#payroll software uk

Explore tagged Tumblr posts

Text

Payroll Considerations

Effective payroll management is critical for organizations to guarantee employee payments are correct, timely, and in compliance with tax rules. Businesses must stay up to date on payroll deadlines and commitments to avoid penalties and keep operations running smoothly.

-> Payroll Services for Specific Industries in the UK:

Payroll Services for Home Carers in the UK: Home care agencies and individual carers can benefit from payroll services suited to their specific requirements, such as handling varying hours, overtime, and holiday pay.

Payroll for Nurseries in the UK: Nurseries and childcare providers require payroll systems that allow for flexible staffing schedules while adhering to child-care standards.

-> Cloud Payroll Software Solutions:

Cloud-based payroll software gives businesses flexibility, scalability, and accessibility. It allows them to administer payroll from any location with an internet connection. With features like automated calculations, real-time reporting, and compliance updates, cloud payroll software is an efficient alternative for organizations of all sizes.

-> Conclusion:

Being aware of significant dates and deadlines for the fiscal year 2024-25 is critical for organizations and people seeking to comply with tax legislation and manage their finances successfully. Businesses may streamline payroll management and maintain smooth operations throughout the fiscal year by using industry-specific payroll services and cloud payroll software solutions.

Read full blog: https://www.brainpayroll.co.uk/blog/financial-year-2024-25-important-dates-to-remember

#cloud based payroll software uk#payroll bureau#payroll bureau software#payroll software#payroll software for accountants#cloud payroll software#cloud based payroll software#cloud payroll software uk#payroll software uk

0 notes

Text

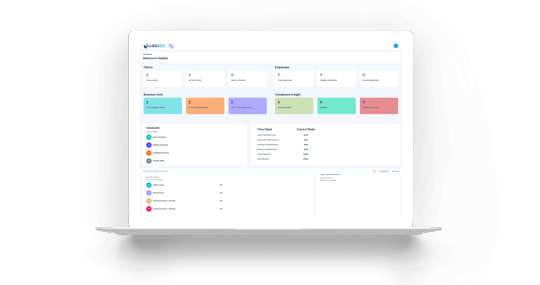

Smart HR and Payroll for UK Small Business Owners

Looking for reliable HR and payroll software for small business UK? Our smart, all-in-one solution is designed specifically for UK small business owners who need a simple, efficient way to manage payroll, employee records, holidays, and compliance. As one of the best HR and payroll systems UK, our platform is fully cloud-based, HMRC-compliant, and built to handle everything from RTI submissions to auto-enrolment and staff self-service. Say goodbye to manual processes and spreadsheets — our intuitive system makes managing your team easier than ever. If you're searching for trusted, affordable HR and payroll systems UK, get started today and experience the difference smart software can make.

0 notes

Text

It's salary time! 📷 Make sure you get your payslips online quickly and easily. Stay organized and on top of your finances with our reliable service. Order now from the UK's leading payroll company!

1 note

·

View note

Text

#tax#payroll#accounting#business#finance#Global Payroll#Payroll#HR#Global Expansion#EOR#India Payroll#UK Payroll#Outsourcing#company registration#eor services#poe hr#poe employer#poe employment#payroll poe#global peo#eor providers#payroll processing#payroll services#payroll software#online payroll#outsourced payroll#tax filing for payroll#payroll tax compliance#direct deposit#pay stubs

1 note

·

View note

Text

Essential Things You Need to Know About Staff Management Software in 2023

In today's fast-paced digital era, the significance of effective staff management cannot be overstated. Staff management software has quickly become an integral part of efficient business operations in various industries. With the continuous evolution of technology, 2023 has brought forth new updates, features, and trends to watch out for. Here's what you need to know about staff management software this year.

Remote Work Adaptability:

With the increase in remote work due to the ongoing pandemic, staff management software now offers features that adapt to this new work model. Tools for virtual meetings, remote project management, and digital timesheets have become standard.

Employee Wellbeing and Engagement:

Employee mental health has gained more focus. In 2023, staff management software increasingly includes features promoting employee wellbeing, such as mood tracking, mental health resources, and wellness programs. Simultaneously, gamification strategies are being utilized to improve employee engagement and satisfaction.

Security and Data Privacy:

As we handle more sensitive data digitally, the importance of cybersecurity has skyrocketed. In 2023, staff management software has stepped up its game with enhanced data encryption, multi-factor authentication, and regular software updates to ward off potential cybersecurity threats.

Integration and Customization:

Integration with other systems such as CRM, payroll, and HRIS is more seamless than ever. Furthermore, staff management software now offers greater customization options to cater to the unique needs of each organization.

Eco-Friendly Practices:

More businesses are looking for ways to reduce their carbon footprint. Paperless management, energy-efficient operations, and other eco-friendly features are more common in staff management software in 2023.

Conclusion:

Staff management software in 2023 is about more than just efficiency and productivity; it's about creating a conducive and sustainable work environment that values employees' mental health and respects data privacy. As technology evolves, we can expect these systems to become even more intelligent, versatile, and user-friendly, becoming an indispensable tool in the modern workplace.

