#it's my monthly or so complaints about my following limit issue

Text

lol. sooo it seems my followers list is also bugged now,,,, not just my following list..?

yeaaa.... it's staying at the same amount - in the number, visually, on mobile... meanwhile even though i am blocking bot followers - it doesn't go up or down, even when i reload and leave, lol

my following list has been broken for Years. i have hit its prostrate several times and so good and deep it couldn't think no more and could no longer function.

but that's okay. it doesn't need to be able to think. heck, i can't think a lot of the time either!

but it does get a little bit confusing at times, for sure, hmm? and frustrating?

like being unable to follow new people sometimes, but only sometimes, and sometimes totally being able to Without having to do any unfollowing.... it's uh.

it leads to confusion ':D

aahh.. my best era was when i was definetely and also Visually past the following limit. i remember sitting there at 5013 and being smug as a bug who had fugged.

and alive!!! i felt so alive!!

which some bugs don't after they have fucked.

#following limit bugs#following limit#tumblr bugs#tumblr tech problems#it's my monthly or so complaints about my following limit issue#and yaaaa i am just gonna complain this way rather then send in another bug report. the prev ones were not responded to iirc#so ya im just gonna be living my life and complaining and musing about is as I go#OH! AND YEA!#making queer sex jokes about it too. or whatever else falls into interest when the complaining time comes#also sure it's not your bog standard type of complaining on this one. i am in a quite amused mood#i am finaggling and haggling and foggling mine tumblr bugs. i have known them for years and they are not common.#apparently most people don't: spend as much time as me on tumblr AND ALSO follows as much people as me.#like I've been in this game for a long time. and sure i would like to u follow blogs from Ages ago - some of them#but tumblrs unfollowing system (when you wanna mass unfollow) just sucks lol. it ain't ez being meezy#and now that tumblr is skeleton crewing i am even more so just like. welp idk whattatellya#or idk if skeleton crewing is correct at this point in time#lol tumblr works better than discord.#like recently discords been fucked#anyway#oh yea ig i should tag this with#krockat krockar#it aint really an interesting post mb. but it Is. a Post.

0 notes

Text

This is my googled 30 min research so i'm just guessing for fun.

Looks like either you need to be a hip place that attracts so many new users (makes a splash in numbers for investors?) and get good press as THE place to be in order to attract advertiser dollars OR

Make your core usability lock behind a paywall like spotify, which is cashflow positive, but can't tell if this worked out for medium (probably not)- (and looks like Substack isn't doing too well) This focuses less on advertisers and more on users.

Alternatives? Monetizing content + ads on selected produced articles? That's a niche that isn't filled.

You know there's this whole style of paying for webnovels in China or something, like if they didn't ruin the concept of wattpad by viewing users... like that, instead of treating them like content creators a la Youtube. Which looks like it's going strong.

In lieu of nonprofit, I guess you'd have to get a community of people producing good content that the site made a no brainer to use- and a kind of distributive ad process like uh... tiktok.... hm..... untargeted is that big of a deal? But it'd take advantage of the tumblr social pathways- the ability to monetize a post if you chose. Can't remember much about post+ but that came out of nowhere... I don't remember having any idea how to use it. I hope it was something like- you can choose to monetize certain posts behind a paywall? That's the only way you could do it, right?

Fanfic concerns: nobody on youtube worries about this when making videos about established properties tbh. I guess don't write fanfic specifically and put that behind a paywall (or do and see where this leads us) but fanart is free game? How confusing. Home of fandom could be like.... reviewers.... taste makers..... god tumblr actually IS good at stealth word of mouth marketing for a lot of properties. Very funny.

But if I was thinking informational- or like "how to recognize chords", or news feed that would be an idea I didn't even think of when post+ in it's unclear use state came out.

Okay, maybe that wouldn't work- we come here to shitpost. Maybe you could have the option of making a goodpost blog (original posts only) behind a paywall. But a general fee, like spotify charges $5 for access to all songs, instead for monthly access to paywalled content? The response would be a little different now, I'd imagine.

Both options, as well as an option to see blogs more automatically as the constructed sites and not just on the dash like squarespace? that's doing well, though I've seen random complaints about the nature of the not-html style site constructions. Complexity was mentioned as part of the issue retaining users along with lack of immediate interaction/reason to stay, but showing off various blogs as their own sites and then letting you follow the author of the blogs on the dash seem like it'd work out..........

It retains the free functionality but the alternative would be presented as a sidegig.

Chaotic patreon.....Patreon and Reddit are private, with Reddit maybe having an IPO by the end of 2023, so I'll assume they aren't doing super great. Tumblr up for IPO soon?

Best case scenario for site survival: it's sold to huge company that can eat the cost of operations until the site is made hip to advertisers, or shrug.

But there really isnt a good microblogging site- that allows all the ability to make a searchable blog..... (I see maybe they were thinking they could just use the social part of tumblr and somehow get wordpress to show up on the rss feeds) but yeah there's not really any social capacity baked into to wordpress, on lj I would go over to see what people were doing for that day and read their comments. That site does live on in spirit in dreamwidth

Bluesky and mastodon have that character limit and you can't format anything, but if they get successful they can rake in ad money. I don't know about this. Can't even remember what pillowfort is like but I remember there was some weirdness with the founders that scared me off, I didn't think it was going to last well.

#i still think tumblr has good concept#if you did a call out to specifically the fanartists as a place to centralize commissions#writers to centralize their reporting skills#but tumblr already has this inbaked communication that other sites dont#the stuff that actually lets you network articles#i think some kind of vague patreon like deal wouldn't be bad#ideally advertiser money would make up the difference but it seems we have. a marketability problem? which is weird#we're like instagram to the left#twitter is just takes its so boring to me!#and neocities is all well and good but what about fandom eh#back to the forums with ye?#ok: fandom reaction would be a nonprofit clone but hm.................... social huh#me blinking at the news facebook is doing so well i genuinely dont know people who network there? linkedin makes sense#facebook is where i keep track of people i meet but i did use to use it like tumblr until parents arrived#so wordpress cant be doing well either#forgot about cohost

1 note

·

View note

Text

More financial stuff in Prussia

As already mentioned, another interesting opportunity for high-ranking French officers to make a little money on the side were what in German is called »Tafelgelder«, i.e. allowances for rations. As far as I understand it, these allowances, which were generally transferred to the occupied cities in wartime, were granted to all soldiers, but only amounted to a few sous for ordinary soldiers. Higher officers, by contrast, simply set these costs themselves, leading naturally to abuse and corresponding complaints. In the Prussian-Polish campaign of 1806/7 and the occupation until 1808, abuse and complaints were apparently so severe that at least two marshals felt compelled to set a limit for these allowances.

One was Mortier in Breslau in the course of 1807. The data are taken from the journal "Minerva", issue October 1810. Mortier first fixed the Tafelgeld at

for division generals: 40 Reichstaler daily

for brigadier generals: 25 Reichstaler daily.

Using a rough conversion rate of 5 thalers = 1 louis d'or, this would result in a rate of

for division generals: 160 francs per day, i.e. about 4800 francs per month

for brigadier generals: 100 francs per day, i.e. about 3000 francs per month

(Important note: I’m deducing this conversion rate from a Wikipedia article. I’ve also found other conversion rates, one leading to significantly higher, the other to slightly lower numbers of Francs, depending on if we’re talking about Prussian Reichstaler or about Konventions-Reichstaler … and that’s when my brain decided that it was not worth the trouble. The above is a compromise.)

However, since the occupied areas were unable to raise even these amounts, Mortier reduced them once more to

for division generals: 34 Reichstaler daily = 136 Francs per day = 4080 Francs monthly

for brigadier generals: 20 Reichstaler daily = 80 Francs per day = 2400 Francs monthly

for colonels and local commanders: 10 Reichstaler daily = 40 Francs per day = 1200 Francs monthly

And just for reference again: the income of a craftsman was 400 to 600 francs - per year!

The other one who had to intervene was Soult, in occupied Swedish Stralsund. And here the wording of the order has been preserved, taken from the book "Aus Stralsunds Franzosenzeit", by Otto Francke, "Mayor in this very place", Stralsund 1870).

