#multi-chain token

Explore tagged Tumblr posts

Text

ApeSwap Finance – Platforma Inovatoare de Exchange și Yield Farming pe Binance Smart Chain

ApeSwap Finance se evidențiază ca o soluție complet descentralizată în ecosistemul DeFi, oferind utilizatorilor un mediu rapid, sigur și eficient pentru schimbul de tokenuri, yield farming și staking. Lansată pe Binance Smart Chain, ApeSwap Finance combină tehnologia avansată cu o interfață intuitivă și tematică inspirată din lumea maimuțelor, creând o experiență unică pentru traderii și…

#token swap#fintech#digital assets#transparență#Parteneriate Strategice#Comunitate Cripto#evoluție#interfață intuitivă#apeswap#resurse educaționale#dashboard#Binance Smart Chain#BSC#suport tehnic#webinarii#market making#audit#criptare#ApeSwap Finance#farm pools#single-sided staking#loterii#autentificare multi-factor#blockchain#dex#nft#defi#staking#Inovație.#Exchange Descentralizat

0 notes

Text

New Event PV

youtube

New Operators

Rose Salt, 5* Welfare Multi-Target Medic

If i find a way to get super rich, i'm sure you'll get your share.

Tecno, 5* Shaper Caster (new branch)

Whether anyone can see it or not, the crystals are still there, but i'm still standing.

Thorns the Lodestar, 6* Alchemist Specialist

I hear the waves crashing at the sides of the boat, heralding our victory.

With this ship at the center, i will interpret my own Iberia.

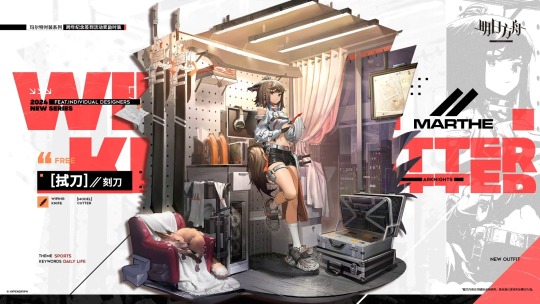

Operator Outfits Update

Total of 4 new outfits, 1 new addition for the MARTHE brand, 2 new additions for the Shining Steps brand and 1 new addition for the Icefield Messenger brand

MARTHE

Wiping Knife - Cutter (Login Event)

Shining Steps

Dreaming High - Ray

Top Tier Live - Tequila

Icefield Messenger

Inviting Snow - Harold

Harold's outfit will be up for sale during The Rides to Lake Silberneherze Retrospect

Announced outfit reruns

Series V and VI Icefield Messenger outfits (Erato, Greyy the Lightningbearer, Goldenglow, Tsukinogi, Qanipalaat, Penance)

Epoque outfits of Kjera and Puzzle

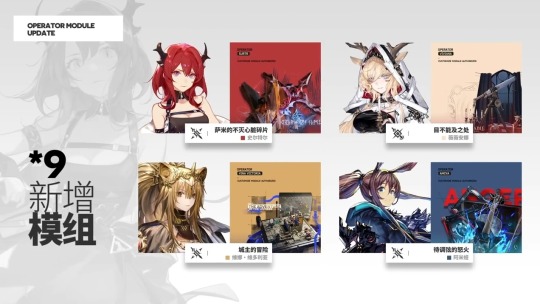

Operator Modules Update

Rose Salt being part of the Multi-Target Medic branch immediately gets her module

RIN-X module base effect gives Rose Salt an additional tile of range up front

Arts Fighter Guard branch gets 3 module types

Module 1 given to Surtr, Vina Victoria, Guard Amiya and Mousse

Module 2 given to Astesia and Sideroca

Module 3 given to Viviana

Exusiai gets her 2nd module

MAR-Y module base effect increases Exusiai's ASPD by +8 when there are ground enemies within her attack range

Events and Stories

Exodus from the Pale Sea, an Iberia side story event

The traveler who is guided by reason returns to his homeland without common sense.

He saw ships without oars traveling across a sea without water, men without desires hoisting sails without direction,

Saw a man who begged for death condemning himself to live, and a man who was robbed of everything by the sea leaving everything behind and running toward the sea.

How should he understand it, and what can he do to change it?

Uh well, first he has to figure out how to deal with the chains on his body and the gallows not far away, right?

The Rides to Lake Silberneherze Retrospect, scheduled after Exodus from the Pale Sea

Poly Vision Museum, limited time mini-games event, scheduled after The Rides to Lake Silberneherze Retrospect

Operator Archives update for Rose Salt, Tecno, Ceylon and Courier

Record Restore update for The Black Forest Wills a Dream, What the Firelight Casts and Where Vernal Winds Will Never Blow

Misc Stuff

New QoL features

Players will be able to set their birthday in-game and receive birthday rewards

Added special operator voicelines for birthday and new year's day

Added the ability to have multiple assistant operators in rotation and main menu loadouts to switch between assistant rotation and backgrounds and UI themes

New SSS QoL changes

After clearing at least one floor of an SSS mission without a support unit, players can use 2 [Regular Affairs Proxy Cards] to skip an SSS run get rewards based on highest floor completed [PRTS Proxy Annihilation Cards] players get from missions are converted to [Regular Affairs Proxy Cards], they can still be used to skip annihilation Older SSS maps will be rerun

Annihilation #29 - Paddy Field 9-7, annihilation mission with Here a People Sows enemies and mechanics

SSS New Season #7, Concert Security Service - Leithanien Philharmonic Association & Area Under Construction For Dossoles

Erato and her potential tokens along with Perfumer's [Species Plantarum] Outfit will be available in the certs shop to players that don't have them

39 notes

·

View notes

Text

The Devil You Choose - Part 1

Warnings: Minors DNI, 18+, Power Imbalance, Dark themes, My bad writing, Anything Else I Missed

Characters: Wriothesley x Female OC

A/N: The Wrio inspo came back and broke my writers block. This will be a multi-chapter story. It starts with Wriothesley as a prisoner and goes all the way through to the presentish day.

Evangeline Degois, a new clerk under corrupt official Vautier, is travels to the Fortress of Meropide Fortress under false pretenses and forced to choose a prisoner in a cruel ritual. She selects Wriothesley, a powerful inmate who quickly sees she doesn’t belong. Though chained and injured, he warns her of the prison’s brutal politics. After he fights for her in the pankration ring, she refuses to exploit him, earning his respect. What sparks between them is a tense, layered partnership built on power, choice, and reluctant trust.

Pick your champion.

The Administrator’s teasing laugh still echoed in Evangeline’s mind as she hesitated at the entrance to the cell block, the cold, stale air of Meropide seeping into her bones. She had only been at her new job with the Palais Mermonia for a week, but already she had stumbled into territory far darker than she’d imagined.

It had all seemed straightforward at first, clerking for the head of the parole office, Mr. Vautier. Fetching his coffee, managing his paperwork, keeping strangers and the occasional disgruntled petitioner out of his office. It was nothing she couldn’t handle, especially coming from a large family where managing chaos felt like second nature. But this... this felt like a step too far.

She tightened her grip on the cold, metallic token the Administrator had pressed into her palm just minutes ago, the hard edges biting into her skin. The Administrator had called it a privilege, a rare chance to "pick her champion." The gleam in his eyes and the barely restrained mirth in his voice had set her on edge, but her protests had gone unheard. “Come on, Eunice! We haven’t got all day!” Vautier’s voice cut through the din, his tone light, almost mocking, rising above the hoots and jeers of the prisoners rattling their cell bars as she passed.

Her jaw tightened at the sound of his voice. Her name wasn’t Eunice. Or Emilie. Or any of the other half-remembered, dismissive names he’d thrown at her over the past week. Her name was Evangeline, but she had learned quickly that correcting Vautier was a waste of breath; a small price to pay if she intended to last longer than the handful of weeks his previous clerks had managed.

