#net asset value (nav) calculation

Explore tagged Tumblr posts

Text

Marketing 101 | For Emerging Managers

Inviting all emerging managers to join this amazing webinar. Secure your spot now: https:https:https://webinar.fundtec.in/meeting/register?sessionId=1336937368

#accounting#financial reporting#finance#investor services#fund administration#crypto business#net asset value (nav) calculation

1 note

·

View note

Text

What Is The Meaning Of NAV In Mutual Funds?

Navigating the world of mutual funds can be a daunting task, especially for beginners. Among the many terms and acronyms, "NAV" stands out as one of the most commonly used yet misunderstood terms. In this blog post, we'll demystify NAV in mutual funds and explain its significance in your investment journey.

Understanding NAV:

NAV, or Net Asset Value, is a fundamental concept in the world of mutual funds. It represents the per-unit market value of a mutual fund scheme's assets on a specific date. Essentially, it tells you what one unit of the fund is worth at a particular moment. But what does that really mean?

Calculation of NAV:

The calculation of NAV is straightforward. It involves two primary components: assets and liabilities.

Assets: These are the investments held by the mutual fund. This can include stocks, bonds, cash, and other securities. The total value of these assets is calculated daily.

Liabilities: These are the expenses and debts associated with managing the mutual fund. This can include management fees, administrative expenses, and other costs.

The formula for calculating NAV is as follows:

\[NAV = \frac{Total Value of Assets - Total Value of Liabilities}{Number of Outstanding Units}\]

Importance of NAV:

1. Price Determination: NAV is used to determine the price at which investors can buy or sell units of a mutual fund. When you invest in a mutual fund, you are essentially buying units at the current NAV.

2. Performance Evaluation: NAV also serves as a measure of a mutual fund's performance. Investors can track the changes in NAV over time to assess how well the fund is doing.

3. Comparing Funds: NAV allows investors to compare the prices of different mutual funds. However, it's essential to note that a higher NAV does not necessarily mean a better fund. What matters is the fund's performance relative to its NAV.

NAV and Mutual Fund Types:

It's important to understand that the significance of NAV can vary depending on the type of mutual fund:

1. Open-End Funds: These funds continuously issue and redeem units at their NAV. Investors buy and sell units at the NAV price, which is calculated at the end of each trading day.

2. Closed-End Funds: These funds have a fixed number of shares that are traded on stock exchanges. The market price of closed-end fund shares may be at a premium or discount to their NAV.

NAV and Market Fluctuations:

The NAV of a mutual fund can fluctuate daily due to changes in the value of its underlying investments. Factors such as market conditions, interest rates, and the performance of the fund's assets can impact NAV. During a market downturn, the NAV may decrease, and during a bull market, it may increase.

Conclusion:

In summary, NAV, or Net Asset Value, is a crucial concept in the world of mutual funds. It represents the per-unit market value of a mutual fund and is used for pricing and performance evaluation. Understanding NAV is essential for investors looking to make informed decisions about their mutual fund investments. It's a valuable tool that provides insight into the financial health and performance of a mutual fund, helping investors navigate the world of investing with confidence.

As you explore mutual fund investments, keep a close eye on the NAV, but remember that it's just one piece of the puzzle. A well-rounded investment strategy should consider factors like the fund's objectives, past performance, and fees in addition to the NAV. Happy investing!

3 notes

·

View notes

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

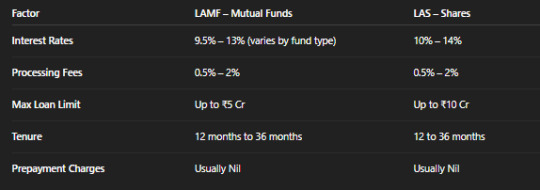

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

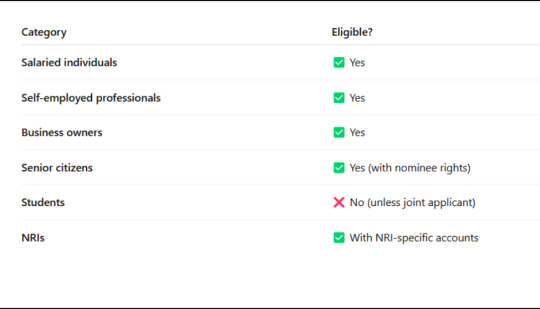

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

Mutual Fund vs ETF: What’s the Difference and Which Is Better for You?

If you’re planning to grow your wealth smartly, you've likely come across the terms mutual fund and ETF (Exchange-Traded Fund). While both are popular choices for retail and institutional investors alike, the mutual fund vs etf debate is crucial for making informed investment decisions especially in 2025 when financial markets are more dynamic than ever. Partnering with a trusted SIP distributor in Gurgaon can also help you navigate these options with greater clarity and confidence.

In this comprehensive guide, we break down the mutual fund vs ETF puzzle with real-world context, easy comparisons, and actionable tips to help you decide what works best for your goals.

What Are Mutual Funds and ETFs?

Both mutual funds and ETFs are types of pooled investment vehicles. This means your money is combined with that of other investors and managed by professionals who buy and sell assets like stocks, bonds, or other securities.

But here’s where the differences begin:

Mutual Funds are priced once daily after market close. You purchase or redeem units at the Net Asset Value (NAV).

ETFs, on the other hand, trade like stocks on the exchange and can be bought or sold throughout the trading day.

ETF vs Mutual Fund Comparison: Key Differences at a Glance

Still wondering how to differentiate between mutual funds and ETFs? Here’s a quick breakdown:

Trading Flexibility

Mutual Funds: Bought or sold only once a day after market close, at the day’s NAV (Net Asset Value).

ETFs: Can be traded anytime during market hours like regular stocks, offering more flexibility.

Expense Ratio

Mutual Funds: Typically have higher expense ratios due to active fund management.

ETFs: Generally lower cost, especially in passively managed ETFs.

Minimum Investment

Mutual Funds: You can start with as little as ₹500–₹1000 through SIPs.

