#me: adds transcript after the fact. I forgot that's a thing I was supposed to do.

Text

July 17th, 2033

Roman: ...Wait....

Abe: What’s wrong?

Roman: [sighing] What do you think?

Abe: It’s gonna be fine.

Roman: You keep saying that...

Abe: Cause it is. It’s only a year... What’s the worst that could happen? ... Don’t answer that.

Roman: ..... You’re sure?

Abe: Of course I’m sure. I mean, the university isn’t even that far away.

Roman: I guess that’s true...

Abe: Besides... It’s us. It’s always been you and me, Ro.

#why would I write a full scene for a flashback when I could just do dialogue#arkhelios#sims 2#sims 2 gameplay#the sims 2#ts2#my posts#Arkh Ch4#Roman Bellamy#Abe Chun#did yall wake up this fine thursday morning and say#'wow I hope Allie hurts me with a flashback'......?#cause uh.... here's a prize if you did. :)#also yes... I did look at this and say#don't worry#we'll be back to prose in literally 20 minutes#me: adds transcript after the fact. I forgot that's a thing I was supposed to do.

16 notes

·

View notes

Text

Dumb Theory of the Tryna...

Yo I forgot to post this last week lol

Don’t take this remotely seriously, I just thought it was a neat idea and a sort of interesting “what if” scenario. It basically all boils down to, if given little ot no physical or mental limitations by using his mask, could Kingdom!Matoro, in theory, reanimate Mata-nui’s dead corpse? And whether or not there is any sort of implication of this not only being true, but was his being given a Tryna perhaps pre-determined in case Matoro failed to revive Mata-nui in time?

Under the cut for length!

So in regards to Kingdom!Matoro (or Matoro as a Mahri I'm general) he was bestowed with the kanohi Tryna - the mask of necromancy reanimation. An interesting choice by the Ignika (which is the supposed source of his and the other Mahri’s mutation) but it got me thinking... (ie I was VERY bored at work).

Now again, this is not to be taken seriously, but after rereading the Into the Darkness podcast transcript again, something just really bugged me about the whole situation with Teridax and Matoro. So, Teridax’s goal was to blackmail Matoro into reanimating Tuyet, because she had remnants of the Nui-stone embedded in her armor (though apparently in the main universe, it wasn’t Nui-stone fragements), and the reason was...so he could bestow it on a Toa?

That got me to thinking just what this implies. We’re all fully aware of Teridax’s psychopathic ability to plan and prepare a thousand backup plans to his backup plans. We also know he has an invested interest in The Plan to take over the Matoran universe, but it can’t be achieved if Mata-nui dies. So, taking into account his tendency to have backup plans in stacks, could he have, say, predicted Matoro being given the Tryna, and thus, his plans for the Nui-stone were in fact to somehow sway Matoro to his side, give him the Nui-stone, and in the event Mata-nui dies, have Matoro harness the stone and, I don’t know, reanimate the husk? At least enough to allow Teridax to slip into the Core Processor and do what he needed to do, because as it stands, it SOUNDS like for him to even get into the GSR, Mata-nui HAD to die at least briefly.

And to me, it just doesn’t entirely add up. Or maybe I’m not remembering things correctly (it’s been A While since I read the books). Why would he want the Nui-stone to begin with? As far as I can tell, it’s used exclusively to enhance Toa.

He showed an unusual interest in Matoro, and I’m going to guess it’s because, one, Matoro is inherently linked to the Ignika for obvious reasons, and two, he has a mask that may or may not be of use to Teridax in some way if something goes wrong.

So, if given the Nui-stone, could Matoro have proved useful in reanimating Mata-nui? My guess is yes. In Tuyet’s hands, she apparently was able to essentially take over the Toa Empire Universe. If given that enhancement, Matoro probably could reanimate a massive, universe-sized robot with very little strain; at least long enough for Teridax to do whatever he needs to do.

On the flip side of things, there is also the possible reason why Matoro got the Tryna. The Inika/Mahri were mutated by the Ignika, and due to the Ignika’s sentience, I wouldn’t be surprised if it had chosen their masks from the get-go. So why the Tryna for Matoro? Why such an obscure, taboo mask?

