#shipping software market

Link

Artificial intelligence, big data analysis and industry 4.0 are expected to drive Shipping Software market growth. By, deployment type the global shipping...

#adroit market research#shipping software market#shipping software market size#shipping software market share

0 notes

Text

https://www.maximizemarketresearch.com/market-report/global-shipping-software-market/87018/

Major players in the shipping industry adopted fueling the growth of the global market. Various rules & regulation of different organization like customs, terminals, forwarders, and carriers were making old systems composite to use. On the flip side, the global shipping software market is hampered by a lack of technical expertise to manage complex software.

0 notes

Link

#adroit market research#shipping software market#shipping software market size#shipping software market share

1 note

·

View note

Link

The global shipping software market is projected to grow at a CAGR of 8.4% during the forecast period.

#adroit market research#shipping software market#shipping software market size#shipping software market share

0 notes

Link

Logistics and shipping were among the early adopters of software that help manage inventories while maintaining a balance in the usage of resources during complex operations.

#adroit market research#shipping software market#shipping software market size#shipping software market share

0 notes

Text

Shipping Software Market Size, Growth, Trend & Report Analysis By 2028

When it comes to Shipping Software market. shipping and logistics, it is all about achieving optimal performance from the field. Customers assume that firms should be able to execute on their intentions flawlessly and create efficient processes for updates.

With the help of new and improved technology, shipping companies have embraced globalization, deregulation, and online marketing. In order to compete in the era of globalization and deregulation, these companies who are investing in new technology to keep up with the trend need effective solutions to effectively market their products while they control disruptions.

The global Shipping Software Market Report examines trends such as drivers and restrictions impacting industry growth, pricing analysis (average cost per sq ft), import/export management (including location), Regulatory analysis "compliance standards".

Request for a sample of this research report @

Shipping software has always been a major disruptor for today’s small businesses as related to global trade and infrastructure without a large centralized management system.

The broad manner in which international trade has taken place for centuries leaves modern supply chains with security breach vulnerabilities on multiple levels - from cyber hacks to sophisticated phishing scams. What is needed is an integrated team working towards secure and seamless specifications & experiences for sales, account management & logistics planning.

About Us

Research Layer is a popular market research and consumer consultant. We maintain our relation with clients until the complete brand life-cycle by providing innovative unique mix and analytical for designing customized solutions for greatest impact delivery..

Research Layer proudly develops, sets industry standards and continuously focuses on innovation. As we blend innovation and analytical thinking for delivering customized solutions to our clients, we can maintain strong and rewarding relationships. Research Layer enables clients to develop marketing and consumer strategies with array of incorporated services.

Contact Us,

Research Layer

17224 S. Figueroa Street,

Gardena, California (CA) 90248, United States

Call: +1 9155293004 (U.S.) / +91 8483 9659 21 (APAC)

Website: www.researchlayer.com

Connect with us: Facebook | Instagram| LinkedIn | Twitter

#Shipping Software market#Shipping Software Market Size#Shipping Software market Research#Shipping Software market report#Shipping Software market growth#Shipping Software market share#Shipping Software market trend#Shipping Software Market analysis

1 note

·

View note

Text

If anyone wants to know why every tech company in the world right now is clamoring for AI like drowned rats scrabbling to board a ship, I decided to make a post to explain what's happening.

(Disclaimer to start: I'm a software engineer who's been employed full time since 2018. I am not a historian nor an overconfident Youtube essayist, so this post is my working knowledge of what I see around me and the logical bridges between pieces.)

Okay anyway. The explanation starts further back than what's going on now. I'm gonna start with the year 2000. The Dot Com Bubble just spectacularly burst. The model of "we get the users first, we learn how to profit off them later" went out in a no-money-having bang (remember this, it will be relevant later). A lot of money was lost. A lot of people ended up out of a job. A lot of startup companies went under. Investors left with a sour taste in their mouth and, in general, investment in the internet stayed pretty cooled for that decade. This was, in my opinion, very good for the internet as it was an era not suffocating under the grip of mega-corporation oligarchs and was, instead, filled with Club Penguin and I Can Haz Cheezburger websites.

