#tax preparation

Text

if you are an American,

🙂 are you good?

it’s officially tax season crunch-time folks!

You know what that means: sweaty searches for your W2 and paralyzing fear over whether you owe or not! 🙂

Will it be a return for you this year or will you be looking for a third job to cover that amount due? 🙃

I’m right there with you friends.

Let my humble contribution below, bring you some laughs as you languish to help combat the Sunday Scaries. 🐀❤️

youtube

#taxes#tax services#taxation#tax preparation#tax planning#tax professional#tax policy#tax payers#tax payment#tax filing#tax forms#tax free#tax liability#tax evasion#tax season#tax savings#tax strategies#tax software#mental health#mental illness#mental heath awareness#mental health matters#Youtube

226 notes

·

View notes

Text

#accounting#management#Accounting Firms#Tax Services#accounting companies#bookkeeping#audits#payroll#tax preparation#outsourcing partner#Florida

2 notes

·

View notes

Video

youtube

The Beatles - Taxman

AND THE COLLATING BEGINS...PAY THE PIPER

2 notes

·

View notes

Text

The Role of Accounting and Bookkeeping in Tax Industry

Accounting and bookkeeping are tedious and arduous but are necessary for the company to gain an advantage over competitors and to make decisions. Bookkeeping is the recording of financial details of the company in an orderly manner over some time. Bookkeepers are people who maintain the accounts. Ileadtax LLC is one of the best tax preparation and planning companies based in New York, India, and California. It offers accounting and bookkeeping services and are adviser for many companies. This article discloses the importance of accounting and bookkeeping in the tax industry and how it is useful to a company.

Accounting and bookkeeping are dependent on each other. Bookkeeping is a sub-branch of accounting that organizes and summarizes financial data and it has accurate financial data. Bookkeepers have access to all financial data of the company and can track their transactions. They ensure the data is up to date and is complete. Bookkeeping helps the company with decisions related to investing and operations. IleadTax LLC is a global company that consists of tax accounting experts in India, New York, and California. They provide their tax experts for all companies which are in need. The accounting and bookkeeping services provided contain detailed records of past transactions.

The first step in achieving flawless tax preparation is keeping accurate financial records. The foundation of this process is accounting and bookkeeping. These tasks entail the meticulous documentation of financial transactions, which results in an accurate depiction of earnings, outlays, assets, and liabilities. Having structured financial records is essential for tax season. Identification of deductible expenses is made possible for people and organizations through accounting and bookkeeping. Taxpayers can properly minimize their taxable income by accurately categorizing their costs and keeping track of the necessary supporting records. This may lead to significant cost savings and a better tax situation.

Beyond tax time, accounting and bookkeeping are important. They serve as the cornerstone for budgeting, investments, and future tax planning, enabling both individuals and corporations to make well-informed choices. It's advantageous to obtain professional advice when dealing with the complicated realm of tax preparation. CPAs (Certified Public Accountants) and seasoned bookkeepers may provide priceless insights, ensuring that you successfully navigate tax season.

A thorough and accurate bookkeeping procedure gives businesses a reliable way to assess their success. It also serves as a benchmark for its income and revenue targets and information for general strategic decision-making. A trustworthy source for businesses to gauge their financial performance is bookkeeping.

Accounting and bookkeeping are more than simply administrative duties; they are also effective instruments that can lessen the strain of tax season and enhance your financial security. A sound accounting and bookkeeping system can result in significant savings, compliance, and financial peace of mind whether you're a business owner or an individual taxpayer. So, as tax season draws near, keep in mind that having a solid financial foundation is the key to success. ILeadTax LLC attempts to deliver results that meet the expectations of the client.

#Accounting and bookkeeping#tax preparation#tax accounting experts in India#accounting and bookkeeping services

4 notes

·

View notes

Text

youtube

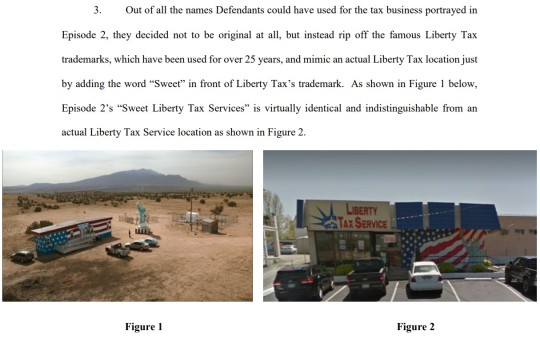

Better Call Saul was SUED IN REAL LIFE by an actual tax company! 👨🏻⚖️

#better call saul#bcs#breaking bad#brba#tv#tv show#tv shows#tv series#did you know#trivia#tv trivia#fun fact#fun facts#sued#lawsuit#liberty tax#taxes#tax preparation#tax services#true story#Youtube

3 notes

·

View notes

Text

The Increasing Use of Artificial Intelligence (AI) in Tax Preparation

The tax code is complex and constantly changing, making it difficult for taxpayers to file their taxes correctly. This is where artificial intelligence (AI) comes in. AI is being used to automate many of the tasks involved in tax preparation, such as data entry and calculations. This is helping to make tax preparation faster and more efficient.