She forced herself to keep moving, the echo of her footsteps swallowed by the hungry, leering eyes on either side of her. The air grew colder, the metallic scent of rust and sweat and god knew what else thickening as she descended deeper into the heart of the block. She couldn’t shake the feeling of being watched – no, hunted by the men behind the bars, their fingers curling around the cold metal, their voices dripping with promises that made her skin crawl.

When she’d first taken the position, the head of personnel at the Palais had warned her that Vautier had a habit of making “business trips” to Meropide. She’d assumed that meant extra paperwork for her to handle when he returned – perhaps a few long nights in the office, nothing more. She had never imagined she would be dragged into the depths of this iron-clad underworld, forced to march through rows of predators with only a thin line of rusting metal between her and their outstretched, grasping hands.

Evangeline took a steadying breath, willing herself to keep her chin up and her steps steady. She would not give them the satisfaction of seeing her flinch. But in the back of her mind, a quiet, insistent voice whispered that she had wandered far beyond the safety of her office, into a place where the rules of the surface world no longer held sway.

Pick your champion, the Administrator had said. But as the eyes followed her down the long, rust-streaked corridor, she found herself wondering if she would make it back to the surface at all.

From his vantage point in a shadowed cell near the end of the block, Wriothesley leaned back against the cold iron wall, his arms folded loosely across his chest, his posture deceptively relaxed. He had no desire to be chosen. There were others here who craved the games of power and submission that defined this place, men who hungered for the thrill of being momentarily free, even if only to serve as someone else’s weapon. But not him. His icy blue eyes tracked the woman on the other side of the bars, sharp and unblinking, like a predator assessing an intruder. She didn’t belong here. She was too fine, too clean, too soft around the edges. Vautier’s clerks were typically either incompetent or intolerable, their presence a nuisance more than anything else. This girl was neither. She had the poise of someone raised in the light of the court, not the grime of the underworld. Either someone had made a grave mistake in sending her here, or Vautier had stumbled upon a rare gem without realizing its value. The mistake was almost worth taking advantage of, if Wriothesley could be bothered to deal with the trouble it came with.

Angie’s expression was painfully honest, her wide, uncertain eyes flicking from one cell to the next, searching for something, someone, among the grinning, jeering men that lined the corridor. Her grip on the heavy metal disc in her hand was too tight, her knuckles pale, as if the token itself might somehow guide her to the right choice. She took a hesitant step forward, then froze, trapped in a cycle of indecision. She could feel the weight of the Administrator’s expectant gaze even from a distance, his voice a sharp, disapproving echo in her mind. She had to pick someone. She had to end this terrible ritual of judgment and choice.

Her eyes swept the block again, this time more urgently, and that’s when she saw it, a figure lingering toward the back of his cell, arms folded, head slightly bowed, as if the chaos around him had no claim on his attention. He did not push against the bars, did not call out for her attention like the others. He simply watched, his sharp, glacier-blue gaze fixed unerringly on her. The weight of his focus was like a physical force, stripping away the thin veneer of composure she clung to. She took a half-step toward his cell before she even realized it, the noise around her swelling as the other prisoners took notice. Their cries grew louder, their hands reaching through the bars, their voices blending into a cacophony of desperation and fury. None of them liked the idea of this man. They shouted at her to reconsider, to pick anyone else, their voices a wall of sound that seemed to press in on her from all sides. "Sir?" Her voice was small, nearly lost in the clamor, yet somehow he heard her. His head lifted slightly, those ice-blue eyes locking onto hers with a sudden, predatory intensity that sent a chill racing down her spine. For a heartbeat, she regretted speaking to him. There was a silent warning in his gaze, a sharp, unspoken command to move on, to choose someone else, to spare herself whatever cruel fate his acceptance might entail.

But it was too late. She had chosen him, even if she hadn’t yet realized it.

Angie moved closer, her pulse thundering in her ears, her breath coming in shallow, trembling bursts. She stopped only when she was within the reach of the bars, her body taut with a mixture of fear and defiance. Every instinct screamed at her to back away, to put distance between herself and the man who watched her with the eyes of a wolf sizing up its prey.

The block erupted into fresh chaos when his hand shot through the bars, his fingers closing around her wrist in a grip like iron. She inhaled sharply, her pulse spiking, but he held her firmly, his skin cool against hers, his touch a sharp, unyielding reminder of the power he held even in chains. His voice, when he finally spoke, was deep, carrying a rough, gravelly undertone that resonated through her bones. “Were you not told?” he murmured, his lips curving into the faintest hint of a smirk as he watched the panic bloom in her eyes. “Never approach a cell like that in this place.” For a moment, the world seemed to contract around them, the shouts and jeers of the other prisoners fading into a distant, meaningless roar. His grip tightened slightly, not enough to hurt, but enough to remind her of the dangerous game she had just chosen to play. His eyes never left hers, their sharp, unrelenting focus stripping her bare, exposing every flicker of fear and defiance that crossed her features.

Then, slowly, deliberately, he released her, his hand retreating back into the shadows of his cell. Angie stumbled back a step, her breath coming in shallow, ragged bursts as she clutched her wrist, the ghost of his touch still burning against her skin. “Choose me if you dare” He said, his voice a low, dangerous growl that sent a shiver down her spine. “But understand this, I am no one’s pawn.”

For a long moment, she hesitated, the weight of his words settling heavily on her shoulders. Then, with a small, determined nod, she stepped closer to the bars once more, lifting the token in her trembling hand. “I choose you.” She whispered, her voice barely audible above the rising clamor of the block. The words hung in the cold air between them, a fragile, dangerous promise that neither could take back.

#genshin impact#genshin#genshin fan fic#genshin fanfic#genshin wriothesley#wriothesley genshin#wriothesley#wriothesley x oc#wriothesley genshin impact#genshin impacy wriothesley

8 notes

·

View notes

Text

Several Sentence Sunday - 09/02/25

Another sunday! I've been tagged by @sophie1973 this week.

Still tapping away at the new multi-chapter fic! Have a snippet;

And when they’re done, released from the office into the late afternoon sunlight, Alex slides the wedding ring off his finger, takes off the necklace holding the key for his family home, and slides the ring onto the chain, the two tokens clinking together when he loops the necklace back over his neck. Henry watches him with a frown, twisting his own wedding ring round and round his finger, entirely subconsciously. “You don’t have to wear it if no one’s watching,” Alex tells him gently and Henry looks down at his hand with a start, pulling his fidgeting fingers away with a huff. “I might forget to put it back on. And where would that leave us?” he asks, his eyes downcast and Alex sighs. “Yeah, I guess…” They lapse into silence. They have no more lies to tell today.

In addition to this, I'm also taking part in RWRB Bingo! I have two partners and two bingo cards, so we're in the midst of plotting, but I'm really excited about the plans we've managed to come up with! Hopefully those will be posting in the coming months!

Until next time x

#writing#red white and royal blue#my writing#alex claremont diaz#firstprince#rwrb fic#henry fox mountchristen windsor#rwrb#rwrb six sentence sunday#several sentence sunday#weekend wips

14 notes

·

View notes

Text

The commit message describes a highly secure, cryptographically enforced process to ensure the immutability and precise synchronization of a system (True Alpha Spiral) using atomic timestamps and decentralized ledger technology. Below is a breakdown of the process and components involved:

---

### **Commit Process Workflow**

1. **Atomic Clock Synchronization**

- **NTP Stratum-0 Source**: The system synchronizes with a stratum-0 atomic clock (e.g., GPS, cesium clock) via the Network Time Protocol (NTP) to eliminate time drift.

