#technical analysis of stocks

Text

Fast and Reliable Metastock Live Data Feed from GlobalDataFeeds

Get access to accurate and reliable real-time market data for Metastock with GlobalDataFeeds. Our Metastock live data feed offers seamless integration with the popular technical analysis software, allowing you to make informed trading decisions based on the latest market trends and insights. With a range of customizable options and user-friendly features, our data feed is designed to meet the needs of both novice and experienced traders. Stay ahead of the competition and subscribe to our Metastock live data feed today! Visit here to know more https://globaldatafeeds.in/

0 notes

Text

If you want to become an Professional Technical Analyst In Just One Month. So, Enroll Now For Our Best Technical Analysis Course Online. In This Course We will discussed basic to advanced level of Technical Analysis. Let's talk some basic points.

Technical analysis is the examination of historical market data with the goal of spotting patterns and forecasting market behaviour. Charts and other tools are used by technical analysts to spot patterns that can indicate future action.

Although it is not a precise science, technical analysis can be a useful tool for traders and investors to spot opportunities and make more sensible choices. There are numerous methods that can be employed, and no one strategy is best for everyone. Gaining knowledge of technical analysis can help you develop your trading and investment abilities.

#technical analysis#technical analysis of stocks#technical analysis course#best technical analysis course#share market technical analysis#stock market technical analysis#technical analysis course online#technical analysis training#technical analysis classes

0 notes

Text

youtube

#Weekly Analysis!Gold Price Litecoin!SilverUSD Ethereum USD!Gold Price Technical Analysis!#The latest Financial update of the Cryptocurrency#Forex#and Commodities Prices. Technical analysis is the art of understanding market moves. In this video#you get crypto market Buy & Sell Trading Signals for Free.#Website Link - https://www.capitalstreetfx.com/en/#Facebook - https://www.facebook.com/CapitalStreetFX/#Telegram - https://www.t.me/CapitalStreetFx/#Instagram - https://www.instagram.com/capitalstreet_fx/#oil price forecast#weekly market review#weekly market recap#weekly market update#technical analysis for beginners#technical analysis#technical analysis of stocks#technical analysis course#market news live#market news#gold market news#gold price#gold price today#gold#gold news#gold forecast#silver price#silver price forecast#silver price analysis#coni#commodities news

1 note

·

View note

Text

Weekend Stock Market Outlook - February 11 2024

Stock Market Outlook entering the Week of February 11th = Uptrend

ADX Directional Indicators: Uptrend

Price & Volume Signals: Uptrend

ANALYSIS

The stock market outlook shows an uptrend in place, as U.S. equities continue notching all time highs.

The S&P500 ($SPX) gained 1.4% last week (again). The index sits ~5% above the 50-day moving average, and 12% above the 200-day moving average. Since…

View On WordPress

10 notes

·

View notes

Text

Bearish Engulfing pattern can result in uptrend ! When and How?

The above chart is a perfect example for a bearish engulfing pattern to act as a bullish trend reversal.This happens when bearish engulfing pattern occurs in the end of downtrend.

Click here to learn more about this in detail.

#stock trader#stock trading#candlestick pattern#crypto traders#future and option trading#forex trading#forex#earn money online#technical analysis

12 notes

·

View notes

Text

Are you looking for a powerful trading platform that offers advanced charting, analysis, and social features? Look no further than TradingView.com!

With TradingView, you can access real-time market data and customize your charts with a variety of technical indicators and drawing tools. Plus, you can share your ideas and insights with a community of traders from around the world.

Whether you're a seasoned pro or just getting started, TradingView has everything you need to stay on top of the markets and make informed trades.

So why wait? Sign up for TradingView today and start taking your trading to the next level!

OUR MISSION

We empower everyone with the best charts, trading tools, and social networking. TradingView is free and open to the world.

People Trust TradingView

The TradingView team has been working on real-time charts, data, and financial tools for more than 20 years. Our charts and tools are an industry standard.

