#stock market Asx

Text

Right Time to Invest in Low Lying Crude Oil?

Factors to Consider:

Market Conditions: Assess the current market conditions and trends. Understand the factors influencing oil prices, such as global demand, geopolitical tensions, and production levels.

Supply and Demand: Changes in global oil supply and demand can significantly impact prices. Consider the current balance between supply and demand and any potential disruptions to the oil supply.

Geopolitical Factors: Geopolitical events, such as conflicts in oil-producing regions, can affect oil prices. Stay informed about geopolitical developments that may impact the oil market.

Economic Indicators: Monitor economic indicators, such as GDP growth, industrial production, and transportation trends. Economic conditions can influence oil consumption and, consequently, prices.

Technological Advances: Advances in technology, such as improvements in renewable energy sources, can impact the long-term demand for oil. Consider the potential effects of technological changes on the oil market.

Environmental Policies: Policies aimed at reducing carbon emissions and promoting clean energy can affect the long-term outlook for the oil industry. Stay informed about environmental regulations and their potential impact on oil demand.

Diversification: If you decide to invest in commodities like crude oil, consider diversifying your investment portfolio. Diversification helps spread risk and reduces the impact of poor performance in any single asset.

Risks and Challenges:

Volatility: Crude oil prices are highly volatile and can be influenced by sudden and unpredictable events. Investors should be prepared for price fluctuations.

Leverage and Derivatives: Some investors use leverage or derivatives to amplify their exposure to oil prices. While this can magnify gains, it also increases the risk of significant losses.

Timing the Market: Timing the market can be challenging. Even if oil prices are currently low, they could continue to decline. It's challenging to predict the bottom of a market.

Storage Costs: Investing in physical oil or oil-related financial instruments may involve storage costs. Consider these costs in your investment strategy.

Investment Vehicles:

Stocks of Oil Companies: Investing in stocks of established oil companies can provide exposure to the industry without directly dealing with the commodity.

Exchange-Traded Funds (ETFs): There are ETFs that track the performance of oil prices or oil-related indices, providing a way for investors to gain exposure to the oil market.

Futures and Options: Some investors trade oil futures or options contracts, but these are complex financial instruments that require a deep understanding of the market.

Before making any investment decisions, it's crucial to conduct thorough research, consider your risk tolerance, and, if needed, consult with a financial advisor. Investing in commodities like crude oil involves risks, and it's important to approach such investments with a clear understanding of the market dynamics and your own financial goals.

Right Time to Invest in Low Lying Crude Oil Prices? with Ace Investors | ACE Investors

#stock market live#stock market asx#stock market today#stock market#youtube#buy dividend stocks#dividend stocks australia#best penny stocks to buy#penny stocks to buy now#buy penny stocks#penny stock market#penny stock#investing stocks#stock analysis#stock#stocks

1 note

·

View note

Text

Stay Ahead With The ASX IPO Calendar

Looking for new investment opportunities? Kalkine Media’s ASX IPO Calendar keeps you updated on upcoming IPOs on the Australian Stock Exchange. Discover the latest companies going public and seize the chance to invest early. Stay informed and make smart investment decisions.

#ASX IPO Calendar#Upcoming IPO#Upcoming IPOs on ASX#Upcoming Australian IPOs#australia#finance#stock market

0 notes

Text

Explore the latest ASX 200 trends: Tuesday’s rebound faces hurdles despite positive Wall Street gains. Insights on expected market dips, rising oil prices, and stock opportunities like Pro Medicus and Telstra.

0 notes

Text

In 2024, I'm Monitoring the SOL Share Price

The Australian Stock Exchange (ASX) hosts a diverse array of companies, each with its own unique characteristics and investment appeal. In this article, we delve into the share price performance and key attributes of two prominent ASX-listed entities: Washington H. Soul Pattinson Ltd (ASX: SOL) and Coles Group Ltd (ASX: COL).

Washington H. Soul Pattinson Ltd

Established in 1903, Washington H. Soul Pattinson (ASX:SOL) stands as one of the oldest investment companies listed on the ASX. With a rich history spanning over a century, SOL boasts a diversified portfolio of assets spanning various industries and asset classes.

Investment Portfolio and Mission

SOL's investment portfolio includes significant stakes in renowned publicly listed companies such as TPG Telecom (ASX: TPG), New Hope Group (ASX: NHC), and a cross shareholding in Brickworks (ASX: BKW). The company's mission revolves around delivering superior returns to its shareholders through capital growth and steadily increasing dividends. As a family-run Listed Investment Company (LIC), SOL prioritizes the alignment of interests between management and shareholders.