ETFs: You need to buy at least one unit, and the price depends on the ETF's market value.

Tax Efficiency

Mutual Funds: Can trigger capital gains taxes due to frequent internal trading by the fund manager.

ETFs: Usually more tax-efficient because of the “in-kind” redemption mechanism.

Liquidity

Mutual Funds: Less liquid; transactions settle after NAV is calculated.

ETFs: Highly liquid; you can enter or exit your position anytime during market hours.

These key points offer a solid etf vs mutual fund comparison that can guide your next investment move.

Which One Should You Choose?

The answer depends on your investing style and financial goals:

Choose Mutual Funds if:

You prefer automated SIPs and long-term wealth building

You value professional fund management

You want exposure to tax-saving schemes like ELSS

Choose ETFs if:

You are a cost-conscious investor

You prefer real-time control over trades

You want diversification with flexibility

As a leading SIP distributor in Gurgaon, we’ve seen that hybrid investors—those who allocate funds to both options—often enjoy a more balanced, resilient portfolio.

What’s the difference between mutual funds and ETFs? Mutual funds are bought at day-end NAV and are ideal for SIP-based investing, while ETFs trade like stocks and offer real-time flexibility with lower fees.

Real-Life Use Case

Take Ritika, a 30-year-old marketing manager from Gurugram. She uses a mutual fund for her tax-saving ELSS and long-term SIP, while investing in ETFs for short-term market exposure. Her approach balances automation with control—exactly what most modern investors aim for.

2025 Market Trends to Note

India’s ETF market is growing at 35% YoY, led by investor demand for low-cost options.

AMFI data shows that SIP inflows hit a record ₹19,000 crore/month as of March 2025.

SEBI’s push for investor awareness is increasing accessibility to both options.

So, it’s not just about mutual fund vs etf, but about aligning the product with your life stage, risk tolerance, and tax considerations.

Final Thoughts

The mutual fund vs ETF decision shouldn’t stress you out. Instead, think of it as selecting the best tools for different financial goals. Diversification doesn't mean choosing one over the other—it means using both wisely.

Ready to Make Smarter Investment Decisions

Still unsure about the right investment route for your goals? At BellWether, we don't just sell financial products—we help you build wealth strategies that work in real life. Whether you're keen on SIPs or intrigued by ETFs, our experts will help you create a custom plan suited to your needs.

5 Unique FAQs

1. Can I invest in both mutual funds and ETFs at the same time? Absolutely. Many investors use a blended approach—mutual funds for long-term SIPs and ETFs for tactical plays. This helps diversify risk and improve liquidity access.

2. Are ETFs suitable for beginners? Yes, especially passive ETFs that track indices like Nifty 50 or Sensex. Just ensure you have a Demat account, as ETFs trade like stocks.

3. Do mutual funds have lock-in periods? Some do. For example, ELSS mutual funds have a 3-year lock-in. But many open-ended funds are flexible and can be redeemed anytime post minimum holding.

4. Which is better during market volatility: ETF or mutual fund? Mutual funds with professional fund managers might perform better in volatile markets due to active decision-making. ETFs, however, offer real-time exit opportunities.

5. Do SIPs work with ETFs? Not directly. Most platforms don’t allow SIPs into ETFs yet. But you can manually invest a fixed amount monthly in ETFs to mimic SIP-style discipline.

#mutual fund vs etf#etf vs mutual fund comparison#SIP distributor in Gurgaon#invest smartly#passive investing India#financial planning India

0 notes

Text

How to Check Mutual Fund Performance: A Beginner’s Guide

How to Check Mutual Fund Performance

Introduction to Mutual Funds

Mutual funds are one of the simplest and most popular ways to grow wealth. They pool money from investors and invest in a mix of stocks, bonds, or other securities. But just like you check your phone’s battery or car’s mileage, you need to regularly track how your mutual fund is doing.

Why Checking Fund Performance is Important

Would you drive a car without a fuel gauge? Probably not. The same logic applies to your investments. Regularly checking a fund’s performance ensures your money is growing in the right direction and helps you decide whether to hold, switch, or exit.

Key Metrics to Track Mutual Fund Performance

Net Asset Value (NAV)

The NAV represents the per-unit price of a mutual fund. It changes daily based on market movements and reflects the fund’s current market value. But NAV alone doesn’t indicate performance — it should be compared with past NAVs or benchmarks.

Historical Returns (1-Year, 3-Year, 5-Year)

Look at how the fund performed over different time frames:

1-year return shows short-term trends.

3-year and 5-year returns reflect long-term consistency.

Expense Ratio

This is the fee charged by fund managers, expressed as a percentage. Lower expense ratios mean you keep more of your returns.

Risk Ratios

Sharpe Ratio: Higher is better, showing better risk-adjusted returns.

Standard Deviation: Indicates volatility. Lower is more stable.

Beta: Measures fund movement compared to the market. A beta of 1 means it moves in line with the market.

Alpha and Benchmark Comparison

Alpha shows a fund’s performance compared to its benchmark. A positive alpha means the fund outperformed its benchmark.

Tools and Platforms to Check Mutual Fund Performance

AMFI (Association of Mutual Funds in India)

Visit amfiindia.com for official mutual fund data, NAV updates, and performance charts.

Fund House Websites

Every mutual fund company publishes detailed performance reports and factsheets on their official sites.

Mobile Apps

Apps like Groww, Kuvera, and Paytm Money provide instant fund performance tracking, SIP returns, and portfolio analysis.

Financial News Websites

Sites like Moneycontrol, Value Research, and ET Money offer fund ratings, comparison tools, and insights.

How to Analyze SIP Performance

Tracking SIP returns is slightly different:

Check CAGR (Compounded Annual Growth Rate) for overall performance.

Use SIP calculators available on most apps and websites.

Compare SIP returns with lump sum returns for better insights.

Understand Portfolio Holdings and Sector Allocation

See where your money is invested — sectors, stocks, or bonds. Funds heavily concentrated in one sector can be riskier.

Interpreting Risk-Return Trade-Off

High returns often come with high risk. A balanced risk-return ratio is ideal for steady wealth creation.

