#loan without collateral

Explore tagged Tumblr posts

Text

Are Personal Loans Worth Taking? Eligibility, EMI & Benefits Explained!

💸 क्या पर्सनल लोन लेना फायदेमंद है? (Are Personal Loans Worth It?) आजकल आप हर जगह पर्सनल लोन के ऑफर देखते होंगे – मोबाइल ऐप्स, बैंक कॉल्स, SMS और सोशल मीडिया पर भी।लेकिन क्या ये लोन आपके लिए सही हैं? आइए जानें पर्सनल लोन लेने से पहले किन बातों का ध्यान रखना चाहिए, और आप इसके लिए कितने योग्य (eligible) हैं। 📌 पर्सनल लोन क्या होता है? Personal Loan एक unsecured loan होता है, यानी आपको इसके लिए…

#best personal loan#CIBIL score#compare loan offers#EMI calculator#Financial Planning#instant personal loan#interest rates India#loan eligibility#loan repayment#loan without collateral#monthly EMI#personal finance tips#Personal Loan#personal loan in India#unsecured loan

0 notes

Text

Understanding Private Financers: Key Players in Alternative Funding

Private financiers invest in businesses or projects for a profit. Private financer in Gurgaon has fewer restrictions on who they lend to than banks or governmental financing sources. They may invest in innovative, small, or large ventures that banks may not lend to due to risk. Businesses seeking growth, expansion, or special projects are more likely to receive private funds.

Private financer in Gurgaon gives money, guidance, and mentorship. Venture investors like fast-growing, high-profit firms. These firms are generally tech or biotech. Private equity firms seek well-known companies that need restructuring, expansion, or financial improvement. Family offices, which invest affluent families' money, may offer private financing.

Private finance is flexible and tailored to the firm or project, which is a significant benefit. Private financiers may be willing to take on additional risk to increase profits. Freedom sometimes comes with higher interest rates, equity stakes, or other riskier investment arrangements. Many firms that wish to develop or support innovative ventures may choose Vintage finance.

#Personal loan in Gurgaon#Private financer in gurgaon#Private personal loan providers in gurgaon#Personal loan without cibil check in gurgaon#Instant loan in gurgaon#Financer in Gurgaon#Instant Personal Loan Gurgaon#Best Personal Loan Providers in Gurgaon#Low Interest Personal Loan Gurgaon#Personal Loan without Collateral Gurgaon#Online Personal Loan Gurgaon#Quick Personal Loan Gurgaon#Personal Loan for Salaried in Gurgaon#NBFC Personal Loan Gurgaon#Personal Loan Eligibility Gurgaon

0 notes

Text

Instant Working Capital Loan for Startups & SMEs – No Collateral Needed (2025)

Why Working Capital is the Lifeline of Your Business

Running a small business or startup in 2025 is exciting—but let’s be honest, it’s not without its challenges. Whether you’re launching a new venture or growing an existing one, cash flow can make or break your success. You might have the best products or services, but without steady working capital, daily operations can come to a halt.

That’s where a working capital loan for small businesses and startups becomes your best financial ally. In this guide, we’ll simplify everything you need to know—from how it works, where to get it, interest rates, documents, and even myths busted—to help you make the smartest funding decision.

What is a Working Capital Loan?

A working capital loan is a type of business loan specifically meant to finance the short-term operational needs of a business. This includes everyday expenses like rent, payroll, raw materials, marketing, and inventory.

Unlike long-term loans that are meant for purchasing assets or equipment, working capital loans for businesses ensure you don’t run out of cash while waiting for customer payments or during a slow sales season.

Who Needs a Working Capital Loan?

New business owners need cash to survive the initial months.

Startups are waiting on seed funding or investor payouts.

MSMEs are scaling their team or stocking inventory for seasonal demand.

Small manufacturers or traders need bridge funding between supply and sales.

Whether you're looking for a working capital loan for a new business in India or need help to manage fluctuating revenues, these loans provide the necessary breathing room.

