#shes kind of everything 2m e...

Explore tagged Tumblr posts

Text

Was Isle Esme a lie?

Okay okay but hear me out. I've been completely grooving on @panlight's meta about the Cullens as NPCs. Which is so true and is basically why I finally started writing fanfic to begin with--I read these books and just had this sense of "This writer left so much on the table" that I had never had when reading a series before. Everything about this story was built to support E/B, and when you think about it, many of the parts don't hold up on their own.

But the last section of this meta is honestly something I had absolutely taken as canon and now am suddenly realizing that another explanation makes a ton more sense. Basically, I've never seen a fic/fanficcer/fandom member--including me!--not take as gospel truth that Carlisle bought Isle Esme for Esme on whatever anniversary yadda yadda yadda. And yet, as pan points out, this really is contrived for the sake of E/B and it's not even ever about C/Es. It's like "oh it would be convenient for the Cullens to own an island!" and so boom, they do.

And I buy into this wholly because, y'all islands are actually quite cheap in the grand scheme of things. A private island can be had for the low six figures, depending on where it is. Add a modest house at the cost of construction and you're in the mid six-figures. I realize that when you're twelve, as many big Twifans were when they read the series for the first time, $400,000 seems like a lot of money, but I assure you, it is not. (stepping on my personal finance soapbox for a second: if you intend to retire well, younger twifans, $400,000 needs to be a number that is real to you and is in your investment accounts at around age 45. Trust me on this...) So if you are a decabillionaire, which I think we all can agree Carlisle is, and you also have an intense need for privacy, the odds that you drop $1-2M every now and then on a nice vacation spot are pretty high. It makes every sense in the world for Carlisle to have bought Esme an island. I always assume they own several.

However. When you consider that Isle Esme comes completely out of the blue, and isn't at all about Carlisle and Esme, and that in fact, Esme supposedly chooses to decorate the cottage as though it is like her supposedly private island that Carlisle bought her as some grand romantic gesture, which is kind of a weird thing for a mom to do, you know?...

...and you add that to the degree to which we know for a fact that Edward tries very unsuccessfully to honor Bella's desire for non-lavish gifts, and the degree to which we know, from the "crystal" heart he already gave her, that he is absolutely willing to lie to make Bella okay with an extravagant gift...

I am now suddenly thinking he lied about Isle Esme. He bought it, for Bella, for the purpose of this honeymoon. Esme decorated the house on the island, and then also decorated the cabin just like it, because she expected they would have wonderful memories of this place that is just theirs. Edward presents the idea that Carlisle bought it for Esme because he is still somewhat careful to help Bella to not lose her mind that he bought a freaking island (because it seems really extravagant, even if for ultra rich people, it is not, see above) and at some point in time, this is all going to come to a head in some giant Cullen foofaraw that involves Carlisle frowning disappointedly about Edward lying yet again and Bella forgiving him inside the space of three seconds as she is wont to do.

So, reversing ten years of headcanon...I think Isle Esme is really Isle Bella and Edward, as usual, lied through his skinny seventeen-year-old teeth about it. He bought it. Not Carlisle. It's for Bella. Not Esme. And oh, to be a fly on the wall when Bella found out.

718 notes

·

View notes

Text

This isn’t important at all but because of social distancing I have nowhere else to vent my feelings about this game too and my friends have all blocked me.

Man, you ever see someone so beautiful that you know they are going to overrun your life because not to be dramatic, but I will lay my fucking life down for Seox

Like fucking, move over Gilgamesh. I have not touched FGO or BSDTOL because I’ve just been playing gbf 24/7. Literally, its 5am when I’m typing this (mostly because of the new drang and strum event which I will get to later in this essay)

Btw I have this weird auto-correct on, idk how to turn it off or why it only fixes some words, so if names get mixed up that’s why

I started this game because I saw Belial being posted 84 times on my twitter and I’m thinking, who is this man and why is he on my dash so many times. Turns out he’s from gbf. like okay seems interesting. turns out it a mobile game. well, buddy lemme level with you I don't have any more phone storage so ripp but oh shit wait I can play this mobile game on my browser??? I've been trying to get FGO on my computer for 84 years (I haven't actually I'm too lazy) okay now I am very very intrigued because playing a mobile game on my browser is apparently a big deal to me

okay play the tutorial seems like an okay game, kinda boring I think after a while but oh wait

they got me where it hurts

the gambling addiction

and when you first start you get free 10 draws every day for maybe a week? and its like fuckinggg??? my first ssr was melleau (I will treasure her forever) so I was pretty much sold

I just wanted to peek into the lore then fucking tripped on my ass and fell into the rabbit hole that is lucilius and sandalphon because ummmm sandy is my bread and butter and I hate the fact I didn't get his summer version. literally, I started Feb 25 this year just I was right before the 6th anniversary and the GOD DAMN FUCKING SCRATCHER BULLSHIT but my gacha luck is fucking god tier in that game but my e rank luck sucks all the life out of it so I have a pretty stacked team (let’s ignore the fact that I could have gotten grimnir 2 times on the scratcher but nope more fucking soul berries yay...though I shouldn’t be complaining too much because it gave me cain, Lucio, monika, and someone else?? I don’t remember) but did sandy wanna come home? no of course not

though I did get percival summer and halluel and malluel and they can do 2M dmg if the boss your facing is at max health with one ability/skill. Basically, I’ve got a pretty stacked team for all elements but weapons are awful because I may be Lvl 100+ but I'm on chapter fucking 9 because I accidentally made an oops and got the 1hr Exp boost and did slime search with my nuke team over and over again. Also I was super sad I couldn’t get Heles summer event character either cause she’s a god tier okie dokie in my heart. I also love Zeta and Beatrix like fuck dude. I have both of them and their white day scenes are so cute, esp Bea. Side note, I would smash Esser/Tien so hard into the ground because holy fuck my heart cannot take this abuse?? She’s also such a sweetheart and I basically love everyone in this game

But yeah, seox, I love him and I am so upset that when I started, it was during the unite and fight event and I could have gotten his revenant weapon and nope I fucking went for niyon and seite and I didn’t realize that when I fully upgrade the weapons I get the eternal and even then. i literally fucking switched draw boxes because I didn't understand how uncapping worked so I have a 2 star siete weapon sword thing and a 2 star harp and I wanna kms basically because I could have gone for the six ruin fist to get seox or the fucking dagger because oh my god I love quatre/feower??? I played the seeds of redemption and thought he was low-key kind of a prick but NO I UNDERSTAND NOW HE IS A PRECIOUS CHILD AND I WILL ALSO LAY MY LIFE FOR HIM. Dude is so pretty its unfair and my fugly ass. i looked like the joker from the Animated batman cartoons (you fucking know the one) But its okay, at least I went for two wind eternals and I like pretty much everyone except funf. Precious child and everything but I hate her voice. Also vryn, like best lizard but a fucking gremlin that I wish I could mute

this entire game is basically me understanding that I really like sweetheart tsunderes and self-empowered girls and that I really enjoy guys that are all gay to some fucking dumbass bastard, hate life, and angsty 24/7 and full of anger but that's okay because I am stuck in reality and self aware

but is that going to stop me? probably not

Also can i just go on an entire different subject and talk about lancelot because FGO did him wronggggggg. I love him. So much. Like holy shit dude im so happy him and Percy got into gbf versus

Also when I was doing lucio’s fate episode I love him but god damn i wanted to skip that fate episode. homeboy comes out with a fucking spotlight on him and starts spitting bullshit like he's god damn Shakespeare

Also, I really like Sandalphon with Lyria and Drang with Strum platonically cause its some major wholesome shit. The new event for Drang and Strum is some pure stuff and I’m speedrunning the event so I can get all the materials and etc but holy shit do people kill the event raids so fast??? i still have ptsd trying to solo nehan tho granted drang and strum aren’t that hard to beat. Also playable nehan when??? Mugen is great and all and I have him but if it was nehan instead that means I could have gotten nehan AND I WANT THAT TRADE. Mugen goes super saiyan and he’s an absolute unit so it’s alright but i love nehan and fuck dude give me seeds of redemption part 2 please

In conclusion, my love for seox has turned violent but I will be the first to say that when he get’s his mask taken from siero it is not okie dokie for my heart when he acts surprised

#not super major spoilers just talk about events but nothing super story related#this entire corona virus is just an excuse for me to play more gbf#you know people aka one of my friends was saying how hard it was for them to stay inside 24/7 and im over here like...i do this everyday i#dont have work or school or i need to go out and buy food so i dont starve#i just stay in my room like the hermit i am#gamers rise up#gbf#granblue fantasy#seox gbf

