#simplify your vendors

Explore tagged Tumblr posts

Text

youtube

Simplify Your Vendors | Easy Setup of Vendor Boards in monday.com | Tara Horn

how to use monday.com,monday.com tutorials,monday.com,custom implemention,monday,simplyday,vendors boards,set up vendors boards in monday.com,monday.com step by step guide,simplify your vendors,vendor management.,vendor boards,easy tutorial for vendor boards,work flow optimization,business efficiency,tech solutions,vendor management,easy setup of vendor boards in monday.com,tara horn monday.com,tara horn tutorials

#how to use monday.com#monday.com tutorials#monday.com#custom implemention#monday#simplyday#vendors boards#set up vendors boards in monday.com#monday.com step by step guide#simplify your vendors#vendor management.#vendor boards#easy tutorial for vendor boards#work flow optimization#business efficiency#tech solutions#vendor management#easy setup of vendor boards in monday.com#tara horn monday.com#tara horn tutorials#Youtube

0 notes

Text

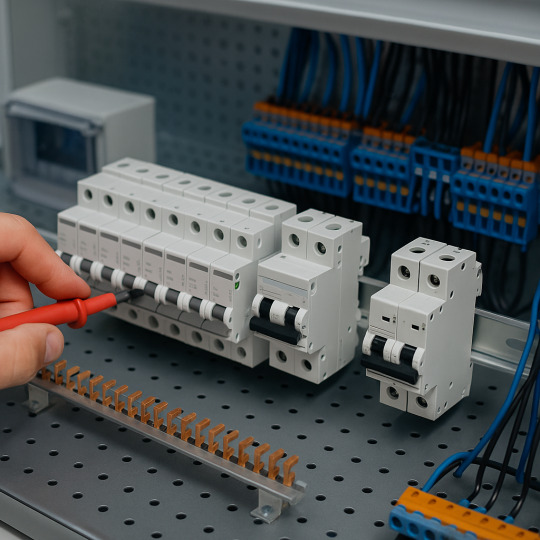

How the Right Supplier Can Improve Your Panel Assembly Workflow

In the competitive world of electrical panel manufacturing, time, consistency, and precision are everything. A well-organized panel assembly workflow can be the difference between hitting deadlines and losing contracts. But one often-overlooked factor in achieving operational efficiency is this:

The right supplier isn’t just a vendor — they’re a strategic partner. In this blog, we’ll break down how the right supplier can directly enhance your panel assembly workflow, reduce friction in operations, and elevate your entire production process.

1. Ensuring Reliable Component Availability

Panel assembly often stalls because of component shortages. When you’re missing critical parts — like circuit breakers, contactors, or terminal blocks — your line goes idle.

A dependable supplier:

· Maintains ready stock of high-demand components

· Offers real-time inventory updates

· Provides just-in-time (JIT) delivery

This ensures your team always has what it needs, minimizing production downtime and keeping your project timelines on track.

Impact: Faster production starts, fewer delays, better throughput.

2. Simplifying the Procurement Process

Juggling multiple vendors for various panel parts creates complexity — multiple orders, invoices, and deliveries. It eats up time your team could spend on value-added tasks.

A smart supplier partner:

· Consolidates a wide range of panel components

· Offers bundled BOM support

· Provides a single point of contact for all orders

This streamlined approach reduces your procurement overhead, lowers admin costs, and frees up your internal resources.

Impact: Faster ordering, reduced paperwork, smoother coordination.

3. Improving Product Selection and Compatibility

Choosing the wrong component — even slightly incompatible — can lead to rework, panel redesign, or even failures in the field. That’s a major risk to quality and your brand.

A technically capable supplier:

· Understands your electrical panel design and specs

· Guides you on compatible, compliant components

· Helps you select cost-effective alternatives when needed

With expert support, your team avoids costly errors and gets it right the first time.

Impact: Better accuracy, fewer mistakes, higher quality output.

4. Reducing Lead Times Through Local Sourcing

Global supply chains can be unreliable — delays at ports, shipping bottlenecks, and customs hold-ups all hurt your workflow.

A locally positioned supplier:

· Sources and stocks components closer to your facility

· Offers same-day or next-day delivery

· Bypasses import-related delays

This leads to shorter lead times, more predictable schedules, and the ability to react quickly to urgent needs.

Impact: Agile production schedules, improved customer responsiveness.

5. Supporting Scalable Growth

As your panel-building business grows, your workflow complexity increases. You’ll need a supplier that can scale with you.

A growth-ready supplier:

· Keeps track of your recurring BOM patterns

· Prepares for larger, scheduled orders

· Offers credit terms or inventory reserves for long-term customers

Instead of being reactive, you can plan your production proactively — without worrying about supply issues.

Impact: Smooth scaling, reduced bottlenecks, confident expansion.

6. Providing Value-Added Services

Beyond just selling products, great suppliers offer services that make your workflow leaner:

· Pre-kitting: All components bundled per job

· Labeling and part tagging

· Custom panel parts or DIN rail assemblies

· Training on new product integration

These extras can shave hours off assembly time and improve jobsite or factory efficiency.

Impact: Leaner processes, faster panel builds, lower labor costs.

Conclusion: Suppliers Are Part of Your Workflow Strategy

Your workflow is only as strong as its weakest link — and for many panel builders, that weak link is a slow or unreliable supplier.

At Daleel Trading, we go beyond supplying components. We

Stock what you need

Deliver when you need it

Support you with technical know-how

And grow with your business

The right supplier doesn’t just deliver products — they deliver productivity.

Ready to streamline your panel assembly workflow?

Contact Daleel Trading today to discover how we can simplify your sourcing, boost your efficiency, and help you build better panels — faster.

8 notes

·

View notes

Text

Boost Your Planning Business with the Best Wedding and Event Software Tools

In today’s fast-paced world, planning events and weddings is more complex than ever. With countless moving parts, deadlines, vendors, and clients to manage, many professionals are turning to smart digital solutions to streamline their work. Using tools like wedding planner computer software has become a game-changer for professionals in the event industry.

Organize Better with Smart Wedding Planning Tools

Staying on top of every detail is critical in this industry. That’s where event planning software for wedding planners makes a big impact. These platforms allow you to manage guest lists, plan timelines, and coordinate vendors more efficiently than ever before.

One of the best investments for any professional in this space is software for wedding planners. It’s a must-have for anyone serious about delivering seamless events. From timeline creation to payment tracking, software for wedding planners reduces manual tasks and helps planners stay ahead of schedule.

In addition, wedding planner software simplifies client communication, ensuring that everyone is on the same page from day one. This results in happier clients, better feedback, and more referrals.

Take Control of the Entire Planning Process

To manage a growing list of clients and events, professionals use wedding planning software that provides a central dashboard for all planning tasks. These tools allow planners to focus more on creativity and client experience, rather than chasing down details manually.

Manage Your Business Like a Pro

Beyond event coordination, running a successful planning business also requires solid business tools. That’s why many professionals depend on event planning business software to manage contracts, invoices, and client records securely.

Choosing the right software for event planning can make day-to-day operations smoother. It allows planners to avoid unnecessary stress and focus on delivering unforgettable experiences.

Many teams now rely on Software for planning events that offer collaboration features, calendar syncing, and reporting tools to measure performance.

Empower Teams and Manage Venues More Efficiently

For teams that work together on multiple events, using event planners software is essential. It allows seamless task delegation, timeline updates, and easy communication, helping everyone stay aligned.

