#subscription billing solution

Explore tagged Tumblr posts

Text

Transform Subscription Models with SAP Subscription Billing by Acuiti Labs

Acuiti Labs helps businesses unlock growth with SAP Subscription Billing—designed for modern subscription management. From flexible pricing to full lifecycle automation, we offer tailored SAP billing solutions and a risk-free POC to accelerate your subscription transformation.

#SAP Subscription Billing#SAP Subscription Management#SAP Billing Solution#Acuiti Labs#Subscription Lifecycle#Recurring Billing#Cloud Billing#Quote-to-Cash#Subscription Automation

0 notes

Text

Streamlining NetSuite Subscription Billing with SuiteWorks Tech: Enhancing NetSuite’s Capabilities

In today’s fast-paced business environment, managing subscriptions efficiently is crucial for success. NetSuite Subscription Billing is a powerful tool that can help businesses streamline their billing processes. However, to unlock its full potential, integrating it with a robust solution like SuiteWorks Tech is essential. This blog will explore how SuiteWorks Tech enhances NetSuite’s capabilities, providing a comprehensive subscription billing solution that not only automates processes but also elevates customer satisfaction.

The Need for Efficient Subscription Billing

As businesses transition to subscription-based models, the complexity of billing can increase exponentially. Manual processes can lead to errors, missed payments, and ultimately, dissatisfied customers. The NetSuite Subscription Billing solution addresses these challenges by automating recurring billing, but integrating it with SuiteWorks Tech takes this automation to the next level.

Understanding SuiteWorks Tech Subscription Billing Solution

Comprehensive Automation

SuiteWorks Tech subscription billing solution is natively built on the NetSuite platform, ensuring seamless integration into your existing ERP environment. This powerful billing engine automates the creation of recurring invoices, significantly reducing manual intervention. By automating these processes, businesses can focus on growth and customer service rather than getting bogged down in administrative tasks.

Key Features of SuiteWorks Tech Subscription Billing

For full blog click the below link

#Leading Subscription Billing Software for NetSuite#Best Subscription Billing Software for NetSuite#Top Subscription Billing Software for NetSuite#Subscription Billing Software for NetSuite#Subscription Billing Suiteapp#Subscription Billing solutions provider#Subscription Billing software provider#NetSuite Subscription Billing Solution#Subscription Billing solutions provider in india#Subscription Billing solutions provider in hyderabad

0 notes

Text

https://www.acuitilabs.com/q2c-customerportal/

#Q2C Customer Portal#Subscription Management Software#SAP BRIM Integration#S4HANA Cloud Billing#Self-Service Subscription Platform#Acuiti Labs Billing Solutions#Subscription Billing Automation#Customer Self-Management Tools#B2B Subscription Management#Mobile Subscription Management App#Scalable Subscription Software#Subscription Lifecycle Management#Invoicing and Payment Automation

1 note

·

View note

Text

https://www.expeditecommerce.com/billing-software

Maximize customer satisfaction with Expedite Commerce's Billing & Subscription Management. Automate billing, revenue recognition, and empower customers with self-service. Supercharge revenue today!

#billing#billing software#USA#b2b#b2b sales#expeditecommerce#business#recurring billing software#recurring billing#billing software for small businesses#revenue management solutions#revenue management#subscription management

0 notes

Text

Things the Biden-Harris Administration Did This Week #38

Oct 11-18 2024

President Biden announced that this Administration had forgiven the student loan debt of 1 million public sector workers. The cancellation of the student loan debts of 60,000 teachers, firefighters, EMTs, nurses and other public sector workers brings the total number of people who's debts have been erased by the Biden-Harris Administration using the Public Service Loan Forgiveness to 1 million. the PSLF was passed in 2007 but before President Biden took office only 7,000 people had ever had their debts forgiven through it. The Biden-Harris team have through different programs managed to bring debt relief to 5 million Americans and counting despite on going legal fights against Republican state Attorneys General.

The Federal Trade Commission finalizes its "one-click to cancel" rule. The new rule requires businesses to make it as easy to cancel a subscription as it was to sign up for it. It also requires more up front information to be shared before offering billing information.

The Department of Transportation announced that since the start of the Biden-Harris Administration there are 1.7 million more construction and manufacturing jobs and 700,000 more jobs in the transportation sector. There are now 400,000 more union workers than in 2021. 60,000 Infrastructure projects across the nation have been funded by the Biden-Harris Bipartisan Infrastructure Law. Under this Administration 16 million jobs have been added, including 1.7 construction and manufacturing jobs, construction employment is the highest ever recorded since records started in 1939. 172,000 manufacturing jobs were lost during the Trump administration.

The Department of Energy announced $2 billion to protect the U.S. power grid against growing threats of extreme weather. This money will go to 38 projects across 42 states and Washington DC. It'll upgrade nearly 1,000 miles worth of transmission lines. The upgrades will allow 7.5 gigawatts of new grid capacity while also generating new union jobs across the country.

The EPA announced $125 million to help upgrade older diesel engines to low or zero-emission solutions. The EPA has selected 70 projects to use the funds on. They range from replacing school buses, to port equipment, to construction equipment. More than half of the selected projects will be replacing equipment with zero-emissions, such as all electric school buses.