3 notes

·

View notes

Note

what kind of youtube channels/personalities would the dregs have?

kaz: kaz? having a social media account? or anything where anyone could find any information about him? @dirtyhands would be fuckin empty, no information, no profile picture, his history of watching really questionable how-to videos and sleight of hand magic on private.

inej: bought a gopro. strapped it to her chest. climbs to crazy heights. who is she? how does she get up so high? nobody knows. every one of her videos goes viral tho.

jesper: posts anything and everything. dance videos, prank videos, haul videos, challenge videos, gaming videos with friends, honestly doesn’t have a lot of followers because of the wild variety that he posts but he’s really funny and it’s earned him 100k. (more popular on vine)

wylan: flute covers like a fuckin nerd

nina: the most Personality™ of the dregs. 2m followers. Makeup videos af, haul and challenge videos. liveblogs her life a lot. sometimes clickbaity titles. almost always has a guest star (loves doing jesper’s makeup and sings bad-but-in-a-cute-way song covers w inej). b a k i n g v i d e o s.

matthias: nina convinced him to make an account and it sat there dead for years until jesper had the idea to have him review products. the catch? he hates everything. @bigbroodingtulip is matthias literally being ron swanson. the dregs will usually surprise him with something to review and matthias, unscripted, will sit down and bitch about it. it’s actually really hilarious. jesper edits the videos to include dramatic zoom-ins. he’s got 400k followers.

kuwei: memes. has like 5k followers but kaz but every time he mentions kruge it gets faster has over 600k views.

talk to me abt soc!

426 notes

·

View notes

Text

AY2019/2020 Y1S2 Module Reviews

AY2019/2020 year 1 semester 2 review

Wew this semester was more of a honeymoon period for me still since I cant advance past CS1010S - this is only the first CS mod i have to take big oof. First half of the sem was spent mostly on (re)doing CS1010S AFAST and the rest went to catching up on other modules that are of relatively lower intensities compared to modules i imagine i will have to take next semester? The most challenging mods this sem goes to CS1010S, EC1301 and also.. ST2334? About half of the semester was done at home though due to the COVID-19 pandemic and so the never-ending heap of online lectures to review (for which i am always behind on unfortunately). I have no need to S/U any module this sem fortunately but that also means I might have effectively wasted my last COVID S/Us. I’m also the kind that is happy enough just to pass.

Modules taken this semester:

CS1010S (AFAST)

GEH1031

GES1041

EC1301

ST2334

MKT1705X

CS1010S Programming Methodology (Python) – AFAST

School of Computing

Prof: Ben Leong

Exam Dates: 16 Jan (Midterm Mock - not graded) / 24 Feb (Practical Exam) / 28 Feb (Finals)

Weightage:

Coursemology – 25%

Participation – 5%

Midterm test – NA

Practical exam – 20%

Final assessment – 50%

Since i took the alternative finals i have updated the final weightage for this module (last sems CS1010S had different weightages).

As we already know, this module (or any CS modules in general) easily has the highest workload compared to other modules, except this time without needing to complete missions every week? Also since its a re-module, there were no lectures/tutorials/recitations for this module and the prof spent lesser time than the first module with us. There is just one consultation slot per week that lasts about 1.5-2h, where the TAs/ prof Ben goes through exam questions over the past years and where students get to voice any doubts they might have. Hence, a lot of self-discipline is required on our part to grind past year papers consistently and drill our brains. Not sure if i’ve mentioned this before, but it’s nice of them to provide comprehensive worked solutions for about 50 exam papers (or maybe more) the profs claimed it was the only module in NUS to be doing this. Prof mentioned he was a bit disappointed in our batch as many werent putting in considerable effort right from the start aka ponning consultation slots arranged over the holidays (in December) - which is a lot of effort coming from the professor to arrange this just for our batch (first batch of CS1010S AFAST). Just name me any prof who does this for their students, coming back over the holidays to teach unpaid. Those who were not at level 50 in Coursemology had more time now to finish the missions/side-quests needed to achieve level 50 and get the full points for Coursemology (as we were expected to in Sem 1). Things were a bit rusty after the holidays at the start but it became better with practice. Was a bit disappointed at not being able to get question 2 right during the written paper (finals) it was a bit of an IQ-ish problem solving question. Anyways winged the 4m what-did-you-learn essay question (as usual) at the end as a saving grace and passed albeit by a very bit. I improved by 2 marks ?? compared to the last semester for finals, not the nicest thing to see after so much effort being put in but still. I think I’m just better at writing essays than coding....

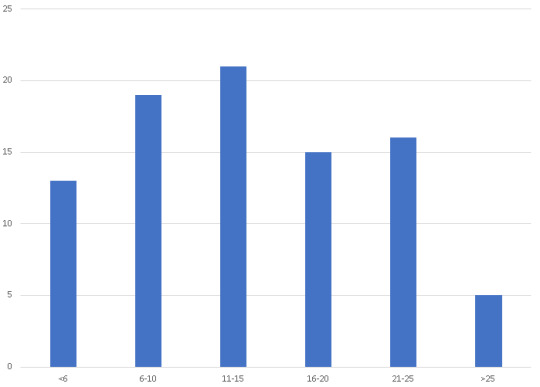

Results for the PE

Mean is 14. Median is also 14. Standard Deviation is 7.6. Highest grades was 30/30 Question 1 turned out to be harder than we had intended, but Q2 was quite easy and most of Q3 was doable by most, as you can see in the results. Passing mark for PE is roughly 10/30.

Mean is 51/10, median is 53/100 and standard deviation is 14.4. Highest was 81/100. Generally, the performance was much worse than we had expected. Pass grade for Finals is roughly 40/100.

Basically, if got 10/30 for PE and 40/100 for Finals and you have done your Coursemology assignments you can expect a C grade. If not, then prepare to SU. CS1010S is not graded on a curve. We set question to test that you have mastered certain concepts and your final grade is a reflection of what you seem to have mastered as reflected by your exam performance.

This whole module was done by recess week so we have more time to focus on other mods. Honestly will be happy enough just to pass. Now, how do i survive CS23030 and CS2040 rip.

GEH1031 Understanding the Universe

Faculty of Science (Physics)

Prof: Cindy Ng

Weightage:

Term Test 1 (3 Mar) – 25%

Term Test 2 (16 Apr) – 25%

Video presentation 5 Apr – 25%

Video critiques 17 Apr – 10%

Astrophotograph 17 Apr – 10%

Quizzes – 10%

Ng is relatively a slower-paced lecturer, which is good for someone like me who cant keep up with faster-paced profs. 2x on her elearning lecture videos makes the best pace imo. Her lecture slides are concise and simple, and will suffice in revision. While she does explain more in depth especially for concepts that are harder to grasp (not many) during the lecture i love that she keeps her lecture slides straight forward to the point. Everything was in point form, short and sweet much appreciated. Also if you pay attention to her lectures, you will do well for the quizzes at the end of each chapter for sure. Though i think you get the marks for quizzes as long as you did them before each deadline like participation marks kinda (?) rather than being graded on whether you answered them correctly. I didn’t do too well for term test 2 unfortunately and I also only just found out you can display the statistics of where you place among the cohort in LUMINUS and needless to say I didn’t place too well. It’s a relatively manageable module though there’s still a lot of content. Term test 1 consisted of MCQs and about 3 2m questions which she call “essay questions” which can be misleading for some (like me!). The MCQs are very tricky and most come in the format of these options: is A/ is not A/ is B/ is not B and you have to pick the right combination (2) out of these 4 options to score 1 point, which of course means less chances of getting them correct compared to the usual 25% in a typical MCQ. Term test 2 was held on LUMINUS at home, and this time since its an e-exam there was only 10mins to do about 25 MCQ, leaving only 0.4 minutes = 24s for 1 MCQ, which proved to be really stressful for many as voiced out by other cohort mates in the forum section (so very valid). The e-exam also had an essay component, 2m per question with 4 questions under 10 minutes. The implementation of this time constraint was to prevent cheating but the duration given was (I feel) unreasonable. As for the video presentation, we had to come up with a 7 min (at most) video most of which lasts 5/6mins on a news article in 2020 regarding astronomy. We had to form groups of 3 at the start of the semester, and were told to look for members on the forums if we did not have enough members. It is not necessary to show your face so you can be creative! For my group, we had a Germany graduate exchange student to work with us which was really cool. Our group’s theme was NASA’s discovery of exoplanets with the use of TESS which was wrapped up in March, before the deadline in April. Really thankful for him to prompt us each week for progress and have it done and over with instead of rushing it last minute when things get busy during reading week. (I think the guy was really done with us im so sorry Philipp if you are reading this.) Also since term test 2 was done by mid-April we had more time allocated for other modules to prepare for finals (swee). Video critiques were supposedly 50 words long if i remembered correctly but i didnt find out until i hit the submit button and :_D i left 1/2-liners for each. One of the criteria of this video critique was showing that you have watched the videos of other groups well but i dont rmb my critiques proving that ive watched the videos carefully though i really did. I think our group did the best in our cluster though! (based on the critiques). For the astrophotograph, we could take part in the astronomy sessions held on a Friday of every month to use the telescopes but there wasn’t any this semester sadly due to the pandemic.

