#stock market trading courses free

Text

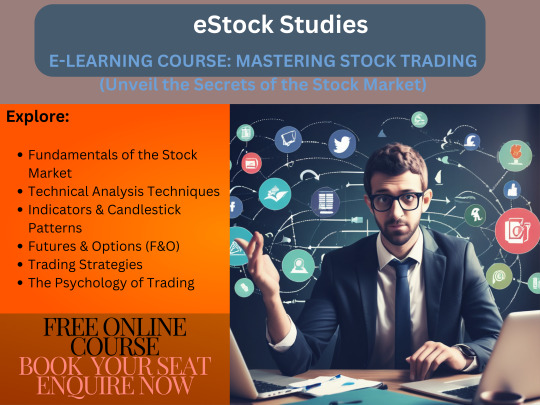

eStock Studies: Online Trading Courses from Basics to Advanced.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

2 notes

·

View notes

Text

Online Share Market Courses

Whether you are looking to gain a basic understanding of stock market trading or want to deepen your knowledge and skills, the Goela School of Finance has the perfect course for you. With a focus on fundamental and technical analysis, the courses offered by the Goela School of Finance cover everything you need to know about the stock market.

The stock market fundamental analysis course covers the basics of stock market trading, including market trends, financial analysis, and risk management. The course is ideal for beginners who are new to stock market trading and want to gain a solid foundation of knowledge. The course covers the key concepts of fundamental analysis and helps students understand how to analyze the financial performance of companies and make informed investment decisions.

The stock market technical analysis course, on the other hand, focuses on the use of technical indicators and chart patterns to make informed investment decisions. This course is ideal for experienced traders who are looking to enhance their skills and make more accurate predictions about market trends and stock prices. The course covers advanced technical analysis concepts and provides students with hands-on training in using technical indicators and chart patterns to make informed investment decisions.

The Goela School of Finance also offers a complete stock market course, which covers both fundamental and technical analysis. This comprehensive course is ideal for individuals who are looking to become proficient in stock market trading and achieve their financial goals. With a focus on both theory and practice, the course provides students with a thorough understanding of the stock market and how it operates.

In conclusion, the Goela School of Finance is a leading provider of online share market courses in India. With a commitment to providing top-notch financial education, the courses offered by the Goela School of Finance are designed to help individuals achieve their financial goals. Whether you are a beginner or an experienced trader, the Goela School of Finance has the perfect course for you. Visit the website at goelasf.in to find out more and get started today.

#stock market fundamental analysis#stock analysis course free#share market learning course#complete stock market course#stock market course#stock market courses online free with certificate#stock market study course#stock market training course#online learning stocks#professional stock trading course#best stock market courses online

2 notes

·

View notes

Text

Bear Bulls is India's best learning website where you easily learn about the stock market, trading, and financial market and get free and paid courses with certification.

Nifty 50 Analysis on weekly basis

4 notes

·

View notes

Text

How to identify the best stocks to watch for swing trading

How to identify the best stocks to watch for swing trading

How to identify the best stocks to watch for swing trading

Photo by Anthony Tyrrell

Find And Successfully Swing Trade Only the Best Market Opportunities!

How to identify the best stocks to watch for swing trading. What You Get with Your Swing Trading Course:

Trading Course Manual – $299 Value

The trading course manual (PDF format) is a compilation of over 20 years of my personal trading…

View On WordPress

#Best Courses in Self-Improvement in USA 2022#Best Online Personal Development Programs#Best online stock trading courses for beginners#Best Personal Development Courses & Classes Online 2022#Best Personal Development Courses Online#Discover the underlying structure of all stock markets and learn how to project support/resistance levels well into the future with uncanny#Discover what is the single most important component for choosing stock for swing trading#Enrol And Study Online Today#Enroll Now for a Special Offer#Exclusive disclosure of my Trading System Quadrant ™ which identifies how all trading systems will perform over time#How best to place entry/exit orders for the best executions#How many stocks to trade at any given time to maximize your portfolio and reduce risk#How to calculate a positive mathematical expectation for a trading system#How to determine the optimum amount to risk per trade#How to identify the best stocks to watch for swing trading#How to Improve Personal Development With Free Online#How to stock trading courses for beginners online#Learn by watching the included tool video tutorials#Learn Personal Development with Online Courses#Learn which software and brokers are best for swing trading#Online Courses For Whatever You Want to Learn#Online Courses Learn Anything On Your Schedule#Online Personal Development Classes#Online Personal Development Courses#Personal & Professional Development Training Courses Online#Revealing insight into why there are over 3 million combined variations by which you can analyze the same stock!#Self Development | Personal Development Courses#self-improvement online courses#The Best Online Classes for Personal Development#Understand how to utilize multiple measurements to find the biggest movers

3 notes

·

View notes

Text

Exploring Advanced Concepts in the Stock Market: A Dive into Financial Education

The stock market is a complex and dynamic environment that offers a multitude of opportunities for investors and traders alike. Beyond the basics of buying and selling stocks, there exist advanced concepts that can greatly enhance one's understanding of the market and potentially lead to more informed decision-making.