The Department of The Interior and State of California broke ground on the Salton Sea Species Conservation Habitat Project. The Salton Sea is California's largest lake at over 300 miles of Surface area. An earlier project worked to conserve and restore shallow water habitats in over 4,000 acres on the southern end of the lake, this week over 700 acres were added bring the total to 5,000 acres of protected land. The Biden-Harris Administration is investing $250 million in the project along side California's $500 million. Part of the Administration's effort to restore wild life habitat and protect water resources.

The Department of Energy announced $900 Million in investment in next generation nuclear power. The money will help the development of Generation III+ Light-Water Small Modular Reactors, smaller lighter reactors which in theory should be easier to deploy. DoE estimates the U.S. will need approximately 700-900 GW of additional clean, firm power generation capacity to reach net-zero emissions by 2050. Currently half of America's clean energy comes from nuclear power, so lengthening the life space of current nuclear reactors and exploring the next generation is key to fighting climate change.

The federal government took two big steps to increase the rights of Alaska natives. The Departments of The Interior and Agricultural finalized an agreement to strengthen Alaska Tribal representation on the Federal Subsistence Board. The FSB oversees fish and wildlife resources for subsistence purposes on federal lands and waters in Alaska. The changes add 3 new members to the board appointed by the Alaska Native Tribes, as well as requiring the board's chair to have experience with Alaska rural subsistence. The Department of The Interior also signed 3 landmark co-stewardship agreements with Alaska Native Tribes.

The Department of Energy announced $860 million to help support solar energy in Puerto Rico. The project will remove 2.7 million tons of CO2 per year, or about the same as taking 533,000 cars off the road. It serves as an important step on the path to getting Puerto Rico to 100% renewable by 2050.

The Department of the Interior announced a major step forward in geothermal energy on public lands. The DoI announced it had approved the Fervo Cape Geothermal Power Project in Beaver County, Utah. When finished it'll generate 2 gigawatts of power, enough for 2 million homes. The BLM has now green lit 32 gigawatts of clean energy projects on public lands. A major step toward the Biden-Harris Administration's goal of a carbon pollution-free power sector by 2035.

Bonus: President Biden meets with a Kindergarten Teacher who's student loans were forgiven this week

#Thanks Biden#Joe Biden#kamala harris#student loans#click to cancel#politics#US politics#american politics#native rights#jobs#the economy#climate change#climate action#Puerto Rico

2K notes

·

View notes

Text

Sacred Self Care (Mike Schmidt)

i'm 100% supposed to be cleaning my room up for family but i may go insane if i do not write RIGHT NOW!! so, this is something i've had in my mind for so long. i PROMISE after thanksgiving i'll give yall peeta and finnick content and get to more asks. i could not hold back on this one any longer though, so sit back, and enjoy!

summary: mike discovers self care, but what happens when his ritual becomes a little too intricate and he ends up in a silly predicament?

warnings: mentions of nudity, one or two innuendos

word count: 2,288

---------------

Mike Schmidt did not have time to take care of himself. This was a fact that was all too noticeable. His dry curls practically begged to be lathered in moisture, or at least in something that wasn’t a bar of soap that was also used on his face and body. His nails were dirty whenever he was busiest, the only time they were well groomed being when he was prepared to be knuckles deep inside of you. His eyebags were sunken in and his facial hair grew in patches, untrimmed. Mike did not care, nor did he think wasting time on such a meticulous thing would be beneficial to him. There were better things to do than to primp himself when he could be doing something more productive, such as getting to the bottom of his brother’s disappearance… thirteen years later. When he wasn’t obsessing over every minute detail in his dream that could lead him to the solution or fathering Abby in his own backwards but still productive way, he was admiring you and your glory.

While Mike may not have been someone for self-care, you most definitely were. You were constantly looking up new ways to better yourself, new hair masks to try and new ways to make your skin as smooth as butter. The water bill also certainly showed your love for self-care. Some nights, you’d prance into the bedroom after an intricate shower, throwing your leg up on the bed as you demanded for Mike’s rough hands to feel, every centimeter of hair gone, the smell of cocoa butter sifting in the air. He was amused when he’d walk in to you sitting on the couch, some new green goop slathered on your face, or some strange piece of paper stuck to your nose. On occasion, you’d convince Mike to join you and Abby, his desperation to spend more quality time with the two of you trumping his disdain for fifteen minutes of clay on his face. He’d peel away at chunks as they flaked into his lap, you and Abby giggling every few seconds as the pile would grow amusingly larger before Mike would give up, running to the bathroom to scrub his face clean before the timer went off.

He wasn’t sure when it clicked. Perhaps it was when Abby told him he’d looked rough lately (he attempted to take this with a grain of salt, as she was his little sister, scolding her and telling her that was not very nice) or perhaps it was when one morning after work, he’d noticed new wrinkles covering his forehead and increasingly pale skin with purple dips underneath his eyes. One day, he found himself in the shampoo aisle at Target. It started with something simple. He bought real shampoo and conditioner, specifically designed for curly dry hair. He enjoyed the scent it radiated as he lathered it through his locks in the warm shower, the aftermath amazing. He’d never seen his hair so fluffy as it dried, his once brittle strands now feeling smooth as he ran his fingertips through it. Then, there was skincare. Somehow, he ended up getting a free sample in the mail from one of those makeup subscription companies you subscribed to, the company accidentally sending you a made-for-men miniature face wash and eye cream set. You eagerly tossed it his way with a giggle, assuming he tossed it in the trash the moment he got it. Instead, that very night, Mike added it to his shower along with his brand-new hair products, patting the eye cream underneath his eyes once he got out. The next morning, the once deep reddish purple was now only tinted a light color. Before he knew it, underneath the cabinet tucked away in a corner were different hair oils, beard creams, moisturizers, and lotions. He’d gotten into different kinds of cologne, opting for scented deodorants as well.