Comparison Table: Best Working Capital Loan Providers in India (2025)

Tip: Choose a provider that aligns with your business size, speed needs, and repayment comfort. Don’t just go for the lowest interest rate.

Working Capital Loan Calculation

To calculate how much you need, use this simple formula:

Working Capital = Current Assets – Current Liabilities

If you’re still unsure, many online platforms offer working capital loan calculators. You just need to input:

Monthly expenses

Current receivables

Outstanding dues

And you’ll get a quick estimate of how much working capital you actually need to keep your business flowing smoothly.

How to Get a Working Capital Loan in India (2025 Process)

Getting a quick approval working capital loan online in 2025 has become easier than ever. Here’s the step-by-step breakdown:

Step 1: Check Eligibility

Minimum 6 months to 1 year of business operations.

Monthly turnover requirement (differs by lender).

Business registration documents.

Step 2: Compare Loan Offers

Look for low-interest working capital loans comparison across platforms like BankBazaar, LendingKart, and directly on bank websites.

Step 3: Apply Online

Fill in a working capital loan application on the lender's portal. Upload necessary documents like PAN, Aadhaar, GST returns, and bank statements.

Step 4: Loan Disbursal

Upon approval, funds are transferred to your account—sometimes within 24 hours.

Top Banks & Startup-Friendly Schemes

Here are some startup-friendly working capital loan schemes you should explore:

MUDRA Yojana (for new businesses and MSMEs)

Stand-Up India Scheme (for SC/ST/Women entrepreneurs)

SIDBI Startup Mitra

Kotak Startup Working Capital Loan

These schemes offer lower interest rates and relaxed eligibility for startups and MSMEs.

Long-Term Working Capital Financing Options

If your need is not short-term and you’re looking for longer repayment periods, consider:

Working Capital Term Loans (up to 5 years)

Overdrafts & Cash Credit Lines

Invoice Discounting & Receivables Financing

These allow more flexibility and sustainability for businesses scaling over the long term.

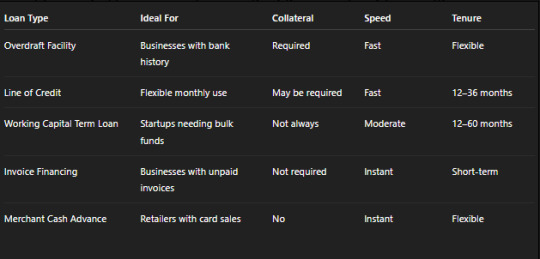

Types of Working Capital Loans

Understanding the type of loan that suits your requirements is key:

Real Scenario

I run a small packaging business in Pune. During Diwali season, orders doubled, but I didn’t have enough stock or staff to handle them. I applied for a quick working capital loan through LendingKart. It was approved in 48 hours, and I scaled operations in time. That loan saved my biggest sales season.

— Anil Mehta, Small Business Owner

Benefits of Working Capital Loans for Small Businesses

No need to dilute equity or seek investors

Quick processing and disbursal

Available even without collateral

Flexible repayment tenures

Helps manage cash flow during lean months

Documents Required for Working Capital Loan Application

PAN card of the business owner & entity

Aadhaar card

GST registration

Business registration proof (Udyam/MSME/Partnership Deed)

Last 6–12 months’ bank statements

ITR filings or audited financials (if applicable)

Final Thoughts: Should You Go for It?

A working capital loan for a small business or new startup isn’t just about getting money—it’s about gaining control over your cash flow. If your revenue is seasonal, your clients pay late, or you’re in growth mode, this could be your smartest decision in 2025.

Just remember: Borrow smart. Compare terms. Read the fine print. And most importantly, only borrow what you can repay without hurting your business.

FAQs on Working Capital Loans (2025)

1. Can I get a working capital loan for a new business in India?

Yes, startups and new businesses can apply under government schemes like MUDRA or from fintech lenders offering startup-friendly terms.