Supposedly masks are a sort of nod to a trait of a Matoran/Toa's personality or ability, or perhaps at the least prove utility to their programmed profession. So, supposedly, masks align with one’s destiny. Matoro’s destiny is to die to revive Mata-nui. If we assume over-use of mask powers causes strain, we can assume if he tried to reanimate Mata-nui without a Nui-stone, he would probably die in the procees. But what would be the point? There is no utilitary reason for Matoro to have the Tryna that isn’t just symbolism (which is rife within the MU, but I digress). The other Mahri, on the other hand, all got masks they could utilize to their new enviroment. Jaller got echolocation, Hewkii got gravity powers, Hahli can mimic Rahi, Kongu can summon demons and Rahi and god knows what else, and Nuparu got stealth ninja powers. One could argue there’s A Lot of dead things in the ocean, but there is literally SO many other masks Matoro could have been given that would have been much more useful in The Pit.

So does the Tryna just imply his destiny is to revive someone (ie Mata-nui)? Or was he given the Tryna because, regardless of the Ignika and REGARDLESS of whether or not Matoro dies or if he has a Nui-stone, the Tryna would act as an end all contingency? I can't see it being the former, and while the latter is REALLY pushing it, it makes more sense. This may or may not also be supported by the fact that a contingency mask DOES exist, and that is the Ignika itself. It’s supposed to both be Mata-nui’s defibrillator, but it’s also a reset button.

I don’t know, it just feels very off to me, both Matoro’s mask and Teridax’s motivations for the Nui-stone. I can’t recall if it was ever expanded upon if he even had a Toa in mind to give the stone to, and if not, I doubt he would have gone to the trouble of finding it. That’s a HUGE detour to take when he’s on such a tight time crunch now.

Anyways, that’s gonna do it for me, so if anyone has any thoughts, discuss!

#Shut Up Sumi#Sumi has Headcanons#Long Post#Bionicle#Bionicle headcanon#Matoro#Tryna#Toa Mahri#Teridax#Makuta#What If?#Theory#Bionicle Theory#Wow I actually forgot to post this last week

32 notes

·

View notes

Text

TRANSCRIPT for Episode 1.01 "Sam's Chia Pudding" (PART 2/2)

ACT II

SAM: Thanks! I did it myself. I can do yours too, if you want! You haven't been using hair conditioner, have you?

ELAINE: Why?

SAM: Oh, Elaine. Everyone knows that after a nuclear event you have to, one, shave your head and beard, and two, avoid conditioner. It locks in moisture right alongside airborne radioactive materials.

ELAINE: Oh my. Then I suppose I will take you up on that haircut offer.

SAM: We can do it here if we have any down time tomorrow. Seems like we're seeing fewer and fewer patients these days.

ELAINE: But more of each other! So it's a trade-off. But Sam. As much as I'd love to keep admiring your new clean-shaven look you have, we should probably wrap up this delicious recipe you brought, a Choco-Coco Chia Pudding!

SAM: That's right, Elaine! Before the break we combined a cup of whole chia seeds, a quarter cup of the highest quality unsweetened cocoa powder you can find. For us, that's medium quality, folks.

ELAINE: True. Then we added an entire 32oz carton of coconut milk, plus a whole 13.5oz can of coconut milk. We whisked all of these ingredients together and let them rest for twenty minutes.

SAM: Fun fact: chia seeds are one of those super-foods that people went crazy for a while ago. They are just extremely healthy, but also happen to taste tolerable and can be added to many different dishes as seeds or in a ground powder form.

ELAINE: Plenty of fiber and protein. By itself, it has extremely few calories, but lucky for us the coconut milks can provide us with that much needed element.

SAM: I think this is ready! In a past life, I may have chilled this for another hour after letting these chia seeds soak up what coconut milk they could, but since all our refrigeration and freezer units were seized last week...heck, we're just going to enjoy as is!

ELAINE: Here are our two mugs I fetched from the tech lab.

[MUGS ARE SET DOWN]

SAM: Perfect. I'm just going to fill these guys up...

[PLOPPING OF CHIA IN MUGS]

SAM (CONT’D): ...and we're ready to dive right in!

[SPOONS SCRAPING]

ELAINE: Mm. Oh my, Sam! It is chocolatey, textured, yet not too heavy!

SAM: Oh shoot, Elaine I forgot the final surprise! Close your eyes!

ELAINE: What--

[BOX OPENS, POURS CLUNKY CONTENTS INTO MUGS]

SAM: It's a simple topping. I'm not adding much to each mug. Just a small fistful for extra crunch and a little kick of sugar. It's--

ELAINE: My favorite brand of breakfast cereal, Assloads of Oat Clusters with Almonds! Sam, this really sets the whole thing off!