Mike had to admit, he enjoyed this new routine of his. As it progressed, it became almost ritualistic. He’d get home from work at exactly 6:15, about 45 minutes before you’d wake up. He would hop into the shower, taking in the feeling of his fingertips massaging his scalp, his body feeling the tension flooding down as the water from the shower flooded down the drain. Then, the aromatic smell of musky body wash would fill his nose, cleansing his senses of the smell of ancient dusts from working at the pizzeria. He’d step out of the shower, his skin tinted pink from the hot water, his face freshly washed. He’d apply lotion, shape his beard and add his creams, he’d even gotten into grooming his nails every night, ensuring they were crisply clean and applying a protective clear coat on top.

He couldn’t quite figure out why he was so embarrassed by his ritual. Perhaps it was the way it made him feel less masculine, knowing damn well deep down that it didn’t make him any less of a man and it was just his years’ worth of built-up toxic masculinity that you were so desperately trying to get him to break down. Maybe it was the way he was splurging on things he simply didn’t feel he needed until now, until it suddenly felt like a necessity, something he’d go insane without. Most of all and the most likely of all the scenarios, it was admitting that he was wrong, that something you and Abby had so desperately attempted to beg him to get into was exactly what the two of you had explained to him. It was majestic and comforting. At least 45 minutes a day were dedicated to him and only himself, his whole body feeling renewed each time he stepped out of the shower. He felt rebirthed, imagining this was what religious people felt when they were deemed ‘saved’ at confessional. Even with that being said, he couldn’t let you and Abby in on his little ritual. No, he couldn’t possibly admit to it. It wasn’t because he wanted to hide something from you two but instead because his embarrassment seeped deep down into his skull every time he thought about revealing it. Instead, he would slowly creep himself into bed, wrapping his arms around you as he pressed a kiss to your forehead, pretending to sleepily open his eyes as your alarm went off.

You’d suspected he was hiding something, and you were worried. The new signature scents, the freshly groomed look, the way he seemed to care more about his clothing and the wrinkles that were shown. Your first thought was that there was somebody else, someone he had needed to impress, much like he once felt the need to impress you every time he was around you, suppressing his comfortable and more Mike-like fashion choices. In the mornings, you’d sense the lack of his presence after hearing the door creak open, feeling the bed dip right before your alarm went off, sirens ringing in your head each time as if to warn you something wasn’t right. You would spend some nights he was away at work after Abby was in bed evaluating who it could possibly be. There was Vanessa, the blonde police officer who would make occasional appearances in conversation. There was the waitress at the diner who’d taken a liking to Mike, but you weren’t sure who else it could be. Of course, women ogled over Mike all the time in public. There was something about a man with a slightly off putting aura and messy tussled hair. But regardless, you had always trusted him, and besides, Mike didn’t really talk to many people as is.

It wasn’t until Mike added in a peel off face mask into the mix that the jig was up. One week, he’d managed to get the entire week off, ensuring the pizzeria was boarded closed and begging Vanessa to keep an eye on things. You’d felt slightly better having him around more and at normal hours. He was very much still head over heels for you, following you around like a lost puppy, the two of you showering together, cooking together, and of course, having as much ‘alone time’ as you could possibly fit in when Abby was asleep or away at a friends. Even with that, in the back of your mind, you couldn’t shake the feeling. You were passed out on the couch after a movie night and it was late. Mike had crept away from the living room, tucking your sleeping body under a blanket, slipping into the shower. He followed his typical ritual, something he’d had to put off for a while in fear of getting caught, still unsure of what made him so anxious. After his shower, he applied his peel off mask, attempting to avoid his facial hair, but without thinking, he’d applied a layer over his entire chin. What would soon become a panic inducing issue in a short sum of ten minutes hadn’t occurred to him quite yet.

As the timer on his phone went off, he began slowly peeling the mask off, starting at his forehead before he froze, realizing more of his face was covered than usual. He brushed it off, continuing to peel before he noticed that not only was the thin, purple layer coming off, but multiple specks of hair were attached as well. Oh fuck, he thought to himself, unsure of how to proceed. No, he couldn’t just rip it off. He was attached to his facial hair. It made his baby face look mature and manly. No, of course it didn’t occur to him to just add water, simply wiping it away. There was only one option, and that was to waltz into the living room with his bright purple face and to wake you up, puppy dog eyes pleading for you to help him with his predicament.

You stirred away as you felt a hand shake your shoulder, your eyes widening as you sat up with a confused expression.

“Well, hello there,” you croaked out, your voice laced with gravel from exhaustion. He looked at you with embarrassment laced over his face, his eyebrows furrowed.

“Help, please. I…” he trailed off, gesturing his hands towards his face. “I just need it off,” he grumbled lowly, his fingertips holding the piece holding his facial hair tenderly, ensuring he didn’t rip anything else off.

You couldn’t help but let out a loud giggle, amused by the man standing in front of you. You grabbed his hand, leading him into the bathroom. You both sat on the ledge of the tub as you tenderly wiped his face clean with a warm washcloth, his reddened cheeks from both the mask being on too long and the embarrassment becoming more apparent by the second.