#staff management software#employee work management system#staff management system#employee management system#employee payroll management system#employee database management software#best staff management software#temporary staff management software#temporary staffing uk#medical staffing solutions timesheet#employee management software

1 note

·

View note

Text

The Benefits of Outsourcing Payroll Services in UK

One of the most crucial parts of managing a business is payroll. For smooth operations, employees must be paid on time and accurately according to tax laws. According to Manag, internal payroll is complicated, time-consuming, and error-prone.

For this reason, many UK-based companies outsource their payroll services. Through outsourcing, a company can save Time, reduce costs, ensure strict compliance with HMRC regulations, and focus on expanding its operations. The following article describes the major benefits of outsourcing UK payroll services and why firms of any size should opt for it.

1. Decrease Administrative Load and Save Time

Payroll processing consumes much time and labor, especially in organizations with hundreds of employees. Activities like following up on pensions, determining earnings, and making tax deductions can take up to 30 hours monthly.

UK-based business organizations may diminish the administrative burden and allow the HR and finance teams to focus on critical roles such as employee training and business expansion.

2. Confirms Conformity to UK Payroll Legislation

HMRC, Her Majesty's Revenue and Customs, controls the UK's payroll. The following are some rules by which companies have to be governed:

PAYE ensures that everyone gets the proper deductions for taxes and national insurance. Automatic-enrolment pension schemes: managing the pension contributions of the employees.

Payroll details will be filed with HMRC through RTI returns.

Payroll processing mistakes may lead to penalties or legal issues.

Payroll outsourcing ensures that experts handle compliance, reducing the likelihood of fines and legal complications.

3. Reduces Processing Charges for Payroll

Though some companies believe handling payroll in-house will save money, the cost is often much higher due to the software, employee training, and probable errors. A firm can save by paying a flat rate to an outside source for its payroll service instead of keeping a payroll department in-house.

4. Fewer Payroll Errors

Payroll inaccuracies, especially errors in making the proper taxation, delayed or unduly made salaries, etc, can eventually cause HMRC penalties and irate employees. The UK utilizes professional payroll solutions that employ professionals for payroll together with automated platforms that ensure reliability and minimize possible costly mistakes

5. Has Private and Security-Payroll Processing

Internal payroll processing might lead to fraud and data theft. Payroll companies that are outsourced encrypt, have a secure system, and follow the GDPR to keep the sensitive information of the workers' payroll secure and confidential.

6. Satisfaction of Workers

Worker satisfaction goes up when payrolls are made correctly and within Time. Employees want:

✔ Correct salary disbursals

✔ Easy online payslips

✔ A clear tax and deduction statement

Outsourced payroll services guarantee employees receive their pay on Time, every Time, which means employees will trust and be satisfied in the workplace.

10. Business Growth Focus

Outsourcing payroll services gives business owners and managers Time to focus on strategic growth initiatives rather than wasting Time on payroll administration. Payroll in expert hands means businesses can scale operations, improve services, and enhance customer satisfaction.

Conclusion

Outsourcing payroll services in the UK is wise for businesses that want to save Time, reduce costs, and ensure compliance with UK payroll regulations. Professional payroll providers can help companies minimize errors, improve employee satisfaction, and focus on growing their business without payroll-related stress.

Whether you run a small startup or a large enterprise, outsourcing payroll ensures accurate, secure, and hassle-free payroll management—making it a worthwhile investment for any business.

3 notes

·

View notes

Text

Corporate Visa Compliance for Employers Global Hiring Guide 2025

The global hunt for talent has never been more competitive or more regulated. As companies expand across borders and remote work dissolves geographic boundaries, corporate visa compliance is no longer just an HR concern, it's a business-critical strategy.

From onboarding engineers in Berlin to deploying consultants in Dubai, every global hiring decision now walks a tightrope of immigration laws, labor regulations, and visa timelines. One misstep can result in visa denials, hefty fines, and reputational damage.

In this guide, we break down the core components of corporate visa compliance in 2025 and what employers need to know to hire and move global talent safely, quickly, and legally.

What Is Corporate Visa Compliance?

Corporate visa compliance refers to an employer’s ability to:

Legally sponsor international employees or contractors

Ensure timely visa issuance and renewal

Maintain proper documentation and records

Avoid violations like unauthorized work or overstays

Cooperate with government audits or inquiries

Whether you’re hiring from abroad or moving internal talent between offices, compliance ensures you’re not breaking immigration or labor laws intentionally or otherwise.

Why Compliance Is More Important Than Ever

In 2025, visa regulations are tighter, and governments are quicker to penalize non-compliance. Here's why employers need to take it seriously:

1. Increased Audits and Digital Oversight

Many countries now use digital case tracking and biometric systems to monitor visas. Employers can be audited at any time.

2. Cross-Border Remote Work Raises Red Flags

Employees working abroad even temporarily—may trigger unintended tax and visa consequences.

3. Severe Employer Penalties

Companies found in violation may face:

Fines of $5,000 to $50,000+

Temporary or permanent bans on visa sponsorship

Public blacklisting or compliance warnings

Key Elements of Employer Visa Compliance

1. Sponsorship Eligibility

Before hiring foreign talent, ensure your company qualifies as a legal visa sponsor in that country. This often includes:

Business registration and good standing

No prior immigration violations

Demonstrated need for foreign workers

2. Right Visa, Right Role

Match the visa type to the role. Using a tourist or business visa for a long-term or hands-on job is illegal.

