#onlinepaymentgateways

Text

A Mobile Payment Gateway allows users to authorize and process payments via mobile apps. It uses encryption and security protocols to protect transaction data. A gateway is a service that allows clients to connect with businesses in order to make financial transactions more convenient.

A mobile payment gateway is a technology that enables secure payment transactions using a mobile device, such as a smartphone or tablet. It acts as an intermediary between a merchant's website or mobile app and the customer's mobile wallet or bank account. To know more, visit the post.

0 notes

Text

🚀 Say hello to the future of payments with mobi! 💳💻

Empower your business with seamless contactless digital payments through mobi - the ultimate integration solution! 🌐 Our globally connected platform ensures your business stays ahead in a rapidly changing market, providing reassurance to travelers with digital-first touchless transactions.

Revolutionize your operations with mobi Payment Gateway Malaysia, simplifying transactions and guaranteeing a secure, hassle-free experience for both you and your customers. 💼✨

Ready to step into the future of payments? Let mobi take your business to new heights now: https://gomobi.io/

#payment gateway#forex payment gateway#paymentprocessing#malaysia payment gateway#onlinepaymentgateway#top payment gateway malaysia#malaysiapaymentgateway#online payment gateway#paymentgateway#best payment gateway malaysia

0 notes

Text

Transform your finance business with SurekhaTech's FinTech Solutions

With over a decade of experience, we specialize in developing cutting-edge finance management systems tailored for banking, financial services, and insurance businesses. Our expertise lies in empowering BFSI businesses through innovative solutions, incorporating AI, IoT, and Blockchain technologies.

We offer a wide range of software solutions designed to streamline finance management, including payment and digital wallets, mobile banking, investment management, personal finance management, insurTech solutions, lending and borrowing platforms, fraud detection software, financial CRM software, and accounting software.

Experience the future of finance with SurekhaTech – your partner in FinTech innovation.

In addition to the above, feel free to visit our website for more detailed insights and solutions.

#fintech#finance#financesolutions#accounting#accountmanagement#bankingsystem#onlinepaymentgateway#softwaredevelopmentcompany#digitalsolution#digitaltransformation#SurekhaTechnologies#SurekhaTech

1 note

·

View note

Text

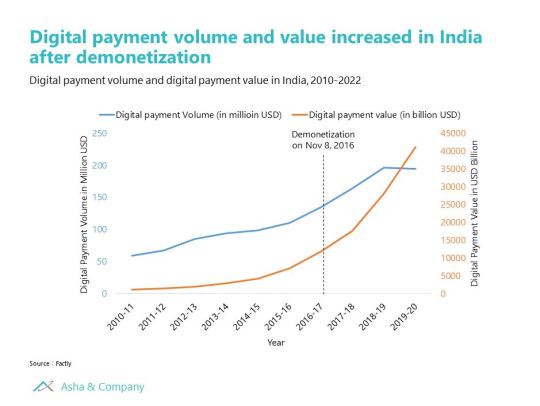

Rise of Digital Payment in India

Digital payments in India grew from 25B transactions in FY20 to 64B in FY22. This adoption of digital payment was fueled by the government's “Digital India” initiative, UPI payment, and lower mobile data costs. By 2026, India’s digital payment landscape is expected to grow to 411B transactions by FY27.

#market research#Digital Payment#digital payment solution#upi#Paytm#online payments#online paise kaise kamaye#onlinepaymentgateway#business intelligence#indian market

1 note

·

View note

Text

payg.in/payment-frauds-in-covid-19.html

Novel Payment Frauds in the times of COVID-19

Today, along with keeping oneself safe from the coronavirus (COVID-19), we ought to likewise be aware of cybercriminals. One of the methods of instalment seeing an expansion in fraud is the Unified Payment Interface (UPI), an advanced instalment stage that encourages cashless, continuous exchanges through cell phones.

#bestpaymentgatewayIndia#freepaymentgateway#onlinepaymentgatewayinindia#onlinepaymentgateway#paymentgatewayprovidersinindia

0 notes

Text

Instant Payment Gateway Solutions | LetsPe: Secure and Efficient Transactions

Discover LetsPe's instant payment gateway solutions, offering secure and efficient transactions for your business. With a wide range of accepted payment methods, including credit cards, debit cards, and digital wallets, LetsPe ensures seamless processing and a hassle-free checkout experience for your customers. Trust in the secure and reliable technology provided by LetsPe to streamline your payment processes and enhance customer satisfaction. Experience the convenience of LetsPe's instant payment gateway solutions today.

0 notes

Text

Why Credit Ratings Matter: Understanding the Importance of Credit Ratings

In today's financial landscape, credit ratings play a crucial role in various aspects of our personal and business lives. Whether you're applying for a loan, seeking favorable interest rates, or even renting an apartment, your credit rating can significantly impact the opportunities available to you. Understanding the importance of credit ratings is essential for managing your financial well-being effectively.