“Facial hair is saved,” you said triumphantly, pressing a kiss to his lips. “I do have to ask though, why the sudden liking to all of this? And why not just.. tell me?” you hummed curiously, shaking your head.

“I just.. I don’t know. I think I didn’t want to admit I was wrong or that I was spending so much money on such worthless stuff. It started out so small and then became so big, I just couldn’t,” he sighed, shaking his head. “I am really sorry for keeping it from you,” he hummed before he went into a further explanation, explaining the way it made him feel.

You let out a sigh of relief along with a content giggle, shaking your head. “I knew something was up, but I wasn’t sure what,” you said, cocking an eyebrow as you placed a hand on his knee, your cheeks now warming up.

“What, did you think I was getting all fancy schmancy for another girl?” he teased, bumping his elbow against your shoulder. Your eyes widened as your mouth opened and closed as you went to say something, his expression dropping into something more serious.

“Oh my god, Y/N, honey, no, I’d never,” he said, placing his warm hand on your exposed shoulder. “Baby, no,” he chuckled, happy he could reassure you but somewhat upset that you had to sit through that alone. “No, I love you very much, I promise you, there is no other woman... just, your silly grumpy man being too embarrassed to admit I like girly things,” he teased, leaning in to press a warm kiss to your lips. The kiss was all you needed for electrical sparks to be sent through your body, your brain buzzing as the anxious thoughts began to disappear.

For the rest of the night, Mike walked you through his entire routine, both for fun and for transparency. You two joked back and forth, you occasionally poking at him, telling him he should become an influencer. Afterwards, you both did a face mask together, this time ensuring the product did not cover his chin.

Yes, you and Mike most definitely had your own things to work on, but at the end of the day, you were happiest with him. Your heart felt warm. He had finally found a way to take care of himself, a way to feel more content in his own skin, and even though he had an odd way of going about it, you were pleased, happy he was also finally willing to share this with you. From now on, Mike would wait for his routine in the mornings until you woke up, instead crawling into bed and cradling you in his arms, thinking about how lucky he was to have such a sweet, loving, and accepting partner like you to share his life with, even if it was just skincare and Vaseline kisses.

#josh hutcherson x reader#mike schmidt fluff#mike schmidt#mike schmidt x reader#mike schmidt imagine#josh hutcherson fluff#josh hutcherson imagine#josh hutcherson#josh hutcherson fanfic#michael schmidt x reader

535 notes

·

View notes

Text

I think some info about scams will help people grasp what Ludinus is doing.

You’ve no doubt received really shitty e-mail scams. Here’s your Excel invoice for something you didn’t order from Amazon, please ignore that the e-mail is misspelled, call this number if you have questions. Final notice to cancel this subscription you don’t have, ignore the other 20 people cc’d, click this personalized link to cancel. Your credit score sucks, [misspelled your name], but we’re got this amazing rate offer for you, limited time, finish the application process at our website. They’re so obvious. Why haven’t they improved at this?

They don’t want to get “better” at scamming because that’s part of their process. They don’t want calm, detail-oriented, or thoughtful people to contact them. They don’t want people who know enough about this to have a healthy amount of doubt. They want the people who are tired, stressed, emotional, and scared. Vulnerable. If a target missed those initial signs, they’ll be easier to manipulate.

Recruiting for the Ruby Vanguard works the same way. This is not the modern world. Most people are not educated. In addition, most are not magical. When a group of powerful, magical people comes along and offers a solution to all your worries, offers you a place to belong and develop powers that finally seem to make sense, doesn’t it just feel like a dream? Something is finally going right, and it’s going to get better, it’ll just be hard, because of course that’s how it works. It’ll be okay because now you’re not alone and you know who the real enemy is…

Bell’s Hells aren’t Ludinus’s usual targets because they’ve wisened up to his bullshit already. But he needs potential vessels, and both Imogen and Fearne might fit the bill. That’s rare enough that, even when his usual offers aren’t working, he’s going to keep trying.

43 notes

·

View notes

Text

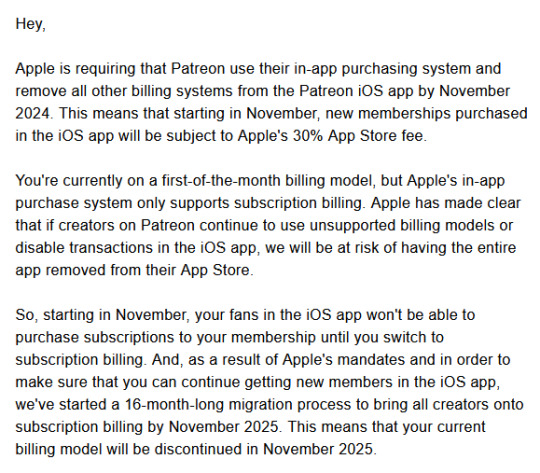

In case folks haven't seen, Patreon is forcing everyone to switch over to the subscription billing model within the next year or so. Yes there was enormous pushback about this from creators when they tried to force it out a couple years back, no they did not care then, and no we do not have a choice now. How this has anything to do with Apple's shitty fees, I don't know, and there isn't any explanation in this email except that the App Store doesn't like it. And for some reason that means nobody is allowed to use it. This makes no sense, but okay! Okay! (Fuck you.)

