#ipo advisory

Text

NIX Advisory: Your Online Destination for Business Loans Apply Online NIX Advisory offers a streamlined and efficient platform for businesses seeking financial support through business loans. With our online application process, we aim to simplify the often complex journey of securing funding, empowering entrepreneurs to access the capital they need to grow and thrive. Our platform is designed with the needs of modern businesses in mind, offering convenience, accessibility, and transparency throughout Business Loans Apply Online. https://nixadvisory.com/business-loan/

#financial advisory services#financial consulting firms#financial advisory#financial advisors#investment firm#ipo advisory india#ipo advisory#best loan settlement agency#financial services agency#business loans apply online#business loans#advisory services

0 notes

Text

We Help Your Business To Grow Faster

#mistrymehta#business growth#businessgrowthadvisory#business advisory#business consultant#sme ipo advisory#mergerandacquisition#financial consultant#debt advisory services#equity advisory services#business advisory services

0 notes

Text

National Strategic IPO Guidance: Premier Advisory Services in India

Our extensive advising services across India ensure a well-planned and prosperous market debut as you set out on your IPO journey. Our elite advisors offer strategic direction for your company by utilizing industry knowledge and nationwide insights. We expertly handle the complexities of the Indian business landscape using a range of approaches, from thorough market research to customized plans. Regardless of your level of experience, our national reach guarantees that your IPO Advisory Services in India endeavor is supported by top-notch industry expertise. Together, we can redefine success in the Indian market, where careful execution combined with strategic direction leads to long-term growth and significance.

0 notes

Text

IPO Readiness Advisory

Get expert guidance for your company's IPO journey with our IPO Readiness Advisory. Navigate regulatory complexities, optimize financials, and ensure strategic preparedness for a successful public offering. Position your business for the next level of growth with our comprehensive advisory services.

0 notes

Text

Long-Term Prospects of the Investment Banking Industry Beyond 2022

The field of investment banking is widely recognized as among the most prestigious in the whole financial services sector. Underwriting the issue of stocks and bonds, as well as other investment-related tasks, are standard parts of this line of business.

The Role of an Investment Banker

Investment banking firms in India facilitate capital-raising and other financial transactions for corporations, governments, and other organizations. When compared to retail banks, which cater to the needs of individual customers, investment banks have a very different focus. Instead, they play the role of go-betweens for businesses, investors, and other third parties. Financial institutions may focus on M&A, private equity, or venture capital as an area of expertise.

When it comes to making investments,IPO Lead Managers play a crucial role. A manager's duties often include research, project management, and strategic advice. Specialists in investment banking provide various financial services to individuals, businesses, and government organizations. Many investment banks have their own in-house investment researchers or contract with external businesses to help them evaluate and track the ever-changing capital market. As a result, they can advise their clients on crucial financial matters.

Build Prospects in Investment Banking

Investment banking firms in India have the ability to compete in the investment banking sector with high-velocity results. The future rests on their propensity to innovate, restructure, and rely on the support of other financial institutions. It can be difficult, expensive, and time-consuming for certain firms to untangle old structures and build and acquire digital technologies to better connect with customers and secure ecosystem partners (service providers). However, this other option is likely to reduce market competition and slow down the process of disintermediation.

Steps to Disrupt Investment Banking to eliminate bottlenecks

When looking at what needs to be done, firms must first "zoom out," or see a large picture without limiting details, and then "zoom in," or zero in on minutiae. You might think of this building as a road map for their journey.

Investment firms in India can only face these obstacles head-on by adopting a methodical approach to formulating and carrying out their strategies.

Guidelines for Creating Tomorrow's Financial Institutions

In order to prevail over these challenges, investment banks must adhere to the following three principles:

Collaboration across industries: Keep in touch with the people that make up the market so that issues may be tackled as a group. One way to accomplish this is by expanding existing relationships with fintech companies, utilities, and incumbent service providers.

More standardization: As does the creation of standards that encourage innovation and new technology adoption.

Create the plan, learn about the major expenditures, and keep things as simple as possible: Businesses that want to reap the journey's benefits and avoid falling into an investment trap must invest in it consistently over time.

These days, consumers are looking for products and deals specifically designed for them. Despite a shift away from cookie-cutter product development, few financial institutions are equipped to determine clients' true needs. Many financial institutions may still be using antiquated data systems that were designed for a time when banking was far less complex and data was kept in separate silos.