Trade Together

TradingView is your partner. We work with you and your brokerage. We want to be a necessary add-on and friend, not a competitor.

#invest#investor#investing#finance#finance news#financial freedom#financial#investment#stocks#stock market#stock market news#stock charts#stock chart#cryptocurrency#crypto#bitcoin#ethereum#crypto trading#technical analysis#candlestick chart analysis – an impactful stock trading tool#tradingview#trading tools#futures#crypto market#stock prices#wall street#trading platform

12 notes

·

View notes

Text

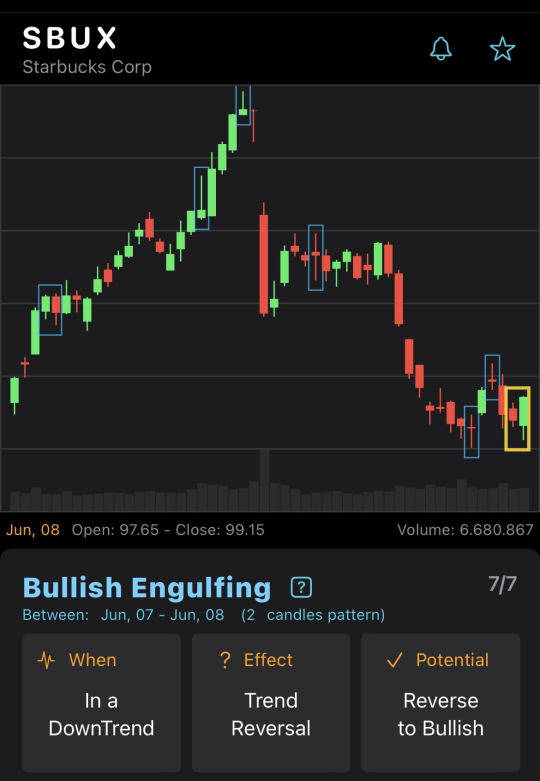

Bullish Engulfing on SBUX chart

BullishEngulfing CandleStickPattern on SBUX end-of-day chart on Jun, 08. Potential reverse to bullish.

6 notes

·

View notes

Text

2 notes

·

View notes

Text

Take four minutes to read this post, its timely and critical

#charts#lunar#bull market#cycles#dow#contrary thinker#bear market#technical analysis#hedge#stocks#bonds#gold#volatility#In the money#options#futures#liquidity

3 notes

·

View notes

Text

https://www.stockvidyapeeth.com/

Online Stock Market Courses in Delhi | Stockvidyapeeth

Stock Vidyapeeth offers comprehensive online stock market courses in Delhi - designed to equip beginners and professionals alike with valuable insights and practical skills to navigate the dynamic world of stock trading. Our expert faculty and industry-relevant curriculum ensure that you stay ahead of the competition and achieve your financial goals.

Visit here - https://www.stockvidyapeeth.com/

#Best stock market courses in Delhi#option trading course in delhi#Technical analysis training in Delhi#Share market classes in Delhi#Equity research course in Delhi#Stock Market course for JOB

2 notes

·

View notes

Text

Doji Candlestick Pattern and Trading Doji

The doji pattern is a candlestick pattern commonly used in technical analysis to indicate indecision in the market. It occurs when the opening price and the closing price of an asset are very close to each other, resulting in a candlestick with a very small real body.

The doji pattern can have different shapes, but the common characteristic is that it has a small real body, a long upper and…

View On WordPress

#candlestick patterns#Candlesticks#Doji#dragonfly doji#gravestone doji#learn technical analysis#long legged doji#Patterns#stock markets#stock trading#technical analysis#trading doji

3 notes

·

View notes

Text

Indian Stock Market Hit by SVB Crisis and Global Market Volatility

The Indian stock market is facing turbulence due to the SVB crisis and global market volatility. #OptionTrading #BankNifty #Nifty50 #BankCrises #IndianStockMarket #GlobalMarketVolatility

Indian Stock Market Hit by SVB Crisis and Global Market Volatility

The Indian stock market is reeling from the recent failure of Silicon Valley Bank (SVB) in the United States and the ripple effect it is having on global equity markets. This comes on the heels of the Adani crisis, making it another blow to the market’s recovery efforts.