This means that creators on Patreon will no longer receive a lump sum payment of all supporters at the beginning of the month (you know, when we have to pay bills), but instead get a drip-feed of single-member payments throughout the month, based on the day of the month that supporter first pledged. This is, to put it simply, absolutely fucking devastating to the vast majority of creators on the platform. Anyone who isn't making several thousand dollars a month is going to suffer. The only way to get a lump sum with this method is to wait until the last day of the month to request a payout, so the switching process will necessitate we all have at least one month where we have to change over from getting paid on the first day to getting paid on the last—which means we essentially have a month where we just don't fucking get paid.

There is no solution for this, I'm just pissed off and wanted folks to be aware of what's going on. I've been on the fence about keeping my Patreon up recently anyway, we'll see what I do here. I am white-hot angry that in spite of creators being the reason their platform exists in the first place, they really don't care about us at all.

22 notes

·

View notes

Text

Boost Your Website Performance with URL Monitor: The Ultimate Solution for Seamless Web Management

In today's highly competitive digital landscape, maintaining a robust online presence is crucial. Whether you're a small business owner or a seasoned marketer, optimizing your website's performance can be the difference between success and stagnation.

Enter URL Monitor, an all-encompassing platform designed to revolutionize how you manage and optimize your website. By offering advanced monitoring and analytics, URL Monitor ensures that your web pages are indexed efficiently, allowing you to focus on scaling your brand with confidence.

Why Website Performance Optimization Matters

Website performance is the backbone of digital success. A well-optimized site not only enhances user experience but also improves search engine rankings, leading to increased visibility and traffic. URL Monitor empowers you to stay ahead of the curve by providing comprehensive insights into domain health and URL metrics. This tool is invaluable for anyone serious about elevating their online strategy.

Enhancing User Experience and SEO

A fast, responsive website keeps visitors engaged and satisfied. URL Monitor tracks domain-level performance, ensuring your site runs smoothly and efficiently. With the use of the Web Search Indexing API, URL Monitor facilitates faster and more effective page crawling, optimizing search visibility. This means your website can achieve higher rankings on search engines like Google and Bing, driving more organic traffic to your business.

Comprehensive Monitoring with URL Monitor

One of the standout features of URL Monitor is its ability to provide exhaustive monitoring of your website's health. Through automatic indexing updates and daily analytics tracking, this platform ensures you have real-time insights into your web traffic and performance.

Advanced URL Metrics

Understanding URL metrics is essential for identifying areas of improvement on your site. URL Monitor offers detailed tracking of these metrics, allowing you to make informed decisions that enhance your website's functionality and user engagement. By having a clear picture of how your URLs are performing, you can take proactive steps to optimize them for better results.

Daily Analytics Tracking

URL Monitor's daily analytics tracking feature provides you with consistent updates on your URL indexing status and search analytics data. This continuous flow of information allows you to respond quickly to changes, ensuring your website remains at the top of its game. With this data, you can refine your strategies and maximize your site's potential.

Secure and User-Friendly Interface

In addition to its powerful monitoring capabilities, URL Monitor is also designed with user-friendliness in mind. The platform offers a seamless experience, allowing you to navigate effortlessly through its features without needing extensive technical knowledge.

Data Security and Privacy

URL Monitor prioritizes data security, offering read-only access to your Google Search Console data. This ensures that your information is protected and private, with no risk of sharing sensitive data. You can trust that your website's performance metrics are secure and reliable.

Flexible Subscription Model for Ease of Use

URL Monitor understands the importance of flexibility, which is why it offers a subscription model that caters to your needs. With monthly billing and no long-term commitments, you have complete control over your subscription. This flexibility allows you to focus on growing your business without the burden of unnecessary constraints.

Empowering Business Growth

By providing a user-friendly interface and secure data handling, URL Monitor allows you to concentrate on what truly matters—scaling your brand. The platform's robust analytics and real-time insights enable you to make data-driven decisions that drive performance and growth.

Conclusion: Elevate Your Website's Potential with URL Monitor

In conclusion, URL Monitor is the ultimate solution for anyone seeking hassle-free website management and performance optimization. Its comprehensive monitoring, automatic indexing updates, and secure analytics make it an invaluable tool for improving search visibility and driving business growth.

Don't leave your website's success to chance. Discover the power of URL Monitor and take control of your online presence today. For more information, visit URL Monitor and explore how this innovative platform can transform your digital strategy. Unlock the full potential of your website and focus on what truly matters—scaling your brand to new heights.

3 notes

·

View notes

Text

Unexpected Bills? How Instant Cash Advances Can Help (And What to Watch For)

Life is full of surprises, and not all of them are pleasant. Sometimes, an unexpected expense can pop up – a car repair, a medical bill, or an urgent home maintenance issue. When your regular paycheck doesn't quite cover these sudden costs, it can be stressful. In these moments, many people consider options for quick financial relief. One such option that has gained popularity is the instant cash advance. But what exactly is it, and how can you use it wisely?

Understanding Instant Cash Advances

An instant cash advance is typically a small, short-term sum of money you can access quickly, often through an app or online service. Unlike traditional loans, the approval process is usually faster, and the funds can be available almost immediately, especially if you meet certain criteria like having a supported bank account. The primary appeal is speed and convenience. When you're in a bind, waiting days for a bank loan isn't always feasible. Practical tip: Before seeking any advance, assess if the expense is a true emergency or something that can be deferred. This helps avoid unnecessary borrowing.

