#microfinance online business

Text

Section 8 Microfinance Company Registration - Fees, Process, Documents

Section 8 Microfinance Company or Micro-finance Institution (MFI) is a financial organisation that provides credit to people and organisations who are denied access to traditional financial institutions due to poverty, occupation, ethnicity, religion, or nationality.

A Microfinance Company is registered with the Registrar of Companies as per Section 8 of the Indian Companies Act, 2013. Thus, it comes under the Ministry of Corporate Affairs (MCA).

Microfinance companies are the most convenient business to register that can provide unsecured loans without RBI approval at rates upto 26% p.a.

Benefits of Section 8 Microfinance Company:

No RBI Approval required

Can lend Unsecured loan

No Demographic Barrier

Best Rate of Interest

Minimum capital not required

Defaulters can be sued for non-payment

Limited Compliances

Documents required for Section 8 Microfinance Company:

PAN & Aadhar Card of both the directors

Bank Statement with the address of both the directors (not older than 2 months)

Passport Size Photo

Email address & Phone number

Utility Bill of the premises

To know more (click here)

#business#startup#india#business growth#manage business#partnership firm registration#nidhi company registration#private limited company registration in bangalore#private limited company registration in chennai#private limited company registration online#section 8 microfinance company registratioin#microfinance#section 8 registration

0 notes

Text

Apply Online for Quick Loan with Instant Approval

We often run out of finance and need quick funding to fulfill our dreams and aims. The obvious solution for the same is to choose for the loan. But in the fear of rejections or due to less knowledge we often end up taking financial aid from informal sources at higher interest rates. This puts our life in debt and creates financial stress. To avoid all these things the easier solution is to opt for the loan that can help you to overcome your financially harder time.

There are many financial aid companies that are making the tough task of taking loans easy by helping the borrowers in documentations and processing of the loan. With the introduction of technology many financial aid companies have inculcated and have shifted successfully to the technology to ease the process of loans. Now you can apply online for loan online and avail of the loan without much trouble. The article below is an attempt to make the readers understand about the loan providers companies. Further it will explain to you the benefits of choosing the loan providers. At the end, the article will conclude by giving you the list of top loan providers in Delhi.

What are loan Providers companies? What are the benefits of choosing Loan Providers?

Loan providers are companies or financial institutions that offer loans to individuals, businesses, or other entities in need of financial assistance. You can apply for quick loan and fulfill your dreams. These loans can be used for various purposes, such as personal expenses, buying a house or a car, funding a business venture, or consolidating debts.

Some common types of loan providers include:

Banks

Credit Unions

Online Lenders

Peer-to-Peer Lending Platforms

Microfinance Institutions

Payday Lenders

Credit Card Companies

Finance Companies

Choosing loan providers can offer several benefits, depending on your financial needs and circumstances. Here are some of the advantages of opting for loan providers:

Access to Funds: Loan providers offer you access to the funds you need when you are facing financial constraints or have specific financial goals, such as purchasing a home or funding a business.

Flexible Repayment Options: Many loan providers offer various repayment plans, allowing you to choose a schedule that aligns with your income and financial capabilities. This flexibility can make it easier to manage your debt.

Quick Processing and Approval: These companies offer easy loan applications to the borrowers. With the advent of online lending platforms, the loan application and approval process have become quicker and more streamlined. In many cases, you can receive loan approval within a short period, providing you with swift access to funds.

Build Credit History: Responsible borrowing and timely repayments can help you build a positive credit history. A good credit score can open doors to better loan options and lower interest rates in the future.

Consolidating Debt: Loan providers may offer debt consolidation loans, allowing you to combine multiple debts into a single loan with a potentially lower interest rate. This can simplify your finances and reduce overall interest costs.

Competitive Interest Rates: By shopping around and comparing different loan providers, you can find competitive interest rates that suit your budget and save you money over time.

Specialized Loan Products: Some loan providers offer specialized loan products tailored to specific needs, such as home loans, auto loans, student loans, or small business loans.

Online Accessibility: Many loan providers now offer online applications, making it convenient to apply for a loan from the comfort of your home and access customer support through digital channels.

Avoiding Depletion of Savings: Taking out a loan for planned expenses can help you preserve your savings for emergencies or unexpected financial situations.

Top Loan Providers in Delhi

Here is the list of top finance companies in Delhi with their locations. These loan companies in Delhi shall help you to get instant loan the assistance you need in financial aid matters.

My Mudra: It is a largest growing fintech having headquartered in Delhi. The company is providing financial services since decades.

Credset: It is a loan provider agency based in Karol Bagh Delhi.

Finance loan in India online

Trust: They are providing different types of loans and have been based out in Netaji Subhash Palace, Pitampura, Delhi.

KG Loan Expert Pvt. Ltd: It is a loan provider agency based in Netaji Subhash Palace in Delhi.

GRD India Financial Service: This is a financial aid provider company based out in Ashok Nagar Delhi.

Conclusion

It's essential to carefully consider the terms and conditions, interest rates, and repayment terms offered by different loan providers before committing to a loan. Borrowers should also ensure that they can comfortably meet their repayment obligations to avoid financial difficulties. My Mudra is one of the top fintech organizations which has been making loans and helping people since decades.

#Apply Online for Loans#apply for quick loan#loan instant approval#get instant loan#loan in India online#top fintech organizations

2 notes

·

View notes

Text

LAW FAQs

Is it wise to buy just the license of an existing microfinance bank that is closing down?

Acquiring an existing Microfinance Bank (MFB) license can be a viable strategic move, but it comes with significant risks and considerations.

Indeed, acquiring an existing MFB license can be appealing due to factors like:

Ease of entry into the financial sector.

Bypassing the lengthy registration process for new MFBs is a tempting advantage.

Existing infrastructure and customer base

Acquiring established infrastructure and a ready customer base can save time and resources.

It's essential to act cautiously while carefully considering the significant risks and potential challenges.

Understanding the reasons for closure

Thoroughly investigate why the previous owner is shutting down.

Are there underlying financial or regulatory issues?

Uncovering compliance and regulatory issues

Scrutinize the MFB's history for non-compliance penalties, sanctions, or outstanding obligations to regulatory bodies.

Assessing existing financial liabilities

Identify any debts, unpaid obligations, or potential legal liabilities that could be inherited.

Evaluating operational challenges

Significant compliance and financial liabilities can indicate a poor loan portfolio, lack of quality assets, and even reputational damage within the business community. This can also raise concerns with regulatory authorities responsible for approving the acquisition.

Due diligence

Conduct thorough due diligence to assess the extent of these risks.

In some cases, reviving a struggling MFB might be possible if the underlying problems are not compliance-related.

Negotiate warranties and indemnities from the seller to mitigate potential liabilities.