How to Compare Similar Category Funds

Never compare a small-cap fund with a large-cap fund. Always compare funds within the same category (e.g., large-cap funds) using:

Returns over the same period

Risk ratios

Expense ratios

Red Flags to Watch in a Mutual Fund’s Performance

Consistent underperformance against benchmarks and category peers

High expense ratio

Sudden changes in fund management

Low asset size (AUM) for equity funds

Should You Exit if a Fund is Underperforming?

Not always. Analyze if it’s a short-term market phase or a genuine fund issue. Stay invested if the fundamentals are strong.

Common Mistakes in Tracking Fund Performance

Looking only at recent returns

Ignoring expense ratio

Not comparing against the right benchmark

Panic selling during market corrections

Tips for Long-Term Mutual Fund Tracking

Check performance quarterly or bi-annually

Focus on consistency, not just returns

Review SIPs annually

Monitor changes in fund objectives or management

Real-Life Example: How Tracking Saved an Investor from Losses

Amit invested ₹2 lakhs in an equity fund that performed well initially but started lagging behind its category and benchmark for 18 months. Regularly tracking his fund’s return and risk metrics, he switched to a better-performing fund, saving himself from an eventual 15% dip.

Final Thoughts

Regularly tracking your mutual fund performance ensures your financial goals stay on course. Use a mix of official sites, apps, and financial news platforms to stay updated. Always remember — patience is key, but blind patience can be costly. Stay informed, stay invested.

FAQs

Q1: How often should I check my mutual fund performance? Once every 3-6 months is ideal, unless market conditions or personal financial goals demand sooner.

Q2: Is NAV enough to judge a mutual fund? No, NAV alone isn’t enough. Compare historical returns, risk ratios, and benchmarks.

Q3: Which tools are best for tracking mutual fund performance? AMFI, Moneycontrol, Groww, and Value Research are among the best.

Q4: What does a high Sharpe Ratio mean? It means better risk-adjusted returns — a good sign for a mutual fund.

Q5: Can I switch mutual funds if it underperforms? Yes, but only after reviewing the reasons for underperformance and assessing alternative options.

0 notes

Text

How Businesses Should Handle Valuation Under the Income Tax Act

Proper Valuation Under the Income Tax Act is not just a legal requirement—it's a strategic tool for businesses to ensure compliance, avoid litigation, and drive accurate financial planning. Whether you’re a startup raising funds, a company undergoing restructuring, or a business facing scrutiny from tax authorities, getting your valuation right is essential.

In this article, we’ll explore how businesses should approach valuation in the context of the Income Tax Act, the key methodologies involved, and common challenges to avoid.

Understanding the Need for Valuation Under the Income Tax Act

Valuation under the Income Tax Act becomes relevant during several key business transactions, such as:

Issue of shares (Section 56(2)(viib)): Especially in startups and private companies issuing shares at a premium.

Transfer of assets or shares: Involving capital gains (Section 50CA and 50D).

Mergers, acquisitions, or restructuring: To determine fair market value (FMV) for taxation purposes.

Wealth declaration and scrutiny assessments: Where the assessing officer may question the declared value.

The objective of these valuations is to determine a fair and accurate representation of an entity's worth, ensuring that income, gains, or losses are taxed appropriately.

Key Provisions Governing Valuation Under the Income Tax Act

Valuation Under the Income Tax Act for Share Issuance – Section 56(2)(viib)

When a closely held company issues shares to a resident at a price exceeding the fair market value, the excess may be treated as income from other sources and taxed accordingly. This anti-abuse provision aims to curb the practice of laundering black money through inflated valuations.

To determine FMV, businesses can choose either:

Net Asset Value (NAV) Method

Discounted Cash Flow (DCF) Method

The choice of method must be justified with proper documentation and ideally backed by a Category I Merchant Banker valuation report.

Transfer of Shares – Section 50CA

When shares of an unlisted company are transferred for consideration lower than the FMV, the FMV is deemed to be the sale consideration for capital gains computation. This clause ensures capital gains aren’t avoided by under-reporting sale value.

The Valuation Under the Income Tax Act here must be based on recognized methods—typically involving a certified merchant banker or a chartered accountant following prescribed guidelines.

Valuation for Capital Gains – Section 50D

In scenarios where consideration is not determinable, like in barter transactions or asset exchanges, Section 50D applies. It mandates that the FMV of the asset transferred will be considered the sale value.

Acceptable Valuation Methods Under the Income Tax Act

Understanding acceptable valuation methodologies is crucial for businesses to comply with tax norms and avoid disputes. These include:

1. Net Asset Value (NAV) Method

This method calculates the value of a business based on the net assets recorded in its books. While straightforward, NAV is more suited for asset-heavy companies and may not reflect true value for tech or service-based firms.

2. Discounted Cash Flow (DCF) Method

DCF is a forward-looking method that estimates value based on projected future cash flows discounted to present value. It’s widely used in startup valuations and is accepted by tax authorities if backed by reasoned assumptions and certified reports.

3. Comparable Company Multiple (CCM) Method

Although not specifically mentioned under the Act, this method is useful during litigation or in determining arm’s length pricing for transfer pricing cases.

Compliance Tips for Valuation Under the Income Tax Act

Preparing Documentation

Ensure that all assumptions, methodologies, and calculations used in the valuation are documented thoroughly. A proper valuation report from a Category I Merchant Banker or qualified CA can be vital.

Consistency Across Reporting

The valuation used for tax purposes should align with that used for other statutory or financial reporting, like under Companies Act or FEMA, unless justifiable differences exist.

Maintain Forecast Integrity

Especially when using the DCF method, ensure your cash flow projections are realistic and based on verifiable data. Overly aggressive forecasts can lead to tax disputes and potential penalties.

Common Mistakes Businesses Make in Valuation Under the Income Tax Act

1. Ignoring Regulatory Changes

Tax provisions related to valuation are dynamic. Failing to stay updated on the latest notifications and CBDT circulars can result in non-compliance.

