#mobilepayment

Text

Simplifying Website Design and Development: Your Ultimate Guide

Simplifying Website Design and Development: Your Ultimate Guide

In today's digital age, having a strong online presence is essential for businesses of all sizes. A well-designed and developed website not only enhances your brand image but also serves as a powerful marketing tool to attract and engage customers. In this comprehensive guide, we'll explore everything you need to know about website design and development, including services, companies, and agencies in the USA and Canada.

Understanding Website Design and Development

Website design and development encompass the process of creating and building a website from scratch or redesigning an existing one. It involves various elements such as layout design, user interface (UI) and user experience (UX) design, coding, content creation, and optimization for search engines.

Website Design and Development Services

Professional website design and development services cater to the diverse needs of businesses seeking to establish or enhance their online presence. These services typically include:

Custom Website Design: Tailored design solutions to reflect your brand identity and meet specific business objectives.

Responsive Web Development: Building websites that adapt seamlessly to different devices and screen sizes for optimal user experience.

E-commerce Development: Creating online stores with secure payment gateways, product catalogs, and shopping cart functionality.

Content Management Systems (CMS): Integration of user-friendly CMS platforms like WordPress, Joomla, or Drupal for easy website management.

Search Engine Optimization (SEO): Implementing strategies to improve website visibility and rankings on search engine results pages (SERPs).

Website Maintenance and Support: Ongoing support, updates, and maintenance services to ensure website performance and security.

Website Design and Development Companies and Agencies

In the USA and Canada, numerous companies and agencies specialize in website design and development. These firms offer expertise in creating high-quality websites tailored to clients' unique needs and preferences. Some key characteristics to look for in a reputable website design and development company or agency include:

Experience and Expertise: Choose a company with a proven track record of delivering successful projects across various industries.

Portfolio: Review their portfolio of past work to gauge the quality and diversity of their designs and developments.

Client Reviews and Testimonials: Read reviews and testimonials from previous clients to assess their satisfaction and experiences.

Communication and Collaboration: Look for a company that emphasizes clear communication and collaboration throughout the project lifecycle.

Affordability and Value: Consider companies that offer competitive pricing without compromising on quality and value-added services.

Website Design and Development Companies in the USA and Canada

In the USA, reputable website design and development companies include:

ABC Web Solutions: A leading web development firm specializing in custom website design, e-commerce solutions, and digital marketing services.

XYZ Creative Agency: Known for innovative web design, responsive development, and SEO optimization strategies tailored to clients' specific needs.

123 Digital Studio: Providing comprehensive website design and development services, including UI/UX design, CMS integration, and ongoing support.

In Canada, notable website design and development companies include:

Maple Leaf Web Design: Offering professional website design, e-commerce development, and SEO services for businesses across Canada.

Great White North Digital: Specializing in responsive web design, custom development, and online marketing solutions to help Canadian businesses thrive online.

True North Web Solutions: A full-service web agency providing creative design, robust development, and strategic digital solutions tailored to clients' goals.

Conclusion

Investing in professional website design and development is crucial for businesses looking to establish a strong online presence and attract customers. By understanding the services offered and choosing reputable companies or agencies, you can create a visually appealing, functional, and user-friendly website that drives business growth and success.

Whether you're based in the USA or Canada, there are numerous options available to help you achieve your website design and development goals. Take the time to research, compare, and select the right partner to bring your vision to life and propel your business forward in the digital landscape.

#mobilepayment#ed teach#fintech startup#website#web development#web developing company#webcore#website development#smm services#seo services#webdesign#fintechindustry#investment#google ads#google adwords#google ad manager#google ad agency

13 notes

·

View notes

Photo

Let's talk about Andrew Kortina and how an accident inspired the creation of Venmo!

Tap on this👉 link to see this amazing story

2 notes

·

View notes

Text

As of a couple weeks now, the Finnish Mobilepay, the Danish Mobilepay, and the Norwegian Vipps have consolidated to one system. Ostensibly this means that I can use my Mobilepay anywhere in, send money to, and request money from these countries. However, it seems I can't. Their website claims I'm not allowed to send money to my Norwegian friend, even though he shows up on my app now. Their customer service is leaving me on read. Does anyone know what's going on with this? Why did they even merge if their systems didn't?

