#Integrated Payment Processing

Explore tagged Tumblr posts

Text

SHOPIFY PAYMENTS: SIMPLIFYING TRANSACTIONS FOR YOUR CUSTOMERS

In the dynamic world of e-commerce, the ability to provide a seamless and secure payment experience is paramount. Shopify, a leading e-commerce platform, understands this necessity and has introduced Shopify Payments as an integrated solution to streamline transactions for both merchants and customers.

Understanding Shopify Payments:

Shopify Payments is a payment gateway designed to simplify the online purchasing process for businesses operating on the Shopify platform. It eliminates the need for third-party payment processors, offering an all-in-one solution that seamlessly integrates with the Shopify ecosystem.

Seamless Integration:

One of the key advantages of Shopify Payments is its seamless integration with the Shopify platform. Merchants can set up and manage their payment processes directly within their Shopify dashboard, eliminating the need for additional third-party accounts or complex integrations. This streamlines the entire process, allowing businesses to focus on their products and customer experience.

Diverse Payment Options:

Shopify Payments supports a wide range of payment methods, catering to the diverse preferences of customers globally. Whether it’s credit cards, debit cards, or alternative payment methods, Shopify Payments ensures that businesses can offer a variety of options to their customers, enhancing convenience and accessibility.

Enhanced Security:

Security is a top priority in online transactions, and Shopify Payments prioritizes the protection of sensitive information. It is fully PCI compliant, adhering to industry standards for secure payment processing. With end-to-end encryption and fraud prevention measures, customers can have confidence in the safety of their transactions.

Streamlined Checkout Experience:

Shopify Payments contributes to a smooth and efficient checkout process. The integration allows customers to complete their transactions without being redirected to external websites, reducing friction and increasing the likelihood of successful purchases. This user-friendly experience can lead to higher conversion rates and improved customer satisfaction.

Automatic Updates and Reporting:

Shopify Payments provides merchants with automatic updates on transactions and settlements directly within their Shopify admin. The platform also offers detailed reports and analytics, giving businesses valuable insights into their sales performance, customer behavior, and payment trends.

Multi-Currency Support:

For businesses with a global customer base, Shopify Payments supports transactions in multiple currencies. This feature allows merchants to sell internationally without the hassle of currency conversions, providing a more transparent and convenient shopping experience for customers around the world.

Customer Trust and Brand Loyalty:

By utilizing Shopify Payments, businesses can build trust with their customers. The integration of a reliable and secure payment system enhances the overall brand image, fostering customer loyalty and encouraging repeat business.

In conclusion, Shopify Payments stands out as a robust and user-friendly solution for handling transactions in the e-commerce realm. From its seamless integration with the Shopify platform to its diverse payment options and emphasis on security, Shopify Payments plays a crucial role in simplifying the payment process for both merchants and customers, contributing to a more efficient and trustworthy online shopping experience. To know more visit us at https://magnigeeks.com

#Shopify Payments#E-commerce Transactions#Simplified Payments#Secure Online Payments#Shopify Payment Gateway#Integrated Payment Solutions#Online Store Payments#Shopify Merchant Services#Simplify Customer Transactions#Shopify POS Payments#Secure and Easy Online Transactions#Integrated Payment Processing#magnigeeks

1 note

·

View note

Text

🌟 SmilePayz Payment Solution: Covering All Industries, Seamless Integration! 🌟

SmilePayz specializes in Indonesia, Thailand, Brazil, and Mexico, offering cryptocurrency payment solution as well. Since we are a direct payment source for these countries, we can provide the lowest rates in the market. We also offer same-day settlement/D0 settlement!

✅ Easy Integration: Diversified API interfaces for quick system compatibility, improving efficiency. ✅ 24/7 Support: Professional service around the clock, ensuring peace of mind.

Whether you're in online gaming, forex, online casino, live streaming, entertainment, forex, or financial services, SmilePayz is your best payment solution! [We do not accept business that is related to pornography and scamming.

🌐 Contact us now to experience more convenient and secure payment services!

Telegram: @Thompson7837

Telegram: @Thompson7837

Telegram: @Thompson7837

#payment gateway#api integration#high risk payment processing#high risk payment gateway#paymentsolutions#payment#payments#e commerce#online gambling#forex

2 notes

·

View notes

Text

issuu

Payment gateway integration is the seamless incorporation of a payment gateway into your website, allowing secure and efficient online transactions. Your Merchant Services Rep offers expert payment gateway integration services, ensuring enhanced security, seamless checkout experiences, and increased trust for your business.

2 notes

·

View notes

Text

How Acumatica Authorize.Net Integration Supports Global Payment Scalability

Global businesses demand payment solutions that can scale effortlessly with growth, adapt to diverse markets, and ensure seamless transactions. The integration of Authorize.Net with Acumatica is a game-changer, providing businesses with a reliable platform to streamline global payment processing and ensure uninterrupted scalability.

Global Payment Processing Made Easy

In a world where businesses transact across borders, handling diverse payment methods and currencies is essential. The Authorize.Net integration with Acumatica empowers organizations to process payments globally, ensuring smooth operations regardless of geographical location. By supporting multiple currencies and secure payment options, this solution aligns with the needs of a modern, interconnected marketplace.

Seamless Scalability with Acumatica

Scalability is at the core of any successful business model. The Authorize.Net connector ensures that as your business grows, your payment processing capabilities expand seamlessly. Whether you're scaling up transaction volumes or entering new markets, Acumatica's flexibility coupled with Authorize.Net's robust features ensures your systems remain agile and efficient.

