#starting a startup in india

Text

Unleashing the Potential: Investing in Emerging Startups in India

India's startup ecosystem has witnessed exponential growth in recent years, fueled by a combination of innovation, entrepreneurship, and investment. As the country continues to position itself as a global hub for startups, investors are increasingly recognizing the vast potential and opportunities that India's burgeoning startup landscape offers. In this blog, we'll explore why investing in startups in India is an attractive proposition, the factors driving the growth of the startup ecosystem, and the benefits of supporting emerging startups in India.

The Rise of Startups in India

India has emerged as one of the world's fastest-growing startup ecosystems, with thousands of new startups being launched across various sectors every year. From technology and e-commerce to healthcare and fintech, Indian startups are disrupting traditional industries, driving innovation, and creating new opportunities for economic growth and job creation.

Why Invest in Startups in India?

1. Massive Market Potential: With a population of over 1.3 billion people and a rapidly growing middle class, India presents a vast and untapped market for startups to scale and expand their businesses.

2. Growing Consumer Demand: Rising disposable incomes, increasing internet penetration, and changing consumer preferences are driving demand for innovative products and services, creating lucrative opportunities for startups in India.

3. Abundant Talent Pool: India boasts a large pool of highly skilled and talented entrepreneurs, engineers, and professionals, many of whom have been educated at top universities and institutions both domestically and abroad.

4. Government Support and Initiatives: The Indian government has launched various initiatives and programs, such as Startup India and Make in India, to promote entrepreneurship, facilitate funding, and foster growth in the startup ecosystem.

5. Thriving Innovation Ecosystem: India is home to numerous incubators, accelerators, co-working spaces, and startup hubs that provide support, mentorship, and resources to entrepreneurs and startups at various stages of their journey.

6. Low Entry Barriers: Compared to other markets, the cost of starting and scaling a business in India is relatively low, thanks to factors such as affordable talent, office space, and infrastructure.

7. High Return Potential: While investing in startups inherently carries risks, successful investments in Indian startups have the potential to generate significant returns for investors due to the rapid growth and scalability of these companies.

8. Diverse Investment Opportunities: Indian startups span a wide range of industries and sectors, offering investors diverse opportunities to allocate capital and build a diversified portfolio tailored to their investment objectives and risk tolerance.

9. Strategic Partnerships and Collaborations: Investing in startups allows investors to establish strategic partnerships and collaborations with innovative companies, gain exposure to new technologies and trends, and leverage synergies for mutual benefit.

10. Social Impact: Many Indian startups are addressing pressing social and environmental challenges, such as access to healthcare, education, clean energy, and financial inclusion, making investment in these startups not only financially rewarding but also socially impactful.

Factors Driving the Growth of the Startup Ecosystem in India

1. Digital Transformation: The rapid adoption of digital technologies, mobile internet, and e-commerce platforms has created new opportunities for startups to disrupt traditional industries and address emerging market needs.

2. Venture Capital and Private Equity Investment: Increasing investment from domestic and international venture capital firms, private equity investors, and angel investors has provided startups in India with the capital and resources.

3. Government Policies and Initiatives: Pro-entrepreneurship policies, regulatory reforms, and initiatives such as Startup India, Make in India, and Digital India have created a conducive environment for startups to thrive and flourish in India.

4. Globalization and Market Access: Indian startups are not only targeting the domestic market but also expanding internationally, leveraging technology and digital platforms to reach customers and clients across borders.

5. Entrepreneurial Culture and Mindset: There is a growing culture of entrepreneurship and risk-taking in India, with more individuals choosing to pursue entrepreneurship as a career path and create their own startups.

6. Industry Collaboration and Support: Collaboration between startups, corporates, academia, and government institutions has facilitated knowledge sharing, skill development, and innovation in the startup ecosystem.

7. Access to Talent and Mentorship: Startups in India have access to a diverse pool of talent, mentorship, and support networks, including experienced entrepreneurs, industry experts, and investors who provide guidance and mentorship to startups.

8. Technology Infrastructure: The availability of affordable and accessible technology infrastructure, including cloud computing, mobile connectivity, and digital payment systems, has empowered startups to build and scale innovative solutions rapidly.

9. Evolving Consumer Behavior: Changing consumer preferences, lifestyles, and behaviors are driving demand for innovative products and services, creating opportunities for startups to cater to evolving market needs and preferences.

10. Resilience and Adaptability: Despite challenges such as regulatory hurdles, market volatility, and economic uncertainty, Indian startups have demonstrated resilience, adaptability, and agility in navigating obstacles and seizing opportunities for growth.

