#International Finance Assignment Help

Explore tagged Tumblr posts

Text

Unlocking Success with International Finance Assignment Help

Celebrating one year of academic triumphs with FinanceAssignmentHelp.com and their exceptional international finance assignment help! As a student navigating the intricate world of international finance, I stumbled upon this academic haven when the challenges seemed insurmountable. Today, on my one-year anniversary with their services, I can't help but reflect on how they have been instrumental in shaping my academic journey.

How FinanceAssignmentHelp.com Helped Me:

International finance is a labyrinth of concepts, theories, and practical applications. Navigating through the complexities of exchange rates, capital flows, and risk management can be daunting for even the most dedicated students. That's where FinanceAssignmentHelp.com stepped in to illuminate the path to success.

This online platform offers unparalleled international finance assignment help, providing customized solutions tailored to individual needs. Whether it's understanding the intricacies of foreign exchange markets or deciphering the nuances of global investment strategies, their team of experts has consistently delivered top-notch assistance.

Why I Needed This Service:

The realm of international finance demands a comprehensive understanding of economic principles, market dynamics, and geopolitical factors. As a student with a fervent desire to excel, I found myself grappling with the intricate details of my international finance assignments. The need for clarity and expert guidance became evident, and that's when I turned to FinanceAssignmentHelp.com.

This service became my academic anchor, offering a lifeline when the waters of financial theories seemed too turbulent. Their team not only possesses profound knowledge of international finance but also has a knack for simplifying complex concepts, making them accessible to students at any level.

How to Find This Service:

Discovering FinanceAssignmentHelp.com was a game-changer for me, and it's a journey that began with a simple online search. The website's user-friendly interface and transparent approach stood out immediately. Navigating through their services, I found a dedicated section for international finance assignment help, complete with testimonials from satisfied students.

The process of finding this service is straightforward. A quick search using keywords like "international finance assignment help" led me straight to their website. The clear layout and detailed information about their services instilled confidence from the start. It's evident that they understand the unique challenges students face in international finance courses and are committed to providing targeted assistance.

Steps to Submitting Assignments and Receiving Solutions:

One of the aspects that sets FinanceAssignmentHelp.com apart is the seamless process they've established for submitting assignments and receiving solutions. The user-friendly interface ensures that even those new to online academic assistance can navigate the process effortlessly.

Place an Order:

Start by placing an order on their website, specifying the details of your international finance assignment. This includes the topic, deadline, and any specific requirements provided by your instructor.

Receive a Quote:

Shortly after submitting your order, you'll receive a quote outlining the cost of the service. The transparent pricing model ensures that you know exactly what to expect, with no hidden fees.

Make Payment:

Once you approve the quote, proceed to make the payment securely through their platform. Multiple payment options are available for convenience.

Work Commences:

The moment your payment is processed, their team of experts starts working on your international finance assignment. Regular updates and communication ensure that you're in the loop throughout the process.

Review and Feedback:

Before the final solution is delivered, you have the opportunity to review the work and provide feedback. This collaborative approach ensures that the solution aligns with your expectations.

Receive the Solution:

Once the assignment is finalized and reviewed, you'll receive the solution promptly. The comprehensive and well-explained answers serve as a valuable learning resource, enhancing your understanding of international finance concepts.

Conclusion:

As I celebrate one year of academic excellence with FinanceAssignmentHelp.com, I can confidently say that their international finance assignment help has been a cornerstone of my success. The journey from grappling with complex concepts to mastering the intricacies of international finance has been transformative, thanks to their unwavering support.

For any student navigating the challenging waters of international finance, I wholeheartedly recommend FinanceAssignmentHelp.com. Their commitment to academic excellence, transparent processes, and a team of knowledgeable experts make them the go-to destination for those seeking not just answers, but a profound understanding of international finance. Here's to many more years of partnership and continued success!

#International Finance Assignment Help#Help With International Finance Assignment#Online International Finance Assignment Help#International Finance Assignment Help Service

10 notes

·

View notes

Text

Seeking assignment assistance regarding international finance? 🌍📈 Geopolitical risks significantly affect how an international investment strategy is formed, market volatility, and asset allocation. Political turmoil, economic sanctions, as well as trade disputes strike quite a number of times at market manners and even at investor confidence. Visit at: https://www.finance-helpdesk.com/international-finance-assignment-homework-help.php

0 notes

Text

Working Capital Optimization: Essential Help for Finance Assignments

Introduction: What is Working Capital?

Working capital constitutes a crucial principle in the field of finance, signifying the short-term liquidity position of a firm. It is defined as the difference between an organization's current assets—encompassing cash, inventory, and accounts receivable—and its current liabilities, including accounts payable and short-term debt. In essence, it denotes the financial resources available to the company to facilitate its daily operational needs. Effective working capital management ensures that a company can meet its operational needs and financial obligations, while also channeling available resources to facilitate growth in the company.

Every student or learner involved in finance studies or assignments particularly those that relate to working capital, must understand the factors that explain the working capital. Why? Working capital belongs to the most critical indicators of financial performance since they directly reflect the financial result, availability of funds for operations, and risks involved. Effective management of work capital can enhance or develop efficiency in the business hence enhancing the performance by the firm. For students, to understand these dynamics students are usually tasked to solve various numerical questions to gain insights into the practical financial operations of businesses.

By opting for finance assignment help, students can get to know more about the perspective of working capital optimization and other advanced techniques in the field. This means that one can seek working capital study assistance from professional experts, especially in complex working capital problems as opposed to what is found in textbooks and theories. This involves an opportunity for students to gain a greater understanding of the subject, hence exposing them to applicable strategies for succeeding in their assignments.

Working Capital Optimization: Issue Diagnosis in Details

Working capital optimization can be defined as the means and methods that are used in the management of the short-term assets and liabilities of a business with the aim of ensuring the operations of the firm are done in the most efficient and profitable manner. This also means that there is a fine line to be drawn between the need for liquid assets to meet short-term obligations and bringing down capital expenses.

As regards finance students, it may appear that working capital optimization is quite simple and quite basic as a subject however in a real sense, it is quite an elaborate and complicated subject that can make or break a business. In this regard, we shall look at why working capital optimization is important, how the companies achieve these goals and real cases where companies have demonstrated a working capital optimization impact.

Why Optimize Working Capital?

It is quite evident that working capital management is of great importance for all businesses as it influences many key performance metrics:

Liquidity: Sufficient working capital ensures that the company can perform its short-term obligations in terms of paying off suppliers and employees.

Profitability: Proper working capital management will minimize the capital cost incurred, therefore increasing cash flows available for financing growth and innovation.

Operational Performance: Focused and disciplined working capital management enables businesses to operate more efficiently, decrease waste, and enhance stock control.

Risk Management: Working capital management in a business alleviates the operational risk exposure – Supply Chain risks, economic downturns, and other surprises that a business may experience.

For students, such a study helps to understand the rationale behind the varying impacts of the financial decisions made in a company on its various operations.

Ways on how Working Capital can be Improved

There are various strategies that can be recommended for companies that require improvement of the working capital. These strategies are aimed at ensuring that companies maintain adequate amounts of cash, increase cash inflows, and reduce cash outflows that are unnecessary in the first place.

Inventory Management

Inventory management is one of the key components of working capital management. A firm can enhance its liquidity profile by lowering the total stock holding of unsold products by minimizing excess stocks.

Methods such as JIT manufacturing systems, where products are sourced and produced only when needed. This approach helps companies save on stockholding expenditure and overproduction.

