquisitions, and capital-raising activities. Understanding the impact of these frameworks on decision-making is crucial for entities operating in dynamic and competitive business environments.

4.3. Global Adoption Trends: A Comparative Analysis

The adoption trends of GAAP and IFRS provide insights into the global dynamics of financial reporting standards. While GAAP maintains dominance within the United States, IFRS has gained traction in numerous jurisdictions worldwide. Understanding the factors influencing these trends, such as regulatory requirements, investor preferences, and global market integration, sheds light on the evolving landscape of accounting standards.

“Accounting isn’t just about profits and losses; it’s about sculpting the financial soul of a company.” Michael Johnson

5. The Evolution of Accounting Standards

5.1. GAAP’s Historical Odyssey

a. Post-1929: A Catalyst for Change

The stock market crash of 1929 served as a catalyst for rethinking the approach to financial reporting. The chaos that ensued prompted the establishment of standardized accounting principles, laying the foundation for what would later become GAAP. The primary goal was to restore investor confidence by providing a reliable framework for financial statements, reducing uncertainty and fostering stability in financial markets.

b. Amendments and Updates: Shaping GAAP’s Trajectory

GAAP’s journey has not been static; it has evolved through amendments and updates to address emerging challenges and align with changing business dynamics. The Financial Accounting Standards Board (FASB) plays a pivotal role in shaping GAAP, ensuring that it remains relevant, transparent, and responsive to the needs of companies and investors. The ongoing commitment to refinement reflects a dedication to maintaining the integrity of financial reporting.

5.2. Internationalization Efforts

a. Pioneering Attempts at Global Standardization

As globalization gained momentum, so did the recognition of the need for global accounting standards. Efforts were made to align U.S. GAAP with international standards, but achieving a universal standard proved challenging. The push for global standardization gained traction with the rise of IFRS, offering a framework that transcends national boundaries and facilitates consistency in financial reporting for multinational corporations.

b. The Challenge of Aligning U.S. Standards Globally

While the concept of global accounting standards gained support, aligning U.S. GAAP with international standards presented formidable challenges. The unique legal, regulatory, and cultural landscape in the United States posed hurdles to seamless integration. Despite these challenges, the pursuit of convergence and harmonization continued, reflecting the recognition of the interconnectedness of global economies.

5.3. Convergence Initiatives

a. The Ongoing Pursuit of Harmonization

Convergence initiatives aimed at harmonizing GAAP and IFRS gained prominence in the early 21st century. The objective was to reduce disparities between the two frameworks, fostering a more standardized global approach to financial reporting. While full convergence remained elusive, progress was made in aligning specific standards, reflecting a commitment to minimizing inconsistencies and facilitating ease of comparison for investors and stakeholders.

b. Prospects and Hurdles in a Unified Global Standard

The prospects of a unified global accounting standard remain a tantalizing goal, promising enhanced comparability and consistency in financial reporting. However, hurdles such as divergent national interests, legal complexities, and varying levels of standard-setting infrastructure continue to challenge the realization of this vision. Navigating these obstacles requires ongoing collaboration and a commitment to the overarching goal of global financial transparency.

6. Regulatory Bodies Influencing GAAP

6.1. FASB’s Pivotal Role

a. GAAP’s Guardian: The FASB Mandate

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, wielding influence over the development and refinement of accounting standards. FASB’s mandate goes beyond rule-making; it encompasses a commitment to improving financial reporting, ensuring that standards are not only relevant but also responsive to the evolving needs of businesses and investors.

b. FASB’s Mission in Financial Reporting Improvement

FASB’s mission revolves around the improvement of financial reporting through the development of high-quality accounting standards. The board operates under a due process system, seeking input from various stakeholders, including investors, auditors, and preparers of financial statements. This collaborative approach ensures that GAAP remains a robust and adaptive framework that reflects the intricacies of modern business transactions.

6.2. SEC’s Watchful Eye

a. SEC’s Authority in Recognizing GAAP Standards

The Securities and Exchange Commission (SEC) plays a crucial role in the oversight of financial reporting in the United States. While the FASB sets accounting standards, the SEC has the authority to recognize and prescribe the principles used in the preparation of financial statements for publicly traded companies. This dual-layered system ensures a balance between industry expertise and regulatory oversight in shaping GAAP.

b. SEC’s Contributions to Financial Transparency

The SEC’s contributions to financial transparency extend beyond its recognition of GAAP standards. The commission actively engages in rule-making and enforcement to ensure that companies adhere to accounting principles and provide accurate and timely financial information to investors. The synergy between the SEC and FASB reinforces the integrity of financial reporting in the U.S. capital markets.

6.3. AICPA’s Industry Impact

a. AICPA: Nurturing Professional Standards

The American Institute of Certified Public Accountants (AICPA) plays a vital role in shaping professional standards within the accounting industry. While not directly involved in setting GAAP, the AICPA contributes to the development of ethical and professional standards that guide the conduct of accountants. This commitment to excellence enhances the credibility of financial reporting, reinforcing the trust that stakeholders place in GAAP.

b. Industry-Wide Compliance through AICPA Guidance

The AICPA’s influence extends beyond standards development to encompass industry-wide compliance. The organization provides guidance on best practices, ethical considerations, and emerging issues within the accounting profession. This guidance ensures a cohesive and ethical approach to financial reporting, aligning with the principles embedded in GAAP and contributing to the overall reliability of financial statements.