Share Price Analysis

In 2024, SOL's share price has experienced a notable uptick, rising by 27.5% since the beginning of the year. Despite fluctuations, SOL maintains a strong track record of capital growth and dividend payments. Currently, the company offers a dividend yield of approximately 2.72%, trading below its 5-year average of 2.54%. This suggests potential value for investors considering SOL shares.

Coles Group Ltd (ASX: COL)

Founded in 1914, Coles Group Ltd (COL) is a leading Australian retailer offering a diverse range of everyday products, including fresh food, groceries, general merchandise, liquor, fuel, and financial services. Despite its humble beginnings, Coles has evolved into a household name, serving millions of customers across Australia.

Business Operations

Coles' earnings primarily stem from its supermarkets segment, supplemented by revenues from adjacent businesses such as flybuys, Liquorland, First Choice, Vintage Cellars, and Coles Express. The company's commitment to providing quality products at competitive prices has solidified its position as a preferred shopping destination for Australian consumers.

Market Position

While Coles trails behind Woolworths in market share, holding approximately 28% compared to Woolworths' nearly 40%, it remains a formidable competitor in the retail landscape. With a strong presence in essential food and drink categories, Coles continues to attract millions of Australian shoppers weekly.

Conclusion

In conclusion, Washington H. Soul Pattinson Ltd and Coles Group Ltd represent two prominent entities within the ASX ecosystem, each offering unique investment opportunities. While SOL boasts a diversified investment portfolio and a history of capital growth, Coles stands out as a leading retailer with a widespread consumer base. Investors seeking exposure to these sectors should carefully evaluate the respective attributes and growth prospects of SOL and COL.

1 note

·

View note

Text

BHP Stock Sees Positive Momentum on Thursday with Prospects for Further Upside

On Thursday, BHP Group, a global resources company, experienced a surge in its share price, signaling positive momentum in the market. Investors are optimistic about the company's performance, and there are indications that the stock may continue to see gains in the near future.

ASX BHP shares displayed a notable upward trend on Thursday, reflecting the positive sentiment among investors. The market witnessed increased buying activity, contributing to the company's share price rise. Analysts attribute this positive movement to several factors, including robust financial performance, favorable market conditions, and a positive industry outlook.

The company's solid financial standing has been a key driver of investor confidence. BHP Group has consistently demonstrated strong operational and financial results, fostering trust among shareholders. Its strategic initiatives and effective cost management have positioned the company well in a competitive market environment.

Also, check our economics news section

In addition to the company's performance, broader market conditions have also played a role in the positive trajectory of BHP Group's stock. Favorable economic indicators and positive sentiment in the resource sector have created a conducive environment for BHP's growth. As economic activities rebound and demand for resources remains robust, BHP Group stands to benefit from these favorable conditions.

Furthermore, the positive outlook for the resource industry, coupled with BHP Group's diversified portfolio, has garnered attention from investors seeking exposure to the sector. The company's diverse range of commodities, including iron ore, copper, and energy resources, positions it to capitalize on various market trends and demands.

Looking ahead, analysts are optimistic about the prospects of BHP Group's stock. With a positive momentum observed on Thursday, there is a growing anticipation that the stock may continue to see gains in the coming days. Investors closely monitor key indicators and market developments that could further influence BHP Group's performance.

It's important to note that while positive momentum is promising, the stock market inherently involves risks, and past performance does not guarantee future results. Investors are advised to conduct thorough research, consider their risk tolerance, and stay informed about relevant market factors before making investment decisions.

In conclusion, BHP Group's share price experienced a positive uptick on Thursday, fueled by strong financial performance, favorable market conditions, and a positive outlook for the resource sector. As investors show confidence in the company's potential for growth, the stock is tipped for further gains. However, individuals considering investment in BHP Group should exercise due diligence and consider the inherent risks associated with the stock market.