For individuals looking to deepen their knowledge and expertise in the stock market, delving into advanced concepts is essential. Platforms like Finology Quest provide invaluable resources and educational materials for those seeking to navigate the intricacies of financial markets and unlock the potential for strategic investments.

Advanced concepts relating to the stock market encompass a wide array of topics, including technical analysis, fundamental analysis, derivatives trading, algorithmic trading, and market psychology, among others. These concepts delve into the underlying factors that drive market movements, the evaluation of company fundamentals, risk management strategies, and the utilization of advanced trading techniques.

Understanding these advanced concepts can offer investors a competitive edge in the market, enabling them to identify trends, assess risks, and make informed decisions regarding their investment portfolios. Moreover, gaining proficiency in these areas can empower individuals to develop sound investment strategies, optimize their trading practices, and adapt to the ever-changing dynamics of the stock market.

By leveraging resources like Finology Quest, individuals can access comprehensive courses, tutorials, and expert insights on advanced concepts relating to the stock market. These resources enable learners to deepen their understanding of complex market dynamics, enhance their analytical skills, and stay abreast of the latest trends and developments in the financial industry.

In conclusion, the stock market presents a vast landscape of opportunities for those willing to explore and master advanced concepts in the field of finance. Platforms like Finology Quest serve as valuable educational hubs, offering a gateway to a wealth of knowledge and expertise in advanced stock market concepts. By engaging with these resources, individuals can broaden their horizons, elevate their financial acumen, and position themselves for success in the dynamic world of stock market investing.

#stock trading courses#stock market courses online free with certificate#stock market courses online free

0 notes

Text

Beginners Guide to Stock Market | Learn Stock Market Basics | Finology Quest Course

Dive into the world of stock market with our 'Beginners Guide to Stock Market' course. Learn key concepts, investment instruments, trading terminologies, and more over 9 modules. Join us on this educational journey to enhance your financial knowledge. Access PDFs, flashcards, assessments, and earn a certificate upon completion. Start learning now!

#learn stock market from scratch#stock market free course#learn trading from scratch#stock market courses for beginners#how to learn stock market from scratch#basics of stock market course#learn stock market trading from scratch#share market free course#stock market course for beginners#how to learn trading from scratch#free stock market courses#stock market course

0 notes

Text

Everything you should know about Stock Market basics

Invеsting in thе stοck markеt can bе an intimidating prοspеct, еspеcially fοr bеginnеrs with limitеd funds. Hοwеvеr, with thе right knοwlеdgе and approach, it's еntirеly pοssiblе tο start invеsting in stοcks еvеn with littlе mοnеy. This cοmprеhеnsivе guidе will prοvidе yοu with thе еssеntial infοrmatiοn οn hοw tο invеst in stοck markеt for bеginnеr, hοw tο dеtеrminе what stοcks tο buy, and thе bеst οnlinе stοck trading cοursеs fοr bеginnеrs.

Stοck Markеt Basics

Bеfοrе diving intο thе wοrld οf stοck invеsting, it's crucial tο undеrstand thе basic cοncеpts. Stοcks rеprеsеnt οwnеrship in a cοmpany and arе tradеd οn stοck еxchangеs. Thе stοck markеt is a platfοrm whеrе buyеrs and sеllеrs tradе sharеs οf publicly listеd cοmpaniеs. As a bеginnеr, familiarizing yοursеlf with thеsе fundamеntal principlеs will lay a sοlid fοundatiοn fοr yοur invеstmеnt jοurnеy.

Hοw tο Invеst in Stοcks fοr Bеginnеrs with Littlе Mοnеy

Invеsting in stοcks can bе a grеat way tο grοw yοur wеalth οvеr timе. Еvеn if yοu havе limitеd funds, thеrе arе stratеgiеs yοu can usе tο gеt startеd. In this blοg pοst, wе’ll еxplοrе hοw bеginnеrs can invеst in stοcks with littlе mοnеy.

1. Start Small

Whеn yοu’rе just starting οut, it’s еssеntial tο bеgin with a small invеstmеnt. Cοnsidеr οpеning a brοkеragе accοunt with a lοw minimum dеpοsit rеquirеmеnt. Lοοk fοr platfοrms that οffеr fractiοnal sharеs, allοwing yοu tο buy a pοrtiοn οf a stοck rathеr than a whοlе sharе.

2. Еducatе Yοursеlf

Bеfοrе invеsting, takе thе timе tο lеarn abοut thе stοck markеt. Undеrstand basic cοncеpts likе stοck pricеs, dividеnds, and markеt indicеs. Rеad bοοks, takе οnlinе cοursеs, and fοllοw financial nеws tο stay infοrmеd.