7. International Bodies Shaping IFRS

7.1. IASB’s Global Mandate

a. IASB’s Significance in IFRS Development

The International Accounting Standards Board (IASB) holds a central role in the development and maintenance of IFRS. Unlike the FASB’s role in the U.S., the IASB operates on a global scale, aiming to set accounting standards that are applicable and relevant to entities worldwide. The IASB’s commitment to a principles-based approach reflects its recognition of the diverse needs of global businesses.

b. A Global Perspective in Standard Setting

The IASB’s global perspective is intrinsic to its standard-setting process. The board considers input from various regions, industries, and stakeholders, ensuring that IFRS reflects the nuances of international business. The principles-based approach allows for adaptability, catering to the diverse legal, economic, and cultural landscapes in which entities operate globally.

7.2. IFRIC’s Interpretative Role

a. Navigating Grey Areas: IFRIC’s Guidance

The International Financial Reporting Interpretations Committee (IFRIC) plays a crucial role in navigating interpretative challenges within IFRS. Given the principles-based nature of IFRS, grey areas may arise, requiring clarification and guidance. IFRIC addresses these challenges by providing interpretations and guidance, ensuring consistent application of IFRS standards across diverse industries and jurisdictions.

b. Consistent Application of IFRS Standards

Consistency in the application of IFRS standards is paramount to ensuring comparability and reliability in financial reporting. IFRIC’s interpretative role contributes to this objective by offering guidance on ambiguous or complex issues. This commitment to clarity and consistency aligns with the overarching goal of IFRS – to provide a common language for financial reporting that transcends geographical and industry-specific boundaries.

7.3. Monitoring Board’s Oversight

a. Ensuring Independence in Standard Setting

The Monitoring Board plays a crucial oversight role in ensuring the independence and effectiveness of the IFRS Foundation, which houses the IASB. Independence is a cornerstone of credible standard-setting, and the Monitoring Board’s role is to safeguard the integrity of the standard-setting process. This commitment to independence reinforces the trust that global stakeholders place in IFRS as a reliable and unbiased framework.

b. The Role of the Monitoring Board in IFRS Integrity

The Monitoring Board’s vigilance extends beyond independence to the broader integrity of the IFRS framework. By overseeing the activities of the IFRS Foundation and IASB, the Monitoring Board contributes to the credibility of IFRS as a global accounting standard. This oversight ensures that IFRS continues to meet the evolving needs of global financial markets and remains a trusted framework for transparent financial reporting.

8. Impact on Financial Reporting

8.1. Side-by-Side Comparison

a. Financial Statement Variances: GAAP vs IFRS

A side-by-side comparison of financial statements prepared under GAAP and IFRS reveals variances arising from differences in principles, approaches, and interpretations. These variances extend to revenue recognition, asset valuation, and consolidation methods, influencing the reported financial position and performance of entities. Investors and analysts must navigate these differences to glean accurate insights into a company’s financial health.

b. Interpretation Challenges for Investors

Investors face interpretation challenges when analyzing financial statements prepared under different frameworks. Understanding the nuances of GAAP and IFRS differences is crucial for making informed investment decisions. The ability to discern how specific accounting choices impact financial metrics empowers investors to evaluate risks, assess potential returns, and navigate the complexities of the global investment landscape.

8.2. Revenue Recognition Dynamics

a. The Nuances of Revenue Recognition

The nuances of revenue recognition under GAAP and IFRS reflect the underlying philosophies of each framework. GAAP, with its prescriptive guidelines, provides specific criteria for recognizing revenue in various industries. In contrast, IFRS adopts a broader approach, emphasizing the substance of transactions over rigid rules. Navigating these nuances requires a deep understanding of industry dynamics and the specific requirements of each framework.

b. Implications for Investor Decision-Making

The implications of revenue recognition dynamics extend to investor decision-making. Differences in when and how revenue is recognized can influence perceptions of a company’s immediate financial performance. Investors must factor in these nuances to make informed decisions, considering the impact on key financial metrics such as earnings per share, profit margins, and return on investment.

8.3. Asset Valuation Approaches

a. Valuation Philosophies: Fair Value vs. Historical Cost

The variance in asset valuation philosophies between GAAP and IFRS introduces complexities in financial reporting. GAAP’s adherence to historical cost provides stability and consistency, albeit potentially understating the current market value of assets. In contrast, IFRS’s emphasis on fair value introduces a more dynamic and responsive approach to asset valuation. Companies must navigate the trade-offs between stability and accuracy in presenting their financial position.

b. Balancing Accuracy and Stability in Asset Reporting

Balancing accuracy and stability in asset reporting requires careful consideration of the trade-offs between fair value and historical cost. Companies must weigh the benefits of presenting current market values against the potential volatility introduced by fair value measurements. Striking the right balance ensures that financial statements accurately reflect the economic reality of a company’s assets while providing stakeholders with a stable and reliable foundation for decision-making.

9. Challenges in Adoption

9.1. Corporate Resistance Factors

a. Unpacking Corporate Hesitations

The decision to adopt new accounting standards, whether transitioning from GAAP to IFRS or vice versa, is met with corporate hesitations. Companies fear the potential disruptions, costs, and uncertainties associated with the transition. Understanding these resistance factors is essential for regulatory bodies, standard-setters, and industry stakeholders to develop strategies that facilitate smoother adoptions and ensure widespread compliance.

b. Overcoming Corporate Resistance Challenges

Overcoming corporate resistance challenges requires a multi-faceted approach. Clear communication on the benefits of the new standards, comprehensive training programs, and support mechanisms can alleviate concerns. Regulators and standard-setters must collaborate with industry representatives to address specific challenges faced by different sectors, fostering a cooperative environment conducive to successful adoptions.

