#magic of compounding interest calculator

Explore tagged Tumblr posts

Text

Power of Compounding: The Prescription for Wealth Growth

Power of Compounding Calculator is the only way to understand the future goals and also help to manage your financials according to your requirements. Because if anyone have a proper direction in that case they can manage his life accordingly, So if you don't have any direction, anything in that case they can star investment accordingly, So this is the Power of Compounding Calculator.

#power of compound interest calculator#rate of return calculator#magic of compounding interest calculator

0 notes

Note

What is the akatsuki like?

hiiii my loves🫶🏻sorry for my inactivity, I’ve been really busy with work😭 for those who have never seen my page, I’m a shifter, mostly to Naruto, but I also shift to Bleach, demon slayer, arcane, and JJK. Everything I post is based on my DR.

•

I’m going to start off by saying the akatsuki are my family, we may not be blood related at all but our bond as friends is unbreakable🖤I truly feel accepted with them^.^

•

Also! We have 4 extra members of the akatsuki, who will be added to this description!

•

Konan: she’s a quiet natured woman, calm and level headed yet calculated. I swear I’ve never seen her scared or even anxious. She’s so strong, physically and mentally! She’s a romantic too. In my DR she’s married to Pain, and Nagato and omg. Such a lover girl, it’s the cutest thing seeing her with them. (Only time I see her get flustered☺️)

Pain: just like his wife, he’s more on the quiet side. He handles handing out tasks and assigning missions. If he’s not away on a mission himself, you’ll most likely find him tucked away in his office handling the countless paperwork the man has to handle. He enjoys reading and learning to cook(he isn’t the best and has burnt more things than making anything edible. Konan is teaching him :)

Nagato: lives in Amegakure and comes to visit every once in a while. He handles a lot of more private affairs which is why he doesn’t live with us full time. Insanely powerful and every time he visits, he trains 1on1 with every member to help strengthen our skills. He’s really kind and gets nervous easily lol!

Itachi: he recently went through a break up and for a while was rather down about it but his spark came back! He’s insanely patient and an absolutely amazing big brother. Sasuke will come visit time to time or he’ll pop into the hidden leaf to visit his parents. Family is everything to him. He keeps his bedroom neat and clean, everything has their own place lol. His favorite genre of movies is thriller

Kisame: for starters, the dude is MASSIVE. In height and size in general. He works out daily, and before the end of the day will be found outside training. Itachi is like a brother to him, he can read Tachi like an open book and tends to know when he’s upset before Itachi even realizes it himself. Was quite the ladies man before getting into a committed relationship with a sweetheart ^.^

Zetsu: May be a bit of an odd ball but I mean that in a sweet way. His sense of humor is rather interesting and tends to be funny when he can’t read the room. Likes to magically appear to scare people or to pass on messages from other members. He’s very close with Tobi and myself so he’ll hang out with us time to time when he’s bored

Orochimaru: tends to be in his lab, all the time. If any of us want to hang out with him, we’d have to go downstairs and enter his laboratory to do so. He doesn’t mind it, he enjoys the company and isn’t afraid to admit as such. Weekly, he’ll visit the Hidden Leaf to have lunch or dinner with Lady Tsunade and Jiraiya. (Was the one to encourage Jiraiya to finally ask Tsunade out, and they’ve been together for quite some time now!)

Kabuto: he’s surprisingly super shy. He only trains with Orochimaru and only does so when the compound is primarily empty. He’s very respectful and just like Itachi, he’s very patient.

Zabuza: level headed, and an extreme strategist. Rather loud, especially when he talks about something he enjoys. Tends to work out with Kisame a few times a week. Haku is his assigned partner and they’re away a lot of the time, as they both like to be on the move but Zabuza always enjoys being able to come home and relax on the couch, watching a movie. (Doesn’t have a favorite genre, he’ll watch anything)

Haku: soft spoken and kind. Can be a smart ass which is rather amusing because he always has a comeback for everything. Enjoys baking, and on the days he’s not running around, you’ll find him in the kitchen, reading from a book as he works on a new recipe.

Deidara: confident! He’s proud of his scars and doesn’t shy away from past mistakes or ‘failures’. He’s also what a lot of the akatsuki refer to as a pretty boy since anytime we all go out, the girls flock to him. Takes pride in his hair and appearance but he’s never cocky. Has never outright said it but it’s presumed he’s bisexual🥰

Sasori: just like orochimaru, he tends to be in his room, working on new creations and preparing damaged puppets. Deidara will also be found in his room more times than his own. Doesn’t smoke like some of us do but he’ll enjoy a nice cold glass of sake at the end of a tiring work week

Tobi: goofy, childish, flamboyant, and easily excitable. Now, sometimes this persona will falter, mostly whenever he’s in our shared room where Obito takes over. As Obito, he’s much more reserved, dominant, intimidating and a major softy. He helps me work on repairs(I have my own business of custom made weaponry, Kunai’s shuriken, etc) he’s also a medical ninja, and his level is very close to Sakura’s.

Kakuzu: quiet, and grouchy. Tends to not be as vocal about his affections unless him and I are alone. He’ll never admit it but loves having his hair played with or back scratches. Has fallen asleep in my lap from me doing so. His favorite food is onigiri, all kinds of doesn’t matter what the middle is filled with. He’s not a picky eater in the slightest. Just like Kisame, he’s massive. He’s the tallest member, standing at 6’5.

Hidan: anytime he’s in the mood, he’ll team up with Tobi. It’s a recipe for chaos. If he wants attention, he’s taken after what Tobi does and have multiple shadow clones ‘annoy’ me until I give in and pay attention to him lol. Hidan is very in tune with his emotions and knows when he needs to step away and take a break from things. He’s also an affectionate drunk, so he’ll be found wrapping his arms or his body around me. Trailing along behind me like a lost puppy🥺

•

If you got this far, thank you☺️

Ps: if you want to know more, please send in requests, I love talking with you guys. Also don’t be scared to ask about my other DR’s, or even a specific person!