Seek guidance from regulatory bodies like the Central Bank of Nigeria (CBN) and compliance professionals before making a decision.

Starting fresh: The safer alternative:

Overall, starting a new MFB is often advisable. This approach allows you to:

Build the bank from the ground up to ensure compliance with all regulations.

Avoid inheriting potential hidden issues that could lead to significant financial and reputational damage.

The CBN's launch of an online portal last September for MFB registration has streamlined the previously manual procedure, and made starting a new MFB even more accessible.

#faq hashtag#law hashtag#mfb hashtag#microfinancebank hashtag#nigerianlaw hashtag#aaLawsng hashtag#avielavenantelawpratice hashtag#entrepreneurs

0 notes

Text

Why the Importance of FinTech Solutions is Growing

In recent years, the financial technology (FinTech) sector has evolved from a niche market to a cornerstone of the global economy. With advancements in technology and shifting consumer expectations, FinTech solutions are becoming increasingly crucial. Here’s why their importance is surging:

1. Enhanced Financial Inclusion

One of the most significant impacts of FinTech is its ability to promote financial inclusion. Traditional banking systems often exclude large segments of the population, especially in developing regions. FinTech solutions like mobile banking apps, digital wallets, and microfinance platforms offer financial services to those who previously had limited or no access. This inclusion helps bridge the gap between the underserved and the global economy, fostering economic growth and stability.

2. Convenience and Accessibility

The modern consumer values convenience, and FinTech solutions deliver on this front by providing 24/7 access to financial services. Mobile apps enable users to conduct transactions, monitor their accounts, and access investment opportunities from anywhere at any time. This ease of access is transforming how people manage their finances, moving away from traditional banking hours and physical branch visits.

3. Cost Efficiency

FinTech innovations often come with lower costs compared to traditional financial services. Banks and financial institutions have overhead costs associated with physical branches, staff, and infrastructure. In contrast, many FinTech solutions operate primarily online, reducing operational costs and passing these savings on to consumers through lower fees and better rates.

4. Enhanced Security

With rising concerns over financial security, FinTech companies are leveraging cutting-edge technology to protect users’ data and transactions. Advanced encryption, biometric authentication, and blockchain technology are some of the tools being used to ensure secure transactions and safeguard against fraud. As cyber threats evolve, FinTech solutions continually adapt to provide robust security measures.

5. Personalization and Innovation

FinTech solutions are designed to offer personalized experiences tailored to individual needs. Advanced algorithms and data analytics enable these platforms to provide customized financial advice, investment opportunities, and budgeting tools. This level of personalization helps users make more informed financial decisions and manage their finances more effectively.

6. Speed and Efficiency

Traditional financial processes can be slow and cumbersome. FinTech solutions streamline these processes, making transactions faster and more efficient. For example, blockchain technology can facilitate near-instantaneous cross-border payments, eliminating the delays associated with traditional banking systems. This speed and efficiency benefit both consumers and businesses by reducing transaction times and improving cash flow.

7. Innovation in Financial Products and Services

FinTech is a hotbed of innovation, continually introducing new financial products and services that cater to evolving consumer needs. From peer-to-peer lending platforms to robo-advisors and cryptocurrency exchanges, the FinTech sector is driving the creation of new financial instruments and methods. This innovation encourages healthy competition, leading to better options and services for consumers.

8. Data-Driven Insights

The ability to harness and analyze vast amounts of data is a game-changer for the financial industry. FinTech companies use data analytics to gain insights into customer behavior, market trends, and risk management. These insights allow for more accurate financial forecasting, personalized recommendations, and improved decision-making.

9. Regulatory Evolution

As the FinTech industry grows, regulatory frameworks are evolving to keep pace. Governments and financial authorities are working to create regulations that balance innovation with consumer protection. This regulatory evolution helps build trust in FinTech solutions and ensures that they operate within a framework that protects users and maintains financial stability.

10. Global Reach

FinTech solutions are breaking down geographical barriers, enabling global transactions and investments. Businesses can expand their reach beyond local markets, and individuals can access international financial services with ease. This global connectivity is reshaping the financial landscape and creating new opportunities for economic growth and collaboration.

Conclusion

The growing importance of FinTech solutions reflects their transformative impact on the financial industry. From enhancing financial inclusion and accessibility to driving innovation and improving security, FinTech is reshaping how we interact with and manage our finances. As technology continues to advance and consumer expectations evolve, the role of FinTech will undoubtedly become even more pivotal in the global economy.

Need to develop a FinTech solution? Don't worry Techtsy can help you. It is one of the largest software development company in Malaysia and it has an specialty

0 notes

Text

How Fintech is Breaking Barriers: Astonishing Solutions for Financial Inclusion

Financial inclusion, the ability of individuals and businesses to access useful and affordable financial products and services, is a crucial aspect of economic development. However, millions of people around the world remain unbanked or underbanked, facing barriers to accessing traditional financial services. Enter fintech – the innovative force transforming the financial landscape and bridging the gap in financial inclusion.

The Need for Financial Inclusion

Financial inclusion is vital for empowering individuals, fostering economic growth, and reducing poverty. Without access to financial services, people struggle to save securely, borrow affordably, and manage risks. This exclusion perpetuates a cycle of poverty and limits opportunities for economic advancement.

How Fintech is Making a Difference

Fintech, a fusion of finance and technology, is revolutionizing the way financial services are delivered. By leveraging technology, fintech companies are creating innovative solutions that address the challenges of traditional banking and extend financial services to underserved populations.

1. Digital Payments

Digital payment platforms have become game-changers in the quest for financial inclusion. Mobile money services, such as M-Pesa in Kenya, enable users to perform financial transactions using their mobile phones. These services eliminate the need for a bank account, making it easier for people in remote areas to send, receive, and store money securely.

2. Microfinance and Peer-to-Peer Lending

Fintech companies are disrupting traditional lending models by offering microfinance and peer-to-peer lending solutions. These platforms connect borrowers directly with lenders, often bypassing the need for a credit history or collateral. By leveraging technology, fintech lenders can assess creditworthiness using alternative data, such as social media activity or mobile phone usage, thus providing loans to those previously deemed unbankable.

3. Digital Banking

Neobanks, or digital-only banks, are challenging the status quo of traditional banking. With no physical branches, these banks operate entirely online, reducing operational costs and passing the savings on to customers through lower fees and better interest rates. Neobanks offer a wide range of services, from savings accounts to loans, making banking accessible to anyone with a smartphone.

4. Financial Education and Literacy

Fintech is also playing a pivotal role in enhancing financial literacy. Educational apps and platforms provide users with the knowledge and tools to manage their finances effectively. By empowering individuals with financial education, fintech solutions are helping people make informed decisions, avoid debt traps, and build a secure financial future.