Example: Toyota was able to change the face of the auto industry with the implementation of the manufacturing system called Just In Time (JIT), giving the extra edge of efficiency coupled with a reduction in working capital requirements.

Accounts Receivable Management

Customers paying their bills within the set timeframe is very important. For further optimization of receivables, some credit control measures are often applied such as allowing discounts for early payments or limiting credit for customers with a history of poor payments.

Another approach known as factoring helps in supplementing working capital. This involves receivables sold to a third party thus providing cash flow in a shorter time frame.

Case Study: In its attempt to improve cash flow, General Electric in the year, 2009 commenced sales of parts of its receivables and created 2 billion in capital within a year leading the firm to focus more on growth and investment avenues.

Accounts Payable Management

The payable side is much more interesting. This is about optimizing for the longest period before making any payment ta the supplier without jeopardizing any existing credit or relationships. Cash flow may be enhanced if payment terms can be adjusted without any serious penalty for longer terms.

Purchasers may utilize the assisted financial program to make early payments to their suppliers through financial institutions, while the purchaser gets extended terms to preserve working capital.

Example: Walmart has entered into extended payment terms with its suppliers to preserve its working capital for longer terms.

Cash Management

Firms need to ensure that there is an optimal cash reserve committed to the working capital requirements and also minimize cash that is idle earning no returns.

Firms utilize sweeping mechanisms, in which the excess cash is transferred to an interest-bearing account thereby making returns out of excess cash and at the same time preserving liquidity.

Example: Microsoft is well known for its cash management practices. The world’s biggest computer software company has for many years managed to keep positive working capital instead of spending it on many things and maintains generous cash reserves for investments, buying back stock, and paying dividends.

The Role of Working Capital Management

The effect of working capital optimization is not limited to the enhancement of liquidity and cash flow alone. This is capable of reinventing the potential of a company for growth and competitiveness within the industry.

Better Financial Condition: Reduction in the amounts tied up in working capital positively impacts the company's operating cycle and the balance sheet. Improvement in some of the operational ratios such as current and quick ratios is also observed. This subsequently increases the creditworthiness and the cost of borrowing reduces.

Secure Superior Position: Efficient working capital allows organizations to respond to changes in the market more effectively. For instance, they will be able to take advantage of bulk buying discounts and invest in new opportunities more quickly than its competitors.

Recovery from Impacts: When the economy is going through difficult times, the likelihood of companies that strategically manage their working capital to manage disruptions. For instance, during the most recent period when the majority of the companies were in a cash liquidity crisis due to covid19 pandemic, companies that effectively managed cash flows survived.

Long-Term Development: Firms can free up cash from operational efficiency which then allows them to seek more growth opportunities like R&D, marketing, or expansion. Optimization of working capital, therefore, becomes the initial move towards the attainment of competitive advantage in due time.

Case Example: Apple Inc.

Apple Inc. is probably the most referenced case when it comes to the optimization of working capital. This has been made possible because of the peculiarities in the businesses of Apple-it is able to maintain working capital which is negative by collecting money from customers before it pays suppliers. This offers the company a huge liquidity edge and a key reason behind its financial performance.

Due to Apple’s excellent supply chain management processes and beneficial contractual payment agreements with suppliers, the company does not require additional working capital. Such a strategy releases massive amounts of cash flow, which Apple has invested in R&D, advertising, and acquisitions. As a result, Apple has grown and become a market leader.

Expert Finance Assignment Help for MBA Students

Our finance assignment assistance service is primarily directed toward MBA students who are having a tough time comprehending and practicing difficult areas such as working capital management. We offer detailed, individualized help to students in dealing with difficult assignments, case studies, and analysis.

As for complicated financial topics including working capital optimization, our company employs seasoned financial specialists with expertise in sophisticated techniques on liquidity, cash flow, and operational efficiency management. We break down these concepts into simple steps for students to facilitate their understanding of the theory and practical aspects of the problem. Our aim is not only to assist the learners in solving practical problems but help them learn how and when to utilize these techniques when they face real financial problems.

How Our Service Makes Complex Financing Problems Simple

We use a combination of visuals, like flowcharts and financial models in order to simplify difficulties in complicated financial problems. By demonstrating the relation between the problem to its financial theory, we make sure that students never miss any important aspect of the solution. We offer tailored solutions for case studies and give in-depth information on different working capital strategies used by top companies. This helps students understand how to use these strategies in their studies.

More Sophisticated Techniques and Wider Scope

We introduce students to new and improved methods that they can adopt in solving questions that go beyond the basics of financial management. Among those advanced techniques include; modeling of dynamic working capital, cash conversion optimization, and enhancing working capital with financial technologies.

Apart from working capital optimization, we also offer finance assignment assistance in a wide range of subjects including but not limited to:

Corporate Finance

Risk Management

Investment Analysis

Financial Statement Analysis

Capital Budgeting

Mergers & Acquisitions

Benefits for MBA Students:

Many students ask the question: “Why should I choose your service?” The explanation is that they not only get custom-made solutions that enable them to complete their tasks in due time but also enhance their grasp of contemporary financial principles. Our specialists always give new ideas to the students to enable them to apply in their coursework assignments for top grades.

Conclusion:

Working capital management is an important aspect of financial management. This influences liquidity and profitability as well as risk factors. Students studying finance must learn the concepts to have a deeper understanding of the practical issues of business functioning. By opting for our service and getting help with finance assignments, students can learn from experts and understand important topics better. We provide sample problems, case studies, textbooks, and research papers to help students complete their assignments confidently and clearly.

Textbooks and References for Students

For students who want to undertake deeper studies in the area of working capital optimization, the is a selection of relevant textbooks and some research papers that lay a good base.

One such textbook is “Financial Management: Theory and Practice” by Eugene F. Brigham & Michael C. Ehrhardt.– This particular book attempts to explain the fundamentals of why decisions are made financially with reasonable chapters on working capital management.

Corporate Finance Jonathan Berk and Peter DeMarz– A commonly recommended textbook, which considers some of the working capital management aspects among other principles of financial management.

#Financial analysis homework help#Help with finance projects#Personal finance assignment assistance#Financial management homework help#Online finance tutoring services#Finance case study assistance#International finance assignment help#Accounting and finance assignment help#Financial modeling assignment support

0 notes

Text

Currency Related Risks in International Finance: Comprehensive Assignment Support Notes

Measures such as the degree of currency fluctuation, commonly referred to as exchange rate risk plays a central role in international finance and risk management. It refers to the risk of loss of the value of investments by an individual, either an investor or a company, because of the changes in the foreign exchange rates. Currency risk is an important concept with which the students of international finance should become familiar as it impacts international business, investments, and financial reports. This article gives detailed information of how firms can be exposed to currency risk, how this risk affects their businesses, a list of current and past examples and case studies as well as where to get help with finance assignments.

What is Currency Risk?

Currency risk refers to the situation where a business or an investor transacts in more than one currency. A fluctuation in exchange rate affects the business in terms of either profit or loss.

Apple Inc. has a big presence in the global market and conduct business transactions in numerous currencies. Through the Apple’s annual report, the effect of exchange rate fluctuations on its business can be easily identified. For instance, in 2022, due to the Russia-Ukraine war, Apple suffered up to an extent of about $2.8 billion.

Types of Currency Risk:

1. Transaction Risk: It is a situation where an individual or company received an order and getting the payment for the same. For instance, an American company that sells products to the European market will be adversely affected if the Euro declines relative to the Dollar between the time the invoice is issued and the time it is paid.

