#studyloans

Text

#studyabroad#abroadcube#studyabroadconsultants#studyincanada#studyinusa#studyinuk#fullyfundedscholarships#scholarshippositions#educationloan#studyloan#canadastudyvisa

1 note

·

View note

Text

study loan singapore

Everything you need to know about studying in Singapore - courses available, top colleges to choose from, admission cycle & our study in Singapore loans. Know more!

0 notes

Text

A guide to overseas education loan for Bachelors and Masters degree in Canada

Canada has grown to be the number one destination for studies abroad. The country’s point based permanent residency system entices the students to study in Canada. Once they pass out and get a job they would more or less qualify for the point based system and hence become permanent residents of Canada. Canadian universities are known for high-class education, practical approach and well diverse student base. Study loan for Canada is very easily available in terms of both secured and unsecured loan options. Let’s look at each of the lenders in relation to the overseas education loan for Canada

Nationalized banks – Study loan for Canada Is offered by nationalized banks for Bachelors, Post graduate diploma and Masters. They do not fund diploma programs. Nationalized banks require collateral for overseas education loans; the interest rate is between 8% to 9.5%. They have a moratorium period of one year post completion of the course as well as they do not take the interest while the student is studying. This is very beneficial to students as they do not need to pay any interest during the study thereby reducing the financial burden.

Private banks – Private banks such as ICICI and Axis offer unsecured loans to a huge number of Canadian universities and colleges. ICICI bank is particularly very Aggressive about study loans for Canada and has approved nearly 100+ colleges and universities for unsecured loans. Axis bank as well has a few universities wherein it can provide unsecured loans. Both these banks however require you to pay the interest accrued on the loan while at study. In case the student is looking at an unsecured loan, private banks become mobile local options due to the interest rates being between 9.5 to 11% as well as lower processing fees then other unsecured lenders for overseas education loan.

Non-Banking finance Corporation – NBFCs offer unsecured loans for students studying Masters in leading Canadian universities such as University of Toronto, University of Waterloo, etc. NBFCs basically rely on the income of the cosigner to ascertain the amount of the unsecured loan for study abroad. They are ready to pay as much as 40 lakhs for a STEM masters from a top university. They also do not fund diploma students looking to study abroad. We at Edu loans believe that studying loans for Canada will become very competitive by NBFC in the near future and students will get better terms of loans.

International funds– Mpower funds selected University for Masters program in Canada. They provide unsecured loans without requiring a valid cosigner. This is especially very helpful for students who do not have a strong financial background. Study loan for Canada is given in US dollars and hence conversion charges between US dollar and Canadian dollars will apply while taking loan from International Funds.

Eduloans Is a single platform which would provide you all types of lenders. We provide you with the Best comparison between each type of loan and lender and help you ascertain your best and most suitable option for overseas education. We are particularly pleased with helping in study loans for Canada.

#eduloan#studyloan#overseaseducationloan#educationloan#educationloanforbachelors#educationloanformasters#studyloanforcanada#educationloanforIndianstudents#educationloanforstudyabroad

0 notes

Photo

We help you to get loans starting from kinder Garten to college education and career coaching. We promise reliable services by providing quick loan approvals with minimum paperwork. Education is made accessible to all with creditap.ai easy fee loans.

Reach out to us to know more:

👉Visit: https://www.creditap.ai/

🤩⬇️Download the app today!

#EMIs #studies #collegeeducation #highereducation #educationloan #educationloans #studyloan #loan #students #finance #loansinindia #studentloan #Creditap #schoolfee #collegefee #educationloan #financial #dreambig #applyloan #applynow #parents #child #education

1 note

·

View note

Photo

What will it take to Solve the student loan Crisis? A question that haunts students as well as the economy. Above all student effort to earn grade along with their part times are becoming more and more difficult. We present 13 steps that will help the student to repay their debt.

Any subject - Any assignment-flat rate-$30.

Whatsapp +1 680-200-1343

Email: [email protected]

#assignment#assignment help#assignmenthelp#homework#homeworkhelp#stud#student#students#studyloans#studyloan#college#university#studentlife#studentloan#educating