#desired reality#naruto shippuden#shifting#alternate universe#naruto#naruto shifter#hidan#hidan x you#kakuzu#kakuzu x you

14 notes

·

View notes

Text

It's of course actually because it's been 10 more hours of listening, but it feels like magic.

Hours 5-6 of HP4 I could understand on first listen enough of the details to distract me from anything else - the competition and its age 17 requirement, introduction of the schools, giving the password at the lady, hearing about professor t speaking about the future and guessing a birthday wrong, m saying insulting shit about the w's from the newspaper, and then moody turning him into something and mcgonagal coming to yell at moody and say that he had to have been told these punishments arent allowed. I'm relistening, again, because that seems to be the trick to turn "some of main idea understanding" into "all of main idea and some details understanding" into "all of main idea and MANY details understanding." But yeah just 6 hours into the book, 11 hours into listening, already seeing significant increase in words I recognize.

I did some word lookups since my attention was on the details I heard anyway, and its interesting to me how many words i can kind of "guess" from words i know like jiaoxue 教学 teaching (professor+teaching), fuyuanle 复原了 restored (my brain though returned to original), tubiao 图标 icon (i think it was used as an omen, its map+label so the new word makes sense in context), hansheng 喊声 and xiaosheng 小声 are yell and whisper respectively, suanming 算命 is fortune telling (calculate life - that makes sense). Took me like 10 minutes to realize mudi was Moody instead of "purpose/goal."

Learning chinese as an english speaker, there's no cognates benefit to the huge degree Spanish or French have cognates. But there are a LOT of compound words made up of smaller words in chinese (like airport in english), where if you know the smaller word then the longer word might make sense in context. (There's also words like carpet in english, where a carpet has nothing to do with cars or pets). I am finding a lot of the compound words and 4 hanzi phrases made up of stuff I know is what's being picked up now, in terms of new nouns and verbs and descriptives.

I might finally be learning some new words through listening? I feel like I didn't know fuyuan before. But maybe I've read it? I know the individual hanzi.

There's still plenty of words I'm not getting, and details I am not catching lol. Although, if I can catch the verbs and nouns, and some of what people are physically doing, it's doable to follow the plot. Mostly those words are clear to me, just some verbs and nouns I have to guess or relisten to clarify. I can also grasp about half the dialogue lines.

Kangyi ended up being useful from the podcast i learned it in the other day! They used kangyi in the audiobook "the students at the table roared in protest" or something like that. I was surprised to hear kangyi 抗议 again so soon.

I find myself unsure recently if I hear yin or ying, zhang or chang or shang, yu or yv, qi or ji, when listening. With yin and ying i think it's because genuinely ive heard some podcast person's accent where yin has a "ng" sound at the end, whereas with the others I'm mixing up I think my ear just is still working out how to parse those sounds when I hear them fast. The word changpao/shangpao for long robe in HP4 i just could not figure out what I was hearing... i think changpao because that literally means long robe, but i can't hear clearly if its chang. I knew paozi was robe, but the chang part i was unsure about. Qi and ji i can usually hear clearly, but if it's the beginning of a word i occasionally get them mixed up. I'm finally telling clearer when they're saying huo (huode get) versus hou (like houlong neck).

Now that in audiobook 3 i learned 城堡 chengbao for castle, i'm hearing it a TON. No idea why it took so long to pick up, except maybe its a brand new word to me? Im used to reading/hearing gong and gongdian for palace, not castle.

#progress#rant#chinese listening experiment#i am not sure i can tell tone differences that greatly yet when hearing newer words to me#but i could hear that changpao (long robe) was clearly not chengbao (castle)#even though pao and bao sound pretty similar to me right now. and chang cheng do too

2 notes

·

View notes

Text

"But just"/"Why don't you just?" is not always the magic solve you think it is, boomers

Feeling a little disheartened today by the way that my mum point-blank refuses to acknowledge structural barriers. And I do think it is at least partially a generational thing.

The thing about the deck being stacked against you that has the most impact, and that certain folk of a certain age seem unable to put together is that...

You reach a point in your life, or in your career, or in your day to day financial situation where not only is there no magical solution, there are also no good options.

And it's the kind of situation where it's not the case where there are no good options because you, the individual, made mistakes or burned bridges or wasted your starting out nest egg or your initial savings so you have only yourself to blame - or even where if you just reduced your basic outgoings down several levels you'd be able to build a nest egg (back) up in order to give yourself more options again... There just aren't any good options from the jump.

Recent solves my mum has put to me as if I'm not an adult, in my 30s, living independently in another country from her with over 10 years' working experience, include:

Why don't you just get a higher paying job?

Why don't you get a pension?

Why don't you buy a house?

Why don't you move further away from your work (and your established community and the amenities you rely on) so you can buy a house?

The undertone implication is a) that we haven't already considered all the options before us, done the calculations and concluded that (unfortunately, as if it worked out it would be helpful) it isn't viable right now, and b) that by not doing these things you are somehow deliberately crafting your own misery and setting yourself up for more hardship, instead of the reality that we are making the best of what's available to us within the system that is how our generation are asked to live and exist.

I don't 'just get a higher paying job' because the structural barriers are my lack of education and my lack of social connections among the higher strata of the demographic that, by their wealth-funded access to as many qualifications as they would like to pay for, and by being able to buy the time to complete them, holds a monopoly on hiring. That's something that's come from making education something available to the highest bidder, rather than grant-funded and obtainable by anyone with the capacity to qualify for the course.

I don't have a pension (right now) because I can't afford one. The minimum contribution that I can make by law to a pension is 10% of my income a month, and I can't afford to lose an extra 10% of my income when I'm already paying around that out of my salary to a student loan with compound interest that was sold to me as a loan that wouldn't have compound interest added. I'm also paying 50%+ of my income per month on housing alone, and more on bills. Where am I supposed to find more? And of course, if my salary goes up, so too does the amount I'm meant to pay back the student loan.