Investors have lost a whopping Rs 6.6 lakh crore in the…

View On WordPress

#bank stocks#bearish momentum#candlestick patterns#candlestick trading#global market volatility#rate hike#Silicon Valley Bank#SVB crisis#technical analysis#trading strategies

2 notes

·

View notes

Text

Forex - Has no End?

Riddle: What has no end, yet always comes back around?

Forex trading and stock trading are both popular investment options, but many people are unsure which one is better. Both forex and stocks offer the potential for profitability, but they also bring their own unique risks. To help you decide which one is right for you, let’s take a look at the pros and cons of forex trading versus stock trading.

When it comes to forex trading, the primary benefit is that it is a 24-hour market. This means that you can trade any time of day or night, regardless of the stock market hours. This can be particularly advantageous for investors who have busy schedules or who trade from different parts of the world. Additionally, forex trading allows you to trade on multiple currency pairs, giving you the potential to diversify your portfolio.

The downside of forex trading is that it is a highly leveraged market. This means that you can leverage your investments to a greater degree than you can with stocks, which can result in greater potential losses. Additionally, the forex market can be extremely volatile, making it difficult to predict future movements.

When it comes to stock trading, the primary benefit is that it is a regulated market. This means that stocks are traded under set rules and regulations, making it easier to protect your investments. Additionally, stock trading allows you to invest in individual companies and funds, giving you the potential to diversify your portfolio more than you can with forex.

The downside of stock trading is that you have to pay fees to trade stocks. These fees can add up quickly, making it difficult to make a profit on small trades. Additionally, stock markets tend to be less liquid than forex markets, making it more difficult to buy and sell stocks quickly.

Overall, forex trading and stock trading both offer the potential for profitability, but they also bring their own unique risks. Forex trading allows you to trade on multiple currency pairs and offers the potential for 24-hour trading, but it is highly leveraged and can be extremely volatile. Stock trading offers the potential to invest in individual companies and funds and is regulated, but it also comes with fees and is less liquid. Ultimately, the best choice for you will depend on your own personal goals and risk tolerance.

Answer to Riddle: The Stock Market

#“forex vs stocks which is more profitable”#“which is best forex or stock market”#“forex vs stocks for beginners”#“is technical analysis the same for forex and stocks”#“pros and cons of forex vs stocks”#“forex market vs stock market size”#“forex vs stocks which is more profitable reddit”#“forex stock price”#stock market#investors#investment#invest

4 notes

·

View notes

Text

Weekend Stock Market Outlook - May 19 2024

Stock Market Outlook entering the Week of May 19th = Uptrend

ADX Directional Indicators: Uptrend

Price & Volume Signals: Uptrend

On Balance Volume Indicator: Uptrend

ANALYSIS

The stock market outlook starts the week in an uptrend, with the index just shy of an all time high, thanks to lower than expected CPI data.

The S&P500 ($SPX) rose 1.5% last week and now sits above the 50 and 200-day…

View On WordPress

3 notes

·

View notes

Text

What do you know about the complete course on stock market

Taking a cue from this example you should now understand that Indian Stock Market Course acts as your guide. It empowers you to establish a sound career in the trading affairs of the financial market. Get more info: https://bit.ly/3wYx5lO

#indian stock market course#share trading course#Derivative Market Course#technical analysis course#Stock Market Course#intraday trading course

2 notes

·

View notes

Text

WHEN A BEARISH ENGULFING PATTERN IS SIGN OF SIDEWAYS TREND?

A bearish harami can sometimes result in a sideways trend.This happens when the bearish harami takes a form called the high price harami.

#stock trader#stock market#technical analysis#candlestick pattern#crypto traders#future and option trading#forex trading#forex

14 notes

·

View notes