Then around the 2010-2012 years, a few things happened. Interest rates got low, and then lower. Facebook got huge. The iPhone took off. And suddenly there was a huge new potential market of internet users and phone-havers, and the cheap money was available to start backing new tech startup companies trying to hop on this opportunity. Companies like Uber, Netflix, and Amazon either started in this time, or hit their ramp-up in these years by shifting focus to the internet and apps.

Now, every start-up tech company dreaming of being the next big thing has one thing in common: they need to start off by getting themselves massively in debt. Because before you can turn a profit you need to first spend money on employees and spend money on equipment and spend money on data centers and spend money on advertising and spend money on scale and and and

But also, everyone wants to be on the ship for The Next Big Thing that takes off to the moon.

So there is a mutual interest between new tech companies, and venture capitalists who are willing to invest $$$ into said new tech companies. Because if the venture capitalists can identify a prize pig and get in early, that money could come back to them 100-fold or 1,000-fold. In fact it hardly matters if they invest in 10 or 20 total bust projects along the way to find that unicorn.

But also, becoming profitable takes time. And that might mean being in debt for a long long time before that rocket ship takes off to make everyone onboard a gazzilionaire.

But luckily, for tech startup bros and venture capitalists, being in debt in the 2010's was cheap, and it only got cheaper between 2010 and 2020. If people could secure loans for ~3% or 4% annual interest, well then a $100,000 loan only really costs $3,000 of interest a year to keep afloat. And if inflation is higher than that or at least similar, you're still beating the system.

So from 2010 through early 2022, times were good for tech companies. Startups could take off with massive growth, showing massive potential for something, and venture capitalists would throw infinite money at them in the hopes of pegging just one winner who will take off. And supporting the struggling investments or the long-haulers remained pretty cheap to keep funding.

You hear constantly about "Such and such app has 10-bazillion users gained over the last 10 years and has never once been profitable", yet the thing keeps chugging along because the investors backing it aren't stressed about the immediate future, and are still banking on that "eventually" when it learns how to really monetize its users and turn that profit.

The pandemic in 2020 took a magnifying-glass-in-the-sun effect to this, as EVERYTHING was forcibly turned online which pumped a ton of money and workers into tech investment. Simultaneously, money got really REALLY cheap, bottoming out with historic lows for interest rates.

Then the tide changed with the massive inflation that struck late 2021. Because this all-gas no-brakes state of things was also contributing to off-the-rails inflation (along with your standard-fare greedflation and price gouging, given the extremely convenient excuses of pandemic hardships and supply chain issues). The federal reserve whipped out interest rate hikes to try to curb this huge inflation, which is like a fire extinguisher dousing and suffocating your really-cool, actively-on-fire party where everyone else is burning but you're in the pool. And then they did this more, and then more. And the financial climate followed suit. And suddenly money was not cheap anymore, and new loans became expensive, because loans that used to compound at 2% a year are now compounding at 7 or 8% which, in the language of compounding, is a HUGE difference. A $100,000 loan at a 2% interest rate, if not repaid a single cent in 10 years, accrues to $121,899. A $100,000 loan at an 8% interest rate, if not repaid a single cent in 10 years, more than doubles to $215,892.

Now it is scary and risky to throw money at "could eventually be profitable" tech companies. Now investors are watching companies burn through their current funding and, when the companies come back asking for more, investors are tightening their coin purses instead. The bill is coming due. The free money is drying up and companies are under compounding pressure to produce a profit for their waiting investors who are now done waiting.

You get enshittification. You get quality going down and price going up. You get "now that you're a captive audience here, we're forcing ads or we're forcing subscriptions on you." Don't get me wrong, the plan was ALWAYS to monetize the users. It's just that it's come earlier than expected, with way more feet-to-the-fire than these companies were expecting. ESPECIALLY with Wall Street as the other factor in funding (public) companies, where Wall Street exhibits roughly the same temperament as a baby screaming crying upset that it's soiled its own diaper (maybe that's too mean a comparison to babies), and now companies are being put through the wringer for anything LESS than infinite growth that Wall Street demands of them.