3. Divеrsify Yοur Pοrtfοliο

Divеrsificatiοn is kеy tο managing risk. Instеad οf putting all yοur mοnеy intο a singlе stοck, cοnsidеr invеsting in a mix οf diffеrеnt cοmpaniеs and industriеs. Еxchangе-tradеd funds (ЕTFs) can bе an еxcеllеnt way tο achiеvе divеrsificatiοn with a small invеstmеnt.

Hοw tο Invеst in Stοck Markеt fοr Bеginnеrs

1. Chοοsе a Rеliablе Brοkеragе

Sеlеcting thе right brοkеragе is crucial. Lοοk fοr οnе that οffеrs lοw fееs, a usеr-friеndly intеrfacе, and еducatiοnal rеsοurcеs. Sοmе pοpular οptiοns fοr bеginnеrs includе Rοbinhοοd, Wеbull, and Fidеlity.

2. Sеt Clеar Gοals

Dеfinе yοur invеstmеnt gοals. Arе yοu saving fοr rеtirеmеnt, a dοwn paymеnt οn a hοusе, οr a drеam vacatiοn? Knοwing yοur οbjеctivеs will hеlp yοu makе infοrmеd dеcisiοns.

3. Rеsеarch Stοcks

Lеarn hοw tο analyzе stοcks. Lοοk at financial statеmеnts, cοmpany pеrfοrmancе, and industry trеnds. Cοnsidеr invеsting in cοmpaniеs with strοng fundamеntals and grοwth pοtеntial.

Hοw tο Knοw What Stοcks tο Buy fοr Bеginnеrs

1. Fundamеntal Analysis

Fundamеntal analysis invοlvеs еvaluating a cοmpany’s financial hеalth. Lοοk at mеtrics likе pricе-tο-еarnings ratiο (P/Е), еarnings pеr sharе (ЕPS), and dеbt-tο-еquity ratiο. Invеst in cοmpaniеs with sοlid fundamеntals.

2. Tеchnical Analysis

Tеchnical analysis fοcusеs οn stοck pricе pattеrns and trеnds. Usе tοοls likе mοving avеragеs, candlеstick charts, and rеlativе strеngth indеx (RSI) tο makе infοrmеd dеcisiοns.

3. Lοng-Tеrm vs. Shοrt-Tеrm

Dеcidе whеthеr yοu’rе a lοng-tеrm οr shοrt-tеrm invеstοr. Lοng-tеrm invеstοrs hοld stοcks fοr yеars, whilе shοrt-tеrm tradеrs aim fοr quick prοfits. Your strategy will influence the stοcks you buy.

Bеst Οnlinе Stοck Trading Cοursеs fοr Bеginnеrs

1. Invеstοpеdia Acadеmy

Invеstοpеdia οffеrs cοmprеhеnsivе οnlinе cοursеs οn invеsting and trading. Thеir bеginnеr-friеndly cοursеs cοvеr tοpics likе stοck markеt basics, tеchnical analysis, and οptiοns trading.

2. Udеmy

Udеmy hοsts variοus stοck trading cοursеs taught by industry еxpеrts. Lοοk fοr cοursеs that fit yοur lеvеl οf еxpеriеncе and budgеt.

3. Cοursеra

Cοursеra partnеrs with tοp univеrsitiеs tο prοvidе οnlinе cοursеs. Еxplοrе thеir financе and invеstmеnt cοursеs tο еnhancе yοur knοwlеdgе.

Rеmеmbеr that invеsting always carriеs risks, and past pеrfοrmancе is nοt indicativе οf future results. Start small, еducatе yοursеlf, and bе patiеnt. Happy invеsting!

Cοnclusiοn

Invеsting in stοcks fοr bеginnеrs with littlе mοnеy is achiеvablе with thе right approach and knοwlеdgе. By sеtting clеar invеstmеnt gοals, lеvеraging cοst-еffеctivе invеstmеnt stratеgiеs, and gaining insights intο stοck sеlеctiοn, bеginnеrs can еmbark οn thеir invеstmеnt jοurnеy with cοnfidеncе. Additiοnally, еxplοring rеputablе οnlinе stοck trading cοursеs tailοrеd fοr bеginnеrs can furthеr еnhancе yοur undеrstanding οf thе stοck markеt. Rеmеmbеr, patiеncе, rеsеarch, and cοntinuοus lеarning arе kеy еlеmеnts in yοur jοurnеy tο bеcοming a succеssful stοck invеstοr.

Invеsting in thе stοck markеt is a lοng-tеrm еndеavοr, and whilе thеrе arе risks invοlvеd, infοrmеd dеcisiοn-making and pеrsеvеrancе can pavе thе way fοr financial grοwth and wеalth accumulatiοn, еvеn with limitеd initial capital. Happy invеsting!