2. Overstating or Understating Valuation

Artificial inflation or deflation of valuation—either to attract investors or reduce tax liability—can attract heavy scrutiny under Sections 56, 50CA, and 50D.

3. Inadequate Professional Advice

Valuation is not just a number; it’s a strategic and legal exercise. Engaging qualified valuation professionals ensures accuracy and defensibility.

Consequences of Incorrect Valuation Under the Income Tax Act

Failing to adhere to proper valuation protocols can lead to:

Tax demand notices and penalties

Disallowance of share premium as income

Litigation with income tax authorities

Loss of investor confidence

In severe cases, incorrect valuation may be interpreted as a willful attempt to evade tax, inviting prosecution under relevant sections.

Best Practices for Handling Valuation Under the Income Tax Act

Engage a Registered Valuer or Category I Merchant Banker

Particularly when mandated under Section 56(2)(viib).

Conduct Periodic Valuations

Especially useful for fast-growing startups where FMV can change rapidly.

Keep Stakeholders Informed

Ensure that internal finance teams, auditors, and legal advisors are aligned.

Reconcile Valuation for Multiple Authorities

Valuation under FEMA, Companies Act, and Income Tax Act can differ; proper reconciliations should be maintained.

Conclusion

Handling Valuation Under the Income Tax Act is not merely a compliance checkbox—it’s a vital component of responsible business management. Accurate valuations protect businesses from tax pitfalls, ensure smooth investor relations, and uphold corporate credibility.

By staying updated on regulatory expectations, adopting best practices, and consulting qualified professionals, businesses can navigate the valuation landscape with confidence and clarity.

0 notes

Text

The Ultimate Guide to Understanding Mutual Fund NAV and Returns

Introduction If you're stepping into the world of mutual fund investing, one term you'll come across frequently is Net Asset Value (NAV). For many investors, especially beginners, NAV can seem like a confusing number—some even believe that a low NAV means a fund is cheaper or better. This is a common myth.

In reality, NAV is simply the per-unit value of a mutual fund and has little to do with the fund's performance or quality. Understanding how NAV works is key to making smarter, well-informed investment decisions.

In this guide from Zebu, we’ll break down everything you need to know about NAV, how it’s calculated, what affects it, and how it relates to your investment returns.

1. What is NAV (Net Asset Value)? Definition of NAV NAV is the per-unit price of a mutual fund, calculated as:

NAV=Total Assets – Total Liabilities Total Outstanding Units NAV= Total Outstanding Units Total Assets – Total Liabilities It reflects the current market value of each unit of the mutual fund.

How NAV Works in Mutual Funds When you invest in a mutual fund, you buy units at the current NAV.

Example: If NAV is ₹10 and you invest ₹10,000, you receive 1,000 units.

If the NAV rises to ₹15 in a year, your investment becomes ₹15,000.

Important: NAV is just the entry or exit price. It does not determine how much the fund will grow.

2. How is NAV Calculated? NAV is calculated at the end of each trading day based on the value of the underlying assets.

NAV=Market Value of All Securities + Cash Holdings – Liabilities Total Outstanding Units NAV= Total Outstanding Units Market Value of All Securities + Cash Holdings – Liabilities Example: Market value of holdings: ₹500 crore

Cash: ₹10 crore

Liabilities: ₹5 crore

Units: 50 crore

NAV=(500+10–5)50 =₹10.10 NAV= 50(500+10–5) =₹10.10 With Zebu’s real-time tracking tools, you can monitor NAV updates with precision.

3. The Relationship Between NAV and Mutual Fund Performance Myth: Lower NAV = Cheaper Fund This is incorrect. NAV only tells you the per-unit price, not whether a fund is a good investment.

Example:

Fund A (NAV ₹10) grows 20% → NAV becomes ₹12

Fund B (NAV ₹100) grows 20% → NAV becomes ₹120

Both deliver the same 20% return.

Zebu’s fund comparison features help debunk such myths and guide you towards better decisions.

4. What Factors Affect Mutual Fund NAV? a) Market Performance of Assets Equity Funds: Move with stock prices.

Debt Funds: Impacted by interest rates and bond yields.

b) Expense Ratio Higher expenses reduce NAV over time.

Zebu displays the Expense Ratio of all funds clearly, so you know your costs upfront.

c) Dividend Payouts NAV drops when dividends are paid.

Growth funds reinvest profits, leading to higher NAV over time.

d) Investor Activity Heavy buying increases cash inflow.

Large redemptions during market dips may reduce NAV temporarily.

5. NAV and Returns: How to Measure Performance a) Absolute Returns Simple difference between buying and current NAV.

Absolute Return =(Ending NAV – Starting NAV) Starting NAV×100 Absolute Return= Starting NAV(Ending NAV – Starting NAV) ×100 b) CAGR (Compounded Annual Growth Rate) CAGR=(Ending NAV Starting NAV)1𝑛–1 CAGR=( Starting NAV Ending NAV ) n1 –1 c) Rolling Returns Shows consistency over different periods. Zebu's tools allow you to track rolling returns with ease.

d) XIRR (for SIP Investors) Crucial for calculating returns from monthly investments.

Zebu’s SIP calculator with XIRR support is a powerful ally for long-term investors.

6. How to Use NAV When Selecting a Mutual Fund ✅ Don’t Judge by NAV Alone A higher or lower NAV does not reflect performance quality.

✅ Evaluate Fund Performance Over Time Use 3, 5, and 10-year CAGR for better insights.

✅ Assess the Fund Manager's Track Record Strong leadership = better decisions = consistent returns.

✅ Mind the Expense Ratio Lower cost = better long-term NAV growth. Zebu highlights this in every fund listing.

✅ Compare with Benchmarks A good fund consistently beats its benchmark index.

7. Common Misconceptions About NAV ❌ NAV is not the same as a stock price.

❌ A lower NAV does not make a fund “cheaper.”

❌ NAV is not a performance metric.

❌ Dividend payouts reduce NAV—they are not “extra” returns.

Zebu helps clarify these misconceptions through curated investor education content.