5. Blockchain and Cryptocurrencies

Blockchain technology and cryptocurrencies hold immense potential for financial inclusion. Blockchain’s decentralized nature ensures secure and transparent transactions, reducing the reliance on intermediaries. Cryptocurrencies can offer an alternative to traditional banking, especially in regions with unstable financial systems. By enabling cross-border transactions with minimal fees, blockchain and cryptocurrencies are opening new avenues for financial inclusion.

The Road Ahead

While fintech is making significant strides in promoting financial inclusion, challenges remain. Ensuring data privacy and security, addressing regulatory hurdles, and bridging the digital divide are crucial for the sustained growth of fintech solutions. Collaboration between governments, regulators, and fintech companies is essential to creating an enabling environment for innovation and inclusivity.

In conclusion, fintech is not just a buzzword; it’s a powerful tool driving financial inclusion and economic empowerment. By breaking down barriers and offering innovative solutions, fintech is transforming lives and building a more inclusive financial ecosystem. The journey is ongoing, but the impact is undeniable – fintech is truly bridging the gap in financial inclusion.

0 notes

Text

The Rise of Fintech Companies in MENA: Transforming Financial Landscapes

Introduction

The Middle East and North Africa (MENA) region is undergoing a significant transformation driven by the rapid rise of fintech companies. These innovative enterprises are leveraging technology to revolutionize financial services, enhance accessibility, and promote financial inclusion across the region. In this blog, we explore the factors driving the fintech boom in MENA, key players, and the impact on the financial landscape.

The Driving Forces Behind Fintech Growth

1. Young, Tech-Savvy Population MENA boasts a predominantly young population that is highly tech-savvy. With increasing smartphone penetration and internet access, this demographic is eager to adopt digital financial services, creating a fertile ground for fintech innovation.

2. Government Support and Regulatory Reforms Governments in the MENA region are actively fostering fintech growth by implementing supportive policies and regulatory frameworks. Initiatives like regulatory sandboxes, fintech hubs, and favorable licensing conditions are encouraging startups and investors to enter the market.

3. High Unbanked Population A significant portion of the MENA population remains unbanked or underbanked. Fintech companies are addressing this gap by offering accessible and affordable financial solutions, from mobile wallets to digital lending platforms, thus promoting financial inclusion.

4. Investment and Collaboration The region has seen a surge in investment in fintech startups, with venture capitalists and financial institutions recognizing the potential for substantial returns. Collaborations between traditional banks and fintech firms are also driving innovation and expanding the reach of digital financial services.

Key Players in the MENA Fintech Ecosystem

1. PayTabs PayTabs, a Bahrain-based payment solutions provider, is a prominent player in the MENA fintech landscape. The company offers secure and seamless online payment processing, catering to businesses of all sizes across the region.

2. Fawry Egypt's Fawry is a leading electronic payment network, providing a wide range of financial services, including bill payments, mobile banking, and e-commerce solutions. Fawry's extensive network of retail locations makes it a critical player in promoting digital financial services.

3. Souqalmal Based in the UAE, Souqalmal is a financial comparison platform that empowers consumers to make informed financial decisions. The platform offers comparisons of banking, insurance, and investment products, enhancing transparency and competition in the financial sector.

4. Sarwa Sarwa, a robo-advisory platform from the UAE, is democratizing investment by offering affordable and accessible wealth management services. The platform leverages technology to provide personalized investment portfolios tailored to individual risk profiles and financial goals.

Impact on the Financial Landscape

1. Enhanced Financial Inclusion Fintech companies in MENA are playing a crucial role in bridging the financial inclusion gap. By offering digital banking, payment solutions, and microfinance services, they are empowering previously underserved populations to participate in the formal economy.

2. Increased Efficiency and Innovation The integration of technology in financial services is streamlining operations, reducing costs, and enhancing efficiency. Fintech firms are driving innovation in areas such as blockchain, artificial intelligence, and machine learning, setting new standards for the industry.

3. Competition and Consumer Empowerment The rise of fintech is fostering healthy competition in the financial sector. Traditional banks are compelled to innovate and improve their services to keep pace with agile fintech startups. Consumers, in turn, benefit from a broader range of choices and improved service quality.

4. Economic Growth and Job Creation The fintech boom is contributing to economic growth by attracting investment, fostering entrepreneurship, and creating jobs. As the fintech ecosystem expands, it generates opportunities for skilled professionals in technology, finance, and related fields.

Conclusion

The fintech revolution in the MENA region is transforming the financial landscape, driving financial inclusion, and fostering economic growth. With continued support from governments, investors, and consumers, the region's fintech ecosystem is poised for even greater expansion and innovation. As fintech companies continue to disrupt traditional financial services, they are paving the way for a more inclusive, efficient, and dynamic financial future in MENA.

0 notes

Text

Unlocking Business Loans in Kolkata: A Guide for Startups

New businesses and startups often face significant hurdles in securing funding due to their lack of credit history and proven profitability. Here are several strategies to improve your chances:

Build a Strong Business Plan: Clearly outline your business model, market analysis, and financial projections. This demonstrates to lenders that you have a well-thought-out strategy for success.

Seek Alternative Lenders: Besides traditional banks, explore alternative lending options such as microfinance institutions, credit unions, and online lenders that may have more flexible criteria.

Consider Crowdfunding: Platforms like Kickstarter or GoFundMe can provide initial funding and validate your business idea through community support.

Leverage Government Programs: Look for government-backed schemes that offer support and funding to startups, which often come with lower interest rates and favorable terms.

Offer Collateral: If possible, offering collateral can make it easier to secure a loan, as it reduces the risk for the lender.

By exploring these avenues, startups in Kolkata can enhance their access to necessary funding. Remember, finding the right business loan in Kolkata may require looking beyond traditional banks and presenting a solid case for your business’s potential.

#Business loan in Kolkata#loan inkolkata#finacialfreedom#financial service#loans#business loan#like#share

0 notes

Text

Small Business Funding: Opportunities Beyond Loans

Small business funding encompasses a variety of opportunities beyond traditional loans. Understanding and leveraging these options can significantly enhance your business's financial stability and growth potential. While loans are a common go-to for many entrepreneurs, diversifying your funding sources can provide a more robust financial foundation and open doors to unique opportunities.

Grants and Subsidies

Grants for Small Businesses and subsidies are excellent funding sources for small businesses, often provided by government agencies, non-profit organizations, and private foundations. Unlike loans, grants do not need to be repaid, making them an attractive option. However, obtaining a grant is highly competitive and requires a compelling application. Grants typically focus on specific industries, projects, or demographics, so it's crucial to research and identify those that align with your business goals. The application process involves detailing your business plan, the project's scope, and the expected outcomes, showcasing how your business meets the grant's criteria and how the funds will be utilized effectively.