Examples:

Project Manager → Intra-company Transfer Visa (ICT)

Software Developer → Skilled Worker Visa

Short-term Consultant → Business Visa (with no labor activity)

Tip: Work with an immigration advisor to classify the role correctly.

3. Labor Market Testing (Where Required)

In countries like Canada, the UK, and Australia, you may need to prove that no local candidate was available before sponsoring an international hire.

Keep records of:

Job postings

Interview summaries

Salary benchmarking

4. Maintain Accurate Documentation

Employers should keep organized records of:

Offer letters and contracts

Visa approval letters and ID copies

Proof of ongoing employment (e.g., payroll)

Tax and health insurance registrations

Pro tip: Digitize and centralize immigration files with expiration date reminders.

5. Monitor Visa Validity and Expiry

Set reminders for key visa dates:

Expiry

Renewal windows

Work location changes

Role changes (promotion, department switch)

Failing to update immigration authorities after a role change can count as a violation.

Real-World Scenario: A Costly Oversight

GlobalTech, a U.S.-based software firm, transferred a senior developer to Germany under a short-term Schengen business visa. But the role involved daily hands-on programming beyond the visa’s scope.

When flagged during a client audit, the developer was deported, and GlobalTech was fined €20,000. Worse, their sponsorship status was suspended, delaying three other hires.

Building a Corporate Visa Compliance Framework

To stay ahead, companies should create an internal compliance framework:

Assign a Mobility Compliance Officer Or work with an external immigration law firm.

Build a Visa Tracker System Use spreadsheets or software to track:

Visa type

Dates

Renewal status

Standardize Hiring and Onboarding Include immigration paperwork and guidance in the global HR process.

Train Local Managers They should understand the basics of visa do’s and don’ts to avoid accidental violations.

Conduct Annual Compliance Audits Review visa files, sponsorship eligibility, and country-specific changes at least once a year.

Don’t Just Hire Globally Hire Legally

Global hiring can be a game changer for innovation and growth. But it only works if you bring in talent the right way.

Visa compliance isn’t just paperwork it’s about protecting your company, your employees, and your global reputation.

Final Thoughts: Get Compliance Right, Right From the Start

In 2025, companies that thrive globally won’t just be fast; they'll be compliant, consistent, and prepared. By treating corporate visa management as a core business function, not an afterthought, you ensure that global growth is built on a solid legal foundation.

#corporate visa compliance#global hiring 2025#employer immigration guide#work permit rules#visa sponsorship tips#international employee onboarding#business visa laws#HR mobility compliance#cross-border employment rules

0 notes

Text

Why Specialized Accounting Matters for Medical and Wellness Providers in 2024

In today’s rapidly evolving healthcare landscape, financial accuracy and compliance are more important than ever. Whether you're a general practitioner, physiotherapist, wellness coach, or clinic owner, managing your finances with generic accounting tools can put your business at risk. That’s why specialized accounting for medical professionals and wellness businesses is no longer optional—it’s essential.

The Complex Nature of Medical and Wellness Accounting

Medical and wellness providers deal with a unique set of financial challenges. From understanding NHS reimbursements and private practice billing to complying with the latest healthcare tax codes and maintaining accurate payroll records, the financial side of a healthcare or wellness practice is multi-dimensional.

Generic accountants may miss vital aspects such as:

HMRC rules regarding medical vs. non-medical services

VAT exemptions for specific healthcare treatments

Handling multi-location financial reporting

Proper depreciation of expensive medical equipment

This is where healthcare accounting services from a specialized provider like Mindspace Outsourcing can make a significant impact.

What Is Specialized Healthcare Accounting?

Healthcare accounting services are tailored financial solutions specifically designed for medical professionals, clinics, wellness centers, and therapy providers. These services focus on:

Understanding healthcare and wellness industry tax codes

Implementing accounting software compatible with patient management systems

Managing income from various sources such as insurance, NHS, and out-of-pocket payments

Ensuring compliance with GDPR and medical data handling laws

By opting for industry-specific services, providers gain both financial clarity and regulatory compliance.

Why EEAT Matters in Choosing a Healthcare Accounting Partner

Google’s EEAT (Experience, Expertise, Authoritativeness, and Trustworthiness) guidelines are crucial in choosing a healthcare accounting firm in 2024. Businesses need to rely on accountants who don’t just understand balance sheets but also the intricate details of wellness business accounting.

At Mindspace Outsourcing, our experienced team combines:

Experience with over 15 years in healthcare and wellness accounting

Expertise through continuous updates on UK healthcare financial regulations

Authority by working with multiple NHS and private health clients

Trust from client testimonials and consistent compliance delivery

Our EEAT-compliant services are tailored to offer both digital accuracy and human expertise.