8. Why Understanding NAV Matters for Investors Empowers informed decision-making.

Helps compare mutual funds more effectively.

Prevents reliance on misleading assumptions.

With Zebu’s expert insights, smart analytics, and investor-first platform, understanding and tracking NAV is easier than ever especially in 2025’s fast-moving markets.

Conclusion NAV is an important number, but it’s just one part of the bigger picture. Investors should focus on performance trends, expense ratios, consistency, and portfolio quality—not just the NAV.

Zebu empowers investors to go beyond the surface by offering smart comparison tools, expert-backed research, and transparent data to guide every investment decision.

Disclaimer This blog is for educational purposes only and does not constitute financial advice. Past performance is not indicative of future results. Please consult a SEBI-registered advisor before investing. For accurate, official data, refer to sources like SEBI, NSE, BSE, RBI, AMFI, or respective AMC websites.

#zebu#finance#investment#financialfreedom#investwisely#investors#investing#makemoney#investmentgoals#mutual funds

0 notes

Text

How are mutual funds versus ETFs traded?

Mutual Funds:

Mutual funds cannot be traded throughout the day. Instead, they are bought and sold at the end of the trading day based on their Net Asset Value (NAV), which is calculated after the market closes. This means that if you place an order to buy or sell shares of a mutual fund during the day, your transaction will be executed at the NAV price, which is determined after the market has closed. As a result, mutual fund investors do not have the flexibility to react to intraday market movements.

Mutual Funds: Mutual funds are typically actively managed by portfolio managers who make decisions on behalf of the fund’s investors. These managers research, select, and monitor securities (stocks, bonds, or other assets) within the fund to meet specific investment goals. In actively managed funds, the goal is often to outperform a particular market index or sector. The managers use their expertise to decide which securities to buy or sell, and they adjust the fund’s portfolio based on market conditions and economic forecasts.

Some mutual funds, however, are passively managed, meaning they aim to replicate the performance of a particular index (like the S&P 500). These funds still have managers, but their role is limited to maintaining the fund’s portfolio in line with the index’s performance.

ETFs:

ETFs trade like individual stocks on the stock exchange and can be bought or sold anytime during market hours. The price of an ETF fluctuates throughout the day based on supply and demand, and investors can buy or sell shares at the market price at any given moment, just as they would with a stock. This flexibility allows ETF investors to react to market movements in real-time, which is a key difference between mutual fund versus ETF.

ETFs: Most ETFs are passively managed, meaning they track a specific market index (e.g., S&P 500, NASDAQ-100, etc.). The fund’s portfolio is designed to mirror the index it tracks by purchasing the same securities in the same proportions as the index. This approach generally aims to match the performance of the index, rather than outperform it. However, there are also actively managed ETFs, where fund managers make decisions about the securities in the ETF’s portfolio based on research, market trends, and strategies.

The management of ETFs tends to be more hands-off compared to mutual funds, particularly with passive ETFs, as the goal is simply to track the performance of an underlying index rather than exceed it.

For more check our website: Best Stock Market Course In India

#ISMT#MutualFunds#ETFs#Investing101#ETFvsMutualFund#StockMarketBasics#FinanceTips#TradingETFs#MutualFundTrading#InvestmentStrategies#FinancialEducation#PersonalFinance#MoneyMatters#SmartInvesting#InvestorTips#MarketInsights#LearnFromISMT#ISMTInstitute

1 note

·

View note

Text

What is XIRR? The Right Way to Track Your SIP Returns

When you invest in mutual funds through SIP (Systematic Investment Plan), you're investing a fixed amount regularly—usually monthly. Over time, as market values fluctuate, your investments grow. But how do you measure the true return from this scattered and systematic investment? The answer lies in XIRR.

Let’s understand what XIRR is, and why it is the most accurate way to track your mutual fund SIP returns.

What is XIRR?

XIRR (Extended Internal Rate of Return) is a financial metric used to calculate the annualized return on investments where there are multiple cash flows at different intervals. It takes into account each investment date, amount, and the final redemption amount to give you a true picture of your investment performance.

In simple terms: XIRR shows the average yearly return you earned across all your SIPs—even if they were made on different dates and amounts.

Why XIRR is Ideal for SIPs?

In SIPs, you're investing the same amount every month, but at different NAVs (Net Asset Values). This means:

Each investment is made on a different date

Each amount is compounded differently

Market fluctuations affect every SIP installment uniquely

Using a simple average return won’t capture this complexity. That’s where XIRR shines.

How Does XIRR Work?

XIRR calculates the return based on:

Each investment amount and date

The final redemption amount and date

The time period each investment was held

It uses a formula that estimates the rate at which your total inflows and outflows break even over time.

Example:

Let’s say you invested ₹5,000 monthly from Jan 2022 to Dec 2024 (total ₹1.8 lakh). On 1st Jan 2025, the value of your mutual fund is ₹2.1 lakh.

The XIRR formula will calculate how much return (in %) per year you earned on your SIPs from start to end.

Benefits of Using XIRR

Gives accurate annualized return on irregular cash flows

Helps compare different investment options

Reflects actual performance of SIP-based investments

Can be used to track partial withdrawals or top-ups

How to Calculate XIRR?

You don’t need to do complex math. Just use:

In Excel or Google Sheets:

List all SIP amounts as negative values (outflows)

Add the current value or redemption as positive value (inflow)

Add corresponding dates

Use the formula: =XIRR(values, dates)

It will instantly show the annualized return percentage.

Tools That Automatically Show XIRR:

Most mutual fund platforms (NJ Wealth, CAMS, Zerodha Coin, Groww, etc.)

Mutual fund account statements

Portfolio tracking apps like Kuvera, Paytm Money, and ET Money

Final Thoughts

XIRR is the most reliable way to track your SIP returns. Unlike simple returns or CAGR, XIRR adjusts for the timing and flow of your investments—giving you a real-world view of how your mutual fund is performing.

So, next time you check your portfolio, don’t just look at the current value—check the XIRR to know how well your money is truly working for you.