2. Translation Risk: Impacts those multinational firms that have their financial statements prepared in a foreign currency and are required to convert into their home currency. Changes in exchange rates can affect the reported earnings and the value of assets on the balance sheet.

3. Economic Risk: This simply relates to the long term effect of such exchange rate changes on the particular company’s worth and market share.

How to effectively Managing Currency Risk?

Effectively managing currency risk involves various strategies and financial instruments:

1. Hedging: Hedging is the most widely used approach used to manage currency risk. Hedging is the utilization of financial instruments like forward contracts, futures, options and swaps to guarantee that exchange rates are fixed so as to counter balance undesirable fluctuation.

2. Natural Hedging: Refers to the organization of operations in a way that provides for the netting of currency exposure. For instance, a company may decide to offset the operating revenue in one foreign currency with an equivalent operating expense in the same currency to eliminate the net exposure.

3. Diversification: Investing in different geographic areas and having exposure to different currencies to hedge the effect of any currency’s fluctuation.

4. Currency Clauses: Incorporating clauses that trigger changes in prices charged in contracts to cover for adverse fluctuation in the exchange rates.

Let us assume an American firm has anticipated receivables of €1 million from a European buyer, within the next three months. One way to manage exchange risk and particularly the risk of the Euro depreciating against the Dollar is use of forward foreign exchange contracts whereby the company will forward sell €1 million at the current exchange rate thus removing this kind of uncertainty entirely.

How Technology Plays a Role in Managing Currency Risk?

The technological developments have changed the worlds of currency risk in the context of other businesses. Advanced tools including software and algorithms are capable of reading the market and the future behavior of the currency as well as independently calculate the hedge options. Fintech companies provide platforms that supply such information in real time with facts and the assessment of risks and possible transactions for better currency risk management.

Impact of Geopolitical Events in Currency

Knowing the geopolitical exposures are important because when used correctly they can help international investors and businesses to manage the exchange risks effectively. Factors such as unstable Governments, economic sanctions and trade wars can result in fluctuations of currency. For instance, trade tensions between the US and China have resulted in fluctuations in the Chinese Yuan (CNY), posing a risk to those companies that invest in China.

Get expert service for international finance homework support

Understanding currency-related risks is crucial for anyone involved in international finance, as these risks significantly impact businesses, investors, and economies worldwide. For students learning about international finance and risk management, it is essential to grasp these risks and develop strategies to mitigate them. This involves using hedging techniques, staying updated on geopolitical events, and leveraging advanced technology to manage currency risks effectively.

To further assist with assignments and coursework in international finance, students can refer to their textbooks and the resources mentioned earlier. For additional support, students in the USA and UK can access the International Finance Assignment Help service. This service offers personalized assistance to help with coursework and assignments, ensuring that students understand complex concepts and succeed academically.

Common Exam and Assignment Questions

Students studying international finance often face tasks like analyzing the impact of exchange rate fluctuations on a company’s financial performance, understanding currency risk, and designing hedging strategies using financial instruments like forward contracts, options, and swaps. Assignments may include solving real-world case studies, such as those involving Brexit or US-China trade tensions, and assessing a company's economic exposure to currency risk. Understanding the effect of currency fluctuations on multinational companies' financial statements is also a common exam question. For personalized assistance, the International Finance Homework Help provides expert guidance tailored to students' academic needs.

How the Service Can Help Tackle Such Tasks

The International Finance Assignment Help offers detailed explanations of complex concepts, uses real-world examples and case studies, and provides customized solutions for specific assignments. It guides students to helpful study resources like textbooks and articles and offers revision support to improve drafts for clarity and accuracy. This comprehensive support helps students understand and excel in their international finance tasks.

Helpful Resources and Textbooks

International Financial Management by Jeff Madura: This textbook provides comprehensive coverage of international finance, including currency risk management, hedging strategies, and real-world examples.

"Multinational Business Finance" by David K. Eiteman, Arthur I. Stonehill, and Michael H. Moffett: A detailed guide to managing financial operations in a global environment, with a focus on currency risk and exposure.

Financial news websites like Bloomberg and Reuters that offer real-time data, analysis, and news on global currency markets.

Finance-helpdesk.com for content on basic finance concepts, computational questions and case studies.

0 notes

Text

Empower yourself for success with Finance Assignment Help. Our expert guidance and tailored solutions ensure students excel in their finance coursework. Gain confidence, achieve top grades, and unlock your academic potential with our assistance.

0 notes

Text

Navigating the Complex World of Finance: An Interview with an International Finance Assignment Help Expert

As the global economy continues to evolve, the field of international finance becomes increasingly intricate and challenging for students. To shed light on this complex subject and provide valuable insights, we sat down for an enlightening conversation with an International Finance Assignment Help expert. Our goal was to unravel the mysteries of international finance, understand the challenges students face, and explore the importance of seeking assistance when tackling assignments in this dynamic field.

Student (S): Thank you for joining us today. To kick things off, could you share a bit about your background and expertise in international finance?

International Finance Assignment Help Expert (E): Certainly! I have been immersed in the world of finance for over a decade, specializing in international finance. My journey began with a passion for understanding how financial markets operate on a global scale. I pursued advanced degrees in finance and have since been dedicated to helping students navigate the complexities of international finance through assignment assistance and guidance.

S: That's impressive. International finance can be quite overwhelming for students. Can you highlight some common challenges they face when dealing with assignments in this field?

E: Absolutely. One of the primary challenges students encounter is the extensive range of topics within international finance. From exchange rates and international investment to risk management and financial markets, the sheer breadth of the subject can be daunting. Additionally, the dynamic nature of global financial markets means that students must stay updated on the latest trends and geopolitical events, adding another layer of complexity to their assignments.

S: Given these challenges, how can seeking International Finance Assignment Help benefit students?

E: Seeking assistance can provide students with several advantages. Firstly, it offers a personalized approach to learning. Many students find that one-on-one guidance helps them grasp intricate concepts more effectively. Moreover, assignment help services often employ experts who have practical experience in the field, offering real-world insights that go beyond textbook knowledge. This can be invaluable in understanding the practical applications of international finance theories.

S: That makes sense. When students approach you for help, what are some of the common areas they struggle with the most?

E: A recurring theme is the application of theoretical concepts to real-world scenarios. Students often find it challenging to bridge the gap between what they learn in class and how it translates to practical situations. Additionally, understanding the intricacies of currency markets, managing exchange rate risk, and comprehending the impact of global economic events on financial decisions are areas where many students seek clarification.

S: How do you approach guiding students through these challenging areas?

E: I believe in a hands-on approach. Rather than just providing answers, I strive to guide students through the thought processes and methodologies involved in solving problems. This not only helps them complete their assignments but also enhances their analytical and problem-solving skills, which are crucial in the field of international finance. It's about fostering a deeper understanding of the subject matter.

S: That sounds like a comprehensive approach. Speaking of real-world applications, can you share any examples of how international finance concepts play a role in today's global business landscape?

E: Certainly. Take, for instance, multinational corporations. They operate in multiple countries, dealing with various currencies and facing diverse financial challenges. Understanding how to manage exchange rate risk and make informed financial decisions in such a complex environment is crucial. Additionally, global economic events, like trade tensions or geopolitical shifts, can have a profound impact on financial markets, influencing investment decisions and risk management strategies.

S: It's fascinating how these concepts directly influence business operations. For students aspiring to enter the field of international finance, what advice would you offer?