Real Case Study: A Multi-Practice GP Clinic

A group of GP practices in Manchester faced challenges in consolidating reports, maintaining compliance with NHS fund allocations, and handling payroll for rotating staff. After switching to Mindspace Outsourcing’s accounting for medical professionals, they experienced:

35% time saved on monthly financial reporting

Smooth payroll transition with full pension compliance

Zero compliance issues in their next NHS audit

This is the power of working with a firm that understands your industry’s language.

Wellness Industry: A Fast-Growing Sector That Needs Financial Structure

From yoga instructors and nutritionists to mental health therapists and alternative medicine providers, the wellness industry has seen exponential growth. But with growth comes complexity—especially in tax classification, income diversification, and compliance with employment laws.

Wellness business accounting focuses on:

Categorizing services for proper tax filing

Managing seasonal cash flow fluctuations

Expense tracking for retreats, workshops, or pop-up events

Proper employee and freelancer classification for legal protection

Mindspace Outsourcing provides clear, actionable financial insight so wellness entrepreneurs can focus on healing, not bookkeeping.

Testimonials That Build Trust

“Mindspace Outsourcing has helped our clinic stay on top of compliance while giving us the financial clarity to grow.” — Dr. Ritu Sharma, Private Dermatologist, Birmingham

“As a wellness coach running retreats across the UK, I needed someone who understood wellness-specific accounting. Mindspace gave me peace of mind.” — Anita Mehra, Holistic Wellness Entrepreneur, London

Client feedback and case studies speak louder than claims. That’s why at Mindspace, we make transparency a priority.

Conclusion: Future-Proof Your Practice with Industry-Specific Accounting

In 2024, the financial landscape for healthcare and wellness businesses is more regulated, competitive, and digitized than ever before. Generic accounting services can leave costly gaps that lead to audits, fines, and lost growth opportunities.

Specialized accounting for medical professionals and wellness providers ensures your practice is compliant, efficient, and ready to grow. From VAT exemptions and payroll to performance analytics and strategic planning, Mindspace Outsourcing offers a full spectrum of healthcare accounting services designed with your needs in mind.

✅ Ready to upgrade your accounting? 📞 Contact Mindspace Outsourcing today and future-proof your healthcare or wellness business.

0 notes

Text

Outsourcing Accounting Services in the UK: A Smart Move for Modern Businesses

Managing finances is a core part of running any business, but handling accounting in-house can be time-consuming and costly. That’s why more UK businesses are turning to outsourcing accounting services in the UK. This approach offers practical benefits, from cost savings to improved compliance, making it an effective solution for companies of all sizes.

What is Outsourcing Accounting Services in the UK ?

Outsourcing accounting services in the UK means hiring an external provider to manage your accounting functions. These can include bookkeeping, payroll, tax returns, VAT compliance, and financial reporting. Instead of maintaining an in-house accounting team, businesses partner with accounting outsourcing companies in the UK to handle these tasks efficiently and accurately.

Why UK Businesses Choose Outsourcing

Cost Efficiency

Outsourcing accounting services in the UK can reduce costs by up to 50% compared to in-house teams.

Businesses only pay for the services they need, eliminating expenses like salaries, benefits, and training for permanent staff.

Lower overhead means more resources for growth and innovation.

Access to Expertise

Accounting outsourcing companies in the UK employ qualified professionals with up-to-date knowledge of UK regulations and tax laws.

These experts use advanced accounting software and technology, ensuring accuracy and compliance.

Companies gain access to a wider talent pool without the challenges of recruitment and retention.

Scalability and Flexibility

Outsourcing accounting services in the UK allows businesses to scale support up or down as needed—ideal for seasonal peaks or rapid growth.

Services are tailored to each client’s requirements, from small businesses to large firms.

Flexible contracts mean companies can adjust their service packages as their needs change.

Improved Focus on Core Activities

By outsourcing routine accounting tasks, businesses can focus on core operations and strategic growth.

Internal teams are freed from time-consuming administrative work, boosting productivity and morale.

Key Services Offered by Accounting Outsourcing Companies in the UK

Outsourcing providers offer a wide range of services, including:

Bookkeeping and VAT returns

Payroll management

Year-end accounts preparation

Management accounts and financial reporting

Tax compliance and planning

Company secretarial services

These services are delivered using secure, cloud-based systems, ensuring data safety and easy access for clients.

How Outsourcing Accounting Services in the UK Works

Initial Consultation: The provider assesses your business needs and recommends suitable services.

Data Transfer: Secure systems are used to transmit financial data.

Service Delivery: The outsourcing team handles your accounting tasks, providing regular reports and updates.

Ongoing Support: Providers offer ongoing advice and can adjust services as your business evolves.

Choosing the Right Accounting Outsourcing Companies in the UK

When selecting a partner for outsourcing accounting services in the UK, consider the following factors:

Experience: Look for companies with a proven track record in the UK market.

Compliance: Ensure the provider is GDPR-compliant and follows UK accounting standards.

Technology: Choose firms that use up-to-date, secure software.

Client Reviews: Check testimonials and case studies for reliability and service quality.

Support: Opt for providers that offer UK-based support teams for better communication.

Some leading accounting outsourcing companies in the UK include Initor Global, Doshi Outsourcing, and Corient Business Solutions, all known for their compliance, expertise, and cost-effective solutions.

