#personal accountant calgary

Text

Professional Tax Accountants Calgary

Professional tax accountants play a crucial role in assisting individuals and businesses with tax compliance, planning, and optimizing their financial positions. Their expertise in tax laws and regulations ensures accurate and efficient tax management, providing clients with peace of mind and potential tax savings.

Professional tax accountants are trained and qualified professionals who specialize in providing tax-related services to individuals, businesses, organizations, and other entities. These accountants have expertise in tax laws, regulations, and tax planning, enabling them to assist clients in various tax-related matters.

Matrix Accounting is one of the best accounting firm in Calgary, with the team of highly professional accountants to deal with all tax matters at personal and corporate levels.

Book a free consultation with experts today at 403-668-4070.

#tax accountant calgary#accounting firm calgary#calgary accountants#personal tax accountant calgary#calgary tax services#personal accountant calgary#calgary tax accountant#best accountants calgary#calgary tax consultants#professionaltaxservice

0 notes

Text

Introducing Wave Taxes Inc, your trusted partner for comprehensive tax and accounting services. With our expertise in Canada payroll service, business advisory services, tax accountant Calgary, estate planning, and bookkeeping service, we provide a comprehensive suite of financial solutions tailored to meet your specific needs. Our team of experienced professionals is dedicated to assisting individuals and businesses in navigating the complex world of taxes and finances. Whether you need assistance with tax preparation, strategic business advice, payroll management, or estate planning, we are here to help you achieve your financial goals. Choose Wave Taxes Inc for reliable, efficient, and personalized financial services that make a real difference. visit us: https://wavetaxes.ca

#bookkeeping service#tax preparation#tax planning#personal accountant calgary#tax services calgary#personal tax accountant calgary#best personal tax accountant calgary

0 notes

Text

Why Personal Income Tax Planning is Crucial - Know from Calgary Personal Tax Accountants

There are different strategies that will help you reduce your personal income tax liability - providing you with a better way of saving something more and pay lesser, but in legal way. Staying in touch with experienced Calgary personal tax accountants will surely the right way to help you get the right solutions. They allow you to maximize available exemptions, deductions and benefits.

It depends on your earnings; you can leverage personal tax planning techniques or refundable tax credits. There are varied ways to save more on taxes like a registered retirement savings plan contribution that can lower the net income. The profits in this plan are entirely tax-free. In simple words, you don’t have to pay taxes on dividends and interest earned from the investment.

Personal Tax Planning - Helpful in Varied Saving Options

Personal tax planning is crucial for home buyer’s plan and lifelong learning plan. You will get a chance of saving on registered education savings plan. In addition to the aforementioned benefits, you will be eligible for refundable tax credits like Charitable donations, child disability benefits, medical expense tax credits, eligible educator credits, Canada Caregiver Credits, Tuition tax credits, interest on Student loans, and a lot more.

You are advised by the Calgary personal tax accountant to increase your tax refund - mainly to minimize a large tax bill. You should ensure that you file your income tax return correctly and within the deadlines. You should also pay attention to optimal tax planning in advance with the professional Calgary personal tax accountant to ensure your year-end goals are met and all deductions and credits are professionally handled.

What If Not Doing Proper Personal Tax Planning?

If you are not following the criteria of personal tax return or income tax return, you are giving an open invitation to some financial issues. the Federal Government earns 30% of its revenue from personal income taxes. You are doing your bit to help pay for the country’s public infrastructure, schools, healthcare, and cultural activities as a Canadian Taxpayer. The tax filing deadlines for a particular year falls on April 30 of the following year. A few exceptional circumstances may extend the deadline.

If you file your returns after the filing due date, the Canada Revenue Agency or CRA charges a daily compound interest on the outstanding balance starting May 1 until you pay your taxes in full. The more delay in payment means bigger penalty.

Getting professional support from professional Calgary personal tax accountant will keep you worry-free and provide you with the right solutions. You have to make a contact as per your requirement, go through the details and get the right solutions.