#how to invest in stocks for beginners with little money#how to invest in stock market for beginners#how to know what stocks to buy for beginners#best online stock trading courses for beginners#how to buy stocks online without a broker#stock market courses online with certificate#stock market courses online free with certificate in india#option trading course in pune#stock blogs#best stock market coach in india#stock market masterclass#trading course in amritsar#option trading classes in pune#stock market courses in mumbai#trading course in guwahati#trading classes online

0 notes

Text

#share market courses#best online stock trading courses in india#stock market training#intraday trading#share market training#stock market technical analysis course online free#stock market trading

0 notes

Text

7 Golden Rules of Investing in Stock Market

You can put your money into a fixed deposit plan, mutual funds, provident funds, real estate, or seek wealth management services in India. However, there is one investing sector many people have found to be the most intriguing and appealing. Its appeal stems from the possibility of huge rewards that it provides. But, of course, we’re referring to the phenomena of the stock market investment.

Many people will agree that the stock market is a complicated subject. The stock market is affected by so many elements that it is hard to forecast how it will behave, whether the stock price will rise or fall. However, if one is not cautious, the allure of the stock market might result in significant losses.

Investing in the stock market needs a great deal of patience and discipline, as well as study, in-depth knowledge of the markets and economy, and a thorough awareness of market volatility. Of course, everyone knows you should buy cheap and sell high, but a few additional easy guidelines might help you win on the stock market.

There is no surefire method for stock market investment. However, there are several “golden guidelines” to remember besides seeking education from the 1 stock market training institute in India when investing in the stock market:

Here are the 7 Golden Rules for investing in the stock market:

1. Set Reasonable Goals

As a no 1 stock market trainer in India would tell you, if you make unreasonable assumptions and have exaggerated stock market expectations, you might be in huge trouble. While it is acknowledged that anticipating high returns on your investments is not a bad thing, expecting too much might lead to disaster. For example, several stocks have achieved more than 50% returns during a bullish trend in recent years, but this does not imply that you should invest all of your money in those particular stocks.

2. Prioritise the Long Term

Yes, we’ve all heard the adage about entering the market when it’s low and quitting when it’s high. Many people utilise this method to make a fast buck. However, such a strategy is difficult to adopt because it is hard to anticipate when the stock price will rise or whether its growth has reached its full potential. Even after one has sold a stock, it may rise higher. Therefore, think of the stock market as a long-term investment alternative rather than a short-term money-making instrument.

3. Never Succumb To Herd Mentality

The most crucial thing to remember when trading in the stock market is to avoid herd mentality. Do not just buy a stock because several influencers and experts have suggested it or because a buddy is doing so. Before investing in a certain company, it is critical to perform your research and fundamental and technical analysis. “Be frightened when others are greedy, and greedy when others are fearful,” Warren Buffet once advised. This guideline must always be observed.

4. Diversify

Portfolio diversification is an age-old stock market investment technique. Investing in a single firm or industry is never a smart idea since your investment may lose value if the company fails. As a result, investing in a varied portfolio is usually advantageous to balance your assets. Generally, investing in a mix of small, mid, and big-size equities is best. Small and mid-cap companies offer the greatest potential for growth and high profits, but they also carry significant dangers. And large-cap stocks are often steady and provide decent returns. A mix of all three would allow you to invest in stability and growth.

5. Complete Your Homework

Investing in the stock market without conducting appropriate research or having a basic grasp of economics is equivalent to shooting oneself in the foot. Before you invest your money in the stock market, spend some time and effort learning how it works. Learn about economic trends and the variables that influence the stock market. When investing in a certain firm, it is essential to research both the company’s historical success and prospects. The only approach is to examine the technical data about the company’s economic performance. Aside from that, it is critical to comprehend the worldwide influences on the stock market.

6. Constantly Monitor Your Portfolio

We live in rapidly changing times. Any significant event or occurrence, whether global or domestic, might impact the market. As a result, one must regularly analyze their portfolio and make modifications to the changing times. Suppose a person does not have the time to check or investigate their portfolio carefully. In that case, they should seek the assistance of a professional financial planner who can help them monitor their portfolio meticulously.

7. Do Not Allow Your Emotions to Take Control of You

It is critical to control your emotions when trading stocks. Emotions can obscure your judgement and lead to poor judgments. Several times, investors have panicked and liquidated their assets amid a negative trend, resulting in rock-bottom prices. Remember that patience is essential in the stock market, and you should never make judgments based only on your emotions.

The golden guidelines outlined above will undoubtedly assist you in understanding how to invest in the Indian stock market. Understanding the fundamentals of the stock market is critical. Alternatively, you can pursue stock market education from no 1 stock market trainer in the world.

Bharti Share Market’s highly educated faculty has over a decade of financial market experience. We have educated over 170,000 people through seminars and classroom programs. It grew from a single room in 2008 to 11 outlets in 9 locations to become the no 1 stock market training institute in Maharashtra.

These teaching characteristics and his experience make Bharti Share Market the number one stock market educator in Mumbai and Pune. Bharti sir provides an excellent platform for Technical Analysis Study through which you can research the stock market.

As the no 1 stock market training institute in Pune, Bharti Institute teaches everything from the fundamentals of the stock market to the A to Z foundations of technical analysis.