0 notes

Text

A dozen years ago, we just could go shopping to offline store and take payment by using cash. Now, smart mobile phones are everywhere. We can buy something and pay for them on mobile phone. It's much more convenient than before. With shopping and payment ways are increasingly diverse, pos terminal machine is also changing and developing.

What do you think that how will the mobile payment develop in the future?

Welcome to share your mind with us.

www.jtact.com

1 note

·

View note

Text

Here's to another successful day at the Money Trends 2023 Conference by INFiN! Visit us at Booth #404 to see our must-have #PaymentsSoftwareSolutions. To learn more, click here: https://tinyurl.com/2p8f2pst.

0 notes

Text

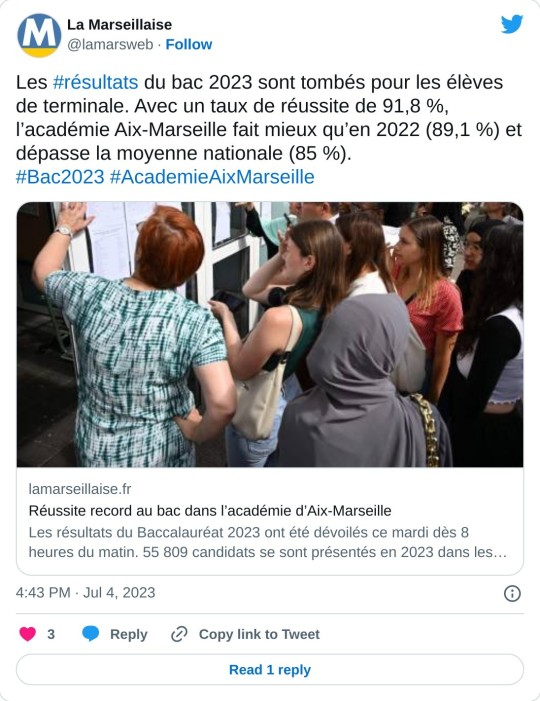

News from Marseille, France, 11 July.

A transformer fire in Marseille has left thousands of residents without electricity, resulting in closed businesses, limited access to essential services, and uncomfortable living conditions.

The lack of electricity has caused significant inconvenience and frustration for residents, who are unable to charge their phones, access information, or properly cool their homes.

Enedis is working to restore power, but the exact cause of the transformer fire is still unknown, leaving affected households uncertain about when they can expect a return to normalcy.

2. Aix-Marseille will soon implement open payment for public transportation, allowing passengers to pay with their phone or credit card, eliminating the need for cash or physical tickets.

The open payment system will be gradually rolled out across the entire metropolitan network, making it more convenient for residents and tourists to use public transportation.

The open payment system will be tested by a panel of users from July 17-30 on buses, trams, and metros in Marseille, as well as the Aix-Marseille and airport lines.

3. Several towns in France have decided to cancel their Bastille Day celebrations, including fireworks and firefighter balls, due to concerns over potential riots and urban violence.

Some municipalities are also canceling fireworks displays to minimize the risk of wildfires, while others are opting to replace fireworks with drone shows.

A decree has been issued banning the sale, possession, transportation, and use of fireworks and pyrotechnics nationwide until July 15th to prevent serious disturbances to public order during the festivities.

4. A man in his fifties died after a collision with a bus while riding an electric scooter in Marseille.

This is the second serious accident involving a scooter and a bus in two months in the city. The man lost control of the scooter and fell onto the road, where he was hit by the bus. Despite attempts to revive him, he was pronounced dead at the scene.

In 2022, there have been 34 scooter-related deaths in France, which is a significant increase compared to previous years. The rise in accidents is a concern for road safety authorities.

5. The results of the French National Diploma for academies in Aix-Marseille, Dijon, and Strasbourg have been released, with the exception of Guyane.

In 2022, 87.5% of candidates passed the exam, with 24.4% receiving the highest distinction of "très bien."