Equity Financing

Equity financing involves raising capital by selling shares of your business to investors. This method does not require repayment, but it does mean giving up a portion of ownership and potentially some control over business decisions. Equity financing can come from various sources, including venture capitalists, angel investors, and crowdfunding platforms. Venture capitalists typically invest in high-growth potential businesses and offer substantial funds in exchange for equity. Angel investors are often individuals who provide smaller amounts of capital at earlier stages, while crowdfunding allows you to raise small amounts of money from a large number of people, usually through online platforms. Equity financing is particularly beneficial for startups and businesses with high growth potential, as it provides significant funding without the burden of debt repayment.

Microfinance and Peer-to-Peer Lending

Microfinance institutions provide small loans to entrepreneurs who may not qualify for traditional bank loans. These loans are often used to start or expand small businesses and can be a vital resource for entrepreneurs in developing economies or those with limited credit history. Microfinance institutions often offer additional support, such as business training and mentoring, to help ensure the success of their borrowers. Peer-to-peer (P2P) lending is another alternative where individuals can borrow money directly from other individuals through online platforms. P2P lending platforms connect borrowers with investors willing to fund their loans, often at competitive interest rates. Both microfinance and P2P lending offer accessible and flexible funding options, especially for small businesses that may struggle to secure traditional financing.

Business Incubators and Accelerators

Business incubators and accelerators provide funding, mentorship, and resources to startups and small businesses, typically in exchange for equity. Incubators offer support in the early stages, providing workspace, administrative services, and networking opportunities to help businesses grow. Accelerators, on the other hand, focus on scaling businesses rapidly, often through intensive, time-bound programs that include seed funding, mentorship, and opportunities to pitch to investors. These programs can be highly competitive, but they offer invaluable resources and support that can significantly boost a business's chances of success.

Angel Investors

Angel investors are individuals who invest their own money in small businesses and startups, usually in exchange for equity or convertible debt. They often provide not only capital but also valuable business advice and mentorship. Angel investors are typically more willing to take risks on early-stage businesses than traditional lenders, making them an excellent funding source for innovative startups. To attract angel investors, it's crucial to have a solid business plan, a clear value proposition, and a compelling pitch that outlines the potential for significant returns on investment.

Crowdfunding

Crowdfunding allows entrepreneurs to raise small amounts of money from a large number of people, typically through online platforms. There are different types of crowdfunding, including reward-based, equity-based, and donation-based crowdfunding. Reward-based crowdfunding involves offering backers a product or service in return for their investment, while equity-based crowdfunding involves selling shares of your business. Donation-based crowdfunding is often used for charitable or social causes and does not involve any financial return for backers. Crowdfunding is a powerful tool for validating your business idea, building a customer base, and generating publicity. To run a successful crowdfunding campaign, you need a compelling story, a clear value proposition, and a robust marketing strategy to reach and engage potential backers.

Venture Capital

Venture capital (VC) is a type of private equity financing provided by firms or funds to startups and small businesses with high growth potential. VCs typically invest in exchange for equity and often play an active role in the business, providing strategic advice and support. Securing venture capital can be challenging, as VCs look for businesses with the potential for substantial returns. A strong business plan, a proven track record, and a scalable business model are essential to attract venture capital investment. While VC funding can provide significant financial resources, it also involves giving up a portion of ownership and potentially some control over business decisions.

Government Programs

Many governments offer programs to support small businesses, including grants, low-interest loans, tax incentives, and other resources. These programs are designed to stimulate economic growth, innovation, and job creation. Researching and applying for government programs can provide valuable funding and support for your business. These programs often have specific eligibility criteria and application processes, so it's essential to thoroughly understand the requirements and demonstrate how your business meets the program's objectives.

Supplier and Trade Credit

Supplier and trade credit involve obtaining goods or services from suppliers on credit, allowing you to defer payment until a later date. This type of financing can help manage cash flow and reduce the need for immediate capital outlay. Establishing good relationships with suppliers and negotiating favorable payment terms can provide a valuable source of short-term funding. Supplier credit is particularly useful for businesses with seasonal fluctuations in cash flow or those looking to expand inventory without immediate upfront costs.

Revenue-Based Financing

Revenue-based financing (RBF) involves raising capital by agreeing to repay the investor with a percentage of your business's future revenue. This method aligns the investor's return with your business's performance, providing a flexible repayment structure that adjusts to your revenue fluctuations. RBF is particularly attractive for businesses with steady revenue streams but who may not qualify for traditional loans or prefer not to give up equity. The repayment terms are typically based on a percentage of monthly revenue until a specified amount is repaid, making it a versatile option for businesses with varying cash flow.

Strategic Partnerships and Joint Ventures

Forming strategic partnerships and joint ventures with other businesses can provide access to new markets, resources, and funding opportunities. These collaborations can involve sharing costs, profits, and risks while leveraging each partner's strengths and expertise. Strategic partnerships can take many forms, including marketing alliances, distribution agreements, and co-development projects. Joint ventures, on the other hand, involve creating a new business entity owned by the partnering companies. Both strategies can provide valuable funding and growth opportunities, especially when entering new markets or developing new products.

Conclusion

Exploring funding opportunities beyond traditional loans can significantly enhance your business's financial stability and growth potential. Grants and subsidies provide non-repayable funds for specific projects or demographics, requiring a compelling application to secure. Equity financing involves selling shares of your business to investors, offering substantial funds without the burden of debt repayment. Microfinance and peer-to-peer lending provide accessible and flexible funding options for entrepreneurs who may not qualify for traditional loans. Business incubators and accelerators offer funding, mentorship, and resources in exchange for equity, while angel investors provide capital and valuable advice for early-stage businesses. Crowdfunding allows entrepreneurs to raise small amounts of money from a large number of people, validating business ideas and generating publicity. Venture capital provides substantial financial resources for high-growth potential businesses in exchange for equity. Government programs offer grants, loans, and tax incentives to support small businesses, while supplier and trade credit provide short-term funding for managing cash flow. Revenue-based financing aligns investor returns with business performance, offering a flexible repayment structure. Strategic partnerships and joint ventures provide access to new markets, resources, and funding opportunities through collaborative efforts. By diversifying your funding sources and leveraging these opportunities, you can build a more robust financial foundation and drive the success and growth of your small business. Each funding option has its advantages and considerations, so it's essential to evaluate which aligns best with your business goals and needs.

0 notes

Text

Economic Perspectives: Voices from Today's Student Scholars

In today's rapidly evolving academic landscape, the field of economics is a vibrant arena where student scholars actively engage with complex issues, offering fresh insights and innovative solutions. As these budding economists navigate their educational journey, they often seek resources to enhance their understanding and performance. Tools like the business economics Homework Helper play a crucial role in this process, providing essential support to students striving to grasp intricate economic concepts.

