#paytm ipo

Text

Paytm's 20% Crash: Impact on Fund Houses & Insurance Companies

Paytm’s 20% Crash: Impact on Fund Houses & Insurance Companies

The recent 20% plunge in Paytm’s stock price has sent shockwaves through the financial sector, particularly impacting fund houses and insurance companies that hold significant investments in the digital payments giant. Here’s a breakdown of the situation:

Impact on Fund Houses:

Estimated loss of Rs. 585 crore: Based on publicly…

View On WordPress

#paytm#paytm app#paytm crash#paytm ipo#paytm ipo crash#paytm ipo crashed#paytm ipo details#paytm ipo gmp#paytm ipo latest news#paytm ipo news#paytm ipo review#paytm loss paytm share crash#paytm share#paytm share analysis#paytm share crash#paytm share crash today#paytm share latest news#paytm share news#paytm share news today#paytm share price#paytm share target#paytm shares crash 20%#paytm stock#paytm stock crash#paytm stock price

0 notes

Text

youtube

0 notes

Text

India’s share market in 75 years of Independence: Milestones in transformation of stock market

India’s share market in 75 years of Independence: Milestones in transformation of stock market

India is all set to celebrate the 75th year of Independence on Monday. India has come a long way since its independence from British rule, and so have the country’s stock markets. The stock market trading in India began in the year 1855. Bombay Stock Exchange, now known as BSE, the first ever stock exchange in Asia was established in 1875. The Government of India officially recognised BSE under…

View On WordPress

#75 years of Indian independence day#Bombay stock exchange#BSE Sensex#derivatives#FII#Independence day#LIC ipo#national stock exchange#nse nifty#Paytm IPO#Stock Market#uti

1 note

·

View note

Text

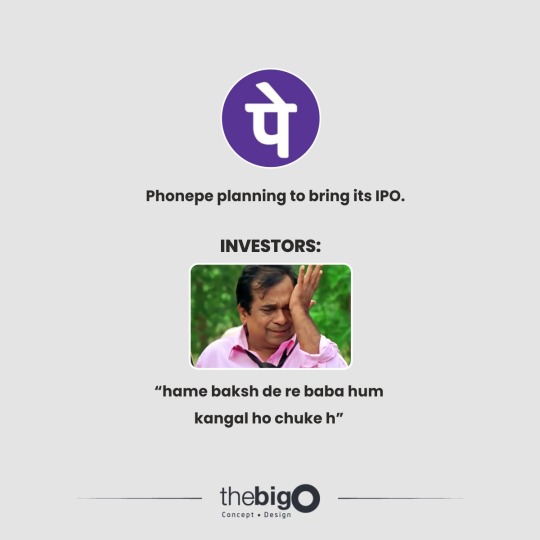

After the breakdown of the IPO launched by Paytm and LIC, inventors are shown the uncertainty of investing. And at the same time, PhonePe is planning to launch its IPO.

So what are your opinions on the Phonepe IPO will it shine?

#digital marketing strategy#digitalmarketing#branding#business#businessgrowth#socialmediamarketing#social media#paytm ipo#lic ipo#investors#phonepe#planning

0 notes

Text

पेटीएम का शेयर बन गया रॉकेट, ऑल टाइम लो से 24% की आई तेजी, अब ₹1000 पर जाएगा स्टॉक, एक्सपर्ट बुलिश

पेटीएम का शेयर बन गया रॉकेट, ऑल टाइम लो से 24% की आई तेजी, अब ₹1000 पर जाएगा स्टॉक, एक्सपर्ट बुलिश

Paytm share price today: पेटीएम (Paytm) के शेयरों में तेजी बरकार है। सोमवार की तेजी के बाद आज फिर पेटीएम के शेयर उड़ान भर रहे हैं। मंगलवार को पेटीएम के शेयरों में लगभग 2% की तेजी है। कंपनी के शेयर एनएसई पर 710.70 रुपये पर कारोबार कर रहे हैं। इससे पहले सोमवार को इस शेयर में 8.80% की तेजी थी। पेटीएम शेयर की कीमत मई 2022 में ₹510.05 के ऑल टाइम लो लेवल पर पहुंचने के बाद लगातार बढ़ रही है। पेटीएम के…