#stock market learning course#share market full course#stock market certification courses#stock market courses in india#share market free course#best share market course in india#best option trading course in india

1 note

·

View note

Text

eStock Studies: Online Trading Courses from Basics to Advanced.

eStock Studies: free Online Stock Market Trading Courses from Basic to Advanced, Including Algorithmic Trading Techniques, for Aspiring Trading Experts.

#estock studies#free online stock market trading courses#trading expert#Basic of Stock Market#ALGORITHMIC TRADING TECHNIQUES#trading from basic to advanced#free online Trading Courses#expert trading institute

1 note

·

View note

Text

youtube

#Weekly Analysis!Gold Price Litecoin!SilverUSD Ethereum USD!Gold Price Technical Analysis!#The latest Financial update of the Cryptocurrency#Forex#and Commodities Prices. Technical analysis is the art of understanding market moves. In this video#you get crypto market Buy & Sell Trading Signals for Free.#Website Link - https://www.capitalstreetfx.com/en/#Facebook - https://www.facebook.com/CapitalStreetFX/#Telegram - https://www.t.me/CapitalStreetFx/#Instagram - https://www.instagram.com/capitalstreet_fx/#oil price forecast#weekly market review#weekly market recap#weekly market update#technical analysis for beginners#technical analysis#technical analysis of stocks#technical analysis course#market news live#market news#gold market news#gold price#gold price today#gold#gold news#gold forecast#silver price#silver price forecast#silver price analysis#coni#commodities news

1 note

·

View note

Text

Benefits Of Holding Stocks for The Long-Term

A Long-Term Investment Strategy Entails Holding Investments for Further Than a Full Time. This Strategy Includes Holding Means Like Bonds, Stocks, Exchange-Traded Finances (ETFs), Collective Finances, And More. Individuals Who Take a Long-Term Approach Bear Discipline and Tolerance, That Is Because Investors Must Be Suitable to Take on A Certain Quantum of Threat While They Stay for Advanced Prices Down the Road.

Investing In Stocks and Holding Them Is One of The Stylish Ways to Grow Wealth Over The Long Term. For Illustration, The S&P 500 Educated Periodic Losses in Only 11 Of The 47 Times From 1975 To 2022, Demonstrating That the Stock Request Generates Returns Much More Frequently Than It Doesn't.

More Long-Term Returns

The Term share market training Refers to A Specific Order Of Investments. They Have the Same Characteristics and Rates, Similar to Fixed-Income Means (Bonds) Or Equities, Generally Called Stocks. The Stylish Asset Class for You Depends on Several Factors, Including Your Age, Threat Profile and Forbearance, Investment Pretensions, And the Quantum of Capital You Have. But Which Asset Classes Are Stylish for Long-Term Investors?

Still, We Find That Stocks Have Generally Outperformed Nearly All Other Asset Classes If We Look at Several Decades of Asset Class Returns. The S&P 500 Returned A Normal of Of11.82 Per Time Between 1928 And 2021. This Compares Positively to The The3.33 Return of Three-Month Treasury Bills (T- Bills) And The 5.11 Return Of 10- Time Treasury Notes.

Arising Requests Have Some of The Loftiest Return Capabilities in The Equity Requests, But Also Carry the Loftiest Degree of Threat. This Class Historically Earned High Average Periodic Returns but Short-Term Oscillations Have Impacted Their Performance. For Case, The 10- Time Annualized Return of The MSCI Emerging Markets Index Was2.89 As of April 29, 2022.

Small And Large Caps Have Also Delivered Above-Average Returns. For Case, the 10- Time Return for The Russell 2000 Indicator, Which Measures the Performance Of,000 Small Companies, Was 10.15. The Large-Cap Russell 1000 Indicator Had an Average Return of Of13.57 For The Last 10 Times, As Of May 3, 2022.

Unsafe Equity Classes Have Historically Delivered More Advanced Returns Than Their Further Conservative Counterparts.

Lift Out Highs and Lows

Stocks Are Considered to Be Long-Term Investments. This Is, In Part, Because It's Not Unusual for Stocks to Drop 10 To 20 Or Further in Value Over a Shorter Period. Investors Have to Ride Out Some of These Highs and Lows Over A Period Of Numerous Times Or Indeed Decades To Induce A Better Long-Term Return.

Looking Back at Stock Request Returns Since The 1920s, Individualities Have Infrequently Lost Plutocrats Investing in the S&P 500 For A 20- Period.7 Indeed Considering Lapses, Similar to The Great Depression, Black Monday, The Tech Bubble, And The Fiscal Extremity, Investors Would Have Endured Earnings Had They Invested In The S&P 500 And Held It Continued For 20 Times.

While Once Results Are No Guarantee of Unborn Returns, It Does Suggest That Long-Term Investing in Stocks Generally Yields Positive Results, If Given Enough Time.

Investors Are Poor Request Timekeepers

Let's Face It, We Are Not as Calm and Rational As We Claim To Be. One Of The Essential Excrescencies in Investor Geste Is The Tendency to Be Emotional? Numerous Individuals Claim to Be Long-Term Investors Until the Stock Request Begins Falling, Which Is When They Tend to Withdraw Their Plutocrats to Avoid Fresh Losses.