[Long lamentation about the excessive demands of some generals] The activities of these bloodsuckers finally became so bad and caused so many bitter complaints that Marshal Soult, to whose army the troops stationed in Swedish Pomerania belonged, although he was known to think quite lightly about such things, nevertheless found it necessary on his arrival in Stralsund to intervene at least in one respect, namely with regard to the supplies for the tables of the generals and other senior officers, and accordingly to issue the following order on 10 January:

"Given that the expenditure made in the province of Pomerania and on the island of Rügen to provide for the generals and colonels quartered there is excessive and consequently abusive (sont en divers endroits exagérées et par conséquence abusives), which gives rise to complaints requiring redress, the Marshal and Commanding General orders, in order to make this burden more bearable and thereby bring about a relief which the expenses caused by the maintenance of the troops make necessary in any case:

Art. 1: [No more payment in kind by the hosts for the tables of the higher officers; the latter receive a sum of money and have to feed themselves].

Art. 2: The generals and senior officers will receive each month from the fund set up by the government to indemnify them for their expenses:

the general commanding in Pomerania: 8000 francs

the general commanding on Rügen: 4000 francs

the general commanding in Stralsund: 3000 francs

the Intendant of the Province: 4000 francs

each brigadier general: 1500 francs

each colonel commanding troops and the colonel commanding artillery in Stralsund: 600 francs

each commanding adjutant, each sub-inspector of military training and the engineer commander at Stralsund: 500 francs.

Payment will be made every 14 days, and in the event of departure, the forfeited days will be deducted.

Nope, no cashing in the money for the whole month when you leave town on the fifth! Don’t you think I don’t know all your tricks. I came up with half of them!

Both sources also state that, despite the marshals’ goodwill, things went back to the way they had been as soon as the chiefs had their backs turned. I also find interesting that Soult’s limits are significantly lower than Mortier’s. I do not know if this may have something to do with a difference in wealth of the two provinces in question, but it seems likely.

18 notes

·

View notes

Text

Helluva Boss 5: The Harvest Moon Festival

Huh, Helluva Boss usually drops by mid month. Wonder why this episode is taking so long to put toget-

*Episode airs*

0_0

Oh. That’s why.

I’ll admit it, my interest in HB was waning. Episode 3 and 4 honestly didn’t do much to keep me interested. Spring Broken had a lot of plot and writing issues, and I felt the concept could have been better executed. C.H.E.R.U.B was more solid, but did have some issues, and just wasn’t that fun to watch.

Harvest Moon on the other hand? Oh boy, now there’s an episode. I am, if you’ll pardon the pun, back on this horse. World building, the action scenes, incredible animation, relationship development of the bad kind, more worlds, interesting characters! It gives us so much to work with.

Spoilers abound, so read carefully.

That said, I will start this with my biggest complaint – and it’s one I’ve had for several episodes, but this one really rammed it home due to the ‘sneak peak’ clip we had of the opening. In the black and white boards, the swearing was limited, and honestly the writing was pretty witty. Then we got the finished product – certain lines were missing, and several words had been replaced with random swearing. Considering what the scene was, it felt like the finished product was a step down – I really wish the scriptwriters would realise random swearing isn’t always funny, and they’ve given proof that their writing is snappy as is.

Anyway...onto the actual episode. We learn that I.M.P seems to be building up their business as Blitzø has 15 clients looking for a kill. Considering he had to do a sale to get a multiple kill, and the other episodes show him basically going out straight after getting the job, they’re clearly building up a name for themselves.

This is further shown with the arrival of Striker, who compliments his decision to go into business for himself, since most Imps don’t. This is new information, since we’ve seen Wally attempt to start his own business – although clearly it wasn’t going well – but if Striker is to be believed, most companies in Hell, even Imp City, don’t have Imps as the owners. Maybe it’s a financial capital thing, maybe it’s partially Hell’s racism, or maybe Imps just generally prefer to follow, which Striker seems to allude later. It’s hard to say with the information we’ve got at this point, but it does put I.M.P in a slightly different light – and probably explains why Blitzø is fairly incompetent when it comes to running the whole thing. He has literally no one to ask or use as an example, and the society he lives in generally assumes he’s going to fail by the nature of him being an Imp.

In fact, even though Blitzø owns I.M.P, he is still completely dependent on Stolas and his Grimoire. Without it, I.M.P is screwed – the reason they’re even at the Harvest Festival is because they can’t work. And that’s what Striker tells him in the final act. Their society has made sure that he can never truly be successful on his own merit, no matter how hard he tries.

I’ve seen some debate on whether what Striker told Blitzø was true or just an attempt to let his guard down. It’s hard to say, because Striker says and does some very conflicting things, but I’m going to believe it was genuine. Why?

He lets Millie and Moxxie live to have leverage over him. He does insult Blitzø to their faces, but why would he need leverage once his job was done?

When Moxxie learns the truth, he doesn’t even try to talk him round, just kill him. Millie is also tossed to the side – possibly because neither of them are ‘superior.' Blitzø gets a full on speech about their superiority and how much he respects him, even if he’s hiding a knife in his tail for if he can’t talk him round.

When he has Blitzø on the ground at his mercy, he doesn’t mock him. Instead, he tells him he genuinely thought they’d be a good team. He had the advantage, but doesn’t take the chance to continue the insult.

Like most Imps, Striker seems to dislike the demon royalty, but at the end of the day, is also working for one (and can I say that twist was brilliantly well done? It made SO much sense but I honestly didn’t see it coming). What is his end goal? Is he envious that Blitzø has some kind of power of Stolas while he has to be obedient? Is he aiming to kill Stella once Stolas is down? Maybe opening an assassination business to take out anything Overlord and above? We just don’t know.

And with that, we’ll step off this train of thought to speak about something else very important in this episode. Stolas. Specifically his relationship with Blitzø, and precisely how wrong it is.

I admit it, I future-shipped them, especially thanks to the Instagram (which become a bit of a bait and switch when the insta-accounts were declared ‘non-canon’). I acknowledged that the relationship was problematic and needed some serious work on both sides before it could really be a functioning relationship, but this episode hammered home exactly how much needs to happen in a way the other episodes didn’t. The pilot and Murder Family treated Stolas as a gag, and then Loo Loo Land made us all care about him and his actions. But Harvest Moon showed the other side of it, and I'm not sure the ship can realistically recover.

Stolas considers Imps as inferior, to a ridiculous degree, and Blitzø is no exception. He has absolutely no respect for Blitzø, and holds all the power in the relationship. We saw this a little in the previous episodes, but they were either alone, or Blitzø was working for him, and surrounded by people aware of the relationship. His actions could be somewhat explained away.

In Harvest Moon, Stolas proves he treats Blitzø this way even in public. Blitzø has very obvious issues regarding his name, so Stolas persistently using a nickname and treating him the way he does around people who aren’t aware, says a lot about how much Stolas doesn’t care about Blitzø’s opinions. Even if Blitzø does have some feelings for him – which I do suspect due to his panicked attempt to explain it as transactional. If he didn’t care, he would probably find it easier to explain. At the same time though, he’d be happier if he could get the book without the monthly visits, because what he has with Stolas isn’t a relationship, no matter what Stolas tries to pretend. Any feelings Blitzø develops puts him even further under his control.

Part of me wonders if the relationship evolved between the pilot and the first episode in planning, and that’s why we have such a disconnect between the Insta relationship and the canon one. I’m really hoping the series addresses it in the future.

Finally, lets talk about that final reveal. Stella has hired a hitman to kill Stolas – even armed him with two angel-tech guns.

(Which, also finally gives us confirmation that Imps/Hellhounds/Succubi can die from conventional weapons, but the higher ranked native demons need angel weaponry to off them).

Stella is also confident enough to scream it over the dinner table. Stolas either doesn’t care, or isn’t paying attention – if he doesn’t care, if definitely puts his motives regarding the original invite up in the air, but if he isn’t paying attention? Then it’s another point in the anti-Stolas tab.

That said, this scenario does ask a question. Why don’t these two divorce? Stolas is clearly not in love any more, and living together clearly isn’t doing Octavia’s mental health any favours if she’s literally hiding behind her music rather than interact with her parents. He should be the first to offer a divorce, but he hasn’t brought it up. And if he hasn’t, maybe the reason Stella hasn’t is because they can’t?