Enhanced Efficiency and Security

Managing large-scale payment operations requires not only efficiency but also security. This integration uses tokenization to protect sensitive customer payment data, ensuring compliance with PCI standards. The built-in transaction logs and enhanced error handling further streamline operations, allowing businesses to focus on growth without being bogged down by operational challenges.

Why Choose the Authorize.Net Connector for Acumatica?

Continuity and Familiarity: Businesses can maintain their existing workflows, avoiding disruptions caused by switching payment gateways.

Cost-Effectiveness: Avoid hefty fees and training costs typically associated with adopting new systems.

Global Reach: The connector supports international transactions, making it ideal for businesses operating on a global scale.

Conclusion

As businesses expand into global markets, the combination of Acumatica’s scalability and Authorize.Net’s global payment processing capabilities is a winning formula. This integration empowers organizations to process payments seamlessly, scale effortlessly, and ensure secure, efficient transactions.

Ready to future-proof your payment infrastructure? Explore how Authorize.Net connector can support your global ambitions with Acumatica’s scalable platform today! Visit us now: https://www.authorizenet.biz/

0 notes

Text

POS Implementation

POS Implementation: A Comprehensive Guide

In today’s fast-paced retail and service environments, implementing a Point of Sale (POS) system can significantly streamline operations, enhance customer experience, and improve overall efficiency. Whether you’re upgrading from a traditional cash register or installing your first POS system, proper implementation is crucial to maximizing its benefits. This guide will walk you through the essential steps of POS implementation.

Step 1: Identify Business Needs

Before selecting a POS system, assessing your business requirements is important. Consider the following:

The size and type of your business.

Specific features you need (e.g., inventory tracking, customer loyalty programs).

Budget constraints.

Integration requirements with existing software and hardware.

Step 2: Choose the Right POS System

Not all POS systems are created equal. Here’s how to select one that fits your needs:

Research and compare various providers.

Look for scalability to accommodate future growth.

Ensure it supports multiple payment methods.

Check reviews and testimonials from similar businesses.

Step 3: Hardware and Software Setup

A POS system consists of hardware (like barcode scanners, receipt printers, and card readers) and software. Ensure you:

Acquire hardware compatible with your chosen POS software.

Install and configure the software according to your operational needs.

Test all components to ensure they work seamlessly together.

Step 4: Data Migration

If you’re transitioning from an older system, data migration is a critical step:

Back up your existing data.

Transfer inventory, sales history, and customer information to the new system.

Verify the accuracy of migrated data.

Step 5: Employee Training

Proper training ensures your team can effectively use the POS system:

Organize hands-on training sessions.

Provide user manuals and support materials.

Address common troubleshooting scenarios.

Step 6: Pilot Testing

Before full-scale implementation, conduct a pilot test:

Use the system in a controlled environment.

Monitor for any issues or inefficiencies.

Gather feedback from staff and customers.

Step 7: Go Live

Once testing is complete, it’s time to roll out the system:

Schedule the launch during a low-traffic period to minimize disruptions.

Ensure on-site support is available for the initial days.

Communicate the change to your team and customers.

Step 8: Monitor and Optimize

Implementation doesn’t end with the launch. Regular monitoring is essential:

Analyze performance metrics (e.g., transaction times, error rates).

Update the system as needed to fix bugs and improve features.

Seek ongoing feedback from employees and customers.

Conclusion

Implementing a POS system is an investment in your business's future. With proper planning and execution, it can simplify daily operations, enhance customer satisfaction, and drive growth. By following the steps outlined above, you can ensure a smooth and successful implementation.

#POS System Implementation#Point of Sale Guide#Retail Technology#Business Efficiency#POS Hardware and Software#Data Migration Tips#Employee Training for POS#Pilot Testing POS#POS System Optimization#Small Business Solutions#Inventory Management#Customer Loyalty Programs#Payment Integration#Retail Operations#Streamlining Business Processes

0 notes

Text

Billing Software Development Services IBR Infotech

IBR Infotech specializes in providing custom billing software development services designed to streamline your invoicing, payment processing, and transaction management. Our solutions offer seamless integration with existing systems, ensuring accurate, automated billing processes that enhance financial operations.

With a focus on user-friendly interfaces and robust security, our billing software helps businesses reduce manual errors, improve cash flow, and maintain compliance. Whether you're a small business or a large enterprise, our scalable solutions can be tailored to meet your specific needs, ensuring efficiency and accuracy across your billing cycles. Let IBR Infotech transform your billing system into a powerful tool for financial management and business growth. Read more -https://www.ibrinfotech.com/solutions/custom-billing-software-development #BillingSoftware #SoftwareDevelopment #CustomBilling #InvoicingSoftware #PaymentProcessing #TransactionManagement #AutomatedBilling #FinancialManagement #SecureBilling #BillingSolutions #ScalableSoftware #BusinessSoftware #CashFlowManagement #BillingSystem #TechSolutions #EnterpriseSoftware #BillingServices #FinancialTech #SoftwareDevelopmentServices

#billing software development#custom billing software#invoicing software solutions#payment processing software#transaction management system#automated billing#secure billing software#financial management software#billing system integration#custom invoicing software#user-friendly billing system#billing software for businesses#financial operations software#automated invoicing solutions

0 notes

Text

Prepaid Cards Revolutionize Cashless Dining in Food Courts

Introduction to Prepaid Cards

In today's fast-paced world, convenience is paramount, especially when it comes to dining out. Prepaid cards have emerged as a revolutionary solution, offering a seamless and efficient way to enjoy cashless dining experiences. The concept of prepaid cards is not new, but their integration into food courts has sparked a significant shift in consumer behavior.