SAM: I know, right?

ELAINE: Well. I must say, although things appear to be endlessly worsening in the outside world, it is moments like this, when I get to dine upon the very genius of my lovely friend and trusted colleague, that I feel most like myself.

SAM: Elaine, I know exactly what you mean. Now here's the thing.

ELAINE: The thing.

SAM: I know what you all are probably thinking. Oh, big fancy dental assistant guy. Happens to have medium-quality unsweetened cocoa powder on hand. Must be nice.

ELAINE: It's fair to say that most people can't afford such luxuries these days.

SAM: I just wanted to say...I feel that. I bartered probably more than what is reasonable. A can of tinned meat and four packs of Top Ramen, plus a pair of socks, the fresh ones I was gonna make into hand puppets. It is still possible to get chocolate if it's worth it to you, like if you're celebrating a birthday or a reunion with an old friend.

ELAINE: Oh Sam.

SAM: But let's say you don't have chocolate powder. I was hoping that I could share a few alternative takes on chia pudding. If you don't mind, of course.

ELAINE: Please do!

SAM: So maybe you can't rock that cocoa powder lifestyle just yet. Maybe you have some imitation vanilla to sub in! Maybe you've got part of some canned peaches you can add. Maybe you're the kind of person who has stocked up on granola before this whole nuclear apocalypse unfolded. Add that on top! And if I can be perfectly honest…

ELAINE: I'll brace myself.

SAM: The stuff is pretty good on its own. It's just a light, yet nutrient-dense snack that can serve up to six people. If you're eating this on your own, I'd say you have three solid meals here. It probably won't be super- safe to eat after sitting unrefrigerated for more than a day, but if you're anything like me, you're no stranger to playing with the boundaries of food safety just to make it through. Have I gotten a tummy ache once or twice?

ELAINE: Okay--

SAM: Sure I have! Has e.coli made a visit to the gut of Sam H. Gately? Just a few times.

ELAINE: I don't know if everybody wants--

SAM: Have I spent a few sultry nights between a five-gallon bucket and the toilet seat because I was spewing out of both ends?

ELAINE: Oh my.

SAM: It's just a part of living, baby!

ELAINE: I feel I should stop you there.

SAM: I'm talking about diarrhea, here, folks. We're all dealing with the same diarrhea. And there is really only one way to deal with diarrhea. Loudly and proudly. Am I right, Elaine?

ELAINE: Well, I can't deny I've been foolish enough to attempt to will certain items beyond their expiration date and...paid the price.

SAM: Right, and you paid through the butt for it.

ELAINE: Fine.

SAM: With diarrhea!

ELAINE: I wonder if there is a good- practices guide to how many times a non-medical podcast should use the word "diarrhea."

SAM: How many are we at now?

ELAINE: Oh. Let me see.

[CLACKS AWAY AT COMPUTER]

ELAINE (CONT’D): I knew this transcription software would come in handy. Six times! Oh my, I hope we haven't alienated our audience too much.

SAM: Nice. Well, the rest of the chia is yours to keep, Elaine! I really gotta get going.

ELAINE: Oh, you sure? I mean, I've kind of lost my appetite for this chocolate pudding here after all the talk about--

[RUSTLING OF CLOTHING]

SAM: I'm positive! I'm riding my Razor scooter home, so I can't really carry the leftovers anyway. I'll see you tomorrow?

ELAINE: I can only hope. Sam, thank you so much for joining me after work hours to put together this truly charming episode.

SAM: My pleasure. And if I could leave your audience with one last tip?

ELAINE: By all means.

SAM: The best way to deal with diarrhea is prevention. Boil your water and avoid all perishable items, especially vegetables. Barring that, don't be too proud to seek out Imodium. It'll stop you right up in a good way.

ELAINE: Sam Gately, folks!

[APPLAUSE SFX]

SAM: Goodnight!