Investing in Eco-Friendly Startups in India

1. Renewable Energy and CleanTech: Investing in startups that develop renewable energy solutions, such as solar, wind, and hydroelectric power, and clean technologies to reduce environmental impact and promote sustainable development.

2. Circular Economy and Waste Management: Supporting startups that focus on recycling, waste management, and circular economy solutions to minimize waste generation, conserve resources, and promote sustainable consumption and production.

3. Sustainable Agriculture and FoodTech: Investing in startups that leverage technology and innovation to promote sustainable agriculture practices, reduce food waste, and address food security and nutrition challenges.

4. Green Transportation and Mobility: Supporting startups that develop electric vehicles, shared mobility solutions, and smart transportation systems to reduce carbon emissions, alleviate traffic congestion, and improve air quality.

5. Water Conservation and Management: Investing in startups that provide solutions for water conservation, purification, and management to address water scarcity, pollution, and access challenges in India and globally.

6. Climate Change Mitigation and Adaptation: Supporting startups that develop climate change mitigation and adaptation solutions, such as carbon capture and storage, climate-resilient infrastructure, and disaster preparedness technologies.

7. Sustainable Fashion and Apparel: Investing in startups that promote sustainable fashion and apparel practices, such as eco-friendly materials, ethical sourcing, and circular fashion models, to reduce environmental impact and promote ethical consumption.

8. Health and Wellness: Supporting startups that focus on promoting health and wellness through sustainable and holistic approaches, including preventive healthcare, mental health awareness, and wellness technology solutions.

9. Education and Awareness: Investing in startups that develop educational tools, platforms, and content to raise awareness about environmental issues, sustainability, and responsible consumption among consumers, businesses, and communities.

10. Impact Measurement and Reporting: Supporting startups that develop tools and technologies for measuring, monitoring, and reporting on environmental and social impact, enabling investors to make informed decisions and track the progress of their investments.

In conclusion, investing in startups in India presents a compelling opportunity for investors to capitalize on the country's dynamic and rapidly evolving startup ecosystem. With a combination of market potential, innovation, talent, and government support, India offers a fertile ground for startups to thrive and succeed, driving economic growth, job creation, and social impact. By supporting emerging startups in India, investors can not only generate attractive financial returns but also contribute to building a more sustainable, inclusive, and prosperous future for generations to come.

This post was originally published on: Foxnangel

#startups in india#starting a startup in india#registering a startup in india#investing in startups in india#investing in startups#make in india#fdi in india#franchise in india#foxnangel

0 notes

Text

Discover the convenience of online laundry service in Hyderabad with PKC Laundries. Schedule pickups, enjoy eco-friendly cleaning, and have your clothes delivered to your door. Experience hassle-free laundry and reclaim your free time today

#startup#laundry#dry cleaning#hyderabad#stain removal#india#doorstepdelivery#steam iron#hyderabad news#start up

2 notes

·

View notes

Text

Discover the essential steps to start a company in India with Maksim Consulting. Expert guidance to ensure a smooth startup registration process. Call us.

0 notes

Text

A4 Copier Paper Manufacturing Business Plan

Want to know how to make paper pay off? 📝 Learn how to start your own A4 Copier Paper Manufacturing Business and unlock a world of opportunities! 🌟 Hit follow and stay tuned for more business insights! 📲 #EntrepreneurGoals #BusinessGrowth #SideHustle

Paper is widely used in our daily lives and despite the transition to digital media, the demand for paper continues to increase. And A4 paper is the largest paper in the world. It is used for many documents, including magazines, catalogues, articles and documents belonging to various businesses and organizations. Therefore, starting an A4 paper business is a profitable business. So, If you’re…

#A4 Copier Paper Manufacturing#a4 paper making machine#a4 paper manufacturing business plan#a4 paper manufacturing in india#a4 size paper business plan#a4 size paper wholesale business#business ideas#Business Opportunities#copier paper business#Copier Paper Production#entrepreneurship#How to Start a Paper Business#how to start a4 paper business#how to start an a4 copier paper manufacturing business#manufacturing business ideas in india#Manufacturing Process#Paper Industry in India#Paper Manufacturing Business#small business ideas#startup ideas#𝐗𝐞𝐫𝐨𝐱 𝐏𝐚𝐩𝐞𝐫 business

0 notes

Text

What content is included in idea- stage startups pitch desk?

Most entrepreneurs understand that they must have a killer pitch that impresses investors in order to achieve their desired level of success. A startup pitch deck gives investors the ability to identify the best high-value, low-risk investment opportunities. To accelerate growth, create prototypes and expand their business, an idea-stage firm must raise money.