E: My advice would be to embrace curiosity and stay curious. International finance is a dynamic field that requires a continuous willingness to learn and adapt. Stay updated on global economic trends, explore case studies, and seek practical experiences through internships or projects. And, of course, don't hesitate to seek help when needed. The field is vast, and collaboration with experts can provide valuable perspectives that enhance your understanding.

S: Wise words. Finally, how do you see the future of international finance education evolving, and what role will assignment help services play in this evolution?

E: The future holds exciting possibilities for international finance education. As the global economy becomes more interconnected, the demand for professionals with expertise in international finance will likely increase. In response, educational institutions may further integrate practical applications and real-world scenarios into their curriculum. Assignment help services will continue to play a crucial role by providing students with the support they need to excel in this evolving landscape, ensuring that they are well-prepared for the challenges of the global financial arena.

In conclusion, our conversation with the International Finance Assignment Help expert has shed light on the intricate world of international finance. As students grapple with complex assignments, seeking assistance from experienced professionals proves to be a valuable resource. By fostering a deeper understanding of theoretical concepts, bridging the gap between theory and practice, and providing real-world insights, these experts contribute significantly to the success of aspiring finance professionals in an ever-changing global economy.

#international finance Assignment Help#Help With international finance Assignment#Online international finance Assignment Help#international finance assignment help service

0 notes

Text

GAAP vs IFRS

Decoding US Accounting Rules: GAAP vs IFRS | Expert Insights in 2024

Navigate the GAAP vs IFRS debate in US Accounting effortlessly. Gain expert insights, make sense of regulations. Your guide to financial clarity.

The evolving landscape of accounting standards unfolds a nuanced debate between the Generally Accepted Accounting Principles and the International Financial Reporting Standards. These two frameworks, while sharing a common goal of transparent financial reporting, diverge in their approaches, giving rise to a multifaceted discourse with far-reaching implications for the financial world.

1. Introduction

The evolution of accounting standards has witnessed the crystallization of two dominant frameworks – General Accounting Accepted Principles and International Financial Reporting Standards. In the labyrinth of financial reporting, companies grapple with choosing between these standards, each with its unique history, principles, and global relevance. The debate surrounding GAAP vs IFRS is not a mere academic exercise but a pivotal consideration with implications for investment decisions, legal compliance, and the global financial landscape.

1.1. Evolution of Accounting Standards

The journey of accounting standards traces back to the aftermath of the 1929 stock market crash when the need for standardized, transparent financial reporting became glaringly apparent. What emerged were the General Accounting Accepted Principles, designed to restore investor confidence by providing a reliable framework for financial statements. Over time, GAAP has become deeply embedded in the U.S. financial system, shaping the way companies communicate their financial health.

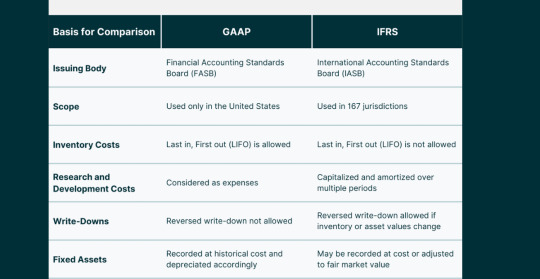

On the global stage, the International Financial Reporting Standards evolved as a response to the growing interconnectedness of economies. The International Accounting Standards Board (IASB) took the reins in developing IFRS, aiming for a standardized global language of financial reporting. This set the stage for a two-pronged approach to financial reporting standards – General Accounting Accepted Principles dominating in the U.S. and International Financial Reporting Standards gaining traction internationally.

1.2. The Crucial Role of GAAP and IFRS

GAAP stands as the bedrock of accounting standards in the United States, overseen by the Financial Accounting Standards Board (FASB). Its principles, rooted in historical cost, revenue recognition, and matching, provide stability and a familiar structure for U.S. businesses. On the other hand, IFRS, under the stewardship of the IASB, operates as a global player, emphasizing fair value, substance over form, and materiality.

The significance of General Accounting Accepted Principles lies in its historical context and its alignment with the unique needs of the U.S. business environment. Its principles have served as a guiding light for American companies, offering a consistent framework for financial reporting. International Financial Reporting Standards, with its global perspective, caters to the interconnectedness of today’s businesses, providing a common language for multinational corporations.

1.3. Navigating the GAAP vs IFRS Dilemma

The choice between General Accounting Accepted Principles and International Financial Reporting Standards is not a one-size-fits-all decision. Companies grapple with a complex decision-making process, considering factors such as their geographical reach, industry nuances, and investor preferences. This debate is not isolated to boardrooms; it resonates in financial markets, legal proceedings, and regulatory landscapes, shaping the very fabric of financial reporting practices.

2. Understanding GAAP

2.1. The Foundation of GAAP

a. Historical Roots and Evolution

GAAP’s roots delve deep into the need for a standardized accounting framework post the 1929 stock market crash. FASB emerged as a response to the chaos that ensued, charged with the responsibility of establishing and improving financial accounting and reporting standards. The journey of GAAP has been one of continuous evolution, adapting to the changing business landscape and regulatory requirements.

b. FASB’s Ongoing Influence

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, playing a pivotal role in setting and refining accounting standards. FASB’s mission goes beyond rule-making; it seeks to improve financial reporting, providing transparency and relevance in financial statements. The ongoing influence of FASB ensures that GAAP remains adaptive and responsive to the dynamic nature of business transactions.

2.2. Core Principles Anchoring GAAP

a. Embracing the Historical Cost Principle

One of the cornerstones of GAAP is the historical cost principle, dictating that assets should be recorded at their original cost. This principle provides stability and reliability in financial statements, allowing users to assess the financial health of a company based on the actual cost of its assets at the time of acquisition. While critics argue that this approach may not reflect current market values, proponents emphasize the prudence and consistency it offers.

b. Revenue Recognition as a Cornerstone

GAAP’s approach to revenue recognition centers on the realization and earned criteria. Revenue is recognized when it is realized or realizable and earned. This conservative approach ensures that revenue is not prematurely recognized, aligning with the matching principle. While this method may defer recognizing revenue until later stages in the sales cycle, it safeguards against potential overstatement and presents a cautious picture to investors.

c. The Significance of the Matching Principle

The matching principle is a guiding force in GAAP, emphasizing the alignment of expenses with the revenue they generate. This principle ensures that the costs associated with generating revenue are recognized in the same period as the revenue itself, presenting a more accurate portrayal of a company’s profitability. While adhering to the matching principle might result in lower reported profits during high-revenue periods, it provides a more realistic long-term view.

2.3. Scrutinizing Criticisms and Recognizing Limitations

a. Rigidity vs. Stability

One common criticism leveled against GAAP is its perceived rigidity, particularly regarding the historical cost principle. Critics argue that this approach may not capture the true economic value of assets, especially in industries with rapidly changing market conditions. However, proponents assert that this rigidity provides stability and consistency, allowing for easier comparison across periods and industries.

b. The Balancing Act of Revenue Recognition

The conservative approach to revenue recognition in GAAP has faced scrutiny for potentially understating a company’s immediate financial performance. Critics argue that this caution may not be reflective of a company’s true economic position, especially in industries where revenue realization is instantaneous. However, the balancing act lies in mitigating the risk of premature revenue recognition, ensuring financial statements maintain integrity and accuracy.

c. Challenges in Adhering to the Matching Principle

While the matching principle aligns expenses with revenue, critics contend that it introduces complexities in determining the direct association between costs and specific revenue streams. This challenge becomes more pronounced in industries with diverse revenue sources. Despite these challenges, adhering to the matching principle remains integral in presenting a holistic view of a company’s financial health, helping investors make informed decisions.