Cashless Dining Trends

The global trend towards cashless transactions has gained momentum in recent years, driven by advancements in technology and changing consumer preferences. In food courts, where speed and convenience are key, the adoption of cashless payment methods has become increasingly prevalent.

Challenges in Traditional Payment Methods

Traditional payment methods, such as cash or credit/debit cards, pose several challenges in food court settings. Cash transactions can lead to long queues and delays, while credit/debit card payments may be inconvenient for both consumers and vendors due to processing fees and minimum purchase requirements.

The Emergence of Prepaid Cards in Food Courts

To address these challenges, food courts are embracing prepaid card systems, revolutionizing the way customers pay for their meals. By preloading funds onto a card, customers can enjoy quick and hassle-free transactions, eliminating the need for cash or physical cards.

How Prepaid Cards Work

Prepaid cards operate on a simple premise: customers load funds onto their cards either online or at designated kiosks within the food court. They can then use these funds to make purchases at any participating vendor within the food court.

Advantages of Prepaid Cards in Food Courts

The benefits of prepaid cards in food courts are manifold. For consumers, they offer unmatched convenience and speed, allowing them to make purchases with a simple tap or swipe. Additionally, prepaid cards provide consumers with greater control over their spending, helping them stick to their budgets more effectively.

For food court operators, prepaid cards streamline transaction processing, reducing wait times and enhancing overall efficiency. By centralizing payments through a single platform, vendors can also gain valuable insights into consumer behavior and preferences, enabling them to tailor their offerings accordingly.

Enhanced Customer Experience

One of the key advantages of prepaid cards in food courts is the enhanced customer experience they provide. By minimizing wait times and offering seamless transactions, prepaid cards ensure that customers spend less time queuing and more time enjoying their meals.

Moreover, prepaid cards enable food court operators to implement customized loyalty programs, rewarding customers for their continued patronage. By offering incentives such as discounts or freebies, operators can further enhance the overall dining experience and foster customer loyalty.

Security and Safety Measures

Security is a top priority in any payment system, and prepaid cards are no exception. With robust encryption protocols and built-in fraud detection mechanisms, prepaid card systems offer consumers peace of mind knowing that their financial information is safe and secure.

Additionally, prepaid cards eliminate the need for consumers to carry large amounts of cash, reducing the risk of theft or loss. In the event that a card is lost or stolen, most prepaid card providers offer 24/7 customer support and the ability to freeze or deactivate the card remotely.

Adoption and Acceptance

The adoption of prepaid cards in food courts is steadily increasing, driven by the growing demand for cashless payment options. As more consumers become accustomed to the convenience and benefits of prepaid cards, food court vendors are increasingly recognizing the need to offer these payment methods to remain competitive.

Impact on Business Operations

From a business perspective, the integration of prepaid card systems can have a transformative impact on operations. By automating transaction processing and streamlining administrative tasks, vendors can reduce overhead costs and improve overall efficiency.

Moreover, prepaid card systems provide vendors with valuable data insights, allowing them to track sales trends, identify popular menu items, and target specific customer demographics more effectively. This data-driven approach enables vendors to make informed decisions that drive business growth and profitability.

Future Trends and Innovations

Looking ahead, the future of prepaid cards in food courts looks promising, with continued advancements in technology driving innovation and customization. From mobile payment solutions to personalized loyalty programs, vendors are constantly seeking new ways to enhance the customer experience and stay ahead of the competition.

Challenges and Concerns

Despite the many benefits of prepaid cards, there are also challenges and concerns that must be addressed. Chief among these is the need to ensure consumer privacy and data security. As prepaid card systems become more sophisticated, it is essential for vendors to implement robust privacy policies and security measures to protect customer information.

Additionally, accessibility remains a concern for some consumers, particularly those who may not have access to smartphones or digital payment methods. To address this issue, food courts must ensure that alternative payment options are available to accommodate all customers.

Case Studies and Success Stories

Numerous food courts around the world have already embraced prepaid card systems with great success. From small-scale vendors to large multinational chains, businesses of all sizes have reported significant improvements in transaction processing times, customer satisfaction, and overall revenue.

For example, a recent case study conducted by a major food court operator found that the implementation of prepaid card systems resulted in a 30% increase in sales and a 20% reduction in wait times. These impressive results demonstrate the tangible benefits that prepaid cards can

offer to both consumers and businesses alike.

Consumer Education and Awareness

Despite the growing popularity of prepaid cards, there is still a need for consumer education and awareness. Many consumers may be unfamiliar with how prepaid cards work or may have misconceptions about their usage and benefits. As such, food courts must invest in educational campaigns to inform consumers about the advantages of prepaid cards and how to use them effectively.

Conclusion

In conclusion, prepaid cards are revolutionizing the way consumers pay for their meals in food courts. By offering unmatched convenience, speed, and security, prepaid cards are transforming the dining experience for both customers and vendors alike. As the adoption of prepaid cards continues to grow, food courts are poised to reap the benefits of improved efficiency, increased revenue, and enhanced customer satisfaction.

We hope you enjoyed reading our blog posts about food court billing solutions. If you want to learn more about how we can help you manage your food court business, please visit our website here. We are always happy to hear from you and answer any questions you may have.