I don't buy a house because I can't afford one, despite saving for a deposit for several years. Unfortunately, Liz Truss crashed the economy last year and as a result, the banks don't offer mortgages as high as they used to, and require larger deposits for properties. As such the amount that I have saved up might have been enough to put down a healthy deposit two years ago, but now, isn't. And I can't save any more because of the aforementioned draws on my income above.

And if I was to move further afield to buy a house, what's the benefit to me? I'd have to spend more money on my commute, I'd probably have to live in a much less safe area, and it's going to be cold comfort to me that I own a property if I end up getting assaulted or stabbed on my way home at night.

Trust me, I would love to live in an era where I didn't have to overthink these basics. Where the fact that I have a college degree and multiple years of specialised work experience across multiple sectors including private business and government would actually count for something and afford me a solid and stable standard of living.

But it doesn't any more. And this is my life, and the lives of many of us nowadays. And we can't just sit and mope about it, we have to accept it, and adapt, and do the best we can to keep going until something gets a little easier for us, until the luck of the draw rolls our way or until someone with the power and ability through government or big business to effect a real change takes that shot and acts to make things just that bit less bleak for us.

Until then, a little empathy wouldn't hurt instead of a lecture.

#text post#whew this became an essay#boomers#generational change#uk#structural barriers#millennials#personal#society#2023#liz truss#uk politics#anti tory#cw violence#tw violence#generation gap#adult life

23 notes

·

View notes

Text

Nadya's Thoughts on Kumamoto Division

Aoba Yamamura

"In the grand experiment of society, Aoba Yamamura is a fascinating subject, embodying the dichotomy of order and chaos. As a librarian, he is the custodian of knowledge, a role that demands meticulous organization and a reverence for the structured accumulation of human understanding. Yet, beneath this façade of tranquility, he harbors a volatile reactivity, akin to a latent chemical compound awaiting activation. His nocturnal alter-ego 'Bluefire' is the manifestation of an exothermic reaction, releasing energy in the form of societal upheaval and destruction."

"From a scientific standpoint, Aoba's actions could be seen as a response to external stimuli, a psychological entropy driving him towards disorder as a means of coping with past traumas. His targeting of Chuohku-related edifices aligns with a hypothesis that his behavior is not random but rather a calculated reaction to perceived injustices. As a fellow traveler on the path of vengeance, I can't help but observe his methodology with a certain degree of professional interest, noting the precision of his 'experiments' with the same rigor I would apply to my own research. However, unless his actions intersect with my objectives against Chuohku, he remains a variable outside my immediate purview."

Kunio "Kurome" Chōten

"The younger brother of the leader of Aoyama Division, Tomi Chōten. Unlike his older sibling, he presents an intriguing case of social defiance. His rejection of Aoyama's elitism and his subsequent self-exile reflect a deliberate thermodynamic shift from a state of high potential energy to one of kinetic activism. His transformation from a privileged heir to a theatrical revolutionary is a reaction to the catalyst of familial betrayal, a process I find more compelling than the predictable stability of his brother's socialite existence."

"In the context of our shared enmity towards Chuohku, Kunio's desire for retribution resonates with my own objectives. His dramatic flair and strategic use of illusion in rap battles suggest a complex character, one who understands the power of perception and influence. His renouncement and his quest for revolution in Aoyama earn a measure of my admiration. His actions, though not directly aligned with mine, contribute to a larger pattern of disruption that could be advantageous."

Natsume Kurome

"Natsume Kurome, the aforementioned Kunio's husband. He is an enigma wrapped in the guise of an artist and fortune-teller. While his artistic contributions to Kumamoto are undeniable, his secondary occupation as a seer of futures is, from a scientific standpoint, less credible. As I mentioned before with Chinami Chinen of Ota Division, the notion of predicting the future through tarot is antithetical to the principles of empirical evidence and reproducibility that govern scientific inquiry. Such practices, often reliant on Barnum statements, cannot withstand the scrutiny of the scientific method."

"However, despite my doubts about the veracity of his fortune-telling, Natsume's influence within Kumamoto and his role in Strange Magic cannot be overlooked. His partnership with Kunio and their shared vision for revolution suggest a strategic mind at work, one that understands the power of symbolism and narrative in swaying public opinion. In this light, Natsume's 'supernatural abilities' may simply be a tool for cultivating his persona and furthering his goals. It is a tactic I can appreciate, even if I don't subscribe to its mystical underpinnings."

Strange Magic

"Strange Magic is a collective that, despite its eclectic composition, has demonstrated a unified front in the pursuit of revolution. Their selection of 'Phantometals' as a technological advancement aligns with my own scientific endeavors to innovate and disrupt the status quo. While our relationship is not one of camaraderie, there exists a mutual respect born from recognition of each other’s capabilities and the acknowledgment that our respective goals may converge on the battlefield of change."

"The team's diverse backgrounds: from Aoba's dual life as a librarian and a terrorist, Kunio's theatrical rebellion, to Natsume's artistic and fortune-telling pursuits, they all create a multifaceted force. Their individual stories weave together to form a tapestry of resistance against common adversaries. It is this very diversity that lends them strength and unpredictability, qualities that I find both strategically valuable and scientifically intriguing. Our collaboration on 'Phantometals' is a testament to the potential of interdisciplinary innovation, and while we operate independently, the resonance of our objectives cannot be ignored."

#hypmic#hypmic oc#hypnosis mic#hypnosis mic oc#hypnosis microphone#nadya kuromiya#kumamoto division#strange magic#aoba yamamura#kunio chōten#natsume kurome

6 notes

·

View notes

Text

The Power of Compound Interest Explained

Compound interest is often referred to as the “eighth wonder of the world,” and for good reason. It has the potential to turn small, consistent investments into a significant sum over time. Understanding how compound interest works is essential for anyone looking to grow their wealth, plan for retirement, or achieve long-term financial goals.