Internal to the tech industry, you get MASSIVE wide-spread layoffs. You get an industry that used to be easy to land multiple job offers shriveling up and leaving recent graduates in a desperately awful situation where no company is hiring and the market is flooded with laid-off workers trying to get back on their feet.

Because those coin-purse-clutching investors DO love virtue-signaling efforts from companies that say "See! We're not being frivolous with your money! We only spend on the essentials." And this is true even for MASSIVE, PROFITABLE companies, because those companies' value is based on the Rich Person Feeling Graph (their stock) rather than the literal profit money. A company making a genuine gazillion dollars a year still tears through layoffs and freezes hiring and removes the free batteries from the printer room (totally not speaking from experience, surely) because the investors LOVE when you cut costs and take away employee perks. The "beer on tap, ping pong table in the common area" era of tech is drying up. And we're still unionless.

Never mind that last part.

And then in early 2023, AI (more specifically, Chat-GPT which is OpenAI's Large Language Model creation) tears its way into the tech scene with a meteor's amount of momentum. Here's Microsoft's prize pig, which it invested heavily in and is galivanting around the pig-show with, to the desperate jealousy and rapture of every other tech company and investor wishing it had that pig. And for the first time since the interest rate hikes, investors have dollar signs in their eyes, both venture capital and Wall Street alike. They're willing to restart the hose of money (even with the new risk) because this feels big enough for them to take the risk.

Now all these companies, who were in varying stages of sweating as their bill came due, or wringing their hands as their stock prices tanked, see a single glorious gold-plated rocket up out of here, the likes of which haven't been seen since the free money days. It's their ticket to buy time, and buy investors, and say "see THIS is what will wring money forth, finally, we promise, just let us show you."

To be clear, AI is NOT profitable yet. It's a money-sink. Perhaps a money-black-hole. But everyone in the space is so wowed by it that there is a wide-spread and powerful conviction that it will become profitable and earn its keep. (Let's be real, half of that profit "potential" is the promise of automating away jobs of pesky employees who peskily cost money.) It's a tech-space industrial revolution that will automate away skilled jobs, and getting in on the ground floor is the absolute best thing you can do to get your pie slice's worth.

It's the thing that will win investors back. It's the thing that will get the investment money coming in again (or, get it second-hand if the company can be the PROVIDER of something needed for AI, which other companies with venture-back will pay handsomely for). It's the thing companies are terrified of missing out on, lest it leave them utterly irrelevant in a future where not having AI-integration is like not having a mobile phone app for your company or not having a website.

So I guess to reiterate on my earlier point:

Drowned rats. Swimming to the one ship in sight.

35K notes

·

View notes

Text

Integrating E-Commerce Solutions across Websites and Apps for Multi-Platform Selling

In digital age, e-commerce has become an integral part of the retail industry. With the rapid growth of online shopping, businesses are constantly seeking ways to expand their reach and maximize their sales potential. One effective strategy that has emerged is multi-platform selling, which involves integrating e-commerce solutions across websites and apps to create a seamless shopping experience for customers.

Without a doubt, selling across various platforms is a game changer in the realm of custom eCommerce development, with the potential to propel any organization to new heights. This blog will look at all aspects of multi-platform selling and how it affects the modern eCommerce business scene. Let us get started.

eCommerce Evolution: A New Era of Online Selling

Welcome to the new era of online selling! With the ever-growing popularity of e-commerce, businesses are constantly seeking ways to expand their reach and increase their sales. One such method that has gained significant traction is multi-platform selling, which involves integrating e-commerce solutions across websites and apps.

However, because consumer behaviours and market demands change so quickly, an all-in-one or single eCommerce strategy is insufficient for long-term success. This is where multi-platform selling provides numerous chances for firms looking to increase engagement and diversify their reach.

What Does Multi-Platform Selling Mean?