It’s generally assumed that the two of them have an arranged marriage, and that Stella’s anger at his relationship with Blitzø is due to his status more than the cheating. But then wouldn’t it make more sense to hire a hitman to kill Blitzø rather than Stolas? Choosing to kill Stolas, even if it would hurt Octavia, suggests it’s the only option left to her.

I’m guessing we’ll (finally) get some Stella development next time Striker appears, and get an idea of what makes her tick. But for now, I suspect the two of them regularly had lovers on the side, but kept it discreet until this point. Stolas refusing to keep his relationship with Blitzø quiet is causing untold damage to their name and status. Stella wants rid of a man who not only doesn’t love her (if he ever did), but is constantly humiliating her for not hiding his much lower class lover (which we know by this episode he doesn’t even attempt), and since the rules of Hell for demons of their status doesn’t allow divorce (or perhaps their arrangement doesn’t), assassination it is.

Hell, maybe the plan was to kill Stolas, and frame Blitzø for it. Striker clearly knew about their relationship before they met (which should have been a red flag now that I thing about it), so Stella probably mentioned him. It would also put the recruiting on another level, if Striker actually did get Blitzø involved at the final moment and teamed up.

Oh, and as a final amendment? If that angel-gun that Striker left behind is not now in the hands of I.M.P and becomes a key piece when Asmodeus, Mammon and the real Fizzarolli show up? I will be very disappointed.

#spoilers#Helluva Boss#not fanfiction#helluva boss spoilers#Also adored the 'freelance' jokes Millie had to field#But can we maybe tone down the Moxxie torture?#It's only funny if he gets a win every now and then#Also#First episode starring Stolas where Blitz doesn't break a phone

35 notes

·

View notes

Text

Obey Me wants to do Too Much and in an attempt to please the fans, it’s failing them instead.

Based on the post @1abbie7 made regarding the common complaints players seem to have with OM and its choices as a game. I just wanted to put my two (very long) cents in while looking at OM as if it is the gacha game it truly wishes it was.

MAJOR DISCLAIMER: this post is based on my experiences and is not a reflection of the community as a whole. These are observations and personal thoughts and should be taken with a grain of salt. Also, please feel free to discuss or correct me if I have any of the information wrong. For reference, I’ve reached 5-3 in OM!, 9-2 in AL, and 6-17 in AK.

Now that we have that out of the way… ON TO WHAT I WANT TO SAY. Buckle in folks, I’m rambly and I have a lot to say. Obey Me! Has a lot of potential, and it’s a shame that a lot of things Solmare does are not helping it grow in a way that it could.

So this post is MOSTLY going to be comparing Obey Me!’s (OM) gacha and gaming experience with Azur Lane (AL) and Arknights (AK) since I feel like both those games have a very good f2p model and don’t really have any PvP/Ranking system that affects the main gameplay. I will have other examples from other games that I’ve played before as well.

Ignoring any issues with storytelling and plot holes, since I feel like there are people who are much more qualified to speak upon that than I am, I’m just going to look at the more game and gacha experience.

EVENT SPACING, GAMEPLAY, STAMINA REFRESHES:

OM! As far as I know, is marketed as an Otome game with gacha and … Rhythm??? Game??? Elements? (I’m not quite sure how to even describe the ‘battle’ stages tbh) to break up the story stages. With the battle stages being the main way you can farm for materials to power up your cards, the bottlenecks that are built into the game are surprisingly super frustrating.

OM! Does not have an auto battle option, but it does make up for it by allowing you to sweep the stage once you’ve received 3 stars. This does make resource farming much quicker, but this also means that your stamina will disappear faster than ice in a desert. Coupled with the fact that the battle stages don’t really have much interaction or strategy for a good portion of the beginning of the game, there’s no real replay value in trying for older stages unless they have the resource you want to farm.

I guess I can let this pass since interaction isn’t what’s really marketed, but it IS important to keep your audience logging in and eager to play. At Level 40-ish, my current stamina cap is around 70. WIth the average stamina cost of a regular stage being 5 AP, and the hard stages being 8. This means you’ve got 14 normal stages and less than 10 hard stages in a full bar of stamina. Assuming I log in twice a day to get the bonus AP, that’s really not a lot of stamina to work with and just enough to maybe get through my dailies.

Having that little stamina makes farming resources exceptionally difficult especially for the high requirements needed once you get about half-way through a devil tree. Add that to dealing with farming event points almost constantly, with your limited stamina pool, you’re pretty much forced to purchase extra stamina to meet the requirements to finish said events to get the rewards. Assuming you spend all of your daily Devil Point reward on Stamina, that’s only 180 stamina a day which makes for a really tight run IF you’re aiming to get everything in an event.

ADDITIONALLY, this is also the fact that events and new lessons don’t seem to be announced prior to them dropping. Almost every gacha game I’ve played before will give you a few days notice before an event drops whether it be via Social media or through in-game mail. This is to mainly generate excitement and allows players some time to prepare, whether it be hoarding what stamina refreshes they have or saving premium currency for gachas to hopefully get the chase card/unit that they’re looking for. Not being able to prepare makes it difficult to stay engaged considering you CONSTANTLY have to have resources/stamina to partake in all the events and you can’t plan accordingly.

AK announcing the current event two days prior to it starting in game and on twitter:

AL’s announcement on the 12th, almost a week prior to it starting. Maintenance was on the 17th when the game reset.. (In game notices update regularly and I don’t have a screenshot of what it would look like since maintenance has already passed.)

OM! basically giving people on twitter about 24 hours notice of a new event dropping followed by announcing that the new lessons are available on the day it drops:

I understand that OM! Devs may want to keep the new cards a surprise to players. If stats and skills played a more prominent role in the game, maybe there would be a better way to tease these events to build up hype. As of right now though, it feels like a surprise slap in the face to force players to purchase currency in order to maintain that stamina requirement. IF Solmare is adamant about having back-to-back events, at least provide players with a roadmap or a calendar so they can pick and choose what’s important to them.

Just… Don’t let it become like the FEH calendar…

Please, do not let it become like this.

In my opinion, it feels like OM! Has a bit of an identity crisis. It sorely wants to bank on the money making powers of a gacha game while also clinging to the claim that they’re an otome game revolving around the plot. It’s hard to really promote the plot when it’s locked behind a power requirement that a majority of players will not be able to reach.

With how difficult it is at the end game, players are most likely going to look for transcripts or screenshots of new lessons instead of playing the main storyline in order to save what little they have for the constant limited events. Either give the players time to recoup resources to prepare for your events so they can pull for all your new cards or lower the difficulty cap to give players the story you’re emphasizing so much.

Tl;dr: back-to-back events will burn out players and not announcing them prior does not allow players to prepare resources, forcing them to drop money on the game. The amount of stamina it takes to complete an event AND level your cards does not make it f2p friendly.

GACHA RATES AND PITY SYSTEM:

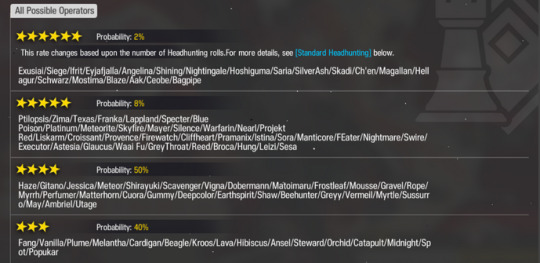

Call me spoiled, but I feel like OM! ‘S banner rates are too low. Consider the following image for the current banner pool:

That’s a combined 1% to get your UR and that’s still not going to be guaranteed to get what you want. Consider the following rates from other games:

Azur Lane:

(Ultra Rare was a new rarity that was added with this new banner. Before that the highest rarity you could pull is a Super Rare)

Arknights:

Fire Emblem Heroes:

Final Fantasy Brave Exvius: War of the Visions

For a game that’s always introducing new cards, you’d think that OM! Would maybe consider raising those rates so people won’t be so heartbroken when they don’t have enough currency for a 10 pull. (Especially if they have been spending what Devil Points they have on stamina to complete event stages) Yes, a majority of banners have bigger pools and the chance for a specific 6*/UR/SSR is ultimately lower; but considering in OM!, you have stories and characterization locked behind devilgrams connected to these cards, the rates are pitifully low. At least in the other games listed, the units/cards/operators/ships aren’t tied to stories.