At its core, compound interest is the process by which interest is added to the initial principal, and then new interest is earned on that larger amount. In contrast to simple interest, which is calculated only on the original principal, compound interest continually adds to the total amount, allowing your money to grow faster.

Let’s break it down with an example. Suppose you invest $1,000 in an account that earns 5% interest annually. After one year, you would have $1,050. The following year, your interest would be calculated on $1,050, not just the original $1,000. This cycle continues, and over time, the growth becomes exponential. Even though the rate stays the same, the amount of interest earned each year increases because it’s being calculated on a larger balance.

One of the most powerful aspects of compound interest is the impact of time. The earlier you start investing, the more time your money has to grow. A person who starts saving for retirement at age 25 will likely accumulate much more than someone who begins at age 40, even if the older investor contributes more money. That’s the magic of compounding—your money earns interest, and that interest earns more interest.

Frequency of compounding also plays a role. Interest can be compounded annually, semiannually, quarterly, monthly, or even daily. The more frequently it compounds, the faster your money grows. For example, if two people invest the same amount at the same interest rate, the one whose interest is compounded monthly will end up with more than the one whose interest is compounded annually.

Compound interest is not only useful for investing; it can also work against you in the form of debt. Credit card balances, for example, often grow rapidly due to high interest rates and frequent compounding. This is why it’s crucial to pay off credit cards quickly and avoid carrying a balance if possible.

To make the most of compound interest, start saving early, contribute consistently, and reinvest your earnings. Retirement accounts like 401(k)s and IRAs are excellent tools for compounding because they offer tax advantages and often come with employer contributions.

Financial tools such as compound interest calculators can help you visualize how your money will grow over time. By inputting your starting amount, interest rate, contribution frequency, and time period, you can see the long-term benefits of consistent investing.

In conclusion, compound interest is a powerful financial principle that can significantly enhance your savings and investments. By understanding how it works and putting it to use early in life, you can build wealth steadily and efficiently. Whether you’re saving for a home, college tuition, or retirement, compound interest can help turn your financial goals into reality.

0 notes

Text

Wisdom for Tomorrow's Investors. Timeless Lessons in an Ever-Changing Market

The investment landscape never stands still, yet certain truths remain constant beneath the surface turbulence. For those looking to build lasting wealth in the years ahead, understanding these enduring principles — while adapting to new realities — makes all the difference between reacting to markets and shaping one’s financial future.

Eric Hannelius, CEO of Pepper Pay, reflects on two decades of observing market cycles: “The investors who thrive long-term aren’t necessarily those with the sharpest predictions, but those with the deepest understanding of how money, psychology, and innovation interact. They know when to stand firm and when to pivot.”

The Discipline of Patience.

In an era of instant gratification and meme stock frenzies, patience remains the quiet superpower of successful investing. The magic of compounding works its wonders gradually — like a tree growing rather than a firework exploding. Investors who chase quick wins often miss the steady gains available to those who allow quality investments time to mature.

Eric Hannelius notes an interesting pattern: “We’ve observed that our most successful clients share one trait — they treat investing as a process of careful cultivation rather than a series of transactions. They understand that real wealth is built in the space between market headlines.”

Seeing Around Corners.

While no one predicts the future perfectly, the best investors develop what might be called “peripheral vision” — the ability to spot trends before they become obvious. This doesn’t mean chasing every new fad, but rather developing the discernment to separate passing hype from genuine transformation.

Consider how some investors recognized the staying power of mobile payments early, while others dismissed them as a niche convenience. The difference came from observing human behavior as much as analyzing balance sheets.

“Successful investing requires equal parts calculator and curiosity,” says Eric Hannelius. “The numbers tell you what is, but only asking ‘what if’ helps you see what could be.”

The Emotional Compass.

Market volatility tests every investor’s resolve. Those who navigate it successfully learn to recognize their own emotional triggers — the fear that prompts selling at lows, the greed that leads to buying at highs. Developing this self-awareness creates what might be called an “emotional compass” — an inner guidance system that helps maintain direction when markets become turbulent.

Eric Hannelius shares a revealing insight: “We noticed that our clients who maintained investment journals — recording not just what they bought and sold, but why — consistently outperformed those who relied on memory alone. Writing forces clarity about whether decisions are grounded in reason or reaction.”

Diversification Reimagined.

The old adage about not putting all eggs in one basket still holds, but the nature of baskets has changed. True diversification now considers not just asset classes but exposure to different technological shifts, demographic trends, and even climate scenarios.

An investor might balance traditional stocks with investments in renewable energy infrastructure, digital assets, and emerging market consumer goods — not as speculation, but as recognition that the global economy is evolving in multiple directions simultaneously.

“Diversification used to be about spreading risk,” Eric Hannelius observes. “Today it’s equally about positioning for different versions of the future.”

The Due Diligence Difference.

In an information-saturated world, the ability to conduct thoughtful due diligence has become both harder and more valuable. The best investors cultivate what might be called “informed skepticism” — the habit of looking beyond surface-level data to understand underlying drivers and potential blind spots.

This means asking different questions: Not just “Is this company profitable?” but “How durable are those profits?” Not just “What’s the growth rate?” but “What could disrupt that growth?”

Eric Hannelius emphasizes: “The most overlooked part of due diligence is understanding how a company treats its customers during difficult times. That often reveals more about long-term prospects than any financial ratio.”

Adaptability as Strategy.

The investors who thrive across decades share a willingness to evolve without abandoning core principles. They understand that markets change, and strategies must adapt accordingly — not by chasing every trend, but by recognizing when foundational shifts require new approaches.

This balanced adaptability shows in how they handle new asset classes — not dismissing them outright nor embracing them uncritically, but taking time to understand their role in a broader portfolio.