You can reach us by phone at +91 9810078010 or by email at [email protected]. Thank you for your interest in our services.

FAQs

1. Are prepaid cards accepted at all vendors in the food court?

Yes, prepaid cards can typically be used at any participating vendor within the food court.

2. Can I reload funds onto my prepaid card?

Yes, most prepaid card systems allow users to reload funds either online or at designated kiosks within the food court.

3. Is my personal information secure when using a prepaid card?

Yes, prepaid card systems employ robust security measures to protect customer information and prevent unauthorized access.

4. Are there any fees associated with using a prepaid card?

Some prepaid card providers may charge nominal fees for certain services, such as reloading funds or replacing lost or stolen cards.

5. Can I earn rewards or loyalty points with a prepaid card?

Yes, many prepaid card systems offer rewards or loyalty programs that allow users to earn points or discounts on their purchases.

#prepaid cards#cashless dining#food courts#payment methods#prepaid card systems#consumer convenience#customer experience#cashless transactions#digital payments#financial security#loyalty programs#transaction processing#data analytics#customer education#privacy concerns#business efficiency#innovation#technology integration#consumer awareness#case studies#success stories#FAQs#blogging#digital trends#restaurant industry#financial technology#prepaid card benefits#prepaid card acceptance

0 notes

Text

Scammers sophistication technique have reached a new apex, making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been keeping most retirees that reinvested most of their retirement plan sleepless after words of the threat that swept the streets does not seem to have not weakened at all.

Masses are appealing for a more stringent countermeasure to be in place as soon as possible, such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the data, but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris scan and many more folds multiplied compared to a fingerprint.

Several years ago, I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is the most affordable business appliance that can serve the majority, representing the poor to medium class and the trending plot of global economic structure just like a triangle.

Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our global population to pitch in the global trade for us to achieve having reserves and surplus will be more conceivable.

To make it a little impenetrable and globally under tighter scrutiny, I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobile number as the key index that will permanently our lifetime phone number. In the event of loss, the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance, which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also compliment tracking effort, narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding successful connection recorded by cell sites would enable us to speculate the linear direction as it trends.

We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the global trade and cover a larger scope and as far-reaching it could service most specially the marginalized poor a chance to lift their social status getting connected and finally be able to join our bandwagon to the brighter future. The fact can't be denied that they have been left without an adequate means to tap the convenience and business opportunity through eCommerce. Through the mobile payment gateway, even in the absence of a banking system in their region, they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card or as to many known financial credibility.

#mobilepaymentgateway

#mobiletechnology

#mCommerce

#onlinefraud

#RetinaScan

Scammers sophistication technique have reached a new apex, making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been keeping most retirees that reinvested most of their retirement plan sleepless after words of the threat that swept the streets does not seem to have not weakened at all.

Masses are appealing for a more stringent countermeasure to be in place as soon as possible, such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the data, but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris scan and many more folds multiplied compared to a fingerprint.

Several years ago, I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is the most affordable business appliance that can serve the majority, representing the poor to medium class and the trending plot of global economic structure just like a triangle.

Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our global population to pitch in the global trade for us to achieve having reserves and surplus will be more conceivable.

To make it a little impenetrable and globally under tighter scrutiny, I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobile number as the key index that will permanently our lifetime phone number. In the event of loss, the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance, which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also compliment tracking effort, narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding successful connection recorded by cell sites would enable us to speculate the linear direction as it trends.

We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the global trade and cover a larger scope and as far-reaching it could service most specially the marginalized poor a chance to lift their social status getting connected and finally be able to join our bandwagon to the brighter future. The fact can't be denied that they have been left without an adequate means to tap the convenience and business opportunity through eCommerce. Through the mobile payment gateway, even in the absence of a banking system in their region, they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card or as to many known financial credibility.

#mobilepaymentgateway

#mobiletechnology

#mCommerce

#onlinefraud

#RetinaScan

#FraudAlert

#FraudAlert

#Scammers sophistication technique have reached a new apex#making Banking Fraud just like a walk in the park to this crime syndicates with richer background helter-skelters depositors and has been k#Masses are appealing for a more stringent countermeasure to be in place as soon as possible#such are adding more authentication request. Although retina scanner can slow down the process with the amount or rather the size of the da#but it also gives us an opportunity of having time to lockout perpetrators. The size of the data makes it at least 70% better than an iris#Several years ago#I foresaw that the mCommerce (mobile commerce) would be ruled out as the mainstay of electronic processing for the sole reason that it is#representing the poor to medium class and the trending plot of global economic structure just like a triangle.#Having mCommerce | Mobile Technology as our economic transport offers the possibility of catering and adding the biggest chunk of our globa#To make it a little impenetrable and globally under tighter scrutiny#I proposed that we adopt the universal identification system. We will integrate every other form of identity attached to it using our mobil#the telco will make a SIM based on a secret code given to the subscriber upon the receipt of your subscription and issuance#which will be honored and will be service by other Telcos if subscriber opt to change carrier. The number coding of telcos should also comp#narrowed down within the radius and range of a few kilometers apart where the last signal was received or transmitted. The succeeding succ#We will enable the mobile technology to be a conduit of payment gateways or as a payment gateway itself. Our objective is to open the globa#even in the absence of a banking system in their region#they can now fulfill the checkout process by loading or charging it from your telco which is even less intricate than having a debit card o#mobilepaymentgateway#mobiletechnology#mCommerce#onlinefraud#RetinaScan#FraudAlert

0 notes

Text

Elevate your business efficiency! Choosing the right billing software is key. Find an intuitive, secure, and scalable solution that streamlines invoicing and boosts productivity. #BillingSoftware #BusinessEfficiency

#Billing Software#Invoicing Tools#Business Efficiency#Billing Features#Payment Processing#Automation#Reporting#Integration

0 notes

Text

InviMatic is a leading provider of customised payment gateway solutions in the USA. With a strong reputation for excellence in financial technology, InviMatic offers tailored payment processing solutions to businesses across various industries. Their expertise in creating secure and efficient payment gateways enables seamless transactions, ensuring both convenience for customers and enhanced financial management for businesses. InviMatic's commitment to innovation and client-centric services makes them a trusted partner for companies seeking reliable payment processing solutions in the United States.