[JANGLE OF OUTSIDE DOOR]

ELAINE: Listeners, there is so much to be said for consistency--the act of being consistent, I mean. The unfolding of the flower every morning, the bubbling coffee pot, the tired but genuine smile of an old friend. How you perceive these small evidences of continued existence--heartbreaking or beautiful, or perhaps a mixture of both--is the only choice left. At a time where everything seems so uncertain, it is tempting to pretend like nothing has changed. But things are changing, and rapidly. It is possible that this podcast will be heard well after the raw wound of this nuclear apocalypse has been healed over by time. On the other hand, perhaps things are about to get inconceivably worse, and these episodes will simply be a few moments of perfectly encapsulated, tragic innocence. I dare to be optimistic enough to hope for the former. I hope this humble cooking podcast finds you safe, happy, and turning towards the rising sun. This has been Elaine's Cooking Podcast for the Soul. Please join us next week for another new and clear recipe for our nuclear lifestyle! In the meantime, I'm Elaine Martínez, not crying, hugging you goodnight.

[OUTRO MUSIC]

END OF ACT II

0 notes

Text

Stranger Than Fanfiction — An addendum

So, I have a Twitter account. I know I hardly ever mention it, and the link to it is easy to miss in the blog's theme, but it exists. I almost forget about it myself, because I am the kind of human being who does that. Ahem.

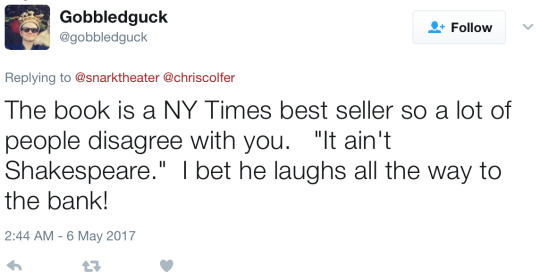

All this to say, it feels like a semi-miracle that someone actually replied to one of my tweets on the Snark Theater account (specifically, the one about my Stranger Than Fanfiction review, and like another semi-miracle that I noticed it within just a few hours and not…like, months later. And I guess that adds up to a full miracle, because my miracle math is flawless like that.

Let's have a look (Disclaimer: I do not endorse people reading this blog post going after this Twitter user, so please don't do that, guys.)

Transcript:

The book is a NY Times best seller so a lot of people disagree with you. "It ain't Shakespeare." I bet he laughs all the way to the bank!

Hoo boy. Well, on the plus side, thank you, Twitter user gobbledguck, for reminding me about a crucial point I completely missed in my original review. Let's discuss. And I'm warning you in advance, this is probably going to be a little rambling. More than usual, I mean.

Now, I'm not talking about the tweet in general. "But if popular, how can it be bad?" is a question to which I've had a definitive answer for five years now: Fifty Shades of Grey. We live in a post-Fifty Shades world and popularity has been thoroughly debunked as a measure of quality.

So I'm not going to argue with the fact that the book is a best-seller, especially in the case of this specific book, which, in case you forgot, is written by a person who has millions of pre-established fans for something that has nothing to to with writing and who would buy anything he puts out there. Including, reluctantly so, this guy right here typing this blog post. I did not mention having a celebrity crush on Chris Colfer as a joke. It is well documented.

With the ritual self-depantsing out of the way, let's talk about the actually interesting thing in this tweet, and the one that actually ties back into the book. The (incorrect, but let's ignore that detail) quote. Let's put it back in context, which is from page 2 of Stranger Than Fanfiction.

Naturally, when it first premiered the critics treated the show [Wiz Kids, the fictional show protagonist Cash Carter stars in] like a piñata. […] However, with each fatal blow Wiz Kids only received more attention. People tuned in to see the "absurdity" for themselves, but they were not repulsed as promised. Audiences found the show's campiness to be rather charming, its unique underdog spirit resonated with them, and a global phenomenon was born.

No, it wasn't Shakespeare, but on the bright side, it wasn't Shakespeare.

The low-hanging fruit response to this tweet is pretty simple. They are, after all, referencing the fact that the show is terrible, in the book's own text. It is beloved, but even the book's protagonists admit in hindsight that they don't like the show for itself as much as they like it for the community it gave them. (Which is pretty comparable to Chris Colfer's own Glee).

But let's not reach for the low-hanging fruit, because I think choosing Shakespeare of all points of comparison to be incredibly interesting. You could rephrase that last sentence of the quote as "it wasn't high art, but on the bright side, it was accessible." Which is funny to use Shakespeare for that, who…you know, made low-brow entertainment. Yeah, Shakespeare's popularity didn't stem from him writing stuffy, obscure stuff that only a tiny amount of elites could understand. It came from him writing (mostly) good stuff.