Multi-platform selling refers to the practice of selling products or services through multiple online channels simultaneously. This approach allows businesses to reach a wider audience and cater to customers' preferences across various platforms, including websites, mobile apps, social media platforms, and marketplaces. By offering a consistent shopping experience across different channels, businesses can enhance customer engagement, increase brand visibility, and boost sales.

Whether you run a little business or a large corporation, if you carefully position your company on these platforms, you will meet all of your customers' expectations by providing a convenient purchasing experience. However, managing sales across several channels is not as simple as it appears; a custom eCommerce development solution is required to optimize the process.

Major Perks of Multi-Platform Selling

There are several significant perks associated with multi-platform selling. Let's take a closer look at some of the major advantages that businesses can enjoy:

1. Expanded Reach: By leveraging multiple platforms, businesses can tap into a larger customer base and target diverse demographics. This broadens their reach and increases the chances of attracting new customers.

2. Enhanced Customer Experience: Multi-platform selling enables businesses to provide a seamless and consistent shopping experience across various channels. Customers can browse products, make purchases, and access support services conveniently, regardless of the platform they prefer.

3. Increased Sales Opportunities: With multiple channels at their disposal, businesses have more opportunities to showcase their products and services and convert leads into sales. Each platform serves as an additional sales channel, increasing the chances of generating revenue.

4. Improved Brand Visibility: Businesses may increase brand awareness and familiarity by maintaining a presence across many media. Consistent branding across channels promotes client trust and loyalty.

5. Better Data Insights: Multi-platform selling allows businesses to gather data from different sources, providing valuable insights into customer behaviour, preferences, and trends. This data can be used to optimize marketing strategies, personalize customer experiences, and drive informed business decisions.

Other key benefits of multi-platform selling include:

Improved conversion rate

Better customer loyalty.

Improved inventory transparency.

Improved customer segmentation.

Mobile commerce trend capitalization

Best Platforms for Multi-Channel eCommerce Business

1. Shopify: Shopify offers a comprehensive e-commerce platform that allows businesses to create and manage online stores. It provides seamless integration with various sales channels, including websites, mobile apps, social media platforms, and marketplaces.

2. Magento: Magento is a highly flexible and scalable e-commerce platform that caters to businesses of all sizes. It supports multi-channel selling by integrating with multiple platforms, enabling businesses to sell across websites, mobile apps, and marketplaces.

3. Etsy: If you want to sell antique, handcrafted, craft supplies, or other one-of-a-kind things online, Etsy is a great place to start. Users may easily access a wide range of product categories on this marketplace, including clothing, jewellery, tools, home, living, kids & babies, and entertainment.

4. Amazon Marketplace: As one of the largest online marketplaces, Amazon provides businesses with a vast customer base and global reach. Selling on Amazon Marketplace can significantly expand the visibility and sales potential of products.

5. eBay: eBay is another popular online marketplace that allows businesses to sell products to a wide range of customers. With its auction-style listings and fixed-price options, eBay offers flexibility for multi-channel selling.

6.Walmart Marketplace: Walmart is a frequently used marketplace that provides excellent prospects for online enterprises. This is a curated e-commerce portal. As a seller, you must meet specified requirements for providing excellent customer service.

7. Facebook Marketplace: This is Facebook's integrated platform that provides fantastic online selling choices to local sellers and small enterprises. This platform is simple to use and helps you promote your goods to a social media-savvy customer audience.

How to Set Up a Successful Multi-Platform Selling Strategy:

1. Identify Target Platforms:

Research and analyse the platforms that align with your target audience and business objectives. Consider factors such as platform popularity, user demographics, and integration capabilities.

2. Seamless Integration:

Select e-commerce platforms that offer robust integration capabilities with various channels. Ensure that your chosen platforms can synchronize product listings, inventory, pricing, and order management across all channels.

3. Consistent Branding:

Maintain consistent branding elements, such as logo, colors, and messaging, across all platforms. This creates a cohesive brand identity and fosters customer recognition and trust.

4. Optimize User Experience:

Provide a user-friendly and intuitive shopping experience on every platform. Optimize website and app performance, ensure mobile responsiveness, and streamline the checkout process to minimize friction and maximize conversions.