Summary: Calgary personal tax accountant professionals are here to help you solve your queries and provide you with the right solutions for the issues related to income tax returns.

1 note

·

View note

Text

Tax Panning advisors

Welcome to Calgary Tax Consulting! We are your trusted partners for all your tax and financial needs in Calgary. Our experienced team of tax professionals is dedicated to providing comprehensive and personalized services to individuals and businesses.

With our extensive knowledge and expertise, we offer a wide range of services including tax planning, preparation, and filing, bookkeeping and accounting, payroll management, international tax services, and more.

0 notes

Text

Corporate Tax Return Canada: Ensure Compliance with Our Expert Services

Corporate tax returns can be complex and time-consuming, but with our expert services, you can ensure compliance and peace of mind. Our team of experienced professionals will work with you to file your corporate tax return in Canada, providing you with the guidance and support you need along the way.

#personal tax accountant calgary#tax advisor calgary#tax planning advisors calgary#calgary tax consulting

1 note

·

View note

Text

Personal Tax Consultant Calgary

Get personalized tax advice from a qualified tax consultant in Calgary. Our team of certified professionals will help you minimize your taxes and maximize your returns. Discover how we can help to save you money on your taxes today.

#Personal Income Tax Services Calgary#Preparation of Personal Tax Calgary#Filing of Personal Tax Calgary#Tax Accountant Near Me Calgary#Best Tax Preparers Near Me#Personal Tax Accountant Near Me

0 notes

Note

I know you used to have a book wishlist, where did that go?

Yes I did, it was gently retired, though we had some very generous people who sent me books (THANK YOU <3 I continue to be shocked and warmed by this community's generosity) I found that I am much more of an audiobook person. I have trouble keeping information in my mind if I am reading it physically. That being said, I have also begun requesting books from my local library, which has been a massive resource that has assisted me more than I could have imagined before I started using it.

That being said, there are some books that I wish I had access to still, just because they don't have audiobooks. Currently my list is made up of:

Feeling Backward: Loss and the Politics of Queer History by Heather Love: "Feeling Backward" makes an effort to value aspects of historical gay experience that now threaten to disappear, branded as embarrassing evidence of the bad old days before Stonewall. It looks at early-twentieth-century queer novels often dismissed as "too depressing" and asks how we might value and reclaim the dark feelings that they represent. Heather Love argues that instead of moving on, we need to look backward and consider how this history continues to affect us in the present.

Prairie Fairies: A History of Queer Communities and People in Western Canada, 1930-1985 by Valerie Korinek: Prairie Fairies draws upon a wealth of oral, archival, and cultural histories to recover the experiences of queer urban and rural people in the prairies. Focusing on five major urban centres, Winnipeg, Saskatoon, Regina, Edmonton, and Calgary, Prairie Fairies explores the regional experiences and activism of queer men and women by looking at the community centres, newsletters, magazines, and organizations that they created from 1930 to 1985.

Racism and the Making of Gay Rights: A Sexologist, His Student, and the Empire of Queer Love by Laurie Marhoefer: Racism and the Making of Gay Rights shows how Hirschfeld laid the groundwork for modern gay rights, and how he did so by borrowing from a disturbing set of racist, imperial, and eugenic ideas. Yet on his journey with Li, Hirschfeld also had inspiring moments - including when he formulated gay rights as a broad, anti-colonial struggle and as a movement that could be linked to Jewish emancipation. Following Hirschfeld and Li in their travels through the American, Dutch, and British empires, from Manila to Tel Aviv to having tea with Langston Hughes in New York City, and then into exile in Hitler's Europe, Laurie Marhoefer provides a vivid portrait of queer lives in the 1930s and of the turbulent, often-forgotten first chapter of gay rights.