Real-World Impact: Facts and Figures

UK accountancy salaries rose by 6.5% in recent years, making outsourcing an attractive cost-saving option.

Many businesses report saving up to 50% on accounting costs after switching to outsourcing.

Outsourcing firms often have teams of 200+ professionals, ensuring reliable service even during busy periods.

Why Choose Aone ?

As a leading provider of outsourcing accounting services in the UK, Aone Outsourcing delivers tailored solutions for businesses of all sizes, from startups to established firms. Their team of qualified accountants and bookkeepers combines deep expertise in UK financial regulations with advanced technology, ensuring accuracy, compliance, and efficiency. By choosing Aone Outsourcing, businesses benefit from cost-effective services, scalable support, and a commitment to high-quality results—all designed to streamline your financial operations and let you focus on growth.

Conclusion

Outsourcing accounting services in the UK is a practical solution for businesses aiming to cut costs, access expert knowledge, and stay compliant with ever-changing regulations. By partnering with trusted accounting outsourcing companies in the UK, you can streamline your financial operations and focus on what matters most—growing your business.

0 notes

Text

Affordable Accounts Services: Reliable Accounting Without Breaking the Bank

In today’s economy, every penny matters—especially for small businesses, startups, freelancers, and entrepreneurs. Hiring an in-house accountant or engaging a large firm may not always be practical or cost-effective. That’s where Affordable Accounts Services step in: professional, reliable, and budget-friendly accounting solutions tailored to your business needs.

With accurate financial reporting, tax compliance, and bookkeeping at your fingertips, you no longer have to compromise between affordability and quality.

What Are Affordable Accounts Services?

Affordable Accounts Services refer to accounting and bookkeeping support provided at budget-friendly rates—without compromising professionalism, accuracy, or compliance. These services are typically offered by cloud-based firms or smaller boutique agencies that specialize in helping:

Small businesses

Sole traders

Contractors

Freelancers

Partnerships

Startups

E-commerce sellers

They offer the core financial services every business needs—at a fraction of the traditional cost.

10+ SEO Keywords Used in This Article

To support fast indexing and high rankings, this article includes the following high-volume keywords:

Affordable accounts services

Cheap accounting for small businesses

Online bookkeeping services

Fixed fee accountants UK

Budget-friendly tax return help

Freelance accounting support

Low-cost VAT and PAYE services

Professional accounts on a budget

HMRC compliance accounting

Startup accounting services

Monthly bookkeeping packages

Cloud-based accounts services

These keywords help your content rank for various user queries and increase organic traffic.

Who Needs Affordable Accounting Services?

If you relate to any of the following situations, affordable accounting is a perfect match for you:

You’re running a business solo or with a small team

You don’t have the budget for a full-time finance manager

You need help filing your taxes, VAT returns, or payroll

You want to switch from Excel spreadsheets to cloud accounting

You’ve received penalties for late or incorrect filings

You want to grow your business without worrying about compliance

Services Offered by Affordable Accounts Providers

When you choose a reputable firm like Accountants4Less, you gain access to a range of essential accounting services such as:

Accurate bookkeeping

Self-assessment tax returns

Annual accounts preparation

Corporation tax (CT600) filing

VAT registration and returns

Payroll and PAYE support

CIS returns for contractors

Business performance reporting

Expense tracking and invoicing

Cloud accounting setup (Xero, QuickBooks)

All these services are bundled into transparent pricing packages that ensure you only pay for what you need.

Why Choose Accountants4Less for Affordable Accounts Services?

Accountants4Less is a UK-based accounting firm known for offering high-quality, low-cost accounting services tailored to small businesses and self-employed professionals. Here’s what makes them stand out:

✅ Fixed, affordable pricing—no hidden fees ✅ Certified UK accountants with real industry experience ✅ Free consultations and easy onboarding ✅ Fully digital platform—upload docs from anywhere ✅ Cloud software support (Xero, QuickBooks, FreeAgent) ✅ Ongoing support and proactive tax advice ✅ Fast turnaround on tax and account filings

They deliver all the essentials that small business owners need—without the corporate pricing tag.

Real Benefits of Using Affordable Accounts Services

1. Cost Savings Outsourcing to a fixed-fee accountant saves thousands annually compared to hiring in-house or using expensive firms.

2. Better Accuracy Certified accountants know how to prepare and submit documents correctly—avoiding HMRC penalties.

3. Time Efficiency Spend more time running your business while your accountant handles your books.

4. Professional Support Year-Round Get advice and help any time—not just during tax season.

5. Scalable Services As your business grows, your accountant can scale their services with you.

Common Mistakes Avoided by Affordable Accounting Services

❌ Missing deadlines for VAT, Self-Assessment, or Corporation Tax ❌ Misclassifying income and expenses ❌ Failing to register for taxes on time ❌ Not reconciling business bank accounts ❌ Overpaying or underpaying HMRC ❌ Inconsistent or non-compliant bookkeeping

These mistakes can lead to serious fines or even investigations—something a qualified accountant prevents entirely.

Pricing Guide: What Do Affordable Account Services Cost?