“The best investors I know maintain what I’d call ‘strong opinions, weakly held,’” says Eric Hannelius. “They have clear investment philosophies but remain open to refining them as the world changes.”

For those investing in the years ahead, the path won’t be linear. There will be breakthroughs and setbacks, surprises both welcome and otherwise. What remains constant is that the investors who succeed will be those who combine financial literacy with emotional awareness, who balance conviction with humility, and who understand that markets ultimately reflect both numbers and human nature.

As Eric Hannelius puts it: “Investing isn’t just about building wealth — it’s about developing wisdom. The money matters, but so does the perspective you gain along the way. Those who approach markets as a continuous learning experience tend to do well financially while sleeping better at night.”

The most valuable investment any of us can make may be in developing the patience, perspective, and discernment to navigate whatever markets bring next. These qualities, unlike stock prices, only appreciate with time.

0 notes

Text

Unlocking Financial Growth: The Power of a Compound Interest Calculator

If you've ever wondered how small investments today can lead to substantial wealth tomorrow, then you've already touched on the concept of compound interest. It's often described as the "eighth wonder of the world" for good reason. Whether you're saving for retirement, building an emergency fund, or planning a big purchase, understanding how compound interest works can transform the way you manage money. One of the best tools to help visualize this financial magic is a Compound Interest Calculator.

What Is Compound Interest?

Compound interest is the process of earning interest on both the original amount of money (the principal) and the interest that has already been added. Over time, this creates a snowball effect — your money grows faster because you're earning interest on interest.

For example, if you invest $1,000 at an annual interest rate of 5%, you'll have $1,050 at the end of the first year. In the second year, you'll earn interest not just on the $1,000, but also on the $50 you earned the year before — giving you $1,102.50 by the end of year two. The longer your money stays invested, the more powerful this effect becomes.

Why Use a Compound Interest Calculator?

Doing these calculations manually can be time-consuming and error-prone, especially if you're trying to factor in monthly contributions, varying interest rates, or long investment horizons. That’s where a Compound Interest Calculator comes in.

This handy tool allows you to:

Quickly estimate how much your money will grow over time.

Test different interest rates and compounding frequencies.

See the benefits of regular contributions.

Set realistic financial goals based on projected returns.

Many free compound interest calculators are available online. All you need to do is input your principal amount, interest rate, time period, and frequency of compounding (monthly, quarterly, annually, etc.). Some calculators even let you include regular deposits or withdrawals to make the estimate more accurate.

Benefits of Planning with Compound Interest

Using a Compound Interest Calculator not only helps you understand the math behind financial growth, but it also motivates you to start early and be consistent. The earlier you start saving or investing, the more time compound interest has to work in your favor.

It’s also a great way to compare investment options. For instance, seeing the long-term results of a 5% return versus a 7% return can highlight the value of even small differences in interest rates.

Final Thoughts

Financial planning doesn't have to be complicated. With tools like a Compound Interest Calculator, anyone can start making smarter decisions about money. Whether you're a student starting your first savings account or a professional planning for retirement, understanding compound interest is key to long-term success.

So go ahead, plug your numbers into a compound interest calculator today — your future self will thank you!

0 notes

Text

RD Calculator: Plan Your Savings with a Recurring Deposit Calculator

An rd calculator is your personal savings companion. In just a few taps, this tool shows exactly how much your monthly deposits will grow, taking the guesswork out of planning. A good recurring deposit calculator helps you see your total contributions, interest earned, and final payout—all without confusing formulas. Whether you’re building an emergency fund or saving for a dream trip, an rd calculator puts you in control from day one.

How Does an RD Calculator Work?

Let’s break down the magic:

Monthly Instalment (P): You enter how much you’ll save each month.

Interest Rate (R): Add the annual rate your bank or post office offers.

Tenure (t): Choose how many months or years you’ll keep saving.

Hit “Calculate,” and your rd calculator uses a built‑in rd calculator formula to deliver:

Total Deposits you’ve made

Interest Earned over time

Maturity Amount you’ll receive

No more paper calculations—this recurring deposit calculator does the math for you in seconds.

Why Use a Recurring Deposit Calculator?

An rd interest calculator feature brings extra clarity:

Instant Insights: See your maturity amount right away.

Error‑Free Answers: Avoid mistakes that cost you money.

Side‑by‑Side Comparison: Plug in different rates or tenures to find the best deal.

Goal Tracking: Match your monthly instalment to your savings target.

Pairing this recurring deposit calculator with smart planning helps you stay on track and worry‑free.

Understanding the RD Calculator Formula

Behind every rd calculator is a simple compound interest model. Here’s the rd calculator formula.

A = P × (1 + R/N)^(N × t)

A = Final maturity amount

P = Monthly instalment

R = Annual interest rate (in decimal form)

N = Number of compounding periods per year (usually 4)

t = Time in years

This rd calculator formula multiplies each instalment by compound growth, giving you an accurate result every time.

Top Benefits of an RD Maturity Calculator

A dedicated RD maturity calculator offers powerful perks:

Time‑Saver: No manual math—get results in a flash.

Accurate Results: Relies on the proven rd calculator formula for precision.

Flexible Planning: Experiment with instalments or tenure until your plan fits.

Visual Breakdown: Some tools show charts or tables to track principal vs. interest.

Mobile Access: Use your RD maturity calculator on any device for on‑the‑go planning.

With an RD maturity calculator, you make savings decisions confidently and quickly.

Simple Steps to Plan with Your RD Calculator

Step 1: Open the rd calculator on your device.

Step 2: Enter your monthly savings (P).

Step 3: Input the interest rate (R) and choose compounding frequency.

Step 4: Set your tenure (t) in months or years.

Step 5: View your maturity amount plus total interest earned.

Use this rd calculator anytime you want to compare new rates or update your goals.

FAQs

Q1: What makes an rd calculator different from an FD calculator? An rd calculator handles fixed monthly instalments, while an FD calculator works with a one‑time lump sum.