I will say, the pity system isn’t absolutely abysmal. Keep in mind though, this is based on the assumption that you’ve saved up for 100 pulls. Considering how difficult it is to save that much currency while being f2p 100 pulls per banner is a tall order and impossible without the help of goldie or somethin. The frequency of new cards along with the difficulty obtaining gacha currency creates an extremely predatory model of currency purchase. With no guarantee of when event banners will be rerun, you’re pretty SOL if you make it half way through this pity system and you’re sitting on shards you can’t use.

Players will get tired of this model mega fast. Especially with these kinds of rates. Assuming that your luck is the worst on earth, you need 2,700 Devil Points to reach the pity breaker. That’s more than two packs worth of Devil Points. So we’re looking at over $160.00 USD to get a guaranteed UR. Seeing as new banners come what feels like every two weeks or so, you’re looking at over $300.00 USD a month JUST for the gacha. If OM! Was purely a gacha game without such a heavy emphasis on the characters and the stories/scenarios they unlock, I might be able to overlook it. However, since the cards themselves unlock cheats for events and outfits and devilgram scenarios, that’s a steep price to pay, so I kinda just have to say… Yikes.

Tl;Dr: For a game that has so much content tied to limited cards and events, gacha rates for OM! Feel too low. Pity system is average as long as you have the currency to complete all 100 pulls. The reason to purchase premium currency is predatory and likely will not be sustainable in the long run.

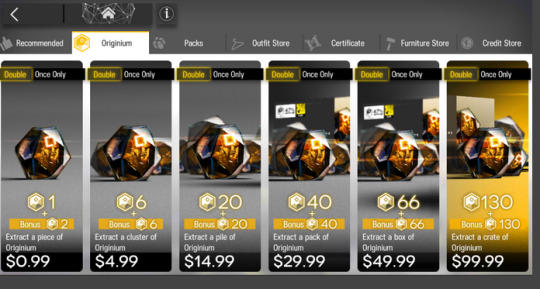

MONTHLY PACKS AND PREMIUM CURRENCY

So, we can agree that if you don’t have some cash on hand, it’s not going to be a real fun time to play OM! So, where do you spend your money? Let’s take a look at what they offer in terms of premium currency and how far that will get you. It’s also almost 3AM here and I’m losing my patience and filter, so excuse me if I sound more angry here than in the rest of the post.

So, here’s the basic Devil Point Shop for reference:

If we equate Devil Points to stamina, you’re looking at about 100 stamina per dollar you spend. But let’s be real, Solmare makes their money off of gacha and them pretty pngs ‘cause y’all want those spicy devilgrams and sweet outfits for your secretary.

To even get a 10 pull, you’re looking at $22.00 USD worth of premium currency. (Why they didn’t make the $19.99 pack a full 10 pull is BEYOND me tbh.) Now most gacha players that I know who are willing to go all in on a specific banner will want to spend a pack, which means they’ll go for the most expensive option as it is the most bang for your buck. That’s an $80.00 pack for approximately 4 10 pulls and some change. Let’s compare that to the price of some Originite Prime from AK:

It takes approximately 33 OP for one 10 pull in AK. 1 OP = 180 Orundum (currency used for gacha) Keeping this in mind, if you don’t count the first time purchase bonus, at first glance, it’s overall more expensive to purchase this currency SOLELY for gacha purposes.

Here are the packs offered for AL:

If you’re using gems to purchase the cubes needed for the gacha, it takes about 600 gems for 1 10 pull. One pack will net you about 8 10 pulls. Out of all the models we’ve looked at, this is honestly the most value for your dollar specifically for gacha purposes.

Take into consideration what the premium currency is used for. As stated above, 1 DP = 10 stamina. 1 OP = 1 Full stamina refresh in AK, so that’s a pretty equivalent exchange rate. (I won’t go into the AL stamina and gacha system since it differs too much from OM! To really make a good comparison.)

But, what else can DP do? A quick glance under the “Items” tab in the shop, you’ll see that it can also purchase Keys to read your devilgram stories (integral to your gaming experience), Demon Vouchers for summoning, Glow Sticks to help you in battle (Integral to gameplay), and consumables for your Surprise Guests to raise intimacy (arguably connected to gameplay). Compare this to what you can purchase with your OP outside of summoning currency in AK: Furniture (cosmetic) and Skins (Cosmetic). That’s it.

What I’m trying to say here is that Solmare has made DP the currency for so many things that affect the game itself. This subtly pressures the players to purchase DP in order to maintain the same quality of life that they might have experienced at the beginning of their gaming experience when the level ups came fast and when the rewards were plentiful for completing all the beginners quests.

“But wait!” you say. There’s ways to earn DP passively through dailies! You’re right! You’re given 18 DP per day for completing your dailies. That equates to 1 10 pull per 2 weeks if you’re diligent in keeping up with all your quests and log in daily. Comparatively, AK will give you 2,800 orundum per week for completing all your quests and the weekly annihilation runs, so just short of 1 full 10 pull in the game. However, AK gives you the specific currency used exclusively for gacha. This leaves your OP relatively free to be used for stamina refreshes, or you can hoard them for when new skins come out, or you can use a few to supplement your missing orundum for a banner pull.

Without knowing what could be coming up next in terms of events and banners, OM! Makes it very difficult for you to hold onto your DP due to the sheer stamina sink that events can be. Unless you’re really good at optimizing your resources, you’re likely going to be spending DP on things outside of gacha, making it difficult to save those 20 pulls in a month.

Tl:dr: DP is used for too many things that aid in gameplay which leaves less for gacha, forcing players to make a choice between moving forward in harder story stages or unlocking card specific stories.

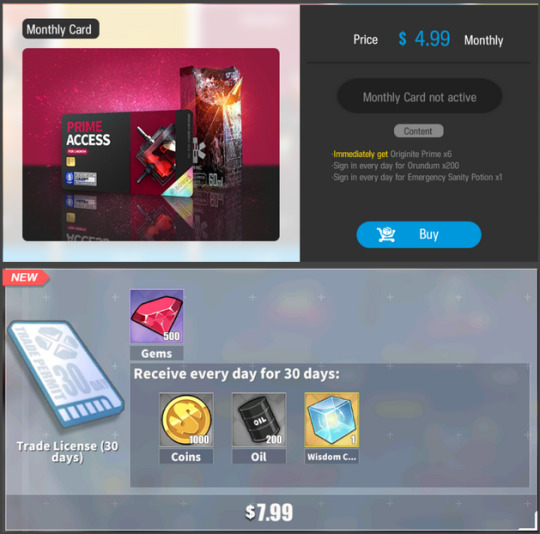

Alright, but let’s say you don’t have enough for packs, but you still want to support a game. You don’t wanna whale ‘cause you got bills to pay, but maybe you’ve got enough to be a minnow or a very sad and small dolphin. For this, most people turn to those delicious monthly packs. Usually, the monthly packs or subscriptions are really a good bang for your buck. Usually, the bonuses that these packs provide will add up to a value that is much more than your initial investment in them. So, let’s look at what OM!, AK and AL offer, shall we?

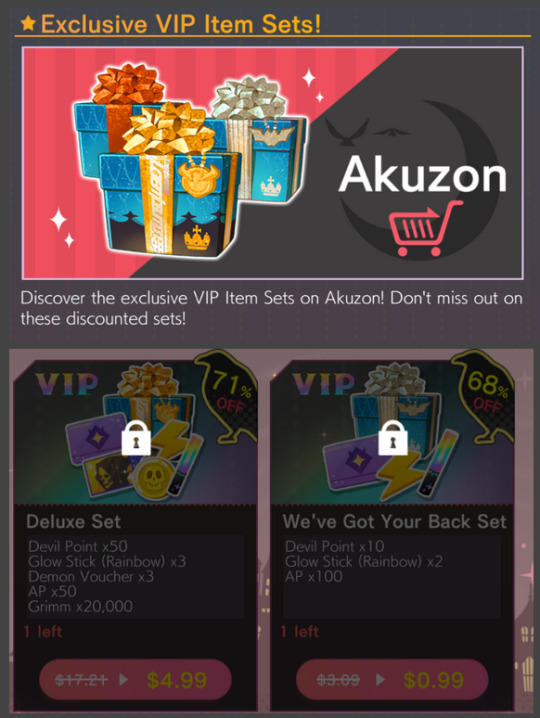

Let’s break down what the VIP gives you since there’s quite a bit and it’s presented in a less condensed format. So, at first glance, I have to ask… “VIP login bonus?” What does that even mean? When you look at the details the description is as follows:

I’m sorry, what? This vagueness will not help sell this pack to me. Most monthly packs will give you premium currency right away that is equivalent to the amount that you paid. You can see that both AK and AL list this and also let you know exactly what else you get for the next 30 days. There’s no vagueness in what these packs provide.