3. Embracing IFRS

3.1. IFRS: A Global Framework

a. The Rise of International Financial Reporting Standards

The emergence of IFRS marks a significant shift towards a globalized approach to financial reporting. As businesses expanded internationally, the need for a common accounting language became evident. IFRS, under the stewardship of the International Accounting Standards Board (IASB), rose to prominence as a framework that transcends borders, providing a standardized set of principles for companies operating on the world stage.

b. IASB’s Pivotal Role in Shaping IFRS

The International Accounting Standards Board (IASB) shoulders the responsibility of developing and maintaining IFRS. Unlike GAAP, IFRS operates under a principles-based approach, focusing on broad principles rather than detailed rules. This flexibility allows for easier adaptation to diverse business environments, making IFRS an attractive choice for multinational corporations seeking a harmonized approach to financial reporting.

3.2. Unpacking Core Principles of IFRS

a. Fair Value Measurement: A Paradigm Shift

One of the fundamental differences between GAAP and IFRS lies in the approach to asset valuation. While GAAP predominantly adheres to the historical cost principle, IFRS leans towards fair value measurement. Fair value reflects the current market value of assets, providing a more dynamic and responsive perspective. Critics argue that fair value introduces volatility, but proponents emphasize its relevance in capturing real-time economic conditions.

b. Substance Over Form: Emphasizing Economic Reality

In IFRS, the substance of transactions takes precedence over their legal form. This principle ensures that financial statements reflect the economic reality of transactions, promoting transparency and accuracy. While this approach aligns with the overarching goal of providing relevant information to users, it requires careful judgment and interpretation, potentially introducing subjectivity in financial reporting.

c. Materiality’s Role in Flexibility

IFRS introduces greater flexibility in materiality judgments compared to GAAP. Materiality refers to the threshold at which information becomes relevant to users. The more flexible stance in IFRS allows entities to exercise judgment in determining what information is material, considering both quantitative and qualitative factors. This flexibility, while enhancing the adaptability of IFRS, also raises concerns about potential inconsistencies in financial reporting.

3.3. Weighing Advantages and Drawbacks

a. IFRS Flexibility: A Double-Edged Sword

The flexibility embedded in IFRS is both its strength and weakness. Proponents argue that this adaptability makes IFRS suitable for diverse business environments, allowing for easier integration with various industries and legal systems. However, critics contend that this very flexibility can lead to inconsistencies and a lack of comparability, challenging the reliability of financial statements for investors and stakeholders.

b. Global Appeal vs. Application Challenges

The global nature of IFRS makes it an attractive choice for multinational companies aiming for consistency in financial reporting across borders. The common language of IFRS facilitates international transactions and fosters a seamless global financial landscape. However, the application of IFRS can pose challenges in jurisdictions with varying legal and regulatory frameworks, potentially leading to complexities in implementation and interpretation.

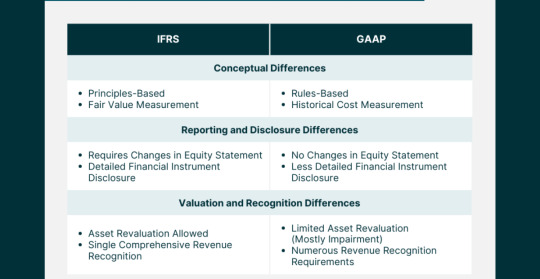

4. Key Differences Between GAAP and IFRS

4.1. Delving into Variances

a. Revenue Recognition: The GAAP-IFRS Divergence

One of the pivotal differences between GAAP and IFRS lies in the recognition of revenue. While both frameworks aim to depict the economic reality of transactions, their approaches diverge in certain key aspects. GAAP tends to be more prescriptive, providing specific guidelines for various industries, whereas IFRS adopts a broader principles-based approach, allowing entities more room for interpretation.

b. Inventory Valuation: Differing Approaches

The treatment of inventory valuation varies significantly between GAAP and IFRS. GAAP typically follows a specific set of rules for valuing inventory, such as the Last In, First Out (LIFO) or First In, First Out (FIFO) methods. In contrast, IFRS permits the use of various methods, including FIFO and weighted average, offering companies more flexibility in choosing an approach that aligns with their specific business dynamics

c. Consolidation Methods: Navigating Complexity

Consolidation methods, particularly in the context of subsidiaries and investments, showcase differences between GAAP and IFRS. GAAP often employs a more rule-based approach, specifying conditions for consolidation. In contrast, IFRS focuses on a principles-based approach, considering the substance of relationships rather than relying on rigid criteria. This variance introduces nuances in financial reporting, influencing how companies present their financial position and performance.

4.2. The Impact on Financial Statements

a. Shaping Investor Perception

The differences in revenue recognition, inventory valuation, and consolidation methods contribute to variations in financial statements produced under GAAP and IFRS. Investors, as key stakeholders, must navigate these differences to gain an accurate understanding of a company’s financial health. The choice between GAAP and IFRS significantly shapes investor perception, influencing investment decisions and risk assessments.

b. Decision-Making Dynamics

Companies, in choosing between GAAP and IFRS, must consider the implications on decision-making dynamics. The framework adopted affects how financial information is presented, potentially influencing strategic decisions, mergers and acquisitions, and capital-raising activities. Understanding the impact of these frameworks on decision-making is crucial for entities operating in dynamic and competitive business environments.

4.3. Global Adoption Trends: A Comparative Analysis

The adoption trends of GAAP and IFRS provide insights into the global dynamics of financial reporting standards. While GAAP maintains dominance within the United States, IFRS has gained traction in numerous jurisdictions worldwide. Understanding the factors influencing these trends, such as regulatory requirements, investor preferences, and global market integration, sheds light on the evolving landscape of accounting standards.

“Accounting isn’t just about profits and losses; it’s about sculpting the financial soul of a company.” Michael Johnson

5. The Evolution of Accounting Standards

5.1. GAAP’s Historical Odyssey

a. Post-1929: A Catalyst for Change

The stock market crash of 1929 served as a catalyst for rethinking the approach to financial reporting. The chaos that ensued prompted the establishment of standardized accounting principles, laying the foundation for what would later become GAAP. The primary goal was to restore investor confidence by providing a reliable framework for financial statements, reducing uncertainty and fostering stability in financial markets.

b. Amendments and Updates: Shaping GAAP’s Trajectory

GAAP’s journey has not been static; it has evolved through amendments and updates to address emerging challenges and align with changing business dynamics. The Financial Accounting Standards Board (FASB) plays a pivotal role in shaping GAAP, ensuring that it remains relevant, transparent, and responsive to the needs of companies and investors. The ongoing commitment to refinement reflects a dedication to maintaining the integrity of financial reporting.

5.2. Internationalization Efforts

a. Pioneering Attempts at Global Standardization

As globalization gained momentum, so did the recognition of the need for global accounting standards. Efforts were made to align U.S. GAAP with international standards, but achieving a universal standard proved challenging. The push for global standardization gained traction with the rise of IFRS, offering a framework that transcends national boundaries and facilitates consistency in financial reporting for multinational corporations.

b. The Challenge of Aligning U.S. Standards Globally

While the concept of global accounting standards gained support, aligning U.S. GAAP with international standards presented formidable challenges. The unique legal, regulatory, and cultural landscape in the United States posed hurdles to seamless integration. Despite these challenges, the pursuit of convergence and harmonization continued, reflecting the recognition of the interconnectedness of global economies.