When it comes to managing physical venues, Event Venue Planning Software helps visualize layouts, manage bookings, and ensure spaces are used efficiently. Whether you’re organizing seating charts or managing room availability, this tool adds tremendous value.

Use Technology to Stay Competitive

As events grow more complex, professionals are turning to event management planning software to manage logistics, technical requirements, and scheduling in one streamlined platform. This ensures that no task or deadline gets overlooked.

Many professionals prefer all in one event planning software because it includes everything from task tracking to budgeting and reporting tools. This allows planners to manage entire events from one platform without switching between systems.

The growing demand for online event planning software shows how much the industry is embracing digital tools. Cloud access, data backup, and real-time updates make these platforms ideal for modern-day planning.

With the rise of remote work and mobile access, using Digital wedding planning software has become more important than ever. These tools offer convenience, flexibility, and security, which are key to running a successful planning business.

For venue managers, event venue management software helps track bookings, manage operations, and improve customer service. It’s a vital tool for keeping operations efficient and organized, especially in high-demand seasons.

Final Thoughts

The event and wedding planning industry is moving quickly toward smarter, more efficient solutions. Whether you’re an independent planner or part of a larger team, investing in professional tools like wedding planner computer software and online event & wedding planning software can transform how you work.

Using comprehensive tools such as software for wedding planners, event planning business software, and event venue management software helps reduce stress, improve client satisfaction, and scale your business with confidence.

Frequently Asked Questions (FAQ)

1. What is wedding planner computer software?

Wedding planner computer software is a digital tool that helps wedding planners organize every aspect of a wedding. It includes features like guest list tracking, vendor coordination, budget management, and event scheduling. This software helps planners work more efficiently and deliver seamless wedding experiences.

2. How is online event & wedding planning software different from traditional planning methods?

Online event & wedding planning software offers cloud-based access, allowing planners to manage tasks, clients, and vendors from any location. Unlike traditional methods, this software provides real-time updates, automated reminders, and easier collaboration, making planning faster and more organized.

3. Who should use event planning software for wedding planners?

Event planning software for wedding planners is ideal for professional wedding coordinators, event organizers, and planning teams. It helps streamline operations, manage timelines, and ensure that no detail is missed during the planning process.

4. Is software for wedding planners useful for small businesses?

Yes, software for wedding planners is especially useful for small businesses. It helps manage client communications, organize tasks, and keep track of budgets — all in one place. Even small teams can benefit from these tools to maintain a professional and organized service.

2 notes

·

View notes

Text

What is UPB Token? How You Can Start With Just ₹100 and Earn Big Profits!

In today’s fast-paced digital world, cryptocurrency and blockchain-based tokens are gaining tremendous popularity. Among these rising stars, the UPB Token has recently caught the attention of investors, tech-savvy youth, and fintech enthusiasts across India. But what exactly is the UPB Token, and how can you potentially earn big profits by investing as little as ₹100?

In this blog, we’ll break down everything you need to know about the UPB Token in simple, easy-to-understand language. Whether you're a beginner or someone already exploring digital finance, this could be your next big opportunity!

🌐 What is UPB Token?

UPB Token stands for Universal Payment Bank Token. It is a digital asset designed to simplify, speed up, and secure online payments, banking, and financial transactions, especially in underserved or semi-banked areas of India.

Unlike traditional cryptocurrencies like Bitcoin or Ethereum, UPB Token is purpose-driven, focusing on enhancing financial inclusion and day-to-day digital payments.

🔹 Think of UPB Token as a smart currency that works inside a digital banking ecosystem designed for the future.

💡 Key Features of UPB Token

Let’s explore why UPB Token is becoming so popular:

✅ 1. Low Investment Entry

You can start with as little as ₹100, making it highly accessible for students, small business owners, and first-time investors.

✅ 2. Secure & Transparent

Powered by blockchain technology, all UPB Token transactions are encrypted, traceable, and protected from fraud.

✅ 3. Instant Payments

Use UPB Token to pay for mobile recharges, utility bills, money transfers, and more — all within seconds.

✅ 4. Growing Ecosystem

The UPB Token is part of a larger Universal Payment Bank platform, meaning it can be used across different services, apps, and vendor networks.

✅ 5. Rewards & Cashback

Early adopters and users often get bonus tokens, referral rewards, or cashback, making it a smart way to earn passively.

💰 How Can You Start With ₹100?

One of the best parts of UPB Token is that you don’t need thousands of rupees to begin. Here's a step-by-step guide on how you can start investing in UPB Token with just ₹100:

📝 Step 1: Register on the UPB Platform

Visit the official website or app of Universal Payment Bank and create your account. You’ll need to complete basic KYC using your Aadhaar and PAN card.

🪙 Step 2: Buy UPB Tokens

Once your account is active, go to the “Buy Tokens” section. Enter the amount you want to invest—you can start from ₹100.

📲 Step 3: Store Tokens in Your Wallet

The platform provides you with a secure digital wallet where your tokens are stored. This wallet can be used for transactions or to hold your investment.

💹 Step 4: Watch Value Grow

As UPB Token’s ecosystem expands, the value of each token may increase. Just like stocks or mutual funds, you can hold them until their value grows or use them in daily transactions.

📈 How Can You Earn Profits?

Let’s get to the exciting part — earning from UPB Token! There are multiple ways you can turn a small investment into significant returns.

💎 1. Value Appreciation

As more people adopt UPB Tokens and the platform grows, demand increases, which can raise the token price over time.

Example: If you buy 100 tokens at ₹1 each today and the value goes up to ₹5 later, your ₹100 becomes ₹500.

🔁 2. Trading

You can buy tokens at a low price and sell them when the value increases on supported exchanges or through the platform.

🎁 3. Referral Rewards

Many users earn free tokens by inviting others to join the platform. It's a win-win — your friend learns something new, and you get rewarded!

💼 4. Business Integration

If you’re a merchant or small business owner, you can start accepting UPB Tokens as payment. It reduces transaction fees and gives you access to tech-friendly customers.

📊 Real Example: Small Start, Big Growth

Let’s look at a hypothetical scenario:

Initial Investment: ₹100

Token Price at Entry: ₹1

Tokens Owned: 100

After 6 Months, the Token price rises to ₹4.

Value Now: ₹400

Profit: ₹300 (300% Return)

This is just a simplified example — actual profits depend on the market, demand, and adoption of the token. But it shows how even a small investment can grow over time.

🛡️ Is UPB Token Safe?

Yes, as long as you use official platforms and keep your login credentials secure. Like any digital asset, UPB Token is vulnerable to scams if used carelessly. Here are some tips:

✅ Always use the official UPB app or website.

✅ Do not share OTPs, passwords, or wallet keys.

✅ Don’t fall for “too good to be true” schemes.

✅ Enable two-factor authentication (2FA) where available.

UPB is aiming to operate under RBI-compliant frameworks, which increases its legitimacy.

📌 Who Should Consider UPB Token?

📱 Students & Young Professionals: Learn digital finance and start small.

🧑💼 Small Business Owners: Accept payments and expand customer options.

💡 Early Investors: Get in before the price surges.

🧓 Unbanked/Rural Citizens: Use tokens for daily utility in areas where banking is limited.

🌟 Future of UPB Token

UPB Token isn’t just a digital coin; it’s part of a bigger movement — Digital India. With the rising popularity of UPI, digital wallets, and cashless payments, UPB is positioning itself to be a major player.