There's this weird trend these days to present critical acclaim and commercial success as antithetical, and I don't really get it. Or actually, I do, but the anti-intellectualism it derives from is kind of scary to me and I'm already planning an essay of sorts about anti-intellectualism, so I'm not sure I want to examine it in detail right about now.

The point is: anyone who criticizes something is immediately dismissed as wrong, a buzzkill, or in this specific case, fighting in vain against an overwhelming tide. It's become common to glorify being panned by critics, and it makes me wonder: what exactly are the ambitions of the people doing that?

I mean, look at Chris Colfer. What's his motive for writing this book? Is it to make money, as is implied by our Twitter user above saying he'll be "laughing all the way to the bank" at my little review? I have some serious doubts, considering he's already pretty successful. Is it because he had a story to tell, and wanted to tell it? If so…why would he consider critics to be the enemy? Wouldn't it be preferable to listen to them and strive for the best version of that story you can tell? Is it because he wanted to send a message about LGBT kids (Sam and Joey, sort of Topher), kids from toxic family environments (Mo and Joey), kids raised by single parents (all but Joey)? Then, once again, why not listen to people telling you your message might not really convey as well as you thought it would?

Of course, this is all hypothetical, and reviews aren't really meant for the author anyway. I don't expect Chris Colfer to read my review of his book, nor do I really want to, because I'm writing for potential readers, not for him. I'm talking about the attitude to dismiss critics and present a dichotomy of quality entertainment (here symbolized as "Shakespeare") versus enjoyable entertainment (i.e. Wiz Kids or the book itself). Not just because it doesn't apply to me personally (to paraphrase Lindsay Ellis on her Top Ten Guilty Pleasures video—which is apparently off Youtube at the moment—"no, I don't want to turn off my brain, I'm using it"), but also because it doesn't really seem to apply…in general.

Again, take Shakespeare. Am I supposed to just agree that it's adapted so much because people hate it? Every teenager in love sees themselves as Romeo and Juliet because that play is just so inaccessible and stuffy and high-brow? Yeah, right. (And that's without getting into a debate on whether Romeo and Juliet is a romance, a cautionary tale, or a mix of the two; it's still a pretty well-made play regardless of how you read it)

In fact, it's pretty easy to find things that are good and extremely popular, because it tends to be what survives the test of time (like, you know, Shakespeare). It's not universal, and it doesn't mean you personally have to like any of it. I hate Emile Zola's books and most of the music made before I was born, and for all I've defended him, I'm not a super fan of Shakespeare. But it doesn't mean I can't see the quality in all those things, or the fact that they had some pretty wide appeal, both then and now.

So that dichotomy is bullshit. What about the idea that critics themselves are wrong? You know, the idea that critics are a tool of the status quo rather than a measure of quality. Recently, you see that a lot whenever people criticize anything enjoyed by teenage girls (and not unreasonably so). Except…then you have to consider your definition of a critic. After all, to quote an overused phrase, everyone's a critic. All it takes is having thoughts about a thing. And in the Internet age, once can share those thoughts pretty easily, regardless of how much institutional power they hold. There's a reason this is a blog, is what I'm saying.

Point is: saying any criticism is automatically wrong by virtue of being criticism (so long as you have mass appeal) is a pretty weak counter-argument. And it feeds into a culture where critical thinking itself isn't encouraged, because you don't want to be one of those critics who just can't have fun and enjoy things, do you?

Look, I'm not mad at Twitter user gobbledguck for their reply. I'm not going to say I don't care since…you know…this post exists…but I'm not mad about it. It's symptomatic of a larger, self-perpetuating problem. Which this book is part of, by virtue of this quote, and, in a larger sense, all of Cash Carter's "how dare people criticize what I, a highly public figure with a huge influence on impressionable minds, do while in the public eye" speeches. Which Chris Colfer is a part of too, by virtue of writing this book as a highly public figure with a huge influence on impressionable mind, and publishing it for consumption.

So no, I'm not mad at that Twitter user, but I am mad at this book for participating into a culture that makes that tweet a possibility, and allows this user to go on without questioning their own biases.

I feel like there's probably a better rant about anti-intellectualism and the rejection of all critics in me. Hell, I feel like there's a better rant about it in relationship with this book. But, well, this is a hot take on a tweet. Maybe I'll even regret it in a few days. I've had a streak of regretting some of my recent posts and all.