View On WordPress

#Business News#Business News In Hindi#Hindi News#Hindustan#JP Morgan#News in Hindi#PAYTM IPO#paytm share#paytm share price#stock market#stock return#जेपी मॉर्गन#पेटीएम आईपीओ#पेटीएम शेयर#पेटीएम शेयर प्राइस#स्टाॅक मार्केट#स्टाॅक रिटर्न#हिन्दुस्तान

0 notes

Text

Ant Group and SoftBank to Offload Shares in Paytm Through a Block Deal to Exit from Digital Payments Company

Through a block deal, Ant Group (backed by Jack Ma, a billionaire) and Japan’s SoftBank Group Corp have talked about selling stakes in Paytm brand’s One97 Communications, a digital financial service company. Investment banks and shareholders representing SoftBank and Ant Group have previously approached Sunil Mittal, chairman and founder of Bharti Airtel with a proposal to buy stakes in their firm. But the discussion did not meet any end conclusion for the deal.

SoftBank Group Corp and Ant Group are planning to exit the arena of the digital payment company by gradually offloading shares in the market. Ant Group is the largest shareholder in the fintech company in question, where last year December, it held 24.86% of One97 Communications shares, which increase more than 25% when the repurchase decreased the outstanding number of shares. Elevation Capital and SoftBank on the other hand, hold around 15% and 13% of Paytm shares, respectively.

On 13 February, Ant Group had a window period of 90 days to cut their stake on completing the buyback. In December, One 97 announced around Rs. 850 crores worth of buyback. And in this month, Alibaba Group, a giant Chinese e-commerce station, sold its 3.3% shares of direct stake for Rs. 1,378 crores in One97 Communications in an open market transaction. Since its dismal listing at the end of 2021 (November), Paytm has been under the pressure to generate profits. Their stock was reduced by 70% in the listing, and the previous year, they declined by 60%.

However, signs of profits emerged as Paytm shares took a surge by 40% from the unfortunate low in November. After narrowing their third-quarter loss, their initiative to expand the customer base enhanced the revenue, as per what the company said in February during the exchange. Paytm also said that in the next 12 to 18 months, they will become free cash flow positive, as per their comments last year.

The digital payment company has earlier never traded its IPO beyond the price of Rs. 2,150 from the time of the November 2021 listing. It went through a steep plunge in the first-year share this time in midst of large IPOs as compared to the last decade. Paytm is otherwise backed by Ant Group of China and SoftBank. The company is attracting more customers with its diverse product offering. Paytm is also in pursuit to win investors by showing their earnings potential.

Visit: - https://jsbmarketresearch.com/news/ant-group-and-soft-bank-to-offload-shares-in-paytm-through-block-deal

Follow our social handles: -

Facebook: - https://www.facebook.com/JSBMarketResearchGroup

Instagram: - https://www.instagram.com/p/CpKdJLloDQL/?utm_source=ig_web_copy_link

Twitter: - https://twitter.com/JSBMarket/status/1630160974664826883?s=20

LinkedIn: - https://www.linkedin.com/posts/jsbmarketresearch_paytm-softbank-antgroup-activity-7035926772936323072-hNIS?utm_source=share&utm_medium=member_desktop

Pinterest: - https://pin.it/DpEhB3h

YouTube: - https://youtube.com/shorts/9O5jas54_fo?feature=share

#Paytm#Softbank#AntGroup#blockdeal#digitalpayments#fintech#investments#JackMa#SunilMittal#Alibaba#IPO#stockmarket#technology#startups#economy#India#bloomberg

1 note

·

View note

Text

Paytm Stock Price Today | The Financial Express

Paytm Stock Price Today | The Financial Express

Paytm is being seen for the past few days. The stock has strengthened about 38 percent from its record low of Rs 511. The rally is expected in the future as well.