In the coming years, we could see:

Integration with e-commerce platforms

Acceptance in retail stores

Listing on major token exchanges

Expansion in financial products like microloans or digital gold

📝 Final Thoughts

Investing in the UPB Token is not just about making money — it's about being part of a financial revolution. With just ₹100, you’re opening the door to digital banking, blockchain-based payments, and possibly long-term wealth.

Of course, every investment comes with risk, so make sure to do your research, stay updated, and avoid greedy decisions. But if you’re looking for a low-risk, high-potential entry into the digital finance world, UPB Token is worth exploring.

2 notes

·

View notes

Text

Unlocking the Secrets to Effortless Compliance with ZATCA Phase 2

The Kingdom of Saudi Arabia is leading the way in digital transformation, especially with its structured e-invoicing initiatives. A significant part of this movement is ZATCA Phase 2, which aims to enhance transparency, boost efficiency, and ensure tax compliance across businesses.

If you are a business owner, accountant, or IT professional, understanding ZATCA Phase 2 is no longer optional. It is critical for ensuring that your operations remain compliant and future-ready. This guide breaks down everything you need to know in a simple, easy-to-understand manner.

What Is ZATCA Phase 2?

ZATCA Phase 2, also known as the Integration Phase, is the next major step following Saudi Arabia's Phase 1 e-invoicing requirements. While Phase 1 focused on the generation of electronic invoices, Phase 2 moves beyond that.

It requires businesses to integrate their e-invoicing systems with ZATCA’s Fatoora platform, allowing real-time or near-real-time transmission of invoices for clearance and validation.

This phase ensures that each invoice issued meets strict technical, security, and data format requirements set by the Zakat, Tax and Customs Authority (ZATCA).

Key Objectives Behind ZATCA Phase 2

Understanding the "why" behind Phase 2 can help businesses see it as an opportunity rather than a burden. The main goals include:

Improving tax compliance across all sectors

Minimizing fraud and manipulation of invoices

Streamlining government audits with real-time data

Promoting a transparent digital economy

Enhancing business operational efficiency

Who Needs to Comply?

All businesses registered for VAT in Saudi Arabia must comply with ZATCA Phase 2 regulations. This includes:

Large enterprises

Medium and small businesses

Businesses using third-party billing service providers

Companies operating across multiple sectors

Even if your business operates primarily offline, if you are VAT registered, you need to be compliant.

Important Requirements for ZATCA Phase 2

Compliance with ZATCA Phase 2 is not just about sending electronic invoices. It involves specific technical and operational steps. Here’s what your business needs:

1. E-Invoicing System with ZATCA Compliance

Your billing or accounting system must:

Issue invoices in XML or PDF/A-3 with embedded XML

Securely store invoices electronically

Incorporate UUIDs (Unique Identifiers) for each invoice

Attach a QR code for simplified verification

2. Integration with ZATCA Systems

Businesses must establish a secure Application Programming Interface (API) connection with ZATCA’s platform to allow the real-time sharing of invoice data.

3. Cryptographic Stamp

Each invoice must carry a cryptographic stamp. This verifies the invoice's authenticity and integrity.

4. Archiving

Invoices must be securely archived and retrievable for at least six years in case of audits or regulatory reviews.

Implementation Timeline for ZATCA Phase 2

ZATCA is rolling out Phase 2 gradually, targeting businesses in waves based on their annual revenues:

Wave 1: Businesses with annual revenues above SAR 3 billion (started January 1, 2023)

Wave 2: Revenues above SAR 500 million (started July 1, 2023)

Future Waves: Gradually extending to smaller businesses

Each business is officially notified by ZATCA at least six months before their compliance date, giving them time to prepare.

How to Prepare for ZATCA Phase 2: A Step-by-Step Guide

The good news is that with proper planning, adapting to ZATCA Phase 2 can be straightforward. Here’s a simple preparation roadmap:

Step 1: Review Your Current Systems

Audit your existing accounting and invoicing solutions. Identify whether they meet Phase 2’s technical and security standards. In most cases, upgrades or new software may be required.

Step 2: Select a ZATCA-Approved Solution Provider

Look for software vendors that are pre-approved by ZATCA and offer:

Seamless API integration

Cryptographic stamping

XML invoice generation

Real-time data reporting

Step 3: Integration Setup

Collaborate with IT teams or third-party service providers to set up a secure connection with the Fatoora platform.

Step 4: Employee Training

Ensure that relevant departments, such as finance, IT, and compliance, are trained to manage new invoicing processes and troubleshoot any issues.

Step 5: Test Your Systems

Conduct dry runs and testing phases to ensure that invoices are being properly cleared and validated by ZATCA without delays or errors.

Step 6: Go Live and Monitor

Once your system is ready and tested, begin issuing invoices according to Phase 2 standards. Regularly monitor compliance, system errors, and feedback from ZATCA.

Common Challenges and How to Overcome Them

Businesses often encounter several challenges during their Phase 2 preparation. Awareness can help you avoid them:

Integration Difficulties: Solve this by partnering with experienced ZATCA-compliant vendors.

Employee Resistance: Overcome this with proper training and clear communication on the benefits.

Technical Errors: Regular testing and quick troubleshooting can help prevent issues.

Lack of Budget Planning: Allocate a specific budget for compliance early to avoid unexpected costs.

Preparation is not just technical. It’s organizational as well.

Benefits of Early Compliance with ZATCA Phase 2

Early compliance does more than just prevent penalties:

Improves Financial Reporting Accuracy: Real-time clearance ensures clean records.

Builds Market Trust: Clients and partners prefer businesses that follow regulatory norms.

Enhances Operational Efficiency: Automated invoicing processes save time and reduce errors.

Boosts Competitive Advantage: Staying ahead in compliance projects an image of professionalism and reliability.

Businesses that proactively adapt to these changes position themselves as industry leaders in the evolving Saudi economy.

Conclusion

ZATCA Phase 2 is not just a regulatory requirement. It’s an opportunity to upgrade your operations, improve financial accuracy, and enhance business credibility.

By understanding the requirements, preparing strategically, and partnering with the right solution providers, your business can turn this challenge into a growth opportunity.

The sooner you act, the smoother your transition will be. Compliance with ZATCA Phase 2 is your gateway to becoming part of Saudi Arabia’s dynamic digital economy.

2 notes

·

View notes

Text

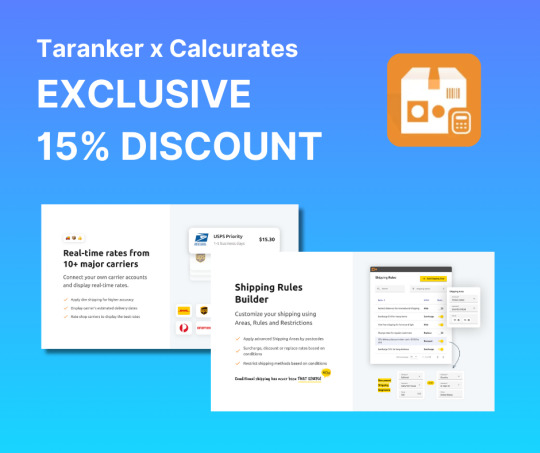

📦 Shipping Just Got Smarter – Welcome Calcurates to Taranker! 🌍

We’re excited to announce our latest partnership with Calcurates: Accurate Shipping, the all-in-one shipping rate calculator trusted by global brands! 💡

💥 EXCLUSIVE DEAL: Get 15% OFF when you install via Taranker!