If you wanted to fund my ability to get my queer hands on these books, here is the link:

#dont feel pressured to pay#and know any and all donations are split#so not all of it is going directly into my book fund lol#answered

153 notes

·

View notes

Note

University of Calgary's administration sent an email out today saying police dispersed the pro-Palestine protesters yesterday because counter-protesters showed up and the risk of clashes made it dangerous. And that that's why they aren't allowed to camp, because the university just wants to make sure they can protest safely and not be approached by counter-protesters in the night. Personally I haven't seen any accounts on social media of counter-protesters.

~~~~

26 notes

·

View notes

Text

CARTER YAKEMCHUK APPRECIATION POST

Carter Yakemchuk was drafted 7th overall and all you have to do is click my profile to see why I’m doing this

A physical offensive defenceman

last season with the Calgary Hitmen he got 30 goals which is the franchise record by a defenceman

might seem like he has a personality of a carboard cut out but it's because he's *dialed*

Literally any interview with him he’s so reserved

Was expected to go 11th out of the North American skaters but on draft day he went 7th!!

He leaned on his teammate/roommate from the Calgary Hitmen Carson Wetsch during the drafting process (draft combine, interviews, prospect games etc.)

quote he said about Carson Wetsch during the draft experience, “I mean the whole year, just to go through with it with Wetsch is pretty special… to be here with him, you know it’s just a familiar face I can go to talk to and it’s been a great experience to do it with him.”

And to add more to these two, this photo

He prefers two way defensemen and likes Morgan Rielly and Evan Bouchard’s game and how they produce offensively

His nickname is yak

He graduated last year (2023) and jokingly called himself an academic weapon after while earlier that school year he allegedly was 50 days behind him in school work (he’s so real for that)

Un-privated his Insta account after he got drafted

The saying “yak on the attack” better follow this man around I’m not joking

Like the classic cup in the helmet to prank his teammates

Had 35 friends and family attending his draft, which is insane, but good for him hope everyone had a fun time

He talks a lot about how he likes spending time with his family

Represented team Canada on the U18 team in 2023 and came 3rd

When asked what other job he would have if it weren’t hockey player he said he would go into another sports most likely NFL (and play quarterback specifically)

His cheat meal is a burger

Loves fishing

“What animal would you be?” He answered a crocodile on the ice and a monkey off the ice and his reasoning is because they are calm

His favourite player growing up was Jordan Eberle

he’s an oilers fan

He was born in Fort McMurray Alberta, grew up in Fort Saskatchewan which is 25km away from Edmonton

Should mention that he’s not going to play in the NHL next season he’s just going to be a sens prospect

Anyways sorry this is so short this is all I could find about him :)

#carter yakemchuk#ottawa senators#nhl#I feel like I just made the most basic white guy dating profile in the world 😞#but please this man has a personality it’s just isn’t big

9 notes

·

View notes

Photo

22-year-old Matthew de Grood was a student at the University of Calgary. The son of a city police officer, he dreamed of attending law school. In the early months of 2014, Matthew started experiencing some bizarre delusions. He believed the world was going to end and that he was locked in a mortal battle with werewolves, zombies, and vampires.

He started to post about his concerns regarding the end of the world on his Facebook account. Matthew believed that there was going to be a war of good and evil and on the evil side, according to him, was the Nazis and Barack Obama.

In the early morning hours of 15 April, 2014, a party was underway at a home near the University of Calgary. It was the end of the school year and students were in a celebratory mood. Approximately 30 guests showed up, one of which was Matthew.

At around 1:20AM, Matthew heard voices in his head, telling him to kill. He grabbed a kitchen knife and started to indiscriminately attack his fellow schoolmates. He killed five people - Joshua Hunter, Kaitlin Perras, Jordan Segura, Lawrence Hong, and Zachariah Rathwell.