GES1041 Everyday Ethics in Singapore

Faculty of Arts and Sciences (Philosophy)

Prof: Chin Chuan Fei

Weightage:

4 Journal Entries – 20%

4 Reading Quizzes – 20%

Group Report – 10%

Group Presentation – 20%

Finals – 40%

Chin’s lectures are pretty enjoyable, his voice/tone really suits lectures. He is a very approachable person too and willing to share a lot of experiences relevant to the topic at hand. He includes snippets of related videos in his slides many of which are insightful that made me share with my friends too. There is a total of 4 main themes in the module which are namely inequality, meritocracy, multiculturalism and migration and he also introduced the use of an ethical toolbox to helps us reach a more definitive thought process especially for an abstract topic like philosophy. I didn’t realise this was a philo mod when bidding for it so I was really surprised when i went for the first lecture (like bro it clearly says ETHICS what was i thinking). I also thought it would be something similar to Social Studies but was proven wrong. There are compulsory readings to do each week, about 20 pages long usually per reading and they are all chapters from books written by other Singaporean philosophers regarding the themes gone through which helped to widen my perspectives and broadened my horizons, those were some really good selection of readings. I have learned more things than I previously knew about the foreign domestic workers, migrant workers, racism in Singapore among the many topics we have dealt with.

This module is for those who are :

Comfortable with reading a lot every week (i put a lot here because i dont usually read)

Comfortable with writing essays (journal entry) 500 words each

Proficient in English (some of the expressions used can be quite complex and may take you a much longer time to process and understand especially with the reading quizzes that tests your comprehension of the readings - really just comprehension in true GP fashion)

Have a lot of experience in this field, those under social work would have many and will be able to share relevant experiences in the journal entry

Interested about the aforementioned themes

Reading quizzes are like comprehension style questions: do your readings and the questions tests you on what you have read so you just have to look for evidence of each option, the questions will refer you to the specific page/reading that will guide you (nice of them to do so). Journal entries and reading quizzes occur on an alternative week basis so reading quizzes followed by journal then reading quiz again and so forth. Nearing the end, you will be grouped according to who you sit close with and you will work together with your group members to work on a project that will have 2 overlapping themes about any policies/ observations of Singapore. It is advisable for the scope to not be too broad. e.g. we chose to talk about offering Muslim food in school canteens vs non-Muslim food (fewer food options for Muslims) and this encompasses both the multiculturalism and inequality themes. The group report will be due before the presentation and it helps identify some main points you will then talk about later during the presentation. Because of the COVID-19 pandemic, the group presentation this semester was done on Microsoft Powerpoint through voice-over slides. God bless, and there goes the need to memorise scripts especially with the finals season so near. The professor was really accommodating and gave us more time to prepare the voice-over slides when he announced that it will be held on powerpoint too. Finals was 20 MCQs in 1 hour on LUMINUS, the questions were similar to the reading quizzes (5 MCQs per quiz).

EC1301 Principles of Economics

Faculty of Arts and Sciences (Economics)

Prof: Ong Ee Cheng

Tutor: Devika

Weightage:

Pre/post-lecture Quizzes

Class Participation

Midterms 7 Mar

Finals 29 Apr

Can’t find the actual breakdown of scores sorry!

Bell-curve is really really steep for this one since its purely MCQ. Divided into micro and macroeconomics so first half of the sem was micro then the other half was macro. Finals was about 70% macro and 30% micro since micro was already tested for midterms. Every week, there’s a pre-lecture quiz to be done before the lecture and a post-lecture quiz due before the next lecture to reinforce your learning. There’s also supplementary readings that were given but i gave up on it by the third week. The way it is taught is a bit different from what I was used to in JC the things they focus on is also a bit different. There’s more calculations than JC whereas JC economics was more conceptual? I took only H1 economics so a lot of concepts were fresh for me like monopolism, comparative/absolute advantages, income elasticity etc. Both midterms and finals was held on Examplify with a lockdown on everything including wifi. The lecturer also provides additional practice questions in the form of quizzes nearing the exams instead of exam papers. To be honest, I felt this module was hard?? Not sure if anyone else felt the same way, it was a struggle.. I thought it was a fluff mod and boy was i very wrong about this. Also important thing to note is though this mod has MCQ-only exam, the MCQs are not 4 options but 6 options long with many tricky options and of course time constraint. Finals was 70/80 questions long in 1h iirc. Midterms was 40 questions. After the 3rd (?) tutorial, there was no more physical tutorials held just zoom tutorial sessions which only 3 ppl in my slot regularly attended. Towards the finals, a lot more zoom sessions were opened up and we could attend other TA’s zoom sessions this was a godsend thank you. My tutor wasn’t really clear in her explanations or maybe it is just me her accent came off a bit strong. I emailed her some questions but even now I have not receive any answers from her, she told me next week, and the next week became next next week and so on. I guess she must have had a lot on her plate. I didn’t think she was a good tutor. I flunked my midterms (5% percentile) so I was a bit dejected.

ST2334 Probability and Statistics

Faculty of Science (Statistics and Applied Probability)

Prof: Chan Yiu Man

Tutor: Li Shang

Weightage:

1. Quiz 1,2,3 (CA1) – 30% (?)

2. Finals – 60% (?)

Prof was really funny and friendly. Although his tutorials left me confused (my friends would care to disagree), his lectures were still pretty good. He always emphasised knowing what we are doing rather than doing the math blindly. The tutor was fast in his replies whenever I asked him questions by email. This module is an extension of statistics in JC, probability and many more probability distribution (F, chi-square, t test, z test) with terms we have never encountered before too (unless you took BT1101 but this mod focuses more on deriving the values than having a program-R calculate it for you). Ever since the outbreak, the lectures were converted to e-lecture slide style but each lesson would take 4 lectures (4h), instead of the 2 lecture per week so we had to spend more time watching the videos than usual. It is easy to be behind on videos when there is only e-lecture videos so much discipline is required to stay on task.

Finals was proctored with zoom and held on Luminus in the form of a quiz. We were expected to scan and submit a pdf with our workings after the exam. I did not have time to finish about 8 questions (a lot of marks gone) there were a total of 30 questions, spent too much time in front on the easier questions. I did study for the later questions but had no chance to utilize what I have revised (sad). I am really dead for this module i hope i dont fail this.

Update. God bless, thought i was really doomed for because i lost so many marks from not being able to finish 8/30 questions that have the most marks rewarded. Guess i really took time to make less mistakes on the previous questions.

MKT1705X Principles of Marketing

Business School (Marketing)

Prof: Regina Yeo

Tutor: Ms Canley

Weightage:

Individual Assignment – 15%

Group Assignment – 25% due in tutorials 4/5

Subject Pool – 10% *

Class Participation – 10% *

Final Exam 30 Apr – 40% *

* not too sure, checked from other reviewers

Individual assignment questions (total of 5) for tutorials 1-3 are given at the start for which the tutor will go through in the allocated weeks. We get to choose the question we want to do and if that week, the question will be discussed that week will be the deadline for our IAs. The other questions in the IA do not have to be submitted but will be discussed in class. There’s class participation for this module so people were more eager than I was used to, to answer questions in class. I had no opportunity to though in this module (halfway into the semester it became elearning), the tutor had too many hands to pick. The tutor was very accommodating and knew our difficulties and was willing to work out compromise. However, her classes were centered mainly on her experiences (which can be a bit boring) it could have been better if she went through the content. Understand that it is a fluff module that requires many examples, but would be good to relate them back to the content we are expected to master. Tutorials are held every alternate week and we are expected to do the individual questions even if we do not need to submit so that we have something at least to share in class. Subject pool was giveaway marks basically do 6 research surveys and u will get the full marks for that. Final exam comprises of 3 essay questions (40m, 30m, 30m) that you have to submit in 1.5h (i thought it was 2h during the paper rip mad rush for the end), no references/research needed but there’s a plagiarism checker by TurnItIn on luminus basically testing the application of concepts to examples.