5. Data-Driven Decision Making:

Leverage analytics and data insights to monitor and measure the performance of each platform. Identify trends, customer preferences, and areas for improvement, and use this information to refine your multi-platform selling strategy.

6. Customer Support:

Offer consistent and responsive customer support across all platforms. Provide multiple channels for customer inquiries, such as live chat, email, and phone, to ensure a seamless support experience.

7. Cross-promotion:

Cross-promotion is a marketing strategy where two or more parties promote each other's products or services to their respective audiences. It's a mutually beneficial arrangement that can help increase brand exposure, reach new customers, and drive sales.

8. Privacy and Data Security:

- Manage all of your customers' data safely.

- Display all privacy policies to your customers to develop trust.

9. Focus on market trends.

- Keep up with the latest industry developments, platform updates, and client requests.

- Be prepared to change your business approach (if necessary) to stay ahead of the market.

Conclusion:

Multi-platform selling has become a crucial strategy for businesses aiming to thrive in the competitive e-commerce landscape. By integrating e-commerce solutions across websites and apps, businesses can expand their reach, enhance the customer experience, and boost sales. With the availability of various platforms, businesses can choose the ones that align with their target audience and business goals. By implementing a well-planned multi-platform selling strategy, businesses can establish a strong presence across multiple channels, drive customer engagement, increase brand visibility, and ultimately achieve success in the evolving world of e-commerce.

#Multi-Vendor E-Commerce Market Place Software#Best Multi-Channel Listing Software Solutions For Ecommerce Sellers#ECommerce Management Solution#ECommerce Product Management#Best ECommerce Software#Multi-Channel Selling Software#Shipping Software#Multi-Channel eCommerce Inventory Management Software#Product Listing Software#Multichannel Marketplace Software#Connect Infosoft#E-commerce website development#E-commerce website optimization#Mobile commerce optimization#Mobile commerce solutions#Multi-channel sales management

0 notes

Text

ship spare parts suppliers in Dubai

Ship Spare Parts We are a supplier and stockiest of marine engine spare Parts Ship Engine Spare Parts Almashal Marine services L.L.C specialize in the sourcing and supply of electrical fixtures, fittings, spare parts and consumables to the marine & offshore industries. From our base at Dubai, United Arab Emirates, We Supply meets the requirements of shipping companies, ships managers, ships chandlers and ship repair companies worldwide https://almashalmarine.com/.

1 note

·

View note

Text

The rise of on-demand delivery services and their impact on intracity logistics

The growth of on-demand delivery services has also led to an increase in the number of jobs in the logistics and transport marketplace sector. These companies are creating new employment opportunities for drivers, delivery personnel, and other logistics-related roles. This has led to an increase in the number of people employed in the sector and has also created new career opportunities for people with the right skills and experience.

#digital logistics platforms#shipment tracking#global shipping and visibility platform#logistics software#advanced shipment notification#freight transport#transportation#transport market place#patang transport

0 notes

Link

Artificial intelligence, big data analysis and industry 4.0 are expected to drive Shipping Software market growth. By, deployment type the global shipping...

#adroit market research#shipping software market#shipping software market size#shipping software market share

0 notes

Text

https://www.maximizemarketresearch.com/market-report/global-shipping-software-market/87018/

The shipping software is a single combined platform that aids organization in shipment tracking, coordinating, planning, and routing on a real-time basis in complex supply chain management. This software is helpful for both the business and the customer.

#Shipping Software Market#Shipping Software Market growth#Shipping Software Market analysis#Shipping Software Market demand

0 notes

Text

Humans are weird: Prank Gone Wrong

( Please come see me on my new patreon and support me for early access to stories and personal story requests :D https://www.patreon.com/NiqhtLord Every bit helps)

“Filnar Go F%$@ Yourself!” was possibly the most disruptive software virus the universe had ever seen.

The program was designed to download itself to a computer, copy the functions of existing software before deleting said software and imitating it, then running its original programming all the while avoiding the various attempts to locate and remove it by security software.