#how payment gateway integration works#customised payment gateway solutions#payment gateway integration process

0 notes

Text

The so-called Department of Government Efficiency (DOGE) is starting to put together a team to migrate the Social Security Administration’s (SSA) computer systems entirely off one of its oldest programming languages in a matter of months, potentially putting the integrity of the system—and the benefits on which tens of millions of Americans rely—at risk.

The project is being organized by Elon Musk lieutenant Steve Davis, multiple sources who were not given permission to talk to the media tell WIRED, and aims to migrate all SSA systems off COBOL, one of the first common business-oriented programming languages, and onto a more modern replacement like Java within a scheduled tight timeframe of a few months.

Under any circumstances, a migration of this size and scale would be a massive undertaking, experts tell WIRED, but the expedited deadline runs the risk of obstructing payments to the more than 65 million people in the US currently receiving Social Security benefits.

“Of course, one of the big risks is not underpayment or overpayment per se; [it’s also] not paying someone at all and not knowing about it. The invisible errors and omissions,” an SSA technologist tells WIRED.

The Social Security Administration did not immediately reply to WIRED’s request for comment.

SSA has been under increasing scrutiny from president Donald Trump’s administration. In February, Musk took aim at SSA, falsely claiming that the agency was rife with fraud. Specifically, Musk pointed to data he allegedly pulled from the system that showed 150-year-olds in the US were receiving benefits, something that isn’t actually happening. Over the last few weeks, following significant cuts to the agency by DOGE, SSA has suffered frequent website crashes and long wait times over the phone, The Washington Post reported this week.

This proposed migration isn’t the first time SSA has tried to move away from COBOL: In 2017, SSA announced a plan to receive hundreds of millions in funding to replace its core systems. The agency predicted that it would take around five years to modernize these systems. Because of the coronavirus pandemic in 2020, the agency pivoted away from this work to focus on more public-facing projects.

Like many legacy government IT systems, SSA systems contain code written in COBOL, a programming language created in part in the 1950s by computing pioneer Grace Hopper. The Defense Department essentially pressured private industry to use COBOL soon after its creation, spurring widespread adoption and making it one of the most widely used languages for mainframes, or computer systems that process and store large amounts of data quickly, by the 1970s. (At least one DOD-related website praising Hopper's accomplishments is no longer active, likely following the Trump administration’s DEI purge of military acknowledgements.)

As recently as 2016, SSA’s infrastructure contained more than 60 million lines of code written in COBOL, with millions more written in other legacy coding languages, the agency’s Office of the Inspector General found. In fact, SSA’s core programmatic systems and architecture haven’t been “substantially” updated since the 1980s when the agency developed its own database system called MADAM, or the Master Data Access Method, which was written in COBOL and Assembler, according to SSA’s 2017 modernization plan.

SSA’s core “logic” is also written largely in COBOL. This is the code that issues social security numbers, manages payments, and even calculates the total amount beneficiaries should receive for different services, a former senior SSA technologist who worked in the office of the chief information officer says. Even minor changes could result in cascading failures across programs.

“If you weren't worried about a whole bunch of people not getting benefits or getting the wrong benefits, or getting the wrong entitlements, or having to wait ages, then sure go ahead,” says Dan Hon, principal of Very Little Gravitas, a technology strategy consultancy that helps government modernize services, about completing such a migration in a short timeframe.

It’s unclear when exactly the code migration would start. A recent document circulated amongst SSA staff laying out the agency’s priorities through May does not mention it, instead naming other priorities like terminating “non-essential contracts” and adopting artificial intelligence to “augment” administrative and technical writing.

Earlier this month, WIRED reported that at least 10 DOGE operatives were currently working within SSA, including a number of young and inexperienced engineers like Luke Farritor and Ethan Shaotran. At the time, sources told WIRED that the DOGE operatives would focus on how people identify themselves to access their benefits online.

Sources within SSA expect the project to begin in earnest once DOGE identifies and marks remaining beneficiaries as deceased and connecting disparate agency databases. In a Thursday morning court filing, an affidavit from SSA acting administrator Leland Dudek said that at least two DOGE operatives are currently working on a project formally called the “Are You Alive Project,” targeting what these operatives believe to be improper payments and fraud within the agency’s system by calling individual beneficiaries. The agency is currently battling for sweeping access to SSA’s systems in court to finish this work. (Again, 150-year-olds are not collecting social security benefits. That specific age was likely a quirk of COBOL. It doesn’t include a date type, so dates are often coded to a specific reference point—May 20, 1875, the date of an international standards-setting conference held in Paris, known as the Convention du Mètre.)