#startups in india#startups#company registration#Business Registration#How to start a business in India

0 notes

Text

Trademark Registration in Jayanagar & JP Nagar

Comprehensive Trademark Registration services for businesses in Jayanagar & JP Nagar. Ensure your brand's exclusivity. Connect with us for expert assistance.

#trademark registration near JP Nagarr#online trademark filing JP Nagarr#file trademark online JP Nagarr#JP Nagarr trademark registration#JP Nagarr trademark application process#JP Nagarr trademark filing services#trademark registration jp nagar bangalore#file trademark near jp nagar#affordable trademark lawyer jp nagar#startup trademark registration jp nagar#register brand name jp nagar#how to choose a trademark in bangalore#common trademark mistakes to avoid#trademark search online india#how much does it cost to register a trademark in jp nagar#get a free trademark consultation jp nagar#start trademark registration online#check trademark availability india#download trademark application form#compare trademark filing services jp nagar

0 notes

Text

Funding Scheme 2023 | Seed Funding | Expertbells

The "Startup India Seed Fund Scheme (SISFS) 2024" is a cornerstone of the broader Startup India initiative, designed to empower early-stage startups by providing essential seed funding. Eligibility criteria for the scheme ensure inclusivity, allowing a diverse range of entrepreneurs to benefit. Under the Startup India Seed Fund Scheme, startups meeting specified criteria can access crucial financial support, fostering innovation and entrepreneurship across various sectors. The amount available through the scheme plays a pivotal role in catalyzing these early-stage ventures. By strategically injecting funds into promising startups, the initiative aims to propel technological advancements, job creation, and economic growth. The "Startup India Seed Fund Scheme 2024" reflects the government's commitment to nurturing a dynamic startup ecosystem in India, positioning the country as a global leader in entrepreneurship.

#startup india seed fund scheme eligibility#seed fund scheme startup india#startup india seed fund scheme amount#start up india seed fund scheme

0 notes

Text

Unlocking Growth: A Deep Dive into Venture Capital and Its Types

Title: Unlocking Growth: A Deep Dive into Venture Capital and Its Types

Introduction:

Venture capital (VC) plays a pivotal role in fueling innovation and driving economic growth by providing funding to early-stage, high-potential startups. This dynamic form of financing involves investors injecting capital into promising businesses in exchange for equity, often taking on a level of risk that traditional lenders might shy away from. In this blog, we'll explore the fundamentals of venture capital and delve into the various types that shape the entrepreneurial landscape.

I. What is Venture Capital?

At its core, venture capital is a type of private equity financing that supports startups and small businesses with high growth potential. Unlike traditional financing methods such as loans, venture capital involves investors taking an ownership stake in the companies they fund. This investment model aligns the interests of both parties, as the success of the startup directly correlates with the profitability of the venture capital firm.

II. Types of Venture Capital:

Seed Funding:

Definition: Seed funding is the initial capital provided to startups in their earliest stages of development.

Purpose: Used to conduct market research, develop a prototype, and establish a business model.

Investors: Angel investors and early-stage venture capital firms are common sources of seed funding.

Early-Stage Venture Capital:

Definition: This type of funding is provided to startups that have moved beyond the seed stage and have a proven business model.

Purpose: Used to scale operations, refine products, and expand market reach.

Investors: Venture capital firms specializing in early-stage investments.

Late-Stage Venture Capital:

Definition: Late-stage venture capital is injected into startups that have achieved a certain level of success and are gearing up for a significant expansion.

Purpose: Used for market consolidation, global expansion, and preparation for an initial public offering (IPO).

Investors: Larger venture capital firms, private equity firms, and sometimes corporations seeking strategic investments.

Mezzanine Financing:

Definition: Mezzanine financing is a hybrid form of funding that combines elements of debt and equity financing.

Purpose: Typically used to support a company's rapid growth, acquisitions, or a management buyout.

Investors: Institutional investors and specialized mezzanine funds.

Corporate Venture Capital (CVC):

Definition: CVC involves established corporations investing in or acquiring startups to gain strategic advantages.

Purpose: Enhances innovation, fosters partnerships, and provides access to emerging technologies.

Investors: Large corporations seeking to stay ahead in their industries.

Social Venture Capital:

Definition: Social venture capital is dedicated to funding businesses that have a positive impact on society or the environment.

Purpose: Supports social enterprises and sustainable business models.

Investors: Impact investors and foundations with a focus on social responsibility.

Conclusion:

Venture capital serves as a catalyst for innovation, enabling startups to bring groundbreaking ideas to fruition. From the seed stage to late-stage investments, the diverse types of venture capital play distinct roles in nurturing entrepreneurial ventures. As the global business landscape continues to evolve, venture capital will remain a driving force behind the growth and success of the most promising startups.