3 notes

·

View notes

Photo

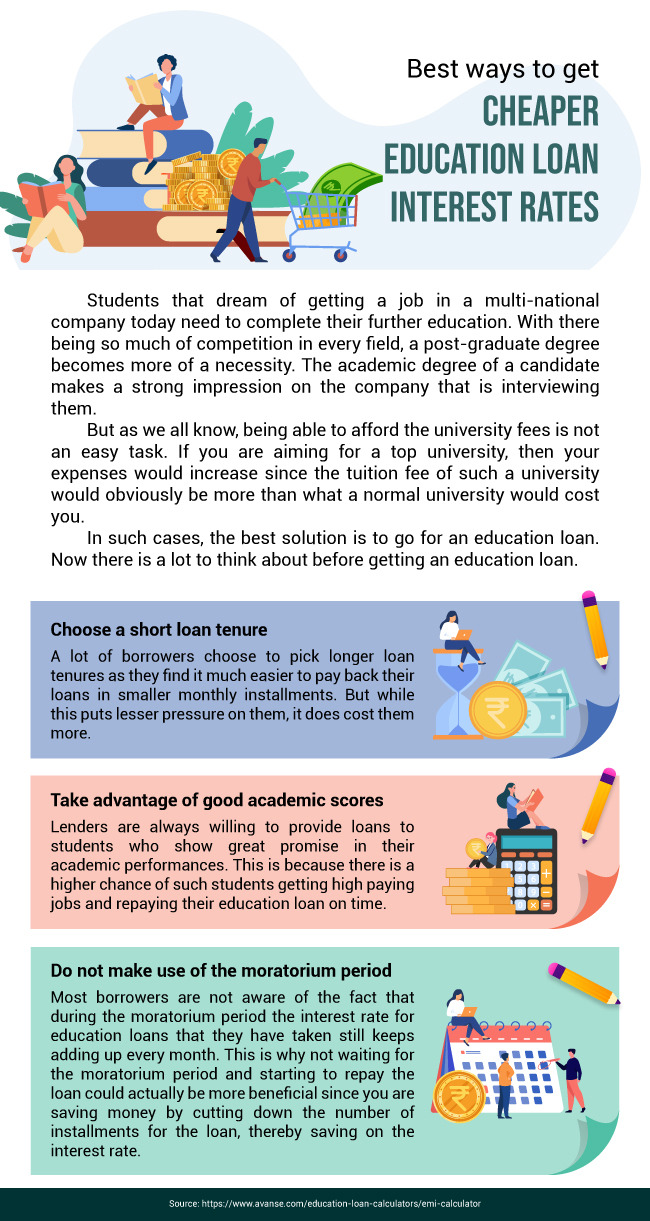

A lot of borrowers choose to pick longer loan tenures as they find it much easier to pay back their loans in smaller monthly installments. But while this puts lesser pressure on them, it does cost them more. This is because the interest rate for education loan plans is added with each installment, hence cutting down the installments to pay back the loan in a shorter loan tenure is actually more beneficial.

You can find more interesting things on these social sites mentioned below :-

Facebook:-

https://www.facebook.com/AvanseEducationLoan/

Twitter:-

https://twitter.com/avanseeduloan

YouTube:-

https://www.youtube.com/channel/UCcsuUx1EH1C08XmX2embpug

Instagram:-

https://www.instagram.com/avansefinancialservices/

#EducationLoan#EducationalLoan#EducationLoans#StudyInIndia#StudyLoan#StudyLoans#OverseasEducationLoan#EducationLoanForAbroadStudies#InterestRateForEducationLoan

1 note

·

View note

Photo

Learning should always be a continuous process. We help you with your education by providing a loan.

Visit: https://bit.ly/2LpuYSj

#Learning#Educationloan#Developapassion#Education#Growth#Loan#Financesolutions#Studentloan#Furtureloan#Studies#Brightfurture#Abroad#studyloans#loansparadise#Finfreeenterprises

0 notes

Text

Is it easy to getting education loan?

The education loan is an amount especially for students who are seeking for further education. The loan amount comprises the education fees along with the books, tuition fees, etc.

There is no denying of the fact that learning or education plays an important role in building personality. And institutions give them enriching atmosphere to every student to achieve this.

Before going for educational loan, every student should know about it first several types of loan are as follows;

Based on demographic:

Domestic loan is for those students who are seeking for education in India. This type of loan covers education from graduation to post graduation level. This loan will get approved only when, if the applicant is admitted to an Indian educational institution and fulfill all the eligibility criteria.

Overseas loan is for Students who realise their dream of pursuing the next level education from their desired abroad institution. The loan covers the airfare, accommodation, and tuition fee for students who wish to study in foreign but they have to satisfy the eligibility criteria.

Based on education level:

Undergraduate education loan is gives financial support to the students so they can complete their concerned degrees. An undergraduate degree will usually be a 3 to the 4-year duration course for various specialisations. Undergraduate degree allow individuals to grab a decent job and start their earning.

Postgraduate loan seekers are generally undergraduate students would like to continue their education with a postgraduate course. The duration may vary based on the discipline. Usually, MBA’s, Medical and Engineering students go for this.

For other courses there are bunch of professionals who take a break from their job and go for skill up gradation professional courses or training to grow their career. Some professionals try to grow their career technical institutions to upgrade their skills.

Based on collateral:

Based on Loan against property, deposit, securities such as agricultural land, plot, flat, house, fixed deposit, recurring deposits, gold deposits, bonds, and equity shares to get the required loan to pursue education.

A guarantee from third party letter from an employee of the bank or a local bank can help the student for getting this loan.

0 notes

Text

Lots of students decide to go outside from their hometown/abroad for higher education. That is where the Best Education Loans Providers in India are helpful.

