#online document processing

Explore tagged Tumblr posts

Text

U.S. Intensifies Crackdown on Undocumented Immigrants, Increasing Demand for Remote Immigration Document Services

As the U.S. government strengthens immigration enforcement, the demand for expedited visa and residency document issuance and authentication services is surging among immigrants. Recently, U.S. authorities have expanded their crackdown to include individuals with expired visas and those lacking proper immigration documentation, leading to an increase in detentions and deportations. These…

#apostille certification#visa authentication#online document processing#document verification#immigration documents

0 notes

Text

I figured out a day or two ago that SSO Ridethrough still exists. The unique domain name just expired, so it's back to using a wordpress url, which is why a bunch of the old links don't work

So if you guys want to see the Old Quest Dialogue (like 2018 and earlier), look for ssoridethrough.wordpress.com (not linking it directly because we all know tumblr can be weird about links). If a link on the site doesn't work trying the search function instead, so far it's worked for me.

#sso#star stable online#starstableonline#I was in the processing of archiving a bunch of it on the wayback machine#and also in documents#and realized 'oh wait she switched to a unique domain rather than using the wordpress one oooh'#which answers why so many of the links don't work but the pages actually still exist#I'm still in the process or archiving it's just a long process and I've been hella busy#god I hope one day I can get my own dialogue reference site up and running#boatload of work but also so handy for the community#like I have videos and screenshots and documents of the events and quests going back to 2019 or maybe 2018 so like#I do have all that stuff it's just not very searchable or available for people

80 notes

·

View notes

Text

pov classes start in two weeks, sign up for classes starts tomorrow, your university refuses to enrol you, and the website tells you "do not call us regarding enrolment status" is that a good sign

#i KNEW i shouldn't have come back to germany I already spent over 300€ to apply to university and that doesn't even include tuition yet#because they REFUSE to let me pay tuition and enrol. it's been over 5 weeks and the status has not changed from 'we have received your#documents' yea it's an online process I gathered so when I uploaded my documents. do you intend to look at them anytime soon.#there is genuinely nothing as infuriating as german bureaucracy like by far

11 notes

·

View notes

Text

Dubai Visa Check: Track Your Application Status Online

Easily monitor your Dubai visa application status with our user-friendly online tool. Stay informed every step of the way!

#Dubai visa#Visa status#Check online#Application tracking#Dubai travel#Immigration#UAE visa#Visa application#Dubai tourism#Travel to Dubai#Visa updates#Dubai trip#Online check#UAE travel#Application status#Tourist visa#Visit Dubai#Travel documents#Immigration status#UAE tourism#Visa process#Dubai holiday#Visa renewal#Visa inquiry#Entry permit#Dubai vacation#Travel authorization#UAE immigration#Visa services#Dubai experience

4 notes

·

View notes

Note

HIS LONG HAIR 😭😭😭😭 while we were waiting for him i was fr on the verge of tears thinking about how long his hair must’ve gotten

IM CYRIGNGN YOUR PRIORITIES ARE SO REAL.

6 notes

·

View notes

Text

https://fusioncomplianceservices.com/service/bis-crs-certification/

BIS Certificate Consultants: Elevate your products with BIS certification expertise. Our consultants streamline the process, ensuring compliance with quality standards, opening doors to the Indian market's vast potential.

FMCS Certificate: Obtain Factory Mutual Certification Services (FMCS) to bolster safety and resilience. Trust us to guide you through FMCS requirements, fortifying your business against risks.

CRS Certificate: Navigate the complex world of BIS Conformity Requirement Scheme (CRS) certification effortlessly. We specialize in simplifying compliance, enabling you to thrive in India's demanding market landscape.

#bis certificate#fmcs certificate#tec certificate#bis crs certificate#bis certificate in india#bis certification consultants#what is bis certificate#isi certificate#bis certificate documents#certificate#what is bis certificate in india#iso certificate#stqc certificate#bis certificate apply online#bis certificate cost#bis certificate process#bis licence consultants#how to apply bis certificate#how to apply for bis certificate#bis registration certificate

2 notes

·

View notes

Text

Loan Against Mutual Funds Online in 2025 – Fast Approval Without Selling Investments

In 2025, if you need urgent cash and own investments like mutual funds or shares, there's good news—you no longer need to sell your assets. Thanks to the rise of LAMF (Loan Against Mutual Funds) and LAS (Loan Against Shares), you can instantly apply for a digital loan without disturbing your portfolio. Whether it's for a wedding, education, travel, or medical emergency, you can unlock funds in minutes — no income proof, no selling, just swipe and go.

Let’s explore how a digital loan against mutual funds or shares works, who can apply, what the features, limits, eligibility, and more. This guide will clearly and naturally answer every user's question, utilizing all the important search keywords to help both readers and search engines trust and rank this content.