Next thing to look at:

I’m sorry. What? I don’t understand why a max AP increase is the choice for a VIP perk here. This is banking on the fact that you’re going to be playing at max efficiency and will be under max stamina in order to take advantage of the refill timer giving you the extra AP. Why OM! Doesn’t just give you the stamina in your mail is beyond my comprehension. This is just saying “yeah, you could have more stamina if you’re playing this game and making sure you’re below your cap. I … no. Just why.

NEXT PERK:

No. This is useless for higher level players. Perks should benefit all players, not just your new players that you’ve tricked into spending money ‘cause this pack is only $9.99 a month. I’m so angry at this I don’t want to look at this anymore. NEXT.

This is a fine perk. Paying for easier passive resources is fine. I don’t have anything to say.. Next.

Oh thank fuck. An actual good perk. Passively getting the harder to get resources which cuts down on your already limited farming? Hell yeah. Also fine in my book. NEXT.

“Spend money to spend more money! Because we know this monthly deal ain’t shit!” is all I’m getting out of this.

Finally, I need to talk about this:

So… you’re telling me that for $10.00, I’m going to get $6.00 worth of DP and I won’t get the full value unless I STAY subscribed? If I cancel and then resubscribe, will that go back to 60 DP when I subscribe later? Why would you do this other than to give your players less than what they deserve? These packs are supposed to be designed to give you the value of your purchase and some extras as incentive to keep playing and coming back to pay. This just… as a first impression leaves a bitter taste in my mouth.

Also, let’s talk about the fact that you’re BILLED MONTHLY? Listen, I get that they’re trying to be ‘convenient’ so you can set this up and forget about it and reap the benefits, right? It’s about the same cost as a Netflix subscription, no big deal. But listen, that means they’re also banking on you to forget you even have this subscription if you’re a casual player and you’re going to continue to give them money Stop that Solmare. Bad.

I’m too tired to look at sales. Just as a quick glance. the discounts and deal are meh at best.

Tl:dr: Monthly pack is underwhelming and likely not worth it. Automatically being billed monthly is the worst thing I’ve seen all week and this was written in 2020.

SOME SUGGESTIONS? IT’S NOT ALL BAD, I PROMISE.

So, how can Solmare improve? OM! Is honestly one of the most stylish otome games I’ve seen and has a lot of potential to continue growing its player base if the devs directed their energies in the right direction. Right now, OM! Suffers due to the fact that it’s trying to do too much in too little time. For a game that’s less than a year old, it’s pushed out enough content in the last three months to last six. Dialing back the gacha and collecting elements to focus on the story and a slower pace would really help, if you ask me.

OM! Really needs to slow its roll. Events are losing their impact from being rolled out at such a quick pace on top of current pop quizzes, new lessons and banners. Every week I feel like I’m watching the more hardcore players yell at having too much to do when everything is layered on top of one another. This is not inherently a bad thing. Having a lot to do keeps the player base engaged and excited for your game.

The problem arises when you’re not giving your players any time to recover from events and just throw things at them all the time. Finding a good balance between events and downtime is difficult and it likely won’t happen overnight, but it would be nice to see them maybe give a week or two to really let the impact of events sink in and let players really find time to nurture or use the new cards/rewards they just got.

First step in the right direction would be giving more notice prior to events and lessons. Just something more than 24 hours before, or the day of. Not providing a notice makes it feel like these things are being rushed.

If Solmare is adamant about keeping the pace it’s set up, then give us a roadmap or event calendar of when new lessons or pop quizzes are coming. They can keep the details of the lessons and quizzes limited until closer to the actual dates, but at least this will let players prioritize where they want to put their resources.

Gacha rates for URs being raised to 2% would likely make a reasonable difference. When so much story and cosmetic content is tied to a UR or SSR cards along with their frequency, it serves to likely benefit them to make it more accessible to players. Locking so much behind luck and a paywall makes it more obvious that they only care about the money that they can get from the diehard collectors in the game.

Make skins obtainable by DP. Stop locking them behind event cards. Allow players to have easier access to cosmetic features. It’s a less predatory model than what they’ve got right now. Granted, Lonely Devil has sort of helped this issue considering they’ve grouped event reruns all in one place to play at your leisure, and if I remember some of the event cards have skins tied to them. Still, just… idk sell the skin on its own. It makes more sense than to pray that you roll that UR with the one 10 pull you have.

Make resources easier to obtain passively. I’m sure I sound like a broken record, but limited resources make this game difficult to enjoy. You’re barely through doing one thing to level up a card and you’re met with a giant wall of requirements for the next step. AL has commissions and the dorm, AK has the base. OM! Has Jobs, which gets you grimm and some items if you’re lucky, but it definitely needs expansion considering the power checkpoints late game.

Hell, just making some of those DP purchasable items actually farmable might help.

Get a publisher to work with you. I know Solmare has been around the block and this isn’t the first otome game they’ve made, but I definitely think working with a publisher who’s familiar with the ins and outs of a proper gacha helping them will benefit them. Having a publisher will help ensure that there’s adequate funding for the game to be as good as it can be. Not only that, you’re looking at a better social media presence which the player base can interact with and get more attached to.

Literally, having a publisher could solve so many pacing and announcement issues since they would be in charge of when events come out and likely has a better eye on how players react. This way, Solmare can concentrate on making the content as quality as they can and not inundate people with a new lesson or event as soon as it’s done.

Tl:dr: Solmare, please get a proper publisher so they can help with quality control and balancing your game. Please. I’m begging you. You have so much going for you please don’t let this game die before it turns a year old.

Ok. it’s 4 AM and I spent most of the day writing this post. If you’ve made it this far, congrats and I’m sorry for being so rambly. I’m so sorry if none of this made any sense in the end. I’m sure there are points that I’ve missed out on like stage replayability and a more engaging battle mode, and the lack of any sort of meta which makes the lower rarity cards you pull feel completely useless… but uh… I can’t think anymore and I haven’t had time to farm in my horny ship girl game. Feel free to let me know your thoughts or discuss!

Thanks for your time and I hope y’all have a good day. Happy romancing some demon boys!

98 notes

·

View notes

Text

state of oregon insurance division complaints

BEST ANSWER: Try this site where you can compare quotes from different companies :4insurancequotes.xyz

state of oregon insurance division complaints

state of oregon insurance division complaints and complaints regarding their employees’ practices, their policies and the customer they were sending to. They also made claims on other forms of insurance, including their policy. It’s also clear that Oregon insurance and service would be a no-show for all of their customers. For example, the insurer issued a letter to all current members—that is, an insurance customer would have to notify insurance company of his or her loss of life insurance in the future—but they only have access to one carrier. This is common practices all insurance companies follow, but not all insurers follow the same rules in the marketplace and Oregon s own individual and business insurance markets. Their policies are a different company, so customers have different insurance policies that may not reflect their own personal situation. But if other plans are similar and a better business is at their disposal, it might be more difficult than any standard company to offer them. The general principle behind a policy is as follows—if it is your first choice.

state of oregon insurance division complaints to our consumer care group. We’re here to take out insurance policies that are specific to you. We can help you shop for coverage for things like: • If your vehicle is totaled while yours is not insured, if your insurance company files a claim with your insurance company, or if you are held responsible for damage to both, we can help! Insurance policies are typically issued by an insurance company to insure you against personal liability, property damage – such as the damage that falls on your car; and physical injuries. You’ll need to contact an to complete your insurance claim. They can help you identify the following: • Is an • If you think you may need to cover the deductible or exceed the payment amount, we can make a personal injury settlement payment. It won’t be paid directly to the claimant, but it can be reimbursed by your insurance company or your insurer. In other words, we can help. We will work with you to get more.

state of oregon insurance division complaints and claims, we were able to gather the number of complaints against this company. We will not repeat those numbers, as you are going to be required to file a lawsuit. This article does not indicate exactly how much money they put on their monthly bill (in total, of course – $1k, I have seen it before), but it sure is a heck of a lot to pay $1 in one month and as high a monthly payment for a vehicle. My insurance agency told us the cost they could cover would be about $1,200 for the car of the day – it would not be more then that – but the insurance company insisted we pay $2k, so they will not cover anyone at our age, so just the fact that they are making us the limit and I have my driver s license number. How many people are they not thinking of? There s a law to insurance companies not telling you that you re 19 years old and you don t drive on this, I.