9.2. Implementation Costs

a. Financial and Operational Impacts

The implementation of new accounting standards incurs financial and operational impacts for companies. Costs associated with staff training, system upgrades, and adjustments to internal processes contribute to the overall financial burden. Companies must carefully assess these costs and develop comprehensive implementation plans to mitigate disruptions and ensure a seamless transition to the new standards.

b. Strategies for Mitigating Implementation Costs

Strategies for mitigating implementation costs involve proactive planning, phased adoption approaches, and leveraging technology. Companies can benefit from engaging with industry peers that have successfully navigated similar transitions, learning from best practices and challenges. Collaboration between standard-setters, regulatory bodies, and industry associations plays a crucial role in developing strategies that balance the need for improved standards with the practicalities of implementation.

9.3. Training and Skill Gaps

a. The Need for Specialized Training

The adoption of new accounting standards introduces the need for specialized training to ensure that professionals possess the skills required for compliance. Training programs must address the nuances of the new standards, focusing on changes in accounting principles, reporting requirements, and the application of new methodologies. Bridging skill gaps is crucial for maintaining the integrity and accuracy of financial reporting.

b. Collaborative Approaches to Skill Development

Collaborative approaches to skill development involve partnerships between educational institutions, professional organizations, and industry players. The goal is to create comprehensive training programs that equip professionals with the knowledge and skills necessary for successful compliance. Standard-setters and regulators can play a pivotal role in promoting and endorsing such collaborative initiatives, fostering a culture of continuous learning within the accounting profession.

10. Legal Implications for Corporations

10.1. Legal Challenges in GAAP Compliance

a. Litigation Risks in GAAP Adherence

The legal challenges associated with GAAP compliance include litigation risks arising from alleged non-compliance. Companies adhering to GAAP must navigate the complexities of the legal landscape, ensuring that their financial statements withstand scrutiny. Implementing robust internal controls, engaging in transparent communication, and staying abreast of legal developments are essential strategies for mitigating litigation risks.

b. Strategies for Legal Compliance in GAAP

Strategies for legal compliance in GAAP involve proactive measures to minimize litigation risks. This includes fostering a culture of compliance within the organization, conducting regular internal audits, and seeking legal counsel to ensure alignment with evolving regulations. Companies that prioritize legal compliance contribute to the overall stability and trustworthiness of the financial reporting ecosystem.

10.2. Legal Battles in IFRS Adoption

a. Navigating Legal Challenges in IFRS Transition

The transition to IFRS introduces legal battles that companies must navigate effectively. Disputes may arise over interpretations of IFRS standards, potentially leading to litigation. Companies must engage in comprehensive risk assessments, understanding the legal implications of IFRS adoption, and implementing measures to mitigate potential legal challenges.

b. Legal Safeguards for Companies Adopting IFRS

Legal safeguards for companies adopting IFRS involve proactive steps to minimize legal risks. This includes engaging legal experts in the transition process, conducting impact assessments, and implementing robust governance structures. Companies that prioritize legal safeguards position themselves to navigate the complexities of IFRS adoption with resilience and integrity.

10.3. Risk Mitigation Strategies

a. Legal Safeguards: Mitigating Risks in Regulatory Compliance

Legal safeguards play a pivotal role in mitigating risks associated with regulatory compliance. Companies must implement effective risk management strategies, including regular legal audits, compliance training, and a responsive approach to legal developments. A proactive stance towards legal safeguards enhances a company’s ability to navigate the intricate landscape of financial reporting standards.

b. Strategies for Minimizing Legal Challenges in Reporting Standards

Strategies for minimizing legal challenges in reporting standards involve a holistic approach to risk management. This includes collaboration with legal professionals, staying informed about evolving regulations, and fostering a culture of compliance within the organization. Companies that prioritize these strategies not only mitigate legal challenges but also contribute to the overall reliability and credibility of financial reporting standards.

11. Investor Perspectives

11.1. Investor Preferences

a. Surveying Investor Preferences: GAAP or IFRS?

Understanding investor preferences is crucial in the GAAP vs. IFRS discourse. Surveys play a valuable role in gauging investor sentiment and preferences regarding financial reporting standards. The insights gleaned from such surveys inform standard-setters, regulators, and companies in aligning financial reporting practices with investor expectations.

b. Implications of Investor Preferences on Reporting Standards

The implications of investor preferences on reporting standards are far-reaching. Companies that align with investor preferences enhance transparency and communication, fostering trust and confidence. Standard-setters and regulators, informed by investor feedback, can shape standards that not only meet regulatory requirements but also cater to the information needs of investors in a dynamic and competitive market.

11.2. Impact on Investment Decision-Making

a. Investor Decision Dynamics: GAAP vs IFRS

Investor decision dynamics are influenced by the choice between GAAP and IFRS. Differences in financial reporting standards can impact the comparability of financial statements, influencing investment decisions. Investors must consider the implications of these standards on key metrics, risk assessments, and overall financial analysis to make informed and strategic investment decisions.

b. Strategic Impacts on Investment Choices

The strategic impacts of financial reporting standards on investment choices go beyond compliance. Companies that recognize the link between transparent financial reporting and investor confidence gain a strategic advantage. Similarly, investors who factor in the nuances of GAAP and IFRS differences in their decision-making processes navigate the complexities of the investment landscape more effectively.

11.3. Investor Education Initiatives

a. The Imperative of Investor Education

The imperative of investor education underscores the need for initiatives that enhance investor understanding of financial reporting standards. Educational programs, informational resources, and collaborative efforts between financial institutions and regulatory bodies contribute to a more informed investor community. An educated investor base not only demands higher standards of transparency but also actively participates in shaping the future trajectory of financial reporting.

b. Educating Investors on GAAP vs IFRS Implications

Educating investors on GAAP vs. IFRS implications involves demystifying the complexities of these frameworks. Providing accessible information, conducting investor workshops, and leveraging digital platforms for educational outreach are essential components. Investors empowered with a deeper understanding of financial reporting standards contribute to market efficiency and hold companies accountable for transparent and reliable reporting.