During his trial, his defence lawyer contended that Matthew believed his victims were werewolves and vampires and that he had to kill them because they threatened his life. Two experts found that he was suffering from severe untreated schizophrenia.

Much to the upset of the family members of his victims, Matthew was found not criminally responsible for the murders. “There will be no peace for us. Our wounds will never fully heal because every year our families will have to wonder what will be the fate of the man who destroyed so many lives,” said Hong’s brother. Matthew was sent to a secure hospital where he shall remain until he is released.

In 2017, it was reported he was granted more privileges such as being allowed to walk around the hospital grounds while supervised. After receiving his treatment plan for his mental illness, Matthew release a statement which read: “It breaks my heart that the good times they had with their loved ones are over. They may not care that I am schizophrenic. The act of killing five innocent people and putting their families through that agony is unconscionable. To them, I am either a very evil person or a psychotic individual who is dangerous and can’t be trusted.“

The tragic case of Matthew de Grood poses the question: Would the outcome have been different if somebody took heed to his warning signs?

69 notes

·

View notes

Text

https://matrixaccounting.ca/key-benefits-of-hiring-a-professional-tax-service/

Key Benefits of Hiring a Professional Tax Service

Hiring a professional tax service can offer several key benefits, making it a wise decision for individuals and businesses alike. hiring a professional tax service offers expertise, time savings, error prevention, audit support, and customized tax planning. It allows individuals and businesses to navigate the complexities of tax laws effectively, ensuring accurate and compliant tax filings while maximizing tax benefits and financial opportunities.

https://matrixaccounting.ca/key-benefits-of-hiring-a-professional-tax-service/

#tax accountant calgary#accounting firm calgary#calgary accountants#personal tax accountant calgary#calgary tax accountant#calgary tax services#personal accountant calgary#best accountants calgary#calgary tax consultants#professionaltaxservice

0 notes

Text

Why Hiring a Personal Tax Accountant in Calgary Makes Sense

Tax season is approaching again. Many find tax filing as tedious as a root canal without anesthetic. If so, you may need an accountant. In particular, a Calgary personal tax accountant can simplify the procedure.

Imagine relaxing while a professional handles your receipts and tax code issues on weekends. An accountant knows the newest regulations and deductions to maximize your return. They calculate and fill out all forms for you precisely and on time.

Sound good? If you want a stress-free tax season and a higher tax refund, choose a personal tax accountant calgary. Leave the pros to their work so you may live your life.

Profit of Hiring a Personal Tax Accountant

An accountant to manage your Calgary personal taxes makes sense. Some key advantages:

Save Time and Stress and Maximum Refund

Taxes can be complicated. A skilled tax accountant can handle anything. They follow new tax laws, so you don't. You save time and stress and know your taxes are right. They know all tax deductions and credits. They can find neglected deductions and maximize tax benefits. This frequently boosts tax refunds.

Avoid Mistakes and Penalties

As the tax system becomes more complicated, mistakes might result in penalties. Personal tax accountants know how to file taxes correctly the first time. They keep comprehensive records and paperwork for audits. This provides you confidence your taxes are done correctly without errors costing you money.

Year-round help

An excellent personal tax accountant calgary can advise you year-round. They can help with tax planning to reduce current and future taxes. They also answer tax questions year-round. Maintaining an accountant relationship yields the finest benefits.

Now save your money with a Personal Tax Accountant

Your tax accountant can help you save more by discovering missed deductions and credits.

They Know Current Tax Laws

Tax regulations change frequently, so accountants stay current to help you reduce your tax liability. They can find hidden deductions and credits. With professional advice, you could earn thousands in tax savings each year.