One 97 Communications Stock Price: Digital payment platform Paytm has been the worst return giving IPO in the last 1 year. However, for the past few days, there has been some rally in the stock. The stock has strengthened 38 percent…

View On WordPress

#Big drop in Paytm stock#buy or sell paytm#buy paytm#digital payment platform#experts positive on paytm#IPO#One 97 Communications#One 97 Communications share price#payment bank stocks#Paytm#paytm build a strong base after big fall from IPO#paytm ceo#paytm consumer base#paytm loan business#paytm owner#paytm seen breakout#paytm share new target#paytm short term target#Paytm stock at new low#paytm stock price#RBI&039;s action on Paytm#share of paytm#vijay shekhar sharma#wealth destroyer ipo

0 notes

Text

LIC IPO Share Price: LIC shares to start trading on Tuesday. Will retail investors burn fingers?

LIC IPO Share Price: LIC shares to start trading on Tuesday. Will retail investors burn fingers?

Millions of Indians investing in the country’s biggest listing could turn sour on the equity market if the stock follows the poor performance of its state-run predecessors.

Prime Minister Narendra Modi’s government raised $2.7 billion by selling shares in Life Insurance Corporation of India, including to millions of families nationwide that hold LIC policies. The stock starts trading Tuesday at a…

View On WordPress

#coal india ltd#Featured#gic#lic#LIC IPO#lic ipo gmp#lic ipo grey market premium#LIC IPO Listing#LIC IPO share price#lic listing date#lic listing news#lic share price#LIC shares#new india assurance#paytm

0 notes

Text

#lic ipo#ipo#share market#stock market futures#stock maket news#stock market news#stock market updates#ipo date#ipo update#ipo paytm#ipo fundraising#investors#ipo roadshows#sebi#rbi

0 notes

Text

How to apply for a public offering of LIC on Zerodha, Paytm, Upstox, and Groww

LIC IPO: The government of India has provided a 60 percent discount for LIC policyholders and a 45 percent discount for employees and retail category applicants.

The LIC IPO (Initial Public Offering) is now open for subscription, and bidding will continue through May 9, 2022. The Government of India (GoI) has set the price range for the LIC IPO at 902 to 949 rupees per equity share. The Government of India has also provided a 60 percent discount for LIC policyholders and a 45 percent discount for employees and retail category applicants. Because a large number of Demat accounts have been opened in recent years to apply for the public issue of insurance coverage, new Demat account holders may have problems applying.

Here's a step-by-step guide on how to apply for a LIC IPO on Zerodha, Paytm, Upstox, and Groww if you have a demat account:

How to Apply for LIC IPO on Zerodha

1] Sign in to the Zerodha app with your account information;

2] Pick the LIC IPO;

3] Type in your UPI ID;

4] Select the option to bid;

5] Select an investor type: person, employee, or policyholder.

6] Enter the lot size and price cut-off;

7] Select 'Confirm' and 'Submit' from the drop-down menus.

Following submission, LIC IPO applicants should accept the mandate request to proceed with the public offering on the UPI app.

How to Apply for the LIC Initial Public Offering on Upstox

1] Use your credentials to log in to the Upstox app or website;

2] 'Click on 'Invest in IPOs' under the 'Discover' option;

3] On your home screen, you'll see three options: overview, timeline, and apply.

4] Select the Apply option to be directed to the LIC IPO application website.

5] Complete the forms and select 'Proceed';

6] A payment pending message for UPI Mandate will appear on your home screen;

Accept the mandate, and your LIC IPO application will be successfully submitted.

How to Apply for the LIC Initial Public Offering on Groww

1] Login with your Groww credentials and select the IPO tab;

2] A list of open IPOs will be published;

3] Choose LIC IPO and press the 'Apply' button.

4] Submit your bid and specify how many LIC IPO lots you want to apply for;

5] Determine the cut-off price;

6] Choose from individual, employee, and policyholder investors;

7] Accept the obligation by entering your UPI ID.

Your LIC IPO application will be successfully submitted after the UPI mandate is accepted.

2 notes

·

View notes

Text

Tech Investments: Riding the Digital Wave in India

Invest in India: Unleashing the Digital Potential

Think of a bustling marketplace not with physical goods but with fluid, tech-savvy solutions. Hello, there. The Indian digital revolution is comparable to a jingling bazaar of bytes, with ideas thriving and gadgets practically redefining the landscape. Not only is this change in character metaphorical of the transformation of the market of a traditional town to that of a high-tech place, but it is also such in real life.