Whether you're a growing store or managing multi-origin logistics, Calcurates helps you: ✅ Show real-time shipping rates from 10+ carriers ✅ Apply smart shipping rules by postcode, weight & dimensions ✅ Calculate delivery dates, duties, and taxes ✅ Handle multi-origin and vendor-specific rates ✅ Customize everything, even the rate names at checkout!

💼 Say goodbye to shipping guesswork and hello to precision, transparency, and control.

🔗 Claim your 15% discount now: 👉 https://taranker.com/shopify-calcurates-accurate-shipping-app-promo-code-discount-coupons-and-special-deals#deal

Let Calcurates simplify your shipping.

#taranker#shopify#ecommerce#shopify experts#shopify tips#shopify development company#shopify ecommerce development

2 notes

·

View notes

Text

Steps to Apply Through IMLC as a Physician Assistant

The IMLC Physician Assistant pathway offers a faster solution for multistate licensing. Although initially designed for physicians, the Interstate Medical Licensure Compact (IMLC) now opens opportunities for qualified physician assistants to obtain licenses in multiple states through a simplified process. Understanding the exact steps for application helps avoid delays and ensures full compliance with medical board standards.

This guide explains how to navigate the IMLC Physician Assistant process—from eligibility to final license issuance.

Understand the IMLC Physician Assistant Pathway

The IMLC Physician Assistant application enables medical professionals to expand their reach while reducing paperwork. By applying through the compact, eligible physician assistants can hold licenses in various states with one primary application. The compact improves patient access to care and makes it easier for certified physician assistants to work across jurisdictions.

Step 1: Check Eligibility Criteria

Before starting your IMLC Physician Assistant application, ensure you meet the basic qualifications:

Hold a full and unrestricted license in a compact state

Reside, work, or have graduated from a program in that state

Pass the PANCE exam

Have no disciplinary history or criminal record

Graduate from an accredited PA program

Meeting these requirements makes you eligible to use your current state as your State of Principal License (SPL) for the compact process.

Step 2: Identify Your State of Principal License

Your SPL must be a participating IMLC state and meet at least one of the following:

It's your primary residence

It’s where you primarily practice

It’s where you completed your PA program

Once confirmed, your SPL will review and verify your IMLC Physician Assistant application details before issuing a Letter of Qualification (LOQ).

Step 3: Submit Your IMLC Application Online

Start the IMLC Physician Assistant application by creating an account at the official IMLC website. You will need to:

Fill out the application form accurately

Upload supporting documents like education records and ID

Pay fees for background checks and state license processing

Ensure every detail is correct to avoid delays during the verification phase.

Step 4: Complete Fingerprinting and Background Check

As part of the IMLC Physician Assistant process, fingerprint-based background checks are mandatory. Schedule fingerprinting with an approved vendor and complete this step quickly after submitting your application.

Once completed, your results are sent directly to your SPL for clearance.

Step 5: Wait for Letter of Qualification

After successful background verification, the SPL reviews your credentials and issues the LOQ. This letter confirms your eligibility to apply for medical licenses in other IMLC states as a physician assistant. The LOQ is valid for a limited time, so act quickly to apply for additional licenses.

Step 6: Choose Additional States and Apply

With the LOQ in place, you can now use your IMLC portal to apply for licenses in other participating states. Your documents are forwarded automatically. This is one of the main advantages of the IMLC Physician Assistant process—it reduces duplicate effort and speeds up license approvals.

Step 7: Monitor Application Progress

Log into your IMLC account regularly to track your license status. The dashboard will show:

States receiving your application

States currently reviewing

Final approvals and license issuance

Respond quickly to any additional document requests from state boards to avoid processing delays.

Step 8: Renew Licenses Separately

While the IMLC Physician Assistant system speeds up initial licensing, each state still handles renewals separately. This means:

You must follow each state’s renewal schedule

CME requirements vary

You are responsible for submitting renewals on time

Failure to renew on time may result in penalties or suspension.

Why Licensing Services Are Useful

The IMLC Physician Assistant process can be time-consuming. Many professionals use licensing services to:

Track application deadlines

Ensure document accuracy

Handle multistate communication

Speed up application workflows

Professional help makes the process easier, especially for busy physician assistants expanding into several states.

Helpful Tips for IMLC Physician Assistants

To stay on track and prevent issues:

Start collecting documents early

Create a checklist for IMLC steps

Monitor your application dashboard

Respond fast to state board emails

Keep your LOQ valid by acting quickly

These small steps make a big difference during the IMLC Physician Assistant application.

Conclusion

The IMLC Physician Assistant process simplifies multistate licensing for eligible professionals. By following each step—checking eligibility, submitting accurate applications, and using the portal to manage progress—you can secure licenses in multiple states without repetitive paperwork. Whether applying on your own or through a licensing service, staying organized helps you succeed with ease.

1 note

·

View note

Text

How I Solved My Invoice Payment Hassles: A Baker’s Story

Owning a bakery in a quaint little town is like living in a warm, flour-dusted dream. But I’ll admit it’s not without its challenges. One of the biggest hurdles I’ve faced over the years has been managing my invoices and payments. It’s not something I like to talk about, but there were times when my lack of organization led to missed payments and strained relationships with suppliers.

I remember one particularly stressful week. My supplier called me early on a Monday morning, frustrated that I hadn’t paid for the last flour shipment. I sighed and said, “I’m so sorry. I completely forgot about it. I’ll fix it right away.” But fixing it wasn’t as easy as it sounded. I’d been so busy juggling orders and experimenting with new recipes that I completely forgot to make the invoice payment. Now, I was scrambling to make things right while dealing with an already hectic week. It felt like no matter how hard I tried, the administrative side of running my bakery always got the better of me.

That’s when a fellow business owner, Jake, mentioned Zil Money to me. Over coffee one afternoon, Jake said, “Man, you gotta try this platform. It’ll change your life.” They raved about how Zil Money had simplified their invoicing and payment processes. At first, I was hesitant. “Can it really make that much of a difference?” I asked. But I was desperate for a solution, so I decided to give it a shot.

Before Zil Money, I was juggling multiple platforms to meet my suppliers’ preferences. Some wanted checks, others needed ACH transfers, and a few insisted on wire payments. It was a logistical nightmare. I always felt like I was one step away from a disaster. With Zil Money, all of that changed. The platform allowed me to handle all these payment methods in one place. Whether I needed to send a check, initiate an ACH transfer, or make a wire payment, Zil Money made it quick and easy.

One day, I was at the local farmer’s market picking out fresh ingredients for a new tart recipe when my phone buzzed. It was a message from one of my vendors reminding me about an invoice that needed to be paid. In the past, this would have meant rushing back to the bakery, digging through paperwork, and losing precious time. But this time, I simply opened the app on my phone and made the payment right then and there. It took less than a minute, and I didn’t have to break my stride. “That was so easy,” I thought, smiling to myself. That’s when I realized just how much Zil Money had transformed my workflow.

Over time, I’ve seen the ripple effects of using Zil Money. My suppliers are happier because they know they’ll get paid on time. I’ve saved countless hours that I now spend focusing on my customers and perfecting my recipes. And, perhaps most importantly, I feel more in control of my business.