But what I'm pretty sure I won't regret is the main point, the tl;dr as we are used to saying here on the Internet: "No, it wasn't Shakespeare, but on the bright side, it wasn't Shakespeare" is more or less equivalent to admitting you have no interest in writing (or reading) a good story, and honestly, I feel kind of sad for you and your admitted creative bankruptcy.

Now I'll get off my high horse before someone points out to me that that Twitter account has all of four tweets, and the other three are dedicated to shipping Chris Colfer with his co-star, and I'm probably being played by a troll and/or falling on deaf ears with this one. Reviews aren't meant for the author anyway, and I suppose this is no exception.

Okay, that should be enough self-deprecating humor that this post doesn't come across as too insufferable. Now I'll go back to bitching about a popular TV show or something.

#stranger than fanfiction#chris colfer#anti intellectualism#criticism#critical thought#critics#attacking the critics#young adult#ya books#books#young adult books#book reviews#ya#reviews#book#book review#review#st: book reviews

10 notes

·

View notes

Text

01/27/2017 DAB Transcript

Exodus 4:1-5:21 ~ Matthew 18:1-20 ~ Psalm 22:19-31 ~ Proverbs 5:15-21

Today is January 27th. Welcome to the Daily Audio Bible. I'm Brian. It is a pleasure to be here with you today and we’re here to take the next step forward in the adventure that is the scriptures. We’re just a couple days into the book of Exodus, which is a very dramatic story that fits in huge puzzle pieces about who these children of Israel are and why they are the chosen ones. So from the Contemporary English Version this week, Exodus chapter 4, verse 1 through 5, verse 21 today.

Commentary

We have a number of things that we should talk about today from the scriptures. We’ll begin in the Old Testament.

We’re getting to know this man named Moses who is becoming a large figure in the story and has a hand on us having these writings that we’re reading in the Old Testament at all. We’re moving into this next season after Joseph. We found out how the children of Israel, how that family got to Egypt. We found out how they multiplied and how the Egyptians forgot how they ever got there in the first place and had enslaved them. We learned of Moses and all of the male children that were supposed to be thrown into the Nile. So Moses was kind of thrown into the Nile, so to speak, but in a wicker basket and the Pharaoh's daughter found him and he was raised Egyptian even though he was Hebrew. He killed an Egyptian and ran away. So we’ve gone through all of that, but now Moses is meeting with God. Moses is having this conversation with God and his conversation is filled with all kinds of questions, like how can I be sure that you’re going to do what you say you’re going to do? How are the people going to believe me?

God is entering into this conversation. He doesn’t come down and shoot a lightning bolt right next to Moses’ left foot and make him dance away with a singed toe and say, “I am God and that is why they’ll believe me!” He enters into a conversation. This is God's way. Collaboration. Intimate relationship.

So they are having this conversation. Even though Moses is asking all kinds of questions to indicate that he is not sure that he believes this is true, God begins to show him there is power here, that he is sending him, he has an important role to play and he is going to lead God's people out of the land of Egypt. In the end Moses kind of runs out of excuses and so he digs deep into the barrel and says, “But I can’t speak in front of people. I'm slow at talking. I can’t think of what to say in those kinds of situations.” Of course, God's’ reply is, “I will help you. I’ll be with you. I’ll give you the words to say.” Moses, who is going to become a large and important figure whose life still affects us today, ends up saying something really sad because it's in us all. “Lord, please send someone else to do it.”

So there it is. The mirror of the Bible goes back up in front of our faces and makes us look at ourselves once again. How many times have we been in that position? God is moving. God is leading. We’re afraid. We don’t trust. We’re not sure this is for real and so we start finding all of the reasons that this can’t be real, can’t be happening and then we talk ourselves out of it, just like Moses is doing, send someone else to do it, you’re asking too much of me, you’re asking me for something I can’t do. It's like we were talking about yesterday. This life that we live is so often lived from a place of impossible, when that is not something that exists for a person who has been made fully whole and human.

As we move into the New Testament, we see the same collaboration. We see the same weightiness of choice. We see the same intimacy coming from Jesus’ lips. “I promise you that God in heaven will allow whatever you allow on earth, but he will not allow anything you don’t allow.” Or put in more traditional language, whatever you bind on earth will be bound in heaven and whatever you loose on earth will be loosed in heaven. So there is no way to get around this without acknowledging that what we do does matter and the world that we currently live in is the one that we have created for ourselves. Obviously it is not the one God intended, but it is the one that he allowed. The choices that we make are creating the world that we live in and we can’t escape that. We try to escape that. We try to blame everyone. We try to blame God. But the mirror isn’t lying.