Here’s a look at typical pricing from UK providers: Accounting ServiceMonthly Cost (Approx.)Sole Trader Package£30 – £70Limited Company (Non-VAT)£60 – £120Limited Company (With VAT & Payroll)£100 – £180Contractor/Freelancer Accounting£40 – £90Annual Self-Assessment Only£50 – £150 (one-time)

Accountants4Less offers some of the most competitive packages in the UK, starting at just £29/month for essential services.

Key Features to Look for in an Affordable Accounting Partner

When searching for budget-friendly accounting help, always look for:

Transparent pricing (no surprise invoices)

Certified professionals (not unqualified bookkeepers)

Digital tools for reporting and uploads

Experience with your business size or industry

Availability year-round—not just at year-end

Clear communication and support access

You get all of the above and more with Accountants4Less.

When to Hire an Affordable Accountant

Hire an accountant immediately if:

You’re registering as a sole trader or limited company

You’re unsure how to handle VAT or PAYE

You want to track your expenses more professionally

You’ve received HMRC letters you don’t understand

You’re launching your first online business

You want to avoid tax penalties or filing stress

You’re planning to scale your business and need support

The sooner you hire a professional, the better your financial foundation will be.

Getting Started with Accountants4Less

It’s fast and easy:

Request a Free Quote Answer a few questions online about your business.

Receive a Custom Plan A team member provides a transparent, tailored plan.

Upload Your Docs Digitally Use their secure portal to send invoices, receipts, or bank statements.

Relax While They Handle It You get regular updates, reminders, and expert insights throughout the year.

Final Thoughts: Smart Business Starts with Smart Accounting

Affordable accounting doesn’t mean cutting corners—it means choosing the right partner who understands your needs, your budget, and your growth potential. Whether you're a side hustler, a full-time entrepreneur, or an established small business, Affordable Accounts Services give you the peace of mind to focus on what matters most: running your business.

Let Accountants4Less take care of your finances—accurately, affordably, and professionally.

0 notes

Text

Payroll Bureau Services: Streamline Your Payroll Procedures.

Find out how our Payroll Bureau services can help you streamline your payroll operations. We provide dependable payroll solutions that are customized to your specific needs. For additional information, go to https://www.brainpayroll.co.uk

#cloud based payroll software#cloud payroll software#payroll bureau#payroll software#payroll software for accountants#cloud payroll software uk#cloud based payroll software uk#payroll bureau software#payroll software uk

0 notes

Text

Introducing our flexible #Payslip delivery! Opt for the convenience of #Digital payslips straight to your inbox or enjoy the tangible assurance of paper copies. Your payroll, your way!

✅ Go Green: Embrace digital convenience. ✅ Traditional Comfort: Receive paper copies securely. ✅ Secure Delivery: Your financial info is in safe hands.

Choose your payslip journey. Explore more at Payslips Online UK

#Payslips #DigitalVsPaper #FlexibleOptions #OnlinePayslips

1 note

·

View note

Text

MTD for ITSA - UK Accountants: Go Digital with Affinity Outsourcing

As the 2026 rollout of Making Tax Digital for Income Tax Self-Assessment (MTD for ITSA) approaches, accountancy firms across the UK are preparing for a fundamental shift in how they support self-employed clients and landlords. But while compliance is a top priority, many firms are asking an important strategic question:

How can we meet the demands of MTD for ITSA, without increasing internal pressure, hiring costs, or operational complexity?

For many, the answer lies in outsourcing.

What Is MTD for ITSA?

MTD for ITSA is HMRC’s next major step in its digital transformation agenda. From April 2026, self-employed individuals and landlords with income over £50,000 will need to:

Maintain digital records

Submit quarterly income and expense updates via MTD-compliant software

File an annual End of Period Statement and Final Declaration

From April 2027, the threshold will lower to £30,000.

What Challenges Will Accountants Face?

MTD for ITSA represents a significant workload increase, not just in volume, but in frequency and complexity.

Quarterly Submissions = More Frequent Deadlines

Most accountants are used to annual cycles. MTD shifts this to a 5-report-per-year model per client, meaning hundreds (or thousands) of extra deadlines annually.

Digital Transformation Pressure

Even tech-savvy firms will need to spend time:

Helping clients move to MTD-compliant cloud software

Educating them on new processes

Ensuring ongoing digital record-keeping

Increased Admin, Reduced Bandwidth

The time required to monitor submissions, provide support, and manage tech issues can drain in-house resources, especially for firms trying to scale or retain advisory focus.

Why Outsourcing Is a Smart Move for MTD

Outsourcing doesn’t just help manage extra volume; it allows practices to scale efficiently while keeping overheads lean.

Scale Without Hiring

Outsourcing provides instant access to trained bookkeeping and tax support staff, no recruitment, onboarding, or payroll costs involved.

Improve Turnaround Times

With a dedicated outsourced team handling MTD-related tasks (like record-keeping, submission prep, and reconciliations), firms can reduce delays and focus more on advisory.

Reduce Overhead, Increase Capacity

Rather than overstretch internal teams or bring on costly headcount, outsourcing allows you to expand capacity on demand and only pay for what you need.

Why Work with Affinity Outsourcing?