One of the most striking features of contemporary economic education is the diversity of perspectives that students bring to the table. With backgrounds spanning various cultures, regions, and socio-economic contexts, today's student scholars enrich the discourse with unique viewpoints. They explore topics ranging from global trade dynamics and environmental economics to behavioral finance and digital currencies. This plurality of voices fosters a dynamic learning environment where traditional theories are continuously challenged and refined.

A key driver behind the success of these students is their ability to leverage modern educational resources. Online platforms, peer-reviewed journals, and interactive learning modules have become indispensable tools in their academic arsenal. Moreover, the advent of assignment help websites has revolutionized the way students approach their coursework. These platforms offer personalized assistance, enabling students to tackle difficult assignments with confidence and clarity. The integration of technology in education has not only democratized access to information but also fostered a culture of collaboration and shared learning.

In addition to utilizing digital resources, student scholars are increasingly engaging in collaborative research projects. These projects often address real-world economic issues, providing practical experience and honing critical thinking skills. For instance, students might analyze the economic impacts of climate change policies or evaluate the effectiveness of microfinance initiatives in developing economies. Such hands-on experiences are invaluable, equipping students with the skills necessary to navigate the complexities of the modern economy.

Another significant trend among student economists is their proactive involvement in academic conferences and symposiums. These events offer a platform for students to present their research findings, network with professionals, and gain exposure to cutting-edge developments in the field. Participation in such events not only enhances their academic profile but also fosters a sense of community and shared purpose among young economists.

While the academic journey of an economics student is undoubtedly rigorous, the support systems in place, including the business economics Homework Helper, ensure that students have the necessary tools to succeed. These resources empower students to delve deeper into their studies, overcome challenges, and emerge as competent and confident economists.

In conclusion, the voices of today's student scholars are shaping the future of economics in profound ways. Their diverse perspectives, coupled with the strategic use of modern educational resources, are driving innovative research and fostering a vibrant academic community. As these young economists continue to explore and address the pressing economic issues of our time, their contributions will undoubtedly leave a lasting impact on the field.

#economics#student#university#education#homework helper#do my economics homework#economics homework helper#business economics Homework Helper

0 notes

Text

Empowering Entrepreneurs: The Rise of Retail Business Owners in Accra

Accra, the vibrant capital city of Ghana, is experiencing a dynamic transformation fueled by the entrepreneurial spirit of its residents. Over the past decade, retail businesses have surged, reshaping the economic landscape and creating a thriving ecosystem for innovation and commerce. This rise of retail business owners in Accra is not just a testament to the city's economic potential but also a beacon of empowerment for aspiring entrepreneurs across the region.

The Economic Boom in Accra

Accra's economic boom can be attributed to several factors, including political stability, strategic urban planning, and an influx of investment. The city has become a hub for business activities, attracting both local and international investors. This economic environment has created fertile ground for retail businesses to flourish. From bustling markets to modern shopping malls, the retail sector in Accra is diverse and dynamic.

Empowerment through Entrepreneurship

One of the most significant aspects of Online Shopping Accra, Ghana retail boom is the empowerment of local entrepreneurs. Many individuals, particularly young people and women, are taking advantage of the opportunities available in the retail sector. With access to microfinance, business training, and a growing market, these entrepreneurs are breaking barriers and building successful enterprises.

Women, in particular, are making significant strides in the retail industry. Organizations such as the Ghana Women Entrepreneurs Association are providing support and resources to help women start and grow their businesses. This empowerment is not only boosting the economy but also promoting gender equality and social development.

The Role of Technology

Technology has played a crucial role in the rise of retail business owners in Accra. The proliferation of mobile phones and the internet has revolutionized the way businesses operate. E-commerce platforms, social media, and digital payment systems have opened up new avenues for retail businesses to reach customers and streamline operations.

Online marketplaces like Jumia and Tonaton have made it easier for entrepreneurs to sell their products beyond the local markets, tapping into a broader customer base. Additionally, social media platforms such as Instagram and Facebook have become powerful tools for marketing and customer engagement. Retailers can now showcase their products, interact with customers, and build brand loyalty through these digital channels.

Challenges and Opportunities

Despite the positive trends, retail business owners in Accra face several challenges. Access to capital remains a significant hurdle for many entrepreneurs. While microfinance institutions provide some relief, the high-interest rates can be prohibitive. Moreover, the competition is fierce, and staying relevant in a rapidly changing market requires constant innovation and adaptability.

However, these challenges also present opportunities for growth and development. The government and private sector are increasingly recognizing the importance of supporting small and medium-sized enterprises (SMEs). Initiatives such as the National Entrepreneurship and Innovation Program (NEIP) and various incubator programs are designed to provide financial support, mentorship, and training to budding entrepreneurs.

Community and Collaboration

The rise of retail business owners in Accra is also fostering a sense of community and collaboration. Entrepreneurs are forming networks and associations to share knowledge, resources, and support. Co-working spaces and business hubs are popping up across the city, providing affordable workspaces and fostering a culture of innovation and collaboration.

Events such as the Accra Business Expo and various trade fairs are creating platforms for retail businesses to showcase their products, connect with potential customers, and forge partnerships. These events not only boost sales but also enhance the visibility of local businesses, contributing to their growth and success.

The Future of Retail in Accra

Looking ahead, the future of retail in Accra appears bright. With a young and growing population, increasing urbanization, and a strong entrepreneurial spirit, the retail sector is poised for continued growth. As technology continues to evolve and more resources become available, retail business owners in Accra will have even more opportunities to innovate and expand.

The rise of Retail business owners Accra is a powerful example of how entrepreneurship can drive economic development and empower individuals. By embracing technology, fostering collaboration, and overcoming challenges, these entrepreneurs are not only transforming the retail landscape but also shaping the future of Accra.

0 notes

Text

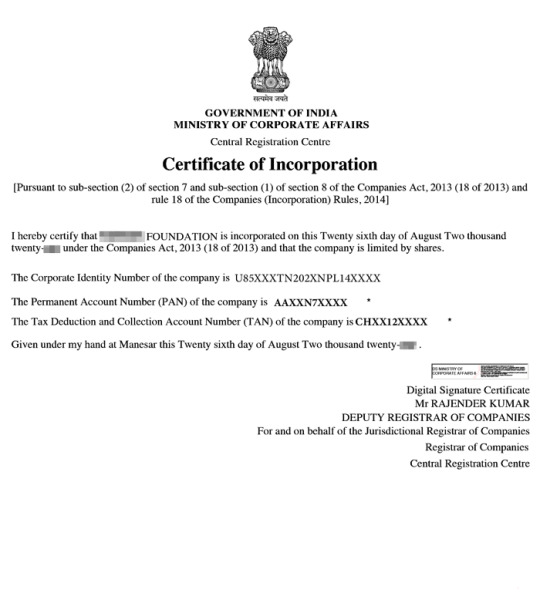

What is the process of Section 8 microfinance company registration?