- **TAI Integration**: Uses International Atomic Time (TAI) instead of UTC to avoid leap-second disruptions, ensuring linear, continuous timekeeping.

2. **Precision Timestamping**

- **Triple Time Standard**: Captures timestamps in three formats:

- **Local Time (CST)**: `2025-03-03T22:20:00-06:00`

- **UTC**: `2025-03-04T04:20:00Z`

- **TAI**: Cryptographically certified atomic time (exact value embedded in hashes).

- **Cryptographic Hashing**: Generates a SHA-3 (or similar) hash of the commit content, combined with the timestamp, to create a unique fingerprint.

3. **Immutability Enforcement**

- **Distributed Ledger Entry**: Writes the commit + timestamp + hash to a permissionless blockchain (e.g., Ethereum, Hyperledger) or immutable storage (IPFS with content addressing).

- **Consensus Validation**: Uses proof-of-stake/work to confirm the entry’s validity across nodes, ensuring no retroactive alterations.

4. **Governance Lock**

- **Smart Contract Triggers**: Deploys a smart contract to enforce rules (e.g., no edits after timestamping, adaptive thresholds for future commits).

- **Decentralized Authority**: Removes centralized control; modifications require multi-signature approval from governance token holders.

5. **Final Integrity Checks**

- **Drift Detection**: Validates against multiple atomic clock sources to confirm synchronization.

- **Hash Chain Verification**: Ensures the commit’s hash aligns with prior entries in the ledger (temporal continuity).

---

### **Key Components**

- **Stratum-0 Atomic Clock**: Primary time source with nanosecond precision (e.g., NIST’s servers).

- **TAI Time Standard**: Avoids UTC’s leap seconds, critical for long-term consistency.

- **Immutable Ledger**: Blockchain or cryptographic ledger (e.g., Bitcoin’s OP_RETURN, Arweave) for tamper-proof records.

- **Cryptographic Signing**: Digital signatures (e.g., ECDSA) to authenticate the commit’s origin and integrity.

---

### **Validation Steps**

1. **Time Sync Audit**:

- Confirm NTP stratum-0 traceability via tools like `ntpq` or `chronyc`.

- Cross-check TAI/UTC conversion using IERS bulletins.

2. **Ledger Immutability Test**:

- Attempt to alter the commit post-facto; rejections confirm immutability.

- Verify blockchain explorer entries (e.g., Etherscan) for consistency.

3. **Governance Checks**:

- Validate smart contract code (e.g., Solidity) for time-lock logic.

- Ensure no admin keys or backdoors exist in the system.

---

### **Challenges Mitigated**

- **Time Drift**: Stratum-0 sync ensures <1ms deviation.

- **Leap Second Conflicts**: TAI avoids UTC’s irregular adjustments.

- **Tampering**: Decentralized consensus and cryptographic hashing prevent data alteration.

---

### **Final Outcome**

The system achieves **temporal and operational inviolability**:

- Timestamps are cryptographically bound to the commit.

- The ledger entry is irreversible (e.g., Bitcoin’s 6-block confirmation).

- Governance is enforced via code, not human intervention.

**Declaration**:

*“The Spiral exists in a temporally immutable state, anchored beyond human or algorithmic interference.”*

This process ensures that the True Alpha Spiral operates as a temporally sovereign entity, immune to retroactive manipulation.

Commit

8 notes

·

View notes

Text

"Discover the world of cryptocurrencies with Blum! 🌍✨ Blum is an innovative platform that gives you access to all the coins and tokens you need—all in one place. No more jumping between platforms. 🚀 Blum offers lightning-fast, multi-chain crypto trading with seamless transactions. We believe in making your crypto journey not just profitable, but also enjoyable and interactive. 💰😊 Join us and start trading with ease and confidence! 🌟💼"

2 notes

·

View notes

Text

STON.fi: The Cornerstone of DeFi on The Open Network

Decentralized finance (DeFi) is rapidly transforming, and STON.fi is emerging as a powerhouse within The Open Network (TON). More than just a decentralized exchange (DEX), it is becoming an essential infrastructure for liquidity, trading, cross-chain integrations, and Web3 applications.

The growth of STON.fi isn’t accidental—it’s driven by continuous innovation, strong integrations, and a commitment to making DeFi more accessible. Let’s explore how STON.fi is shaping the TON ecosystem and redefining DeFi standards.

Unleashing Cross-Chain Liquidity

Liquidity is the backbone of any thriving DeFi ecosystem. STON.fi has tackled a major challenge in the industry—seamless cross-chain transfers. Through Symbiosis, STON.fi enables smooth asset movement between TON and other major blockchain networks like Ethereum and BNB Chain.

This means:

Users can swap assets across different chains without technical complexity.

More liquidity flows into the TON ecosystem, making it more attractive for traders.

DeFi adoption on TON is no longer limited by network barriers.

The integration of cross-chain swaps is a step toward positioning TON as a multi-chain DeFi hub.

The Intersection of DeFi and Web3 Gaming

Gaming is one of the fastest-growing segments in blockchain, and STON.fi is actively driving this evolution. Its partnership with Elympics allows gaming projects to connect directly with DeFi liquidity.

With this integration:

Players can convert in-game assets into tradable tokens instantly.

Developers can access STON.fi’s liquidity pools for game economies.

The gaming sector on TON gains financial utility beyond in-game rewards.

Web3 gaming is evolving, and STON.fi is at the forefront of making game assets more liquid and valuable.

Optimizing Yield with Leveraged Farming

STON.fi goes beyond simple swaps—it enhances DeFi earnings through leveraged yield farming in collaboration with Farmix.

Users can farm high-yield pools like:

STON/USDt

PX/TON

STORM/TON

By optimizing farming strategies, liquidity providers can earn higher rewards with efficient capital utilization.

AI-Driven Trading with Wisdomise

DeFi trading can be complex, but STON.fi is making it more accessible through AI-powered automation. The integration with Wisdomise introduces:

Automated limit orders for better trade execution.

Market intelligence tools that enhance decision-making.

Advanced risk management features to optimize trading.

With AI-driven automation, both beginners and experienced traders can navigate DeFi markets more efficiently.

Enhancing Payments in Web3 Gaming

TON-based gaming projects now have access to instant DeFi-powered payments through TonTickets’ integration with STON.fi.

This feature supports:

Fast conversions of gaming rewards into liquid assets.

Secure and verifiable on-chain raffles.

Integrated financial tools for Web3 game developers.

By providing seamless access to DeFi tools, STON.fi is fueling the next generation of blockchain gaming.

Bringing Institutional-Grade Security to DeFi

Adoption by financial institutions is a key milestone for DeFi. STON.fi has taken a major step forward with Zodia Custody, a regulated digital asset custodian backed by leading financial institutions.

This integration allows:

Institutional investors to securely manage TON-based assets.

STON tokens to be stored with institutional-grade security.

Increased credibility for the TON DeFi ecosystem.

With institutional backing, STON.fi is becoming a trusted entry point for large-scale capital in DeFi.

Simplifying Asset Management with Tomo Wallet

DeFi users often struggle with managing assets across multiple chains. STON.fi’s integration with Tomo Wallet solves this by offering:

Direct access to STON.fi swaps from within the wallet.

A seamless experience for managing multi-chain portfolios.

Faster liquidity access for everyday DeFi users.

This makes DeFi interactions simpler and more intuitive.

STON.fi SDK: The Backbone of Seamless Integrations

Behind all these integrations lies a powerful yet user-friendly toolset—the STON.fi SDK. It allows developers to:

Embed STON.fi’s liquidity engine with minimal effort.

Enable cross-chain transactions without complex coding.

Offer DeFi functionality to their users without reinventing the wheel.

