#it’s also educated a lot of ppl on the law itself and opened up their eyes to it

Text

never thought I’d see the day that people would be angrier about a rap bar than they would about actual child predators but here we are lmao.

#also saw where megan kanka’s father is talking about suing meg for the name drop#which nobody can tell him how to feel#but it’s not going to end with the result he thinks it will#also I can’t help but shake the feeling that it has something to do with onika#bc everytime she gets ate up she starts recruiting people to attack others character#I just hope ppl realize thiis is far beyond rap beef and that actual ppl are being harmed bc of this lady’s actions#and I hope mr. kanka doesn’t get caught up in that web either#but then again…it could be bc of another reason#no disrespect but 🌚🌚#yeah#even though everybody is gagging over the song#it’s also educated a lot of ppl on the law itself and opened up their eyes to it#this isn’t the first time that this stuff has been mentioned in songs#an indie rock band literally used his child’s picture on the cover of their song#there’s like two other tracks called amber alert that I am aware of#and hell even one of my fav artists put the heavens gate cults pics on their artwork#so I don’t think he realizes that it isn’t something he can sue over#what would be tragic is if somebody in his life or nicki’s camp is stirring the pot and pushing him to do so#he takes it to court and they remove her name from it altogether#cherry chats 🍒

84 notes

·

View notes

Text

I think it says a lot about us as a society that when you try to search YouTube for videos about domestic violence charges and trials, almost every video that comes up is about how to beat/get out of domestic violence charges. nice

#I'm over here trying to find things from a victim pov#trying to even see how these things work in court and what rights i have and how to strengthen a case etc#accountability when a criminal did do what they've been charged with and a conviction should be open shut#but there's like no education on any of that#nothing about the prosecutor or victims side of the trial#just telling criminal abusers how to manipulate their way out of charges#and sadly with dv that just usually ends up with them going on to do worse and worse#this is so fucked up. our system is fucked up. we need a lot of changes. legislation etc.#I'm just so disgusted rn#thinking about the Tiffany Hill case#it's heartbreaking#it's too common#it's not ok that ppl can buy their way out of anything if they afford the right lawyer#*that one verse of lifestyles of the rich and famous plays*#or that one buzzfeed unsolved case!!!Rex something... charged like 53 times with felonies freaking shot ppl but got away w it all#but like i see that it's not the prosecutors it's the law itself there's so many changes that need to be made#and police reform they need to actually learn the laws to enforce like wtf with lawyers training v police it just#but seriously i want to like. petition for bills somehow#idk whether state or federal level tho#but like. things NEED to change. also more awareness about and getting rid of gender politics and bias in DV cases bc like#ahh my keyboard just screwed up idk what i was in the middle of saying#but men can and do experience DV too my husband was physically assaulted by her but didn't report it at the time bc he knew the police#...wouldn't take it seriously. how often does that happen#how many people are getting the shit beat out of them but unable to report the crime? warn others? see justice etc? ?????????????#then that just tells other abusers they can get away with it so it's not even just personal it's society#i just. anyway.#personal#dv#domestic violence#abuse

3 notes

·

View notes

Text

Tax and Self Employment Report

My career after qualifying is to be an art therapist. Typical working hours are 37 to 39, thought they are variable and will include a lot of paperwork/reports and evening work. The average starting salary is £30,401. The jobs are freelance of self-employed. Settings include hospitals, education settings and personal buildings.

Before starting anything, I will need to set up my branding, identity and business plan. This will help me decide if I need to take out a loan beforehand to set-up or if it will be enough to start from a small self-investment. It will also make sure I have thought all things through and can survive the first two years (when the average new business fails). It should be expected that I will not make profit in the first year as the average earns profit during the 18-24 month. This means I need to make sure I am able to pay the house bills and other personal payments.

Going down the self-employed art therapist, gives me 2 main options. I work from my own home or I rent/buy out a space to work there. Alternatively, I could take a contracted route (freelance) and travel to where I am required. Because the subjects of the job, I will be opting to work from a rented office space. Usually there are counselling offices available throughout the UK. I will need to provide my own equipment. This includes a laptop or PC to type up my notes and a safe and secure back-up set-up.

Before I go about finding a suitable location for my business or even register myself as a business owner, I am required to have a few things in order. First, I will need to sign up for a DBS check. There are two options, an annual membership which will allow me to start work right away at any placements/business I go too. Or a one-off DBS which is only covered at the location I am working at. Whichever option I choose it is required I have it done every 3 years.

I will need to register with the Health and Care Professions Council (HCPC). Failing this I could face a fine of £5,000. I will then need to make sure I have registered for my The British Association of Art Therapists (BAAT). Although this isn’t essential it does improve trust and quality. I also get access to a range of perks such as cash back rewards, discount on books, access to the research library and can further my training at a discounted rate.

Additional requirements I will need is a bare minimal of level 3 in British sign language. This is a minimum requirement by the professional industry to be able to work with D/deaf clients. Ideally, I’d be much higher but as I am deaf myself, I am unable to get higher levels as they are aimed at interpreters. I can however submerge myself within the Deaf community. A bonus to this will be networking.