They Create Strategic Tax Plans

A skilled tax accountant will analyze your financial situation to create a customized tax strategy. They can assist you in maximizing income and deductions and deferring or avoiding taxes.

They Double-Check Errors

Doing your taxes can lead to blunders that cost you money or an audit. Tax professionals can verify returns for mistakes and omissions before filing. They can spot items you miss and ensure a smooth return.

Conclusion

All done. A personal tax accountant calgary makes sense for busy. Save time, money, and stress. Life can be lived while someone handles tough taxes. Their understanding ensures you get all deductions and credits to save money. Why handle tax season alone when you have a proficient, helpful partner? Today, interviewed tax accountants. Self-appreciation follows.

0 notes

Text

California to smash prison e-profiteers

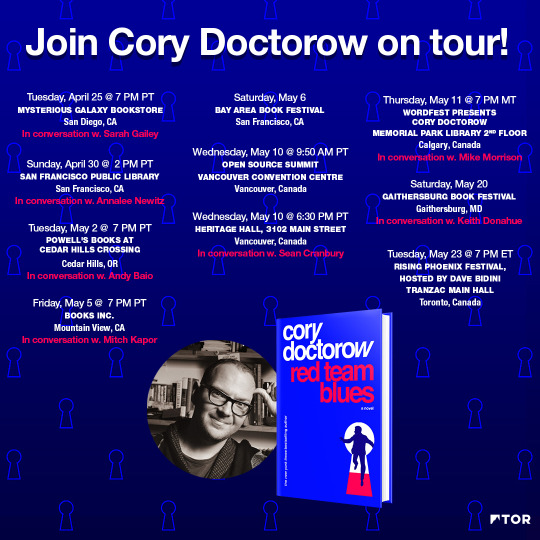

On Weds (May 10), I’m in Vancouver for a keynote at the Open Source Summit and a book event for Red Team Blues at Heritage Hall and Thu (May 11), I’m in Calgary for Wordfest.

It’s a double-whammy that defines 21st century American life: a corporation gets caught doing something terrible, exploitative or even murderous, and a government agency steps in — only to discover that there’s nothing it can do, because Reagan/Trump/Clinton/Bush I/Bush II deregulated that industry and stripped the agency of enforcement powers.

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/05/08/captive-audience/#good-at-their-jobs

Man, that feels awful. The idea that extremists gutted our democratically accountable institutions so that there’s nothing they can do, no matter how egregious a corporation’s conduct is so demoralizing. Makes me feel like giving up.

But the law is a complex and mysterious thing. Regulators aren’t actually helpless. There are authorities, powers and systems that the corporate wreckers passed over, failed to notice, or failed to neuter. Take Section 5 of the FTC Act, which gives the Commission broad powers to prevent “unfair and deceptive” practices. Since the 1970s, the FTC just acted like this didn’t exist, even though it was right there all along, between Section 4 and Section 6.

Then, under the directorship of FTC chair Lina Khan, Section 5 was rediscovered and mobilized, first to end the practice of noncompete “agreements” for workers nationwide:

https://mattstoller.substack.com/p/antitrust-enforcers-to-ban-indentured

A new breed of supremely competent, progressive regulators are dusting off those old lawbooks and figuring out what powers they have, and they’re using those powers to Get Stuff Done. It’s like that old joke:

Office manager: $75 to kick the photocopier?

Repair person: No, it’s $5 to kick the photocopier, $70 to know where to kick it.

There’s a whole generation of expert photocopier-kickers in public life, and they’ve got their boots on:

https://pluralistic.net/2022/10/18/administrative-competence/#i-know-stuff

This is the upside of technocracy — where you have people who are appointed to do good things, and who want to do good things, and who figure out how to do good things. There are dormant powers everywhere in law. Remember when Southwest Air stranded a million passengers over Christmas week and Transport Secretary Pete Buttigieg responded by talking sternly about doing better, but without opening any enforcement actions against SWA?

At the time, Buttigieg’s defenders said that was all he could do: “Pete isn’t the boss of Southwest’s IT department, you know!” He’s not — but he is in possession of identical powers to the FTC to regulate “unfair and deceptive” practices, thanks to USC40 Section 41712(a), which copy-pastes the language from Article 5 of the FTC Act into the DOT’s legislative basis:

https://pluralistic.net/2023/01/10/the-courage-to-govern/#whos-in-charge

The failures of SWA were a long time coming, and were driven by the company’s shifting of costs from shareholders to employees and fliers. SWA schedules many flights for which they have no aircraft or crew, and when the time to fly those jets comes, the company simply cancels the emptiest flights. This is great for SWA’s shareholders, who don’t have to pay for fuel and crew for half-empty planes — but it’s terrible for crew and fliers.