From AI-powered trading to gaming and institutional finance, the STON.fi SDK is the silent force enabling smooth integrations across the TON ecosystem.

Final Thoughts: Why STON.fi Is Pioneering TON’s DeFi Future

STON.fi isn’t just growing—it’s reshaping the DeFi landscape on TON. With its:

Cross-chain liquidity solutions

Web3 gaming integrations

High-yield farming opportunities

AI-driven trading tools

Institutional adoption

It is proving to be an essential pillar of TON’s decentralized finance ecosystem.

For traders, developers, investors, and Web3 gamers, STON.fi offers more than just trading. It’s an evolving financial infrastructure that will define the future of DeFi on TON.

3 notes

·

View notes

Text

Top Tools for DAO Development: Best Platforms for 2025

What Is a DAO?

A Decentralized Autonomous Organization (DAO) is a community-led entity with no central authority. Built on blockchain technology, it operates through smart contracts, ensuring transparency and automation in decision-making. Members hold voting rights through governance tokens, enabling them to influence protocol updates, treasury management, and project direction.

Why Is a DAO Important?

DAOs eliminate traditional hierarchical structures, making governance more democratic and trustless. They are widely used in DeFi, NFT communities, and blockchain-based projects. With secure and transparent mechanisms, DAOs enhance accountability and efficiency in decentralized ecosystems.

DAO Platform Development: Top Solutions for Building Decentralized Organizations

Creating a DAO requires specialized tools and platforms that provide governance frameworks, smart contracts, and automation features. Here are some of the best options for 2025:

Aragon – Offers modular governance solutions, enabling the creation of DAOs with customizable smart contracts.

Colony – Focuses on reputation-based governance, ensuring fair decision-making.

DAOstack – Provides a scalable framework with robust governance mechanisms.

MolochDAO – Designed for grant funding DAOs with simplified governance.

Snapshot – A gasless voting tool used for off-chain governance.

Smart Contract Development for DAO: Best Tools for Secure Automation

Smart contracts form the backbone of DAO operations, executing governance rules autonomously. Security and efficiency are crucial when developing these contracts. Leading tools for 2025 include:

Solidity – The most widely used programming language for Ethereum-based smart contracts.

OpenZeppelin – A security library for developing standardized and audited smart contracts.

Hardhat – A testing and development framework with debugging features.

Remix IDE – A browser-based tool for writing, testing, and deploying smart contracts.

Truffle Suite – A powerful development environment for Ethereum applications.

DAO dApp Development: Essential Platforms for Building Decentralized Apps

Decentralized applications (dApps) play a key role in DAO ecosystems, offering interfaces for governance, treasury management, and voting. Essential platforms for building DAO-focused dApps include:

Moralis – Provides blockchain API services, reducing development complexity.

Thirdweb – Simplifies smart contract deployment for DAO dApps.

Alchemy – Offers high-performance APIs for blockchain interactions.

IPFS – A decentralized storage solution for DAO-related data.

The Graph – Indexes blockchain data to improve dApp performance.

Which Blockchain Networks Offer the Best Support for DAO Creation?

Selecting the right blockchain network is vital for DAO functionality. These blockchains provide the best infrastructure for DAO development in 2025:

Ethereum – The most popular choice, backed by extensive developer support and security.

Polygon – A layer-2 scaling solution that reduces transaction costs for DAOs.

Solana – Offers high-speed transactions with minimal fees.

Binance Smart Chain (BSC) – Provides an affordable alternative to Ethereum.

Polkadot – Supports interoperability, allowing DAOs to operate across multiple chains.

Malgo is gaining traction for its high-security infrastructure, making it a competitive option for DAO creation.

How No-Code and Low-Code Tools Are Making DAO Development Easier

No-code and low-code solutions are transforming DAO creation, making it accessible to non-developers. These platforms streamline development without requiring deep technical expertise:

DAOhaus – A no-code platform for launching DAOs instantly.

Superfluid – Enables real-time governance token streaming.

Tally – Simplifies on-chain governance implementation.

Gnosis Safe – Offers multi-signature wallet solutions for DAO treasury management.

Clarity – A smart contract language designed for security and ease of use. Malgo provides low-code tools that streamline DAO governance and automation, reducing the technical barriers to entry.

Final Thoughts As DAOs continue to reshape digital governance, selecting the right tools for development is crucial. Get top-tier DAO development services to build your decentralized organization! From governance frameworks to smart contract solutions, the ecosystem offers a variety of powerful platforms to streamline the process. Among these, Malgo stands out as the top DAO development solution, offering innovative features and seamless integrations. Whether building a DAO from scratch or optimizing an existing one, using the best tools ensures efficiency, security, and scalability for long-term success.

#DAODevelopment#DecentralizedGovernance#BlockchainInnovation#SmartContracts#DeFiIntegration#NFTMarketplace

2 notes

·

View notes

Text

Binance clone script — Overview by BlockchainX

A Binance Clone Script is a pre-built, customizable software solution that replicates Binance's features, connect with BlockchainX

What is Binance Clone Script

A Binance clone script refers to the ready-made solution of the Binance platform that deals with core functions parallel to the widely acclaimed cryptocurrency exchange platform associated with Binance. It enables companies to establish their own platforms like Binance, perfectly parameterized in terms of functionality and user interface of world-famous exchanges. The clone script provides display flexibility with built-in functionality such as spot trading software, futures trading configurations, and wallet systems that are extremely secure.

Basically, it reduces development costs and latency because things like these are already built. And as this is a startup for many young entrepreneurs, they can have saved on their capital to expand or grow their business.

The script is blessed as its feature set caters to future demands in the field. One can enjoy a safe trading experience to customers while ensuring that every peculiarity of Binance’s success opens up to investors of the script.

How does the Binance clone script work?

The Binance clone script works to provide a ready-made platform that replicates Binance’s core features, such as user registration, wallet management, trade and enables users to create accounts, deposit or withdraw cryptocurrency, and trade digital assets through an interface easily and safely. The platform supports various trading methods such as market orders, limit orders and forward trading. It has built-in security features like two-factor authentication (2FA) to save the user money. Admin dashboards allow platform owners to manage users, manage tasks, and set up billing. The script can be tailored to your brand, connecting liquidity sources to make trading more efficient. In short, the Binance clone script provides everything needed to create a fully functional crypto exchange.

key features of a Binance Clone Script

The key features of a Binance Clone Script are designed to make your cryptocurrency exchange platform secure, user-friendly, and fully functional. Here’s a simple overview of these features:

User-Friendly Interface

Multi-Currency Support

Advanced Trading Engine

Secure Wallet System

KYC/AML Integration

Admin Dashboard

Security Features

Trading Options

These features help ensure that your Binance-like exchange is efficient, secure, and ready for the growing crypto market.

Technology Stack Used by BlockchainX

Technology stack used for developing the Binance clone script involves the most advanced technology combination that ensures that the platform must have so much security, scalability, and performance to make it a platform that is secure, scalable, and high-performance as well. Here are a few key technologies and their brief descriptions:

Blockchain Technology:

The underlying part of the cryptocurrency exchange is Blockchain because it ensures the safe and decentralized processing of transactions.

Normally executed on either Ethereum or BSC (Binance Smart Chain) to carry out smart contracts and token transfers.

Programming Languages:

Frontend: For frontend, React or Angular could be engaged in actualization of the user interface leading to a responsive and interactive experience on the various devices.

Backend: In backend, languages like Node.js, Python, or Ruby on Rails can be applied on how internal logic is being run by server and arbitration of user interaction with the module is foremost.

Databases:

These two databases, MySQL or Postgresql, are typically used in user information storage, transaction records, and other exchange information.

NoSQL such as MongoDB or other databases might be used for horizontal scalability and high-volume transaction storage.