6. The results of the Baccalaureat 2023 dropped last week. With a success rate of 91.8%, the Aix-Marseille Academy is doing better than in 2022 (89.1 %) and exceeds the national average (85 %) .

#MarseillePowerOutage#TransformerFire#ElectricityRestoration#Enedis#CommunityImpact#LivingConditions#EssentialServices#Uncertainty#OpenPaymentMarseille#PublicTransportation#CashlessPayment#MobilePayment#CreditCardPayment#TransportationConvenience#AixMarseille#TransportationInnovation#BastilleDayCancellations#PublicSafety#RiotConcerns#FireworksBan#DroneShows#PyrotechnicsBan#Municipalities#MarseilleScooterAccident#ElectricScooter#RoadSafety#TrafficAccident#BusCollision#ScooterRelatedDeaths#RoadSafetyConcerns

0 notes

Text

Imagine a world without instant payment platforms?

We can’t! Thanks to the existence of concepts like interoperability in the banking world, customers are enjoying a life of convenience and stress-free transactions. Learn more about how Bangladesh transformed their instant mobile payments with the help of Binimoy Interoperability Digital Transaction Platform.

Read more: https://lnkd.in/g_Vzgdqc

#digitalbanking#retailbanking#mobilepayments#IDTP#Bangladesh#digitalpayment#mobilepayment#digitalplatform#clayfin

0 notes

Text

Do you know how much capable is your MuPursu wallet?

It supports the NRI feature which makes transactions just one click away.

Take a look by downloading it now: https://cutt.ly/q35cbcZ

0 notes

Text

A Mobile Payment Gateway allows users to authorize and process payments via mobile apps. It uses encryption and security protocols to protect transaction data. A gateway is a service that allows clients to connect with businesses in order to make financial transactions more convenient.

A mobile payment gateway is a technology that enables secure payment transactions using a mobile device, such as a smartphone or tablet. It acts as an intermediary between a merchant's website or mobile app and the customer's mobile wallet or bank account. To know more, visit the post.

0 notes

Text

At PayPound.Ltd we ensure to keep the risk under control by tracking the transactions and patterns to avoid any possible frauds.

If you are running an high-risk business, securing a reliable credit card processor that enables you to accept payments across the globe will good approval ratio and regular payouts are very important!

Get your High-risk Merchant Account today!

Contact us NOW!

+44 800 832 1733

[email protected]

https://paypound.ltd/

#payment#paytm#creditcards#payments#pointofsale#digitalpayment#onlinepayment#noreturn#merchantservices#paymentgateway#creditcardprocessing#mobilepayments#paymentprocessing#onlinepayments#digitalpayments#noexchange#paymentsolutions#trafficsafety#highriskmerchantaccount#merchantaccount#business#offshoremerchantaccount#merchant#cbd#creditcard#paypal#highriskmerchantservices#businessowner#money#stripe

8 notes

·

View notes

Text

youtube

Today, everyone is opting for digital payments. Card and cash payments are decreasing. In terms of digital payments, India is surpassing the leading countries in the world. You can gauge the popularity of UPI payments from the latest figures. With the increasing craze for UPI payments, mobile transactions are getting a boost. People consider UPI as the top choice for digital payments. Amidst the rapid growth in India's digital payments, FY 2023-24 witnessed significant growth in UPI transactions compared to the previous year. According to transaction numbers, there has been a 56% growth in UPI transactions, and in terms of valuation, there has been a 43% increase. This is the first time that UPI transactions have crossed the mark of 100 billion. In the fiscal year 2023-24, transactions through UPI reached 131 billion, compared to 84 billion in the fiscal year 2022-23.