These services are designed to bridge the gap until your next payday. According to the Bureau of Labor Statistics (BLS), average household expenditures can fluctuate, making it hard to predict when you might need a little extra. An instant cash advance apps can provide that buffer. Actionable insight: Keep a small emergency fund, even $500, to reduce reliance on advances for minor unexpected costs.

Key Considerations Before Using an Instant Cash Advance

While the allure of quick cash is strong, it's crucial to approach these services with caution and awareness. Not all instant cash advance providers are created equal. Many charge fees, which can include subscription fees, express transfer fees, or even interest, effectively increasing the cost of borrowing. Practical tip: Always read the terms and conditions carefully. Understand all potential fees and repayment terms before committing.

Another point to consider is the impact on your overall financial health. Relying frequently on cash advances can sometimes mask underlying budgeting issues. The Federal Reserve offers numerous resources on financial literacy that can help individuals manage their money better. Actionable insight: Use cash advances sparingly and for genuine emergencies, not for routine spending or discretionary purchases.

What to Look For in a Provider

When evaluating instant cash advance options, look for transparency in fees, clear repayment terms, and good customer reviews. Some newer services are challenging the traditional model by offering advances with fewer or no fees. Consider how quickly you need the funds and if there are charges for expedited access. Practical tip: Check if the provider requires access to your bank account and understand their security measures for protecting your financial data. You can also check average household bill costs on sites like Doxo Insights to better plan your budget.

It's also wise to explore alternatives. Could you negotiate a payment plan for the unexpected bill? Is there anything you can temporarily cut back on? Sometimes, a conversation with the creditor can yield a solution. Actionable insight: Maintain a list of financial resources, including community assistance programs, which might offer help in times of need.

A Modern Alternative: Gerald App

If you're looking for an instant cash advance option that prioritizes transparency and user benefit, you might consider Gerald App. Gerald offers Buy Now, Pay Later (BNPL) services and cash advances with a unique approach: zero fees. This means no service fees, no transfer fees, no interest, and no late fees. To access a fee-free cash advance transfer, users typically need to first make a purchase using a BNPL advance. For eligible users with supported banks, these transfers can be instant at no extra cost.

Gerald's model is different because it aims to provide financial flexibility without the hidden costs often associated with other services. They even offer eSIM mobile plans via BNPL. This approach can be particularly helpful for managing unexpected expenses without the fear of spiraling fees. Remember, responsible use is key for any financial tool.

#instant cash#instant cash advance#instant cash advance app#instant cash advance apps#cash advance#cash advance app#cash advance apps#free instant cash advance apps#buy now pay later

2 notes

·

View notes

Text

Benefits of Fast Online Payments — Quick Pay

In today’s digital economy, fast online payments are no longer just a convenience—they are a necessity. From e-commerce stores to freelancers and service providers, everyone is shifting toward quicker, safer, and smarter payment solutions. Among the many options available, Quick Pay has emerged as a leading platform offering seamless online payment experiences for both businesses and customers.

If you're a business owner or entrepreneur looking to scale your operations and improve customer satisfaction, understanding the benefits of fast online payments is crucial. And when it comes to delivering these benefits efficiently, Quick Pay stands out with its cutting-edge features and reliable service.

1. Enhanced Customer Experience

The first and most obvious benefit of fast online payments is an improved customer experience. Today’s consumers expect instant transactions. A slow or complicated checkout process can lead to cart abandonment and loss of revenue.

With Quick Pay, customers can complete payments in just a few clicks. The user-friendly interface, minimal redirects, and fast processing ensure that your clients enjoy a hassle-free payment journey, increasing the chances of repeat business.

Quick Pay Advantage:

One-click checkout

Mobile-optimized experience

Multiple payment options: UPI, cards, wallets, net banking

2. Faster Cash Flow for Businesses

One of the major benefits of fast online payments is accelerated cash flow. Unlike traditional bank transfers that may take days, fast payment systems like Quick Pay ensure that your money reaches you quickly—often on the same day.

For small businesses and startups, this is a game-changer. You no longer have to wait endlessly for payments, allowing better cash management, investment in growth, and operational efficiency.

Quick Pay Benefit:

Same-day settlements (T+0 and T+1 options)

Instant payment notifications

Transparent tracking of incoming funds

3. Higher Conversion Rates

Online businesses thrive on conversion rates. A complicated or slow payment process can discourage potential customers right at the final step. By offering a quick and secure payment gateway like Quick Pay, businesses can increase their checkout success rate dramatically.

Speed combined with security builds trust and reduces the bounce rate.

Quick Pay Features That Help:

Secure payment environment (PCI DSS compliant)

Optimized checkout for mobile and desktop

Auto-fill and tokenized payments for returning users

4. Increased Trust and Credibility

When customers notice that your website or app uses a reputed and fast payment solution like Quick Pay, it instantly boosts your brand’s credibility. Shoppers feel more secure transacting on your platform, knowing that their personal and financial data is in safe hands.

This trust translates into higher engagement, more referrals, and long-term brand loyalty.

Quick Pay Security Standards:

End-to-end encryption

Two-factor authentication

Fraud detection and chargeback control

5. Support for Recurring Payments

Many businesses today rely on subscription models—whether it's digital services, SaaS platforms, or fitness memberships. A major benefit of fast online payments is the ability to automate recurring billing.