#ASX BHP#ASX BHP Share Price#ASX BHP Stock Price News#ASX BHP Share Price News#ASX BHP Market Update

1 note

·

View note

Text

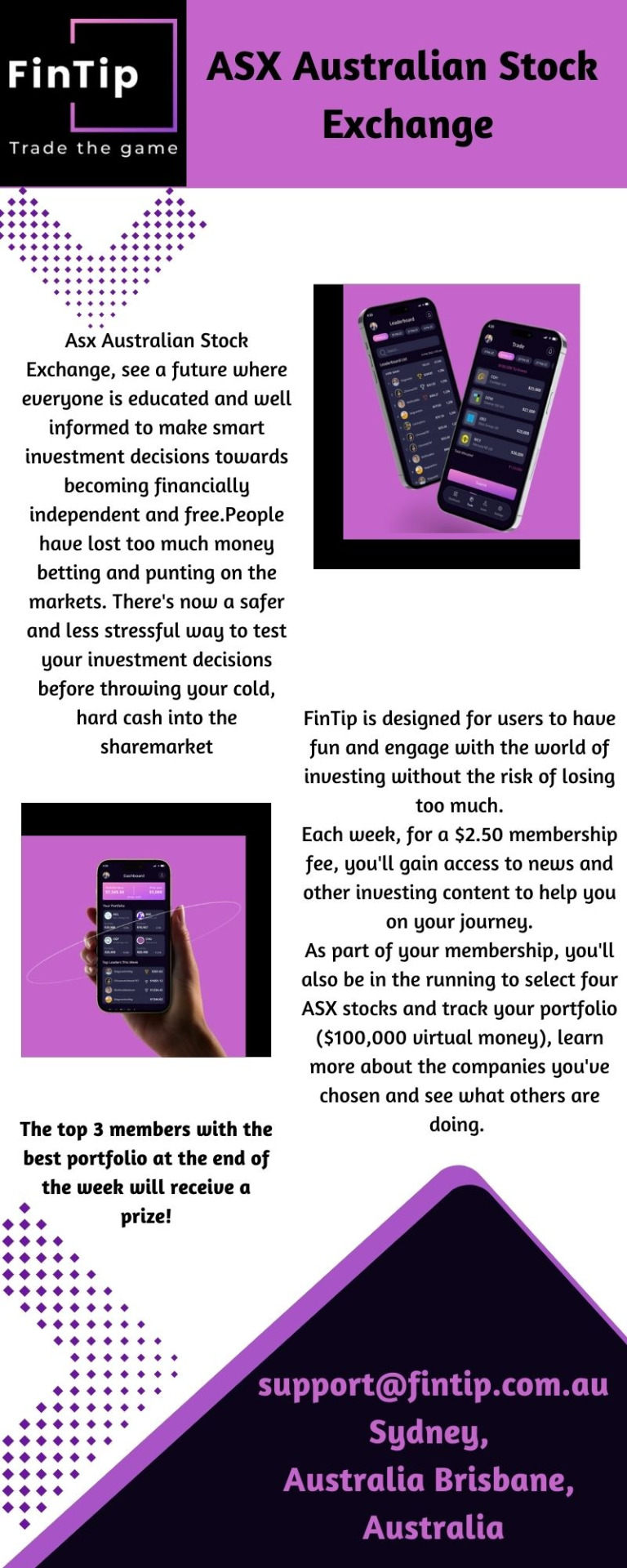

ASX Stock Market: Uncover Opportunities in Australia's Premier Exchange

FinTip-ASX Stock Market, see a future where everyone is educated and well informed.This is a simulated game and your $100,000 portfolio is virtual money only. There are no stock orders, trade or ownership involved.We allow four stocks to provide for some diversification and avoid highly skewed results from concentrating stocks in only 1 or 2.To know more visit us-https://fintip.com.au/

0 notes

Text

Four ASX High-dividend Yield Stocks Worth Buying in 2023

The year 2023 is set to welcome new heights in the stock market with high dividend stocks. Even investors are drowning more towards high-dividend-yielding stocks that pay decent returns regularly.

The considerable part is, investing in high-dividend-yielding stocks could ensure consistent income generation to endure a topsy-turvy market in the widespread recession fears and foreseeable future.

Are you also planning to invest in ASX stocks? Here are the top four ASX stocks with high-dividend worth buying in 2023. Read further to learn more.

#ASX BHP#ASX Companies#ASX NEWS#AVA Risk Group Limited#BHP Group#BHP Group Limited#BHP Group Limited (ASX: BHP)#Dividend Yield Stocks#Fortescue Metals Group#stock market#TerraCom Limited#asx updates

0 notes

Text

0 notes

Text

What is driving the demand for lithium?