What’s even better is that Zil Money doesn’t just help with making payments—it also lets you create and send invoices effortlessly. With a few clicks, I can customize invoices and send them directly to my vendors. Collecting payments has become just as simple. I can send out personalized payment links to my vendors, and when they click on the link, they’re taken to a secure checkout page. From there, they can pay using their credit card or bank account, making the entire process smooth and efficient.

Jake was right. Zil Money didn’t just simplify one part of my business; it transformed the way I operate. One of the best features is how mobile-friendly it is. Whether I’m at the market or in the kitchen, I can handle invoices and payments from my phone.

There was one moment that really made me grateful for Zil Money. I was busy decorating a wedding cake when I got a notification about a payment due. Normally, I’d have to stop everything, clean up, and go to my computer. But this time, I pulled out my phone, tapped a few buttons, and the payment was done. I didn’t even lose my focus. “I couldn't believe how much simpler things had become,” I muttered, shaking my head in disbelief.

Since I started using Zil Money, I’ve gained back so much time and energy. My customers are happy, my suppliers are happy, and I’m happy. If you’re a small business owner struggling with invoicing and payments, take it from me: Zil Money can make a world of difference. It’s not just a tool; it’s like having an extra set of hands when you need them most.

2 notes

·

View notes

Text

Top Qualities to Look for in USA-Based Hotel Linen Suppliers

Introduction

The hospitality industry thrives on guest satisfaction, and quality linens play a crucial role in creating memorable stays. Whether it's soft, luxurious sheets or durable, stain-resistant tablecloths, choosing the right hotel linen supplier is essential for maintaining your property’s standards. For hoteliers in the USA, selecting a reliable wholesale supplier involves evaluating several key qualities. Here’s a closer look at what to consider when partnering with USA-based hotel linen suppliers.

1. Commitment to Quality and Durability

The first and foremost quality to look for in a hotel linen supplier is the ability to deliver high-quality and long-lasting products. Linens in hotels face frequent laundering and heavy usage, making durability just as important as comfort. USA-based suppliers that offer premium materials such as Egyptian cotton, high-thread-count fabrics, and stain-resistant technologies are ideal choices. A supplier’s commitment to providing durable products ensures cost efficiency and consistent guest satisfaction over time.

2. Wide Range of Products to Suit Different Needs

A good hotel linen supplier should offer a comprehensive range of products to meet your property’s specific requirements. From bed sheets and pillowcases to towels, table linens, and bathrobes, having a one-stop supplier can simplify procurement. Look for USA suppliers who cater to a variety of hospitality settings, including luxury resorts, boutique hotels, and budget accommodations, ensuring that you can find the perfect linens for your brand.

3. Customization Options for Unique Branding

Personalization is becoming a hallmark of modern hospitality. USA-based suppliers that offer customization options, such as embroidered logos, unique color palettes, or bespoke designs, can help your hotel stand out. Custom linens not only enhance the guest experience but also reinforce your property’s branding, creating a cohesive and memorable impression.

4. Sustainability and Eco-Friendly Practices

In today’s environmentally conscious market, partnering with a supplier that prioritizes sustainability is a smart move. Many USA hotel linen suppliers are adopting eco-friendly practices, offering organic cotton, recycled materials, and responsible sourcing. Choosing sustainable linens not only aligns with guest preferences but also supports your property’s green initiatives, enhancing your reputation as an environmentally friendly establishment.

5. Reliable Delivery and Inventory Management

Timely delivery is critical for maintaining smooth operations. USA-based linen suppliers should provide reliable shipping options and have efficient inventory management systems in place. Some suppliers even offer automated reordering solutions, ensuring that your hotel never faces a linen shortage. Partnering with a supplier known for on-time delivery and accurate order fulfillment can save time and reduce operational stress.

6. Competitive Pricing and Bulk Discounts

Cost-effectiveness is another vital factor when selecting a linen supplier. Look for USA-based wholesalers who offer competitive pricing, bulk discounts, and flexible payment terms. While affordability is important, it should never come at the expense of quality. A good supplier strikes the right balance between cost and value, helping your hotel maintain its budget without compromising guest satisfaction.

7. Exceptional Customer Support and Communication

Strong customer support can make all the difference in a long-term partnership. Choose a supplier who values open communication and provides prompt assistance for any queries or issues. USA-based suppliers with dedicated account managers or responsive customer service teams are better equipped to address your hotel’s unique needs and build a trustworthy relationship.

Selecting the right hotel linen supplier in the USA is about more than just finding a vendor—it’s about building a partnership that aligns with your hotel’s goals. By prioritizing quality, sustainability, reliability, and customization, you can ensure that your linens enhance the guest experience while streamlining operations. With the right supplier by your side, your hotel will be well-equipped to meet the demands of today’s competitive hospitality landscape.

2 notes

·

View notes

Text

Revolutionizing Transactions with PayWint Digital Wallet

In a world where convenience and efficiency dominate, the demand for reliable and feature-rich digital wallets has skyrocketed. Enter PayWint, the ultimate digital wallet solution designed to streamline your financial transactions while ensuring security and ease of use. Whether you're a student, traveler, freelancer, or small business owner, PayWint is here to revolutionize how you manage, send, and receive money.

Why Choose PayWint?

PayWint stands out in the crowded digital wallet space with its seamless features tailored to meet diverse user needs. From real-time alerts to AI-powered fraud detection, PayWint ensures your transactions are not just swift but also highly secure.

Key Features at a Glance:

Instant Money Transfers: Request, send, and receive money in real-time, making it the perfect companion for personal and professional needs.

Multi-Currency & Multi-Language Support: Operate effortlessly across borders, thanks to PayWint's global usability.

Shared Wallets: Split bills or manage group expenses with family, friends, or business partners through shared wallets.

Virtual & Physical Cards: Open a digital bank account and enjoy the convenience of virtual or physical cards.

Perfect for Everyone

PayWint caters to a diverse audience, ensuring inclusivity and functionality for all.

Students and Freelancers can use PayWint to manage international payments, ensuring they can receive funds from clients or family abroad without delays.

Small Business Owners can streamline payroll, vendor payments, and even customer transactions, all from one centralized platform.

Travel Enthusiasts can enjoy hassle-free currency conversions and transactions no matter where they are.

Unparalleled Integrations

One of PayWint's standout features is its ability to integrate with leading financial and payment platforms such as Apple Pay, Google Pay, PayPal, CashApp, and Venmo. Users can also link multiple bank accounts or credit and debit cards for effortless transactions. Moreover, businesses can integrate accounting platforms like QuickBooks, Zoho, or FreshBooks to simplify bookkeeping.

Enhanced Security & Real-Time Updates

Security is at the heart of PayWint. With encryption and AI-powered fraud detection, users can trust their financial data is always safe. Real-time alerts via text, email, or push notifications ensure you stay informed about every transaction.

Beyond Payments

PayWint isn't just a digital wallet; it's a comprehensive financial management tool. The AI-powered budget planner helps users track expenses and set financial goals. For businesses, the ability to schedule recurring payments and integrate payment widgets into websites adds unparalleled convenience.

Always There for You

With 24/7 customer support available via phone, email, text, and chat, help is always just a call or message away. You can reach us at (408) 516-1413 for any assistance. Whether it's a quick query or a technical issue, PayWint ensures you're never left in the dark.