0 notes

Text

What is NAV in mutual funds?

NAV, or Net Asset Value, is the price per share or unit of a mutual fund. It represents the total value of the fund's assets minus its liabilities, divided by the number of outstanding shares. NAV is calculated at the end of each trading day and is a crucial metric for investors, as it determines the price at which they can buy or sell shares of the fund. it is calculated as:

NAV= Total Assets - Total Liabilities / Total Unit Outstanding

Key Points about Net Asset Value (NAV):

Represents Per-Unit Price – NAV determines the price at which investors buy (purchase price) and sell (redemption price) mutual fund units.

Calculated Daily – NAV changes daily based on the market value of the underlying assets (stocks, bonds, etc.).

Not an Indicator of Performance – A higher or lower NAV does not mean a better or worse fund; returns depend on percentage growth.

Impacts SIP and Lump Sum Investments – Investors get units based on NAV at the time of purchase.

Excludes Market Trading Impact – Unlike stocks, mutual funds are traded at NAV, not market fluctuations during the day.

0 notes

Text

In the age of digital transformation, the role of a Real Estate Fund Administrator has become indispensable for ensuring the smooth operation and growth of real estate funds. Fundtec’s commitment to innovation, industry expertise, and client-centric approach positions it as a key partner in navigating the complexities of fund administration. As the financial landscape continues to evolve, Fundtec remains dedicated to delivering cutting-edge solutions that drive the success of real estate funds and other investment vehicles.

#Real Estate Fund Administration#Property Accounting#Investor Services#Net Asset Value (NAV) Calculation#Property Valuation#Lease Management#Compliance Management#Regulatory Reporting#Asset Appraisal#Portfolio Analysis#Investor Relations#Reconciliation#Property Acquisition#Asset Disposition#Fund Performance Reporting#Property Due Diligence#Real Estate Investment Trust (REIT) Administration#Asset Management#Financial Reporting#Real Estate Fund Technology

0 notes

Text

Mutual Fund Investment Advisor in India: Grow Your Wealth with Battu Investments.

Mutual Fund Investment Advisor in India: Grow Your Wealth with Battu Investments.

Entrusting your financial journey to a knowledgeable mutual fund investment advisor might be the turning point. BATTU INVESTMENTS, we are proud to be your exclusive mutual fund advisor, providing unrivaled knowledge in navigating the complexities of the financial markets. Our experienced team of advisers recognizes that each investor is unique, so we personalize our strategies to your specific objectives and risk tolerance. With a dedication to in-depth market analysis, we assist you through the ever-changing universe of investment options, ensuring your portfolio is not just well-managed but also poised for development. Beyond the figures, our open communication and client-centric approach develop trust, allowing you to make educated decisions.

Why Choose Mutual Funds?

Mutual funds offer a range of benefits that make them an ideal choice for investors:

Diversification: Spread your investments across various assets to minimize risk.

Professional Management: Access to expert fund managers who optimize your investments.

Flexibility: Choose from a variety of fund types to suit your financial goals and risk appetite.

Affordability: Start investing with as little as ₵500 per month through SIPs (Systematic Investment Plans).

Liquidity: Easily redeem your investments when needed.

BENEFITS OF MUTUAL FUNDS INVESTMENT

Diversification

Mutual funds allow investors to diversify their portfolios across various securities, reducing the impact of individual asset performance on the overall investment. This diversification helps mitigate risk and increase the potential for consistent returns.

Professional Management

With mutual funds, investors benefit from the expertise of professional fund managers who conduct in-depth research and analysis to make investment decisions. These experienced professionals have the knowledge and resources to identify investment opportunities and manage risks effectively.

Accessibility and Affordability

Mutual funds provide access to a wide range of investment opportunities that may not be readily available to individual investors. Moreover, the minimum investment requirements for mutual funds are often relatively low, making them affordable and accessible to a broad investor base.

Liquidity

Investors can easily buy or sell mutual fund shares based on the fund's net asset value (NAV), which is calculated at the end of each trading day. This liquidity allows investors to convert their investments into cash quickly if needed.

Transparency

Mutual funds are required to provide regular updates and reports on their holdings, performance, and expenses. This transparency enables investors to stay informed about their investments and make well-informed decisions.

TYPES OF MUTUAL FUNDS

Equity Funds

Equity funds invest primarily in stocks, aiming for long-term capital appreciation. They can focus on specific sectors, regions, or market capitalizations, offering investors the opportunity to participate in the potential growth of different segments of the stock market.

Bond Funds

Bond funds invest in fixed-income securities such as government bonds, corporate bonds, or municipal bonds. These funds provide regular income through interest payments and are generally considered less risky than equity funds.

Balanced Funds

Balanced funds, also known as hybrid funds, invest in a combination of stocks and bonds. They seek to balance the potential for capital appreciation with income generation, making them suitable for investors seeking a balanced approach to growth and income.

Index Funds

Index funds aim to replicate the performance of a specific market index, such as the S&P 500. These funds offer broad market exposure and generally have lower expense ratios compared to actively managed funds.

Money Market Funds

Money market funds invest in short-term, low-risk securities such as Treasury bills and commercial paper. They are characterized by high liquidity and stability, making them suitable for investors looking for capital preservation and easy access to cash.

How do I choose a Financial Advisor?

Determine your needs

Research Advisor Types

Check Qualifications and Credentials

Understand the Fee Structure

Availability and Convenience

SEBI Regulations for MF Financial Advisors

The Securities and Exchange Board of India (SEBI) regulates mutual funds in India. SEBI has introduced a variety of restrictions for mutual fund financial advisers (MFAs) to protect investors' interests.

The key Regulations For a mutual Fund Advisor Include

Registration

Suitability

Conflicts of Interest

Code of Conduct

Battu Investments: Your Trusted Mutual Fund Advisor

At Battu Investments, we simplify the mutual fund investment process and provide tailored advice to help you achieve your financial aspirations. Here’s how we make a difference:

1. Personalized Investment Strategies

We understand that every investor is unique. Our experts take the time to understand your financial goals, risk tolerance, and investment horizon before recommending the most suitable mutual funds.