How AI is used in Tax Preparation

There are many ways that AI is being used in tax preparation. Here are a few examples:

Automating data entry: AI can be used to automatically enter taxpayer data into tax preparation software. This saves time and reduces the risk of errors.

Performing calculations: AI can be used to automatically perform complex calculations, such as depreciation and interest deductions. This ensures that taxpayers are taking advantage of all of the deductions and credits that they are eligible for.

Identifying potential errors: AI can be used to identify potential errors in tax returns. This helps to prevent taxpayers from making mistakes that could lead to penalties or interest charges.

Providing personalized advice: AI can be used to provide taxpayers with personalized advice on their tax situation. This can help taxpayers to make the best decisions for their individual needs.

The Benefits of AI in Tax Preparation

There are many benefits to using AI in tax preparation. Here are a few of the most important benefits:

Speed: AI can help taxpayers to file their taxes faster. This is because AI can automate many of the tasks involved in tax preparation, such as data entry and calculations.

Accuracy: AI can help taxpayers to file their taxes more accurately. This is because AI can identify potential errors in tax returns.

Cost-effectiveness: AI-powered tax prep services can be more cost-effective than hiring a human tax preparer. This is because AI-powered tax prep services typically charge a flat fee, which can be much lower than the hourly rate of a human tax preparer.

Accessibility: AI-powered tax prep services are available 24/7, so taxpayers can file their taxes whenever it is convenient for them.

The Future of AI in Tax Preparation

The use of AI in tax preparation is still in its early stages, but it is growing rapidly. As AI technology continues to develop, it is likely to have an even greater impact on the way that taxes are prepared.

In the future, AI is likely to be used to automate even more of the tasks involved in tax preparation. This could include tasks such as interpreting tax laws, researching tax deductions, and preparing tax returns. AI could also be used to provide taxpayers with more personalized tax advice.

The increasing use of AI in tax preparation is likely to have a major impact on the tax prep services industry. As AI-powered tax prep services become more sophisticated, they are likely to pose a threat to traditional tax preparation firms. However, traditional tax preparation firms can adapt to this new technology by offering their own AI-powered tax prep services.

Conclusion

The increasing use of AI in tax preparation is having a positive impact on the way that taxpayers file their taxes. It is making tax preparation faster, more efficient, and more accurate. As AI technology continues to develop, it is likely to have an even greater impact on the tax prep services industry.

If you are looking for a way to file your taxes quickly, easily, and accurately, then you should consider using an AI-powered tax prep service. These services are the future of tax preparation, and they are already making a big difference in the way that taxpayers file their taxes.

2 notes

·

View notes

Text

Esmtaxservices has the best service and staff who speak English and Spanish... When contacting them, say they are calling from this Tumblr page. Thank you.

2 notes

·

View notes

Text

The Most Important Information to Give the IRS to Settle Your IRS Tax Debts

If you Owe Back Taxes, if you are suffering from an Economic Hardship and if can’t pay your Monthly Living Expenses, you May be in Luck!☘️

When you owe back taxes to the IRS, May suddenly become very interested in your monthly income and expenses!

In fact you may want the IRS to know about your personal financial situation!

You may want to share your monthly expenses, such as your;

• Housing costs

• Car payment, gas, and insurance

• Gas, water, electric and other utility bills

• Medical insurance

• Cell phone

• Groceries and dining out

…and much more.

Why would you share this information with the IRS?

It all comes down to what the IRS calls Allowable Living Expenses.

The second you become a tax debtor, the IRS has a Secret tax lien against everything you own, including your future income. This is a feature of federal law, and it’s the basis for all the other collection actions that the IRS can take against you, such as a Wage Garnishment or Bank Levy.

Because of the lien, the IRS legally has a say in how you spend your money. Nobody likes this, but it’s the reality of how the US tax code works.

As with most laws, there is a long and complicated list of rules that go into determining what place the IRS holds in line behind or ahead of your other creditors, but the bottom line is that the IRS wants to get paid, and they have power to make your life a living nightmare by enforcing the tax laws over your money and assets.