Get Started with PayWint

Ready to transform how you handle money? Download the PayWint Digital Wallet Mobile App today from the Apple Store or Google Play Store. Alternatively, visit PayWint.com to access your financial world instantly.

2 notes

·

View notes

Text

A Guide to Building Your Ecommerce Website Effectively

Building an effective eCommerce website is a crucial step in creating a successful online business. The right design and functionality not only attract customers but also provide them with an enjoyable shopping experience. Wartiz Technologies, with its expertise in web development, can help you build an eCommerce development services platform that stands out in the competitive online market.

1. Define Your Goals and Audience

Before diving into the design and development, it’s essential to clearly define your business goals and target audience. Are you looking to sell products directly, provide a marketplace for other vendors, or offer a subscription-based service? Understanding these aspects will help shape the overall structure and features of your site.

At Wartiz Technologies, we work with you to pinpoint your objectives and ensure that your website reflects your vision while catering to your customer base's needs.

2. Choose the Right Platform

Selecting the right eCommerce platform is critical for long-term success. Popular options like Shopify, WooCommerce, and Magento offer various features, but it’s important to choose the one that aligns with your business needs. If you require a highly customizable site, WooCommerce or Magento might be ideal. For a simpler, user-friendly experience, Shopify could be the best fit.

Wartiz Technologies can guide you through these choices, considering factors like scalability, ease of use, payment integration, and product catalog management.

3. Design for User Experience

A user-friendly design is at the heart of every successful eCommerce website. It’s essential to create a clean, intuitive layout that makes navigation easy for visitors. The goal is to ensure that customers can quickly find what they’re looking for without getting frustrated.

Focus on:

Simplified Navigation: Categories, filters, and search options should be easily accessible.

Mobile Optimization: A mobile-friendly design is crucial as most shopping is now done on smartphones.

Visual Appeal: Use high-quality images and a consistent color scheme to match your brand.

Wartiz Technologies excels in creating responsive and visually appealing designs that enhance the overall user experience, ensuring that visitors stay engaged and convert into customers.

4. Optimize for Speed and Performance

Website performance plays a vital role in both user experience and search engine rankings. Slow-loading pages can frustrate visitors and lead to abandoned carts. Optimizing images, enabling caching, and using content delivery networks (CDNs) are some strategies to ensure fast load times.

Wartiz Technologies employs best practices to optimize the performance of your eCommerce site, reducing bounce rates and improving your site's overall effectiveness.

5. Implement Secure Payment Gateways

Security is a significant concern for online shoppers. Ensuring that your site is equipped with secure payment gateways is crucial to protect sensitive customer data. Popular options like PayPal, Stripe, and Authorize.Net offer safe and seamless payment processing.

We prioritize security at Wartiz Technologies by integrating reliable payment solutions and enabling SSL encryption to safeguard transactions.

6. SEO and Content Strategy

Search engine optimization (SEO) is fundamental for driving organic traffic to your site. Your eCommerce website should be optimized for relevant keywords, product descriptions, and alt tags for images. A well-structured content strategy with blogs, guides, and customer reviews can also improve rankings.

Our team at Wartiz Technologies ensures that your eCommerce site is SEO-friendly, helping you reach a wider audience and increase visibility in search engine results.

7. Analytics and Continuous Improvement

Once your website is live, tracking its performance is essential to understanding customer behavior and identifying areas for improvement. Tools like Google Analytics provide insights into traffic, sales, and user interactions.

Wartiz Technologies offers ongoing support to help you analyze data, make informed decisions, and implement continuous improvements to maximize sales and customer satisfaction.

Conclusion

Building an eCommerce development services for website that delivers a seamless shopping experience and drives business growth requires careful planning, the right tools, and expert implementation. Wartiz Technologies is here to help you navigate the process, ensuring that your website is optimized for both user experience and business success.

Whether you’re starting from scratch or looking to improve your existing site, contact Wartiz Technologies to turn your eCommerce vision into a reality.

#Utility Billing Software#Wartiz Technologies#IT company Mohali#Ecommerce Development Services#Online Marketing Services#Digital Marketing Services

2 notes

·

View notes

Text

What Are the Best Payout Solutions for Your Business?

In today’s fast-paced digital economy, businesses of all sizes need efficient and secure payout solutions to manage their financial transactions. Whether you're running a small e-commerce store, a large enterprise, or providing services in the gig economy, selecting the right payout solution is crucial. From disbursing salaries to paying vendors or customers, a seamless payout process can enhance trust and streamline operations.

In this article, we will explore the best payout solutions for businesses, focusing on their features, benefits, and how they cater to diverse business needs. We’ll also touch upon the importance of working with a reliable micro ATM service provider and highlight Xettle Technologies as an example of innovation in this space.

Understanding Payout Solutions

Payout solutions refer to systems or platforms that facilitate the transfer of funds from a business to its employees, partners, customers, or vendors. These solutions are essential for ensuring smooth financial transactions and reducing manual intervention. Modern payout solutions are designed to be flexible, secure, and capable of handling high transaction volumes with ease.

The best payout solution for your business will depend on several factors, including the size of your company, the frequency of payouts, and the geographical location of your recipients. Let’s dive into the key elements to consider when selecting the right solution.

Features of Effective Payout Solutions

Multi-Channel Accessibility A good payout solution should support multiple payment channels, such as bank transfers, mobile wallets, UPI, and cards. This ensures that your business can cater to the diverse preferences of your recipients.

Scalability As your business grows, your payout needs will evolve. A scalable solution can accommodate increasing transaction volumes without compromising on speed or security.

Security and Compliance Protecting sensitive financial data is paramount. Choose a payout solution that complies with industry standards and regulatory requirements, ensuring the safety of your transactions.

Integration Capabilities Seamless integration with your existing systems, such as accounting software or enterprise resource planning (ERP) tools, can simplify operations and improve efficiency.

Real-Time Processing In today’s competitive environment, real-time payouts can be a game-changer. Recipients value quick access to their funds, making this a must-have feature.

Types of Payout Solutions

1. Bank Transfers

This is one of the most common methods, offering a direct and secure way to transfer funds to recipients' bank accounts. However, it may not be ideal for real-time payouts due to processing times.

2. Digital Wallets

Digital wallets like Paytm, Google Pay, and others provide a convenient and fast way to transfer funds. They are particularly popular in regions with high mobile penetration.

3. Prepaid Cards

Prepaid cards are a versatile option that allows businesses to load funds for employees or customers. They can be used for shopping or cash withdrawals.

4. Micro ATM Services

For businesses operating in rural or remote areas, a micro ATM service provider can be a game-changer. These services enable cash disbursements even in areas with limited banking infrastructure, bridging the financial inclusion gap.

How Micro ATM Service Providers Add Value

Micro ATM service providers are transforming the way businesses manage payouts in underbanked regions. These portable devices allow users to perform basic banking functions, such as cash withdrawals, balance inquiries, and fund transfers. By partnering with a reliable micro ATM service provider, businesses can expand their reach and cater to rural audiences effectively.

For instance, a small-scale retailer or a government agency can use micro ATM services to disburse payments to beneficiaries without requiring them to travel long distances to access banking facilities. This enhances convenience and boosts trust among recipients.

A Spotlight on Xettle Technologies

Xettle Technologies has emerged as a leader in the payout solutions space, offering innovative platforms that cater to diverse business needs. Their solutions are designed to enhance operational efficiency and provide a seamless experience for businesses and recipients alike. By leveraging advanced technology, Xettle Technologies ensures secure, real-time payouts while simplifying the integration process for businesses.