2. What is the typical interest rate for working capital loans?

Interest rates range from 9% to 16%, depending on the lender, credit profile, and collateral (if any).

3. Is collateral mandatory for a working capital loan?

Not always. Many SME working capital loans are without collateral, especially from online lenders or government schemes.

4. How long does it take for loan approval?

With online applications, quick working capital loans can be approved within 24–72 hours, especially with complete documentation.

5. How is working capital loan repayment structured?

Repayment is usually done through EMIs or bullet payments over 12 to 60 months depending on the loan structure.

#working capital loan for new business#working capital loan for small business#working capital loan calculation#what is working capital loan#how to get working capital loan#working capital loan application#working capital loan for business#business working capital loan#working capital loan for new business in india#quick working capital loans#best working capital loan providers#long-term working capital financing options#low interest working capital loans comparison#top banks for working capital loans in India#startup-friendly working capital loan schemes#SME working capital loan without collateral#quick approval working capital loan online

1 note

·

View note

Text

Get instant personal loans with Kashti—fast approval, minimal paperwork, and flexible repayment options.

#apply online for personal loan without visiting bank#quick loan approval without salary slip#get personal loan with low interest online#best instant personal loan app in India#how to get a personal loan instantly online#online loan without documents#personal loan for emergencies#same-day loan approval#no collateral personal loan#flexible loan repayment options#quick personal loan application#personal loan with minimal paperwork

0 notes

Text

Advance Salary Loans for Instant Financial Support

Struggling to make it to the next payday? ATD Money offers advance salary loans to help salaried individuals manage their expenses without stress. Get instant approval and quick disbursal with minimal documentation. Whether it’s rent, utilities, or emergency needs, ATD Money ensures you get the small cash loans you need, when you need them. Our loans with e-KYC process make borrowing seamless and hassle-free. Don’t let financial shortfalls hold you back—apply for an advance salary loan today and stay financially secure!

#instant payday loans#payday loan#quick cash loans#fast cash loans in india#advance salary loan#best loan app in india#fast cash loans#loans without visiting banks#collateral-free loans#hassle-free loans

1 note

·

View note

Text

💸 Need urgent funds in #Gurgaon? No collateral. No long waits. Get a Personal Loan up to ₹1 Lakh with fast approval & flexible EMIs! Apply now – 100% online! 🚀

0 notes

Text

A co-signer loan involves a trusted family member, known as a co-signer, sharing the legal responsibility of loan repayment with the primary borrower. This means both the borrower and the co-signer are equally responsible for making timely loan repayments.

At Prodigy Finance, we understand that every student’s financial situation is unique. That’s why we offer the option to include a co-signer on your loan application. Whether you apply with or without a co-signer, our personalised financial solutions are designed to help you achieve your dreams.

#academia#college life#college#education#co-signer student loans#international student loan without co-signer#student loans without collateral#Prodigy Finance co-signer policy#education loans for international students#global student loans#loan

0 notes

Text

Explore education loans for studying in the UK without collateral. Learn about loan options, lenders, interest rates, and eligibility criteria to fund your UK education.

0 notes

Text

business loan without collateral:- Get a business loan without collateral to support your small business or startup. Explore flexible, unsecured loan options with easy application processes and quick approvals to meet your financial needs.

0 notes

Text

business loan without collateral:- Get a business loan without collateral to support your small business or startup. Explore flexible, unsecured loan options with easy application processes and quick approvals to meet your financial needs.

0 notes

Text

business loan without collateral :

Get a business loan without collateral to support your small business or startup. Explore flexible, unsecured loan options with easy application processes and quick approvals to meet your financial needs.

0 notes

Text

No Collateral? No Problem! Best Working Capital Loans for Small Businesses & Startups in India (Low Interest, Quick Approval)

Starting Up? Or Facing Cash Flow Issues? This Guide Is for You.