12. Ethical Considerations

12.1. Ethical Dimensions in Financial Reporting

a. Ethics in Financial Reporting Standards

Ethical considerations are integral to the formulation and adherence to financial reporting standards. The principles of integrity, objectivity, and transparency underpin ethical financial reporting. Standard-setters, regulators, and companies must navigate ethical dimensions to ensure that financial reporting serves the interests of investors and the broader public.

b. Upholding Integrity and Objectivity in Reporting

Upholding integrity and objectivity in reporting requires a commitment to ethical conduct. Companies must prioritize accurate representation over short-term gains, fostering a culture that values transparency. Regulators play a crucial role in setting the ethical tone, emphasizing the importance of unbiased and principled financial reporting in maintaining the integrity of capital markets.

12.2. Ethical Challenges for Accountants

a. Common Ethical Dilemmas in GAAP and IFRS

Accountants face common ethical dilemmas in navigating the intricacies of GAAP and IFRS. Issues such as revenue recognition, asset valuation, and disclosure requirements present challenges where ethical considerations intersect with professional responsibilities. Accountants must navigate these dilemmas with a commitment to ethical conduct, considering the broader impact on stakeholders and financial markets.

b. Navigating Ethical Challenges in Reporting Standards

Navigating ethical challenges in reporting standards involves equipping accountants with the tools and guidance needed for principled decision-making. Ongoing professional development, ethical training programs, and mentorship initiatives contribute to a culture of ethical awareness within the accounting profession. Companies, in turn, benefit from the assurance that financial reporting is not only compliant but also aligns with the highest ethical standards.

12.3. Regulatory Measures for Integrity

a. Regulatory Safeguards: Ensuring Ethical Conduct

Regulatory safeguards play a crucial role in ensuring ethical conduct in financial reporting. Regulatory bodies must establish and enforce ethical standards, conduct regular audits, and impose sanctions for non-compliance. A robust regulatory framework promotes integrity in financial reporting, reinforcing public trust in the accuracy and reliability of financial statements.

b. Maintaining the Integrity of Financial Reporting Standards

Maintaining the integrity of financial reporting standards requires a collaborative effort between regulators, standard-setters, and industry stakeholders. Periodic reviews, stakeholder consultations, and responsiveness to emerging ethical challenges contribute to the ongoing refinement of standards. The commitment to upholding ethical principles ensures that financial reporting continues to serve as a cornerstone of trust in the global business landscape.

13. Future Trajectories

13.1. The Evolution of Reporting Standards

a. Anticipating Future Changes

Anticipating future changes in reporting standards involves considering the dynamic nature of global business, technological advancements, and shifts in investor expectations. Standard-setters must adopt a forward-looking approach, engaging in scenario planning and staying attuned to emerging trends. The ability to anticipate future changes ensures that reporting standards remain relevant and adaptive to the evolving needs of the business environment.

b. Technological Innovations and Reporting

Technological innovations are poised to shape the future trajectory of reporting standards. The integration of artificial intelligence, blockchain, and data analytics introduces opportunities for enhanced accuracy, efficiency, and transparency in financial reporting. Standard-setters and companies must embrace these innovations responsibly, balancing the benefits of technology with the imperative of maintaining ethical and transparent financial practices.

13.2. Convergence vs. Divergence

a. Assessing Convergence Prospects

The prospects of convergence between GAAP and IFRS continue to be a topic of consideration. While convergence offers the promise of a more standardized global approach, challenges such as differing legal frameworks and regulatory philosophies persist. Assessing convergence prospects involves a nuanced examination of global trends, regulatory developments, and ongoing efforts by standard-setters to bridge divergences.

b. Navigating Divergences in Global Standards

Navigating divergences in global standards requires a pragmatic approach that acknowledges the unique needs of individual jurisdictions. The coexistence of multiple standards necessitates effective communication, education, and cross-border collaboration. Standard-setters can play a pivotal role in facilitating harmonization efforts, fostering a global financial reporting landscape that balances convergence with the flexibility needed to accommodate diverse economic and regulatory environments.

13.3. Sustainable Reporting Paradigms

a. The Rise of Sustainable Reporting

The rise of sustainable reporting reflects a paradigm shift in the broader understanding of corporate performance. Investors, regulators, and the public increasingly recognize the importance of environmental, social, and governance (ESG) factors. Future reporting standards are likely to integrate sustainable reporting paradigms, providing a more comprehensive view of a company’s long-term value creation and societal impact.

b. Integrating ESG Metrics into Reporting Standards

Integrating ESG metrics into reporting standards requires a collaborative effort between standard-setters, regulators, and industry stakeholders. The development of clear guidelines, standardized metrics, and transparent disclosure requirements enhances the credibility of sustainable reporting. Companies embracing ESG considerations in their financial reporting contribute to a more informed and responsible investment landscape.

14. Conclusion

Financial reporting standards, whether grounded in GAAP or IFRS, serve as the bedrock of transparency, trust, and accountability in the global business landscape. The evolution of these standards reflects a journey of adaptation to changing business dynamics, regulatory landscapes, and investor expectations. While GAAP and IFRS diverge in certain philosophies and approaches, they share a common goal – to provide reliable and relevant information for decision-making.

As we navigate the complexities of GAAP vs. IFRS, it is imperative to recognize the strengths and limitations of each framework. GAAP, with its historical cost emphasis and rule-based approach, offers stability and comparability. In contrast, IFRS, operating under a principles-based approach, provides flexibility and a global perspective. Understanding the variances in revenue recognition, asset valuation, and consolidation methods is essential for investors, analysts, and companies alike.