What is a Loan Against Mutual Fund (LAMF)?

A Loan Against Mutual Fund (LAMF) allows you to borrow money using your mutual fund units as collateral. Instead of redeeming your mutual funds, lenders provide you with a credit line or term loan based on the NAV (Net Asset Value) of your holdings.

Similarly, a Loan Against Shares (LAS) lets you pledge your equity shares and get funds instantly. The biggest advantage? You retain ownership and continue to earn returns, dividends, and capital gains while enjoying liquidity.

Top Features of Loan Against Mutual Funds & Shares (LAMF LAS)

How Does a Digital Loan Against Mutual Fund Work in 2025?

Log in to your Demat or Mutual Fund platform. Most AMCs and fintech apps now offer LAMF APIs directly integrated.

Select the funds to pledge. ELSS, debt, hybrid, and large-cap funds are typically eligible.

Get an instant offer based on NAV. The higher the NAV and fund stability, the better your loan terms.

E-sign documents and complete KYC online.

Loan is disbursed digitally – often within 30 minutes!

This is how a digital loan against mutual funds online saves you time, paperwork, and the stress of liquidating long-term wealth.

LAMF Eligibility & Documents – Who Can Apply in 2025?

Eligibility for Loan Against Mutual Funds (LAMF):

Age: 21 to 65 years

Must own eligible mutual fund units (ELSS, debt, hybrid, or equity)

Resident Indian with valid PAN & Aadhaar

Salary slip or ITR is not mandatory (many lenders skip this)

LAMF Documents Required:

PAN Card

Aadhaar or Passport/Voter ID

Mutual Fund Statement (CAS)

Cancelled Cheque (for loan disbursal)

Optional: Income proof for higher limits

You can also use a loan against mutual funds eligibility calculator available on most lending platforms to get your eligible amount instantly.

Top Use Cases – Why People Apply for a Loan Against Mutual Funds in 2025

Loan Against Mutual Funds for Wedding Expenses Don’t touch your SIPs or ELSS—get a short-term loan without penalty.

Loan Against Mutual Funds for Higher Education Quick and smart funding option without breaking your portfolio.

Loan Against Mutual Funds for Financial Planning Use for emergencies or opportunities while your investments grow.

Loan Against Mutual Funds for Financial Needs Medical emergencies, travel, family events, or even down payments.

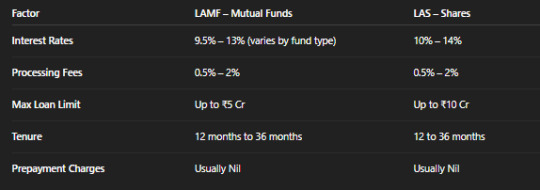

Interest Rates, Processing Fees & Limits – All You Need to Know

Digital loan platforms use LAMF APIs to instantly evaluate, process, and disburse loans, making the loan against mutual funds processing fees and interest rates transparent and user-friendly.

How to Apply for a Loan Against Mutual Funds Online – Step-by-Step (2025)

Visit a digital lending platform (like Groww, Zerodha, Paytm Money, or a Bank site)

Click on “Apply for Loan Against Mutual Fund.”

Enter PAN & link your MF folio or Demat

Select eligible funds (ELSS, debt, equity)

View the loan offer via the LAMF eligibility calculator

E-sign documents and submit KYC

Get instant disbursal to your linked bank account

Some fintech apps offer a loan against shares interest rates comparison to help you choose LAS vs LAMF smartly.

FAQs – Loan Against Mutual Funds or Shares in 2025

1. What is a loan against a mutual fund?

A Loan Against Mutual Fund (LAMF) allows you to borrow money without selling your investments by pledging them digitally.

2. Who can apply for a loan against mutual funds in India?

Any Indian citizen above 21 who holds mutual funds in their name can apply. Many platforms don’t require income proof or a high CIBIL.

3. Can I apply for a loan against ELSS mutual funds?

Yes, loan against ELSS is allowed, but with certain lock-in caveats. Many lenders accept ELSS if held for over 3 years.

4. How much can I borrow through LAMF?

Using a loan against mutual funds eligibility calculator, most users can obtain a loan of up to 70%-80% of their mutual fund's NAV.

5. Is LAS or LAMF better in 2025?

If you hold mutual funds, go for LAMF. If you own equity shares, LAS offers better liquidity options. Compare both using the Loan Against Securities Interest Rates before choosing.

Final Thoughts: Borrow Smart, Invest Smarter

In 2025, you no longer need to choose between growth and liquidity. With smart fintech platforms offering digital loans against mutual funds or shares, you get the best of both worlds — access to instant funds without selling your long-term assets.