In order to migrate all COBOL code into a more modern language within a few months, DOGE would likely need to employ some form of generative artificial intelligence to help translate the millions of lines of code, sources tell WIRED. “DOGE thinks if they can say they got rid of all the COBOL in months, then their way is the right way, and we all just suck for not breaking shit,” says the SSA technologist.

DOGE would also need to develop tests to ensure the new system’s outputs match the previous one. It would be difficult to resolve all of the possible edge cases over the course of several years, let alone months, adds the SSA technologist.

“This is an environment that is held together with bail wire and duct tape,” the former senior SSA technologist working in the office of the chief information officer tells WIRED. “The leaders need to understand that they’re dealing with a house of cards or Jenga. If they start pulling pieces out, which they’ve already stated they’re doing, things can break.”

260 notes

·

View notes

Text

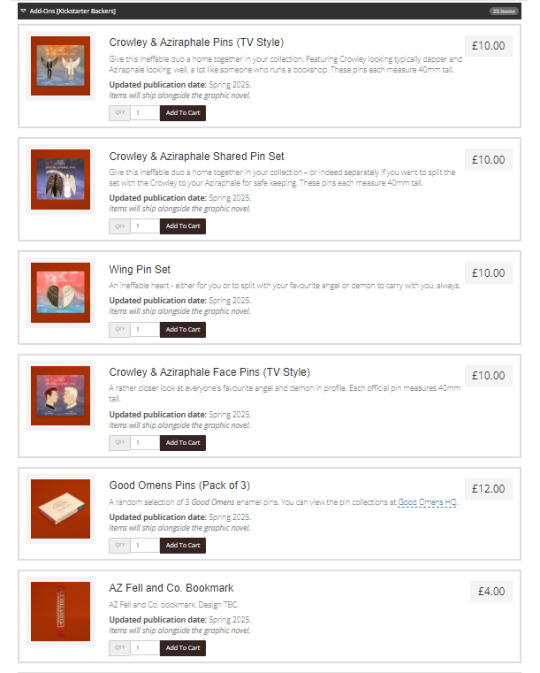

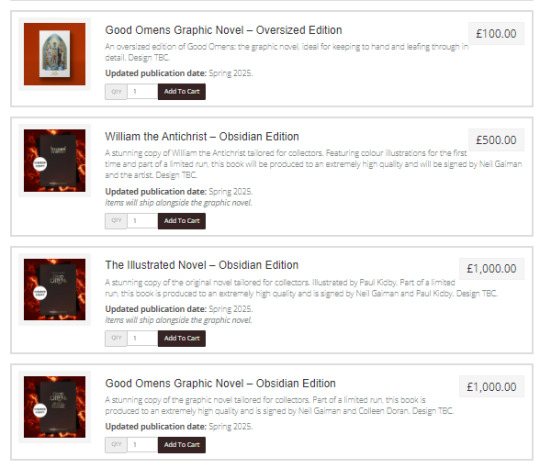

The PledgeManager has launched!

Thank you for bearing with us. We’re happy to say that, as promised, the PledgeManager has officially launched!

In case you missed it, we detailed earlier this week that the publication of the graphic novel has been pushed back from its original July 2024 estimate into Spring 2025 - you can read the full update here. We also want to take a moment to say that we have seen the outpouring of love and support on Kickstarter, and across various platforms, wishing Colleen well in her recovery and the time needed for the graphic novel - a huge thank you from all of the team for your understanding and patience, and for the genuine community and care we’ve seen these past few days. We appreciate you all.

PledgeManager

With this in mind, we think it’s important to underline: though PledgeManager has launched, you do not need to pay for your shipping fees immediately.

The PledgeManager is there for those who missed the campaign to order the graphic novel, and indeed for any backers who would like to upgrade, get some other add-ons, or the new items. You, as a pre-existing backer, should receive an email with information via Kickstarter and/or PledgeManager to inform you that this is now open to you - note, these are sent in waves of smaller batches, so if you don't get yours immediately, don't panic! It will likely take between 12-18 hours to process all the backers.

You are, of course, welcome to pay your shipping right away if you'd like, however we completely understand that you may want to wait until closer to the fulfilment time, or when more solid dates are confirmed, before actioning this.

For this stage, we have compiled a quick FAQ below covering some key questions:

Will the whole project be moving from Kickstarter to PledgeManager? No. This is just for the fulfilment side and logistics - all updates will still remain here.

Do PledgeManager backers get everything that Kickstarter backers do? No. While the remaining tiers will be made available for those who missed it, with certain stretch goals (e.g. additions to the book, loot boxes, etc), Kickstarter backers have a number of exclusives such as the Good Omens HQ discount code for when the store launches, and the backers only events.

My PledgeManager address will be different to what is listed on my Kickstarter. Is that fine? Yes. We are handling all logistics through PledgeManager and, as such, that is the only place where we will need your address. If you move or need to change any details, that will be the place to do so.

Can I change my address? Yes. You can update your address until we are at the shipping stage. We will keep this option open for as long as possible to ensure maximum flexibility around this.

How are shipping fees calculated? It is based on both weight and the country it is being sent to. We have been working over the past months to streamline processes and bring the costs down from their original starting point.

Do I have to pay just now? You do not need to pay immediately, but payment will need to be made prior to your items being shipped. You now have a bigger window during which you can make payment. As above, we will keep updating you on the progression of the publication schedule, should you be waiting for firmer dates before doing so.