Looking ahead, the trajectory of reporting standards involves a delicate balance – between convergence and divergence, between technological innovation and ethical considerations, and between traditional financial metrics and sustainable reporting paradigms. The future holds the promise of more standardized, adaptive, and responsible reporting standards that cater to the diverse needs of a dynamic global economy.

In conclusion, as the landscape of financial reporting continues to evolve, stakeholders must remain vigilant, adaptive, and collaborative. Whether one adheres to GAAP or IFRS, the shared commitment to integrity, transparency, and accountability ensures that financial reporting remains a cornerstone of trust in the interconnected world of business and finance.

#cfo#banking#accounting#finance#investment#personal finance#international finance assignment help service#financial management#financial markets#financial modeling#financial planning#financial dominance#financial services#financial literacy#financial drain#management#business#entrepreneur

0 notes

Text

International Finance Mastery: The Key Role of Assignment Help in Student Success

In the dynamic realm of academic pursuits, mastering international finance is a critical milestone for students aspiring to navigate the complexities of global economies. As students delve into the intricate world of international finance, they often find themselves grappling with challenging assignments that demand a deep understanding of diverse financial concepts. This is where the invaluable support of international finance assignment writing help comes into play. In this blog, we will explore the significance of assignment assistance in enhancing student success in the field of international finance.

Understanding the Challenges:

International finance is a multifaceted discipline that encompasses a wide array of topics, including exchange rates, foreign direct investment, global financial markets, and risk management. The complexity of these subjects often leaves students feeling overwhelmed and in need of guidance. Assignments in international finance require students to apply theoretical concepts to real-world scenarios, analyze data, and draw meaningful conclusions. This can be a daunting task, especially for those still grasping the fundamentals of the subject.

The Role of International Finance Assignment Writing Help:

Conceptual Clarity: International finance assignment help services play a pivotal role in providing students with conceptual clarity. Professional writers with expertise in international finance can break down complex theories and explain them in a manner that is easy for students to comprehend. This not only aids in completing assignments successfully but also contributes to a deeper understanding of the subject matter.

Timely Submission: The academic journey is often characterized by tight deadlines and competing priorities. Assignment help services offer a lifeline to students by ensuring timely submission of assignments. Meeting deadlines is crucial for academic success, and expert assistance can alleviate the stress associated with last-minute rushes, allowing students to focus on learning rather than time constraints.

Customized Solutions: Every assignment is unique, and international finance assignments are no exception. Assignment help services provide customized solutions tailored to the specific requirements of each task. This ensures that students receive content that is not only accurate but also relevant to the assignment's objectives, enhancing the overall quality of their submissions.

Enhanced Research Skills: Assignments in international finance often require extensive research and data analysis. Seeking assistance from professionals in the field can serve as a learning opportunity for students, helping them develop their research skills. By reviewing well-crafted assignments, students can gain insights into effective research methodologies and apply them to their future academic endeavors.

Graded Excellence: The ultimate goal of any student is to achieve academic excellence. International finance assignment writing help services are equipped to deliver assignments that meet the highest academic standards. As a result, students stand a better chance of securing top grades, boosting their overall academic performance and opening doors to future opportunities.

Mentorship and Guidance: Beyond the completion of assignments, seeking help from professionals provides students with valuable mentorship and guidance. Experienced writers can offer insights into the practical applications of international finance concepts, preparing students for challenges they may encounter in the real-world scenarios of the global financial landscape.

Conclusion:

In the intricate landscape of international finance, assignment help services serve as a beacon of support for students navigating the challenges of this dynamic field. From conceptual clarity to timely submission and mentorship, the benefits of seeking international finance assignment writing help are manifold. As students aspire to master the complexities of global finance, they can leverage these services to not only excel academically but also gain valuable insights that will shape their future success in the international financial arena. Embracing this assistance is not a sign of weakness but a strategic move towards a brighter and more informed academic journey.

#Online international finance Assignment Help#international finance assignment help service#international finance assignment help online#international finance assignment help usa#international finance assignment help australia

0 notes

Text

Jedi Order Bureaucratic Structure

I’ve been working for a while on worldbuilding the inner workings of the Jedi Order. Below is a flowchart of the administrative bodies, their duties, and any other admin bodies they oversee. More details on each below the cut.

These are different groups involved in running the Jedi Order. For different roles within the Jedi, see my Jedi Order Corps and Subdivisions.

High Council: (Finance, bylaws, PR, major trials)

Determines the budget(s)

Relations with the Senate

Only body that can expel members

Librarian's Assembly: (Ensures knowledge is available to Jedi)

Fund academic researchers (many Jedi researchers work directly for the assembly)

Archives: (Run the Archives & research)

Host academic conferences

Protect important artifacts

Run basically directly by the Librarian's Assembly

Department of Classes: (Adult education)

Organize all classes that aren't geneds

Set criteria for certifications/ degrees

Help members get degrees from external organizations

Council of Reassignment: (Oversees transfers & is Jedi CPS)

New Initiate paperwork

Transfers between corps and/or branches

Helps members leave the Order

Checks the CoFK when necessary

Padawanship paperwork filed here (crèchemasters sign off, padawan signs off, check master for red flags/ not allowed to take apprentice, sometimes mind healer signs off)

Council of Justice: (Attourneys & internal justice system)

Try & punish cases committed by Jedi & internal to the Jedi Order

Mediate interpersonal disputes

Lawyers for the Order

Cannot expel members

Council of Outreach: (Manages outposts & patrols)

Assigns Jedi to satellite locations or watchfolk posts

Hires other outpost staff

Ships supplies to & from outposts

Tracks the locations of missions & sends Vanguards to areas that haven't been visited recently

Council of Temple Maintenance: (Oversees internal services and temple upkeep)

In charge of the cleaning droids

Coordinates trash & recycling with Coruscant government

Has the occasional member who can do specialized maintenance (ex. plumber, electrician)

Volunteers sign up to fix things

Hires outside contractors when there isn't a Jedi with the necessary skills

Assigns Jedi to living quarters

Interior decor

Delegates chores such as taking out the trash, mopping, dusting, etc.