Choosing the Right Payout Solution

Selecting the best payout solution requires careful consideration of your business’s specific needs. Here are some steps to guide you:

Assess Your Requirements Determine the frequency and volume of payouts your business handles. This will help you identify a solution that matches your operational scale.

Evaluate Security Measures Ensure the platform offers robust encryption, fraud detection, and compliance with financial regulations.

Test for User-Friendliness The solution should be easy to use for both your team and your recipients. Look for platforms with intuitive interfaces and reliable customer support.

Consider Costs Compare the transaction fees, setup costs, and other charges associated with different solutions. Opt for one that offers value for money without compromising on quality.

Final Thoughts

Choosing the right payout solution is not just about facilitating transactions; it’s about building trust and ensuring smooth financial operations. Whether you’re looking for traditional methods like bank transfers or innovative options like micro ATM services, the key lies in understanding your business needs and selecting a partner that aligns with your goals.

From scalability to security, modern payout solutions offer a range of features that can empower your business to operate efficiently in a competitive landscape. By leveraging the right tools and technologies, such as those offered by Xettle Technologies, you can simplify your payout processes and focus on growing your business.

2 notes

·

View notes

Text

Bookkeeping in India by MASLLP: Simplify Your Financial Management

In today’s fast-paced business environment, maintaining accurate financial records is essential for businesses to succeed and grow. Efficient bookkeeping helps track income, expenses, and overall financial performance, ensuring compliance with legal requirements. MASLLP, a trusted name in financial solutions, offers top-notch bookkeeping services in India tailored to meet the diverse needs of businesses.

Why Choose MASLLP for Bookkeeping in India?

Expertise in Financial Management With a team of experienced professionals, MASLLP specializes in delivering bookkeeping solutions that cater to businesses of all sizes. Whether you are a startup or an established enterprise, their team ensures precision and timeliness in managing your financial records.

Tailored Solutions for Every Business MASLLP understands that every business is unique. Their bookkeeping services are customized to match your specific needs, whether you require basic record-keeping or comprehensive financial management.

Compliance with Indian Accounting Standards Navigating the complexities of Indian accounting laws and regulations can be challenging. MASLLP ensures full compliance with Indian Accounting Standards (Ind AS), GST norms, and other legal requirements, saving you from potential financial and legal troubles.

Cost-Effective and Scalable Services By outsourcing bookkeeping to MASLLP, businesses can save on hiring in-house staff and investing in expensive accounting software. Their services are scalable, allowing your bookkeeping requirements to grow with your business.

Bookkeeping Services Offered by MASLLP

Recording Transactions MASLLP ensures all financial transactions, including sales, purchases, receipts, and payments, are accurately recorded.

Bank Reconciliation Their experts reconcile your bank statements with your financial records to detect and resolve discrepancies.

Accounts Payable and Receivable Management MASLLP manages invoices, vendor payments, and customer collections to keep your cash flow healthy.

Financial Reporting Generate accurate financial statements, including profit and loss statements, balance sheets, and cash flow reports, for better decision-making.

GST Compliance and Filing Stay ahead with GST-compliant bookkeeping and timely filing of GST returns to avoid penalties.

Payroll Processing Simplify your payroll management with error-free calculation of salaries, taxes, and benefits.

Benefits of Bookkeeping in India to MASLLP Focus on Core Business Activities: Leave the complexities of bookkeeping to the experts while you concentrate on growing your business. Accurate Financial Insights: Make informed decisions with real-time, error-free financial data. Timely Compliance: Avoid penalties with on-time tax filings and compliance updates. Reduced Overheads: Save money on hiring and training in-house accounting staff. Why Bookkeeping is Crucial for Businesses in India Bookkeeping is not just about maintaining records; it’s the foundation of sound financial management. It helps businesses:

Monitor cash flow effectively. Plan budgets and allocate resources. Ensure tax compliance. Detect fraud and prevent financial mishaps. By partnering with MASLLP for bookkeeping in India, you ensure your business operates smoothly, remains compliant, and is prepared for growth.

#accounting & bookkeeping services in india#audit#businessregistration#chartered accountant#foreign companies registration in india#income tax#auditor#taxation#ap management services

6 notes

·

View notes

Text

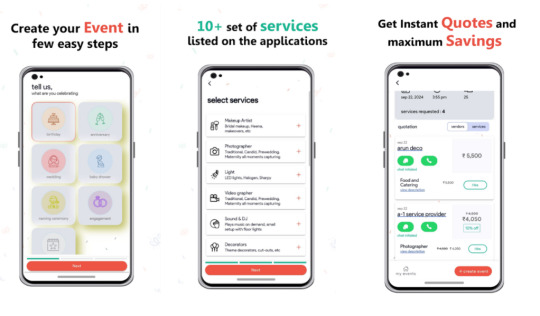

🎉 Say Hello to Seamless Event Planning with Ootbo App! 🎉

Planning an event can feel like juggling too many tasks at once. From finding the perfect venue to managing vendor communications and staying within budget, it’s easy to get overwhelmed. But what if you had an app that handled everything in one place? Enter the Ootbo App—the ultimate event planning tool designed to make organizing events stress-free, seamless, and fun! 🎈

Whether you’re planning a wedding, corporate event, birthday party, or any special occasion, the Ootbo App is your go-to solution for managing every aspect of the event planning process. 🗓️✨

🌟 Why Choose Ootbo App?

Gone are the days of switching between multiple apps, emails, and spreadsheets. Ootbo App simplifies the entire event planning process, from start to finish. Here’s how:

1. Create Events Effortlessly 🎨

Ootbo offers an intuitive interface that allows you to create detailed events in minutes. Simply input event details, set the date and time, and let Ootbo do the rest. 💡 Pro Tip: Customize your event profile to include specific requirements and preferences for vendors!

2. Receive Multiple Vendor Quotes 💼

Why chase down vendors when they can come to you? With Ootbo, you can: 🔍 Post your event requirements. 📩 Receive multiple quotes from verified vendors. 📊 Compare options side-by-side to choose the best fit.

This saves you time and ensures you get competitive pricing without the hassle of endless phone calls. 📞

3. In-App Vendor Chats 💬

Communication is key when planning an event, and Ootbo has you covered! 📱 Chat with potential vendors directly through the app. 📋 Discuss availability, services, and pricing in real time. 📎 Share documents, photos, and event details seamlessly.

Forget the confusion of scattered email threads—Ootbo keeps all your conversations in one place, organized and easy to access.

4. In-App Calls for Quick Decisions 📞

Sometimes, a quick call can make all the difference. Ootbo allows you to: 🔊 Make in-app calls to vendors without sharing personal contact details. 📌 Record important discussions and reference them later. 📈 Keep all event-related calls connected to your event profile.

No more searching through your call history for vendor numbers—everything stays in the app!

5. Hire Vendors with Confidence 🤝

Once you’ve reviewed quotes and discussed details, hiring your chosen vendor is as easy as a tap! 📄 Securely finalize agreements within the app. 💳 Pay vendors through a secure payment gateway. 🔒 Enjoy peace of mind knowing your transactions are protected.

With Ootbo, you’re not just hiring vendors—you’re partnering with professionals who are ready to make your event a success! 🎉

🏆 The Benefits of Using Ootbo App

All-in-One Solution: Manage your event from creation to completion in a single app.