I got a B+ for group assignment, and A- for individual assignment. I think i can only do essay styled questions, is this a sign to do arts.....

Oh the presentation was changed to a one-shot video recording (no stitching of individual videos together) instead of an actual presentation in front of your tutorial mates. I think a lot of other groups also read off their scripts but ours was really obvious. The tutor grades (structures her own bell-curve) based on those who attempted the same question to be more fair rather than comparing among all the different questions so in a way, the difficulty of the questions won’t affect your grade.

Epilogue. this is probably the last and only time i could do this well.... even if it does not fit the conventional definition of doing well......

0 notes

Link

Search Voat Limit to v/pizzagate Submission Info Posted by: Johnny3names Posting time: 2 months ago on 12/13/2016 4:35:31 AM Last edit time: never edited. Traffic stats Views: 2645 Score SCP: 75 80 upvotes, 5 downvotes (94% upvoted it) Share a link Discuss pizzagate unsubscribe block 12204 subscribers ~1837 users here now Darknet Hack DATA COLLATION MEGATHREAD Pizzagate Subverse Network /v/AskPizzagate – Pizzagate-related questions /v/pizzagatewhatever – anything Pizzagate-related /v/PizzagateMemes – Pizzagate memes /v/pizzagatemods – meta concerns and Pizzagate moderation discussion Submission Requirements Please review BEFORE you submit content. Submissions not meeting these requirements will be removed. 1 ALL submissions should be directly related to Pizzagate, and this is how we define Pizzagate. It is the responsibility of the poster to demonstrate relevance. In most cases this will require a Discussion post where you provide a brief explanation of how your content relates to the investigation. Sometimes there will be content (like an article on Pizzagate) where a link post with an accurate, descriptive title will be enough to satisfy this requirement. 2 EVERY claim that is made as part of your post needs to be sourced. If you are asking a question, give a brief summary of what led to your question, and provide sources for those elements. If you are giving an explanation of how your content relates to Pizzagate (satisfying Rule 1), and you need to connect a few dots to do so, please provide sources for your "dots". If you wish to ask general questions about Pizzagate, please do so HERE. 3 LINK posts (VIDEO, IMAGE, ARTICLE, etc.) all need to include an accurate description of the actual content. If you can't provide an accurate summary in the title of a Link post then you must submit it as a Discussion post where you provide the link with a brief description of the content. 4 META submissions and general discussion submissions without sources will be removed. To avoid diluting the front page, please make those sorts of submissions HERE. Please bring any meta concerns you have HERE (this is also where the mods will discuss moderating the sub, so you are welcome to participate in those conversations as well). 5 Standalone MEMES will be removed. Please post standalone memes HERE. If you feel that a given meme can be used to raise awareness, please link it as part of a Discussion post where you source the elements that it is related to and discuss the best ways to use it. If you want to discuss the accuracy of a meme, again, link it in a Discussion post that sources the relevant elements from the investigation. 6 NSFW submissions (gore, nudity, etc.) must be labeled as such. This is not an adult subverse. Adspam, illegal content, and personal info about Voat subscribers will be removed, and the offender will be banned. Moderator Rules and On-Demand Removal Explanations Submission Removal Log WARNING! Due to the nature of this investigation, some links could result in the opening of incriminating material. Always practice common sense before clicking links, and make sure you're browsing safely. Use archive.is to archive and distribute sources. Links Resources for Investigators Memes and Infographics List of Independent Pizzagate Subverses List of External Pizzagate Sites – Stay secure! Chatroom #voatpizzagatemain:matrix.org (Riot) created by kingkongwaswrong a community for 3 months Advertisement Eat my ass Want to advertize on Voat? message the moderators MODERATORS kingkongwaswrong [O] Crensch [O] heygeorge [D] VictorSteinerDavion [O] Millennial_Falcon [M] rktyp [J] belphegorsprime [M] wecanhelp [M] l4l1lul3l0 [J] Kwijibo [J] Vindicator [M] abortionburger [J] SpikyAube [J] sensitive [J] MODERATION LOGS Removed submissions Removed comments Banned users 80 Nancy Pelosi and husband accused of shipping little boys in for Harry Reid back in 2014... (pizzagate) submitted 2 months ago by Johnny3names I posted this over on the shipping thread already but... Idk how dependable this publication is but I just ran across a post from 2014 accusing Pelosi and her husband of using his business to ship in little boys for Harry Reid. Anybody know what business her husband's in or a company name? His wikipedia page just makes some vague reference to American businesses with no real specifics. Well, today we found out, from the same unimpeachable whistleblower who gave us the information about Reid, that Nancy Pelosi has been Reid’s primary supplier of little boys. Apparently her husband has a multinational business and he’s been shipping in children for Harry.> http://conservativebyte.com/2014/03/harry-reids-pedophile-nancy-pelosi-supplying-children/ Harry Reid has been one of the asshole faces everywhere you look lately pushing one line of bullshit or another, Idk if this is it but he's got some kind of baggage somewhere. 31 comments unsave source report sort by: New Bottom Intensity Old Sort: Top [–] coincidencesmyass 8 points (+8|-0) 2 months ago (edited 2 months ago) Not that it's proof or anything, but I've always thought that Nancy Pelosi's wide eyes looked psychopathic. Her eyes remind me of the eyes of the guy with the dyed orange/red hair that shot up that movie theater. His are worse, but still, her eyes are not the eyes of an average person. permalink save source reply report [–] Bulgakov 4 points (+4|-0) 2 months ago I always assumed her plastic surgeon didn't do an even job...really opened that one eye permalink parent save source reply report [–] Johnny3names [S] 3 points (+3|-0) 2 months ago (edited 2 months ago) More of these assholes than not look weird af with either bugged out or bird of prey eyes. They all remind me of the Skeksis from the 80's Jim Henson movie The Dark Chrystal or Montgomery Burns from the Simpsons and Mitch McConnell has a face like a shaved droopy nutsack wearing glasses. No one can ever say "never woulda guessed". permalink parent save source reply report [–] rail606 1 points (+1|-0) 2 months ago What you dont like?JPG permalink parent save source reply report 1 reply [–] it_was_foretold 3 points (+3|-0) 2 months ago wide-eyes think mk-ultra permalink parent save source reply report [–] [deleted] 3 points (+3|-0) 2 months ago [Deleted] parent [–] coincidencesmyass 1 points (+1|-0) 2 months ago ethic-eze, I love it. The men have the cremation of care at Bohemian Grove, maybe the Stepford wives are given medication. permalink parent save source reply report [–] blind_sypher 2 points (+2|-0) 2 months ago You can always tell by their eyes. permalink parent save source reply report [–] Forgetmenot 6 points (+6|-0) 2 months ago Harry Reid was absolutely not happy about bannons appointment to trumps cabinet. http://www.cnn.com/2016/11/15/politics/harry-reid-donald-trump-steven-bannon-floor-speech/index.html Could it be because bannon might be aware of the same information that Andrew breitbart was tweeting about? There was also a video where breitbart yells what is in your closet podesta but I cannot find it. Maybe someone can post it. http://www.infowars.com/andrew-breitbarts-chilling-podesta-tweet-from-the-grave/ permalink save source reply report [–] FyndersKeepers 1 points (+1|-0) 2 months ago It can be safely assumed Breitbart filled Bannon in on everything that Bannon wasn't already privvy to. permalink parent save source reply report [–] hashtaggery 4 points (+4|-0) 2 months ago Have you looked into Paul Pelosi Jr (her son)? He seems to hang around with a rough crowd - James E. Cohen / Joseph Corazzi. I'll dig around to see what I can find. permalink save source reply report [–] LearningTheLessons 4 points (+4|-0) 2 months ago (edited 2 months ago) In the comments of this article about Bengazi someone posts "Nancy Pelosi's husband was the money manager for the Muslim Brotherhood in Turkey, when they were married in 1963. It's in their wedding announcement in the NY Times. Pelosi's husband has been orchestrating from behind the scenes." http://www.washingtonsblog.com/2014/04/real-benghazi-story.html permalink parent save source reply report [–] LearningTheLessons 2 points (+2|-0) 2 months ago http://gawker.com/5113868/paul-pelosi-jr-the-fresh-green-prince-of-san-francisco permalink parent save source reply report [–] jbooba 2 points (+2|-0) 2 months ago This is another hint ..: Pelosi’s daughter leads effort to block Trump through Electoral College permalink save source reply report [–] FyndersKeepers 1 points (+1|-0) 2 months ago A hint treading on giveaway grounds. permalink parent save source reply report [–] Mrs_Ogynist01 2 points (+2|-0) 2 months ago Utah is perusing a $2 million bribe case against Reid. http://www.sltrib.com/home/4533272-155/a-2m-check-harry-reid-and permalink save source reply report [–] 28leinad82 2 points (+2|-0) 2 months ago a lot of emails from nancy and about her in the podesta wikileaks if you want to dig further. permalink save source reply report [–] BRING_DOWN_THE_RING 1 points (+1|-0) 2 months ago Well, there's always the Pelosi Goat Hill Pizza thing... http://magafeed.com/guccifer-2-0-nancy-pelosis-goat-hill-pizza-may-be-a-front-company/ permalink save source reply report [–] ALDO_NOVA 1 points (+1|-0) 2 months ago (edited 2 months ago) http://www.sfgate.com/politics/article/Pelosi-s-husband-prefers-a-low-profile-2660253.php " the couple's net worth, most of it linked to Paul Pelosi's investments, has made the Nancy the ninth-richest person in the House(of Representatives)." permalink save source reply report [–] surgit2 1 points (+1|-0) 2 months ago She and her husband Paul own a Napa Valley vineyard: http://www.latimes.com/politics/la-pol-ca-richest-nancy-pelosi-vineyard-story.html permalink save source reply report [–] The_Kuru 1 points (+1|-0) 2 months ago The reason they promote people to the top positions who are horribly compromised like Hastert and Reid is that they can be trusted. Same reason that you have to be destroyable before you can be "made" in the mafia. permalink save source reply report [–] [deleted] 1 points (+1|-0) 2 months ago [Deleted] [–] Votescam 3 points (+3|-0) 2 months ago Goat Hill Pizaa http://magafeed.com/guccifer-2-0-nancy-pelosis-goat-hill-pizza-may-be-a-front-company/ The owner of Goat Hill Pizza is Philip DeAndrade. as per this article from October 2016 He was a former staff member of Nanci Pelosi as recently as 2013 which can be found in the document ‘NP STAFF LIST UPDATED.xlsx’. Suggest a few others involved in purchase: Monley, Dickinson, Lipski Goat Hill Pizza is owned by Goat Hill Inc. Another website reports: BREAKING: Guccifer 2.0 - Nancy Pelosi’s Goat Hill Pizza Restaurant Is A Front Company Used To Funnel Money To The Democrats. Goat Hill Pizza is REGISTERED IN PANAMA. Who registers a pizza place that is in San Francisco in Panama? https://www.reddit.com/r/The_Donald/comments/55w48s/breaking_guccifer_20_nancy_pelosis_goat_hill/ permalink parent save source reply report [–] LargePepperoni 1 points (+1|-0) 2 months ago You know about her and Goat Hill Pizza? permalink save source reply report [–] Johnny3names [S] 1 points (+1|-0) 2 months ago Not at all, but I grew up in the bay and I shit you not my HS Social Studies teacher was married to one of the owners. The mf didn't believe in deoderant and taught in an inner classroon with no fucking windows, it was insane. permalink parent save source reply report [–] VictorDaniels777 1 points (+1|-0) 2 months ago Harry Reid hasn't gotten enough attention. Nice lead. permalink save source reply report [–] sunshine702 4 points (+4|-0) 2 months ago (edited 2 months ago) Harry Reid resigned his office in such an abrupt fashion. Not long after this happened: http://www.nytimes.com/politics/first-draft/2015/01/02/reid-is-hospitalized-after-exercise-accident/ There are some whispers about a "Mr. Exercise Equipment" paying him a visit at home over Christmas week but who knows?! permalink parent save source reply report [–] CadiBug 1 points (+1|-0) 2 months ago (edited 2 months ago) "Mr. Exercise Equipment" = Ried's younger brother I believe permalink parent save source reply report [–] quantokitty 0 points (+0|-0) 2 months ago Paul Pelosi is a land developer. https://www.google.com/#q=nancy+pelosi%27s+husband "Paul Francis Pelosi, Sr. is an American businessman who owns and operates Financial Leasing Services, Inc., a San Francisco, California-based real estate and venture capital investment and consulting firm. Wikipedia" Then there's the gifting of Treasure Island to this b*tch. This article leaves out that Clinton forced the military to sell the land. https://sadbastards.wordpress.com/2009/01/28/the-real-nancy-pelosi-multi-millionaire-non-union-resort-baroness/ permalink save source reply report [–] madmanpg 0 points (+0|-0) 2 months ago As much as I wish this were true, "I heard Harry Reid touches little boys" has been a meme for a long time, mainly in response to his unsubstantiated claims that Mitt Romney cheated on his taxes during the 2012 election. He claimed to have an anonymous source but never produced them or any evidence, and his announcement of the baseless charge on the Senate floor was seen as proof that he was a slimy, ruthless piece of amphibian shit. I am looking forward to when he drops dead, and I really don't doubt that he's a kid-toucher if pizzagate turns out to be real...but going to any conservative blog for that source is going to be a dead end. permalink save source reply report