Financial institutions like investment banks and transaction advisory services of the future will differ significantly from those of today. Banks will need to begin implementing strategies today to assist them to prepare for banking in 2030 in the face of shifting consumer expectations, evolving technologies, and new business models.

There is intense competition among investment management firms in India for the business of any given company. Finding a company whose first priority is your financial well-being is not always easy. With experience gained from completing over a hundred successful fund-raising agreements in over a dozen countries for over five thousand distinct firms, Pantomath Advisory Service Group is a frontrunner in the field. Want to know more? Contact us today!

#investment banking firms in india#IPO lead manager#investment banking#transaction advisory services

0 notes

Text

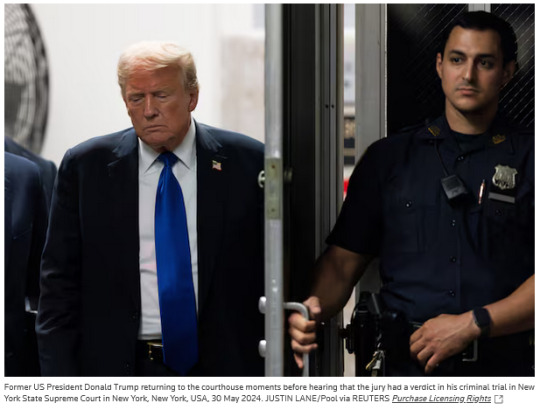

Trump found guilty: Stock markets slide, read investor reaction

https://www.reuters.com/legal/view-jury-finds-trump-guilty-all-counts-hush-money-trial-2024-05-30/

NEW YORK, May 30 (Reuters) - Donald Trump became the first U.S. president to be convicted of a crime on Thursday when a New York jury found him guilty of falsifying documents to cover up a payment to silence a porn star ahead of the 2016 election.

After deliberations over two days, the 12-member jury announced it had found Trump guilty on all 34 counts he faced. Unanimity was required for any verdict.

The verdict, which came back after the close of the U.S. stock market, plunges the United States into unexplored territory ahead of the Nov. 5 presidential election, when Trump, the Republican candidate, will try to win the White House back from Democratic President Joe Biden.

Shares in Trump Media & Technology Group (DJT.O), opens new tab

, parent of the former president's social media site Truth Social, fell 14% after the verdict.

TOM HAYES, CHAIRMAN, GREAT HILL CAPITAL, NEW YORK

“I think the next step will likely be an appeal. And if he appeals that would get pushed out past the election. So ultimately, the risk is that the rest of the world views this as a political prisoner, which undermines our legal and economic system."

"If the world starts to view it that the last bastion of democracy, free markets, fair legal system, is perceived to be tainted, you could start to see a shift in capital flows. We’ve been a major beneficiary of equity flows and demand for our Treasuries.”

BILL STRAZZULLO, CHIEF MARKETS STRATEGIST, BELL CURVE TRADING, BOSTON

“What I think ... is that the biggest threat to the economy, markets and democracy is Trump. He gets more and more unhinged every day and the fact that he’s convicted on all counts, I assume, will resonate with some people.

"The election will more than likely be a close election because we have a divided country. He has done everything he can to circumvent these various charges. For the American people, there’s no excuse. He’s a convicted felon. Period. End of story. If this is the guy you want in the White House, shame on you and shame on us as a country . . . The fact that today is a serious blow to his reelection chances is a big deal.”

JACK ABLIN, CHIEF INVESTMENT OFFICER, CRESSET CAPITAL, CHICAGO

“I don’t think there will be a lot of impact.”

“The market will just digest it and move on.”

“We likely know most of (Trump and Biden's) thoughts on economic policy and other crucial questions. Certainly, both seem to agree on running large deficits.”

Ablin said that even looking past the November election date, market volatility – as reflected in options pricing – remains low.

KEITH LERNER, CO-CHIEF INVESTMENT OFFICER, TRUIST ADVISORY SERVICES, ATLANTA

“There was a lot of uncertainty about the election before this. This adds to some of the uncertainty going forward, but in the interim is probably not going to be a significant market mover, and the market right now is relatively flat reacting to this news.”