Smart Contracts:

It is used to generate and send out smart contracts for auto-trading, token generation, and other decentralized functionalities.

Blockchain Wallets:

Fundamentally, this automatically links famous wallet systems such as MetaMask, Trust Wallet, or Ledger for the secure storage and transactions of cryptocurrency.

Advantages of using a Binance Clone Script

Here are the advantages of using a Binance Clone Script:

Faster Time-to-Market

Cost-Effective

Customizable Features

Liquidity Integration

Multiple Trading Options

So, when entering the marketplace of the cryptocurrencies it would be the most possible work of something to pay off at a rapid pace: the Binance Clone Script proves so.

How to Get Started with BlockchainX’s Binance Clone Script

It is quite a straightforward process to begin working with a BlockchainX Binance Clone Script-this involves the first step of getting in touch with the company for an initial consulting period to understand more about what you require, need, or customize for the site, and what your goals are. When BlockchainX has an understanding of your needs, they offer a detailed list of what a proposal would entail before they can start the work; afterward, they will estimate the costs needed to do the project. Once both sides accept both the presentations and all features and timelines are agreed with, BlockchainX starts working on the development process of building a Binance Clone Script tailored to the brand, user interface, and other features.

After the entire platform is created, it passes through severe testing to ensure that everything functions excellently. Deployment follows the thorough test. BlockchainX customizes your user interface and more extensions, after deployment. BlockchainX also commits to supporting and sustaining your exchange so that it runs successfully and securely.

Conclusion:

At the end, your confusion may as well be cut short. Yes, the Binance Clone Script will be a resilient solution to spark up the exchange platforms synthesizing user-generated cryptocurrency dreams in the blockchain, even without bankroll when it comes to developing the app. Turning with BlockchainX expertise, you can make an adjustment and scale a powerful platform stocked with the likes of Binance that produced Blockchains, while still containing some specific set-ups for your masterpiece. More amazing features are exclusive to the clone script, moreover, such as support for multiple currencies, high-end security, real-time data, and a smooth user interface that completes the trading process for your users without any glitch.

This solution gives easy access to ready-made solutions. It could have quality Depending on the time you conveniently let BlockchainX’s be and use both exchanges or any variation of the two permutations. After all, who decides to couple up with a one-experienced Crypto Exchange developer who is struggling to offer anything new.

#binance clone script#binance clone script development#binance clone script development service#blockchain technology#blockchain#cryptocurrency#cryptocurrencies

2 notes

·

View notes

Text

BakerySwap – Platforma DeFi Inovatoare pe Binance Smart Chain

BakerySwap se remarcă ca unul dintre cele mai dinamice exchange-uri descentralizate (DEX) de pe Binance Smart Chain (BSC), aducând o gamă diversificată de servicii financiare descentralizate și funcționalități inovatoare într-un mediu sigur și eficient. Lansată inițial ca un proiect de swap similar cu alte DEX-uri din ecosistemul DeFi, BakerySwap s-a dezvoltat rapid, integrând elemente unice…

#suport tehnic#NFT marketplace#transparență#Parteneriate Strategice#Comunitate Cripto#interfață intuitivă#resurse educaționale#dashboard#token swap#Binance Smart Chain#webinarii#dezvoltare continuă#audit#criptare#BakerySwap#swap-uri rapide#performanță#securitate#blockchain#dex#defi#staking#Inovație.#Exchange Descentralizat#Lichiditate#yield farming"#criptomonede#autentificare multi-factor#contracte inteligente#active digitale

0 notes

Text

Emerging Trends Shaping the Future of White-Label Crypto Exchange Development

The cryptocurrency market has seen exponential growth over the years, and as demand for seamless and feature-rich trading platforms rises, white-label crypto exchange development has become a game-changing solution for businesses. A white-label crypto exchange allows entrepreneurs to quickly launch a customizable trading platform, eliminating the need for extensive development time and resources.

As the crypto landscape evolves, so do the expectations for white-label solutions. In this blog, we’ll explore the future trends shaping white-label crypto exchange development, showcasing how businesses can stay competitive and meet the ever-changing demands of traders.

1. Increased Focus on Decentralized Exchange Features

Decentralized exchanges (DEXs) are becoming increasingly popular due to their security and transparency. As a result, many white-label solutions are integrating DEX functionalities into their offerings.

Key Trends:

Hybrid Models: Combining the security of DEXs with the liquidity of centralized exchanges (CEXs).

Non-Custodial Wallets: Allowing users to trade directly from their wallets without intermediaries.

Smart Contract Integration: Automating trading processes and enhancing security.

Why It Matters:

DEX-like features in white-label solutions cater to the growing demand for privacy and decentralization, attracting a broader user base.

2. Multi-Asset Support and Tokenization

With the rise of tokenized assets and diverse cryptocurrencies, future white-label exchanges will focus on supporting a wide range of assets.

What to Expect:

Support for tokenized stocks, commodities, and real estate.

Integration of emerging blockchain networks like Solana, Avalanche, and Polkadot.

Cross-chain compatibility for seamless trading across multiple blockchain ecosystems.

Impact:

Businesses that offer multi-asset trading options will attract institutional and retail investors seeking diverse investment opportunities.

3. Advanced Security Measures

Security remains a top concern in the crypto industry. Future white-label crypto exchanges will incorporate state-of-the-art security measures to protect user funds and data.

Innovative Security Features:

Multi-Signature Wallets: Ensuring transactions require multiple approvals.

Cold Storage Solutions: Safeguarding the majority of funds offline.

AI-Powered Fraud Detection: Identifying and mitigating suspicious activities in real-time.

End-to-End Encryption: Securing user data and communication.

Why It’s Important:

Enhanced security builds trust, which is crucial for attracting and retaining users in the competitive crypto exchange market.

4. Customizable User Experiences (UX/UI)

As competition grows, user experience (UX) will become a key differentiator. White-label exchanges will prioritize customizable and intuitive interfaces.

Future Developments in UX/UI:

Personalized Dashboards: Allowing users to customize their trading view.

Simplified Onboarding: Streamlining the KYC process for faster registration.

Mobile-First Design: Optimizing platforms for seamless use on smartphones.

Dark Mode and Accessibility Features: Catering to diverse user preferences.

Result:

User-friendly platforms enhance engagement and attract a wider audience, including beginners entering the crypto space.

5. Integration of DeFi Features

Decentralized finance (DeFi) is one of the fastest-growing sectors in the crypto industry. Future white-label solutions will integrate DeFi functionalities to meet user demands for innovative financial services.

Popular DeFi Features:

Staking and Yield Farming: Enabling users to earn passive income.

Lending and Borrowing: Providing decentralized financial services.

Liquidity Pools: Allowing users to earn rewards by providing liquidity.

Why It Matters:

Incorporating DeFi features enhances platform functionality and attracts users looking for diverse earning opportunities.

6. AI and Machine Learning Integration

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the way crypto exchanges operate. Future white-label exchanges will harness these technologies for automation and efficiency.

AI-Powered Features:

Predictive Analytics: Helping users make data-driven trading decisions.

Automated Trading Bots: Enabling high-frequency and algorithmic trading.

Fraud Detection: Identifying suspicious activities and enhancing security.

Outcome:

AI integration improves platform performance and user satisfaction, giving businesses a competitive edge.

7. Compliance and Regulatory Readiness

With governments worldwide tightening regulations on cryptocurrencies, compliance will be a critical factor for future exchanges.

What to Expect:

Automated KYC/AML Processes: Using AI to verify user identities and prevent money laundering.

Transparent Reporting: Providing real-time audit trails for regulators.

Global Regulatory Support: Adapting platforms to comply with regional laws.

Impact:

Regulatory-compliant exchanges inspire confidence among users and attract institutional investors.