Credit ratings are assessments of an individual's or organization's creditworthiness. They reflect the likelihood of the borrower repaying their debts based on their credit history, financial stability, and repayment patterns. Here's why credit ratings matter:

Access to Credit: Lenders, such as banks and financial institutions, rely on credit ratings to evaluate the risk associated with lending money. A good credit rating can help you secure loans, credit cards, and mortgages with favorable terms and interest rates. It gives lenders confidence in your ability to repay borrowed funds responsibly.

Cost of Borrowing: Credit ratings directly impact the cost of borrowing. A higher credit rating indicates lower credit risk, resulting in better interest rates and loan terms. On the other hand, a lower credit rating can lead to higher interest rates or even loan denials. Maintaining a good credit rating can save you money in the long run by reducing the cost of borrowing.

Rental Applications: Landlords and property managers often check credit ratings when assessing rental applications. A positive credit rating demonstrates financial responsibility and reliability, increasing your chances of being approved for a rental property. It also provides leverage in negotiating lease terms and security deposits.

Employment and Business Opportunities: Some employers and companies review credit ratings as part of their hiring or business partner selection process. While credit ratings alone may not determine eligibility, they can be a factor in assessing an individual's financial stability and responsibility. A good credit rating can enhance your professional reputation and open doors to certain job positions or business opportunities.

Insurance Premiums: In certain cases, credit ratings may influence insurance premiums. Insurance providers may consider credit ratings as an indicator of risk, potentially impacting the cost of auto insurance, homeowner's insurance, or other types of coverage. Maintaining a good credit rating can help keep insurance costs lower.

Future Financial Goals: Building and maintaining a good credit rating is essential for achieving future financial goals. Whether you plan to buy a home, start a business, or invest in real estate, a strong credit rating provides you with the financial foundation and credibility needed to pursue these endeavors.

To improve or maintain a good credit rating, it's important to practice responsible financial habits. This includes paying bills on time, keeping credit card balances low, minimizing debt, and regularly reviewing your credit reports for accuracy.

In conclusion, credit ratings are critical for accessing credit, obtaining favorable terms and interest rates, and making significant financial decisions. Understanding the importance of credit ratings empowers you to take control of your financial health and work towards achieving your long-term goals.

0 notes

Link

Key Details

What is a payment processor?

What is a merchant account?

What is a payment gateway?

Who is involved in payment processing?

Applying for Payment Processors: The Process

Merchant Account Application: Approval Questions

Payment Processors: Getting Started

How do online payments work?

#paymentprocessing#paymentmethods#payments#onlinepaymentgateway#onlinepaymentprocessing#PaymentProcessingGuide

0 notes

Photo

Flutterwave Shuts Down Virtual Dollar Card Service In Nigeria ........... We are writing to inform you that effective Sunday, 17th July 2022, all our Virtual Dollar cards will be unavailable for any transactions and purchases. This is due to an update from our card partner, which will cause the card service to be unavailable for an extended period of time. Here is a breakdown of what to expect from 17th July: 1. You will be unable to make online and in-store payments and purchases using your Virtual Dollar Card(s). 2. You will be unable to fund existing Virtual Dollar Card(s). 3. Your existing Virtual Dollar Card(s) will be terminated, and the corresponding balance will be credited to your payment balance. 4. You will be unable to create new Virtual Dollar Card(s). Urgent next steps: 1. We recommend that you unlink your Dollar Card(s) from any recurring payments, and replace with .... GUYS, WHAT DO YOU THINK? #flutterapp #flutterappdevelopment #BARTER #onlinepaymentgateway #flutterwave ........ LINKS YOU MIGHT LIKE ( OPTIONAL TO CLICK) 1. Visit My Blog For More News : www.edesononlinenews.com 2. I Register Business Names, Limited Liability Company, NGO, Social Clubs, etc At Corporate Affairs Commission. I Do Nationwide Newspaper Publication. 08136125128. 3. I Design Websites, Blogs & Graphics. I Publish Apps On Google PlayStore. 4. Know About My Services On My Company Website: www.edesoninfotech.com.ng . (at Lagos, Nigeria) https://www.instagram.com/p/CgDEViKshrh/?igshid=NGJjMDIxMWI=

0 notes

Photo

Digital Portal for Fee Management

Transform one of the most time-consuming components of managing an educational institution’s finances into a breeze. vmedulife provides a fee management system that covers all the features you’ll need in a school ERP system to not only accelerate student school fee collection but also to provide an enhanced experience for students and parents.

vmedulife’s online fee management software’s secure payment channel allows parents to pay their children’s fees with a few mouse clicks. In addition, when successful payments are made, the school software generates and sends them automated e-receipts.

https://blog.vmedulife.com/digital-portal-for-fee-management/

0 notes

Video

youtube

In a rapidly evolving digital landscape, optimizing your business's efficiency and providing customers with seamless payment experiences are more critical than ever. Join us in this enlightening video as we delve into the world of payment processing. From high-risk industries like CBD and credit repair to the thriving e-commerce realm, we'll uncover the secrets to streamlining your operations and embracing the power of credit card payments.