What was strange about such a highly advanced virus was that it did not steal government secrets, nor siphon funds from banking institutions, it ignore critical infrastructure processes, and even bypassed trade markets that if altered could cause chaos on an unprecedented scale. The only thing the software seemed focused on was in locating any information regarding the “Hen’va” species, and deleting it.

First signs of the virus outbreak were recorded on the planet Yul’o IV, but once the virus began to migrate at an increasing rate and latched on to several subroutines for traveling merchant ships things rapidly spiraled out of control. Within a week the virus had infected every core world and consumed all information regarding the Hen’va. It still thankfully had not resulted in any deaths, but the sudden loss of information was beginning to cause other problems.

Hen’va citizens suddenly found that they were not listed as galactic citizens and were detained by security forces on numerous worlds. Trade routes became disrupted as Hen’va systems were now listed as uninhabited and barren leading to merchants seeking to trade elsewhere. Birth records and hospital information for millions of patients were wiped clean as they now pertained to individuals who did not exist.

Numerous software updates and purges were commenced in attempting to remove the virus. Even the galactic council’s cyber security bureau was mobilized for the effort, but if even a single strand of the virus’s code survived it was enough to rebuild itself and become even craftier with hiding itself while carrying out its programming. This was made worse by the high level of integration the various cyber systems of the galaxy had made it so the chance of systems being re-infected was always high.

After ten years every digital record of the Hen’va was erased from the wider universe. All attempts to upload copies were likewise deleted almost immediately leaving only physical records to remain untouched.

To combat this, the Hen’va for all official purposes adopted a new name; then “Ven’dari”. In the Hen’va tongue in means “The Forgotten”, which is rather ironic as the Hen’va have had to abandon everything about their previous culture to continue their existence. The virus had become a defacto component of every computer system in the galaxy and continued to erase all information related to the Hen’va. Even the translator units refused identify the Hen’va tongue and so the Ven’dari needed to create a brand new language.

It wasn’t until another fifty years had passed before the original creator of the virus stepped forward and admitted to their crime. A one “Penelope Wick”.

At the time of the programs creation Ms. Wick was a student studying on Yul’o IV to be a software designer. While attending the institution Ms. Wick stated that a fellow student, a Hen’va named “Filnar”, would hound her daily. He would denounce her presence within the school and repeatedly declared that “what are the scrapings of humans compared to the glory of the Hen’va?”

The virus was her creation as a way of getting back at the student for his constant spite. Ms. Wick was well aware of the dangers it could pose if released into the wild and so had emplaced the limitation that the virus would only infect computers on site with the campus. The schools network was setup that students could only work on their projects within the confines of the institution to ensure they did not cheat and have others make them instead. What she had not counted on was this rule only applied to students and not teachers. So when a teacher brought home several student projects to review and then sharing those infected files with their personal computer, the virus then gained free access to the wider planets networks.

When the Ven’dari learned of this there were several hundred calls for Ms. Wick to be held accountable for her actions, and nearly twice as many made to take her head by less patient individuals who had seen their entire culture erased. Much to their dismay Ms. Wick died shortly after her confession from a long term disease that had ravaged her body for several years.

Much to her delight, she had achieved her goals of removing the source of her mockery.

#humans are insane#humans are weird#humans are space oddities#humans are space orcs#story#scifi#writing#original writing#niqhtlord01#funny#prank#prank gone wrong#virus

360 notes

·

View notes

Link

The global shipping software market is projected to grow at a CAGR of 8.4% during the forecast period.

#adroit market research#shipping software market#shipping software market size#shipping software market share

0 notes

Text

About Unity these past few days

A lot of people have asked me about Unity and their strange new per-install charges policy that they rolled out on September 12th, 2023. I wanted to give them at least 24 hours before I posted my take on it - let the dust settle a bit so I could get a chance to read the new policy properly and all that. First, however, I think we need to take a step back and get a wider perspective. Unity Software Inc. is in some serious financial trouble. Here are their operating numbers from 2019 to 2023.