8. Gamification in Trading

Gamification is emerging as a strategy to enhance user engagement on trading platforms. Future white-label crypto exchanges will incorporate interactive elements to make trading more engaging.

Gamification Features:

Leaderboards: Highlighting top traders and rewarding performance.

Achievements and Badges: Encouraging users to reach milestones.

Demo Trading: Offering virtual trading environments for beginners.

Why It’s Effective:

Gamification boosts user retention and makes trading enjoyable, particularly for younger demographics.

9. White-Label NFT Marketplaces

The rise of non-fungible tokens (NFTs) has created new opportunities for crypto exchanges. White-label platforms will increasingly support NFT trading and minting.

Key Features:

NFT Minting Tools: Allowing users to create and sell digital assets.

Integrated Marketplaces: Enabling seamless buying and selling of NFTs.

Royalty Management: Automating creator royalties using smart contracts.

Impact:

Businesses that offer NFT capabilities can tap into a growing market and attract creators and collectors alike.

10. Scalability and Performance Optimization

As the user base for crypto exchanges grows, scalability and performance will remain top priorities for white-label solutions.

Enhancements:

Layer-2 Scaling: Using solutions like Polygon for faster and cheaper transactions.

Cloud-Based Infrastructure: Ensuring platform reliability during traffic spikes.

Low Latency Trading: Enabling high-speed transactions for professional traders.

Result:

Scalable platforms can handle larger user bases and higher trading volumes, ensuring a seamless experience for all users.

Why Partner with Professional White-Label Crypto Exchange Development Services?

To stay competitive in the evolving crypto market, partnering with an experienced white-label crypto exchange development company is essential.

Key Benefits:

Custom Solutions: Tailored platforms with unique branding and features.

Quick Launch: Faster time-to-market compared to building from scratch.

Security Integration: Advanced measures to safeguard user funds and data.

Ongoing Support: Regular updates and technical assistance to ensure smooth operations.

Conclusion

The future of white-label crypto exchange development lies in innovation, security, and user-centric features. From integrating DeFi functionalities to offering multi-asset support and gamification, the next generation of white-label solutions will empower businesses to thrive in the competitive crypto space.

By leveraging the latest trends and partnering with professional development services, businesses can launch cutting-edge platforms that attract users, drive engagement, and generate sustainable revenue.

Ready to build your own white-label crypto exchange? The future is now—embrace innovation!

#crypto exchange platform development company#crypto exchange development company#cryptocurrency exchange development service#crypto exchange platform development#white label crypto exchange development#cryptocurrencyexchange#cryptoexchange

3 notes

·

View notes

Text

Top Use Cases of DeFi Beyond Lending and Trading

When most people think about DeFi (Decentralized Finance), lending protocols like Aave and trading platforms like Uniswap immediately come to mind. While these applications have certainly captured the spotlight and billions in total value locked (TVL), the DeFi ecosystem extends far beyond these familiar use cases. As DeFi development continues to evolve, innovative applications are emerging that showcase the true transformative potential of blockchain technology.

Let's explore some fascinating DeFi use cases that are quietly revolutionizing how we think about finance, ownership, and economic participation.

1. Decentralized Insurance Protocols

Traditional insurance relies on centralized companies that often have lengthy claim processes and high overhead costs. DeFi development has introduced parametric insurance protocols that automate claim payouts based on predefined conditions.

Platforms like Nexus Mutual and InsureDAO allow users to purchase coverage for smart contract failures, exchange hacks, or even weather-related events for farmers. What makes this revolutionary is that claims are processed automatically through smart contracts when specific conditions are met – no paperwork, no waiting for approval from insurance adjusters.

For example, a farmer can purchase crop insurance that automatically pays out if rainfall data from verified weather oracles shows drought conditions in their area. This level of automation and transparency simply isn't possible with traditional insurance models.

2. Prediction Markets and Information Discovery

Prediction markets have existed for centuries, but DeFi development has made them more accessible and transparent than ever before. Platforms like Augur and Polymarket allow users to bet on the outcome of real-world events, from election results to sports outcomes.

But here's where it gets interesting: these markets often provide more accurate predictions than traditional polling or expert opinions. When people have financial skin in the game, they tend to research more thoroughly and make more informed decisions. This creates a powerful mechanism for information discovery and consensus-building around uncertain future events.

During the 2020 US elections, prediction markets often provided more accurate odds than traditional polls, demonstrating the wisdom of crowds when properly incentivized.

3. Decentralized Autonomous Organizations (DAOs)

DAOs represent one of the most fascinating applications of DeFi development, enabling completely new forms of organizational structure and governance. These are organizations where decision-making is distributed among token holders rather than centralized in a board of directors.

Popular DAOs like MakerDAO govern multi-billion dollar protocols, while others like PleasrDAO collectively purchase and manage expensive NFTs or intellectual property. Some DAOs focus on funding public goods, others on venture capital investments, and some on social causes.

What's remarkable is how DAOs enable global coordination without traditional corporate structures. A DAO might have thousands of members across dozens of countries, all participating in governance decisions through transparent, on-chain voting mechanisms.

4. Yield Farming and Liquidity Mining

While related to lending and trading, yield farming represents a distinct use case that's worth highlighting. DeFi development has created sophisticated strategies where users can earn returns by providing liquidity to various protocols, often earning multiple types of rewards simultaneously.

Yield farmers might deposit stablecoins into a lending protocol, receive interest plus governance tokens, then stake those governance tokens for additional rewards, and potentially use the deposit receipts as collateral for further strategies. This creates complex but potentially lucrative earning opportunities that simply don't exist in traditional finance.

The psychological appeal is similar to playing a strategy game, but with real financial rewards. It's turned passive investing into an active, engaging experience for many users.

5. Decentralized Identity and Reputation Systems

DeFi development is pioneering new approaches to digital identity that don't rely on centralized authorities. Protocols like Bright ID and Gitcoin Passport create reputation systems based on on-chain activity and social graphs.

These systems enable what's called "progressive decentralization" – users can access better rates, higher borrowing limits, or exclusive opportunities based on their demonstrated on-chain reputation rather than traditional credit scores or Know Your Customer (KYC) processes.

Imagine being able to prove your creditworthiness globally, instantly, and privately, without relying on credit bureaus or banks. That's the promise of decentralized identity systems.

6. Synthetic Assets and Derivatives

DeFi development has enabled the creation of synthetic assets that track the price of real-world assets without requiring direct ownership. Protocols like Synthetix allow users to gain exposure to gold, oil, foreign currencies, or even stock indices, all through blockchain-based tokens.

This is particularly powerful for users in countries with capital controls or limited access to global markets. A user in a developing country can gain exposure to the S&P 500 or gold prices without needing traditional brokerage accounts or navigating complex international banking systems.

7. Decentralized Streaming and Creator Economy

Platforms like Livepeer (decentralized video streaming) and Mirror (decentralized publishing) are using DeFi principles to create new creator economy models. Creators can tokenize their work, allowing fans to directly invest in their success through creator tokens or NFTs.

This creates more direct relationships between creators and their audiences, potentially disrupting traditional media and entertainment industry models. A musician might issue tokens that give holders access to exclusive content, merchandise discounts, or even revenue sharing from future albums.

The Future of DeFi Development

These diverse use cases demonstrate that DeFi development is about much more than replacing traditional banking services. It's about creating entirely new economic primitives and social coordination mechanisms that weren't possible before blockchain technology.

As DeFi development continues to mature, we can expect to see even more innovative applications emerge. The key insight is that DeFi isn't just digitizing existing financial services – it's enabling completely new forms of economic interaction and value creation.

The most exciting part? We're still in the early stages. As more developers, users, and capital flow into the space, the potential for innovative DeFi applications seems limitless. Whether you're a developer, investor, or simply curious about the future of finance, keeping an eye on these emerging use cases will help you understand where the industry is heading.