What about taxes and import duty? UK: VAT is included in the costs UK backers pay, there should be no extra tax charges. US: We believe (but cannot guarantee) that imports under $800USD in value should not attract import duty, those pledges above may be taxed at import. EU & REST OF THE WORLD: If taxes or duties apply to your pledge, these will need to be paid at time of import into your country. We’ve spent months trying to integrate the costs at this stage, but in having the project open across the globe, it has proven too complex to be able to fully refine and cover all instances and locations, and we’ve been advised that this is the best route forward. We know a lot of international backers, particularly in the EU – for example – will already be used to this process, and we will keep you all updated on any developments on this front. For all of our backers, we are working hard to make labelling and declaring all of the contents of your pledges as transparent as possible, in order to make taxing and importing as easy and affordable as possible.

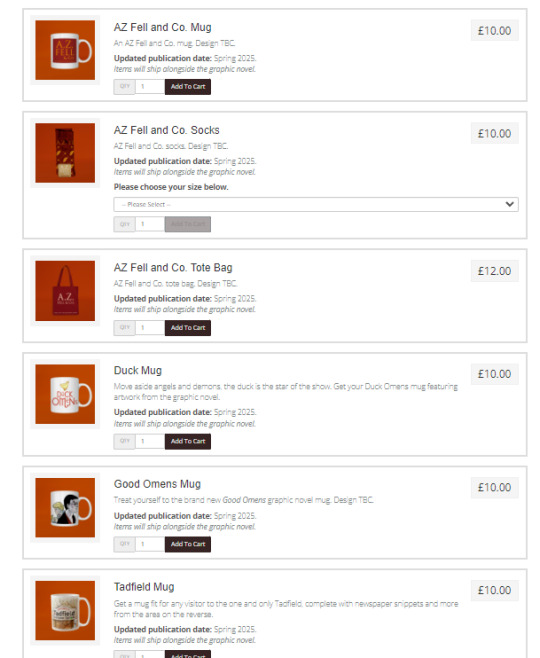

I want to buy the new items, but am waiting to pay shipping. Are they limited? The pins, mugs, notebooks - all the new items specifically added to the PledgeManager are not limited and will be available regardless of whether you get them now, or months down the road. The only limited items are the remaining tiers that have moved over from the Kickstarter (e.g. the Obsidian Tier) that were limited to begin with, and a very limited run of the Alien Parking ticket. Everything else is fully available, in perpetuity.

Will you be adding extra items to the PledgeManager? No. What is there at launch is all we plan to include at this point - any new items afterwards will instead originate via the Good Omens HQ store.

Will Kickstarter backers get items first? Yes. We will have a staggered approach for fulfilment: Kickstarter backers, then PledgeManager, then everything that is moving to the Good Omens HQ store will subsequently be made available.

You can also view the more general PledgeManager FAQ at terrypratchett.com.

We will keep PledgeManager and logistical notes present in all the monthly updates going forward, but felt this warranted a dedicated one-off.

These are available as part of the PledgeManager. Another beauty from our pin designer, Carl Sutton.

Thanks again for your patience. Back in the April monthly update.

In short: :)

The Good Omens Pledge Manager has launched:

those who missed the Graphic Novel Kickstarter: Now you can order the Graphic novel, not all things that were in the original Kicstarter are available but there is stil a lot of options and fuckton of lovely ineffable add-ons! :)<3

those who participated inthe original GO GN Kickstarter: you should an email (Dunmanifestin needs more information to fulfill your reward) with a link that logs you (if not log manually) into the pledgemanager and lets you edit the order (add new add ons) (yep, my wallet weeps :D<3)

The addons:

I mean... how can one resist for example these I do not know... :D

#good omens graphic novel#good omens#graphic novel#graphic novel kickstarter#merchandise#good omens merchandise#wahoo!

657 notes

·

View notes

Text

🌟SmilePayz Payment Solution: Covering All Industries, Seamless Integration! 🌟

SmilePayz specializes in Indonesia, Thailand, Brazil, and Mexico, offering cryptocurrency payment solution as well. Since we are a direct payment source for these countries, we can provide the lowest rates in the market. We also offer same-day settlement/D0 settlement!

✅ Easy Integration: Diversified API interfaces for quick system compatibility, improving efficiency.

✅ 24/7 Support: Professional service around the clock, ensuring peace of mind.

Whether you're in online gaming, forex, online casino, live streaming, high risk gaming (I-Gaming), forex, or financial services, SmilePayz is your best payment solution!

[Note: We do not accept business that is related to pornography and scamming‼️]

🌐 Contact us now to experience more convenient and secure payment services!

Telegram: @Thompson7837

Telegram: @Thompson7837

Telegram: @Thompson7837

#payment gateway#api integration#high risk payment gateway#high risk payment processing#payments#paymentsolutions#paymentprovider

1 note

·

View note

Text

CREVH - GOLD

QuickBooks is a renowned accounting software that offers a seamless solution for small businesses to manage their financial tasks efficiently. With features designed to streamline accounting processes, QuickBooks simplifies tasks such as tracking receipts, income, bank transactions, and more. This software is available in both online and desktop versions, catering to the diverse needs of businesses of all sizes. QuickBooks Online, for instance, allows users to easily track mileage, expenses, payroll, send invoices, and receive payments online, making it a comprehensive tool for financial management. Moreover, QuickBooks Desktop provides accountants with exclusive features to save time and enhance productivity. Whether it's managing income and expenses, staying tax-ready, invoicing, paying bills, managing inventory, or running reports, QuickBooks offers a range of functionalities to support businesses in their accounting needs.