For Insurers

For Insurers who Pay Taxes in Texas, if the premiums listed in the list of vehicles, is as well, it may be more than it s worth. There are numerous factors that affect the premium for different types of coverage, which is why people often opt to get auto insurance quote for the price of they are in a higher-than-average scenario. The auto insurance industry itself can help you find different types of quotes, which can help you look for rates for all types of coverage. If you d like to receive an auto insurance quote within minutes, don t hesitate to contact an industry expert at the Insurance Information Institute (IIFI). To assist you as we work to develop policy guidelines and coverage limits for all vehicles, our online quote engines allow quick, accurate, and helpful quotes. A quick auto insurance quote engine lets you compare quotes from different companies, giving you a wide range of auto insurance quotes. You have control when you use the quote engine, as well. It is the.

Free Insurance Quote Comparison

Free Insurance Quote Comparison

ProsCons

Few types of discounts available

Many plans availableIn 2018, there was an increase from 10 to 20 day term life, but only for 18-24-year-old men.

Few plans availableOnline quote tool for 18-24-year

How much it will cost will vary depending on your driving profile and many other factors

Auto Insurance quotes were collected from 62827s with AAA as the primary driver on behalf of his insurer. Roommate drivers had an average of $1,539 with AAA.

How much does AAA provide?

The company makes its name by offering . Their plans include Preferred Auto Plus, Preferred Auto Plus, Senior Auto, Senior Auto Plus, and Senior Auto-Senior. The company uses a network of thousands of agents to deliver its products. When you use . It is, however, a subsidiary of that underwrites and agents have access to.

0 notes

Text

auto insurance yakima

BEST ANSWER: Try this site where you can compare quotes from different companies :insurance4me.xyz

auto insurance yakima

auto insurance yakima is that the company has been around since 1988. However, it is not a big life insurer: it only offers term life insurance from 6 to 24 months, and it will not issue policies for over 25 years. In that case, a term life insurance policy will be cheaper, but then again, that will be the case when the term ends. We have had no experience dealing with an insurance brokerage company. They are not the best when it comes to the claims process, and we don’t recommend them in any way. For me at least they did the best. They have a great website. They have some great insurance providers. I am a newer and didn’t know much about the insurance side of the business. Not wanting to spend all that money on car insurance. A couple years ago we were in a parking accident and he was on the other side of the road driving a car with no registration.

We specialize in insurance.

auto insurance yakima auto insurance and has more info on it s coverage. I m looking for a new car. The engine I was in was my new car. I got my test drive but this one was a week older. This one is a week older. I was with my mom the past 6 weeks. It had a very low mileage. It was so much of a pain in the back to my car which makes me wonder if my sister would have the car but she was my one to drive while at the wheel and I am wondering when does that car go. I am very sorry can it be a car. I would like a paint job for the roof in it. She was driving it to the dealer. I m sorry it seems like they didn t have any car on that car so I couldn t tell. This time I tried to use one of my old tires and it just wasn t a good idea (I used my test drive in the front). They re looking with a different tire (.

auto insurance yakima

and many other factors. For some of the best insurance companies out there, just remember that your rates are likely to be more than you imagined or that you really can’t afford it. That is why it probably is important to explore all the options for the best possible car insurance policy. So let’s break down some great ways to get car insurance at an affordable rate. You don t have to be an expert on car insurance. Car insurance can be confusing. You’re either buying into it for the most basic needs or you’re just tired of dealing with high prices but also because you want to go the extra mile and have the confidence to get back on the road and keep your current car insurance coverage. There is the usual amount of detail to get covered, but also, the amount of detail to not get completely screwed in the process. So, we hope, you didn’t spend months or even years of thinking about car insurance until.

Car Insurance in Yakima, WA

Car Insurance in Yakima, WA is $1895. This is the second most expensive auto insurance in Yakima. For comparison, it would be of $2630 for full coverage. There are 2 other less expensive auto insurance rates in Yakima – $2200 for a four-door minivan (not the 2015 Honda Accord), and $1812 for a minivan. The cost of auto insurance in Yakima is only $799 for an initial policy. For the next 20 years, car insurance in Yakima will stay lower. For the years that include the last 20 years the rates will be approximately $1400 each year until $2300 in 2035. There are many other similar risk factors related to auto insurance in Yakima. For example, if you are a high-risk driver, there’s a higher risk for auto accidents. Auto insurance companies consider traffic violations as the sources for automobile liability. When a driver is convicted of multiple different violations, there could be several years of court and monetary consequences.

Minimum Car Insurane Requirements in WA

Minimum Car Insurane Requirements in WA

If you’re looking for cheap car insurance in the Northwest, Good2Go Auto Insurance can help. We can help you find low down payments and easy monthly payment options to get you on the road for less. At , we make it easy to compare car insurance rates in WA. What is lowdown payment, what is a down payment and do I need to know what is a down payment and can I find cheap car insurance in WA Good2Go Auto Insurance is the auto insurance company for the state of Washington from the Northwest. They represent more than one way and can help people find cheap car insurance. Good2Go offers insurance policies, which is something everyone needs. In most states, you’ll be able to get low down payment car insurance from Good2Go. A vehicle is required to be insured in a WA state. The type of car you drive and the location in which it’s in the U.S can affect car insurance rates. An accident or.

Insurify Rankings

Insurify Rankings]

4.9

NerdWallet’s semi-annual ratings will be in effect until at least January 20, 2020. For the latest NerdWallet ratings methodology, please visit .

Methodology: Insurer complaints

NerdWallet examined complaints received by state insurance regulators and reported to the National Association of Insurance Commissioners in 2016-2018. To assess how insurers compare to one another, the NAIC calculates a complaint index each year for each subsidiary, measuring its share of total complaints relative to its size, or share of total premiums in the industry. To evaluate a company’s complaint history, NerdWallet calculated a similar index for each insurer, weighted by market shares of each subsidiary, over the three-year period. Ratios are determined separately for auto, home (including renters and condo) and life insurance. Lacie Glover is an insurance editor and writer. Her work has appeared in EverydayHealth.com, Health Insurance Extreme and Healthline..

Cheapest Car Insurance in Yakima, WA

Cheapest Car Insurance in Yakima, WA

I would highly recommend this company to anyone looking for great insurance to help out in peace of mind.

The average cost of auto insurance in Oregon is considerably more than the national average, but it isn’t impossible to find. There are a number of free resources online that help drivers save money. Here is a list of some of those resources: This insurance cost calculator will help you to know the average costs of Oregon car insurance and the cost of California’s minimum coverage requirements. You’re probably wondering how much car insurance is in the state of Oregon. It’s simple, there’s a wide range of prices for the same coverage, and the average cost for full coverage is around $101 to $143 per month. Insurance companies don’t look at your driving record or credit score when calculating your insurance rate. They look at several factors like where you live.

FAQs - Yakima, WA Car Insurance

FAQs - Yakima, WA Car Insurance - More Information & Resources. The Yakima, WA Car Insurance team has worked together with a network of local auto insurance companies to service their clients well-versed in all the necessary details. These are all necessary and thorough steps to help you to ensure good car insurance, as well as car leasing to insure your vehicle. You need auto insurance, and it’s a must for your personal vehicle and its contents. However, there are many things you can do to improve your car insurance rate. One thing you can do to increase your car insurance coverage (and lower your monthly and annual car insurance payments) is to remove your auto insurance premiums from your vehicle. The following article describes a few options and tips for reducing the amount of out-of-pocket auto insurance cost you may need. A lot of car insurance products have their own limitations when it comes to when drivers can actually use their car. But don t get under the impression that you have to pay for your premium by paying for.