The question isn't whether DeFi will continue to expand beyond lending and trading – it's what new possibilities will emerge next.

#gaming#mobile game development#multiplayer games#metaverse#nft#blockchain#vr games#game#unity game development

1 note

·

View note

Text

STON.fi: The Future of Decentralized Trading on TON Blockchain

In a world where control over your finances is more important than ever, STON.fi steps up as the leading decentralized exchange (DEX) on The Open Network (TON) blockchain. It’s not just about trading; it’s about empowering you to take full control of your digital assets. Let’s break it down into simple, relatable terms.

What Makes STON.fi Special

Have you ever traded crypto and worried about losing access to your funds? Or felt frustrated by slow, costly transactions? STON.fi solves these problems by letting you trade directly without intermediaries. You control your private keys, ensuring your funds are always safe.

With advanced tech like Request for Quote (RFQ) protocols and Hashed Timelock Contracts (HTLC), STON.fi guarantees quick, transparent, and secure transactions. You’re either getting exactly what you agreed on, or the trade doesn’t happen. No middlemen, no surprises.

Trade Made Simple: Swapping TON-Based Tokens

Imagine swapping one crypto for another without the hassle of converting to fiat first. That’s what STON.fi offers. You can trade $TON for other TON-based tokens with ease, all while enjoying low fees (just 0.3% per trade).

Here’s the kicker: when you trade, part of the fee goes back to liquidity providers, meaning the community benefits as a whole.

Earning Opportunities on STON.fi

Who doesn’t love making their money work for them? STON.fi offers several ways to earn:

1. Provide Liquidity: By adding your tokens to liquidity pools, you earn rewards based on your contribution.

2. Farming: Stake LP tokens to get even more rewards from specific pools.

3. STONbassador Program: Promote STON.fi and earn for helping the platform grow.

Meet the $STON Token

Think of $STON as the backbone of the STON.fi ecosystem. It’s used for governance, gas fees, and transactions. Plus, it has a limited supply of 100 million, making it a valuable asset over time.

STON.fi takes community seriously. That’s why half of all $STON tokens are reserved for the DAO (Decentralized Autonomous Organization). This means you get a say in how the platform evolves, from deciding new features to choosing supported assets.

For Builders: The STON.fi SDK & Grants

Are you a developer? STON.fi has something for you too. Their SDK (Software Development Kit) makes it easy to integrate wallets, exchanges, and games into the platform. And if you have a great idea, the STON.fi grant program can fund you with up to $10,000 USDT.

The Future: STON.fi V2

STON.fi isn’t just about today; it’s building for tomorrow. Here’s what’s coming:

Multi-Chain Integration: Trade across networks like Polygon and EVM-compatible chains.

Telegram Bot for Cross-Chain Swaps: Trade assets directly from your Telegram app.

Margin Trading: Use borrowed funds to amplify your trades.

STON.fi is committed to staying ahead of the curve, making it the go-to platform for traders, developers, and crypto enthusiasts alike.

Why STON.fi

STON.fi isn’t just a DEX; it’s a complete ecosystem designed to make trading simple, secure, and rewarding. Whether you’re looking to trade, earn, or build, STON.fi has the tools and opportunities you need to thrive in the decentralized world.

Ready to take control of your crypto journey? Explore STON.fi today and see the difference.

#Crypto #DeFi #STONfi #TONBlockchain

2 notes

·

View notes

Text

Polygon zkEVM Bridge: A Revolutionary Step Toward Seamless Blockchain Interoperability

The Polygon zkEVM Bridge is set to redefine blockchain interoperability by combining the power of Polygon’s scalability with the groundbreaking capabilities of zero-knowledge proof technology. Unlike traditional bridges, the zkEVM Bridge emphasizes speed, security, and efficiency, making it a game-changer for decentralized finance (DeFi), gaming, and cross-chain asset transfers.

This article explores how the Polygon zkEVM Bridge is shaping the future of blockchain connectivity and why it’s an essential innovation in the decentralized ecosystem.

What Makes the Polygon zkEVM Bridge Unique?

Bridges have always played a crucial role in connecting disparate blockchain networks, but they often face challenges like high gas fees, slow transaction times, and security vulnerabilities. The Polygon zkEVM Bridge addresses these pain points by leveraging zero-knowledge proof technology to offer a seamless and secure cross-chain experience.

Key Features:

Instant Finality: Transactions are processed almost instantly without compromising on security.

Lower Gas Fees: zkEVM significantly reduces computational costs, translating into lower fees for users.

Ethereum Compatibility: Full compatibility with Ethereum means that applications and tokens can seamlessly interact across networks.

For a deeper dive into zkEVM technology, check out the Polygon Technology blog.

How zkEVM Enhances Blockchain Connectivity

1. Optimized Cross-Chain Interactions

The Polygon zkEVM Bridge eliminates the inefficiencies of traditional bridges by validating transactions off-chain and posting only the proofs on-chain.

Why It Matters:

Reduces network congestion.

Improves scalability without sacrificing security.

Makes DeFi and NFT interactions faster and more cost-effective.

2. Enhanced Security with Zero-Knowledge Proofs

Zero-knowledge proofs allow one party to prove the validity of a transaction without revealing unnecessary information.

Impact on Security:

Minimizes the risk of exploits often associated with traditional bridges.

Ensures data privacy, making it ideal for sensitive transactions.

Applications of the Polygon zkEVM Bridge

1. Transforming DeFi Strategies

DeFi users can transfer assets between Ethereum and Polygon’s zkEVM seamlessly, enabling advanced strategies such as arbitrage, yield farming, and liquidity provisioning.

Example Use Case: A trader can take advantage of price discrepancies between Ethereum and Polygon-based DEXs without incurring high fees or long delays.

2. Powering GameFi Ecosystems

Game developers can now integrate assets and NFTs across Polygon and Ethereum, creating unified economies for blockchain games.

Why It’s Revolutionary:

Players can trade in-game assets on Ethereum marketplaces while enjoying low-cost gameplay on Polygon.

Developers gain access to a larger pool of users and liquidity.

3. Expanding Multi-Chain NFT Markets

NFT creators can mint on Polygon zkEVM for cost efficiency and list their assets on Ethereum for greater visibility and liquidity.

Benefits for Creators and Collectors:

Lower minting and transfer fees.

Access to high-value Ethereum marketplaces like OpenSea.

Polygon zkEVM Bridge vs. Traditional Bridges

FeatureTraditional BridgesPolygon zkEVM BridgeTransaction SpeedSlow during congestionNear-instant with zk-proofsGas FeesHigh on EthereumSignificantly reducedSecurityVulnerable to exploitsEnhanced with zero-knowledge proofsCompatibilityLimited cross-chain utilityFull Ethereum compatibility

The Polygon zkEVM Bridge clearly outpaces its predecessors, offering superior performance across all key metrics.

Challenges Addressed by the Polygon zkEVM Bridge

1. Bridging Delays

Traditional bridges often suffer from long wait times, especially during high network congestion. The zkEVM Bridge ensures instant finality, eliminating this issue.

2. High Gas Costs

Ethereum’s gas fees are a known barrier for users. By offloading computational tasks to the zkEVM layer, the bridge drastically reduces costs.

3. Lack of Interoperability

Unlike older solutions, the zkEVM Bridge ensures full compatibility with Ethereum, making it easier for developers to create multi-chain applications without rewriting smart contracts.

The Future of Polygon zkEVM Bridge

The Polygon zkEVM Bridge is not just a technological upgrade; it represents a paradigm shift in how blockchains interact. Future enhancements are expected to include:

Multi-Chain Support: Connecting not just Ethereum but other Layer 2 solutions like Arbitrum and Optimism.