Time-Saving: No more endless emails, phone calls, or spreadsheets.

Competitive Pricing: Receive and compare quotes to get the best value for your budget.

Seamless Communication: Chat and call vendors directly within the app.

Secure Transactions: Make payments and finalize contracts with confidence.

🎯 Who Can Use Ootbo?

Ootbo is designed for everyone! Whether you’re:

👰 Planning a wedding. 🏢 Organizing a corporate event. 🎂 Hosting a birthday party. 🎭 Coordinating a community event.

Ootbo App is your trusted event planning companion.

📲 Download the Ootbo App Today!

Ready to take the stress out of event planning? Download the Ootbo App today and experience the future of event management!

🔗 Visit Ootbo App to learn more. 📱 Available on iOS and Android.

Make your next event unforgettable with Ootbo! 🎉

With the Ootbo App, event planning has never been easier or more efficient. Start planning your dream event today! 🎈

#vent planning app#Best event management tool#Event vendor management#In-app vendor communication#Compare event vendor quotes#Event budget management app#Online event planning solution#Seamless event planning app#Event planning made easy#Chat with event vendors#Event organizer tool#Hire vendors online#Manage events from mobile#Event planning software for Android & iOS#ow to plan events with a mobile app#Best app to hire event vendors#Manage event budgets and vendors in one app#Event planning solution for weddings and parties#Secure in-app payments for event vendors

2 notes

·

View notes

Note

hi please let me pay u somehow if u answer this because i for the life of me cannot find this out and i’m pretty sure this isn’t the kind of thing u do but

what was the primary demographic of newspaper vendors in the 18th century? how much people got their papers through subscription over buying them off the street? did people usually stay “loyal” to one publisher or did they read multiple at a time? where would you usually see vendors?

sweats profusely

okay so yeah this is really hard to find information because it was such an every day part of life that people didn't really think to document it, so i've definitely had to dig. also it is the kind of thing i do!! this is very much within my area of study, and i've even been known to answer asks outside of that, so no worries! also don't pay me, i'm too southern to accept your money. also because of the lack of resources on this, i've really only been able to 18th century North America, but you might be able to find some information on my notes on Eric Hazan's A People's History of the French Revolution in this here doc.

So, first things first, what was the primary demographic od newspaper vendors in the 18th century?

This all really depends on what newspaper your talking about, what part of the 18th century, and where it was published. Newspapers in the early part of the century were mostly confined to the town they were published in, and featured a variety of subjects of interest to that community. At the beginning of the century, the only newspaper was the Boston News-Letter which was directly curated to Puritan readers. On a larger scale, newspapers coming from England were intended for English gentlemen, not colonists.

In several critical historical moments, such as the American pre-Revolution (1760s-early 1770s), politics became hyper-relevant and the papers began to be marketed to the masses, with language being more simplified for wider understanding. Critical documents such as Common Sense by Thomas Paine were published in this period.

Aside from this, it can be inferred by the price and the movement to make them more accessible to the masses that they were most often read by the middle to upper classes. Many newspapers were created with the almost exclusive purpose of making money, so having a well funded subscriber base was crucial.

We also see later in the century that the government gave sanctions to make newspapers more accessible financially, by creating a monopoly on paper distribution which would eventually become the postal service we know today.

This postal service is also relevant to your next question: how many people got their newspapers by subscription vs buying on the street?

This also seems to be a regional thing, but newspaper subscriptions seem to become more frequent throughout the century, as we see government acts such as the Postal Clause in the US Constitution and the Post Office Act of 1792, which made subscription-based newspaper delivery easier. That indicates that more people were purchasing newspapers through subscription. Newspapers also tended to be quite expensive, so most people would share copies of the papers that they got through their subscription services.

Additionally, many people got their news outside of newspapers, due to this high price. There were also public readings of printed materials (printers usually published other forms of literature besides just newspapers) in coffeehouses, taverns, and in the streets. These readers probably also advertised the papers they were reading! so people could buy them there.

Now the next question is what I found most difficult: were people loyal to one newspaper or did they read multiple papers?

I think the only way to find this out would be to look at subscription records, but I haven't come across records from the newspaper offices, so I'd think to know for sure you'd have to look at individuals' purchase records and no one has time for that.

However, my own personal knowledge of history can come into play here. Like I said before, newspapers were usually confined to the local area. In the Revolutionary period, people usually read political newspapers that adhered to their personal beliefs, with Tories reading Loyalist papers and Whigs reading Patriot papers. These are the papers that would publish radical and exciting news accusing people of being in the opposing party, which would prompt riots, boycotts, and yk. tarring and feathering.

In the Early Republic, we see the same partisan split but with Federalists and Democratic Republicans. The Federalist paper was the Gazette of the United States and the Republican paper was the National Gazette. These two papers frequently attacked each other, and there were smaller, more local papers based off the information that they published.

Now where would you usually see vendors?

I mentioned public readings before, and that seems to be a very frequent source of purchasing newspapers. Printers also tended to have stores that also functioned as their offices, with their presses in the back or in the basements. They would also sell merchandise, groceries, and patent medicines. These would be just like normal stores in the cities! So people walking the streets would pass by them along with taverns, coffee houses, law offices, etc.

I hope this gives you all you need, feel free to ask further questions, because I'd be happy to answer them. Again, information on this kind of thing tends to be scarce, but this is what makes history research fun! Thank you for the ask :3

17 notes

·

View notes

Text

Secret Email System Review: The Ultimate Guide to Building a Profitable Online Business with Email Marketing

Introduction: Secret Email System Review

Email marketing functions as one of the most potent digital resources for developing profitable online businesses in present-day society. Numerous people admit they fail to succeed effectively with email marketing techniques. The Secret Email System operates as the solution for these needs. Through the innovative creation of Matt Bacak you can now achieve simplified email marketing which generates steady online income even without prior experience.

The purpose of this extensive analysis is to examine all aspects of the Secret Email System including its capabilities and business advantages and the ways it reshapes online startups. The upcoming guide exists to support your decision regarding this product’s purchase regardless of your experience level.

Overview: Secret Email System Review

Vendor: Matt Bacak

Product: Secret Email System

Front-End Price: Only $5.60 Today

Bonus: Yes

Niche: Affiliate Marketing, Email Marketing, Content Marketing, Email Campaigns

Guarantee: 30-days money-back guarantee!

Recommendation: Highly recommended

Contact Info: Email me

What is the Secret Email System?

The Secret Email System provides students with a systematic teaching approach to develop sustainable online businesses based on email marketing techniques. Using his wealth of experience in online marketing Matt Bacak developed The Secret Email System. The system enables people to achieve financial independence without requiring any website presence or social media followers or a big audience.

Email marketing enables the program to construct enduring connections with audiences that generate regular sales beyond basic strategies. Persons seeking an escape from their everyday jobs while building autonomous revenue can use Commission Hero to create their goals.

#EmailMarketing#OnlineBusiness#EmailSystem#DigitalMarketing#MarketingStrategy#BusinessGrowth#EntrepreneurTips#PassiveIncome#EmailListBuilding#MarketingAutomation#SecretEmailSystem#ProfitableBusiness#ContentMarketing#EmailCampaigns#LeadGeneration#SmallBusinessTips#AffiliateMarketing#OnlineIncome#BusinessSuccess#EmailMarketingTips#WorkFromHome#EntrepreneurLife#MarketingSuccess

1 note

·

View note