Padawans and initiates are often assigned these chores as punishments

Kitchenmasters: (Mess halls)

Make & serve food in the mess halls

Label the food with which species can eat it

Order food supplies

Supervise initiate clans helping in the kitchens

Quartermasters: (Distribute supplies & manage finances)

Bulk-order supplies for the Order

Provide mission allotments

Desk operators help members pick up supplies

Accounting

Transport Office: (Run the hangar bay & speeder pool)

Responsible for the Order's vehicles

Mechanics

Vehicles are checked in & out like a library for cars & ships

Hire external staff when there aren't enough Jedi

Temple Guard: (Security & emergency response)

Guard against exterior threats to the temple

Security during criminal situations

Really good at sensing danger to temple inhabitants

First responders (fire & police-- MedCorp handles EMS)

Change lightbulbs and smoke detector batteries

Odd jobs on behalf of the CoTM

Uses the lore by Adsecula in "Nameless"

Council of Reconciliation: (Central hub of Jedi outreach & diplomacy)

All aid requests go through them

Sets mission objectives

Approve or deny aid/ mission requests

Reviews behavior of Jedi on missions when there are issues

Mission Consignment: (Assign Jedi to approved missions)

Desk jockeys

Not officially divided by type of mission/ Jedi role needed, but missions will be passed to people who are more familiar with the experts required

Organizes specifics for missions such as transportation and housing

Council of First Knowledge: (Runs Initiate & Padawan dorms, clans, & childhood education)

Initiate clans members live together with their crèchemasters rotating out night shifts

Padawans & Senior Initiates live in individual rooms in designated halls with some crèchemasters living in each hall

Department of Seekers: (Regulates conduct of Seekers)

Create regulates for what Seekers can & cannot do & how they should act

Investigate reported misconduct by Seekers

Crèche: (Organizes care for Initiates)

Sort Initiates into clans

Run events/ field trips/ etc.

Set educational standards

see my post about Living Quarters in the Jedi Temple

Department of Primary Classes: (Classroom education for younglings)

Standard elementary school operation stuff

Provides the general education classes all Jedi take as younglings

Circle of Healers: (Sets certification requirements)

Certified to train medical professionals for a variety of degrees

Determines when Jedi have fulfilled requirements for medical certifications

Sets the qualifications for Force-specific medical degrees

Halls of Healing: (Healthcare within the Order & internal outreach)

Like a local hospital but also has general practitioners

IRB: (Reviews research for ethical concerns)

Institutional Review Board

"Under FDA regulations, an Institutional Review Board is group that has been formally designated to review and monitor biomedical research involving human subjects. In accordance with FDA regulations, an IRB has the authority to approve, require modifications in (to secure approval), or disapprove research. This group review serves an important role in the protection of the rights and welfare of human research subjects."

IRB for the entire Order, not just the MedCorps

#dorphin's jedi lore#gffa worldbuilding#jedi worldbuilding#star wars worldbuilding#lore#mine#jedi#jedi order#pro jedi

35 notes

·

View notes

Text

“HQ Portable and Dumpsters - The Best Solution for Same Day Waste Disposal”

Introduction

When it involves dealing with waste, no matter if from homestead renovations, backyard refreshing-ups, or industrial tasks, having the right disposal answer is valuable. Enter HQ Portable and Dumpsters – the superb resolution in your waste disposal desires. With expertise tailor-made for similar-day beginning, they stand out as a professional resolution in an a growing number of busy international. Whether you might be are seeking "lower priced dumpster rentals near me" or "equal day dumpster condo close to me," HQ Portable and Dumpsters have you covered.

In this finished handbook, we’ll explore why HQ Portable and Dumpsters are the surest answer for similar-day waste disposal and delve into quite a number points of dumpster leases. From knowledge one-of-a-kind different types of rentals to navigating pricing systems, we’ll support you are making educated judgements approximately your waste management necessities.

HQ Portable and Dumpsters - The Best Solution for Same Day Waste Disposal

When you think that of environment friendly waste disposal, what involves intellect? Convenience? Affordability? Reliability? HQ Portable Porta Potty Rentals in Rhode Island and Dumpsters embody these types of traits. Their commitment to consumer pride guarantees that no matter where you’re positioned, that you would be able to get right of entry to nice provider immediately.

Whether you desire a momentary dumpster condo for a homestead assignment or a roll-off field for a monstrous production activity, their fluctuate of services meets multiple wants. Their related-day provider capacity that should you're knee-deep in debris from renovations or backyard paintings, help is only a mobilephone name away.

Understanding Dumpster Rentals What Are Dumpster Rentals?

Dumpster rentals are packing containers introduced through establishments to take away waste ingredients effectually. They come in varying sizes and are sometimes used for residential initiatives, business jobs, or creation web sites.

Types of Dumpster Rentals

Residential Dumpster Rentals Near Me

Perfect for residence tasks like renovations or cleaning out garages.

Commercial Dumpster Rentals Near Me

Designed for organisations needing typical waste disposal offerings.