#startups#startup india#start funding#marketing#frenchise#entrepreneur#expo#delhi#business expo#accounting

0 notes

Text

Startup India: A Resource for Aspiring Entrepreneurs

Startup India is a government initiative to boost entrepreneurship and economic development in India. The program provides resources and support to aspiring entrepreneurs, helping them to turn their ideas into successful businesses. Startup India is about creating prosperity in India by unleashing the potential of its people. and Startup India aims to foster prosperity in India by empowering enterprising individuals to realize their business dreams.

1 note

·

View note

Text

5 Impactful Investing Opportunities in India in 2024

Investing in startups in India has emerged as a promising avenue for investors seeking high-growth opportunities and impactful returns. With a vibrant entrepreneurial ecosystem, technological innovation, and supportive government policies, India offers a conducive environment for startup investments. In this comprehensive guide, we will explore five impactful investing opportunities in India in 2024, providing insights into emerging trends, sectors, and investment strategies that have the potential to generate significant returns and drive positive societal impact.

1. Fintech Innovation:

Fintech, or financial technology, is one of the most dynamic and rapidly evolving sectors in India's startup ecosystem. With the proliferation of smartphones, internet connectivity, and digital payment infrastructure, fintech startups are revolutionizing the way people access financial services, manage their finances, and conduct transactions. Opportunities abound in areas such as digital banking, mobile payments, peer-to-peer lending, robo-advisory services, and blockchain-based solutions. Investing in fintech startups allows investors to capitalize on India's digital transformation, financial inclusion initiatives, and the transition towards a cashless economy. By supporting innovative fintech solutions, investors can drive financial empowerment, promote economic growth, and create value for underserved segments of the population.

Here's a detailed explanation of why fintech innovation is an impactful investing opportunity in India in 2024:

1. Digital Transformation of Financial Services:

Fintech startups are at the forefront of India's digital transformation journey, offering innovative solutions to meet the evolving needs of consumers and businesses in the financial services sector. With the widespread adoption of smartphones, internet banking, and digital payment platforms, fintech startups are leveraging technology to deliver seamless, accessible, and user-friendly financial services, including digital banking, mobile payments, remittances, wealth management, and insurance.

2. Financial Inclusion and Access:

Fintech innovation is driving financial inclusion and expanding access to financial services for underserved and unbanked segments of the population in India. By leveraging mobile technology, biometric authentication, and digital KYC (Know Your Customer) processes, fintech startups are overcoming traditional barriers to banking, enabling individuals and businesses in remote areas to open bank accounts, access credit, make digital payments, and manage their finances more effectively.

3. Disruption of Traditional Banking Models:

Fintech startups are disrupting traditional banking models and challenging incumbents by offering agile, customer-centric, and cost-effective alternatives to traditional banking services. Digital-only banks, peer-to-peer lending platforms, and fintech-driven lending solutions are gaining traction among tech-savvy consumers and millennials who prioritize convenience, transparency, and personalized financial services.

4. Innovation in Payment Systems:

Fintech startups are driving innovation in payment systems and reshaping the payments landscape in India. Mobile wallets, UPI (Unified Payments Interface), contactless payments, and QR code-based payment solutions have transformed the way people transact and conduct business, offering speed, security, and interoperability across different payment platforms. Fintech startups are also exploring emerging technologies such as blockchain and cryptocurrency to enable cross-border payments, reduce transaction costs, and enhance financial inclusion.

5. Wealth Management and Investment Solutions:

Fintech startups are democratizing access to wealth management and investment solutions, making it easier for individuals to invest in stocks, mutual funds, and other financial instruments. Robo-advisors, algorithmic trading platforms, and online investment platforms offer personalized investment advice, portfolio management services, and automated investment strategies tailored to individual risk profiles and investment goals.

6. Regulatory Support and Innovation Sandbox:

The Indian government and regulatory authorities have been supportive of fintech innovation, introducing policies and regulatory frameworks to promote digital payments, encourage fintech investments, and foster innovation in the financial services sector. Initiatives such as the Regulatory Sandbox Framework and the Bharat Bill Payment System (BBPS) provide a conducive environment for fintech startups to test innovative solutions, collaborate with traditional financial institutions, and scale their operations while ensuring compliance with regulatory requirements.

7. Global Expansion and Market Opportunities:

Fintech startups in India are well-positioned to expand their footprint and tap into global markets, leveraging India's strong technology talent pool, English-speaking workforce, and growing reputation as a fintech hub. With increasing investor interest, strategic partnerships, and cross-border collaborations, Indian fintech startups have the opportunity to scale their operations internationally, address global challenges, and drive financial inclusion and innovation on a global scale.