4 notes

·

View notes

Link

A billionaire walks into a vintage clothing showroom. Usually this space, tucked down an unassuming avenue in Paris’ chic 16th arrondissement, is off limits to the general public, but being a part of the global 0.001 per cent opens doors that would otherwise remain closed.

“He was a friend of a friend so I agreed,” says Gauthier Borsarello, a former classical musician and the owner of the showroom. A smooth-headed and smoother-mannered 30-year-old Parisian, Borsarello’s name alone feels tailor-made for a collector and purveyor of rare and exquisite vintage clothing. Jackets from WWII, Fifties collegiate sweatshirts and Levi’s 501s line the walls and shelves. There’s an original Abercrombie & Fitch hunting jacket the brand desperately wants to buy for its archive, but Borsarello can’t — won’t — part with it.

“He [the aformentioned billionaire] showed me his credit card,” Borsarello adds, “and said, ‘With this I can buy anything in the world, but what I’m looking for is an experience, something that not just anyone can get’. Guys like him are looking for something that is really exclusive. That’s why I think people are interested in vintage. This kind of clientele is growing and growing.”

Borsarello opened his showroom in 2016 and, unless you’re a billionaire yourself, access is reserved strictly for designers and fashion insiders. His clothes are bought or rented by brands and used as inspiration and reference for collections that will hit the shelves two or three years from now. “Designers come to see something they’ve never seen before: a patch, a button, a piece of fabric,” he says.

Part of a young, dynamic and multi-hyphenated group of second-hand aficionados who combine new-school social media fluency with old-fashioned, on-the-ground scouring ability, Borsarello also owns Le Vif — a vintage store which is open to the general public — across the road from his eponymous showroom. He is also the creative director of retro-inspired label Holiday Boileau and editor-in-chief of L’Etiquette magazine. He posts regular updates of his best finds and vintage “inspo” to his 32,200 Instagram followers. “Instagram made my business really,” he says. Via WhatsApp he connects with a global network of “pickers”, people who trawl through warehouses of vintage clothing, on the hunt for the kind of rare and interesting pieces that clients like Borsarello will part with big money to acquire.

“In the past, people would go to their tailor and have two suits made for the year,” Borsarello says. “Ten shirts, a coat, a couple of pairs of shoes and that was it. I think people are coming back to this way of thinking and consuming, whether they’re buying new or vintage. I think, to be honest, people are tired of all the shit out there.”

The statistics support this claim. According to a joint report by fashion platform ThredUp and analytics firm GlobalData, the resale market has grown 21 times faster than apparel retail over the last three years, and the global secondhand clothing industry is set to be 50 per cent larger than the fast fashion sector within 10 years. By 2028, it’s predicted to be a £50bn entity. On average, consumers own 28 fewer items than they did two years ago. H&M is rushing to join in; the Swedish company recently piloted a “vintage” programme that will allow the re-sale of secondhand garments on its websites.