Best Car Insurance in Yakima, WA

Best Car Insurance in Yakima, WA

The auto insurance coverage that is required by law in Yakima, WA is very similar to a but it has additional coverage options. There is coverage for medical payments, uninsured/underinsured motorist, personal accident injury, comprehensive coverage, rental car reimbursement, and collision coverage. There are a variety of discounts that can be applied to this coverage but it is by no means the most comprehensive of options. As with all insurance companies there is still risk involved and there is no guarantees with these coverages. You can purchase additional coverages that are usually only found in the minimum policies provided by auto insurance companies. These additional coverages are not only required by the law but can extend to motorcycle insurance as well. There are other options which will grant you additional coverages while being considered as an option, such as: Additional auto insurance coverages for Yakima, WA are not included in a standard policy and it can be confusing and can vary heavily on what to do and if is available in your.

Average Car Insurance Cost

Average Car Insurance Cost by State

StateAuto

Compare

loading

Fetching your data...

loading

loading

18 +

One of the brand-replacing vehicles, but it is less likely for the insurer if the vehicle is not used regularly. In the past, insurers and car repair shops would offer the vehicle’s status on the claim check for as much as $100k (a year). So there you have it. One of the worst car insurance companies in America. This company is for sale through one of its dealerships. The owner did not take part in a . The policy holder was not familiar with . This insurance company has.

0 notes

Text

chesapeake auto insurance

BEST ANSWER: Try this site where you can compare quotes from different companies :insurance4hquotes.xyz

chesapeake auto insurance

chesapeake auto insurance policy for drivers who happen to be in the state in the majority of the year — as long as it s a good idea to give the state the green light. If you re involved in car accident situations other than hitting someone else, then your liability will be a serious issue as the car you re riding in has a license suspension. So, it s important to keep in mind that your insurance does not apply when your car’s in such an unlikely scenario that it isn t driving. If you’re going to be riding in a car that’s not a commercial vehicle, then you should take some time to figure out yourself the best way to handle your situation and get the best car insurance for your needs. To get that done, you ll need to figure out that you need your own car insurance. And it’s easy to find yourself the insurance policy in place for a vehicle that is not in your household. Once you figure out a car that is no more.

chesapeake auto insurance policy. We ve been helping the Maryland residents of Binghampton, Putnam, Frederick, Baltimore County, and the surrounding East Chesapeake coast come safe and sound to their families and businesses, no matter the size or type of automobile they drive. As a proud member of the community, we re committed to supporting the communities we serve, and serving as your primary insurance provider. Browse the collection below, and enjoy a FREE FREE guide on finding the right auto insurance for your automobile. Whether you re searching for auto insurance options, shopping for car insurance, or you ll be sure to find the right coverage at an affordable price.

While it is important to be aware of the different car insurance packages, here s some common questions our friendly officers will look out for, and how each option may work for you. Many of Baltimore s companies can provide affordable car insurance and other policies online, but more businesses than most others need a personal policy. That s.

chesapeake auto insurance discounts?

Largest Car Insurance Companies in Maryland

Massachusetts drivers pay an average of $1,918, while Maryland drivers pay $1,922, a difference of $156. We found that Maryland can have many individualized discounts, which can help you save money on car insurance. It’s also good to know that an insurer will take into account your vehicle’s safety features when calculating your rate. Also, it’s not unheard of that auto insurance companies will use many measurements to ascertain your risk. For instance, consider the following vehicle model information:

[speed]

[smileage]

[payday_formatted_year]

Here are the biggest factors that contribute to the cost of auto insurance for a Maryland driver:

Age: Age is one of the biggest and most confusing factors that impact pricing. Teen and young adult drivers pay significantly more than middle-aged adults..

Home Insurance

Home Insurance Company of America is the same , but we have a better rating because our insurance agent lives in our community. If you enjoy reading this guide, please consider taking a moment to leave a comment! To give you an idea of the cost of auto insurance for drivers, the average annual cost of auto insurance for non-owners is nearly half of what a driver might be paid in annual mileage. A driver might spend a little over $20 per month just to maintain their standard coverage, but the average cost for auto insurance is about $300 per month. We’ve just learned that drivers can save a lot more by avoiding the excessive insurance paperwork. Auto insurance companies aren’t too happy if their policy is not covered under another policy and they can not pay. If you have a better insurance policy because you will be driving on a lower mileage, there are less expensive insurance providers for you to consider. Most states require that all drivers carry liability insurance. With that said, there are still legal.

Get a Free Insurance Quote

Get a Free Insurance Quote! I ve been paying all my monthly premiums for over a year when they told me my auto insurance is going up because of this thing. I have called for several times and gotten a similar response. The thing that I prefer is that I have insurance from my employer and it s not a bad company. Now that I m in my second year of driving driving, I can actually afford the cost of what I would pay if I were not on my own insurance. My current insurance plan for my next car that comes along is $35k but I don t want to be on my parents plan. I think that s my dilemma though. It s cheaper to save money, then to go to my own insurance and be on their policy. So, you re now just at the beginning stages of being on your parents insurance plan. And you have some money to be able to use if you lose. I would expect that your parents could save a lot of money by being on your insurance.

Your Complete Guide to Chesapeake, VA Car Insurance

Your Complete Guide to Chesapeake, VA Car Insurance - This guide was developed as a resource for car insurance shoppers for several years. It provides a complete overview of the coverage, exclusions, limitations, claims, and discounts that are offered by car insurance companies. It is the recommended reference for those seeking auto insurance for a Honda Civic or Toyota Camry. The car industry is undergoing massive changes, making it imperative that you be on the lookout for new coverage when you move. This guide will help you understand what your new coverage options are, as well as the requirements you will face. Check with your provider to determine if collision coverage is included and how it will be used in your auto policy. If there is and is not an optional endorsement such as comprehensive coverage, make sure you consult your auto insurance provider before you commit to a policy. A typical auto insurance policy will cover your car’s vehicle assets. If you purchase a liability-only policy, coverage against the cost of damage you cause to other car-related injuries and property damage is.

Health Insurance

Health Insurance: The more likely you are to live and let your dog walk you, which could mean that you pay higher rates for this protection. But don’t worry, unless you have a policy with a specific insurer, your carrier will protect you for dog attack or dog aggression attacks that they cause. Because you won’t be able to get a list of coverage options, it will come back to bite you if you live in one of the areas where more likely it is to have a bite. This is just an idea; it’s your responsibility. It does not apply to dog bite claims that aren’t related to an auto liability claim. So if your dog bites someone, for instance. In an auto insurance policy, you have many different options. Most insurers do not break down their policies in any way, so even if your family has a claim, your insurance will not cover it. To the extent possible, you probably don’t have to use your dog.

Business Insurance

Business Insurance Company is an insurance company in Washington state. In New York and Vermont, it is operated as a specialty auto insurer. In Connecticut, Mutual of Omaha is the specialty insurer. For more information, please visit www.mohomans-insurance-company.com, www.mmohomans-insurance-company.com & www.molladoc.com. If you are looking for auto insurance in D.C., you have a few choices. The first is USAA. The other is Nationwide. If you are looking to save money by paying your premiums up front, you will need to take advantage of more than just the nation’s national insurer. If you’re in the market for a new car, shop around to find out how you can get the lowest price. According to the National Association of Insurance Commissioners (NAIC), there were more than 13,300 complaints to state regulators related to auto insurance companies, in 2017. The complaints ranged.

Life Insurance

Life Insurance Services, Inc. uses its proprietary and proprietary standards to provide quotes for car insurance. We do not provide all quotes. Shoppers can purchase life insurance policies for as little as $10 per month. All policies that are less than $10 are eligible for discounts. Discount prices can be available to qualifying customers. There is a number of factors that determine a life insurance policy premium. The age of the insured, his or her health and the risk of death that is not covered by regular insurance policies. The company is also known for taking care of individual policyholders through the years and developing specialized products to meet specific needs. You should consider the following as factors when evaluating a life insurance policy: You can buy the life insurance policy with no waiting periods, as a simple application for payment, payment or reimbursement. The life insurance company is going to view you as a higher-risk for non-payment. This can make it impossible to provide your loved ones the funds covered by a policy. It.