5.3. Convergence Initiatives

a. The Ongoing Pursuit of Harmonization

Convergence initiatives aimed at harmonizing GAAP and IFRS gained prominence in the early 21st century. The objective was to reduce disparities between the two frameworks, fostering a more standardized global approach to financial reporting. While full convergence remained elusive, progress was made in aligning specific standards, reflecting a commitment to minimizing inconsistencies and facilitating ease of comparison for investors and stakeholders.

b. Prospects and Hurdles in a Unified Global Standard

The prospects of a unified global accounting standard remain a tantalizing goal, promising enhanced comparability and consistency in financial reporting. However, hurdles such as divergent national interests, legal complexities, and varying levels of standard-setting infrastructure continue to challenge the realization of this vision. Navigating these obstacles requires ongoing collaboration and a commitment to the overarching goal of global financial transparency.

6. Regulatory Bodies Influencing GAAP

6.1. FASB’s Pivotal Role

a. GAAP’s Guardian: The FASB Mandate

The Financial Accounting Standards Board (FASB) stands as the guardian of GAAP, wielding influence over the development and refinement of accounting standards. FASB’s mandate goes beyond rule-making; it encompasses a commitment to improving financial reporting, ensuring that standards are not only relevant but also responsive to the evolving needs of businesses and investors.

b. FASB’s Mission in Financial Reporting Improvement

FASB’s mission revolves around the improvement of financial reporting through the development of high-quality accounting standards. The board operates under a due process system, seeking input from various stakeholders, including investors, auditors, and preparers of financial statements. This collaborative approach ensures that GAAP remains a robust and adaptive framework that reflects the intricacies of modern business transactions.

6.2. SEC’s Watchful Eye

a. SEC’s Authority in Recognizing GAAP Standards

The Securities and Exchange Commission (SEC) plays a crucial role in the oversight of financial reporting in the United States. While the FASB sets accounting standards, the SEC has the authority to recognize and prescribe the principles used in the preparation of financial statements for publicly traded companies. This dual-layered system ensures a balance between industry expertise and regulatory oversight in shaping GAAP.

b. SEC’s Contributions to Financial Transparency

The SEC’s contributions to financial transparency extend beyond its recognition of GAAP standards. The commission actively engages in rule-making and enforcement to ensure that companies adhere to accounting principles and provide accurate and timely financial information to investors. The synergy between the SEC and FASB reinforces the integrity of financial reporting in the U.S. capital markets.

6.3. AICPA’s Industry Impact

a. AICPA: Nurturing Professional Standards

The American Institute of Certified Public Accountants (AICPA) plays a vital role in shaping professional standards within the accounting industry. While not directly involved in setting GAAP, the AICPA contributes to the development of ethical and professional standards that guide the conduct of accountants. This commitment to excellence enhances the credibility of financial reporting, reinforcing the trust that stakeholders place in GAAP.

b. Industry-Wide Compliance through AICPA Guidance

The AICPA’s influence extends beyond standards development to encompass industry-wide compliance. The organization provides guidance on best practices, ethical considerations, and emerging issues within the accounting profession. This guidance ensures a cohesive and ethical approach to financial reporting, aligning with the principles embedded in GAAP and contributing to the overall reliability of financial statements.

7. International Bodies Shaping IFRS

7.1. IASB’s Global Mandate

a. IASB’s Significance in IFRS Development

The International Accounting Standards Board (IASB) holds a central role in the development and maintenance of IFRS. Unlike the FASB’s role in the U.S., the IASB operates on a global scale, aiming to set accounting standards that are applicable and relevant to entities worldwide. The IASB’s commitment to a principles-based approach reflects its recognition of the diverse needs of global businesses.

b. A Global Perspective in Standard Setting

The IASB’s global perspective is intrinsic to its standard-setting process. The board considers input from various regions, industries, and stakeholders, ensuring that IFRS reflects the nuances of international business. The principles-based approach allows for adaptability, catering to the diverse legal, economic, and cultural landscapes in which entities operate globally.

7.2. IFRIC’s Interpretative Role

a. Navigating Grey Areas: IFRIC’s Guidance

The International Financial Reporting Interpretations Committee (IFRIC) plays a crucial role in navigating interpretative challenges within IFRS. Given the principles-based nature of IFRS, grey areas may arise, requiring clarification and guidance. IFRIC addresses these challenges by providing interpretations and guidance, ensuring consistent application of IFRS standards across diverse industries and jurisdictions.

b. Consistent Application of IFRS Standards

Consistency in the application of IFRS standards is paramount to ensuring comparability and reliability in financial reporting. IFRIC’s interpretative role contributes to this objective by offering guidance on ambiguous or complex issues. This commitment to clarity and consistency aligns with the overarching goal of IFRS – to provide a common language for financial reporting that transcends geographical and industry-specific boundaries.

7.3. Monitoring Board’s Oversight

a. Ensuring Independence in Standard Setting

The Monitoring Board plays a crucial oversight role in ensuring the independence and effectiveness of the IFRS Foundation, which houses the IASB. Independence is a cornerstone of credible standard-setting, and the Monitoring Board’s role is to safeguard the integrity of the standard-setting process. This commitment to independence reinforces the trust that global stakeholders place in IFRS as a reliable and unbiased framework.

b. The Role of the Monitoring Board in IFRS Integrity

The Monitoring Board’s vigilance extends beyond independence to the broader integrity of the IFRS framework. By overseeing the activities of the IFRS Foundation and IASB, the Monitoring Board contributes to the credibility of IFRS as a global accounting standard. This oversight ensures that IFRS continues to meet the evolving needs of global financial markets and remains a trusted framework for transparent financial reporting.

8. Impact on Financial Reporting

8.1. Side-by-Side Comparison

a. Financial Statement Variances: GAAP vs IFRS

A side-by-side comparison of financial statements prepared under GAAP and IFRS reveals variances arising from differences in principles, approaches, and interpretations. These variances extend to revenue recognition, asset valuation, and consolidation methods, influencing the reported financial position and performance of entities. Investors and analysts must navigate these differences to glean accurate insights into a company’s financial health.

b. Interpretation Challenges for Investors

Investors face interpretation challenges when analyzing financial statements prepared under different frameworks. Understanding the nuances of GAAP and IFRS differences is crucial for making informed investment decisions. The ability to discern how specific accounting choices impact financial metrics empowers investors to evaluate risks, assess potential returns, and navigate the complexities of the global investment landscape.

8.2. Revenue Recognition Dynamics

a. The Nuances of Revenue Recognition

The nuances of revenue recognition under GAAP and IFRS reflect the underlying philosophies of each framework. GAAP, with its prescriptive guidelines, provides specific criteria for recognizing revenue in various industries. In contrast, IFRS adopts a broader approach, emphasizing the substance of transactions over rigid rules. Navigating these nuances requires a deep understanding of industry dynamics and the specific requirements of each framework.

b. Implications for Investor Decision-Making

The implications of revenue recognition dynamics extend to investor decision-making. Differences in when and how revenue is recognized can influence perceptions of a company’s immediate financial performance. Investors must factor in these nuances to make informed decisions, considering the impact on key financial metrics such as earnings per share, profit margins, and return on investment.