Farfetch, the £4.6bn-valued e-commerce platform, already has a pre-owned section where it works with vintage boutiques around the world. “I think our customers recognise that these are pieces that don’t really exist anymore, and that they can’t find anywhere else,” says the website’s deputy editor, Rob Nowill. “We’ve seen an incredible reaction to it.”

“Secondhand shopping has recently become quite popular among millennials,” adds Morgane Le Caer, a reporter at Lyst, a fashion search engine that saw a 329 per cent increase in traffic to luxury re-sale products last year. “The thrill of finding something special hidden among hundreds of other pieces is inspiring people to give vintage clothes a second chance.”

Not just clothes: StockX, the trainers and streetwear re-sale marketplace launched in 2016, was in an April funding round which would value it in excess of $1bn (it claims more than $2m a day in gross sales). Cool-hunting men and women are equally likely to shop online at Vestiaire Collective, the Paris-based “authenticated pre-owned luxury fashion” retailer, as they are at Net-a-Porter or Matches Fashion.

Those who still associate vintage clothing with pokey thrift stores, empty charity shops and church hall jumble sales might do well to check out the website of Grailed, a New York-based start-up that launched in 2015 and now boasts 3.2m registered users and a team of 50. It is, according to brand director Lawrence Schlossman, a “men’s fashion community marketplace”. Basically, whatever your personal “grail” (streetwear parlance for a dream item of clothing) chances are someone on Grailed is selling it… for a price. Last year, news broke of a Raf Simons “Riot” camo bomber jacket from the Belgian designer’s autumn/winter 2001 collection selling for $47,000 (£37,000), a site record.

With 440,000 followers on Instagram, Grailed also has an influence on what is and isn’t hot in the online world of men’s streetwear and fashion. Its memes and original content have contributed to the proliferation of recent, wide-spreading trends and talking points such as Patagonia fleeces, Blundstone work boots, teens’ obsession with archival Helmut Lang, tie-dye and a rising US interest in Stone Island.

“Not to fire any shots,” says Schlossman, “but think of eBay. Yes, I can buy a vintage T-shirt and a new pair of Balenciaga sneakers that have sold out, but I can also buy a washing machine — eBay wants to be, and is, everything to everyone regardless of what you’re looking for. We take pride in being laser- specific to men’s clothing.

“When we launched, there was a pervasive idea that ‘vintage’ or ‘used’ had negative connotations,” says Schlossman. “The idea that someone is trying to sell an old, shitty thing they don’t care about or have any need for. I think there’s a whole generation realising authenticity is important, and I think they relish the opportunity to tell people, ‘I’ve been looking for this thing for a year and I found it!’ That’s an important signifier that shows you really care and have great taste, rather than walking into a generic fast fashion outlet and buying their version of whatever a trendy pant is.”

Emily Bode (pictured) has found success re-purposing vintage fabrics into one-of-a-kind clothing

Where once “box fresh” was a vital component of a purchase, today having an item with signs of wear is a key element of cool. Brands like Bode, started by New York designer Emily Bode, are testament to that. She takes dead-stock cloth, old and rare fabrics, and reimagines them as beautiful work jackets or hand-embroidered trousers. Something that began life as a quilt or a curtain is transformed into a one-off item. Brand new is retro: retro is brand new. Kids that are two generations too young to have heard the band play live in its heyday are now obsessed with The Grateful Dead’s merchandise: the wild tie-dyed T-shirts are mysterious and appealing. Some luxury trainers, such as those by Gucci, come “pre-worn” for your aesthetic convenience.

The entrance to Cassie Mercantile, the by appointment only vintage experts whose clothes have inspired some of the biggest brands in the world

On a heavy spring day in Holland Park, I find the hidden entrance to Cassie Mercantile. A gate leads into a garden with the kind of greenery that is rare — and comes at a premium — in London. Leaves hang low and birds sing freely. If this was an episode of Grand Designs, Kevin McCloud might describe it as an “urban sanctuary��.

Gauthier Borsarello told me about Graham Cassie, speaking his name in hushed tones when we talked on the phone. “He’s someone I really admire. I would like to be like him,” he said. “He has something like 600 Instagram followers [it’s actually 1,176], but he’s a legend in the industry and his showroom is amazing.”

Cassie, 59, wears strong black glasses and his beanie like a Brooklyn barista, his Scottish accent worn down by decades in London. He’s been in vintage his whole life, having owned a shop, Eat Your Heart Out, on the King’s Road in the Eighties. “I don’t want to deal with the general public anymore,” he says with a chuckle. Cassie Mercantile opened here 16 years ago. He was, he claims, the first to open a vintage showroom (designers only) in Europe. “If I showed you my client list, the brands I work with, you’d say, ‘Woah!’” he says without pretence. They are indeed woah.

In one photo on his Instagram feed, Cassie poses next to David Beckham, in another with Kanye West. He’s not sure how West found him. “People seem to hear about me,” he says. “He was very nice, though, very thorough. He came in with just one other person and is the first and only client to go through every single item of clothing we have. You can see why he’s so successful, the attention to detail was obvious.”

What immediately stands out is how modern everything feels despite, in many cases, some items being more than a century old. Bucket hats, printed open-collar shirts, bright and battered Nike running shoes, and stacks of Victorian rugby jerseys, Thirties T-shirts and slouchy Vivienne Westwood knitwear from her punk era. The new wave of colourful sportswear and prep could well have been born from this little showroom. Undoubtedly some was.

Finlay Renwick

“I like to think we’re a fashion forecasting company more than a vintage clothes company,” Cassie says. “I’ve always loved the mix of fashion and vintage with a modern outlook. Often there’s this anorak mentality in the vintage business, people love to be able to quote what number a military jacket is or the year it was made. I’ll always remember Ralph Lauren saying, ‘I don’t care what number the jacket is — is it a cool jacket?’ That’s always been my philosophy.”

0 notes

Text

The Must-Follow Asian Bloggers With Endless Beauty Knowledge

New Post has been published on https://www.claritymakeupartistry.com/the-must-follow-asian-bloggers-with-endless-beauty-knowledge/

The Must-Follow Asian Bloggers With Endless Beauty Knowledge

In the expansive world of beauty bloggers and vloggers, one thing is certain—there are some seriously talented Asian artists out there. From the maverick Michelle Phan to newer faces, Instagram and YouTube audiences are seeing more and more Asian representation, and it is amazing and much needed.

As the seasons are shifting, look to these 11 influencers for when you need to know which moisturizer will save dry skin and what dark lip techniques will make your lips stand out the most. Honestly, look to them all year round because they will no doubt have endless beauty knowledge.

Michelle Phan

The original beauty vlogger, Phan got her start on YouTube in 2008 when her Lady Gaga makeup tutorials went viral, and she has since paved the way for beauty influencers. The Vietnamese-American beauty powerhouse has shied away from social media to pursue more of the business side of the industry, but she still has 8M+ YouTube subscribers and 2M+ Instagram followers. She founded the popular boxed subscription service Ipsy and her own cosmetics line called Em Cosmetics, and she has written a book.

Photo: Instagram @michellephan.

Patrick Starr

Born Patrick Simondac, the beauty content creator is from Orlando and is Filipino-American. Starr, 28, was one of the first “makeup men” on YouTube and has been filming since 2013. He has done multiple collections with MAC Cosmetics, amassed 4.5 M+ followers on Instagram, sings, executive produces E!’s Snapchat show Face Forward, started an influencer management company called the Beauty Coop, and still films YouTube content—what kind of coffee is he drinking??

Photo: Instagram @patrickstarrr.

Joanna Vongphuomy

Vongphuomy, who found fame on Instagram through viral one-minute makeup tutorials, is Laotian-American and from Providence, RI, but she now resides in California. She has more than 100K YouTube subscribers and more than 136K Instagram followers. Her videos feature everything from natural makeup how-tos to fantasy-inspired full-glam looks.

Photo: Instagram @jvongphoumy.

Nikita Dragun

Vietnamese blogger and transgender activist Dragun has a huge following on social media (1.7M+ on YouTube, 2.9M+ on Instagram). She’s a force in the beauty and transgender YouTube communities and covers everything from makeup product reviews to commentary on LGBT+ subjects.

Photo: Instagram @nikita_dragun.

Bretman Rock

The Filipino YouTuber, and former Viner, gained notoriety for his beauty looks as well as his comedy style. His hilarious videos have gained him a massively impressive 10.5M+ Instagram followers and 4.2M+ subscribers on YouTube. He also recently collaborated with Morphe on a highlighter palette.

Photo: Instagram @bretmanrock.