हमारे Channel का प्रयास है हर निवेशक को सही निवेश की राय देना। आज ही इस चैनल को Like और Subscribe करें। Follow us on: YouTube: https://youtube.com/@indianewsbusiness Twitter: https://twitter.com/indianewsbiz Facebook: https://www.facebook.com/indianewsbus... Official Website: https://indianewsbusiness.com/

#indianews#IndiaNewsBusiness#DigitalPayments#UPI#Demonetization#COVID19#CashlessIndia#MobilePayments#Fintech#FinancialInclusion#India#Economy#DigitalTransformation#FinancialTechnology#UPIPayments#UPITransactions#UPIGrowth#UPIValuation#CashlessEconomy#IndianEconomy#DigitalIndia#FinancialServices#FinancialTech#UPIRevolution#OnlinePayments#TransactionTrends#FY2023_24#CashlessTransactions#DigitalTransactions#FinancialSector

0 notes

Text

The Magic of Fintech: A Beginner's Guide to Money Management in the Digital Age

In today's fast-paced world, managing money has become easier and more convenient, thanks to the rise of fintech. But what exactly is fintech, and how is it changing the way we handle our finances? Let's dive into the world of fintech and unravel its mysteries in simple terms!

What is Fintech?

Fintech, short for financial technology, is like having a digital piggy bank that helps you do all sorts of cool things with your money. It uses fancy technology, like computers, smartphones, and the internet, to make banking, investing, and paying for things as easy as snapping your fingers.

Blockchain in Fintech:

Ever heard of a magic chain that keeps your money safe from bad guys? That's blockchain! In fintech, blockchain technology acts like a super-strong shield, protecting your money transactions from hackers and keeping them super secure.

Financial Technology:

Imagine having a toolbox filled with gadgets that help you with money stuff. That's financial technology! It includes things like mobile banking apps, digital wallets, payment platforms, and investment apps, making money management a breeze!

Banking Fintech:

Remember the days when you had to wait in long lines at the bank? Well, with banking fintech, you can do all your banking right from your phone or computer! You can check your balance, transfer money, pay bills, and even deposit checks without ever leaving the comfort of your couch.

Fintech Brands:

Just like how you have favorite superheroes, there are fintech brands that are like the superheroes of money management! Companies like PayPal, Venmo, Cash App, and Acorns are some popular fintech brands that help millions of people manage their money every day.

Fintech Development Outsourcing:

Ever wonder how those cool fintech apps are made? Sometimes, big companies need help from outside experts to build their money magic tools. That's where fintech development outsourcing comes in! It's like hiring a team of tech wizards to bring your money dreams to life.

Fintech Startup:

Have you ever dreamed of starting your own business? Well, a fintech startup is like launching your own money adventure! Whether it's building a new payment app, creating a budgeting tool, or revolutionizing how people invest, fintech startups are the brave pioneers of money innovation.

Wrapping up

In summary, fintech is like having a magical friend who helps you manage your money smarter and faster. From digital wallets to blockchain technology, fintech is transforming the way we think about money, making it simpler, safer, and more accessible for everyone. So, whether you're a tech enthusiast, a finance whiz, or just curious about the future of money, there's something in the world of fintech for everyone to explore and enjoy!

#mobilepayment#fintechindustry#cryptocurreny trading#fintech industry#fintech#fintech startup#fintech launch#fintech news