2. Healthcare Technology:

Healthcare technology, or healthtech, is experiencing unprecedented growth and innovation in India, fueled by factors such as rising healthcare costs, increasing chronic diseases, and the need for accessible and affordable healthcare solutions. Healthtech startups are leveraging technologies such as artificial intelligence, telemedicine, remote monitoring, and electronic health records to improve healthcare delivery, diagnosis, and patient outcomes. Investing in healthtech startups offers investors the opportunity to address critical healthcare challenges, enhance access to quality healthcare services, and promote preventive care and wellness. By supporting innovative healthtech solutions, investors can contribute to improved healthcare access, reduced healthcare costs, and better health outcomes for millions of people across India.

Here's a detailed explanation of why healthcare technology presents an impactful investing opportunity in India in 2024:

1. Addressing Healthcare Challenges:

India faces significant healthcare challenges, including inadequate infrastructure, shortage of healthcare professionals, uneven distribution of healthcare services, and rising disease burden. Healthtech startups are leveraging technology to address these challenges by offering innovative solutions in areas such as telemedicine, remote patient monitoring, digital diagnostics, electronic health records (EHR), and healthcare analytics. By improving access to healthcare services, enhancing diagnostic capabilities, and optimizing healthcare delivery, healthtech startups have the potential to transform India's healthcare landscape and drive positive health outcomes.

2. Telemedicine and Remote Consultations:

Telemedicine platforms allow patients to consult with healthcare providers remotely through video calls, chat sessions, and virtual consultations. These platforms enable patients to access medical advice, diagnosis, and treatment from the comfort of their homes, reducing the need for physical visits to healthcare facilities and overcoming geographical barriers to healthcare access. Telemedicine startups are leveraging artificial intelligence (AI), machine learning (ML), and data analytics to offer personalized, evidence-based healthcare recommendations and improve patient outcomes.

3. Remote Patient Monitoring and IoT Devices:

Remote patient monitoring (RPM) solutions and Internet of Things (IoT) devices enable continuous monitoring of patients' vital signs, health parameters, and medication adherence outside of traditional healthcare settings. Wearable devices, smart sensors, and mobile health apps collect real-time data on patients' health status, allowing healthcare providers to track disease progression, manage chronic conditions, and intervene proactively in case of emergencies. RPM startups are leveraging IoT technology to empower patients to take control of their health, prevent hospital readmissions, and reduce healthcare costs associated with chronic disease management.

4. Digital Diagnostics and Imaging:

Digital diagnostics startups are revolutionizing medical imaging, pathology, and diagnostic testing through the use of advanced imaging techniques, AI algorithms, and cloud-based platforms. AI-powered diagnostic tools analyze medical images, laboratory results, and patient data to detect abnormalities, identify diseases, and assist healthcare providers in making accurate diagnoses. Digital diagnostics solutions enable faster, more accurate diagnosis, reduce diagnostic errors, and improve patient outcomes by facilitating early detection and treatment of diseases such as cancer, cardiovascular disorders, and infectious diseases.

5. Electronic Health Records and Interoperability:

Electronic health records (EHR) platforms digitize patients' medical records, histories, and treatment plans, enabling secure storage, retrieval, and sharing of health information across healthcare providers and institutions. Interoperable EHR systems facilitate seamless exchange of patient data, medical histories, and diagnostic reports between hospitals, clinics, pharmacies, and laboratories, ensuring continuity of care and coordination among healthcare providers. EHR startups are leveraging blockchain technology and secure data exchange protocols to ensure patient privacy, data security, and compliance with regulatory requirements such as HIPAA (Health Insurance Portability and Accountability Act) and GDPR (General Data Protection Regulation).

6. Healthcare Analytics and Predictive Modeling:

Healthcare analytics startups analyze large volumes of healthcare data, including clinical records, claims data, and patient demographics, to derive actionable insights, identify trends, and optimize healthcare delivery. Predictive analytics models leverage machine learning algorithms to forecast disease outbreaks, predict patient outcomes, and optimize resource allocation in healthcare facilities. Healthcare analytics solutions enable evidence-based decision-making, resource optimization, and cost-effective healthcare delivery, leading to improved patient outcomes, reduced healthcare costs, and enhanced operational efficiency in healthcare organizations.

7. Regulatory Support and Policy Initiatives:

The Indian government and regulatory authorities have introduced policies and initiatives to support healthcare technology innovation, promote digital health adoption, and improve healthcare access and affordability. Initiatives such as the National Digital Health Mission (NDHM), Digital India Healthcare Vision, and Telemedicine Practice Guidelines provide a conducive environment for healthtech startups to develop and deploy innovative solutions, collaborate with healthcare providers, and scale their operations while ensuring compliance with regulatory requirements and quality standards.