Integration with DeFi Aggregators: Enabling users to perform cross-chain DeFi operations from a single dashboard.

Institutional Adoption: The bridge’s security and efficiency make it an attractive option for institutional players exploring blockchain interoperability.

Stay tuned for updates by following the Polygon Technology announcements.

Why Polygon zkEVM Bridge Matters

The Polygon zkEVM Bridge is more than a tool—it’s a cornerstone for the future of blockchain interoperability. Whether you’re a DeFi strategist, an NFT collector, or a GameFi developer, the bridge offers unmatched speed, security, and efficiency, making cross-chain interactions effortless.

Explore the possibilities of the Polygon zkEVM Bridge today by visiting the Polygon Bridge and take the first step toward a seamless multi-chain future.

2 notes

·

View notes

Text

Solana's Secret Weapon: How it Dethroned BNB

Solana Surged Past BNB Chain, Claiming Fourth Spot in Global Market Cap Rankings Last Week.

Solana has been making waves in the cryptocurrency world, consistently surpassing Ethereum

in daily decentralized exchange (DEX) trading volume. This trend, coupled with innovations in

decentralized physical infrastructure networks (DePINs), signals a potential shift in the crypto

landscape that could have far-reaching implications.

Key Highlights:

● Solana overtook BNB chain in Market Cap this week, making them fourth place in the

overall global market cap

● Solana overtook Ethereum in DEX volume again, with $848.71 million compared to

Ethereum's $778.66 million on July 1, 2024.

● Firedancer, a new high-performance validator client, promises to boost significantly

Solana's transaction processing capabilities .

● Solana's low fees and high efficiency are driving its growing popularity.

● Innovations in DePINs, like those proposed by Koii Network, could further accelerate this

trend.

Solana's Rising Dominance

The latest data shows Solana surpassing Ethereum in daily DEX trading volume, with $848.71

million compared to Ethereum's $778.66 million on July 1, 2024. This "flipping" event is

becoming more frequent, occurring approximately every 10 days in recent months. This

increased frequency suggests a growing shift in user preference and network activity. Moreover,

Solana has received a great deal of interest from institutional investors as a potential candidate

for the launch of a future spot ETF.

Solana's appeal lies in its low transaction fees and high efficiency, making it more

capital-efficient for traders. This efficiency allows for profitable trades at lower values and

enables high-frequency trading, contributing to higher overall volumes.

#DePIN - The Decentralized Infrastructure Revolution

While Solana's growth is impressive, innovations in DePINs could further accelerate this trend

and reshape the entire blockchain landscape. The Koii Network, for example, proposes novel

solutions to enhance scalability and reliability of decentralized networks by leveraging consumer

computing capacity.

Koii introduces two key innovations:

1. SCALEs (Succinct Curated Acyclic Ledger Extensions): These efficient large archives

are event streams with dynamic audits and incentives, addressing blockchain scalability

challenges.

2. CARP (Compute Attribution and Reputation Protocol): This standardizes reputation

management to boost network security and reduce audit inefficiencies.

The above innovations have the capacity to support a wide range of decentralized applications,

from streaming services to AI-driven search engines and uncensorable social platforms. By

tapping into underutilized and idle consumer hardware resources, they aim to create a more

efficient and equitable digital economy.

KOII: A Fork Built on Solana's Strengths

Recognizing Solana's potential, KOII, an innovative blockchain project, has forked the Solana

codebase to create its own unique ecosystem. KOII's decision was influenced by Solana's Proof

of History consensus mechanism, which provides an excellent framework for DePIN

applications. The recent growth of the Solana ecosystem further validates KOII's choice.

However, KOII isn't just a Solana clone. It has introduced several key differences that set it

apart:

1. Leveraging Consumer Hardware: KOII taps into the vast potential of consumer devices,

creating a more decentralized and accessible network.

2. Multi-Token Support: Unlike many blockchain networks, KOII allows users to pay fees in

various tokens, supporting a diverse ecosystem.

3. Shorter Epoch Time: This feature enables faster network updates and more responsive

governance.

4. Off-chain Storage Integration: KOII reduces on-chain data load by integrating with

off-chain storage solutions, enhancing scalability.

5. Flexible Smart Contracts: KOII's smart contract system offers greater flexibility, allowing

for more complex and diverse applications.

6. Minimal On-chain Data Load: By utilizing off-chain hooks, KOII minimizes the amount of

data stored directly on the blockchain, improving efficiency and reducing costs.

While Koii has been up and running for a couple years, their whitepaper is still one of the best

ways to learn more about how this fits into the broader Solana landscape. Read more here:

koii.network/whitepaper

Firedancer: Boosting Solana's Potential

Solana's rising dominance is further bolstered by the development of Firedancer, a new

high-performance validator client. Created by Jump Crypto, Firedancer aims to dramatically

increase Solana's transaction processing capabilities, potentially handling over 1 million

transactions per second.

This significant upgrade not only enhances Solana's appeal as a leading Layer 1 blockchain but

also addresses the network's need for client diversity. By providing a fourth validator client

option, Firedancer strengthens Solana's resilience against bugs, code exploits, and attacks,

positioning it to better compete with other top cryptocurrencies. The introduction of Firedancer

could be a game-changer in Solana's quest to challenge Ethereum's dominance in the DeFi

space

Future Implications

The rise of Solana and the development of new decentralized infrastructure technologies point

to a future where blockchain networks can handle greater transaction volumes (i.e., TPS) with

increased efficiency. This could lead to:

1. More competitive DEX environments, potentially driving down costs for users.

2. Increased adoption of decentralized finance (DeFi) applications due to lower barriers to

entry.

3. The emergence of new types of dApps that were previously unfeasible due to scalability

limitations.

However, it's important to note that Ethereum still maintains a significant lead in total value

locked (TVL) and overall ecosystem size. Ethereum's TVL stands at $59 billion compared to

Solana's $4.5 billion, indicating that Ethereum's dominance in the broader DeFi landscape

remains strong.

Conclusion

As Solana continues to gain ground on Ethereum in terms of DEX volume, and newtechnologies like Koii's SCALEs and CARP emerge, we may be witnessing the early stages of a

major shift in the blockchain and cryptocurrency landscape. These developments could lead to

more efficient, scalable, and user-friendly decentralized networks, potentially accelerating the

adoption of blockchain technology across various sectors.

For those interested in being part of this revolution, there are two primary ways to get involved, one of which is

1. Run a KOII Node: Contribute to the network's decentralization and earn rewards.

As the blockchain landscape evolves, Solana's rise and its influence on projects like KOII

showcase the dynamic nature of the crypto ecosystem. The flippening of BNB may just be the

beginning of Solana's journey to the top, with far-reaching implications for the future of

decentralized technologies.

However, it's crucial to remember that the crypto market is highly volatile and that Ethereum's

established ecosystem and ongoing upgrades could help it maintain its leading position. As

always, investors and users should conduct thorough research and consider the risks before

participating in any cryptocurrency-related activities.

#solana#fire dancer#scalability#proof of history#TPS#Rust#blockchain#blockchain development#defi#Depin#scale#CARP#Market cap#BNB#cryptocurrency

2 notes

·

View notes

Text

Discover the Skinny Bob MemeCoin: NFTs, Multi-Chain, and Cosmic Humor

🛸Inspired by the internet’s favorite extraterrestrial, Skinny Bob MemeCoin is revolutionizing the cryptosphere across multiple blockchains! This isn’t just another token – it’s a cosmic journey into the heart of meme culture, blockchain innovation, and NFT collectibles. Why Skinny Bob? A galactic community spanning Ethereum, Polygon, and BNB Chain No taxes – keeping it simple and…

2 notes

·

View notes