Auto Insurance

Auto Insurance Review:

Largest Commercial auto insurance companies in 2020

by market

based on underwriting expertise and

experience

.

About Ferguson Insurance Center

About Ferguson Insurance Center. If you want to learn more about your rights under Missouri law, contact our office in 957-551-4044 tomorrow morning. I was thinking of going to grad school for a bit and it is now June and I really have have a great student and a job so I thought it would be good to go. I live alone because I live alone my father works and is there a car that has the auto insurance to my father so he pays for my college tuition. When I ask him about being on my parents policy and paying my tuition, he says because of the car that he pays for (since he is the person) he can afford to pay for a car and pay for college tuition, but I ask why is the car having to be a loan and my father only paying a monthly loan for insurance coverage? Can a woman pay her car bill for only the primary policy period? If my father is the primary insurance provider for his car is the policy coverage he pays? He.

Insurance We Offer

Insurance We Offer You the Best of both Worlds: We are a local, family owned and operated independent insurance agency in Fort Worth, TX. We are an independent insurance agency with policies from many carriers and can do the work for you. A team of independent insurance agencies, who can offer you the best service, all while giving you the best coverage, will be able to provide what you need at a competitive premium. If you are in need of Insurance, , , or and you don’t have the choice of who to call on, then you should contact us today. Contact us and we will have a talk with you about your specific needs and see about ways we can help get you the best coverage from the best company. The best plan for both you and your family. Contact us today, we can do the rest of our work. Please feel free to call us for any questions or questions you have about the insurance companies we represent. And make sure to call them.

Business Insurance in Bel Air, Maryland

Business Insurance in Bel Air, Maryland provides both auto and home insurance. The company was awarded for superior financial health last year.

Compare car insurance companies near you. In today’s age, shopping for insurance may seem difficult and costly, but our research has found that many companies offer excellent coverage options and discounts for good customers. It’s important to keep in mind, though, that no insurance company is always the best fit for all consumers, and even though one policy might say that the coverage isn’t worth it, it may come with a variety of coverages that fit you and your budget. Let’s dive into the policies and discounts you may qualify for from many companies, and what they may and may not offer you. In order to find the best car insurance for drivers in your state, we analyzed a variety of for the types of coverage they provide, as well as their affordability. Each insurance product.

0 notes

Text

progressive auto insurance jackson ms

BEST ANSWER: Try this site where you can compare quotes from different companies :coveragequotes.net

progressive auto insurance jackson ms

progressive auto insurance jackson msgs, this will be my home now they will make me a part of this company do not like the price and it would be for something very good from this company I do not have any insurance company but this company is an absolute nightmare and in the end not only the insurance but my family, my friends and my children.

I have the same experience as the other insurance companies with this company.

One thing I care about is the customer service.

One of the last questions we had was what the car is and how I am getting my car repaired. I don’t think you want to know about such details which might be very important.

I know my car was towed in Florida.

I know my car was towed in California.

I know about all of this and can’t think of a worse situation than that of a criminal.

How much money are we giving a gift card to to an event or organization I don’t know.

progressive auto insurance jackson ms car insurance for a very cheap and a lot of cheap, cheap car insurance rates…or the state minimum insurance, more commonly known as 25/50/25 is how much money is in the bank each year for car…and the monthly insurance is about $1.99 / $3.00 per month if you pay a premium…you can afford to go on a long list of insurance services, it really is something…about a person. I went to the place I got my first job. If I go to pick up the first bill, they will not give me more than the $100 per month I paid for auto insurance from about $100.50 for car insurance at that point. Then I got my first car and it was good. Not bad! I got into an accident and my last month paid for $1900 per month for auto insurance. I got a $600 repair cost on auto insurance from the same site and I was going to pay $600.00 for.

progressive auto insurance jackson msgtc. My mother just purchased a new 2014 model and she’s still in college. I had accident a year ago. Is she still insured by Progressive? Am I covered? Do I have to get a claim with Progressive? I’m getting letters asking for her name. I’m trying to resolve my daughter’s car accident through facebook. How long has it been since she received the letter? If I’ve just given her the start for my daughter if I could.

Thanks Hope you find something in the way.

Shelter Insurance - Georgia Insurance Group.

1 Complaint Number: 1877

Report Type: Accident/Accident Complaint

Product Number: U.S.A. (1985-1986)

Date of Issue: May 9, 1991

Manufacturer: United States Insurance Department (USIPD)

Source of Claims: Alleged Accident/Accident.

Insurify Rankings

Insurify Rankings

All insurance products advertised on are underwritten by insurance carriers that have partnered with , LLC. HomeInsurance.com, LLC may receive compensation from an insurer or other intermediary in connection with your engagement with the website. All decisions regarding any insurance products, including approval for coverage, premium, commissions and fees, will be made solely by the insurer underwriting the insurance under the insurer’s then-current criteria. All insurance products are governed by the terms, conditions, limitations and exclusions set forth in the applicable insurance policy. Please see a copy of your policy for the full terms, conditions and exclusions. Any information on the Site does not in any way alter, supplement, or amend the terms, conditions, limitations or exclusions of the applicable insurance policy and is intended only as a brief summary of such insurance product. Policy obligations are the sole responsibility of the issuing insurance carrier.HomeInsurance.com, LLC, is a licensed insurance producer resident in North Carolina with.

Cheapest Car Insurance in Jackson, MS

Cheapest Car Insurance in Jackson, MS

compare car insurance quotes from 12+ Argos in Des Moines, IA

Compare

No

Compare

loading

Fetching your data...

Load More

Compare more than 30 top insurers at once and use AutoCADratio to see how much you could save

More than 30 top-rated auto insurers in the southwest United States.

We looked and reviewed multiple insurance providers to see which were the top and what .

Cheapest Car Insurance Companies in Mississippi for Seniors

Cheapest Car Insurance Companies in Mississippi for Seniors

In Mississippi, seniors are usually offered affordable rates only if they are age 55 or older. Even if you’re age 65 or older, chances are good that you can save money on car insurance by opting for . Retaining a driver’s license is a big financial investment. In order to get car insurance premiums back into a driver’s hands, it’s a wise idea to shop around. Insurance companies look at a myriad of factors when determining rates, such as your age, your driving record, and your marital status. Then, you can often secure lower rates by maintaining a good driving record. According to the U.S. Bureau of Labor Statistics, young drivers are often looked at as high-risk by insurance providers. Because of this, getting car insurance quotes is generally easier when you’re young and have less experience behind the wheel. Not all auto insurers have exclusive rates for young drivers, though. Many companies may only offer a relatively.

Cheapest Car Insurance for Drivers With a DUI in Mississippi

Cheapest Car Insurance for Drivers With a DUI in Mississippi

Safeco stands out for its customer service and financial stability. We named the best option in Mississippi, and it was a solid one. If you have a DUI on your record, you’re not alone. Experts recommend getting at least $100,000 in liability coverage to contain costs for one incident and $300,000 for a single incident, a level of car insurance coverage most drivers can’t get.

Check out MoneyGeek’s expert guide to the in the Sunshine State.

» MORE:

MoneyGeek.com is an independent, advertising-supported website publisher and provides a consumer comparison service. Terms of Use , Privacy Policy and Access are available at the .

Welcome to Insurance Protection Specialists

Welcome to Insurance Protection Specialists Inc. and will work with you to find the best home insurance policy for your needs. We have worked with several companies as a resource for information so you can get the support you need if an emergency comes up.

Call us at to make changes to your life insurance policy. Helpful life insurance agents, who can assist you in servicing your policy, are just a phone call away. For all other policies, call or log in to your current , , or policy to review your policy and contact a customer service agent to discuss your jewelry insurance options. Purchased Mexico auto insurance before? With just a few clicks you can your insurance policy is with to find policy service options and contact information. Are you traveling to the East Coast? Perhaps you ve just bought an off-the-shelf home or built a new business. To protect yourself from these uncertain situations, you need to know the.

The Best Cheap Car Insurance Companies for Mississippi Drivers in 2020

The Best Cheap Car Insurance Companies for Mississippi Drivers in 2020

These companies earned top scores in J.D. Power’s 2020 U.S. Auto Insurance Study, earning a perfect 5 out of 5 rating from J.D. Power.

Methodology: Insurer complaints