Heart Defensor Telagaarta

Born and raised in the Philippines, Telegaarta rose to fame on YouTube and is best known for her hair videos, although she does cover other subjects like shopping hauls, lifestyle, and makeup reviews. She currently lives in L.A. (most beauty bloggers make this move) and has more than 2.2M subscribers on YouTube.

Photo: Instagram @thatsheart.

This Korean-American beauty and style blogger has such a cute YouTube handle (clothesencounters). Aside from just getting hitched a few months ago (Congrats!), Im vlogs about her travels, fashion tips, favorite products, and other lifestyle subjects to her 2.2M+ YouTube subscribers.

Photo: Instagram @imjennim.

Amata Chittasenee

The U.S.-born Thai blogger and makeup artist has 1.5M+ Instagram followers and has already collaborated with brands like Too Faced and Shiseido. Her colorful photos of all her travels are especially mesmerizing to look at. She has a unique and amazing sense of design.

Photo: Instagram @pearypie.

Sophia Chang

The Korean lifestyle and beauty vlogger does step-by-step makeup technique tutorials and also shares fun videos like one of her and her mom doing Zumba. What’s not to love? Her Instagram bio reads, “My life as a mood board,” and her content does not disappoint.

Photo: Instagram @sophiachang.

Chriselle Lim

Known for her polished fashion collection, Lim also takes the time to post about her favorite makeup products, beauty tips, and life hacks on her blog. The Korean-American blogger is also expecting her second child! (#mominspiration!)

Photo: Instagram @chrisellelim.

Stephanie Villa

The Spanish and Chinese vlogger is edgier than most, but that just makes her more intriguing. Villa, 28, is tattooed and sometimes rocks a septum piercing. She’s good friends with Jenn Im (She was a bridesmaid at her wedding!) and posts videos on product reviews, dating, and travel to her 300K+ YouTube subscribers.

Photo: Instagram @soothingsista.

Next slideshow starts in 10s

13 Under-$10 Deals to Shop at Ulta’s Fall Haul Event

Source: http://stylecaster.com/beauty/asian-beauty-bloggers/

0 notes

Text

How Do You Evaluate A Multi-Plex For Investment?

TorontoRealtyBlog

Well first of all, if you’re looking at buying a multiplex for investment – good on you, you’ve clearly done something right!

But believe it or not, there’s serious competition for multiplexes – those properties with 3-or-more dwellings.

Cap rates are down, demand is high, and investors are accepting lower returns in order to get into the market.

Let me outline nine criteria that a would-be investor must consider, at the bare minimum, for any multiplex purchase…

Should I outline these in order?

Sure, I could try.

And by try, I mean that every investor has a different set of criteria, and my #4 might be somebody else’s #7.

Of course, you might have a #10, #11, and #12 to add to the list.

And all the while, many of these points go hand-and-hand.

So let me start from the top, where I find most of my clients see it…

–

1) Yield

This should be at the top of the list, no?

Some people would put #2 on the list, but I don’t think that’s smart in this market.

When you buy a stock, what are you looking for?

Well, I suppose that’s a terrible example, since everybody wants to watch the stock go up, up, and up, and they’re looking at the appreciation potential, with the “buy low, sell high” mentality.

But in the��good ole days, investors were looking for dividends!

How much is the stock paying you to own it? You’re a shareholder; you own a portion of the company, so how much of the company’s profit are you receiving?

Times have changed, both in terms of the stock market, and the real estate market.

Ask the man on the street, and he’s looking to buy a stock for $10, and sell it for $15. But ask the pension funds, and they’re looking for a steady, consistent, predictable, safe return. They’re the savviest of investors, and they’re looking for a 6% return in perpetuity.

When it comes to investing in real estate, my personal belief is that if you forecast a zero percent appreciation, and the investment makes sense to you based on yield, then the investment will pay out and exceed your expectations.

There’s that old adage in real estate: “When is the best time to sell a piece of real estate?”

The answer: “Never.”

Life happens, situations change, and more often than not, even a long-term investor will need or want to sell.

But on a long-enough time horizon, the appreciation is the icing on the cake, and where the investor makes, by far, the most money.

But at the onset, the short and immediate-term numbers have to make sense.

What does that mean? What kind of numbers are we looking at in this market?

I see multi-unit dwellings selling at 3% cap rates, and I can’t make sense of it.

When I got into real estate 5.5-6% cap rates on multi-unit properties were the norm. Over time, those figures have dropped, and it’s up to the investor to decide what works.

2) Appreciation Potential

I suppose the “yield” section was just the preamble for some people.

Every time I talk about yield, and give the example of the dividend-paying-stock, people tell me, “This isn’t 1880; you’re not buying paper-shares of the Great Pacific.”

Fair point. Times change.

But I’m conservative by nature, and when it comes to buying multi-unit dwellings for long-term investing, I would argue until I’m blue in the face that you have to consider appreciation potential after yield.

Over the last few years, it’s been easy to refute my argument.

I’ve told this story before, so you long-time readers might remember it…

Back in 2010, I had an investor-client in from Los Angeles, who was looking at purchasing a couple of 4-5 unit dwellings.

He was primarily concerned with yield, and the financing ability of the properties (which we’ll explore below), and truly believed, despite his desire to buy, that prices in Toronto were likely headed for a dip.

We found a property in Queen West that was perfect, and hit on several of the other points listed below as well.

It was around a 5.25% cap rate at the list price, and although it would be slightly cash-flow negative each month based on his downpayment, he was willing to consider it.

The property didn’t have an “offer night” as is the custom today, but it still received four offers, and sold for $100,000 over the list price.

My client told me, “This makes no sense. This is simply the greater fool theory; whoever is buying this property, is expecting to sell it to somebody else down the line for more.”

He wasn’t wrong, logically.

But in practice, he was proven tragically incorrect.

That property, listed at $1.2M, that sold for $1.3M, recently sold for over $2M.

Now tell me again – what’s more important: yield or appreciation potential?

And am I naive to say “appreciation is just icing on the cake?”

3) Location

How can you have any list about real estate evaluation criteria without location?

Location is all part and parcel of the overall evaluation.

Some investors would choose a superior location over a better return, and I wouldn’t disagree.

Earlier this year, I sent a client the listing for a turnkey 4-plex in Mimico, with a rare 4.8% cap rate, what I perceived to be below-market rents, and a copy of the inspection – which looked fantastic.

My client responded with a 3-word email: “It’s in Mimico.”

Enough said.

I liked the income, I liked potential for more income, and I loved the condition of the property. But he would have rather had a property with a 3.5% cap rate, steps to Trinity-Bellwoods, and at the risk of sounding cliche, “To each, their own.”

Toronto is a rapidly-growing city, both in terms of the population and the urban sprawl, but also in the eyes of the world.

For investors thinking long-term, the best appreciation will undoubtedly be found with those properties that are closest to the city centre, as is the case with every world-class city. But those properties will have substantially lower yields.

It’s up to the buyer to decide where the best value, for he or she, ultimately lays.

4) Condition

Have you ever looked at the “financials” for an income-property listed on MLS?

It’s hilarious.

You’re lucky if you get property taxes, water, and gas. Sellers and listing agents love to pretend like electricity and insurance don’t exist. They’ll be really quick to tell you about the $25 per month the property generates in basement coin-laundry, but they’ll n-e-v-e-r detail the overall cost of ongoing maintenance, upkeep, and repairs.

Part of the reason why many Toronto real estate investors have turned toward condos in the past few years (aside from the lower cost) is because of the maintenance of an 80-year-old 4-plex. You can do the most thorough of home inspections, and find the property is in A++ shape, but you’ll still be opening your wallet for something, every few months.

As with everything else above, the condition of the property has to be taken into consideration with the other criteria. You might be willing to pay more, and accept a lower yield, for a true “turnkey” income property. Or you might decide to pay less, do the work yourself, and hope to add value.

Of course, you can always combine this with #5…

5) Market Rents

Just a brief point to make here, but an important one.

Many properties are being sold with tenants attached, who are leasing at rents well below fair market value.

If properties are sold based on capitalization rates, those rates are taking current rents into consideration, and those rents are below FMV, then it goes without saying that the property is under-valued.

Yes, it can be difficult to get a tenant out so you can raise the rent, and it’s going to become tougher thanks to the Ontario Fair Housing Plan. But tenants don’t stay forever.

And if you have a property that needs work and has below market rents, when the tenants vacate, you can put work into the property to increase the rents, and add value at the same time.