The process of Section 8 microfinance company registration:-

Step 1: Obtain the Digital Signature Certificate (DSC).

To start a corporation, you must apply for the digital signature certificates of the proposed firm's directors. Section 8 corporations file all of their documentation online, and e-forms must be digitally signed. As a result, the designated directors must receive their DSCs from certification agencies.

Step 2: Apply for Name Approval.

The following step is to apply for name approval. The name must indicate that it is a Section 8 company. The company's industrial activity code and object clause must be defined when applying for its name.

Step 3: Submit the SPICe Form (INC-32).

After the name has been approved, the SPICe+ form must be filled out with registration information for the company. It is a simpler proforma for incorporating a business electronically. The details of the form are as follows.

Details of the company

Details of members and subscribers

Application for the Director Identification Number (DIN)

Application for PAN and TAN, including declarations by directors and subscribers.

Declaration and certification by professional

Step 4: File the MoA and AoA under "Finance" Objective

SPICe e-MoA and e-AoA are the related forms that must be completed when applying for company registration.

SPICe e-MoA and e-AoA are the related forms that must be completed when applying for company registration.

The company must draft the MoA and AoA and submit them along with the required documentation.

The Memorandum of Agreement is the foundation upon which the company is founded. It defines the company's constitution, powers, and objectives.

The AoA outlines all of the rules and regulations that govern the company's management.

Step 5: Issue of Incorporation Certificate

Following approval of the paperwork by the Ministry of Corporate Affairs, the competent department will issue the PAN, TAN, and Certificate of Incorporation.

0 notes

Text

Microfinance Market Forecast and Analysis Report (2023-2032)

Despite a projected decrease in size from USD 646.25 million in 2023 to USD 228.7 million by 2032, the microfinance market exhibits a positive growth trajectory with a CAGR of 10.41%.

The microfinance market is a crucial component of the global financial system, designed to provide financial services to individuals and small businesses who lack access to traditional banking. This market primarily serves low-income populations in developing regions, offering a range of financial products including small loans, savings accounts, insurance, and payment services. Microfinance institutions (MFIs) play a pivotal role in fostering financial inclusion, enabling underserved communities to invest in their businesses, improve their livelihoods, and achieve economic stability. The sector has gained significant attention for its potential to alleviate poverty, empower women, and drive social and economic development.

Microfinance operates on the principle of providing small amounts of capital with flexible terms and conditions, often without the need for collateral. This accessibility allows entrepreneurs and small business owners to pursue opportunities that would otherwise be unattainable. The market has evolved with the integration of digital technologies, enhancing the efficiency and reach of MFIs. Mobile banking, digital payments, and online platforms have revolutionized microfinance, making it easier for clients to access services and for institutions to manage risks and reduce operational costs.

Despite its benefits, the microfinance market faces several challenges. High interest rates, often necessary to cover the costs of lending to high-risk clients, can be a burden for borrowers. Additionally, there have been instances of over-indebtedness among clients, leading to financial distress. Regulatory frameworks vary significantly across countries, impacting the growth and stability of microfinance institutions. Nevertheless, the sector continues to adapt, with many MFIs focusing on financial literacy programs to educate clients about responsible borrowing and financial management.

Microfinance plays a vital role in supporting small businesses by providing access to financial services that are typically unavailable through traditional banking channels. Here are several ways microfinance helps small businesses:

Access to Capital

Microfinance institutions (MFIs) offer small loans, often referred to as microloans, to entrepreneurs and small business owners who lack the collateral or credit history required by conventional banks. These loans enable business owners to start, sustain, or expand their operations, invest in inventory, purchase equipment, and cover other essential expenses.

Flexibility in Loan Terms

Microfinance loans are designed to be more flexible than traditional bank loans. They often have smaller principal amounts, shorter repayment periods, and more lenient collateral requirements. This flexibility makes it easier for small business owners to manage their cash flow and repay the loans without overwhelming financial strain.

Financial Inclusion

Microfinance promotes financial inclusion by bringing unbanked and underbanked individuals into the formal financial system. By providing financial services to those who have been traditionally excluded, MFIs help entrepreneurs establish a financial history, which can lead to future opportunities for larger loans and better financial products.

Empowerment and Growth

Access to microfinance empowers small business owners, particularly women, by providing them with the financial means to achieve economic independence and improve their livelihoods. This empowerment often translates into broader social benefits, such as improved education and healthcare for the business owners' families and communities.

Training and Support

Many MFIs offer training and support services alongside financial products. These services can include business development training, financial literacy programs, and mentorship. Such support helps entrepreneurs build the necessary skills to manage their businesses effectively, improve their financial practices, and make informed decisions.

Risk Mitigation

Microfinance can help small businesses manage risks by offering a range of financial products, including savings accounts, insurance, and emergency loans. These products provide a safety net that helps business owners cope with unexpected challenges, such as natural disasters, health emergencies, or economic downturns.

Community Development

Microfinance has a broader impact on community development. By supporting small businesses, MFIs contribute to job creation, economic diversification, and poverty reduction within communities. Thriving small businesses can stimulate local economies by increasing demand for goods and services, creating employment opportunities, and fostering a culture of entrepreneurship.

Encouraging Innovation

Access to microfinance enables small businesses to invest in innovative solutions and new business models. Entrepreneurs can experiment with different approaches to improve productivity, reach new markets, and enhance their competitiveness. This innovation can lead to more sustainable and resilient business practices.

The microfinance market is characterized by intense competition among a diverse range of players, including traditional microfinance institutions (MFIs), non-governmental organizations (NGOs), cooperatives, commercial banks, and fintech companies. Traditional MFIs, such as Grameen Bank and FINCA, have established strong reputations and extensive networks, providing them with a significant competitive edge in reaching underserved populations. However, the entry of commercial banks into the microfinance space has introduced new dynamics, as these banks leverage their extensive resources and infrastructure to offer microloans, often at competitive interest rates.

Fintech companies are also making substantial inroads by leveraging technology to streamline operations, reduce costs, and enhance customer experience. These tech-driven firms, such as Tala and Branch, use mobile platforms and data analytics to offer quick and convenient access to microfinance services, appealing particularly to younger and tech-savvy clients. The ability to harness big data for alternative credit scoring gives fintechs a competitive advantage in assessing and mitigating risks more effectively than traditional MFIs.