We could easily say well, God is sovereign over all of this and why would he allow our choices to matter when our choices aren’t going to be the best ones? This goes all the way back to the beginning. Love, true love, real authentic, intimate, honest, deep love is something that is entered into by choice. There is no other way. You can’t be co-opted into true love. You can’t be strong-armed into true love. You can’t be enslaved into true love. Those things can happen, but the result isn’t true love. True love is entered into by choice. The intimacy and collaboration that we have with God, whatever state or shape that it is in, is by choice. It is one of the gifts of Eden that we are created in the image of God and we get to choose to be truly in love with him or not. And those choices in big and small ways, they make the life that we have created and the world that we have created for ourselves.

So may we take that to heart today and understand once again, because the Bible is going to hammer this home over and over in all kinds of ways from all kinds of angles, it matters what you do. This is an invitation to a collaboration with God in restoring all things. We’re part of that story. If we can’t even do it in our own hearts, if it can’t even spill into our own homes, well then we can’t blame God for what we are allowing because he is allowing what we’re allowing.

Prayer

Father, there is certainly a weightiness to that. There is some heft there. So as we sit with that today, we invite your Holy Spirit because it's not always about the big mistakes or the big victories. Those are maybe the things that we remember or focus on most, but all of those things, they came together because of a series of choices, many different nuanced choices that we’ve made. Where we sit right now, wherever it is that we’re listening to this, whether it's in a car or on a train or in a bed or in a shower or wherever, we are standing or sitting where we are right now because of the systematic choices that we have made over the course of years. So here we are and you’ve allowed it because you will allow what we will allow. So Father, we need some help. We need your Holy Spirit's wisdom. We need to see the way that we habitually make choices that end us up in the same kinds of places. We need to see how we’ve been trying to manage this on our own as our own sovereign and not even talking to you about the small things, but the small things add up to big things, so we need your counsel. We need your Holy Spirit to well up within us in everything that we do and say and think because they all go somewhere and we are here to be about the business of bringing and being your Kingdom. We’re just completely distracted from that on most days. Give us the eyes and the ears of the Kingdom. Let us lift our heads from the ground up to the horizon and see that it is bigger than us. It is bigger than we know and you have invited us to play a role. So come Holy Spirit, let us feel the weightiness of that and live our lives nobly, honoring the fact that our choices matter and we choose you. Come Jesus, we pray in your name, amen.

Announcements

Www.DailyAudioBible.com is home base. It's the website. It is where you find out what is going on around here, so check it out. Check out the resources that are available there and events and prayers and connection points. Everything that you would be looking for you can find there. So check it out.

If you want to partner with the Daily Audio Bible, you can do that at www.DailyAudioBible.com as well. There is a link. It's on the home page. And if you’re using the Daily Audio Bible App, you can push the More button in the lower right-hand corner, or if you prefer the mail, the mailing address is P.O. Box 1996, Spring Hill, TN 37174.

And, as always, if you have a prayer request or comment, (877) 942-4253 is the number to dial.

And that's it for today. I'm Brian. I love you and I’ll be waiting for you here tomorrow.

Community Prayer Requests and Praise Reports

Hi, this is Lisa, the Encourager just calling tonight to pray for Bill B. He called in. He was on his way to the Veteran's Hospital and I think it is also appropriate for me to thank him so much for his service and everything he's done for us in serving in the military and pray for the others that are still serving today, so I’ll do that tonight. Dear Lord, I pray for Bill as he was on his way to the hospital because he is having some breathing problems. Lord Jesus, I just pray that you will help the doctors at the Veteran's Hospital to use wisdom and practice whatever they need to do to help Bill to be better soon and to find a solution to why he is having breathing problems quickly and be able to resolve the issue and there would be minor difficulties, there won't be anything major wrong and that you just send your guidance and your angels to watch over him and comfort his family and help him to have a speedy recovery from whatever it is that is ailing him at this time, Lord. And I want to thank you so much for his service for our country as a veteran and everything that he did while he served so that all of us could be right here on the land free and able to exercise our freedom because of what our veterans did for us, Lord. I also pray for all the veterans that are out there serving today, right now as we are in the comfort of our homes, in the comfort of our lives and our jobs and all the food and all the luxuries of life that we have here as they are out there serving our country. And I just pray for each and every one of them. I pray for the ones that don’t have a relationship with you.