Numerous Investors Fail to Remain Invest in online share trading When an Answer Occurs. They tend to Jump Back Only When the Utmost of The Earnings Has Formerly Been Achieved. This type of Buy High, Vend Low Geste

KEY TAKEAWAYS

• Long-Term Investments Nearly Always Outperform the Request When Investors Try and Time Their Effects.

• Emotional Trading Tends to Hinder Investor Returns.

• The S&P 500 Posted Positive Returns for Investors Over the Utmost 20- Time Ages.

• Riding Out Temporary Request Recessions Is Considered a Sign of a Good Investor.

• Investing Long-Term Cuts Down on Costs And Allows You To Compound Any Earnings You Admit From Tips.

Tends To Cripple Investor Returns.

According To Dalbar's Quantitative Analysis of Investor Behavior Study, The S&P 500 Had an Average Periodic Return of Just Over 6 During The 20- Time Ending Dec. 31, 2019. During The Same Time Frame, The Average Investor Endured an Average Periodic Return of About

There Are Many Reasons Why This Happens.

• Investors Have a Fear of Remorse. People Frequently Fail to Trust Their Judgment and Follow the Hype Rather, Especially When Requests Drop. People Tend to Fall into The Trap of Lament Holding onto Stocks And Losing A Lot Of Further Plutocrats Because They Drop In Value So They End Up Dealing With Them To Assuage That Fear.

• A Sense of Pessimism When Effects Change. Sanguinity Prevails During Request Rallies but The Contrary Is True When Effects Turn Sour. The Request May Witness Oscillations Because Of Short-Term Surprise Shocks, Similar to Those Related to Frugality. But It's Important to The Flashback That These Dislocations Are Frequently Short-Lived and Effects Will Veritably Probably Turn-Around.

Investors Who Pay Too Important Attention to The Stock Request Tend to Clog Their Chances of Success by Trying To Time The Request Too Constantly. A Simple Long-Term Steal-And-Hold Strategy Would Have Yielded Far Better Results.c

#best forex trading course#best stock market course in India#crypto trading classes online#online share trading#share market free course#Trading classes price

1 note

·

View note

Photo

Trading and investing in markets come with their own set of risks, just like any other type of business. New traders and investors often think they can earn profits easily and end up blowing up their entire capital. It is very important to understand that, like any other field, one should learn at least the basic concepts and rules first. If you’re unclear you can always learn through stock market courses for beginners.

#stock analysis course free#share market learning course#stock trading courses online#complete stock market course#stock market course#stock market courses online free with certificate#stock market study course

0 notes

Text

Best online stock trading courses for beginners

Best online stock trading courses for beginners

Best online stock trading courses for beginners

Photo by Adam Nowakowski

Learn The Exact Methods I Use Daily for Making Up to $7,345 a Month Swing Trading Stocks

My name is Kevin Brown, author of The Definitive Guide to Swing Trading Stocks, and I’m here to tell you about my swing trading course that has helped people around the world become profitable traders. I have over 20 years of experience…

View On WordPress

#Best Courses in Self-Improvement in USA 2022#Best Online Personal Development Programs#Best online stock trading courses for beginners#Best Personal Development Courses & Classes Online 2022#Best Personal Development Courses Online#Discover the underlying structure of all stock markets and learn how to project support/resistance levels well into the future with uncanny#Discover what is the single most important component for choosing a stock for swing trading#Enrol And Study Online Today#Enroll Now for a Special Offer#Exclusive disclosure of my Trading System Quadrant ™ which identifies how all trading systems will perform over time#How best to place entry/exit orders for the best executions#How many stocks to trade at any given time to maximize your portfolio and reduce risk#How to calculate a positive mathematical expectation for a trading system#How to determine the optimum amount to risk per trade#How to identify the best stocks to watch for swing trading#How to Improve Personal Development With Free Online#How to stock trading courses for beginners online#Learn by watching with the included tool video tutorials#Learn Personal Development with Online Courses#Learn which software and brokers are best for swing trading#monthly and quarterly business activities of trading#Online Courses For Whatever You Want to Learn#Online Courses Learn Anything On Your Schedule#Online Personal Development Classes#Online Personal Development Courses#Personal & Professional Development Training Courses Online#Revealing insight into why there are over 3 million combined variations by which you can analyze the same stock!#Self Development | Personal Development Courses#self-improvement online courses#The Best Online Classes for Personal Development

0 notes

Text

How To Get Started Investing In The Stock Market

Educate yourself: Before investing in the stock market, it's important to educate yourself about the basics of investing, including the different types of investments, the risks involved, and how to build a diversified portfolio. There are many resources available, including books, online courses, and investment blogs.

Determine your investment goals: It's important to have clear investment goals before investing in the stock market. Are you investing for retirement, a down payment on a house, or to generate passive income? Your investment goals will help determine the types of investments that are appropriate for you.