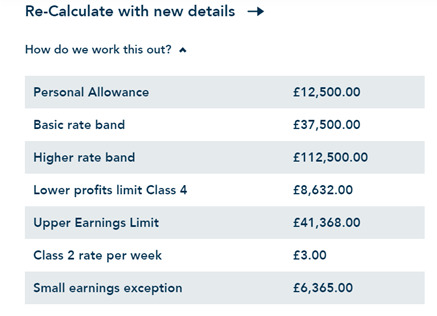

It is expected of me to keep a record of my business’s sales and expenses, send self-assessment tax returns each year and pay income tax on profits and class 2/4 national insurance. If my turnover is £85,000 or more I will be required to register for VAT. Having an accounting method will support this and is something I will be required to do solo or hire external for. If my income is £150,000 or less I can use cash basis reporting. I only record income or expenses when the money is received or a bill is paid. By doing this I won’t need to pay income tax on anything I have not yet been paid. The standard tax-free personal allowance is £12,500. This means I won’t need to pay any income tax until I am earning more. This changes if I am married and claim marriage allowance. I must also continue to pay my National Insurance contribution (NICs) if my business begins to make more than £6,365 a year. The flat rate is currently £3 a week. This is along side my income tax. If I earn £8,631 or more I will then have to pay the class 4 NICs which is 9% on the profit and 2% after. This can be paid at the same time as my income tax and class 2 NICs. Using the calculator online and creating a made-up annual income using the bare minimal of the average art therapist income, which is (37 hours @ £40 per hour (1,480) x 4 weeks = (5,920) x a year12 = 71,040. I would take home 50,824 a year after tax and NIC. Within a year I would have paid 15,916 for income tax and 156 in class 2 NIC and 4,143 in class 4 NIC.

I will need insurance to protect myself and others in the event of incidents, accidents and emergencies. My trade description falls under “holistic therapist”. Salon Gold offer a package designed just for art therapist. It includes public liability, product liability, malpractice cover and financial loss. Additional add on include legal expense, stock/equipment, money cover, personal accident and employer’s liability.

Finding a building comes with its own separate task and legal requirements, depending on if I rent or buy my building. I have been saving up with the intention to buy a property to turn into a joint art recovery centre and art community. A friend wants to do a similar thing so there is talk of potentially working together (which brings in more legal requirements and partnership agreements). When it comes to renting, I will need to find a suitable place. This requires me to think like my audience and use my personas. Considering accessibility, travel, parking and lighting. I will need to carry out a health and safety risk assessment. This is to remove any hazards I may encounter. In terms of the building itself these are things like fire safety, electrical equipment, gas safety (if there is any) and deal with any asbestos. For inside the building and a working environment I will need to con sider temperature, space/ventilation/lighting, toilet and washing, safe equipment and drinking water. There is a downloadable file on gov.uk called “Workplace health, safety and welfare: a short guide” which has been written by the health and safety executives (HSE). Not mentioned here is reasonable adjustments being made. This can be done through “access to work”. It is crucial that I follow these health and safety rules as I leave myself open to be prosecuted under the “Health and Safety at Work etc. Act1974”. I also want to be a decent human being and I believe the above requirements are a bare minimum, if that. The HSE and my local council will be responsible for making sure I am following the law. Other requirements are much the same as renting a home property. I am to pay my monthly rent, instead of council tax I am to pay something called “business rates”. Rate relief are available for business rates. I am to pay for utility bills. If I wish to have the TV or/and a radio in my waiting room or at my office I will require a TV license or/and a license to play music (two type are required PPL and PRS). This is because the UK law recognises that any music playing in public falls under “public performance”. I will also need to set up a Wi-Fi and phone line. Usually any responsibility not brought up on the lease will be my responsibility. Some offices provide all of the above within an all inclusive monthly fee.

Finally I’ll want to be opening a business account. With my current bank, they would offer me pre-customer benefits such as access to 18 months’ free day-to-day. Non-members get 6 months. I would also be given access to the financial and digital tools for my business. Having a business account means I can keep my personal and business money separate. I will be able to pay myself a wage (when I start to earn enough) and leave the money for the business in the business account. I am also entitled to better protection that you wouldn’t get with a personal account.

The British Association of Art Therapist (BAAT) offer free business advise to those wishing to start self-employment as an art therapist. The recommendations for payment rate from 2014 are:

· Individual art therapy at £40-£60 per hour

· Administration (note writing, meetings, etc.) at £30 per hour

· Group art therapy (1.5 hours face-to-face contact and 30 minutes setting up, clearing up and writing reports or notes): £90 - £110 (per group)

The BAAT expect all members to obey the code of conduct and must:

·maintain their registration by the HCPC;

·adhere to this Code of Ethics and the Principles of Professional Practice and Guidelines for Members;

·undertake supervision in accordance with supervision guidelines;

·hold personal professional indemnity insurance (PII) as stated in the EU directive

·2011/24/EU if this is not provided by an employer’s vicarious responsibility insurance.

·undertake continuing professional development (‘CPD’) as required by both the BAAT and

·the HCPC.

(Taken directly from the British Association of Art Therapist “Code of Ethics and Principles of Professional Practise for Art Therapist” document.)

After all of this is in place I can now register with HMRC and being my self-employment adventure.

0 notes