Byte-Sized Beginnings: From Code to Commerce

In the '90s, India registered its presence among the courts of digital history by becoming a provider of information technology (IT) services. In this context, companies such as Infosys and Wipro were the initial retailers that brought their goods and services to the virtual marketplace. We go forward a few years into the future, and today, these internet giant companies—Flipkart and Amazon—have changed their whole marketing strategy. They’ve made the market into an online cosmos where commerce only interferes with a pleasure akin to magic. Smartphones, our contemporary broomsticks, through services like Paytm and PhonePe, help people transact cash-free with their digital wallets, thereby digitalizing the marketplace.

Trailblazing Titans: TCS and Tata Technologies

For TCS and Tata Technologies, the digital revolution has been a driving force in defining their legacy. TCS, an IT company among the heavyweights, has moved beyond the basics, having realized the use of AI and blockchain. In contrast to automotive engineering, Tata Technologies, a sibling firm within the Tata Group, engineers solutions in automobiles and aerospace. Innovative solutions have today embraced the startup-to-IPO transition as a watershed sign of the landscape impact.

From 5G Whirlwinds to Startup Stardom

The chronology rewinds, and the Indian digital world’s engine has started to run. Imagine the future with 5G having the capacity to achieve faster internet speeds and all kinds of devices communicating through the concept of the Internet of Things (IoT). As computers learn autonomously using machine learning, Our market will be revamped into a turbocharged one, i.e., shine and strengthen the gadget connections, use smarter gadgets, set a new horizon, and explore so many possibilities.

Here is an amazing new turn—a rise of spoilers! How about those famous Indian startups like Zomato, Byju's, and their kind? These aren't just local breakthroughs; they are all game-changers in the global context. People often go to simple brick-and-mortar stalls without giving a second thought to where they are; suddenly they are in their favorite places.

Investment Opportunities: The Digital Stock Market

Now start viewing this as an opportunity to select the top-grade stalls in a market, and the market is a massive one. Instead of the big players that have their firmly established footing, the novelty is that which can be found with the disrupters, that is, those who have executive abilities in surfing the oceans of constant innovation.

Invest in India—a country where GDP is projected to reach $10 trillion by the end of this decade and $40 trillions by 2047. India’s FDI inflow has been impressive, with a 76% increase in manufacturing FDI in 2021–22. The sheer size and speed of India’s growth defy comparison. It’s an economic saga unfolding before our eyes.

Conclusion:

Investing in India isn’t merely a goal; it’s a journey marked by precision, insight, and transformative success. At Fox&Angel, we’re your premier global expansion partner, guiding brands through the intricate maze of global growth. We simplify the complexities by hand-holding businesses from their home countries to new markets. Let’s celebrate unprecedented growth together.

Ready to grow with India? Reach out to us at Fox&Angel and embark on your growth journey today!

0 notes

Text

Paytm को 24 घण्टे में 3 जोरदार झटके !

RBI का पेटीएम पर बैन लगाना पेटीएम के लिए आफत बनता जा रहा है। बाजार में शेयर हर दिन लूट फिट रहा है और बाहर पेटीएम के लिए हवा खराब होती चली जा रही है। बीते 24 घंटे में पेटीएम को तीन जोरदार झटके लगे हैं, जो उसमें पेटीएम की नींव हिला दी है।

एक इपीऐफ़ओह ने पेटियम पेमेंट बैंक में क्रेडिट करने और क्लेम सेट्लमेंट करने पर रोक लगा दी है।

दूसरा आज पेटियम के शेयर में जोरदार गिरावट देखी गई है।

तीसरा कल पेटीएम की इंडिपेंडेंट डाइरेक्टर मंजू अग्रवाल ने इस्तीफा दे दिया।

Paytm को 24 घण्टे में 3 जोरदार झटके !