6) Size & Scope

What do you for a living?

What’s your personal life like?

Tell me about your family…

Now tell me if you would be able to manage a 5-unit property that’s a 45-minute drive in traffic, with whatever knowledge, skill, and capability you currently possess.

Buying a 5-plex is one thing, but managing it is another.

There’s the ongoing maintenance and upkeep, the supervising of tenants, the collection (and chasing…) of rents, and the search for new tenants.

Savvy investors know how to make the property, and the tenants, work for them. Many landlords will offer a tenant a nominal sum (start with the basement tenant and $30…) to take out the garbage every week. Many landlords will “allow” the tenants to paint, provided it’s in a neutral colour, and done well. I put “allow” in quotes, of course, because it’s value-add for the landlord to have a fresh coat of paint, and yet many tenants believe it’s a privilege.

Some investors do this full time – they buy, manage, and maintain multi-unit dwellings. They have the time, and the experience, to do so.

Other investors have no clue what they’re doing, and they either know that in advance, or find out very quickly!

The fee to manage a property varies drastically, but you’re looking at 5% of gross rents as a starter. If you can’t handle the size and scope of the property, then factor that cost into your initial financial analysis.

7) Ability To Finance

There’s no hard-and-fast rule on this, but most mortgage brokers will tell you:

4-Units – residential financing

5-Units – there might be a lender out there that will provide residential financing

6-Units – this is commercial, without a doubt

I’ve had clients in the past purchase 5-unit properties and obtain residential financing, but lending criteria changes like the direction of the wind. More often than not, it depends on which lender you’re talking to, and which underwriter is handling the file. I’ve seen the 5-unit properties fall into a serious grey area over the years, as some underwriters will lend with residential criteria, and some won’t.

And keep in mind – we’re talking about downpayment and rate!

To buy a 3-plex, you simply need to meet the minimum downpayment criteria (used to be 5%, now it’s 20% for a “second property” subject to some exceptions), and you can obtain a current residential rate, ie. a 5-year, fixed-rate of 2.49%.

When you get into 6-plex and above, you may be required to put down 35%, and the rates could be into the 4-6% range. Yes, that’s a wide range, but as I said – it depends on your mortgage broker, and which lenders and underwriters they’re talking to.

Going from a 4-unit property, with a 20% down payment, and 2.49% interest rates, to 6-unit property, and a 35% down payment, with a 4.49% interest rate, can be tough to swallow.

But keep in mind, not all “investors” are taking on debt. Some are buying in cash, some take on debt because it’s cheap (ie. 4.49% is less than their rate of expected return in other investment vehicles), and thus it’s not really a “problem” per se for those looking to buy 6-plexes and up.

You might also argue the yield is better as you climb in the number of units. Clearly a duplex offers a lower rate of return than a 6-plex, not only because there’s more demand, but because it’s cheaper, easier to afford for the average investor, and thus the price gets bid up.

Ultimately the ability to finance will come into play for an overwhelming majority of investors, and so you might actually start with this.

8) Tenants

Wow, we’re really starting to see how all of these points are intertwined.

The size and scope of the property, combined with the location, combined with the market rents, will ultimately dictate what type of tenants you’ve got.

An investor-client of mine once told me, “Basement apartments aren’t worth the hassle.”

I asked what he meant, and he said, “They’re not worth the $600 they bring in each month.”

Now, this was a long time ago, hence the $600 figure. Maybe the hassle has been lessened over the years as rents have increased.

But he elaborated in saying, “Ask yourself – what kind of person rents a sh!tty basement apartment for $600 per month? The lowest common denominator of society, that THAT is now one of my partners in my financial endeavor.”

Sensitivities aside, he might not be wrong.

I’m sure some of the most wonderful people in the world have rented basement apartments, but on the whole, the person looking for the absolutely lowest-priced rental in the city does so not out of desire, but out of necessity.

This client went on to tell me that most of the tenants he’s had renting basements have been troublesome, sometimes in terms of their character and how they treat the unit, but primarily in terms of their ability to service the rent.

Personally, I think if you’re an investor running multi-unit dwellings, there’s a learning curve, and you’ll figure out how to deal with tenants – at every rent level. And with basement apartments going for $800, $900, or $1,000 in the city, who can turn that kind of money down?

Ultimately, the type of property you have, plus the location, will determine what kind of tenants you get.

And if you’re looking at a property that is tenanted, you want to know everything you can about the tenants in place.

I’ve seen some really sharp listing agents put together info packages on the tenants themselves – their income, occupation, FICO scores, duration of tenancy, and frequency of payments. That goes a long way toward marketing the property to investors.

9) Proximity To Transit

Perhaps this falls into the “location” category, but having already flushed that out, I think this deserves its own point.

Transit in Toronto is just God-awful, as we all know.

And without generalizing too much here, dare I say that many people who rent, also take transit.

The market rent will be affected by the proximity to transit, the yield will be affected by the market rent, and once again, we see how these points are intertwined.

You could suggest that proximity to parks, schools, retail, etc. bear consideration, but I don’t put them anywhere near the level of importance as transit. This is my generalization – about renters taking transit, and you can disagree if you want to. But I’m speaking from experience, with what my clients see out there.

–

You’re probably looking for a point #10, but this list isn’t meant to be well-rounded; it’s meant to point out the most important criteria when evaluating a multiplex for investment.

Somewhere within these points lays a happy medium for the investor.

And as we know, every investor is different.

The post How Do You Evaluate A Multi-Plex For Investment? appeared first on Toronto Real Estate Property Sales & Investments | Toronto Realty Blog by David Fleming.

Originated from http://ift.tt/2slZ4bE

0 notes

Text

How Do You Evaluate A Multi-Plex For Investment?

TorontoRealtyBlog

Well first of all, if you’re looking at buying a multiplex for investment – good on you, you’ve clearly done something right!

But believe it or not, there’s serious competition for multiplexes – those properties with 3-or-more dwellings.

Cap rates are down, demand is high, and investors are accepting lower returns in order to get into the market.

Let me outline nine criteria that a would-be investor must consider, at the bare minimum, for any multiplex purchase…

Should I outline these in order?

Sure, I could try.

And by try, I mean that every investor has a different set of criteria, and my #4 might be somebody else’s #7.

Of course, you might have a #10, #11, and #12 to add to the list.

And all the while, many of these points go hand-and-hand.

So let me start from the top, where I find most of my clients see it…

–

1) Yield

This should be at the top of the list, no?

Some people would put #2 on the list, but I don’t think that’s smart in this market.

When you buy a stock, what are you looking for?

Well, I suppose that’s a terrible example, since everybody wants to watch the stock go up, up, and up, and they’re looking at the appreciation potential, with the “buy low, sell high” mentality.

But in the good ole days, investors were looking for dividends!

How much is the stock paying you to own it? You’re a shareholder; you own a portion of the company, so how much of the company’s profit are you receiving?

Times have changed, both in terms of the stock market, and the real estate market.

Ask the man on the street, and he’s looking to buy a stock for $10, and sell it for $15. But ask the pension funds, and they’re looking for a steady, consistent, predictable, safe return. They’re the savviest of investors, and they’re looking for a 6% return in perpetuity.

When it comes to investing in real estate, my personal belief is that if you forecast a zero percent appreciation, and the investment makes sense to you based on yield, then the investment will pay out and exceed your expectations.

There’s that old adage in real estate: “When is the best time to sell a piece of real estate?”

The answer: “Never.”

Life happens, situations change, and more often than not, even a long-term investor will need or want to sell.

But on a long-enough time horizon, the appreciation is the icing on the cake, and where the investor makes, by far, the most money.

But at the onset, the short and immediate-term numbers have to make sense.

What does that mean? What kind of numbers are we looking at in this market?

I see multi-unit dwellings selling at 3% cap rates, and I can’t make sense of it.

When I got into real estate 5.5-6% cap rates on multi-unit properties were the norm. Over time, those figures have dropped, and it’s up to the investor to decide what works.

2) Appreciation Potential

I suppose the “yield” section was just the preamble for some people.

Every time I talk about yield, and give the example of the dividend-paying-stock, people tell me, “This isn’t 1880; you’re not buying paper-shares of the Great Pacific.”

Fair point. Times change.

But I’m conservative by nature, and when it comes to buying multi-unit dwellings for long-term investing, I would argue until I’m blue in the face that you have to consider appreciation potential after yield.

Over the last few years, it’s been easy to refute my argument.

I’ve told this story before, so you long-time readers might remember it…