Every startup or small business in India hits a moment where funds get tight, but the ambition stays big. Whether you’re waiting for client payments, need to buy inventory, or want to seize a new opportunity, working capital loans can keep your business engine running.

In this 2025 guide, we’re breaking down the best working capital loan options in India—with low interest, no collateral, and instant approvals. We’ll also answer your top queries and help you compare the right lenders.

Let’s explore how you can get business capital fast, even if you’re a startup without financial proof or assets to pledge.

What Is a Working Capital Loan?

A working capital loan is a type of business financing that helps meet your company’s short-term operational needs, like rent, salaries, inventory purchases, marketing, or bills. It's not meant for long-term asset investments like machinery or real estate.

Whether you’re an established SME or just launched your startup, a working capital loan acts like your business survival fund when cash flow slows down.

Why Startups & Small Businesses Need Working Capital Loans

Many Indian entrepreneurs today are:

Running bootstrapped startups

Managing seasonal businesses

Facing delayed payments from clients

Needing funds for bulk purchases

If that sounds like you, business working capital loans can solve your liquidity crunch, without selling equity or pledging property.

Let’s talk about your options.

Types of Working Capital Loans in India (2025)

Top Benefits of Working Capital Loans for Startups & SMEs

No Collateral Required (in many cases)

Fast Disbursal – Some offer funds within 24–48 hours

Improves Cash Flow without diluting equity

Customizable Tenures as per business cycle

Builds Credit Score for your enterprise

If you’re worried about long paperwork and high rejection rates, don’t be. With fintech platforms, you can now apply for a working capital loan online in minutes!

Working Capital Loan Eligibility in India – 2025 Guidelines

While exact criteria vary by lender, here’s what most NBFCs, fintechs, and banks look for:

Business vintage of 6–12 months (some accept 3 months for startups)

Monthly turnover of ₹50,000+ (varies)

Valid GST registration or business proof

Indian citizen aged 21–65

Basic KYC documents and bank statements

Even if you’re a new business or have no ITR, some lenders offer a working capital loan without collateral by assessing cash flows and digital sales.

Where to Apply for Working Capital Loans in India?

Here are the best platforms to consider for 2025:

Tip: Always compare working capital loan interest rates and repayment terms before applying. Online aggregators help you do this easily.

How to Apply for a Working Capital Loan (Step-by-Step)

Applying for a working capital loan in India is now easier than ever:

Choose a lender or aggregator (Razorpay, Lendingkart, etc.)

Fill out a basic application form online

Upload KYC and bank statement docs

Get eligibility check instantly

Receive funds directly in your business account

Some platforms offer pre-approved working capital loans for small businesses based on UPI or GST data. So, no need to wait for days!

Real Human Insight: This Loan Saved My Startup!

When my B2B startup faced a payment delay from a key client, we were nearly out of cash. I applied for an instant working capital loan from Lendingkart. Funds hit my account in 48 hours. It literally saved my team’s salaries.

— Ritika Sharma, SaaS Founder, Bengaluru

This is the real-world power of business capital loans. They’re not just numbers—they protect dreams, jobs, and growth.

Use Case Examples: Where These Loans Help

Retail shop owners restocking seasonal inventory

Freelancers needing to scale with a team or tools

E-commerce sellers bridging logistics gaps

MSMEs are waiting for invoice clearance

Service providers handling short-term bulk orders

Frequently Asked Questions (FAQs)

1. Can I get a working capital loan without collateral?

Yes, many fintech lenders and NBFCs in India now offer working capital loans without collateral, especially to startups and digitally active businesses.

2. What is the interest rate for working capital loans in India?

It typically ranges between 11% to 24% p.a., depending on the lender, tenure, and business health. Always compare the working capital loan interest rate before applying.

3. Are working capital loans good for startups?

Absolutely. Many working capital loans for startups require minimal documents and offer quick access to funds. They're ideal when you need money fast but don't want to give up equity.

4. What is the tenure of a Working Capital Term Loan?

Tenures usually range from 12 months to 60 months, but short-term options (like invoice financing) may be for 3–6 months only.