ये तीन खबरें पेटियम के लिए परेशानी का सबब बन गई है, क्योंकि पहले ही आरबीआई की तलवार पेटीएम पर लटकी हुई है।

हो सकता है की आर बी आई 29 तारीख की डेडलाइन को पेटीएम के लिए एक्सटेंड कर दे और और सब कुछ दुरुस्त करने का पेटीएम को थोड़ा समय और मिल जाए।

लेकिन क्या इससे समस्या हल हो जाएगी? पेटीएम के लिए इपीऐफ़ओह के दरवाजे बंद होना या इंडिपेंडेन्ट डाइरेक्टर का कंपनी को छोड़ कर जाना भले ही पेटीएम पर ज्यादा इम्पैक्ट ना डाले लेकिन जिस तरह से बाजार में पेटीएम के शेयर का भाव लगातार ताश के पत्तों के जैसे बिखर रहा है।

पेटीएम के 2150 के आईपीओह का टाइम वाले भाव पर फंसे निवेशकों का क्या होगा? ऐसे में कुछ बड़े सवाल खड़े हो जाते हैं।

क्या पेटियम की लिस्टिंग टाइम के भाव कभी आ सकते हैं? अगर पेटीएम डूब जाती है तो क्या होगा? मोटे तौर पर अगर देखा जाए तो पेटीएम के शेयर में करीब 11,00,000 लोगों ने रिटेल इन्वेस्टर्स के तौर पर निवेश किया हुआ है। पेटीएम के निवेशक उसके IPO के बाद से भाव टूटने की मार को झेल रहे हैं।

IPO के टाइम का भाव आएगा या नहीं आएगा ये तो वक्त बताएगा लेकिन अब ऐसे में अगर पेटीएम डूब जाती है तो सबसे ज्यादा नुकसान इन्हीं 11,00,000 लोगों को उठाना होगा। हालांकि पेटीएम में निवेश करने वालों में सिर्फ रिटेल इन्वेस्टर ही नहीं है। बल्कि पेटीएम में 514 FIISऔर 97 म्यूचुअल फंड स्कीम्स का पैसा भी लगा है।

ज़ाहिर तौर पर 97 म्यूचुअल फंड कंपनियों में भी आम आदमी का ही पैसा लगा है। इस तरह देखा जाए तो पेटीएम के डूबने से मार्केट में भयानक तबाही आ सकती है। बाजार में शेयर का हाल तो आप जानते ही होंगे। लगातार पेटीएम का शेयर धराशायी होता जा रहा है।

शुक्रवार को शेयर बाजार खुलते ही पेटीएम के शेयर में जोरदार गिरावट हुई। पेटीएम का 9 फरवरी का लो ₹410 का रहा। गनीमत रही की आखरी कुछ घंटों में बाजार में फिर वापसी करी और सुधार दिखा।

9 फरवरी का 448 रुपए का रहा था, लेकिन शेयर में स्थिरता नहीं दिखाई दी, जिसके चलते बाजार में पेटियम 9 फरवरी के दिन अपने ओपेन 420 के भाव के करीब जाकर ही बंद हो गया।

पेटीएम के शेयर पिछले 2 दिन में 17 फीसदी से ज्यादा गिर चुका है। वही एक महीने के दौरान इसके शेयर में 39.76 फीसदी की गिरावट आ चुकी है।

अब देखना होगा कि कब तक और कैसे पेटियम का समय बदलता है और कैसे निवेशकों को राहत मिलती है।

Read the full article

0 notes

Text

ऐसा ही Paytm IPO को लॉन्च करते वक्त विजय शर्मा ने गलती की थी। जब Paytm IPO को लॉन्च किया गया था तब दिनांक 08 नोवेंबर और साल 2021 था। तब केतु की दशा व शनि का अंतर्दशा चल रही थी और मूल नक्षत्र का चौथा चरण था। क��तु और शनि की युति से धन हानि होता है साथ ही साथ कोर्ट के चक्कर भी लगाने पड सकते है। ज्योतिष कार के अनुसार इन गलतियों के कारण आज यह सब विजय शर्मा को देखना पड रहा हैं।

0 notes

Text

Big news for Paytm!

After plunging 40% in just two trading sessions, and losing the confidence of thousands of institutional investors, the stock has found an unlikely ally: Morgan Stanley. The company has gained 0.8%.

For those who don't know, Paytm's stock has been in a bearish trend for the past 2 days, ever since the Reserve Bank of India (RBI) imposed stringent measures on the company's banking arm Paytm Payments bank, triggering a sell-off as investors lost confidence in the company.