Whether you’re planning a big event or tackling a financial emergency, LAMF or LAS ensures you get cash on tap with low documentation, transparent interest rates, and minimal stress. Just a few clicks, and you’re good to go — No Sell, Just Swipe.

#lamf#loan against mutual funds online#lamf eligibilty & documents#loan against elss#digital loan against mutual fund#how to apply loan against mutual funds#loan against mutual funds explained#features of loan against mutual funds#how does a loan against mutual fund work#loan against mutual funds faqs#lamf api#loan against mutual funds processing fees and interest rates#what is a loan against mutual fund#loan against mutual funds max limit#lamf eligibility#lamf loan#loan against mutual funds for wedding#loan against mutual funds eligibility calculator#loan against mutual funds for financial planning#apply for loan against mutual fund#loan against mutual funds for financial needs#loan against mutual funds features#loan against mutual funds for higher education#loan against mutual funds limit#loan against mutual funds eligibility and documents#digital loan against mutual funds interest rate#who can apply for loan against mutual funds#lamf documents#LAS#Loan Against Securities Interest Rates

0 notes

Text

Angel One Free Demat Account

A demat account is a must-have for anyone looking to invest in the stock market, serving as a digital vault for holding securities like stocks, mutual funds, and bonds. Among the many options available, Angel One stands out as a leading choice for opening a free demat account.

#angel one pe demat account kaise khole#Angel One account opening documents#how to open angel one account online#angel one demat account opening process#Angel One account opening process#angel one free demat account#angel one open demat account

0 notes

Text

E-Recording Companies and API Integrations: The Future of Legal Workflow Automation

The legal industry is undergoing a quiet revolution—one driven not just by changing regulations, but by the accelerating pace of technology. Among the most impactful developments in recent years is the rise of e-recording companies and their seamless API integrations. These innovations are reshaping how law firms manage document filings, with applications ranging from deeds and liens to the e-record renewal of judgments.

For law firms, title agencies, and debt collection professionals, staying competitive today means more than just offering legal expertise. It’s about delivering speed, accuracy, and compliance through automated workflows. And that’s where API-enabled e-recording services—like those offered by Countrywide Process—come into play.

The Traditional Workflow Challenge:

Legal document recording has long been plagued by delays, inefficiencies, and human error. Filing a document with a county recorder’s office traditionally involved:

Printing physical copies

Manually preparing cover pages

Mailing or hand-delivering to county offices

Waiting days (or even weeks) for confirmation

Risking document rejection due to minor formatting errors

This process is particularly problematic for time-sensitive filings like the e-record renewal of judgment, where missing a statutory deadline can render a judgment unenforceable and cost clients thousands of dollars.

Enter E-Recording Services + API: A Game-Changer

E-recording services allow legal professionals to submit documents digitally, but what’s truly transforming the industry is the integration of APIs (Application Programming Interfaces). APIs serve as bridges between your firm’s case management software and the systems of e-recording companies, enabling automatic document generation, submission, and status tracking without the need for manual input.

For example, when a judgment renewal date approaches, your system can trigger an automatic submission of the required documents to the recorder’s office—handling everything from file formatting to confirmation receipts. This creates a frictionless experience that saves time, reduces risk, and enhances compliance.

Key Benefits of API Integration for E-Record Renewal of Judgment:

1. Automated Document Filing

Imagine being able to schedule the e-record renewal of the judgment process well in advance. With API-enabled platforms, your firm can generate renewal forms directly from your client management system, attach required exhibits, and instantly submit them through your integrated e-recording services provider—all without leaving your dashboard.

This dramatically reduces the chances of error, while also allowing paralegals and attorneys to focus on more critical tasks.

2. Real-Time Filing Status and Alerts

Gone are the days of wondering whether your documents were accepted. With API-powered e-recording companies, your system receives real-time updates on document status—submitted, accepted, rejected, or pending corrections. This level of transparency not only improves accountability but also allows legal teams to act quickly if any issues arise with the filing.

3. Compliance-First Approach

For judgment renewals, timing is everything. Courts and counties often have strict deadlines for filing the renewal paperwork, typically within 10 years from the date the judgment was entered. Missing the renewal window can result in the loss of enforceability.

By automating the e-record renewal of judgment through API-integrated platforms like those used by Countrywide Process, firms gain peace of mind that deadlines won’t slip through the cracks.

4. Seamless Integration with Existing Software

Most small and mid-sized firms use some form of practice management software. API integration doesn’t require changing these systems—instead, it enhances them. Countrywide Process provides flexible API endpoints that integrate with common platforms like Clio, My Case, and custom-built legal CRMs, allowing firms to retain their workflows while gaining the benefits of automation.

Why Countrywide Process Leads the Way?

At Countrywide Process, we understand the urgency and precision needed for document recording—especially when it involves the e-record renewal of judgment. That’s why we’ve built our platform around smart API integrations, allowing legal teams to scale operations without scaling costs.

