#payment gateway integration service

Explore tagged Tumblr posts

Text

#merchant payment gateway#payment gateway#payment gateway integration#payment gateway service provider

0 notes

Text

Reliable Shopify Payment Gateway Integration Services by CartCoders

CartCoders offers reliable Shopify payment gateway integration services to help you accept online payments with ease. We support major gateways like PayPal, Stripe, Razorpay, and more. Our team configures your store securely, sets up APIs, and tests transactions to avoid errors.

Whether you need multiple payment methods or country-specific options, we build it to match your store’s setup. Get a smooth and secure payment experience for your customers without any technical stress.

0 notes

Text

Looking to grow your online business? Get a high-performing, SEO-friendly e-commerce website with expert development services in Kolkata. Build, scale, and succeed today

#website designer in kolkata#seo#business#web designer in kolkata#website development#web design#best website design company in kolkata#seo services provider in kolkata#website#Website Development in Kolkata#e-commerce website development company in Kolkata#Payment gateway integration services in Kolkata#professional web developers in Kolkata

0 notes

Text

BillDesk API Integration by Infinity Webinfo Pvt Ltd: Seamless and Secure Payment Solutions for Businesses

In today's fast-paced digital economy, businesses must provide seamless, secure, and scalable online payment experiences. BillDesk, one of India’s leading payment gateway providers, offers a robust API that enables organizations to accept and manage a wide range of digital payments efficiently. When paired with the technical expertise of Infinity Webinfo Pvt Ltd, businesses gain a powerful solution through reliable API integration services that accelerate digital transformation.

What is the BillDesk API?

The BillDesk API is a powerful interface that allows merchants, financial institutions, and service providers to connect their platforms to BillDesk’s secure payment infrastructure. It supports a broad spectrum of payment modes including:

Credit and Debit Cards

Net Banking

UPI and Wallets

Bharat Bill Payment System (BBPS)

This API ensures high uptime, fraud prevention mechanisms, and seamless reconciliation of transactions, making it ideal for large-scale and enterprise-grade implementations.

API Integration Services by Infinity Webinfo Pvt Ltd

Infinity Webinfo Pvt Ltd is a trusted technology partner known for its expertise in API integration services across various domains such as fintech, travel, e-commerce, and utilities. With a client-first approach, Infinity Webinfo delivers tailor-made integration solutions that are secure, scalable, and easy to maintain.

Key Features of Their Integration Approach:

End-to-End Technical Support: From planning and development to testing and deployment.

Custom Workflows: Built to suit your business logic and operational model.

Security Compliance: Ensures all integrations are PCI-DSS compliant.

Rapid Deployment: Proven methodologies reduce time-to-market significantly.

Post-Integration Maintenance: Ongoing support and updates for uninterrupted services.

Why Integrate BillDesk API with Infinity Webinfo Pvt Ltd?

Combining the robust capabilities of the BillDesk API with the integration proficiency of Infinity Webinfo Pvt Ltd ensures:

Enhanced Security: Safeguard transactions with enterprise-grade encryption and risk monitoring.

Faster Checkout: Streamlined processes reduce user drop-off and boost conversions.

Automated Reconciliation: Eliminate manual processes and ensure financial accuracy.

Broader Reach: Accept payments from across India via all major banks and wallets.

Industries Benefiting from BillDesk Integration

E-commerce platforms for frictionless customer checkouts.

Government services for utility and tax payments.

Educational institutions to collect fees online.

Fintech startups looking to offer embedded finance features.

Conclusion

As digital payments continue to evolve, choosing the right integration partner is crucial. Infinity Webinfo Pvt Ltd, with its deep domain knowledge and technical expertise, stands out as a reliable partner for BillDesk API integration. Their comprehensive API integration services ensure that businesses not only meet customer expectations but also scale with confidence.

To get started with BillDesk API integration, contact Infinity Webinfo Pvt Ltd today.