Quick Pay makes recurring payments smooth and effortless. Customers don’t need to re-enter their details every time, and businesses enjoy predictable revenue without delays.

With Quick Pay, You Get:

Automated recurring billing setup

Smart invoicing and reminders

Custom billing cycles

6. Lower Operational Costs

Handling cash or bank transfers manually involves time, risk, and additional staff. Online payments automate this entire process, reducing overhead costs. Quick Pay’s all-in-one dashboard helps manage your transactions, analytics, and customer data in one place.

Over time, businesses save money on labor, reconciliation, and administrative tasks.

Quick Pay’s Business Dashboard Offers:

Real-time transaction tracking

Sales reports and analytics

Easy refund and dispute management

7. Wider Customer Reach

Fast online payments open up a global customer base. Whether you're selling in your local city or shipping products across the world, a payment gateway like Quick Pay ensures that you never miss a sale due to geographical or banking limitations.

Quick Pay supports multi-currency payments and international cards, making it easier to scale your business globally.

Quick Pay Global Features:

Support for major global currencies

Acceptance of Visa, Mastercard, AmEx, and more

Integration with international platforms like Shopify, WooCommerce, and others

8. Seamless Integrations with Online Platforms

The benefits of fast online payments are amplified when your payment gateway easily integrates with your website, mobile app, or POS system. Quick Pay offers ready-made plugins and robust APIs for smooth integration.

This reduces developer time, lowers setup costs, and gets you live faster.

Quick Pay Integration Highlights:

Easy plugins for WordPress, Shopify, Magento

Android/iOS SDKs for mobile apps

API documentation and 24/7 tech support

9. Better Customer Retention

A smooth payment experience not only helps you close a sale but also encourages customers to return. Fast refunds, saved payment options, and friendly interfaces make users feel valued.

Quick Pay includes customer retention features like:

Smart retry on failed transactions

Branded payment pages

Custom thank-you messages and emails

10. Real-Time Analytics and Insights

Understanding how your customers pay can guide better business decisions. Quick Pay’s powerful analytics tools offer deep insights into payment trends, user behavior, and settlement reports—all in real time.

This data can be used to optimize your marketing campaigns, identify high-value customers, and plan inventory.

What Quick Pay Analytics Offers:

Dashboard with payment trends and patterns

Conversion rate tracking

Refund and dispute summary

Why Choose Quick Pay?

When it comes to maximizing the benefits of fast online payments, Quick Pay checks all the boxes:

✅ Fast and secure transactions ✅ Same-day settlements ✅ Easy integrations ✅ Scalable for small to enterprise businesses ✅ Exceptional customer support

Whether you're a growing startup, a large enterprise, or a freelancer, Quick Pay empowers your business to accept payments quickly, securely, and with minimal friction.

Final Thoughts

The world is moving fast, and so should your payments. Embracing the benefits of fast online payments can revolutionize your business operations, boost customer satisfaction, and drive consistent revenue.

With its reliable technology, business-friendly features, and unmatched customer support, Quick Pay is the ideal partner for modern businesses looking to thrive in the digital age.

Ready to Get Started?

Visit www.usequickpay.com to create your free account and start accepting payments within minutes.

#finance#online payments#payments#branding#economy#quickpay#bestpaymentgateway#FastOnlinePayments#QuickPayIndia#DigitalPaymentsSolution

2 notes

·

View notes

Text

Boost Efficiency with SuiteWorks Tech Subscription Billing SuiteApp

Suite Works Tech is a leading subscription billing solutions provider in India, offering the best NetSuite Subscription Billing SuiteApp to supercharge your operations. As a top subscription billing software provider in Hyderabad, we specialize in delivering tailored solutions for businesses using NetSuite. Whether you need advanced subscription billing software for NetSuite or an innovative subscription billing solution, our expertise ensures seamless implementation and enhanced productivity. Optimize your billing processes with the best subscription billing software for NetSuite today!

#Leading Subscription Billing Software for NetSuite#Best Subscription Billing Software for NetSuite#Top Subscription Billing Software for NetSuite#Subscription Billing Software for NetSuite#Subscription Billing Suiteapp#Subscription Billing solutions provider#Subscription Billing software provider#NetSuite Subscription Billing Solution#Subscription Billing solutions provider in india#Subscription Billing solutions provider in hyderabad

0 notes

Text

https://www.acuitilabs.com/media/

#AcuitiMedia#Usage-Based Billing Solution#Media and Entertainment Industry#SAP Billing#Digital Transformation for Media#Subscription Management#Pre-Pay and Post-Pay Billing#Revenue and Innovations Management#SAP BRIM Accelerator#Acuiti Labs#Media Industry Technology#Enhancing Customer Experience#Streamlined Billing Process

1 note

·

View note

Text

New Features of SAP Subscription Billing: Efficiency & Flexibility

Explore the latest SAP Subscription Billing features designed to enhance billing flexibility, automation, and customer experience for subscription businesses.

2 notes

·

View notes

Text

Efficient Credit Card Processing for Subscription-Based Models

Article by Jonathan Bomser | CEO | Accept-Credit-Cards-Now.com

In the rapidly evolving digital realm, businesses demand a dependable and effective credit card processing system, especially when engaged in subscription-based models. Credit card acceptance isn't just a matter of convenience; it's a strategic necessity that fuels expansion and ensures smooth financial transactions. In this article, we will delve into the universe of credit card processing, with a particular focus on its pivotal role in subscription-based enterprises.