What’s more, selling tickets for planes that don’t exist is plainly unfair and deceptive. A good photocopier-kicker in charge of the DOT would have arrived with a “first 100 days” plan that included opening hearings into this practice, as a prelude to directly regulating this conduct out of existence, averting the worst aviation scheduling crisis in US history. That’s what Buttigieg’s critics wanted from him: a competent assessment of his powers, followed by the vigorous use of those powers to protect the American people.

One domain that’s been in sore need of a photocopier-kicker for years is prison tech. America (“the land of the free”) incarcerates more people than any nation in the history of the world — more than the USSR, more than China, more than Apartheid-era South Africa.

For corporate prison profiteers, those prisoners are a literal captive audience, easy pickings for gouging on telephone calls, books, music, and food. For years, companies like Securus have been behind an incredibly imaginative array of sadistic tactics that strip prisoners of the contact, education and nutrition that governments normally provide to incarcerated people, and then sells those prisoners and their families poor substitutes for those necessities at markups that cost many multiples of the equivalent services in the free world.

Think of prisons that reduce the amount of food served to sub-starvation levels, then sell food at high markups in the prison commissary. For prisoners whose families can afford commissary fees, this is merely extortion. But for prisoners who don’t have anyone to top up their commissary accounts, it’s literal starvation.

This is the shape of every prison profiteer’s grift: take something vital away and then sell it back at a massive markup, dooming the prisoners who can’t afford it. The most obvious way to gouge prisoners is by charging huge markups for phone calls. Prisoners who can afford to pay many dollars per minute can stay in touch with their families, while the rest rot in isolation.

In 2015, the FCC tried to halt this practice, passing an order capping the price of calls, but in 2017, the DC District Court struck down the order, ruling that the FCC couldn’t regulate in-state call tariffs, which are the majority of prison calls:

https://www.cadc.uscourts.gov/internet/opinions.nsf/0/C62A026B396DD4C78525813E004F3BC5/%24file/15-1461-1679364.pdf

This was a bonanza for prison profiteers. Companies like Jpay (now a division of Securus) cranked up the price of prisoners’ calls. At the same time, dark-money lobbying campaigns urged prisons to get rid of their in-person visitation programs in the name of “safety”:

https://www.mic.com/articles/142779/the-end-of-prison-visitation

Not just visitation: prisons shuttered their libraries and banned shipments of letters, cards and books — again, in the same of “safety.” Jpay an its competitors stepped in with “free tablets” — cheap, badly made Chinese tablets. Instead of checking out books from the prison library or having them mailed to you by a friend or family member, prisoners had to buy DRM-locked ebooks at many multiples of the outside world price (these same prices were slapped on public domain books ganked from Project Gutenberg):

https://www.prisonpolicy.org/blog/2018/07/24/no-cost-contract/

Instead of getting letters and cards from your family members and friends, you had to pay to look at scans of them, buying “virtual stamps” that had to accompany every page (they even charged by the “page” for text messages):

https://www.wired.com/story/jpay-securus-prison-email-charging-millions/

Enshittification is my name for service-decay, where companies that have some kind of lock-in make things worse and worse for their customers, secure in the knowledge that they’ll keep paying because the lock-in keeps them from leaving. When your customers are literally locked in (that is, behind bars), the enshittification comes fast and furious.

Securus/Jpay and its competitors found all kinds of ways to make their services worse, like harvesting recordings of their calls to produce biometric voice-prints that could be used to track prisoners after they were released:

https://theintercept.com/2019/01/30/prison-voice-prints-databases-securus/

Of course, once the prison phone-carriers started harvesting prisoners’ phone calls, it was inevitable that they would leak those calls, including intimate calls with family members and privileged calls with lawyers:

https://www.aaronswartzday.org/securedrop-prisoner-data/

Prison-tech companies know they can extract huge fortunes from their captive audience, so they are shameless about offering bribes (ahem, “profit-sharing”) to prison authorities and sheriffs’ offices to switch vendors. When that happens, prisoners inevitably suffer, as happened in 2018, when Florida state prisons changed tech providers and wiped out $11.8m worth of prisoners purchased media — every song prisoners had paid for:

https://www.eff.org/deeplinks/2018/08/captive-audience-how-floridas-prisons-and-drm-made-113m-worth-prisoners-music

As bad as these deals are for prisoners, they’re great for jailers, who are personally and institutionally enriched by prison-tech giants. This is textbook corruption, in which small groups of individuals are enriched while vast, diffuse costs are extracted from large groups of people. Naturally, the deals themselves are swathed in secrecy, and public records requests for their details are met with blank, illegal refusals:

https://www.muckrock.com/news/archives/2018/may/25/laramie-county-prison-phones/

The “shitty technology adoption curve” predicts that technological harms that are first visited upon prisoners and other low-privilege people will gradually work its way up the privilege gradient:

https://pluralistic.net/2021/07/29/impunity-corrodes/#arise-ye-prisoners

Securus powered up the Shitty Tech Adoption Curve. They don’t just spy on and exploit prisoners — they leveraged that surveillance empire into a line of product lines that touch us all. Securus transformed their prisoner telephone tracking business into an off-the-books, warrantless tracking tool that cops everywhere use to illegally track people:

https://www.nytimes.com/2018/05/10/technology/cellphone-tracking-law-enforcement.html

In other words, our jails and prisons are incubators that breed digital pathogens that infect all of us eventually. It’s past time we got in the exterminators and flushed out those nests.

That’s where California’s new photocopier-kickers come in. Like many states, California has a Public Utility Commission (PUC), which regulates private companies that provide utilities, like telecoms. That means that the state of California can reach into every jail and prison in the state and grab the prison profiteers by the throats and toss ’em out the window.

Writing in The American Prospect, Kalena Thomhave does an excellent job on the technical ins-and-outs of calling on PUCs to regulate prison-tech, both in California and in other states where PUCs haven’t yet been neutered or eliminated by deregulation-crazed Republicans:

https://prospect.org/justice/2023-05-08-california-prison-phone-calls-free/

Thomhave describes how California’s county sheriffs have waxed fat on kickbacks from the prison-tech sector: “for example, the Yuba County Sheriff’s Office receives 25 percent of GTL/ViaPath’s gross revenue on video calls made from tablets.” Small wonder that sheriffs offices lobby against free calls from jail, claiming that prisoners’ phone tariffs are needed to fund their operations.

It’s true that the majority of this kickback money (51%) goes into “inmate welfare funds,” but these funds don’t have to go to inmates — they can and are diverted to “maintenance, salaries, travel, and equipment like security cameras.”

But limiting contact between prisoners and their families in order to pay for operating expenses is a foolish bargain. Isolation from friends and family is closely linked to recidivism. If we want prisoners to live productive lives after their serve their time, we should maximize their contact with the outside, not link it to their families’ ability to spend 50 times more per minute than anyone making a normal call.

The covid lockdowns were a boon to prison-tech profiteers, whose video-calling products were used to replace in-person visits. But when pandemic restrictions lifted, the in-person visits didn’t come back. Instead, jails continued to ban in-person visits and replace them with expensive video calls.

Even with new power, the FCC can’t directly regulate this activity, especially not in county jails. But PUCs can. Not every state has a PUC: ALEC, the right-wing legislation factory, has pushed laws that gut or eliminate PUCs across the country:

https://alec.org/model-policy/telecommunications-deregulation-policy-statement/

But California has a PUC, and it is gathering information now in advance of an order that could rein in these extractive businesses and halt the shitty tech adoption curve in its tracks:

https://docs.cpuc.ca.gov/PublishedDocs/Efile/G000/M478/K075/478075894.PDF

That’s some top-notch photocopier-kicking, right there.

Catch me on tour with Red Team Blues in Vancouver, Calgary, Toronto, DC, Gaithersburg, Oxford, Hay, Manchester, Nottingham, London, and Berlin!

[Image ID: A prison cell. Behind the bars is the bear from the California state flag. There is an old-fashioned telephone headset near his ear, such that he appears to be making a call.]

#pluralistic#smartprison#prison#prison-tech#photocopier kickers#california#carceral state#jail#profiteers#prison profiteers#marty hench#the bezzle#puc#jpay#public utility commission#Securus#global tellink#gtl#viapath#fcc#voip

45 notes

·

View notes

Text

Tax and Bookkeeping Services: The Ultimate Solution for Small Businesses

As a small business owner, you have a lot on your plate. Let us lighten the load with our tax and bookkeeping services. From tax preparation to bookkeeping and accounting, we're here to help you manage your finances and grow your business.

#personal tax accountant calgary#tax advisor calgary#calgary tax consulting#corporation tax return calgary

0 notes

Text

Why I might block a follower

Bots won't read this nor care, but for new followers I thought it might be interesting to periodically touch on why I might (or might not) block someone who follows me. And if you aren't a bot and still you don't care, here's a page break so you can skip this. tl;dr pretty much anything goes if you aren't a p*rnbot.

I've been pretty lucky: it's been a while since I've been subject to "p*rnbot" spamming. Obviously, if I open a new follower's page and the first thing I see is a bunch of naked pictures or dick pics (the anti-nudity rules Tumblr put in a few years back did NOT stop such accounts from being created), then it's being blocked. Similarly there are some blogs that just repost sexy photos of celebs. If it looks like the blog is just there to farm my post next time I reblog a pic of Jenna Coleman I'll give it a closer look and if it's definitely a celeb "p*rnbot" (you can tell if it's not just someone who likes to reblog pictures of celebs they like, which is fine), then into the blocker it goes.

Content-wise, I don't go vetting sites for what they write. Not enough time and I'm not into that sort of thing. Obviously if I post something and it gets reblogged by somebody who has views on things that are opposed to mine (whether political or related to Doctor Who, etc.), I assume people understand it's not an endorsement by me (and of course I won't reblog anything I vehemently disagree with unless I am making a rebuttal). That said I will block for content if I find out a follower, say, posts hatred, whether that be towards people who are critical of recent versions of Doctor Who (I had to do that a couple of times and am pretty sure I've been blocked myself for not worshipping at the altar of Chibnall though I've never posted hate), or obviously people who post racism, etc. (I personally don't seem to attract those types to my blog, which is a good thing. I'm more likely to have someone call me a p*do for supporting Whouffaldi - which has happened - than the triple-K stuff).

I've had to unfollow the occasional blog if they go overboard on posting. I had one once post something like 100 reblogs in a row and it rendered my dashboard unusable and they did it a few times because they were really enthusiastic about a topic (non-Who, btw), so I had to unfollow them. But I didn't block them.

Finally, anyone who makes me a follower of them without my actually following them voluntarily gets blocked and reported (I haven't had it happen for a long time, no idea how it can be done, but I have occasionally discovered I've "followed" businesses and one or two p*rnbots. Usually when I suddenly start seeing boobs on my dashboard - which sounds like a great title for a song, but I digress). If a business wants to follow me, of course, by all means (I recently got followed by a business that sells riot gear. No idea why; maybe I'll get a discount next time a fight breaks out at the next Calgary Stampede Pancake Breakfast).

2 notes

·

View notes