0 notes

Link

In an era where speed and convenience reign supreme, the Unified Payments Interface (UPI) has emerged as a game-changer in India's digital transaction landscape. This revolutionary payment system has not only gained widespread popularity domestically but is also making waves internationally. Let's delve into the intricacies of UPI, exploring how it works and unveiling the top five UPI payment apps that are reshaping the way India transacts. Understanding UPI: A Seamless Digital Payment Revolution What is UPI? Unified Payments Interface (UPI) is a real-time payment system in India that facilitates instant money transfers between bank accounts through mobile devices. It operates 24/7, allowing users to execute seamless and immediate fund transfers, bill payments, and more. UPI leverages the Immediate Payment Service (IMPS) infrastructure and is administered by the National Payments Corporation of India (NPCI). How Does UPI Work? Users link their bank accounts to a UPI-enabled app, creating a unique UPI ID. To initiate a transaction, users enter the recipient's UPI ID, specify the amount, and authorize the payment with a secure PIN. UPI's interoperable platform streamlines digital payments, offering a convenient solution for users across various banks and financial institutions. India's Top 5 UPI Payment Apps: A Deep Dive Google Pay (GPay) Formerly known as Tez, Google Pay has become a household name in India, renowned for its user-friendly interface and secure transactions. Its rewards system, featuring scratch cards and cashback on transactions, keeps users engaged. The innovative audio QR feature enhances security for proximity payments, setting it apart from the competition. PhonePe: A Versatile Payment Ecosystem PhonePe stands out for its smooth user experience and diverse service offerings, including mobile plan recharges, bill payments, and travel bookings. The option of a digital wallet provides users with additional payment flexibility, while the investment module allows for gold and fund investments, making PhonePe more than just a payment app. Paytm: Beyond UPI Payments Paytm, a versatile digital payment platform, has expanded its services into a comprehensive financial suite, covering banking, investments, insurance, and gaming. Its widespread QR code payment system makes it a ubiquitous choice, and recent enhancements in cybersecurity have boosted user confidence in conducting larger transactions. BHIM: Simplicity Backed by the Government Developed by the National Payments Corporation of India (NPCI), BHIM stands out for its simplicity and direct government backing. Focused solely on payments and money transfers, BHIM provides a stable and straightforward UPI experience, making it an ideal choice for users seeking simplicity and reliability. Amazon Pay: Integration with E-commerce Giant Amazon's foray into UPI payments with Amazon Pay has seamlessly integrated within the Amazon app. Offering benefits like cashback and instant checkout for Amazon purchases, Amazon Pay extends its functionality to bill payments, recharges, and money transfers. The Amazon Pay Later feature provides a convenient credit facility for eligible customers. FAQs: Unraveling Common Queries on UPI Q1: What is UPI's role in India's digital future? A1: UPI apps are pivotal in shaping India's financial landscape, providing accessibility and convenience for various transactions, from grocery shopping to mutual fund investments. Q2: How secure are UPI transactions? A2: UPI transactions are highly secure, requiring users to authorize payments with a secure PIN. Enhanced cybersecurity measures across UPI apps further ensure the safety of transactions. Q3: Can UPI apps be used for investments? A3: Yes, several UPI apps, such as PhonePe and Paytm, offer investment modules, allowing users to invest in assets like gold, tax-saving funds, and liquid funds. Q4: Is BHIM recommended for users seeking a straightforward payment experience? A4: Absolutely, BHIM is designed for users seeking simplicity and stability, focusing solely on payments and money transfers without additional services. Q5: How has UPI influenced e-commerce? A5: UPI's influence on e-commerce is evident, with even giants like Flipkart entering the UPI payment space, showcasing the growing significance of UPI in the digital commerce landscape.

#AmazonPay#BHIM#cybersecurity#DemystifyingUPI#Digitaltransactions#digitalwallet#ecommerce#financialservices.#GooglePay#IMPS#mobilepayments#NPCI#Paytm#PhonePe#UnifiedPaymentsInterface#UPI#UPIpaymentapps

0 notes

Text

Big win for EU as Apple cracks open its mobile payment system! 🇪🇺

#applepay#antitrust#eu#mobilepayments#nfc#competition#fintech#ios#appstore#googlepay#samsungpay#contactlesspayments#eucommission#marketdominance#privacy#userchoice#futureofpayments

0 notes

Text

Welcome to visit our booth.

JTact is here.

Booth: B6

#fintech#menafintech#dubaifintech#africapayments#identification#APIDE2023#afrique#cybersecurity#security#data#DigitalAfrica#PaymentInnovation#epaymentsolutions#POSterminal#mobilepayment#qrcodepayment#jtact

0 notes

Text

Does Walmart Take Apple Pay? Learn About Mobile Payments At Walmart.

Many customer who prefer apple have to ask at the transaction Does Walmart Take Apple Pay? Walmart does not accept apple pay however you could incorporate apple card in walmart app for payment.

In today’s digital age, mobile payment options have become increasingly popular offering convenience and adeptness to consumers. Two prominent service provider in the mobile payment arena are Walmart Pay and Apple Pay.

https://metadictory.com/does-walmart-take-apple-pay/

0 notes