The growing adoption of electric vehicles (EVs) is driving the demand for lithium. Lithium (Li) is a good conductor of heat and electricity. In recent years, there has been a resurgence in demand for lithium due to its key role in lithium-ion batteries for electric vehicles. Major global automakers are continuing to accelerate their plans to transition to EVs, by developing new product lines and converting existing manufacturing facilities for EVs. The global market share for passenger EVs increased fivefold since 2019, with EV sales accounting for about 14% of the overall passenger vehicles market in 2022. The strong underlying demand for EVs and declarations of EV makers imply that EV sales could reach about 40% of vehicle sales over the next decade. The global demand for lithium is estimated to increase from 814,000 tonnes of lithium carbonate equivalent (LCE) in 2022 to almost 1 million tonnes in 2023 and over 2 million tonnes by 2028, with Asia remaining the major source of demand despite the spread of new battery manufacturing capacity into Europe and the US. The global demand for lithium is expected to outmatch lithium production by around 3% in 2023. The current demand-supply mismatch situation will only go away in 2027, when production will outpace global lithium demand. Australia will continue to be the largest lithium producer, accounting for around 32% or 661,000 tonnes of global lithium carbonate equivalent (LCE) production by 2027-28.

The strong demand outlook for lithium chemicals is attracting capital to build a global supply

Several expansions and new projects have been announced over the past year, with exploration and drilling activities picking up in many countries over recent months. Several capital projects and new projects have been announced in recent years. Australia's lithium hydroxide industry is to take off in 2023, with the Kwinana lithium hydroxide refinery (51% Tianqi and 49% IGO) commencing commercial production of battery-grade lithium hydroxide in Train 1 in late 2022. By the end of 2024, Australia could have up to 10% of global lithium hydroxide refining capacity, rising to over 20% of global lithium refining by 2028.

Several capital projects have been announced at Greenbushes in Western Australia, with IGO Limited expecting to increase its installed production capacity from approximately 1.5Mtpa to around 2.5Mtpa over the next four years. The construction of Chemical Grade Plant 3, which will have a production capacity of 500,000 tonnes of spodumene concentrate, is scheduled to complete by the second half of 2025.

In the Dec'22Q, Pilbara Minerals (ASX: PLS) commenced the construction of its 'P680' Project with a revised capital cost estimate of A$404 million and is targeting commissioning in the Sep'23Q, with full capacity targeted for the end of 2023.

Following the FID in 2022, Liontown (ASX: LTR) has ramped up construction at its Kathleen Valley project. The project is expected to deliver about 500,000 tonnes of spodumene concentrate in the first year, rising to about 700,000 tonnes a year by year 6. The first production is expected in mid-2024.

In late 2022, the Kwinana lithium hydroxide refinery (51% Tianqi and 49% IGO) started commercial production of battery-grade lithium hydroxide in Train 1. The company announced a revised ramp-up schedule in January 2023, with Train 1 now expected by IGO to operate between 60% and 70% throughput capacity by the end of 2023. The company noted that significant progress is underway on Train 2, with commissioning expected in 2024. Each train has a capacity of 24,000 tonnes a year.

Covalent Lithium's (Wesfarmers 50%, SQM 50%) Kwinana lithium hydroxide refinery is progressing and is forecast to start in the first half of 2025. The construction of the concentrator is now over 70% complete, and the first production is expected in the first half of 2024.

What are driving lithium stocks?

Since the start of 2023, spot prices for lithium have eased after reaching record highs in late 2022. Spot spodumene concentrate averaged about US$5,920 per tonne in Feb'2023. However, this was more than double the average spot prices in Feb'2022 and tenfold in Feb 2021. As per the ABS trade data, the average realized prices (a mix of contract and spot-priced exports) have increased strongly since early 2022 as processors sought to ensure that supply was sufficient to meet likely demand. Average realized spodumene prices are forecast to rise from $3,110 a tonne in 2022 to US$4,350 a tonne in 2023 (in real terms), due to the resetting of contract prices in late-2022. This increase in the realized prices has helped a plethora of lithium producers to report strong operational performance in Dec'2023Q and, consequently a positive move in share prices over the last year. (Source: Resources and Energy Quarterly March 2023)

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188) authorized representative of Alpha Securities Pty Ltd (AFSL No.303575). Ace Investors has made all efforts to warrant the reliability and accuracy of the views and recommendations articulated in the reports published on its websites. Ace Investors research is based on the information known to us or which was obtained from various sources which we believed to be reliable and accurate to the best of its knowledge. Ace Investors provides only general financial information through its website, reports and newsletters without considering financial needs or investment objectives of any individual user. We strongly advocate that you seek advice, with your financial planner, advisor or stock broker, the merit of each recommendation before acting on any recommendation for their own specific financial circumstances and realize that not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability, to the scope permitted by law to resupply of the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide.