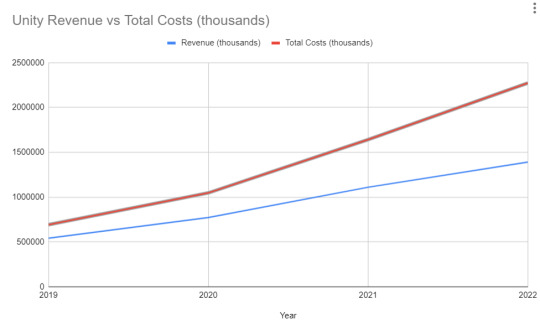

The blue line here is how much money they take in and the red line is the amount of money they are spending each year. You may notice that they are spending significantly more money year over year than they earn. In fact, over the past 12 months alone (August 2022 to August 2023), Unity Software Inc. has lost almost $1 billion.

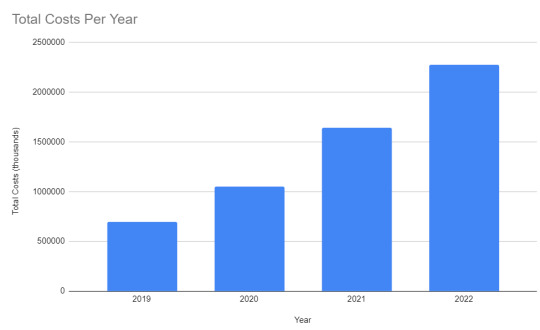

In 2022, Unity spent four times as much money as they did in 2019. If they had managed to keep costs at double their spending in 2019, they still would have earned $243 million in profit. Instead, they lost $882 million in 2022.

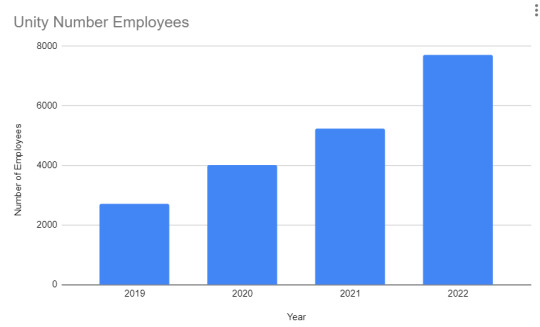

Where does all of this cost come from? In any software company like Unity, the vast vast majority of costs comes from employee salaries. And we can directly see it in Unity's number of employees:

Unity Software Inc. more than tripled its headcount from 2019 to 2022, and it did all of this hiring during the pandemic while competing with many many other developers all trying to hire from the same pool. I don't work for Unity, but I was in the market and I had lots of recruiters trying to recruit me during that time.

In short, Unity is suffering from the same miscalculation that Embracer Group did, that EA did, that Activision-Blizzard did, that Square-Enix did, and just about everybody else in the tech industry - they misjudged the good times at the beginning of the pandemic, overspent hiring people thinking the good times would last, and are now scrambling to figure out how to survive. The difference is that Unity was getting all of their operating money from Venture Capitalists (VCs) hoping that they would eventually become profitable, but VC money has all but dried up because it's become much more expensive to borrow money over the past two years.

As a result, the Unity executives are likely grasping at straws in hopes of saving a sinking ship. This wild and decidedly senseless pricing plan is their (seemingly-desperate) attempt to juice their revenues. It really makes very little sense from the developer perspective, which is what makes the whole thing reek of desperation. That isn't greed talking, it's survival. My guess is that Unity is currently desperately looking for a buyer to save them and doing whatever they can to buy themselves some more runway. They already announced layoffs back in May, but I suspect they'll probably have to announce some really big layoffs (e.g. 40-50%) soon. Unity Software Inc. is living on borrowed time and they know it.

[Join us on Discord] and/or [Support us on Patreon]

Got a burning question you want answered?

Short questions: Ask a Game Dev on Twitter

Long questions: Ask a Game Dev on Tumblr

Frequent Questions: The FAQ

#the business of video games#unity 3d#business business business#where the money goes#financial things

458 notes

·

View notes