WhatsApp: +91 9711090237

#Billdesk API Integration#Billdesk Payemntgateway API Integration#api integration services#api integration#infinity webinfo pvt ltd#website design#travel portal development#travel portal company#payment gateway api integration

0 notes

Text

🚀 Launch Your Own White-Label Payment Gateway in Just 30 Days! 🔐

Want a custom-branded payment solution without the hassle? 💳 With Payomatix, you can set up a secure, scalable, and fully compliant white-label payment gateway in just 30 days! ✅

In this post, we break down the step-by-step process to get started.

#White-label payment gateway#Integrated payment systems#Payment tokenization services#payment gateway#paymentsolutions#payomatix

0 notes

Text

why online payments and how to fix them in 2024

Have you ever experienced the frustration of a failed online payment? It can be incredibly frustrating, especially when you're in a hurry or trying to complete a purchase

Ever clicked the "Buy Now" button only to see your screen freeze? Or receive that annoying "Transaction Failed" message? It’s frustrating, isn’t it? I’ve experienced it too.

Online payments are like the lifeblood of e-commerce. They’re what makes it possible for us to shop from the comfort of our homes, pay bills, and handle transactions with just a few clicks. However, just like any system, online payments can sometimes encounter problems. From technical glitches to issues with payment methods or security concerns, These issues can mess up your shopping and make you frustrated. Whether it’s a problem with processing, card declines, or connectivity issues, understanding the root causes of payment failures is crucial. By addressing these issues head-on and knowing how to fix them, you can ensure a smoother and more reliable payment experience. This means fewer disruptions, happier customers, and a more efficient operation for your business. In the following sections, we’ll dive into the common reasons why online payments fail and offer practical solutions to keep your transactions running smoothly.

Read more...

#online payment gateway in UAE#Secure payment gateway#online payment UAE#online payment integration#Online payment solutions in dubai#UAE#Payment gateway provider uae#payment gateway in UAE#Foloosi business in sharjah#Digital payment solution abu dhabi#merchant service UAE

0 notes

Text

Bespoke Web And Mobile App Development

Unlock your business potential with our Bespoke Web And Mobile App Development services. We specialize in creating customized digital solutions that drive growth, enhance user experience, and meet your unique needs. Partner with us for innovative, tailored applications that set you apart from the competition. Experience the power of bespoke development today.

#prologictechnologies#custom ecommerce applications#custom telemedicine solution provider#Custom UI UX Design and Development Services#Bespoke Payment Gateway Integration Services

0 notes

Text

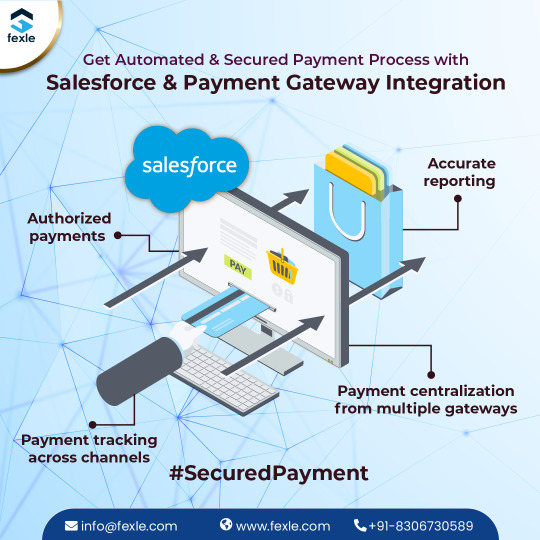

Streamline Your Checkout & Boost Sales: Salesforce Payment Gateway Integration

Struggling with a clunky checkout process? Salesforce integration with a payment gateway can be your game-changer!

This powerful combo simplifies transactions, reduces errors, and speeds up customer purchases.

Enjoy a seamless buying experience and watch your sales soar!