2. Comprehensive Fund Selection

With access to top-performing mutual funds in India, we help you build a diversified portfolio that aligns with your objectives. Whether you’re looking for equity, debt, or hybrid funds, we’ve got you covered.

3. Expert Guidance

Our experienced advisors stay updated on market trends and fund performance to provide you with informed recommendations. We’re here to guide you at every step, from fund selection to portfolio management.

4. Systematic Investment Planning

SIPs are a disciplined way to invest in mutual funds. Battu Investments helps you set up SIPs tailored to your budget and goals, ensuring consistent wealth creation over time.

5. Transparent Processes

We prioritize transparency in all our dealings. You can trust us to provide clear insights into fund performance, charges, and potential risks.

We Help To Mutual Fund Investment

Customized Investment Strategies

We understand that every investor has unique financial goals and risk tolerance. Our team of experienced professionals works closely with you to develop customized investment strategies that align with your specific needs and objectives.

Diversification and Risk Management

We help you build a well-diversified mutual fund portfolio by considering your risk tolerance, investment horizon, and financial goals. Our aim is to optimize your returns while managing risk effectively through diversification across different asset classes and investment styles

Professional Expertise

With our expertise in the financial industry, we stay updated with market trends and conduct thorough research to identify top-performing mutual funds. We carefully analyze fund performance, historical data, and fund manager track records to select funds that align with your investment objectives.

Continuous Monitoring and Performance Evaluation

We continuously monitor the performance of the mutual funds in your portfolio to ensure they remain in line with your expectations and goals. If necessary, we recommend adjustments or rebalancing to optimize your investment returns.

Secure Your Financial Future Today

Investing in mutual funds doesn’t have to be complicated. With Battu Investments, you get the expertise and tools you need to make informed decisions and achieve your financial dreams. Start your journey to financial freedom today.

Visit Battu Investments for expert mutual fund advice and solutions tailored to your needs!

Amit Ashok Battu, Certified Personal Financial Advisor (CPFA-1), MBA (Marketing) and B.E (Mech) is Mutual Fund Distributor and founder of BATTU Investments , a Mutual Fund, Life Insurance and FDs Distribution Firm. We do not take any fees from Clients.

Address:

303, shreenath enclave, near ketkar brothers, shreehari kute marg, nashik-422002

Phone: 9422758038 9422703746

Email: [email protected]

Productshttps://battuinvestments.in/best-mutual-funds-investment-service-india.htmlhttps://battuinvestments.in/sbi-life-insurance-co-ltd.htmlhttps://battuinvestments.in/lic-life-insurance-corporation-company-in-india.htmlhttps://battuinvestments.in/hdfc-deposits-secure-your-saving.htmlhttps://battuinvestments.in/shreeram-deposits-secure-and-rewarding-fixed-deposits.html

Our Serviceshttps://battuinvestments.in/financial-investment-planning-service-analysis.htmlhttps://battuinvestments.in/wealth-management-financial-services.htmlhttps://battuinvestments.in/insurance-planning-service-company.htmlhttps://battuinvestments.in/tax-planning-and-service-management.htmlhttps://battuinvestments.in/best-retirement-investment-services-planning-india.html

Goal Based Planninghttps://battuinvestments.in/best-child-education-planning.htmlhttps://battuinvestments.in/best-wedding-plan-for-child-marriage.htmlhttps://battuinvestments.in/dream-house-planner-with-battu-investments.htmlhttps://battuinvestments.in/your-dream-car-planning-financial-possibilities.htmlhttps://battuinvestments.in/dream-vacation-planning-investments-with-mutual-funds-sip.htmlhttps://battuinvestments.in/family-protection-life-insurance-plan.htmlhttps://battuinvestments.in/custom-goal-planning-financial-success.html

1 note

·

View note

Text

Loan Against Mutual Funds Charges: Processing Fees, Interest & More Explained

Have you ever needed urgent funds but didn’t want to break your mutual fund investments?

You’re not alone. In 2025, with inflation, unexpected medical emergencies, education costs, and business needs rising, many investors are turning towards Loan Against Mutual Funds (LAMF) — a smart way to unlock liquidity without redeeming your assets.

If you’ve ever searched “what is LAS or LAMF,” or wondered about “loan against mutual funds interest rate,” or “who can apply for loan against mutual funds” — then this article is your one-stop guide.

What Is Loan Against Mutual Funds (LAMF)?

A Loan Against Mutual Funds is a type of Loan Against Securities (LAS) where you pledge your mutual fund units to a bank or NBFC in exchange for a loan. You don’t sell your investment—you simply borrow against it.

This helps retain your long-term financial goals while giving you immediate liquidity.

Why Consider a Loan Against Mutual Funds?

Here’s what makes LAMF an attractive option:

No need to redeem mutual funds

Lower interest rate than personal loans or credit cards

Instant digital processing in many cases

Flexible repayment options

Continue earning capital gains/dividends on mutual funds

Loan Against Mutual Funds vs. Loan Against Shares: A Quick Comparison

Minimum Balance Requirements – What You Should Know

Many banks have their own policies regarding minimum balance or value of mutual fund portfolio before approving the loan.

Here’s what you typically need:

A minimum of ₹25,000 to ₹50,000 in mutual funds (varies by lender)

Approved mutual fund types (Equity, Hybrid, or Debt)

Portfolio with consistent returns or stable value

For example:

HDFC Bank may require ₹50,000+ in approved mutual funds.

ICICI Bank offers loans starting from ₹10,000 if it’s processed digitally.

Tip: Always check with your bank or NBFC for the latest minimum NAV requirement.

Charges Involved in LAMF

Understanding the charges is crucial before you proceed:

Looking for the lowest interest rate of loan against mutual fund in India? Always compare loan against securities interest rates online before choosing.