Good morning DAB family. I'm Carol from the UK. Thank you so much, Brian, for sharing your very moving account of your mom's last few days. I'm sure that many people like myself were in tears. In 1939 I was evacuated into a loving Christian family and their neighbors also were Christians who had a daughter younger than myself. We formed a lifelong friendship which is still there today, over 76 years later. She met a local boy who I actually went to school with and because I was an evacuee who was bullied as if I was an alien or an immigrant, he was the only person who stuck up for me and supported me. A few years ago my friend informed me that her husband was suffering from Parkinson's and the onset of dementia. He, like your mom, Brian, couldn’t eat or swallow anything. My friend told me he was suffering so much she just wanted God to take him. I told her that God was preparing his room for him when he was ready and a few days later she told me that his room was ready for him early that morning. She told me that although she was somewhat relieved, she still missed him terribly. My husband of 59 years is almost 87, reasonably good health, has been a wonderful husband and father and we’re still very much in love with each other. Although he is a believer as such, he has not yet accepted Jesus as his Savior, so please pray for him to take Jesus as his Lord and Savior before it is too late. Thank you so much and God bless you all.

Good morning family and friends. This is Cherry C., Cherry Pie. I want to send this to Salvation is Mine. Hey girl, letting you know I’ve got your back. You're covered. I do understand where you are. Just knowing that you’re covered, relax. Just relax and let God just totally take over and you’re going to be fine. You know you’ve got a lot of people praying for you, thousands of people praying for you. We’re right here by your side, so just relax. Try to relax anyway. I love you and I am going to continue to pray for you. You guys, I want to do a roll call, Tasha from New York, (there are a lot of people missing that have not called in), Sinner Redeemed, where are you? Blessed Like Me, I miss your calls. There are so many that I can’t even get all the names out, but come on guys. You all call in. I'm constantly and I'm sure everybody else is thinking about you guys. Call in and let us know how you’re doing and where you are in life. You guys have a great, blessed, and marvelous day. I am. I love you guys. I will talk with you guys soon.

Hi, this is Loralee from Boynton Beach and I would like to pray for the Hardin family right now. I was waiting for the Holy Spirit to give me God's word because I didn’t have any words. Heavenly Father, I would like to thank you for Mrs. Hardin and I know she is having a really good day right now. I would like to lift up the comforting words of your son, Jesus, and sow it into the Daily Audio Bible family right now. The scripture is John 19:26-27. When Jesus saw his mother and the disciple whom he loved standing nearby, he said to his mother, “Woman, behold your son.” Then he said to the disciple, “Behold your mother” and from that hour the disciple took her to his own home. Mrs. Hardin, you are home __________ greatly honored to greet you in heaven and I thank you and I pray that we all, as mothers of sons, will leave a legacy in our own son's lives, that they obey what they were made to do and to sow into lives of many life-giving words every day, giving glory to God. In Jesus’ name, amen.

Good morning, this is Under His Wing, a first-time caller. I would like to beg prayers for a dear and longtime friend especially of my husband. His name is Peter and late last summer he was diagnosed with brain cancer. He was doing well until Christmastime and now isn’t. Hospice has been called in. Many thanks and blessings to all of you, including Brian Hardin and family. Thank you.

Hi Brian, this Paula from __________, OH and I just finished listening to your tribute to your mother. I hope I can get through this message. I'm just speechless. It was the most beautiful message and I think it can educate a lot of people on dementia and I hope that I can share this. But I am late for work now because my makeup is streaming down my face, but thank you so much for opening your heart to us. We love you. You’ll never know the changes that you have done for so many people including myself. I just want to thank you and bless you. It is such a tribute to know you and to have you share the love that you had for your mother and your father. My mother will be 91 in March and she is still living and I’ll give her a big hug from you. God bless you and your family and Jill and Zekey and all your children. We love you so much, Brian. Thank you for walking in Christ daily. Bye-bye.

1 note

·

View note

Text

Bitcoin Tale of Two MASSIVE Patterns! March 2020 Price Prediction & News Analysis

VIDEO TRANSCRIPT