However, the company has found a surprising ally in the form of global investment banking giant Morgan Stanley who bought 50 lakh shares at Rs 487 per share, translating to a purchase worth Rs 244 crores!

This purchase through open market transactions could be interpreted as a significant sign of faith in the company as investors could buy at such low levels. Still, the same remains uncertain due to the significant impact on the company’s business.

On Friday, the stock of Paytm closed at Rs 487.20, down 71% from its IPO price.

Follow ProCapitas page on LikedIn for more financial insights.

0 notes

Text

Paytm Shares Witness Sharp Decline: Plummet 20% to Hit Fresh Lower Circuit Limit

Introduction: In a dramatic turn of events, Paytm shares have experienced another significant downturn, plummeting by 20% and hitting a fresh lower circuit limit. The fintech giant, which made headlines with its high-profile IPO, has been facing challenges in the stock market, raising concerns among investors and analysts alike.

Factors Contributing to the Decline: Several factors may have contributed to the sharp decline in Paytm shares. Market sentiment around technology and fintech stocks has been fluctuating, influenced by regulatory concerns, changing investor preferences, and broader economic conditions. Additionally, specific company-related developments or concerns may be influencing the stock's performance.

Regulatory Scrutiny: Fintech companies, including Paytm, have been under increased regulatory scrutiny in recent times. Concerns regarding compliance, governance, and regulatory changes can have a substantial impact on investor confidence. The evolving regulatory landscape, both domestically and globally, has added an element of uncertainty to the fintech sector.

Investor Sentiment: The decline in Paytm shares suggests a shift in investor sentiment. Investors may be reevaluating their positions based on evolving market conditions, company-specific news, or broader economic trends. As a result, the stock has hit a lower circuit limit, reflecting a pause in trading to prevent a further free fall.

Market Dynamics: The stock market is influenced by a complex interplay of factors, including investor psychology, macroeconomic indicators, and industry-specific trends. In the case of Paytm, the recent downturn highlights the volatility and sensitivity of the market, particularly for companies in emerging sectors.

Company Response and Future Outlook: As Paytm shares experience a sharp decline, market observers will closely monitor how the company responds to the situation. Management statements, strategic adjustments, and any corrective measures will be scrutinized for their potential impact on the stock's future trajectory. Investors will be keenly interested in the company's plans to address challenges and navigate the evolving market conditions.

Conclusion: The 20% drop in Paytm shares and the triggering of a fresh lower circuit limit underscores the challenges and uncertainties faced by the fintech giant in the current market environment. As the situation unfolds, stakeholders will closely follow regulatory developments, company responses, and broader market dynamics to gauge the potential implications for Paytm's future performance. In the ever-evolving landscape of the stock market, such instances serve as a reminder of the need for vigilance and adaptability in investment strategies.

For more information visit us:

0 notes

Text

Latent View Analytics IPO: कंपनी के इश्यू को पहले दिन मिलीं करीब 25 गुना बोलियां, एंकर इनवेस्टर्स से जुटाए 267 करोड़ रुपये

Latent View Analytics IPO: कंपनी के इश्यू को पहले दिन मिलीं करीब 25 गुना बोलियां, एंकर इनवेस्टर्स से जुटाए 267 करोड़ रुपये

नई दिल्ली. डाटा एनालिटिक्स सर्विसेज फर्म लेटेंट व्यू एनालिटिक्स के पब्लिक ऑफर (Latent View Analytics IPO) को पहले ही दिन 1.5 गुना ज्यादा बोलियां मिल चुकी हैं. इस आईपीओ को खुदरा निवेशकों (Retail Investors) की ओर से उत्साहजनक प्रतिक्रिया मिली है. वहीं, कंपनी ने एंकर इनवेस्टर्स (Anchor Investors) से 267 करोड़ रुपये पहले ही जुटा लिए हैं. कंपनी के 600 करोड़ रुपये के आईपीओ में जारी 1.75 करोड़ शेयरों…

View On WordPress

#Anchor Investors#Fund raises#ipo#IPO bids#Latent View Analytics IPO#Nykaa IPO#PAYTM IPO#retail investors

0 notes