Q2: How often should I use the rd interest calculator? Re‑run it whenever interest rates change or you adjust your deposits or tenure.

Q3: Can I compare multiple plans with a recurring deposit calculator? Yes! Simply enter different rates or tenures to see which option gives you the best maturity amount.

Q4: Do I need to know the rd calculator formula? No. The formula runs in the background—you just enter numbers and get instant, accurate results.

Conclusion

An RD calculator is a simple online tool that estimates your recurring deposit maturity amount in seconds. Just enter your monthly instalment, interest rate, and tenure, and the recurring deposit calculator shows your total deposits, interest earned, and final payout. It uses a compound-interest formula behind the scenes, eliminating manual errors and saving time. You can adjust rates and tenures to compare different plans and match your savings goals. Many tools even provide an amortization breakdown and mobile access. By using an RD calculator, you gain clarity, choose the best option, and confidently track your progress toward a secure financial future.

#investing#calculator#rd calculator#recurringdeposit#recurringrevenue#recurring income#recurring payments#investsmart#investment

0 notes

Text

Power of Compounding Calculator | Compound Interest Calculator

Power of Compounding Calculator is used to know that how much your money can grow over time. And also you want to earn highest return from any where but how you can know that your today money how much give you after 20 or 30 years, so to know your exact amount after your decided year, you just open power of compounding calculator and select your interest rates, no of years and than you will get your return. compound interest calculator is a world wide software in todays time everyone use this calculator and when you know your target amount in that case you can invest accordingly, so don't waste time you just open Compound Interest Calculator and se the results.

#compounding calculator#power of compound interest calculator#magic of compounding interest calculator#sip calculator#sip return calculator#rate of return calculator

0 notes

Text

The Importance of Saving Money | Kotak Life

Importance of Saving Money Saving money is a cornerstone of financial stability and prosperity, yet it’s a habit that many people overlook or underestimate. Whether you’re saving for short-term goals like a vacation or long-term aspirations like retirement, the importance of saving money cannot be overstated.

Savings is a Step towards attaining Financial Freedom Consider allowing yourself the liberty to do as you please, spend as you please, and create more time for leisure in your life. Well, since knowing the importance of saving money makes all of this possible, its significance as a financial goal increases regularly. Without understanding the importance of savings, a person may feel trapped in a situation if they heavily rely on a paycheck. Still, with knowing the importance of savings, the situation is very different because money is set away for emergencies and contingencies.

Long-Term Security Given the ambiguity of the future, it is even more crucial to save money. Saving plans provide long-term security, and it’s generally believed that the more you save, the more secure you’ll be. One cannot weather the storms or face problems that arise in the course of a life without money. Additionally, with the importance of savings plan, one can consider various investment opportunities that might yield returns for them, and with such returns, people can undoubtedly ensure long-term stability.

Savings Reduce Stress A monthly savings plan is unquestionably one of the most crucial aspects of living stress-free. You feel relieved and at ease knowing that you have amassed a particular amount of money. You may accomplish your long-term and short-term goals, plan for your children’s education, take better care of your family, a finance major purchases, be ready for unforeseen events, and overcome most financial challenges by practicing disciplined saving. Therefore, one must be persuaded that saving money is a crucial objective that everyone should pursue.

Saving Money Allows You to take Calculated Risks You can explore many opportunities if you create savings plans and consistently add to your money each month or at frequent intervals. For instance, investing in stocks, launching a new company, contributing to an NGO, etc. Savings, therefore, give you the freedom to take calculated risks without heavily relying on a paycheck. Put another way, it enables you to feel more secure about your finances and take calculated risks with the money you have saved.

Savings Allows Taking Benefits of Compound Interest Savings has several advantages, but one of the main advantages is that it enables people to take advantage of compound interest. As a result, you might start seeing great benefits if you start saving today and investing your money wisely. It takes time for compound interest to work its magic. As a result, the monthly savings plan must be given time to increase. In actuality, people have built wealth through the power of compounding, which increases the significance of saving.

0 notes

Link

#credit#CreditCard#creditcardapr#creditcarddebt#CreditCardInterest#creditcardinterestexplained#creditcardinterestrate#creditcardinterestrates#CreditCards#creditcardsexplained#creditcardsforbeginners#creditcardsinterest#creditscore#howcreditcardinterestworks#howcreditcardswork#howdocreditcardswork#howdoescreditcardinterestwork#howtocalculatecreditcardinterest#interest#interestratescreditcards

0 notes

Text

How Does a Systematic Investment Plan in Nashik Use the Power of Compounding?

When it comes to investing, many people wonder how small, regular contributions made through a Systematic Investment Plan in Nashik can result in substantial returns over time. Well, the answer lies in a combination of compounding and rupee-cost averaging.

What is Compounding?

Compounding is a financial concept where the returns you earn on an investment are reinvested, allowing you to earn even more returns on those returns. In other words, compounding is the process of earning interest on both the principal amount you invested and the interest that accumulates on it over time. This “snowball effect” enables investments to grow exponentially, even if the amount invested each month is relatively small.

To understand compounding, let’s take a simple example. Imagine you invest ₹1,000, and it earns 10% interest. At the end of the first year, you have ₹1,100. In the second year, instead of earning interest only on the original ₹1,000, you earn interest on ₹1,100. This process continues, and over time, even a modest investment grows significantly due to the cumulative effect of compounding. Soman’s Magnum Investments offers reliable mutual fund SIP service in Nashik, so reach out if you need to get started.

The Role of Rupee Cost Averaging in SIPs

A Systematic Investment Plan (SIP) allows you to invest a fixed amount regularly into mutual funds. By investing consistently, regardless of market conditions, you take advantage of rupee cost averaging. This means that you buy more units when prices are low and fewer units when prices are high. Over time, this reduces the average cost of your investments and protects you from the ups and downs of the market. Rupee cost averaging helps investors stay committed to their investments without worrying about market timing.