Roll-Off Dumpster Rentals Near Me

Ideal for better initiatives; they shall be really rolled off trucks.

youtube

Benefits of Using HQ Portable and Dumpsters

Using HQ Portable’s facilities deals a large number of merits:

Same-Day Service: Need a thing gone instant? They give on quick realize. Variety of Sizes: Whether you're decluttering or coping with major production debris, they have got the properly length dumpster. Affordable Pricing: Their aggressive rates make it more convenient to set up your finances. How to Choose the Right Dumpster Rental Service Consider Your Project Size

Select a dumpster that suits the dimensions of your mission:

Small (10-15 yards): Great for minor fresh-ups Medium (20 yards): Suitable for transforming jobs Large (30+ yards): Necessary for e

0 notes

Text

A Comprehensive Guide to a Legal Advisor in Qatar

A legal advisor is a legal expert who provides legal advice and counsel to individuals, companies, and organizations. Their role goes beyond merely interpreting laws; they are strategic partners who contribute to making sound decisions to protect their clients' interests.

Role of a Legal Advisor in Qatar

In Qatar, a legal advisor plays a crucial role given the active business environment and evolving laws. Here are some of the key roles of a legal advisor:

Providing Legal Advice: Offering counsel on a wide range of legal matters, including real estate, corporate, international trade, criminal, and labor issues.

Drafting Legal Documents: Preparing and reviewing contracts and legal documents to ensure they comply with Qatari laws and protect clients' interests.

Representing Clients in Court: Defending clients' rights in courts and arbitration proceedings.

Legal Research: Conducting comprehensive legal research to provide the best legal advice.

Employee Training: Providing legal training to employees in companies and organizations.

Read More: Criminal lawyer in Qatar

Importance of Hiring a Legal Advisor in Qatar

Legal Protection: A legal advisor helps protect individuals and companies from legal risks.

Saving Time and Effort: They conduct complex legal research on behalf of their clients, saving them time and effort.

Ensuring Compliance: They help ensure that business operations comply with Qatari laws and regulations.

Making Informed Decisions: They provide the information and analysis needed to make sound legal and business decisions.

Read More: Procedures for assigning a case to a lawyer

How to Choose a Legal Advisor in Qatar?

Specialization: Ensure the legal advisor has the necessary expertise and specialization for your case.

Reputation: Inquire about the legal advisor's reputation among colleagues and past clients.

Fees: Compare the fees of different legal advisors.

Communication: Make sure you feel comfortable communicating with the legal advisor and understand their legal language.

Read More: Divorce law for harm in Qatar

Practice Areas of a Legal Advisor in Qatar

Legal advisors in Qatar work in a variety of fields, including:

Commercial Law: Commercial contracts, corporations, foreign direct investment.

Corporate Law: Company formation, corporate management, mergers and acquisitions.

Real Estate Law: Buying and selling real estate, leasing, real estate development.

Criminal Law: Defending accused persons in criminal cases.

Labor Law: Employment contracts, labor dispute resolution.

Banking and Finance Law: Banking services, securities, insurance.

0 notes

Text

Navigating the Complex World of Finance: An Interview with an International Finance Assignment Help Expert

As the global economy continues to evolve, the field of international finance becomes increasingly intricate and challenging for students. To shed light on this complex subject and provide valuable insights, we sat down for an enlightening conversation with an International Finance Assignment Help expert. Our goal was to unravel the mysteries of international finance, understand the challenges students face, and explore the importance of seeking assistance when tackling assignments in this dynamic field.

Student (S): Thank you for joining us today. To kick things off, could you share a bit about your background and expertise in international finance?

International Finance Assignment Help Expert (E): Certainly! I have been immersed in the world of finance for over a decade, specializing in international finance. My journey began with a passion for understanding how financial markets operate on a global scale. I pursued advanced degrees in finance and have since been dedicated to helping students navigate the complexities of international finance through assignment assistance and guidance.

S: That's impressive. International finance can be quite overwhelming for students. Can you highlight some common challenges they face when dealing with assignments in this field?

E: Absolutely. One of the primary challenges students encounter is the extensive range of topics within international finance. From exchange rates and international investment to risk management and financial markets, the sheer breadth of the subject can be daunting. Additionally, the dynamic nature of global financial markets means that students must stay updated on the latest trends and geopolitical events, adding another layer of complexity to their assignments.

S: Given these challenges, how can seeking International Finance Assignment Help benefit students?

E: Seeking assistance can provide students with several advantages. Firstly, it offers a personalized approach to learning. Many students find that one-on-one guidance helps them grasp intricate concepts more effectively. Moreover, assignment help services often employ experts who have practical experience in the field, offering real-world insights that go beyond textbook knowledge. This can be invaluable in understanding the practical applications of international finance theories.

S: That makes sense. When students approach you for help, what are some of the common areas they struggle with the most?

E: A recurring theme is the application of theoretical concepts to real-world scenarios. Students often find it challenging to bridge the gap between what they learn in class and how it translates to practical situations. Additionally, understanding the intricacies of currency markets, managing exchange rate risk, and comprehending the impact of global economic events on financial decisions are areas where many students seek clarification.

S: How do you approach guiding students through these challenging areas?

E: I believe in a hands-on approach. Rather than just providing answers, I strive to guide students through the thought processes and methodologies involved in solving problems. This not only helps them complete their assignments but also enhances their analytical and problem-solving skills, which are crucial in the field of international finance. It's about fostering a deeper understanding of the subject matter.

S: That sounds like a comprehensive approach. Speaking of real-world applications, can you share any examples of how international finance concepts play a role in today's global business landscape?

E: Certainly. Take, for instance, multinational corporations. They operate in multiple countries, dealing with various currencies and facing diverse financial challenges. Understanding how to manage exchange rate risk and make informed financial decisions in such a complex environment is crucial. Additionally, global economic events, like trade tensions or geopolitical shifts, can have a profound impact on financial markets, influencing investment decisions and risk management strategies.

S: It's fascinating how these concepts directly influence business operations. For students aspiring to enter the field of international finance, what advice would you offer?