#salesforce#fexle#crm consulting#salesforce integration#hire fexle#salesforce gold partner#salesforce consulting services#payment gateway integration

0 notes

Text

Maximizing Sales: The Ultimate Guide to Payment System Integrations on Shopify

In today’s digital age, having a strong online presence is imperative for businesses looking to thrive in the competitive market. Among the myriad of e-commerce platforms available, Shopify stands out as a leading choice for entrepreneurs seeking to establish and grow their online stores. With its user-friendly interface, customizable design options, and robust features, Shopify provides a powerful foundation for e-commerce success. However, to truly maximize sales potential, seamless integration with a reliable payment system is crucial.

In this comprehensive guide, we will delve into the intricacies of integrating Shopify with a payment system to streamline transactions, enhance customer experience, and ultimately boost sales.

Understanding the Importance of Integration:

Integrating a payment system with your Shopify store is more than just a convenience – it’s a strategic move that can significantly impact your bottom line. By offering multiple payment options and ensuring a smooth checkout process, you remove barriers to purchase and increase the likelihood of conversion. Moreover, seamless integration eliminates manual handling of transactions, reducing the risk of errors and enhancing efficiency.

Choosing the Right Payment System:

When selecting a payment system to integrate with Shopify, it’s essential to consider factors such as reliability, security, and compatibility with your target market. Popular options include PayPal, Stripe, Square, and Authorize.Net, each offering unique features and pricing structures. Conduct thorough research and choose a payment system that aligns with your business needs and customer preferences.

Step-by-Step Integration Process:

Integrating a payment system with Shopify may seem daunting, but with the right approach, it can be a straightforward process. Here’s a step-by-step guide to help you navigate the integration seamlessly:

Select Your Payment System: Begin by choosing the payment system you wish to integrate with Shopify. Consider factors such as transaction fees, supported currencies, and compatibility with Shopify’s API.

Set Up Your Payment Gateway: Log in to your Shopify account and navigate to the “Settings” tab. Select “Payment providers” and choose the option to add a payment gateway. Follow the prompts to configure the settings for your chosen payment system.

Test Transactions: Before making your payment system live, conduct thorough testing to ensure that transactions process smoothly and without errors. This step is crucial for identifying any potential issues and ensuring a seamless customer experience.

Go Live: Once you’re confident that everything is working correctly, activate your payment system and make it live on your Shopify store. Monitor transactions closely in the initial days to address any unforeseen issues promptly.

Maximizing Sales with Cloudify:

While integrating Shopify with a payment system is essential for optimizing sales, managing multiple integrations can be complex. That’s where Cloudify comes in. Cloudify offers a comprehensive integration platform that simplifies the process of connecting Shopify with various payment systems, eliminating the need for manual coding and streamlining operations. With Cloudify, you can seamlessly manage transactions, track sales data, and optimize your e-commerce strategy for maximum success.

In conclusion, integrating Shopify with a reliable payment system is a critical step in maximizing sales and ensuring a seamless shopping experience for your customers. By following the steps outlined in this guide and leveraging tools like Cloudify, you can streamline operations, drive conversions, and take your e-commerce business to new heights of success.

Ready to elevate your Shopify store? Explore the possibilities with Cloudify today!

#crm#erpsoftware#automation services#business growth#crm software#integration#saas#b2b saas#businessintelligence#pipedrive#shopify#shopify integration#payment gateway

0 notes

Text

1 note

·

View note

Text

Scammers sophistication technique have reached a new apex, making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been keeping most retirees that reinvested most of their retirement plan sleepless after words of the threat that swept the streets does not seem to have not weakened at all.

Masses are appealing for a more stringent countermeasure to be in place as soon as possible, such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the data, but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris scan and many more folds multiplied compared to a fingerprint.

Several years ago, I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is the most affordable business appliance that can serve the majority, representing the poor to medium class and the trending plot of global economic structure just like a triangle.

Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our global population to pitch in the global trade for us to achieve having reserves and surplus will be more conceivable.