Utilizing qb accounting software purposes comes with a myriad of benefits that can significantly enhance business operations. Some key advantages of using QuickBooks include:

- Efficient tracking of income and expenses

- Simplified tax preparation and compliance

- Streamlined invoicing and payment processes

- Effective management of inventory

- Generation of insightful financial reports

- Integration with payroll and HR functions

These benefits not only save time and effort but also contribute to better financial decision-making and overall business growth. QuickBooks is designed to meet the diverse needs of businesses, offering tailored solutions for various industries and sizes.

When considering accounting qb software options, QuickBooks stands out as a versatile and comprehensive choice. To provide a holistic view, let's compare QuickBooks with two other popular accounting software options - Xero and FreshBooks. quick book accounting package and offers robust features for small businesses, including advanced accounting capabilities, invoicing, payment processing, and payroll management. Xero, on the other hand, is known for its user-friendly interface and strong collaboration features, making it a popular choice among startups and small businesses. FreshBooks excels in invoicing and time tracking functionalities, catering to freelancers and service-based businesses. By evaluating the features, pricing, and user experience of these accounting software options, businesses can make an informed decision based on their specific needs and preferences.

555 notes

·

View notes

Text

Axolt: Modern ERP and Inventory Software Built on Salesforce

Today’s businesses operate in a fast-paced, data-driven environment where efficiency, accuracy, and agility are key to staying competitive. Legacy systems and disconnected software tools can no longer meet the evolving demands of modern enterprises. That’s why companies across industries are turning to Axolt, a next-generation solution offering intelligent inventory software and a full-fledged ERP on Salesforce.

Axolt is a unified, cloud-based ERP system built natively on the Salesforce platform. It provides a modular, scalable framework that allows organizations to manage operations from inventory and logistics to finance, manufacturing, and compliance—all in one place.

Where most ERPs are either too rigid or require costly integrations, Axolt is designed for flexibility. It empowers teams with real-time data, reduces manual work, and improves cross-functional collaboration. With Salesforce as the foundation, users benefit from enterprise-grade security, automation, and mobile access without needing separate platforms for CRM and ERP.

Smarter Inventory Software Inventory is at the heart of operational performance. Poor inventory control can result in stockouts, over-purchasing, and missed opportunities. Axolt’s built-in inventory software addresses these issues by providing real-time visibility into stock levels, warehouse locations, and product movement.

Whether managing serialized products, batches, or kits, the system tracks every item with precision. It supports barcode scanning, lot and serial traceability, expiry tracking, and multi-warehouse inventory—all from a central dashboard.

Unlike traditional inventory tools, Axolt integrates directly with Salesforce CRM. This means your sales and service teams always have accurate availability information, enabling faster order processing and better customer communication.

A Complete Salesforce ERP Axolt isn’t just inventory software—it’s a full Salesforce ERP suite tailored for businesses that want more from their operations. Finance teams can automate billing cycles, reconcile payments, and manage cash flows with built-in modules for accounts receivable and payable. Manufacturing teams can plan production, allocate work orders, and track costs across every stage.

86 notes

·

View notes

Text

I want to tell the young people about what floppy disks are and why computers needed them and I'm from the 90s so I'm missing info on what came before it but from what I do know:

These bad boys are floppy disks in various sizes:

The plastic square is the outer casing and protects the small little disk inside that actually stores the data. Typically these would have like a built in fuzzy thing to keep dist off the disk.

When we think of computers, we think of zillions of codes working together so fluidly and quickly and they're able to operate tons of processes at once but a when computers were more new, they could only handle so much code at a time! Ye old computers were huge and clunky and could only tackle so much processing.

Think of them like babies- programmers could do tons with computers but the computers themselves could only store so much data!

And in fact we still use SD (storage disk) cards for computers and phones the same purpose.

That's where a floppy disk comes in! The computer would have a disk drive which would run whatever program was on the disk when you inserted it. That way you didn't clog your processing computer with code it couldn't handle.

You could also store files on the floppy disk so they didn't take up computer processing space.

Eventually we got much better at figuring out how to store data and instead of putting it on a tiny disk we made the disks bigger and CD ROMs were used for the same purpose.

Eventually when we got better at making storage smaller and easier to integrate, things like floppy disks and CD Roms wrre deemed no longer needed.l and their disk reader were omitted from most computers and laptops which is a shame!

Downloading apps is easy but you used to be able to own an actual physical copy of the thing you purchased so if your computer crashed and you couldn't get it back and had to buy a new one, you wouldn't have to pay for the program again, you'd already have a copy!

We used to have a photoshop disk that came with its own verification key and you could put it onto any computer you wanted with thw activation key with absolutely no subscription needed. One payment and your tool is yours permanently!

Likewise we can play our dvds from my old Toshiba because it still has a DVD and CD reader and the ancient 90s Dell can play old PC games because it has a CDRom reader!

Sometimes progress is great but the physical nature of the floppy disks and CD and DVDs are highly missed in today's digital based and gatekept society!

So anyways that's what floppy disks are.

Now when an old person glares at you youngins and says ha! Bet you dont know what this is! You can say why thats a floppy disk!

And if they say aha! But what's it for?

You can say IT WAS AN OLS VERSION OF STORING DATA AND PROGRAMS THE COMPUTER COULDN'T STORE ON ITS OWN BEFORE COMPUTWRS GOT FASTER ANS HAD BETTER STORAGE.

They will be so mad and so impressed.

93 notes

·

View notes