As one of the most trusted e-recording companies, we offer:

Direct API access for high-volume firms

Cloud-based dashboards for submission tracking

Bulk document uploading and formatting tools

Secure, encrypted communication channels

Integration with more than 2,000 counties nationwide

Whether you’re a boutique law firm or a growing collections agency, our e-recording services are built to meet your evolving needs.

The Future Is Automated, Compliant, and Faster:

As legal clients demand more responsive service and courts move toward digitization, the firms that embrace automation will be the ones that thrive. Partnering with API-driven e-recording companies enables you to eliminate tedious manual processes, improve client satisfaction, and ensure airtight legal compliance.

In the context of critical filings like the e-record renewal of judgment, automation isn't just a convenience—it’s a competitive advantage.

✅ Ready to Automate Your Legal Workflow?

👉 Connect to Countrywide Process Today – Start E-Recording Smarter

#e recording services#e recording companies#judgment renewal#erecord renewal of judgement#renewal of judgement online#efile and erecord renewal of judgement#e-record renewal of judgment#e-recording services#e-recording companies#legal workflow automation#API integration legal tech#legal technology solutions#digital document filing#judgment renewal automation#law firm automation#Countrywide Process#legal compliance tools#electronic recording

0 notes

Text

🆔 PAN Registration in India: Complete Guide for Individuals & Entities

1. Introduction PAN Registration India : A Permanent Account Number (PAN) is a 10-digit alphanumeric identifier issued by the Income Tax Department under Section 139A. It’s mandatory for all taxpayers and individuals engaged in financial transactions. PAN ensures tax tracking, simplifies ITR filing, and is a key identity proof across India. 2. Eligibility Criteria Anyone fitting one or more of…

#apply for pan#apply PAN online#ePAN download#Form 49A documents#how to get pan#Income Tax PAN guide#PAN Aadhaar Link#PAN correction process#PAN minor application#pan number application#PAN registration India

0 notes

Text

Angel One Demat Account Opening Process Guide Step by Step

Opening a Demat account has become essential for modern investors, and Angel One provides a seamless experience for anyone looking to invest in the stock market. If you're new to online trading or switching brokers, understanding the angel one demat account opening process is the first step. In this article, we’ll walk you through the entire procedure in a clear, structured, and easy-to-follow format.

#angel one account opening process#angel one demat account opening process#angel one free demat account#how to open angel one account online#angel one account opening documents#angel one open demat account#angel one pe demat account kaise khole

0 notes

Text

Quick and Hassle-Free E-Visa Solutions

Get fast and reliable e-visa solutions for your international travel. Enjoy a smooth application process with expert support.

#quick visa#e-visa solutions#fast visa processing#online visa#visa services#travel visa#visa assistance#quick travel documents

0 notes

Text

Open angle one free demate account

A demat account is a must-have for anyone looking to invest in the stock market, serving as a digital vault for holding securities like stocks, mutual funds, and bonds. Among the many options available, Angel One stands out as a leading choice for opening a free demat account.

#angel one pe demat account kaise khole#Angel One account opening documents#how to open angel one account online#angel one demat account opening process#Angel One account opening process#angel one free demat account#angel one open demat account#angelone demat account

0 notes

Text

Apostille Services in India|Document Authentication by Experts

India's Apostille Services in India ensure secure, same-day processing for personal, educational, and commercial documents.call me:-+9199582 98424,https://www.apostilleinindia.com/

#Apostille Service Provider in India#Online Apostille Services India#Apostille for Personal Documents#Commercial Document Apostille India#Apostille Certificate India#Apostille Process in India#Apostille for Marriage Certificate#Apostille for Degree Certificate

0 notes

Text

🇨🇦 In Canada, the Social Insurance Number (SIN) is a mandatory 9-digit number required for working and accessing government benefits 🇨🇦 Check out who needs a SIN and how to apply or update SIN online 👇🏻

#canada immigration news#contact Service Canada for SIN issues#CPP#documents required for SIN application#EI#how to apply for a SIN in Canada#immigration news canada#protecting your Social Insurance Number#registering newborn for SIN Canada#Service Canada SIN application process#SIN fraud prevention tips#Social Insurance Number#tax filings#updating SIN record online#what to do if SIN is stolen#who needs a Social Insurance Number

0 notes

Text

Get Your Indian Birth Certificate – No Matter Where You Are!

NRIs can now apply for an Indian birth certificate without visiting India. Murvin handles the complete process securely and hassle-free from start to finish.

#NRI birth certificate#Indian birth certificate online#birth certificate for NRIs#document services for NRIs#apply birth certificate abroad#NRI documentation help#birth certificate India process#Murvin NRI services#certificate reissue NRI#NRI legal documents India

0 notes