3. Clean Energy and Sustainability:

Clean energy and sustainability have emerged as priority areas for investment in India, driven by environmental concerns, climate change mitigation efforts, and the transition towards renewable energy sources. Startups in the clean energy sector are developing innovative solutions in areas such as solar power, wind energy, energy storage, electric vehicles, and sustainable agriculture. Investing in clean energy startups allows investors to support India's renewable energy goals, reduce carbon emissions, and promote environmental sustainability. By backing innovative clean energy solutions, investors can contribute to India's energy security, create green jobs, and mitigate the adverse impacts of climate change on communities and ecosystems.

4. Edtech Revolution:

The education technology, or edtech, sector in India is undergoing a rapid transformation, driven by factors such as digitization of education, remote learning trends, and the adoption of online education platforms. Edtech startups are leveraging technology to deliver personalized, interactive, and accessible learning experiences across various subjects and skill levels. Opportunities abound in areas such as online tutoring, test preparation, skill development, vocational training, and lifelong learning. Investing in edtech startups allows investors to support inclusive and equitable education, bridge the digital divide, and empower learners of all ages to acquire knowledge and skills for personal and professional growth. By backing innovative edtech solutions, investors can contribute to India's human capital development, workforce productivity, and socio-economic progress.

5. Agritech Innovation:

Agritech, or agricultural technology, is poised for significant growth and innovation in India, driven by the need to enhance agricultural productivity, improve farmer livelihoods, and ensure food security. Agritech startups are leveraging technologies such as precision farming, IoT sensors, drones, AI-powered analytics, and supply chain optimization to address challenges across the agricultural value chain. Opportunities abound in areas such as farm management software, precision agriculture, crop monitoring, market linkages, and post-harvest management. Investing in agritech startups allows investors to support sustainable agriculture practices, increase farm efficiency, and reduce food waste. By backing innovative agritech solutions, investors can contribute to rural development, farmer prosperity, and food sustainability in India.

In conclusion, investing in startups in India presents investors with five impactful opportunities to drive positive change and achieve financial returns in 2024. By strategically allocating capital to sectors such as fintech, healthtech, clean energy, edtech, and agritech, investors can support innovative solutions, promote socio-economic development, and address pressing challenges facing India and the world. However, startup investing carries inherent risks, and investors should conduct thorough due diligence, diversify their portfolios, and seek professional advice to mitigate risks and maximize returns. With the right investment strategies, investors can play a significant role in fueling innovation, driving economic growth, and creating lasting impact through startup investments in India.

This post was originally published on: Foxnangel

#investing opportunities#startups in india#investing in startups in india#start up investment in india#startup investments#investment strategies#fintech innovations#invest in startups india#foxnangel

1 note

·

View note

Text

"When a severe water shortage hit the Indian city of Kozhikode in the state of Kerala, a group of engineers turned to science fiction to keep the taps running.

Like everyone else in the city, engineering student Swapnil Shrivastav received a ration of two buckets of water a day collected from India’s arsenal of small water towers.

It was a ‘watershed’ moment for Shrivastav, who according to the BBC had won a student competition four years earlier on the subject of tackling water scarcity, and armed with a hypothetical template from the original Star Wars films, Shrivastav and two partners set to work harvesting water from the humid air.

“One element of inspiration was from Star Wars where there’s an air-to-water device. I thought why don’t we give it a try? It was more of a curiosity project,” he told the BBC.

According to ‘Wookiepedia’ a ‘moisture vaporator’ is a device used on moisture farms to capture water from a dry planet’s atmosphere, like Tatooine, where protagonist Luke Skywalker grew up.

This fictional device functions according to Star Wars lore by coaxing moisture from the air by means of refrigerated condensers, which generate low-energy ionization fields. Captured water is then pumped or gravity-directed into a storage cistern that adjusts its pH levels. Vaporators are capable of collecting 1.5 liters of water per day.

Pictured: Moisture vaporators on the largely abandoned Star Wars film set of Mos Espa, in Tunisia

If science fiction authors could come up with the particulars of such a device, Shrivastav must have felt his had a good chance of succeeding. He and colleagues Govinda Balaji and Venkatesh Raja founded Uravu Labs, a Bangalore-based startup in 2019.

Their initial offering is a machine that converts air to water using a liquid desiccant. Absorbing moisture from the air, sunlight or renewable energy heats the desiccant to around 100°F which releases the captured moisture into a chamber where it’s condensed into drinking water.