It’s not all bad, however. There are specific legal protections that exist to prevent the IRS from taking everything you own. In simple terms, the IRS is not allowed to make you destitute. In other words, they are not allowed to put your family out on the street or force your children to starve if it creates an Financial Hardship on you and your family.

This is where those Allowable Living Expenses (ALE) come in. The IRS must allow you to pay all your basic living expenses, even if it means you cannot pay the IRS what you owe them. Sounds Great! Mostly, other than the tax lien they may file.

The IRS has legal standards that is required to follow and allow you and your family to pay before the IRS can collect anything. These are the usual categories:

• Food, clothing, personal care products, and “miscellaneous”

• Out of pocket health care costs

• Vehicle ownership and operating costs

• Rent or mortgage

• Utilities, including gas, water, electric, cell phone, Internet, and more

For vehicle operating costs, housing, and utilities, they do take into account regional variations for these costs. The rest are all based on national numbers. All the numbers also have adjustments based on family size.

These numbers “dictate” what the IRS will allow you to spend every month to live. Your income, when compared to these allowable standards, is what determines which IRS tax relief options you may be eligible for.

If your income is less than the total monthly allowable living expenses for Honolulu or where you live and family size, you might be eligible for a program that allows you to pay the IRS nothing. Yes, nothing. Zero. Nada. Zilch.

If your income is also less than the total monthly allowable living expenses, the IRS calculate for you, but you have assets – such as lots of equity in your home, stocks, bonds, classic cars, crypto, or the world’s most valuable Vinyl Record collection – then they’re going to take into consideration the value of those assets, too. But, in such a situation, you may be able to settle your tax debt for less than what you owe, and walk away from the rest.

If your income is more than the allowable living expense calculation, then the IRS is going to take that “excess” income into consideration for a reduced settlement. If you’re not eligible for a reduced settlement – which most people are not – then this “excess” income becomes the monthly minimal payment the IRS can require as a monthly payment.

One of the first things that Tax Relief Services can help our clients when they hire us to help them with a tax debt problem is to conduct a detailed Preliminary Analysis the exact same detailed financial analysis that the IRS should do but most of the time will not. We do the Preliminary Analysis for a number of reasons, such as:

1. Determining which IRS programs you’re eligible for.

2. Seek opportunities to legally increase your allowable living expenses.

3. Determine if the IRS balances are correct.

4. Look for unique circumstances that might open doors to outside-the-box resolution options.

This preliminary financial analysis is crucial for us to be able to get the best possible deal for our clients. Since the vast majority of tax debtors will end up on a monthly payment plan to the IRS, our job is to help get you the smallest possible monthly payment and help you minimize the short-term financial impact on your budget.

The IRS is NOT LOOKING OUR FOR YOU, BUT TAX RELIEF SERVICES IS!

If you’re in a situation where the IRS is hounding your, then we should chat. You don’t want to wind up in a situation where the IRS simply pigeon-holes you into the situation that is most convenient for them, leaving you unable to pay other monthly bills. Just schedule a time to chat:

WWW.TAXRELIEFSERVICES.COM

CALL TODAY!

TAX PROBLEMS DON’T GO AWAY!

808.589.232

#accounting#tax relief#taxreduction#tax#personal debt#tax expert#tax help#taxprofessional#tax reprieve#taxpayers#irs#financial#taxes#business#tax return#tax preparation

5 notes

·

View notes

Text

SoCal Business Services

Looking For Comprehensive Business Services For Your New Startup? Howard Dagley, CPA goes above and beyond for more than just taxes! He’ll make sure your business gets the best start possible in 2024. Howard is proudly serving businesses in the Santa Clarita Valley, San Fernando Valley & Los Angeles areas.

Call Howard Dagley, CPA today at for help with your new business at 1-661-255-8627. Howard…

View On WordPress

#Accountant Santa Clarita#best cpa in Santa Clarita#book keeping#Business Services#business valuations#CPA San Fernando Valley#CPA SCV#CPA SFV#Howard Dagley CPA SCV#Tax Preparation#Tax Returns#tax services Santa Clarita

0 notes

Text

The Role of Accountants in Tax Planning and Preparation

Find out how accountants play a crucial role in helping individuals and businesses with tax planning and preparation.

1 note

·

View note

Text

#excise taxes#tax preparation#individual income taxes#tax#taxi service#new york#ramconsultant#nassau#bahamas

0 notes

Text

Tips For Ensuring Accuracy And Compliance In Corporate Tax Return Preparation

Preparing corporate tax returns is a meticulous and complex process that requires attention to detail, thoroughness, and adherence to ever-changing tax laws and regulations. Ensuring accuracy and compliance in corporate tax return preparation is crucial for avoiding penalties, audits, and legal complications while maximizing tax savings for your business. Here are some essential tips to help you navigate this process effectively:

Stay Updated with Tax Laws and Regulations: Tax laws are constantly evolving, with new regulations and updates issued regularly. To ensure accuracy and compliance, stay informed about changes in tax laws that may impact your business. Subscribe to reputable tax publications, attend seminars or webinars, and consult with tax professionals to stay abreast of relevant developments.