#educationloans#studentloans#educationloanindia#studentloanscompany#studentloansgov#privatestudentloans#beststudentloans#applyforstudentloan#studentloanapplication#studyloan

0 notes

Text

The various advantages of opting for an overseas education loan

The biggest struggle of today’s time is to obtain an education from a reputed university. The reason being, companies of today’s times scrutinize your educational credentials. Thus, you have to make sure that you graduate from a reputable university. There are a lot of universities in India; however, most of the top-ranked universities are in foreign countries. Therefore, there are many Indian students who are traveling abroad to pursue higher education. But yet, there are still many meritorious students that are unable to obtain an education of their choice; because of the high cost of education fees. However, now there are a lot of banks and NBFCs (non-banking financial companies) that have started providing overseas education loan. You can make use of them and reap their benefits.

But before everything else, let’s understand what an abroad education loan is: It takes care of all of your study related expenses. The various expenses those are included under education loan for abroad studies range from the cost of study material, living expenses, travel expenses, tuition fees, college fees, etc. The education loans even include other miscellaneous expenses that you incur when completing your education. There are a number of advantages of opting for an overseas education loan. A few of them are as follows:

·The interest rates charged by banks and NBFCs (non-banking financial companies) are way lower than those charged by traditional financiers. There are also a number of other discounts provided for meritorious students and women. Thus, you can make use of them and pursue higher education abroad.

·The collateral required to obtain an education loan is determined on the basis of the quantum of loan amount borrowed and the primary debtor’s credit-worthiness. This collateral can be any of your residential properties, non-agricultural land, life insurance policy, fixed deposit, etc. Even the repayment of these loans is hassle-free; it is done in the flexible form of installments. Thus, you can carefully plan out all of your future repayments in advance.

· There is also a moratorium period given to students applying for an overseas education loan. This period starts from the day; the loan amount is disbursed into your account. The financial institutions also provide you with an additional 6 months to 1 year for searching for a stable job and start making repayments.

·There are a lot of financial institutions which have started providing their loan services online. The only things that you need to make use of these loans are an internet connection and a laptop, computer, or a smartphone. You can apply for these loans anytime you want- the services are available 24/7.

However, there are certain eligibility criteria you need to fulfill. The different types of criteria are your educational qualifications, nationality, co-borrower, credit score and history of the co-borrower, as well as the income of the co-borrower. Other than those, your educational institution, the country in which you are opting to study, educational course, collateral, etc. also play a major role in determining your overseas education loan eligibility.

Hope this article will help you make an informed decision. Best of luck!

1 note

·

View note

Text

Apply for an Education Loan today and get up to Rs 10,000 cashback. You will get Quicker processing and multiple quotes from 10+ banks & NBFCs in single application.

#educationloan#education#studyabroad#highereducation#studyincanada#studyinuk#studyloan#loan#studyinusa#personalloan#hdfccredila#educationforall#studyinaustralia#studentloans#incred#nbfc#overseaseducationloan#eduloans#statebankofindia#bankofbaroda#msinaustralia#axisbank#icicibank#studyingermany#educationconsultant#avanse#mpower#educationmatters

1 note

·

View note

Photo

If you’re still not sure about getting a Student Loan to fulfill your foreign education goals, consult Valmiki’s expert counselors who’ll guide you with its benefits, procedure and much more.

Call us at 8179939194

https://www.valmikigroup.com/counselling.php

0 notes

Photo

EDUCATION LOAN FOR INDIA AND ABROAD STUDY. Contact: 9558816181 Deepak Jain For INDIA and ABROAD Study 100% Unsecure - No Property or any othe security require in maximum courses. Send Students Offer Letter / Confirmation Letter 👉 Get Loan upto 50 Lacs as per Study 👉 Pre Visa Disbursement 👉 EMI will start after completion of study in certain Master Courses We Charge LendingIndia.Com Processing Fees for this product Apply Now Anywhere from India: https://lendingindia.com Thank you Deepak Jain 91-9558816181 LENDINGINDIA.COM #educationloan #education #loan #studentloan #student #loan #studyloan #study #loan #lendingindia #india #usa #uk #canada #europe #australia #newzealand #ahmedabad #Gujarat (at Ahmedabad, India) https://www.instagram.com/p/CZ6oNr_vMOo/?utm_medium=tumblr

#educationloan#education#loan#studentloan#student#studyloan#study#lendingindia#india#usa#uk#canada#europe#australia#newzealand#ahmedabad#gujarat

0 notes

Photo

#intelligentoverseaseducation | Study in France.

✅Promote 100+ Top Ranked Universities

✅Stay Back Opportunities Up to 2 years

✅Application Fees Waived Off*

✅IELTS Waived Off*

✅Scholarships Available

✅Paid Internship Opportunities

Apply Now | 2022 Jan Intake #studyinfrance Dial +91 96001-68411 | +91-89253-11187

Visit Us: www.intelligentoverseaseducation.com

0 notes

Photo

What will it take to Solve the student loan Crisis? A question that haunts students as well as the economy. Above all student effort to earn grade along with their part times are becoming more and more difficult. We present 13 steps that will help the student to repay their debt.

2 notes

·

View notes