To make it a little impenetrable and globally under tighter scrutiny, I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobile number as the key index that will permanently our lifetime phone number. In the event of loss, the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance, which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also compliment tracking effort, narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding successful connection recorded by cell sites would enable us to speculate the linear direction as it trends.

We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the global trade and cover a larger scope and as far-reaching it could service most specially the marginalized poor a chance to lift their social status getting connected and finally be able to join our bandwagon to the brighter future. The fact can't be denied that they have been left without an adequate means to tap the convenience and business opportunity through eCommerce. Through the mobile payment gateway, even in the absence of a banking system in their region, they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card or as to many known financial credibility.

#mobilepaymentgateway

#mobiletechnology

#mCommerce

#onlinefraud

#RetinaScan

Scammers sophistication technique have reached a new apex, making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been keeping most retirees that reinvested most of their retirement plan sleepless after words of the threat that swept the streets does not seem to have not weakened at all.

Masses are appealing for a more stringent countermeasure to be in place as soon as possible, such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the data, but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris scan and many more folds multiplied compared to a fingerprint.

Several years ago, I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is the most affordable business appliance that can serve the majority, representing the poor to medium class and the trending plot of global economic structure just like a triangle.

Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our global population to pitch in the global trade for us to achieve having reserves and surplus will be more conceivable.

To make it a little impenetrable and globally under tighter scrutiny, I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobile number as the key index that will permanently our lifetime phone number. In the event of loss, the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance, which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also compliment tracking effort, narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding successful connection recorded by cell sites would enable us to speculate the linear direction as it trends.

We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the global trade and cover a larger scope and as far-reaching it could service most specially the marginalized poor a chance to lift their social status getting connected and finally be able to join our bandwagon to the brighter future. The fact can't be denied that they have been left without an adequate means to tap the convenience and business opportunity through eCommerce. Through the mobile payment gateway, even in the absence of a banking system in their region, they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card or as to many known financial credibility.

#mobilepaymentgateway

#mobiletechnology

#mCommerce

#onlinefraud

#RetinaScan

#FraudAlert

#FraudAlert

#Scammers sophistication technique have reached a new apex#making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been k#Masses are appealing for a more stringent countermeasure to be in place as soon as possible#such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the da#but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris#Several years ago#I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is#representing the poor to medium class and the trending plot of global economic structure just like a triangle.#Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our globa#To make it a little impenetrable and globally under tighter scrutiny#I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobil#the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance#which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also comp#narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding succ#We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the globa#even in the absence of a banking system in their region#they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card o#mobilepaymentgateway#mobiletechnology#mCommerce#onlinefraud#RetinaScan#FraudAlert

0 notes

Text

Zaakpay Payment Gateway API Integration by Infinity Webinfo Pvt Ltd

In today’s digital era, seamless online transactions are essential for the success of any e-commerce platform or service-based website. One of the most reliable solutions for enabling secure and efficient payments is the Zaakpay Payment Gateway. Known for its robust features and user-friendly interface, Zaakpay offers a streamlined way to handle online payments. To harness the full potential of this powerful tool, professional API integration is key—and that’s where Infinity Webinfo Pvt Ltd steps in.

What is Zaakpay Payment Gateway?

Zaakpay is a leading payment gateway solution that enables businesses to accept payments through various channels such as credit cards, debit cards, net banking, UPI, and digital wallets. It provides real-time transaction processing, high-security standards, and supports a wide range of e-commerce platforms and applications. Whether you're a startup or an established business, Zaakpay ensures your customers enjoy a smooth and secure checkout experience.

Importance of Zaakpay Payment Gateway API Integration Services

In the digital economy, the ability to accept online payments seamlessly is no longer a luxury—it’s a necessity. For businesses aiming to grow online, integrating a robust payment solution like Zaakpay Payment Gateway is a strategic move. However, the real game-changer lies in professional API integration services, which ensure that the gateway functions smoothly with your website or app.