📣 Unravel the Future of High-Risk Payment Solutions with TouchSuite®! 🎯💼📈

🔍 Seeking advanced payment processing for high-risk businesses? Dive into the vast range of services we offer in this video: from high-risk payment processing, merchant accounts, and e-commerce gateway solutions, to specialized services for credit repair and CBD industries.

🌐✉️📞 With a legacy of excellence and serving thousands of global businesses, TouchSuite® is your trusted high-risk payment solutions provider.

#AcceptCreditCardPayments #PeymentProcessing #MerchantAccounts

#HighRiskPaymentProcessing #AcceptCreditCards #OnlinePaymentGateway #MerchantProcessing #CreditCardPaymentGateway #HighRiskMerchantAccount

0 notes

Link

0 notes

Text

https://www.asha.inc/blogs/digital-payments-india/

#market research#Digital Payment#digital payment solution#upi#Paytm#online payments#online paise kaise kamaye#onlinepaymentgateway#business intelligence#indian market

0 notes

Text

payg.in/understanding-merchant-dashboard-systems.html

Understanding Merchant Dashboard System

Accepting payments through multiple channels is a quick and simple approach to develop your business. With a Merchant Dashboard, one can start processing credit and debit cards for all forms of purchases and can easily integrate in your system within a minute.

#bestpaymentgatewayIndia#freepaymentgateway#onlinepaymentgatewayinindia#onlinepaymentgateway#paymentgatewayprovidersinindia

0 notes

Text

Secure and Fast Instant Payment Gateway in India for Your Business Needs

LetsPe, most secure and fastest payment gateway in India. Payment gateway platform provides seamless payment processing for businesses of all sizes. Our platform is designed to provide businesses and customers with secure and instant payment processing. As India's leading instant payment gateway, we provide a seamless user experience that ensures maximum convenience and peace of mind. With easy integration options, start accepting payments in no time.

#instantpaymentgatewayinindia#instantpaymentgateway#onlinepaymentgatewayinindia#onlinepaymentgateway#letspe#letspeonlinepayment gateway

0 notes

Text

Revolutionizing Payment Processing: The Power of POS Swipe Machines

In the ever-evolving world of commerce, innovative technologies have transformed the way we make transactions. One such groundbreaking solution is the Point of Sale (POS) swipe machine. These sleek and efficient devices have revolutionized payment processing, providing businesses with seamless and secure transaction experiences.

Enhanced Payment Security: POS swipe machines prioritize security by encrypting sensitive customer data during each transaction. Utilizing advanced encryption algorithms, these devices protect financial information, significantly reducing the risk of data breaches and fraud. As a result, customers can confidently make purchases without worrying about compromising their personal information.

Versatility and Convenience: Gone are the days of carrying around bulky cash or cumbersome checkbooks. POS swipe machines enable customers to make payments effortlessly using their credit or debit cards. With contactless payment options, such as Near Field Communication (NFC) and mobile wallets, customers can simply tap or wave their cards or smartphones to complete transactions swiftly, enhancing convenience for both customers and businesses.

Real-Time Transaction Tracking: POS swipe machines offer real-time transaction tracking capabilities. Merchants can instantly monitor sales, inventory levels, and revenue, allowing for effective business management. This data-driven approach empowers businesses to make informed decisions, optimize stock levels, and identify trends, ultimately enhancing operational efficiency and profitability.

Streamlined Accounting and Reporting: The integration of POS swipe machines with accounting systems simplifies financial management for businesses. These devices automatically record sales data, providing accurate and detailed reports on revenue, taxes, and expenses. This seamless synchronization reduces manual data entry errors and streamlines accounting processes, enabling business owners to focus more on core operations and strategic planning.

Customer-Centric Experience: With the advent of POS swipe machines, businesses can elevate the customer experience to new heights. These devices enable swift transaction processing, reducing wait times and enhancing customer satisfaction. Additionally, the availability of customized receipts, loyalty programs, and targeted promotions adds a personal touch, fostering stronger relationships between businesses and their customers.

In conclusion, NTT DATA Payment Services POS swipe machines have emerged as a game-changer in the realm of payment processing. With their enhanced security, convenience, real-time tracking, streamlined accounting, and customer-centric features, they empower businesses to stay ahead in an increasingly competitive landscape. Embracing this innovative technology is a step towards unlocking new levels of efficiency and success in the digital age of commerce.

0 notes