How Compounding Works in SIPs

With an SIP, you are contributing to your investment regularly, which makes compounding even more powerful. Since your investment is growing at a compounded rate, each year’s returns are calculated based on a growing base. The longer you remain invested, the more you benefit from compounding because your earnings are reinvested year after year.

Conclusion

The combination of compounding and rupee-cost averaging works like magic in systematic investment plans, and that's how your small investments grow big over time. This means you can accomplish even the biggest of financial goals like planning your retirement, or your child's education with small contributions with a SIP. So, take the first step today and harness the power of compounding with an SIP.

#Systematic Investment Plan in Nashik#finance management company in Nashik#AMFI registered mutual fund distributor in Nashik#mutual fund investments agency in Nashik#mutual fund sip service in Nashik

0 notes

Text

The Magic of Compound Interest: Why It’s Never Too Late to Start

Ever heard the saying, "Make your money work for you"? That’s what compound interest is all about. It's the process where your investment earns interest, and that interest earns even more interest. The result? Your savings start to grow exponentially over time.

The best part? You don’t need to be a financial expert to take advantage of it. Even small, regular contributions to a savings or investment account can lead to significant growth. The key is to start early—or if you're a little late to the game, start now!

Think of compound interest as planting a tree: the earlier you start, the more time it has to grow and flourish. But even if you plant it later, it'll still grow—just start watering it regularly!

So if you haven’t yet, take that first step today. Your future self will thank you.

Play with compounding numbers here : https://www.bearsavings.com/tools/compound-interest-calculator

0 notes

Video

youtube

How to Double Your Money (The Rule of 72 Explained)

Want to unlock the magic of the Rule of 72 and understand how it can help you with passive income? Watch this video for a simple explanation on how the Rule of 72 works in financial education. You know, there's something almost magical about the Rule of 72. Just a simple formula, yet it holds the power to transform how we view our investments. Picture this: you've got a little nest egg, and you want to see it grow. With an annual return of 8%, you can quickly calculate that in about nine years, your money will double. Nine years! It's like a countdown to financial freedom. But here's the catch-this isn't a crystal ball. It's an approximation, a handy little shortcut that works best when the rates are between 6% and 10%. Beyond that, you might need a calculator or some fancy software to get the real picture. Still, it's a reminder of the beauty of compounding. Each year, your money earns interest, and then that interest earns interest. It's a snowball effect, and understanding it can change your entire approach to investing. Isn't that empowering?

0 notes

Text

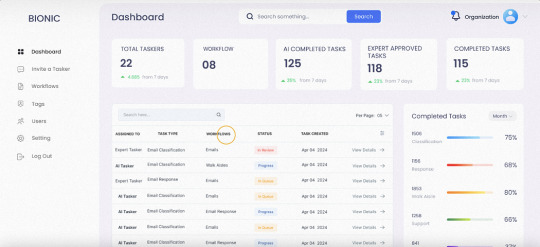

What is Enterprise Automation? A Comprehensive Guide for Beginners - Bionic

This Blog was Originally Published at:

What is Enterprise Automation? A Comprehensive Guide for Beginners — Bionic

Last month, our team experienced a breakthrough when we fully integrated enterprise automation into our daily operations. The change was palpable. Tasks that used to consume hours of our time were now completed in minutes.

One day, during a routine project update meeting, I noticed my colleague Sarah looking relieved. She shared how she had just completed a complex report that would have taken her days to finish manually.

Instead, the automation system had pulled the necessary data, generated the report, and even sent it to the stakeholders — all while she enjoyed her morning coffee.

It promised to streamline processes and free up my time for more strategic tasks. This guide will help you understand what is enterprise automation and how it can revolutionize your business operations.

What is Enterprise Automation?

Enterprise automation refers to using technology to automate business processes. It involves implementing systems and tools that handle repetitive tasks without human intervention.

In simple terms, it’s like setting up a virtual assembly line where tasks flow smoothly from one stage to the next. This allows employees to focus on more critical aspects of their jobs.

Enterprise automation can encompass various functions, including data entry, customer relationship management, and financial processes.

How Enterprise Automation Works

Let’s peel back the curtain and take a closer look at the key components that make this automation magic happen:

Robotic Process Automation (RPA): You can consider RPA as software robots (or “bots”) that mimic human actions on a computer. They can log into systems, copy and paste data, fill out forms, extract information from documents, and even make calculations. These bots are incredibly fast, accurate, and don’t need coffee breaks. They’re perfect for handling repetitive, rule-based tasks that can be done by using AI for business.

Business Process Management (BPM): BPM is like spring cleaning for your business processes. It involves analysing how work gets done, identifying bottlenecks or inefficiencies, and then designing improved workflows. Think of it as a map that guides your team through their tasks in the most efficient way possible. BPM tools often include features like process modeling, workflow automation, and performance monitoring, helping you continuously improve and optimize your operations.

Artificial Intelligence (AI) and Machine Learning (ML): This is where things get interesting. AI and ML are the brains behind intelligent automation. They enable systems to learn from data, make decisions, and even predict future trends. For example, an AI-powered chatbot can understand customer inquiries and provide instant, personalized responses. ML algorithms can analyze massive amounts of data to identify patterns and insights that humans might miss, helping you make better business decisions. The growth of AI in the last decade is miraculous too. According to a report, the global artificial intelligence market size is projected to expand at a compound annual growth rate (CAGR) of 37.3% from 2023 to 2030. It is projected to reach $1,811.8 billion by 2030.

Low-Code/No-Code Platforms: These platforms are like Lego blocks for building automation. You don’t need to be a tech wizard to create simple AI automation with these tools. They often have drag-and-drop interfaces, pre-built templates, and visual workflows, making it easy for non-technical users to design and deploy automation. This democratization of automation empowers your team to solve problems and automate tasks without relying solely on IT.