Digital Loan Against Mutual Funds: Fast & Paperless

Gone are the days of branch visits and heavy paperwork. With digital loan against mutual fund services by ICICI, HDFC, Axis, and fintechs like Paytm and Groww:

Instant eligibility check via PAN + mobile

e-KYC + e-Sign

Loan disbursed in a few hours

Manage everything via app

Many even show you the digital loan against mutual funds interest rate transparently before applying.

Documents Needed

You usually don’t need many documents. If applying digitally:

PAN Card

Aadhaar (linked to mobile)

Mutual fund folio details

Bank account proof

If applying offline or for higher amounts, income proof and address proof may be needed.

Who Can Apply for Loan Against Mutual Funds?

If you've been wondering who can apply for loan against mutual funds, here's the answer:

Things to Keep in Mind Before Applying

Loan tenure: Usually up to 36 months. Choose based on your repayment capacity.

Prepayment options: Check if there are charges.

Mutual Fund Type: Some lenders only accept debt or equity-oriented funds.

Ownership: Joint holding mutual funds may need consent of all holders.

Interest Calculation: It’s usually daily reducing balance.

5 Frequently Asked Questions (FAQ)

1. Can I apply for a loan against SIP mutual funds?

Yes, if your SIP investments have accumulated to a minimum NAV (₹25K to ₹50K). The loan is based on NAV, not just SIP frequency.

2. How much loan can I get against my mutual fund?

Typically, up to 75% of your NAV (Net Asset Value). Some equity funds allow up to 50–60%.

3. Will my mutual funds get sold during the loan?

No. They are pledged, not sold. You still own them unless you default.

4. Is loan against mutual funds better than a personal loan?

Yes, it’s cheaper and quicker if you have an MF portfolio. You save on interest and still retain your investment benefits.

5. Are there any tax benefits on LAMF?

No direct tax benefits, but since it’s not an income, it doesn’t increase your taxable income like some withdrawals might.

Final Thoughts: Should You Go for LAMF?

If you’re looking for an instant loan with lower interest rates, don’t want to disturb your long-term financial goals, and want flexibility—Loan Against Mutual Funds (LAMF) is a smart choice.

Especially with digital loan against mutual fund options and competitive loan against mutual funds interest rates offered by top banks and NBFCs, it’s now easier than ever to get the funds you need without hassle.

Pro Tip: Always compare loan against shares interest rates, loan against securities interest rates, and LAMF offers to pick the one that suits you best.

#Loan Against Securities (LAS)#Loan Against Mutual Funds#Loan Against Mutual Funds Interest Rate#Loan Against Securities Interest Rates#Loan Against Shares#loan against shares interest rates#LAMF#digital loan against mutual funds interest rate#digital loan against mutual fund#who can apply for loan against mutual funds

0 notes

Text

Caldwell Unifies Funds to Boost Dividend Investment Opportunities

Caldwell Investment Management Ltd. has successfully merged the Clearpoint Global Dividend Fund with the Caldwell U.S. Dividend Advantage Fund, reinforcing its position in dividend-focused investing. This merger, effective October 30, 2019, consolidates the two portfolios into one unified entity, the Caldwell U.S. Fund.

This strategic move reflects Caldwell’s broader goal of streamlining its fund offerings and optimizing growth potential for investors. The merger was executed on a tax-deferred basis, ensuring no immediate tax implications for unitholders. Caldwell Investment Management also absorbed all associated costs and administrative expenses, safeguarding investor returns from any additional financial burdens.

Clearpoint Global Dividend Fund unitholders automatically transitioned into the Caldwell U.S. Fund under favorable exchange terms. For every unit held, Series A investors received 0.6527 units in the Caldwell U.S. Fund, while Series F unitholders gained 0.7781 units. These exchange ratios were determined by assessing the net asset values (NAV) of each fund as of October 29, 2019. The calculated ratios facilitated a fair and transparent process, ensuring investors were neither advantaged nor disadvantaged by the integration. Check here to learn more.

The merger represents more than just operational consolidation—it strengthens the Caldwell U.S. Fund by increasing its asset base, which can lead to enhanced diversification and greater economies of scale. Unitholders benefit from broader exposure to dividend-paying equities, a hallmark of Caldwell’s investment philosophy. The transition also positions the fund to pursue higher returns while mitigating risks through expanded market participation.

By streamlining its product lineup, Caldwell eliminates redundancy and sharpens its focus on high-performing funds. This decision aligns with an industry-wide trend of fund managers consolidating similar offerings to reduce overhead and enhance competitive edge. As Caldwell continues to adapt to changing market dynamics, the merger underscores its proactive approach to fund management and long-term value creation.

For investors, the merger unlocks opportunities by combining resources and expanding the pool of dividend-focused assets. A larger fund often translates into improved liquidity and cost efficiencies, which can enhance performance over time. Additionally, with Caldwell Investment Management covering all costs, investors reap the benefits without bearing the financial strain typically associated with such transactions.

Founded in 1990, Caldwell Investment Management has built a solid reputation for managing dividend-driven equity portfolios. The Toronto-based firm caters to both Canadian and U.S. markets, emphasizing consistent income generation and capital growth. Through disciplined investment strategies and a client-first approach, Caldwell has earned the trust of individual and institutional investors alike.

The merger reflects Caldwell’s ongoing mission to refine its fund offerings in response to market conditions. In an era of financial uncertainty, the strengthened Caldwell U.S. Fund offers a resilient investment vehicle focused on dividend yields and stability. As economic landscapes shift, Caldwell’s ability to adapt positions its investors for sustainable long-term success.

For those seeking reliable dividend income and growth, the newly enhanced Caldwell U.S. Fund represents a compelling investment opportunity. Caldwell’s unwavering dedication to operational excellence ensures that investors remain well-positioned for future prosperity.

(Disclaimer: This article is for informational purposes only and does not reflect the views of Caldwell Investment Management)

0 notes

Text

Indicative Net Asset Value (iNAV) in Mutual Funds

NAV is an intraday, real-time estimate of the Net Asset Value (NAV) of an Exchange Traded Fund (ETF). iNAV is calculated at the end of the day and is based on the assets and liabilities of the fund.

iNAV - What is it and why is it important?

0 notes