JAMIE COX, MANAGING PARTNER, HARRIS FINANCIAL, RICHMOND, VIRGINIA

“I don’t know if it has any effect on markets necessarily. But it certainly has an effect on the recently-IPOed DJT. It’s market-moving news for that. The market has already discounted a guilty conviction in the hush money case because it was widely believed to be more of a side show. I think it would have been much more news for the market had he been not convicted. But at this particular moment, markets have been down all week for other reasons, specifically about inflation. That’s what markets is concerned with and not the theater of the trial of a former president.”

PETER CARDILLO, CHIEF MARKET ECONOMIST, SPARTAN CAPITAL SECURITIES, NEW YORK

“I don’t think it means much to the markets, what matters tomorrow is the PCE report. As we get closer to the election it could make a difference.”

“What does this mean going forward? We’ll have to wait and see if the Republicans even nominate him. Now that (Trump has) been found guilty there’s a good possibility that they’ll have a change of heart.”

“But regarding tomorrow, PCE will dominate the market action.”

Jumpstart your morning with the latest legal news delivered straight to your inbox from The Daily Docket newsletter. Sign up here.

Compiled by the Global Finance & Markets Breaking News team

6 notes

·

View notes

Text

Investment Banks and Finance Companies.

Investment banks offer services in equity capital markets, leveraged debt capital markets, commercial real estate, asset finance and leasing, and corporate lending services. The major functions of investment banks are raising funds, asset management, mergers and acquisitions advisory services, brokerage services, and market making. The asset management function of investment banks involves managing the funds of corporations and investing in stocks, fixed-income securities/bonds, derivatives investments, and other types of investments. Investment banks are actively involved in mergers and acquisitions by performing the functions of deal making. Securities underwriting is the process by which investment banks raise investment capital from investors in the form of equity and debt capital on behalf of companies and government authorities. Underwriters offer a set of services for initial public offerings (IPOs) or seasoned equity offerings. The methods used for IPO pricing are the fixed price method and book building process. The debt capital markets services divisions of investment banks solicit structures and execute investment-grade debt and related products, which include new issues of public and private debt. The strategic changes in investment banks has often been cited as a reason for the economic crisis that crippled the global economy.

Finance companies are specialized financial institutions that make loans to individuals and corporations for the purchase of consumer goods and services. The three major types of finance companies are consumer finance, business or commercial finance, and sales finance.

Learn more about Investment Banks and Finance Companies related to the publication - Strategies of Banks and Other Financial Institutions: Theories and Cases.

#initial public offerings (IPOs)#investment capital#investment banks#sales finance#consumer finance#business or commercial finance#and#international day of banks#4 december#asset liability management

2 notes

·

View notes

Text

Exploring the Pillars of Finance: The Three Main Areas of Financial Services

Financial services form the backbone of modern economies, encompassing a broad spectrum of activities aimed at managing money, mitigating risks, and facilitating economic transactions. Within the vast landscape of financial services, three main areas emerge as fundamental pillars, each playing a crucial role in supporting individuals, businesses, and governments in achieving their financial goals. In this article, we delve into these three primary areas of financial services, examining their essential functions, players, and significance in the global economy.

Banking Services

Banking services constitute the cornerstone of the financial system, providing essential functions such as deposit-taking, lending, and payment processing. Banks serve as intermediaries between savers and borrowers, channeling funds from individuals and businesses with surplus capital to those in need of financing.

Retail Banking

Retail banking focuses on serving individual consumers and small businesses, offering a range of deposit and lending products tailored to their needs. Typical services provided by retail banks include savings accounts, checking accounts, personal loans, mortgages, and credit cards. Additionally, retail banks often offer essential financial advisory services and access to electronic payment systems for everyday transactions.

Commercial Banking

Commercial banks cater to the financial needs of businesses ranging from small enterprises to large corporations. In addition to traditional banking services such as business loans and lines of credit, commercial banks may offer specialized services such as treasury management, cash management, and trade finance to facilitate international trade and business operations. Commercial banks also play a vital role in underwriting debt and equity securities issued by corporations, providing critical capital market services.

Investment Banking

Investment banking encompasses a diverse set of financial services focused on facilitating capital raising, mergers and acquisitions (M&A), and other corporate advisory activities. Investment banks act as intermediaries between issuers of securities (e.g., corporations) and investors, assisting companies in raising capital through initial public offerings (IPOs), secondary offerings, and private placements. Additionally, investment banks provide advisory services on strategic transactions such as mergers, acquisitions, divestitures, and restructuring, helping clients optimize their capital structure and maximize shareholder value.