NGOs and cooperatives continue to play a crucial role, especially in rural and remote areas where other players may have limited reach. They often offer more personalized services and have a deep understanding of local communities, which fosters trust and long-term relationships with clients.

The competitive landscape is further shaped by regulatory frameworks and government policies aimed at promoting financial inclusion and consumer protection. Regulatory support can provide certain players with advantages, such as easier market entry or incentives for offering sustainable financial products.

Key Player:

Annapurna Finance Pvt Ltd

Bank Rakyat Indonesia (BRI)

Bandhan Bank

CDC Small Business Finance

Grameen America

Cashpor Micro Credit

Grameen Bank

Kiva

Madura Microfinance Ltd.

Pacific Community Ventures Inc.

More About Report- https://www.credenceresearch.com/report/microfinance-market

The microfinance market offers numerous opportunities driven by evolving economic landscapes, technological advancements, and increased emphasis on financial inclusion. Here are some of the key opportunities within the microfinance market:

Digital Transformation

The integration of digital technologies presents a significant opportunity for the microfinance market. Mobile banking, digital payments, and online platforms can enhance the efficiency of microfinance operations, reduce transaction costs, and expand reach to remote and underserved areas. Digital tools can also improve client onboarding, loan disbursement, and repayment processes, making microfinance services more accessible and user-friendly.

Expanding Financial Inclusion

There is a growing global emphasis on financial inclusion as a means to reduce poverty and promote economic development. Microfinance institutions can capitalize on this by expanding their services to underserved populations, including rural communities, women, and marginalized groups. Tailoring products to meet the specific needs of these segments can help in capturing a larger market share and driving social impact.

Innovative Financial Products

The development of innovative financial products tailored to the unique needs of microfinance clients represents a substantial opportunity. This includes micro-insurance, micro-savings, and tailored loan products for specific sectors such as agriculture, small-scale manufacturing, and artisanal trades. These products can help clients manage risks, save for the future, and invest in growth opportunities.

Partnerships and Collaborations

Collaborating with fintech companies, non-governmental organizations (NGOs), and government agencies can provide microfinance institutions with additional resources and expertise. Such partnerships can help in developing new financial products, implementing technology solutions, and expanding outreach efforts. Additionally, partnerships with large financial institutions can facilitate the flow of capital to microfinance initiatives.

Impact Investment

There is an increasing interest in impact investing, where investors seek both financial returns and social impact. Microfinance institutions can attract impact investors by demonstrating their contributions to poverty alleviation, economic empowerment, and social development. Access to impact investment funds can provide the necessary capital for MFIs to scale their operations and innovate their service offerings.

Regulatory Support

In many regions, governments are recognizing the role of microfinance in economic development and are creating supportive regulatory frameworks. This can include policies that promote financial inclusion, protect borrowers, and encourage responsible lending practices. Favorable regulatory environments can create opportunities for microfinance institutions to expand their services and reach more clients.

Data Analytics and Credit Scoring

The use of data analytics and alternative credit scoring models can enhance the ability of microfinance institutions to assess the creditworthiness of potential clients. By leveraging data from non-traditional sources, such as mobile phone usage and social media activity, MFIs can make more informed lending decisions, reduce default rates, and extend credit to those who may not have formal credit histories.

Green Microfinance

As environmental concerns become increasingly important, there is an opportunity for microfinance institutions to develop green microfinance products. These products can support sustainable practices among small businesses, such as funding for renewable energy projects, eco-friendly farming techniques, and energy-efficient technologies. Green microfinance can contribute to environmental sustainability while addressing the financial needs of clients.

Financial Education

Providing financial education and literacy programs alongside microfinance services can empower clients to make better financial decisions, manage their businesses effectively, and achieve greater economic stability. MFIs that invest in financial education can improve their clients' success rates and reduce the risk of loan defaults.

Segments:

Based on Provider Type

Banks

Micro Finance Institute (MFI)

NBFC (Non-Banking Financial Institutions)

Others

Based on Purpose

Agriculture

Manufacturing/Production

Trade & Services

Household

Browse the full report – https://www.credenceresearch.com/report/microfinance-market

Browse Our Blog: https://www.linkedin.com/pulse/microfinance-market-projections-global-industry-analysis-eogif

Contact Us:

Phone: +91 6232 49 3207

Email: [email protected]

Website: https://www.credenceresearch.com

0 notes

Text

A Simple Guide on Microfinance in Singapore

Starting a small business in Singapore is a positive step if you are looking to transform yourself and further develop your business. The success of small to medium enterprises is inspiring more and more people to take up microloans and start their businesses.

Before taking this route, you need to know some things. In this blog post, we take you through some of the most notable things about microfinance. Read on and find out more.

Microfinance is frequently connected with business loans. However, it incorporates much more. It is a device for overseeing cash earnings and, in any event, earning interest on savings. This extensive understanding can open opportunities for hopeful business visionaries and small business proprietors.

Other loan products are designed for housing, much like a traditional mortgage. Ensure you clearly know what will come your way before taking out a corporate loan in Singapore.

We can only conclude by mentioning that microfinance enables borrowers. In fact, borrowers can quickly address solutions while making it easy for individuals to depend on themselves.

If more is needed, it offers populations in the developing world a way of taking their enterprises a notch higher without stressing over having enough money. That is precisely what you need to avoid the stress that life brings now and again.

The above are some of the things you need to know about microfinance. Fortunately, endless institutions offer corporate loan Singapore. This doesn't mean you should rely on the first institution you come across. Doing this could cost you a lot of time.

It might be ideal to assume you were sure you were getting the ideal deals, and it can only happen to expect you to finish your work. I willingly volunteered to explore the reputation and interest rates offered by a prospective microloan lender in Singapore.

Check its online reviews and testimonials to understand better what others say about it. Only then do you stand a chance of getting the ideal corporate loan in Singapore?

0 notes

Text

Unlocking Growth: Your Guide to Securing a Business Loan in Kolkata

In Kolkata, accessing a business loan can be a pivotal step for entrepreneurs aiming to expand their ventures. Understanding the process and finding the right solution is crucial. As a financial service specialist and content writer, I offer an efficient approach to this challenge.

Firstly, entrepreneurs should assess their financial standing and business plan. Lenders often require a solid plan showcasing how the loan will be utilized and repaid. Clear financial projections and a strong credit history enhance the chances of approval.

Next, explore diverse financing options. Traditional banks offer stability but may have stringent requirements. Non-bank lenders, including online platforms and microfinance institutions, provide more flexible terms, albeit at higher interest rates. Government schemes and grants can also be valuable resources.

Networking and building relationships with local financial institutions are beneficial. Establishing rapport with bank managers or loan officers can streamline the application process and potentially lead to better terms.