The whole process takes 12 hours but can produce a staggering 2,000 liters, or about 500 gallons of drinking-quality water per day. [Note: that IS staggering! That's huge!!] Uravu has since had to adjust course due to the cost of manufacturing and running the machines—it’s just too high for civic use with current materials technology.

“We had to shift to commercial consumption applications as they were ready to pay us and it’s a sustainability driver for them,” Shrivastav explained. This pivot has so far been enough to keep the start-up afloat, and they produce water for 40 different hospitality clients.

Looking ahead, Shrivastav, Raja, and Balaji are planning to investigate whether the desiccant can be made more efficient; can it work at a lower temperature to reduce running costs, or is there another material altogether that might prove more cost-effective?

They’re also looking at running their device attached to data centers in a pilot project that would see them utilize the waste heat coming off the centers to heat the desiccant."

-via Good News Network, May 30, 2024

#water#india#kerala#Kozhikode#science and technology#clean water#water access#drinking water#drought#climate change#climate crisis#climate action#climate adaptation#green tech#sustainability#water shortage#good news#hope#star wars#tatooine

1K notes

·

View notes

Text

What is Pre Seed Investors in India? JC Team Capital

Seed funding is an early stage of investment in a startup company, usually given in exchange for equity. It is the initial capital used to help a new business get off the ground and begin its operations. The purpose of seed funding is to help the company validate its business idea, build its initial product or service, and attract more investment to support its growth. Seed funding can come from a variety of sources, including angel investors, venture capitalists, and government grants. The amount of seed funding can vary greatly, but it typically ranges from a few tens of thousands of dollars to a few million dollars.

#seed funding In India#venture capital firm India#start up funding in india#funding for startups in india

1 note

·

View note

Text

Top 15 Must-Have Manufacturing Machines For Small Business

🤖 Dive into the world of efficiency with our Top 15 Best Small Machines for Manufacturing Business! From idea to implementation, these machines are your ticket to success. 🚀 Hit that follow button for more innovative tips! 🛠️ #ManufacturingMachines

Starting a small business can be an exciting journey, filled with numerous opportunities for growth and innovation. In today’s fast-evolving industrial landscape, small machines have become crucial for both large-scale manufacturing giants and emerging small businesses. From startups to established companies, these compact yet powerful machines provide the perfect blend of technology and…

#best business ideas#best business ideas 2023#business idea#business ideas#business ideas 2023#business ideas in india#Business machines#garage based business ideas#garage business machines#home business#low investment business ideas#manufacturing business ideas#Manufacturing Machines for Small Business#new business ideas#new business ideas 2023#small business#small business ideas#small business ideas at home#small business machine#small manufacturing machines for home business#start a business#startup ideas#top 10 business machine in iNDIA#top manufacturing machines for small business ideas

0 notes

Text

Indian Start-up Funding Opportunities: A Guide for Entrepreneurs.

In recent years, there has been an increase in the number of people. For small enterprises trying to start their own firms in India. Starting a business may be an exciting and gratifying experience. It can also be difficult and particularly when it comes to obtaining capital.

The Indian government has started an initiative called Start-up India. On August 15, 2015, Indian Prime Minister Narendra Modi declared the campaign for the first time. The action plan for this programme focuses on three areas: simplification, hand-holding, and collaboration.

The Advantages of Start-ups in India

Start-ups registered under the Start-up India initiative are exempt from paying taxes. This exemption is valid only for the first three years. Incubators are exempt from paying taxes on any investment that exceeds the market price.

One of the benefits of Start-up India is that qualified enterprises may register using a single form. This is possible using the Start-up India smartphone app. Start-ups can register using a single form in the application.

Start-ups can self-certify their compliance with nine labour and environmental regulations. And in this case no inspections will be performed for three years.

There are several funding options accessible in India for start-ups and entrepreneurs. Angel investors, venture capital firms, crowdsourcing platforms, and government funding initiatives are examples of these.

Angel investors are one of the most prevalent sources of finance in start-up funding India. Individuals who are willing to put their personal money in a start-up or early-stage firm are known as angel investors. They often give capital in return for firm stock. Networks, angel investor clubs, and internet platforms can help you find angel investors.

Venture capital firms are another prominent alternative. In return for stock, these firms invest in start-ups and early-stage enterprises. They often have a lengthy investment horizon. An are looking for firms with the potential to develop fast and earn significant profits.

Crowdfunding platforms have also grown in popularity in India. They allow businesses to obtain financing from a wide number of individuals rather than a just few investors. Crowdfunding campaigns may be established using websites such as Kickstarter, Indiegogo, and Wishberry.