Asset Management

Asset management involves the professional management of investment portfolios on behalf of individual and institutional investors. Asset managers deploy various investment strategies to generate returns while managing risk according to the objectives and risk tolerance of their clients.

Mutual Funds

Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. Managed by professional portfolio managers, mutual funds offer investors a convenient way to gain exposure to a diversified mix of assets without the need for individual security selection. Mutual funds come in various types, including equity funds, bond funds, index funds, and balanced funds, catering to different investment preferences and risk profiles.

Hedge Funds

Hedge funds are alternative investment vehicles that employ a wide range of investment strategies to generate returns, often with the aim of achieving absolute returns regardless of market conditions. Unlike mutual funds, hedge funds typically have greater flexibility in their investment approach, allowing them to invest in a broader array of asset classes and employ leverage and derivatives to enhance returns. Hedge funds are typically open only to accredited investors and may impose higher fees and performance-based incentives.

Private Equity and Venture Capital

Private equity and venture capital involve investing in privately held companies with the aim of providing capital, strategic guidance, and operational support to drive growth and enhance value. Private equity funds focus on mature companies with established cash flows, often through leveraged buyouts or recapitalizations. Venture capital funds, on the other hand, specialize in early-stage and growth-stage investments in high-potential startups and emerging companies. Private equity and venture capital firms play a vital role in fueling innovation, entrepreneurship, and economic development by providing capital and expertise to promising businesses.

Insurance Services

Insurance services play a critical role in protecting individuals, businesses, and assets against unforeseen risks and losses. Insurance companies offer a variety of insurance products and risk management solutions designed to provide financial compensation in the event of specified adverse events.

Life Insurance

Life insurance provides financial protection to individuals and their families in the event of the policyholder's death or disability. Life insurance policies pay out a death benefit to the designated beneficiaries upon the insured individual's passing, providing financial security and support during difficult times. Additionally, some life insurance policies offer investment features, allowing policyholders to accumulate cash value over time.

Property and Casualty Insurance

Property and casualty insurance covers a wide range of risks related to property damage, liability, and loss of income. Common types of property and casualty insurance include homeowners insurance, renters insurance, auto insurance, and commercial property insurance. These policies provide financial protection against events such as fire, theft, natural disasters, and accidents, helping individuals and businesses recover from unexpected losses and liabilities.

Health Insurance

Health insurance provides coverage for medical expenses and healthcare services, helping individuals manage the high costs associated with illness, injury, and medical treatment. Health insurance policies may cover a variety of services, including doctor visits, hospital stays, prescription medications, and preventive care. With rising healthcare costs and evolving regulatory requirements, health insurance has become an essential component of financial planning for individuals and families.

Banking services, asset management, and insurance services represent the three main pillars of financial services, each playing a distinct yet interconnected role in supporting economic activity and managing financial risks. From facilitating savings and lending to managing investments and protecting against unforeseen events, these financial services form the foundation of modern economies. They provide individuals, businesses, and governments with the tools and resources needed to achieve their financial objectives and navigate an increasingly complex and dynamic economic landscape.

0 notes

Text

Career Crossroads: Investment Banking vs. Other Financial Careers

Standing at the precipice of a career choice in finance can feel overwhelming. The world of finance offers a plethora of exciting opportunities, each with its own unique challenges and rewards. Two prominent paths that often cause initial confusion are investment banking and other financial careers. This blog delves into the distinctions between these exciting fields, helping you navigate your career crossroads.

Investment Banking: The Dealmakers

Investment banking is a fast-paced and demanding career focused on facilitating financial transactions for corporations and governments. Investment bankers act as intermediaries, connecting companies seeking capital with investors looking for lucrative opportunities. Their core responsibilities include:

Mergers and Acquisitions (M&A): Advising clients on mergers, acquisitions, and divestitures, structuring deals, and navigating the complex negotiation process.

Capital Markets: Assisting companies with raising capital through public offerings (IPOs) and debt issuance, ensuring they secure the best possible terms.

Financial Restructuring: Providing advisory services to companies in financial distress, including debt restructuring, bankruptcy proceedings, and turnaround strategies.

Investment Banking: A Life of Hustle and High Stakes

Investment banking is renowned for its long hours, intense work pressure, and highly competitive environment. It demands exceptional analytical skills, financial modeling expertise, and an unwavering commitment to client needs. Success in this field often translates to significant financial rewards and a prestigious career path.

Is Investment Banking for You?