Here’s why Zaakpay Payment Gateway API Integration Services are crucial:

Smooth User Experience

A well-integrated payment gateway ensures fast, frictionless checkouts. Customers can complete payments without delays or errors, reducing cart abandonment and boosting sales.

High Security & Compliance

Payment gateways handle sensitive financial data. Professional API integration ensures adherence to the latest PCI-DSS standards, encryption protocols, and secure handling of data to protect both you and your customers.

Real-Time Transaction Processing

Proper API integration enables real-time payment confirmations and status updates. This is critical for businesses dealing with time-sensitive services like ticket bookings, digital subscriptions, and instant deliveries.

Support for Multiple Payment Modes

Zaakpay supports cards, UPI, wallets, and net banking. With effective API integration, your business can offer a wide range of payment options without disrupting the user experience.

Custom Workflows & Automation

Every business has unique needs. Through customized API integration, you can automate processes such as invoicing, refund handling, transaction alerts, and reporting—saving time and reducing manual errors.

Faster Settlements and Dashboard Sync

With proper integration, all transactions get recorded and synced with your backend system or CRM. This transparency helps in reconciliation and financial planning.

Scalability and Flexibility

As your business grows, your payment system must adapt. A scalable API integration ensures that new features, products, or services can be added without reworking the entire payment structure.

Why Choose Infinity Webinfo Pvt Ltd?

Infinity Webinfo Pvt Ltd is a trusted name in the tech services domain, offering top-tier payment gateway API integration services for various platforms. With a dedicated team of developers and years of experience, Infinity ensures that your Zaakpay Payment Gateway integration is flawless, secure, and customized to meet your business needs.

Key Features of Their Integration Services:

End-to-End Integration: From sandbox testing to live deployment, every step is handled professionally.

Real-Time Support: Quick response times and ongoing technical support.

Secure Transactions: Integration that adheres to industry-standard encryption and security protocols.

Customization: Solutions tailored for your specific website or application framework.

Compliance Assistance: Help with documentation and KYC compliance required by Zaakpay.

Industries Served

Infinity Webinfo Pvt Ltd has successfully implemented Zaakpay Payment Gateway for:

E-commerce platforms

Travel portals

Subscription-based services

Ed-tech applications

Freelance and portfolio websites

Final Thoughts

Incorporating a reliable payment gateway like Zaakpay is a crucial step for any online business. With professional API integration services from Infinity Webinfo Pvt Ltd, you not only ensure smooth transactions but also gain a competitive edge in the digital marketplace. Whether you’re building a new platform or upgrading your existing system, their expertise can help you create a secure and scalable payment experience for your users.

📩 Contact us today to schedule a free consultation and take your travel business to the next level.

WhatsApp: +91 9711090237

#zaakpay#Zaakpay API Integration#api integration services#api integration#infinity webinfo pvt ltd#website design#payment gateway api integration#travel portal company#travel portal development

0 notes

Text

In the fast-paced world of digital marketing, businesses are constantly seeking innovative ways to reach their target audience and drive growth. E-commerce has emerged as a powerful tool that not only expands the reach of businesses but also enhances customer experience. In this comprehensive guide, we will explore the dynamic realm of e-commerce and how it can elevate your business in the digital marketing landscape.

Do Read: https://ennobletechnologies.com/e-commerce/e-commerce-solutions/

#Conversion Rate Optimization#Cross-Platform Shopping#Customer Retention Strategies#Digital Payment Solutions#Digital Storefronts#E-Commerce Analytics#E-Commerce Branding#E-commerce content marketing#E-Commerce Data Analysis#E-Commerce Marketing#E-Commerce Optimization#E-Commerce Platforms#E-Commerce Sales Funnels#e-commerce SEO services#E-Commerce Solutions in Digital Marketing#E-Commerce Website Development#Mobile Shopping Apps#Online Retail Strategies#Payment Gateway Integration#SEO for E-Commerce#Shopping Cart Integration#Social Commerce

1 note

·

View note

Text

SHOPIFY PAYMENTS: SIMPLIFYING TRANSACTIONS FOR YOUR CUSTOMERS

In the dynamic world of e-commerce, the ability to provide a seamless and secure payment experience is paramount. Shopify, a leading e-commerce platform, understands this necessity and has introduced Shopify Payments as an integrated solution to streamline transactions for both merchants and customers.