As an established outsourcing partner for UK accountancy firms, Affinity offers:

UK-trained bookkeeping and tax professionals

Seamless cloud integration (QuickBooks, Xero, FreeAgent, etc.)

Flexible packages to match your MTD client volume

Transparent pricing, dedicated resource, and 100% data security

Whether you're preparing for 2026 or already adjusting to earlier phases of MTD, we help you scale up without scaling your team.

MTD for ITSA is a major operational shift — and with the right outsourcing partner, it’s also an opportunity: to grow, to adapt, and to modernise how you deliver value.

Let’s Make Tax Digital, without the headache. Learn more: https://affinityoutsourcing.net/mtd-for-itsa-uk-accountants/

0 notes

Text

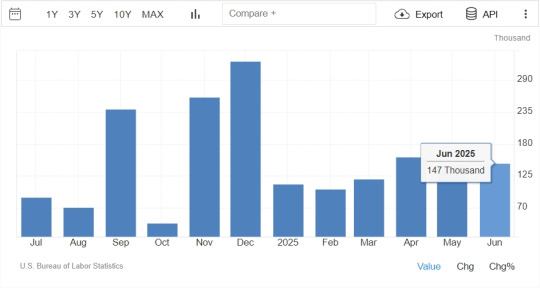

NFP Surprises, Wall Street Winning Streak Continues

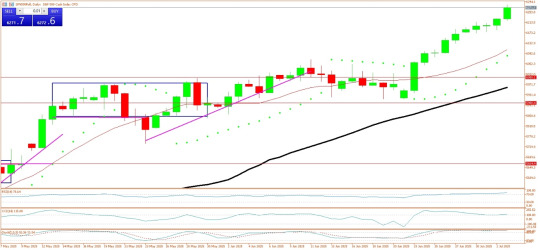

US stocks ended higher following a half-day trading session on Thursday as a strong June jobs report pointed to a resilient labor market, also lifting the dollar and Treasury bond yields.

For the third time in four days, the S&P 500 index and the Nasdaq Composite both hit fresh record closing highs, albeit on a shortened trading session which closed at 1pm ahead of the July 4 US Independence Day holiday.

US non-farm payrolls rose by 147,000 last month from an upwardly revised 144,000 in May, confounding expectations for a decline of 111,000.

US NFP

Meanwhile, the US jobless rate fell to 4.1% in June against forecasts for a rise to 4.3%, and average hourly earnings growth also eased, down to 0.2% on a monthly basis from 0.3%.

The latest initial jobless claims data also painted a more optimistic picture of the US labor market, coming in at 233,000 for last week, down from the previous reading of 237,000 and below the forecast number of 240,000.

On foreign exchanges, the US dollar rose as the resilient labor market data was seen as easing pressure on the Federal Reserve to consider interest rates cut as early as this month. The dollar index, which tracks the greenback against a basket of six other currencies, gained 0.4% to 97.12.

Traders were also eyeing the final vote on President Trump’s ‘Big and Beautiful’ tax-and-spending bill in the House of Representatives on Thursday after Republican party leaders worked through last minute procedural resistance from a handful of members on Wednesday. However, the vote came after the Wall Street close following some filibustering.

There was also some optimism over expectations for additional US trade deals ahead of President’s Trump’s July 9th deadline. On Wednesday, Trump revealed that the US has reached a trade agreement with Vietnam. Under the agreement, Vietnamese exports to the US will face a 20% tariff, while goods transiting through Vietnam — such as Chinese products — will be taxed at 40%.

With less than a week until the self-imposed deadline, the US has secured only three trade deals - with the UK, China, and Vietnam.

Meanwhile, gold prices retreated on the firmer dollar and as safe haven buying waned in the face of trade deal optimism. Spot gold shed 0.7% to $3,332 an ounce.

At the stock market close in New York, the blue-chip Dow Jones Industrials Average (DJIA) was up 0.8% to 44,828, while the broader S&P 500 index also added 0.8% to 6,279, and the tech-laden Nasdaq Composite rose 1.0% to 20,601.

SPX500Roll Daily

Chip stocks were among the tech gainers, with NVIDIA adding 1.3% after the US Commerce Department lifted restrictions on chip design technology exports to China as part of a recent trade agreement between Washington and Beijing. Meanwhile Synopsys rose 4.9% and Cadence gained 5.1%.

In corporate news, Tripadvisor leaped 16.7% after the Wall Street Journal reported that activist investor Starboard Value has taken a stake of more than 9% in the online travel company.

Lucid Group added 5.4% as the electric-vehicle company said it delivered more vehicles in the second quarter.

And Datadog jumped 14.9% after the software company’s stock was announced as the newest addition to the S&P 500 index.

Elsewhere, oil prices fell as a build in crude stockpiles spurred concerns over weak US demand. Official data showed crude inventories rose by 3.85 million barrels last week, the largest increase in three months, defying forecasts for a 2-million-barrel decline.

Adding to the pressure, OPEC+ will meet over the weekend, and is expected to boost production by a further 411,000 barrels per day (bpd) in August.

USOILRoll H1

US WTI crude futures shed 0.8% to $66.92 a barrel, and UK Brent crude futures lost 0.7% to $68.62 a barrel.