Consider these factors before embarking on an investment banking career:

Do you thrive in a fast-paced, high-pressure environment?

Are you comfortable with long hours and intense workloads?

Do you possess excellent analytical and problem-solving skills?

Are you a strong communicator and negotiator?

Are you passionate about the financial markets?

If you answered yes to these questions, then investment banking might be a perfect fit. However, the financial world extends far beyond the realm of investment banking. Let's explore some alternative financial careers:

Beyond Investment Banking: Diverse Paths to Financial Success

The financial sector offers a multitude of rewarding career options beyond investment banking. Here are some prominent examples:

Financial Analysis: Financial analysts delve into financial data to assess a company's financial health and investment potential. They provide research reports and recommendations to investors, contributing to informed investment decisions.

Portfolio Management: Portfolio managers construct and manage investment portfolios for individuals or institutions, aiming to achieve optimal returns while managing risk.

Wealth Management: Wealth managers provide personalized financial advice and investment services to high-net-worth individuals and families.

Financial Technology (FinTech): The intersection of finance and technology presents exciting career opportunities in areas like online payments, blockchain technology, and algorithmic trading.

Risk Management: Risk management professionals identify, assess, and mitigate financial risks faced by organizations. This field requires a strong grasp of financial instruments and risk analysis techniques.

A Spectrum of Options: Finding Your Financial Niche

Each of these financial careers offers distinct challenges and rewards. Here's how to determine the best fit for you:

Identify your interests: Are you drawn to the analytical rigor of financial analysis, or do you prefer the personalized approach of wealth management?

Consider your skills: Do your strengths lie in research and data analysis, or are you a natural communicator and relationship builder?

Research career paths: Explore the educational requirements, work environment, and career progression associated with each financial career path.

Investing in Yourself with Investment banking course Mumbai

Regardless of your chosen path, a solid foundation in finance is crucial. Investment banking courses in Mumbai can equip you with the knowledge and skills necessary for success in diverse financial careers. These courses cover core financial concepts, valuation techniques, financial modeling, and industry best practices.

Investment Banking Course Mumbai: Building a Strong Financial Foundation

Here's how a cyber security course mumbai can empower you in the financial world:

Develop Financial Modeling Skills: Learn to build sophisticated financial models used for valuation, deal structuring, and investment decisions.

Master Financial Analysis Techniques: Sharpen your skills in analyzing financial statements, understanding key financial ratios, and assessing risk.

Gain Industry Knowledge: Investment banking courses in Mumbai provide insights into the workings of investment banks, the financial markets, and various financial products.

Enhance your Resume: Completing a reputed investment banking course in Mumbai demonstrates your commitment to a career in finance and can significantly enhance your job prospects.

Conclusion: Charting Your Financial Future

Investment banking offers a high prestige and lucrative career path, but it demands intense work pressure and a specific skillset. Other financial careers present exciting opportunities with varying work styles and educational requirements.

Choosing the Right Path:

Ultimately, the choice between investment banking and other financial careers depends on your individual personality, interests, and strengths. Here are some additional factors to consider:

Work-Life Balance: Investment banking is notorious for long hours and demanding schedules. Other financial careers may offer a better work-life balance, depending on the specific role and company.

Educational Requirements: While a bachelor's degree in finance or a related field is often the minimum requirement for most financial careers, investment banking may favor candidates with additional qualifications like an MBA or a Master's in Finance.

Exit Opportunities: Investment banking can be a stepping stone to other lucrative careers in private equity, hedge funds, or corporate finance. Other financial careers may offer different exit opportunities depending on the specific field.

Taking the First Step: Explore Investment Banking Courses in Mumbai

No matter which financial path you choose, investing in your education is crucial for success. Investment banking courses in Mumbai can provide a valuable head start, equipping you with the knowledge and skills you need to excel in a competitive financial landscape.

Beyond Investment Banking Courses:

Explore resources beyond traditional investment banking courses in Mumbai. Consider attending financial industry conferences, networking with professionals, and conducting informational interviews to gain firsthand insights into different financial careers.

Continuous Learning: A Key to Success

The financial sector is constantly evolving. Regardless of your chosen path, a commitment to continuous learning is essential. Stay updated on industry trends, regulatory changes, and new financial technologies.

Embrace the Journey: Your Financial Career Awaits

The world of finance offers a plethora of exciting and rewarding career options. By carefully considering your interests, skills, and career aspirations, you can navigate your career crossroads and embark on a fulfilling journey in the financial sector. Remember, investment banking courses in Mumbai can be a valuable tool in your financial toolkit, empowering you to take the first step towards a successful career.