8.3. Asset Valuation Approaches

a. Valuation Philosophies: Fair Value vs. Historical Cost

The variance in asset valuation philosophies between GAAP and IFRS introduces complexities in financial reporting. GAAP’s adherence to historical cost provides stability and consistency, albeit potentially understating the current market value of assets. In contrast, IFRS’s emphasis on fair value introduces a more dynamic and responsive approach to asset valuation. Companies must navigate the trade-offs between stability and accuracy in presenting their financial position.

b. Balancing Accuracy and Stability in Asset Reporting

Balancing accuracy and stability in asset reporting requires careful consideration of the trade-offs between fair value and historical cost. Companies must weigh the benefits of presenting current market values against the potential volatility introduced by fair value measurements. Striking the right balance ensures that financial statements accurately reflect the economic reality of a company’s assets while providing stakeholders with a stable and reliable foundation for decision-making.

9. Challenges in Adoption

9.1. Corporate Resistance Factors

a. Unpacking Corporate Hesitations

The decision to adopt new accounting standards, whether transitioning from GAAP to IFRS or vice versa, is met with corporate hesitations. Companies fear the potential disruptions, costs, and uncertainties associated with the transition. Understanding these resistance factors is essential for regulatory bodies, standard-setters, and industry stakeholders to develop strategies that facilitate smoother adoptions and ensure widespread compliance.

b. Overcoming Corporate Resistance Challenges

Overcoming corporate resistance challenges requires a multi-faceted approach. Clear communication on the benefits of the new standards, comprehensive training programs, and support mechanisms can alleviate concerns. Regulators and standard-setters must collaborate with industry representatives to address specific challenges faced by different sectors, fostering a cooperative environment conducive to successful adoptions.

9.2. Implementation Costs

a. Financial and Operational Impacts

The implementation of new accounting standards incurs financial and operational impacts for companies. Costs associated with staff training, system upgrades, and adjustments to internal processes contribute to the overall financial burden. Companies must carefully assess these costs and develop comprehensive implementation plans to mitigate disruptions and ensure a seamless transition to the new standards.

b. Strategies for Mitigating Implementation Costs

Strategies for mitigating implementation costs involve proactive planning, phased adoption approaches, and leveraging technology. Companies can benefit from engaging with industry peers that have successfully navigated similar transitions, learning from best practices and challenges. Collaboration between standard-setters, regulatory bodies, and industry associations plays a crucial role in developing strategies that balance the need for improved standards with the practicalities of implementation.

9.3. Training and Skill Gaps

a. The Need for Specialized Training

The adoption of new accounting standards introduces the need for specialized training to ensure that professionals possess the skills required for compliance. Training programs must address the nuances of the new standards, focusing on changes in accounting principles, reporting requirements, and the application of new methodologies. Bridging skill gaps is crucial for maintaining the integrity and accuracy of financial reporting.

b. Collaborative Approaches to Skill Development

Collaborative approaches to skill development involve partnerships between educational institutions, professional organizations, and industry players. The goal is to create comprehensive training programs that equip professionals with the knowledge and skills necessary for successful compliance. Standard-setters and regulators can play a pivotal role in promoting and endorsing such collaborative initiatives, fostering a culture of continuous learning within the accounting profession.

10. Legal Implications for Corporations

10.1. Legal Challenges in GAAP Compliance

a. Litigation Risks in GAAP Adherence

The legal challenges associated with GAAP compliance include litigation risks arising from alleged non-compliance. Companies adhering to GAAP must navigate the complexities of the legal landscape, ensuring that their financial statements withstand scrutiny. Implementing robust internal controls, engaging in transparent communication, and staying abreast of legal developments are essential strategies for mitigating litigation risks.

b. Strategies for Legal Compliance in GAAP

Strategies for legal compliance in GAAP involve proactive measures to minimize litigation risks. This includes fostering a culture of compliance within the organization, conducting regular internal audits, and seeking legal counsel to ensure alignment with evolving regulations. Companies that prioritize legal compliance contribute to the overall stability and trustworthiness of the financial reporting ecosystem.

10.2. Legal Battles in IFRS Adoption

a. Navigating Legal Challenges in IFRS Transition

The transition to IFRS introduces legal battles that companies must navigate effectively. Disputes may arise over interpretations of IFRS standards, potentially leading to litigation. Companies must engage in comprehensive risk assessments, understanding the legal implications of IFRS adoption, and implementing measures to mitigate potential legal challenges.

b. Legal Safeguards for Companies Adopting IFRS

Legal safeguards for companies adopting IFRS involve proactive steps to minimize legal risks. This includes engaging legal experts in the transition process, conducting impact assessments, and implementing robust governance structures. Companies that prioritize legal safeguards position themselves to navigate the complexities of IFRS adoption with resilience and integrity.

10.3. Risk Mitigation Strategies

a. Legal Safeguards: Mitigating Risks in Regulatory Compliance

Legal safeguards play a pivotal role in mitigating risks associated with regulatory compliance. Companies must implement effective risk management strategies, including regular legal audits, compliance training, and a responsive approach to legal developments. A proactive stance towards legal safeguards enhances a company’s ability to navigate the intricate landscape of financial reporting standards.

b. Strategies for Minimizing Legal Challenges in Reporting Standards

Strategies for minimizing legal challenges in reporting standards involve a holistic approach to risk management. This includes collaboration with legal professionals, staying informed about evolving regulations, and fostering a culture of compliance within the organization. Companies that prioritize these strategies not only mitigate legal challenges but also contribute to the overall reliability and credibility of financial reporting standards.

11. Investor Perspectives

11.1. Investor Preferences

a. Surveying Investor Preferences: GAAP or IFRS?

Understanding investor preferences is crucial in the GAAP vs. IFRS discourse. Surveys play a valuable role in gauging investor sentiment and preferences regarding financial reporting standards. The insights gleaned from such surveys inform standard-setters, regulators, and companies in aligning financial reporting practices with investor expectations.

b. Implications of Investor Preferences on Reporting Standards

The implications of investor preferences on reporting standards are far-reaching. Companies that align with investor preferences enhance transparency and communication, fostering trust and confidence. Standard-setters and regulators, informed by investor feedback, can shape standards that not only meet regulatory requirements but also cater to the information needs of investors in a dynamic and competitive market.

11.2. Impact on Investment Decision-Making

a. Investor Decision Dynamics: GAAP vs IFRS

Investor decision dynamics are influenced by the choice between GAAP and IFRS. Differences in financial reporting standards can impact the comparability of financial statements, influencing investment decisions. Investors must consider the implications of these standards on key metrics, risk assessments, and overall financial analysis to make informed and strategic investment decisions.

b. Strategic Impacts on Investment Choices

The strategic impacts of financial reporting standards on investment choices go beyond compliance. Companies that recognize the link between transparent financial reporting and investor confidence gain a strategic advantage. Similarly, investors who factor in the nuances of GAAP and IFRS differences in their decision-making processes navigate the complexities of the investment landscape more effectively.

11.3. Investor Education Initiatives

a. The Imperative of Investor Education

The imperative of investor education underscores the need for initiatives that enhance investor understanding of financial reporting standards. Educational programs, informational resources, and collaborative efforts between financial institutions and regulatory bodies contribute to a more informed investor community. An educated investor base not only demands higher standards of transparency but also actively participates in shaping the future trajectory of financial reporting.

b. Educating Investors on GAAP vs IFRS Implications

Educating investors on GAAP vs. IFRS implications involves demystifying the complexities of these frameworks. Providing accessible information, conducting investor workshops, and leveraging digital platforms for educational outreach are essential components. Investors empowered with a deeper understanding of financial reporting standards contribute to market efficiency and hold companies accountable for transparent and reliable reporting.