Disclaimer: The information contained in this market commentary is of general nature only and does not take into account your objectives, financial situation or needs. You are strongly recommended to seek independent financial advice before making any investment decisions. Trading margin forex and CFDs carries a high level of risk and may not be suitable for all investors. Investors could experience losses in excess of total deposits. You do not have ownership of the underlying assets. AC Capital Market (V) Ltd is the product issuer and distributor. Please read and consider our Product Disclosure Statement and Terms and Conditions, and fully understand the risks involved before deciding to acquire any of the financial products provided by us. The content of this market commentary is owned by AC Capital Market (V) Ltd. Any illegal reproduction of this content will result in immediate legal action.

0 notes

Text

Leading Customized Software Development Company in the UK – Equiconsulting Services Pvt. Ltd.

Equiconsulting Services Pvt. Ltd. is a top-tier customized software development company serving businesses across the UK with innovative, scalable, and result-oriented software solutions. We specialize in delivering tailor-made software applications that perfectly align with your unique business processes, goals, and operational challenges.

Our expertise lies in building robust and efficient custom software across industries such as manufacturing, logistics, retail, healthcare, education, real estate, and professional services. We focus on automation, integration, data security, and user experience to help businesses increase efficiency, reduce manual workload, and gain a competitive edge.

Our Key Custom Software Services Include:

ERP (Enterprise Resource Planning) Development

CRM (Customer Relationship Management) Solutions

Inventory & Warehouse Management Systems

HRM & Payroll Management Software

Billing & Accounting Software

Custom Web Portals & Dashboards

API Integration & Third-Party Connectivity

Cloud-Based Solutions & Data Backup Systems

Why Equiconsulting Services Pvt. Ltd.:

Experienced team of software engineers and domain experts

Agile development process for faster deployment

Full-cycle services: consultation, design, development, testing, and support

Technology stack includes .NET, PHP, Python, Java, Angular, React, Node.js, and more

Highly secure and scalable software architecture

Long-term maintenance, upgrades, and training support

We understand that off-the-shelf software doesn’t fit every business. That’s why we analyze your operational model thoroughly to craft a fully customized, high-performance software solution that drives measurable business outcomes.

Serving Clients Across the UK: From London and Manchester to Birmingham and Glasgow – we deliver excellence in software development to businesses of all sizes, ensuring local understanding with global standards.

📞 Get in Touch: Future-proof your business with custom software tailored just for you. Contact Equiconsulting Services Pvt. Ltd. for a free consultation or project demo.

0 notes

Text

Why You Should Study BSc in Accounting Abroad

Accounting is often called the language of business—and for good reason. Every organization, whether private or public, relies on accurate financial reporting to make informed decisions. A Bachelor of Science in Accounting (BSc Accounting) offers a strong foundation in financial principles, equipping students with the skills needed to manage, analyze, and report on business finances.

If you’re detail-oriented, good with numbers, and interested in business strategy, pursuing a BSc in Accounting—especially abroad—could be the perfect step toward a secure and rewarding career.

What Does a BSc in Accounting Cover?

A BSc in Accounting is typically a 3–4 year undergraduate degree that blends theory with practical financial training. Core subjects often include:

Financial Accounting

Management Accounting

Auditing and Assurance

Taxation

Business Law

Corporate Finance

Financial Reporting

Accounting Information Systems

Many universities also integrate real-world business case studies, Excel modeling, and software training (like QuickBooks or SAP), helping students prepare for the demands of modern accounting roles.

Why Study Accounting Abroad?

Studying accounting in an international environment enhances your global perspective and exposes you to international financial standards, such as IFRS and GAAP. Here are key benefits of pursuing your accounting degree overseas:

Learn from top-ranked business schools in countries like the UK, Canada, USA, Australia, and the Netherlands

Get access to internship and co-op opportunities with multinational firms

Experience diverse economic systems and business practices

Improve your English and cross-cultural communication skills

Increase your employability in both local and global job markets

Career Opportunities with an Accounting Degree

A degree in accounting opens the door to countless career paths in both the public and private sectors. Whether you’re interested in working with startups, global corporations, or government agencies, accounting skills are always in demand.

Popular job titles include:

Accountant

Auditor

Tax Consultant

Financial Analyst

Budget Analyst

Forensic Accountant

Payroll Specialist

Management Accountant

With professional certifications (like ACCA, CPA, or CIMA), accounting graduates can further specialize and increase their earning potential.

How Boost Abroad Can Help

Planning to study abroad can be challenging—but with Boost Abroad, you don't have to navigate the process alone.

We support you with:

Free consultation to help you choose the right program and destination

Personalized application assistance including SOPs, CVs, and reference letters

Preparation for IELTS, TOEFL, and Duolingo English tests

Guidance on scholarships and financial aid

Support with student visa applications and accommodation

Our mission is to make your study abroad journey easy, successful, and stress-free.

Final Thoughts

Choosing to study BSc in Accounting abroad is a smart investment in your future. You'll gain international knowledge, global experience, and professional skills that are highly valued in the job market.

📩 Ready to take the next step? Contact Boost Abroad today and let us help you build a career in accounting that crosses borders.

0 notes