0 notes

Text

Unlocking IPO Success: Partner with Inspirigence Advisors for Seamless Navigation

Thinking about going public? Let Inspirigence Advisors be your partner in success. With our comprehensive guidance and unwavering support, we'll navigate the complexities of the IPO process together.

Connect with our experts : 70219-45422 / 98692-05280For More Info. Visit - https://inspirigence.in/ipo-advisory-service-in-india/

0 notes

Text

https://nixadvisory.com/IPO-advisory-services/

0 notes

Text

Grow Your Business With Mistry And Mehta

#mistrymehta#financial consultant#business consultant#business growth#business growth advisory#business advisory#sme ipo advisory#merger and acquisition#debt advisory#equity advisory#debtandequityadvisory

0 notes

Text

Ensuring IPO Success: All-inclusive Consultancy Services in Delhi

Examine specialized options for your Delhi IPO Advisory Services in Delhi project. Our all-inclusive consultancy services are centered on achieving success by careful execution and strategic preparation. Our knowledgeable advisors guarantee a smooth and significant market debut in Delhi's fast-paced commercial climate, from positioning to market research. Whether your company is new or well-established, our consulting services are tailored to match your unique needs by utilizing our years of experience and industry knowledge. Come along on a successful journey where every facet of your initial public offering (IPO) is skillfully designed for long-term growth and significance inside the cutthroat market.

0 notes

Text

investment with Integrated Enterprises

Integrated Enterprises (India) Pvt Ltd is a leading financial advisory companies in india, dedicated to helping you achieve your financial goals. We offer a comprehensive selection of investment and insurance products. Open a Demat and trading account to trade stocks or invest in Mutual Funds through SIP, a convenient method for regular investing. Secure your future with life and health insurance plans tailored to your needs. We also provide the National Pension System (NPS) for retirement planning and the Margin Trading Facility (MTF) for experienced traders looking to leverage their investments. Invest in upcoming IPOs through our user-friendly platform. Let Integrated Enterprises (India) Pvt Ltd be your partner on your path to financial security.

0 notes

Text

Investment banking services to decide Business Investment Opportunities

What is investment banking? Investment banking is a set of opportunities to make money by purchasing something (investing) that will increase in value in the future for your company.

A business opportunity is an often-overlooked investment, but it can satisfy the "unknowns" that plague other types of investments. Investing in a business is an investment in yourself.

Purchasing a business is a way to invest both your money and your skills. It is an investment in your future in which you have control over the variables. A business exists to make money, and it does so actively, with your help.

Investment banking is a subset of banking that helps people decide which businesses offer the best business investment opportunities. It assists individuals and organizations in raising capital and providing financial consulting services. Investment bankers act as go-betweens for security issuers and investors, and they assist new companies to go public.

To aid them in their efforts to go public and get listed on stock exchanges, companies often turn to IPO Lead Managers, who are independent financial organizations registered with SEBI. A lead manager oversees all aspects of an initial public offering.

Services provided by an outside party, such as a consulting firm or an investment bank, are known as transaction advisory services. They serve as a backbone for your company, allowing you to handle the many moving parts involved in your transactions from beginning to end while fulfilling the needs of your growing company.

What do we, at Pantomath, offer?

Vital Work experience:- For many years, we have been the only logical option for our clientele among all the investment banking firms in india. Here at Pantomath, we help our clients invest wisely by drawing on our decades of experience and extensive knowledge of the many investment banking services we offer.

That pervasive efficiency: - With a robust team of experts, including experts, qualified persons, and devoted members of the customer service team and support personnel, we are here for you at all times to ensure that your job is completed effectively and on schedule.

Budget-friendly expenses that can save you a huge amount: - We understand the importance of your time and money, which has helped us reach new heights of success. Because we know how valuable your time is, we work quickly and efficiently to complete all of the tasks we are given. This helps us provide you with the best business investment opportunities.

Convenience to the clients: - With the help of state-of-the-art technology, our services can be completed and sent on time, every time. We go above and beyond by sending you notifications and updates about our services via email. So no matter where you are, you can always count on us to be right there with you. Sharing event details is simple and inexpensive.