For individuals seeking government assistance. The Indian government has a variety of programmes and initiatives in place to encourage entrepreneurship and small company growth. Start-up India, which gives investment, tax breaks, and other incentives to entrepreneurs, and the Pradhan Mantri Mudra Yojana, which provides loans to small enterprises, are two examples.

In addition to these financial possibilities. India has a number of accelerators and incubators that offer cash, mentorship, and other resources to entrepreneurs. Organizations such as Zone Start-ups India, NASSCOM 10,000 Start-ups, and the Indian Angel Network are among them.

NASSCOM started its 10,000 Companies project in 2013, with the purpose of assisting 10,000 Indian entrepreneurs over a ten-year period. This is how it works: chosen businesses receive financial assistance from venture capitalists, government funding, and angel investors, among others. The start-ups are matched with accelerators, coached, and helped build strategic relationships with NASSCOM’s network. The focus industries include healthcare, agriculture, education, smart cities and infrastructure, and AI across industries.

It is crucial to remember, however, that the start-up fundraising process may be quite competitive. Not all entrepreneurs are successful in obtaining investment. It’s critical to have a well-thought-out business strategy, a strong team, and a clear vision for how the company will produce money. It’s also critical to network and reach out to possible investors, mentors, and advisers.

Insperon Journal is the best source for funding news where one can learn about different start-ups, what they are doing, and submit their own start-up.

Finally, there are a variety of funding sources accessible in India. For start-ups and entrepreneurs, including angel investors, venture capital companies, crowdsourcing platforms, and government funding programmes. Entrepreneurs may improve their chances of obtaining finance for their firms by being aware of these options and knowing the procedure.

0 notes

Text

Who are early-stage investors in India?

Early-stage investors in India are venture capitalists and angel investors who provide seed funding or early-stage funding for startup companies. Early-stage investors play a crucial role in the growth and development of such companies. They help in providing capital, mentoring, and strategic guidance to entrepreneurs. Early-stage investors in India are typically private equity (PE) firms, venture capital (VC) firms, angel investors, or venture debt providers. These investors offer investment capital to early-stage companies in exchange for equity or debt securities. This type of investment is also known as seed funding or angel investment. These investors have a higher risk appetite and are willing to invest in startups with a potential for high returns. In recent years, the Indian startup ecosystem has seen a surge in early-stage investors, with many angel investors, venture capitalists, and other institutions investing in startups. This is mainly due to the government's initiatives to provide a favourable environment for startup growth. The government has also introduced tax incentives and other programs to attract more early-stage investors. Early-stage investors in India have helped nurture the growth of many start-ups, providing them with the capital and mentorship necessary for success. With the increasing investor appetite for startups, India is fast becoming a hub for early-stage investors, with the country now being a major destination for venture capital and angel investors.

#early-stage investors in india#angel investors in india#funding for start up businesses#companies that invest in startups#scalable startup#find a growth hacker for your startup#venture capital companies#find investors for startup#early growth stage in entrepreneurship#early stage investment in a business

0 notes

Text

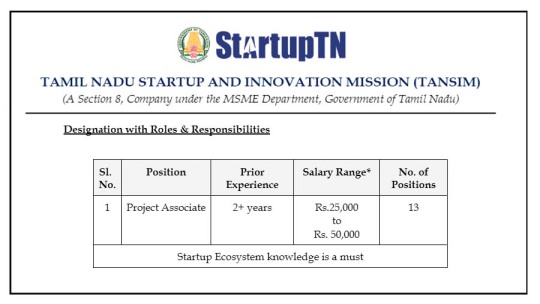

TANSIM Recruitment 2022 13 Project Associate Vacancy

TANSIM Recruitment 2022 13 Project Associate Vacancy

#govtjobs #upsc #ssc #currentaffairs #gk #ssccgl #ias #jobs #governmentjobs

TANSIM – Tamil Nadu Startup and Innovation Mission Recruitment 2022 Apply Project Associate Vacancies » Official Notification Released. Tamilnadu Government Official Release The Notification Interested & Eligible Candidate Please Must Check Full Notification Details , Education Details , Salary Details , Age Relaxation , Vacancies Details, Address Details Next Strat The Apply Process Eligible…

View On WordPress

#atal innovation mission#it startup tamil#startup#startup business ideas#startup company#startup india scheme tamil#startup stories tamil#startup tamil#startups#tamil nadu innovation grand challenge#tamil nadu startup and innovation mission#tamil nadu startup and innovation policy#tamil nadu startup seed grant fund#tamilnadu start up innovation mission ceo#tamilnadu start-up and innovation mission#tamilnadu startup and innovation mission new job recruitment#TANSIM Recruitment 2022 13 Project Associate Vacancy

1 note

·

View note