Maintain Accurate Financial Records: Accurate financial records form the foundation of a well-prepared corporate tax return. Maintain detailed records of income, expenses, assets, liabilities, and transactions throughout the year. Use accounting software or hire a professional bookkeeper to organize and categorize your financial data systematically. By keeping your records up-to-date and accurate, you streamline the tax preparation process and reduce the likelihood of errors or discrepancies.

Segregate Personal and Business Expenses: It's essential to separate personal and business expenses to ensure compliance with tax regulations. Avoid commingling funds or using business accounts for personal expenses, as this can raise red flags during tax audits. Establish clear policies for expense reimbursement and maintain documentation for all business-related transactions. Segregating personal and business expenses not only facilitates accurate tax reporting but also demonstrates financial discipline and transparency.

Maximize Deductions and Credits: Take advantage of available deductions and credits to minimize your corporate tax liability legally. Familiarize yourself with deductible expenses, such as salaries, rent, utilities, supplies, and business-related travel. Additionally, explores tax credits for activities such as research and development, energy efficiency upgrades, and hiring veterans or individuals from disadvantaged backgrounds. Working with a tax professional can help you identify and leverage all eligible deductions and credits to optimize your tax savings.

Review Tax Forms and Schedules Carefully: Corporate tax returns typically involve numerous forms, schedules, and attachments, depending on the structure and activities of your business. Take the time to review each form and schedule carefully, ensuring accuracy and completeness. Double-check calculations, reconcile discrepancies, and verify that all required information is provided accurately. Pay special attention to supporting documentation, such as financial statements, receipts, and statements of income and expenses.

Consider Tax Planning Strategies: Strategic tax planning can help you minimize tax liabilities and maximize savings throughout the year. Work with a tax professional to develop tax planning strategies tailored to your business's goals and circumstances. Consider options such as deferring income, accelerating deductions, utilizing tax-advantaged retirement accounts, and exploring entity structure optimization. By implementing proactive tax planning strategies, you can optimize your tax position and mitigate the impact of tax law changes on your business.

Seek Professional Assistance if Needed: Corporate tax return preparation can be complex and time-consuming, especially for businesses with intricate financial structures or specialized activities. Don't hesitate to seek professional assistance from the best tax preparation company in Mayfield Heights OH if you encounter challenges or uncertainties. A tax professional can offer expert guidance, ensure compliance with tax laws, and provide valuable insights to help you navigate the complexities of corporate taxation effectively.

In conclusion, ensuring accuracy and compliance in corporate tax return preparation is paramount for small and large businesses alike. By staying updated with tax laws, maintaining accurate financial records, segregating personal and business expenses, maximizing deductions and credits, reviewing tax forms carefully, considering tax planning strategies, and seeking professional assistance when needed, you can streamline the tax preparation process and minimize the risk of errors or non-compliance.

0 notes

Text

Take a moment and read the quotes, have a little laugh and then get back to it. Remember this day ends at midnight, relax you still have plenty of time.

0 notes

Text

Tax Professional Near Me

Need tax planning and preparation accountant in Atlanta, GA? Contact our tax accountant for business tax planning and filing services to stand above the rest and make your investments more tax-efficient. Call today!

0 notes

Text

Superstein PA is a full‐service accounting firm specializing in complex finances, tax, accounting, and audit and assurance services for businesses, not‐for‐profit entities, and individuals. We’re based in South Florida and also operate out of South Carolina. Although we have offices in these two states, we proudly serve clients throughout the U.S. and abroad.

Our mission is to simplify complicated finances, so our clients understand their options. We’re hard‐working, fair, and always willing to put in an honest day’s work to deliver excellence. You’ll be backed by a team of experienced managers, supervisors, seniors, and staff professionals—all of whom have distinguished education and backgrounds. With Superstein PA, you’ll see an immediate impact on the profitability and growth of your company. We’re a firm known for providing exceptional service and for going the extra mile for our clients, and we invite you to learn more about our team members.

3830 Hollywood Blvd, Suite 101

Hollywood, FL 33021

(954) 602-9100

supersteincpa.com - IRS Representation

#tax planning#tax preparation#real estate tax#irs representation#expat services#international taxation

1 note

·

View note