Your organisation can have a diversified portfolio with leases, inventory, commercial real-estate, startup equity with Pantomath. Expertise in curating investment opportunities which will quantify your organisation’s growth with our reputed partners.

We are one of India's premier investment banks, and we've helped our clients finance over INR 2,000+ CR through initial public offerings and further public offerings in just 8 years.

Conclusion:

When trying to put money into a firm, investment banking services are essential. Pantomath's creative and unconventional methods, combined with our extensive background in closing deals and extensive relationships with a wide range of investors, have allowed us to complete transactions in extremely short periods of time. We can help you find the best possible business investment opportunities.

0 notes

Text

Haanuwise: Empowering Financial Firms Through Data and Technology

In an era where data reigns supreme and technology evolves at breakneck speed, financial institutions face the daunting task of not just surviving, but thriving in a fiercely competitive landscape. Haanuwise, a UK-based financial services company, is on a mission to revolutionize the industry by empowering firms with a potent combination of research, data analytics, and technology-driven solutions.

Comprehensive Services Tailored to Success

At the heart of Haanuwise's offering lies a suite of services meticulously designed to address the diverse needs of financial firms:

Investment Banking and Advisory: Haanuwise offers comprehensive investment banking advisory services, covering a wide spectrum of areas including:

Mergers & Acquisition: Providing expert guidance and support throughout the M&A process, from strategic planning to execution, to help clients achieve their objectives seamlessly.

Valuation and Transaction Advisory: Offering in-depth valuation services and transaction advisory to ensure clients have a clear understanding of their assets' worth and make informed decisions.

Investment Banking Analytics: Leveraging advanced analytics to provide actionable insights into market trends, investment opportunities, and potential risks, enabling clients to make data-driven decisions.

Equity Capital Markets: Assisting clients in navigating the equity capital markets, from initial public offerings (IPOs) to secondary offerings, to optimize their capital-raising strategies.

Presentation & Graphic Support (DTP): Providing professional presentation and graphic support services to help clients effectively communicate complex financial information to stakeholders.

Investment Research: Haanuwise delivers comprehensive investment research services, including:

Equity Research: Conducting thorough analysis of individual stocks, sectors, and markets to provide clients with actionable investment recommendations.

Financial Modelling: Developing sophisticated financial models to evaluate investment opportunities, assess risk, and forecast future performance.

Research Content & Publishing Services: Offering end-to-end support in content creation, publication, and distribution, ensuring that clients' research reaches their target audience effectively.

Consulting and Corporates: Haanuwise provides consulting services tailored to corporates, including:

Corporate Strategy: Collaborating with clients to develop and implement strategic plans that drive sustainable growth and maximize shareholder value.

Industry Research: Conducting in-depth research into specific industries to provide insights on market dynamics, trends, and competitive landscapes.

Business Research Services: Offering a range of customized research services to address clients' specific business challenges and opportunities.

Sector Coverage: Providing comprehensive coverage of various sectors, including analysis of key players, market dynamics, and investment opportunities.

Sales Services: Haanuwise helps financial firms boost their sales effectiveness through:

Lead Generation Services: Leveraging data-driven approaches to identify and qualify potential leads, enabling clients to focus their efforts on high-potential opportunities.

The Haanuwise Advantage

Partnering with Haanuwise offers financial firms a multitude of benefits:

Deep Industry Expertise: Haanuwise boasts a team of seasoned professionals with extensive experience in the financial services industry, ensuring that clients receive expert guidance tailored to their unique needs.

Data-Driven Approach: Haanuwise leverages robust data analytics to deliver actionable insights that drive informed decision-making and strategy development, helping clients stay ahead of the curve.

Technological Innovation: Haanuwise stays at the forefront of technological advancements, equipping clients with cutting-edge tools and solutions to maintain a competitive edge in an ever-evolving landscape.

Global Reach: With a presence in over five countries, Haanuwise provides clients with a global perspective and support network, enabling them to navigate local regulations and tap into international markets with confidence.

Haanuwise emerges as a beacon of innovation and expertise in the realm of financial services. By harnessing the power of research, data analytics, and technology, Haanuwise empowers financial firms to unlock new growth opportunities, drive revenue, and navigate the complexities of the financial landscape with confidence. In a world where change is the only constant, partnering with Haanuwise ensures that financial institutions not only survive but thrive in the digital age.

#Investment Banking and Advisory Services#Sales Services Services#Consulting and Corporates Services#Investment Research Services#Haanuwise

0 notes