Understanding Shopify Payments:

Shopify Payments is a payment gateway designed to simplify the online purchasing process for businesses operating on the Shopify platform. It eliminates the need for third-party payment processors, offering an all-in-one solution that seamlessly integrates with the Shopify ecosystem.

Seamless Integration:

One of the key advantages of Shopify Payments is its seamless integration with the Shopify platform. Merchants can set up and manage their payment processes directly within their Shopify dashboard, eliminating the need for additional third-party accounts or complex integrations. This streamlines the entire process, allowing businesses to focus on their products and customer experience.

Diverse Payment Options:

Shopify Payments supports a wide range of payment methods, catering to the diverse preferences of customers globally. Whether it’s credit cards, debit cards, or alternative payment methods, Shopify Payments ensures that businesses can offer a variety of options to their customers, enhancing convenience and accessibility.

Enhanced Security:

Security is a top priority in online transactions, and Shopify Payments prioritizes the protection of sensitive information. It is fully PCI compliant, adhering to industry standards for secure payment processing. With end-to-end encryption and fraud prevention measures, customers can have confidence in the safety of their transactions.

Streamlined Checkout Experience:

Shopify Payments contributes to a smooth and efficient checkout process. The integration allows customers to complete their transactions without being redirected to external websites, reducing friction and increasing the likelihood of successful purchases. This user-friendly experience can lead to higher conversion rates and improved customer satisfaction.

Automatic Updates and Reporting:

Shopify Payments provides merchants with automatic updates on transactions and settlements directly within their Shopify admin. The platform also offers detailed reports and analytics, giving businesses valuable insights into their sales performance, customer behavior, and payment trends.

Multi-Currency Support:

For businesses with a global customer base, Shopify Payments supports transactions in multiple currencies. This feature allows merchants to sell internationally without the hassle of currency conversions, providing a more transparent and convenient shopping experience for customers around the world.

Customer Trust and Brand Loyalty:

By utilizing Shopify Payments, businesses can build trust with their customers. The integration of a reliable and secure payment system enhances the overall brand image, fostering customer loyalty and encouraging repeat business.

In conclusion, Shopify Payments stands out as a robust and user-friendly solution for handling transactions in the e-commerce realm. From its seamless integration with the Shopify platform to its diverse payment options and emphasis on security, Shopify Payments plays a crucial role in simplifying the payment process for both merchants and customers, contributing to a more efficient and trustworthy online shopping experience. To know more visit us at https://magnigeeks.com

#Shopify Payments#E-commerce Transactions#Simplified Payments#Secure Online Payments#Shopify Payment Gateway#Integrated Payment Solutions#Online Store Payments#Shopify Merchant Services#Simplify Customer Transactions#Shopify POS Payments#Secure and Easy Online Transactions#Integrated Payment Processing#magnigeeks

1 note

·

View note

Text

#best payment gateway integration services#payment gateway#payment gateway connection#payment gateway integration

0 notes

Text

Invimatic is a cutting-edge platform specializing in continuous integration testing. Their innovative services empower software developers and teams to streamline their development processes by automating the testing and integration of code changes. With a focus on efficiency and quality assurance, Invimatic offers a comprehensive suite of tools and solutions for optimizing software development workflows. This platform plays a crucial role in ensuring that software applications are robust and reliable through continuous integration testing, ultimately contributing to smoother and more successful project outcomes.

0 notes