12. Ethical Considerations

12.1. Ethical Dimensions in Financial Reporting

a. Ethics in Financial Reporting Standards

Ethical considerations are integral to the formulation and adherence to financial reporting standards. The principles of integrity, objectivity, and transparency underpin ethical financial reporting. Standard-setters, regulators, and companies must navigate ethical dimensions to ensure that financial reporting serves the interests of investors and the broader public.

b. Upholding Integrity and Objectivity in Reporting

Upholding integrity and objectivity in reporting requires a commitment to ethical conduct. Companies must prioritize accurate representation over short-term gains, fostering a culture that values transparency. Regulators play a crucial role in setting the ethical tone, emphasizing the importance of unbiased and principled financial reporting in maintaining the integrity of capital markets.

12.2. Ethical Challenges for Accountants

a. Common Ethical Dilemmas in GAAP and IFRS

Accountants face common ethical dilemmas in navigating the intricacies of GAAP and IFRS. Issues such as revenue recognition, asset valuation, and disclosure requirements present challenges where ethical considerations intersect with professional responsibilities. Accountants must navigate these dilemmas with a commitment to ethical conduct, considering the broader impact on stakeholders and financial markets.

b. Navigating Ethical Challenges in Reporting Standards

Navigating ethical challenges in reporting standards involves equipping accountants with the tools and guidance needed for principled decision-making. Ongoing professional development, ethical training programs, and mentorship initiatives contribute to a culture of ethical awareness within the accounting profession. Companies, in turn, benefit from the assurance that financial reporting is not only compliant but also aligns with the highest ethical standards.

12.3. Regulatory Measures for Integrity

a. Regulatory Safeguards: Ensuring Ethical Conduct

Regulatory safeguards play a crucial role in ensuring ethical conduct in financial reporting. Regulatory bodies must establish and enforce ethical standards, conduct regular audits, and impose sanctions for non-compliance. A robust regulatory framework promotes integrity in financial reporting, reinforcing public trust in the accuracy and reliability of financial statements.

b. Maintaining the Integrity of Financial Reporting Standards

Maintaining the integrity of financial reporting standards requires a collaborative effort between regulators, standard-setters, and industry stakeholders. Periodic reviews, stakeholder consultations, and responsiveness to emerging ethical challenges contribute to the ongoing refinement of standards. The commitment to upholding ethical principles ensures that financial reporting continues to serve as a cornerstone of trust in the global business landscape.

13. Future Trajectories

13.1. The Evolution of Reporting Standards

a. Anticipating Future Changes

Anticipating future changes in reporting standards involves considering the dynamic nature of global business, technological advancements, and shifts in investor expectations. Standard-setters must adopt a forward-looking approach, engaging in scenario planning and staying attuned to emerging trends. The ability to anticipate future changes ensures that reporting standards remain relevant and adaptive to the evolving needs of the business environment.

b. Technological Innovations and Reporting

Technological innovations are poised to shape the future trajectory of reporting standards. The integration of artificial intelligence, blockchain, and data analytics introduces opportunities for enhanced accuracy, efficiency, and transparency in financial reporting. Standard-setters and companies must embrace these innovations responsibly, balancing the benefits of technology with the imperative of maintaining ethical and transparent financial practices.

13.2. Convergence vs. Divergence

a. Assessing Convergence Prospects

The prospects of convergence between GAAP and IFRS continue to be a topic of consideration. While convergence offers the promise of a more standardized global approach, challenges such as differing legal frameworks and regulatory philosophies persist. Assessing convergence prospects involves a nuanced examination of global trends, regulatory developments, and ongoing efforts by standard-setters to bridge divergences.

b. Navigating Divergences in Global Standards

Navigating divergences in global standards requires a pragmatic approach that acknowledges the unique needs of individual jurisdictions. The coexistence of multiple standards necessitates effective communication, education, and cross-border collaboration. Standard-setters can play a pivotal role in facilitating harmonization efforts, fostering a global financial reporting landscape that balances convergence with the flexibility needed to accommodate diverse economic and regulatory environments.

13.3. Sustainable Reporting Paradigms

a. The Rise of Sustainable Reporting

The rise of sustainable reporting reflects a paradigm shift in the broader understanding of corporate performance. Investors, regulators, and the public increasingly recognize the importance of environmental, social, and governance (ESG) factors. Future reporting standards are likely to integrate sustainable reporting paradigms, providing a more comprehensive view of a company’s long-term value creation and societal impact.

b. Integrating ESG Metrics into Reporting Standards

Integrating ESG metrics into reporting standards requires a collaborative effort between standard-setters, regulators, and industry stakeholders. The development of clear guidelines, standardized metrics, and transparent disclosure requirements enhances the credibility of sustainable reporting. Companies embracing ESG considerations in their financial reporting contribute to a more informed and responsible investment landscape.

14. Conclusion

Financial reporting standards, whether grounded in GAAP or IFRS, serve as the bedrock of transparency, trust, and accountability in the global business landscape. The evolution of these standards reflects a journey of adaptation to changing business dynamics, regulatory landscapes, and investor expectations. While GAAP and IFRS diverge in certain philosophies and approaches, they share a common goal – to provide reliable and relevant information for decision-making.

As we navigate the complexities of GAAP vs. IFRS, it is imperative to recognize the strengths and limitations of each framework. GAAP, with its historical cost emphasis and rule-based approach, offers stability and comparability. In contrast, IFRS, operating under a principles-based approach, provides flexibility and a global perspective. Understanding the variances in revenue recognition, asset valuation, and consolidation methods is essential for investors, analysts, and companies alike.

Looking ahead, the trajectory of reporting standards involves a delicate balance – between convergence and divergence, between technological innovation and ethical considerations, and between traditional financial metrics and sustainable reporting paradigms. The future holds the promise of more standardized, adaptive, and responsible reporting standards that cater to the diverse needs of a dynamic global economy.

In conclusion, as the landscape of financial reporting continues to evolve, stakeholders must remain vigilant, adaptive, and collaborative. Whether one adheres to GAAP or IFRS, the shared commitment to integrity, transparency, and accountability ensures that financial reporting remains a cornerstone of trust in the interconnected world of business and finance.

#cfo#banking#accounting#finance#investment#personal finance#international finance assignment help service#financial management#financial markets#financial modeling#financial planning#financial dominance#financial services#financial literacy#financial drain#management#business#entrepreneur

0 notes

Text

DARKNESS OF DEVOTION

PAIRING: sunghoon x fem!reader

GENRE/CW: smut, dubcon, unprotected sex (wrap it before you tap it), blowjob, fingering, bondage, degradation, impact play, usage of nicknames, breeding, possessiveness, stalkerish behaviour, lmk if i missed anything.

SYNOPSIS: Never in a million years you could have imagined your polished and perfect boss to have handcuffs in his office, and well, stalker tendencies. You thought you were just an intern for him, but he simply saw you as possession.

WORD COUNT: 2.6k words

WARNING: 18+ content, minors dni

A/N: hihi, loves! i truly have never tried the concept of dubcon before, but this is for @hoondrop who loves possessive hoon and @evermorehoon who preaches head pusher hoon agenda ! i hope you guys will like it :3 all likes, comments, reblogs and feedbacks are highly appreciated! iloveyou all <33