5. How much loan can I get as a small business?

Amounts range from ₹50,000 to ₹2 Crore, depending on turnover, credit score, business vintage, and lender policies.

Final Words: Get the Right Working Capital Loan Today

If you're running a startup or SME in India, you don't need to struggle alone with cash flow gaps. With instant business loans in India, low interest rates, and no collateral requirements, 2025 has opened doors to faster, smarter funding.

Whether you’re just starting out or growing fast, there’s a business capital loan built for your goals. Choose wisely, compare options, and apply online to unlock the next level of your business journey.

#working capital loan#working capital loans for small business#business working capital loans#instant working capital loan#working capital loan in india#working capital loan eligibility#working capital loan without collateral#apply for working capital loan#working capital loan interest rate#business capital loan#Working Capital Term Loan#working capital loans for startups

1 note

·

View note

Text

Smart Way to Fund Your Studies with Collateral-Free Loans

The costs of tuition and other expenses associated with financing quality education continue to rise, making quality education an expensive option for many students. It is usually difficult to pay for education without assistance. However, one practical solution to this problem would be private education loans. Unlike traditional loans, private education loans are usually taken out without collateral, allowing students more options. Some of these loans have many advantages including the flexibility of the repayment options, attractive interest rates and the possibility of making use of such loans to pay a lot of educational costs. Read on in this blog post to see how this form of collateral-free private education loan would be an effective way to pay for your studies without stressing over finances.

#Studies with Collateral-Free Loans#Collateral-Free Private Education Loans#Private education loans without collateral#financing quality education loan#private education loan#fiancenu

0 notes

Text

किसानों के लिए बड़ी खबर: RBI ने कोलैटरल-फ्री लोन की सीमा बढ़ाई, अब 2 लाख रुपये तक का कर्ज संभव

भारतीय रिजर्व बैंक (RBI) ने किसानों के लिए एक राहतभरी घोषणा की है। अब किसान बिना किसी संपत्ति को गिरवी रखे 2 लाख रुपये तक का लोन ले सकेंगे। इससे पहले यह सीमा 1.6 लाख रुपये थी। RBI का यह फैसला किसानों को बढ़ती महंगाई और कृषि लागत से निपटने में मदद करेगा। क्यों बढ़ाई गई सीमा? RBI के अनुसार, यह कदम किसानों की बढ़ती जरूरतों और खेती में बढ़ते निवेश को ध्यान में रखकर उठाया गया है। खेती की लागत में तेजी…

#2 lakh loan without collateral#agriculture news#Collateral free agriculture loan#collateral free loan#farmers news hindi#Khabar Junction Hindi News#Khabar Junction News in Hindi#latest update#loan for agriculture#loan for farmers#rbi increased agri loan limit#reserve bank of india

0 notes

Text

Easy Small Cash Loans for Daily Needs

Need urgent cash but don’t want the hassle of a big loan? ATD Money’s small cash loans are perfect for daily financial needs like groceries, bills, or minor repairs. With quick approvals and simple cash loan processing, you get funds without any stress. Forget traditional banking delays—ATD Money offers instant, paperless loans through an easy-to-use online platform. Experience financial flexibility today and never let cash shortages hold you back!

#instant payday loans#payday loan#quick cash loans#fast cash loans in india#advance salary loan#best loan app in india#fast cash loans#loans without visiting banks#collateral-free loans#hassle-free loans

1 note

·

View note

Text

Unsecured Business Loans & Bridge Funding, sme loan

Explore unsecured business loans and bridge funding options with SME Loan. Get quick access to funds without collateral to manage cash flow gaps, cover expenses.

unsecured loan, unsecured personal loan, business personal loans, loans without collateral, collateral loans, unsecured loans online, personal loan company, credit loan, online personal loans in bhandup, mumbai, india.

#unsecured loan#unsecured personal loan#business personal loans#loans without collateral#collateral loans

0 notes