E: My advice would be to embrace curiosity and stay curious. International finance is a dynamic field that requires a continuous willingness to learn and adapt. Stay updated on global economic trends, explore case studies, and seek practical experiences through internships or projects. And, of course, don't hesitate to seek help when needed. The field is vast, and collaboration with experts can provide valuable perspectives that enhance your understanding.

S: Wise words. Finally, how do you see the future of international finance education evolving, and what role will assignment help services play in this evolution?

E: The future holds exciting possibilities for international finance education. As the global economy becomes more interconnected, the demand for professionals with expertise in international finance will likely increase. In response, educational institutions may further integrate practical applications and real-world scenarios into their curriculum. Assignment help services will continue to play a crucial role by providing students with the support they need to excel in this evolving landscape, ensuring that they are well-prepared for the challenges of the global financial arena.

In conclusion, our conversation with the International Finance Assignment Help expert has shed light on the intricate world of international finance. As students grapple with complex assignments, seeking assistance from experienced professionals proves to be a valuable resource. By fostering a deeper understanding of theoretical concepts, bridging the gap between theory and practice, and providing real-world insights, these experts contribute significantly to the success of aspiring finance professionals in an ever-changing global economy.

#international finance Assignment Help#Help With international finance Assignment#Online international finance Assignment Help#international finance assignment help service

0 notes

Text

How to Prepare for Your First Year Studying in Germany

Starting your first year studying in Germany is an exciting adventure, but it requires thorough preparation. From adjusting to a new culture to understanding the academic system, here’s a guide to help you make a smooth transition into your student life in Germany.

1. Master the German Language

One of the most important steps to prepare for studying in Germany is improving your German language skills. While many universities offer programs in English, knowing German will help you navigate daily life with ease. Enrolling in a German language course will not only boost your confidence but also allow you to communicate better with locals, making it easier to settle in.

To enhance your language proficiency, consider seeking guidance from German Study Abroad Consultants, who can connect you with quality courses and resources to improve your language skills before arriving in Germany.

2. Organize Your Finances

Germany is known for its affordable education, but it’s important to plan your finances wisely. Make sure to create a budget that covers tuition fees, living expenses, and travel costs. Open a German bank account and research scholarships or part-time job opportunities to help reduce financial strain.

You can also consult Overseas Education Consultants for advice on managing your expenses while studying abroad, as they often provide tailored solutions for students to ensure financial stability.

3. Arrange Accommodation Early

Finding accommodation in German cities can be competitive, especially for international students. It’s a good idea to start your housing search early, either in student dormitories or private apartments. Many universities have dedicated international student offices to assist with this process.

For expert assistance in securing accommodation, you can contact German Education Consultants, who specialize in guiding students through housing arrangements, ensuring a hassle-free transition.

4. Understand the Academic System

The German academic system might differ from what you're used to, with more emphasis on independent study and fewer contact hours. Understanding how exams, assignments, and credits work is crucial for your success. Get familiar with your course requirements and the grading system early on, and don’t hesitate to ask your professors or peers for advice.

5. Learn About German Culture

Cultural integration is key to enjoying your time in Germany. Familiarize yourself with the customs, social norms, and even the local cuisine. Engaging in cultural activities and socializing with local students can help you feel more at home.

Participating in university events or joining student clubs can also provide valuable networking opportunities. If you’re unsure where to start, reaching out to Higher Education Consultants can help guide you through cultural nuances and ensure a smoother transition.

6. Prepare for Health and Safety

Health insurance is mandatory for all international students in Germany. Before you arrive, ensure that you have health insurance that complies with German regulations. You should also make yourself aware of local emergency services and health facilities near your residence.

Conclusion

Preparing for your first year in Germany involves more than just packing your bags. By mastering the language, organizing finances, securing accommodation, and understanding the academic and cultural landscape, you’ll set yourself up for a successful and enjoyable experience. For additional guidance, connecting with Study Abroad Consultants can provide the expert advice needed to navigate your journey.

0 notes

Text

IQVIA, a global leader in clinical trials and healthcare insights, is seeking qualified candidates for the role of Associate Clinical Trial Manager in Thane, Maharashtra. If you have a background in healthcare, scientific disciplines, and clinical research experience, this position offers an excellent opportunity to contribute to groundbreaking medical treatments.

About the Role: Associate Clinical Trial Manager

As an Associate Clinical Trial Manager at IQVIA, you will play a critical role in the delivery of clinical trials. You will work alongside clinical teams to bring new drugs to the market efficiently, helping improve patient outcomes. This role is integral to the success of clinical projects and involves the oversight of project operations, quality management, and compliance with regulatory standards.

Key Responsibilities:

Ensure clinical delivery of assigned projects in compliance with regulatory requirements (International Conference on Harmonization (ICH)-Good Clinical Practice (GCP), protocol), customer requirements (contract), and internal requirements (policies, Standard Operating Procedures (SOPs), project plans).

Accountable for meeting projects’ recruitment targets and ensuring appropriate recruitment strategies are in place.

Contribute to the development of the project risk mitigation plan and manage clinical risks throughout the project’s lifecycle.

Ensure clinical quality delivery by identifying quality standards/requirements, planning how compliance will be measured, monitoring and overseeing management of clinical quality issues.

Manage clinical aspects of Project Finances including Estimate at Completion (EAC). Understand the scope of clinical delivery and create plans to deliver. Monitor and manage changes against baseline Estimate at Completion (EAC) and identify additional service opportunities or out of scope work.

Identify clinical stakeholder landscape for the project and manage both internal and external stakeholders through effective communication and resolution management.

Collaborate with the clinical team to support milestone achievements. Report to internal and external stakeholders as per project scope requirements.