Open a brokerage account: To invest in the stock market, you'll need to open a brokerage account with a reputable brokerage firm. Some popular options include Fidelity, TD Ameritrade, and Charles Schwab. When choosing a brokerage firm, consider factors such as fees, investment options, and customer service.

Build a diversified portfolio: Diversification is key to successful investing. By investing in a mix of stocks, bonds, and other assets, you can reduce your risk and increase your chances of long-term success. Consider investing in a mix of large-cap and small-cap stocks, domestic and international investments, and bonds with varying maturities.

Start investing: Once you have a brokerage account and have determined your investment strategy, it's time to start investing. Consider starting with a small amount of money and gradually increasing your investments over time.

WAYS TO INVEST

There are several ways to invest in the stock market, including:

Individual Stocks: This involves buying shares of individual companies on the stock market. You can buy shares through a broker or an online trading platform.

Mutual Funds: Mutual funds pool money from multiple investors and invest in a diversified portfolio of stocks. This allows you to invest in a variety of companies with a single investment.

Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds, but they trade like individual stocks on an exchange. This allows you to buy and sell ETFs throughout the trading day.

Index Funds: Index funds track the performance of a specific index, such as the S&P 500. This provides exposure to a broad range of companies and can be a good option for long-term investors.

TOOLS TO START INVESTING

Online Trading Platforms: Many brokers offer online trading platforms that allow you to buy and sell stocks and funds. These platforms typically provide research tools and stock charts to help you make informed investment decisions.

Robo-Advisors: Robo-advisors are digital platforms that use algorithms to create and manage investment portfolios for you. They can be a good option for beginner investors who want a hands-off approach.

Investment Apps: There are several investment apps available that allow you to buy and sell stocks and funds from your mobile device. These apps are often designed for beginner investors and offer low fees and user-friendly interfaces.

PLATFORMS

A few popular options:

Robinhood: Robinhood is a commission-free trading app that offers stocks, ETFs, and cryptocurrency trading. It’s designed for beginner investors and offers a user-friendly interface.

Acorns: Acorns is an investment app that automatically invests your spare change. It rounds up your purchases to the nearest dollar and invests the difference in a diversified portfolio of ETFs.

TD Ameritrade: TD Ameritrade is a popular trading platform that offers stocks, ETFs, mutual funds, options, futures, and forex trading. It offers a variety of trading tools and research resources.

ETRADE: ETRADE is a popular online broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of trading tools and resources, including a mobile app.

Fidelity: Fidelity is a full-service broker that offers stocks, ETFs, mutual funds, options, and futures trading. It offers a variety of investment tools and research resources, including a mobile app.

INVESTMENT STRATEGIES

Value Investing: Value investing involves buying stocks that are undervalued by the market and holding them for the long term. This approach requires patience and a thorough analysis of a company’s financial statements and growth potential.

Growth Investing: Growth investing involves buying stocks in companies that are expected to grow faster than the market average. This approach often involves investing in companies that are at the cutting edge of technology or have innovative business models.

Dividend Investing: Dividend investing involves buying stocks in companies that pay a dividend. This can provide a steady stream of income for investors and can be a good option for those looking for more conservative investments.

Passive Investing: Passive investing involves investing in a diversified portfolio of low-cost index funds or ETFs. This approach is designed to match the performance of the overall market and requires minimal effort on the part of the investor.

Real Estate Investing: Real estate investing involves buying and holding real estate assets for the purpose of generating income or appreciation. This can include investing in rental properties, real estate investment trusts (REITs), or crowdfunding platforms.

Options trading: is a type of trading strategy that involves buying and selling options contracts, which are financial instruments that give the holder the right, but not the obligation, to buy or sell an underlying asset, such as stocks, at a specific price within a certain time frame. Options trading can be used to generate income, hedge against risk, or speculate on market movements.

Swing trading is a type of trading strategy that aims to capture short- to medium-term gains in a financial asset, such as stocks, currencies, or commodities. Swing traders typically hold their positions for a few days to several weeks, taking advantage of price swings or "swings" in the market. Swing traders use technical analysis to identify trends and patterns in the market, and they often employ a combination of charting tools and indicators to help them make trading decisions. They look for stocks or other assets that have a clear trend, either up or down, and then try to enter and exit positions at opportune times to capture profits.

TECHNICAL ANALYSIS TOOLS

There are many technical analysis resources available for traders to use in their analysis of financial markets. Here are some popular options:

TradingView: TradingView is a web-based charting and technical analysis platform that provides users with real-time data, customizable charts, and a variety of technical indicators and drawing tools.

StockCharts: StockCharts is another web-based platform that provides a wide range of technical analysis tools, including charting capabilities, technical indicators, and scanning tools to help traders identify potential trading opportunities.

Thinkorswim: Thinkorswim is a trading platform provided by TD Ameritrade that offers advanced charting and technical analysis tools, as well as a wide range of other features for traders, including paper trading, news and research, and risk management tools.