Key Areas Where Enterprise Automation Shall Be Executed

Data Management: Automating data entry and management tasks can significantly reduce errors and save time. Instead of manually entering customer information, artificial intelligence tools for business can extract data from forms and input it directly into the system.

Workflow Automation: This involves automating the flow of tasks within an organization. For example, approval processes can be streamlined by automatically routing documents to the appropriate stakeholders, ensuring that nothing gets lost in the shuffle.

Customer Relationship Management (CRM): Automating customer interactions, such as sending follow-up emails or scheduling appointments, can enhance the customer experience. This allows businesses to maintain consistent communication without the need for manual intervention.

Financial Processes: Automating invoicing, expense tracking, and payroll can reduce the administrative burden on finance teams. This not only speeds up processes but also ensures accuracy in financial reporting.

Human Resources: From onboarding new employees to managing performance reviews, HR processes can benefit greatly from automation. Automated systems can handle paperwork, track employee progress, and facilitate communication between HR and staff.

IT Management: Automating IT processes, such as software updates and system monitoring, can help organizations maintain their technology infrastructure with minimal downtime.

Benefits of Enterprise Automation

Increased Efficiency: By automating repetitive tasks, employees can focus on more strategic initiatives that drive business growth. This leads to a more productive workforce and faster project completion.

Cost Savings: While there may be an initial investment in automation tools, the long-term savings can be substantial. Reduced labor costs, fewer errors, and increased productivity all contribute to a healthier bottom line.

Improved Accuracy: Human error is inevitable, especially when dealing with repetitive tasks. Automation minimizes mistakes, ensuring that processes are executed consistently and accurately.

Scalability: As businesses grow, so do their operational demands. Automation allows organizations to scale their processes without the need for proportional increases in staff, making it easier to handle increased workloads.

Enhanced Customer Experience: With automation, AI and business can respond to customer inquiries more quickly and efficiently. This leads to higher customer satisfaction and loyalty, which are crucial for long-term success.

Better Compliance: Automated systems can help organizations adhere to industry regulations by maintaining accurate records and ensuring that processes are followed consistently.

Challenges and Considerations

While the benefits of enterprise automation are compelling, there are also challenges that organizations or any AI agency must navigate:

Initial Investment: Implementing automation solutions can require significant upfront costs, including software purchases and staff training.

Change Management: Employees may resist changes to established processes. It’s essential to communicate the benefits of automation and provide adequate training to ease the transition.

Integration Issues: Integrating new artificial intelligence tools for business with existing systems can be complex. Organizations must ensure that different software solutions can communicate effectively to avoid data silos.

Data Security: With increased automation comes the responsibility to protect sensitive data. Organizations must implement robust security measures to safeguard information from breaches.

Over-Reliance on Technology: While automation can enhance efficiency, organizations must strike a balance. Over-reliance on automated systems can lead to a lack of human oversight, which may be necessary for certain tasks.

Steps to Get Started with Enterprise Automation

Identify Pain Points: Begin by assessing your current processes to identify areas that are time-consuming or prone to errors. Engage with employees to gather insights on their challenges.

Define Goals: Clearly outline what you hope to achieve through automation. Whether it’s reducing costs, improving accuracy, or enhancing customer service, having specific goals will guide your implementation strategy.

Research Automation Tools: Explore various artificial intelligence tools for business that align with your goals. Consider factors such as ease of use, integration capabilities, and scalability when evaluating options.

Pilot Program: Before fully committing to an automation solution, consider running a pilot program. This allows you to test the effectiveness of the tool in a controlled environment and make necessary adjustments.

Train Your Team: Provide comprehensive training for employees who will be using the automation tools. This will help them feel more comfortable with the use of artificial intelligence for business and understand its benefits.

Monitor and Optimise: After implementation, continuously monitor the performance of your automated processes. Gather feedback from users and make adjustments as needed to optimize efficiency.

Consult an AI agency: Hiring an AI agency can help organizations implement AI solutions with all the expertise by outsourcing automation. Hiring an Artificial intelligence agency to implement Ai solutions can save on costs and efforts to develop an in-house AI automation team.

How Bionic can help you with Enterprise Automation?

Bionic is an innovative AI platform designed to streamline business processes by automating customer-facing interactions and handling repetitive tasks. It aims to enhance productivity and efficiency, allowing businesses to focus on more strategic initiatives.

Affordable and Trustworthy AI Solutions: Bionic offers a cost-effective approach to AI automation without compromising reliability. The platform combines advanced AI technology and grounding AI techniques with human oversight to ensure high-quality results. This dual approach minimizes the risk of errors often associated with AI, such as AI hallucinations or inappropriate responses.

Scalable and User-Friendly Workflows: The platform is designed to be easily configurable, allowing businesses or any artificial intelligence automation agency to set specific tasks and requirements according to their needs. Users can trigger tasks on demand, making it adaptable to varying workload demands. As Bionic’s AI capabilities improve over time, the cost of operations becomes cheaper, providing a scalable solution that grows with the business.

Human-in-the-Loop Approach: Bionic employs a unique human-in-the-loop model, where AI and human taskers collaborate to ensure quality and manage exceptions effectively. While the AI handles repetitive tasks, human oversight guarantees that the output meets the required standards. This synergy not only enhances productivity but also allows for quick adjustments during peak workloads or urgent task requirements.

Conclusion

Reflecting on my initial skepticism about enterprise automation, it’s clear that the potential for transformation is immense.

By embracing automation, organizations can streamline their operations, reduce costs, and empower their teams to focus on what truly matters.

As we move forward in an increasingly digital world, adopting enterprise automation is not just a trend; it’s a necessity for businesses looking to thrive.

So, if you find yourself bogged down by repetitive tasks, consider leaping enterprise automation. Bionic can completely assist you with that one. The journey may require effort and investment, but the rewards will undoubtedly reshape the way you work, allowing you to innovate and grow in ways you never thought possible.

0 notes