The Significance of Credit Card Processing It's not just a payment choice; it stands as the gateway to success for subscription-based models. Envision a scenario where your customers confront complex payment procedures, leading to exasperation and eventual abandonment. Proficient payment processing eradicates these hurdles, positioning itself as a critical component of your subscription-based business strategy.

Why Credit Card Processing is Crucial Payment processing in subscription-based models is a fundamental element of customer satisfaction and retention. It guarantees seamless transactions, providing your customers with a fuss-free experience when subscribing to your services. Furthermore, modern payment processing systems incorporate robust security measures, safeguarding sensitive customer data and thwarting fraudulent activities. The automation of recurring billing is indispensable for subscription-based models, guaranteeing punctual payments and minimizing churn rates. Additionally, accepting credit cards broadens your business horizons, breaking down geographical barriers and enabling you to tap into a global audience.

Embracing Credit Cards for High-Risk Ventures For high-risk businesses, securing a reliable payment processing solution is of paramount importance. Whether your operations fall within the CBD industry, credit repair services, or e-commerce niches, you need a high-risk credit card processing system capable of addressing the unique challenges posed by your sector.

Merchant Accounts for High-Risk Enterprises High-risk merchant accounts are tailored explicitly for businesses with an elevated likelihood of chargebacks or fraud. If your subscription-based model falls within this category, obtaining a high-risk merchant account becomes indispensable for sustainable growth.

youtube

The E-commerce Advantage In the era of online shopping, e-commerce payment processing is absolutely indispensable. Online enterprises, whether they reside in traditional markets or high-risk domains, rely on efficient e-commerce payment gateways to expedite transactions and ensure customer contentment.

In conclusion, the universe of subscription-based models revolves around proficient credit card processing. It's not just about accepting payments; it's about crafting a smooth and secure experience for your clientele. Whether you operate in a high-risk industry or e-commerce, the right payment processing system can be the cornerstone for sustainable growth and global outreach.

#high risk merchant account#high risk payment gateway#high risk payment processing#merchant processing#payment processing#credit card payment#credit card processing#accept credit cards#payment#youtube#Youtube

23 notes

·

View notes

Text

How to Build a Seamless Payment Platform with Cash App Clone Script?

In the competitive landscape of digital finance, launching a peer-to-peer (P2P) payment app like Cash App presents a lucrative opportunity for entrepreneurs. With the rise of cashless transactions, businesses seeking to enter the fintech space can leverage a Cash App Clone Script to establish a robust and feature-rich payment solution. Bizvertex offers a scalable and cost-effective Cash App Clone Software tailored for startups and enterprises aiming to penetrate the digital payment sector.

Rapid Market Entry with White Label Cash App Clone Software

Developing a P2P payment application from scratch involves extensive research, development, and compliance measures, leading to high costs and prolonged time-to-market. A White Label Cash App Clone Software significantly reduces these challenges, allowing businesses to deploy a fully functional platform with minimal investment. By utilizing Bizvertex’s clone solution, entrepreneurs can customize the software to align with their brand identity, ensuring a seamless user experience while maintaining regulatory compliance.

Essential Features of a Cash App Clone Script

To compete in the fintech industry, a Cash App-like platform must offer key functionalities that enhance user engagement and transaction security. The Cash App Clone Script by Bizvertex includes:

Instant P2P Money Transfers – Enables users to send and receive money effortlessly.

QR Code Payments – Facilitates quick transactions via QR code scanning.

Multi-Currency Support – Allows users to transact in different fiat and digital currencies.

Bank Account Integration – Provides seamless linking with bank accounts for deposits and withdrawals.

Cryptocurrency Transactions – Supports Bitcoin and other digital assets for modern financial needs.

Robust Security Measures – Includes two-factor authentication, encryption, and fraud detection.

Bill Payments & Mobile Recharge – Enhances user convenience by integrating utility bill payments.

Custom Branding & UI/UX – Ensures a personalized experience for end-users.

Business Advantages of Choosing a Cash App Clone Software

1. Cost-Effective Development

Investing in a White Label Cash App Clone Software significantly reduces development costs compared to building a payment app from scratch. Bizvertex provides a ready-made yet customizable solution, ensuring a high return on investment (ROI) for entrepreneurs.

2. Faster Time-to-Market

Speed is crucial in the fintech industry. By opting for a Cash App Clone Script, businesses can launch their P2P payment app quickly and start acquiring users without delays.

3. Scalability & Customization

A pre-built clone solution from Bizvertex allows startups to scale as their user base grows. The software is fully customizable, enabling businesses to add unique features and branding elements.

4. Revenue Generation Opportunities

A Cash App-like platform offers multiple revenue streams, including transaction fees, subscription models, merchant partnerships, and cryptocurrency trading commissions.

Build a Profitable P2P Payment App with Bizvertex

For entrepreneurs aiming to establish a foothold in the fintech industry, Bizvertex’s Cash App Clone Software provides a reliable and efficient pathway. With advanced security features, a seamless user interface, and multi-currency support, businesses can create a successful and profitable P2P payment platform. Get started with Bizvertex today and build a fintech brand that stands out in the market.

3 notes

·

View notes