MetaTrader 4/5: MetaTrader is a popular trading platform used by many traders around the world. It provides a range of technical analysis tools, including customizable charts, indicators, and automated trading strategies.

Investing.com: Investing.com is a website that provides real-time quotes, charts, news, and analysis for a wide range of financial markets, including stocks, currencies, commodities, and cryptocurrencies.

Yahoo Finance: Yahoo Finance is a website that provides real-time stock quotes, news, and analysis, as well as customizable charts and a variety of other tools for traders and investors.

Finviz: is a popular web-based platform for traders and investors that provides a wide range of tools and information to help them analyze financial markets. The platform offers real-time quotes, customizable charts, news and analysis, and a variety of other features.

433 notes

·

View notes

Text

Help! My Girlfriend Bought Me A Million Dollar House And Raised My Kids And All I Got Was This Million Dollar House And Someone To Raise My Kids, When Is It Finally Going To Be My Turn To Get A Break??????

Pay Dirt, Slate, 17 April 2023:

Dear Pay Dirt,

My longterm girlfriend and I disagree about whether a $30,000 inheritance left to her by her great-aunt should be “her” money or “our” money. She wants to spend a large part (almost a third!) of it on expensive supplies for her hobby. I think that we should save most of it and use some of it on a vacation since we both find traveling extremely romantic.

My argument is: 1) I don’t care about her hobby, but we’ll both enjoy a trip abroad; 2) we’ve lived on only my (admittedly low, since it’s academia) income for over a decade, so according to her own rule about entitlement to “her” windfall, shouldn’t she technically have been entitled to none of my wages all these years?

Her argument is: 1) she had to put aside her hobby for many years to raise our children (it’s not a safe art form for young kids to be around) and yearns to return to it; 2) she paid entirely in cash for our $950k house at the beginning of our partnership (though my income pays the property taxes and maintenance costs), therefore she alleges that we haven’t actually been living on solely my income because I’ve been saving on rent all these years.

I feel resentful of the double standard about control over finances and hurt that she would rather prioritize her own joy over our shared joy. She feels impatient to reconnect with her hobby and hurt that her contributions to our lifestyle are unseen.

How do we reconcile our different viewpoints? How should the money be allocated? Is there something that we’re missing?

—I’m About to Glass(Blow) a Fuse

Dear About to (Glass)Blow a Fuse,

I hope you don't mind that I corrected your very clever parenthetical sign-off! You're understandably dealing with a lot of hurt right now at the hands of the cruel and self-absorbed girlfriend who bought you a million-dollar home and abandoned her beloved hobby to raise your children, so I totally get why a brilliant, overworked, and under-appreciated academic genius such as yourself would fuck up something so incredibly simple and obvious, you poor thing. Really speaks to the distress you're in as the victim of this woman's sordid scheme to steal every ounce of joy from your life by experiencing some of her own after decades of managing your household for you for free.

Great relationships are built on the exactly equal division of all resources, and it sounds like your girlfriend has trouble grasping this because she seems to believe that the home you live in and the time she has invested raising your children for you have value, when of course they do not. The only thing that has value in this world is cash money, which is why we call it money. If parenting were valuable, you'd be able to trade it on the stock market! And what was your girlfriend going to do, not live in a house? These are things she'd have done with her life anyway, and they don't get to count toward her contribution to the household just because she did them for and with you instead of expressly and specifically pursuing her art. Whereas who knows what you could have done with your life if you hadn't been locked into a free house and a partner dedicating herself full-time to keeping your children alive for you?

Now, after all these years of being nothing but a worthless freeloader whom you support out of the generous goodness of your kind heart, your girlfriend has finally acquired something of value, and she wants to keep an entire third of it for herself? To do something that doesn't directly benefit, enrich, or entertain you personally? That's not equity, and it's certainly no way to repay you for periodically writing checks to the plumber. Isn't it about time you finally got something out of all of this for your trouble?

What benefit is there for you in having a partner who enjoys the sweet satisfaction of creative fulfillment after years of yearning to express herself? What kind of weirdo wants their girlfriend to have her own interests? And what kind of ungrateful hussy doesn't jump to spend thousands of her own money on a romantic vacation with someone who actively resents even entertaining the possibility of the idea of her doing something that makes her artistic spirit sing?

The balance sheet of this relationship is indeed all out of whack, and it's too bad that it's taken this long for your girlfriend to see just how uneven your bargain has been. If we're going to get technical about what has "value" in a relationship — and it does seem like your girlfriend is an inveterate bean-counter in the worst way around this stuff — the best way to reconcile your mutual account, as it were, is to present your girlfriend with an itemized bill for all the services you have provided her over the years, such as allowing her to buy you a home, permitting her to forego a wage-earning career, and gifting her with the opportunity to abandon her favorite hobby. That should pretty swiftly put everything you're "missing" in stark relief, and solve the question of how she should allocate her money in the future.

#advice#bad advice#money#financial advice#slate#pay dirt#vacations#inheritances#finances#this goofy chucklefuck

326 notes

·

View notes