For more Details: https://www.aceinvestors.com.au/

#stock market#stock market today#stock market live#stock market asx#lithium#buy lithium stock#youtube

1 note

·

View note

Text

People I wanna know better

Tagged once again by @imlivingformyselfdontmindme.

Last song?

It's Australia Day and my family went on a road trip today. However, I'm pretty sure the last song I heard from my BIL's playlist whilst driving is this song (followed by a short discussion on all the reasons why Joe Jonas sucks 😆)

youtube

Favourite colour?

Poppy red 😊

Currently watching?

Since changing jobs, I found that I don't have as much time (and energy) to watch TV (or something similar) as I used to. However, I am not missing any episodes of these Thai series.

Cherry Magic TH

Last Twilight

The Sign

[Edit to add] Cooking Crush

I also used to watch Pit Babe but stopped at Episode 4. I might resume watching this in February, though.

Last movie?

I haven't gone to watch a proper movie in the theatre since the pandemic. This movie I watched on a plane whilst travelling abroad.

Sweet/Spicy/Savory?

Spicy and Savoury. I am Asian. You need to give me some heat and plenty of umami 😅

Relationship status?

An auntie-corn. (It's like the regular single auntie, but more awesome lol)

Current obsessions?

I said it before, but I am currently obsessed with learning how the share market works. Reading all kinds of materials relating to this subject is also one of the reasons why I spend less time watching Thai dramas. I just want to get rich faster🤣🤣🤣

Last thing you googled?

Prices of specific stocks in ASX to see if I can afford them 😅

Selfie or another pic you took?

I also happened to love Salvador Dali's art. Fortunately, there is a winery in South Australia that features his amazing works (sculptures) like this one:

I do hope I am not annoying people by constantly tagging them 😅 @lost-my-sanity1, @telomeke, @dribs-and-drabbles, @dimplesandfierceeyes, @sparklyeyedhimbo, @waitmyturtles, and anyone who would like to answer these questions.

7 notes

·

View notes

Text

Global X Semiconductor ETF (ASX: SEMI) Buying Insight: Watch for buying opportunities in SEMI as it recovers from a recent price dip, with strong long-term growth prospects.

0 notes

Text

ASX: BHP, a leading global resources company, is renowned for its diversified portfolio in mining, metals, and petroleum. BHP is a key player on the Australian Securities Exchange.

1 note

·

View note

Text

Stock Market Today: Top 10 things to know before the market opens today

Stock market news : Trends in SGX Nifty indicate a negative opening for the broader index in India with losses of 87 points.

The market is expected to open in the red as trends in SGX Nifty indicate a negative start for the broader index in India with losses of 87 points.

BSE Sensex fell 188 points to 56,410, while Nifty 50 fell 40 points to 16,818 . Formed a bearish candle on the daily chart yesterday.

As per the Pivot chart, the key support level for Nifty is placed at 16,729 followed by 16,640. If the index moves up, the key resistance levels to watch are 16,967 and 17,115.

Stay tuned with bigbullishstock to find out what happens in the currency and equity markets today. We have compiled a list of important headlines on news platforms that may affect the Indian and international markets.

US Markets

Wall Street eased sharply on Thursday over concerns that the US Federal Reserve's aggressive fight against inflation could overwhelm the US economy, and as investors worried about a collapse in global currency and debt markets. The Nasdaq sank near its 2022 lows set in mid-June, with tech heavyweights Apple Inc and Nvidia Corp down more than 4%.

The S&P 500 ended the session down 2.11% at 3,640.47. The Nasdaq fell 2.84% to 10,737.51 points, while the Dow Jones Industrial Average fell 1.54% to 29,225.61.

Asian Markets

Asia-Pacific shares tumbled on Friday, the last day of the third quarter, after another selloff on Wall Street overnight. China factory activity data is due later today.

In Japan, the Nikkei 225 fell 1.32% and the Topix index fell 0.87%. Australia's S&P/ASX 200 fell 0.48%. In South Korea, the Kospi fell 1%. MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.15%.

For more details on this topic visit :- Stock Market Today

For more information on stock market

6 Easy Ways To Make Money In Stocks

35 Candlestick Chart Patterns

Can we hold Intraday stock pros and cons?

What is an IPO?

Share market

#stocknews#stocktrading#stockmarketnews#stock market today#investing#stocks to watch#market#businessnews#stockmarket#sharemarketknowledge#indiansharemarket#share market basics#sharemarketclasses

2 notes

·

View notes