Additionally, collateral can significantly influence loan approval and interest rates. Offering valuable assets as security mitigates risk for lenders, thereby increasing the likelihood of approval and securing favorable terms.

Embracing digital solutions simplifies the application process. Many lenders now offer online applications, reducing paperwork and expediting the approval process. Leveraging technology enhances efficiency and convenience.

Furthermore, seek professional guidance if needed. Financial advisors or consultants can offer valuable insights, helping entrepreneurs navigate complex financial landscapes and choose the most suitable financing option.

In conclusion, securing a business loan in Kolkata requires thorough preparation, strategic planning, and exploring diverse avenues. By understanding your financial needs, building relationships, leveraging collateral, embracing technology, and seeking expert advice, you can optimize your chances of success in obtaining the necessary funding to fuel business growth.

0 notes

Text

The Impact of Fintech SEO Agency on Financial Inclusion

Financial inclusion, the accessibility of financial services to all individuals and businesses, is a critical driver of economic development and social equality. Historically, many have been excluded from mainstream financial services due to geographic location, income level, or lack of documentation. However, with the rise of financial technology (fintech), particularly the role of a specialized agency like fintech SEO agency, there has been a notable shift towards greater financial inclusion.

Understanding Financial Inclusion

Financial inclusion encompasses providing essential financial services such as banking, loans, insurance, and investments to individuals and businesses, especially those traditionally underserved by conventional banks and financial institutions. The goal is to empower individuals economically and promote overall community financial stability.

The Role of Fintech

Fintech, an umbrella term for innovative technology-driven financial solutions, has been a game-changer in advancing financial inclusion. Unlike traditional banking methods that rely heavily on physical infrastructure, FinTech leverages digital platforms, mobile technology, and data analytics to reach a broader audience efficiently and cost-effectively.

Importance of SEO for Fintech Agencies

In this digital era, having a robust online presence is crucial for fintech companies aiming to promote financial inclusion. Search Engine Optimization (SEO) is pivotal in enhancing visibility and attracting relevant traffic to fintech platforms. Fintech SEO agency specialize in optimizing websites and content to rank higher on search engine results pages (SERPs), thereby increasing organic traffic and brand awareness.

Enhancing Accessibility

Fintech SEO agencies employ various strategies to enhance accessibility to financial services:

Targeted Keywords: By researching and strategically incorporating relevant keywords (e.g., "microfinance services," "digital banking for rural areas"), a fintech SEO agency helps fintech firms reach specific segments of the population seeking financial services.

Localized SEO: A Fintech agency optimizes websites for local searches, ensuring that individuals in underserved areas can easily find and access financial solutions tailored to their needs.

Content Marketing: Through informative and engaging content creation (such as blog posts, guides, and tutorials), fintech SEO agencies educate and inform potential customers about financial services and benefits.

Bridging the Digital Divide

One of the significant barriers to financial inclusion is the digital divide – the gap between those who have access to digital technologies and those who do not. A Fintech SEO agency actively contributes to bridging this gap by:

Mobile Optimization: Ensuring fintech websites are mobile-friendly, catering to individuals who primarily access the internet through smartphones.

Simplified User Experience: A Fintech SEO agency focuses on creating intuitive and user-friendly interfaces, making financial services more accessible to technologically diverse populations.

Regulatory Compliance and Trust

A Fintech SEO agency also assists Fintech firms in navigating regulatory frameworks. Compliance with financial regulations is crucial for establishing trust and credibility, particularly when serving underserved communities. A fintech SEO agency contributes to building a trustworthy fintech ecosystem by adhering to industry standards and best practices.

A Fintech SEO agency plays a vital role in promoting financial inclusion by leveraging digital marketing strategies to enhance the visibility and accessibility of financial services. Through targeted SEO practices, these agencies enable fintech firms to reach underserved populations efficiently and cost-effectively. As technology continues to evolve, the impact of a fintech SEO agency on financial inclusion is poised to grow, ultimately driving economic empowerment and fostering inclusive economic growth globally.

0 notes

Text

Empowering Communities: Exploring BClub CM

In the pursuit of social progress and economic development, community engagement plays a pivotal role. Recognizing the importance of fostering collaboration and empowerment at the grassroots level, the BClub CM initiative has emerged as a beacon of hope and opportunity for communities across the globe. Let's delve into the transformative power of BClub CM and its impact on local economies and societies.

A Catalyst for Change

bclub cm, short for Community Club, embodies the ethos of empowerment and inclusivity. At its core, BClub CM seeks to harness the collective strength and ingenuity of communities to address pressing challenges, seize opportunities for growth, and improve quality of life. Whether it's through economic development projects, social initiatives, or cultural exchanges, BClub CM serves as a catalyst for positive change at the grassroots level.

Building Bridges, Fostering Connections

Central to the BClub CM philosophy is the belief that meaningful change occurs through collaboration and partnership. By bringing together individuals, businesses, nonprofits, and government agencies, BClub CM creates a dynamic ecosystem where ideas are shared, resources are mobilized, and collective action is taken to address community needs. Through networking events, workshops, and online forums, BClub CM facilitates dialogue and fosters connections, laying the groundwork for impactful projects and initiatives to take shape.

Economic Empowerment and Entrepreneurship

One of the cornerstones of BClub CM is its focus on economic empowerment and entrepreneurship. By providing training, mentorship, and access to resources, BClub CM empowers individuals to start their own businesses, create jobs, and contribute to the local economy. Whether it's through microfinance programs, skills development workshops, or business incubators, BClub CM equips community members with the tools they need to succeed in the competitive marketplace.

Social Impact and Community Development

Beyond economic empowerment, bclub login also champions social impact and community development initiatives. From education and healthcare to environmental sustainability and gender equality, BClub CM supports a wide range of projects aimed at improving quality of life and fostering social cohesion within communities. Through partnerships with local NGOs, grassroots organizations, and government agencies, BClub CM addresses systemic issues and drives positive change from the ground up.

Joining the BClub CM Movement

Getting involved with BClub CM is simple. Whether you're an individual looking to make a difference in your community or a business seeking to support social initiatives, there are countless opportunities to get involved. Visit the BClub CM website, explore ongoing projects and initiatives, and reach out to local chapters or community leaders to learn how you can contribute your time, expertise, or resources to the cause.

Conclusion

In a world grappling with complex challenges and inequalities, BClub CM stands as a beacon of hope and solidarity. By empowering communities, fostering collaboration, and driving positive change at the grassroots level, BClub CM is paving the way for a brighter, more inclusive future for all. So, whether you're a changemaker, an entrepreneur, or simply someone who cares about making a difference, consider joining the BClub CM movement and be part of the journey towards a more equitable and sustainable world.

0 notes